- MPAA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Motorcar Parts of America (MPAA) DEF 14ADefinitive proxy

Filed: 11 Oct 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

MOTORCAR PARTS & ACCESSORIES, INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

/ / | Fee paid previously with preliminary materials. | |||

/ / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

MOTORCAR PARTS & ACCESSORIES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 8, 2002

To Our Shareholders:

We will hold our 2002 annual meeting of the shareholders of Motorcar Parts & Accessories, Inc. (the "Company") on Friday, November 8, 2002 at 10:00 a.m., Los Angeles time, at the Marriott Hotel, 3635 Fashion Way, Torrance, California 90503. As further described in the accompanying Proxy Statement, at this meeting we will consider and act upon:

(1) The election of six directors to our board of directors to serve for a term of one year or until their successors are duly elected and qualified.

(2) The ratification and approval of the appointment of Grant Thornton, LLP as our independent certified public accountants for the fiscal year ended March 31, 2003.

(3) Consider and act upon a proposal to approve the proposed amendment to our 1994 Stock Option Plan, as amended, to increase the maximum number of shares of our common stock issuable under the plan by 195,000 shares.

(4) The transaction of other business as may come properly before the meeting or any meetings held upon adjournment of the meeting.

Our board of directors has fixed the close of business on September 30, 2002 as the record date for the determination of shareholders entitled to vote at the meeting or any meetings held upon adjournment of the meeting. Only record holders of our common stock at the close of business on that day will be entitled to vote. A copy of our 2002 Annual Report on Form 10-K is enclosed with this notice, but is not part of the proxy soliciting material.

We invite you to attend the meeting and vote in person.If you cannot attend, to assure that you are represented at the meeting, please sign and return the enclosed proxy card as promptly as possible in the enclosed postage prepaid envelope. If you attend the meeting, you may vote in person, even if you previously returned a signed proxy.

By order of the board of directors

Charles W. Yeagley,

Secretary

Torrance, California

October 11, 2002

MOTORCAR PARTS & ACCESSORIES, INC.

2929 California Street

Torrance, California 90503

PROXY STATEMENT

We are sending you this proxy statement on or about October 11, 2002 in connection with the solicitation of proxies by our board of directors. The proxies are for use at our 2002 annual meeting of stockholders, which we will hold at 10:00 a.m., Los Angeles time, on Friday, November 8, 2002, at the Marriott Hotel, 3635 Fashion Way, Torrance, California 90503. The proxies will remain valid for use at any meetings held upon adjournment of that meeting. The record date for the meeting is the close of business on September 30, 2002. All holders of record of our common stock on the record date are entitled to notice of the meeting and to vote at the meeting and any meetings held upon adjournment of that meeting. Our principal executive offices are located at 2929 California Street, Torrance, California 90503, and our telephone number is (310) 972-4005.

A proxy form is enclosed. Whether or not you plan to attend the meeting in person, please date, sign and return the enclosed proxy as promptly as possible, in the postage prepaid envelope provided, to ensure that your shares will be voted at the meeting. You may revoke your proxy at any time prior to its use by filing with our secretary an instrument revoking it or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Unless you instruct otherwise in the proxy, any proxy, if not revoked, will be voted at the meeting:

Our only voting securities are the outstanding shares of our common stock. At the record date, we had approximately 7,960,455 shares of common stock outstanding and approximately 50 shareholders of record. If the shareholders of record present in person or represented by their proxies at the meeting hold at least a majority of our outstanding shares of common stock, a quorum will exist for the transaction of business at the meeting. Shareholders of record who abstain from voting, including brokers holding their customers' shares who cause abstentions to be recorded, are counted as present for quorum purposes.

For each share of common stock you hold on the record date, you are entitled to one vote on all matters that we will consider at this meeting. You are not entitled to cumulate your votes. Brokers holding shares of record for their customers generally are not entitled to vote on certain matters unless their customers give them specific voting instructions. If the broker does not receive specific

instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called "broker non-votes."

The voting requirements for the proposals we will consider at the meeting are:

We will pay for the cost of preparing, assembling, printing and mailing this proxy statement and the accompanying form of proxy to our shareholders, as well as the cost of soliciting proxies relating to the meeting. We have requested banks and brokers to solicit their customers who beneficially own our common stock in names of nominees. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses regarding these solicitations. Our officers, directors and employees may supplement the original solicitation by mail of proxies by telephone, telegram and personal solicitation. We will pay no additional compensation to our officers, directors and employees for these activities.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Under our Bylaws, the authorized size of our board is between three and seven members. At a meeting of the board of directors duly held on October 8, 2002, the board increased the size of the board of directors from four members to six members and appointed Douglas Horn and Irving Siegel to fill the two vacant board seats created by such increase. There were no changes to the Company's board of directors during the fiscal year ended March 31, 2002 ("fiscal 2002"). We are asking you to elect six members to serve on our board of directors for a term of office consisting of the coming year or until their respective successors are elected and qualified. Our board has nominated the four individuals named below for election as directors. Each nominee has agreed to serve as a director if elected.

The persons named as proxies in the accompanying form of proxy have advised us that at the meeting they will vote for the election of the nominees named below, unless a contrary direction is indicated. If any of these nominees becomes unavailable for election to the board of directors for any reason, the persons named as proxies have discretionary authority to vote for one or more alternative nominees designated by our board of directors.

No arrangement or understanding exists between any nominee and any other person or persons pursuant to which any nominee was or is to be selected as a director. Richard Marks, advisor to the board and to our Chief Executive Officer, is the son of Mel Marks. None of the other nominees has any family relationship with any other nominee or with any of our executive officers.

Information concerning nominees to our board of directors

The directors of the Company, their ages and present positions with the Company, are as follows:

| Name | Age | Position with the Company | ||

|---|---|---|---|---|

| Selwyn Joffe* | 44 | Chairman of the Board of Directors | ||

| Anthony Souza | 47 | President, Chief Executive Officer and Director | ||

| Mel Marks | 74 | Director | ||

| Murray Rosenzweig* | 78 | Director | ||

| Douglas Horn | 74 | Director | ||

| Irving Siegel | 56 | Director |

Selwyn Joffe has served as a director of the Company since June 1994, and as a consultant to the Company since September 1995. In November 1999, Mr. Joffe was elected to his current position as chairman of the board of directors. He has served as a member of our audit and compensation committees since June 1994. Currently, Mr. Joffe is president and chief executive officer of NetLock Technologies, a company that specializes in securing data-in-motion. Mr. Joffe served as founder, president and chief operating officer of Palace Entertainment, which is a roll-up of amusement parks. From 1989 to 1996, Mr. Joffe was president and chief executive officer of the Wolfgang Puck Food Company. Mr. Joffe is a graduate of Emory University in Atlanta, with degrees in both Business and Law, a member of the Georgia State Bar and a Certified Public Accountant.

Anthony Souza served as a consultant to the Company from September 1999 through November 1999. In December 1999, Mr. Souza was appointed to his current position as president and

3

chief executive officer of the Company and elected to our board of directors. From January 1996 through August 1999, Mr. Souza was involved in commercial and residential real estate development as well as serving as president of a start-up company that developed a police firearms device. From January 1980 to December 1995, Mr. Souza served as the President of TELACU Industries. TELACU Industries operated a number of businesses through its subsidiaries, including a thrift and loan company, with seven branch offices, an affordable housing corporation, a commercial real estate development company, a building material company, and an underground utility company. Annual sales for these companies exceeded $200 million. Mr. Souza is a graduate of the University of Southern California and is a certified public accountant.

Mel Marks founded the Company in 1968. Mr. Marks has served as the Company's chairman of the board of directors and chief executive officer from that time until July 1999. Mr. Marks has continued to serve as an active consultant to the Company since July 1999.

Murray Rosenzweig is a certified public accountant and has served as a director of the Company since February 1994. Since 1973, Mr. Rosenzweig has been the president and chief executive officer of Linden Maintenance Corp., which operates a fleet of taxicabs in New York City.

Douglas Horn is a retired certified public accountant and attorney and was a revenue agent for the Internal Revenue Service. Mr. Horn worked as a staff accountant for Peat Marwick, was a senior partner of Douglas Horn & Company, a certified public accounting firm, and was a senior partner in the law firm of Horn & Shapiro specializing in tax law until he retired in 1991. Mr. Horn also served as the treasurer of the American Diabetes Association for the New York Chapter.

Irving Siegel is a retired attorney admitted to the bar of the state of New Jersey with a background in corporate finance. Since 1993, Mr. Siegel has been the principal owner of Siegel Company, a full service commercial real estate firm, and Mr. Siegel has also served as the director of real estate for Wolfgang Puck Food Company since 1992.

Information about our non-director executive officers

The executive officers of the Company (other than executive officers who are also nominees to our board of directors), their wages and present positions with the Company, are as follows:

| Name | Age | Position with the Company | ||

|---|---|---|---|---|

| Steven Kratz | 47 | Sr. Vice President—QA/Engineering | ||

| Charles Yeagley | 54 | Chief Financial Officer/Secretary |

Our executive officers are appointed by and serve at the discretion of our board of directors. A brief description of the business experience of each of our executive officers, other than executive officers who are also nominees to our board of directors, is set forth below.

Steven Kratz has been employed by the Company since 1988. Before joining the Company, Mr. Kratz was the general manager of GKN Products Company, a division of Beck/Arnley-Worldparts. As senior vice president-QA/Engineering, Mr. Kratz heads our quality assurance, research and development and engineering departments.

Charles Yeagley has been the Company's chief financial officer since June 2000, responsible for all of our finance issues, including financial reporting, investor relations, product costing, cash flow, capital expenditures, budgeting, forecasting, and financial planning. Mr. Yeagley is also responsible for the management of the accounting, purchasing, information technology, material, and human resource departments. From February 1995 to June 2000, Mr. Yeagley was the chief financial officer of Goldenwest Diamond Corporation (d/b/a The Jewelry Exchange), which is the largest privately held

4

manufacturer and retailer of fine jewelry. From July 1979 to December 1994, Mr. Yeagley was a principal in Faulkinbury and Yeagley, a certified public accounting firm that he co-founded. Mr. Yeagley is a certified public accountant and holds a Bachelor of Business Administration Degree with an emphasis in Accounting from Fort Lauderdale University and Master of Business Administration Degree from Golden Gate University.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Act of 1934, as amended, requires that our directors and executive officers, and persons who own more than ten percent of the Company's common stock, file with the Securities and Exchange Commission (the "SEC") initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. To the best of our knowledge, based solely on a review of the copies of such reports furnished to the Company during fiscal 2002, there were no late or delinquent filings.

Information regarding our board of directors and its committees

Our board of directors met five times during fiscal 2002 and took action by written consent on one occasion. Each of our directors attended 75% or more of the total number of meetings of the board during fiscal 2002.

In fiscal 2002, our audit committee consisted of Selwyn Joffe and Murray Rosenzweig. The audit committee oversees our auditing procedures, receives and accepts the reports of our independent certified public accountants, oversees our internal systems of accounting and management controls and makes recommendations to the board concerning the appointment of our auditors.

In fiscal 2002, our compensation committee consisted of Selwyn Joffe and Murray Rosenzweig. The compensation committee is responsible for developing and making recommendations to the board with respect to our executive compensation policies. The compensation committee is also responsible for evaluating the performance of our chief executive officer and other senior officers and making recommendations concerning the salary, bonuses and stock options to be awarded to these officers. No member of the compensation committee has a relationship that would constitute an interlocking relationship with the executive officers or directors of another entity. For further discussion of our compensation committee, see "Compensation Committee; Interlocks and Insider Participation" below.

5

Summary Compensation Table

The following table sets forth information concerning the annual compensation of the Company's chief executive officer and the other most highly compensated executive officers and directors whose salary and bonus exceeded $100,000 for fiscal 2002, and for services in all capacities to the Company during fiscal 2000, 2001 and 2002.

| Name & Principal Position | Year | Salary | Bonus | Other Annual Compensation | Shares Underlying Options | All Other Compensation | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Selwyn Joffe(1) | 2002 | — | — | $ | 159,996 | 1,500 | — | |||||||||||

| Chairman of the Board | 2001 | — | — | $ | 160,220 | 1,500 | — | |||||||||||

| 2000 | — | — | $ | 83,667 | 41,500 | — | ||||||||||||

Anthony Souza(2) | 2002 | $ | 293,108 | $ | 593,189 | — | — | $ | 25,037 | (4) | ||||||||

| President & CEO | 2001 | $ | 301,985 | $ | 25,000 | — | 60,000 | $ | 8,332 | (4) | ||||||||

| 2000 | $ | 121,154 | — | — | 60,000 | $ | 24,996 | (4) | ||||||||||

Mel Marks | 2002 | — | — | $ | 197,500 | 1,500 | — | |||||||||||

| Director | 2001 | $ | 57,692 | — | $ | 105,000 | 1,500 | $ | 11,481 | (5) | ||||||||

| 2000 | $ | 269,231 | — | — | — | $ | 19,336 | (5) | ||||||||||

Steven Kratz | 2002 | $ | 219,345 | $ | 25,000 | — | — | $ | 3,604 | (5) | ||||||||

| Sr. VP—Engineering | 2001 | $ | 250,000 | $ | 10,000 | — | — | $ | 5,604 | (5) | ||||||||

| 2000 | $ | 250,000 | — | $ | 526,423 | (3) | — | $ | 5,604 | (5) | ||||||||

Charles Yeagley | 2002 | $ | 175,257 | $ | 88,974 | — | — | $ | 25,037 | (4) | ||||||||

| Chief Financial Officer | 2001 | $ | 109,644 | $ | 10,000 | — | 25,000 | $ | 18,747 | (4) | ||||||||

| 2000 | — | — | — | — | — | |||||||||||||

Richard Marks | 2002 | $ | 318,000 | $ | 483,118 | — | — | — | ||||||||||

| Advisor to the Board | 2001 | $ | 298,783 | $ | 25,000 | — | — | — | ||||||||||

| and the CEO | 2000 | $ | 391,692 | — | $ | 276,474 | (3) | — | $ | 13,904 | (5) | |||||||

6

Option Grants in Last Fiscal Year

Option Grants in the Last Fiscal Year

The following table provides summary information regarding stock options granted during fiscal 2002 to each of the Company's named executive officers. The potential realizable value is calculated assuming that the fair market value of the Company's common stock appreciates at the indicated annual rate compounded annually for the entire term of the options, and that the option is exercised and sold on the last day of its term for the appreciated stock price. The assumed rates of appreciation are mandated by the rules of the SEC and do not represent the Company's estimate of the future prices or market value of the Company's common stock.

| | Option Grants in Fiscal 2002 | | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Potential Realizable Value at Assumed Annual Rates of Stock price Appreciate for Option Terms | |||||||||||||

| | Number of Securities Underlying Options Granted | | | | ||||||||||

| | % of Total Options Granted to Employees in Fiscal 2002 | | | |||||||||||

| Name | Exercise or Base Price | Expiration Date | ||||||||||||

| 5% | 10% | |||||||||||||

| Anthony Souza | 60,000(1) | 40.1% | $1.10/share | 4/12/2011 | $ | 41,507 | $ | 105,187 | ||||||

Aggregated Fiscal 2002 Year-End Option Values

No options were exercised during fiscal 2002. The following table sets forth the number and value of exercisable and unexercisable options held as of March 31, 2002 by each of the named executive officers.

| | Number of Securities Underlying Unexercised Options at March 31, 2002 | Value of Unexercised In-the-Money Options at March 31, 2002 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||

| Anthony Souza | 120,000 | — | $ | 348,000 | — | ||||

| Selwyn Joffe | 86,750 | — | $ | 165,375 | — | ||||

| Richard Marks | 125,000 | — | $ | 175,000 | — | ||||

| Charles Yeagley | 25,000 | — | $ | 90,500 | — | ||||

| Steven Kratz | 63,600 | — | $ | 29,040 | — | ||||

During fiscal 2001, the board of directors approved a program to give the Company's executives and other key employees an opportunity to cancel previously granted stock options in exchange for the grant of an equal number of new options in the future (the "Exchange Program"). The Company cancelled outstanding stock options (the "initial options") to purchase an aggregate of 232,350 shares of the Company's common stock that had been granted to these executives. The options covered by such cancellations had exercise prices ranging from $7.25 to $19.06 per share, with a weighted average exercise price of $13.30 per share. The Exchange Program was approved by the compensation committee based upon the determination that the initial options no longer provided meaningful incentive for these executives. Subject to their continued employment with the Company, these executives were awarded new stock options to purchase an aggregate of 232,350 shares of common stock six months and one day after the date of the cancellation of the executive's initial options. The

7

following table indicates the impact that this re-pricing had on options held by the five most highly compensated executives of the Company:

| Name | Date | Securities Underlying Number of Options/SARs Reissued or Amended | Market Price of Stock at Time of Reissuance | Exercise Price at Time of Cancellation | New Exercise Price | Length of Original Option Term Remaining at Date of Repricing or Amendment | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Selwyn Joffe | November 15, 2001 | 1,500 | $ | 3.15 | $ | 8.00 | $ | 3.15 | 2yrs, 3mos | ||||||

| November 15, 2001 | 6,250 | $ | 3.15 | $ | 13.13 | $ | 3.15 | 3yrs, 2mos | |||||||

| November 15, 2001 | 1,500 | $ | 3.15 | $ | 17.31 | $ | 3.15 | 3yrs, 11mos | |||||||

| November 15, 2001 | 15,000 | $ | 3.15 | $ | 13.44 | $ | 3.15 | 4yrs, 3mos | |||||||

| November 15, 2001 | 1,500 | $ | 3.15 | $ | 15.63 | $ | 3.15 | 4yrs, 11mos | |||||||

| November 15, 2001 | 15,000 | $ | 3.15 | $ | 19.06 | $ | 3.15 | 5yrs, 2mos | |||||||

| November 15, 2001 | 1,500 | $ | 3.15 | $ | 18.38 | $ | 3.15 | 5yrs, 11mos | |||||||

| November 15, 2001 | 1,500 | $ | 3.15 | $ | 11.81 | $ | 3.15 | 6yrs, 7mos | |||||||

| Steve Kratz | November 15, 2001 | 8,600 | $ | 3.15 | $ | 7.25 | $ | 3.15 | 1yr, 9mos | ||||||

| November 15, 2001 | 35,000 | $ | 3.15 | $ | 13.13 | $ | 3.15 | 3yrs, 2mos | |||||||

| November 15, 2001 | 20,000 | $ | 3.15 | $ | 16.00 | $ | 3.15 | 3yrs, 10mos | |||||||

| Richard Marks | November 15, 2001 | 50,000 | $ | 3.15 | $ | 14.69 | $ | 3.15 | 4yrs, 5mos | ||||||

| November 15, 2001 | 75,000 | $ | 3.15 | $ | 11.16 | $ | 3.15 | 6yrs, 7mos | |||||||

| Total | 232,350 | ||||||||||||||

Employment Agreements

We entered into an employment agreement with Mr. Anthony Souza pursuant to which he is employed full-time as the Company's president and chief executive officer. The original agreement, entered into on December 1, 1999, which was scheduled to expire on June 1, 2001, was extended to June 1, 2003 and provides for an annual base salary of $300,000. As additional consideration for services to be rendered, in January 2000, Mr. Souza was granted a ten-year option to purchase 60,000 shares of the Company's common stock, at $2.20 per share, pursuant to the terms of the Company's 1994 Stock Option Plan. In April 2001, Mr. Souza was granted an additional ten-year option to purchase 60,000 shares of the Company's common stock at $1.10 per share, pursuant to the terms of the Company's 1994 Stock Option Plan (the "1994 Stock Option Plan"). Furthermore, Mr. Souza is entitled to an incentive bonus equal to 62/3% of the pre-tax income (without giving effect to any tax on such income, whether actual or offset by loss carryovers) earned by the Company in each fiscal year; provided that no bonus shall be payable for any such year unless and until the amount of such pre-tax income in such year shall be at least $1.5 million, without carryover from year to year. Our board may also grant supplemental bonuses or increase the base salary payable to Mr. Souza. In addition to his cash compensation, Mr. Souza receives an automobile allowance and other benefits, including those generally provided to our other employees.

We entered into an employment agreement with Mr. Richard Marks pursuant to which he is employed full-time as a direct report to the board of directors and chief executive officer of the Company. This agreement, entered into on January 1, 2000, is scheduled to expire on January 1, 2004 and provides for an annual base salary of $300,000. As an incentive, Mr. Marks shall be paid a bonus equal to 5% of the pre-tax income (without giving effect to any tax on such income, whether actual or offset by loss carryovers) earned by the Company in each fiscal year; provided that no bonus shall be payable for any such year and until the amount of such pre-tax income in such year shall be at least $2 million, without carryover from year to year. Our board may also grant supplemental bonuses or increase the base salary payable to Mr. Marks. In addition to his cash compensation, Mr. Marks

8

receives an automobile allowance and other benefits, including those generally provided to our other employees as well as an allowance for the purpose of obtaining life insurance on Mr. Marks' life and that of his spouse. The agreement further provides, under certain circumstances, that the Company, as liquidated damages or severance pay or both, shall pay Mr. Marks (1) salary through the termination date of his employment agreement at the annual rate in effect immediately prior to the termination date and (2) three times the amount of such annual rate.

We entered into an employment agreement with Mr. Chuck Yeagley pursuant to which he is employed full-time as the Company's chief financial officer. The agreement, entered into on June 26, 2000, scheduled to expire on June 1, 2001, was extended to May 31, 2003 and provides for an annual base salary of $175,000. As additional consideration for services to be rendered, Mr. Yeagley was granted, for a period of ten years from date of grant, an option to purchase 25,000 shares of the Company's common stock, at $0.93 per share, pursuant to the terms of the Company's 1994 Stock Option Plan. Furthermore, Mr. Yeagley shall be paid an incentive bonus equal to 1% of the pre-tax income (without giving effect to any tax on such income, whether actual or offset by loss carryovers) earned by the Company in each fiscal year of the term of this Agreement, provided that no bonus shall be payable for any such year unless and until the amount of such pre-tax income in such year shall be at least $2 million, without carryover from year to year. Our board may also grant supplemental bonuses or increase the base salary payable to Mr. Yeagley. In addition to his cash compensation, Mr. Yeagley receives an automobile allowance and other benefits, including those generally provided to our other employees.

We entered into a three year employment agreement dated February 23, 2000 with Mr. Steven Kratz pursuant to which he is employed full-time as the Company's senior vice president—QA/Engineering. The agreement expires on February 23, 2003 and provides for an annual base salary of $250,000 and a one-year severance agreement, which guarantees $300,000 to be paid within 60 days of termination. Our board may also grant bonuses or increase the base salary payable to Mr. Kratz. In addition to his cash compensation, Mr. Kratz has use of a Company-owned automobile and he receives additional benefits, including those that are generally provided to our other employees. Mr. Kratz was granted, for a period of ten years from the date of grant an option has to purchase 63,600 shares of the Company's common stock at $3.15 per share, all of which are fully vested pursuant to the terms of the 1994 Stock Option Plan.

In conformity with the Company's policy, all of our directors and officers execute confidentiality and nondisclosure agreements upon the commencement of employment with the Company. The agreements generally provide that all inventions or discoveries by the employee related to the Company's business and all confidential information developed or made known to the employee during the term of employment shall be the exclusive property of the Company and shall not be disclosed to third parties without prior approval of the Company. The Company's employment agreements with Messrs. Souza, Marks, and Yeagley also contain non-competition provisions that preclude each employee from competing with the Company for a period of two years from the date of termination of his employment. The Company's employment agreement with Mr. Kratz contains a non-competition provision which precludes him from competing with the Company for a period of one year from the date of termination of his employment. Public policy limitations and the difficulty of obtaining injunctive relief may impair the Company's ability to enforce the non-competition and nondisclosure covenants made by its employees.

Director compensation

Two of the Company's board members have supplemental compensatory arrangements with the Company. In August 2000, the board of directors agreed to engage Mr. Mel Marks to provide consulting services to the Company. Mr. Marks has 45 years of relevant experience in the industry and the Company and has relationships with key industry executives. Mr. Marks was paid an annual

9

consulting fee of $180,000, which was increased in January, 2002 to $250,000 per year. The Company may terminate this arrangement at any time.

Effective December 1, 1999, the Company entered into a consulting agreement with Mr. Selwyn Joffe, the chairman of the board of the Company, pursuant to which he has been retained as a consultant to provide oversight, management, strategic and other advisory services to the Company. The consulting agreement was scheduled to expire on June 1, 2001 but was extended through June 1, 2003, and provides for annual compensation to Mr. Joffe in the amount of $160,000. As additional consideration for the consulting services, Mr. Joffe was granted an option to purchase 40,000 shares of the Company's common stock pursuant to the Company's 1994 Stock Option Plan. Of these options, 20,000 options were exercisable on the date of grant and the remaining 20,000 options were fully vested on the first anniversary of the date of grant. The options have an exercise price of $2.20 per share and expire ten years after the grant date. Mr. Joffe is currently serving as chairman of the board of directors.

Mr. Joffe and the Company entered into an additional consulting services agreement, dated as of May 9, 2002, providing for Mr. Joffe to assist the Company in considering and pursuing potential transactions and relationships intended to enhance shareholder value. In connection with this arrangement, the Company has agreed to pay Mr. Joffe $10,000 per month for one year and 1% of the value of any transactions which close by the second anniversary of the agreement, less any monthly fees paid.

In addition, each of the Company's other non-employee directors receives annual compensation of $10,000, is paid a fee of $2,000 for each meeting of the board of directors attended and $500 for each meeting of a Committee of the board of directors attended and is reimbursed for reasonable out-of-pocket expenses.

The Company's 1994 Non-Employee Director Stock Option Plan (the "Non-Employee Director Plan") provides that each non-employee director of the Company will be granted ten-year options to purchase 1,500 shares of common stock upon his or her initial election as a director, which options are fully exercisable on the first anniversary of the date of grant. The exercise price of the option will be equal to the fair market value of the common stock on the date of grant. The Non-Employee Director Plan, was adopted by the board of directors on October 1, 1994, and by the shareholders in August 1995, in order to attract, retain and provide incentive to directors who are not employees of the Company. The board of directors does not have the authority, discretion or power to select participants who will receive options pursuant to the Non-Employee Director Plan, to set the number of shares of common stock to be covered by each option, to set the exercise price or period within which the options may be exercised or to alter other terms and conditions specified in such plan.

In addition, the 1994 Stock Option Plan provides that each non-employee director of the Company receive formula grants of stock options as described below. Each person who served as non-employee director of the Company during all or part of a fiscal year (the "Fiscal Year") of the Company, including March 31 of that Fiscal Year, will receive in that Fiscal Year an award under the 1994 Stock Option Plan of immediately exercisable ten-year options to purchase 1,500 shares of common stock. Each non-employee director who served less than all of a given Fiscal Year is awarded options to purchase 125 shares of common stock for each month or portion thereof that he or she served as a non-employee director of the Company. As formula grants under the 1994 Stock Option Plan, the forgoing grants of options to directors are not subject to the determinations of the board of directors or the compensation committee.

Compensation Committee; Interlocks and Insider Participation

The members of the compensation committee during fiscal 2002 were Mssrs. Joffe and Rosenzweig. The compensation committee is responsible for developing and making recommendations

10

to the board with respect to our executive compensation policies. The compensation committee is also responsible for evaluating the performance of the Company's chief executive officer and other senior Company officers and to make recommendations concerning the salary, bonuses and stock options to be awarded to these Company officers. For a discussion of the contractual rights that certain Company officers have to bonuses and option grants, see "Employment Agreements" above. Although several key officers were not entitled to a bonus under the terms of their respective employment agreements, during fiscal 2002, the compensation committee determined to provide bonuses to key members of management, in order to retain these employees.

No member of the compensation committee has a relationship that would constitute as interlocking relationship with executive officers or directors of another entity.

11

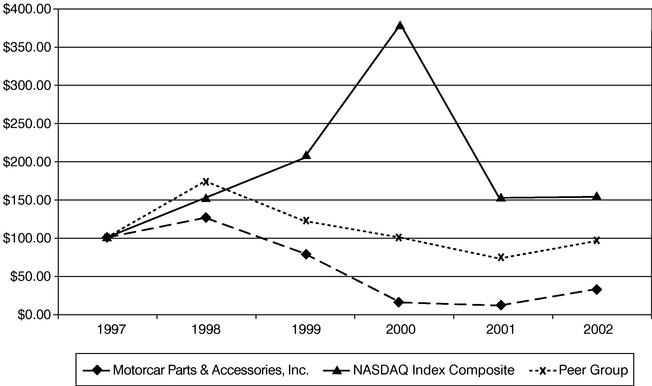

The following graph compares the cumulative return to holders of common stock of the Company for the fiscal years ended March 31, 1998, 1999, 2000, 2001, and 2002 with the National Association of Securities Dealers Automated Quotation ("NASDAQ") Market Index and a peer group index of five competing companies (set forth below) for the same periods ("Peer Group"). The comparison assumes $100 was invested at the close of business on March 31, 1997 in the common stock of the Company and in each of the comparison groups, and assumes reinvestment of dividends.

Total Shareholder Returns—Dividends Reinvested

Annual Return Percentage—Based upon historical performance, the following table depicts the annual percentage return earned in each of the three comparison groups:

| | Year Ended March 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 1998 | 1999 | 2000 | 2001 | 2002 | ||||||

| Motorcar Parts & Accessories, Inc. | 26.11 | % | -37.19 | % | -83.02 | % | -28.95 | % | 225.00 | % | |

Peer Group | 74.48 | % | - -30.76 | % | - -17.73 | % | - -27.97 | % | 32.84 | % | |

NASDAQ | 51.57 | % | 35.10 | % | 86.03 | % | - -60.01 | % | 0.58 | % | |

12

Indexed Returns—Based upon historical performance, the following table displays the results of $100 invested at the close of business on March 31, 1997 in the common stock of each of the comparison groups and assumes reinvestment of dividends:

| | | Year Ended March 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Base Period 31-Mar-97 | |||||||||||

| | 1998 | 1999 | 2000 | 2001 | 2002 | |||||||

| Motorcar Parts & Accessories, Inc. | 100.0 | 126.11 | 79.21 | 13.45 | 9.56 | 31.06 | ||||||

Peer Group | 100.0 | 174.48 | 120.81 | 99.39 | 71.60 | 95.11 | ||||||

NASDAQ Index Composite | 100.0 | 151.57 | 204.77 | 380.94 | 152.35 | 153.23 | ||||||

Note: Data complete through last fiscal year; Corporate Performance Graph with peer group uses peer group performance only (excludes only company); Peer group indices uses beginning of period market capitalization weighting; and S&P index returns are calculated by Zacks.

| Peer Group Population | | |

|---|---|---|

| Champion Parts, Inc. Dana Corporation Hastings Manufacturing Company Standard Motor Production Company Superior Industries International, Inc. |

13

REPORT OF THE COMPENSATION COMMITTEE

REGARDING COMPENSATION

Our compensation committee is composed of two directors, Murray Rosenzweig, an outside member of our board, and Selwyn Joffe, our chairman of the board of directors. The compensation committee is responsible for developing and making recommendations to the board with respect to our executive compensation policies. The compensation committee is also responsible for evaluating the performance of the Company's chief executive officer and other senior company officers and to make recommendations concerning the salary, bonuses and stock options to be awarded to these Company officers.

The objectives of our executive compensation program are to:

We believe that the executive compensation program provides an overall level of compensation opportunity that is competitive within the automotive remanufacturing industry, as well as with a broader group of companies of comparable size and complexity.

Executive Officer Compensation Program. Our executive officer compensation program is comprised of base salary, bonus and long-term incentive compensation in the form of stock options and various benefits, including medical plans and deferred compensation arrangements.

Base Salary. Base salary levels for our executive officers are competitively set relative to companies in comparable manufacturing industries. In determining salaries, the committee also takes into account individual experience and performance and specific issues particular to the Company. The committee considered each of these factors in approving the salaries for all of the executive officers.

Bonus Arrangements. As noted in the discussion under the caption "Employment Agreements," several of our executive officers have contractual rights to bonuses and option grants and they were awarded those accordingly.

Stock Option Program. The stock option program is our long-term incentive plan for providing an incentive to key employees (including directors and officers who are key employees), consultants and directors.

Deferred Compensation. We contribute on behalf of each executive officer $.25 on each dollar, up to 6% of such executive officer's annual salary and bonus, to our non-qualified deferred compensation plan.

Benefits. We provide to executive officers medical benefits that are generally available to our other employees. The amount of perquisites, as determined in accordance with the rules of the SEC relating to executive compensation, did not exceed 10% of salary for fiscal 2002.

Selwyn Joffe

Murray Rosenzweig

14

The audit committee of the board of directors oversees the auditing procedures of the Company, receives and accepts the reports of the Company's internal systems of accounting and management controls and makes recommendations to the board of directors as to the selection and appointment of auditors for the Company.

The audit committee recommended to the board of directors the approval of the independent accountants engaged to conduct the independent audit. The audit committee met with management and the independent accountants to review and discuss the March 31, 2002 consolidated financial statements. The audit committee also discussed with the independent accountants the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee reviewed written disclosures from the independent accountants required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with the independent accountants their firm's independence.

Based upon the audit committee's discussions with management and the independent accountants and the audit committee's review of the representations of management and the independent accountants, the audit committee recommended that the board of directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended March 31, 2002 be filed with the Securities and Exchange Commission.

| THE AUDIT COMMITTEE Selwyn Joffe Murray Rosenzweig |

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 1, 2002, certain information as to the common stock ownership of each of the Company's directors and nominees for director, each of the officers included in the Summary Compensation Table below, all executive officers and directors as a group and all persons known by the Company to be the beneficial owners of more than five percent of the Company's common stock.

| Name and Address of Beneficial Shareholder | Amount and Nature of Beneficial Ownership(1) | | Percent of Class | ||||

|---|---|---|---|---|---|---|---|

| Wells Fargo Bank 333 S. Grand Avenue, Suite 940 Los Angeles, CA 90071 | 400,000 | (2 | ) | 4.6 | % | ||

| Dimensional Fund Advisors, Inc. 1299 Ocean Avenue Santa Monica, CA 90401 | 341,700 | (3 | ) | 3.9 | % | ||

| Mel Marks Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 2,152,431 | (4 | ) | 24.6 | % | ||

| Richard Marks Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 513,566 | (5 | ) | 7.8 | % | ||

| Anthony Souza Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 120,000 | (6 | ) | 1.4 | % | ||

| Selwyn Joffe Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 86,750 | (7 | ) | 1.0 | % | ||

| Steven Kratz Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 63,600 | (8 | ) | * | |||

| Murray Rosenzweig Linden Maintenance Corp. 134-02 33rd Avenue Flushing, NY 11354 | 50,000 | (9 | ) | * | |||

| Charles Yeagley Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 25,000 | (10 | ) | * | |||

| Douglas Horn Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | 151,200 | 1.7 | % | ||||

| Irving Siegel Motorcar Parts & Accessories, Inc. 2929 California Street Torrance, CA 90503 | — | * | |||||

| Directors and executive officers as a group—8 persons | 2,648,981 | (11 | ) | 30.3 | % |

16

Certain Relationships and Related Transactions

The Company has entered into consulting agreements with two of the members of its board of directors, Selwyn Joffe and Mel Marks. For more information, see the discussion under the caption "Director Compensation" above.

In connection with the settlement of a class action lawsuit, the Company agreed to sell Mel Marks 1,500,000 shares of common stock for a total cash price of $1,500,000. The proceeds from the sale of this stock were used to pay the Company's portion of the settlement of a class action lawsuit against the Company.

17

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT

OF

INDEPENDENT CERTIFIED ACCOUNTANTS

The audit committee of the board has selected Grant Thornton, LLP as independent accountants to audit our consolidated financial statements for fiscal 2003. Representatives of Grant Thornton, LLP are expected to be present at the meeting. These representatives will have an opportunity to make a statement and will be available to respond to questions regarding appropriate matters. The board believes it is appropriate to submit for approval by our shareholders the appointment of Grant Thornton, LLP as our independent certified public accountant for fiscal 2003.

The board of directors recommends that shareholders vote FOR this proposal.

PROPOSAL NO. 3

APPROVAL OF AN INCREASE IN THE

1994 STOCK OPTION PLAN

On January 28, 1994, our board of directors adopted, and our shareholders approved, the 1994 Stock Option Plan. The 1994 plan was amended on July 26, 1994, October 4, 1996, June 1, 1998 and December 13, 2001 to increase the number of shares available under the 1994 plan and to qualify the 1994 plan for the sale of securities under California law. Under the 1994 plan, up to 960,000 shares of our common stock may be issued upon the exercise of stock options granted under the 1994 plan.

The proposed amendment

On October 8, 2002, our board of directors approved an amendment to the 1994 plan, subject to shareholder approval, to increase the maximum number of shares of our common stock reserved for issuance under the 1994 plan, from 960,000 shares to 1,155,000 shares. At this meeting, our shareholders will be asked to approve this amendment to the 1994 plan.

The 1994 plan plays an important role in our efforts to attract and retain employees, and to align the interest of our employees with those of our shareholders through increased ownership of the Company by those employees. Of the 960,000 shares authorized to be issued under the 1994 plan, as of October 1, 2002, 793,875 shares were subject to outstanding options granted under the 1994 plan and 9,000 shares remained eligible for future option grants.

Summary description of the 1994 plan

Purpose of the 1994 Plan. The general purpose of the 1994 Plan is to further the growth, development and financial success of the Company and its subsidiaries by providing additional incentives to the Company's and its subsidiaries' key employees (including officers and directors who are key employees), non-employee directors and consultants. By assisting these persons in acquiring shares of the Company's common stock, the Company can ensure that these persons will themselves benefit directly from the Company's and its subsidiaries' growth, development and financial success.

Eligibility Under the 1994 plan. The 1994 plan provides for the granting of options to purchase shares of the Company's common stock to certain key employees (including officers and directors who are key employees), non-employee directors and consultants of the Company or of any present or future subsidiaries of the Company. The 1994 plan provides for the grant of incentive stock options, or ISOs, within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, or Code, and nonqualified stock options, or NQSOs.

18

Director Options. On April 30 of each year, each non-employee director of the Company who was a director on March 31 of that year is granted an option, a Director option, to purchase 125 shares of common stock for each month during the 12-month period that this person served as a director.

Administration of the 1994 plan. The 1994 plan is administered by a committee of the board of directors of the Company consisting of not less than three directors, each of whom is a disinterested person within the meaning of the rules and regulations promulgated by the Securities and Exchange Commission. The committee is authorized, among other things, to determine (i) the persons who are to receive options under the 1994 plan, (ii) the number of shares of common stock subject to the options, (iii) whether an option granted is to be an ISO or NQSO, (iv) the term of each option, (v) the date each option is to become exercisable, in whole, in part or in installment, (vi) whether to accelerate the date of exercise of any installment, and (vii) to interpret, amend and terminate the 1994 plan. The good faith interpretation and construction of any of the provisions in the 1994 plan by the committee is final, conclusive and binding. The 1994 plan provides that no member of the committee shall be liable for actions or determinations made with respect to the 1994 plan or any option granted under the 1994 plan.

Option Agreement. Options granted pursuant to the 1994 plan are evidenced by a written stock option agreement executed by the Company and the optionee.

Exercise Price. The exercise price for the shares of common stock under each option (other than a Director Option) granted under the 1994 plan is determined by the Committee; however, the exercise price may not be less than 100% of the fair market value of the common stock subject to the option on the date of grant. In addition, if, at the time an ISO is granted, the optionee owns shares possessing more than 10% of the total combined voting power of all classes of stock of the Company, of any of its subsidiaries or of a parent, the exercise price of the ISO may not be less than 110% of the fair market value of the common stock subject to the ISO on the date of grant. The exercise price for the shares of common stock under each Director Option is equal to the fair market value of the common stock on the date of grant.

No Rights as a Shareholder. An optionee or a transferee of an option granted under the 1994 plan has no rights as a shareholder with respect to any shares covered by the option until the option is exercised.

Not an Employment Agreement. Nothing contained in the 1994 plan or any option agreement confers to any optionee any right of employment or continued employment with the Company or any subsidiary.

Shares Subject to the 1994 plan. The 1994 plan authorizes the issuance of options to purchase up to 960,000 shares of common stock, subject to adjustment. The shares of common stock may consist either in whole or in part of authorized but unissued shares of common stock or shares of common stock held in the treasury of the Company. If any option granted under the 1994 plan expires or terminates without being exercised, the unpurchased shares of common stock then become available for grant.

Vesting and Exercise of Options. Options vest for the number of shares of common stock subject to the option in installments as determined by the committee. Options that are vested may be exercised by delivering each of the following to the Company before expiration or termination:

19

acquired shares of common stock having an aggregate fair market value, on the date of exercise, equal to the aggregate exercise price of all options being exercised; (iv) in any combination of (i), (ii) and (iii); or (v) as the Committee may specify; and

The Company has the right to require optionees to pay to the Company any taxes required to satisfy the tax withholding obligations arising as a result of the exercise of any options prior to the issuance of any certificates representing the shares of common stock.

Nontransferability. Options are not transferable by the holder either voluntarily or by operation of law, other than by will or the laws of descent and distribution, by inter vivos or testamentary trust in which the options are to be passed to beneficiaries upon the death of the trustor (settlor), or by gift to "immediate family," and options may be exercised, during the lifetime of the optionee, only by the optionee, the optionee's legal representatives or member's of the optionee's immediate family. "Immediate family" means the optionee's child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law, and shall include adoptive relationships.

Termination of Options. Each option expires on the date the committee determines, but no later than ten years from the date the option is granted, subject to earlier termination in the event of a dissolution, liquidation, reorganization or merger. However, if at the time an ISO is granted, the optionee owns 10% or more of the voting shares of the Company, of any of its subsidiaries or of a parent, the term of the option may not exceed five years. Each Director Option has a term of ten years.

Amendment and Termination. The committee may at any time suspend, terminate, amend or revise the terms of the 1994 plan. However, the consent of our shareholders is required to increase the maximum number of shares of common stock for which options may be granted under the 1994 plan, materially increase the benefits to participants under the 1994 plan or change the eligibility requirements for individuals entitled to receive options under the 1994 plan.

No options may be granted under the 1994 plan after January 27, 2004.

Adjustments Upon Changes in Common Stock. In the event of any change in the outstanding common stock by reason of a share dividend, recapitalization, merger or consolidation in which the Company is the surviving corporation, split-up, combination or exchange of shares or the like, the aggregate number and kind of shares subject to the 1994 plan, the aggregate number and kind of shares subject to each outstanding option and the exercise price will be appropriately adjusted by the board of directors.

Any outstanding options will terminate, unless other provisions are made in the transaction, in the event of any of the following:

Federal income tax consequences of the 1994 plan

The following discussion is a general summary of the principal federal income tax consequences under current law relating to options granted under the 1994 Plan. The summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign income and other tax

20

consequences. We encourage participants to consult their own tax advisors with respect to the tax consequences of their participation in the 1994 plan.

Incentive Stock Options. An optionee will not recognize taxable income upon the grant or the exercise of an incentive stock option, or ISO, and the Company will not be entitled to an income tax deduction as the result of the grant or exercise of an ISO. Any gain or loss resulting from the subsequent sale of shares acquired upon exercise of an ISO will be long-term capital gain or loss if the sale is made after the later of:

If an optionee sells shares acquired upon the exercise of an ISO prior to the expiration of both of these periods, the sale will be a "disqualifying disposition" under the federal tax laws. The optionee will generally recognize ordinary income in the year of the disqualifying disposition in an amount equal to the difference between the exercise price of the ISO and the fair market value of the shares on the date of exercise of the ISO. However, the amount of ordinary income recognized by the optionee generally will not exceed the difference between the amount realized on the sale and the exercise price. The Company will be entitled to an income tax deduction equal to the amount taxable as ordinary income to the optionee. Any additional gain recognized by the optionee upon the disqualifying disposition will be taxable as long-term capital gain if the shares have been held for more than one year before the disqualifying disposition or short-term capital gain if the shares have been held for one year or less before the disqualifying disposition.

The amount by which the fair market value, determined on the date of exercise, of the shares purchased upon exercise of an ISO exceeds the exercise price is also an item of tax preference that may be subject to the alternative minimum tax in the year that the ISO is exercised. However, if the shares acquired upon exercise of an ISO are unvested and subject to repurchase by the Company for less than fair market value in the event of the optionee's termination of service prior to vesting in those shares, then the item of tax preference for purposes of the alternative minimum tax will computed at the time when the shares vest (e.g., when the Company's repurchase option for less than fair market value lapses). The optionee may, however, elect under Section 83(b) of the Internal Revenue Code to cause the recognition of the item of tax preference with respect to the exercise of an ISO to occur at the time of exercise. In order to make a Section 83(b) election with respect to shares received upon exercise of an ISO, a notice of election which meets the requirements of the Treasury Regulations must be made within 30 days of the date of exercise. If the Section 83(b) election is made, the optionee will not recognize any additional items of tax preference as and when the shares vest.

Nonqualified Stock Options. An optionee will not recognize taxable income on the grant of a Nonqualified Stock Option, or NQSO, and the Company will not be entitled to an income tax deduction as the result of the grant of an NQSO. However, upon the exercise of an NQSO, the optionee generally will recognize ordinary income, and the Company will be entitled to an income tax deduction, in the amount by which the fair market value of the shares purchased upon exercise, determined as of the date of exercise, exceeds the exercise price. If an optionee is an employee of the Company, this income will be considered part of the optionee's "wages" for which the Company is required to withhold federal and state income as well as employment taxes.

However, if shares acquired by an optionee upon exercise of a NQSO are unvested and subject to repurchase by the Company for less than fair market value in the event of the optionee's termination of service prior to vesting in those shares, then the optionee will not recognize any taxable income at the time of the exercise of the NQSO but will have to report as ordinary income, generally as and when the shares vest (e.g., when the Company's repurchase option for less than fair market value lapses), an amount equal to the excess of (i) the fair market value of the shares on the date of vesting

21

over (ii) the amount, if any, paid for the shares. The Optionee may, however, elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year of exercise of a NQSO an amount equal to the excess of (i) the fair market value of the Shares on the date of exercise over (ii) the amount, if any, paid for the Shares. In order to make a Section 83(b) election with respect to Shares received upon exercise of a NQSO, a notice of election which meets the requirements of the Treasury Regulations must be made within 30 days of the date of exercise. If the Section 83(b) election is made, the Optionee will not recognize any additional income as and when the shares vest.

Upon the subsequent disposition of shares which were acquired by an optionee upon exercise of a NQSO, provided that the shares are vested at the time of disposition or, if such shares are unvested, a timely Section 83(b) election was made for such shares, the optionee will generally recognize capital gain or loss in an amount equal to the difference between the proceeds received upon disposition and the optionee's tax basis in the shares (generally, the sum of the amount paid by the optionee for such shares and the amount of ordinary income previously recognized by the optionee with respect to such shares, as described above). However, if Shares are unvested at the time of disposition and no Section 83(b) election was made for such shares, then the optionee will recognize ordinary income in the amount equal to the difference between the proceeds received from the disposition and the optionee's tax basis in the shares (i.e., the amount paid by the optionee for such shares).

If the gain recognized in connection with such disposition qualifies for capital gain treatment, the federal capital gains tax rate for such sale will be determined based on the holding period of the shares. The optionee's holding period of shares acquired by an optionee upon exercise of a NQSO will begin on the day following the date of exercise of the NQSO except where the shares are, at the time of exercise, unvested and no Section 83(b) election is made, in which case the optionee's holding period with respect to such shares will begin on the day following the day on which the shares vest.

Capital Gains and Ordinary Income Tax. Long term capital gains are currently taxed at a maximum federal rate of 20%. However, long term capital gains with respect to stock with a holding period of more than 5 years may qualify to be taxed at a maximum federal rate of 18% if the stock was acquired on or after January 1, 2001 and, if the stock was acquired pursuant to the exercise of an option, if such option was granted to the participant on or after January 1, 2001. Short term capital gains and ordinary income are taxed at marginal federal rates of up to 38.6% (current law provides that this rate is reduced to 37.6% for years 2004 and 2005 and to 35% for year 2006 and thereafter).

Acceleration of Stock Options. If, upon a reorganization, merger, sale or other transaction resulting in a change in control of the Company, the exercisability of certain stock options held by certain employees (generally officers, shareholders and highly compensated employees of the Company) are accelerated (or payments are made to cancel unexercisable options of such employees), such acceleration or payment may be determined to be, in whole or in part, a "parachute payment" for federal income tax purposes. If the present value of all of the optionee's parachute payments exceeds three time the optionee's average compensation for the past five years, the optionee will be subject to a 20% excise tax on the amount of the parachute payment which is in excess of the greater of:

In addition, the Company will not be allowed to deduct any excess parachute payments.

Compensation Deduction Limitation. Section 162(m) of the Internal Revenue Code generally disallows a federal income tax deduction to any publicly held corporation for compensation paid in excess of $1 million in any taxable year to the chief executive officer or any of the four other most highly compensated executive officers who are employed by the corporation on the last day of the taxable year, but does allow a deduction for "performance-based compensation," including plans

22

providing for stock options having an exercise price of not less than 100% of the stock's fair market value (determined at the time the options are granted) provided such plans are administered by a committee composed exclusively of "outside" directors, and are disclosed to and approved by the corporation's stockholders. The Company has structured and intends to implement and administer the 1994 Plan so that compensation resulting from stock options can qualify as "performance-based compensation." The committee, however, has the discretion to grant the options with terms that will result in the options not constituting performance-based compensation.

Section 16 of the Exchange Act. Special rules apply in the case of individuals subject to Section 16(b) of the Securities Exchange Act of 1934. In particular, under current law, unless a Section 83(b) election (as described above) is made, shares received pursuant to the exercise of a stock option may be treated as unvested for a period of up to six months after the date of receipt. Accordingly, the amount of ordinary income recognized, and the amount of the Company's tax deduction, may be determined as of the end of such period.

Applicability of ERISA

The 1994 plan is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974, as amended, and is not a tax-qualified retirement plan under Section 401(a) of the Internal Revenue Code.

23

Options received by or allocated to directors and executive officers

We cannot determine at this time either the number of options that we will allocate to our directors and executive officers participating in the 1994 plan and to other participants in the future or the number of options that these persons will actually receive in the future because the amount and value of awards that we will grant to any participant are within out discretion, subject to the limitations described above. The table below sets forth the number of options granted to certain individuals and groups under the 1994 plan as of October 1, 2002.

| Individual or Group | Number of Options Received | Weighted Average Exercise Price($) | ||

|---|---|---|---|---|

| Selwyn Joffe Chairman of the Board of Directors | 52,250 | 2.24 | ||

| Anthony Souza President, Chief Executive Officer and Director | 120,000 | 1.65 | ||

| Mel Marks Director | 3,000 | 1.18 | ||

| Murray Rosenzweig Director | 32,500 | 3.77 | ||

| Douglas Horn Director | — | — | ||

| Irving Siegel Director | — | — | ||

| Steven Kratz Sr. Vice President QA Engineering | 63,600 | 3.15 | ||

| Charles Yeagley Chief Financial Officer | 25,000 | 0.93 | ||

| Executive officers as a group (4 persons) | 260,850 | 2.08 | ||

| Employees as a group (31 persons) | 627,750 | 2.48 | ||

| Directors as a group (6 persons) | 207,750 | 2.14 | ||

| Eli Markowitz | 90,000 | 3.15 | ||

| Richard Marks | 125,000 | 3.15 |

Recommendation of our board of directors

Our board believes that approval of the proposed amendment to the 1994 plan is in our best interests and the best interests of our shareholders and unanimously recommends a vote "FOR" approval of this proposal. Your proxies will be voted for this proposal unless you specifically indicate otherwise.

24

Shareholder Proposals

Any shareholder proposal intended to be presented at the 2003 Annual Meeting of Shareholders must be received by the Company not later than June 8, 2003 for inclusion in our proxy statement and form of proxy for that meeting.

Other Matters

We do not intend to bring before the meeting for action any matters other than those specifically referred to in this Proxy Statement, and we are not aware of any other matters which are proposed to be presented by others. If any other matters or motions should properly come before the meeting, the persons named in the Proxy intend to vote on any such matter in accordance with their best judgment, including any matters or motions dealing with the conduct of the meeting.

Proxies

All shareholders are urged to fill in their choices with respect to the matters to be voted on, sign and promptly return the enclosed form of Proxy.

By Order of the Board of Directors

Charles W. Yeagley

Secretary

October 11, 2002

25

MOTORCAR PARTS & ACCESSORIES, INC.

| COMMON STOCK | PROXY | BOARD OF DIRECTORS |

This Proxy is solicited on behalf of the Board of Directors of

MOTORCAR PARTS & ACCESSORIES, INC.

The undersigned hereby appoints Charles W. Yeagley and Kevin R. Keenan, and each of them, the true and lawful and proxies of the undersigned, with full power of substitution to vote all shares of the common stock, $0.01 par value per share ("Common Stock"), of MOTORCAR PARTS & ACCESSORIES, INC., which the undersigned is entitled to vote at the Annual Meeting of Stockholders of MOTORCAR PARTS & ACCESSORIES, INC., to be held at 10:00 a.m., Pacific Time, on November 8, 2002 at the Torrance Marriott, 3635 Fashion Way, Torrance, California and any and all adjournments thereof (the "Meeting"), on the proposals set forth below and any other matters properly brought before the Meeting.

Unless a contrary direction is indicated, this Proxy will be voted FOR all nominees listed in Proposal 1 and FOR approval of Proposal 2; if specific instructions are indicated, this Proxy will be voted in accordance therewith.

All Proxies to vote at said Meeting or any adjournment heretofore given by the undersigned are hereby revoked. Receipt of Notice of Annual Meeting and Proxy Statement dated October 11, 2002, is hereby acknowledged.

| (See Reverse Side) | MOTORCAR PARTS & ACCESSORIES, INC. 2929 California Street Torrance, CA 90503 |

Votes must be indicated (x) in Black or Blue ink

The Directors recommend a vote FOR all Nominees listed in Proposal 1 and approval of Proposal 2.

1. Election of Directors

/ / FOR all nominees listed below / / WITHHOLD AUTHORITY to vote for all nominees listed below / / *EXCEPTIONS

Nominees: Selwyn Joffe, Anthony Souza, Mel Marks, Murray Rosenzweig, Douglas Horn, Irving Siegel

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the "Exceptions" box and write that nominee's name in the space provided below.)

| *Exceptions | ||

2. Proposal to ratify the appointment of Grant Thornton, LLP as the Company's independent accountants for the fiscal year ending March 31, 2003.

/ / FOR / / AGAINST / / ABSTAIN

3. Proposal to approve the proposed amendment to the Company's 1994 Stock Option Plan.

/ / FOR / / AGAINST / / ABSTAIN

4. Such other matters as may properly come before the Meeting.

| Change of Address and/or Comments Mark Here / / | ||||||

Dated: | , 2002 | |||||

Signature(s) | ||||||

Signature(s) | ||||||

Please sign exactly as your name appears hereon. When signing as attorney, executor, administrator, trustee, guardian, or corporate officer, please indicate full title. | ||||||