UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

DOMINION HOMES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

Common shares, without par value, of Dominion Homes, Inc. (“Common Stock”)

| | (2) | Aggregate number of securities to which transaction applies: |

10,096,368 shares of the Common Stock and restricted shares with respect to 117,620 shares of the Common Stock.

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

The proposed maximum aggregate value of the transaction, for purposes only of calculating the filing fee, is $6,639,092.20, which is the sum of (i) $0.65 per share of 10,096,368 shares of the Common Stock and (ii) $0.65 per share of restricted shares of 117,620 shares of the Common Stock. The filing fee equals the proposed maximum aggregate value of the transaction multiplied by 0.00003930.

| | (4) | Proposed maximum aggregate value of transaction: |

$6,639,092.20

$260.92

| x | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

DOMINION HOMES, INC.

4900 Tuttle Crossing Boulevard

P.O. Box 4900

Dublin, Ohio 43016-0993

May 9, 2008

Dear Shareholder:

You are cordially invited to attend the special meeting of shareholders of Dominion Homes, Inc. (the “Company”) to be held on May 30, 2008 at 9:00 a.m. local time at The Omni Berkshire Place Hotel, 21 East 52nd Street, New York, New York 10022.

At the Special Meeting, you will be asked to adopt and approve an Agreement and Plan of Merger, dated as of January 18, 2008 (the “Merger Agreement”), pursuant to which the Company will be acquired by an investor group comprised of SPCP Group, LLC (“Silver Point”), Silver Oak Capital, L.L.C. (“Silver Oak,” and together with Silver Point, collectively referred to as the “Sponsors”) and BRC Properties Inc. (“BRC” and together with the Sponsors, the “Investor Group”). Upon completion of the merger (the “Merger”), the Company will be owned 90.38% by the Sponsors and 9.62% by BRC. Under the terms of the Merger Agreement (a copy of which is attached to this Proxy Statement as Appendix A), each share of Common Stock issued and outstanding immediately prior to the effective time of the Merger will, subject to certain limitations, be converted into the right to receive $0.65 in cash, without interest and further subject to applicable withholding taxes (the “Merger Consideration”), and the Company will become a privately held company.

BRC is a significant shareholder of the Company, owning approximately 39.73% of the Common Stock outstanding as of May 5, 2008, and is controlled by certain members of the Borror family. Parent was formed by Silver Point and Silver Oak, each a fund or a nominee acting on behalf of private investment funds affiliated with Silver Point Capital, L.P. and Angelo, Gordon & Co., L.P. The Sponsors, through themselves and/or certain affiliates, are lenders to the Company and have provided the Company with debt financing that to date has given the Company necessary working capital to operate the business.

The $0.65 per share Merger Consideration represents a 38% premium over the closing price of the Company’s common shares on January 17, 2008, the last trading day before the date when the Company’s Board of Directors (the “Board”) approved the Merger.

The Board has formed a special committee of independent directors (the “Special Committee”) to evaluate the fairness of the Merger to the shareholders of the Company unaffiliated with Parent, Merger Sub, BRC or the Borror Group (collectively, the “Unaffiliated Shareholders”), and to negotiate the terms of the Merger. The Special Committee is comprised of Carl A. Nelson, Jr., Robert R. McMaster and Betty D. Montgomery, who are neither directors nor employees of the Sponsors, Parent, or Merger Sub nor employees of the Company. No member of the Special Committee has any material commercial relationship with the Sponsors, BRC or the Borror Group.

The Special Committee, acting with the advice and assistance of its own independent financial advisor, Houlihan Lokey Howard & Zukin Financial Advisors, Inc. (“Houlihan Lokey”), evaluated the Merger proposal and unanimously determined that the proposed Merger is substantively and procedurally fair to the Company’s Unaffiliated Shareholders and recommended that the Board approve the Merger.

The Board, acting with the advice and assistance of its own independent financial advisor, Raymond James & Associates, Inc. (“Raymond James”), and upon the unanimous recommendation of the Special Committee, has approved the Merger Agreement that will effectuate the proposed Merger. In arriving at its decision, the Board gave careful consideration to a number of factors described in the accompanying Proxy Statement, including the fairness opinion and financial analysis of Raymond James as presented to the Board, the financial analysis of Houlihan Lokey as presented to the Board, the fact that Houlihan Lokey presented a fairness opinion to the Special Committee, and the fact that the Board believes the Merger to be the best available means of avoiding bankruptcy and providing any means of recovery for the Unaffiliated Shareholders. The Board believes that the Merger is in the best interests of the Company and the Unaffiliated Shareholders, and recommends that you voteFOR approval of the Merger and adoption of the Merger Agreement.

The attached “Notice of Special Meeting of Shareholders” and “Proxy Statement” explain the proposed Merger and the terms and conditions of the Merger Agreement, and provide specific information about the special meeting. Please read these materials carefully. In addition to these materials, you may obtain information about the Company from documents that the Company has filed with the Securities and Exchange Commission, including the Schedule 13E-3 Transaction Statement, required in connection with any proposed transaction in which a publicly-traded corporation is taken private.

If you do not vote in favor of the Merger and the Merger Agreement, you will have the right to dissent and to seek appraisal of the fair market value of your common shares if the Merger is consummated. To do so, however, you must properly perfect your appraisal rights under Ohio law in accordance with the procedures described in “RIGHTS OF DISSENTING SHAREHOLDERS” and Appendix G to the accompanying Proxy Statement.

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. THE MERGER CANNOT BE COMPLETED UNLESS THE HOLDERS OF A MAJORITY OF THE OUTSTANDING COMMON SHARES OF THE COMPANY ENTITLED TO VOTE ADOPT THE MERGER AGREEMENT. AS OF THE RECORD DATE, THE NUMBER OF COMMON SHARES HELD BY THE SPONSORS, BRC AND THE BORROR GROUP IS IN EXCESS OF THE REQUIRED MAJORITY NECESSARY TO ADOPT THE MERGER AGREEMENT. ACCORDINGLY, THE COMPANY ANTICIPATES THAT THE APPROVAL OF THE MERGER AGREEMENT WILL BE DULY AUTHORIZED AT THE SPECIAL MEETING.

Whether or not you plan to attend the special meeting, you may ensure your representation by completing, signing, dating and promptly returning the enclosed proxy card. A return envelope, which requires no postage if mailed from within the United States, has been provided for your use. Any proxy may be revoked by a shareholder at any time before its exercise by delivery of a written revocation or a subsequently dated proxy to the Secretary of the Company at 4900 Tuttle Crossing Boulevard, Dublin, Ohio 43016. If you attend the special meeting and inform the inspector of elections of the Company that you wish to vote your shares in person, your proxy will not be used. If you wish to attend the special meeting and your shares are held of record by a brokerage firm, bank or other nominee, you must obtain a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and bring it to the special meeting. In order to vote your shares at the special meeting, you must obtain from the record holder a proxy issued in your name.

On behalf of the Board of Directors, I thank you for your support and encourage you to voteFOR approval of the Merger and adoption of the Merger Agreement.

Very truly yours,

Laura L. Macias

Secretary

THE PROPOSED MERGER HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) OR ANY STATE SECURITIES AUTHORITY, NOR HAS THE SEC OR ANY STATE AUTHORITY PASSED UPON THE FAIRNESS OR MERITS OF THE PROPOSED MERGER OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The accompanying proxy statement is dated May 9, 2008 and is first being mailed to shareholders of the Company on or about May 9, 2008.

DOMINION HOMES, INC.

4900 Tuttle Crossing Boulevard

P.O. Box 4900

Dublin, Ohio 43016-0993

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To our shareholders:

NOTICE IS HEREBY GIVEN, that a special meeting of the shareholders (the “Special Meeting”) of Dominion Homes, Inc., an Ohio corporation (the “Company”), will be held on May 30, 2008 at 9:00 a.m. local time at The Omni Berkshire Place Hotel, 21 East 52nd Street, New York, New York 10022 for the following purposes:

1. To consider and vote on a proposal to adopt and approve an Agreement and Plan of Merger, dated as of January 18, 2008 (the “Merger Agreement”), by and among the Company, Dominion Holding Corp., a Delaware corporation (“Parent”) and Dominion Merger Corporation, an Ohio corporation and a wholly-owned subsidiary of Parent (“Merger Sub”), pursuant to which Merger Sub will be merged with and into the Company, with the Company as the surviving corporation (the “Merger”). Upon consummation of the Merger, each shareholder of the Company (other than Parent, Merger Sub, BRC Properties Inc. (whose shares are being contributed to Parent), shareholders who perfect their dissenters’ rights under Ohio law and the Company with respect to shares held in the Company’s treasury) will be entitled to receive $0.65 in cash, without interest and further subject to applicable withholding taxes, for each outstanding common share, without par value, of the Company (“Common Stock”) owned by such shareholder immediately prior to the effective time of the Merger, and the Company will cease to be a publicly traded corporation; and

2. To transact any other business that may properly come before the Special Meeting or any adjournment or postponement thereof.

Only shareholders of record at the close of business on May 5, 2008 will receive notice of and be entitled to vote at the Special Meeting and at any adjournments or postponements thereof.

The accompanying Proxy Statement describes the Merger Agreement, the proposed Merger and the actions to be taken in connection with the Merger. The Company’s Amended and Restated Code of Regulations require that the holders of at least a majority of the outstanding shares of Common Stock of the Company entitled to vote be present or represented by proxy at the Special Meeting in order to constitute a quorum for the transaction of business. In addition, approval of the Merger and adoption of the Merger Agreement requires the affirmative vote of the holders of at least a majority of the issued and outstanding shares of Common Stock of the Company entitled to vote at the Special Meeting. It is, therefore, important that your shares be represented at the Special Meeting regardless of the number of shares you hold. Whether or not you are able to be present in person, please vote by proxy card by signing, dating and promptly returning the enclosed proxy card in the accompanying envelope, which requires no postage if mailed in the United States. You may revoke your proxy in the manner described in the accompanying Proxy Statement at any time before it is voted at the Special Meeting.

Shareholders who do not vote in favor of adopting the Merger Agreement, who properly perfect their appraisal rights, and who otherwise comply with the provisions of Section 1701.85 of the Ohio Revised Code, will be entitled, if the Merger is completed, to appraisal of the fair value of their common shares. See “RIGHTS OF DISSENTING SHAREHOLDERS” in the accompanying Proxy Statement and the full text of Section 1701.85 of the Ohio Revised Code, a copy of which is attached as Appendix G to the accompanying Proxy Statement, for a description of the procedures that you must follow in order to exercise your appraisal rights.

This Notice, the proxy card and the Proxy Statement enclosed herewith are sent to you by order of the Board of Directors.

By Order of the Board of Directors,

Laura L. Macias

Secretary

Dublin, Ohio

May 9, 2008

DOMINION HOMES, INC.

PRELIMINARY PROXY STATEMENT

FOR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON

May 30, 2008

The date of this Proxy Statement is May 9, 2008.

INTRODUCTION

Dominion Homes, Inc., an Ohio corporation (the “Company”), is furnishing this proxy statement (“Proxy Statement”) to holders of its common shares, without par value (“Common Stock”), in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the Special Meeting of the Company’s shareholders (the “Special Meeting”), to be held at 9:00 a.m. local time at The Omni Berkshire Place Hotel, 21 East 52nd Street, New York, New York 10022 and at any adjournment or postponement of that meeting. Throughout this Proxy Statement, we refer to Dominion Homes, Inc. and its subsidiaries as the “Company,” “we,” “our” or “us,” unless otherwise indicated by context.

The Special Meeting has been called to consider and vote upon a proposal to adopt and approve an Agreement and Plan of Merger, dated as of January 18, 2008 (the “Merger Agreement”), pursuant to which the Company will be acquired by an investor group comprised of SPCP Group, LLC (“Silver Point”), Silver Oak Capital, L.L.C. (“Silver Oak,” and together with Silver Point, collectively referred to as the “Sponsors”) and BRC Properties Inc. (“BRC” and together with the Sponsors, the “Investor Group”). Upon completion of the merger (the “Merger”), the Company will be owned 90.38% by the Sponsors and 9.62% by BRC. Under the terms of the Merger Agreement (a copy of which is attached to this Proxy Statement as Appendix A), each share of Common Stock issued and outstanding immediately prior to the effective time of the Merger will, subject to certain limitations, be converted into the right to receive $0.65 in cash, without interest and further subject to applicable withholding taxes (the “Merger Consideration”), and the Company will become a privately held company.

BRC is a significant shareholder of the Company, owning approximately 39.73% of the Common Stock outstanding as of May 5, 2008, and is controlled by certain members of the Borror family (Douglas G. Borror, the Chairman of the Board, Chief Executive Officer and President of the Company, and David S. Borror, a director and Vice Chairman of the Company, and collectively referred to as the “Borror Group”). Parent was formed by Silver Point and Silver Oak, each a fund or a nominee acting on behalf of private investment funds affiliated with Silver Point Capital, L.P. (“Silver Point Capital”) and Angelo, Gordon & Co., L.P. (“Angelo Gordon & Co.”).

The Merger Consideration was the result of extensive negotiations between the Sponsors and a special committee of the Board (the “Special Committee”), which was formed to represent the interests of the Unaffiliated Shareholders (as defined below). At the time the Special Committee was formed the Company was in default on various financial covenants in the Credit Agreement. The Special Committee and the Board believe that the Merger, the Merger Agreement and the transactions contemplated thereby are fair to and in the best interests of the holders of public shares unaffiliated with the Sponsors, Parent, Merger Sub, BRC or the Borror Group (collectively, the “Unaffiliated Shareholders”), and recommend that all of the Company’s shareholders approve the Merger and adopt the Merger Agreement and the transactions contemplated thereby.

All shares of Common Stock represented by properly executed proxies received prior to or at the Special Meeting and not revoked will be voted in accordance with the instructions indicated in the proxies. If no instructions are indicated, the proxies will be votedFOR approval of the Merger and adoption of the Merger Agreement.

Other than the proposed Merger, the Board knows of no additional matters that will be presented for consideration at the Special Meeting. Submission of a proxy, however, confers on the designated proxy holder discretionary authority to vote the shares covered by the proxy on other business, if any, that may properly come before the Special Meeting or any adjournment thereof.

This Proxy Statement and the accompanying form of proxy are first being sent to shareholders of the Company on or about May 9, 2008.

TABLE OF CONTENTS

i

ii

TABLE OF APPENDICES

iii

SUMMARY TERM SHEET

The following summary, together with the “QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING” immediately following this summary, are intended only to highlight certain information contained elsewhere in this Proxy Statement. This summary and the following question and answer section may not contain all the information that is important to you and the other shareholders. To more fully understand the proposed Merger and the terms of the Merger Agreement, you should carefully read this entire Proxy Statement, all of its Appendices and the documents referenced in this Proxy Statement before voting.

The Parties to the Merger

The Company

The Company is a builder of high-quality homes and condominiums in central Ohio and in the Louisville and Lexington, Kentucky markets. The Company traces its homebuilding roots to 1952 when Donald A. Borror, the Company’s founder, built his first home in Columbus, Ohio. The Borror Group grew the homebuilding business and operated it as part of the homebuilding and related divisions of BRC. The Company was organized as an Ohio corporation in October 1993 under the name Borror Corporation in anticipation of its initial public offering, which was completed in March 1994. In connection with the initial public offering, the Company acquired from BRC, its predecessor company and largest shareholder, its homebuilding operations. BRC is primarily owned and is controlled by the Borror Group. In May 1997, the Company changed its name to Dominion Homes, Inc.

The Company’s principal corporate offices are located at 4900 Tuttle Crossing Blvd., Dublin, Ohio 43016. The telephone number of the Company’s principal corporate offices is (614) 356-5000 and our web site address is www.dominionhomes.com.

Dominion Holding Corp.

Dominion Holding Corp., a Delaware corporation (“Parent”), was formed on January 11, 2008 solely for the purpose of effecting the Merger and the transactions related to the Merger, by SPCP Group, LLC, a Delaware limited liability company (“Silver Point”), and Silver Oak Capital, L.L.C., a Delaware limited liability company (“Silver Oak,” and together with Silver Point, collectively referred to as the “Sponsors”), each a fund or a nominee acting on behalf of private investment funds affiliated with Silver Point Capital, L.P. (“Silver Point Capital”) and Angelo, Gordon & Co., L.P. (“Angelo Gordon & Co.”), respectively, and is backed by the equity commitment of the Sponsors. Immediately prior to the Merger, BRC will contribute 100% of its shares of Common Stock to Parent in exchange for a 9.62% interest in Parent, the remainder interest of which will be owned by the Sponsors.

Parent has not conducted any activities to date other than those incident to its formation and negotiating and entering into the Merger Agreement and other related agreements. The mailing address and telephone number of Parent’s principal executive offices are c/o Silver Point Capital, L.P., Two Greenwich Plaza, 1st Floor, Greenwich, CT 06830, Attn: Charles E. Tauber, (203) 542-4200; and c/o Angelo, Gordon & Co., L.P., 245 Park Avenue, 26th Floor, New York, NY 10167, Attn: Thomas M. Fuller, (212) 692-2000.

Dominion Merger Corporation

Dominion Merger Corporation, an Ohio corporation and a wholly-owned subsidiary of Parent (“Merger Sub”) was formed on January 15, 2008 solely for the purpose of effecting the Merger. Merger Sub has not engaged in any activities to date other than in furtherance of this purpose. Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Company, with the Company as the surviving corporation (the “Surviving Corporation”) of the Merger. The mailing address and telephone number of Merger Sub’s principal executive offices are c/o Silver Point Capital, L.P., Two Greenwich Plaza, 1st Floor, Greenwich, CT 06830, Attn: Charles E. Tauber, (203) 542-4200; and c/o Angelo, Gordon & Co., L.P., 245 Park Avenue, 26th Floor, New York, NY 10167, Attn: Thomas M. Fuller, (212) 692-2000.

1

The Investor Group

Silver Oak / Silver Point—Silver Oak is a nominee acting on behalf of certain private investment funds for which Angelo Gordon & Co. acts as discretionary investment advisor. Angelo Gordon & Co. is a privately-held registered investment advisor dedicated to alternative investing. Angelo Gordon & Co. was founded in 1988 and currently manages, with its affiliates, approximately $18 billion. Angelo Gordon & Co. is headquartered in New York, New York.

Silver Point is a private investment fund based in Greenwich, Connecticut which provides financing to and invests in companies across all industries.

Silver Point and Silver Oak, through themselves and/or certain affiliates, are lenders to the Company pursuant to the Third Amended and Restated Credit Agreement, dated as of December 29, 2006, as thereby amended from time to time (the “Credit Agreement”) and have provided the Company with debt financing that to date has given the Company necessary working capital to operate the business. The Sponsors are also shareholders of the Company, collectively owning an aggregate of approximately 1,510,267 shares, or 15.28%, of the Common Stock outstanding as of May 5, 2008, as a result of the cashless exercise of certain warrants held by the Sponsors on April 30, 2008. For a more detailed discussion regarding the Company’s existing Credit Agreement and the warrants that were previously issued to, and exercised by, the Sponsors, please see the section entitled “SPECIAL FACTORS—Background and Reasons—2006 Credit Facility Renewal” and “COMMON STOCK PURCHASE INFORMATION—Purchases by the Sponsors; Parent; Merger Sub or BRC” in this Proxy Statement. At the time of the Merger, the Sponsors will collectively own 90.38% of Parent.

BRC—The members of the Investor Group other than Silver Point and Silver Oak include BRC. BRC is a significant shareholder of the Company, owning approximately 39.73% of the Common Stock outstanding as of May 5, 2008, and is controlled by the Borror Group. BRC is in the business of owning, managing and consulting on multifamily housing, commercial real estate and undeveloped real estate. At the time of the Merger, BRC will own 9.62% of Parent.

For a more detailed discussion regarding the parties to the proposed Merger, please see the section entitled “THE PARTIES TO THE MERGER” in this Proxy Statement.

What Unaffiliated Shareholders Will Receive in the Merger

Under the terms of the Merger Agreement, at the effective time of the Merger, each share of Common Stock held by the Unaffiliated Shareholders will be converted into the right to receive $0.65 in cash, without interest and subject to applicable withholding taxes. The members of the Borror Group will also be paid $0.65 in cash, without interest and subject to applicable withholding taxes for each of the 64,641 shares of Common Stock held outside of BRC (an aggregate of approximately $42,017).

The Merger Consideration of $0.65 per share represents a 38% premium over the closing price of the Common Stock on January 17, 2008, the last trading day before the date when the Board approved the Merger. If you do not wish to accept the Merger Consideration, you may seek appraisal of the value of your shares under Ohio law. For more information, please see the section entitled “RIGHTS OF DISSENTING SHAREHOLDERS.”

All outstanding options of the Company to purchase shares of Common Stock, whether or not then-exercisable, will be cancelled. As of the date of this Proxy Statement all options are out-of-the-money since they are exercisable at more than $0.65 per share. For more information, please see the section entitled “THE MERGER AGREEMENT—The Merger and Merger Consideration.”

In addition, each outstanding restricted share of the Company, whether or not vested in accordance with its terms, shall become fully vested at the effective time of the Merger, and the holders of such outstanding restricted shares of the Company will be treated as persons holding shares of Common Stock under the Merger Agreement.

2

The Special Committee

The Board formed the Special Committee of independent directors to evaluate the fairness of the Merger to the Unaffiliated Shareholders. The members of the Special Committee are Carl A. Nelson, Jr., Robert R. McMaster and Betty D. Montgomery. Mr. Nelson is the Chairman of the Special Committee. The members of the Special Committee are not employees or directors of the Sponsors, Parent, Merger Sub and BRC and are not employees of the Company. No member of the Special Committee has any material commercial relationship with the Sponsors, Parent, Merger Sub, BRC and the Borror Group. For more information, please see the sections entitled “SPECIAL FACTORS—Background and Reasons” and “Background and Reasons—Recommendation of the Special Committee and the Board; Fairness of the Merger.”

Fairness of the Merger

The Board believes that the Merger is both substantively and procedurally fair to the Unaffiliated Shareholders. The Board, with Messrs. Douglas and David Borror abstaining from all determinations concerning the Merger and the Merger Agreement, upon the recommendation of the Special Committee, approved the Merger and the Merger Agreement, and deemed the Merger to be fair to and in the best interests of the Unaffiliated Shareholders.

In addition:

| | • | | The Merger Consideration of $0.65 per share represents a 38% premium over the closing price of the Common Stock on January 17, 2008, the last trading day before the date when the Board approved the Merger. |

| | • | | The Merger Consideration would allow the Unaffiliated Shareholders to receive some consideration for their Common Stock in connection with the Merger, whereas, given the fact that the Company is currently in default to its lenders under the Credit Agreement and the Company expects there would be no recovery in any liquidation scenario for the Company’s shareholders, after paying secured creditors and liquidation expenses, it is likely that the Unaffiliated Shareholders would receive no consideration for their Common Stock in the event the Company were to seek protection under Chapters 7 or 11 of the Federal Bankruptcy Code. |

| | • | | The continued weakness in the housing market has resulted in reduced sales prices from the sale of homes, margin pressures, decreasing price points of services, and rising costs and expenses, resulting in significant reductions in revenue, operating losses and an inability for the Company to otherwise service its outstanding indebtedness. |

For a discussion of the material factors considered by the Board in reaching its conclusion and the reasons why the Board determined that the Merger is fair, please see the section entitled “SPECIAL FACTORS—Background and Reasons—Recommendation of the Special Committee and the Board; Fairness of the Merger” and “—Parent’s and the Investor Group’s Purpose and Reasons for the Merger; Alternatives to the Merger; Fairness of the Merger.”

Interests of the Company’s Directors and Officers in the Merger

Certain of our officers and directors may have interests in the Merger that are different from, or in addition to, yours, including the following:

| | • | | Our CEO, President and Chairman of the Board, Douglas G. Borror, and our Vice Chairman of the Board, David S. Borror, each an officer, director and shareholder of BRC, have agreed that BRC will contribute all of its shares of Common Stock to Parent immediately before the Merger in exchange for a 9.62% interest in Parent. Each of Douglas G. Borror and David S. Borror have entered into a Voting Agreement with Parent and Merger Sub whereby they have agreed to vote their Common Stock and cause BRC to vote its Common Stock in favor of the Merger. |

3

| | • | | It is anticipated that the current executive officers of the Company will hold substantially similar positions with the Surviving Corporation after completion of the Merger, and that after completion of the Merger, Douglas G. Borror will remain in his role as Chairman of the Board and Chief Executive Officer of the Company and will be appointed to the board of directors of Parent and the Surviving Corporation. |

| | • | | Douglas G. Borror will enter into an amended and restated employment agreement with the Surviving Corporation effective as of the consummation of the Merger, the principal terms of which have been agreed to and are described beginning on page 47. |

| | • | | David S. Borror will enter into a separation and release agreement with the Company immediately prior to the Merger, the principal terms of which have been agreed to and are described beginning on page 47. |

| | • | | Our executive officers and directors will be indemnified in respect of their past service, and Parent will maintain the Company’s current directors’ and officers’ liability insurance, subject to certain conditions. |

Fairness Opinions of Raymond James and Houlihan Lokey

The Board engaged Raymond James & Associates, Inc. (“Raymond James”) as its own independent financial advisor to render an opinion as to the fairness of the Merger Consideration. On January 18, 2008, Raymond James delivered its written opinion to the Board that, as of the date of the opinion, and based upon and subject to the assumptions and qualifications stated in the opinion, the consideration to be received by Unaffiliated Shareholders in the Merger was fair, from a financial point of view, to the Unaffiliated Shareholders. Given Raymond James prior relationship with the Company as its financial advisor, the Special Committee retained Houlihan Lokey Howard & Zukin Financial Advisors, Inc. (“Houlihan Lokey”) as its own independent financial advisor in connection with its evaluation of the fairness from a financial point of view of the Merger Consideration. On January 17, 2008, Houlihan Lokey rendered an oral opinion to the Special Committee (which was confirmed in writing by delivery of Houlihan Lokey’s written opinion dated January 18, 2008), as to the fairness, from a financial point of view, of the consideration to be received by the Unaffiliated Shareholders in the Merger, as of January 18, 2008, and based upon and subject to the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Houlihan Lokey in preparing its opinion.

Houlihan Lokey’s opinion was directed to the Special Committee, and Raymond James’ opinion was directed to the Board. Both opinions only addressed the fairness from a financial point of view of the consideration to be received by the Unaffiliated Shareholders in the Merger, and neither opinion addressed any other aspect or implication of the Merger. The summary of Raymond James’ and Houlihan Lokey’s opinions in this Proxy Statement are qualified in their entirety by reference to the full text of their written opinions, which are included as Appendices E and F, respectively, to this Proxy Statement and set forth the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Raymond James and Houlihan Lokey in preparing their opinions. We encourage our shareholders to read carefully the full text of Raymond James and Houlihan Lokey’s written opinions. However, none of Raymond James and Houlihan Lokey’s opinions nor the summaries of their opinions and the related analyses set forth in this Proxy Statement are intended to be, and do not constitute, advice or a recommendation to the Board, the Special Committee or any shareholder as to how to act or vote with respect to the Merger or related matters. See “SPECIAL FACTORS—Opinion of Houlihan Lokey to the Special Committee” and “SPECIAL FACTORS—Opinion of Raymond James to the Board.”

Alternatives to the Merger

Alternatives to the Merger considered by the Company and Board included:

| | • | | Maintaining the status quo; |

4

| | • | | Effecting a refinancing / capital infusion transaction; |

| | • | | Selling the Company to a financial or strategic buyer; and |

The Merger was structured as a cash merger to accomplish the acquisition in a single step, without the necessity of financing separate purchases of shares in a tender offer, while at the same time not materially disrupting the Company’s operations. For more information, please see the section entitled “SPECIAL FACTORS—Parent’s and the Investor Group’s Purpose and Reasons for the Merger; Alternatives to the Merger; Fairness of the Merger.”

Recommendation of the Special Committee and the Board

The Special Committee and the Board have determined that the terms of the Merger Agreement are fair to, and in the best interests of, the Company and the Unaffiliated Shareholders, based in part on the opinions of Houlihan Lokey and Raymond James, respectively, to the effect that as of the date of the opinions, and based upon and subject to the procedures followed, assumptions made, qualifications and limitations on the review undertaken, the Merger Consideration was fair, from a financial point of view, to the Unaffiliated Shareholders. Accordingly, the Board recommends that you voteFOR approval of the Merger and adoption of the Merger Agreement. For a more detailed discussion, please see the section entitled “SPECIAL FACTORS—Background and Reasons—Recommendation of the Special Committee and the Board; Fairness of the Merger.”

Effects of the Merger

After the Merger:

| | • | | the Company will be the Surviving Corporation of the Merger and will be privately held by Parent; |

| | • | | each Unaffiliated Shareholder (other than dissenting shareholders) will be entitled to receive $0.65 in cash for each share of Common Stock owned at the effective time of the Merger; |

| | • | | all outstanding options to purchase shares of Common Stock will be cancelled. Since all options are out-of-the-money because they are exercisable at greater than $0.65 per share as of the date of this Proxy Statement, the Company expects that all options will be cancelled without payment. |

| | • | | the Company will no longer be a public company, and price quotations for the Common Stock will no longer be available; |

| | • | | the registration of the Common Stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be terminated; and |

| | • | | Unaffiliated Shareholders will no longer have an interest in or be shareholders of the Company, and, therefore, will not be able to participate in the Surviving Corporation’s future earnings and growth, and dividends, if any. The benefits and risks of owning the Company will accrue solely to Parent and any subsequent investors in the privately held company. |

For a more detailed discussion of the effects of the proposed Merger, see the sections entitled “SPECIAL FACTORS—Certain Effects of the Merger” and “—Plans for the Company After the Merger” in this Proxy Statement.

Merger Financing and Expenses of the Merger

Promptly after the closing of the Merger, the Unaffiliated Shareholders and the Borror Group will be paid (assuming no shareholders perfect their dissenters’ rights under Ohio law) a minimum aggregate purchase price of approximately $2.9 million for their shares of Common Stock in connection with the Merger. The Borror

5

Group will be paid $0.65 in cash without interest and subject to applicable withholding taxes for each of the 64,641 shares of Common Stock held outside of BRC (an aggregate of approximately $42,017). In addition, the Company will require approximately $4.2 million to pay its expenses and costs related to the Merger.

Parent has received equity commitments with respect to an aggregate of up to $2.9 million, consisting of up to approximately $1.45 million from Silver Oak and up to approximately $1.45 million from Silver Point to complete the Merger. For a more detailed discussion of the equity commitments, see the sections entitled “OTHER AGREEMENTS—Equity Commitment Letters” in this Proxy Statement.

Each party to the Merger will bear its own expenses, including, without limitation, financial advisor fees, legal fees and printing and filing fees, incurred in connection with their respective obligations under the Merger Agreement (except for certain Company Costs and Expenses incurred by the Company in connection with the entering into of the Merger Agreement and the performance of its obligations thereunder as defined in the Merger Agreement, which the Merger Agreement allocates to Parent). However, if the Company accepts a Superior Proposal (as defined in the Merger Agreement), it may be required to reimburse Parent for all reasonable and documented out-of-pocket expenses it incurs in connection with the Merger, including all professionals’ fees and all Company Costs and Expenses paid by Parent or the Merger Sub. For a more detailed discussion of fees and expenses, see the section entitled “THE MERGER AGREEMENT—Effect of Termination and Expenses.”

Documented and reasonable third party expenses incurred by BRC in connection with the Merger and the Merger Agreement will be paid by Parent or Merger Sub after the closing of the Merger.

Conditions to the Merger

The consummation of the Merger depends on the satisfaction or waiver of a number of conditions, including the following:

| | • | | the Merger Agreement must be adopted by the affirmative vote of the holders of at least a majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting, although as of the record date, the number of shares of Common Stock held by the Investor Group is in excess of the required majority necessary to adopt the Merger Agreement, and as a result the Company anticipates that the approval of the Merger Agreement will be duly authorized at the Special Meeting; |

| | • | | there is no order, injunction, decree or other legal restraint or prohibition preventing the consummation of the Merger; and no governmental entity will have filed any action seeking to enjoin, restrain or otherwise prohibit the Merger; |

| | • | | all required consents or approvals of any governmental authorities have been received; |

| | • | | the Company’s, Parent’s and Merger Sub’s respective representations and warranties in the Merger Agreement must be true and correct as of the effective time of the Merger in the manner described under the caption “THE MERGER AGREEMENT—Conditions to the Merger”; |

| | • | | the Company, Parent and Merger Sub must have performed in all material respects all obligations that each is required to perform under the Merger Agreement; |

| | • | | no Material Adverse Effect (as defined in the Merger Agreement) with respect to the Company or any of its subsidiaries shall have occurred since the date of the Merger Agreement; |

| | • | | no filing by the Company or any subsidiary or a filing against the Company or any subsidiary for relief under Title 11 of the Bankruptcy Code has been made, and no custodian, trustee, receiver or other agent has been appointed or authorized to take charge of a material portion of the property of the Company or any subsidiary; and |

| | • | | concurrently with the consummation of the Merger, the Sponsors must contribute (or shall cause their affiliates to contribute) to Parent the Term B Notes under the Credit Agreement in the principal amount of $20 million. |

6

For a more detailed discussion of the conditions to the Merger, see the section entitled “THE MERGER AGREEMENT—Conditions to the Merger” in this Proxy Statement. See also the text of the Merger Agreement attached as Appendix A to this Proxy Statement.

Restrictions on Solicitation of Other Acquisition Proposals

The Merger Agreement provides that until 11:59 p.m. (EDT), on March 3, 2008 (the “go-shop period”), we are permitted to initiate, solicit and encourage competing acquisition proposals from any party, engage in any discussions or negotiations concerning acquisition proposals for the Company and otherwise cooperate with or assist in, or facilitate, any effort or attempt by potential buyers to make any competing acquisition proposals. Prior to terminating the Merger Agreement or entering into an acquisition agreement with respect to any such proposal, we are required to comply with certain terms of the Merger Agreement described under “THE MERGER AGREEMENT—Acquisition Proposals”, including negotiating with Parent in good faith to make adjustments to the Merger Agreement so that such acquisition proposal will no longer be superior to the Merger. As of the end of the “go-shop period,” commencing on March 4, 2008, the Company had received no such acquisition proposals.

The Merger Agreement provides that, other than the permitted activities with respect to competing acquisition proposals during the “go-shop period” summarized above, we are generally not permitted to:

| | • | | initiate, solicit or knowingly encourage (including by way of providing information) the submission of any inquiries, proposals or offers or any other efforts or attempts that constitute or may reasonably be expected to lead to, any acquisition proposal or engage in any discussions or negotiations with respect thereto or otherwise cooperate with or assist or participate in, or knowingly facilitate, any such inquiries, proposals, offers, discussions or negotiations; |

| | • | | withhold, withdraw, qualify or modify (or publicly propose or resolve to withhold, withdraw, qualify or modify), in a manner adverse to Parent, our Board’s recommendation in favor of the adoption of the Merger Agreement; or |

| | • | | approve or recommend, or publicly propose to approve or recommend, an acquisition proposal or cause or permit us to enter into any acquisition agreement, merger agreement, letter of intent or other similar agreement relating to an acquisition proposal or enter into any agreement requiring us to abandon, terminate or fail to consummate the transactions contemplated by the Merger Agreement or resolve, propose or agree to do any of the foregoing. |

Notwithstanding the above restrictions, under certain circumstances, prior to the adoption of the Merger Agreement by the Company’s shareholders, in accordance with their fiduciary duties, our Board of Directors may respond to a bona fide written proposal for an alternative acquisition, terminate the Merger Agreement and enter into an acquisition agreement with respect to a superior proposal or change or withdraw our recommendation in favor of adoption of the Merger Agreement, so long as we comply with certain terms of the Merger Agreement described under “THE MERGER AGREEMENT—Acquisition Proposals.”

Termination of the Merger Agreement

The Merger Agreement may be terminated and the Merger may be abandoned at any time prior to the consummation of the Merger, whether before or after shareholder approval has been obtained:

| | • | | By mutual written consent of the Company and Parent; |

| | • | | By either the Company or Parent, if: |

| | • | | there shall be any final and non-appealable injunction or other legal requirement that permanently restrains, enjoins or prohibits consummation of the Merger; |

7

| | • | | the Merger is not completed on or before June 30, 2008, so long as the failure to complete the Merger by such date is not caused by the failure of the terminating party to fulfill its obligations under the Merger Agreement; or |

| | • | | our shareholders do not adopt the Merger Agreement at the Special Meeting or any adjournment or postponement thereof. |

| | • | | at any time prior to obtaining the requisite shareholder approval at the Special Meeting, we receive a superior proposal and enter into a definitive agreement with respect to such superior proposal, provided that we have complied with our obligations under the Merger Agreement described under “THE MERGER AGREEMENT—Acquisition Proposals” and “THE MERGER AGREEMENT—Termination and Abandonment”; and provided that we have paid all reasonable out-of-pocket costs and expenses owed to Parent as described under “THE MERGER AGREEMENT—Effect of Termination and Expenses”; or |

| | • | | Parent or Merger Sub has breached or failed to perform any of their respective representations, warranties, covenants or agreements under the Merger Agreement, which would give rise to the failure of certain conditions to closing to be satisfied and such breach is not curable or cured by a certain date. |

| | • | | (i) our Board withholds, withdraws, qualifies, modifies or amends, in a manner adverse to Parent, its recommendation that the Merger Agreement be approved by our Shareholders (the “Company Recommendation” and such change of the Company Recommendation being adverse to Parent, being referred to as a “Change of Company Recommendation”) or fails to reaffirm the Company Recommendation; (ii) a Change of Company Recommendation shall have occurred; (iii) our Board or any committee thereof approves, adopts or recommends any superior proposal or acquisition proposal; (iv) the Company shall have executed any letter of intent, memorandum of understanding or similar contract relating to any superior proposal or acquisition proposal; (v) the Company approves or recommends that its shareholders tender their shares in any tender or exchange offer or the Company fails to send its shareholders, within ten business days after the commencement of such tender or exchange offer, a statement that it recommends rejection of such tender or exchange offer; (vi) the Company publicly announces its intention to take any of the actions in the foregoing clauses; (vii) with the prior consent of our Board, any person or “group” (within the meaning of Section 13(d) of the Exchange Act) acquires beneficial ownership of more than 25% of the outstanding shares of Common Stock; or (viii) the Company breaches its obligation to hold a shareholders meeting set forth in the Merger Agreement (other than solely as a result of actions taken or omitted by the SEC); or |

| | • | | we have materially breached or failed to perform any of our representations, warranties, covenants or agreements under the Merger Agreement, which would give rise to the failure of certain conditions to closing to be satisfied and such breach is not curable or cured by a certain date. |

For a more detailed discussion of the termination provisions of the Merger Agreement, please see the section entitled “THE MERGER AGREEMENT—Termination and Abandonment.” See also the text of the Merger Agreement attached as Appendix A to this Proxy Statement.

Rights of Dissenting Shareholders

Any shareholder who does not wish to accept the Merger Consideration has the right under Section 1701.85 of the Ohio Revised Code to receive the “fair cash value” of the shareholder’s shares, upon perfecting the shareholder’s right of appraisal. Fair cash value: (i) will be determined as of the day prior to the Special Meeting,

8

(ii) will be the amount a willing seller and willing buyer would accept or pay with neither being under compulsion to sell or buy, (iii) will not exceed the amount specified in the shareholder’s written demand, and (iv) will exclude any appreciation or depreciation in market value resulting from the Merger.

This “right of appraisal” is subject to a number of technical requirements. Generally, to exercise appraisal rights:

| | • | | the shareholder must not vote for the approval of Merger or the adoption of the Merger Agreement; and |

| | • | | the shareholder must make a written demand upon the Company for the fair cash value of his, her or its shares of Common Stock within ten days after the date upon which the shareholders vote on the Merger Agreement and the Merger. |

If the Company and a dissenting shareholder cannot come to an agreement on the fair cash value of the dissenting shareholder’s shares within three months of the shareholder’s written demand, the shareholder or the Company may file a petition in court for a formal judicial appraisal. Failure to follow the procedures enumerated in Section 1701.85 of the Ohio Revised Code will waive the shareholder’s right of appraisal. Merely voting against the Merger Agreement and the Merger will not protect a dissenting shareholder’s right of appraisal. For more information, please see the section entitled “RIGHTS OF DISSENTING SHAREHOLDERS” and the text of Section 1701.85 of the Ohio Revised Code, which is attached to this Proxy Statement as Appendix G.

Certain Federal Income Tax Consequences

Your receipt of the Merger Consideration will be a taxable transaction for U.S. federal income tax purposes under the Internal Revenue Code and may be a taxable transaction for foreign, state and local income tax purposes as well. For U.S. federal income tax purposes, you will recognize gain or loss measured by the difference between the amount of cash you receive in the Merger and your tax basis in the shares of Common Stock exchanged for the Merger Consideration, provided that it is possible that if you are related, under applicable attribution rules, to a person deemed to own shares of the Surviving Corporation after the Merger, all the cash you receive could be treated as a dividend of the Surviving Corporation. You should consult your own tax advisor regarding the U.S. federal income tax consequences of the Merger, as well as any tax consequences under state, local or foreign laws. Please see the section entitled “SPECIAL FACTORS—Federal Income Tax Consequences of the Merger.”

Rollover Commitment Letter and Voting Agreement

In connection with the Merger, on January 18, 2008, BRC entered into the Rollover Commitment Letter with Silver Point and Silver Oak. A copy of the Rollover Commitment Letter is included with this Proxy Statement as Appendix B. Under the Rollover Commitment Letter, BRC has agreed, immediately prior to the effective time of the Merger, to contribute its 3,926,324 Company Common Stock to Parent in exchange for a 9.62% interest in Parent. The Company Common Stock contributed to Parent by BRC is subject to put and call rights described in the section entitled “Interim and Definitive Stockholders Agreement.” Assuming neither the put nor the call are exercised, the value assigned to each share of Company Common Stock contributed by BRC to Parent is $0.65 per share.

Further, in connection with the Merger, on January 18, 2008, Parent, Merger Sub and BRC and the Borror Group (together, the “Borror Shareholders”), that in the aggregate own 3,990,965 shares of Common Stock, or approximately 40.39% of the Common Stock outstanding as of May 5, 2008, have entered into a Voting Agreement (the “Voting Agreement”), pursuant to which the Borror Shareholders have agreed, among other things, to vote 3,965,559 of their shares of Common Stock in favor of the Merger and against any third party acquisition proposal other than the Merger contemplated under the Merger Agreement. The Voting Agreement does not include 25,406 shares of Common Stock beneficially owned by Douglas G. Borror through The Principal Group, as Trustee of the Dominion Homes, Inc. Retirement Plan and Trust, which shares of Common Stock will be voted at the direction of Mr. Borror. A copy of the Voting Agreement is included with this Proxy Statement as Appendix C.

9

Interim and Definitive Stockholders Agreement

In connection with the Merger, on January 18, 2008, the Sponsors entered into the Interim Stockholders Agreement with each other and Parent, pursuant to which each of the Sponsors agreed to (i) satisfy its commitment under its Equity Commitment Letter (described below), (ii) exercise its warrants and contribute the shares from the exercise of such warrants to Parent prior to the consummation of the Merger and (iii) contribute Term B Notes in the principal amount of $10 million to Parent immediately prior to the consummation of the Merger.

On or before the closing date of the Merger, the Sponsors and BRC intend to enter into a definitive stockholders agreement, which, as provided in the Rollover Commitment Letter, shall include certain terms regarding the minority shareholder rights to be provided to BRC with respect to its equity interest in Parent. In particular, the terms of the definitive stockholders agreement will provide for certain normal and customary terms associated with such agreements (including certain restrictions on transfer, anti-dilution and tag along and drag along rights). The definitive stockholders agreement will also provide a put/call mechanism related to the Parent’s stock held by BRC, whereby for a 30 day period following the one year anniversary of the closing of the Merger, BRC will have a one-time right to put all of the Parent stock owned by BRC to the Sponsors at a cash price of $1,500,000 (the “BRC Put”), provided that the Parent and/or the Surviving Company is not then in bankruptcy. The BRC Put equates to approximately $0.38 per share of Common Stock of the Company contributed by BRC to Parent. For the period from the end of the BRC Put until three years from the closing of the Merger, the Sponsors will have a one-time right to acquire all of Parent stock owned by BRC and its transferees at a cash price of $3,000,000 (the “Sponsors Call”). The Sponsors Call equates to approximately $0.76 per share of Common Stock of the Company contributed by BRC to Parent.

For a more detailed discussion regarding the proposed terms of the definitive stockholders agreement to be entered into by the Sponsors and BRC prior to the closing of the Merger, please see the section entitled “OTHER AGREEMENTS—Interim and Definitive Stockholders Agreements” below, as well as the Summary of Terms of Minority Shareholder Rights included with the Rollover Commitment Letter described above and included with this Proxy Statement as Appendix B.

Equity Commitment Letters

In connection with the Merger, on January 18, 2008, the Sponsors entered into Equity Commitment Letters with Parent (the “Equity Commitment Letters”), pursuant to which each of the Sponsors committed to contribute $1,488,309.50 to Parent in connection with the transactions contemplated by the Merger Agreement. Copies of the Equity Commitment Letters are included with this Proxy Statement as Appendix D.

Amendment No. 7 and Limited Forbearance to Credit Agreement

In connection with the Merger, on January 18, 2008, the Company and all of the participating lenders under the Credit Agreement entered into Amendment No. 7 and Limited Forbearance to the Credit Agreement, pursuant to which the Company’s lenders agreed, in part, to forbear until the earlier of June 30, 2008 or termination of the Merger Agreement from exercising their rights and remedies under the Credit Agreement in order to facilitate the consummation of the Merger.

10

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following questions and answers are intended to address briefly some commonly asked questions regarding the Merger, the Merger Agreement and the Special Meeting. These questions and answers may not address all questions that may be important to you as our shareholder. Please refer to the “SUMMARY TERM SHEET” and the more detailed information contained elsewhere in this Proxy Statement, the appendices to this Proxy Statement and the documents referred to in this Proxy Statement, which you should read carefully.

| Q. | When and where is the Special Meeting? |

| A. | The Special Meeting of our shareholders will be held on May 30, 2008, at 9:00 a.m. local time at The Omni Berkshire Place Hotel, 21 East 52nd Street, New York, New York 10022. |

| Q. | What matters will be considered and voted on at the Special Meeting? |

| A. | You will be asked to consider and vote on the following proposals: |

| | • | | to adopt the Merger Agreement; and |

| | • | | to act upon other business as may properly come before the Special Meeting or any adjournment or postponement thereof. |

| Q. | How does the Board of Directors recommend that I vote on the Merger proposal? |

| A. | Our Board of Directors unanimously recommends that you vote “FOR” the proposal to adopt the Merger Agreement. |

| Q. | Who is entitled to vote at the Special Meeting? |

| A. | All shareholders of record as of the close of business on May 5, 2008 will be entitled to notice of, and to vote at, the Special Meeting on the proposal to approve the Merger and adopt the Merger Agreement. |

| Q. | How many shares must be present to hold the Special Meeting? |

| A. | The holders of shares of a majority of all outstanding shares of Common Stock entitled to vote at the Special Meeting must be present, in person or represented by proxy, at the Special Meeting in order to hold the Special Meeting and conduct business. This is called a quorum. If you submit a properly executed proxy card, then your shares will be counted as part of the quorum. All shares of the Common Stock present in person or represented by proxy and entitled to vote at the Special Meeting, no matter how they are voted or whether they abstain from voting, will be counted in determining the presence of a quorum. |

| Q. | What vote is required to adopt the Merger Agreement? |

| A. | Approval of the Merger and adoption of the Merger Agreement requires the affirmative vote of the holders of at least a majority of the issued and outstanding shares of Common Stock entitled to vote at the Special Meeting. BRC and the Borror Group who collectively own 40.39% of the shares of Common Stock outstanding as of May 5, 2008, have entered into the Voting Agreement with Parent and Merger Sub. Under the Voting Agreement, 3,965,559 shares of Common Stock will be voted at the Special Meeting for the approval of the Merger and the adoption of the Merger Agreement. In addition, the Company expects that each of the Sponsors, who hold an aggregate of approximately 1,510,267 shares of Common Stock, or 15.28% of the Common Stock outstanding as of May 5, 2008 will vote for the Merger and the Merger Agreement. The Sponsors acquired shares of the Company’s Common Stock by exercising certain warrants held by the Sponsors on April 30, 2008. Consequently, the Company anticipates that the approval of the Merger and the adoption of the Merger Agreement will be duly authorized at the Special Meeting. |

11

| Q. | What will I receive in the Merger? |

| A. | For each share of Common Stock owned, Unaffiliated Shareholders will receive $0.65 in cash, without interest and subject to applicable withholding taxes. |

| Q. | What do I need to do now? |

| A. | We ask that you please vote by proxy, whether or not you plan on attending the Special Meeting in person. If your shares are held in your name, you can vote by completing, signing, dating and mailing your proxy card in the enclosed envelope so that it is received by 5:00 p.m., Eastern Standard Time, on May 29, 2008. If you submit a proxy but do not specify how you want your shares to be voted, they will be voted FOR the approval of the Merger and adoption of the Merger Agreement. |

| Q. | What rights do I have if I oppose the Merger? |

| A. | Shareholders who oppose the Merger may dissent and seek appraisal of the fair value of their shares, but only if they comply with all of the procedures explained in “RIGHTS OF DISSENTING SHAREHOLDERS” and Appendix G to this Proxy Statement. |

| Q. | If I am in favor of the Merger, should I send my share certificates now? |

| A. | No. If the Merger is completed, the Company will send you a transmittal form and written instructions for exchanging your share certificates. |

| Q. | If my shares are held in “street name” by my broker, will my broker vote my shares for me? |

| A. | Your broker will vote your sharesONLY if you instruct your broker on how to vote. You should follow the directions provided by your broker regarding how to vote your shares. |

| Q. | May I change my vote after I have submitted a proxy? |

| A. | Yes. Just send in a written revocation to the Company’s Secretary or submit a later dated proxy before the Special Meeting, or simply attend the Special Meeting, give oral notice that you intend to revoke your proxy, and vote in person. |

| Q. | When is the Merger expected to be completed? |

| A. | The Company is working toward completing the Merger as quickly as possible. If the Merger Agreement is approved at the Special Meeting, we expect to complete the Merger not later than the fifteenth business day thereafter or on such other date as specified by the Company and Parent, subject to satisfaction or waiver of all of the conditions to the Merger are satisfied. |

| Q. | What are the U.S. federal income tax consequences of the Merger to me? |

| A. | Unless you are related to persons owning shares of the Surviving Corporation after the Merger, the cash you receive for your shares generally will be taxable for U.S. federal income tax purposes to the extent the cash received exceeds your tax basis. To review the federal income tax consequences to shareholders in greater detail, see “SPECIAL FACTORS—Federal Income Tax Consequences of the Merger.” |

| Q. | Who can answer my questions? |

| A. | If you have questions about the Merger or would like additional copies of this Proxy Statement, you should contact Dominion Homes, Inc., 4900 Tuttle Crossing Boulevard, Dublin, Ohio 43016-0993, Attn: Chief Financial Officer or by phone at (614) 356-5000. |

12

INFORMATION CONCERNING THE SPECIAL MEETING

Time, Place and Date

This Proxy Statement is being furnished to shareholders of the Company in connection with the solicitation of proxies on behalf of the Board for use at the Special Meeting to be held on May 30, 2008 at 9:00 a.m. local time at The Omni Berkshire Place Hotel, 21 East 52nd Street, New York, New York 10022.

Purpose of the Special Meeting

At the Special Meeting, you will be asked to consider and vote upon a proposal to approve the Merger and adopt the Merger Agreement. Acting on the recommendation of the Special Committee, the Board has determined that the Merger Agreement and the Merger are fair to, and in the best interests of, the Company and the Unaffiliated Shareholders. Consequently, the Board has approved the Merger and adopted the Merger Agreement, and recommends that shareholders voteFOR approval of the Merger and adoption of the Merger Agreement.

The Board has fixed the close of business on May 5, 2008 as the record date to determine the Company shareholders entitled to receive notice of, and to vote at, the Special Meeting. As of the close of business on the record date, the Company had outstanding 9,881,442 shares of Common Stock held of record by approximately 236 registered holders. As of the close of business on the record date, the Borror Shareholders collectively owned 3,990,965 shares of Common Stock, representing approximately 40.39% of the outstanding shares of Common Stock. As of the close of business on the record date, the Sponsors collectively owned approximately 1,510,267 shares of Common Stock, representing approximately 15.28% of the outstanding shares of Common Stock as of May 5, 2008. The Sponsors acquired shares of the Company’s Common Stock by exercising certain warrants held by the Sponsors on April 30, 2008. Each outstanding share of Common Stock is entitled to one vote on all matters coming before the Special Meeting. The presence, either in person or by proxy, of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Special Meeting is necessary to constitute a quorum for the transaction of business at the Special Meeting.

Required Vote; Calculation of Vote; Abstentions and Broker Non-Votes

Approval of the Merger and adoption of the Merger Agreement requires the affirmative vote of the holders of at least a majority of the outstanding shares of Common Stock entitled to vote at the Special Meeting.

BRC and the Borror Group that collectively own an aggregate of 3,990,965 shares of Common Stock, or 40.39% of the Common Stock outstanding as of May 5, 2008, have entered into the Voting Agreement with Parent and Merger Sub. Under the Voting Agreement an aggregate of 3,965,559 shares of Common Stock will be voted at the Special Meeting pursuant to proxies granted under the Voting Agreement for approval of the Merger and the Merger Agreement. The Voting Agreement does not include 25,406 shares of Common Stock beneficially owned by Douglas G. Borror through The Principal Group, as Trustee of the Dominion Homes, Inc. Retirement Plan and Trust, which shares of Common Stock will be voted at the direction of Mr. Borror and which the Company expects will be voted for the Merger and the Merger Agreement. Further, the Company expects that each of the Sponsors, who hold an aggregate of approximately 1,510,267 shares of Common Stock, or 15.28% of the Common Stock outstanding as of May 5, 2008, will vote for the Merger and the Merger Agreement. Consequently, the Company anticipates that the approval of the Merger and the adoption of the Merger Agreement will be duly authorized at the Special Meeting. The Merger is not structured to require the approval of a majority of the Unaffiliated Shares.

At the Special Meeting, the results of shareholder voting will be tabulated by the inspector of elections appointed for the Special Meeting. All shares of Common Stock represented at the Special Meeting by properly executed proxies received prior to or at the Special Meeting, unless previously revoked, will be voted at the Special Meeting in accordance with the instructions on the proxies. Unless contrary instructions are indicated,

13

proxies will be votedFOR the approval of the Merger and the adoption of the Merger Agreement. As explained below in the section entitled “RIGHTS OF DISSENTING SHAREHOLDERS,” a vote in favor of the Merger Agreement means that the shareholder owning those shares will not have the right to dissent and seek appraisal of the fair market value of those shares.

Other than the proposed Merger, the Company does not know of any matters that are to come before the Special Meeting. If any other matters are properly presented at the Special Meeting for action, the persons named in the enclosed proxy will have discretion to vote on such matters in accordance with their best judgment.

Properly authenticated proxies voted “abstain” and shares held in “street name” by brokers that are not voted at the Special Meeting will be counted for purposes of determining whether a quorum has been achieved at the Special Meeting, but will not be treated as either a vote for or a vote against the Merger or the Merger Agreement. Because the approval of the holders of at least a majority of the outstanding shares of Common Stock is required, broker non-votes will have the effect of a vote against the approval of the Merger and adoption of the Merger Agreement.

Revocation of Proxy

Giving a proxy does not preclude the shareholder’s right to vote in person if the shareholder giving the proxy so desires. A shareholder has the unconditional right to revoke his, her or its proxy at any time prior to voting at the Special Meeting either by filing a written revocation with the Company’s Secretary at the Company’s principal executive offices, by submitting a duly executed proxy bearing a later date or by voting in person at the Special Meeting. Attendance at the Special Meeting without stating an intention to revoke a proxy by voting in person will not, by itself, however, revoke a previously given proxy.

Proxy Solicitation

The enclosed proxy is solicited on behalf of the Board. The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Special Meeting and the enclosed proxy will be borne by the Company. The Company is requesting that banks, brokers and other custodians, nominees and fiduciaries forward copies of the proxy materials to their principals and request authority for the execution of proxies. The Company may reimburse these persons for their expenses in so doing. In addition to the solicitation of proxies by mail, the directors, officers and employees of the Company and its subsidiaries may solicit proxies by telephone, facsimile, electronic mail, telegram or in person. Such directors, officers and employees will not be additionally compensated for this solicitation, but may be reimbursed for out-of-pocket expenses incurred.

The Company has not authorized any person to give any information or make any representation not contained in this Proxy Statement. You should not rely on any such information or representation as having been authorized.

Surrender of Stock Certificates

If the Merger Agreement is adopted and the Merger is approved and consummated, holders of Common Stock will be sent instructions regarding the surrender of their certificates representing shares of Common Stock. Shareholders should not send their stock certificates until they receive these instructions. For more information on the surrender of stock certificates, please see the section entitled “THE MERGER AGREEMENT—Procedures for the Exchange of Certificates” in this Proxy Statement.

14

SPECIAL FACTORS

Background and Reasons

General

The Company is a builder of high-quality homes and condominiums in central Ohio and Louisville and Lexington, Kentucky. The Company was organized as an Ohio corporation in 1993 under the name Borror Corporation and completed its initial public offering in 1994. The Company’s customer-driven focus targets primarily entry-level and move-up home buyers. The Company offers a variety of homes and condominiums that are differentiated by price, size, included features and available options. The Company’s homes range in price from approximately $100,000 to $400,000 and in size from approximately 1,000 to 3,500 square feet.

Historical Market Conditions and Financial Performance

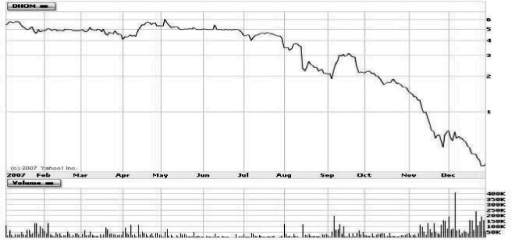

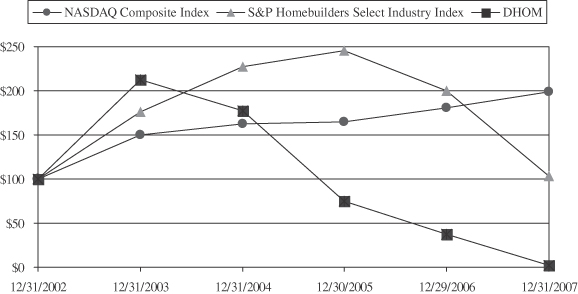

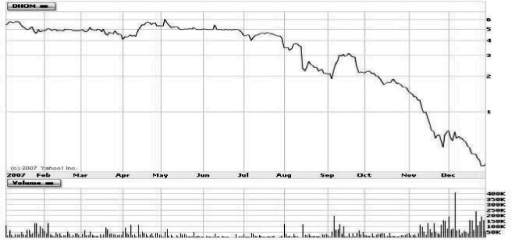

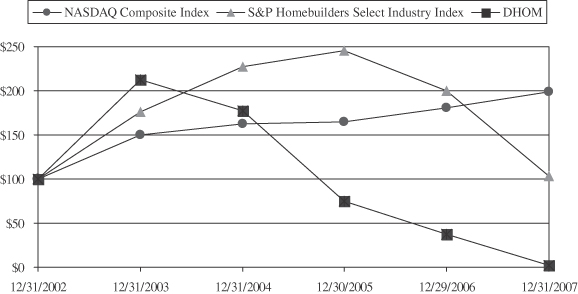

During the past several years, the Company’s operating results have seen a significant deterioration, primarily due to the deteriorating condition of the U.S. housing market. While the Company’s geographic markets have historically been stable for new home sales, widely reported industry concerns over credit tightening, the difficulties of the sub-prime lending market, excess inventory of new and existing homes and weakening consumer demand have significantly impacted the Company’s performance in all of its markets. From 2001 through the early part of 2004, new home sales in the Company’s markets were particularly strong and resulted in record sales levels. Then, in mid-2004, new home sales began to slow, and that trend has continued. The Company believes the reasons for this slowdown include a decline in the overall demand for new homes, slowing sales and price competition in the resale home market, increased supply of existing home inventory, increased interest rates compared to prior years, a lower level of consumer confidence and slower economic activity in the Company’s markets.

Reduced revenues, combined with a higher cost of sales as a percentage of revenues, resulted in net losses of $82.2 million for 2007, compared to net losses of $34.0 million for 2006 and net income of $5.3 million for 2005. In contrast, net income for 2004 was $20.2 million. The decline in profitability over these periods reflects lower unit sales and reductions in our gross profit margins to negative 15.3% in 2007 as compared to 7.0% in 2006, 19.2% in 2005 and 21.3% in 2004. The Company anticipates losses continuing in 2008 as a result of the continued tightening of the U.S. housing market.

In response to declining sales volumes, the Company implemented a series of cost cutting initiatives during 2005 and continued to aggressively manage and control all overhead expenses from 2005 through 2007. In particular, the Company has to date:

| | • | | Delayed land development and construction activities except where required for near term sales; |

| | • | | Slowed all land acquisition; |

| | • | | Offered for sale various developed lots and land parcels that the Company believes are not needed based on current absorption rates; |

| | • | | Significantly reduced selling, general and administrative expenses in order to align cost structure with the current level of sales activity, which included: |

| | • | | Entering into agreements with its executive officers on August 2, 2006 whereby such executive officers agreed to reductions in base pay and agreed to forego bonuses that such officers were otherwise entitled to receive; |

| | • | | Terminating its lease agreement on December 1, 2007 for an office building at 5000 Tuttle Crossing and consolidating its corporate offices into the Company’s 4900 Tuttle Crossing corporate offices; |

15

| | • | | Terminating its lease for space in Lexington, Kentucky and subletting a portion of its space in Louisville, Kentucky; and |

| | • | | Reducing the number of employees from 483 at December 31, 2005 to 191 at December 31, 2007. |

Despite the cost saving measures described above and other efforts to reduce costs, the Company has continued to lose money from its operations. As a result of these continuing losses and the inability of the Company to meet certain financial covenants under the Credit Agreement (discussed below), the report of the Company’s independent registered public accounting firm for the Company’s December 31, 2007 financial statements includes an explanatory paragraph expressing substantial doubt about the Company’s ability to continue as a going concern.

2006 Credit Facility Renewal

Given the Company’s deteriorating financial condition and the continued downturn of the U.S. housing market, in late 2006 the Company’s then-existing lending group under its Second Amended and Restated Credit Agreement, dated as of December 3, 2003, as thereby amended from time to time, exercised their rights to assign their interests to third parties. Such interests were assigned to the Sponsors and their affiliates, who purchased such interests from the Company’s nine existing creditors under the Second Amended and Restated Credit Agreement in a series of transactions that were generally priced at a discount to the face value of the debt. The Company worked with the Sponsors during 2006 with respect to its ongoing liquidity needs, as well as working towards negotiating a possible new credit facility with the Sponsors.

On August 2, 2006 the Company retained Raymond James to provide the Company with various investment banking advisory services, including assisting the Company in negotiating an amended credit facility, as well as to advise the Company with respect to possible strategic alternatives and other financing arrangements that might be available. The Company also retained Squire, Sanders & Dempsey L.L.P. (“Squire Sanders”) to provide the Board with legal advice in connection with evaluating any structural alternatives.

In order to facilitate the consideration of strategic alternatives and financing arrangements, on September 5, 2006 the Board established a standing restructuring committee comprised of three directors (the “Restructuring Committee”) whose purpose was to develop and otherwise pursue viable strategic alternatives to the Company’s existing financing arrangement. The Board appointed Douglas G. Borror, Robert R. McMaster and Carl A. Nelson, Jr. to serve as members of the Restructuring Committee.

From September through December of 2006, Raymond James contacted approximately 5 potential strategic buyers and approximately 45 financial entities that were potential sources of financing. However, although several parties expressed preliminary interest, there were ultimately no parties interested in conducting detailed due diligence on the Company or pursuing a transaction with the Company. Accordingly the Board decided to proceed to negotiate a renewal of the Company’s credit facility with its existing lending group, the majority of which was then comprised of the Sponsors and their affiliates.