- VALE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Vale (VALE) 6-KCurrent report (foreign)

Filed: 30 May 17, 12:00am

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

May 2017

Vale S.A.

Avenida das Américas, No. 700 – Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x Form 40-F o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes o No x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes o No x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes o No x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

1.1 Declaration and Identification of Officials

Name of the person responsible for the |

|

|

content of the form |

| Murilo Pinto de Oliveira Ferreira |

Position of person in charge |

| CEO |

|

|

|

Name of the person responsible for the |

|

|

content of the form |

| Luciano Siani Pires |

Position of person in charge |

| Investor Relations Officer |

The officers, mentioned above, declare that: |

|

a. They have reviewed the form in question; |

|

b. All information contained in the form complies with the provisions of CVM Instruction 480, especially that regarding articles 14 to 19; |

|

c. The set of information contained herein is a true, accurate complete picture of the economic and financial situation of the issuer and the risks inherent to its activities and the securities issued by them. |

STATEMENT BY THE CEO

FOR THE PURPOSE OF ITEM 1.1 OF THE REFERENCE FORM

Murilo Pinto de Oliveira Ferreira, Brazilian citizen, married, business administrator, holder of the Identity Card IFP/RJ No. 004.922.272-2, registered with the CPF/MF under No. 212.466.706-82, resident and domiciled in the city and State of Rio de Janeiro, with commercial address at Avenida das Américas, 700, Bloco 8, Loja 318, 3rd floor, Barra da Tijuca, CEP 22640-100, in the city and State of Rio de Janeiro, in the position of CEO of Vale S.A., a joint-stock company with headquarters in the city and State of Rio de Janeiro, at Avenida das Américas, No. 700, Bloco 8, Loja 318, 3rd. floor, Barra da Tijuca, CEP 22640-100, registered with CNPJ/MF under No. 33,592,510/0001-54 (“The Company”), for the purpose of item 1.1 regarding the above mentioned form for the Company, declares that:

a. He has reviewed the Company’s Reference Form;

b. All information contained in the Reference Form complies with the provisions of the Securities Commission Instruction 480, dated December 7, 2009, as amended, especially regarding articles 14 to 19; and

c. The set of information contained herein is a true, accurate and complete picture of the Company’s economic and financial situation and the risks inherent to its activities and the securities issued by it.

|

|

|

Murilo Pinto de Oliveira Ferreira | ||

CEO | ||

STATEMENT BY THE EXECUTIVE FINANCE AND INVESTOR RELATIONS OFFICER

FOR THE PURPOSE OF ITEM 1.1 OF THE REFERENCE FORM

Luciano Siani Pires, Brazilian, married, mechanical engineer, holder of Identity Card IFP/RJ No. 07.670.915-3, enrolled with the CPF/MF under No. 013.907.897-56, resident and domiciled in the city and State of Rio de Janeiro, with Commercial address at Avenida das Américas, No. 700, Bloco 8, Loja 318, 3rd. floor, Barra da Tijuca, CEP 22640-100, in the city and State of Rio de Janeiro, as Executive Finance and Investor Relations Officer for Vale S.A., a joint-stock company with headquarters in the city and State of Rio de Janeiro, at Avenida das Américas, 700, Bloco 8, Loja 318, 3rd. floor, Barra da Tijuca, CEP 22640-100, registered with CNPJ/MF under No. 33,592,510/0001-54 (“The Company”), for the purpose of item 1.1 regarding the above mentioned form for the Company, declares that:

a. He has reviewed the Company’s Reference Form;

b. All information contained in the Reference Form complies with the provisions of the Securities Commission Instruction 480, dated December 7, 2009, as amended, especially regarding articles 14 to 19; and

c. The set of information contained herein is a true, accurate and complete picture of the Company’s economic and financial situation and the risks inherent to its activities and the securities issued by it.

| ||

|

|

|

Luciano Siani Pires | ||

Executive Finance and Investor Relations Officer | ||

2.1/2.2 - Identification and Remuneration of Auditors

Do you have an auditor? |

| YES | |||

CVM code |

| 418-9 | |||

Type of auditor |

| National | |||

Company Name |

| KPMG Auditores Independentes | |||

CPF/CNPJ |

| 57.755.217/0001.29 | |||

Start of service contract: |

| 04/30/2014 | |||

End of service provision: |

| Ongoing | |||

Description of contracted service |

| Provision of professional services related to the audit of the financial statements, both for local and international purposes and certification work on internal controls (in compliance with Section 404 of the Sarbanes-Oxley Act of 2002) for the financial years ending on December 31, 2014, December 31, 2015 and December 31, 2016 and the review of Quarterly Financial Information (ITR) of June 30, 2014 until March 31, 2017.

In addition, the scope of work also encompasses the provision of other audit-related services, such as issue of previously agreed procedural reports in accordance with NBC TSC4400. | |||

Total amount of remuneration for independent auditors separated by service |

| The services contracted with the Company’s external auditors for the financial year ended December 31, 2016 for the Company and its subsidiaries were as follows: | |||

|

|

|

| Reais (thousand) |

|

|

|

| Financial Audit | 17,380 |

|

|

|

| Auditing - Sarbanes Oxley Act | 1,175 |

|

|

|

| Audit Related Services (*) | 101 |

|

|

|

| Total External Audit Services | 18,656 |

|

|

|

| (*) These services are mostly contracted for periods of less than one year and mainly relate to the issue of reports of previously agreed procedures in accordance with NBC TSC4400 |

Reason for substitution |

| Not applicable | |

Reason presented by the auditor in case of disagreement with the issuer’s justification |

| Not applicable | |

Name of |

| Period of |

| CPF |

| Address |

Manuel Fernandes Rodrigues de Sousa |

| As from 04/30/2014 |

| 783.840.017-15 |

| Av. Almirante Barroso, 52 — 4º andar |

2.3 - Other relevant information

The Vale Board of Directors, at a meeting held on November 28, 2013, approved the contracting of KPMG Auditores Independentes to provide audit services for the financial statements for a period of three years beginning in 2014. That service started to be provided as of the review of the quarterly information (ITRs) for the second quarter of 2014.

The Company has specific internal procedures for the pre-approval of services contracted with its external auditors, in order to avoid conflict of interest or the loss of objectivity of its independent auditors.

The Company’s policy, in relation to independent auditors and in the provision of services not related to external auditing, is based on principles that preserve its independence.

In line with best corporate governance practices, all services provided by our independent auditors are pre-approved by our Fiscal Council and a letter of independence is also obtained from the external auditors.

In addition, the Company clarifies that there are no material transfers of services or resources between the auditors and parties related to the Company, as defined in CVM Deliberation 642/10, which approves Technical Pronouncement CPC 05 (R1).

3.1 - Financial Information - Consolidated

(Reais) |

| Fiscal Year |

| Fiscal Year |

| Fiscal Year |

|

|

|

|

|

|

|

|

|

Equity |

| 133,702,000,000.00 |

| 139,419,000,000.00 |

| 149,601,000,000.00 |

|

Total Assets |

| 322,696,000,000.00 |

| 345,547,000,000.00 |

| 309,415,000,000.00 |

|

Net revenues |

| 94,633,000,000.00 |

| 78,057,000,000.00 |

| 82,619,000,000.00 |

|

|

|

|

|

|

|

|

|

Gross Profit or loss |

| 33,490,000,000.00 |

| 15,277,000,000.00 |

| 28,846,,000,000.00 |

|

Profit (Loss) |

| 13,311,000,000.00 |

| -44,213,000,000.00 |

| 954,000,000.00 |

|

|

|

|

|

|

|

|

|

Number of Shares, Ex-Treasury |

| 5,153,374,926 |

| 5,153,374,926 |

| 5,153,374,926 |

|

Book value per Share (Reais/Unit) |

| 25.94455127 |

| 27.05392136 |

| 29.02971395 |

|

Basic Earnings per Share |

| 2.58000000 |

| -8.58000000 |

| 0.19000000 |

|

Diluted Earnings per Share |

| 2.58 |

| -8.58 |

| 0.19 |

|

3.2 - Non-accounting measurements

a. Value of non-accounting measurements

The Company uses Adjusted EBITDA and Adjusted EBIT as a non-accounting method of measurement. In 2016, 2015 and 2014 respectively (i) Adjusted EBITDA was R$ 40,906 million, R$ 21,741 million and R$ 30,480 million, and (ii) Adjusted EBIT was recognized in the amount of R$ 28,130 million, R$ 8,227 million, R$ 20,050 million, respectively.

b. Reconciliation between the amounts disclosed and the amounts in the audited financial statements

|

| Fiscal Year Ended |

| ||||

(In R$ million, except%) |

| 2016 |

| 2015 |

| 2014 |

|

Net income (loss) for the year |

| 17,454 |

| (45.337 | ) | 2,404 |

|

(+) Income tax and social contributions |

| 9,567 |

| (19,339 | ) | 3,658 |

|

(+) Financial result |

| (6.302 | ) | 36.053 |

| 14.626 |

|

LAJIR (EBIT) |

| 120,720 |

| (28,623 | ) | 20,688 |

|

(+) Depreciation, amortization and depletion |

| 12,107 |

| 12,450 |

| 9,128 |

|

EBITDA |

| 32,827 |

| (16,173 | ) | 29,816 |

|

Result of equity investments in Joint ventures and affiliates |

| (1,111 | ) | 1,526 |

| (1,131 | ) |

Impairment of non-current assets and onerous contracts |

| 3,940 |

| 33,945 |

| (87 | ) |

Impairment of interest in joint ventures and associated companies |

| 4,353 |

| 1,431 |

| 139 |

|

Result of non-current assets held for sale |

| 228 |

| (52 | ) | 441 |

|

Dividends received |

| 669 |

| 1.064 |

| 1.302 |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

| 40,906 |

| 21,741 |

| 30,480 |

|

Dividends received |

| (669 | ) | (1.064 | ) | (1.302 | ) |

Depreciation, amortization and depletion |

| (12,107 | ) | (12,450 | ) | (9,128 | ) |

Adjusted EBIT |

| 28,130 |

| 8,227 |

| 20,050 |

|

c. Reason why the Company is of the opinion that such measurement method is more appropriate for the correct understanding of its financial condition and its operational results.

We calculate the Adjusted EBITDA and Adjusted EBIT according to CVM Instruction 527 dated October 04, 2012 (“CVM Instruction 527”).

The adjusted EBITDA corresponds to EBITDA adding the dividends received from affiliates and Joint ventures, and excluding the recoverable amount, onerous contracts and the profit or loss from the measurement or sale of non-current assets. It shows an approximate measure of the Company’s cash generation, since it excludes non-recurring and non-cash effects.

Adjusted EBIT corresponds to Adjusted EBITDA including depreciation, amortization and depletion and dividends received from affiliates and Joint ventures.

Adjusted EBITDA and Adjusted EBIT are not measurement methods recognized under BR GAAP or the IFRS. Adjusted EBITDA does not represent the cash flow for the periods presented and therefore should not be considered as an alternative measure for profit (loss), as an isolated indicator of operating performance or as an alternative to the cash flow or as a source of liquidity.

The definitions of Adjusted EBITDA and Adjusted EBIT used by Vale may not be comparable to Adjusted EBITDA and Adjusted EBIT posted by other companies.

3.3 - Events subsequent to the latest financial statements

The Company does not provide guidance in the form of quantitative forecasts regarding its future financial performance. The Company seeks to disclose as much information as possible about its vision of the different markets in which it operates, guidelines, strategies and its execution, in order to provide participants in the capital markets with good conditions for the formation of expectations about their medium and long-term performance.

The Company’s Consolidated Financial Statements for the financial year ended December 31, 2016 were issued on February 22, 2017.

The following events subsequent to the Company’s Consolidated Financial Statements were verified, in accordance with the rules set forth in the Technical Pronouncement CPC 24, approved by CVM Deliberation No. 593/09:

· As of January 1, 2017, the Company will adopt Hedge accounting for its net investments abroad considering Vale International S.A. and Vale International Holdings GmbH as the object of the Hedge and its loans with the subsidiary company designated as the Hedge instrument, excluding interest, using exchange rates denominated in US dollars and euros for the amount of US$ 8,067 million (R$ 26,291) million and EUR 1,500 million (R$ 5,129 million) as a Hedge instrument, respectively.

Accordingly, the Company plans to mitigate part of the exchange rate risk exposure, since the foreign exchange gains or Hedge (Effective portion) will be recognized in other covered income sources, offset by any gains and losses arising from the conversion of net investments in the aforementioned subsidiaries abroad. If the relationship is not considered effective, the exchange rate variations of the Hedge will be allocated to income for the year.

In February 2017, the Company issued, through Vale Overseas Limited, bonds with a maturity in August 2026 totaling R$ 3,259 million (US$ 1,000 million). The bonds have a coupon value of 6.250% per annum, paid semi-annually, and were priced at 107.793% of the face value of the security. These bonds will be consolidated, and will form a single series with Vale Overseas bonds, issued in August 2016, at R$ 3,259 million (US$ 1,000) with a coupon value of 6.250%, as mentioned above. Vale has applied the net proceeds of this offer to anticipate a payment of EUR750, maturing in March 2018.

· On February 20, 2017, the Company announced that a new shareholders’ agreement, entered into by Litel Participações S.A., Litela Participações S.A., Bradespar S.A., Mitsui & Co., Ltd. and BNDES Participações S.A. - BNDESPAR (“Valepar agreement”), as shareholders of Valepar S.A. (“Valepar”), jointly called the “Shareholders”, to be effective only after the expiration of the current Valepar Shareholders’ Agreement, as from May 10, 2017.

The Valepar Agreement, in addition to the common rules regarding voting and preemptive rights in the acquisition of shares by the Shareholders, provides for the presentation by the Shareholders of a proposal to the Company in order to enable Vale’s listing in the special segment of the New Market of BM & FBOVESPA (Brazil) and to transform it into a society without defined control, the (“Proposal”). The Proposal is binding on the Shareholders, and is subject to approval by the Company’s corporate bodies. This Valepar Agreement has a term of 6 months, from the beginning of its validity.

The operation contemplated by the Proposal consists of a series of inseparable and interdependent steps, the effectiveness of each being conditioned to the successful completion of the others. The Proposal consists, in addition to the practice of all acts and procedures required by the relevant legal and regulatory provisions, of:

(i) Voluntary conversion of Vale’s class A preferred shares into common shares in the ratio of

0.9342 common share per class A preferred share of Vale, and based on the closing price of the common and preferred shares, with the calculation based on the average of the last 30 trading sessions on BM & FBOVESPA prior to February 17, 2017 (inclusive), weighted by the volume of shares traded in said trading sessions;

(ii) Altering Vale’s Bylaws to adapt it as closely as possible to the rules of the special segment of the BM & FBOVESPA New Market until it can effectively list Vale in this special segment; and

(iii) Incorporation of Valepar into Vale with a substitution ratio that contemplates an increase in the number of shares held by Valepar’s shareholders of 10% in relation to Valepar’s current shareholding position in Vale, and represents a dilution of approximately 3% of the remaining Shareholders in its capital stock.

In line with what is stated in item (iii) above, Valepar’s shareholders will receive 1,2065 common shares issued by Vale for each share issued and owned by Valepar. As a result, Vale will be issued 173,543,667 new common shares, all nominative and without par value in favor of Valepar shareholders, so that Valepar shareholders will hold a total of 1,908,980,340 common shares issued by Vale after the merger of Valepar.

The goodwill recorded in Valepar’s financial statements and its potential tax benefit to be used by Vale will not be capitalized in favor of Valepar’s shareholders, but only in favor of all Vale’s shareholders. At the time of incorporation, Valepar will have sufficient cash and cash equivalents to fully offset its liabilities. The implementation of the Proposal is subject to (i) approval of the Proposal, including the merger of Valepar by the Company, and by Valepar and the Company’s corporate bodies; and, (ii) adhesion of at least 54.09% of class A preferred shares to the aforementioned voluntary conversion, within 45 days of the resolution of the meeting on the matter, which shall result in a shareholder participation of less than 50% of Vale’s common stock. During the deliberations on the voluntary conversion of class A preferred shares into Vale common shares and on the merger of Valepar under the proposed terms, Valepar and the Shareholders will not exercise their voting rights in the respective general shareholders’ meetings of Vale.

Holders of American Depositary Shares representing Vale’s class A preferred shares (Preferred ADSs) may join the voluntary conversion, in which case they will receive American Depositary Shares representing common shares of Vale (common ADSs) under the same conditions offered to holders of class A preferred shares. Class A preferred shares and preferred ADSs that have not adhered to the voluntary conversion mentioned above will continue in circulation.

On the effective date of the merger of Valepar into Vale, if approved, there will be a new shareholders’ agreement (“Vale Agreement”), which will bind only 20% of the total number of common shares issued by Vale, and will be in force until November 9, 2020, without any renewal.

The shareholders bound by the Vale Agreement will still be obliged, during the six-month term, from the effective date of the Vale Agreement, not to dispose, in any form, directly or indirectly, the shares issued by Vale that they may own as a result of the implementation of the Proposal (“Lock-Up”), except for (i) the transfer by the Shareholders of shares of Vale to its affiliates and current shareholders, which will nevertheless still remain subject to Lock-Up and (ii) disposal of unrelated shares held prior to the merger of Valepar.

For more information on the above, see item 6.6 of this Reference Form.

3.4 - Policy for allocation of net earnings

|

| Fiscal Year Ended December 31, | ||||

|

| 2016 |

| 2015 |

| 2014 |

a. Rules on Retained Earnings |

| Pursuant to Article 43 of the Bylaws, the constitution of the distribution of earnings should be considered in the proposal for the; (i) tax incentive reserve to be constituted in accordance with current legislation, and (ii) investment reserve, with the purpose of ensuring the maintenance and development of the main activities that make up the Company’s corporate purpose, in an amount not greater than fifty percent (50%) of net earnings distributable up to the maximum limit of the Company’s capital stock. | ||||

|

|

| ||||

Retained Earnings Values |

| Of the total amount of R$ 13,311,455,285.00, (i) R$ 665,572,764.25 was allocated to the legal reserve, (ii) R$ 1,227,570,177.73 to the tax incentive reserve, (iii) R$ 5,894,586,907.98 to Investment reserve. |

| The net loss in the amount of R$ 44,212,186,731.00 was determined, and said loss was absorbed in accordance with the sole paragraph of Article 189 of Law 6,404 / 1976. Accordingly, no earnings were retained from profits for the financial year ended December 31, 2015. |

| Of the total amount of R$ 954,384,414.00, (i) R$ 47,719,220.70 was allocated to the legal reserve and (ii) R$ 161,770,077.08 (17%) to the tax incentive reserve. |

|

|

|

|

|

|

|

b. Dividend distribution rules |

| Pursuant to Article 44 of the Bylaws, at least 25% (twenty-five percent) of the annual profits, adjusted according to the law, will be used to pay dividends. | ||||

|

|

| ||||

c. Frequency of dividend distributions |

| From the net earnings of the financial year of 2016, R$ 5,523,725,435.04 were paid as interest on own capital, of which R$ 856,975,000.00 was paid in December 2016 and (ii) R$ 4,666,750,435.04 was paid in April 2017. |

| In accordance with the practices adopted by the Company, dividend payments during the financial year ended December 31, 2015, were made in two semi-annual instalments, in the months of April and October. It should be noted that the shareholder remuneration policy was changed at the Ordinary and Extraordinary General Meeting held on April 25, 2016. For information on |

| In accordance with the practices adopted by the Company, dividend payments during the financial year ended December 31, 2014 were made in two semi-annual instalments, in April and October. |

|

|

|

| this policy, see item 3.9 below. |

|

|

|

|

|

|

|

|

|

d. Any restrictions on the distribution of dividends imposed by special legislation or regulations applicable to the issuer, as well as contracts, judicial, administrative or arbitration decisions |

| None |

| None |

| None |

3.5 - Distribution of dividends and retention of net income

(Reais) |

| Fiscal Year 12/31/2016 |

| Fiscal Year 12/31/2015 |

| Fiscal Year 12/31/2014 |

|

Adjusted net income |

| 11,761,350,206.85 |

| 0.00000 |

| 744,895,116.22 |

|

Dividend distributed in relation to adjusted net income |

| 46.97000000 |

| 0.00000 |

| 100.00000000 |

|

Rate of return in relation to the issuer’s net equity |

| 10.46165 |

| 0.00000 |

| 0.65184 |

|

Total Distributed Dividend |

| 5,523,725,435.04 |

| 0.00000 |

| 9,738,750,000.00 |

|

Net Income Withheld |

| 7,787,729,849.96 |

| 0.00000 |

| 161,770,077.08 |

|

Retention approval date |

| 20/04/2017 |

| 25/04/2016 |

| 17/04/2015 |

|

01/01/2016 to 12/31/2016

Type of Share |

| Class of Share |

| Distributed Dividend |

| Amount (Unit) |

| Dividend Payment |

Ordinary |

|

|

| Interest on Equity |

| 2,884,837,166.99 |

| 28/04/2017 |

Preferential |

| Preferred Class A |

| Interest on Equity |

| 1,781,913,268.06 |

| 28/04/2017 |

Ordinary |

|

|

| Interest on Equity |

| 529,754,775.95 |

| 16/12/2016 |

Preferential |

| Preferred Class A |

| Interest on Equity |

| 327,220,224.04 |

| 16/12/2016 |

01/01/2015 to 12/31/2015

Type of Share |

| Class of Share |

| Distributed Dividend |

| Amount (Unit) |

| Dividend Payment |

Ordinary |

|

|

| Interest on Equity |

| 1,917,001,706.26 |

| 30/04/2015 |

Preferential |

| Preferred Class A |

| Interest on Equity |

| 1,184,098,296.20 |

| 30/04/2015 |

Ordinary |

|

|

| Compulsory Dividend |

| 1,190,190,329.63 |

| 30/10/2015 |

Preferential |

| Preferred Class A |

| Compulsory Dividend |

| 735,159,669.85 |

| 30/10/2015 |

01/01/2014 to 12/31/2014

Type of Share |

| Class of Share |

| Distributed Dividend |

| Amount (Unit) |

| Dividend Payment |

Ordinary |

|

|

| Interest on Equity |

| 2,863,596,635.71 |

| 30/04/2014 |

Preferential |

| Preferred Class A |

| Interest on Equity |

| 1,768,793,364.29 |

| 30/04/2014 |

Ordinary |

|

|

| Compulsory Dividend |

| 1,083,253,396.32 |

| 31/10/2014 |

Preferential |

| Preferred Class A |

| Compulsory Dividend |

| 669,106,603.68 |

| 31/10/2014 |

Ordinary |

|

|

| Interest on Equity |

| 2,073,336,466.96 |

| 31/10/2014 |

Preferential |

| Preferred Class A |

| Interest on Equity |

| 1,280,663,533.04 |

| 31/10/2014 |

3.6 - Declaration of dividends from retained earnings or reserves

Dividends distributed from |

| Financial Year Ended December 31, |

| ||||

(in R$ thousand): |

| 2016 |

| 2015 |

| 2014 |

|

Retained Earnings |

| — |

| — |

| — |

|

Realization of Reserves |

| — |

| 5,026,450 |

| 8,993,855 |

|

3.7 - Level of indebtedness

Accounting |

| Sum of current |

| Index Type |

| Indebtedness |

| Description and reason for using another ratio | |

12/31/2016 |

| R$ | 188,994,000,000.00 |

| Indebtedness Ratio |

| 1.50000000 |

|

|

12/31/2016 |

| 0 |

| Other ratios |

| 2.40000000 |

| Gross Debt/Adjusted EBITDA. The index is based on the US dollar. Gross debt consists of the sum of “Short-term loans and financing”, “Current portion of long-term loans” and “Long-term loans and financing”. Adjusted EBITDA is calculated as described in item 3.2.b of this Annualized Reference Form covering the last twelve months - ADJUSTED EBITDA.

The Gross Debt ratio/ Adjusted EBITDA indicates the approximate time it would take for a company to pay all debts using only its cash generation.

The Company adopts the Gross Debt ratio/Adjusted EBITDA and the Adjusted EBITDA-to-Interest Coverage/Interest Expenses ratio. These ratios are widely used by the market (rating agencies and financial institutions) and serve as a reference to evaluate the Company’s financial situation. | |

12/31/2016 |

| 0 |

| Other ratios |

| 6.8000000 |

| Adjusted EBITDA / Interest Expense - This ratio is based on the US dollar. Adjusted EBITDA is calculated as described in item 3.2.b of this Reference Form excluding non-recurring items. Interest expenses comprise the sum of all interest appropriated or capitalized, whether paid or not, in a given period, arising from Company debt.

The interest coverage ratio (Adjusted EBITDA / Interest Expense) is used to determine a company’s ability to generate sufficient cash flow to cover its interest expense.

The Company adopts the Gross Debt ratio/Adjusted EBITDA and the Adjusted EBITDA-to-Interest Coverage/Interest Expenses ratio. These ratios are widely used by the market (rating agencies and financial institutions) and serve as a reference to assess the Company’s financial situation. | |

3.8 - Obligations according to the nature and maturity term

Most recent accounting info (12/31/2016)

Type of obligation |

| Type of Guarantee |

| Other |

| Less than a year |

| One to three years |

| Three to five years |

| Greater than five |

| Total |

| |||||

Debt securities |

| Unsecured |

|

|

| R$ | 1,325,867,490.98 |

| R$ | 5,837,900,000.00 |

| R$ | 8,732,974,999.99 |

| R$ | 35,138,106,934.36 |

| R$ | 51,034,849,425.33 |

|

Loans |

| Other guarantees or privileges |

| Unsecured and Real. See the topic “Remarks” below. |

| R$ | 4,190,460,893.61 |

| R$ | 17,868,511,728.29 |

| R$ | 13,208,047,798.94 |

| R$ | 9,261,939,854.87 |

| R$ | 44,528,960,275.71 |

|

Total |

|

|

|

|

| R$ | 5,516,328,384.59 |

| R$ | 23,706,411,728.29 |

| R$ | 21,941,022,798.93 |

| R$ | 44,400,046,789.23 |

| R$ | 95,563,809,701.04 |

|

Note: The information contained in this item refers to the Company’s consolidated financial statements. Debts without a real or floating guarantee, regardless of whether they have a personal guarantee, were classified as unsecured debts. The debts guaranteed with third party assets, while they did not encumber the Company’s assets, were considered as unsecured debts and classified as such. The debt securities field comprises debt securities and capital market operations. The Loans field was composed on December 31, 2016 for (i) R$ 1.54 billion of loans secured by real guarantees and (ii) R$ 42.99 billion refers to unsecured loans.

3.9 - Other relevant information

Additional Information on Financial Contracts

Part of the financing agreements entered into by the Company, as well as the outstanding debt securities issued by the Company (for more information on such securities, see item 18 of this Reference Form) contain clauses that determine the early maturity of the outstanding instalments in the event of early maturity (Cross acceleration) of another financial agreement signed with the same counterpart and/or any other financial agreement.

The Company also clarifies that since the end of the fiscal year ended December 31, 2016, the Company has already prepaid EUR 750 million of debt in March (corresponding to R$ 2.54 billion) and another of US$ 740 million in April (corresponding to R$ 2.37 billion). On March 31, 2017, net debt totaled US$ 22.777 billion (corresponding to R$ 72.27 billion), with a cash position of US$ 6.779 billion (corresponding to R$ 21.52 billion). This cash position will be used to implement the liability management program with the intention of reducing gross debt in 2017.

Additional Information on Dividend Distributions

Vale recorded a net loss of R$ 44,212 million related to the fiscal year ended December 31, 2015, and this said loss is absorbed in accordance with the sole paragraph of art. 189 of Law No. 6404/1976. Accordingly, no distribution of dividends was approved by the Annual Shareholders’ Meeting held on April 25, 2016.

Note that the dividends and interest on shareholders’ equity distributed by the Company in said fiinancial year of 2015, as indicated in item 3.6 above, were distributed based on the retained earnings reserves approved in the balance sheet for 2014. Considering these retentions, the Board of Directors, at its meeting on (a) April 14, 2015, approved the payment, as of April 30, 2015, of the first instalment of minimum compensation to Vale’s shareholders for 2015, in the total Gross amount of R$ 3,101,100,000.00 in the form of interest on equity, corresponding to the total gross amount of R$ 0.601760991 per outstanding common or preferred share, issued by Vale, which is subject to Income Tax at the current rate; (b) October 15, 2015, payment, as of October 30, 2015, of the second instalment of the compensation to shareholders for 2015 in the form of dividends, in the total gross amount of R$ 1,925,350,000.00, corresponding to the value of R$ 0.3773609533 per outstanding common or preferred share issued by Vale.

Additionally, the Company clarifies that an amendment to the shareholder remuneration policy was approved at the Annual and Extraordinary Shareholders’ Meeting held on April 25, 2016. Under the terms of the approved policy:

· Shareholder remuneration will be at the discretion of the Board of Directors, who will deliberate on the amount to be distributed according to the situation of the Company’s business, considering, among other factors, the Company’s level of leverage and future cash commitments.

· The proposal for remuneration to the shareholders will be analyzed and should payment be authorized, it will be made in two payments. The first instalment (initial instalment) will be analyzed and, if applicable, paid in October of the current year and the second instalment (complementary instalment) will be analyzed and, if applicable, paid until the end of April of the following year. The amount of the first instalment will be determined based on the accumulated results of the period by the Company and the estimated free cash flow generation for that year. The value of the second instalment will be defined after the calculation of the result for the fiscal year.

· The proposal for the first instalment of shareholders’ remuneration will be submitted by the Executive Board for deliberation by the Board of Directors in October of each year and will be announced to the market as soon as it is approved. The second portion of the remuneration will be included in the proposed allocation of net income for the year, to be submitted by the Executive Board to the Board of Directors within the first three months of the subsequent year. The amount related to the second instalment will be announced to the market after its approval by the Board of Directors, with payment subject to approval by the Annual General Meeting.

· The amount of the first parcel of the shareholder’s remuneration will be expressed in US dollars and the payment will be made in the form of dividends and/or interest on equity. The amount determined will be paid in Brazilian currency, with the conversion of the amount proposed in US dollars into Reais made based on the US dollar exchange rate (Ptax-option 5), quoted by the Central Bank of Brazil (BACEN), on the business day immediately prior to the meeting of the Board of Directors who deliberated on the declaration and the respective payment of such remuneration to the shareholders. The value of the second instalment will be expressed and paid in Reais, and payment may be made in the form of dividends and/or interest on equity. The equivalent value in US dollars will be calculated based on the US dollar exchange rate (Ptax-option 5), published by the Central Bank of Brazil (BACEN), on the business day immediately prior to payment.

· During the year, the Board of Executive Officers may propose to the Board of Directors, based on an analysis of the Company’s cash flow evolution and the availability of profits or reserves of existing profits, for the distribution to shareholders of a remuneration in addition to those amounts paid in October or April.

4.1 - Description of risk factors

(a) Risks related to the Company

The Company may not be able to adjust production volume in a timely or cost-effective manner in response to changes in demand.

Lower utilization of the Company’s capacity during periods of weak demand may expose the Company to higher production costs per unit, since a significant part of its cost structure is fixed in the short term due to the high capital intensity of mining operations. In addition, efforts to reduce costs during periods of weak demand may be limited by labor regulations or collective bargaining agreements or by agreements made with the previous government.

On the other hand, during periods of high demand, Vale’s ability to rapidly increase production is limited, which may make it unable to meet the demand for its products. In addition, it is possible that the Company may not be able to complete expansions and new Greenfield projects in time to take advantage of the growing demand for iron ore, nickel or other products. When demand outstrips its production capacity, the Company will be able to meet the excess demand through the purchase of iron ore, iron ore pellets or nickel from joint ventures or resell them, increasing their costs and reducing their operating margins. If it is not able to meet the excess demand of its customers in this way, Vale may lose these customers. In addition, operating near full capacity may expose the Company to higher costs, including over-stay rates (Demurrage) due to constraints on the capacity of their logistics systems.

Lower cash flows, due to the fall in prices of the Company’s products, negatively affected the Company’s credit ratings, as well as the cost and availability of financing.

The lower prices for the Company’s products can adversely affect its future cash flows, Credit ratings and the ability to obtain financing at attractive rates. This may also adversely affect their ability to finance their capital investments, pay dividends and meet financial commitments (Covenants) included in some of its long-term debt securities.

In addition, certain Canadian provinces where the Company operates require the provision of financial guarantees from Vale, such as letters of credit, sureties or guarantees, to cover certain closing and recovery costs upon completion of its operations. The Company may be required to increase the value of these financial guarantees if its credit assessment is downgraded to certain levels. If Vale is unable to provide such financial guarantees, it will have to discuss with other competent jurisdictions alternative options and, ultimately, this could affect its ability to operate in such jurisdictions.

It is possible that the Company may not be able to implement its strategy regarding divestitures and strategic partnerships.

In recent years, the Company has entered into contracts for the sale of assets and strategic partnerships, in order to optimize its business portfolio and implement its financing strategy and capital investment plans. It is possible that the Company will continue to seek divestitures and strategic partnerships in the future. The Company is exposed to a number of risks in relation to these transactions, including the imposition of regulatory conditions, the inability to meet the conditions for completion or receipt of additional payments, in addition to negative market reactions. If the Company is unable to complete divestitures or strategic partnerships, especially the sale of its fertilizer business or the partnership in its coal assets in Mozambique, it may have to review its business and financing strategy and incur additional costs, which could, in turn, adversely affect its operating results, financial condition or reputation.

The Company is involved in lawsuits that may have a material adverse effect on its business in the event of unfavorable results.

The Company is involved in lawsuits in where the opposing parties are claiming substantial amounts, including various lawsuits and investigations related to the breach of the Fundão tailings dam owned by Samarco. Although the Company is vigorously contesting these actions, the outcome is uncertain and may result in obligations that could materially adversely affect its business and the value of the securities issued by Vale and its subsidiaries. For information on such processes, see items 4.3 to 4.7 below.

The Company’s projects are subject to risks that may result in an increase in costs or a delay in their implementation.

The Company is investing to maintain and increase its production capacity and logistics. Vale regularly reviews the economic viability of its projects. As a result of this analysis, the Company may decide to delay, suspend or interrupt the implementation of certain projects. Its projects are also subject to several risks that may adversely affect their prospects for growth and profitability, including the following:

· The Company may not be able to obtain financing at attractive rates.

· There may be delays or costs greater than that anticipated in obtaining the necessary equipment or services and in implementing new technologies to build and operate a project.

· Efforts to develop projects on schedule may be hampered by the lack of infrastructure, including reliable telecommunication and energy supply services.

· Suppliers and contractors may not fulfil their contractual obligations assumed with the Company.

· Unexpected weather conditions or other force majeure events could be faced.

· The Company may not be able to obtain the permits and licenses required to construct a certain project, or it may suffer delays or costs that are greater than those expected for obtaining or renewal of certain permits and licenses

· Changes in market conditions or regulations may make the project less profitable than expected at the time the work is started.

· There may be accidents or incidents during project implementation.

· One can face shortage of qualified personnel.

Operational problems can negatively and significantly affect the Company’s business and financial performance.

Inefficient project management and operational failures can lead to the suspension or reduction of the Company’s operations, causing a general reduction in its productivity. Operational incidents can lead to failures in plants and machinery. It is never certain that inefficient project management or other operational problems will not occur. Any losses to the Company’s projects or delays in its operations caused by inefficient project management or operational incidents can negatively and significantly affect its business and operational results.

The Company’s businesses are subject to several operational risks that may adversely affect the results of its operations, such as:

· Unexpected climatic conditions or other force majeure events.

· Adverse mining conditions can delay or hinder their ability to produce the expected amount of minerals and meet the specifications required by customers, which can lead to price adjustments.

· There may be accidents or incidents involving mines and associated infrastructure, such as dams, power plants, railways, railway bridges, ports and ships.

· Delays or interruptions in the transportation of their products, including on the railways, in ports and ships.

· Tropical diseases, HIV/AIDS and other contagious diseases in regions where some of its operations or some of its projects are located, posing risks to the health and safety of its employees.

· Labor lawsuits may interrupt their operations from time to time.

· Changes in market conditions or regulations may affect the economic prospects of an operation and render it incompatible with the Company’s business strategy.

· Failure to obtain renewal of required licenses and permits, or delays with obtaining same, or higher-than-expected costs to obtain them.

· Interruptions or unavailability of crucial information technology services or systems resulting from accidents or malicious acts.

The Company’s business may be adversely affected by the failure of its counterparts to meet their obligations.

Customers, suppliers, contractors, financial institutions, joint ventures and other counterparts may fail to comply with existing contracts and obligations and may have an unfavorable impact on the Company’s operations and financial results. The ability of the Company’s suppliers and customers to meet their obligations may be adversely affected in times of financial stress or during an economic downturn.

Through joint ventures, Vale currently operates a significant part of its ore segments Iron, pelletizing, nickel, coal, copper, fertilizers, bauxite and steel. Important parts of its investments and electrical energy projects are operated through consortiums or joint ventures. The projections and plans for these joint ventures and consortiums are based on the premise that their partners will fulfill their obligations to make their capital contributions, purchase products and, in some cases, provide qualified and competent management personnel. If any of their partners fail to meet their commitments, the joint venture or the affected consortium may not be able to operate in accordance with its business plans, or it is possible that the Company may have to increase the level of its investment to implement those plans.

Some of the Company’s investments are controlled by partners or may have a separate and independent management. These investments may not fully comply with the Company’s standards, controls and procedures, including health, safety, environment and community standards. Failure to adopt the appropriate standards, controls and procedures by any of its partners or joint ventures can raise costs, reduce production or cause environmental, health and safety incidents or accidents, which can adversely affect the Company’s results and reputation.

The Company may not have adequate insurance coverage for some of the risks concerning its business.

The Company’s business is generally subject to various risks and dangers, which may result in damage or destruction of property, plant and equipment. The insurance that Vale maintains against typical risks in its business may not provide adequate coverage. Insurance against certain risks (including liability for pollution or certain damages to the environment or disruption of certain activities of their business) may not be available at a reasonable cost or at any cost. Even when available, the Company may self-insure when determining that such an act will bring a greater cost-benefit. As a consequence, accidents or other negative occurrences involving the mining, production, or transportation facilities may adversely affect the operations.

The Company’s reserve deposit estimates may differ materially from the mineral volumes that the Company can actually recover. Their estimates of mine useful productive life may not be accurate, and fluctuations in market prices and changes in operating and capital costs may make certain ore reserves economically nonviable for mining.

Reported reserves are estimated amounts of ore and minerals that the Company determines to be economically feasible to be mined and processed, in accordance with present and future assumed conditions. There are numerous uncertainties inherent in estimating the quantity of reserves and projecting possible future mineral production rates, including factors beyond the Company’s control. The reserve report involves estimating mineral deposits that cannot be measured accurately and the accuracy of any reserve estimates is a function of the quality of the data available and the interpretation and judgement of engineers and geologists. As a result, it is not possible to guarantee that the quantity of ore indicated will be recovered or that it will be recovered at the rates that the Company expects. Reserve estimates and the mine`s useful life may require revisions based on actual production experience, projects, up-to-date exploratory drilling data, and other factors. For example, lower market prices for minerals and metals, reduced recovery rates or increased operating costs and capital costs due to inflation, exchange rates, changes in regulatory requirements or other factors, may make proved reserves unprofitable for exploitation and eventually result in a reduction of these reserves. Such reduction may affect depreciation and amortization rates and cause a negative impact on the Company’s financial performance.

The Company may not be able to rebuild its reserves, which may adversely affect its mining prospects.

The Company is involved in mineral exploration, which is highly uncertain in nature, involves many risks and is often unproductive. Its exploration programs, which involve significant expenses, may not result in the expansion or replacement of reduced reserves through current production. If the Company does not develop new reserves, it will not be able to sustain its current level of production beyond the remaining useful lives of its existing mines.

The viability of new mineral projects may change over time.

Once mineral deposits are discovered, it may take several years from the initial drilling phases until production is possible, a period in which the economic viability of production may change. Substantial time and expenses are required to:

· Establish ore reserves through drilling;

· Determine the appropriate mining and metallurgical processes to optimize the recovery of the metal contained in the ore;

· Obtain environmental and other licenses;

· Construct mining and processing facilities and infrastructure necessary for Greenfield operations; and

· to obtain the ore or extract the minerals from the ore.

If it is proven that a project is not economically viable at the time the Company is able to exploit it, it may suffer substantial losses and be required to write off the assets. In addition, possible changes or complications involving metallurgical processes and other technological processes that arise during a project can result in delays and excess costs which, in turn, may make the project not economically viable.

The Company faces an increase in extraction costs or investment requirements as reserves are reduced.

Reserves are gradually reduced during the normal course of a given underground or open-cast mining operation. As mining progresses, distances from the primary crusher and tailing deposits become larger, trenches become steeper, mines can shift from open-cast to underground, and underground operations become deeper. In addition, in some types of reserves, the mineralization content reduces and the solidity increases with greater depths. As a result, over time, the Company generally experiences an increase in the unit extraction costs of each mine, or may need to make additional investments, including adaptation or construction of processing plants and expansion or construction of tailing dams. Many of the Company’s mines have been operated for long periods, and it is probable that the Company will experience an increase in unit extraction costs in the future in these special operations.

Labor lawsuits may eventually interrupt the Company’s operations.

A considerable number of Company employees and some of the employees of their subcontractors are represented by unions and are backed by collective agreements or other labor agreements, which are subject to periodic negotiation. Strikes and other work stoppages in any of its operations may adversely affect the operation of these facilities, the completion period, and the cost of the Company’s major projects. For more information on labor relations, see item 14 of this Reference Form.

In addition, the Company may be adversely affected by work stoppages involving third parties who maybe providing us with goods or services.

Higher costs with energy or energy shortages can negatively affect the Company’s business.

Fuel, diesel and electricity costs are a significant component of the Company’s production cost, accounting for 10.9% of its total cost of goods sold in 2016. To meet its demand for energy, the Company relies on the following resources: petroleum products, which accounted for 36% of total energy needs in 2016, electricity (32%), natural gas (15%), coal (15%) and other sources of energy (2%).

Electricity costs accounted for 3.9% of its total cost of goods sold in 2016. If the Company cannot guarantee safe access to electrical energy at acceptable prices, it may be required to reduce production or may experience higher production costs, both of which may adversely affect its operating results. The Company faces the risk of energy shortages in countries where it maintains operations and projects, especially in Brazil, due to lack of infrastructure or climatic conditions, such as floods or droughts. Future scarcity and government efforts to respond to or avoid shortages may have an adverse impact on the cost or supply of electricity to the Company’s operations.

Failures in the Company’s information technology systems or difficulties in integrating new business resource planning software may interfere with the normal operation of the Company’s business.

The Company has technology information systems (“IT”) for the operation of several of their business processes. Failures in the IT systems, whether caused by accident or malicious acts, can result in the disclosure or theft of sensitive information, misappropriation of resources, and disruption to one’s operations.

The Company’s governance and compliance processes may fail to avoid regulatory penalties and damage to its reputation.

The Company operates in a global environment and its activities span multiple jurisdictions and complex regulatory structures with increasing legal obligations worldwide. Its governance and compliance processes, which include analysis of internal controls through financial reporting, may not be able to prevent future violations of the law, of their accounting standards or governance. The Company may be subject to violations of its Code of Ethics and Conduct, its anti-corruption policies, business conduct protocols, and instances of fraudulent behavior and dishonesty on the part of its employees, contractors and other agents. Failure to comply with applicable of laws and other standards by the Company may result in fines, loss of operating licenses and loss of reputation.

It may be difficult for investors to enforce any court judgement issued outside Brazil against the Company or any of its associates.

The Company’s investors may be located in jurisdictions outside Brazil and may file lawsuits against it or against the members of the Board or executive officers under the Judiciary of its forums of origin. Vale is a Brazilian company, and most of its directors and members of the Board reside in Brazil. The vast majority of the Company’s assets and the assets of its directors and members of the Board are likely to be located in jurisdictions other than the jurisdictions of its foreign investors. It may not be possible for investors located outside Brazil to file the summons within their jurisdiction against the Company or its directors or members of the Board of Directors residing outside its jurisdiction. In addition, a final foreign judgement may be executed in the Brazilian judiciary without a new examination of merit, only if previously filed with the Superior Court of Justice, and the filing will only be granted if the foreign judgement: (a) complies with all the formalities required for its taxability under the law of the country where it was issued; (b) has been rendered by a competent court after the due summons of the defendant, as required by applicable law; (c) is not subject to appeal; (d) does not conflict with a final and un-appealable decision rendered by a Brazilian court; (e) has been authenticated by a Brazilian consulate in the country where it was issued or is duly filed in accordance with the Convention for the Abolishment of the Requirement of Legalization for Foreign Public Documents and accompanied by a sworn translation into Portuguese, unless such procedure has been exempted by an international treaty signed by Brazil; (f) does not cover matters which should be under the exclusive competence of the Brazilian judiciary; and (g) is not contrary to Brazilian national sovereignty, public policies or good customs. Therefore, investors may not obtain a favorable judgement in any legal proceedings against the Company or its directors and executive officers in judgements in the courts of origin from these courts when such judgement is based on the laws of such foreign courts.

(b) Risks related to the Controller or Controlling Group of the Company and (c) Risks related to the Company’s shareholders.

The controlling shareholder of the Company has significant influence over Vale, and the Brazilian Federal Government has certain veto rights.

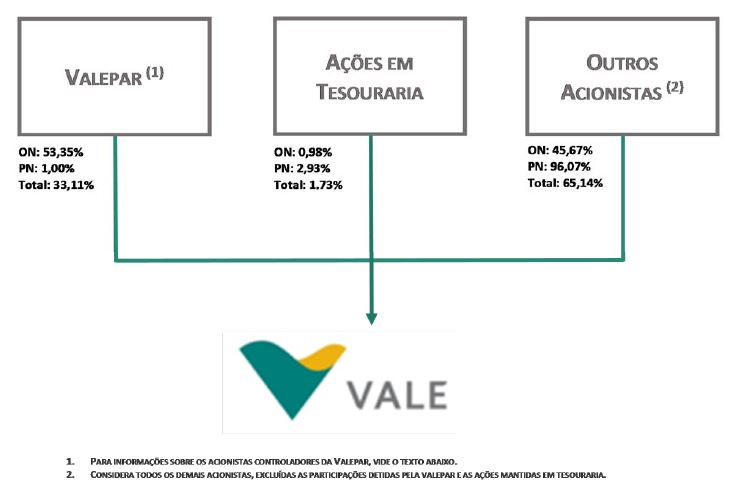

On March 31, 2017, Valepar S.A. (“Valepar”) held 53.9% of the common shares and 33.7% of the Company’s total capital. As a result of this equity interest, Valepar may elect a majority of the members of the Board of Directors and control the results of certain actions that require the approval of the shareholders. Valepar’s shareholders are part of a shareholders’ agreement

governing Valepar’s shares as if they were Vale’s shareholder. The current shareholders’ agreement came into effect on May 10, 2017 and will be in force for a period of six months or until Valepar’s merger with Vale. The new shareholders’ agreement contemplates a proposal to change the Company’s governance structure and to enter into a shareholders’ agreement at the Vale level, binding on 20% of its common shares, which will continue to provide significant influence to these shareholders. For a description of the Company’s shareholding structure, regarding Valepar’s current shareholders’ agreement, see item 15 of this Reference Form.

The Brazilian Federal Government holds 12 special class preferred shares (Golden shares) of Vale, which give it veto power over certain matters involving the Company, such as changes in the corporate name, location of its headquarters and its corporate purpose, regarding mining activities. For a detailed description of the veto power of these Golden shares, see item 18.1 of this Reference Form.

The implementation of a change in the Company’s capital structure and governance, and any potential benefits are subject to uncertainty and may not lead to the benefits that the Company expects to achieve.

In accordance with the Valepar shareholders’ agreement, which entered into force on May 10, 2017, Valepar presented a proposal to simplify the Company’s shareholding structure and corporate governance, with the purpose of eventually allowing Vale to be listed on the special segment of the BM & FBOVESPA New Markets, making it a company without defined control.

The implementation of the proposal to simplify the Company’s shareholding structure is subject, among other requirements, to (i) the approval of the proposal, including the merger of Valepar by Vale, by the shareholders, Executive Officers and members of the Board of Directors of Vale and Valepar and (ii) the acceptance of at least 54.09% of the class A preferred shares from the voluntary conversion into common shares within 45 days of the shareholders’ meeting decision on the matter. It is not possible to predict how long it will take to implement all the necessary steps or whether even if they will be implemented successfully. Finally, the Company cannot predict whether or when it will migrate to the New Market segment of BM & FBOVESPA, since the listing is subject to the conversion of all its preferred shares into common shares.

Uncertainty about timing and actual implementation may delay or limit the Company’s ability to derive certain benefits that may be derived from the simplified corporate structure and the eventual migration to the New Market, such as increased liquidity for shareholders. There can be no assurance that these benefits will be fully realized and any failure to achieve these benefits may affect the value of the Company’s shares and ADSs.

(d) Risks related to the Company’s subsidiaries.

For information on the risks related to companies invested by the Company, see the Risk Factor described in item (a) above: “The Company may have its business affected adversely if its counterparts do not meet their obligations.”

(e) Risks related to Company suppliers

For information on risks related to the Company’s suppliers, see the Risk Factors described in item (a) above: “Higher costs with energy or energy shortages can affect the Company’s business negatively” and “The Company may have its business affected adversely if its counterparts do not meet their obligations.”

(f) Risks related to the Company’s clients

The Company’s business may be adversely affected by declines in demand and prices of products produced by its clients.

Demand for iron ore, coal and nickel products depends on global demand for steel. Iron ore and pellets, which accounted for 71.5% of the Company’s net operating revenues in 2016, are used for the production of carbon steel. Nickel, which accounts for 11.1% of the Company’s net operating revenue in 2016, is mainly used to produce stainless steel and steel alloys. Demand for steel depends largely on global economic conditions, but it also depends on a variety of regional and sectoral factors. The prices of different types of steel and the performance of the global steel industry are highly cyclical and volatile, and these business cycles in the steel industry affect the demand and prices of their products. In addition, the vertical integration of the number of steel and stainless steel industries and the use of scrap can reduce global trans-ocean trade in iron ore and primary nickel. Demand for copper is affected by demand for copper wire and a sustained decline in demand in the construction industry could have a negative impact on the Company’s copper business.

For information on other risks related to the Company’s customers, see the Risk Factor described in item (a) above: and “The Company may have its business affected adversely if its counterparts do not meet their obligations.”

(g) Risks Relating to the Economy Sectors in which the Company operates

The Company’s businesses are exposed to the cyclical effect of global economic activity and require significant capital investments.

As a mining company, Vale is a supplier of industrial raw materials. Industrial production tends to be the most cyclical and volatile component of all global economic activity, affecting the demand for minerals and metals. At the same time, investment in mining requires a substantial amount of financial resources in order to replenish reserves, expand and maintain production capacity, build infrastructure, preserve the environment, and minimize social impacts. Sensitivity to industrial production, coupled with the need for significant long-term capital investments, are important sources of potential risk to Vale’s financial performance and growth prospects.

The adverse economic developments in China may have a negative impact on Vale’s revenue, cash flow and profitability.

China has been the main driver of global demand for minerals and metals in recent years. In 2016, China’s demand accounted for 72% of global transoceanic demand for iron ore, 52% of global demand for nickel and 48% of global demand for copper. The percentage of the Company’s net operating revenue attributable to consumer sales in China was 46.4% in 2016.

Therefore, any slowdown in China’s economic growth may result in a reduction in demand for products, leading to a reduction in revenue, cash flow and profitability. Weak performance in Chinese real estate, the largest consumer of carbon steel in China, would also have a negative impact on the Company’s results.

(h) Risks Relating to the Regulation of Sectors in which the Company operates

Political, economic and social conditions in countries where the Company operates or has projects may have an adverse impact on its business.

Vale may have its financial performance negatively affected by regulatory, political, economic and social conditions in the countries where it operates or has relevant projects. In many of these jurisdictions, Vale is exposed to a number of risks, including political instability, bribery, extortion, corruption, robbery, sabotage, kidnapping, civil war, acts of war, guerrilla activities, piracy on international transportation routes, and terrorism.

These problems may adversely affect the economic conditions and other conditions under which the Company operates in various ways, significantly impairing its business. For example, sections of the Carajás (EFC) railroad in the Brazilian State of Pará and other railroads around the world are subject to disruptions that may adversely affect operations and adversely affect the Company’s business.

Disagreements with the local communities where the Company operates may have a negative impact on its business and reputation.

There may be disputes with the communities where the Company operates. In some cases, the Company’s operations and mineral reserves are located on indigenous lands or on neighboring lands owned or used by indigenous tribes or other interested parties.

Some of the Company’s mining operations and other operations are located in territories whose ownership may be subject to disputes or uncertainties, or in areas intended for agriculture, or for agrarian reform purposes, which may lead to disagreements with landowners, community organizations, local communities and the government. The Company may be required to consult such groups and negotiate with them as part of the process to obtain the necessary licenses to operate in order to minimize the impact on their operations or to gain access to their land.

Disagreements or legal disputes with local groups, including indigenous groups, organized social movements, and local communities may cause delays or disruptions to operations, adversely affecting the Company’s reputation, or impair its ability to develop its reserves and conduct its operations. There have already been situations where demonstrators acted to interrupt the Company’s operations and projects, and may continue to do so in the future, which could adversely affect the Company’s operations and adversely affect its business.

The Company may be adversely affected by changes in public policies or by trends such as the nationalization of resources, including the imposition of new taxes or royalties on mining activities.

Mining is subject to government regulation, including taxes and Royalties, which may have a material financial impact on the Company’s operations. In the countries where the Company is present, the Company is exposed to potential renegotiation, cancellation or forced modification of existing contracts and licenses, expropriation or nationalization of properties, exchange controls, changes in local laws, regulations and policies. The Company is also exposed to new taxes or increased tax rates and royalties, reduction in exemptions and tax benefits, renegotiation of fiscal stabilization agreements or changes in the calculation basis in a way unfavorable to the Company. Governments that have committed themselves to establishing a stable taxation or regulatory environment can change or shorten the duration of these commitments.

The Company also faces the risk of having to submit to the jurisdiction of a foreign arbitration forum or tribunal, or having to enforce a judgement against a sovereign nation within its own territory.

The Company is also required to meet internal processing requirements in certain countries in which it operates, such as local processing standards, export taxes or restrictions, or charges on unprocessed ores. The imposition or increase of such requirements, taxes or charges can significantly increase the risk profile and operating costs in those jurisdictions. The Company and the mining sector are subject to a tendency to increase the nationalism of resources in certain countries where it operates, which may result in restrictions on its operations, increased taxation or even expropriations and nationalization.

The concessions, authorizations, licenses and permits are subject to expiration, limitation or renewal and various other risks and uncertainties.

Vale’s operations depend on authorizations and concessions from government regulatory agencies in the countries where it operates. The Company is subject to the laws and regulations in many jurisdictions, which may change at any time, and such changes in laws and regulations may require modifications to Vale’s technologies and operations, resulting in unexpected capital expenditures.

Some of Vale’s mining concessions are subject to fixed expiration dates and may only be renewed for a limited number of times, for a limited period. In addition to the mining concessions, it is possible that the Company will have to obtain several authorizations, licenses and permits from public agencies and regulatory agencies regarding the planning, maintenance, operation and closure of the Company’s mines and associated logistics infrastructure, which may be subject to fixed expiry dates or periodic revision or renewal. There is no guarantee that such renewals will be granted when requested, and there is no guarantee that new conditions will not be imposed up on renewal. The fees due for mining concessions may increase substantially over time, from that of the original issue of each individual exploration license. If this happens, the costs of obtaining or renewing the mining concessions may render the Company’s business objectives unfeasible. Accordingly, the Company needs to continuously assess the mineral potential of each mining concession, especially at the time of renewal, in order to determine whether the maintenance costs of the concessions are justified by the results of operations so far, and thus may opt to allow some concessions to expire. It cannot be certain that such concessions will be obtained on terms favorable to the Company, or even obtained, for the Company’s mining plans or future exploration targets.

In several jurisdictions where the Company has exploration projects, it may be required to return to the State a certain portion of the area covered by the exploration license as a condition to renew the license or obtain a mining concession. This obligation may lead to a substantial loss of part of the mineral deposit originally identified in its feasibility studies. For more information on mining concessions and other similar rights, see “Regulation of mining activities” in item 7 of this Reference Form.

(i) Risks related to ADSs (American Depositary Shares) belonging to The Company

If holders of ADSs exchange their ADSs for underlying shares, they risk losing the ability to remit foreign currency abroad.

The custodian of the underlying shares of the Company’s ADSs maintains a registration with the Central Bank of Brazil, giving it the right to remit US dollars outside Brazil for dividend payments and other distributions related to the shares underlying the ADSs or through disposal of the underlying shares. If the holder of an ADR exchanges his ADSs for the underlying shares, he will

be entitled to rely on the custodian’s registration for only five business days from the date of exchange. Thereafter, an ADR holder may not be able to obtain and remit foreign currency abroad through the disposal or distributions relating to the underlying shares unless he obtains his own registration in accordance with applicable regulations allowing qualified foreign institutional investors to buy and sell securities at the BM & FBOVESPA. If the ADR holder attempts to obtain his registration, he may incur expenses or be late in the application process, which may delay the receipt of dividends and other distributions relating to the underlying shares or the return of capital in a timely manner.

The record of the custodian or any record obtained may be affected by future changes in the law, and additional restrictions applicable to holders of ADRs, the disposal of the underlying shares or the repatriation of the proceeds from the sale may be imposed in the future.

Holders of ADRs may not be able to exercise their preemptive rights in respect of the underlying shares of their ADSs.

The ability of ADR holders to exercise their preemptive rights is not assured, especially if the applicable law in the holder’s jurisdiction (for example, the Securities Act in the United States) to require that a registration statement be effective or an exemption from registration be available in respect of such rights, as in the case of the United States. The Company is not required to extend the offer of preemptive rights to ARDS holders, to file a registration statement in the United States, or to make any similar registration under any other jurisdiction, regarding preemptive rights, or to take such measures as may be necessary to provide exemptions from the registration, and cannot assure the holders that it will make any registration statement or take such measures.

Holders of ADRs may find it difficult to exercise their voting rights.

Holders of ADRs do not have shareholder rights. They have only the contractual rights established regarding their benefit in the deposit agreements. Holders of ADRs are not permitted to attend general meetings and may only vote by providing instructions to the depositary. In practice, the ability of a holder of ADRs to instruct the depositary on how to vote will depend on the timing and procedures for providing instructions to the depositary, either directly or through the holder’s clearing and custody rights. With respect to ADSs for which no instructions are received, the depositary may, subject to certain limitations, grant a power of attorney to a person designated by the Company.

Legal protections for holders of the Company’s securities differ from one jurisdiction to another and may be inconsistent, unfamiliar or less effective in relation to investor expectations.

Vale is a global company with securities traded in various markets and with investors located in many different countries. The legal regime for investor protection varies across the world, sometimes in important respects, and investors in our securities must recognize that the protections and remedies available to them may be different from those they are accustomed to in their local markets. The Company is subject to securities legislation in several countries that have different standards, monitoring and enforcement practices. The only Corporate S.A. law applicable to the company is the Brazilian corporation law, with its specific and substantial legal rules and procedures. The Company is also subject to corporate governance standards in several jurisdictions where its securities are listed, but only as a foreign private issuer, the Company is not required to follow many of the corporate governance standards applied to US domestic issuers with securities listed in the New York Stock Exchange and is not subject to US procurement rules.

(j) Risks related to socio-environmental issues

The potential obligations and liabilities arising from the rupture of the tailings dam owned by Samarco Mineração S.A. (“Samarco”) in Minas Gerais may adversely affect the Company’s business, financial condition and reputation.

In November 2015, the Samarco-owned Fundão tailings dam broke, causing environmental damage. The rupture of the Samarco tailings dam has adversely affected and will continue to affect the Company’s business, but the overall impact is still uncertain and cannot yet be estimated. Below is an account of the main effects of the rupture of the dam on the Company’s business.

· Court lawsuits. The Company is involved in several processes and investigations related to the dam rupture of Fundão, and other processes and investigations may be initiated in the future. These lawsuits include alleged collective actions by US investors against the Company and some of its directors, a criminal proceeding in

Brazil, public civil actions filed by the Brazilian authorities and several lawsuits involving significant claims related to damages and remedial measures. Adverse results in such processes may adversely affect the liquidity and financial condition of the Company. For more information on these processes, see items 4.3 to 4.7 of this Reference Form.

Obligations of redress and other obligations. In March 2016, Samarco and its shareholders, Vale and BHP Billiton Brasil Ltda. (“BHPB”), a Brazilian subsidiary of BHP Billiton plc, concluded the Transaction Agreement and Adjustment of Conduct TAAC with some government authorities that Samarco, Vale and BHPB agree to create a foundation to develop and implement long-term compensation and compensation programs. In addition, in January 2017, Samarco, Vale and BHPB entered into preliminary agreements with the Federal Public Ministry (“MPF”), which provides, inter alia, for the appointment of experts selected by the MPF to review and monitor the repair programs created under the March 2016 TTAC, provide guarantees to ensure certain repair obligations, and a timetable for negotiation of a final agreement. For more information, see items 4.7 and 7.9 of this Reference Form.