in Millions of Eur Cost of product sold (523) (597) (1,402) (1,569) Selling, general and administration expenses (22) (28) (115) (82) Other income/(expenses) (13) (1) (19) (7) Amortization of intangible assets (13) (14) (40) (40) Finance expense (42) (45) (113) (117) Foreign exchange gain/(loss) (2) (1) (3) - IAS 29 Net monetary loss (1) (7) (4) (7) Income tax (19) (37) (24) (47) The notes are an integral part of these consolidated interim condensed financial statements. ‑

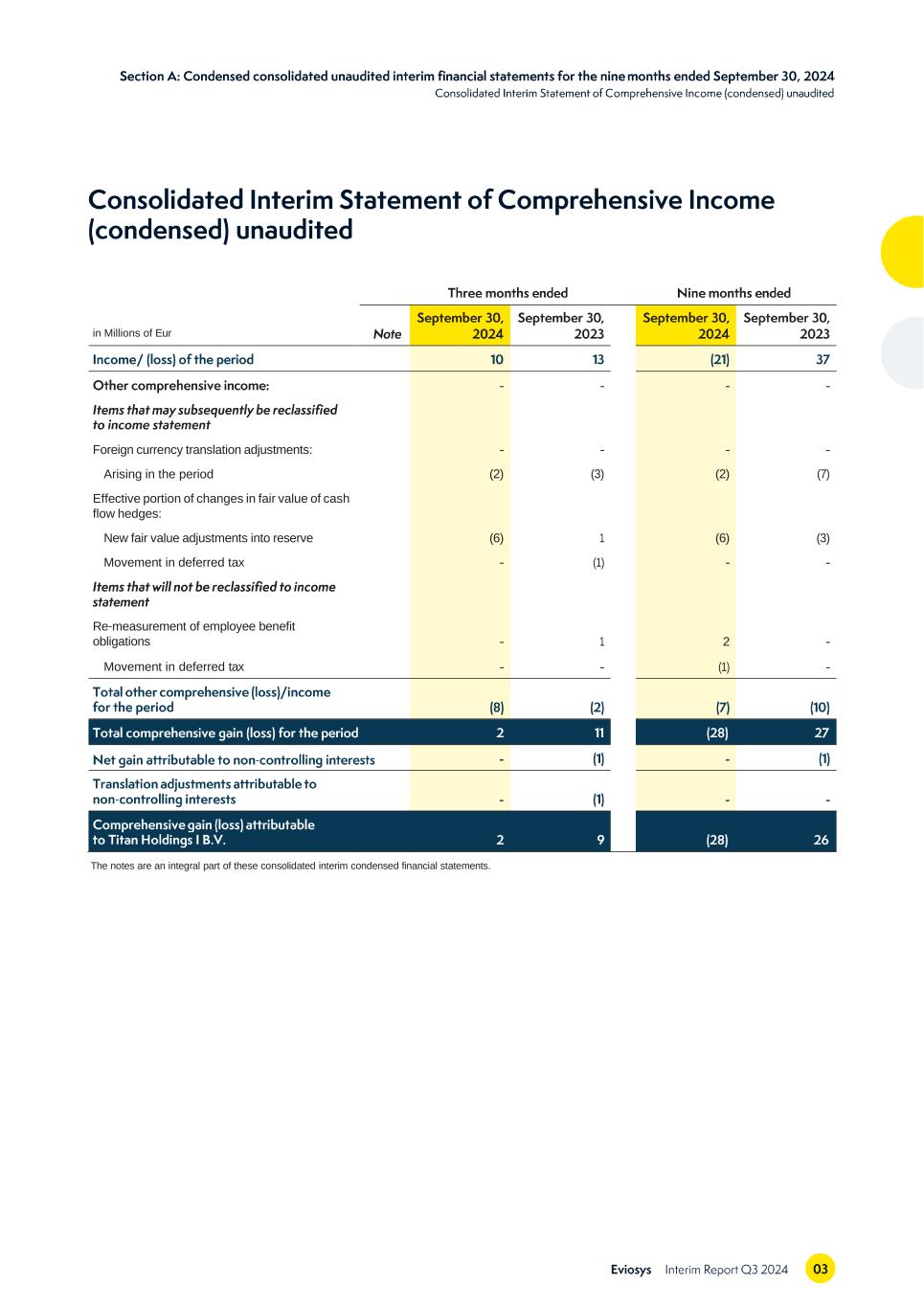

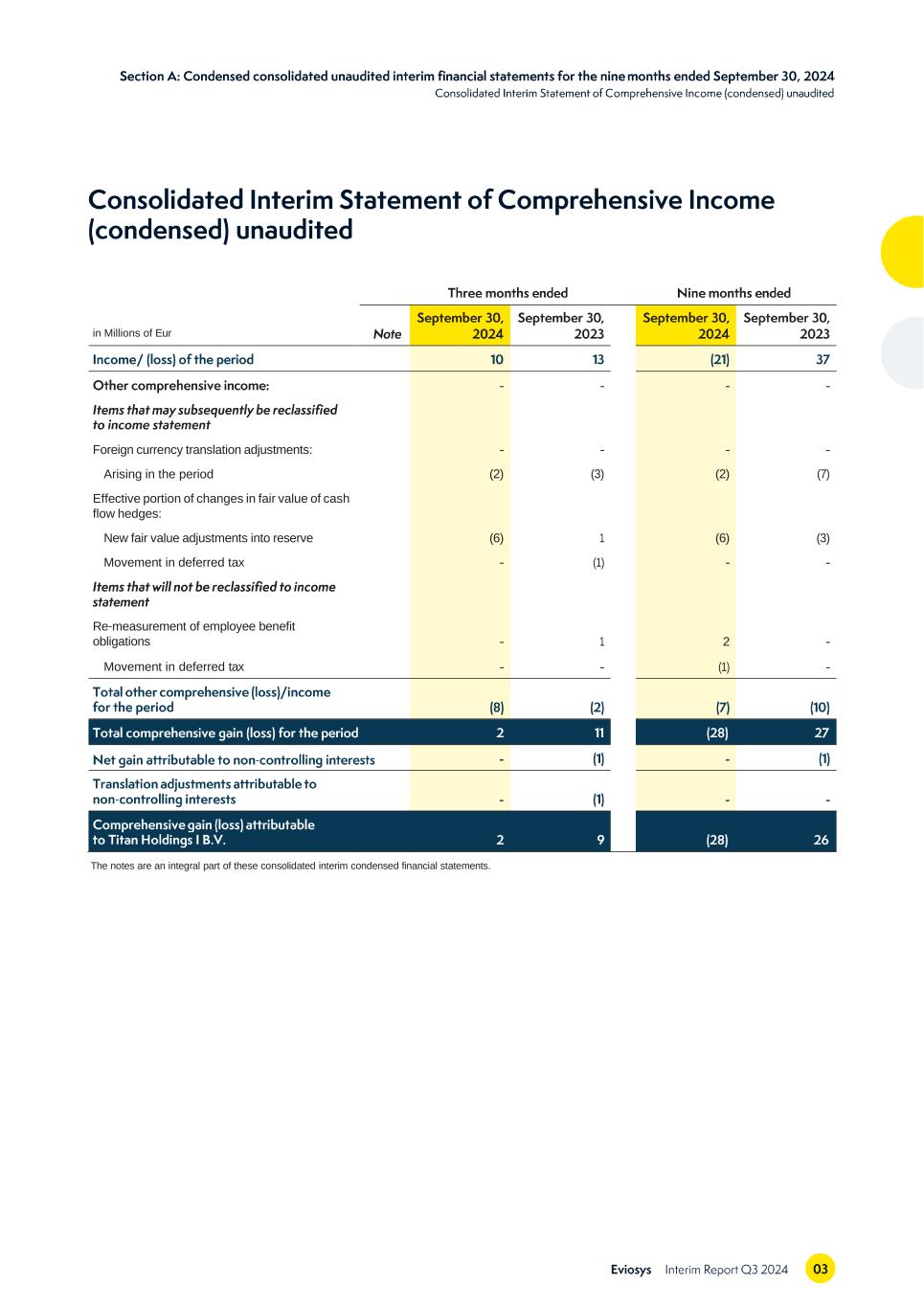

in Millions of Eur Foreign currency translation adjustments: Arising in the period Effective portion of changes in fair value of cash flow hedges: New fair value adjustments into reserve Movement in deferred tax Re‑measurement of employee benefit obligations Movement in deferred tax - - - - - - - - (2) (3) (2) (7) (6) 1 (6) (3) - (1) - - - 1 2 - - - (1) - ‑ ‑ The notes are an integral part of these consolidated interim condensed financial statements.

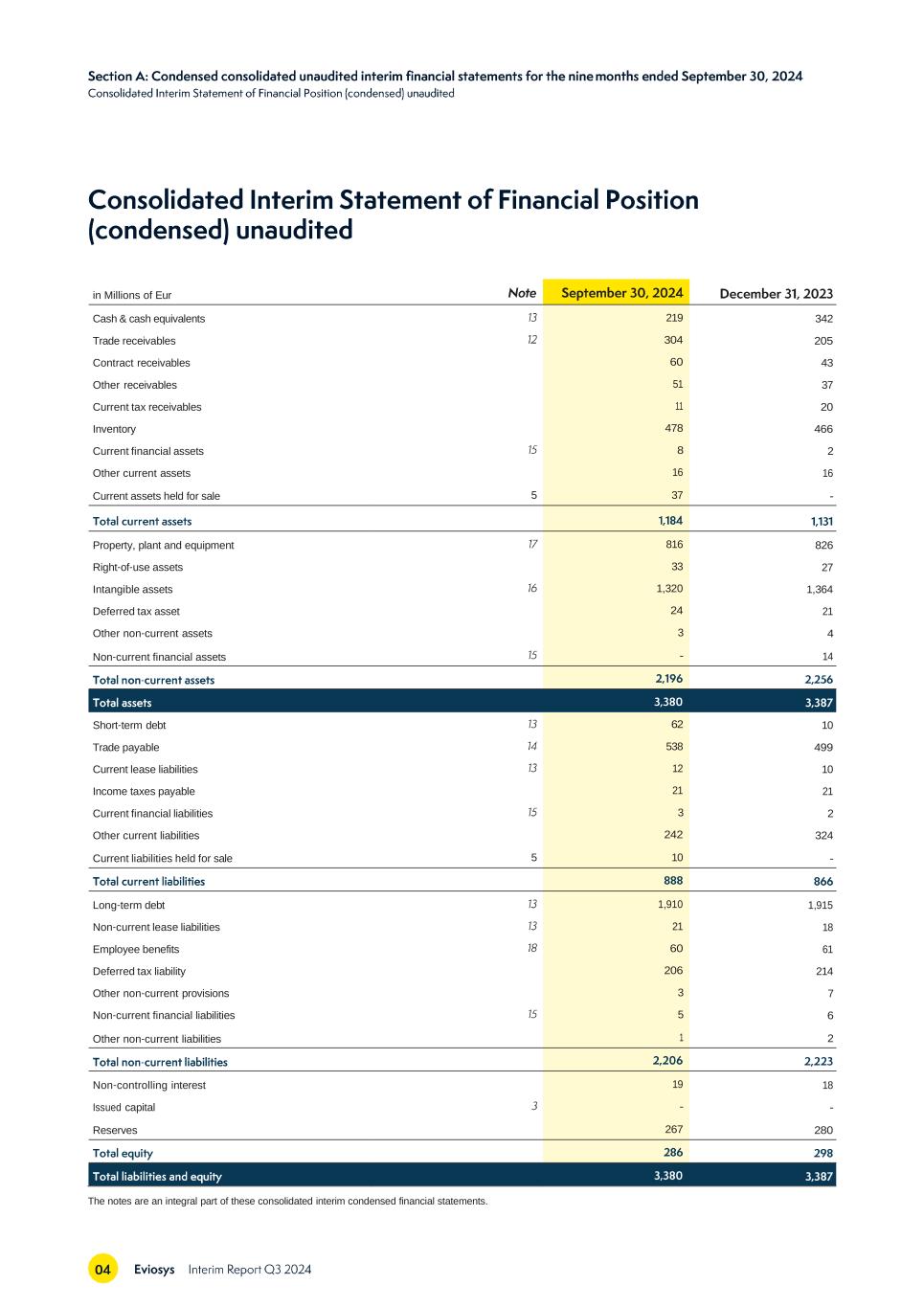

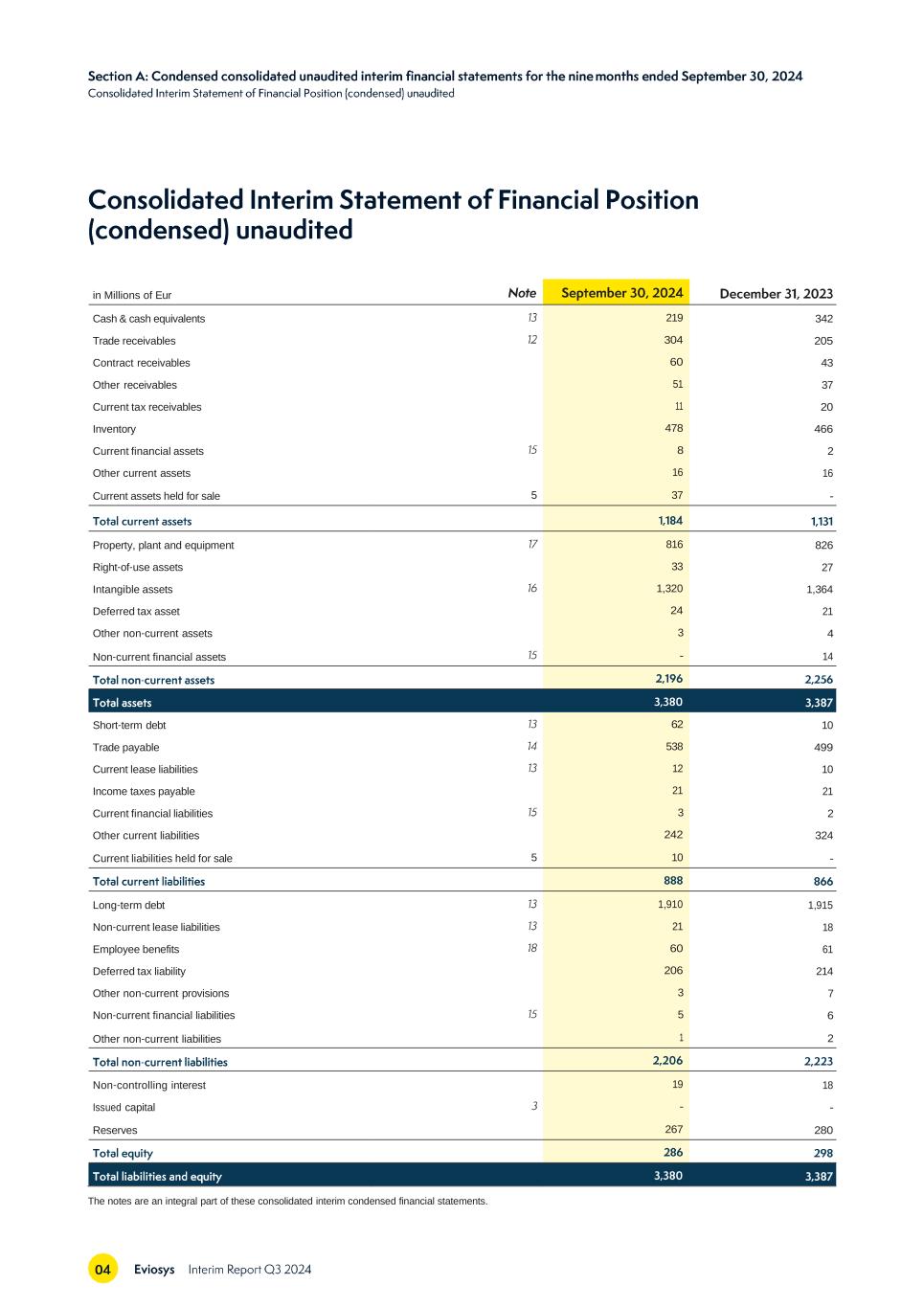

in Millions of Eur Cash & cash equivalents 219 342 Trade receivables 304 205 Contract receivables 60 43 Other receivables 51 37 Current tax receivables 11 20 Inventory 478 466 Current financial assets 8 2 Other current assets 16 16 Current assets held for sale 5 37 - Property, plant and equipment 816 826 Right‑of‑use assets 33 27 Intangible assets 1,320 1,364 Deferred tax asset 24 21 Other non‑current assets 3 4 Non‑current financial assets - 14 ‑ Short‑term debt 62 10 Trade payable 538 499 Current lease liabilities 12 10 Income taxes payable 21 21 Current financial liabilities 3 2 Other current liabilities 242 324 Current liabilities held for sale 5 10 - Long‑term debt 1,910 1,915 Non‑current lease liabilities 21 18 Employee benefits 60 61 Deferred tax liability 206 214 Other non‑current provisions 3 7 Non‑current financial liabilities 5 6 Other non‑current liabilities 1 2 ‑ Non‑controlling interest 19 18 Issued capital - - Reserves 267 280 The notes are an integral part of these consolidated interim condensed financial statements.

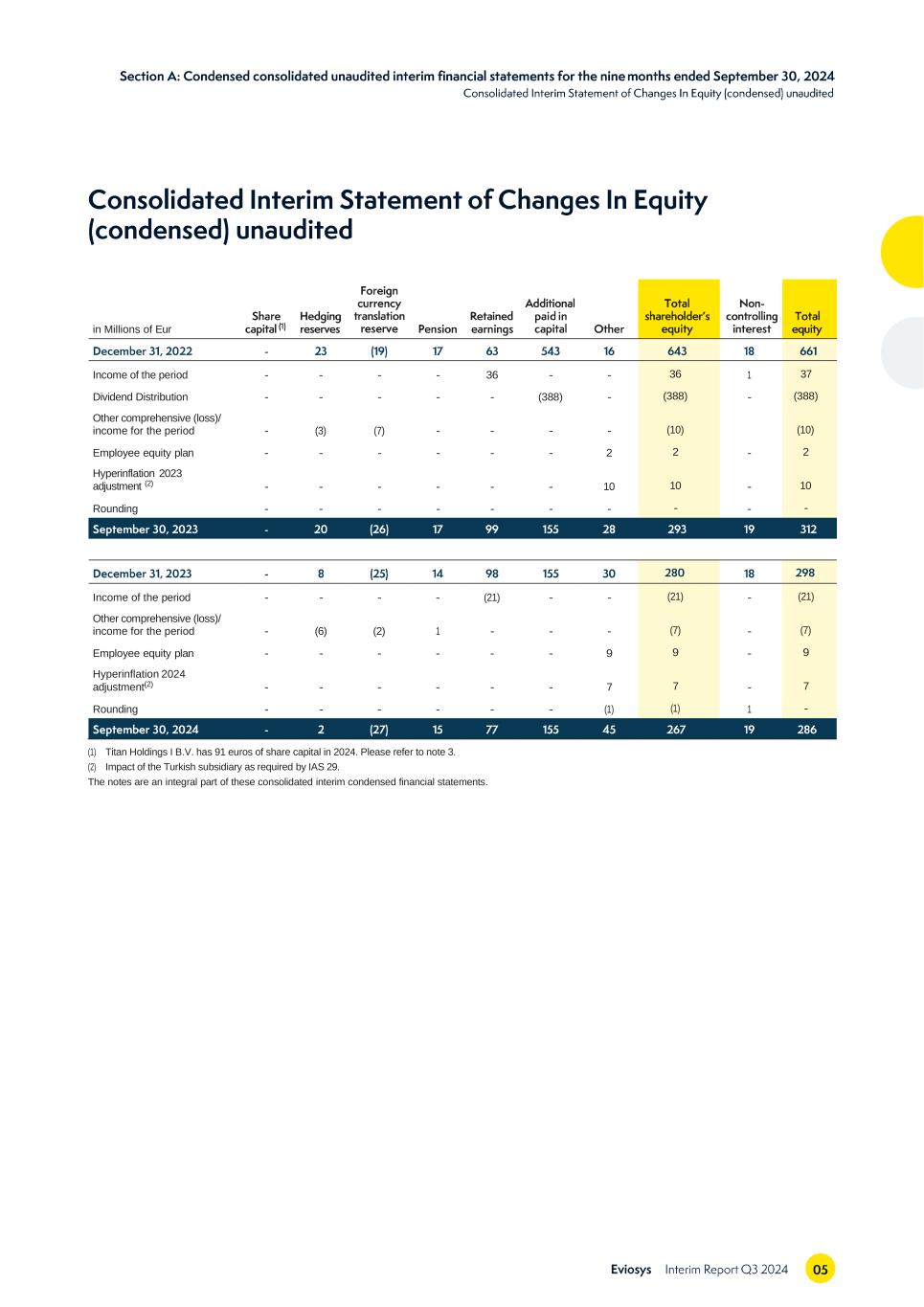

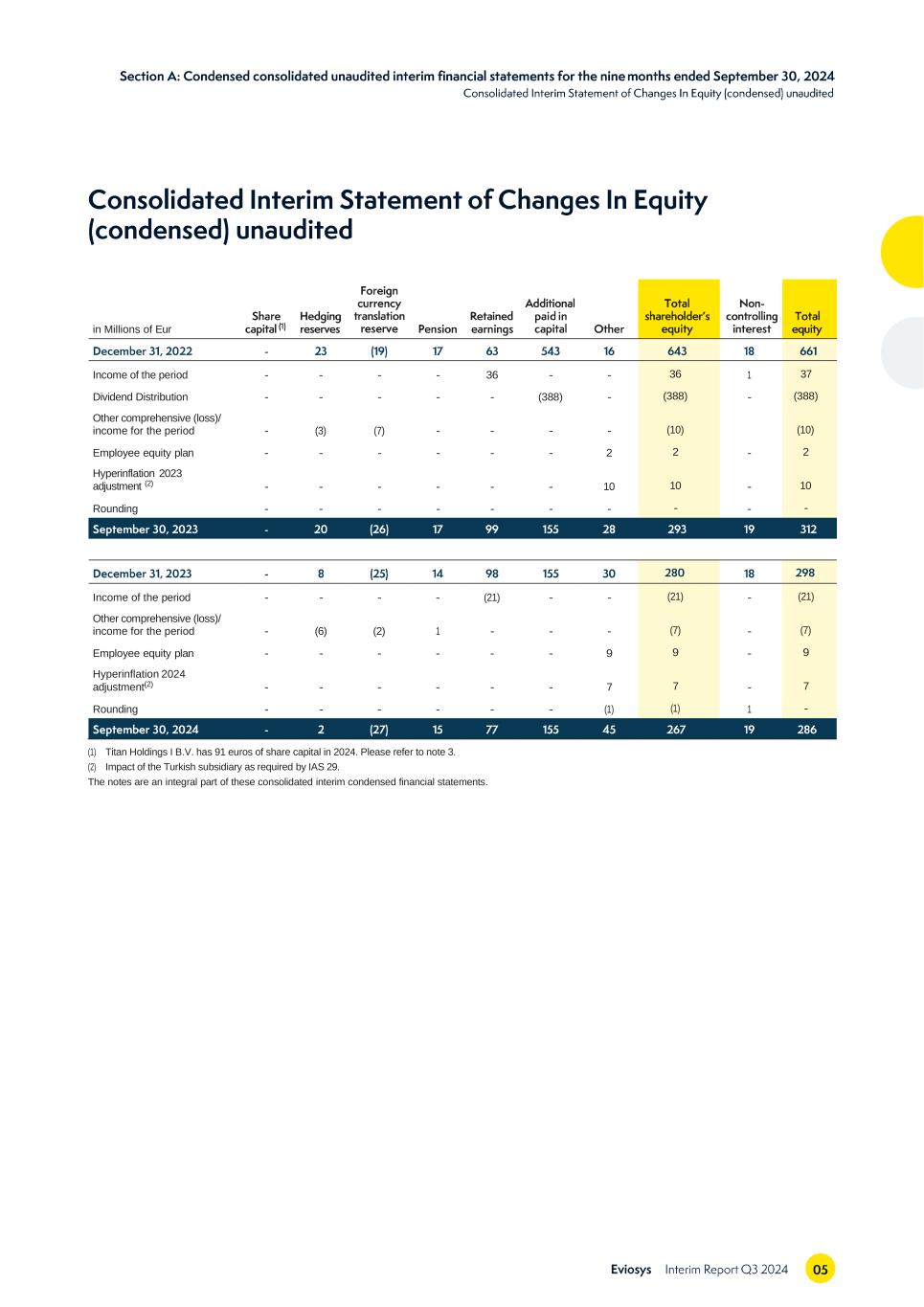

in Millions of Eur Income of the period - - - - 36 - - 36 1 37 Dividend Distribution - - - - - (388) - (388) - (388) Other comprehensive (loss)/ income for the period - (3) (7) - - - - (10) (10) Employee equity plan - - - - - - 2 2 - 2 Hyperinflation 2023 adjustment (2) - - - - - - 10 10 - 10 Rounding - - - - - - - - - - Income of the period - - - - (21) - - (21) - (21) Other comprehensive (loss)/ income for the period - (6) (2) 1 - - - (7) - (7) Employee equity plan - - - - - - 9 9 - 9 Hyperinflation 2024 adjustment(2) - - - - - - 7 7 - 7 Rounding - - - - - - (1) (1) 1 - (1) Titan Holdings I B.V. has 91 euros of share capital in 2024. Please refer to note 3. (2) Impact of the Turkish subsidiary as required by IAS 29. The notes are an integral part of these consolidated interim condensed financial statements.

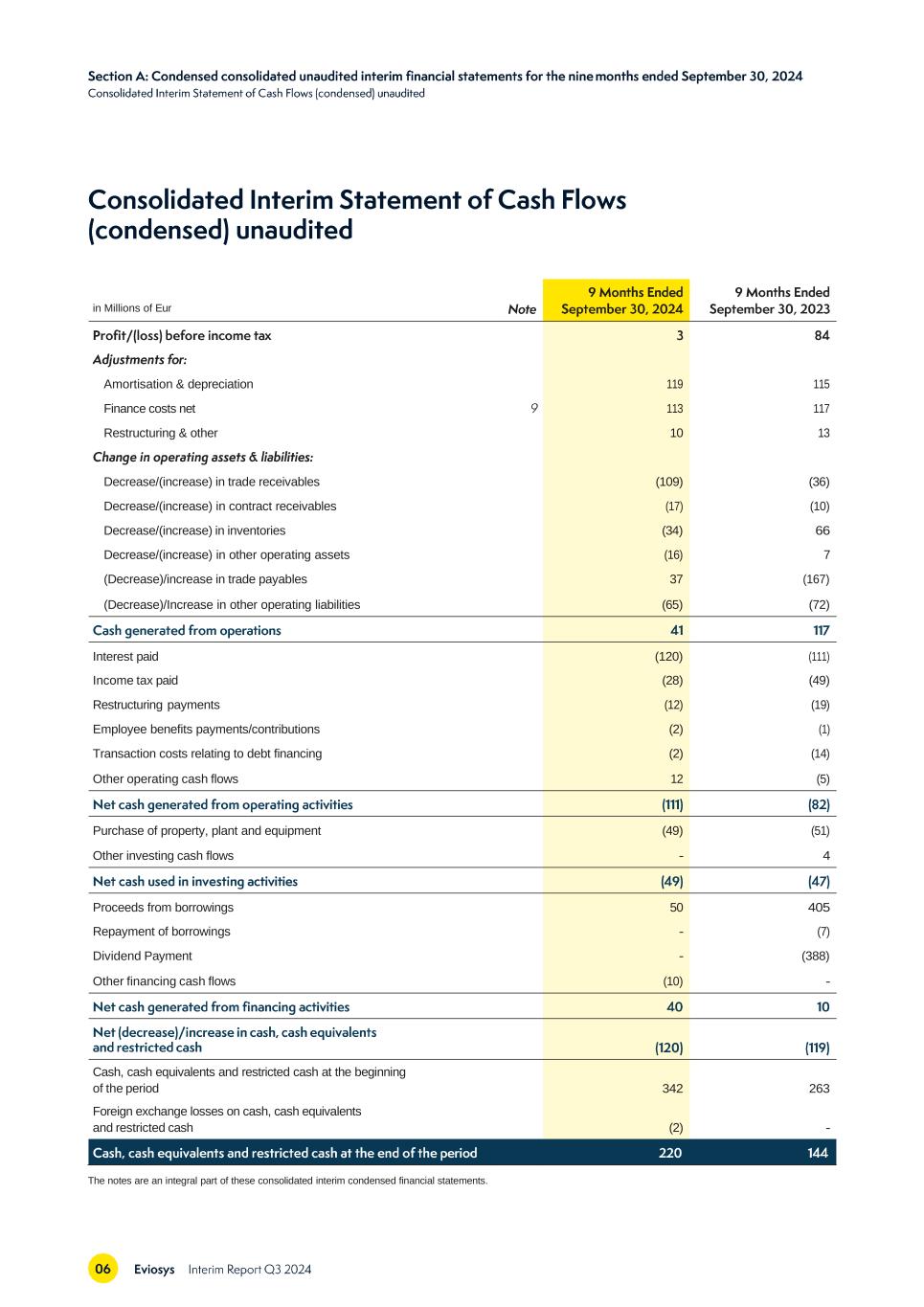

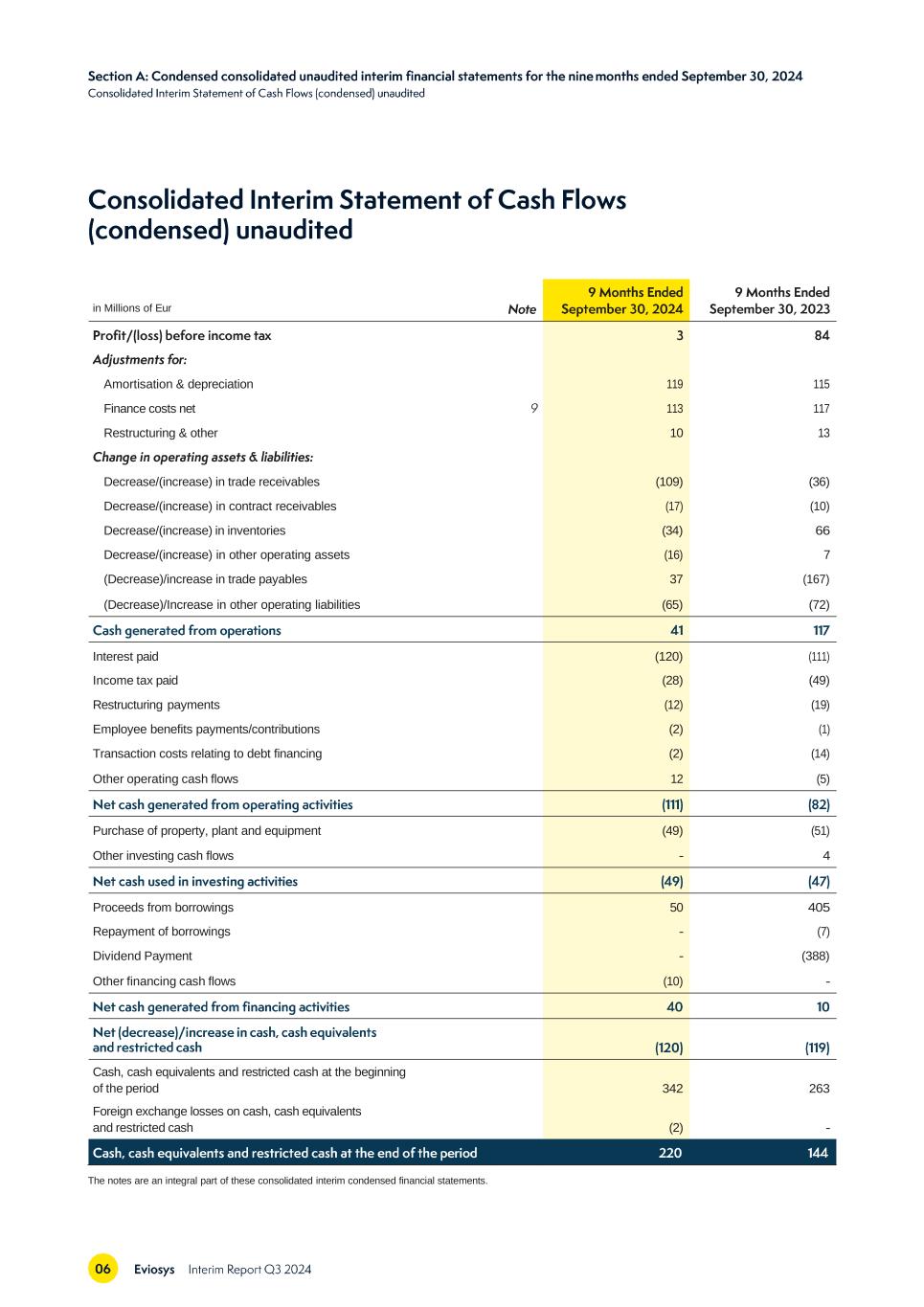

in Millions of Eur Amortisation & depreciation 119 115 Finance costs net 113 117 Restructuring & other 10 13 Decrease/(increase) in trade receivables (109) (36) Decrease/(increase) in contract receivables (17) (10) Decrease/(increase) in inventories (34) 66 Decrease/(increase) in other operating assets (16) 7 (Decrease)/increase in trade payables 37 (167) (Decrease)/Increase in other operating liabilities (65) (72) Interest paid (120) (111) Income tax paid (28) (49) Restructuring payments (12) (19) Employee benefits payments/contributions (2) (1) Transaction costs relating to debt financing (2) (14) Other operating cash flows 12 (5) Purchase of property, plant and equipment (49) (51) Other investing cash flows - 4 Proceeds from borrowings 50 405 Repayment of borrowings - (7) Dividend Payment - (388) Other financing cash flows (10) - Cash, cash equivalents and restricted cash at the beginning 263 of the period 342 Foreign exchange losses on cash, cash equivalents and restricted cash (2) - The notes are an integral part of these consolidated interim condensed financial statements.

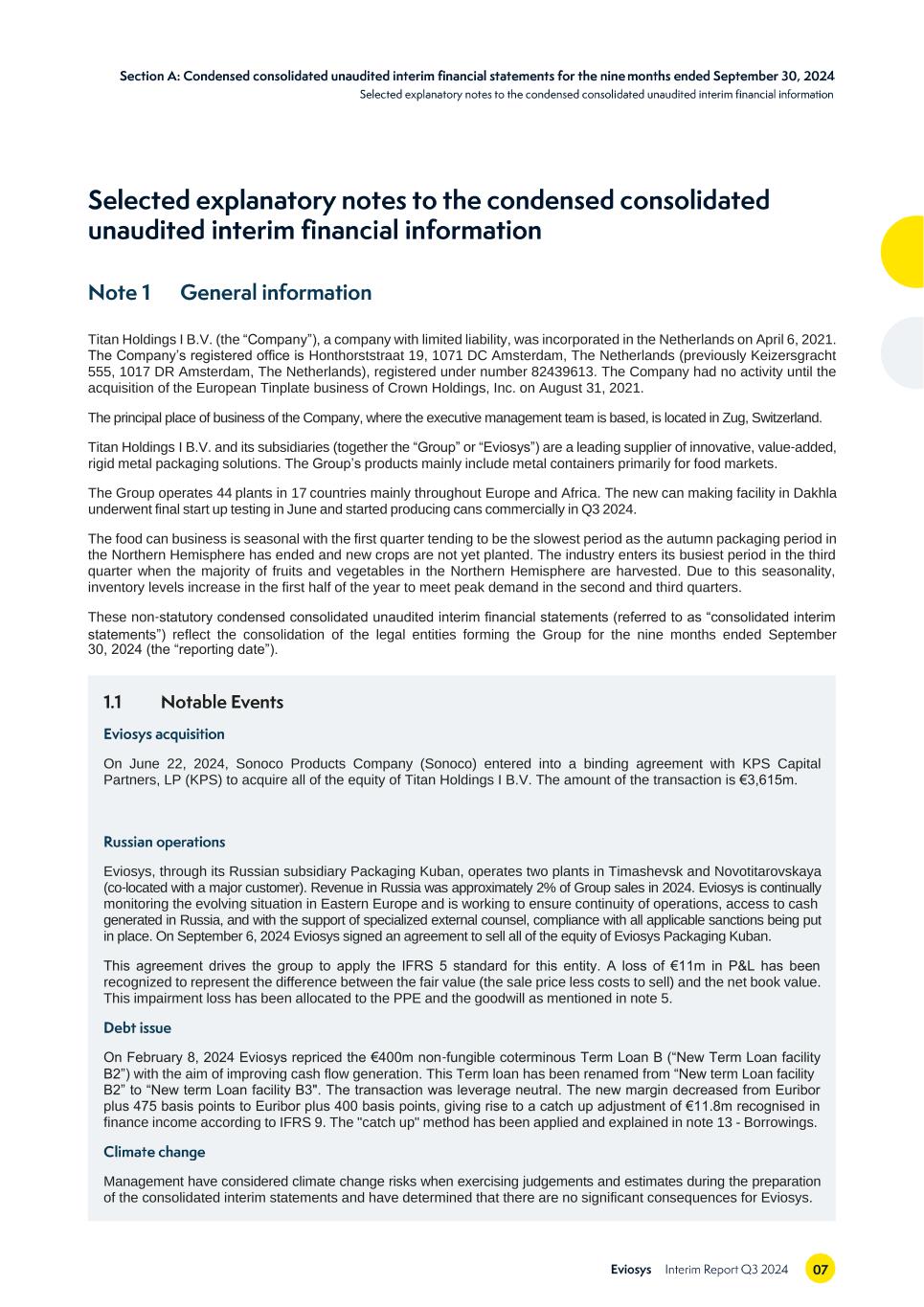

Titan Holdings I B.V. (the “Company”), a company with limited liability, was incorporated in the Netherlands on April 6, 2021. The Company’s registered office is Honthorststraat 19, 1071 DC Amsterdam, The Netherlands (previously Keizersgracht 555, 1017 DR Amsterdam, The Netherlands), registered under number 82439613. The Company had no activity until the acquisition of the European Tinplate business of Crown Holdings, Inc. on August 31, 2021. The principal place of business of the Company, where the executive management team is based, is located in Zug, Switzerland. Titan Holdings I B.V. and its subsidiaries (together the “Group” or “Eviosys”) are a leading supplier of innovative, value‑added, rigid metal packaging solutions. The Group’s products mainly include metal containers primarily for food markets. The Group operates 44 plants in 17 countries mainly throughout Europe and Africa. The new can making facility in Dakhla underwent final start up testing in June and started producing cans commercially in Q3 2024. The food can business is seasonal with the first quarter tending to be the slowest period as the autumn packaging period in the Northern Hemisphere has ended and new crops are not yet planted. The industry enters its busiest period in the third quarter when the majority of fruits and vegetables in the Northern Hemisphere are harvested. Due to this seasonality, inventory levels increase in the first half of the year to meet peak demand in the second and third quarters. These non‑statutory condensed consolidated unaudited interim financial statements (referred to as “consolidated interim statements”) reflect the consolidation of the legal entities forming the Group for the nine months ended September 30, 2024 (the “reporting date”). On June 22, 2024, Sonoco Products Company (Sonoco) entered into a binding agreement with KPS Capital Partners, LP (KPS) to acquire all of the equity of Titan Holdings I B.V. The amount of the transaction is €3,615m. Eviosys, through its Russian subsidiary Packaging Kuban, operates two plants in Timashevsk and Novotitarovskaya (co‑located with a major customer). Revenue in Russia was approximately 2% of Group sales in 2024. Eviosys is continually monitoring the evolving situation in Eastern Europe and is working to ensure continuity of operations, access to cash generated in Russia, and with the support of specialized external counsel, compliance with all applicable sanctions being put in place. On September 6, 2024 Eviosys signed an agreement to sell all of the equity of Eviosys Packaging Kuban. This agreement drives the group to apply the IFRS 5 standard for this entity. A loss of €11m in P&L has been recognized to represent the difference between the fair value (the sale price less costs to sell) and the net book value. This impairment loss has been allocated to the PPE and the goodwill as mentioned in note 5. On February 8, 2024 Eviosys repriced the €400m non‑fungible coterminous Term Loan B (“New Term Loan facility B2”) with the aim of improving cash flow generation. This Term loan has been renamed from “New term Loan facility B2” to “New term Loan facility B3". The transaction was leverage neutral. The new margin decreased from Euribor plus 475 basis points to Euribor plus 400 basis points, giving rise to a catch up adjustment of €11.8m recognised in finance income according to IFRS 9. The "catch up" method has been applied and explained in note 13 - Borrowings. Management have considered climate change risks when exercising judgements and estimates during the preparation of the consolidated interim statements and have determined that there are no significant consequences for Eviosys.

The Group's unaudited Condensed Consolidated Interim Financial Statements for the nine months ended September 30, 2024 are prepared in accordance with IAS 34 “Interim Financial Reporting” and with generally accepted accounting principles under International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). The unaudited Condensed Consolidated Interim Financial Statements do not include all the information and disclosures required in the Consolidated Financial Statements. They should be read in conjunction with the Group’s Consolidated Financial Statements for the year ended December 31, 2023, which were authorized for issue by the Board of Directors on July 31, 2024. Subsequent events impacting these interim financial statements were assessed up to and including February 19, 2025. These unaudited Condensed Consolidated Interim Financial Statements were authorized for issue by management on February 19, 2025. The same accounting policies and methods of computation are followed in these interim financial statements as compared with the most recent annual financial statements except for the application of the effective tax rate in accordance with IAS 34 “Interim Financial Reporting”. Income tax expense is recognised based on management’s estimate of the weighted average annual income tax rate expected for the full financial year. The projected annual tax rate used for the year to September 30, 2024, is 35%. Several amendments and interpretations described below apply for the first time in 2024, but do not have any material impact on the Unaudited Condensed Interim Consolidated Financial Statements of the Group. The Group has not early adopted any other standard, interpretation or amendment that has been issued but is not yet effective. The Group plans to adopt the new standards and interpretations on their required effective dates. The following new standards and amendments are effective for the period beginning January 1, 2024: • Supplier Finance Arrangements (Amendments to IAS 7 & IFRS 7); • Lease Liability in a Sale and Leaseback (Amendments to IFRS 16); • Classification of Liabilities as Current or Non‑Current (Amendments to IAS 1); and • Non‑current Liabilities with Covenants (Amendments to IAS 1). In December 2022, the Member States of the European Union unanimously agreed to adopt the Directive introducing an overall minimum corporate tax rate of 15%, which has entered into force in 2024, in line with the OECD second pillar model framework. On May 23, 2023 the IASB published the amendment to IAS 12 International Tax Reform – Model Pillar Two Rules for immediate application. The Group has applied the exemption to recognising and disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes. (in EUR) April 6, 2021 94 Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of ordinary shares are recognized as a deduction from equity, net of any tax effects. On April 6, 2021 Titan Holdings I B.V. issued authorized capital amounting to USD 100, divided into 10,000 shares with par value USD 0.01.

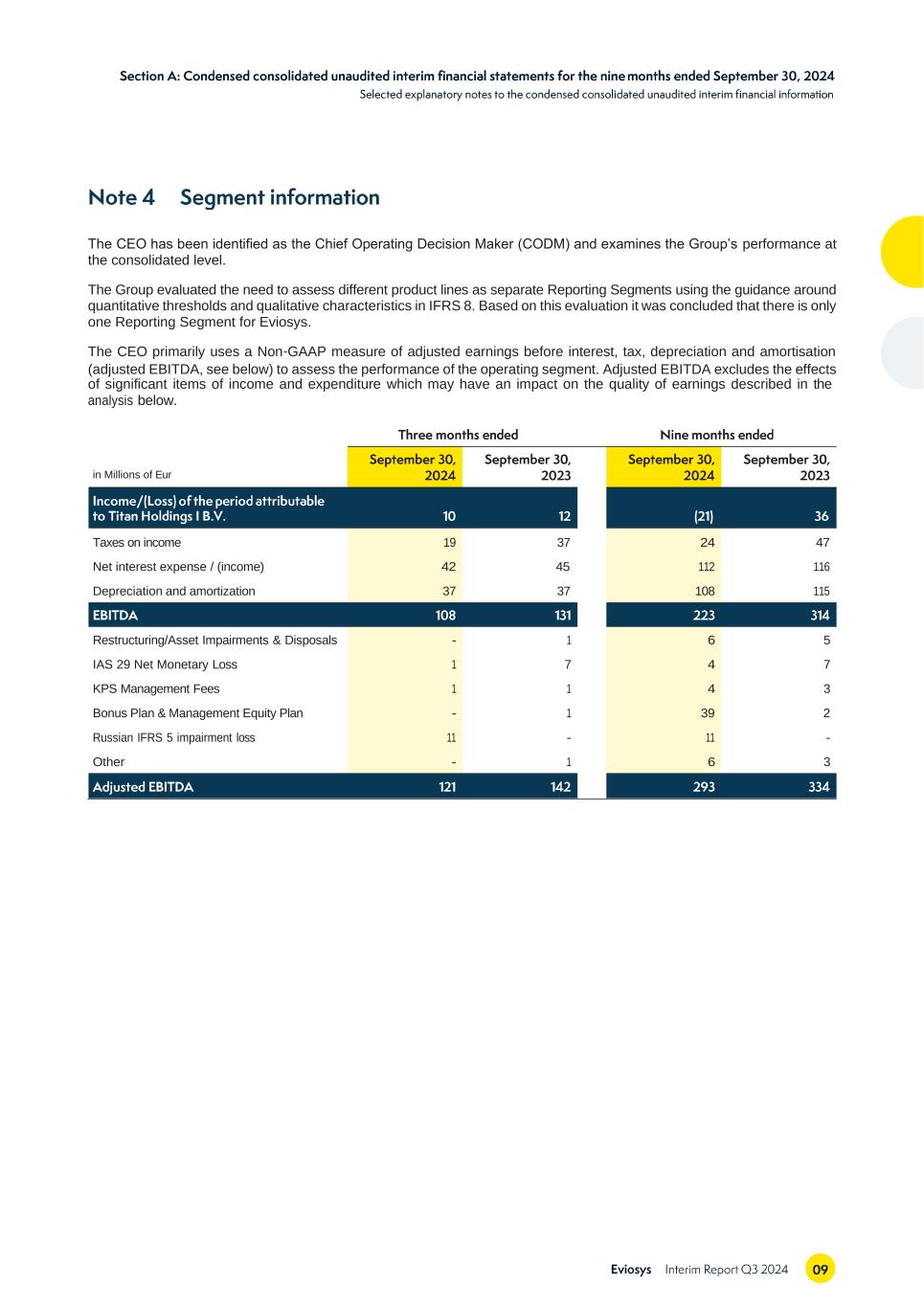

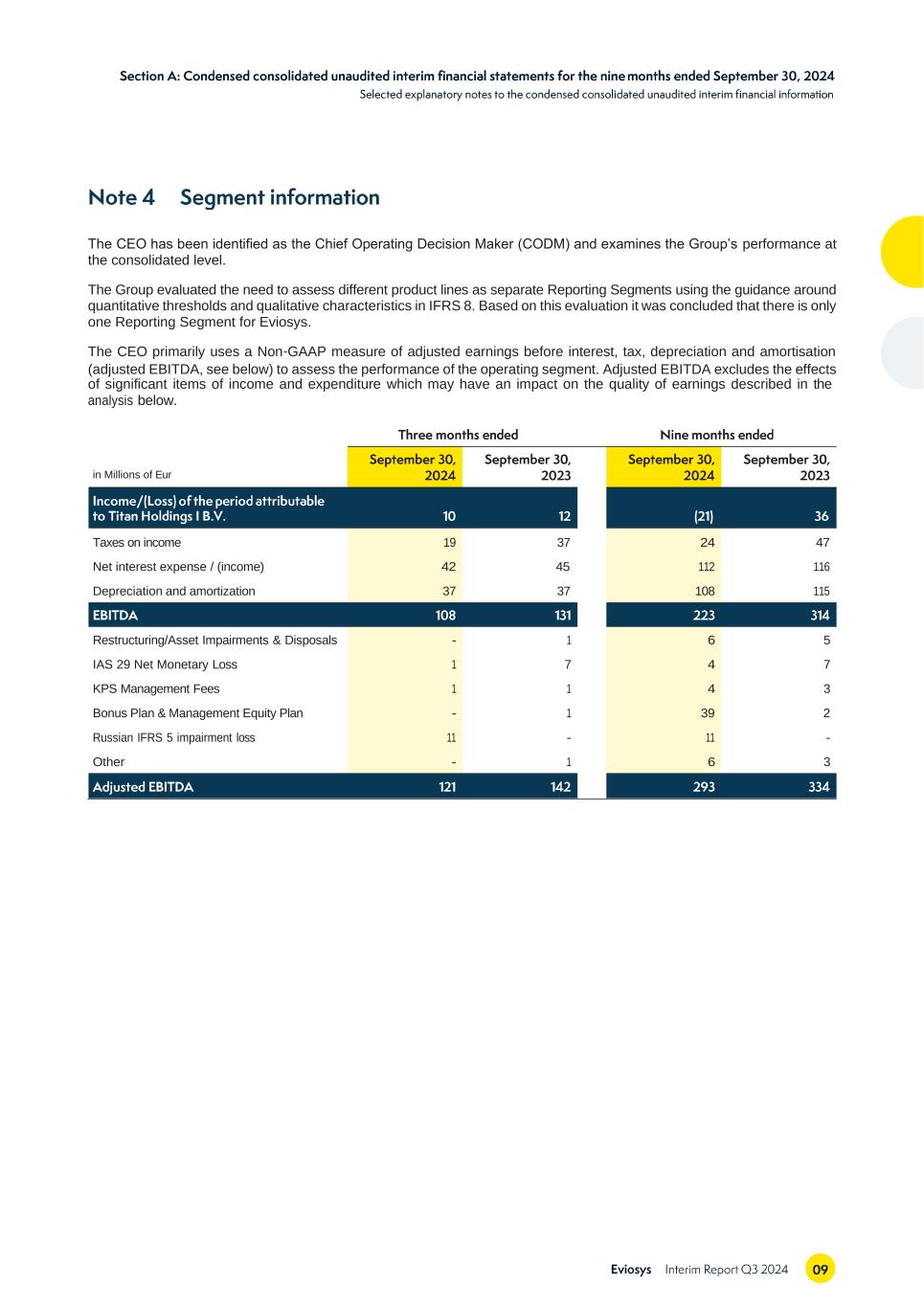

The CEO has been identified as the Chief Operating Decision Maker (CODM) and examines the Group’s performance at the consolidated level. The Group evaluated the need to assess different product lines as separate Reporting Segments using the guidance around quantitative thresholds and qualitative characteristics in IFRS 8. Based on this evaluation it was concluded that there is only one Reporting Segment for Eviosys. The CEO primarily uses a Non‑GAAP measure of adjusted earnings before interest, tax, depreciation and amortisation (adjusted EBITDA, see below) to assess the performance of the operating segment. Adjusted EBITDA excludes the effects of significant items of income and expenditure which may have an impact on the quality of earnings described in the analysis below. in Millions of Eur Taxes on income 19 37 24 47 Net interest expense / (income) 42 45 112 116 Depreciation and amortization 37 37 108 115 Restructuring/Asset Impairments & Disposals - 1 6 5 IAS 29 Net Monetary Loss 1 7 4 7 KPS Management Fees 1 1 4 3 Bonus Plan & Management Equity Plan - 1 39 2 Russian IFRS 5 impairment loss 11 - 11 - Other - 1 6 3

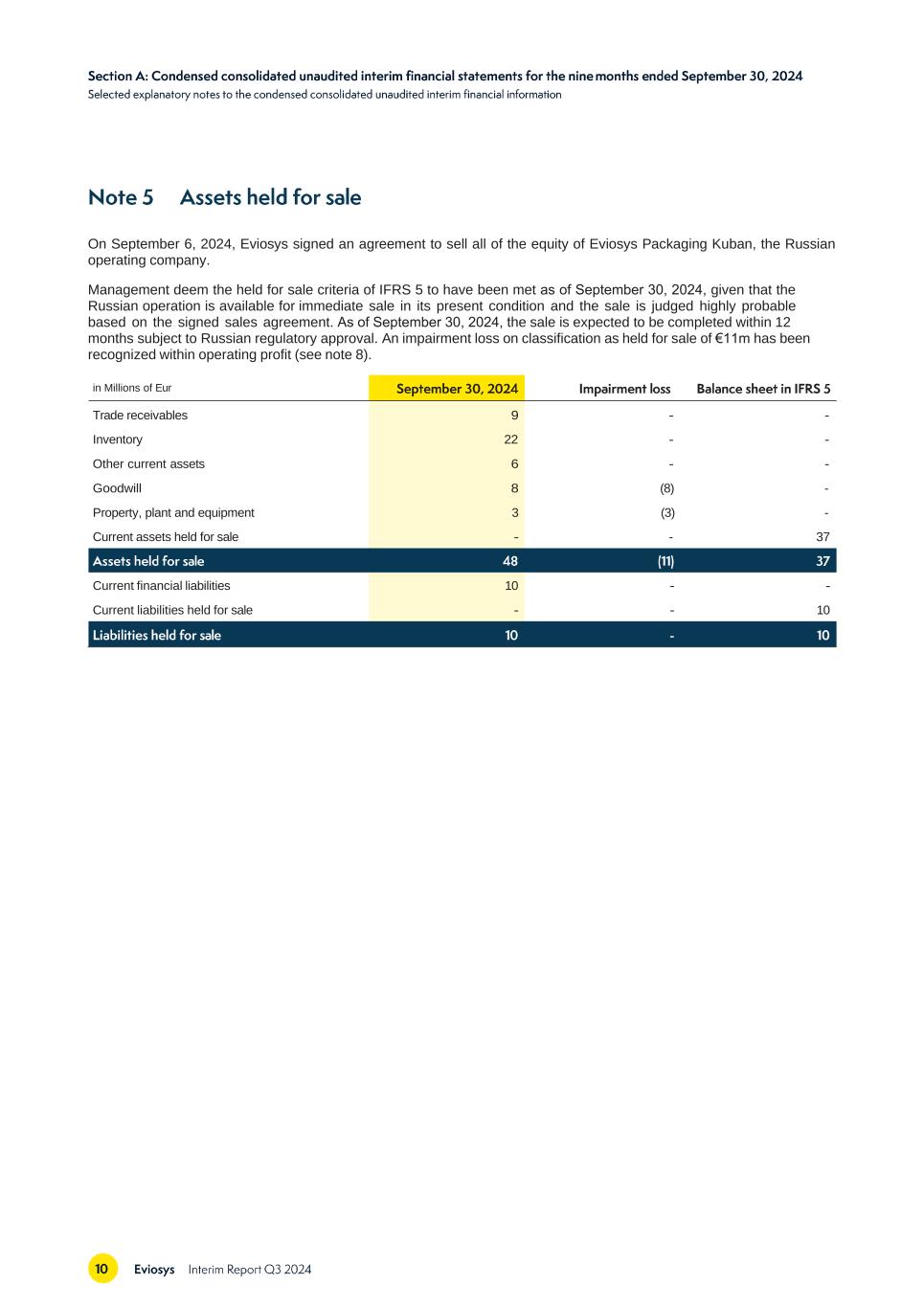

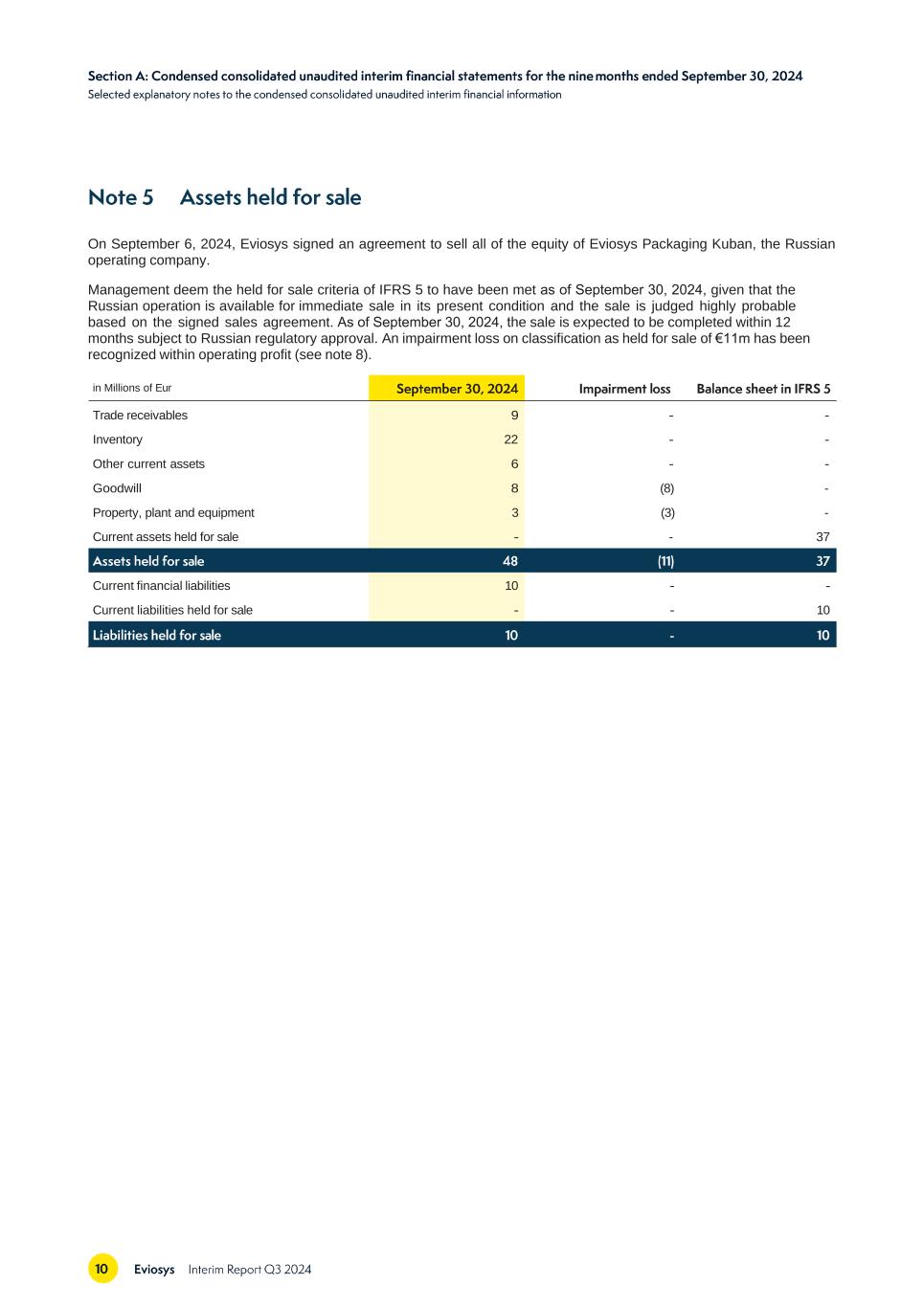

On September 6, 2024, Eviosys signed an agreement to sell all of the equity of Eviosys Packaging Kuban, the Russian operating company. Management deem the held for sale criteria of IFRS 5 to have been met as of September 30, 2024, given that the Russian operation is available for immediate sale in its present condition and the sale is judged highly probable based on the signed sales agreement. As of September 30, 2024, the sale is expected to be completed within 12 months subject to Russian regulatory approval. An impairment loss on classification as held for sale of €11m has been recognized within operating profit (see note 8). in Millions of Eur Trade receivables 9 - - Inventory 22 - - Other current assets 6 - - Goodwill 8 (8) - Property, plant and equipment 3 (3) - Current assets held for sale - - 37 Current financial liabilities 10 - - Current liabilities held for sale - - 10

‑ The Group derives revenue from the transfer of goods over time and at a point in time. The non‑current assets and the revenue by geographic area are presented as follows : in Millions of Eur France Italy 109 109 241 255 Spain 101 109 230 242 United Kingdom 63 91 184 209 Germany 41 44 117 128 Other 252 282 683 779 ‑ in Millions of Eur France 145 146 Italy 107 110 Spain 188 192 United Kingdom 123 114 Germany 43 44 Other 243 247 No other countries have revenue or other non‑current assets in excess of the countries listed above. No customer represents more than 10% of the revenue.

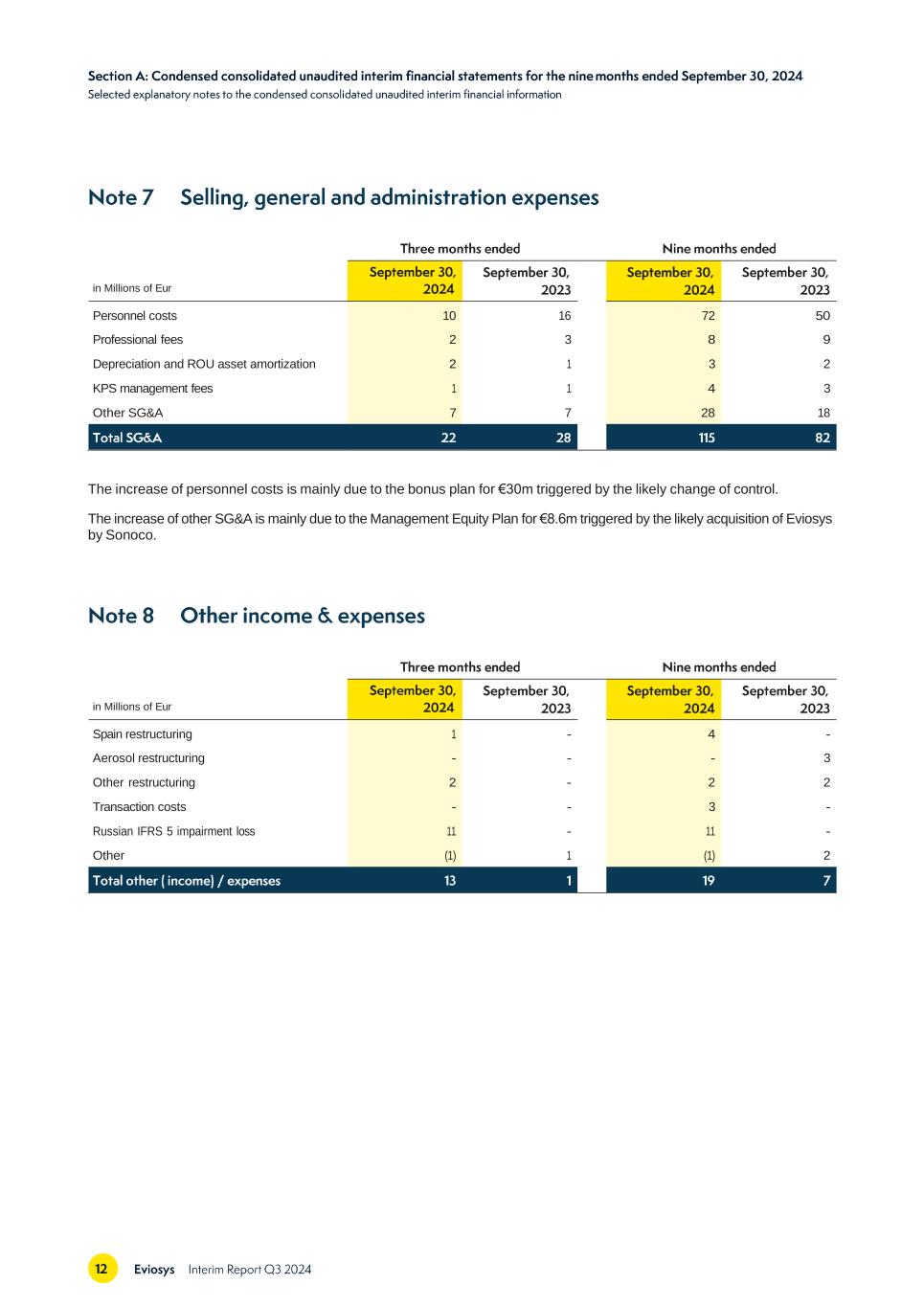

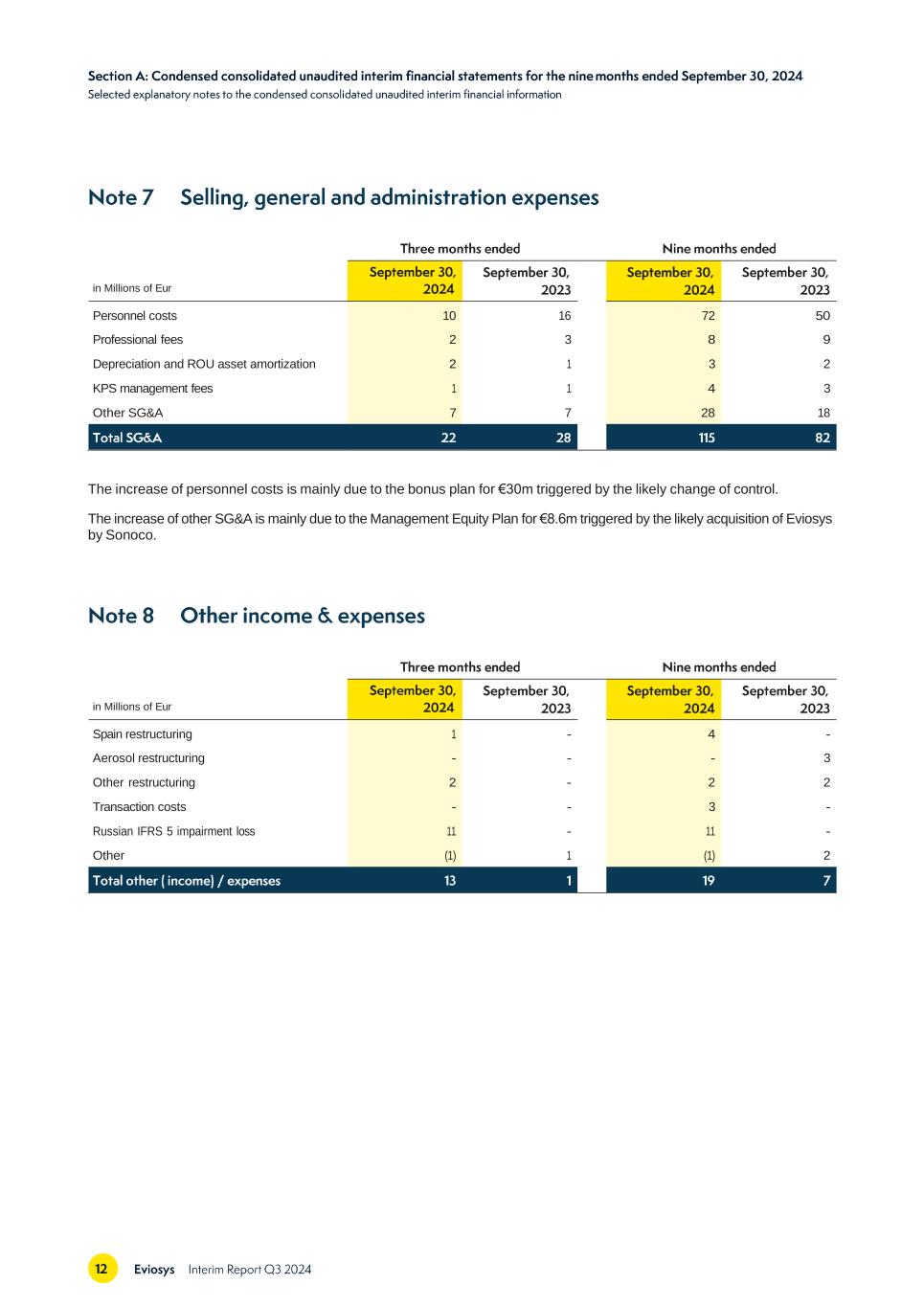

in Millions of Eur Personnel costs 10 16 72 50 Professional fees 2 3 8 9 Depreciation and ROU asset amortization 2 1 3 2 KPS management fees 1 1 4 3 Other SG&A 7 7 28 18 The increase of personnel costs is mainly due to the bonus plan for €30m triggered by the likely change of control. The increase of other SG&A is mainly due to the Management Equity Plan for €8.6m triggered by the likely acquisition of Eviosys by Sonoco. in Millions of Eur Spain restructuring 1 - 4 - Aerosol restructuring - - - 3 Other restructuring 2 - 2 2 Transaction costs - - 3 - Russian IFRS 5 impairment loss 11 - 11 - Other (1) 1 (1) 2

in Millions of Eur Interest expense on debt 31 34 97 89 Interest expense on factoring and securitization 7 9 20 21 Amortization of debt issue cost 3 2 (4) 5 Interest expense on leases 1 - 1 1 Pension and related non services costs/ (income) - - 1 1 Interest income - - (2) - Interest expense mainly comprises the interest due on the Term loan and Senior bonds. The variation in the amortization of debt issue cost is related to the Facility B3. The operation is explained in note 13. The Eviosys subsidiary in Turkey, Eviosys Packaging Türkiye Sanayi Ve Ticaret Limited Sirketi, has Turkish lira as its functional currency. The consumer price index of the Turkish Statistical Institute (TURKSTAT) was 2,526.16 at September 30, 2024 and 1,691.04 at September 30, 2023. The calculated net monetary loss in 2024 is €4m and is recognised in the Statement of Profit or Loss. The projected tax rate of 30% was applied to income before tax for the nine months ended September 30, 2024, after adjustment for the losses in the Netherlands where no tax credit is reported. In September 30, 2024 the tax expense is €24m compared to €47m in September 30, 2023 (In September 2023 the projected tax rate of 29% after adjustment for losses in the Netherlands was applied to the income before tax.) Under the Pillar II legislation the Group is liable to pay a top‑up tax for the difference between its GloBE effective tax rate per jurisdiction and the 15% minimum tax rate. All entities within the Group have an effective tax rate that exceeds 15%, except for three subsidiaries operating in Ireland, Hungary and Switzerland where the statutory tax rate is below 15%. Any top‑up tax payable is not expected to be material.

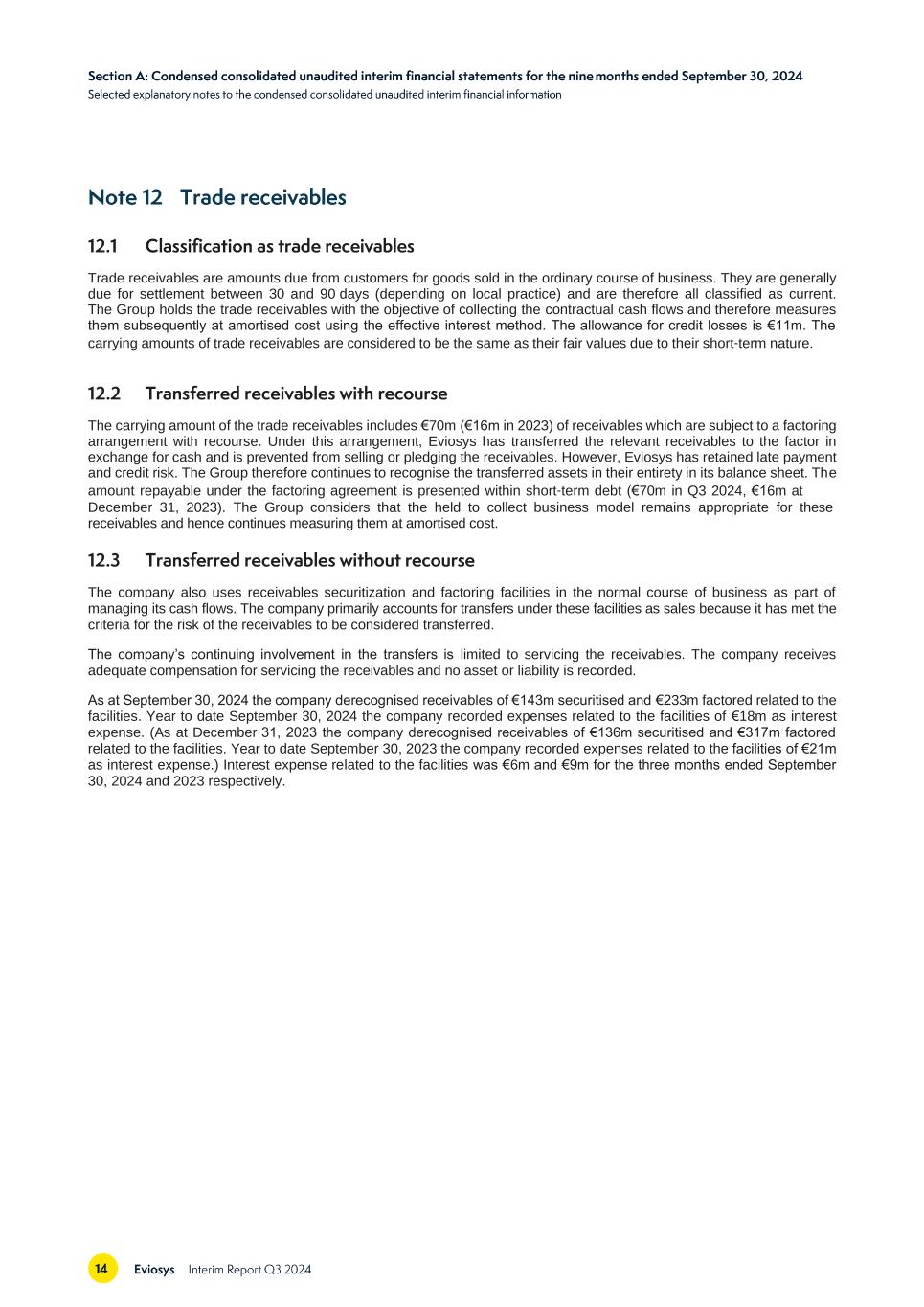

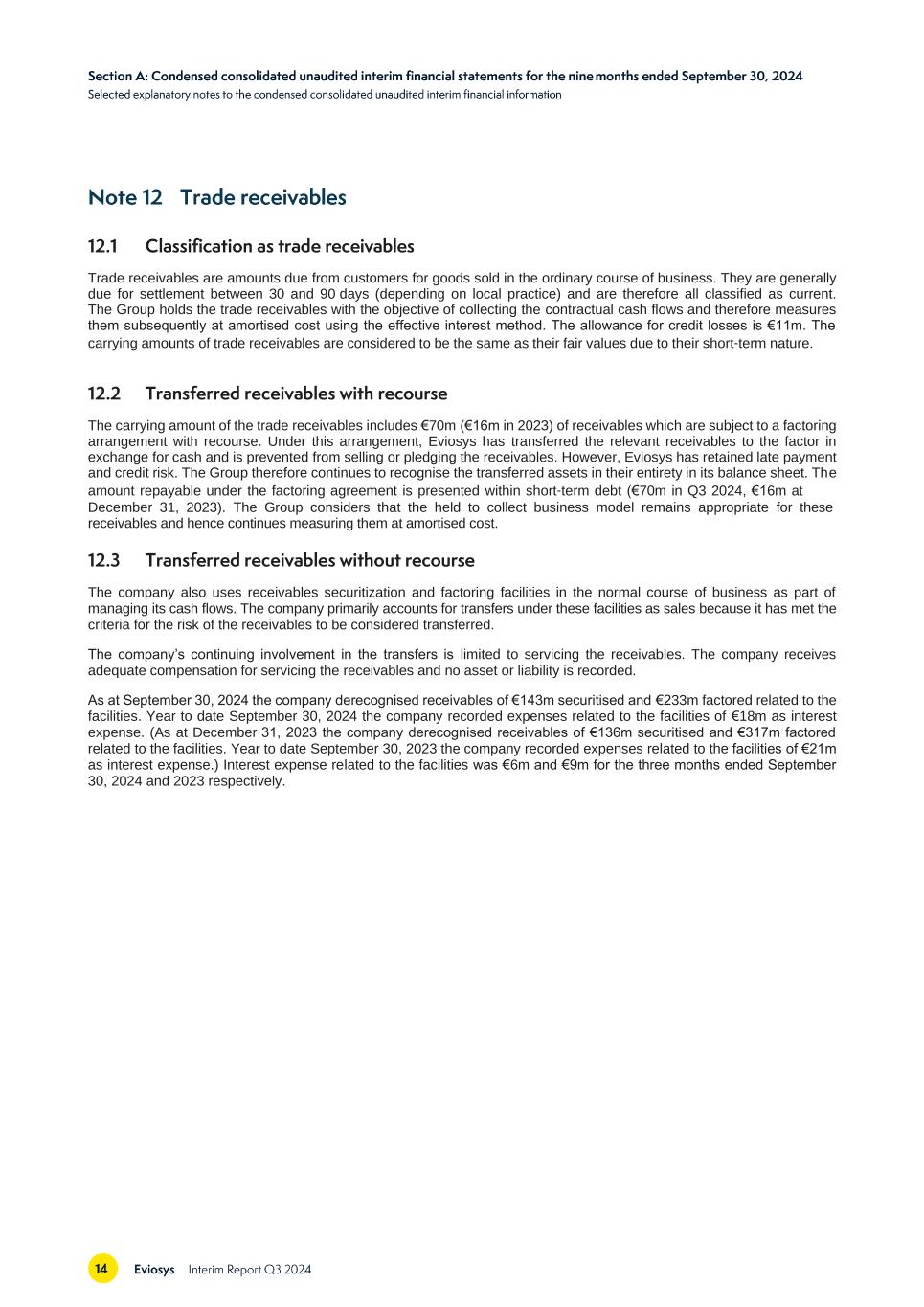

Trade receivables are amounts due from customers for goods sold in the ordinary course of business. They are generally due for settlement between 30 and 90 days (depending on local practice) and are therefore all classified as current. The Group holds the trade receivables with the objective of collecting the contractual cash flows and therefore measures them subsequently at amortised cost using the effective interest method. The allowance for credit losses is €11m. The carrying amounts of trade receivables are considered to be the same as their fair values due to their short‑term nature. The carrying amount of the trade receivables includes €70m (€16m in 2023) of receivables which are subject to a factoring arrangement with recourse. Under this arrangement, Eviosys has transferred the relevant receivables to the factor in exchange for cash and is prevented from selling or pledging the receivables. However, Eviosys has retained late payment and credit risk. The Group therefore continues to recognise the transferred assets in their entirety in its balance sheet. The amount repayable under the factoring agreement is presented within short‑term debt (€70m in Q3 2024, €16m at December 31, 2023). The Group considers that the held to collect business model remains appropriate for these receivables and hence continues measuring them at amortised cost. The company also uses receivables securitization and factoring facilities in the normal course of business as part of managing its cash flows. The company primarily accounts for transfers under these facilities as sales because it has met the criteria for the risk of the receivables to be considered transferred. The company’s continuing involvement in the transfers is limited to servicing the receivables. The company receives adequate compensation for servicing the receivables and no asset or liability is recorded. As at September 30, 2024 the company derecognised receivables of €143m securitised and €233m factored related to the facilities. Year to date September 30, 2024 the company recorded expenses related to the facilities of €18m as interest expense. (As at December 31, 2023 the company derecognised receivables of €136m securitised and €317m factored related to the facilities. Year to date September 30, 2023 the company recorded expenses related to the facilities of €21m as interest expense.) Interest expense related to the facilities was €6m and €9m for the three months ended September 30, 2024 and 2023 respectively.

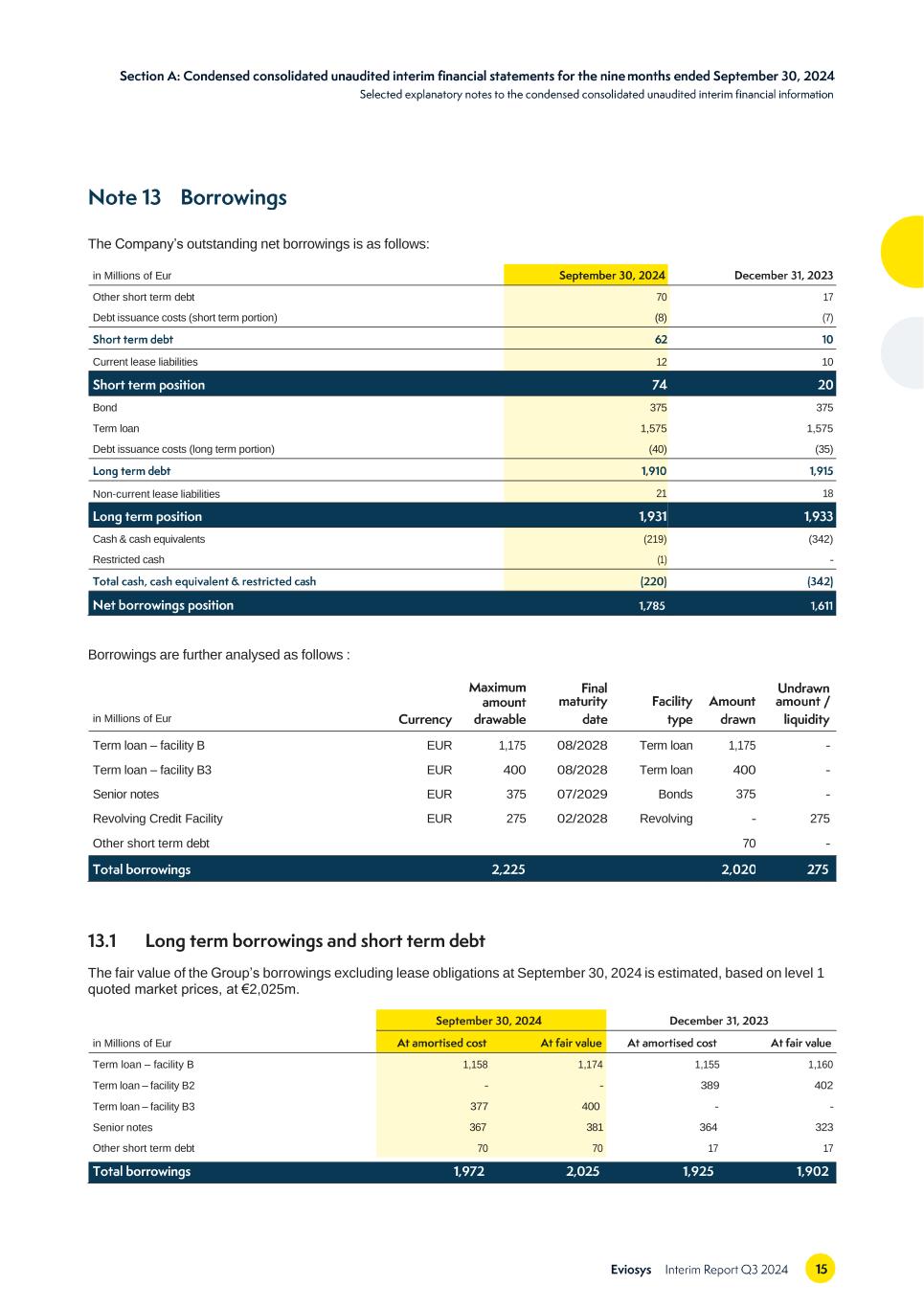

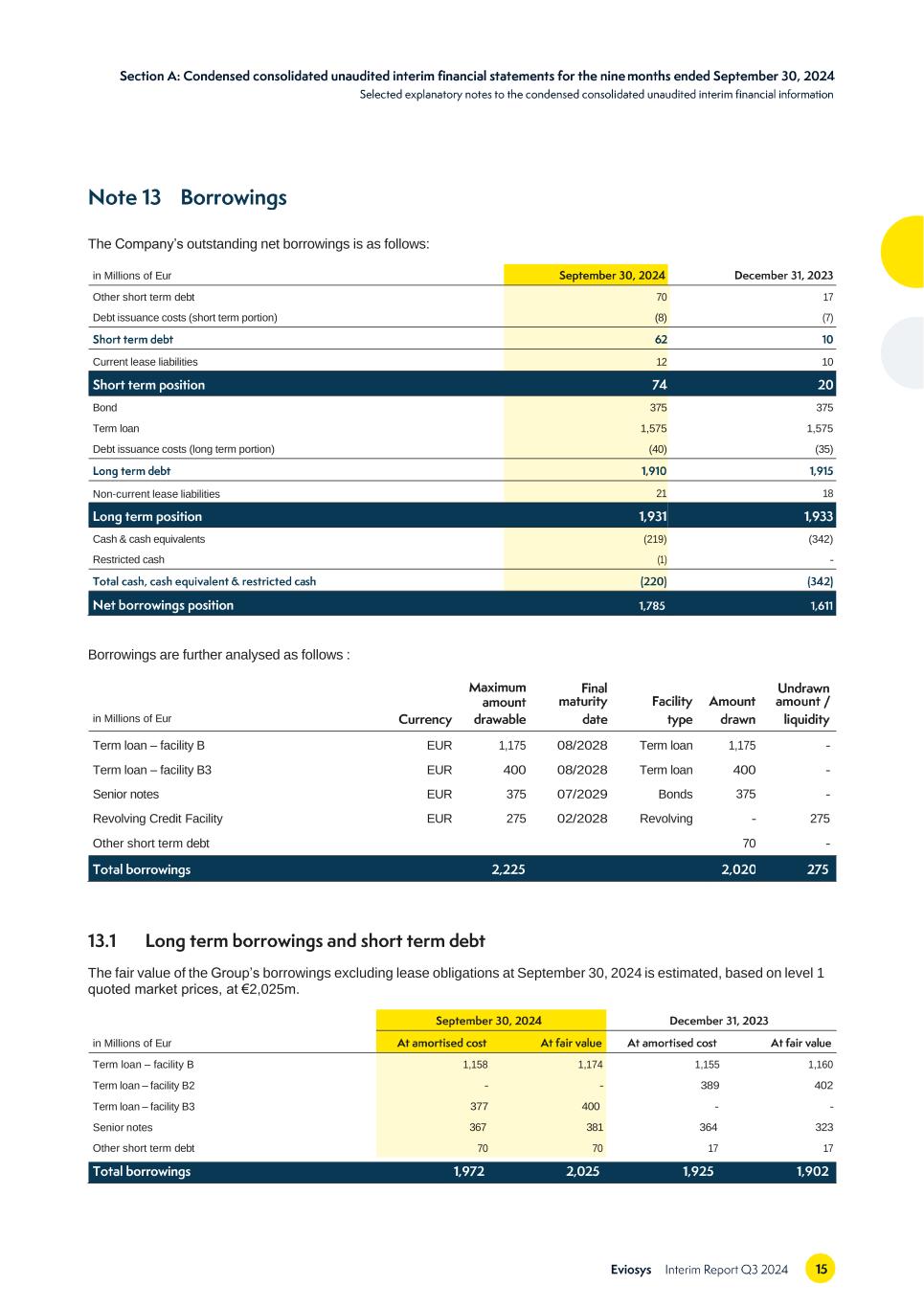

The Company’s outstanding net borrowings is as follows: in Millions of Eur Other short term debt 70 17 Debt issuance costs (short term portion) (8) (7) Current lease liabilities 12 10 Bond 375 375 Term loan 1,575 1,575 Debt issuance costs (long term portion) (40) (35) Non‑current lease liabilities 21 18 Cash & cash equivalents (219) (342) Restricted cash (1) - Borrowings are further analysed as follows : in Millions of Eur Term loan – facility B EUR 1,175 08/2028 Term loan 1,175 - Term loan – facility B3 EUR 400 08/2028 Term loan 400 - Senior notes EUR 375 07/2029 Bonds 375 - Revolving Credit Facility EUR 275 02/2028 Revolving - 275 Other short term debt 70 - The fair value of the Group’s borrowings excluding lease obligations at September 30, 2024 is estimated, based on level 1 quoted market prices, at €2,025m. in Millions of Eur Term loan – facility B Term loan – facility B2 Term loan – facility B3 Senior notes Other short term debt 1,158 1,174 - - 377 400 367 381 70 70 1,155 1,160 389 402 - - 364 323 17 17

On August 31, 2021, Kouti B.V. incurred €1,175m of senior secured term loans to finance, in part, the acquisition of the Tinplate business pursuant to a Senior Facilities Agreement, dated as of July 15, 2021 (the “Senior Facilities Agreement”), by and among Titan Holdings II B.V., Kouti B.V., the lenders and other parties from time to time party thereto, Barclays Bank PLC, as agent, and Deutsche Bank AG, London Branch, as security agent. Under the Senior Facilities Agreement, Kouti B.V. and certain subsidiaries may also borrow senior secured revolving loans up to €275m from time to time. The facilities have the following key terms: • A Term Loan (Facility B Commitments) of €1,175m with a maturity date of August 31, 2028. This tranche incurs interest at the applicable 1, 2, 3 or 6 months EURIBOR rate plus a margin that is subject to a leverage‑based grid and a sustainability‑based ratchet (commencing with delivery of the Company’s non‑financial annual report due within 120 days after the end of each fiscal year). Greater than 3.80:1 3.75% Equal to or less than 3.8:1 but greater than 3.30:1 3.50% Equal to or less than 3.30:1 3.25% ‑ Compliance with sustainability KPIs 0.075% Rate Discount Non‑Compliance with Sustainability KPIs 0.075% Rate Premium Kouti B.V. entered into interest rate swap contracts on March 17, 2022 to fix the EURIBOR component of the interest rate of €450m of the Term Loan at 0.7655% until February 28, 2025. • On March 7, 2023 an additional Facility B tranche of €400m with a maturity date of August 31, 2028, was established under the existing Senior Facilities Agreement (Facility B2). Each of Kouti B.V., Eviosys Packaging France S.A.S, Eviosys Embalajes España, S.A.U. and Eviosys Packaging UK Limited became the borrowers of Facility B2. This tranche incurs interest at the applicable 1, 2, 3 or 6 months EURIBOR rate plus a margin that is subject to a leverage‑based grid and a sustainability‑based ratchet (in each case commencing after two full fiscal quarters after the closing date of Facility B2). Greater than 2.20:1 4.75% Equal to or less than 2.20:1 but greater than 1.70:1 4.50% Equal to or less than 1.70:1 4.25% ‑ Compliance with sustainability KPIs 0.075% Rate Discount Non‑Compliance with Sustainability KPIs 0.075% Rate Premium Kouti B.V. entered into interest rate swap contracts on March 9, 2023 to fix the EURIBOR component of the interest rate of €300m of the Term Loan B2 at 3.6076% until February 28, 2026. The Facility B2 tranche of €400m has been repriced on February 8, 2024 and subsequently renamed to Facility B3. The repricing has been analysed as a debt renegotiation. The Borrowers remain the same: Kouti B.V., Eviosys Packaging France S.A.S, Eviosys Embalajes España, S.A.U. and Eviosys Packaging UK Limited. The maturity date also remains the same. The new margin has decreased from Euribor plus 475 basis points to Euribor plus 400 basis points. In application of IFRS 9, the difference between the former basis points (475 pts) and the new basis (400 pts) has been accounted for in one‑shot according to the “catch‑up” method. This accounting policy drives Eviosys to recognise a €11.8m gain in the Net finance expense in the category : Amortization of debt issuance cost.

The Facility B3 has the following characteristics : Greater than 2.20:1 4.00% Equal to or less than 2.20:1 but greater than 1.70:1 3.75% Equal to or less than 1.70:1 3.50% • A Revolving Credit Facility of €275m with a maturity date of February 29, 2028. When drawn, this Revolving Credit Facility incurs interest at the applicable 1, 2, 3 or 6 months EURIBOR rates plus a margin that is subject to a leverage‑based grid. Greater than 3.80:1 3.75% Equal to or less than 3.8:1 but greater than 3.30:1 3.50% Equal to or less than 3.30:1 but greater than 2.80:1 3.25% Equal to or less than 2.8:1 but greater than 2.30:1 3.00% Equal to or less than 2.3:1 2.75% This Revolving Credit Facility was not drawn as of September 30, 2024. The amount available for direct drawing under the Revolving Credit Facility as of the end of such period was €266m as €9m is blocked as guarantee to an overdraft facility that reduces the revolving commitment on a euro‑for‑euro basis. The commitment fee applied to the available amount of the Revolving Credit Facility is 30% of the applicable margin. On July 15, 2021, Titan Holdings II B.V. issued €375m of 5.125% Senior Notes due in July 2029. The Notes have been offered in connection with the acquisition of, directly or indirectly, the Tinplate business. ‑ Short‑term loans relate to receivables factored with recourse. Refer to note 12. According to IFRS 9, the repricing has been considered as a debt renegotiation. As a result the “catch‑up” method has been applied for the repricing of the Facility B2 to B3. A one‑off gain of €11.8m has been reported. Incremental debt issuance costs amounting to €1.6m related to the repricing transaction have been recorded, giving a total of €69m, of which €19m has already been amortized, leaving €48m recorded against debt. Eviosys has complied with the financial covenants of its borrowing facilities during the 2023 and 2024 reporting periods. The Senior Facilities Agreement contains a springing financial covenant for the benefit of the revolving lenders that, if tested, requires the Group to maintain a minimum consolidated senior secured debt ratio of 8.10x. The financial covenant is tested, if required, on the last day of every financial quarter in which the “Test Condition” is satisfied (commencing on the last day of the third full fiscal quarter to have elapsed after the acquisition closing date). The Test Condition is satisfied if the Revolving Credit Facility usage exceeds 40% of the revolving commitment (excluding letters of credit and ancillary facilities issued thereunder). The test condition was not satisfied at the end of the quarter and therefore the financial covenant was not required to be tested.

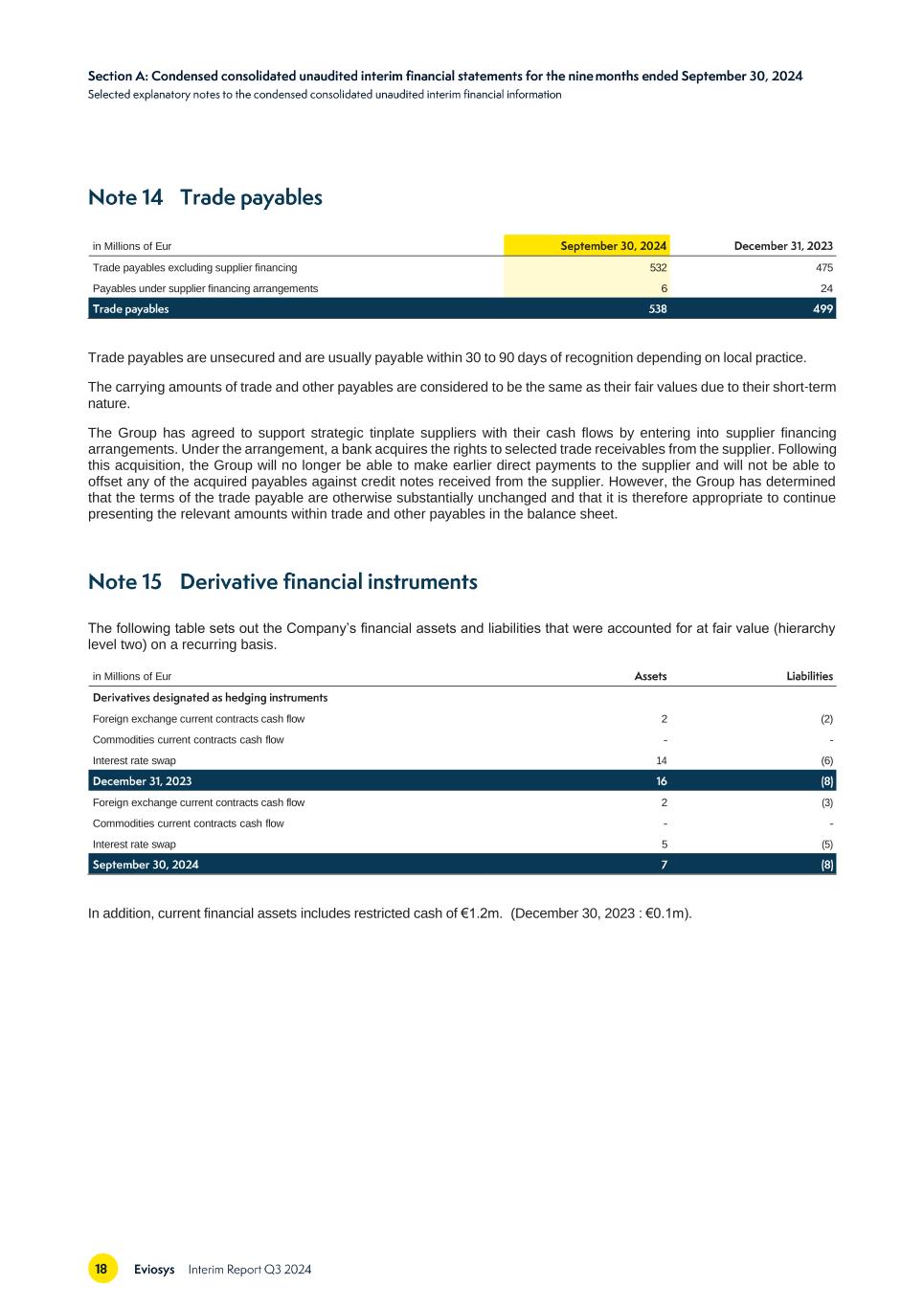

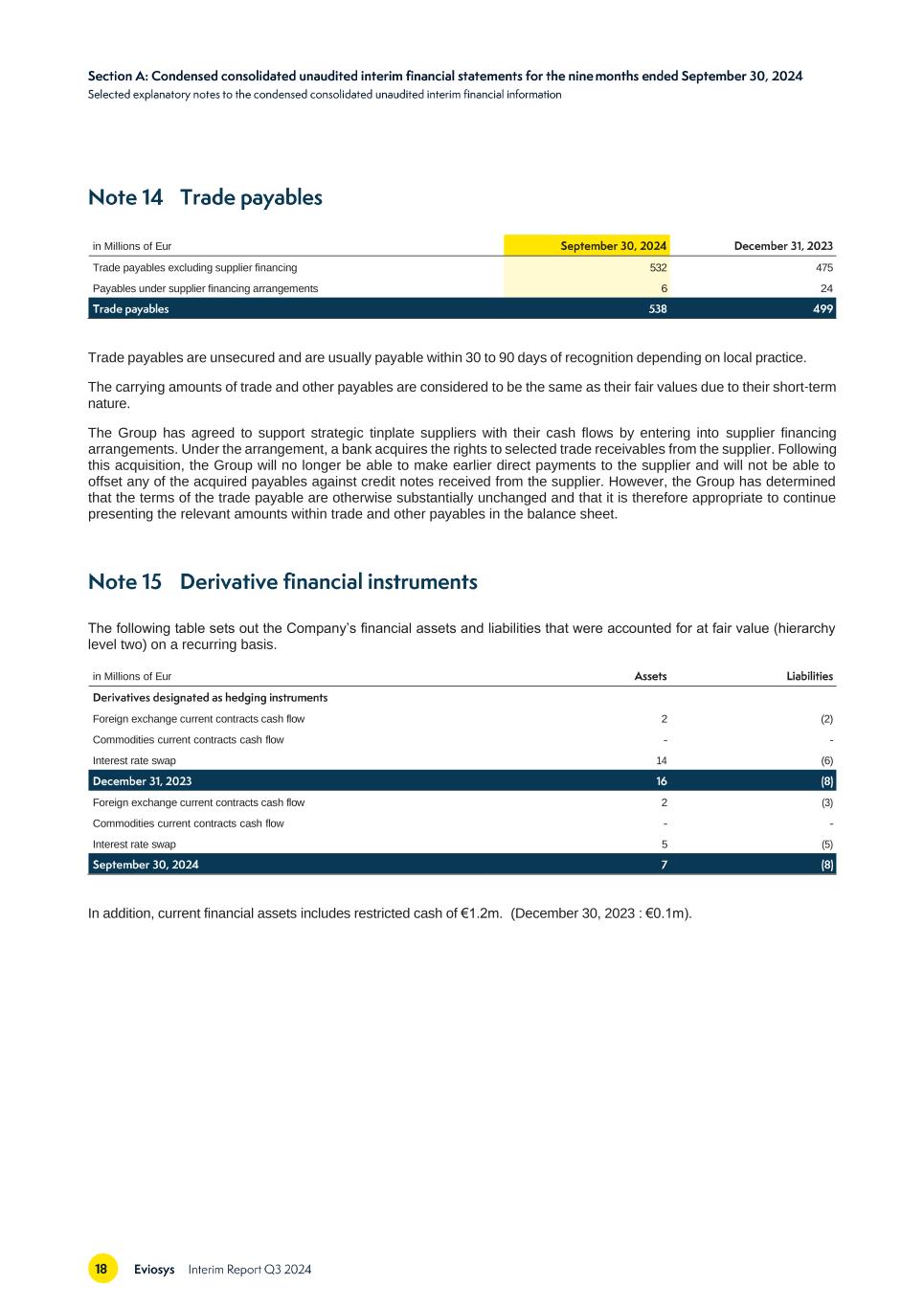

in Millions of Eur Trade payables excluding supplier financing 532 475 Payables under supplier financing arrangements 6 24 Trade payables are unsecured and are usually payable within 30 to 90 days of recognition depending on local practice. The carrying amounts of trade and other payables are considered to be the same as their fair values due to their short‑term nature. The Group has agreed to support strategic tinplate suppliers with their cash flows by entering into supplier financing arrangements. Under the arrangement, a bank acquires the rights to selected trade receivables from the supplier. Following this acquisition, the Group will no longer be able to make earlier direct payments to the supplier and will not be able to offset any of the acquired payables against credit notes received from the supplier. However, the Group has determined that the terms of the trade payable are otherwise substantially unchanged and that it is therefore appropriate to continue presenting the relevant amounts within trade and other payables in the balance sheet. The following table sets out the Company’s financial assets and liabilities that were accounted for at fair value (hierarchy level two) on a recurring basis. in Millions of Eur Foreign exchange current contracts cash flow 2 (2) Commodities current contracts cash flow - - Interest rate swap 14 (6) Foreign exchange current contracts cash flow 2 (3) Commodities current contracts cash flow - - Interest rate swap 5 (5) In addition, current financial assets includes restricted cash of €1.2m. (December 30, 2023 : €0.1m).

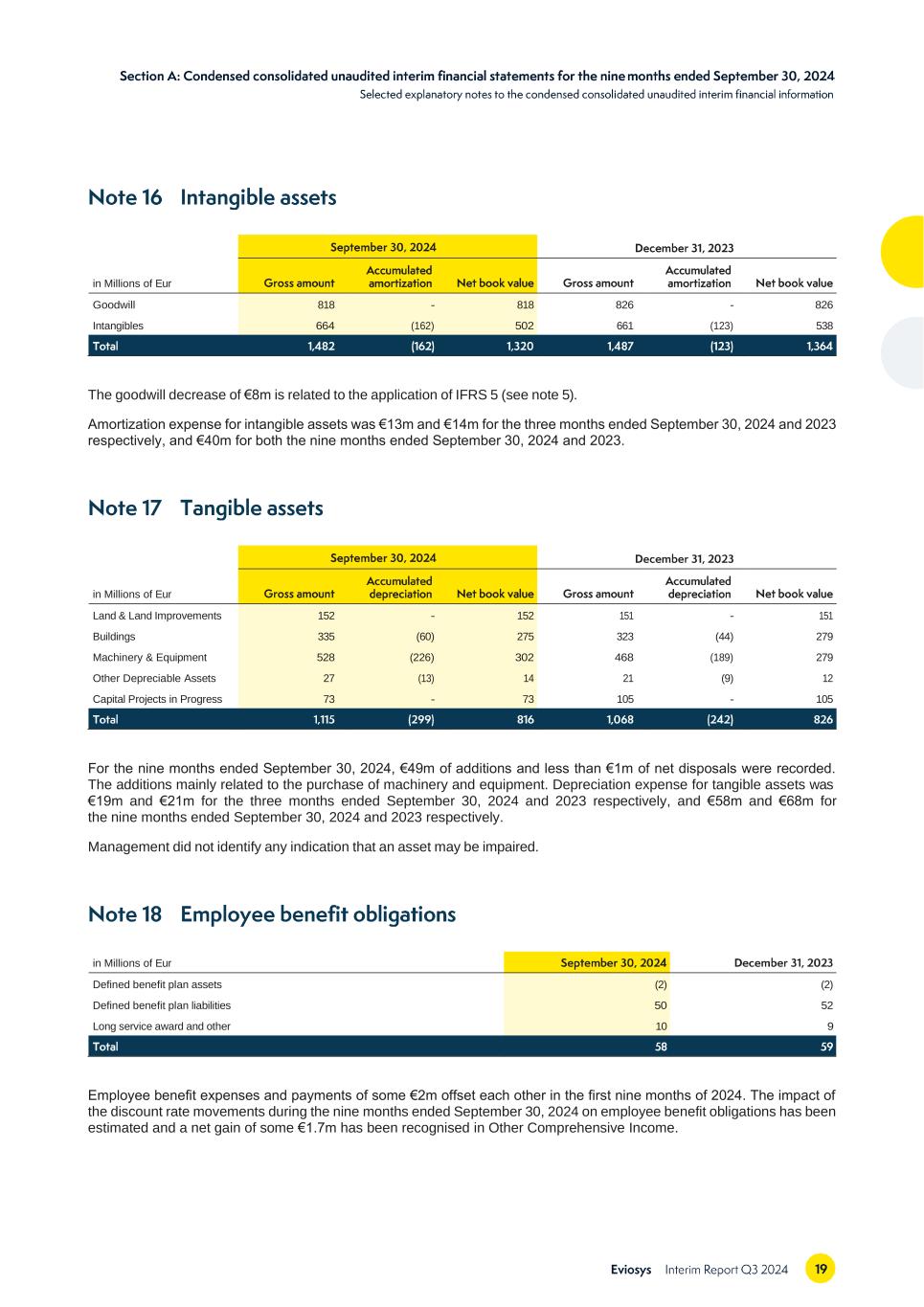

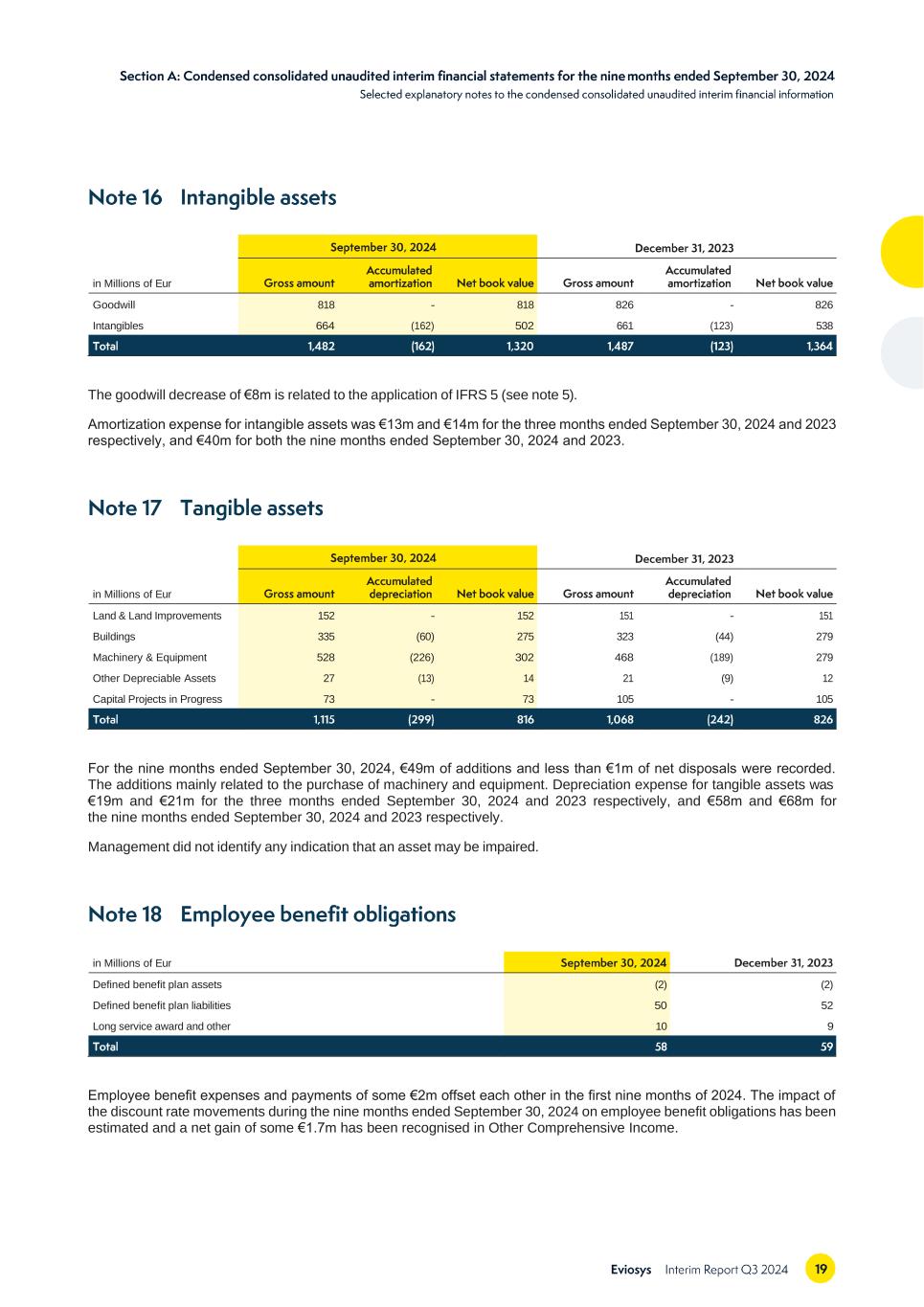

in Millions of Eur Goodwill 818 - 818 826 - 826 Intangibles 664 (162) 502 661 (123) 538 The goodwill decrease of €8m is related to the application of IFRS 5 (see note 5). Amortization expense for intangible assets was €13m and €14m for the three months ended September 30, 2024 and 2023 respectively, and €40m for both the nine months ended September 30, 2024 and 2023. in Millions of Eur Land & Land Improvements 152 - 152 151 - 151 Buildings 335 (60) 275 323 (44) 279 Machinery & Equipment 528 (226) 302 468 (189) 279 Other Depreciable Assets 27 (13) 14 21 (9) 12 Capital Projects in Progress 73 - 73 105 - 105 For the nine months ended September 30, 2024, €49m of additions and less than €1m of net disposals were recorded. The additions mainly related to the purchase of machinery and equipment. Depreciation expense for tangible assets was €19m and €21m for the three months ended September 30, 2024 and 2023 respectively, and €58m and €68m for the nine months ended September 30, 2024 and 2023 respectively. Management did not identify any indication that an asset may be impaired. in Millions of Eur Defined benefit plan assets (2) (2) Defined benefit plan liabilities 50 52 Long service award and other 10 9 Employee benefit expenses and payments of some €2m offset each other in the first nine months of 2024. The impact of the discount rate movements during the nine months ended September 30, 2024 on employee benefit obligations has been estimated and a net gain of some €1.7m has been recognised in Other Comprehensive Income.

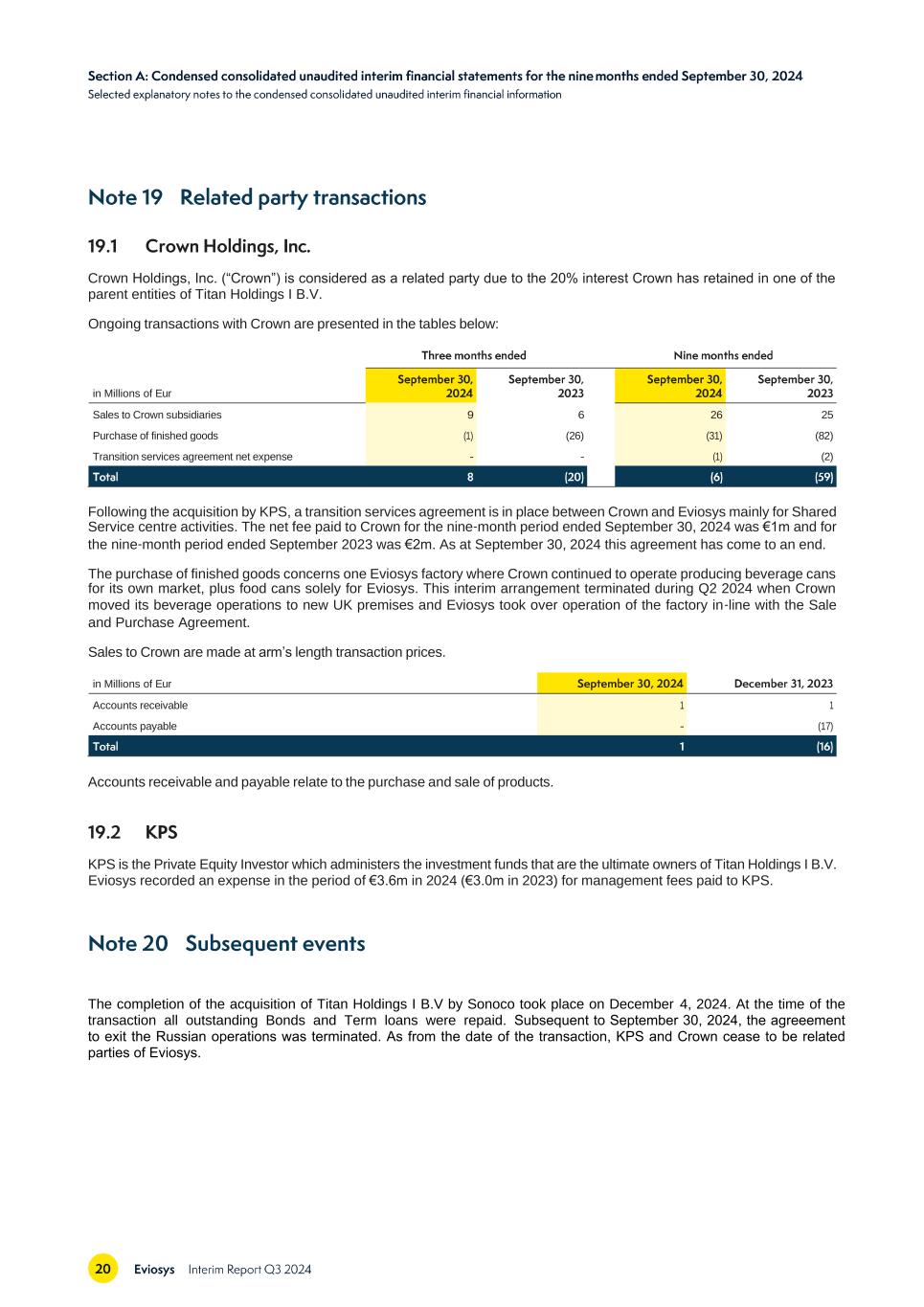

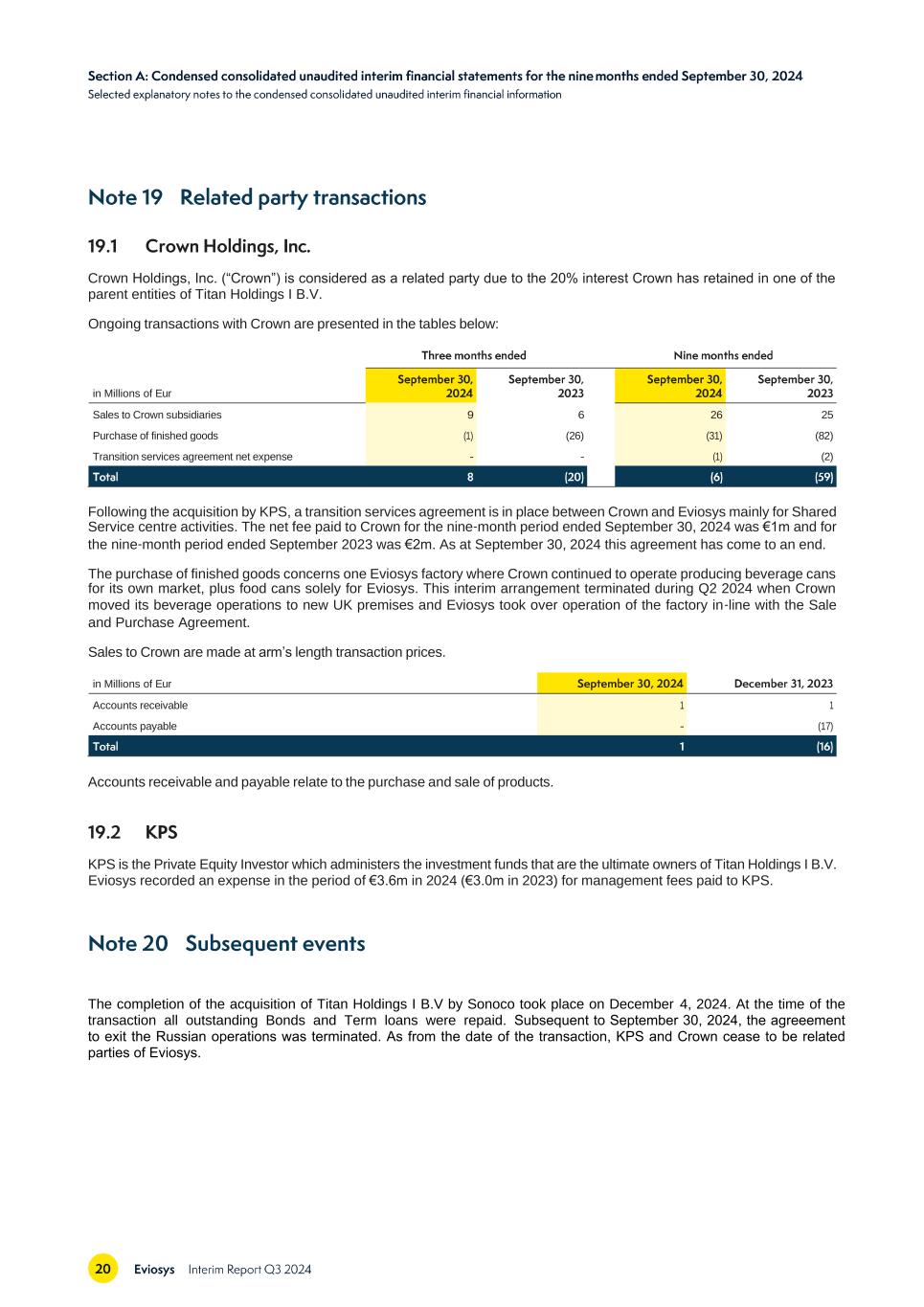

Crown Holdings, Inc. (“Crown”) is considered as a related party due to the 20% interest Crown has retained in one of the parent entities of Titan Holdings I B.V. Ongoing transactions with Crown are presented in the tables below: in Millions of Eur Sales to Crown subsidiaries 9 6 26 25 Purchase of finished goods (1) (26) (31) (82) Transition services agreement net expense - - (1) (2) Following the acquisition by KPS, a transition services agreement is in place between Crown and Eviosys mainly for Shared Service centre activities. The net fee paid to Crown for the nine‑month period ended September 30, 2024 was €1m and for the nine‑month period ended September 2023 was €2m. As at September 30, 2024 this agreement has come to an end. The purchase of finished goods concerns one Eviosys factory where Crown continued to operate producing beverage cans for its own market, plus food cans solely for Eviosys. This interim arrangement terminated during Q2 2024 when Crown moved its beverage operations to new UK premises and Eviosys took over operation of the factory in‑line with the Sale and Purchase Agreement. Sales to Crown are made at arm’s length transaction prices. in Millions of Eur Accounts receivable 1 1 Accounts payable - (17) Accounts receivable and payable relate to the purchase and sale of products. KPS is the Private Equity Investor which administers the investment funds that are the ultimate owners of Titan Holdings I B.V. Eviosys recorded an expense in the period of €3.6m in 2024 (€3.0m in 2023) for management fees paid to KPS. The completion of the acquisition of Titan Holdings I B.V by Sonoco took place on December 4, 2024. At the time of the transaction all outstanding Bonds and Term loans were repaid. Subsequent to September 30, 2024, the agreeement to exit the Russian operations was terminated. As from the date of the transaction, KPS and Crown cease to be related parties of Eviosys.