UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07143

T. Rowe Price Equity Series, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Health Sciences Portfolio

Health Sciences Portfolio Class (QAAGZX)

This annual shareholder report contains important information about Health Sciences Portfolio (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Health Sciences Portfolio Class | $89 | 0.88% |

|---|

What drove fund performance during the past 12 months?

The health care sector posted solid advances in the first nine months of 2024; however, these returns were diminished in the fourth quarter, leaving the group with modest gains for the year. The products and devices subsector was a bright spot as a handful of growth companies with exciting new product cycles led the segment higher. Despite facing heightened concerns around increased regulatory uncertainty at the end of the period, the pharmaceuticals segment was boosted by significant demand for a new class of diabetes and weight-loss drugs. The services subsector was the laggard in the space, largely driven by utilization pressures and heightened negative sentiment around the managed care industry.

From an absolute perspective, the leading contributor to performance was the portfolio’s significant position in Eli Lilly. Shares of the pharmaceutical giant benefited from strong demand and improvements in capacity for its portfolio of incretin medicines, alongside several positive regulatory developments.

Conversely, the leading detractor from absolute performance was Elevance Health. Shares of the insurer traded sharply lower at the end of the period due to multiple factors, including (1) a challenging Medicaid environment driving an uptick in utilization, (2) uncertainty around the health care agenda of the incoming presidential administration, and (3) worsening public sentiment toward the managed care space following the tragic murder of an industry executive.

Our overarching investment philosophy remains focused on innovation, and we believe companies that are producing leading‑edge therapeutics and medical devices offer some of the market’s most attractive growth areas for investors with a multiyear horizon.

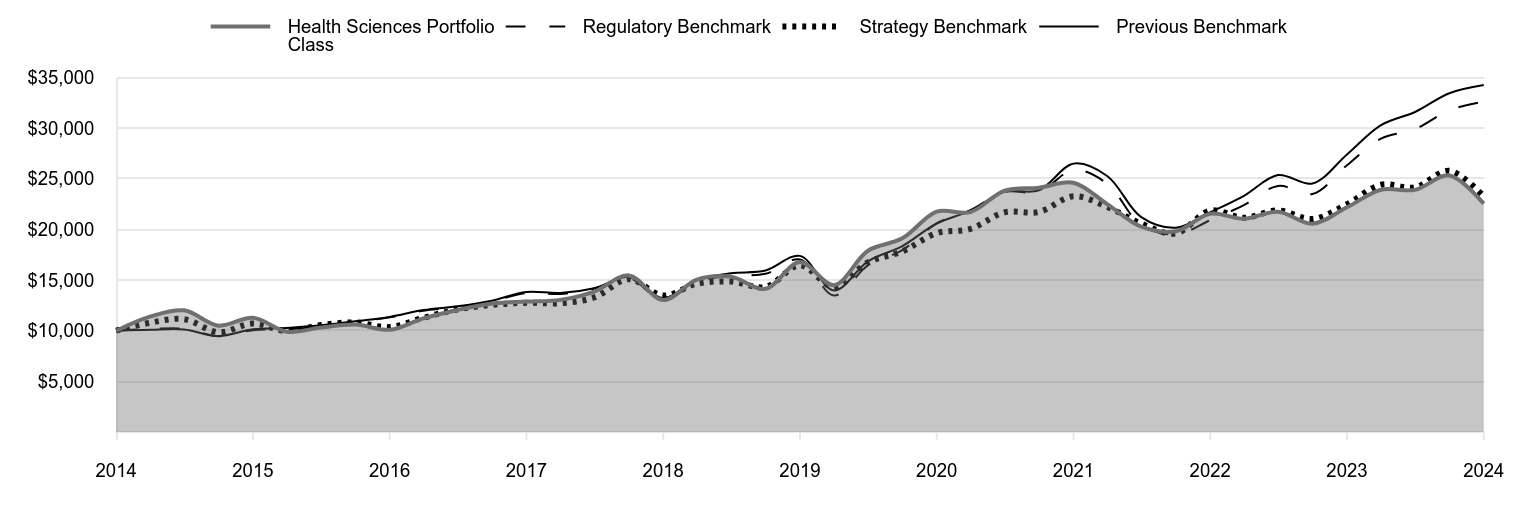

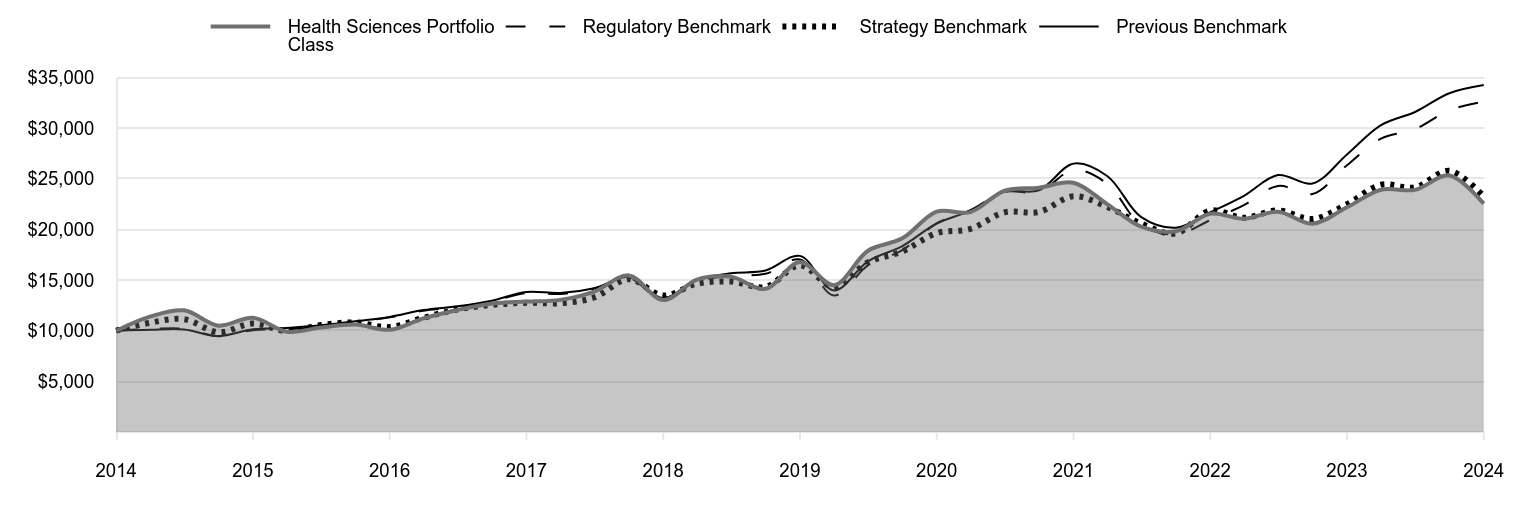

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Health Sciences Portfolio Class | Regulatory Benchmark | Strategy Benchmark | Previous Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 11,390 | 10,180 | 10,780 | 10,095 |

|---|

| 2015 | 12,011 | 10,194 | 11,143 | 10,123 |

|---|

| 2015 | 10,500 | 9,455 | 9,847 | 9,471 |

|---|

| 2015 | 11,276 | 10,048 | 10,714 | 10,138 |

|---|

| 2016 | 9,902 | 10,145 | 9,959 | 10,275 |

|---|

| 2016 | 10,318 | 10,412 | 10,560 | 10,527 |

|---|

| 2016 | 10,608 | 10,870 | 10,813 | 10,933 |

|---|

| 2016 | 10,094 | 11,327 | 10,357 | 11,351 |

|---|

| 2017 | 11,222 | 11,978 | 11,279 | 12,039 |

|---|

| 2017 | 12,049 | 12,339 | 12,098 | 12,411 |

|---|

| 2017 | 12,679 | 12,903 | 12,552 | 12,967 |

|---|

| 2017 | 12,878 | 13,721 | 12,753 | 13,829 |

|---|

| 2018 | 13,045 | 13,633 | 12,715 | 13,724 |

|---|

| 2018 | 13,864 | 14,163 | 13,282 | 14,195 |

|---|

| 2018 | 15,461 | 15,172 | 15,089 | 15,290 |

|---|

| 2018 | 13,021 | 13,002 | 13,471 | 13,223 |

|---|

| 2019 | 15,048 | 14,828 | 14,639 | 15,027 |

|---|

| 2019 | 15,319 | 15,435 | 14,849 | 15,674 |

|---|

| 2019 | 14,141 | 15,614 | 14,313 | 15,940 |

|---|

| 2019 | 16,790 | 17,035 | 16,449 | 17,386 |

|---|

| 2020 | 14,501 | 13,475 | 14,330 | 13,979 |

|---|

| 2020 | 17,899 | 16,443 | 16,748 | 16,850 |

|---|

| 2020 | 19,119 | 17,957 | 17,833 | 18,355 |

|---|

| 2020 | 21,763 | 20,593 | 19,630 | 20,585 |

|---|

| 2021 | 21,713 | 21,900 | 20,050 | 21,856 |

|---|

| 2021 | 23,816 | 23,705 | 21,687 | 23,724 |

|---|

| 2021 | 24,116 | 23,681 | 21,723 | 23,863 |

|---|

| 2021 | 24,614 | 25,877 | 23,282 | 26,494 |

|---|

| 2022 | 22,496 | 24,512 | 22,221 | 25,276 |

|---|

| 2022 | 20,263 | 20,418 | 20,571 | 21,206 |

|---|

| 2022 | 19,822 | 19,506 | 19,600 | 20,170 |

|---|

| 2022 | 21,544 | 20,907 | 21,862 | 21,696 |

|---|

| 2023 | 21,057 | 22,408 | 21,146 | 23,322 |

|---|

| 2023 | 21,749 | 24,288 | 21,874 | 25,361 |

|---|

| 2023 | 20,566 | 23,497 | 21,025 | 24,531 |

|---|

| 2023 | 22,182 | 26,334 | 22,488 | 27,399 |

|---|

| 2024 | 23,922 | 28,973 | 24,405 | 30,291 |

|---|

| 2024 | 23,902 | 29,904 | 24,156 | 31,589 |

|---|

| 2024 | 25,326 | 31,767 | 25,784 | 33,448 |

|---|

| 2024 | 22,549 | 32,604 | 23,270 | 34,254 |

|---|

202501-4140694, 202502-4108594

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Health Sciences Portfolio (Health Sciences Portfolio Class) | 1.66% | 6.08% | 8.47% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell 3000 Health Care Index (Strategy Benchmark) | 3.48 | 7.18 | 8.81 |

|---|

| S&P 500 Index (Previous Benchmark) | 25.02 | 14.53 | 13.10 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$664,924

- Number of Portfolio Holdings274

- Investment Advisory Fees Paid (000s)$5,427

- Portfolio Turnover Rate49.9%

What did the fund invest in?

Industry Allocation (as a % of Net Assets)

| Other Biotechnology | 27.4% |

| Major Pharmaceuticals | 17.1 |

| Implants | 14.9 |

| Life Sciences | 10.9 |

| Payors | 10.9 |

| Other Products & Devices | 6.6 |

| Major Biotechnology | 6.5 |

| Providers | 1.8 |

| Distribution | 0.9 |

| Other | 3.0 |

Top Ten Holdings (as a % of Net Assets)

| Eli Lilly | 10.2% |

| UnitedHealth Group | 6.1 |

| Intuitive Surgical | 5.8 |

| Thermo Fisher Scientific | 4.6 |

| Stryker | 4.2 |

| Danaher | 3.7 |

| Argenx | 3.7 |

| Merck | 2.6 |

| Boston Scientific | 2.5 |

| Vertex Pharmaceuticals | 2.4 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Health Sciences Portfolio

Health Sciences Portfolio Class (QAAGZX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Health Sciences Portfolio

Health Sciences Portfolio - II Class (QAAHBX)

This annual shareholder report contains important information about Health Sciences Portfolio (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Health Sciences Portfolio - II Class | $114 | 1.13% |

|---|

What drove fund performance during the past 12 months?

The health care sector posted solid advances in the first nine months of 2024; however, these returns were diminished in the fourth quarter, leaving the group with modest gains for the year. The products and devices subsector was a bright spot as a handful of growth companies with exciting new product cycles led the segment higher. Despite facing heightened concerns around increased regulatory uncertainty at the end of the period, the pharmaceuticals segment was boosted by significant demand for a new class of diabetes and weight-loss drugs. The services subsector was the laggard in the space, largely driven by utilization pressures and heightened negative sentiment around the managed care industry.

From an absolute perspective, the leading contributor to performance was the portfolio’s significant position in Eli Lilly. Shares of the pharmaceutical giant benefited from strong demand and improvements in capacity for its portfolio of incretin medicines, alongside several positive regulatory developments.

Conversely, the leading detractor from absolute performance was Elevance Health. Shares of the insurer traded sharply lower at the end of the period due to multiple factors, including (1) a challenging Medicaid environment driving an uptick in utilization, (2) uncertainty around the health care agenda of the incoming presidential administration, and (3) worsening public sentiment toward the managed care space following the tragic murder of an industry executive.

Our overarching investment philosophy remains focused on innovation, and we believe companies that are producing leading‑edge therapeutics and medical devices offer some of the market’s most attractive growth areas for investors with a multiyear horizon.

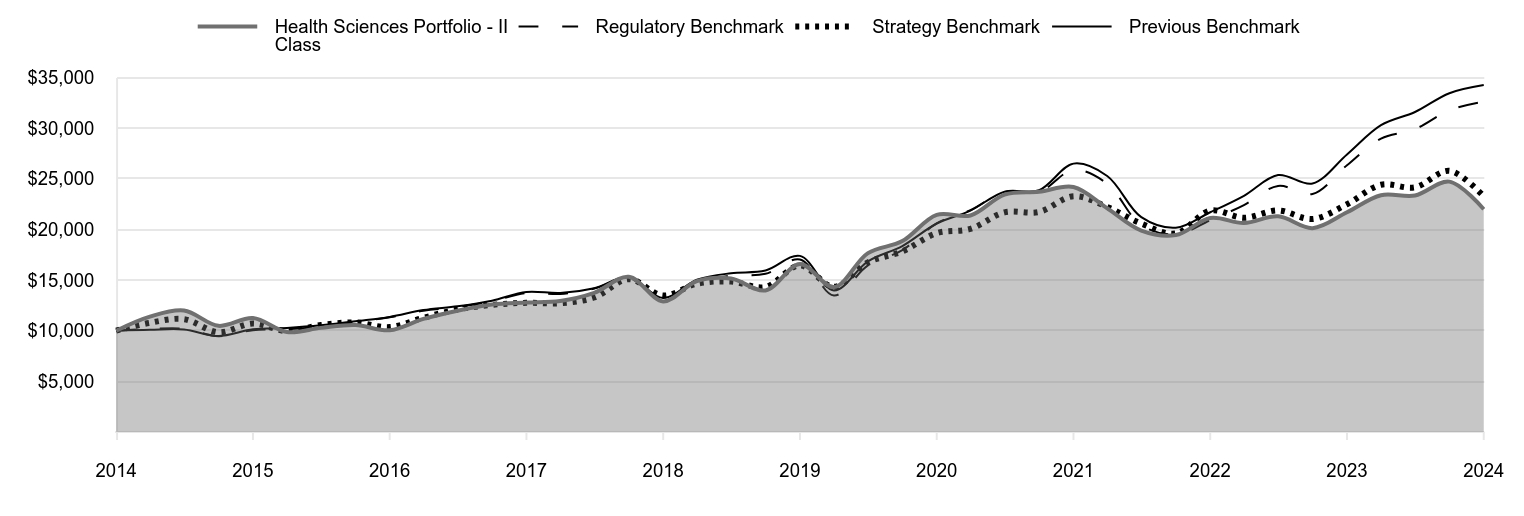

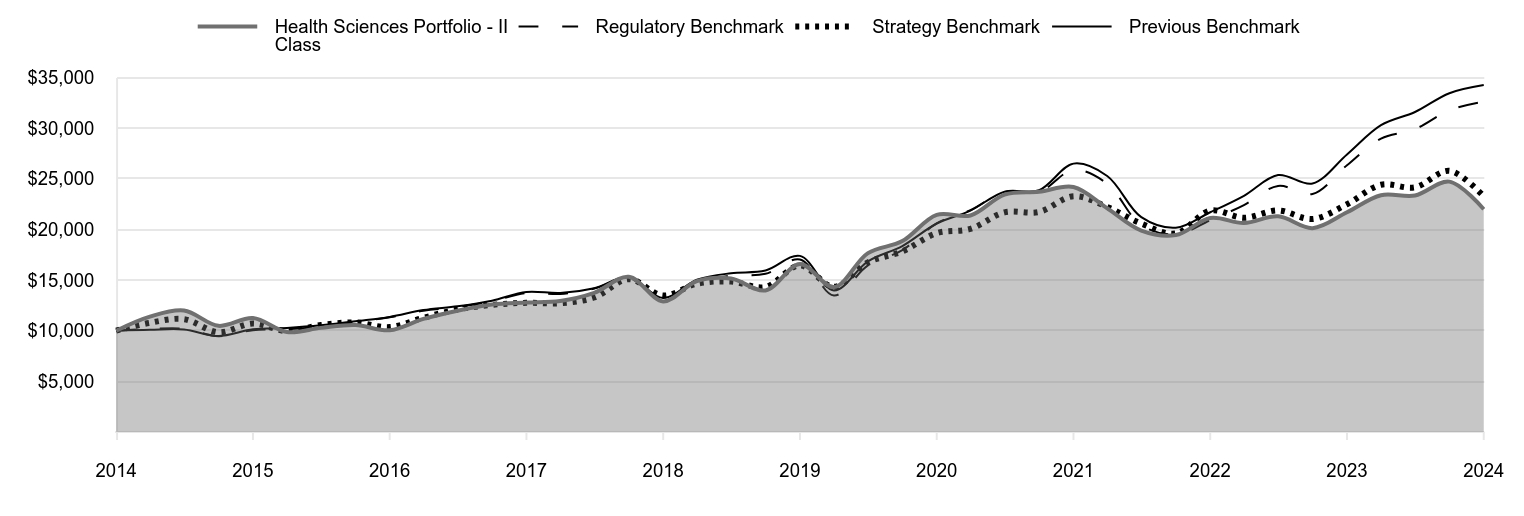

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Health Sciences Portfolio - II Class | Regulatory Benchmark | Strategy Benchmark | Previous Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 11,385 | 10,180 | 10,780 | 10,095 |

|---|

| 2015 | 11,994 | 10,194 | 11,143 | 10,123 |

|---|

| 2015 | 10,480 | 9,455 | 9,847 | 9,471 |

|---|

| 2015 | 11,247 | 10,048 | 10,714 | 10,138 |

|---|

| 2016 | 9,871 | 10,145 | 9,959 | 10,275 |

|---|

| 2016 | 10,280 | 10,412 | 10,560 | 10,527 |

|---|

| 2016 | 10,563 | 10,870 | 10,813 | 10,933 |

|---|

| 2016 | 10,042 | 11,327 | 10,357 | 11,351 |

|---|

| 2017 | 11,161 | 11,978 | 11,279 | 12,039 |

|---|

| 2017 | 11,976 | 12,339 | 12,098 | 12,411 |

|---|

| 2017 | 12,593 | 12,903 | 12,552 | 12,967 |

|---|

| 2017 | 12,784 | 13,721 | 12,753 | 13,829 |

|---|

| 2018 | 12,941 | 13,633 | 12,715 | 13,724 |

|---|

| 2018 | 13,744 | 14,163 | 13,282 | 14,195 |

|---|

| 2018 | 15,320 | 15,172 | 15,089 | 15,290 |

|---|

| 2018 | 12,894 | 13,002 | 13,471 | 13,223 |

|---|

| 2019 | 14,890 | 14,828 | 14,639 | 15,027 |

|---|

| 2019 | 15,147 | 15,435 | 14,849 | 15,674 |

|---|

| 2019 | 13,975 | 15,614 | 14,313 | 15,940 |

|---|

| 2019 | 16,585 | 17,035 | 16,449 | 17,386 |

|---|

| 2020 | 14,311 | 13,475 | 14,330 | 13,979 |

|---|

| 2020 | 17,654 | 16,443 | 16,748 | 16,850 |

|---|

| 2020 | 18,845 | 17,957 | 17,833 | 18,355 |

|---|

| 2020 | 21,439 | 20,593 | 19,630 | 20,585 |

|---|

| 2021 | 21,376 | 21,900 | 20,050 | 21,856 |

|---|

| 2021 | 23,437 | 23,705 | 21,687 | 23,724 |

|---|

| 2021 | 23,718 | 23,681 | 21,723 | 23,863 |

|---|

| 2021 | 24,190 | 25,877 | 23,282 | 26,494 |

|---|

| 2022 | 22,094 | 24,512 | 22,221 | 25,276 |

|---|

| 2022 | 19,889 | 20,418 | 20,571 | 21,206 |

|---|

| 2022 | 19,442 | 19,506 | 19,600 | 20,170 |

|---|

| 2022 | 21,121 | 20,907 | 21,862 | 21,696 |

|---|

| 2023 | 20,630 | 22,408 | 21,146 | 23,322 |

|---|

| 2023 | 21,294 | 24,288 | 21,874 | 25,361 |

|---|

| 2023 | 20,124 | 23,497 | 21,025 | 24,531 |

|---|

| 2023 | 21,688 | 26,334 | 22,488 | 27,399 |

|---|

| 2024 | 23,378 | 28,973 | 24,405 | 30,291 |

|---|

| 2024 | 23,344 | 29,904 | 24,156 | 31,589 |

|---|

| 2024 | 24,716 | 31,767 | 25,784 | 33,448 |

|---|

| 2024 | 21,995 | 32,604 | 23,270 | 34,254 |

|---|

202501-4140694, 202502-4108594

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Health Sciences Portfolio (Health Sciences Portfolio - II Class) | 1.42% | 5.81% | 8.20% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| Russell 3000 Health Care Index (Strategy Benchmark) | 3.48 | 7.18 | 8.81 |

|---|

| S&P 500 Index (Previous Benchmark) | 25.02 | 14.53 | 13.10 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$664,924

- Number of Portfolio Holdings274

- Investment Advisory Fees Paid (000s)$5,427

- Portfolio Turnover Rate49.9%

What did the fund invest in?

Industry Allocation (as a % of Net Assets)

| Other Biotechnology | 27.4% |

| Major Pharmaceuticals | 17.1 |

| Implants | 14.9 |

| Life Sciences | 10.9 |

| Payors | 10.9 |

| Other Products & Devices | 6.6 |

| Major Biotechnology | 6.5 |

| Providers | 1.8 |

| Distribution | 0.9 |

| Other | 3.0 |

Top Ten Holdings (as a % of Net Assets)

| Eli Lilly | 10.2% |

| UnitedHealth Group | 6.1 |

| Intuitive Surgical | 5.8 |

| Thermo Fisher Scientific | 4.6 |

| Stryker | 4.2 |

| Danaher | 3.7 |

| Argenx | 3.7 |

| Merck | 2.6 |

| Boston Scientific | 2.5 |

| Vertex Pharmaceuticals | 2.4 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Health Sciences Portfolio

Health Sciences Portfolio - II Class (QAAHBX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | $ | 46,029 | | | | | | | $ | 46,733 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

T.

ROWE

PRICE

Health

Sciences

Portfolio

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Health

Sciences

Portfolio

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

55

.31

$

55

.74

$

64

.72

$

61

.04

$

49

.82

Investment

activities

Net

investment

loss

(1)(2)

(

0

.11

)

(

0

.12

)

(

0

.13

)

(

0

.26

)

(

0

.12

)

Net

realized

and

unrealized

gain/loss

1

.00

1

.68

(

7

.95

)

8

.19

14

.90

Total

from

investment

activities

0

.89

1

.56

(

8

.08

)

7

.93

14

.78

Distributions

Net

realized

gain

(

4

.94

)

(

1

.99

)

(

0

.90

)

(

4

.25

)

(

3

.56

)

NET

ASSET

VALUE

End

of

period

$

51

.26

$

55

.31

$

55

.74

$

64

.72

$

61

.04

Ratios/Supplemental

Data

Total

return

(2)(3)

1

.66

%

2

.96

%

(

12

.47

)

%

13

.10

%

29

.62

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.89

%

0

.95

%

0

.95

%

0

.95

%

0

.95

%

Net

expenses

after

waivers/payments

by

Price

Associates

0

.88

%

0

.94

%

0

.94

%

0

.94

%

0

.94

%

Net

investment

loss

(

0

.18

)

%

(

0

.21

)

%

(

0

.23

)

%

(

0

.40

)

%

(

0

.23

)

%

Portfolio

turnover

rate

49

.9

%

49

.5

%

27

.9

%

32

.3

%

38

.0

%

Net

assets,

end

of

period

(in

thousands)

$

144,197

$

154,299

$

153,188

$

178,434

$

159,718

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Health

Sciences

Portfolio

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Health

Sciences

Portfolio

-

II

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

51

.85

$

52

.52

$

61

.19

$

57

.96

$

47

.48

Investment

activities

Net

investment

loss

(1)(2)

(

0

.24

)

(

0

.24

)

(

0

.25

)

(

0

.40

)

(

0

.24

)

Net

realized

and

unrealized

gain/loss

0

.95

1

.56

(

7

.52

)

7

.77

14

.16

Total

from

investment

activities

0

.71

1

.32

(

7

.77

)

7

.37

13

.92

Distributions

Net

realized

gain

(

4

.94

)

(

1

.99

)

(

0

.90

)

(

4

.14

)

(

3

.44

)

NET

ASSET

VALUE

End

of

period

$

47

.62

$

51

.85

$

52

.52

$

61

.19

$

57

.96

Ratios/Supplemental

Data

Total

return

(2)(3)

1

.42

%

2

.68

%

(

12

.69

)

%

12

.83

%

29

.27

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1

.13

%

1

.20

%

1

.20

%

1

.20

%

1

.20

%

Net

expenses

after

waivers/payments

by

Price

Associates

1

.13

%

1

.19

%

1

.19

%

1

.19

%

1

.19

%

Net

investment

loss

(

0

.43

)

%

(

0

.47

)

%

(

0

.48

)

%

(

0

.64

)

%

(

0

.47

)

%

Portfolio

turnover

rate

49

.9

%

49

.5

%

27

.9

%

32

.3

%

38

.0

%

Net

assets,

end

of

period

(in

thousands)

$

520,727

$

548,009

$

576,092

$

704,365

$

626,850

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Health

Sciences

Portfolio

December

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

94.8%

BIOTECHNOLOGY

27.8%

International-Biotechnology

0.1%

Ideaya

Biosciences (1)

19,371

498

498

Major

Biotechnology

6.3%

Alkermes (1)

66,471

1,912

Amgen

38,406

10,010

Biogen (1)

8,175

1,250

Celldex

Therapeutics (1)

32,851

830

Exact

Sciences (1)

59,948

3,368

Exact

Sciences

CMO

Milestone,

Acquisition

Date:

1/6/21,

Cost $— (1)(2)(3)

167,424

104

Exact

Sciences

FDA

Milestone,

Acquisition

Date:

1/6/21,

Cost $— (1)(2)(3)

83,712

52

Neurocrine

Biosciences (1)

27,030

3,690

United

Therapeutics (1)

13,600

4,799

Vertex

Pharmaceuticals (1)

39,362

15,851

41,866

Other

Biotechnology

21.4%

Affinivax

Expense

Fund,

Acquisition

Date:

9/12/22,

Cost $1 (1)(2)(3)

562

—

Affinivax

Milestone

Event,

Acquisition

Date:

9/12/22,

Cost $156 (1)(2)(3)

331,976

246

Affinivax

Next

Gen.

Prod.

Milestone

Event,

Acquisition

Date:

9/12/22,

Cost $156 (1)(2)(3)

331,976

123

Agios

Pharmaceuticals (1)

51,400

1,689

Akero

Therapeutics (1)

45,821

1,275

Alector (1)

30,382

57

Allogene

Therapeutics (1)

160,368

342

Alnylam

Pharmaceuticals (1)

64,660

15,215

AnaptysBio (1)

10,500

139

Apellis

Pharmaceuticals (1)

11,061

353

Apogee

Therapeutics (1)

39,727

1,800

Arcellx (1)

44,630

3,423

Arvinas (1)

23,306

447

Ascendis

Pharma,

ADR (1)

50,917

7,010

Aura

Biosciences (1)

20,070

165

Avidity

Biosciences (1)

128,218

3,729

BeiGene,

ADR (1)

36,338

6,712

Bicycle

Therapeutics,

ADR (1)

62,846

880

Biohaven (1)

95,772

3,577

BioMarin

Pharmaceutical (1)

17,822

1,171

Blueprint

Medicines (1)

86,496

7,544

Cabaletta

Bio (1)

24,400

55

Cargo

Therapeutics (1)

60,490

872

Centessa

Pharmaceuticals,

ADR (1)

173,583

2,907

Crinetics

Pharmaceuticals (1)

57,933

2,962

Cytokinetics (1)

33,735

1,587

Day

One

Biopharmaceuticals (1)

3,030

38

Denali

Therapeutics (1)

79,760

1,625

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Disc

Medicine (1)

14,626

927

Dyne

Therapeutics (1)

24,193

570

Entrada

Therapeutics (1)

19,854

343

EyePoint

Pharmaceuticals (1)

26,859

200

Generation

Bio (1)

91,458

97

Ginkgo

Bioworks,

Earn

Out

Shares

$15.00,

Acquisition

Date:

9/17/21,

Cost $— (1)(2)(3)

242

—

Ginkgo

Bioworks,

Earn

Out

Shares

$17.50,

Acquisition

Date:

9/17/21,

Cost $— (1)(2)(3)

242

—

Ginkgo

Bioworks,

Earn

Out

Shares

$20.00,

Acquisition

Date:

9/17/21,

Cost $— (1)(2)(3)

242

—

Gyroscope

Therapeutics,

Milestone

Payment

1,

Acquisition

Date:

2/18/22,

Cost $253 (1)(2)(3)

253,263

—

Gyroscope

Therapeutics,

Milestone

Payment

2,

Acquisition

Date:

2/18/22,

Cost $169 (1)(2)(3)

168,785

—

Gyroscope

Therapeutics,

Milestone

Payment

3,

Acquisition

Date:

2/18/22,

Cost $169 (1)(2)(3)

168,785

—

Helix

Acquisition

Corp.

II (1)

40,147

422

IGM

Biosciences (1)

46,165

282

Immatics (1)

35,941

256

Immuneering,

Class

A (1)

29,046

64

Immunocore

Holdings,

ADR (1)

56,198

1,658

Immunome (1)

84,540

898

Insmed (1)

133,130

9,191

Ionis

Pharmaceuticals (1)

45,448

1,589

Iovance

Biotherapeutics (1)

54,449

403

Krystal

Biotech (1)

13,110

2,054

Kymera

Therapeutics (1)

68,304

2,748

Legend

Biotech,

ADR (1)

31,638

1,029

Lyell

Immunopharma (1)

285,300

183

Monte

Rosa

Therapeutics (1)

64,177

445

MoonLake

Immunotherapeutics (1)

78,080

4,228

Natera (1)

26,714

4,229

Novocure (1)

61,373

1,829

ORIC

Pharmaceuticals (1)

46,600

376

Oruka

Therapeutics

55,896

1,084

Pharvaris (1)

16,499

316

Pliant

Therapeutics (1)

27,537

363

Prelude

Therapeutics (1)

42,748

54

ProfoundBio,

Escrow

Fund

Payment,

EC,

Acquisition

Date:

5/24/24,

Cost $34 (1)(2)(3)

33,627

32

ProfoundBio,

Expense

Fund

Payment,

EC,

Acquisition

Date:

5/24/24,

Cost $— (1)(2)(3)

112

—

Protagonist

Therapeutics (1)

51,434

1,985

Prothena (1)

19,543

271

Regeneron

Pharmaceuticals (1)

16,686

11,886

Relay

Therapeutics (1)

48,819

201

Repligen (1)

12,407

1,786

Replimune

Group (1)

85,041

1,030

T.

ROWE

PRICE

Health

Sciences

Portfolio

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

REVOLUTION

Medicines (1)

85,170

3,725

REVOLUTION

Medicines,

Warrants,

11/14/28 (1)

11,096

2

Rhythm

Pharmaceuticals (1)

15,079

844

Rocket

Pharmaceuticals (1)

53,703

675

Sage

Therapeutics (1)

14,484

79

Sana

Biotechnology (1)

115,664

188

Scholar

Rock,

Warrants,

12/31/25,

Acquisition

Date:

6/17/22,

Cost $— (1)(3)

6,855

246

Scholar

Rock

Holding (1)

108,816

4,703

SpringWorks

Therapeutics (1)

36,450

1,317

Spyre

Therapeutics (1)

20,380

475

Structure

Therapeutics,

ADR (1)

28,505

773

Tenax

Therapeutics,

Warrants,

8/29/29,

Acquisition

Date:

8/6/24,

Cost $— (1)(3)

53,640

62

Ultragenyx

Pharmaceutical (1)

31,232

1,314

Vaxcyte (1)

56,111

4,593

Voyager

Therapeutics (1)

42,811

243

WaVe

Life

Sciences (1)

96,944

1,199

Xencor (1)

33,800

777

Zai

Lab,

ADR (1)

90,020

2,358

Zentalis

Pharmaceuticals (1)

30,265

92

142,637

Total

Biotechnology

185,001

CONSUMER

NONDURABLES

0.2%

Biotechnology

0.1%

MBX

Biosciences,

Lockup

Shares,

Series

C,

Acquisition

Date:

8/2/24,

Cost $429 (1)(3)

34,687

639

639

Pharmaceuticals

0.1%

Tenax

Therapeutics,

Warrants,

Acquisition

Date:

8/6/24,

Cost $305 (1)(3)(4)

101,916

599

599

Total

Consumer

Nondurables

1,238

LIFE

SCIENCES

9.7%

Life

Sciences

9.7%

Agilent

Technologies

23,525

3,160

Bio-Techne

38,087

2,744

Bruker

14,586

855

Danaher

107,863

24,760

Ginkgo

Bioworks

Holdings (1)

2,281

22

Pacific

Biosciences

of

California (1)

81,354

149

Revvity

19,976

2,230

SomaLogic,

Warrants,

8/31/26 (1)

4,962

—

Thermo

Fisher

Scientific

58,242

30,299

Total

Life

Sciences

64,219

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

MISCELLANEOUS

0.0%

Miscellaneous

0.0%

Orchestra

BioMed

Holdings (1)

24,783

99

Total

Miscellaneous

99

PHARMACEUTICALS

17.3%

Major

Pharmaceuticals

16.9%

AstraZeneca,

ADR

210,164

13,770

Chugai

Pharmaceutical

(JPY)

76,700

3,381

Eli

Lilly

87,928

67,880

Merck

171,723

17,083

Novo

Nordisk,

ADR

24,315

2,092

Sanofi,

ADR

137,134

6,614

Teva

Pharmaceutical

Industries,

ADR (1)

66,700

1,470

112,290

Specialty

Pharmaceuticals

0.4%

Madrigal

Pharmaceuticals (1)

7,914

2,442

2,442

Total

Pharmaceuticals

114,732

PRODUCTS

&

DEVICES

21.1%

Capital

Equipment

0.3%

PROCEPT

BioRobotics (1)

23,557

1,897

1,897

Implants

14.8%

Becton

Dickinson

&

Company

35,747

8,110

Boston

Scientific (1)

185,922

16,607

Edwards

Lifesciences (1)

47,257

3,498

Intuitive

Surgical (1)

73,749

38,494

Sonova

Holding

(CHF)

11,921

3,898

Stryker

76,874

27,679

Verily

Life

Sciences,

Series

B,

Acquisition

Date:

1/23/19,

Cost $643 (1)(2)(3)

5,220

351

98,637

Other

Products

&

Devices

6.0%

10X

Genomics,

Class

A (1)

44,877

644

Argenx,

ADR (1)

39,674

24,400

Dexcom (1)

25,744

2,002

Hologic (1)

27,356

1,972

IDEXX

Laboratories (1)

6,000

2,481

Lantheus

Holdings (1)

10,015

896

Pax

Labs,

Class

A,

Acquisition

Date:

4/18/19,

Cost $1,452 (1)(2)(3)

385,684

158

Penumbra (1)

30,257

7,185

Saluda

Medical,

Warrants,

1/20/27,

Acquisition

Date:

1/20/22,

Cost $— (1)(2)(3)

4,672

9

39,747

Total

Products

&

Devices

140,281

SERVICES

13.8%

Distribution

0.9%

Cardinal

Health

17,928

2,120

T.

ROWE

PRICE

Health

Sciences

Portfolio

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Cencora

8,625

1,938

McKesson

3,062

1,745

5,803

Information

0.0%

GeneDx

Holdings (1)

2,338

179

GeneDx

Holdings,

Warrants,

7/22/26 (1)

11,396

2

181

Other

Services

0.5%

ICON (1)

5,711

1,198

PrognomIQ,

Class

A,

Acquisition

Date:

11/15/19

-

9/6/24,

Cost $656 (1)(2)(3)

27,337

17

Quest

Diagnostics

15,672

2,364

3,579

Payors

10.8%

Centene (1)

34,658

2,100

Cigna

Group

32,141

8,875

Elevance

Health

33,964

12,529

Humana

5,257

1,334

Molina

Healthcare (1)

14,950

4,351

Oscar

Health,

Class

A (1)

147,077

1,977

UnitedHealth

Group

80,286

40,613

71,779

Providers

1.6%

BrightSpring

Health

Services (1)

99,302

1,691

HCA

Healthcare

16,417

4,927

Tenet

Healthcare (1)

32,572

4,112

10,730

Total

Services

92,072

Total

Miscellaneous

Common

Stocks

4.9% (5)

32,965

Total

Common

Stocks

(Cost

$351,927)

630,607

CONVERTIBLE

BONDS

0.2%

Galvanize

Therapeutics,

0.00%,

2/13/27,

Acquisition

Date:

2/28/24,

Cost $295 (1)(2)(3)

295,300

295

Galvanize

Therapeutics,

0.00%,

2/28/27,

Acquisition

Date:

12/27/24,

Cost $223 (1)(2)(3)

223,200

223

Immunocore

Holdings,

2.50%,

2/1/30 (6)

739,000

620

Kardium,

10.00%,

12/31/26,

Acquisition

Date:

5/31/24,

Cost $257 (1)(2)(3)

256,500

257

Total

Convertible

Bonds

(Cost

$1,514)

1,395

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

CONVERTIBLE

PREFERRED

STOCKS

4.0%

BIOTECHNOLOGY

2.1%

Other

Biotechnology

2.1%

Aktis

Oncology,

Series

B,

Acquisition

Date:

9/20/24,

Cost $538 (1)(2)(3)

134,478

538

Arbor

Bio,

Series

B,

Acquisition

Date:

10/29/21,

Cost $398 (1)(2)(3)

23,994

99

Arsenal

Biosciences,

Series

C,

Acquisition

Date:

7/9/24,

Cost $651 (1)(2)(3)

35,023

651

Avalyn

Pharma,

Series

C-1,

Acquisition

Date:

9/22/23,

Cost $285 (1)(2)(3)

388,595

285

Bluejay

Therapeutics,

Series

C,

Acquisition

Date:

5/1/24,

Cost $850 (1)(2)(3)

130,259

850

Chroma

Medicine,

Series

I,

Acquisition

Date:

10/12/21

-

12/4/24,

Cost $785 (1)(2)(3)

354,997

355

Delfi

Diagnostics,

Series

A,

Acquisition

Date:

1/12/21

-

4/7/22,

Cost $320 (1)(2)(3)

154,525

749

Delfi

Diagnostics,

Series

B,

Acquisition

Date:

6/10/22,

Cost $407 (1)(2)(3)

84,104

407

Eikon

Therapeutics,

Series

B,

Acquisition

Date:

12/3/21,

Cost $810 (1)(2)(3)

45,781

243

Eikon

Therapeutics,

Series

C,

Acquisition

Date:

5/18/23,

Cost $195 (1)(2)(3)

9,072

48

EndeavorBio,

Series

B,

Acquisition

Date:

1/21/22,

Cost $398 (1)(2)(3)

84,304

550

Endeavour

Bio

Services,

Series

C,

Acquisition

Date:

4/22/24,

Cost $154 (1)(2)(3)

23,627

154

FOG

Pharma,

Series

C,

Acquisition

Date:

1/11/21

-

8/2/21,

Cost $282 (1)

(2)(3)

19,483

165

FOG

Pharma,

Series

D,

Acquisition

Date:

11/17/22,

Cost $296 (1)(2)(3)

27,546

202

FOG

Pharma,

Series

E,

Acquisition

Date:

2/29/24,

Cost $93 (1)(2)(3)

14,904

93

Generate

Bio,

Series

B,

Acquisition

Date:

9/2/21,

Cost $1,001 (1)(2)(3)

84,485

1,001

Generate

Bio,

Series

C,

Acquisition

Date:

5/9/23,

Cost $201 (1)(2)(3)

17,003

201

Genesis

Therapeutics,

Series

A,

Acquisition

Date:

11/24/20,

Cost $191 (1)(2)(3)

37,471

191

Genesis

Therapeutics,

Series

B,

Acquisition

Date:

8/10/23,

Cost $465 (1)(2)(3)

91,103

465

Insitro,

Series

B,

Acquisition

Date:

5/21/20,

Cost $248 (1)(2)(3)

39,793

728

Insitro,

Series

C,

Acquisition

Date:

4/7/21,

Cost $481 (1)(2)(3)

26,282

481

T.

ROWE

PRICE

Health

Sciences

Portfolio

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Kartos

Therapeutics,

Series

C,

Acquisition

Date:

8/22/23,

Cost $486 (1)(2)(3)

85,928

486

Laronde,

Series

B,

Acquisition

Date:

7/28/21,

Cost $1,471 (1)(2)(3)

52,537

116

Metsera,

Series

B,

Acquisition

Date:

11/12/24,

Cost $649 (1)(2)(3)

128,744

649

Obsidian

Therapeutics,

Series

C,

Acquisition

Date:

3/27/24,

Cost $422 (1)(2)(3)

222,385

422

Odyssey

Therapeutics,

Series

B,

Acquisition

Date:

5/13/22,

Cost $319 (1)(2)(3)

50,567

263

Odyssey

Therapeutics,

Series

C,

Acquisition

Date:

10/25/23,

Cost $25 (1)(2)(3)

4,902

25

Ring

Therapeutics,

Series

B,

Acquisition

Date:

4/12/21,

Cost $404 (1)(2)(3)

43,885

202

Ring

Therapeutics,

Series

C,

Acquisition

Date:

10/7/22,

Cost $198 (1)(2)(3)

21,482

99

SalioGen

Therapeutics,

Series

B,

Acquisition

Date:

12/10/21,

Cost $496 (1)(2)(3)

4,690

68

Scribe

Therapeutics,

Series

B,

Acquisition

Date:

3/17/21,

Cost $278 (1)(2)(3)

45,881

278

Sionna

Therapeutics,

Series

B,

Acquisition

Date:

2/2/22,

Cost $239 (1)(2)(3)

24,459

239

Sionna

Therapeutics,

Series

C,

Acquisition

Date:

3/4/24,

Cost $84 (1)(2)(3)

8,642

84

Tessera

Therapeutics,

Series

C,

Acquisition

Date:

2/25/22,

Cost $357 (1)(2)(3)

17,475

357

Third

Arc

Bio,

Series

A,

Acquisition

Date:

7/16/24,

Cost $214 (1)(2)(3)

101,574

214

Treeline

Biosciences,

Series

A,

Acquisition

Date:

4/9/21

-

9/26/22,

Cost $830 (1)(2)(3)

106,061

913

Treeline

Biosciences,

Series

A-1,

Acquisition

Date:

10/2/24,

Cost $1,060 (1)(2)(3)

123,059

1,060

Total

Biotechnology

13,931

CONSUMER

NONDURABLES

0.2%

Biotechnology

0.1%

Arbor

Bio,

Series

C,

Acquisition

Date:

10/21/24,

Cost $64 (1)(2)(3)

15,714

64

Nutcracker

Therapeutics,

Series

C,

Acquisition

Date:

8/27/21,

Cost $501 (1)(2)(3)

46,567

501

565

Health

Care

Services

0.1%

Capsule,

Series

1-D,

Acquisition

Date:

4/7/21,

Cost $553 (1)(2)(3)

38,140

49

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Capsule,

Series

E,

Acquisition

Date:

1/10/23,

Cost $120 (1)(2)(3)

40,875

53

Color

Health,

Series

D,

Acquisition

Date:

12/17/20,

Cost $501 (1)(2)(3)

13,310

235

Color

Health,

Series

D-1,

Acquisition

Date:

1/13/20,

Cost $430 (1)(2)(3)

20,165

242

Color

Health,

Series

E,

Acquisition

Date:

10/26/21,

Cost $199 (1)(2)(3)

1,991

79

658

Total

Consumer

Nondurables

1,223

FINANCIAL

0.1%

Investment

Dealers

0.1%

Seaport

Therapeutics,

Series

B,

Acquisition

Date:

10/18/24,

Cost $540 (1)(2)(3)

113,620

540

Total

Financial

540

LIFE

SCIENCES

0.9%

Life

Sciences

0.9%

Cellanome,

Series

A,

Acquisition

Date:

12/30/21,

Cost $497 (1)(2)(3)

89,839

673

Chromacode,

Series

D-1,

Acquisition

Date:

2/28/22,

Cost $99 (1)(2)(3)

141,298

30

Chromacode,

Series

D-2,

Acquisition

Date:

2/28/22,

Cost $99 (1)(2)(3)

141,298

65

Clear

Labs,

Series

C,

Acquisition

Date:

5/13/21,

Cost $595 (1)(2)(3)

171,440

543

Clear

Labs,

Series

D,

Acquisition

Date:

12/12/24,

Cost $58 (1)(2)(3)

18,600

58

DNA

Script,

Series

C,

Acquisition

Date:

12/16/21,

Cost $960

(EUR) (1)

(2)(3)

1,132

338

Element

Biosciences,

Series

C,

Acquisition

Date:

6/21/21,

Cost $797 (1)(2)(3)

38,785

376

Element

Biosciences,

Series

D,

Acquisition

Date:

6/28/24,

Cost $106 (1)(2)(3)

13,556

106

Element

Biosciences,

Series

D-1,

Acquisition

Date:

6/28/24,

Cost $106 (1)(2)(3)

13,556

106

Inscripta,

Series

E,

Acquisition

Date:

3/30/21,

Cost $572 (1)(2)(3)

64,740

121

Lumicks

Tech,

Series

D,

Acquisition

Date:

4/14/21,

Cost $396 (1)(2)(3)

221

205

National

Resilience,

Series

B,

Acquisition

Date:

10/23/20,

Cost $741 (1)(2)(3)

54,252

2,521

National

Resilience,

Series

C,

Acquisition

Date:

6/9/21,

Cost $854 (1)(2)(3)

19,224

893

Total

Life

Sciences

6,035

PRODUCTS

&

DEVICES

0.3%

Capital

Equipment

0.1%

Reflexion

Medical,

Series

C,

Acquisition

Date:

4/3/18,

Cost $255 (1)(2)(3)

150,708

259

T.

ROWE

PRICE

Health

Sciences

Portfolio

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Reflexion

Medical,

Series

D,

Acquisition

Date:

4/3/20,

Cost $97 (1)(2)(3)

51,079

89

Reflexion

Medical,

Series

E,

Acquisition

Date:

3/1/22,

Cost $199 (1)(2)(3)

83,857

151

Reflexion

Medical,

Series

F,

Acquisition

Date:

11/13/23,

Cost $125 (1)(2)(3)

83,280

110

609

Implants

0.1%

Kardium,

Series

D-5,

Acquisition

Date:

11/29/18,

Cost $391 (1)(2)(3)

403,778

343

Kardium,

Series

D-6,

Acquisition

Date:

1/8/21,

Cost $566 (1)(2)(3)

556,501

473

816

Other

Products

&

Devices

0.1%

Saluda

Medical,

Series

D,

Acquisition

Date:

1/20/22,

Cost $397 (1)(2)(3)

31,146

331

Saluda

Medical,

Series

E,

Acquisition

Date:

4/6/23,

Cost $196 (1)(2)(3)

24,280

235

566

Total

Products

&

Devices

1,991

SERVICES

0.4%

Information

0.0%

Cleerly,

Series

C,

Acquisition

Date:

7/8/22,

Cost $313 (1)(2)(3)

26,533

313

313

Other

Services

0.3%

Caris

Life

Sciences,

Series

C,

Acquisition

Date:

8/14/20,

Cost $467 (1)(2)(3)

169,277

833

Caris

Life

Sciences,

Series

D,

Acquisition

Date:

5/11/21,

Cost $826 (1)(2)(3)

101,939

502

Freenome

Holdings,

Series

B,

Acquisition

Date:

6/24/19,

Cost $325 (1)(2)(3)

71,397

396

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Freenome

Holdings,

Series

C,

Acquisition

Date:

8/14/20,

Cost $276 (1)(2)(3)

41,732

232

Freenome

Holdings,

Series

D,

Acquisition

Date:

11/22/21,

Cost $179 (1)(2)(3)

23,669

132

Freenome

Holdings,

Series

F,

Acquisition

Date:

1/26/24,

Cost $63 (1)(2)(3)

8,542

47

2,142

Providers

0.1%

Honor

Technology,

Series

D,

Acquisition

Date:

10/16/20,

Cost $339 (1)(2)(3)

140,829

241

Honor

Technology,

Series

E,

Acquisition

Date:

9/29/21,

Cost $300 (1)(2)(3)

94,916

162

403

Total

Services

2,858

Total

Convertible

Preferred

Stocks

(Cost

$30,683)

26,578

PREFERRED

STOCKS

0.3%

LIFE

SCIENCES

0.3%

Life

Sciences

0.3%

Sartorius

(EUR)

8,261

1,836

Total

Life

Sciences

1,836

Total

Preferred

Stocks

(Cost

$1,569)

1,836

SHORT-TERM

INVESTMENTS

0.8%

Money

Market

Funds

0.8%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (7)(8)

5,167,594

5,168

Total

Short-Term

Investments

(Cost

$5,168)

5,168

Total

Investments

in

Securities

100.1%

of

Net

Assets

(Cost

$390,861)

$

665,584

‡

Shares/Par

are

denominated

in

U.S.

dollars

unless

otherwise

noted.

(1)

Non-income

producing

(2)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(3)

Security

cannot

be

offered

for

public

resale

without

first

being

registered

under

the

Securities

Act

of

1933

and

related

rules

("restricted

security").

Acquisition

date

represents

the

day

on

which

an

enforceable

right

to

acquire

such

security

is

obtained

and

is

presented

along

with

related

cost

in

the

security

description.

The

fund

may

have

registration

rights

for

certain

restricted

securities.

Any

costs

related

to

such

registration

are

generally

borne

by

the

issuer.

The

aggregate

value

of

restricted

securities

(excluding

144A

holdings)

at

period

end

amounts

to

$29,991

and

represents

4.5%

of

net

assets.

(4)

Perpetual

security

with

no

stated

maturity

date.

(5)

The

identity

of

certain

securities

has

been

concealed

to

protect

the

fund

while

it

completes

a

purchase

or

selling

program

for

the

securities.

T.

ROWE

PRICE

Health

Sciences

Portfolio

.

(6)

Security

was

purchased

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933

and

may

be

resold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers.

Total

value

of

such

securities

at

period-end

amounts

to

$620

and

represents

0.1%

of

net

assets.

(7)

Seven-day

yield

(8)

Affiliated

Companies

ADR

American

Depositary

Receipts

CHF

Swiss

Franc

EC

Escrow

CUSIP;

represents

a

beneficial

interest

in

a

residual

pool

of

assets;

the

amount

and

timing

of

future

distributions,

if

any,

is

uncertain;

when

presented,

interest

rate

and

maturity

date

are

those

of

the

original

security.

EUR

Euro

JPY

Japanese

Yen

T.

ROWE

PRICE

Health

Sciences

Portfolio

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

December

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

—#

$

—

$

178+

Supplementary

Investment

Schedule

Affiliate

Value

12/31/23

Purchase

Cost

Sales

Cost

Value

12/31/24

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

13,820

¤

¤

$

5,168^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

+

Investment

income

comprised

$178

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$5,168.

T.

ROWE

PRICE

Health

Sciences

Portfolio

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Assets

Investments

in

securities,

at

value

(cost

$390,861)

$

665,584

Receivable

for

shares

sold

405

Dividends

and

interest

receivable

310

Foreign

currency

(cost

$68)

67

Other

assets

243

Total

assets

666,609

Liabilities

Payable

for

shares

redeemed

1,051

Investment

management

fees

payable

383

Due

to

affiliates

11

Payable

for

investment

securities

purchased

2

Payable

to

directors

1

Other

liabilities

237

Total

liabilities

1,685

NET

ASSETS

$

664,924

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

272,661

Paid-in

capital

applicable

to

13,748,588

shares

of

$0.0001

par

value

capital

stock

outstanding;

1,000,000,000

shares

of

the

Corporation

authorized

392,263

NET

ASSETS

$

664,924

NET

ASSET

VALUE

PER

SHARE

Health

Sciences

Portfolio

Class

(Net

assets:

$144,197;

Shares

outstanding:

2,813,070)

$

51.26

Health

Sciences

Portfolio

-

II

Class

(Net

assets:

$520,727;

Shares

outstanding:

10,935,518)

$

47.62

T.

ROWE

PRICE

Health

Sciences

Portfolio

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

ok

Year

Ended

12/31/24

Investment

Income

(Loss)

Income

Dividend

(net

of

foreign

taxes

of

$2)

$

5,083

.

Interest

34

Total

income

5,117

Expenses

Investment

management

and

administrative

expenses

(1)

2,263

Investment

management

3,188

Shareholder

servicing

Health

Sciences

Portfolio

Class

$

158

Health

Sciences

Portfolio

-

II

Class

575

733

Rule

12b-1

fees

Health

Sciences

Portfolio

-

II

Class

1,419

Prospectus

and

shareholder

reports

Health

Sciences

Portfolio

Class

7

Health

Sciences

Portfolio

-

II

Class

5

12

Custody

and

accounting

161

Legal

and

audit

46

Directors

2

Miscellaneous

18

Waived

/

paid

by

Price

Associates

(

24

)

Total

expenses

7,818

Net

investment

loss

(

2,701

)

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Securities

60,875

Foreign

currency

transactions

7

Net

realized

gain

60,882

Change

in

net

unrealized

gain

/

loss

Securities

(

45,656

)

Other

assets

and

liabilities

denominated

in

foreign

currencies

(

24

)

Change

in

net

unrealized

gain

/

loss

(

45,680

)

Net

realized

and

unrealized

gain

/

loss

15,202

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

12,501

(1)

Prior

to

May

1,

2024,

the

fund

operated

under

an

all-inclusive

annual

fee

which

is

represented

as

"Investment

management

and

administrative

expense"

on

the

Statement

of

Operations.

See

Note

6.

T.

ROWE

PRICE

Health

Sciences

Portfolio

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

..

.

.

.

.

.

.

.

. ..

.

..

Ended

.

.

.

.

.

.

. .

.

.

.

.

..

..

.

12/31/24

12/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

loss

$

(

2,701

)

$

(

2,873

)

Net

realized

gain

60,882

35,439

Change

in

net

unrealized

gain

/

loss

(

45,680

)

(

14,658

)

Increase

in

net

assets

from

operations

12,501

17,908

Distributions

to

shareholders

Net

earnings

Health

Sciences

Portfolio

Class

(

12,695

)

(

5,381

)

Health

Sciences

Portfolio

-

II

Class

(

49,064

)

(

20,335

)

Decrease

in

net

assets

from

distributions

(

61,759

)

(

25,716

)

Capital

share

transactions

*

Shares

sold

Health

Sciences

Portfolio

Class

12,732

12,277

Health

Sciences

Portfolio

-

II

Class

59,360

48,189

Distributions

reinvested

Health

Sciences

Portfolio

Class

12,695

5,381

Health

Sciences

Portfolio

-

II

Class

49,064

20,335

Shares

redeemed

Health

Sciences

Portfolio

Class

(

25,898

)

(

15,613

)

Health

Sciences

Portfolio

-

II

Class

(

96,079

)

(

89,733

)

Increase

(decrease)

in

net

assets

from

capital

share

transactions

11,874

(

19,164

)

Net

Assets

Decrease

during

period

(

37,384

)

(

26,972

)

Beginning

of

period

702,308

729,280

End

of

period

$

664,924

$

702,308

*Share

information

(000s)

Shares

sold

Health

Sciences

Portfolio

Class

214

223

Health

Sciences

Portfolio

-

II

Class

1,065

931

Distributions

reinvested

Health

Sciences

Portfolio

Class

249

102

Health

Sciences

Portfolio

-

II

Class

1,035

409

Shares

redeemed

Health

Sciences

Portfolio

Class

(

440

)

(

283

)

Health

Sciences

Portfolio

-

II

Class

(

1,733

)

(

1,740

)

Increase

(decrease)

in

shares

outstanding

390

(

358

)

T.

ROWE

PRICE

Health

Sciences

Portfolio

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

Equity

Series,

Inc. (the

corporation) is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

Health

Sciences

Portfolio

(the

fund)

is a

diversified, open-end

management

investment

company

established

by

the

corporation. The

fund

seeks long-term

capital

appreciation.

Shares

of

the

fund

currently

are

offered

only

to

insurance

company

separate

accounts

established

for

the

purpose

of

funding

variable

annuity

contracts

and

variable

life

insurance

policies.

The

fund

has

two

classes

of

shares:

the Health

Sciences

Portfolio

(Health

Sciences

Portfolio

Class)

and

the Health

Sciences

Portfolio–II

(Health

Sciences

Portfolio–II

Class). Health

Sciences

Portfolio–II

Class

shares

are

sold

through

financial

intermediaries,

which

it

compensates

for

distribution,

shareholder

servicing,

and/or

certain

administrative

services

under

a

Board-approved

Rule

12b-1

plan.

Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

both

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

class.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;