SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Peet’s Coffee & Tea, Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | 2. | Form, Schedule or Registration Statement No.: |

PEET’S COFFEE & TEA, INC.

1400 Park Avenue,

Emeryville, California 94608-3520

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 26, 2004

TO THE SHAREHOLDERS OF PEET’S COFFEE & TEA, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Peet’s Coffee & Tea, Inc., a Washington corporation (the “Company”), will be held on Wednesday, May 26, 2004 at 10:00 a.m. local time at The Marriott Courtyard, 5555 Shellmound Street, Emeryville, California 94608, for the following purposes:

| 1. | | To elect two directors to hold office until the 2007 Annual Meeting of Shareholders. |

| 2. | | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent auditors of the Company for its fiscal year ending January 2, 2005. |

| 3. | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on April 1, 2004, as the record date for the determination of shareholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

By Order of the Board of Directors

Thomas P. Cawley

Secretary

Emeryville, California

April 23, 2004

ALLSHAREHOLDERSARECORDIALLYINVITEDTOATTENDTHEMEETINGINPERSON. WHETHERORNOTYOUEXPECTTOATTENDTHEMEETING,PLEASECOMPLETE,DATE,SIGNANDRETURNTHEENCLOSEDPROXY,ORVOTEOVERTHETELEPHONEORTHEINTERNETASINSTRUCTEDINTHESEMATERIALSASPROMPTLYASPOSSIBLEINORDERTOENSUREYOURREPRESENTATIONATTHEMEETING. ARETURNENVELOPE (WHICHISPOSTAGEPREPAIDIFMAILEDINTHE UNITED STATES)ISENCLOSEDFORTHATPURPOSE. EVENIFYOUHAVEGIVENYOURPROXY,YOUMAYSTILLVOTEINPERSONIFYOUATTENDTHEMEETING. PLEASENOTE,HOWEVER,THATIFYOURSHARESAREHELDOFRECORDBYABROKER,BANKOROTHERNOMINEEANDYOUWISHTOVOTEATTHEMEETING,YOUMUSTOBTAINFROMTHERECORDHOLDERAPROXYISSUEDINYOURNAME.

PEET’S COFFEE & TEA, INC.

1400 Park Avenue,

Emeryville, California 94608-3520

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

April 23, 2004

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors of Peet’s Coffee & Tea, Inc., a Washington corporation (“Peet’s” or the “Company”), for use at the Annual Meeting of Shareholders to be held on May 26, 2004, at 10:00 a.m., local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at The Marriott Courtyard, 5555 Shellmound Street, Emeryville, California 94608. The Company intends to mail this proxy statement and accompanying proxy card on or about April 23, 2004, to all shareholders entitled to vote at the Annual Meeting.

SOLICITATION

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to shareholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

VOTING RIGHTSAND OUTSTANDING SHARES

Only holders of record of Common Stock at the close of business on April 1, 2004 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on April 1, 2004, the Company had outstanding and entitled to vote 13,219,186 shares of Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares are represented by votes at the meeting or by proxy. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Brokers have discretionary authority to vote on proposals 1 and 2. Abstentions will be counted towards the quorum but will have no effect on the vote for any proposal.

VOTING VIATHE INTERNETORBY TELEPHONE

Shareholders may grant a proxy to vote their shares by means of the telephone or on the Internet.

1

The telephone and Internet voting procedures below are designed to authenticate shareholders’ identities, to allow shareholders to grant a proxy to vote their shares and to confirm that shareholders’ instructions have been recorded properly. Shareholders granting a proxy to vote via the internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the shareholder.

For Shares Registered in Your Name

Shareholders of record may go to http://www.contintentalstock.com to grant a proxy to vote their shares by means of the Internet. They will be required to provide the company number and control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Any shareholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-293-8533 and following the recorded instructions.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in “street name” receive instructions for granting proxies from their banks, brokers or other agents, rather than using the Company’s proxy card.

A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communications Services program, you may grant a proxy to vote those shares telephonically by calling the telephone number shown on the instruction form received from your broker or bank, or via the Internet at ADP Investor Communication Services’ website at http://www.proxyvote.com.

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 11:59 p.m. E.S.T. on May 25, 2004. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

REVOCABILITYOF PROXIES

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of the Company at the Company’s principal executive office, 1400 Park Avenue, Emeryville, California 94608-3520, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

SHAREHOLDER PROPOSALS

The deadline for submitting a shareholder proposal for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2005 Annual Meeting of Shareholders pursuant to Rule 14a-8 of the Securities and Exchange Commission(“SEC”)is December 31, 2004. Shareholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so not later than the 90th day nor earlier than the 120th day prior to the first anniversary of the 2004 Annual Meeting of Shareholders. Shareholders are also advised to review the Company’s Amended and Restated Bylaws, which contain additional requirements with respect to advance notice of shareholder proposals and director nominations.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended and Restated Articles of Incorporation and Amended and Restated Bylaws provide that the Board of Directors shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors unless the Board determines by resolution that such vacancies shall be filled by the shareholders. A director elected to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board of Directors is presently composed of seven members. There are two directors in the class whose term of office expires in 2004. Each of the nominees for election to this class is currently a director of the Company. If elected at the Annual Meeting, the nominee would serve until the 2007 Annual Meeting and until his or her successor is elected and has qualified, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes presented in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominee named below. In the event that the nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that the nominee will be unable to serve.

It is the Company’s policy to encourage directors to attend the Annual Meeting. All but one of the Company’s directors attended the 2003 Annual Meeting of Shareholders.

Set forth below is biographical information for the person nominated and each person whose term of office as a director will continue after the Annual Meeting.

NOMINEESFOR ELECTIONFORA THREE-YEAR TERM EXPIRINGATTHE 2007 ANNUAL MEETING

Christopher P. Mottern

Christopher P. Mottern, 60, had served as Chairman of the Board since from May 2002 until December 2003, and director of the Company since August 1997. From May 1997 to May 2002, Mr. Mottern was the Chief Executive Officer and President of the Company. From 1992 to 1996, Mr. Mottern served as President of The Heublein Wines Group, a manufacturer and marketer of wines and now a subsidiary of United Distillers & Vintners Ltd. From 1986 through 1991, he served as President and Chief Executive Officer of Capri Sun, Inc., one of the largest single-service juice drink manufacturers in the United States. Mr. Mottern has served on the board of Coen, Inc. since 1990.

Jean-Michel Valette

Jean-Michel Valette, 43, has served as Chairman of the Board of Directors since January 2004 and a director of the Company since July 2001. Currently, Mr. Valette is an independent advisor to select branded consumer companies. From August 1998 to May 2000, Mr. Valette was President and Chief Executive Officer of Franciscan Estates, a premium wine company. From 1987 to 1998, Mr. Valette held various positions, including Managing Director, at Hambrecht & Quist LLC, a San Francisco-based investment bank and venture capital firm. In 1984, Mr. Valette co-founded Procede Ltd., a London-based investment and consulting firm and served as Managing Director from 1984 to 1986. Mr. Valette currently serves as a director of Select Comfort Corporation, The Boston Beer Company and Golden State Vintners, Inc.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

3

DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2005 ANNUAL MEETING

H. William Jesse, Jr.

H. William Jesse, Jr., 52, has served as a director of the Company since August 1998 and was Chairman from January 2001 to May 2002. Mr. Jesse is Chairman and Chief Executive Officer of Jesse Capital Management, Inc. He founded the firm in 1997. Mr. Jesse is also Chairman and Chief Executive Officer of Modern Yachts, Inc., a design firm he founded in 2000. Mr. Jesse served as Chairman and Chief Executive Officer of Vineyard Properties Corporation, a developer of wine grape vineyards from 1988 to 2002. He also served as Chairman of Jesse.Hansen&Co. from 1986 to 2004, and its President from 1986 through 1998.

Gordon A. Bowker

Gordon A. Bowker, 61, has served as a director of the Company from 1971 to 1987 and from September 1994 to the present. Since 1986, Mr. Bowker has been a principal and investor of Apanage Inc., a real estate development company. Mr. Bowker has 30 years of experience with publicly traded and private companies as an investor, founder, director and marketing advisor. He co-founded Starbucks Coffee Company, Redhook Ale Brewery, Incorporated andSeattle Weekly. Mr. Bowker is also a director of Seabear, Inc., a privately held seafood manufacturer and marketer.

Patrick J. O’Dea

Patrick J. O’Dea, 42, has served as a Chief Executive Officer, President and director of the Company since May 2002. From April 1997 to March 2001, he was Chief Executive Officer of Archway/Mother’s Cookies and Mother’s Cake and Cookie Company. Previous to that from 1995 to 1997, Mr. O’Dea was the Vice President and General Manager of the Specialty Cheese Division of Stella Foods. From 1984 to 1995, he was with Procter & Gamble, where he marketed several of the company snack and beverage brands.

DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2006 ANNUAL MEETING

Gerald Baldwin

Gerald Baldwin, 61, has served as a director of the Company since 1971 and as Chairman of the Board from 1994 through January 2001. From 1971 until 1994, Mr. Baldwin was President and Chief Executive Officer. He co-founded Starbucks Coffee Company in 1971. Mr. Baldwin serves as a director of Association Scientifique du Café since 1999 and its President since 2001. Since 2000, he has also served as a director of TechnoServe, Inc. a non-profit NGO, operating in Africa and Latin America.

Hilary Billings

Hilary Billings, 40, has served as a director of the Company since January 2002. Currently, Ms. Billings is Brand Strategist and a member of the Board of Directors of RedEnvelope, a multi-channel gift company. From March 2003 to May 1999, she also served RedEnvelope in other roles, such as Chairman and Chief Marketing Officer. From July 1997 to May 1999, Ms. Billings was Senior Vice President of Brand Development and Design with Starwood Hotels and Resorts, where she helped develop the W Hotels. Before joining Starwood, Ms. Billings was a vice president of product development with Pottery Barn catalog and retail group from 1995 to 1997. Ms. Billings serves as director of RedEnvelope, Hanna Andersson, Inc., and Design Within Reach, Inc.

INDEPENDENCEOFTHE BOARDOF DIRECTORS

As required by the NASDAQ Stock Market (“NASDAQ”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with the Company’s counsel to ensure that the Boards’ determinations are

4

consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of the NASDAQ, as in effect time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board affirmatively has determined that four of the seven Company directors are independent directors within the meaning of the applicable NASDAQ listing standards.

BOARD COMMITTEESAND MEETINGS

During the fiscal year ended December 28, 2003, the Board of Directors held six meetings and acted by unanimous written consent twice during the fiscal year. The Board has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

The Audit Committee meets with the Company’s independent auditors at least quarterly to review the results of the annual audit or quarterly review and discuss the financial statements; recommends to the Board the independent auditors to be retained; oversees the independence of the independent auditors; evaluates the independent auditors’ performance, and receives and considers the independent auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee is composed of three directors: Messrs. Jesse, Bowker and Valette. Mssr. Jesse is the Chairman of the Audit Committee. It met eight times during the fiscal year. All members of the Company’s Audit Committee are independent (as independence is defined in Rule 4200(a)(15) of the NASD listing standards). The Board of Directors has determined that Mssrs. Jesse and Valette qualify as “audit committee financial experts,” as defined in applicable SEC rules. The Audit Committee recently amended and restated its Audit Committee Charter, a copy of which is attached as Appendix A to these proxy materials.

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options and stock purchase rights to employees and consultants under the Company’s stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee is composed of three non-employee directors and is independent (as independence is defined in Rule 4200(a)(15) of the NASD listing standards). They are: Ms. Billings and Messrs. Valette and Jesse. It met twice and acted by unanimous written consent once during the fiscal year. Effective March 8, 2004, Ms. Billings has replaced Mssr. Valette as the Chairperson of the Compensation Committee.

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, and recommending to the Board for selection candidates for election to the board of directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and develop a set of corporate governance principles for the Company. Our Nominating and Corporate Governance Committee charter can be found on our corporate website at www.peets.com. Three directors comprise the Nominating and Corporate Governance Committee: Ms. Billings and Mssrs. Valette and Bowker. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee was formed in February 2004 and has not yet met.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having

5

the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s shareholders. However, the Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the board, the operating requirements of the company and the long-term interests of shareholders. In conducting this assessment, the committee considers diversity, age, skills, and such other factors as it deems appropriate given the current needs of the board and the company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case on new director candidates, the committee also determines whether the nominee must be independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. To date, the Nominating and Corporate Governance Committee has not paid a fee to any third party to assist in the process of identifying or evaluation director candidates. To date, the Nominating and Corporate Governance Committee has not rejected a timely director nominee from a shareholder or shareholders holding more than 5% of our voting stock.

At this time the Nominating and Corporate Governance Committee does not consider director candidates recommended by shareholders. The Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board.

During the fiscal year ended December 28, 2003, each Board member attended 75% or more of the aggregate meetings of the Board and of the committees on which he or she served, held during the period for which he or she was a director or committee member, respectively.

CODEOF ETHICS

The Company has adopted the Peet’s Coffee & Tea, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on our website at www.peets.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the code to any executive officer or director, the company will promptly disclose the nature of the amendment or waiver on its website.

SHAREHOLDER COMMUNICATIONS WITHTHE BOARDOF DIRECTORS

Historically, the Company has not adopted a formal process for shareholder communications with the Board. Nevertheless, every effort has been made to ensure that the views of shareholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to shareholders in a timely manner. We believe our responsiveness to shareholder communication to the Board has been excellent. Nevertheless, during the upcoming year the Nominating and Corporate Governance Committee will give full consideration to the adoption of a formal process for shareholder communications with the Board and, if adopted, publish it promptly and post it on the Company website.

6

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS*

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon.

In this context, the Committee has met and held discussions with management and Deloitte & Touche LLP, the Company’s independent auditors. Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees).

In addition, the Committee has discussed separately with the independent auditors, the auditors’ independence from the Company and its management, including the matters in the written disclosures and the letter from the auditors required by the Independence Standards Board Standard No. 1 (Independence Discussion With Audit Committees).

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board approved the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 28, 2003, filed with the Securities and Exchange Commission on March 12, 2004. The Committee and the Board also have recommended, subject to shareholder approval, the selection of Deloitte & Touche LLP as the Company’s independent auditors.

THE AUDIT COMMITTEE

H. William Jesse, Jr., Chairman

Gordon A. Bowker

Jean-Michel Valette

PROPOSAL 2

RATIFICATIONOF SELECTIONOF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP as the Company’s independent auditors for the year ending January 2, 2005 and has further directed that management submit the selection of independent auditors for ratification by the shareholders at the Annual Meeting. Deloitte & Touche LLP has audited the Company’s financial statements since 1996. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Shareholder ratification of the selection of Deloitte & Touche LLP as the Company’s independent auditors is not required by the Company’s Amended and Restated Bylaws or otherwise. However, the Board is submitting

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing. |

7

the selection of Deloitte & Touche LLP to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its shareholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and voting at the Annual Meeting will be required to ratify the selection of Deloitte & Touche LLP. For purposes of this vote, abstentions and broker non-votes will not be counted in determining whether this matter has been approved. Shares represented by executed proxies will be voted, if no abstention or vote against is marked, for the ratification of Deloitte & Touche LLP as the Company’s independent auditors.

AUDIT FEES. During the fiscal year ended December 29, 2002, the aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte & Touche Tohmatsu, and their respective affiliates (“Deloitte”) for the audit of the Company’s financial statements for such fiscal year and for the review of the Company’s interim financial statements was $169,000, and for the fiscal year ended December 28, 2003, the aggregate fees billed by Deloitte for the audit of the Company’s financial statements for such fiscal year and for the review of the Company’s interim financial statements was $208,991.

AUDIT-RELATED FEES. During the fiscal year ended December 29, 2002, the aggregate fees billed by Deloitte for any other audit-related services (incurred primarily in connection with the Company’s follow-on offering of Common Stock completed in April 2002) other than those described under “Audit Fees” for such fiscal year was $60,000. There were no other audit-related services or fees incurred in 2003.

TAX FEES. During the fiscal year ended December 29, 2002, the aggregate fees billed by Deloitte for services rendered in connection with income tax compliance and related tax services was $67,000 and for the fiscal year ended December 28, 2003, the aggregate fees billed by Deloitte for services rendered in connection with income tax compliance and related tax services was $51,187.

ALL OTHER FEES. During the fiscal year ended December 29, 2002 and December 28, 2003, Deloitte did not render or bill for any other professional services other than those described above under “Audit Fees,” “Audit-Related Fees,” and “Tax Fees”.

The Audit Committee has adopted a policy for the pre-approval of audit and non-audit services rendered by our independent auditors, Deloitte & Touche LLP. The policy generally pre-approves specified services in the defined categories of audit services, audit-related services, and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual explicit case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

The Audit Committee has determined the rendering of the information technology consulting services and all other non-audit services by Deloitte is compatible with maintaining the auditor’s independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2

8

SECURITY OWNERSHIPOF

CERTAIN BENEFICIAL OWNERSAND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s Common Stock as of January 31, 2004 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; and (iii) all executive officers and directors of the Company as a group. Information for all those known by the Company to be beneficial owners of more than five percent of its Common Stock, as stated on Schedules 13D or 13G filed by such beneficial owners, is also included.

Beneficial ownership is determined in accordance with the rules of the SEC which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of Common Stock issuable pursuant to the exercise of stock options or warrants that are immediately exercisable or exercisable within 60 days of January 31, 2004. These shares are deemed to be outstanding and to be beneficially owned by the person holding those options or warrants for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Information with respect to beneficial ownership has been furnished by each director, officer or five percent or more shareholder, as the case may be. Except as otherwise noted below, the address for each person listed on the table is c/o Peet’s Coffee & Tea, Inc., 1400 Park Avenue, Emeryville, California 94608-3520. Applicable percentages are based on 13,036,472 shares outstanding on January 31, 2004, adjusted as required by the rules promulgated by the SEC.

Principal Shareholders Table

| | | | |

| | | Number of Shares

Beneficially Owned

| | Percentage of

Beneficial Ownership

|

Name of Beneficial Owner

| | | | |

Directors and Executive Officers: | | | | |

Gerald Baldwin (1) | | 406,456 | | 3.1 |

Christopher P. Mottern (2) | | 256,091 | | 1.9 |

Patrick J. O’Dea (3) (12) | | 174,193 | | 1.3 |

Gordon A. Bowker (4) | | 162,643 | | 1.2 |

William M. Lilla (5) (12) | | 143,986 | | 1.1 |

Peter B. Mehrberg (6) (12) | | 114,114 | | * |

Michael J. Cloutier (7) (12) | | 66,892 | | * |

H. William Jesse, Jr. (8) | | 62,545 | | * |

Jean-Michel Valette (9) | | 61,944 | | * |

Hilary Billings (10) | | 41,388 | | * |

James E. Grimes (11) (12) | | 19,946 | | * |

All directors and officers as a group (14 persons) (12) (13) | | 1,554,242 | | 11.2 |

| | |

5% Shareholders(14): | | | | |

Delaware Management Holdings 2005 Market Street Philadelphia, PA 19103 | | 1,003,474 | | 7.7 |

| | |

The TCW Group, Inc 865 South Figueroa Street Los Angeles, CA 90017 | | 904,546 | | 6.9 |

| | |

RS Investment Management Company, LLC 388 Market Street San Francisco, CA 94111 | | 832,763 | | 6.4 |

| | |

Wellington Management Company, LLP 75 State Street Boston, MA 02109 | | 652,460 | | 5.0 |

9

| (1) | | Includes 18,333 shares issuable upon the exercise of vested stock options. |

| (2) | | Includes 106,240 shares issuable upon the exercise of vested stock options and 45,267 shares held by the Mottern Family Trust. |

| (3) | | Includes 131,724 shares issuable upon the exercise of vested stock options. |

| (4) | | Includes 96,077 shares issuable upon the exercise of vested stock options. |

| (5) | | Includes 131,661 shares issuable upon the exercise of vested stock options. |

| (6) | | Includes 106,896 shares issuable upon the exercise of vested stock options. |

| (7) | | Includes 62,433 shares issuable upon the exercise of vested stock options. |

| (8) | | Represents 62,545 shares issuable upon the exercise of vested stock options. |

| (9) | | Includes 51,944 shares issuable upon the exercise of vested stock options. |

| (10) | | Represents 41,388 shares issuable upon the exercise of vested stock options. |

| (11) | | Includes 18,750 shares issuable upon the exercise of vested stock options. |

| (12) | | These officers were granted options with seven year cliff vesting to purchase the Company’s Common Stock in 2003. On March 8, 2004, the Board of Directors accelerated these performance-based options so that they were fully vested. These aggregate 135,876 shares issuable upon exercise and are not included in the number of shares beneficially owned in the table above. Excluded are 50,000 shares for Patrick O’ Dea, 10,015 shares for Michael Cloutier, 25,000 shares for James Grimes, 15,023 shares for William Lilla, and 25,000 shares for Peter Mehrberg. |

| (13) | | See footnotes (1) through (12) above, as applicable. |

| (14) | | Information with respect to each beneficial owner of 5% or more of a class of the Company’s Common Stock is based on Schedules 13D or 13G filed by such beneficial owners with the SEC for the 2003 calendar year. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 28, 2003, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with, except for the following reports that were filed late: the Form 4 for Gerald Baldwin, covering one transaction, the Form 4 for Hilary Billings, covering one transaction, the Form 4 for Gordon Bowker, covering one transaction, the Form 4 for Michael Cloutier, covering one transaction, the Form 4 for James Grimes, covering one transaction, the Form 4 for H. William Jesse, Jr., covering one transaction, the Form 4 for William Lilla, covering one transaction, the Form 4 for Peter Mehrberg, covering one transaction, the Form 4 for Christopher Mottern, covering six transactions, the Form 4 for Patrick O’Dea, covering two transactions, the Form 4 for James Reynolds, covering one transaction, and the Form 4 for Jean-Michel Valette, covering one transaction.

10

EXECUTIVE COMPENSATION

COMPENSATIONOF DIRECTORS

Each non-employee director of the Company receives a fee of $1,000 per meeting. In the year ended December 28, 2003, the total compensation paid to non-employee directors was $23,000. The members of the Board of Directors are also eligible for reimbursement for their expenses incurred in connection with attendance at Board meetings in accordance with Company policy. In March 2004, the Company amended its compensation structure for members of the Board of Directors. Each non-employee director will no longer receive a per meeting fee, but instead receive a $10,000 annual retainer, and an additional $5,000 annual fee for committee membership or $7,500 annual retainer for committee chairmanship.

2000 NON-EMPLOYEE DIRECTOR PLAN

The Board adopted a 2000 Non-Employee Director Plan effective upon the completion of the Company’s initial public offering of its Common Stock. The shareholders approved the plan on November 17, 2000. The plan provides for the automatic grant of nonstatutory stock options to purchase shares of Common Stock to the Company’s non-employee directors. The aggregate number of shares of Common Stock that may be issued pursuant to these options under the plan is 450,000 shares.

The Board of Directors administers the plan. Options granted to non-employee directors will generally be subject to the following terms:

| | • | | The exercise price of options granted will be equal to the fair market value of the Common Stock on the date of grant; |

| | • | | The options will have a term of no more than ten years from the date they are granted; |

| | • | | Options granted are not transferable other than by will or by the laws of descent and distribution and are exercisable during the life of the optionee only by the optionee; |

| | • | | An optionee may designate a beneficiary who may exercise the option following the optionee’s death; and |

| | • | | An optionee whose service relationship with the Company or any affiliate (whether as a non-employee director of the Company or subsequently as an employee, director or consultant of either the Company or an affiliate) ceases for any reason may exercise vested options for the term provided in the option agreement (12 months generally, 18 months in the event of death). |

Any individual who becomes a non-employee director for the first time also automatically receives an initial grant to purchase 25,000 shares of Common Stock upon being elected to the Board of Directors. On the day following each annual meeting of the Company’s shareholders, any person who is then a non-employee director automatically receives an annual grant to purchase 10,000 shares of Common Stock. Initial grants vest over a period of three years from their date of grant. Annual grants vest monthly over twelve months from the date of grant. In March 2004, the 2000 Non-Employee Director Plan was amended to reduce the number of options granted to purchase the Company’s Common stock covered by the annual grant from 10,000 to 7,500 options, effective as of the 2004 Annual Meeting.

11

COMPENSATIONOF EXECUTIVE OFFICERS

SUMMARYOF COMPENSATION

The following table shows for 2001, 2002 and 2003, compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer and its other four most highly compensated executive officers at December 28, 2003, referred to as the “named executive officers.”

Summary Compensation Table

| | | | | | | | | | |

Name and Principal Position

| | Fiscal

Year

| | Annual Compensation

| | Long Term

Compensation

| | Other

Compensation ($)(3)

|

| | | Salary

($)(1)

| | Bonus

($)(2)

| | Securities

Underlying

Options

| |

Patrick J. O’Dea President and Chief Executive Officer | | 2003

2002 | | $420,000

$250,385 | | —

— | | 537,501

600,000 | | $4,800

— |

| | | | | |

Michael Cloutier Vice President, Information Technology | | 2003

2002

2001 | | $133,749

$129,618

$120,000 | | $9,574

—

— | | 18,335

24,262

39,402 | | $3,079

$5,500

— |

| | | | | |

James E. Grimes | | 2003 | | $182,404 | | — | | 99,063 | | $2,204 |

Vice President, Operations and Information Systems | | 2002 | | $ 84,135 | | $13,630 | | 90,000 | | — |

| | | | | |

William M. Lilla Vice President, Strategic Partners | | 2003

2002

2001 | | $195,000

$195,000

$193,808 | | $14,362

—

$15,000 | | 26,255

34,707

43,812 | | $4,375

$4,550

$4,550 |

| | | | | |

Peter B. Mehrberg Vice President, Business Development, General Counsel & Assistant Secretary | | 2003

2002

2001 | | $174,904

$160,154

$150,000 | | $11,931

—

— | | 33,320

26,270

29,672 | | $3,271

$5,500

$5,250 |

| (1) | | Includes amounts deferred at the election of the named executive officer pursuant to a plan established under Section 401(k) of the Internal Revenue Code. |

| (2) | | Messrs. Cloutier, Lilla, and Mehrberg received cash bonuses in 2003 for achievement of targeted corporate financial performance goals in 2002. |

| (3) | | Amounts include matching contributions made under the Company’s Section 401(k) plan. As permitted by rules promulgated by the SEC, no amounts are shown, with respect to certain “perquisites,” where such amounts do not exceed the lesser of 10% of bonus plus salary or $50,000. |

STOCK OPTION GRANTSAND EXERCISES

Prior to the completion of the initial public offering, the Company granted options to its executive officers under its 1993 Stock Option Plan, 1994 California Stock Option Plan and 1997 Equity Incentive Plan. Effective upon the completion of the initial public offering, the Board adopted the 2000 Equity Incentive Plan. As of December 28, 2003, options to purchase a total of 2,898,034 shares were outstanding under all of the Company’s plans and options to purchase 139,38 and 160,000 shares remain available for grant under the 2000 Equity Incentive Plan and 2000 Non-Employee Director Plan, respectively. Although no further options will be granted under the 1993 Stock Option Plan, 1994 California Stock Option Plan, and 1997 Equity Incentive Plan, options currently outstanding under those plans will continue in effect under the terms of those plans until such outstanding options are exercised or terminated in accordance with their terms.

12

The following tables show for 2003 certain information regarding options granted to, and held at year end by, the named executive officers.

OPTION GRANTSIN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | | | | | | | |

Name

| | Individual Grants

| | | Exercise

or Base

Price (2)

| | Fair Market

Value on

Grant Date

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option

Term (3)

|

| | Number of

Securities

Underlying

Options

Granted (1)

| | % of Total

Options

Granted to

Employees

in 2003

| | | | | |

| | | | | | | 0%

| | 5%

| | 10%

|

Patrick J. O’Dea | | 50,000 | | 5.8 | % | | $ | 12.98 | | $ | 12.98 | | 02/10/13 | | $ | 1,000 | | $ | 409,782 | | $ | 1,036,933 |

Michael Cloutier | | 10,015 | | 1.2 | % | | | 12.98 | | | 12.98 | | 02/10/13 | | $ | 200 | | $ | 82,079 | | $ | 207,698 |

James Grimes | | 25,000 | | 2.9 | % | | | 12.98 | | | 12.98 | | 02/10/13 | | $ | 500 | | $ | 204,891 | | $ | 518,466 |

William M. Lilla | | 15,023 | | 1.7 | % | | | 12.98 | | | 12.98 | | 02/10/13 | | $ | 300 | | $ | 123,123 | | $ | 311,557 |

Peter B. Mehrberg | | 25,000 | | 2.9 | % | | | 12.98 | | | 12.98 | | 02/10/13 | | $ | 500 | | $ | 204,891 | | $ | 518,466 |

| (1) | | Options granted to the named executive officers during 2003 were non-statutory stock options granted pursuant to the Company’s 2000 Equity Incentive Plan. Each received options to purchase shares at an exercise price of $12.98 per share subject to a seven year vesting schedule and become fully vested at February 10, 2009. On March 8, 2004, the Compensation Committee of the Board of Directors accelerated these performance-based options so that the options granted in 2003 to purchase shares of the Company’s Common Stock were fully vested as of the date of this report. |

| (2) | | The exercise price per share of each option was equal to the fair market value of the Common Stock on the date of grant. |

| (3) | | The potential realizable value is calculated based on the terms of the option at its time of grant (10 years). It is calculated assuming that the fair market value of the Company’s Common Stock on the date of grant appreciates at the indicated annual rate compounded annually for the entire term of the option is exercised and sold on the last day of its term for the appreciated stock price. |

FISCAL YEAR END OPTION VALUES

| | | | | | | | | | | | | | | | |

Name

| | Number of

Shares

Acquired on Exercise

| | Value Realized (1)

| | | Number of Securities Underlying Unexercised Options at December 28, 2003

| | Value of Unexercised In-the-Money Options at December 28, 2003 (2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Patrick J. O’Dea | | 5,775 | | $ | (231 | ) | | 106,724 | | 537,501 | | $ | 170,758 | | $ | 985,502 |

Michael Cloutier | | — | | $ | — | | | 61,185 | | 18,335 | | $ | 549,573 | | $ | 78,527 |

James E. Grimes | | — | | $ | — | | | 15,937 | | 99,063 | | $ | 10,837 | | $ | 153,113 |

William M. Lilla | | — | | $ | — | | | 129,789 | | 26,255 | | $ | 1,264,852 | | $ | 127,822 |

Peter B. Mehrberg | | — | | $ | — | | | 105,648 | | 33,320 | | $ | 1,033,471 | | $ | 140,115 |

| (1) | | Value realized is calculated by subtracting the aggregate exercise price of the options exercised from the aggregate market value of the shares of Common Stock acquired on the date of exercise. |

| (2) | | Value of unexercised in-the-money options is based on the per share deemed value at year end, determined after the date of grant solely for financial accounting purposes, less the exercise price payable for such shares. |

13

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information with respect to all of the Company’s equity compensation plans in effect as of December 28, 2003.

Equity Compensation Plan Information

| | | | | | | | | |

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

| | | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available for

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

(c)

| |

Equity compensation plans approved by security holders | | 2,898,034 | (1) | | $ | 12.75 | | 299,738 | (2) |

Equity compensation plans not approved by security holders | | — | | | | — | | — | |

Total | | 2,898,034 | | | $ | 12.75 | | 299,738 | |

| (1) | | Includes the following: |

| | n | | 2,211,767 shares of the Company’s common stock to be issued upon exercise of outstanding stock options granted under the 2000 Equity Incentive Plan; |

| | n | | 264,768 shares of the Company’s common stock to be issued upon exercise of outstanding stock options granted under the 2000 Non-Employee Director Plan; |

| | n | | 401,731 shares of the Company’s common stock to be issued upon exercise of outstanding stock options granted under the 1997 Equity Incentive Plans; |

| | n | | 18,468 shares of the Company’s common stock to be issued upon exercise of outstanding stock options granted under the 1994 California Stock Option Plan; and |

| | n | | 1,300 shares of the Company’s common stock to be issued upon exercise of outstanding stock options granted under the 1993 Stock Option Plan. |

| (2) | | Includes the following: |

| | n | | 139,738 shares of the Company’s common stock available for issuance under the 2000 Equity Incentive Plan; |

| | n | | 160,000 shares of the Company’s common stock available for issuance under the 2000 Non-Employee Director Plan; |

| | n | | There are no shares of the Company’s common stock available for issuance under the 1997 Equity Incentive Plan; |

| | n | | There are no shares of the Company’s common stock available for issuance under the 1994 California Stock Option Plan; and |

| | n | | There are no shares of the Company’s common stock available for issuance under the 1993 Stock Option Plan. |

14

EMPLOYMENT, SEVERANCEAND CHANGEOF CONTROL ARRANGEMENTS

Change of Control Option Acceleration Plan

In November 1998, the Company established the Change of Control Option Acceleration Plan. The plan provides for the acceleration of vesting of shares covered by outstanding options held by all of the Company’s employees in the event of a change of control of the Company. Employees shall have the right to exercise their options immediately before the change of control. If any surviving or acquiring corporation assumes or substitutes such options, then to the extent the options are not exercised before the change of control, such assumed or substituted options shall be fully vested on and after the change of control.

Key Employee Severance Plan

The Company has adopted a Key Employee Severance Benefit Plan to provide for the payment of severance benefits to all employees holding the position of vice president and above, and any other individual designated as an eligible employee under a Key Employee Agreement. Under the plan, if the employee’s employment, within 12 months after a change of control, is involuntary terminated without cause or voluntarily terminated for good reason (a “change of control termination”), the executive will receive one year of pay and the President and Chief Executive Officer will receive 2 years of pay.

Additionally, if the employee’s employment is involuntarily terminated without cause at any other time, the employee will receive severance payments based upon the terms of each employee’s respective employment agreement. The President and Chief Executive Officer will receive 18 months pay plus 1 month of pay for every year of service up to a 2 year maximum. The other executives will receive 6 months pay plus 1 month of pay for every year of service with a 2 year maximum.

Employment Agreements

The Company entered into key employee agreements with each of the named executive officers, including a key employee agreement with Mr. O’Dea for an initial base salary of $420,000. Salaries in these agreements are subject to annual adjustment at the discretion of the Compensation Committee of the Board of Directors.

In addition, for the Chief Executive Officer and key executives hired before May 2002, the agreements provide that if the executive is involuntarily terminated by the Company without cause or if the executive voluntarily terminates employment due to a “constructive termination,” then the vesting of all of the executive’s outstanding options to purchase Common Stock of the Company will accelerate and become fully exercisable upon the executive’s termination of employment. For executives hired after May 2002, unvested options to purchase Common Stock of the Company are terminated as of the date of termination for all terminations except for those covered under the Change in Control Option Acceleration Plan. Under the agreements, all executives also are entitled to receive benefits to the extent provided under the Key Employee Severance Benefit Plan and the Change of Control Option Acceleration Plan.

REPORTOFTHE COMPENSATION COMMITTEEOFTHE

BOARDOF DIRECTORSON EXECUTIVE COMPENSATION*

The Company’s executive compensation program is administered by the Compensation Committee of the Board of Directors. The Committee currently consists of Jean-Michel Valette, Hilary Billings, and H. William Jesse, Jr., none of whom are employees of the Company. The Committee is responsible for setting the Company’s policies regarding compensation and benefits, and administering the Company’s employee stock option and stock purchase plans. In particular, the Committee evaluates the performance of management and determines the compensation and benefits of executive officers.

15

The Company’s executive compensation program is designed (i) to attract and retain outstanding executive officers capable of leading the Company to fulfillment of its business objectives and (ii) to establish an appropriate link between executive compensation and achievement of the Company’s strategic and financial performance goals, including the enhancement of shareholder value. To that end, the Company’s compensation program offers competitive compensation opportunities that reward individual contributions as well as corporate performance, based on the following policies and principles:

| | • | | Implementation of competitive pay practices, taking into account the pay practices of other companies of comparable size and stage of development with which the Company competes for talented executives. |

| | • | | Emphasis on pay-for-performance as a component of compensation through annual incentive programs designed to reward executives for achievement of annual corporate financial performance goals. |

| | • | | Use of equity-based incentives designed to motivate executives to focus on long-term strategic objectives, to align the interests of management and the shareholders and to provide opportunities for management to share in the benefits that they achieve for the Company’s shareholders. |

For 2003, the Company’s executive compensation program included the following components: (i) base salary, and, (ii) long-term incentives in the form of options to purchase Common Stock. In establishing the size of an executive’s opportunity for incentive compensation, including stock options, the Committee takes into account, in addition to general comparative information, the individual performance of the executive and the financial performance and strategic achievements of the Company during the prior year, the executive’s level of responsibility and potential to influence or contribute to the Company’s operations and direction and the quality of the executive’s long-term strategic decisions made during the year. The Committee generally does not base its considerations on any single performance factor nor does it specifically assign relative weights to factors, but rather considers a mix of factors and evaluates Company and individual performance against that mix. To the extent that qualitative factors are involved in the determination, the Committee must necessarily make a subjective assessment of performance.

BASE COMPENSATION

Base salaries for executives were initially set in the key employment agreements between the executives and the Company. These base salaries are subject to annual review and adjustment. The Committee evaluates executive performance on the basis of a variety of factors, both individual and corporate, as well as level of responsibility, competitive factors and the Company’s internal policies regarding salary increases. The base salary for Patrick J. O’Dea, the Company’s current President and Chief Executive Officer, is $420,000. The base salary (together with the long term compensation discussed below) was negotiated between Mr. O’Dea and the Committee at the time of his hiring and the Committee believes it is competitive with the salaries of chief executive officers of companies in the industry. The base salaries paid to other executives were increased for 2003 by amounts ranging from 0% to 9%, reflecting primarily changes in position and responsibilities and their contributions to the Company in connection with the execution of the Company’s long-term strategic initiatives.

LONG-TERM COMPENSATION

Stock options under the Company’s stock option plans are used to underscore the common interests of shareholders and management. Options are granted to executives to provide a continuing financial incentive to maximize long-term value to shareholders and to help make the executive’s total compensation opportunity competitive. Options may be tax-qualified incentive stock options or nonstatutory stock options. Options granted

| * | | The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission, and is not to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing. |

16

prior to the Company’s initial public offering typically had exercise prices set at 85% of the fair market value of the Common Stock on the date of the grant as determined by the Board of Directors. Options granted after the Company’s initial public offering typically have exercise prices set at the fair market value of the Common Stock on the date of grant. In addition, because stock options generally become exercisable over a period of several years, options encourage executives to remain in the long-term employ of the Company. In 2003, all executive officers were granted options to purchase an aggregate of 135,876 shares. The Board determined that the Company had achieved its operating objectives in 2003 and therefore approved the acceleration of vesting of these stock options so that all were fully vested as of March 8, 2004. In addition, the Compensation Committee met in March 2004 and approved grants of stock options in May 2004 for executive officers. These options grants were based on calculations related to the executive officers’ respective base salaries and are subject to a seven year vesting schedule, subject to acceleration by the Board of Directors.

THE COMPENSATION COMMITTEE

Jean-Michel Valette, Chairman

Hilary Billings

H. William Jesse, Jr.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

As noted above, the Compensation Committee consists of Ms. Billings and Messrs. Jesse and Valette. In fiscal 2003, there were no interlocks or insider participation by member of the Compensation Committee.

17

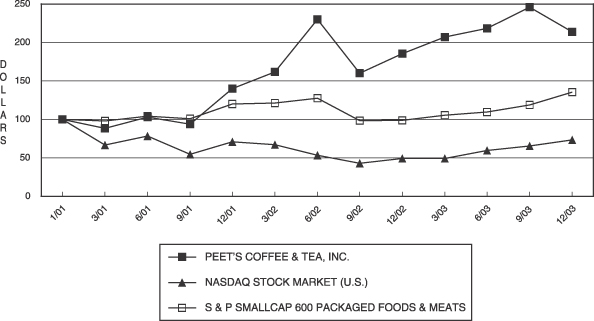

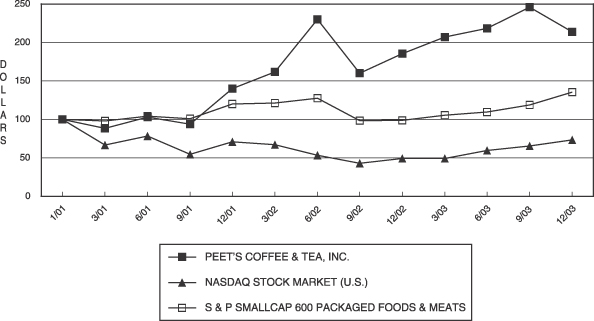

PERFORMANCE MEASUREMENT COMPARISON1

The following graph shows the cumulative total shareholder return of an investment of $100 in cash since the Company’s initial public offering of Common Stock January 25, 2001 for (i) the Company’s Common Stock, (ii) the Nasdaq Stock Market (U.S. Companies) Index and (iii) the Standard & Poor’s Small Capitalization 600 Packaged Foods and Meats Index. All values assume reinvestment of the full amount of all dividends, although dividends have never been declared on the Company’s Common Stock, and are calculated monthly.

| 1 | | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the 1933 Act or the 1934 Act whether made before or after the date hereof and irrespective of any general incorporation language in such filing. |

CERTAIN TRANSACTIONS

The Company has entered into indemnity agreements with certain officers and directors. These agreements, among other things, provide for indemnification of the Company’s directors and executive officers for expenses, judgments, fines and settlement amounts incurred by any such person in any action or proceeding arising out of such person’s services as a director or executive officer or at the Company’s request to the full extent permitted by Washington law. The Company believes that these provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers.

HOUSEHOLDINGOF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same

18

address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for shareholders and cost savings for companies.

This year, a number of brokers with account holders who are Peet’s Coffee & Tea, Inc. shareholders will be “householding” our proxy materials. A single proxy statement will be delivered to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker, or direct your written request to Investor Relations, Peet’s Coffee & Tea, Inc., 1400 Park Avenue, Emeryville, California 94608-3520 or contact Investor Relations at (510) 594-2100. Shareholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

By Order of the Board of Directors

Thomas P. Cawley

SECRETARY

April 23, 2004

A copy of the Company’s Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended December 28, 2003 is available without charge upon written request to: Corporate Secretary, Peet’s Coffee & Tea, Inc., 1400 Park Avenue, Emeryville, California 94608-3520.

19

APPENDIX A

AMENDEDAND RESTATED CHARTEROFTHE AUDIT COMMITTEEOF

THE BOARDOF DIRECTORSOF

PEET’S COFFEE & TEA, INC.

PURPOSEAND POLICY

The Audit Committee of the Board of Directors of Peet’s Coffee & Tea, Inc., a Washington corporation (the “Company”), shall provide assistance and guidance to the Board of Directors in fulfilling its oversight responsibilities to the Company’s shareholders with respect to the Company’s corporate accounting and reporting practices as well as the quality and integrity of the Company’s financial statements and reports to any governmental body or the public. The Audit Committee shall also provide oversight assistance in connection with the Company’s systems of internal controls regarding finance and accounting and legal and ethical compliance programs as established by management and the Board. The policy of the Audit Committee, in discharging these obligations, shall be to maintain and foster open communication between the Audit Committee and the outside auditors and the Company’s financial management.

COMPOSITION

The Audit Committee shall consist of at least three members of the Board of Directors. The members of the Audit Committee shall satisfy the independence and experience requirements of The Nasdaq Stock Market applicable to Audit Committee members. Each member shall remain free from any relationship that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment as a member of the Committee. To the extent mandated by the requirements of the Nasdaq National Market or any domestic exchange where listed for trading, at least one member of the Audit Committee shall be a “financial expert” within the meaning of such requirements.

AUTHORITY

The Audit Committee shall have full access to all books, records, facilities and personnel of the Company as deemed necessary or appropriate by any member of the Audit Committee to discharge his or her responsibilities hereunder. The Audit Committee shall have authority to retain, at the Company’s expense, special legal, accounting or other advisors or consultants as it deems necessary or appropriate in the performance of its duties. The Audit Committee shall have authority to request that any of the Company’s outside counsel, outside auditors or investment bankers, or any other consultant or advisor to the Company attend any meeting of the Audit Committee or meet with any member of the Audit Committee or any of its special legal, accounting or other advisors and consultants.

RESPONSIBILITIES

The primary responsibility of the Audit Committee shall be to review the Company’s financial reporting process (including direct oversight of the outside auditors) on behalf of the Board and to report the results of these activities to the Board. The Audit Committee’s functions and procedures should remain flexible to address changing circumstances most effectively. To implement the policy of the Audit Committee, the Audit Committee shall be charged with the following functions and processes, with the understanding, however, that the Audit Committee may supplement or deviate from these activities as appropriate under the circumstances:

1. To evaluate the performance of the Company’s outside auditors, to consider their qualifications (including their internal quality-control procedures and any material issues raised by that firm’s most recent

A-1

internal quality-control or peer review or any investigations by regulatory authorities) and to determine whether to retain or to terminate the firm of certified public accountants employed by the Company as its outside auditors or to appoint and engage new outside auditors for the ensuing year, which retention shall be subject only to ratification by the Company’s stockholders.

2. To review and determine the engagement of the outside auditors, including the scope of and plans for the audit, the adequacy of staffing and the compensation to be paid to the auditors.

3. To review and approve the retention of the Company’s outside auditors to perform any proposed permissible non-audit services, including the compensation to be paid therefore, authority for which may be delegated to one or more Audit Committee members, provided that all approvals of non-audit services pursuant to this delegated authority be presented to the full Audit Committee at its next meeting.

4. To monitor the rotation of the outside audit partner with primary responsibility for the audit and the outside audit partner responsible for review of the audit as required by applicable law.

5. At least annually, to receive and review written statements from the outside auditors delineating all relationships between the auditors and the Company consistent with Independence Standards Board Standard No. 1, to consider and discuss with the auditors any disclosed relationships or services that could affect the auditors’ objectivity and independence, and to assess and otherwise take appropriate action to oversee the independence of the auditors.

6. To review and approve, upon completion of the audit, the financial statements for inclusion in the Company’s Annual Report on Form 10-K.

7. To discuss with the outside auditors and management, as appropriate, the results of the annual audit, including the auditors’ assessment of the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments and estimates (including material changes in estimates), any audit adjustments noted or proposed by the outside auditors (whether “passed” or implemented in the financial statements), the adequacy of the disclosures in the financial statements and any other matters required to be communicated to the Audit Committee by the outside auditors under Statement on Auditing Standards No. 61.

8. To discuss with management and the outside auditors the results of the auditors’ review of the Company’s quarterly financial statements, prior to release of earnings, to the extent practicable, or filing of the Company’s Quarterly Report on Form 10-Q, and any other matters required to be communicated to the Audit Committee by the outside auditors under Statement on Auditing Standards No. 61. The Chair of the Audit Committee may represent the entire Audit Committee for purposes of this discussion.

9. To discuss with management and the outside auditors, as appropriate, the Company’s disclosures contained in earnings press releases and under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in its periodic reports to be filed with the Securities and Exchange Commission.

10. To review with management and the outside auditors major issues that arise regarding accounting principles and financial statement presentations, including the adoption of new, or material changes to existing, critical accounting policies or to the application of those policies, the potential effect of alternative accounting policies available under GAAP, the potential impact of regulatory and accounting initiatives and any other significant reporting issues and judgments.

11. To evaluate the cooperation received by the outside auditors during their annual audit, including any restrictions on the scope of their activities or access to required records, data and information.

A-2

12. To review with the outside auditors any management or internal control letter issued or, to the extent practicable, proposed to be issued by the auditors and management’s response, if any, to such letter.

13. To confer with the outside auditors and with the senior management of the Company regarding the scope, adequacy and effectiveness of internal accounting and financial reporting controls in effect (including any special audit steps taken in the event of material control deficiencies).

14. Periodically, meet in private sessions with the outside auditors and senior management to discuss any matters that the Audit Committee, the outside auditors or senior management believe should be discussed privately with the Audit Committee.

15. To consider and review with management, the outside auditors, outside counsel, as appropriate, and, in the judgment of the Audit Committee, such special counsel, separate accounting firm and other consultants and advisors as the Audit Committee deems appropriate, any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding the Company’s financial statements and accounting policies.

16. Review, with the Company’s counsel, legal compliance matters including corporate securities trading policies.

17. To establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, including the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

18. To receive and address complaints regarding accounting or auditing matters, and for confidential, anonymous submissions by employees of concerns regarding accounting or auditing matters.

19. To establish, review, and update periodically a Code of Ethical Conduct and ensure that management has established a system to enforce this Code.

20. To review the results of management’s efforts to monitor compliance with the Company’s programs and policies designed to ensure adherence to applicable laws and regulations, as well as to its Code of Ethical Conduct, including review and approval of insider and affiliated-party transactions.

21. Review Travel and Entertainment expenditures of the President and CEO of the Company.

22. Review and approve (subject to standards or criteria as may be established from time to time by the Committee) any proposed or actual related party transaction that would be required to be disclosed by the company pursuant to Item 404 of the Regulations S-K of the Federal securities laws.

23. To prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company’s annual proxy statement.

24. To review and assess the adequacy of this charter annually and recommend any proposed changes to the Board for approval.

25. To report to the Board of Directors with respect to material issues that arise regarding the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance or independence of the Company’s outside auditors or such other matters as the Audit Committee deems appropriate from time to time or whenever it shall be called upon to do so.

It shall be the responsibility of management to prepare the financial statements and the responsibility of the outside auditors to audit those financial statements. These functions shall not be the responsibility of the Audit

A-3

Committee, nor shall it be the Audit Committee’s responsibility to ensure that the financial statements are complete and accurate or conform to generally accepted accounting principles.

FUNDINGOFTHE COMMITTEE’S FUNCTIONSBYTHE COMPANY

The Company shall provide for appropriate funding for the Committee, in its capacity as a committee of the Board, in such amounts as may be determined by the Committee, for payment of compensation to (a) the independent auditors and (b) any other advisors engaged by the Committee in connection with the fulfillment by the Committee of its responsibilities and duties hereunder.

MEETINGSAND MINUTES

The Audit Committee shall hold such regular or special meetings as its members shall deem necessary or appropriate. Minutes of each meeting of the Audit Committee shall be prepared and distributed to each director of the Company and the Secretary of the Company promptly after each meeting.

A-4

ò FOLD AND DETACH HERE ò