QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Sonesta International Hotels Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

116 HUNTINGTON AVENUE, FLOOR 9

BOSTON, MASSACHUSETTS 02116

April 26, 2005

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders to be held on May 16, 2005, at 9:00 a.m., notice of which is enclosed. The Meeting will be held at the Company's Corporate Offices, at 116 Huntington Avenue, Floor 9, Boston, Massachusetts. I hope that as many stockholders as possible will attend.

Please date and sign the enclosed Proxy and return it in the accompanying envelope. This will not prevent you from voting in person at the Meeting if you so desire, in which case you may revoke your Proxy at that time. By returning your signed Proxy now, you can be sure that your vote will be counted even if you are not able to attend the Meeting.

The Annual Report of the Company for 2004 is being forwarded to stockholders together with this Notice and Proxy Statement; however, any stockholder who wishes to receive another copy of the Annual Report or the Company's Form 10-K may obtain one, without charge, by writing to the Secretary of the Company at the above address.

116 HUNTINGTON AVENUE, FLOOR 9

BOSTON, MASSACHUSETTS 02116

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

To the Stockholders of

Sonesta International Hotels Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Sonesta International Hotels Corporation (the "Company"), will be held at the Company's Corporate Offices, at 116 Huntington Avenue, Floor 9, Boston, Massachusetts, on May 16, 2005, at 9:00 a.m., for the following purposes.

- 1.

- To elect a Board of Directors.

- 2.

- To consider and transact such other business as may properly come before the Meeting or any adjournment or adjournments thereof.

Stockholders of record at the close of business on April 22, 2005 are entitled to notice of and to vote at the Meeting.

Dated: April 26, 2005

PROXY STATEMENT

Solicitation of Proxies

The accompanying Proxy is solicited by the Board of Directors of the Company. All shares represented by the accompanying Proxy will be voted in accordance with the specified choice of the stockholders. In the absence of directions, the Proxy will be voted for the election of the nominees for Directors named in this Proxy Statement, and for the ratification of the appointment of Vitale, Caturano & Company, Ltd. as independent auditors for the year 2005. The Proxy may be revoked at any time before it is exercised by notifying the Company in writing at the address listed on the Notice of Annual Meeting of Stockholders, Attention—Office of the Secretary, by delivering a later signed proxy, or by voting in person at the Meeting.

All costs of solicitation of Proxies will be borne by the Company. In addition to solicitation by mail, the Company's Directors, officers and regular employees, without additional remuneration, may solicit Proxies by telephone, facsimile and personal interviews. Brokers, custodians and fiduciaries will be requested to forward Proxy soliciting material to the owners of stock held in their names, and the Company will reimburse them for their out-of-pocket and clerical disbursements in connection therewith. This Proxy Statement and accompanying Proxy are first being mailed to stockholders on or about April 26, 2005.

Outstanding Voting Securities and Voting Rights

The outstanding voting securities of the Company as of April 22, 2005 consisted of 3,698,230 shares of Common Stock. Only stockholders of record at the close of business on April 22, 2005 will be entitled to vote at the Meeting. Stockholders are entitled to one vote per share. All stockholders have cumulative voting rights with respect to the election of Directors, which means that a stockholder's total vote (number of shares held multiplied by the number of Directors to be elected) may be cast entirely for one nominee or distributed among two or more nominees. The Board of Directors is soliciting discretionary authority to cumulate votes. The vote of the holders of a majority of the Common Stock voting at the Meeting will be sufficient to take action on all matters.

For purposes of determining the number of votes cast, only those cast "For" or "Against" are included. Under Securities and Exchange Commission rules, boxes and a designated blank space are provided on the proxy card for stockholders to mark if they wish either to abstain on one or more of the proposals or to withhold authority to vote for one or more nominees for Director. In accordance with New York State law, such abstentions and withholdings of authority are not counted in determining the votes cast in connection with the selection of auditors or the election of one or more of the nominees for Director.

1

1. ELECTION OF DIRECTORS

The persons named in the accompanying Proxy, unless otherwise instructed, intend to vote shares in favor of the election as Directors for the ensuing year of the Nominees named below, and will be entitled to vote cumulatively in respect of any such nominees. In case any of those named should become unavailable to serve, it is intended that votes may be cast for a substitute. Paul Sonnabend, who has served as a Director of the Company since 1961, is not standing for re-election, and Stephen Sonnabend, who served as a Director of the Company from 1964—May 2004, is standing for election to the Board. The Board of Directors of the Company has no reason to believe the persons named will be unable or decline to serve if elected.

Nominees

|

| | Owned Beneficially

as of

April 1, 2005(1)

|

|---|

Name, Age and Principal Occupation

|

| | Shares and

Percent of

Common Stock(2)

|

|---|

| George S. Abrams | Age 73: Director since May, 1995; | | |

| Attorney | | 1,070

(Less than .1%) |

Mr. Abrams has been an attorney associated with the law firm Winer and Abrams, Boston, Massachusetts for more than 25 years. He formerly served as General Counsel and Staff Director of the United States Senate Judiciary Subcommittee on Refugees. Mr. Abrams is a Director of Viacom, Inc. and of National Amusements, Inc. Mr. Abrams also serves as a trustee and on the Visiting Committees of a number of cultural, arts-related and educational institutions, including the Museum of Fine Arts, in Boston, and Harvard University. |

|

|

Vernon R. Alden |

Age: 81; Director since May, 1978; |

|

|

| Director and Trustee of several organizations | | 5,638

(.15%) |

Mr. Alden was Chairman of the Board and Executive Committee of The Boston Company, Inc., a financial services company, from 1969 to 1978. He was President of Ohio University from 1961 to 1969. Mr. Alden is a former Director of Digital Equipment Corporation, Colgate-Palmolive Company, McGraw-Hill, The Mead Corporation and Intermet Corporation. He is an Independent General Partner of three ML-Lee Acquisition Funds and trustee of several cultural and educational organizations. Mr. Alden is Chairman of the Japan Society of Boston. |

|

|

| | | | |

2

Joseph L. Bower |

Age: 66; Director since May, 1984; |

|

|

| Donald Kirk David Professor of Business Administration, Harvard Business School | | 400

(Less than .1%) |

Mr. Bower has been a member of the faculty of the Harvard Business School since l963 and has served as Senior Associate Dean for External Relations, Chair of the Doctoral Programs, Director of Research, and currently chairs The General Manager Program. Mr. Bower is a Director of ANIKA Therapeutics, Inc., Brown Shoe Co., Inc., New America High Income Fund, and Loews Corporation; he is a trustee of the TH-Lee Putnam Emerging Opportunities Portfolio; and he is Vice Chair of the New England Conservatory of Music, and a trustee of the DeCordova and Dana Museum and Sculpture Park. He has published extensively on strategy, organization, and leadership. |

|

|

Charles J. Clark |

Age: 56; Director since May, 2003 |

|

|

| Vice President for Asset Development, YouthBuild USA | | 504

(Less than .1%) |

Mr. Clark is Vice President for Asset Development at YouthBuild USA, a non-profit organization that assists out of work and out of school young adults. Prior to joining YouthBuild, Mr. Clark was a Senior Vice President, Commercial Banking, with USTrust and Citizens Bank of Massachusetts from 1986 to January 2003, and has more than 30 years of experience in banking. Mr. Clark serves on several non-profit boards and committees. He is the Board Chair of Boston Community Capital, and a member of the Executive Committee of Junior Achievement Northern New England. Mr. Clark is a member of the Finance and Administration Committee of the United Way of Massachusetts Bay and a member of the Finance Committee of Federated Dorchester Neighbor Houses. He is a former Trustee of the New England College of Finance; a former Board Member of Jobs For Youth; a former Board Member of the Massachusetts Alliance for Small Contractors; a former member of the Investment Committee of the Property and Casualty Initiative; a former Board Member of Massachusetts Certified Development Corporation; and a former Board Member of YouthBuild USA. |

|

|

| | | | |

3

Peter J. Sonnabend(3) |

Age: 51; Director since May, 1995; |

|

|

| Chief Executive Officer and Vice Chairman of the Board, Sonesta International Hotels Corporation | | 215,724(4)(5)

(5.8%) |

After graduating from Wesleyan University and Boston University School of Law, Mr. Sonnabend practiced law with the Boston law firm of Winer and Abrams from 1980 to 1987. In March 1987, he joined the Company as Vice President and Assistant Secretary, in May 1987 he became Vice President and Secretary, and in May 1995 was named Vice Chairman of the Board. He also represented the Company as General Counsel. In December 2003, Mr. Sonnabend was named Chief Executive Officer and Vice Chairman of the Board. Mr. Sonnabend is a trustee of The Institute of Contemporary Art, in Boston. |

|

|

Roger P. Sonnabend(3) |

Age: 79, Director since May, 1959; |

|

|

| Executive Chairman of the Board, Sonesta International Hotels Corporation | | 184,370(4)

(4.9%) |

Mr. Sonnabend, a graduate of the Massachusetts Institute of Technology and Harvard Business School, became a Vice President of the Company in 1956 after ten years of hotel managerial experience. Subsequently, he was Executive Vice President and from 1963 to 1970 was President of the Company. Since June 1970, Mr. Sonnabend has been Chairman of the Board and from January 1978 until November 1983 he also held the office of President. He served as the Company's Chief Executive Officer and Chairman of the Board until December 2003, when he was named Executive Chairman of the Board. He is involved with many professional, business, community and educational institutions. |

|

|

Stephanie Sonnabend(3) |

Age: 52; Director since January, 1996; |

|

|

| Chief Executive Office and President, Sonesta International Hotels Corporation | | 255,750(4)

(6.9%) |

Ms. Sonnabend graduated from Harvard University in 1975 and The MIT Sloan School of Management, in 1979. She joined the company in 1979 and held various managerial positions including Vice President of Sales, Vice President of Marketing, and Executive Vice President. In January 1996, she became President of the Company, and, in December 2003, was named Chief Executive Officer and President. Ms. Sonnabend serves on the Board of Directors of Century Bancorp and Century Bank and Trust, and the Board of Trustees of New England Conservatory. |

|

|

| | | | |

4

Stephen Sonnabend(3) |

Age:73; Director from April, 1964 - May 2004; |

|

|

| Senior Vice President, Sonesta International Hotels Corporation | | 103,248(4)

(2.8%) |

Mr. Sonnabend has served as General Manager of the Royal Sonesta Hotel in Cambridge and the Sonesta Beach Resort in Key Biscayne. In 1970, he became Senior Vice President of the Company and serves as President of the Sonesta Beach Resort, in Key Biscayne, Florida. |

|

|

Jean C. Tempel |

Age: 62; Director since September 1, 1995 |

|

|

| Managing Director, First Light Capital | | 10,000

(.27%) |

Ms. Tempel is Managing Partner of First Light Capital, a venture capital group, formerly Special Limited Partner, TL Ventures (1996-1998); General Partner, TL Ventures (1994-1996); and President and Chief Operating Officer of Safeguard Scientifics, Inc., a public technology business incubator company (1991-1993). Ms. Tempel holds Directorships at DB Scudder Mutual Funds (family of mutual funds), Aberdeen Group (technology research), United Way of Massachusetts Bay, and The Commonwealth Institute. Ms Tempel is a Trustee of Connecticut College, as well as Vice Chair of the Board and Chair of the Finance Committee. She is also a Trustee of Northeastern University, and Chair of the Funds and Endowment Committee. |

|

|

- (1)

- Shares are considered beneficially owned for the purposes of this Proxy Statement if held by the person indicated as beneficial owner, or if such person, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has the power to vote, to direct the voting of and/or to dispose of or to direct the disposition of, such security, or if the person has the right to acquire beneficial ownership within sixty (60) days.

- (2)

- As of April 1, 2005 the nominees listed in the table above beneficially owned an aggregate of 867,076 shares of the Company's Common Stock, representing 23% of that class of equity securities.

- (3)

- Roger, Paul (an officer of the Company) and Stephen Sonnabend are brothers. Stephanie Sonnabend is the daughter of Roger Sonnabend. Peter J. Sonnabend is the son of Paul Sonnabend.

- (4)

- By virtue of his or her stock ownership interest and position with the Company, he or she may be deemed to control the Company (or be in common control with other stockholders of the Company) within the meaning of the rules and regulations of the Securities and Exchange Commission under the Securities Exchange Act of 1934.

- (5)

- Of these shares, 65,000 are held as a trustee of trusts for the benefit of Paul Sonnabend's children and grandchildren.

5

INFORMATION RELATIVE TO THE BOARD OF DIRECTORS

AND CERTAIN OF ITS COMMITTEES

Determination of Independence

The Company's stock is listed on the NASDAQ Stock Market under the symbol SNSTA. Under current NASDAQ rules, a Director of the Company qualifies as "independent" only if he or she is not an officer or employee of the Company or its subsidiaries and, in the opinion of the Company's Board of Directors, he or she does not have any other relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In addition, Directors will not be independent if they meet certain categorical standards in the NASDAQ rules. In evaluating potentially material relationships, the Company's Board of Directors considers commercial, banking, legal, accounting, charitable and familial relationships, among others. The Company's Board of Directors has determined that none of Messrs. Alden, Abrams, Bower and Clark, nor Ms. Tempel, has a material relationship with the Company, and each of these Directors is "independent" as determined under NASDAQ rules and Securities and Exchange Commission rules and regulations.

Nominating and Corporate Governance Committee and Director Candidates

The Company's Board of Directors has a Nominating and Corporate Governance Committee consisting of Messrs. Bower, Alden, and Clark, all of whom are independent Directors. Mr. Bower serves as Chairman of this Committee. The functions of this Committee include consideration of the composition of the Board of Directors, recommendation of individuals for election as Directors of the Company, and developing procedures and guidelines regarding corporate governance issues. (The "Nominating and Corporate Governance Committee Charter" is available on the Company's website: www.sonesta.com)

The Company's stockholders may recommend Director candidates for inclusion by the Board of Directors in the slate of nominees the Board of Directors recommends to the Company's stockholders for election. The qualifications of recommended candidates will be reviewed by the Nominating and Corporate Governance Committee. If the Board of Directors determines to nominate a stockholder-recommended candidate and recommends his or her election as a Director by the stockholders, the name will be included in our proxy card for the Annual Meeting of Stockholders at which his or her election is recommended.

Stockholders may recommend individuals for the Nominating and Corporate Governance Committee to consider as potential Director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of the Company's stock for at least a year as of the date such recommendation is made to the "Sonesta Nominating and Corporate Governance Committee" c/o Office of the Secretary, Sonesta International Hotels Corporation, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116. The Nominating and Corporate Governance Committee will consider a proposed Director candidate only if appropriate biographical information and background material is provided on a timely basis. The process followed by the Nominating and Corporate Governance Committee to identify and evaluate candidates includes requests to Board of Directors members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of the Nominating and Corporate Governance Committee and the Board of Directors. Assuming

6

that appropriate biographical and background material is provided for candidates recommended by stockholders, the Nominating and Corporate Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board of Directors members.

In evaluating a candidate's experience and skills, the Nominating and Corporate Governance Committee may also consider qualities such as an understanding of the hotel industry, marketing, finance, regulation and public policy and international issues. In evaluating a candidate's independence, the Nominating and Corporate Governance Committee will consider the applicable independence standards of the NASDAQ Stock Market and such other factors as the Committee deems appropriate. The Nominating and Corporate Governance Committee will evaluate each Director candidate in the context of the perceived needs of the Board of Directors and the best interests of the Company and its stockholders. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Company believes that the backgrounds and qualifications of Directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Company's Board of Directors to fulfill its responsibilities.

Audit Committee

The Company's Board of Directors has an Audit Committee consisting of Messrs. Abrams, Alden, Bower and Clark, all of whom are independent Directors. Mr. Clark serves as Chairman of this Committee, which meets periodically with the Company's management and independent public accountants to assure that they are carrying out their responsibilities. Additionally, this Committee assists the Board of Directors in overseeing the integrity of the Company's financial statements, the Company's compliance with legal and regulatory requirements, and the performance of the Company's internal audit function and independent auditors. (The "Audit Committee Charter" is available on the Company's website: www.sonesta.com)

Executive Committee

The Company's Board of Directors has an Executive Committee consisting of Messrs. Bower, Paul Sonnabend, Roger P. Sonnabend, and Ms. Tempel. Mr. Paul Sonnabend presently serves as Chairman of this Committee, but because he is not standing for re-election to the Board, a new Chairman of this Committee will be designated at the next Meeting of the Board of Directors, presently scheduled for May 16, 2005. The Committee has the authority, except as proscribed by law, to exercise the powers of the Directors in the management of the business affairs and property of the Company during the intervals between the meetings of the Board of Directors.

Compensation Committee

The Company's Board of Directors has a Compensation Committee consisting of Messrs. Alden and Bower and Ms. Tempel, all of whom are independent Directors. Mr. Bower serves as Chairman of this Committee, which meets periodically to review, consider and approve the appropriateness of the compensation of the Company's management, and to review the Company's policy objectives regarding executive compensation. (The "Compensation Committee Charter" is available on the Company's website: www.sonesta.com)

7

Communications from Stockholders and Other Interested Parties

The Company's Board of Directors will give appropriate attention to written communications on issues that are submitted by stockholders and other interested parties, and will respond if and as appropriate.

Stockholders who wish to communicate with the Company's entire Board of Directors may do so by writing to Peter J. Sonnabend, Chief Executive Officer and Vice Chairman of the Board, Sonesta International Hotels Corporation, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116. Stockholders who wish to communicate with individual Directors, should address their communications to David A. Rakouskas, Secretary, Sonesta International Hotels Corporation, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116. All such communications will be forwarded by the Secretary directly to the person or persons for whom they are intended, as identified in the relevant communication.

Directors' Attendance and Fees

Directors who are not salaried employees of the Company receive annual compensation of $12,000, plus an attendance fee of $600 per meeting.

During 2004 there were five meetings of the Board of Directors, one meeting of the Compensation Committee, and two meetings of the Audit Committee. The Executive Committee did not meet during 2004. Each of the nominees attended at least 75% of the total number of meetings of the Board of Directors and of the committees on which such Directors served during 2004. The Company has no express policy regarding Board members attendance at its Annual Meeting of Stockholders; all directors attended the Company's 2004 Annual Meeting of Stockholders.

Executive Compensation

Set forth below is the compensation paid and/or accrued by the Company, including its subsidiaries, for services in all capacities for the last three completed fiscal years to or for the benefit of the Chief

8

Executive Officers and each of its four other most highly compensated executive officers whose aggregate cash compensation exceeded $100,000. The Company has no equity based compensation plans.

Summary Compensation Table

| | Annual Compensation

|

|---|

Name & Principal Position

|

|---|

| | Year

| | Salary

| | Bonus*

|

|---|

Roger P. Sonnabend

Executive Chairman of the Board | | 2004

2003

2002 | | $

| 418,374

418,374

418,374 | | $

| 26,803

0

19,833 |

Paul Sonnabend

Chairman of Executive Committee & Executive Vice President |

|

2004

2003

2002 |

|

$

|

396,158

396,158

396,158 |

|

$

|

25,380

0

18,780 |

Felix Madera

Vice President, International |

|

2004

2003

2002 |

|

$

|

388,579

384,732

367,200 |

|

$

|

24,894

0

17,749 |

Jacqueline Sonnabend

Executive Vice President |

|

2004

2003

2002 |

|

$

|

327,694

324,450

310,759 |

|

$

|

20,994

0

14,933 |

Peter J. Sonnabend

Chief Executive Officer and Vice Chairman |

|

2004

2003

2002 |

|

$

|

327,694

324,450

308,942 |

|

$

|

20,994

0

14,933 |

Stephanie Sonnabend

Chief Executive Officer and President |

|

2004

2003

2002 |

|

$

|

327,694

324,450

308,942 |

|

$

|

20,994

0

14,933 |

- *

- These bonuses were paid under the Company's incentive compensation plan (see p. 10)

Agreements with Executives

The Company entered into Restated Employment Agreements with Roger P. Sonnabend, Paul Sonnabend, and Stephen Sonnabend, effective as of January 1, 1992, and amended and updated in November 1995 (Paul) and March 1996 (Roger, Stephen), which replaced Restated Employment Agreements dated January 1, 1984, at annual base salaries of at least $418,374, $396,158, and $280,395, respectively. The current terms ended December 31, 2002, but automatically renew for successive one year terms unless terminated by either party. Upon the death of any of such executives, the Company has undertaken to continue payments to their respective "Beneficiary" (as defined in each Agreement) in an amount equal to fifty percent (50%) of the applicable base salary as of the date of death, for a period of four years following death. Under separate agreements, dated December 31, 1991, and amended and updated in November 1995 (Paul) and March 1996 (Roger, Stephen), the Company has agreed that in the event of the permanent and total disability of Roger P. Sonnabend, Paul Sonnabend or Stephen Sonnabend while in the employ of the Company, the Company will continue payments to such executive in an amount equal to fifty percent (50%) of the applicable base salary at the date of disability, for a period of four years

9

following the disability; and if death occurs during disability, for the balance of the four-year period, to the executive's spouse, estate or other designated beneficiary.

Incentive Compensation Plan

The Company has an incentive compensation plan under which pre-tax profit thresholds are established at the beginning of each year for certain of its hotels. Once the profit threshold is reached at a hotel, key employees of that hotel are entitled to receive a cash bonus equal to 3% of their annual salary, and 10% of any profits in excess of the threshold are shared proportionally by the same group. Additionally, key employees of each hotel may receive a bonus of up to two percentage points based on an evaluation of that hotel's performance in the areas of personal service and hotel physical appearance. The total incentive bonus paid out during each year is capped at 25% of base salary. Executive office key employees, including officers of the Company, are entitled to receive incentive payments equal to that percentage of their respective salaries which equals the average (as a percentage of salaries) of all incentive payments made to certain hotel key employees as a group.

Because of reduced business levels experienced by the Company since 2001, revisions were made to the incentive compensation plan for the years 2002, 2003 and 2004, which will remain in effect for 2005. Under the revised plan, thresholds were established, as usual, but the base bonus amounts and the percentage participation in excess profits were reduced. In addition, the executive office key employees' bonus participation was reduced by eliminating certain components from the hotel bonus calculations which are used as a basis to compute the bonuses for the key executive office employees. The aforementioned changes reduced annual incentive compensation expense from an average of approximately $1,600,000 for the years 1998, 1999 and 2000 to an average of approximately $446,000 during the years 2001, 2002, 2003 and 2004. Incentive bonuses equal to 6.4% of salary were paid to executive office key employees for the year 2004.

Pension Plan

The Company has an I.R.S. qualified defined benefit pension plan which covers all non-union salaried employees at its executive offices and its hotels in Boston (Cambridge), Key Biscayne and New Orleans, and certain of its managed hotels. All officers and Directors who are full-time employees of the Company are covered under this plan. Benefits under the plan are based on the average compensation for the highest sixty consecutive months of service during employment, reduced proportionately for each year of service less than twenty-seven (full service period). The plan provides for integration with 50% of the primary Social Security benefit, reduced proportionately for each year of service less than twenty-seven. It provides for a normal retirement age of 65 and an early retirement age of 55 with five years of service. Benefits become vested at normal retirement age or upon the completion of five years of service and attaining the age of 21. Thus, the Company is unable to ascertain the benefits which may accrue to its Directors and/or officers since the benefits are based on variable factors.

10

The following table sets forth a range of estimated annual retirement benefits under the plan upon retirement at age 65.

PENSION PLAN TABLE

| | Years of Service

|

|---|

Average Annual Compensation

for Highest Sixty

Consecutive Months

|

|---|

| | 15

| | 20

| | 25

| | 30*

| | 35*

|

|---|

| $125,000 | | $ | 28,638 | | $ | 38,184 | | $ | 47,729 | | $ | 51,548 | | $ | 51,548 |

| $150,000 | | $ | 35,582 | | $ | 47,443 | | $ | 59,303 | | $ | 64,048 | | $ | 64,048 |

| $175,000 | | $ | 42,526 | | $ | 56,702 | | $ | 70,877 | | $ | 76,548 | | $ | 76,548 |

| $200,000 | | $ | 49,471 | | $ | 65,961 | | $ | 82,452 | | $ | 89,048 | | $ | 89,048 |

| $225,000 | | $ | 56,415 | | $ | 75,221 | | $ | 94,026 | | $ | 101,548 | | $ | 101,548 |

| $250,000 | | $ | 63,360 | | $ | 84,480 | | $ | 105,600 | | $ | 114,048 | | $ | 114,048 |

| $300,000 | | $ | 77,249 | | $ | 102,999 | | $ | 128,748 | | $ | 139,048 | | $ | 139,048 |

| $350,000 | | $ | 91,138 | | $ | 121,517 | | $ | 151,896 | | $ | 164,048 | | $ | 164,048 |

| $400,000 | | $ | 105,027 | | $ | 140,036 | | $ | 165,000 | | $ | 165,000 | | $ | 165,000 |

| $450,000 | | $ | 118,915 | | $ | 158,554 | | $ | 165,000 | | $ | 165,000 | | $ | 165,000 |

| $500,000 | | $ | 132,804 | | $ | 165,000 | | $ | 165,000 | | $ | 165,000 | | $ | 165,000 |

- *

- The maximum benefit under the Company's Pension Plan is based on 27 years of service.

The above benefits are calculated on a single-life annuity basis and after deducting a portion of Social Security benefits, as described above.

For 2004 the maximum benefit allowable under the Employee Retirement Income Security Act of 1974 is $165,000.

Both Roger and Paul Sonnabend have the maximum number of years of credited service under the pension plan (27 years). Of the other individuals named in the Summary Compensation Table on page 9, Jacqueline Sonnabend has 21 years of credited service, Peter J. Sonnabend has 18 years of credited service, and Stephanie Sonnabend has 26 years of credited service.

Compensation Committee Report on Executive Compensation

The Compensation Committee, which is comprised solely of independent directors, is responsible for reviewing, approving and administering executive compensation. This responsibility includes determining job responsibilities, monitoring job performance, researching the compensation paid to executives in other companies of comparable size and complexity to the Company who hold positions similar to those of Company executives, evaluating the performance and financial condition of the Company, considering factors unique to the Company, and considering changes in the cost of living.

For many years, compensation for Company executives has been based primarily on base salary and the Company's cash incentive bonus program. That formula applied, again, in 2004.

In December 2003, the Compensation Committee met to set the base salaries to be paid to the chief executive officer and the executives named in the Summary Compensation Table, and the profit thresholds regarding the Company's Incentive Compensation Plan, for 2004. The Committee considered the inherent

11

challenges of operating an international hotel company in a travel environment still affected by the impact of September 11, 2001, U.S. military involvement in Iraq, and the increasing challenges posed by third party Internet business generators. Also considered was the fact that over the past two years executive salary increases had totaled 3% (in fact, all executive officers had been required, in 2002, to take one week of unpaid leave). Based on these factors, the Committee, on management's recommendation, approved a one percent (1%) base salary increase for all executive officers of the Company—excluding the chief executive officer, the chairman of the executive committee, and senior vice president, who for the eighth consecutive year received no increase in base salary.

The second component of executive compensation relates to annual bonuses which were earned by the chief executive officer as well as all other executive and key officers of the Company under the Company's Incentive Compensation Plan. The chief executive officer(s) and the other named executive officers earn bonuses under this plan based on the average (as a percentage of salaries) of all incentive payments made to certain key hotel employees under the plan based on performance objectives established by management and approved by the Compensation Committee at the beginning of each year for certain of the Company's hotels. The Company's Incentive Compensation Plan is described in more detail under "Incentive Compensation Plan" contained elsewhere in this Proxy Statement.

The Company has not maintained a stock option plan for several years and none of the executive officers named in the Summary Compensation Table presently hold any stock options. Stock options have not been deemed a necessary part of the Company's compensation program due in part to the fact that five of the six named executive officers are beneficial owners of a significant number of shares of the Company's capital stock.

Submitted by the Compensation Committee.

Vernon R. Alden, Joseph L. Bower, Chairman, and Jean C. Tempel

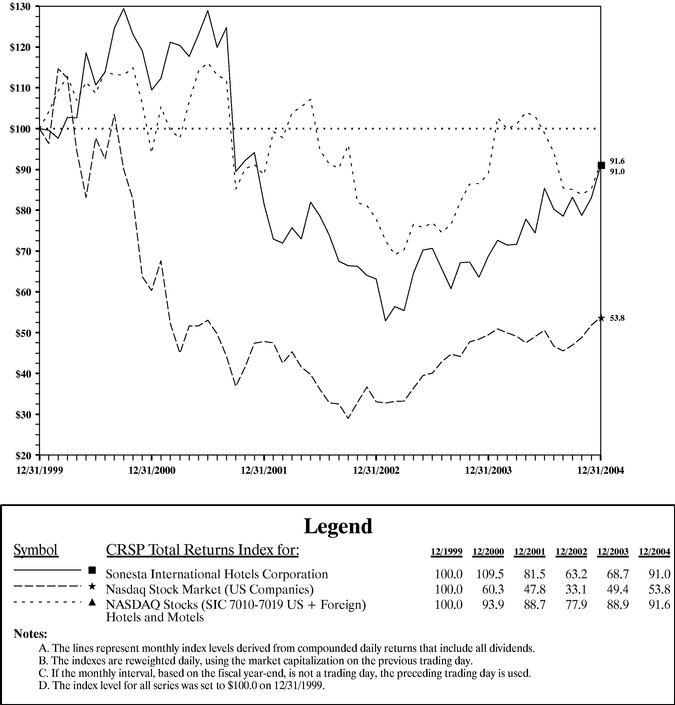

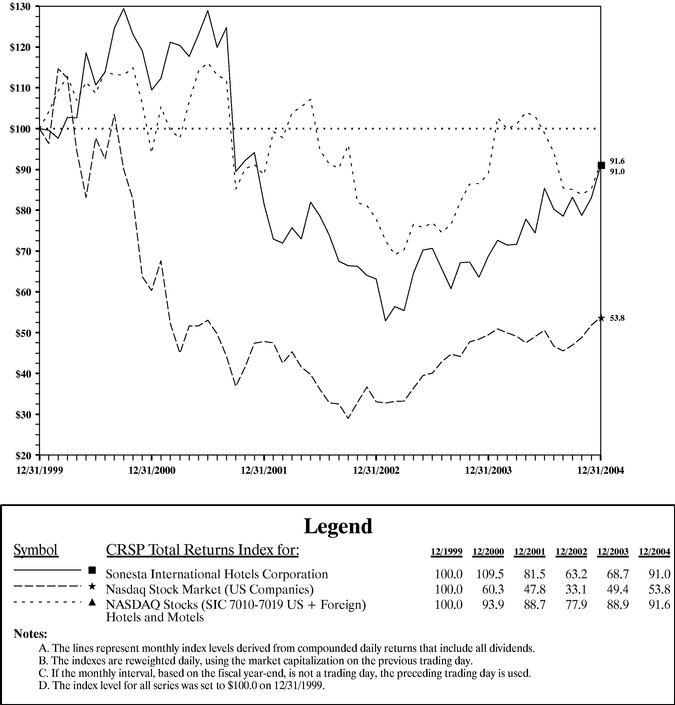

Performance Graph

The following graph compares the annual percentage change in the cumulative total stockholder return on the Company's Common Stock against the cumulative total return of the NASDAQ Stock Market (US Companies) and the NASDAQ Hotels and Motels for the five-year period commencing December 31, 1999 and ending December 31, 2004.

12

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

Sonesta International Hotels Corporation

Produced on 04/13/2005 including data to 12/31/2004

Prepared by CRSP (www.crsp.uchicago.edu), Center for Research in Security Prices, Graduate School of Business, The University of Chicago. Used with permission. All rights reserved. ©Copyright 2005

13

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Company's Board of Directors consisted of Vernon R. Alden, Joseph L. Bower, and Jean C. Tempel throughout 2004. No member of the Compensation Committee is an employee of the Company or its subsidiaries.

Certain Relationships/Transactions

The Company has purchased artwork for its hotels and executive offices from Obelisk Gallery, Inc., a corporation owned by Mrs. Roger Sonnabend. Purchases for artwork for the Company from January 1, 2004 through March 1, 2005, totaled $5,000. In addition, the Company purchased artwork from Obelisk Gallery, Inc. for hotels operated under management agreements. These purchases, which are charged to the individual properties, totaled $30,000 during the period from January 1, 2004 through March 1, 2005. The Company believes that the prices paid for such artwork are at least as favorable to the Company as would have been obtained from unrelated parties.

The Company has extended loans to certain employees. The following person was indebted to the Company in excess of $60,000 during the period January 1, 2004 through March 1, 2005: Jacqueline Sonnabend, Executive Vice President, owed up to $127,107, and paid her entire outstanding balance on March 1, 2005 of $118,081 on that date. The loan accrued interest at Prime plus one percentage point. This loan pre-dated recent legislation prohibiting such loans.

14

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information as of April 1, 2005 with respect to the Company's officers listed in "Summary Compensation Table" above, the Company's executive officers and Directors as a group, and persons known to the Company to be the beneficial owners of more than 5% of the Company's Common Stock. Ownership information for individual Directors appears on pages 2 to 5.

Name and Address

of Beneficial Owner

| | Number of Shares

Beneficially Owned(1)

| | Percent

of Class

| |

|---|

Alan M. Sonnabend

c/o Sonesta Beach Resort

350 Ocean Drive

Key Biscayne, FL 33149 | | 269,198 | | 7.3 | % |

Jacqueline Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 209,056 | | 5.6 | % |

Paul Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 174,516 | | 4.7 | % |

Peter J. Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 215,724 | | 5.8 | % |

Roger P. Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 184,370 | | 4.9 | % |

Stephanie Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 255,750 | | 6.9 | % |

Stephen Sonnabend

116 Huntington Avenue

Boston, MA 02116 | | 103,248 | | 2.8 | % |

Felix Madera

c/o Sonesta Beach Resort

350 Ocean Drive

Key Biscayne, FL 33149 | | 936 | | .02 | % |

Mercury Real Estate Advisors LLC(2)

100 Field Point Road

Greenwich, CT 06830 | | 703,448 | | 19 | % |

| All executive officers and Directors as group (16) persons including those noted above) | | 1,342,144 | | 36 | % |

- (1)

- See note 1 on Page 5.

- (2)

- The information is as of March 30, 2005 and is based solely on a Schedule 13G filed with the SEC on April 4, 2005 by Mercury real Estate Advisors LLC. The relevant members of the filing group are Mercury Real Estate Advisors LLC, Mercury Special Situations Fund LP, David R. Jarvis and Malcolm F. MacLean IV, each with the address as stated in this table, and Mercury Special Situations Offshore Fund, Ltd., with an address of Bison Court, P.O. Box 3460 Road Town, Tortola, BVI E9 00000, British Virgin Islands. Shares beneficially owned by Mercury Real Estate Advisors LLC, David R. Jarvis and Malcolm F. MacLean IV represent shares held by Mercury Special Situations Fund LP, Mercury Special Situations Offshore Fund, Ltd. and certain other entities of which Mercury Real Estate Advisors LLC is the investment adviser. Messrs. Jarvis and MacLean are the managing members of Mercury Real Estate Advisors LLC.

15

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our Directors and certain officers, and any person who owns more than 10% of a registered class of our equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of the Company's Common Stock. Based upon the information supplied to us by such persons, we are required to report any known failure to file these reports with the period specified by the instructions to the reporting forms. To our knowledge, based upon a review of the Section 16(a) reports furnished to us and the written representation of officers and Directors, all these filing requirements were satisfied by our Directors and officers for the fiscal year ending December 31, 2004.

Report of the Audit Committee

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board, and the matters required to be discussed by Statement on Auditing Standards No. 61, "Communications With Audit Committees," and considered the compatibility of nonaudit services with the auditors' independence. In addition, the Chairman of the Audit Committee meets with the independent auditors following the end of each of the first three calendar quarters.

The Audit Committee discussed with the Company's independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Audit Committee held two meetings during 2004, and has held one meeting to date in 2005.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission. The Audit Committee has also approved the selection of the Company's independent auditors for 2005.

Submitted by the Audit Committee.

Vernon R. Alden, George S. Abrams,

Joseph L. Bower, and Charles J. Clark, Chairman

April 26, 2005

16

INDEPENDENT PUBLIC ACCOUNTANTS

Vitale, Caturano & Company, Ltd. was appointed as the Company's independent auditors by the Audit Committee of the Board of Directors of the Company, effective November 15, 2004. Ernst & Young LLP acted as independent auditors for the Company for many years, and was dismissed by the Company's Audit Committee on November 15, 2004. During the fiscal years ended December 31, 2002 and December 31, 2003, and through November 14, 2004, the Company did not consult with Vitale, Caturano & Company Ltd. regarding any accounting or auditing issues.

Vitale, Caturano & Company is a firm of independent auditors. This firm has considerable experience in the hotel industry. In the opinion of the Audit Committee of the Board of Directors of the Company, Vitale, Caturano & Company, Ltd. is fully qualified to act as independent auditors for the Company.

The change in the Company's independent auditors was due to the Company's desire to obtain expert accounting and auditing services, but at a lower cost than was available with Ernst & Young LLP. For the two fiscal years ending December 31, 2002 and December 31, 2003, and through November 15, 2004, Ernst & Young LLP's reports on the Company's financial statements did not contain an adverse opinion or disclaimer of opinion, nor was qualified or modified as to uncertainty, audit scope, or accounting principles. During 2002, 2003, and through November 15, 2004, there were no disagreements with Ernst & Young LLP on any matter of accounting principles or practices, financial statements or disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of Ernst & Young LLP, would have caused it to make a reference to the subject matter of the disagreement(s) in connection with its report. The decision to change the Company's independent auditors was recommended and approved by the Audit Committee.

The Audit Committee has previously reviewed and approved the scope of the annual audit by the Company's independent public accountants. The Committee also reviews all services and fees at the end of each annual audit. Fees paid to Ernst & Young LLP for the last two fiscal years were:

| | FY 2003

| | FY 2004

|

|---|

| Audit Fees | | $ | 165,650 | | $ | 22,000 |

| Audit-Related Fees | | | 13,000 | | | 18,000 |

| Tax Fees | | | — | | | — |

| | |

| |

|

| | Subtotal | | | 178,650 | | | 40,000 |

| All Other Fees | | | — | | | — |

| | |

| |

|

| Ernst & Young LLP Total Fees | | $ | 178,650 | | $ | 40,000 |

| | |

| |

|

Vitale, Caturano & Company, Ltd. received the following fees for services to the Company in 2004:

| | FY 2004

|

|---|

| Audit Fees | | $ | 110,000 |

| Audit-Related Fees | | | — |

| Tax Fees | | | — |

| | |

|

| | Subtotal | | | 110,000 |

| All Other Fees | | | — |

| | |

|

| Ernst & Young LLP Total Fees | | $ | 110,000 |

| | |

|

17

In the above tables, "Audit Fees" are fees the Company paid Ernst & Young LLP and Vitale, Caturano & Company, Ltd. for professional services for the audit of the Company's consolidated financial statements included in the Company's annual report on Form 10-K and reviews of financial statements included in the Company's quarterly reports on Form 10-Q's, or for services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements; "Audit-Related Fees" are fees billed by Ernst & Young LLP for the audit of the Company's Pension Plan and 401(k) Savings Plan; and "All Other Fees" are fees billed to the Company for any services not included in the first three categories. The Audit Committee has reviewed the fees paid to the independent auditors as part of its review of the independent auditors' independence.

The Audit Committee will not approve engagements of the Company's independent auditors to perform non-audit services for the Company if doing so will cause the Company's independent auditors to cease to be independent within the meaning of applicable Securities and Exchange Commission or NASDAQ rules. In other circumstances, the Audit Committee considers, among other things, whether the Company's independent auditors are able to provide the required services in a more or less effective and efficient manner than other available service providers.

In 2004, all services for which the Company engaged its independent auditors were pre-approved by the Audit Committee. The Audit Committee approved the engagement of Ernst & Young LLP to provide non-audit services because they determined that Ernst & Young's providing these services would not compromise its independence (and that its familiarity with the Company's record keeping and accounting systems would permit them to provide these services with equal or higher quality, quicker and at a lower cost than the Company could obtain these services from other providers.)

A representative of Vitale, Caturano & Company, Ltd. is expected to be present at the Meeting and will have an opportunity to make a statement and will be available to respond to stockholders' questions. A representative of Ernst & Young is not expected to attend the Meeting.

STOCKHOLDER PROPOSALS

Proposals that stockholders intend to present at the next Annual Meeting of Stockholders must comply with Rule 14a-8 of the Securities and Exchange Commission issued under the Securities Exchange Act of 1934 and must be received at the principal executive offices of the Company, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116 not later than February 26, 2006.

A stockholder who intends to present a proposal at the 2006 Annual Meeting of Stockholders for inclusion in the Company's proxy materials relating to that meeting must submit the proposal by December 15, 2005. In order for the proposal to be included in the proxy statement, the stockholder submitting the proposal must meet certain eligibility standards and comply with the requirements as to form and substance established by applicable laws and regulations. The proposal must be mailed to David A. Rakouskas, Secretary, Sonesta International Hotels Corporation, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116.

18

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may participate in the practice of "householding" proxy statements and annual reports. This means that unless stockholders give contrary instructions, only one copy of the Company's proxy statement or annual report may be sent to multiple shareholders in each household. The Company will promptly deliver a separate copy of either document to a stockholder if he or she calls or writes to the Company at the following address or telephone number: David A. Rakouskas, Secretary, Sonesta International Hotels Corporation, 116 Huntington Avenue, Floor 9, Boston, Massachusetts 02116; (617) 421-5453. If a stockholder wants to receive separate copies of the Company's proxy statement or annual report in the future, or is a stockholder is receiving multiple copies and would like to receive only one copy per household, he or she should contact his or her bank, broker or other record holder, or he or she may contact the Company at the above address or telephone number.

MISCELLANEOUS

The Board of Directors does not know of any matters, other than those discussed in this Proxy Statement, which may come before the Meeting. However, if any other matters are properly presented at the Meeting, it is the intention of the persons named in the accompanying Proxy to vote, or otherwise act, in accordance with their judgment on such matters.

Dated: April 26, 2005

The Board of Directors hopes that all stockholders will attend the Meeting. In the meantime, you are requested to execute the accompanying Proxy and return it in the enclosed envelope. Stockholders who attend the Meeting may vote their stock personally even though they have sent in their Proxies.

19

ANNUAL MEETING OF STOCKHOLDERS OF

SONESTA INTERNATIONAL HOTELS CORPORATION

May 16, 2005

Proof #3

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ý

| 1. | | ELECTION OF DIRECTORS. |

| | | o

o

o | | FOR ALL NOMINEES

WITHHOLD AUTHORITY

FOR ALL NOMINEES

FOR ALL EXCEPT

(See instructions below) | | NOMINEES:

o G. Abrams

o V. Alden

o J. Bower

o C. Clark

o P.J. Sonnabend

o R. Sonnabend

o Stephanie Sonnabend

o Stephen Sonnabend

o J. Tempel |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark"FOR ALL EXCEPT" and fill in the circle next to each nominee you wish to withhold, as shown here: ý |

|

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. o |

|

|

|

|

|

|

|

| 2. | | Upon such other business as may properly come before the meeting or any adjournment(s) thereof. |

UNLESS OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR PROPOSAL NO. 1. |

PLEASE DATE, SIGN AND MAIL THIS PROXY PROMPTLY.

|

Signature of Stockholder Date: Signature of Stockholder Date:

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

Proof #2

PROXY

SONESTA INTERNATIONAL HOTELS CORPORATION

PROXY For Annual Meeting of Stockholders—May 16, 2005

To be held at Sonesta's Corporate Office

116 Huntington Avenue, Floor 9, Boston, Massachusetts

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of SONESTA INTERNATIONAL HOTELS CORPORATION, a New York corporation, hereby constitutes and appoints BOY A.J. VAN RIEL and PETER J. SONNABEND and each of them, the true and lawful attorneys and proxies of the undersigned with power of substitution in each of them and their respective substitute(s), for and in the name of the undersigned to vote the COMMON STOCK which the undersigned is entitled to vote at the Annual Meeting of Stockholders of Sonesta International Hotels Corporation, to be held on May 16, 2005 at 9:00 A.M., and at any adjournment(s) thereof, to the same extent and with all powers which the undersigned would possess if personally present. A majority of such attorneys and proxies or their substitute(s), or if only one be present and acting at such meeting, then that one, shall have and may exercise all of the powers of all of said attorneys and proxies. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and the Proxy Statement furnished therewith, each dated April 26, 2005.

(Continued and to be SIGNED on the other side)

QuickLinks

PROXY STATEMENT1. ELECTION OF DIRECTORSINFORMATION RELATIVE TO THE BOARD OF DIRECTORS AND CERTAIN OF ITS COMMITTEESPRINCIPAL STOCKHOLDERSINDEPENDENT PUBLIC ACCOUNTANTSSTOCKHOLDER PROPOSALSHOUSEHOLDING OF ANNUAL MEETING MATERIALSMISCELLANEOUSANNUAL MEETING OF STOCKHOLDERS OF SONESTA INTERNATIONAL HOTELS CORPORATION