- VALE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

SC TO-C Filing

Vale (VALE) SC TO-CInformation about tender offer

Filed: 14 Aug 06, 12:00am

Exhibit 99.4

A new step towards value creation Rio de Janeiro August 11, 2006 Companhia Vale do Rio Doce |

Disclaimer “This presentation may contain statements that express management’s expectations about future events or results rather than historical facts. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected in forward-looking statements, and CVRD cannot give assurance that such statements will prove correct. These risks and uncertainties include factors: relating to the Brazilian economy and securities markets, which exhibit volatility and can be adversely affected by developments in other countries; relating to the iron ore business and its dependence on the global steel industry, which is cyclical in nature; and relating to the highly competitive industries in which CVRD operates. For additional information on factors that could cause CVRD’s actual results to differ from expectations reflected in forward-looking statements, please see CVRD’s reports filed with the Brazilian Comissão de Valores Mobiliários and the U.S. Securities and Exchange Commission.” |

Important Information “This presentation may be deemed to be solicitation material in respect of CVRD’s proposed tender offer for the shares of Inco. CVRD will prepare and file a tender offer statement on Schedule TO (containing an offer to purchase and a takeover bid circular) with the United States Securities and Exchange Commission (“SEC”). CVRD, if required, will file other documents regarding the proposed tender offer with the SEC.” INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE TAKEOVER BID CIRCULAR, THE SCHEDULE TO AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE OFFER FOR INCO SHARES. These documents will be available without charge on the SEC’s web site at www.sec.gov. Free copies of these documents can also be obtained by directing a request to Kingsdale Shareholder Services Inc., The Exchange Tower, 130 King Street West, Suite 2950, P.O. Box 361, Toronto, Ontario, M5X 1E2, by telephone to 1-866-381-4105 (North American Toll Free) or 416-867-2272 (Overseas), or by email to: contactus@kingsdaleshareholder.com. |

Since 2001, a new era of CVRD’s history has started. CVRD became the private company that most invests in Brazil 2000 – 20061 1 until June 2006 2 CVRD’s and third party employees Investments US$ 14 billion Exports US$ 31 billion Direct jobs2 137,000 |

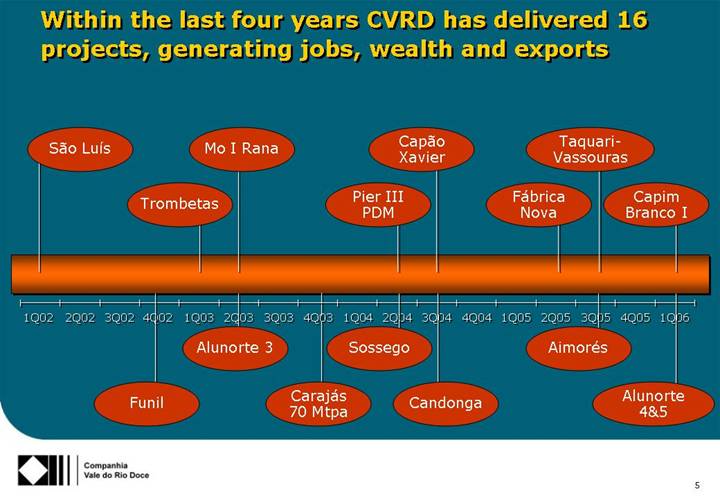

Within the last four years CVRD has delivered 16 projects, generating jobs, wealth and exports Funil Alunorte 3 Carajás70 Mtpa Sossego Candonga Aimorés Alunorte 4&5 São Luís Trombetas Capão Xavier Pier III PDM Mo I Rana Fábrica Nova Taquari-Vassouras Capim Branco I 1Q02 2Q02 3Q02 4Q02 1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 |

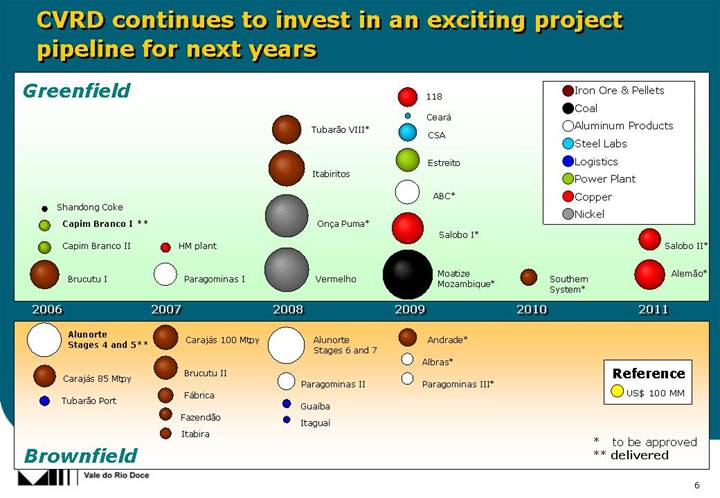

2006 2007 Brownfield Greenfield 2008 2010 Southern System* Alunorte Stages 6 and 7 CSA Estreito Moatize Mozambique* Andrade* ABC* Salobo I* Vermelho 118 Ceará Shandong Coke Capim Branco I ** Brucutu I Paragominas I Itabiritos Brucutu II Fábrica Alunorte Stages 4 and 5** Carajás 85 Mtpy Fazendão Itabira Tubarão Port Salobo II* Alemão* Paragominas II Paragominas III* Reference US$ 100 MM Carajás 100 Mtpy Tubarão VIII* Onça Puma* CVRD continues to invest in an exciting project pipeline for next years Guaíba 2011 2009 Itaguaí Albras* * to be approved ** delivered HM plant Capim Branco II Iron Ore & Pellets Coal Aluminum Products Steel Labs Logistics Power Plant Copper Nickel |

CVRD restructured its business portfolio making several acquisitions. ACQUISITIONS US$ 5.6 billion 2000-2006* * until June 2006 |

CVRD’s internationalization Growth and competitiveness strength requires global action The globalization enhances the capacity to invest and create jobs in Brazil |

CVRD takes a new and important step towards consolidating its position as one of the major mining company in the world Offer to acquire 100% of Inco Offer price: Cdn$ 86.00 per Inco share, total of Cdn$ 19.9 billion |

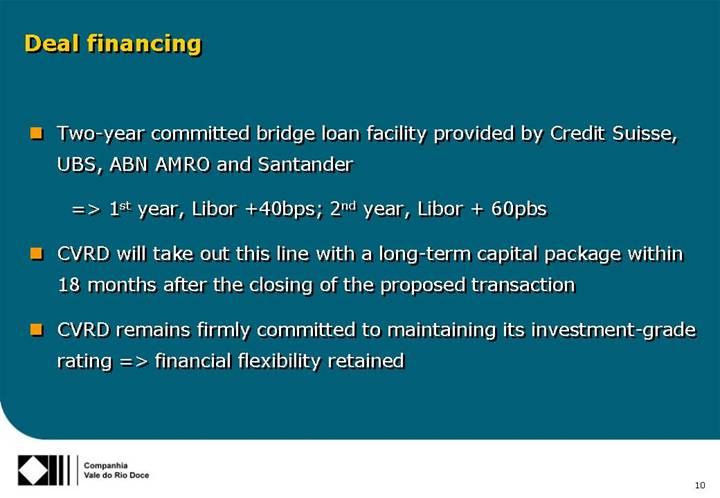

Deal financing Two-year committed bridge loan facility provided by Credit Suisse, UBS, ABN AMRO and Santander => 1st year, Libor +40bps; 2nd year, Libor + 60pbs CVRD will take out this line with a long-term capital package within 18 months after the closing of the proposed transaction CVRD remains firmly committed to maintaining its investment-grade rating => financial flexibility retained |

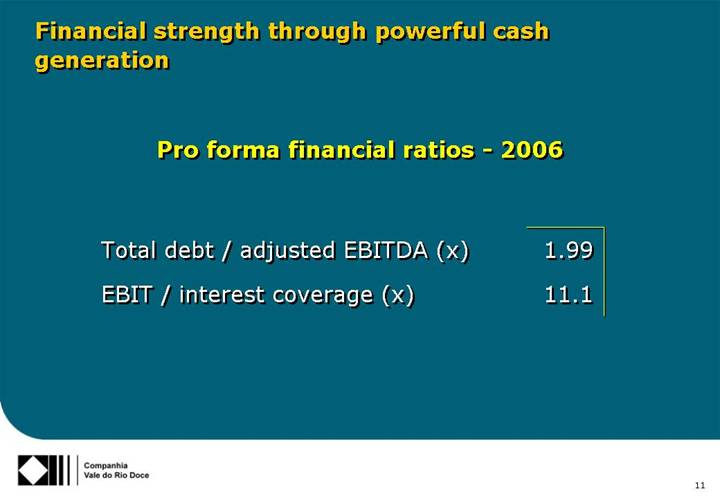

Financial strength through powerful cash generation Pro forma financial ratios - 2006 Total debt / adjusted EBITDA (x) 1.99 EBIT / interest coverage (x) 11.1 |

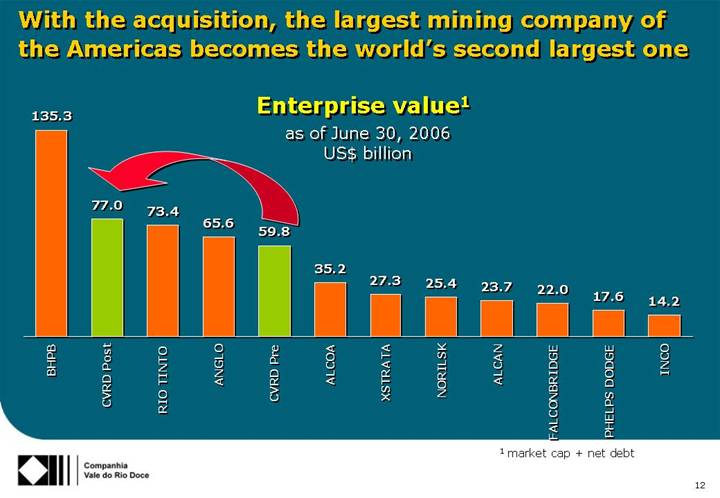

With the acquisition, the largest mining company of the Americas becomes the world’s second largest one as of June 30, 2006 US$ billion Enterprise value1 1 market cap + net debt 14.2 17.6 22.0 23.7 25.4 27.3 35.2 59.8 65.6 73.4 77.0 135.3 BHPB CVRD Post RIO TINTO ANGLO CVRD Pre ALCOA XSTRATA NORILSK ALCAN FALCONBRIDGE PHELPS DODGE INCO |

An overview of Inco World’s second largest nickel producer World’s largest nickel reserve base One of the world’s lowest cost producers of nickel A very attractive growth pipeline of projects A global leader in nickel technology – powerful brand name and premium products |

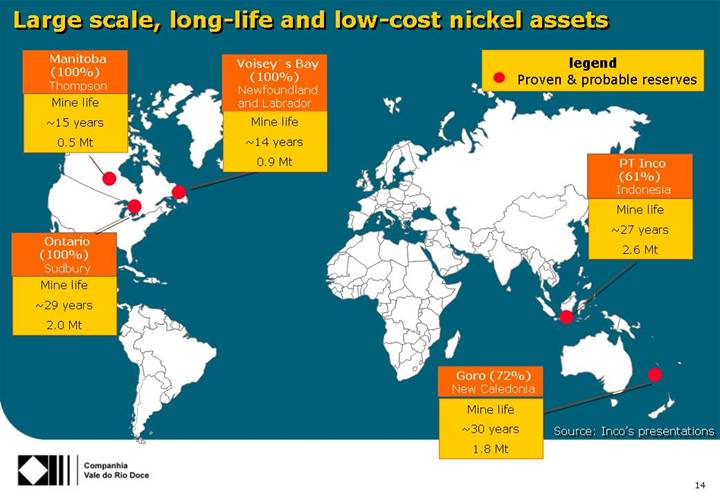

Large scale, long-life and low-cost nickel assets legend Proven & probable reserves Mine life ~29 years 2.0 Mt Ontario (100%) Sudbury Mine life ~15 years 0.5 Mt Manitoba (100%) Thompson Mine life ~30 years 1.8 Mt Goro (72%) New Caledonia Voisey`s Bay (100%) Newfoundland and Labrador Mine life ~14 years 0.9 Mt Mine life ~27 years 2.6 Mt PT Inco (61%) Indonesia Source: Inco’s presentations |

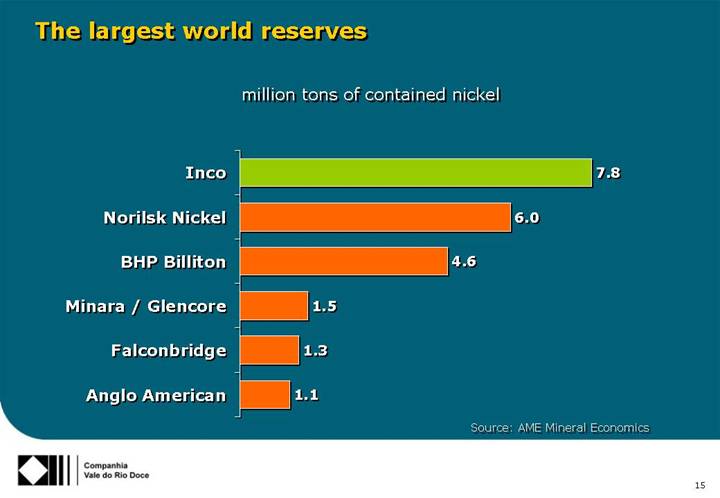

The largest world reserves million tons of contained nickel Source: AME Mineral Economics 6.0 4.6 1.5 1.3 1.1 7.8 Anglo American Falconbridge Minara / Glencore BHP Billiton Norilsk Nickel Inco |

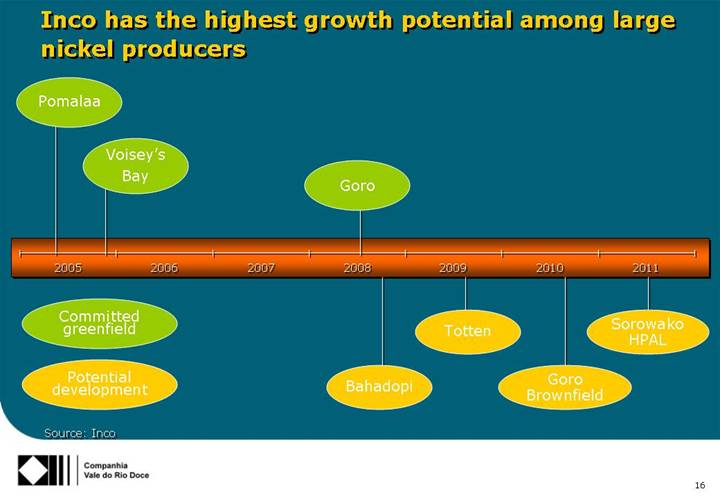

Inco has the highest growth potential among large nickel producers Voisey’s Bay Bahadopi Sorowako HPAL Goro Brownfield Pomalaa Goro Totten Committed greenfield Potential development Source: Inco 2005 2006 2007 2008 2009 2010 2011 |

The new CVRD will enhance its global leadership #1 in iron ore & pellets #2 in nickel with a clear path to #1 #2 in manganese & ferroalloys Future #2 in bauxite and #3 in alumina1 ¹ growth provided by our organic pipeline: Paragominas I, II and III, Alunorte 6 & 7 and ABC |

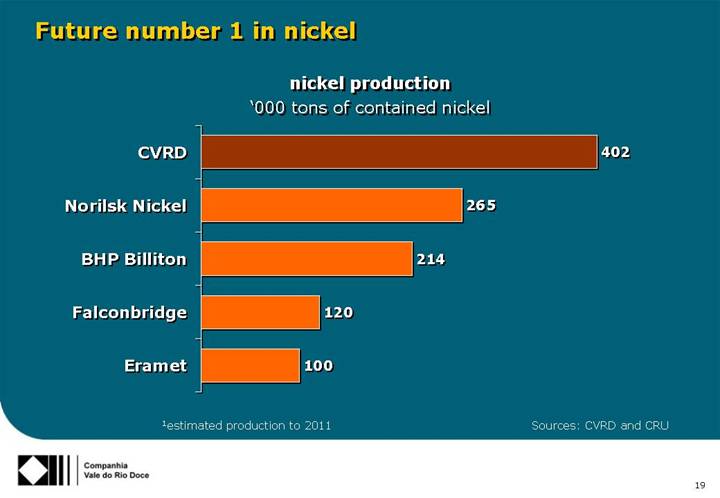

A new growth platform With the new assets and projects, CVRD will become #1 on the global nickel market Inco’s experience and technology will contribute to minimize the development risk of our projects (Vermelho, Onça Puma, São João do Piauí and Água Branca) |

Future number 1 in nickel nickel production ‘000 tons of contained nickel 1estimated production to 2011 Sources: CVRD and CRU 100 120 214 265 402 Eramet Falconbridge BHP Billiton Norilsk Nickel CVRD |

CVRD will become an one-stop shop for the steel industry Metallurgical coal (future) Iron Ore Pellets Fe Mn alloys Nickel CVRD Manganese |

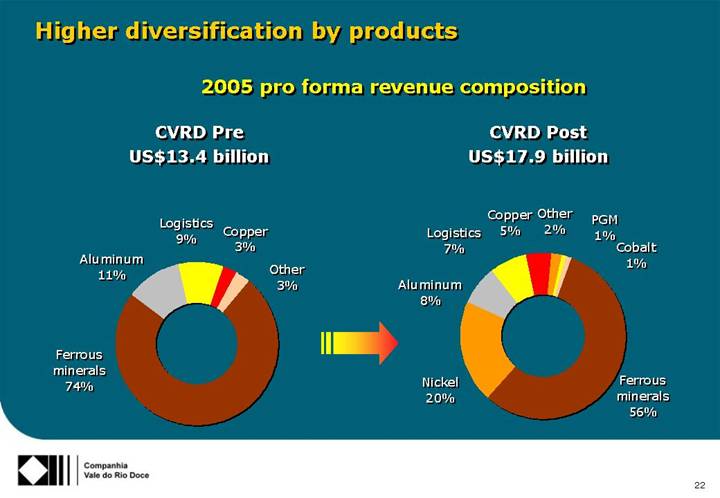

Positive impact on cost of capital Acquisition promotes a better diversification of our activities by products, markets and geographic asset base Clear positive impact on business & financial risks and cost of capital |

2005 pro forma revenue composition Higher diversification by products CVRD Post US$17.9 billion CVRD Pre US$13.4 billion Other 3% Copper 3% Logistics 9% Ferrous minerals 74% Aluminum 11% Other 2% PGM 1% Cobalt 1% Copper 5% Logistics 7% Aluminum 8% Ferrous minerals 56% Nickel 20% |

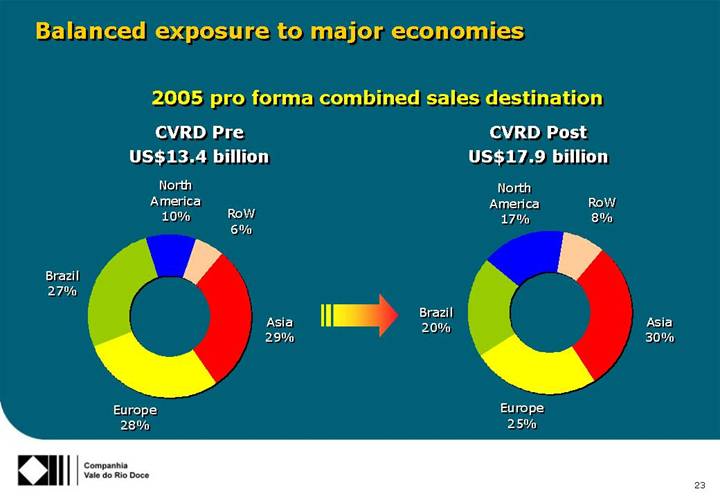

Balanced exposure to major economies 2005 pro forma combined sales destination CVRD Post US$17.9 billion CVRD Pre US$13.4 billion RoW 6% North America 10% Brazil 27% Asia 29% Europe 28% RoW 8% North America 17% Brazil 20% Asia 30% Europe 25% |

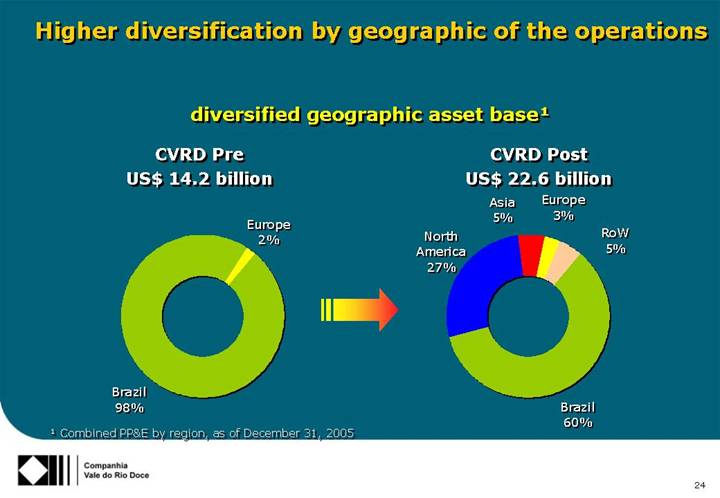

Higher diversification by geographic of the operations CVRD Post US$ 22.6 billion CVRD Pre US$ 14.2 billion ¹ Combined PP&E by region, as of December 31, 2005 diversified geographic asset base¹ RoW 5% Europe 3% Asia 5% Brazil 60% North America 27% Brazil 98% Europe 2% |

The acquisition is an additional effort for value creation We will continue to invest in our organic growth projects in Brazil. In Canada, we intend to continue Inco’s investments in P&D, mineral exploration and projects to maintain the competitiveness of its operations. |

CVRD A Brazilian global leader www.cvrd.com.br E-mail: rio@cvrd.com.br Companhia Vale do Rio Doce |