UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8314

Schwab Annuity Portfolios

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Annuity Portfolios

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Item 1: Report(s) to Shareholders.

| Linda Klingman, Vice President and Head of Money Market Strategies, leads the portfolio management team of Schwab’s money market funds. Ms. Klingman also has overall responsibility for all aspects of the management of the fund. Prior to joining CSIM in 1990, Ms. Klingman was a senior money market trader with AIM Management, Inc. for five years. She has managed money market funds since 1988. |

| Lynn Paschen, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2011, Ms. Paschen held a number of positions at American Century Investments. She was most recently a portfolio manager and from 2000 to 2003, worked as a fixed-income trader. She has managed money market funds since 2003. |

| Nicole Perret-Gentil, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2016, Ms. Perret-Gentil worked at Freddie Mac for 15 years, most recently as a senior portfolio manager where she managed and executed trades for a fixed-income strategy. Prior to that role, she served as a portfolio manager performing fixed-income analysis, a senior research analyst for investor and dealer relations, a senior securities operations analyst in loan and securities operations, and a lead mortgage securities operations specialist. She also worked at Merrill Lynch for a year as a senior specialist in fixed-income global banking and investments. |

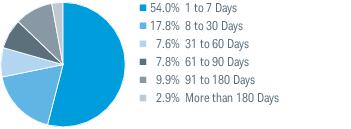

| Weighted Average Maturity2 | 33 Days |

| 1 | Maturity shown is the date the interest rate on those securities is reset, or the date those securities can be redeemed through demand. |

| 2 | Money funds must maintain a dollar-weighted average maturity of no longer than 60 days and cannot invest in any security whose effective maturity is longer than 397 days (approximately 13 months). |

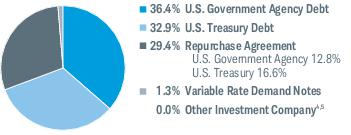

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | Includes the fund’s position in money market mutual funds registered under the Investment Company Act of 1940, as amended. |

| 5 | Less than 0.05% |

| Schwab Government Money Market Portfolio | |

| Ticker Symbol | SWPXX |

| Seven-Day Yield (with waivers)2 | 0.01% |

| Seven-Day Yield (without waivers)2 | -0.11% |

| Seven-Day Effective Yield (with waivers)2 | 0.01% |

| 1 | Fund yields do not reflect the additional fees and expenses imposed by the insurance company under the variable insurance product contract. If those contract fees and expenses were included, the yields would be less than those shown. Please refer to the variable insurance product prospectus for a complete listing of these expenses. |

| 2 | The Seven-Day Yield (with waivers) is the average income paid out over the previous seven days assuming interest income is not reinvested and it reflects the effect of any applicable waivers. Absent such waivers, the fund’s yield would have been lower. The Seven-Day Yield (without waivers) is the yield without the effect of any applicable waivers. The Seven-Day Effective Yield is the yield with waivers assuming that all interest income is reinvested in additional shares of the fund. For additional details, see financial note 4. |

| Expense Ratio (Annualized)1 | Beginning Account Value at 1/1/20 | Ending Account Value (Net of Expenses) at 6/30/20 | Expenses Paid During Period 1/1/20-6/30/202 | |

| Schwab Government Money Market Portfolio | ||||

| Actual Return | 0.35% | $1,000.00 | $1,002.80 | $1.74 |

| Hypothetical 5% Return | 0.35% | $1,000.00 | $1,023.16 | $1.76 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 182 days of the period, and divided by the 366 days of the fiscal year. |

| 1/1/20– 6/30/20* | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | |

| Per-Share Data | ||||||

| Net asset value at beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.00 2 | 0.02 | 0.02 | 0.00 2 | 0.00 2 | 0.00 2 |

| Net realized and unrealized gains (losses) | (0.00) 2 | 0.00 2 | (0.00) 2 | 0.00 2 | 0.00 2 | (0.00) 2,3 |

| Total from investment operations | 0.00 2 | 0.02 | 0.02 | 0.00 2 | 0.00 2 | 0.00 2 |

| Less distributions: | ||||||

| Distributions from net investment income | (0.00) 2 | (0.02) | (0.02) | (0.00) 2 | (0.00) 2 | (0.00) 2 |

| Net asset value at end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total return | 0.28% 4 | 1.91% | 1.52% | 0.45% | 0.01% | 0.01% |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses | 0.35% 5,6 | 0.35% | 0.35% | 0.46% 7 | 0.37% 6 | 0.12% 6 |

| Gross operating expenses | 0.44% 5 | 0.47% | 0.48% | 0.50% | 0.49% | 0.54% |

| Net investment income (loss) | 0.51% 5 | 1.88% | 1.55% | 0.44% | 0.01% | 0.01% |

| Net assets, end of period (x 1,000,000) | $186 | $149 | $138 | $95 | $106 | $116 |

| * | Unaudited. |

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Face Amount ($) | Value ($) | ||||||||

| Fixed-Rate Obligations 45.3% of net assets | ||||||||||||||

| U.S. Government Agency Debt 13.8% | ||||||||||||||

| FEDERAL FARM CREDIT BANKS FUNDING CORP | 1.87% | 09/01/20 | 155,000 | 154,509 | ||||||||||

| 0.70% | 04/12/21 | �� | 200,000 | 200,347 | ||||||||||

| FEDERAL HOME LOAN BANKS | 1.38% | 07/02/20 | 500,000 | 499,981 | ||||||||||

| 1.58% | 07/06/20 | 700,000 | 699,847 | |||||||||||

| 0.20% | 07/07/20 | 1,500,000 | 1,499,950 | |||||||||||

| 0.17% | 07/08/20 | 700,000 | 699,977 | |||||||||||

| 1.51% | 07/09/20 | 250,000 | 249,917 | |||||||||||

| 0.15% | 07/14/20 | 2,700,000 | 2,699,859 | |||||||||||

| 0.20% | 07/21/20 | 300,000 | 299,967 | |||||||||||

| 0.11% | 07/22/20 | 500,000 | 499,969 | |||||||||||

| 0.35% | 08/24/20 | 1,700,000 | 1,699,108 | |||||||||||

| 1.75% | 08/26/20 | 100,000 | 100,177 | |||||||||||

| 0.92% | 09/02/20 | 500,000 | 499,195 | |||||||||||

| 0.45% | 09/09/20 | 1,400,000 | 1,398,775 | |||||||||||

| 0.29% | 09/15/20 | 1,600,000 | 1,599,020 | |||||||||||

| 0.15% | 09/22/20 | 1,500,000 | 1,500,000 | |||||||||||

| 0.29% | 09/25/20 | 900,000 | 899,376 | |||||||||||

| 2.63% | 10/01/20 | 400,000 | 401,755 | |||||||||||

| 0.34% | 11/23/20 | 1,500,000 | 1,497,946 | |||||||||||

| 3.13% | 12/11/20 | 525,000 | 531,246 | |||||||||||

| 0.45% | 03/08/21 | 500,000 | 498,438 | |||||||||||

| 0.40% | 03/09/21 | 500,000 | 498,606 | |||||||||||

| 0.63% | 03/09/21 | 100,000 | 100,199 | |||||||||||

| 2.50% | 03/12/21 | 300,000 | 304,253 | |||||||||||

| 0.50% | 03/16/21 | 200,000 | 199,920 | |||||||||||

| 0.40% | 03/19/21 | 300,000 | 299,130 | |||||||||||

| 0.40% | 03/22/21 | 500,000 | 498,533 | |||||||||||

| FEDERAL HOME LOAN MORTGAGE CORPORATION | 0.68% | 07/17/20 | 1,500,000 | 1,499,547 | ||||||||||

| 1.13% | 07/17/20 | 600,000 | 599,699 | |||||||||||

| 1.88% | 11/17/20 | 500,000 | 501,937 | |||||||||||

| 2.38% | 02/16/21 | 200,000 | 202,250 | |||||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Face Amount ($) | Value ($) | ||||||||

| FEDERAL NATIONAL MORTGAGE ASSOCIATION | 1.50% | 07/30/20 | 2,100,000 | 2,100,565 | ||||||||||

| 2.88% | 10/30/20 | 700,000 | 704,737 | |||||||||||

| 25,638,735 | ||||||||||||||

| U.S. Treasury Debt 31.5% | ||||||||||||||

| UNITED STATES TREASURY | 0.12% | 07/07/20 | 3,400,000 | 3,399,934 | ||||||||||

| 0.18% | 07/09/20 | 300,000 | 299,988 | |||||||||||

| 0.11% | 07/14/20 | 8,000,000 | 7,999,682 | |||||||||||

| 0.10% | 07/14/20 | 600,000 | 599,978 | |||||||||||

| 1.50% | 07/15/20 | 600,000 | 599,940 | |||||||||||

| 0.12% | 07/21/20 | 1,000,000 | 999,933 | |||||||||||

| 0.11% | 07/21/20 | 5,000,000 | 4,999,708 | |||||||||||

| 0.15% | 07/23/20 | 400,000 | 399,963 | |||||||||||

| 0.13% | 07/30/20 | 1,500,000 | 1,499,846 | |||||||||||

| 2.63% | 07/31/20 | 400,000 | 400,313 | |||||||||||

| 0.14% | 08/04/20 | 3,000,000 | 2,999,595 | |||||||||||

| 0.13% | 08/13/20 | 1,000,000 | 999,850 | |||||||||||

| 2.63% | 08/15/20 | 1,500,000 | 1,501,617 | |||||||||||

| 0.12% | 08/20/20 | 1,000,000 | 999,833 | |||||||||||

| 0.14% | 08/25/20 | 2,500,000 | 2,499,465 | |||||||||||

| 0.14% | 08/27/20 | 2,300,000 | 2,299,508 | |||||||||||

| 2.13% | 08/31/20 | 500,000 | 500,430 | |||||||||||

| 0.15% | 09/03/20 | 500,000 | 499,871 | |||||||||||

| 0.39% | 09/10/20 | 1,600,000 | 1,598,769 | |||||||||||

| 0.17% | 09/10/20 | 400,000 | 399,870 | |||||||||||

| 0.24% | 09/15/20 | 300,000 | 299,848 | |||||||||||

| 0.22% | 09/15/20 | 700,000 | 699,675 | |||||||||||

| 0.20% | 09/15/20 | 700,000 | 699,702 | |||||||||||

| 0.18% | 09/17/20 | 1,000,000 | 999,621 | |||||||||||

| 0.16% | 09/22/20 | 1,500,000 | 1,499,452 | |||||||||||

| 0.17% | 09/24/20 | 400,000 | 399,844 | |||||||||||

| 0.16% | 09/24/20 | 1,000,000 | 999,622 | |||||||||||

| 0.19% | 09/29/20 | 1,000,000 | 999,530 | |||||||||||

| 2.00% | 09/30/20 | 600,000 | 600,552 | |||||||||||

| 2.75% | 09/30/20 | 2,100,000 | 2,105,763 | |||||||||||

| 0.17% | 10/06/20 | 2,900,000 | 2,898,684 | |||||||||||

| 0.19% | 10/08/20 | 200,000 | 199,897 | |||||||||||

| 0.18% | 10/08/20 | 700,000 | 699,649 | |||||||||||

| 0.15% | 10/13/20 | 200,000 | 199,915 | |||||||||||

| 0.17% | 10/22/20 | 1,000,000 | 999,482 | |||||||||||

| 1.75% | 10/31/20 | 1,000,000 | 1,000,232 | |||||||||||

| 1.38% | 10/31/20 | 800,000 | 799,311 | |||||||||||

| 2.63% | 11/15/20 | 500,000 | 501,804 | |||||||||||

| 0.19% | 11/24/20 | 700,000 | 699,468 | |||||||||||

| 0.18% | 11/24/20 | 1,000,000 | 999,290 | |||||||||||

| 1.63% | 11/30/20 | 1,100,000 | 1,099,992 | |||||||||||

| 0.17% | 12/24/20 | 1,000,000 | 999,157 | |||||||||||

| 1.75% | 12/31/20 | 300,000 | 300,163 | |||||||||||

| 2.38% | 12/31/20 | 300,000 | 301,107 | |||||||||||

| 2.50% | 12/31/20 | 700,000 | 702,991 | |||||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Face Amount ($) | Value ($) | ||||||||

| 2.38% | 03/15/21 | 400,000 | 405,488 | |||||||||||

| 2.25% | 03/31/21 | 900,000 | 912,344 | |||||||||||

| 58,520,676 | ||||||||||||||

| Total Fixed-Rate Obligations | ||||||||||||||

| (Cost $84,159,411) | 84,159,411 | |||||||||||||

| Variable-Rate Obligations 25.7% of net assets | ||||||||||||||

| U.S. Government Agency Debt 22.8% | ||||||||||||||

| FEDERAL FARM CREDIT BANKS FUNDING CORP | ||||||||||||||

| (1 mo. USD-LIBOR + 0.01%) | 0.19% | 07/02/20 | 1,000,000 | 1,000,000 | ||||||||||

| (1 mo. USD-LIBOR - 0.02%) | 0.15% | 07/06/20 | 08/05/20 | 250,000 | 249,999 | |||||||||

| (1 mo. USD-LIBOR - 0.02%) | 0.16% | 07/01/20 | 09/01/20 | 750,000 | 749,996 | |||||||||

| (1 mo. USD-LIBOR - 0.01%) | 0.17% | 07/30/20 | 10/30/20 | 900,000 | 899,978 | |||||||||

| (1 mo. USD-LIBOR - 0.03%) | 0.15% | 07/06/20 | 03/03/21 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.30%) | 0.38% | 07/01/20 | 04/27/21 | 800,000 | 800,000 | |||||||||

| (SOFR + 0.21%) | 0.29% | 07/01/20 | 10/28/21 | 200,000 | 200,000 | |||||||||

| FEDERAL HOME LOAN BANKS | ||||||||||||||

| (1 mo. USD-LIBOR - 0.02%) | 0.15% | 07/01/20 | 1,000,000 | 1,000,000 | ||||||||||

| (SOFR + 0.10%) | 0.18% | 07/01/20 | 07/17/20 | 200,000 | 200,000 | |||||||||

| (3 mo. USD-LIBOR - 0.24%) | 0.21% | 08/10/20 | 700,000 | 700,000 | ||||||||||

| (SOFR + 0.03%) | 0.11% | 07/01/20 | 08/21/20 | 100,000 | 100,000 | |||||||||

| (SOFR + 0.02%) | 0.10% | 07/01/20 | 08/28/20 | 100,000 | 100,000 | |||||||||

| (SOFR + 0.09%) | 0.17% | 07/01/20 | 09/11/20 | 1,000,000 | 1,000,000 | |||||||||

| (SOFR + 0.23%) | 0.31% | 07/01/20 | 09/25/20 | 1,500,000 | 1,500,000 | |||||||||

| (SOFR + 0.05%) | 0.13% | 07/01/20 | 09/28/20 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.08%) | 0.16% | 07/01/20 | 10/02/20 | 500,000 | 500,013 | |||||||||

| (3 mo. USD-LIBOR - 0.18%) | 1.59% | 07/06/20 | 10/05/20 | 1,000,000 | 999,862 | |||||||||

| (1 mo. USD-LIBOR - 0.01%) | 0.18% | 07/27/20 | 10/26/20 | 750,000 | 750,000 | |||||||||

| (1 mo. USD-LIBOR + 0.00%) | 0.18% | 07/27/20 | 10/26/20 | 2,300,000 | 2,300,015 | |||||||||

| (3 mo. USD-LIBOR - 0.17%) | 0.60% | 07/30/20 | 10/30/20 | 800,000 | 800,000 | |||||||||

| (SOFR + 0.24%) | 0.32% | 07/01/20 | 12/24/20 | 3,800,000 | 3,800,000 | |||||||||

| (3 mo. USD-LIBOR - 0.17%) | 1.18% | 07/08/20 | 01/08/21 | 1,300,000 | 1,301,540 | |||||||||

| (SOFR + 0.11%) | 0.19% | 07/01/20 | 01/15/21 | 250,000 | 250,000 | |||||||||

| (SOFR + 0.10%) | 0.18% | 07/01/20 | 02/22/21 | 700,000 | 700,000 | |||||||||

| (SOFR + 0.07%) | 0.15% | 07/01/20 | 02/26/21 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.08%) | 0.16% | 07/01/20 | 03/04/21 | 1,100,000 | 1,100,000 | |||||||||

| (SOFR + 0.14%) | 0.22% | 07/01/20 | 03/10/21 | 100,000 | 100,000 | |||||||||

| (SOFR + 0.12%) | 0.20% | 07/01/20 | 03/12/21 | 200,000 | 200,006 | |||||||||

| (1 mo. USD-LIBOR - 0.03%) | 0.16% | 07/20/20 | 03/19/21 | 1,100,000 | 1,100,000 | |||||||||

| (1 mo. USD-LIBOR - 0.01%) | 0.16% | 07/06/20 | 04/05/21 | 1,000,000 | 1,000,000 | |||||||||

| (SOFR + 0.17%) | 0.25% | 07/01/20 | 04/09/21 | 200,000 | 200,000 | |||||||||

| (1 mo. USD-LIBOR + 0.07%) | 0.24% | 07/06/20 | 05/04/21 | 700,000 | 700,000 | |||||||||

| (SOFR + 0.10%) | 0.18% | 07/01/20 | 05/07/21 | 250,000 | 250,000 | |||||||||

| (SOFR + 0.06%) | 0.14% | 07/01/20 | 05/14/21 | 2,000,000 | 2,000,000 | |||||||||

| (SOFR + 0.08%) | 0.16% | 07/01/20 | 06/11/21 | 1,000,000 | 1,000,000 | |||||||||

| (SOFR + 0.08%) | 0.16% | 07/01/20 | 07/08/21 | 750,000 | 750,000 | |||||||||

| (SOFR + 0.09%) | 0.17% | 07/01/20 | 09/10/21 | 900,000 | 900,000 | |||||||||

| (SOFR + 0.12%) | 0.20% | 07/01/20 | 02/28/22 | 700,000 | 700,000 | |||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Face Amount ($) | Value ($) | ||||||||

| FEDERAL HOME LOAN MORTGAGE CORPORATION | ||||||||||||||

| (SOFR + 0.04%) | 0.12% | 07/01/20 | 09/10/20 | 1,600,000 | 1,600,000 | |||||||||

| (SOFR + 0.03%) | 0.11% | 07/01/20 | 02/19/21 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.32%) | 0.40% | 07/01/20 | 09/23/21 | 100,000 | 100,000 | |||||||||

| (SOFR + 0.15%) | 0.23% | 07/01/20 | 03/04/22 | 900,000 | 900,000 | |||||||||

| (SOFR + 0.20%) | 0.28% | 07/01/20 | 03/11/22 | 200,000 | 200,000 | |||||||||

| (SOFR + 0.19%) | 0.27% | 07/01/20 | 06/02/22 | 500,000 | 500,000 | |||||||||

| FEDERAL NATIONAL MORTGAGE ASSOCIATION | ||||||||||||||

| (SOFR + 0.08%) | 0.16% | 07/01/20 | 10/30/20 | 1,250,000 | 1,250,065 | |||||||||

| (SOFR + 0.07%) | 0.15% | 07/01/20 | 12/11/20 | 700,000 | 699,589 | |||||||||

| (SOFR + 0.30%) | 0.38% | 07/01/20 | 09/24/21 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.34%) | 0.42% | 07/01/20 | 10/20/21 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.35%) | 0.43% | 07/01/20 | 04/07/22 | 700,000 | 700,268 | |||||||||

| (SOFR + 0.39%) | 0.47% | 07/01/20 | 04/15/22 | 700,000 | 700,000 | |||||||||

| (SOFR + 0.24%) | 0.32% | 07/01/20 | 04/29/22 | 500,000 | 500,000 | |||||||||

| (SOFR + 0.20%) | 0.28% | 07/01/20 | 05/09/22 | 800,000 | 800,000 | |||||||||

| (SOFR + 0.19%) | 0.27% | 07/01/20 | 05/19/22 | 1,200,000 | 1,200,000 | |||||||||

| (SOFR + 0.19%) | 0.27% | 07/01/20 | 05/27/22 | 250,000 | 250,000 | |||||||||

| 42,301,331 | ||||||||||||||

| U.S. Treasury Debt 1.6% | ||||||||||||||

| UNITED STATES TREASURY | ||||||||||||||

| (3 mo. US TBILL + 0.12%) | 0.27% | 07/01/20 | 01/31/21 | 600,000 | 599,856 | |||||||||

| (3 mo. US TBILL + 0.14%) | 0.29% | 07/01/20 | 04/30/21 | 800,000 | 800,257 | |||||||||

| (3 mo. US TBILL + 0.30%) | 0.45% | 07/01/20 | 10/31/21 | 700,000 | 702,269 | |||||||||

| (3 mo. US TBILL + 0.15%) | 0.30% | 07/01/20 | 01/31/22 | 900,000 | 899,898 | |||||||||

| 3,002,280 | ||||||||||||||

| Variable Rate Demand Notes 1.3% | ||||||||||||||

| ALABAMA HFA | ||||||||||||||

| M/F HOUSING RB (CHAPEL RIDGE APTS) SERIES 2005E (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.23% | 07/07/20 | 100,000 | 100,000 | |||||||||

| EMERYVILLE SUCCESSOR REDEVELOPMENT AGENCY | ||||||||||||||

| M/F HOUSING RB (BAY ST APTS) SERIES 2002A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a) | 0.21% | 07/07/20 | 300,000 | 300,000 | |||||||||

| LOUISIANA LOCAL GOVERNMENT ENVIRONMENTAL FACILITIES & COMMUNITY DEVELOPMENT AUTH | ||||||||||||||

| RB (LOUISE S. MCGEHEE SCHOOL) SERIES 2010 (LOC: FEDERAL HOME LOAN BANKS) | (a) | 0.16% | 07/07/20 | 300,000 | 300,000 | |||||||||

| MARYLAND COMMUNITY DEVELOPMENT ADMINISTRATION | ||||||||||||||

| M/F DEVELOPMENT RB (SHARP LEADENHALL APTS) SERIES 2009A (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.15% | 07/07/20 | 100,000 | 100,000 | |||||||||

| METRO GOVERNMENT OF NASHVILLE & DAVIDSON CNTY HEALTH & EDUCATIONAL FACILITIES BOARD | ||||||||||||||

| M/F HOUSING REFUNDING RB (BRENTWOOD OAKS APTS) SERIES 1991 (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a) | 0.21% | 07/07/20 | 100,000 | 100,000 | |||||||||

| NEVADA HOUSING DIVISION | ||||||||||||||

| HOUSING RB (VISTA CREEK APTS) SERIES 2007 (LOC: FEDERAL HOME LOAN BANKS) | (a) | 0.19% | 07/07/20 | 100,000 | 100,000 | |||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Face Amount ($) | Value ($) | ||||||||

| NEW YORK STATE HFA | ||||||||||||||

| HOUSING RB (CAROLINE APTS) SERIES 2008A (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.14% | 07/07/20 | 100,000 | 100,000 | |||||||||

| HOUSING RB (CLINTON GREEN SOUTH) SERIES 2005A (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.17% | 07/07/20 | 200,000 | 200,000 | |||||||||

| ORANGE CNTY HFA | ||||||||||||||

| M/F HOUSING RB (LANDINGS ON MILLENIA BLVD APTS) SERIES 2002A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a) | 0.16% | 07/07/20 | 100,000 | 100,000 | |||||||||

| M/F HOUSING RB (LEE VISTA CLUB APTS) SERIES 2004A (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a) | 0.16% | 07/07/20 | 100,000 | 100,000 | |||||||||

| SACRAMENTO CNTY HOUSING AUTH | ||||||||||||||

| M/F HOUSING RB (LOGAN PARK APTS) SERIES 2007E (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.19% | 07/07/20 | 300,000 | 300,000 | |||||||||

| SAN JOSE | ||||||||||||||

| M/F HOUSING REFUNDING RB (LAS VENTANAS APTS) SERIES 2008B (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.14% | 07/07/20 | 100,000 | 100,000 | |||||||||

| ST. TAMMANY PARISH DEVELOPMENT DISTRICT | ||||||||||||||

| RB (BCS DEVELOPMENT) SERIES 2008 (LOC: FEDERAL HOME LOAN BANKS) | (a) | 0.16% | 07/07/20 | 200,000 | 200,000 | |||||||||

| TEXAS DEPT OF HOUSING & COMMUNITY AFFAIRS | ||||||||||||||

| M/F HOUSING RB (COSTA IBIZA APTS) SERIES 2008 (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.21% | 07/07/20 | 100,000 | 100,000 | |||||||||

| M/F HOUSING RB (TOWER RIDGE APTS) SERIES 2005 (LOC: FEDERAL NATIONAL MORTGAGE ASSOCIATION) | (a) | 0.23% | 07/07/20 | 100,000 | 100,000 | |||||||||

| M/F HOUSING REFUNDING RB (ALTA CULLEN APTS) SERIES 2008 (LOC: FEDERAL HOME LOAN MORTGAGE CORPORATION) | (a) | 0.21% | 07/07/20 | 100,000 | 100,000 | |||||||||

| 2,400,000 | ||||||||||||||

| Total Variable-Rate Obligations | ||||||||||||||

| (Cost $47,703,611) | 47,703,611 | |||||||||||||

| Security | Footnotes | Rate | Number of Shares | Value ($) | ||||||||||

| Other Investment Company 0.0% of net assets | ||||||||||||||

| Money Market Fund 0.0% | ||||||||||||||

| STATE STREET INSTITUTIONAL U.S. GOVERNMENT MONEY MARKET FUND, PREMIER CLASS | (b) | 0.12% | n/a | n/a | 45,600 | 45,600 | ||||||||

| Total Other Investment Company | ||||||||||||||

| (Cost $45,600) | 45,600 | |||||||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Maturity Amount ($) | Value ($) | ||||||||

| Repurchase Agreements 29.7% of net assets | ||||||||||||||

| U.S. Government Agency Repurchase Agreements* 13.0% | ||||||||||||||

| BANK OF MONTREAL | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $1,030,003, 3.37%, due 11/01/20) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Maturity Amount ($) | Value ($) | ||||||||

| BNP PARIBAS SA | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury and U.S. Government Agency Securities valued at $1,027,572, 0.63% - 8.13%, due 05/15/21 - 10/01/49) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| BOFA SECURITIES INC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $2,060,000, 3.00%, due 04/01/50) | 0.09% | 07/01/20 | 2,000,005 | 2,000,000 | ||||||||||

| CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK SA | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $1,030,003, 3.00%, due 10/01/49) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| GOLDMAN SACHS & CO LLC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $5,100,000, 2.50% - 6.00%, due 08/01/22 - 12/20/49) | 0.09% | 07/01/20 | 5,000,013 | 5,000,000 | ||||||||||

| JP MORGAN SECURITIES LLC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $4,120,000, 2.50% - 6.00%, due 02/01/26 - 06/01/50) | 0.09% | 07/01/20 | 4,000,010 | 4,000,000 | ||||||||||

| MIZUHO SECURITIES USA LLC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $1,030,001, 3.16%, due 05/01/29) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| RBC DOMINION SECURITIES INC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $1,030,054, 0.76% - 5.00%, due 09/15/34 - 06/20/50) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| ROYAL BANK OF CANADA | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $7,210,018, 0.64% - 5.50%, due 04/01/35 - 06/20/50) | 0.09% | 07/01/20 | 7,000,018 | 7,000,000 | ||||||||||

| WELLS FARGO SECURITIES LLC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Government Agency Securities valued at $1,030,506, 6.63%, due 11/15/30) | 0.09% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||||||

| 24,000,000 | ||||||||||||||

| U.S. Treasury Repurchase Agreements 16.7% | ||||||||||||||

| BARCLAYS BANK PLC | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $18,360,165, 3.13%, due 02/15/43) | 0.07% | 07/01/20 | 18,000,035 | 18,000,000 | ||||||||||

| CREDIT SUISSE AG (NEW YORK BRANCH) | ||||||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $3,097,842, 0.13% - 3.63%, due 01/15/22 - 04/15/28) | 0.07% | 07/01/20 | 3,037,090 | 3,037,084 | ||||||||||

| Issuer | Footnotes | Rate | Effective Maturity | Maturity Date | Maturity Amount ($) | Value ($) | ||||

| FICC - BANK OF NEW YORK | ||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $1,020,085, 2.25%, due 08/15/27) | 0.10% | 07/01/20 | 1,000,003 | 1,000,000 | ||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $7,140,027, 2.25%, due 08/15/27) | 0.08% | 07/01/20 | 7,000,016 | 7,000,000 | ||||||

| FICC - STATE STREET BANK AND TRUST CO | ||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $1,020,000, 1.38%, due 08/31/26) | 0.08% | 07/01/20 | 1,000,002 | 1,000,000 | ||||||

| RBC DOMINION SECURITIES INC | ||||||||||

| Issued 06/30/20, repurchase date 07/01/20 (Collateralized by U.S. Treasury Securities valued at $1,020,103, 2.13% - 2.88%, due 12/31/22 - 02/15/40) | 0.07% | 07/01/20 | 1,000,002 | 1,000,000 | ||||||

| 31,037,084 | ||||||||||

| Total Repurchase Agreements | ||||||||||

| (Cost $55,037,084) | 55,037,084 | |||||||||

| (a) | VRDN is a municipal security which allows holders to sell their security through a put or tender feature, at par value plus accrued interest. The interest rate resets on a periodic basis, the majority of which are weekly but may be daily or monthly. Unless a reference rate and spread is shown parenthetically, the Remarketing Agent, generally a dealer, determines the interest rate for the security at each interest rate reset date. The rate is typically based on the SIFMA Municipal Swap Index. |

| (b) | The rate shown is the 7-day yield. |

| * | Collateralized via U.S. Government Agency Securities or less frequently by higher rated U.S. Treasury Securities. |

| AUTH — | Authority |

| CNTY — | County |

| FICC — | Fixed Income Clearing Corp |

| HFA — | Housing finance agency/authority |

| LIBOR — | London Interbank Offered Rate is the interest rate banks charge each other for short-term loans. |

| M/F — | Multi-family |

| RB — | Revenue bond |

| SIFMA — | Securities Industry and Financial Markets Association. The SIFMA Municipal Swap Index is a market index comprised of high-grade 7-day tax-exempt Variable Rate Demand Obligations with certain characteristics. |

| SOFR — | Secured Overnight Financing Rate is published daily by the Federal Reserve Bank of New York and is based on the cost of borrowing cash overnight collateralized by U.S. Treasury securities. |

| US TBILL — | The reference rate is the weekly auction stop for the U.S. Treasury Bill. |

| VRDN — | Variable rate demand note |

| Description | Quoted Prices in Active Markets for Identical Assets (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | |

| Assets | |||||

| Fixed-Rate Obligations1 | $— | $84,159,411 | $— | $84,159,411 | |

| Variable-Rate Obligations1 | — | 47,703,611 | — | 47,703,611 | |

| Other Investment Company1 | 45,600 | — | — | 45,600 | |

| Repurchase Agreements1 | — | 55,037,084 | — | 55,037,084 | |

| Total | $45,600 | $186,900,106 | $— | $186,945,706 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments in unaffiliated issuers, at cost and value (Note 2a) | $131,908,622 | |

| Repurchase agreements, at cost and value (Note 2a) | 55,037,084 | |

| Receivables: | ||

| Fund shares sold | 142,463 | |

| Interest | 107,728 | |

| Dividends | + | 5 |

| Total assets | 187,195,902 | |

| Liabilities | ||

| Payables: | ||

| Investment adviser and administrator fees | 36,807 | |

| Fund shares redeemed | 1,459,355 | |

| Distributions to shareholders | 769 | |

| Accrued expenses | + | 79,719 |

| Total liabilities | 1,576,650 | |

| Net Assets | ||

| Total assets | 187,195,902 | |

| Total liabilities | – | 1,576,650 |

| Net assets | $185,619,252 | |

| Net Assets by Source | ||

| Capital received from investors | 185,573,559 | |

| Total distributable earnings | 45,693 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $185,619,252 | 185,620,384 | $1.00 | ||

| Investment Income | ||

| Interest | $756,155 | |

| Dividends | + | 166 |

| Total investment income | 756,321 | |

| Expenses | ||

| Investment adviser and administrator fees | 311,726 | |

| Portfolio accounting fees | 28,839 | |

| Professional fees | 19,385 | |

| Custodian fees | 11,723 | |

| Independent trustees’ fees | 9,759 | |

| Shareholder reports | 7,561 | |

| Transfer agent fees | 1,111 | |

| Other expenses | + | 1,798 |

| Total expenses | 391,902 | |

| Expense reduction by CSIM and its affiliates | – | 84,202 |

| Net expenses | – | 307,700 |

| Net investment income | 448,621 | |

| Realized Gains (Losses) | ||

| Net realized losses on investments | (10) | |

| Increase in net assets resulting from operations | $448,611 | |

| Operations | ||||

| 1/1/20-6/30/20 | 1/1/19-12/31/19 | |||

| Net investment income | $448,621 | $2,710,302 | ||

| Net realized gains (losses) | + | (10) | 117 | |

| Increase in net assets from operations | 448,611 | 2,710,419 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($448,621) | ($2,712,866) | ||

| Transactions in Fund Shares* | ||||

| Shares sold | 146,521,810 | 147,763,496 | ||

| Shares reinvested | 447,852 | 2,712,866 | ||

| Shares redeemed | + | (110,203,358) | (139,896,335) | |

| Net transactions in fund shares | 36,766,304 | 10,580,027 | ||

| Net Assets | ||||

| Beginning of period | 148,852,958 | 138,275,378 | ||

| Total increase | + | 36,766,294 | 10,577,580 | |

| End of period | $185,619,252 | $148,852,958 | ||

| * | Transactions took place at $1.00 per share; figures for share quantities are the same as for dollars. |

| SCHWAB ANNUITY PORTFOLIOS (ORGANIZED JANUARY 21, 1994) | |

| Schwab Government Money Market Portfolio | |

| Schwab S&P 500 Index Portfolio | |

| Schwab VIT Balanced Portfolio | |

| Schwab VIT Balanced with Growth Portfolio | |

| Schwab VIT Growth Portfolio | |

2. Significant Accounting Policies:

3. Risk Factors:

4. Affiliates and Affiliated Transactions:

| Average Daily Net Assets | |

| First $1 billion | 0.35% |

| More than $1 billion but not exceeding $10 billion | 0.32% |

| More than $10 billion but not exceeding $20 billion | 0.30% |

| More than $20 billion but not exceeding $40 billion | 0.27% |

| Over $40 billion | 0.25% |

6. Borrowing from Banks:

7. Federal Income Taxes:

| Ordinary income | $2,712,866 |

8. Independent Registered Public Accounting Firm:

| 1. | the nature, extent and quality of the services provided to the Fund under the Agreement, including the resources of CSIM and its affiliates dedicated to the Fund; |

| 2. | the Fund’s investment performance and how it compared to that of certain other comparable mutual funds and benchmark data; |

| 3. | the Fund’s expenses and how those expenses compared to those of certain other similar mutual funds; |

| 4. | the profitability of CSIM and its affiliates, including Charles Schwab & Co., Inc. (Schwab), with respect to the Fund, including both direct and indirect benefits accruing to CSIM and its affiliates; and |

| 5. | the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Agreement reflect those economies of scale for the benefit of Fund investors. |

| 1 | The meeting on June 9, 2020 was held telephonically in reliance on exemptive relief from the in-person voting requirement under the 1940 Act as provided by the Securities and Exchange Commission. |

| Independent Trustees | |||

| Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

| Robert W. Burns 1959 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) | Retired/Private Investor (Jan. 2009 – present). Formerly, Managing Director, Pacific Investment Management Company, LLC (PIMCO) (investment management firm) and President, PIMCO Funds. | 100 | None |

| John F. Cogan 1947 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Laudus Trust since 2010; Schwab Strategic Trust since 2016) | Senior Fellow (Oct. 1979 – present), The Hoover Institution at Stanford University (public policy think tank); Senior Fellow (2000 – present), Stanford Institute for Economic Policy Research; Professor of Public Policy (1994 – 2015), Stanford University. | 100 | Director (2005 – present), Gilead Sciences, Inc. |

| Nancy F. Heller 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Retired. President and Chairman (2014 – 2016), TIAA Charitable (financial services); Senior Managing Director (2003 – 2016), TIAA (financial services). | 100 | None |

| Stephen Timothy Kochis 1946 Trustee (Trustee of Schwab Strategic Trust since 2012; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) | CEO and Owner (May 2012 – present), Kochis Global (wealth management consulting). | 100 | None |

| Independent Trustees (continued) | |||

| Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

| David L. Mahoney 1954 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Private Investor. | 100 | Director (2004 – present), Corcept Therapeutics Incorporated Director (2009 – present), Adamas Pharmaceuticals, Inc. Director (2003 – 2019), Symantec Corporation |

| Jane P. Moncreiff 1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) | Consultant (2018 – present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009 – 2017), CareGroup Healthcare System, Inc. (healthcare). | 100 | None |

| Kiran M. Patel 1948 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) | Retired. Executive Vice President and General Manager of Small Business Group (Dec. 2008 – Sept. 2013), Intuit, Inc. (financial software and services firm for consumers and small businesses). | 100 | Director (2008 – present), KLA-Tencor Corporation |

| Kimberly S. Patmore 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) | Consultant (2008 – present), Patmore Management Consulting (management consulting). | 100 | None |

| Gerald B. Smith 1950 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2000; Laudus Trust since 2010; Schwab Strategic Trust since 2016) | Chairman, Chief Executive Officer and Founder (Mar. 1990 – present), Smith Graham & Co. (investment advisors). | 100 | Director (2012 – present), Eaton Corporation plc |

| Interested Trustees | |||

| Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) | Principal Occupations During the Past Five Years | Number of Portfolios in Fund Complex Overseen by the Trustee | Other Directorships |

| Walter W. Bettinger II2 1960 Chairman and Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Schwab Strategic Trust since 2009; Laudus Trust since 2010) | Director, President and Chief Executive Officer (Oct. 2008 – present), The Charles Schwab Corporation; President and Chief Executive Officer (Oct. 2008 – present) and Director (May 2008 – present), Charles Schwab & Co., Inc.; Director (Apr. 2006 – present), Charles Schwab Bank, SSB; Director (Nov. 2017 – present), Charles Schwab Premier Bank, SSB; Director (July 2019 – present), Charles Schwab Trust Bank; Director (May 2008 – present) and President and Chief Executive Officer (Aug. 2017 – present), Schwab Holdings, Inc.; Director (July 2016 – present), Charles Schwab Investment Management, Inc. | 100 | Director (2008 – present), The Charles Schwab Corporation |

| Jonathan de St. Paer2 1973 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) | Director (Apr. 2019 – present), President (Oct. 2018 – present), and Chief Executive Officer (Apr. 2019 – Nov. 2019), Charles Schwab Investment Management, Inc.; Senior Vice President (June 2020 – present), Charles Schwab Investment Advisory, Inc.; Trustee and Chief Executive Officer (Apr. 2019 – present) and President (Nov. 2018 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Director (Apr. 2019 – present), Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited; Senior Vice President (Apr. 2019 – present), Senior Vice President – Strategy and Product Development (CSIM) (Jan. 2014 – Mar. 2019), and Vice President (Jan. 2009 – Dec. 2013), Charles Schwab & Co., Inc. | 100 | None |

| Joseph R. Martinetto2 1962 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) | Chief Operating Officer (Feb. 2018 – present) and Senior Executive Vice President (July 2015 – Feb. 2018), The Charles Schwab Corporation; Senior Executive Vice President (July 2015 – present), Charles Schwab & Co., Inc.; Chief Financial Officer (July 2015 – Aug. 2017) and Executive Vice President and Chief Financial Officer (May 2007 – July 2015), The Charles Schwab Corporation and Charles Schwab & Co., Inc.; Director (May 2007 – present), Charles Schwab & Co., Inc.; Director (Apr. 2010 – present) and Chief Executive Officer (July 2013 – Apr. 2015), Charles Schwab Bank, SSB; Director (Nov. 2017 – present), Charles Schwab Premier Bank, SSB; Director (May 2007 – present), Chief Financial Officer (May 2007 – Aug. 2017), Senior Executive Vice President (Feb. 2016 – present), and Executive Vice President (May 2007 – Feb. 2016), Schwab Holdings, Inc. | 100 | None |

| Officers of the Trust | |

| Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) | Principal Occupations During the Past Five Years |

| Jonathan de St. Paer 1973 President and Chief Executive Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) | Director (Apr. 2019 – present), President (Oct. 2018 – present), and Chief Executive Officer (Apr. 2019 – Nov. 2019), Charles Schwab Investment Management, Inc.; Senior Vice President (June 2020 – present), Charles Schwab Investment Advisory, Inc.; Trustee and Chief Executive Officer (Apr. 2019 – present) and President (Nov. 2018 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Director (Apr. 2019 – present), Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited; Senior Vice President (Apr. 2019 – present), Senior Vice President – Strategy and Product Development (CSIM) (Jan. 2014 – Mar. 2019), and Vice President (Jan. 2009 – Dec. 2013), Charles Schwab & Co., Inc. |

| Officers of the Trust (continued) | |

| Name, Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) | Principal Occupations During the Past Five Years |

| Mark Fischer 1970 Treasurer and Chief Financial Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2013) | Treasurer and Chief Financial Officer (Jan. 2016 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Assistant Treasurer (Dec. 2013 – Dec. 2015), Schwab Funds and Laudus Funds; Assistant Treasurer (Nov. 2013 – Dec. 2015), Schwab ETFs; Chief Financial Officer (Mar. 2020 – present) and Vice President (Oct. 2013 – present), Charles Schwab Investment Management, Inc.; Executive Director (Apr. 2011 – Sept. 2013), J.P. Morgan Investor Services; Assistant Treasurer (May 2005 – Mar. 2011), Massachusetts Financial Service Investment Management. |

| Omar Aguilar 1970 Senior Vice President and Chief Investment Officer – Equities and Multi-Asset Strategies (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) | Senior Vice President and Chief Investment Officer (Apr. 2011 – present), Charles Schwab Investment Management, Inc.; Senior Vice President and Chief Investment Officer – Equities and Multi-Asset Strategies (June 2011 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Head of the Portfolio Management Group and Vice President of Portfolio Management (May 2009 – Apr. 2011), Financial Engines, Inc. (investment management firm); Head of Quantitative Equity (July 2004 – Jan. 2009), ING Investment Management. |

| Brett Wander 1961 Senior Vice President and Chief Investment Officer – Fixed Income (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) | Senior Vice President and Chief Investment Officer (Apr. 2011 – present), Charles Schwab Investment Management, Inc.; Senior Vice President and Chief Investment Officer – Fixed Income (June 2011 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Senior Managing Director and Global Head of Active Fixed-Income Strategies (Jan. 2008 – Oct. 2010), State Street Global Advisors; Director of Alpha Strategies (Apr. 2006 – Jan. 2008), Loomis, Sayles & Company (investment management firm). |

| David Lekich 1964 Chief Legal Officer and Secretary, Schwab Funds and Schwab ETFs Vice President and Assistant Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) | Senior Vice President (Sept. 2011 – present) and Vice President (Mar. 2004 – Sept. 2011), Charles Schwab & Co., Inc.; Senior Vice President and Chief Counsel (Sept. 2011 – present) and Vice President (Jan. 2011 – Sept. 2011), Charles Schwab Investment Management, Inc.; Secretary (Apr. 2011 – present) and Chief Legal Officer (Dec. 2011 – present), Schwab Funds; Vice President and Assistant Clerk (Apr. 2011 – present), Laudus Funds; Secretary (May 2011 – present) and Chief Legal Officer (Nov. 2011 – present), Schwab ETFs. |

| Catherine MacGregor 1964 Vice President and Assistant Secretary, Schwab Funds and Schwab ETFs Chief Legal Officer, Vice President and Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2005; Schwab Strategic Trust since 2009) | Vice President (July 2005 – present), Charles Schwab & Co., Inc.; Vice President (Sept. 2005 – present), Charles Schwab Investment Management, Inc.; Vice President (Dec. 2005 – present) and Chief Legal Officer and Clerk (Mar. 2007 – present), Laudus Funds; Vice President (Nov. 2005 – present) and Assistant Secretary (June 2007 – present), Schwab Funds; Vice President and Assistant Secretary (Oct. 2009 – present), Schwab ETFs. |

| 1 | Each Trustee shall hold office until the election and qualification of his or her successor, or until he or she dies, resigns or is removed. The retirement policy requires that each independent trustee retire by December 31 of the year in which the Trustee turns 74 or the Trustee’s twentieth year of service as an independent trustee on any trust in the Fund Complex, whichever occurs first. |

| 2 | Mr. Bettinger, Mr. de St. Paer and Mr. Martinetto are Interested Trustees. Mr. Bettinger is an Interested Trustee because he owns stock of The Charles Schwab Corporation (CSC), the parent company of Charles Schwab Investment Management, Inc. (CSIM), the investment adviser for the trusts in the Fund Complex, is an employee and director of Charles Schwab & Co., Inc. (CS&Co), the principal underwriter for The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust, and is a director of CSIM. Mr. de St. Paer is an Interested Trustee because he owns stock of CSC and is an employee and director of CSIM. Mr. Martinetto is an Interested Trustee because he owns stock of CSC and is an employee and director of CS&Co. |

| 3 | The President, Treasurer and Secretary/Clerk hold office until their respective successors are chosen and qualified or until he or she sooner dies, resigns, is removed or becomes disqualified. Each of the other officers serves at the pleasure of the Board. |

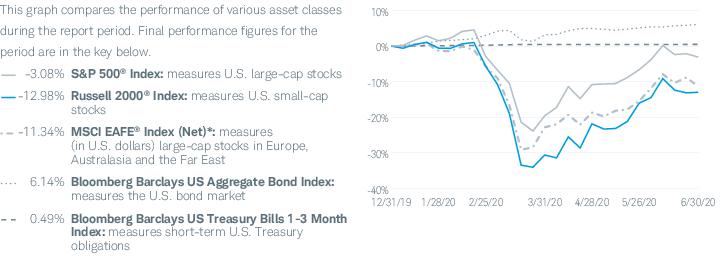

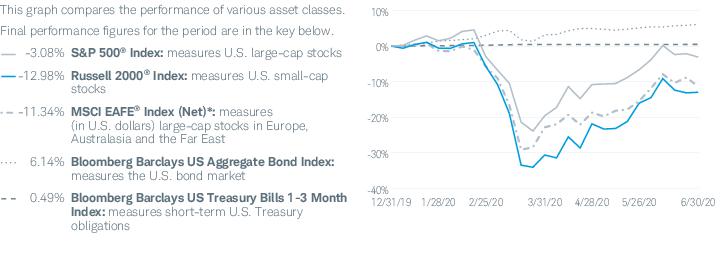

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| Christopher Bliss, CFA, Vice President and Head of Passive Equity Strategies, leads the portfolio management team for Schwab’s passive equity mutual funds and ETFs. He also has overall responsibility for all aspects of the management of the fund. Before joining CSIM in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a managing director and the head of the Americas institutional index team. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Jeremy Brown, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2017, Mr. Brown spent six years with ALPS Advisors, Inc. in Denver, most recently as a senior analyst on the ETF portfolio management and research team where he performed portfolio management, trading, and analytics/research functions for ALPS ETFs and passive funds. Additionally, Mr. Brown led a number of investment research, commentary, industry trend analysis, and sales and marketing support initiatives. |

| Ferian Juwono, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2010, Mr. Juwono worked at BlackRock (formerly Barclays Global Investors) where he spent more than three years as a portfolio manager, managing equity index funds for institutional clients, and two years as a senior business analyst. Prior to that, Mr. Juwono worked for more than four years as a senior financial analyst with Union Bank of California. |

| Sabya Sinha, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2015, Mr. Sinha spent a year at F-Squared Investments on the product development and analytics team. Prior to F-Squared, he worked at IndexIQ Advisors as a senior index portfolio manager for three years and for Bank of America’s Columbia Management subsidiary as a portfolio manager for three years. |

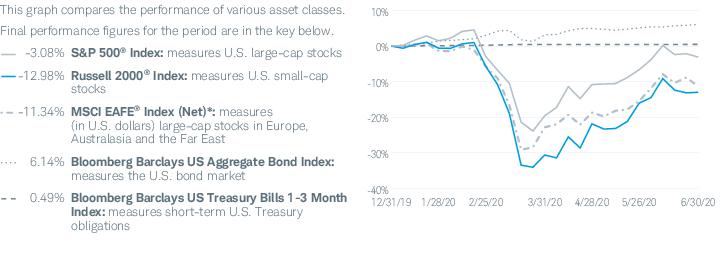

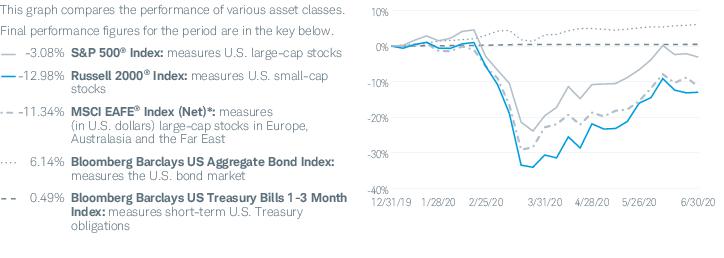

| Fund and Inception Date | 6 Months | 1 Year | 5 Years | 10 Years |

| Fund: Schwab S&P 500 Index Portfolio (11/01/96) | -3.17% | 7.39% | 10.60% | 13.78% |

| S&P 500® Index | -3.08% | 7.51% | 10.73% | 13.99% |

| Fund Category: Morningstar Large-Cap Blend2 | -4.21% | 5.37% | 9.31% | 13.02% |

| Fund Expense Ratio3: 0.03% | ||||

| 1 | Fund performance does not reflect the additional fees and expenses imposed by the insurance company under the variable insurance product contract. If those contract fees and expenses were included, the performance would be less than that shown. Please refer to the variable insurance product prospectus for a complete listing of these expenses. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. |

| Number of Holdings | 507 |

| Weighted Average Market Cap ($ x 1,000,000) | $388,004 |

| Price/Earnings Ratio (P/E) | 23.2 |

| Price/Book Ratio (P/B) | 3.4 |

| Portfolio Turnover Rate | 12% 2 |

| 1 | Excludes derivatives. |

| 2 | Not annualized. |

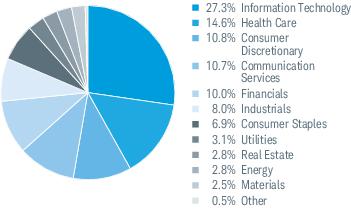

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

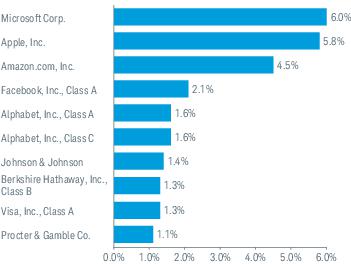

| 4 | This list is not a recommendation of any security by the investment adviser. |

| Expense Ratio (Annualized)1 | Beginning Account Value at 1/1/20 | Ending Account Value (Net of Expenses) at 6/30/20 | Expenses Paid During Period 1/1/20-6/30/202 | |

| Schwab S&P 500 Index Portfolio | ||||

| Actual Return | 0.03% | $1,000.00 | $ 968.30 | $0.15 |

| Hypothetical 5% Return | 0.03% | $1,000.00 | $1,024.75 | $0.15 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by 182 days of the period, and divided by the 366 days of the fiscal year. |

| 1/1/20– 6/30/20* | 1/1/19– 12/31/19 | 1/1/18– 12/31/18 | 1/1/17– 12/31/17 | 1/1/16– 12/31/16 | 1/1/15– 12/31/15 | |

| Per-Share Data | ||||||

| Net asset value at beginning of period | $47.48 | $37.10 | $39.51 | $33.01 | $30.09 | $30.21 |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.56 | 0.91 | 0.82 | 0.71 | 0.62 | 0.59 |

| Net realized and unrealized gains (losses) | (2.07) | 10.64 | (2.51) | 6.39 | 2.85 | (0.24) |

| Total from investment operations | (1.51) | 11.55 | (1.69) | 7.10 | 3.47 | 0.35 |

| Less distributions: | ||||||

| Distributions from net investment income | (0.53) | (0.78) | (0.68) | (0.59) | (0.55) | (0.47) |

| Distributions from net realized gains | (0.08) | (0.39) | (0.04) | (0.01) | — | — |

| Total distributions | (0.61) | (1.17) | (0.72) | (0.60) | (0.55) | (0.47) |

| Net asset value at end of period | $45.36 | $47.48 | $37.10 | $39.51 | $33.01 | $30.09 |

| Total return | (3.17%) 2 | 31.48% | (4.40%) | 21.72% | 11.68% | 1.17% |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Total expenses | 0.03% 3 | 0.03% | 0.03% | 0.06% 4 | 0.22% | 0.24% |

| Net operating expenses | N/A | N/A | N/A 5 | 0.06% 4 | 0.22% | 0.24% |

| Net investment income (loss) | 2.60% 3 | 2.13% | 2.03% | 1.97% | 2.00% | 1.94% |

| Portfolio turnover rate | 12% 2 | 6% | 5% | 3% | 2% | 3% |

| Net assets, end of period (x 1,000,000) | $759 | $588 | $340 | $346 | $282 | $245 |

| * | Unaudited. |

| Security | Number of Shares | Value ($) |

| Common Stock 99.3% of net assets | ||

| Automobiles & Components 0.3% | ||

| Aptiv plc | 7,883 | 614,244 |

| BorgWarner, Inc. | 6,051 | 213,600 |

| Ford Motor Co. | 114,937 | 698,817 |

| General Motors Co. | 37,051 | 937,390 |

| 2,464,051 | ||

| Banks 3.6% | ||

| Bank of America Corp. | 229,643 | 5,454,021 |

| Citigroup, Inc. | 61,227 | 3,128,700 |

| Citizens Financial Group, Inc. | 12,551 | 316,787 |

| Comerica, Inc. | 4,093 | 155,943 |

| Fifth Third Bancorp | 20,974 | 404,379 |

| First Republic Bank | 5,045 | 534,720 |

| Huntington Bancshares, Inc. | 29,850 | 269,695 |

| JPMorgan Chase & Co. | 89,617 | 8,429,375 |

| KeyCorp | 28,586 | 348,178 |

| M&T Bank Corp. | 3,772 | 392,175 |

| People’s United Financial, Inc. | 12,501 | 144,637 |

| Regions Financial Corp. | 28,270 | 314,362 |

| SVB Financial Group * | 1,512 | 325,881 |

| The PNC Financial Services Group, Inc. | 12,478 | 1,312,810 |

| Truist Financial Corp. | 39,629 | 1,488,069 |

| U.S. Bancorp | 40,313 | 1,484,325 |

| Wells Fargo & Co. | 109,729 | 2,809,062 |

| Zions Bancorp NA | 4,827 | 164,118 |

| 27,477,237 | ||

| Capital Goods 5.5% | ||

| 3M Co. | 16,916 | 2,638,727 |

| A.O. Smith Corp. | 3,938 | 185,559 |

| Allegion plc | 2,723 | 278,345 |

| AMETEK, Inc. | 6,748 | 603,069 |

| Carrier Global Corp. | 23,957 | 532,325 |

| Caterpillar, Inc. | 15,918 | 2,013,627 |

| Cummins, Inc. | 4,337 | 751,429 |

| Deere & Co. | 9,201 | 1,445,937 |

| Dover Corp. | 4,218 | 407,290 |

| Eaton Corp. plc | 11,763 | 1,029,027 |

| Emerson Electric Co. | 17,571 | 1,089,929 |

| Fastenal Co. | 16,810 | 720,140 |

| Flowserve Corp. | 3,835 | 109,374 |

| Fortive Corp. | 8,718 | 589,860 |

| Fortune Brands Home & Security, Inc. | 4,138 | 264,542 |

| General Dynamics Corp. | 6,830 | 1,020,812 |

| General Electric Co. | 257,258 | 1,757,072 |

| Honeywell International, Inc. | 20,639 | 2,984,193 |

| Howmet Aerospace, Inc. | 11,352 | 179,929 |

| Huntington Ingalls Industries, Inc. | 1,199 | 209,213 |

| IDEX Corp. | 2,229 | 352,271 |

| Illinois Tool Works, Inc. | 8,453 | 1,478,007 |

| Ingersoll Rand, Inc. * | 10,144 | 285,249 |

| Jacobs Engineering Group, Inc. | 3,828 | 324,614 |

| Johnson Controls International plc | 21,878 | 746,915 |

| L3Harris Technologies, Inc. | 6,347 | 1,076,895 |

| Security | Number of Shares | Value ($) |

| Lockheed Martin Corp. | 7,256 | 2,647,859 |

| Masco Corp. | 7,762 | 389,730 |

| Northrop Grumman Corp. | 4,559 | 1,401,619 |

| Otis Worldwide Corp. | 11,973 | 680,785 |

| PACCAR, Inc. | 10,188 | 762,572 |

| Parker-Hannifin Corp. | 3,765 | 690,012 |

| Pentair plc | 4,926 | 187,139 |

| Quanta Services, Inc. | 4,052 | 158,960 |

| Raytheon Technologies Corp. | 43,250 | 2,665,065 |

| Rockwell Automation, Inc. | 3,406 | 725,478 |

| Roper Technologies, Inc. | 3,070 | 1,191,958 |

| Snap-on, Inc. | 1,607 | 222,586 |

| Stanley Black & Decker, Inc. | 4,533 | 631,810 |

| Teledyne Technologies, Inc. * | 1,077 | 334,893 |

| Textron, Inc. | 6,690 | 220,168 |

| The Boeing Co. | 15,768 | 2,890,274 |

| Trane Technologies plc | 7,022 | 624,818 |

| TransDigm Group, Inc. | 1,479 | 653,792 |

| United Rentals, Inc. * | 2,120 | 315,965 |

| W.W. Grainger, Inc. | 1,279 | 401,811 |

| Westinghouse Air Brake Technologies Corp. | 5,337 | 307,251 |

| Xylem, Inc. | 5,278 | 342,859 |

| 41,521,754 | ||

| Commercial & Professional Services 0.8% | ||

| Cintas Corp. | 2,479 | 660,306 |

| Copart, Inc. * | 6,076 | 505,949 |

| Equifax, Inc. | 3,571 | 613,783 |

| IHS Markit Ltd. | 11,752 | 887,276 |

| Nielsen Holdings plc | 10,428 | 154,960 |

| Republic Services, Inc. | 6,173 | 506,495 |

| Robert Half International, Inc. | 3,372 | 178,143 |

| Rollins, Inc. | 4,127 | 174,944 |

| Verisk Analytics, Inc. | 4,771 | 812,024 |

| Waste Management, Inc. | 11,439 | 1,211,504 |

| 5,705,384 | ||

| Consumer Durables & Apparel 1.0% | ||

| D.R. Horton, Inc. | 9,734 | 539,750 |

| Garmin Ltd. | 4,274 | 416,715 |

| Hanesbrands, Inc. | 10,254 | 115,768 |

| Hasbro, Inc. | 3,730 | 279,563 |

| Leggett & Platt, Inc. | 3,857 | 135,573 |

| Lennar Corp., Class A | 8,077 | 497,705 |

| Mohawk Industries, Inc. * | 1,742 | 177,266 |

| Newell Brands, Inc. | 11,169 | 177,364 |

| NIKE, Inc., Class B | 36,473 | 3,576,178 |

| NVR, Inc. * | 102 | 332,392 |

| PulteGroup, Inc. | 7,464 | 254,000 |

| PVH Corp. | 2,091 | 100,473 |

| Ralph Lauren Corp. | 1,406 | 101,963 |

| Tapestry, Inc. | 8,085 | 107,369 |

| Under Armour, Inc., Class A * | 5,516 | 53,726 |

| Under Armour, Inc., Class C * | 5,703 | 50,414 |

| VF Corp. | 9,381 | 571,678 |

| Whirlpool Corp. | 1,822 | 236,004 |

| 7,723,901 | ||

| Security | Number of Shares | Value ($) |

| Consumer Services 1.5% | ||

| Carnival Corp. (a) | 13,931 | 228,747 |

| Chipotle Mexican Grill, Inc. * | 754 | 793,480 |

| Darden Restaurants, Inc. | 3,822 | 289,593 |

| Domino’s Pizza, Inc. | 1,150 | 424,856 |

| H&R Block, Inc. | 5,719 | 81,667 |

| Hilton Worldwide Holdings, Inc. | 8,151 | 598,691 |

| Las Vegas Sands Corp. | 9,904 | 451,028 |

| Marriott International, Inc., Class A | 7,910 | 678,124 |

| McDonald’s Corp. | 21,866 | 4,033,621 |

| MGM Resorts International | 14,505 | 243,684 |

| Norwegian Cruise Line Holdings Ltd. * | 7,541 | 123,899 |

| Royal Caribbean Cruises Ltd. | 5,037 | 253,361 |

| Starbucks Corp. | 34,352 | 2,527,964 |

| Wynn Resorts Ltd. | 2,874 | 214,084 |

| Yum! Brands, Inc. | 8,863 | 770,283 |

| 11,713,082 | ||

| Diversified Financials 4.5% | ||

| American Express Co. | 19,413 | 1,848,118 |

| Ameriprise Financial, Inc. | 3,600 | 540,144 |

| Berkshire Hathaway, Inc., Class B * | 57,175 | 10,206,309 |

| BlackRock, Inc. | 4,538 | 2,469,080 |

| Capital One Financial Corp. | 13,386 | 837,830 |

| Cboe Global Markets, Inc. | 3,214 | 299,802 |

| CME Group, Inc. | 10,549 | 1,714,634 |

| Discover Financial Services | 9,009 | 451,261 |

| E*TRADE Financial Corp. | 6,513 | 323,891 |

| Franklin Resources, Inc. | 8,180 | 171,535 |

| Intercontinental Exchange, Inc. | 16,100 | 1,474,760 |

| Invesco Ltd. | 10,917 | 117,467 |

| MarketAxess Holdings, Inc. | 1,112 | 557,023 |

| Moody’s Corp. | 4,744 | 1,303,319 |

| Morgan Stanley | 35,226 | 1,701,416 |

| MSCI, Inc. | 2,502 | 835,218 |

| Nasdaq, Inc. | 3,365 | 402,017 |

| Northern Trust Corp. | 6,123 | 485,799 |

| Raymond James Financial, Inc. | 3,569 | 245,654 |

| S&P Global, Inc. | 7,087 | 2,335,025 |

| State Street Corp. | 10,354 | 657,997 |

| Synchrony Financial | 15,796 | 350,039 |

| T. Rowe Price Group, Inc. | 6,695 | 826,832 |

| The Bank of New York Mellon Corp. | 23,706 | 916,237 |

| The Charles Schwab Corp. (b) | 33,493 | 1,130,054 |

| The Goldman Sachs Group, Inc. | 9,105 | 1,799,330 |

| 34,000,791 | ||

| Energy 2.8% | ||

| Apache Corp. | 11,021 | 148,784 |

| Baker Hughes Co. | 19,287 | 296,827 |

| Cabot Oil & Gas Corp. | 11,729 | 201,504 |

| Chevron Corp. | 54,911 | 4,899,709 |

| Concho Resources, Inc. | 5,792 | 298,288 |

| ConocoPhillips | 31,546 | 1,325,563 |

| Devon Energy Corp. | 11,343 | 128,630 |

| Diamondback Energy, Inc. | 4,642 | 194,128 |

| EOG Resources, Inc. | 17,123 | 867,451 |

| Exxon Mobil Corp. | 124,358 | 5,561,290 |

| Halliburton Co. | 25,726 | 333,923 |

| Hess Corp. | 7,682 | 398,004 |

| HollyFrontier Corp. | 4,351 | 127,049 |

| Kinder Morgan, Inc. | 57,087 | 866,010 |

| Marathon Oil Corp. | 23,444 | 143,477 |

| Marathon Petroleum Corp. | 19,132 | 715,154 |

| National-Oilwell Varco, Inc. | 11,311 | 138,560 |

| Security | Number of Shares | Value ($) |

| Noble Energy, Inc. | 14,019 | 125,610 |

| Occidental Petroleum Corp. | 26,475 | 484,492 |

| ONEOK, Inc. | 12,938 | 429,800 |

| Phillips 66 | 12,844 | 923,484 |

| Pioneer Natural Resources Co. | 4,855 | 474,334 |

| Schlumberger Ltd. | 40,860 | 751,415 |

| TechnipFMC plc | 12,321 | 84,276 |

| Valero Energy Corp. | 11,974 | 704,311 |

| Williams Cos., Inc. | 35,721 | 679,413 |

| 21,301,486 | ||

| Food & Staples Retailing 1.5% | ||

| Costco Wholesale Corp. | 12,985 | 3,937,182 |

| Kroger Co. | 23,121 | 782,646 |

| Sysco Corp. | 14,953 | 817,331 |

| Walgreens Boots Alliance, Inc. | 21,670 | 918,591 |

| Walmart, Inc. | 41,642 | 4,987,879 |

| 11,443,629 | ||

| Food, Beverage & Tobacco 3.5% | ||

| Altria Group, Inc. | 54,651 | 2,145,052 |

| Archer-Daniels-Midland Co. | 16,315 | 650,968 |

| Brown-Forman Corp., Class B | 5,340 | 339,944 |

| Campbell Soup Co. | 4,950 | 245,668 |

| Conagra Brands, Inc. | 14,373 | 505,498 |

| Constellation Brands, Inc., Class A | 4,941 | 864,428 |

| General Mills, Inc. | 17,827 | 1,099,035 |

| Hormel Foods Corp. | 8,243 | 397,890 |

| Kellogg Co. | 7,357 | 486,003 |

| Lamb Weston Holdings, Inc. | 4,280 | 273,620 |

| McCormick & Co., Inc. | 3,644 | 653,770 |

| Molson Coors Beverage Co., Class B | 5,505 | 189,152 |

| Mondelez International, Inc., Class A | 41,983 | 2,146,591 |

| Monster Beverage Corp. * | 11,001 | 762,589 |

| PepsiCo, Inc. | 40,812 | 5,397,795 |

| Philip Morris International, Inc. | 45,794 | 3,208,328 |

| The Coca-Cola Co. | 113,693 | 5,079,803 |

| The Hershey Co. | 4,346 | 563,329 |

| The JM Smucker Co. | 3,343 | 353,723 |

| The Kraft Heinz Co. | 18,368 | 585,756 |

| Tyson Foods, Inc., Class A | 8,651 | 516,551 |

| 26,465,493 | ||

| Health Care Equipment & Services 6.7% | ||

| Abbott Laboratories | 52,024 | 4,756,554 |

| ABIOMED, Inc. * | 1,323 | 319,584 |

| Align Technology, Inc. * | 2,102 | 576,873 |

| AmerisourceBergen Corp. | 4,364 | 439,760 |

| Anthem, Inc. | 7,414 | 1,949,734 |

| Baxter International, Inc. | 14,964 | 1,288,400 |

| Becton, Dickinson & Co. | 8,673 | 2,075,189 |

| Boston Scientific Corp. * | 42,024 | 1,475,463 |

| Cardinal Health, Inc. | 8,573 | 447,425 |

| Centene Corp. * | 17,030 | 1,082,256 |

| Cerner Corp. | 8,951 | 613,591 |

| Cigna Corp. * | 10,850 | 2,036,002 |

| CVS Health Corp. | 38,436 | 2,497,187 |

| Danaher Corp. | 18,507 | 3,272,593 |

| DaVita, Inc. * | 2,506 | 198,325 |

| Dentsply Sirona, Inc. | 6,433 | 283,438 |

| DexCom, Inc. * | 2,715 | 1,100,661 |

| Edwards Lifesciences Corp. * | 18,225 | 1,259,530 |

| HCA Healthcare, Inc. | 7,753 | 752,506 |

| Henry Schein, Inc. * | 4,197 | 245,063 |

| Hologic, Inc. * | 7,596 | 432,972 |

| Security | Number of Shares | Value ($) |

| Humana, Inc. | 3,891 | 1,508,735 |

| IDEXX Laboratories, Inc. * | 2,498 | 824,740 |

| Intuitive Surgical, Inc. * | 3,430 | 1,954,517 |

| Laboratory Corp. of America Holdings * | 2,868 | 476,403 |

| McKesson Corp. | 4,759 | 730,126 |

| Medtronic plc | 39,441 | 3,616,740 |

| Quest Diagnostics, Inc. | 3,947 | 449,800 |

| ResMed, Inc. | 4,255 | 816,960 |

| Steris plc | 2,509 | 384,981 |

| Stryker Corp. | 9,481 | 1,708,381 |

| Teleflex, Inc. | 1,367 | 497,561 |

| The Cooper Cos., Inc. | 1,440 | 408,442 |

| UnitedHealth Group, Inc. | 27,891 | 8,226,450 |

| Universal Health Services, Inc., Class B | 2,283 | 212,068 |

| Varian Medical Systems, Inc. * | 2,664 | 326,393 |

| West Pharmaceutical Services, Inc. | 2,169 | 492,732 |

| Zimmer Biomet Holdings, Inc. | 6,082 | 725,947 |

| 50,464,082 | ||

| Household & Personal Products 1.9% | ||

| Church & Dwight Co., Inc. | 7,245 | 560,039 |

| Clorox Co. | 3,679 | 807,062 |

| Colgate-Palmolive Co. | 25,191 | 1,845,493 |

| Coty, Inc., Class A | 8,663 | 38,724 |

| Kimberly-Clark Corp. | 10,015 | 1,415,620 |

| Procter & Gamble Co. | 72,811 | 8,706,011 |

| The Estee Lauder Cos., Inc., Class A | 6,611 | 1,247,363 |

| 14,620,312 | ||

| Insurance 1.9% | ||

| AFLAC, Inc. | 21,092 | 759,945 |

| American International Group, Inc. | 25,326 | 789,665 |

| Aon plc, Class A | 6,796 | 1,308,909 |

| Arthur J. Gallagher & Co. | 5,576 | 543,604 |

| Assurant, Inc. | 1,741 | 179,828 |

| Chubb Ltd. | 13,283 | 1,681,893 |

| Cincinnati Financial Corp. | 4,454 | 285,190 |

| Everest Re Group Ltd. | 1,177 | 242,697 |

| Globe Life, Inc. | 2,871 | 213,114 |

| Lincoln National Corp. | 5,682 | 209,041 |

| Loews Corp. | 7,116 | 244,008 |

| Marsh & McLennan Cos., Inc. | 15,005 | 1,611,087 |

| MetLife, Inc. | 22,671 | 827,945 |

| Principal Financial Group, Inc. | 7,480 | 310,719 |

| Prudential Financial, Inc. | 11,609 | 706,988 |

| The Allstate Corp. | 9,236 | 895,800 |

| The Hartford Financial Services Group, Inc. | 10,564 | 407,242 |

| The Progressive Corp. | 17,214 | 1,379,013 |

| The Travelers Cos., Inc. | 7,436 | 848,076 |

| Unum Group | 6,042 | 100,237 |

| Willis Towers Watson plc | 3,787 | 745,850 |

| WR Berkley Corp. | 4,156 | 238,097 |

| 14,528,948 | ||

| Materials 2.5% | ||

| Air Products & Chemicals, Inc. | 6,498 | 1,569,007 |

| Albemarle Corp. | 3,108 | 239,969 |

| Amcor plc * | 46,305 | 472,774 |

| Avery Dennison Corp. | 2,447 | 279,178 |

| Ball Corp. | 9,588 | 666,270 |

| Celanese Corp. | 3,484 | 300,809 |

| CF Industries Holdings, Inc. | 6,247 | 175,791 |

| Corteva, Inc. * | 22,073 | 591,336 |

| Dow, Inc. * | 21,824 | 889,546 |

| DuPont de Nemours, Inc. | 21,584 | 1,146,758 |

| Security | Number of Shares | Value ($) |

| Eastman Chemical Co. | 3,984 | 277,446 |

| Ecolab, Inc. | 7,276 | 1,447,560 |

| FMC Corp. | 3,799 | 378,456 |

| Freeport-McMoRan, Inc. | 42,876 | 496,075 |

| International Flavors & Fragrances, Inc. | 3,129 | 383,177 |

| International Paper Co. | 11,603 | 408,542 |

| Linde plc | 15,449 | 3,276,887 |

| LyondellBasell Industries N.V., Class A | 7,581 | 498,223 |

| Martin Marietta Materials, Inc. | 1,832 | 378,436 |

| Newmont Corp. | 23,596 | 1,456,817 |

| Nucor Corp. | 8,886 | 367,969 |

| Packaging Corp. of America | 2,775 | 276,945 |

| PPG Industries, Inc. | 6,930 | 734,996 |

| Sealed Air Corp. | 4,529 | 148,778 |

| The Mosaic Co. | 10,249 | 128,215 |

| The Sherwin-Williams Co. | 2,377 | 1,373,550 |

| Vulcan Materials Co. | 3,879 | 449,382 |

| WestRock Co. | 7,691 | 217,348 |

| 19,030,240 | ||

| Media & Entertainment 8.7% | ||

| Activision Blizzard, Inc. | 22,661 | 1,719,970 |

| Alphabet, Inc., Class A * | 8,825 | 12,514,291 |

| Alphabet, Inc., Class C * | 8,602 | 12,159,873 |

| Charter Communications, Inc., Class A * | 4,433 | 2,261,007 |

| Comcast Corp., Class A | 133,959 | 5,221,722 |

| Discovery, Inc., Class A * | 4,635 | 97,799 |

| Discovery, Inc., Class C * | 9,389 | 180,832 |

| DISH Network Corp., Class A * | 7,610 | 262,621 |

| Electronic Arts, Inc. * | 8,491 | 1,121,237 |

| Facebook, Inc., Class A * | 70,720 | 16,058,390 |

| Fox Corp., Class A | 10,077 | 270,265 |

| Fox Corp., Class B * | 4,684 | 125,719 |

| Live Nation Entertainment, Inc. * | 4,209 | 186,585 |

| Netflix, Inc. * | 12,936 | 5,886,397 |

| News Corp., Class A | 11,388 | 135,062 |

| News Corp., Class B | 3,569 | 42,650 |

| Omnicom Group, Inc. | 6,305 | 344,253 |

| Take-Two Interactive Software, Inc. * | 3,352 | 467,839 |

| The Interpublic Group of Cos., Inc. | 11,360 | 194,938 |

| Twitter, Inc. * | 23,079 | 687,523 |

| ViacomCBS, Inc., Class B | 15,838 | 369,342 |

| Walt Disney Co. | 53,126 | 5,924,080 |

| 66,232,395 | ||

| Pharmaceuticals, Biotechnology & Life Sciences 7.9% | ||

| AbbVie, Inc. | 51,833 | 5,088,964 |

| Agilent Technologies, Inc. | 9,070 | 801,516 |

| Alexion Pharmaceuticals, Inc. * | 6,486 | 727,989 |

| Amgen, Inc. | 17,301 | 4,080,614 |

| Bio-Rad Laboratories, Inc., Class A * | 629 | 283,987 |

| Biogen, Inc. * | 4,800 | 1,284,240 |

| Bristol-Myers Squibb Co. | 66,555 | 3,913,434 |

| Eli Lilly & Co. | 24,763 | 4,065,589 |

| Gilead Sciences, Inc. | 36,883 | 2,837,778 |

| Illumina, Inc. * | 4,324 | 1,601,393 |

| Incyte Corp. * | 5,308 | 551,873 |

| IQVIA Holdings, Inc. * | 5,223 | 741,039 |

| Johnson & Johnson | 77,489 | 10,897,278 |

| Merck & Co., Inc. | 74,244 | 5,741,289 |

| Mettler-Toledo International, Inc. * | 703 | 566,302 |

| Mylan N.V. * | 15,126 | 243,226 |

| PerkinElmer, Inc. | 3,294 | 323,109 |

| Perrigo Co., plc | 3,989 | 220,472 |

| Pfizer, Inc. | 163,383 | 5,342,624 |

| Regeneron Pharmaceuticals, Inc. * | 2,967 | 1,850,370 |

| Security | Number of Shares | Value ($) |

| Thermo Fisher Scientific, Inc. | 11,616 | 4,208,941 |

| Vertex Pharmaceuticals, Inc. * | 7,628 | 2,214,485 |

| Waters Corp. * | 1,821 | 328,508 |

| Zoetis, Inc. | 13,959 | 1,912,941 |

| 59,827,961 | ||

| Real Estate 2.8% | ||

| Alexandria Real Estate Equities, Inc. | 3,709 | 601,785 |

| American Tower Corp. | 13,037 | 3,370,586 |

| Apartment Investment & Management Co., Class A | 4,362 | 164,186 |

| AvalonBay Communities, Inc. | 4,137 | 639,746 |

| Boston Properties, Inc. | 4,253 | 384,386 |

| CBRE Group, Inc., Class A * | 9,892 | 447,316 |

| Crown Castle International Corp. | 12,255 | 2,050,874 |

| Digital Realty Trust, Inc. | 7,890 | 1,121,248 |

| Duke Realty Corp. | 10,876 | 384,902 |

| Equinix, Inc. | 2,603 | 1,828,087 |

| Equity Residential | 10,291 | 605,317 |

| Essex Property Trust, Inc. | 1,921 | 440,236 |

| Extra Space Storage, Inc. | 3,796 | 350,636 |

| Federal Realty Investment Trust | 2,058 | 175,362 |

| Healthpeak Properties, Inc. | 15,819 | 435,972 |

| Host Hotels & Resorts, Inc. | 20,712 | 223,482 |

| Iron Mountain, Inc. | 8,414 | 219,605 |

| Kimco Realty Corp. | 12,711 | 163,209 |

| Mid-America Apartment Communities, Inc. | 3,375 | 387,011 |

| Prologis, Inc. | 21,717 | 2,026,848 |

| Public Storage | 4,422 | 848,538 |

| Realty Income Corp. | 10,104 | 601,188 |

| Regency Centers Corp. | 4,992 | 229,083 |

| SBA Communications Corp. | 3,282 | 977,773 |

| Simon Property Group, Inc. | 8,993 | 614,941 |

| SL Green Realty Corp. | 2,249 | 110,853 |

| UDR, Inc. | 8,686 | 324,683 |

| Ventas, Inc. | 11,019 | 403,516 |

| Vornado Realty Trust | 4,641 | 177,333 |

| Welltower, Inc. | 12,276 | 635,283 |

| Weyerhaeuser Co. | 22,007 | 494,277 |

| 21,438,262 | ||

| Retailing 7.9% | ||

| Advance Auto Parts, Inc. | 2,029 | 289,031 |

| Amazon.com, Inc. * | 12,322 | 33,994,180 |

| AutoZone, Inc. * | 687 | 775,018 |

| Best Buy Co., Inc. | 6,673 | 582,353 |

| Booking Holdings, Inc. * | 1,204 | 1,917,177 |

| CarMax, Inc. * | 4,778 | 427,870 |

| Dollar General Corp. | 7,404 | 1,410,536 |

| Dollar Tree, Inc. * | 6,979 | 646,814 |

| eBay, Inc. | 19,427 | 1,018,946 |

| Expedia Group, Inc. | 3,986 | 327,649 |

| Genuine Parts Co. | 4,257 | 370,189 |

| Kohl’s Corp. | 4,584 | 95,210 |

| L Brands, Inc. | 6,804 | 101,856 |

| LKQ Corp. * | 8,979 | 235,250 |

| Lowe’s Cos., Inc. | 22,206 | 3,000,475 |

| O'Reilly Automotive, Inc. * | 2,183 | 920,506 |

| Ross Stores, Inc. | 10,454 | 891,099 |

| Target Corp. | 14,707 | 1,763,810 |

| The Gap, Inc. | 6,363 | 80,301 |

| The Home Depot, Inc. | 31,633 | 7,924,383 |

| The TJX Cos., Inc. | 35,234 | 1,781,431 |

| Tiffany & Co. | 3,213 | 391,793 |

| Security | Number of Shares | Value ($) |

| Tractor Supply Co. | 3,402 | 448,349 |

| Ulta Beauty, Inc. * | 1,657 | 337,067 |

| 59,731,293 | ||

| Semiconductors & Semiconductor Equipment 4.8% | ||

| Advanced Micro Devices, Inc. * | 34,450 | 1,812,414 |

| Analog Devices, Inc. | 10,836 | 1,328,927 |

| Applied Materials, Inc. | 26,956 | 1,629,490 |

| Broadcom, Inc. | 11,758 | 3,710,942 |

| Intel Corp. | 124,525 | 7,450,331 |

| KLA Corp. | 4,560 | 886,829 |

| Lam Research Corp. | 4,270 | 1,381,174 |

| Maxim Integrated Products, Inc. | 7,842 | 475,304 |

| Microchip Technology, Inc. | 7,217 | 760,022 |

| Micron Technology, Inc. * | 32,713 | 1,685,374 |

| NVIDIA Corp. | 18,092 | 6,873,332 |

| Qorvo, Inc. * | 3,371 | 372,597 |

| Qualcomm, Inc. | 33,085 | 3,017,683 |

| Skyworks Solutions, Inc. | 4,907 | 627,409 |

| Texas Instruments, Inc. | 26,992 | 3,427,174 |

| Xilinx, Inc. | 7,153 | 703,784 |

| 36,142,786 | ||

| Software & Services 15.0% | ||

| Accenture plc, Class A | 18,734 | 4,022,564 |

| Adobe, Inc. * | 14,171 | 6,168,778 |

| Akamai Technologies, Inc. * | 4,773 | 511,141 |

| ANSYS, Inc. * | 2,527 | 737,202 |

| Autodesk, Inc. * | 6,449 | 1,542,536 |

| Automatic Data Processing, Inc. | 12,640 | 1,881,970 |

| Broadridge Financial Solutions, Inc. | 3,389 | 427,658 |

| Cadence Design Systems, Inc. * | 8,224 | 789,175 |

| Citrix Systems, Inc. | 3,413 | 504,817 |

| Cognizant Technology Solutions Corp., Class A | 15,898 | 903,324 |

| DXC Technology Co. | 7,503 | 123,799 |

| Fidelity National Information Services, Inc. | 18,171 | 2,436,549 |

| Fiserv, Inc. * | 16,540 | 1,614,635 |

| FleetCor Technologies, Inc. * | 2,465 | 620,021 |

| Fortinet, Inc. * | 3,946 | 541,667 |

| Gartner, Inc. * | 2,621 | 318,006 |

| Global Payments, Inc. | 8,787 | 1,490,451 |

| International Business Machines Corp. | 26,111 | 3,153,425 |

| Intuit, Inc. | 7,669 | 2,271,481 |

| Jack Henry & Associates, Inc. | 2,255 | 414,988 |

| Leidos Holdings, Inc. | 3,937 | 368,779 |

| Mastercard, Inc., Class A | 25,993 | 7,686,130 |

| Microsoft Corp. | 223,037 | 45,390,260 |

| NortonLifeLock, Inc. | 15,937 | 316,031 |

| Oracle Corp. | 61,212 | 3,383,187 |

| Paychex, Inc. | 9,388 | 711,141 |

| Paycom Software, Inc. * | 1,419 | 439,507 |

| PayPal Holdings, Inc. * | 34,534 | 6,016,859 |

| Salesforce Com, Inc. * | 26,500 | 4,964,245 |

| ServiceNow, Inc. * | 5,609 | 2,271,982 |

| Synopsys, Inc. * | 4,435 | 864,825 |

| The Western Union Co. | 12,090 | 261,386 |

| Tyler Technologies, Inc. * | 1,169 | 405,503 |

| VeriSign, Inc. * | 2,990 | 618,422 |

| Visa, Inc., Class A | 49,619 | 9,584,902 |

| 113,757,346 | ||

| Technology Hardware & Equipment 7.5% | ||

| Amphenol Corp., Class A | 8,689 | 832,493 |

| Apple, Inc. | 119,828 | 43,713,255 |

| Security | Number of Shares | Value ($) |

| Arista Networks, Inc. * | 1,573 | 330,377 |

| CDW Corp. | 4,179 | 485,516 |

| Cisco Systems, Inc. | 124,745 | 5,818,107 |

| Corning, Inc. | 22,330 | 578,347 |

| F5 Networks, Inc. * | 1,782 | 248,553 |

| FLIR Systems, Inc. | 3,840 | 155,789 |

| Hewlett Packard Enterprise Co. | 37,921 | 368,971 |

| HP, Inc. | 42,052 | 732,966 |

| IPG Photonics Corp. * | 1,042 | 167,126 |

| Juniper Networks, Inc. | 9,809 | 224,234 |

| Keysight Technologies, Inc. * | 5,498 | 554,089 |

| Motorola Solutions, Inc. | 4,995 | 699,949 |

| NetApp, Inc. | 6,505 | 288,627 |

| Seagate Technology plc | 6,637 | 321,297 |

| TE Connectivity Ltd. | 9,705 | 791,443 |

| Western Digital Corp. | 8,813 | 389,094 |

| Xerox Holdings Corp. * | 5,453 | 83,376 |

| Zebra Technologies Corp., Class A * | 1,562 | 399,794 |

| 57,183,403 | ||

| Telecommunication Services 2.0% | ||

| AT&T, Inc. | 209,540 | 6,334,394 |

| CenturyLink, Inc. | 29,124 | 292,114 |

| T-Mobile US, Inc. * | 16,746 | 1,744,096 |

| Verizon Communications, Inc. | 121,698 | 6,709,211 |

| 15,079,815 | ||

| Transportation 1.7% | ||

| Alaska Air Group, Inc. | 3,610 | 130,898 |

| American Airlines Group, Inc. (a) | 14,616 | 191,031 |

| C.H. Robinson Worldwide, Inc. | 3,964 | 313,394 |

| CSX Corp. | 22,520 | 1,570,545 |

| Delta Air Lines, Inc. | 16,684 | 467,986 |

| Expeditors International of Washington, Inc. | 4,895 | 372,216 |

| FedEx Corp. | 7,069 | 991,215 |

| J.B. Hunt Transport Services, Inc. | 2,467 | 296,879 |

| Kansas City Southern | 2,796 | 417,415 |

| Norfolk Southern Corp. | 7,537 | 1,323,271 |

| Old Dominion Freight Line, Inc. | 2,776 | 470,782 |

| Southwest Airlines Co. | 15,765 | 538,848 |

| Union Pacific Corp. | 19,960 | 3,374,637 |

| United Airlines Holdings, Inc. * | 7,431 | 257,187 |

| United Parcel Service, Inc., Class B | 20,708 | 2,302,315 |

| 13,018,619 | ||