UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

DOMINION HOMES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

DOMINION HOMES, INC.

5000 Tuttle Crossing Boulevard

P.O. Box 5000

Dublin, Ohio 43016-5555

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

You are cordially invited to attend our 2007 annual meeting of shareholders, which will be held at our offices at 4900 Tuttle Crossing Boulevard, Dublin, Ohio, on Wednesday, May 2, 2007, at 9:00 a.m., local time. The annual meeting is being held for the following purposes:

| | (1) | To elect four Class I Directors, each to serve for a two-year term expiring at the 2009 annual meeting of shareholders or until their respective successors have been elected or appointed; and |

| | (2) | To transact any other business which may properly come before the annual meeting or any adjournment thereof. |

These items are more fully described in the following pages, which are made part of this notice. Only shareholders of record at the close of business on March 16, 2007 will be entitled to notice of and to vote at the annual meeting and at any adjournments or postponements thereof.

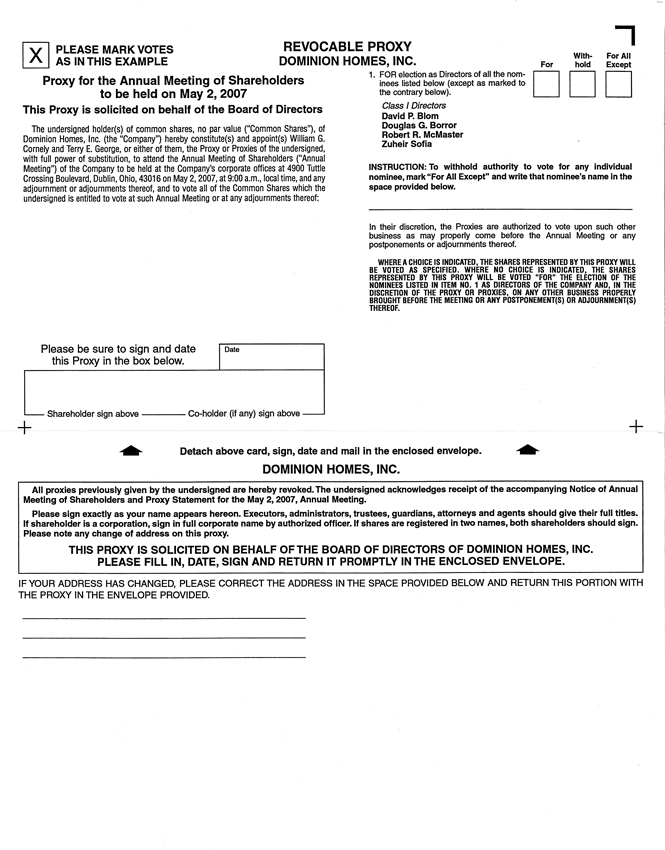

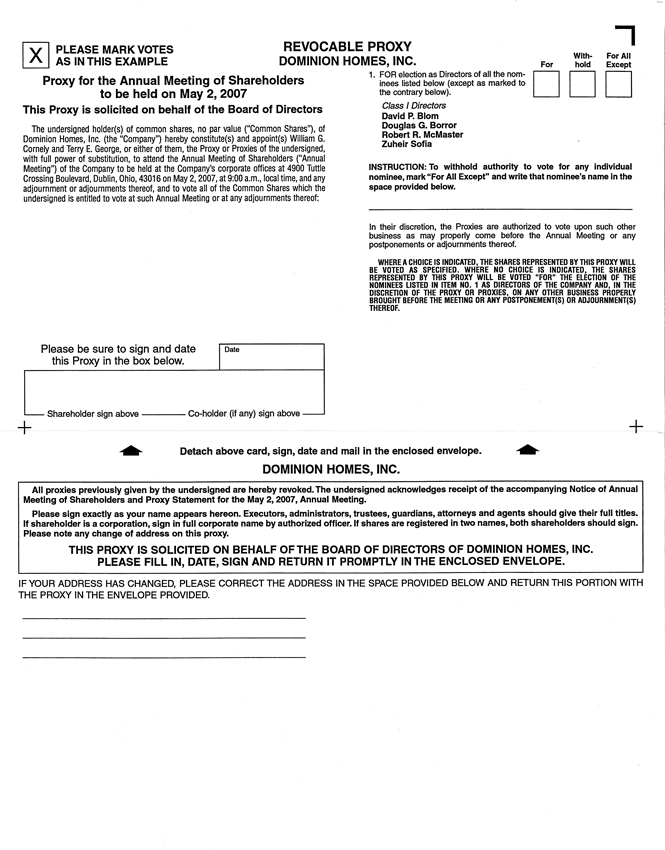

Whether or not you plan to attend the annual meeting, you may ensure your representation by completing, signing, dating and promptly returning the enclosed proxy card. A return envelope, which requires no postage if mailed from within the United States, has been provided for your use. If you attend the annual meeting and inform the inspector of elections of the Company that you wish to vote your shares in person, your proxy will not be used. If you wish to attend the annual meeting and your shares are held of record by a brokerage firm, bank or other nominee, you must obtain a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and bring it to the annual meeting. In order to vote your shares at the annual meeting, you must obtain from the record holder a proxy issued in your name.

Regardless of how many shares you own, your vote is very important. PleaseSIGN, DATE AND RETURN THE ENCLOSED PROXY CARD TODAY.

| | | | |

| | | | By Order of the Board of Directors, |

| | |

| | | | | |

| Dublin, Ohio | | | | Christine A. Murry |

| April 2, 2007 | | | | Secretary |

DOMINION HOMES, INC.

5000 Tuttle Crossing Boulevard

P.O. Box 5000

Dublin, Ohio 43016-5555

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 2, 2007

GENERAL INFORMATION

Purpose, Place, Date and Time of the Annual Meeting

This proxy statement and the accompanying proxy and Notice of Annual Meeting of Shareholders is furnished to you in connection with the solicitation on behalf of our Board of Directors of proxies to be voted at the Company’s 2007 annual meeting of shareholders or any postponement or adjournment of that meeting. The annual meeting will be held at our offices at 4900 Tuttle Crossing Boulevard, Dublin, Ohio on Wednesday, May 2, 2007 at 9:00 a.m., local time for the purposes set forth in the accompanying Notice of Annual Meeting. This proxy statement, the accompanying proxy, Notice of Annual Meeting and a copy of our 2006 Annual Report to Shareholders are first being mailed to shareholders on or about April 2, 2007.

Record Date and Share Ownership

Holders of record of our common shares at the close of business on March 16, 2007 are entitled to notice of and to vote at the annual meeting and any postponement or adjournment of the meeting. At that time, we had 8,415,342 common shares outstanding and entitled to vote. Each common share outstanding on the record date entitles the holder to one vote on each matter submitted at the annual meeting.

Submitting and Revoking Your Proxy

All common shares represented by each properly executed proxy received by the Board of Directors pursuant to this solicitation will be voted in accordance with the shareholder’s directions specified on the proxy. Except as described below with respect to broker non-votes, if no directions have been specified on a proxy, the common shares represented by the proxy will be voted in accordance with the Board’s recommendations, which are as follows:

“FOR” election as directors of the four nominees named in the accompanying form of proxy.

Without affecting any vote previously taken, a shareholder signing and returning a proxy has the power to revoke it at any time prior to its exercise by either: (1) giving notice of such revocation to the Company in writing or other verifiable communication delivered to Christine A. Murry, Secretary of the Company, at our corporate offices at 5000 Tuttle Crossing Boulevard, P.O. Box 5000, Dublin, Ohio 43016-5555, (2) executing a subsequent proxy, or (3) attending the 2007 annual meeting and giving notice of such revocation in person to the inspector of elections at the annual meeting. Attendance at the 2007 annual meeting will not, in and of itself, constitute revocation of a proxy.

Quorum and Required Vote

The presence, in person or by proxy, of a majority of voting shares of the Company outstanding and entitled to vote at the annual meeting is necessary to constitute a quorum for the transaction of business at the annual meeting. Common shares represented by proxies that have been signed or which constitute a verifiable communication and are delivered to us will be counted toward the quorum in all matters, even though they are marked as “Abstain,” “Against” or “Withhold Authority” on any or all matters, or they are not marked at all. Broker non-votes, as described in the following paragraph, also will be counted toward the establishment of a quorum.

Broker/dealers who hold their customers’ common shares in street name may, under the applicable rules of the self-regulatory organizations of which the broker/dealers are members, sign and submit proxies for such common shares and may vote such common shares on routine matters which, under such rules, typically include the election of directors. Broker/dealers may not vote such common shares on other matters without specific instructions from the customers who own such common shares. Proxies signed and submitted by broker/dealers which have not been voted on certain matters as described in the previous sentence are referred to as broker non-votes.

The election of the director nominees requires the favorable vote of a plurality of all votes cast by the holders of our common shares at a meeting at which a quorum is present. Broker non-votes and proxies marked “Withhold Authority” will not be counted toward the election of directors or toward the election of individual nominees specified in the form of proxy and, thus, will have no effect. All other proposals submitted to our shareholders for approval at the annual meeting, require the affirmative vote of holders of a majority of our common shares issued and outstanding as of the record date at a meeting at which a quorum is present. For purposes of determining the number of our common shares voting on such matters, abstentions and broker non-votes will have the same effect as a vote against the proposal.

Cost of Solicitation

We will bear all costs of the solicitation of proxies. Solicitation of proxies will be made by mail. Proxies may be further solicited for no additional compensation by our officers, directors, or employees by telephone, written communication or in person. Upon request, we will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for expenses reasonably incurred by them in sending proxy materials to the beneficial owners of our

-2-

common shares. No solicitation will be made by specially engaged employees or other paid solicitors.

VOTING RIGHTS AND PRINCIPAL SHAREHOLDERS

Ownership of Our Common Shares by Principal Shareholders

The following table sets forth information as of March 16, 2007 (except as noted below), relating to the beneficial ownership of our common shares by each person known by us to own beneficially more than 5% of our outstanding common shares.

| | | | | | | | | | | |

| | | Number of Common Shares Beneficially Owned (1) | |

Name and Address of Beneficial Owner | | Sole Voting

and/or

Investment

Power | | | Shared

Voting

and/or

Investment

Power | | | Total | | Percent of Class(2) | |

Douglas G. Borror(3) | | 70,133 | (4) | | 3,926,324 | (5) | | 3,996,457 | | 47.5 | % |

David S. Borror (3) | | 3,096 | | | 3,926,324 | (5) | | 3,929,420 | | 46.7 | % |

Terry E. George(3) | | 465 | | | 3,926,324 | (5) | | 3,926,789 | | 46.7 | % |

BRC Properties Inc.(3) | | 3,926,324 | (5) | | — | | | 3,926,324 | | 46.7 | % |

BRC Properties Inc.,

Douglas G. Borror,

David S. Borror and

Terry E. George, as a group | | — | | | 3,926,324 | (5) | | 3,926,324 | | 46.7 | % |

Aegis Financial Corporation(6)

1100 North Glebe Road,

Suite 1040

Arlington, VA 22201 | | 1,054,627 | | | — | | | 1,054,627 | | 12.5 | % |

William S. Berno and Paul Gambal(6)

1100 North Glebe Road,

Suite 1040

Arlington, VA 22201 | | — | | | 1,054,627 | | | 1,054,627 | | 12.5 | % |

Scott L. Barbee(6)

1100 North Glebe Road,

Suite 1040

Arlington, VA 22201 | | 12,000 | | | 1,054,627 | | | 1,066,627 | | 12.7 | % |

FMR Corp.(7)

82 Devonshire Street

Boston, MA 02109 | | 820,000 | | | — | | | 820,000 | | 9.7 | % |

-3-

| | | | | | | | |

Dimensional Funds Advisors Inc. (8)

1299 Ocean Avenue, 11th

Floor, Santa Monica, CA

90401 | | 634,280 | | — | | 634,280 | | 7.5% |

Angelo, Gordon & Co., L.P.(9)

245 Park Avenue

New York, NY 10167 | | 769,117 | | — | | 769,117 | | 8.4% |

John M. Angelo and Michael L. Gordon(9)

245 Park Avenue

New York, NY 10167 | | — | | 769,117 | | 769,117 | | 8.4% |

Silver Point Capital Management, L.L.C., Robert J. O’Shea, Silver Point Capital, L.P., Silver Point Capital Fund, L.P. and SPCP Group, L.L.C. (10)

Two Greenwich Plaza

1st Floor

Greenwich, CT 06830 | | — | | 769,118 | | — | | 8.4% |

Edward A. Mule(10)

Two Greenwich Plaza

1st Floor

Greenwich, CT 06830 | | 769,118 | | — | | 769,118 | | 8.4% |

(1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and/or investment power with respect to those shares. |

(2) | Percent of Class is calculated by dividing the number of common shares beneficially owned by a person by the sum of 8,415,342 common shares outstanding as of March 16, 2007 and the number of common shares as to which the person has the right to acquire beneficial ownership within sixty (60) days of March 16, 2007. |

(3) | The address of Douglas G. Borror, David S. Borror, Terry E. George, and BRC Properties Inc. (“BRC”) is 5000 Tuttle Crossing Boulevard, Dublin, Ohio 43016-5555. |

(4) | Includes 30,000 restricted common shares awarded to Mr. Douglas Borror on October 22, 2002, which shares will vest, if at all, upon (a) the expiration of five years from the date of the award, (b) the Company’s achievement of shareholder’ equity of not less than $175,000,000, and (c) Mr. Douglas Borror continuing to be employed with the Company as of such date. Also includes 25,406 common shares held by The Principal Group, as Trustee of the Dominion Homes, Inc. Retirement Plan and Trust, which common shares are voted at the direction of Mr. Douglas Borror. |

(5) | Share total is based on information provided to the Company by BRC. By virtue of their ownership and/or control of BRC, each of Douglas G. Borror, David S. Borror, and Terry E. George may be deemed to beneficially own the common shares of the Company held by BRC. SeeCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS –Description and Ownership of BRC beginning at page 55 for additional information. |

-4-

(6) | Information is based on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2007. According to the Schedule 13G, Aegis Financial Corporation is the beneficial owner of and has the sole power to vote and dispose of 1,054,627 common shares. In addition, each of William S. Berno, Paul Gambal and Scott L. Barbee share the power to vote or dispose of these 1,054,627 shares. In addition to these common shares, Mr. Barbee is the beneficial owner of and has the sole power to vote and dispose of 12,000 common shares. |

(7) | Information is based on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2006, which information was confirmed by the Company with FMR in March 2007. According to the Schedule 13G, Fidelity Management & Research Company (“Fidelity”) is a wholly-owned subsidiary of FMR Corp. (“FMR”) and an investment adviser under the Investment Advisers Act of 1940. Fidelity is an investment adviser to Fidelity Low Priced Stock Fund (the “Fund”), which is the reported owner of the 820,000 common shares listed above. Edward C. Johnson 3d (Chairman of FMR), FMR (through its control of Fidelity) and the Fund each has the power to dispose of the 820,000 common shares. Neither FMR nor Edward C. Johnson 3d has the sole power to vote or direct the voting of the common shares, which power resides with the Fund. Fidelity carries out the voting of the common shares under written guidelines established by the Fund’s board of trustees. |

(8) | Information is based on a Schedule 13G filed with the Securities and Exchange Commission on February 2, 2007. According to this Schedule 13G, Dimensional Fund Advisors Inc. (“Dimensional”), an investment advisor registered under the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are the “Funds.” In its role as investment advisor or manager, Dimensional possesses investment and/or voting power over the common shares that are owned by the Funds, and may be deemed to be the beneficial owner of the common shares by the Funds. However, all common shares are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. |

(9) | Information is based on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2007. According to this Schedule 13G, Angelo, Gordon & Co., L.P. is an investment advisor registered under the Investment Advisers Act of 1940. John M. Angelo and Michael L. Gordon are managing members of JAMG LLC, which is the general partner of AG Partners, L.P., which is the sole general partner of Angelo, Gordon and as the chief executive officer and chief operating officer of Angelo, Gordon, respectively. All of the common shares indicated may be acquired within 60 days upon the exercise of warrants held by the warrant purchasers under a certain Warrant Agreement with the Company dated December 29, 2006. |

(10) | Information is based on a Schedule 13D filed with the Securities and Exchange Commission on January 4, 2007. According to this Schedule 13D, Silver Point Capital Fund, L.P. (“SPC Fund”) is a member of SPCP Group, L.L.C. (“SPCP Group”), Silver Point Capital, L.P. (“Silver Point”) is the investment manager of SPC Fund, Silver Point Capital Management, L.L.C. (“Management”) is the general partner of Silver Point, and Messrs. Edward A. Mule and Robert J. O’Shea are each members of Management and by virtue of such status may be deemed to be the beneficial owners of the shares of common stock held by SPCP Group. The principal business of Management is serving as the general partner of Silver Point. The principal business of Messrs. Mule and O’Shea, in addition to serving as members of Management, is managing other affiliated entities (including Silver Point). The principal business of Silver Point is serving as an investment manager for private investment funds (including SPC Fund). The principal business of SPCP Fund and SPCP Group is acquiring, holding, managing and disposing of investments. All of the common shares indicated may be acquired within 60 days upon the exercise of warrants held by the warrant purchasers under a certain Warrant Agreement with the Company dated December 29, 2006. |

-5-

Ownership of Our Common Shares by Directors and Executive Officers

The following table sets forth information, as of March 16, 2007 (except as noted below) regarding beneficial ownership of our common shares by each of our directors and nominees, each of our executive officers named in the Summary Compensation Table (collectively, the “Named Executive Officers”), and our directors and executive officers as a group:

| | | | | | | | | | | |

| | | Amount and Nature of Common Shares Beneficially Owned (1) | |

Name of Beneficial Owner | | Sole Voting

and/or

Investment

Power | | | Shared

Voting and/or

Investment

Power | | | Total | | Percent of Class(2) | |

David P. Blom | | 12,153 | (3) | | — | | | 12,153 | | * | |

David S. Borror | | 3,096 | | | 3,926,324 | (4) | | 3,929,420 | | 46.6 | % |

Douglas G. Borror | | 70,133 | (5) | | 3,926,324 | (4) | | 3,996,457 | | 47.4 | % |

William G. Cornely | | 45,000 | (6) | | | | | 45,000 | | * | |

Jeffrey A. Croft | | 100,000 | (7) | | | | | 100,000 | | 1.2 | |

R. Andrew Johnson | | 10,117 | (8) | | — | | | 10,117 | | * | |

Robert R. McMaster | | 10,428 | (9) | | — | | | 10,428 | | * | |

Betty D. Montgomery | | — | | | — | | | — | | | |

Carl A. Nelson, Jr. | | 11,408 | (10) | | — | | | 11,408 | | * | |

Zuheir Sofia | | 12,908 | (11) | | — | | | 12,908 | | * | |

All directors (including

director nominees) and

current executive

officers as a group (10

persons)(12) | | 275,243 | | | 3,926,324 | (4) | | 4,201,567 | | 49.7 | % |

| * | Less than one percent (1%). |

(1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and/or investment power with respect to those shares. |

(2) | Percent of Class is calculated by dividing the number of shares beneficially owned by the sum of 8,415,342 shares outstanding as of March 16, 2007, and the number of common shares as to which the person has the right to acquire beneficial ownership within sixty (60) days of March 16, 2007. |

-6-

(3) | Includes options to purchase 7,500 common shares which are exercisable by Mr. Blom within sixty (60) days of March 16, 2007. |

(4) | Share total is based on information provided to the Company by BRC. By virtue of their ownership and/or control of BRC, each of Douglas G. Borror and David S. Borror may be deemed to beneficially own the common shares of the Company held by BRC. SeeCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS –Description and Ownership of BRC beginning at page 55 for additional information. |

(5) | Includes 30,000 restricted common shares awarded to Mr. Douglas Borror on October 22, 2002, which shares will vest, if at all, upon (a) the expiration of five years from the date of the award, (b) the Company’s achievement of shareholders’ equity of not less than $175,000,000, and (c) Mr. Douglas Borror continuing to be employed with the Company as of such date. Also includes 25,406 common shares held by The Principal Group, as Trustee of the Dominion Homes, Inc. Retirement Plan and Trust, which common shares are voted at the direction of Mr. Douglas Borror. |

(6) | Includes restricted common shares awarded to Mr. Cornely on February 7, 2006, which shares will vest as follows: for 50% of the total shares granted (12,500 shares), the restrictions will lapse as to one-fourth of these shares (3,125 shares) on each of the first, second, third, and fourth anniversaries of February 7, 2006; and for the remaining 50% (12,500 shares), the restrictions will lapse upon the Company’s achievement of $220,000,000 in shareholders’ equity at the end of any fiscal quarter through and including the fiscal quarter ended December 31, 2009. |

(7) | Includes restricted common shares awarded to Mr. Croft on May 11, 2006, which shares will vest as follows: for 50% of the total shares granted (50,000 shares), the restrictions will lapse as to one-fourth of these shares (12,500 shares) on each of the first, second, third, and fourth anniversaries of March 20, 2006; and for the remaining 50% (50,000 shares), the restrictions will lapse upon the Company’s achievement of $220,000,000 in shareholders’ equity at the end of any fiscal quarter through and including the fiscal quarter ended December 31, 2009. |

(8) | Includes options to purchase 7,500 common shares which are exercisable by Mr. Johnson within sixty (60) days of March 16, 2007. |

(9) | Includes an option to purchase 2,500 common shares which are exercisable by Mr. McMaster within sixty (60) days of March 16, 2007. |

(10) | Includes options to purchase 7,500 common shares which are exercisable by Mr. Nelson within sixty (60) days of March 16, 2007. |

(11) | Includes options to purchase 7,500 common shares which are exercisable by Mr. Sofia within sixty (60) days of March 16, 2007. |

(12) | In computing the aggregate number of common shares held by the group, the same common shares were not counted more than once. |

-7-

INFORMATION CONCERNING OUR BOARD OF DIRECTORS AND

CORPORATE GOVERNANCE MATTERS

Board of Directors Meetings

Regular meetings of our Board of Directors are generally held four times per year, and special meetings are scheduled when required. At each regular meeting of our Board of Directors, members who are “independent directors” meet in executive session without the presence of management. Our Board of Directors held 7 meetings in 2006. Each director is expected to attend each meeting of the Board and the committees on which he or she serves. In addition to meetings, the Board and its committees review and act upon matters through unanimous written consent procedures. During 2006, except for Donald A. Borror, each of our directors attended 75% or more of the total number of (i) meetings of the Board and (ii) meetings of committees of the Board on which the director served.

Director Independence

The following individuals served on our Board of Directors during 2006: David P. Blom, David S. Borror, Donald A. Borror, Douglas G. Borror, R. Andrew Johnson, Gerald E. Mayo, Robert R. McMaster, Carl A. Nelson, Jr., Zuheir Sofia, and Ronald Tilley. Messrs. Mayo and Tilley retired from the Board effective May 10, 2006, and Mr. McMaster was elected to the Board effective as of the same date. Except for Messrs. David Borror, Donald Borror, and Douglas Borror, all other members of the Board serving in 2006 were determined by the Board to be “independent” pursuant to the listing requirements of The Nasdaq Stock Market LLC (the “Nasdaq Stock Market”). The Board has determined that Betty D. Montgomery, who was appointed as a Class II Director of the Company in February 2007 to fill the vacancy created with the passing of Mr. Donald Borror in December 2006, is also “independent” pursuant to the Nasdaq Stock Market listing requirements.

During 2006, we purchased merchandise from The Johnson Family’s Diamond Cellar for employee service awards (to recognize years of service with the Company) and sales achievement awards totaling approximately $32,212. R. Andrew Johnson, a member of the Company’s Board of Directors since May 2004, is the Chief Executive Officer and a shareholder of The Johnson Family’s Diamond Cellar. This transaction was approved by our Audit Committee. The Board has determined that this transaction does not affect Mr. Johnson’s independence in serving on the Board.

Standing Committees of the Board

Our Board of Directors has three standing committees: an Audit Committee, a Nominating and Corporate Governance Committee, and a Compensation Committee. In addition, during 2006 the Board established a special committee to work closely with senior management and the Company’s financial advisors on the extension of the Company’s credit facility, and/or other potential financing transaction alternatives. The special committee considered and approved the engagement of Raymond James & Associates as the Company’s financial advisors. The special committee also approved, and recommended to the Board for its

-8-

approval, the extension of the Company’s credit facility and issuance of warrants in connection therewith, effective December 29, 2006. Messrs. Douglas Borror, Nelson and McMaster served on this committee. The committee held a total of seven meetings in 2006.

The Audit Committee oversees management’s conduct of our financial reporting process, including the financial reports and information that we provide to our shareholders or to the Securities and Exchange Commission, our system of internal control over financial reporting, and the annual independent audit of our financial statements. The Audit Committee also acts on behalf of the Board of Directors with respect to the appointment of our independent registered public accounting firm, and all audit and other activities performed for us by our independent registered public accounting firm. Finally, the Audit Committee is responsible for reviewing all proposed related party transactions between us and our affiliates. Our Audit Committee Charter can be found on our Internet website atwww.dominionhomes.com under the heading “Investor Relations” - “Corporate Governance.” The Audit Committee is comprised solely of directors who are “independent” directors pursuant to the listing requirements of The Nasdaq Stock Market and applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Currently, Messrs. Nelson (Chairman), McMaster and Sofia serve as members of our Audit Committee. The Audit Committee held a total of 13 meetings during 2006. For additional information on the Audit Committee, seeREPORT OF THE AUDIT COMMITTEE beginning at page 51 of this proxy statement.

The Compensation Committee determines the compensation of our Chief Executive Officer, our other executive officers and other key senior management members, and administers our incentive equity plans. The Compensation Committee’s Charter can be found on our Internet website atwww.dominionhomes.com under the heading “Investor Relations” – “Corporate Governance.” The Compensation Committee is comprised solely of directors who are “independent” directors pursuant to the listing requirements of The Nasdaq Stock Market. Currently, Messrs. Sofia (Chairman), Blom and McMaster serve as members of our Compensation Committee. Our Compensation Committee held a total of 6 meetings during 2006. For additional information on the Compensation Committee, seeCOMPENSATION DISCUSSION AND ANALYSIS beginning at page 35 of this proxy statement.

The Nominating and Corporate Governance Committee (the “Governance Committee”), identifies individuals qualified to become members of our Board of Directors and recommends to our Board the slate of directors to be nominated by the Board at the annual shareholders’ meeting and any director to fill a vacancy on the Board. The Governance Committee also reviews and makes recommendations to the Board regarding Board committee structure and membership, assists the Board in evaluating the Board’s overall effectiveness, and oversees the development and implementation of our corporate governance policies. The Governance Committee will consider recommendations for nominees for directorships submitted by our shareholders. SeeDirector Nomination Process beginning at page 11 of this proxy statement. The Governance Committee’s Charter can be found on our Internet website atwww.dominionhomes.com under the heading “Investor Relations” – “Corporate Governance.” The Governance Committee is comprised solely of directors who are “independent” directors pursuant to the listing requirements of The Nasdaq Stock Market. Currently, Messrs. Johnson (Chairman), Blom and Nelson serve as members of our Governance Committee. Our

-9-

Governance Committee held 3 meetings during 2006.

Lead Director

Our Board of Directors has a Lead Director whose purpose is to serve as a channel of communication between the Company’s independent directors and the Chief Executive Officer/Chairman of the Board. Pursuant to our Corporate Governance Guidelines, the Chairman of the Governance Committee also will serve as the Lead Director and, as a result, the Lead Director will be an independent director. Mr. Johnson was appointed to serve as the Company’s Lead Director on May 2, 2006.

The Lead Director’s responsibilities include: (1) providing input to the Chief Executive Officer/Chairman in establishing the agenda for Board meetings; (2) chairing executive sessions of the independent directors; and (3) working with the Chief Executive Officer/Chairman to ensure that the Board has adequate information and resources to support its decision-making requirements. The Lead Director also meets regularly with the Chief Executive Officer/Chairman outside of Board meetings to discuss agenda items, personnel issues, and such other Board and Company matters as they deem appropriate.

Communications with the Board

Shareholders, employees of the Company, and other interested parties may contact any director or committee of the Board of Directors by writing to them at: c/o Corporate Counsel, Dominion Homes, Inc., 5000 Tuttle Crossing Boulevard, P.O. Box 5000, Dublin, Ohio 43016-5555. Questions or concerns relating to our financial statements, accounting practices or internal control over financial reporting should be addressed to the Chairman of the Audit Committee. Questions or concerns relating to our governance practices, business ethics or corporate conduct should be addressed to the Chairman of the Governance Committee. Questions or concerns regarding our compensation practices should be addressed to the Chairman of the Compensation Committee. Any person who submits a question, concern or complaint in this manner and includes his, her or its name and mailing address in the submission will receive a written acknowledgement within 14 days of the Company’s receipt of the submission. Communications also may be submitted on an anonymous basis. The process for the Corporate Counsel’s forwarding of these communications to the appropriate Board members has been approved by our independent directors.

Questions, complaints and concerns also may be submitted to our directors by telephone through our Business Ethics Help Line at 1-800-418-6423, ext. 366, or by electronic mail atConfide2SV@securityvoice.com.

-10-

Qualifications of Directors

When identifying and evaluating director nominees, the Governance Committee will consider the following:

| | • | | The candidate’s demonstrated character and integrity. |

| | • | | The candidate’s relevant expertise and experience, including leadership qualities and experience, high-level managerial experience in a relatively complex organization or experience dealing with complex problems. |

| | • | | The candidate’s ability to provide advice and practical guidance based on his or her experience and expertise. |

| | • | | Whether the candidate meets the criteria for independence as established by the Securities and Exchange Commission and the listing standards of The Nasdaq Stock Market. The Board of Directors must be comprised of at least a majority of independent directors. |

| | • | | Whether the candidate would be considered a “financial expert” or financially literate according to the criteria established by the Securities and Exchange Commission and the listing standards of The Nasdaq Stock Market. |

| | • | | The candidate’s ability to exercise sound and independent business judgment and commitment to shareholder value. |

| | • | | The candidate’s ability to devote sufficient time to Board activities and towards the fulfillment of his or her responsibilities to the Company. A candidate’s service on other boards of public companies must not interfere with his or her ability to effectively serve on the Board. |

| | • | | Whether the candidate assists in achieving a mix of Board members that represents a diversity of background and professional experience, including with respect to ethnic background, age and gender. |

For incumbent directors, the Governance Committee also will consider the candidate’s overall service to the Company during his or her term and any transactions by the candidate with the Company during his or her term.

Director Nomination Process

In accordance with Section 2.03 of our Amended and Restated Code of Regulations (the “Regulations”), a nominee for election as a director may be proposed only by our directors or by a shareholder entitled to vote for the election of directors if such shareholder has proposed such nominee in a written notice which meets all of the requirements set forth in this paragraph. Each

-11-

written notice of a proposed nominee must set forth (1) the name, age, business or residence address of each nominee proposed in such notice; (2) the principal occupation or employment of each such nominee for the past five years; and (3) the number of shares of each series and class of the Company owned beneficially and/or of record by each such nominee and the length of time any such shares have been owned. The written notice of a proposed nominee must be delivered or mailed by first class United States mail, postage prepaid, to our Secretary at our principal office and, in the case of a nominee proposed for election as a director at an annual meeting of shareholders, received by the Secretary on or before the later of (i) February 1, immediately preceding such annual meeting or (ii) the sixtieth (60th) day prior to the first anniversary of the most recent annual meeting of our shareholders held for the election of directors, provided, however, that if the annual meeting for the election of directors in any year is not held on or before the thirty-first (31st) day next following such anniversary, then the written notice must be received by the Secretary within a reasonable time prior to the date of such annual meeting.

The Governance Committee is charged with assisting the Board of Directors in identifying and evaluating prospective candidates, and recommending to the Board of Directors its candidate(s) for Board membership. The Governance Committee will consider new director candidates suggested by shareholders of the Company, members of the Board of Directors, management, a professional search firm (if the Governance Committee has engaged one), or other interested parties. Prior to recommending a candidate to the Board for nomination as a director, at least one member of the Governance Committee and the Chief Executive Officer/Chairman will interview the director candidate.

Prior to the filing of our proxy statement for each annual meeting of shareholders, the Governance Committee will consider new and incumbent director candidates to recommend to the Board of Directors for nomination and election at the annual meeting. The Governance Committee will consider each director candidate by reviewing relevant information provided by the candidate (including information contained in the candidate’s mandatory questionnaire), and by applying the criteria listed above and with respect to incumbent directors, by confirming the candidate’s willingness to stand for re-election if nominated. The Governance Committee will consider and evaluate director candidates nominated by shareholders in the same manner after ensuring that any such nomination has been made in compliance with the Regulations and the applicable rules and regulations of the Securities and Exchange Commission governing shareholder nominations. Upon conclusion of its evaluation, the Governance Committee will approve and recommend to the Board of Directors its final candidate(s) for Board membership. The nomination of such candidates for election at the annual shareholder meeting is subject to the approval of the Board of Directors.

On February 7, 2007, the Board, upon the recommendation of the Governance Committee, appointed Betty D. Montgomery as a Class II director to fill the vacancy created with the passing of Donald A. Borror in December 2006. Ms. Montgomery was recommended to the Committee by the Company’s Chairman and Chief Executive Officer. All nominees for election as directors at the 2007 annual meeting are current members of the Board of Directors and have been nominated by the Board of Directors and elected by the shareholders in prior years.

-12-

To date, the Company has not employed a search firm on behalf of the Governance Committee to identify and assist in evaluating suitable director candidates, although the Governance Committee is authorized to retain a search firm for this purpose if it deems necessary.

Attendance of Directors at Annual Meetings

All members of our Board of Directors are strongly encouraged, but not required, to attend our annual shareholder meetings. At our 2006 annual meeting, all director nominees and persons who were then members of the Board of Directors were in attendance, except for Donald A. Borror and retiring directors Gerald E. Mayo and C. Ronald Tilley.

Agreements with Respect to the Election of Directors

BRC Voting Agreement. On December 29, 2006, the Company and all of the participating lenders named therein entered into the Third Amended and Restated Credit Agreement (the “Credit Facility”) for the amendment and restatement of the Company’s existing credit facilities. The Credit Facility includes: (i) a $35 million senior secured revolving line of credit; (ii) $110 million senior secured Term A loan facility (“Term A Notes”); and (iii) $90 million senior secured second lien Term B loan facility (“Term B Notes”) with detachable warrants exercisable for approximately 1,538,235 common shares of the Company (the “Warrants”). Under the Credit Facility, holders of the Term B Notes are entitled to designate two members, reasonably acceptable to the Company, for election to the Board of Directors, so long as the original holders of the Term B Notes continue to hold at least 51% of the outstanding principal amount of the Term B Notes. Each designated Board member will be elected for a two year term and may be removed from office for cause, including a violation of the Company’s Code of Ethics. Pursuant to the terms of a Voting Agreement dated December 29, 2006, between the holders of the Term B Notes, purchasers of the Warrants, and BRC Properties, Inc. (“BRC”), which is the holder of approximately 46.6% of our outstanding common shares, BRC will vote all of the shares of the Company that it beneficially owns in favor of the designated Board members.

If the original Term B Lenders (as defined in the Credit Facility) no longer have the right to designate members for election to the Company’s Board of Directors, as long as the Warrant purchasers hold (i) at least 1,000,000 warrants or warrant shares, such purchasers shall be permitted to designate two members for election to the Board, and (ii) less than 1,000,000 but more than 500,000 Warrants or warrant shares, such purchasers shall be permitted to designate one member for election to the Board. Each designated Board member will be elected for a two year term and may be removed from office for cause, including a violation of the Company’s Code of Ethics.

BRC Close Corporation Agreement. BRC has agreed in a Close Corporation Agreement with its shareholders to use its best efforts to elect David S. Borror as a director of the Company for so long as certain contingencies are satisfied and for so long as BRC has the ability to elect at least two (2) directors of the Company. SeeCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS -Description and Ownership of BRC beginning at page 55 of this proxy statement.

-13-

Family Relationships

Douglas G. Borror, Chairman and Chief Executive Officer, and David S. Borror, Vice Chairman of the Board and director are brothers and are the sons of Donald A. Borror. Until his death in December of 2006, Donald A. Borror was the Chairman Emeritus and a director of the Company. There are no other family relationships among our executive officers and/or directors.

Code of Business Conduct and Ethics

Pursuant to Section 406 of the Sarbanes-Oxley Act of 2002, on March 10, 2004, our Board of Directors adopted a Code of Business Conduct and Ethics, which applies to all of our officers (including our Chairman and Chief Executive Officer, and senior financial officers), employees and directors. The Board of Directors re-approved the Code on July 27, 2005. The Code of Business Conduct and Ethics can be found on our Internet website atwww.dominionhomes.com under the heading “Investor Relations” – “Corporate Governance.” If the Company makes any substantive amendment of, or grants any waiver for an executive officer or director to, the Code of Business Conduct and Ethics, the Company will disclose the nature of such amendment or waiver on our website atwww.dominionhomes.com.

Corporate Governance Guidelines

On July 21, 2004, at the recommendation of the Governance Committee, our Board of Directors adopted Corporate Governance Guidelines to assist the Board in fulfilling its responsibility to the Company’s shareholders to oversee the work of management and the Company’s business results. The Corporate Governance Guidelines may be found on our Internet website atwww.dominionhomes.com under the heading “Investor Relations” – “Corporate Governance.” The Governance Committee is responsible for reviewing these Guidelines and recommending any changes to the Board of Directors.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

AND COMPENSATION MATTERS

Executive Officers

In addition to Douglas G. Borror and David S. Borror, whose biographies are set forth in this proxy statement underELECTION OF DIRECTORS beginning at page 58, the following individuals are executive officers of the Company:

William G. Cornely, age 57, has served as Executive Vice President of Finance since February 2007 and as Chief Financial Officer of the Company since January 2006. From January 2006 to February 2007, Mr. Cornely served as our Senior Vice President of Finance. From November 2005 to January 2006, Mr. Cornely worked with the Company as a consultant to assist management with the negotiation of modifications and an extension to the Company’s

-14-

credit facility. Prior to that time, Mr. Cornely served as Executive Vice President, Chief Operating Officer and Treasurer of Glimcher Realty Trust (“Glimcher”) from March 1998 to April 2005. Mr. Cornely also served as Chief Financial Officer of Glimcher from April 1997 to June 2002, and as a member of its Board of Trustees from October 1999 to May 2004. Prior to that time, Mr. Cornely was an Audit Partner with the accounting firm of PricewaterhouseCoopers LLP (formerly Coopers & Lybrand).

Jeffrey A. Croft, age 49, has served as President and Chief Operating Officer of the Company since March 2006. From December 2003 until March 2006, Mr. Croft was an independent consultant. Prior to that time, Mr. Croft spent 19 years in various positions with Pulte Homes, Inc., most recently as Region President – Northeast Region from November 1997 to December 2003. In this capacity, Mr. Croft was responsible for strategic and operational activities of all Pulte brands in that region.

Compensation of Executive Officers

The following table sets forth for the fiscal year ended December 31, 2006, cash and non-cash compensation we paid to our Chairman and Chief Executive Officer and to each of our other most highly compensated executive officers who served as such during 2006, for services rendered in all capacities by such persons:

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | | Bonus

($) | | | Stock

Awards

($)(1) | | | Non-Equity

Incentive Plan

Compensation

($)(2) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings

($)(3) | | All Other

Compensation

($)(4) | | | Total ($) |

Douglas G. Borror

CEO and Chairman | | 2006 | | 566,667 | (5) | | — | | | (216,772 | )(6) | | — | | 253,729 | | 303,006 | (7) | | 906,630 |

William G. Cornely(8)

EVP of Finance and CFO | | 2006 | | 229,808 | | | 25,000 | (9) | | 29,849 | | | — | | — | | 35,462 | (10) | | 320,119 |

David S. Borror

Vice Chairman of the Board | | 2006 | | 197,916 | (11) | | — | | | (153,686 | )(12) | | — | | 53,015 | | 127,357 | (13) | | 224,602 |

Jeffrey A. Croft(14)

President and COO | | 2006 | | 315,385 | | | — | (15) | | 88,083 | | | — | | — | | 183,636 | (16) | | 587,104 |

(1) | Amounts shown reflect the compensation expense recognized by the Company for financial statement reporting purposes with respect to restricted shares during the 2006 fiscal year in accordance with SFAS 123R. The assumptions used to calculate the value of stock awards are set forth under Notes 1 and 10 of the Notes to Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for fiscal 2006 filed with the SEC on March 14, 2007. |

-15-

(2) | In November 2006, each of the Named Executive Officers offered to forego any annual incentive cash bonuses that these officers might otherwise be entitled to receive pursuant to the terms of their annual incentive compensation plans. Based on the Company’s results for 2006, the foregone amounts included $162,500 for Mr. Douglas Borror, $62,500 for Mr. David Borror, $100,000 for Mr. Croft and $62,500 for Mr. Cornely. |

(3) | All amounts shown reflect the change in value of an executive officer’s account pursuant to the Company’s Supplemental Executive Retirement Plan (“SERP”) from the prior fiscal year. For additional information on the SERP see thePENSION BENEFITS table beginning at page 21 herein, andCOMPENSATION DISCUSSION AND ANALYSIS –Deferred Compensation Benefits–Supplemental Executive Retirement Plan beginning on page 43. |

(4) | The Company’s methodology for valuation of perquisites is as follows: (i) for personal use of company aircraft, amount includes the aggregate incremental cost to the Company of personal use of the Company’s aircraft, calculated based on the variable operating costs to the Company, including the hourly rate, fuel costs, mileage, landing/ramp fees and other miscellaneous variable costs, and excluding fixed costs which do not change based on usage, such as pilot salaries, the amortization of the purchase price of the Company’s interest in the aircraft, and the cost of maintenance not related to trips; and (ii) for automobile lease payments, the amount reflects the actual cost of lease payments made. |

(5) | Mr. Douglas Borror volunteered to reduce his base salary from $650,000 to $450,000 effective July 30, 2006 through December 31, 2006. At Mr. Borror’s recommendation, this reduction has been extended through 2007. |

(6) | Includes the forfeiture of 40,000 restricted common shares granted to Mr. Douglas Borror on October 22, 2003, which shares were to vest, if at all, upon (i) the expiration of three years from the date of the award, and (ii) the Company’s achievement of a book value per share of $30.00. The shares did not vest as a result of the performance condition in (ii) not having been met. |

(7) | Includes $10,573 for long-term disability insurance premiums paid by the Company, $150,000 for life insurance premiums paid by the Company to fund a contractually obligated death benefit (which life insurance policy can be used to fund the Company’s Supplemental Executive Retirement Plan), and $17,670 for payment of taxes related to (i) use of the Company aircraft and (ii) financial planning reimbursement. Also includes country club dues and fees, reimbursement of dues and expenses related to membership in professional civic organizations, fuel reimbursement, medical expense reimbursement, financial planning reimbursement, and home office equipment, none of which individually exceeds $25,000. Also includes $35,955 attributable to personal use of the Company aircraft, and $26,243 for automobile lease payments. |

(8) | Mr. Cornely became SVP of Finance and CFO on January 17, 2006. |

(9) | Amount represents signing bonus in connection with Mr. Cornely’s commencement of employment with the Company. In August 2006, Mr. Cornely volunteered to forego his 2006 guaranteed minimum bonus of $100,000. |

(10) | Includes reimbursement of COBRA premiums for the months of January and February 2006, an automobile allowance, and medical expense reimbursement, none of which individually exceeds $25,000. |

(11) | Mr. David Borror volunteered to reduce his base salary from $250,000 to $125,000 effective July 30, 2006 through December 31, 2006. |

(12) | Includes the forfeiture of 20,000 restricted common shares granted to Mr. David Borror on October 22, 2003, which shares were to vest, if at all, upon (i) the expiration of three years from the date of the award, and (ii) the Company’s achievement of a book value per share of $30.00. The shares did not vest as a result of the performance condition in (ii) not having been met. |

(13) | Includes $31,000 for life insurance premiums paid by the Company to fund a contractually obligated death benefit (which life insurance policy can be used to fund the Company’s Supplemental Executive Retirement |

-16-

| | Plan) and $11,469 for payment of taxes related to: (i) personal use of the Company aircraft, and (ii) financial planning reimbursement. Also includes personal use of the Company aircraft, automobile lease payments and fuel reimbursement, medical expense reimbursement, financial planning reimbursement and home security, none of which individually exceeds $25,000. |

(14) | Mr. Croft became President and COO on March 6, 2006. |

(15) | In August 2006, Mr. Croft volunteered to forego his 2006 guaranteed minimum bonus of $250,000. |

(16) | Includes country club dues and fees, an automobile allowance, and medical expense reimbursement, none of which individually exceeds $25,000. Also includes a reimbursement of $102,133 for costs incurred by Mr. Croft in connection with his relocation to the Columbus, Ohio area upon his initial employment with the Company, and $49,532 for payment of taxes related to such relocation costs. Amount indicated for relocation costs includes the actual cost of temporary lodging and travel for Mr. Croft, as well as realtor fees and closing costs in connection with the sale of Mr. Croft’s existing home. |

GRANTS OF PLAN-BASED AWARDS

The following table shows all plan-based awards granted to the Named Executive Officers during fiscal 2006:

| | | | | | | | | | | | | | | | | | |

| | | | | Estimate Future Payouts under Non-

Equity Incentive Plan Awards(1) | | Estimated Future Payouts under Equity

Incentive Plan Awards(2) | | All Other

Stock Awards:

Number of

Shares of | | Grant Date

Fair Value of

Stock Awards

and |

Name | | Grant Date | | Threshold

($) | | Target ($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | Stock or Units

(#)(2) | | Option Awards ($)(3) |

Douglas G. Borror | | 3/20/2006 | | 195,000 | | 487,500 | | 812,500 | | — | | — | | — | | — | | — |

William G. Cornely | | 3/20/2006 | | 75,000 | | 187,500 | | 312,500 | | — | | — | | — | | — | | — |

| | 2/7/2006 | | — | | — | | — | | — | | 12,500 | | — | | 12,500 | | 260,500 |

David S. Borror | | 3/20/2006 | | 75,000 | | 187,500 | | 312,500 | | — | | — | | — | | — | | — |

Jeffrey A. Croft | | 3/20/2006 | | 120,000 | | 300,000 | | 500,000 | | | | | | | | | | — |

| | 5/11/2006 | | — | | — | | — | | — | | 50,000 | | — | | 50,000 | | 1,057,000 |

(1) | Amounts shown reflect 2006 potential incentive cash bonus payouts for (i) Mr. Douglas Borror under the Dominion Homes, Inc. Incentive Growth Plan (the “Incentive Growth Plan”), and (ii) the remaining Named Executive Officers, under their 2006 incentive cash bonus plans, based on achievement of the 2006 corporate performance objectives set forth in such plans. SeeCOMPENSATION DISCUSSION AND ANALYSIS –Annual Cash Compensation–Incentive Cash Bonus beginning on page 39 for additional information. In November 2006, the Company accepted the offer of each of the Named Executive Officers to forego any annual incentive cash bonuses that they might otherwise be entitled to receive pursuant to the terms of their annual incentive compensation plans. Based on the Company’s results for 2006, the foregone amounts included $162,500 for Mr. Douglas Borror, $62,500 for Mr. David Borror, $100,000 for Mr. Croft and $62,500 for Mr. |

-17-

| | Cornely. Since no incentive cash bonuses were paid, these foregone amounts were not reported in the Summary Compensation Table. |

(2) | Represents restricted shares awarded to the Named Executive Officer in 2006, 50% of which shares will vest in equal amounts on the first, second, third and fourth anniversaries of the date of grant, and the remaining 50% of which will vest upon the Company’s achievement of $220,000,000 in shareholders equity at the end of any fiscal quarter through and including December 31, 2009. |

(3) | The grant date fair value of the stock awards are determined in accordance with SFAS 123R. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

In August 2006, Messrs. Douglas Borror and David Borror offered to have their base salaries reduced significantly. The Committee and the Board approved these base salary reductions, which included a decrease from $650,000 to $450,000 for Mr. Douglas Borror, and from $250,000 to $125,000 for Mr. David Borror. These decreases were originally effective from July 30, 2006 through December 31, 2006, and have been extended for 2007.

During 2006, each of the Named Executive Officers other than Mr. Douglas Borror participated in an annual incentive cash bonus plan, while Mr. Douglas Borror participated in the Dominion Homes, Inc. Incentive Growth Plan (the “Incentive Growth Plan”). In November 2006, Messrs. Croft and Cornely, and Messrs. Douglas Borror and David Borror each offered to forego any annual cash incentive bonuses that these executive officers might otherwise be entitled to receive pursuant to the terms of their annual incentive cash bonus plans described above. The Committee and the Board approved this recommendation. Based on the Company’s final results for 2006, in which the Company failed to achieve both the target net income and debt management objectives, but achieved a 96% customer satisfaction rate, the foregone amounts included $162,500 for Mr. Douglas Borror, $62,500 for Mr. David Borror, $100,000 for Mr. Croft and $62,500 for Mr. Cornely. For additional information regarding these bonus plans, seeCOMPENSATION DISCUSSION AND ANALYSIS –Annual Cash Compensation –Incentive Cash Bonus beginning at page 39 herein.

We have employment agreements with the following Named Executive Officers: Douglas G. Borror, our Chairman and Chief Executive Officer, David S. Borror, our Vice Chairman of the Board, William G. Cornely, our Executive Vice President of Finance and Chief Financial Officer, and Jeffrey Croft, our President and Chief Operating Officer.

Douglas G. Borror Employment Agreement

We entered into an employment agreement with Mr. Douglas Borror effective July 1, 2004. The agreement is for a period of five years, and renews automatically for additional one-year terms unless the Board of Directors has notified Mr. Borror within 90 days prior to the expiration of the initial term (or any extension period) of its decision not to extend the agreement. On August 1, 2006, Mr. Borror’s employment agreement was amended to reflect his voluntary reduction in base salary from $650,000 to $450,000. Mr. Borror also is entitled to participate in our 2002 Incentive Growth Plan (the “Incentive Growth Plan”), and to receive such

-18-

other benefits (including, but not limited to health and life insurance coverages, sick leave and disability programs, tax-qualified retirement plans, and other perquisites and benefits) as we may provide from time to time to actively employed senior executives of the Company. In addition, Mr. Borror is entitled to the following: (1) use of the Company’s aircraft for personal travel not to exceed pre-established annual limits set by the Compensation Committee, (2) payment of dues and reimbursement of reasonable expenses related to his membership in professional and civic organizations (including the Young President’s Organization), (3) payment of dues and expenses related to his membership in two country clubs, (4) a monthly automobile allowance or leased Company car, in accordance with the Company’s policies and procedures, and (5) reimbursement of reasonable expenses related to his service on the Board of Trustees of The Ohio State University, which are not otherwise reimbursed by the University. During 2006, the Compensation Committee suspended all personal use of the Company aircraft. In October 2006, the Company sold its remaining fractional interest in the Company aircraft.

Mr. Borror’s employment agreement is attached as Exhibit 10.1 to our Quarterly Report on Form 10-Q for the period ending September 20, 2004. The amendment to Mr. Borror’s employment agreement is attached as Exhibit 10.1 to our Current Report on Form 8-K filed dated August 2, 2006.

David S. Borror Employment Agreement

We entered into an employment agreement with Mr. David Borror effective July 1, 2004. The agreement is for an initial three-year term, and renews automatically for additional one-year terms unless the Board of Directors has notified Mr. Borror within 90 days prior to the expiration of the initial term (or any extension period) of its decision not to extend the agreement. On August 1, 2006, Mr. Borror’s employment agreement was amended to reflect his voluntary reduction in base salary from $250,000 to $125,000. On November 3, 2006, a second amendment to Mr. Borror’s employment agreement was entered into to reflect a further reduction in his base salary effective as of January 1, 2007, in connection with his transition from Corporate Executive Vice President to Vice Chairman of the Board as of the same date. Mr. Borror is also entitled to participate in our annual incentive compensation program and to participate in such other programs and receive such other benefits as we may provide from time to time to actively employed, similarly situated executives. In addition, Mr. David Borror is entitled to the following: (i) use of the Company’s aircraft for personal travel not to exceed pre-established annual limits set by the Compensation Committee, (2) payment of dues and expenses related to his membership in one (1) country club, and (3) a monthly automobile allowance or leased Company car, in accordance with the Company’s policies and procedures. During 2006, the Compensation Committee suspended all personal use of the Company aircraft. In October 2006, the Company sold its remaining fractional interest in the Company aircraft.

Mr. Borror’s employment agreement is attached as Exhibit 10.2 to our Quarterly Report on Form 10-Q for the period ending September 20, 2004. The amendments to Mr. Borror’s employment agreement are attached as Exhibit 10.2 to our Current Report on Form 8-K dated August 2, 2006, and as Exhibit 99.4 to our Current Report on Form 8-K dated October 31, 2006.

-19-

William G. Cornely Employment Agreement

We entered into an employment agreement with Mr. Cornely effective January 17, 2006. The agreement is for a three-year term, and renews automatically for additional one-year terms unless the Board of Directors has notified Mr. Cornely within 180 days prior to the expiration of the initial term (or any extension period) of its decision not to extend the agreement. Under the agreement, Mr. Cornely’s initial base salary is $250,000, and may be increased during the term by the Compensation Committee of our Board of Directors. Mr. Cornely is also entitled to participate in our annual incentive compensation program and to participate in such other programs and receive such other benefits as we may provide from time to time to actively employed, similarly situated executives. On August 1, 2006, Mr. Cornely’s employment agreement was amended to reflect his offering to forego a guaranteed minimum bonus of $100,000 for 2006.

Mr. Cornely’s employment agreement is attached as Exhibit 10.1 to our Current Report on Form 8-K dated February 7, 2006. The amendment to Mr. Cornely’s employment agreement is attached as Exhibit 10.6 to our Current Report on Form 8-K dated August 2, 2006.

Jeffrey A. Croft Employment Agreement

We entered into an employment agreement with Mr. Croft effective March 6, 2006. The agreement is for a three-year term, and renews automatically for additional one-year terms unless the Board of Directors has notified Mr. Croft within 180 days prior to the expiration of the initial term (or any extension period) of its decision not to extend the agreement. Under the agreement, Mr. Croft’s initial base salary is $400,000, and may be increased during the term by the Compensation Committee of our Board of Directors. Mr. Croft is entitled to participate in our annual incentive compensation program and to participate in such other programs and receive such other benefits as we may provide from time to time to actively employed, similarly situated executives. On August 1, 2006, Mr. Croft’s employment agreement was amended to reflect his offering to forego a guaranteed minimum bonus of $250,000 for 2006.

Mr. Croft’s employment agreement is attached as Exhibit 10.1 to our Current Report on Form 8-K dated May 3, 2006. The amendment to Mr. Croft’s employment agreement is attached as Exhibit 10.5 to our Current Report on Form 8-K filed on August 2, 2006.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table includes information regarding all outstanding equity awards held by the Named Executive Officers at the end of fiscal 2006.

-20-

| | | | | | | | | | | | |

| | | Stock Awards |

Name | | Number of

Shares or Units

of Stock That

Have Not

Vested (#) | | | Market Value of

Shares or Units

of Stock That

Have Not Vested ($)(1) | | Equity Incentive Plan

Awards: Number of

Unearned Shares,

Units or Other Rights

That Have Not

Vested (#) | | | Equity Incentive Plan

Awards: Market or

Payout Value of

Unearned Shares, Units

or Other Rights That

Have Not Vested ($)(1) |

Douglas G. Borror | | — | | | | — | | 30,000 | (2) | | $ | 158,400 |

William G. Cornely | | 12,500 | (3) | | $ | 66,000 | | 12,500 | (3) | | $ | 66,000 |

David S. Borror | | — | | | | — | | — | | | | — |

Jeffrey A. Croft | | 50,000 | (4) | | $ | 264,000 | | 50,000 | (4) | | $ | 264,000 |

(1) | Value is based on the close price of the Company’s common stock of $5.28 on December 29, 2006. |

(2) | Reflects award of 30,000 restricted common shares to Mr. Douglas Borror on October 22, 2002 under the Company’s Stock Incentive Plan, which shares will vest, if at all, upon (a) the expiration of five years from the date of the award, (b) the Company’s achievement of shareholders’ equity of not less than $175,000,000, and (c) Mr. Douglas Borror continuing to be employed with the Company as of such date. |

(3) | Represents award of 25,000 restricted common shares to Mr. Cornely on February 7, 2006 under the Company’s 2003 Stock Option and Incentive Equity Plan (the “2003 Stock Plan”), 50% of which (12,500 shares) will vest in equal amounts on the first, second, third and fourth anniversaries of the date of grant, and the remaining 50% of which will vest, if at all, upon the Company’s achievement of $220,000,000 in shareholders equity at the end of any fiscal quarter through and including December 31, 2009. |

(4) | Represents award of 100,000 restricted common shares to Mr. Croft on May 11, 2006 under the Company’s 2003 Stock Plan, 50% of which (50,000 shares) will vest in equal amounts on the first, second, third and fourth anniversaries of the date of grant, and the remaining 50% of which will vest, if at all, upon the Company’s achievement of $220,000,000 in shareholders equity at the end of any fiscal quarter through and including December 31, 2009. |

PENSION BENEFITS

The Company maintains a non-qualified, unfunded defined supplemental executive retirement plan (the “Supplemental Executive Retirement Plan” or “ SERP”) adopted January 1, 2003, in which Mr. Douglas Borror, Mr. David Borror, and other key employees of the Company participate. Under the SERP, participating employees are eligible for retirement benefits if certain vesting criteria set forth in the employee’s notice of participation are satisfied. Such vesting criteria include, among other things, participation in the SERP for a minimum of 72 months. Provided such criteria have been satisfied, upon the participant’s termination of employment, he will be entitled to receive, at his election, either (i) assignment of the insurance policy purchased by the Company as a source of the participant’s SERP plan benefit, or (ii) a lump sum cash payment in an amount equal to the participant’s account. In administering the SERP, the Company created an account (which account is an unfunded book-keeping entry) for each participant. The Company annually credits this account with an amount such that the value

-21-

of the account at the date of the participant’s vesting in the SERP will equal the cash surrender value of the life insurance policy at vesting. The Company has no control or influence over the cash surrender value of the life insurance policy. For additional information, seeCOMPENSATION DISCUSSION AND ANALYSIS –Deferred Compensation Benefits -Supplemental Executive Retirement Plan beginning on page 43.

The following table further describes the benefits payable to Messrs. Douglas Borror and David Borror under the SERP at December 31, 2006.

| | | | | | | | |

Name | | Plan Name | | Number of

Months Credited

Service (#) | | Present Value of

Accumulated Benefit ($)(1) | | Payments During Last

Fiscal Year ($) |

Douglas G. Borror | | Supplemental Executive Retirement Plan | | 48 | | 841,416 | | — |

William G. Cornely | | — | | — | | — | | — |

David S. Borror | | Supplemental Executive Retirement Plan | | 48 | | 160,669 | | — |

Jeffrey A. Croft | | — | | — | | — | | — |

(1) | Represents the Named Executive Officer’s account balance under the SERP at December 31, 2006, which reflects all amounts credited by the Company to the executive’s account through that date. The Company periodically credits the account with the intent that, upon vesting, the account will have the same value as the cash surrender value of a life insurance policy which the Company has acquired. Currently, the Compensation Committee credits the account based upon an assumed rate of return of 5% which is based on the historical rate of return of the cash surrender value of the insurance policy. The Compensation Committee may periodically adjust the assumed rate of return should the case surrender value of the insurance policy deviate from its historical average, or for any other reason in its discretion. |

NONQUALIFIED DEFERRED COMPENSATION

The Company maintains an Executive Deferred Compensation Plan (the “Deferred Compensation Plan”) that permits officers, including the Named Executive Officers, and directors of the Company to voluntarily defer receipt of a portion of their annual compensation (up to 20% of total base salary and annual bonus for employees and up to 100% of directors’ fees for outside directors) until the date or dates selected by the participant. Under the Deferred Compensation Plan, the Company will make a matching contribution for each participant equal to 25% of the amount deferred, which matching contribution may not exceed $2,500 in any year. Our matching contribution vests in 20% increments over a five-year period, subject to accelerated vesting upon a “change in control.” The contribution and match amounts are used by the trustee of a rabbi trust to acquire common shares of the Company in the open market. These common shares are held and voted by the trustee pursuant to the rabbi trust agreement.

The following table shows certain information for the Named Executive Officers under the Deferred Compensation Plan.

-22-

| | | | | | | | | | | | |

Name | | Executive

Contributions

in Last FY ($) | | Registrant

Contributions

in Last FY ($) | | Aggregate

Earnings

(Loss) in

Last FY ($)(1) | | | Aggregate

Withdrawals/

Distributions

($) | | | Aggregate

Balance at Last

FYE ($) (2) |

Douglas G. Borror | | — | | — | | (72,675 | ) | | 27,583 | (3) | | 59,275 |

David S. Borror | | — | | — | | (14,173 | ) | | 15,343 | (4) | | 13,340 |

Jeffrey A. Croft | | — | | — | | — | | | — | | | — |

William G. Cornely | | — | | — | | — | | | — | | | — |

(1) | Amount reflects change in value of the participant’s deferred compensation account from January 1, 2006 to December 31, 2006, based on the change in the fair market value of the Company’s common shares during the same period. Amounts reported in the aggregate earnings column are not included in the Summary Compensation Table for 2006 as such earnings are entirely derived from changes in the fair market value of the Company’s common shares. The Company reports salary, bonus, and matching contributions in the Summary Compensation Table for the year in which such amounts were deferred and matching contributions made. |

(2) | Based on a closing price of $5.28 of the Company’s common shares on December 29, 2006. |

(3) | Mr. Douglas Borror received a distribution of 3,732.54 vested shares under the Deferred Compensation Plan on August 16, 2006. Amount is based on a closing price of $7.39 of the Company’s common shares on August 15, 2006. |

(4) | Mr. David Borror received a distribution of 1,442.0 vested shares under the Deferred Compensation Plan on January 3, 2006. Amount is based on a closing price of $10.64 of the Company’s common shares on December 30, 2005, which was the last trading day prior to January 3, 2006. |

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE-IN-CONTROL

This section describes and quantifies the payments that would be due to the Company’s Named Executive Officers in connection with their termination, or in connection with a “change in control” of the Company.

Douglas G. Borror

On July 1, 2004, the Company entered into an employment agreement with Mr. Douglas Borror, pursuant to which Mr. Borror will be entitled to receive certain post-termination payments under various termination scenarios as more fully described below. Mr. Borror also currently holds restricted shares awarded under the Company’s 2003 Stock Plan, and participates in the Company’s Incentive Growth Plan, SERP, and Deferred Compensation Plan, each of which provide for post-termination payments to Mr. Borror under certain circumstances.

Pursuant to his employment agreement, in the event that Mr. Borror’s employment is terminated for cause (as defined in his employment agreement) or if he terminates his employment other than for good reason (as defined in his employment agreement), he will be entitled to receive any accrued but unpaid base salary, any accrued but unused vacation, and any unreimbursed business expenses, all as of the date of termination. Under the Executive Deferred Compensation Plan, Mr. Borror will also be entitled to receive vested shares in accordance with

-23-

the distribution dates established by Mr. Borror at the time of deferral, which distributions may be accelerated by the Compensation Committee in its discretion. Mr. Borror’s retirement or resignation would be treated as a termination by Mr. Borror without good reason under his employment agreement. In the event of retirement, provided that all other vesting criteria have been satisfied, Mr. Borror would also be entitled to receive, at his election, either (i) assignment of the insurance policy purchased by the Company as a source of his SERP plan benefit, or (ii) a lump sum cash payment from his participant account, the amount of which account currently is intended to equal the net cash surrender value of the insurance policy at termination. As of December 31, 2006, the vesting criteria set forth under the SERP for Mr. Borror had not been satisfied.

If Mr. Borror’s employment is terminated as a result of death or disability, he (or his estate, as applicable) will be entitled to receive: (i) any accrued but unpaid base salary, any accrued but unused vacation, and any unreimbursed business expenses, all as of the date of termination; (ii) his target bonus award under the Incentive Growth Plan for the year in which termination occurs; and (iii) vested shares under the Deferred Compensation Plan in accordance with the distribution dates established by Mr. Borror at the time of deferral, subject to acceleration by the Compensation Committee. In addition, in the event of his death, Mr. Borror’s estate will be entitled to receive a contractually obligated death benefit from the Company, which the Company has funded through the purchase of a life insurance policy on Mr. Borror.

In the event that Mr. Borror’s employment is terminated by the Company without cause (as defined in the agreement) or he terminates his employment with the Company for good reason (as defined in the agreement), he will be entitled to the following:

| | • | | any accrued but unpaid base salary, any accrued but unused vacation, and any unreimbursed business expenses, all as of the date of termination; |

| | • | | his target bonus award under the Incentive Growth Plan for the year in which termination occurs; |

| | • | | an amount equal to the greater of (a) two, or (b) the number of years (and fractions of years) remaining on the term of his employment agreement, multiplied by the greater of (c) the amount of the award paid to him under the Incentive Growth Plan for the last full year preceding his termination of employment or (d) the average of the amount of the award paid to him under the Incentive Growth Plan for the three years prior to his termination of employment, payable in equal monthly installments during the 24 month period following termination; |

| | • | | in exchange for non-competition, non-solicitation and non-disparagement covenants effective for two years after his termination without cause or for good reason, Mr. Borror will receive an amount equal to the greater of (a) 24 months, or (b) the number of months remaining on the term of his agreement, of base salary in effect on the date of termination, paid in equal monthly installments over the 24 month period following termination; and |

-24-

| | • | | continuation of coverage under our group health plan for a period of twenty-four (24) months after the date of termination or, if continuation is not permitted, an amount necessary for him (and, if applicable, his family) to obtain an individual health insurance policy that will provide coverage for the twenty-four (24) month period that is substantially similar to the coverage provided under our group health plan. |

Additionally, under his employment agreement, as well as the 2003 Stock Plan and his restricted share award agreement, in the event of a termination by the Company without cause, any unvested restricted shares previously awarded to Mr. Borror will fully and immediately vest. Finally, Mr. Borror will be entitled to receive vested shares under the Deferred Compensation Plan in accordance with the distribution dates established by Mr. Borror at the time of deferral, subject to acceleration by the Compensation Committee.