UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07143

| T. Rowe Price Equity Series, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Item 1. Report to Shareholders

| Mid-Cap Growth Portfolio | June 30, 2015 |

| ● | Mid-cap growth stocks slowed their advance but still moved higher in the first half of the year.

|

| ● | The Mid-Cap Growth Portfolio handily outperformed its benchmark and peer group.

|

| ● | The portfolio’s top contributors included several companies that have benefited from the merger boom; energy stocks generally detracted from performance.

|

| ● | The market environment remains ebullient, but we are determined to maintain our disciplined investment process. |

The views and opinions in this report were current as of June 30, 2015. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Mid-Cap Growth Portfolio

Fellow Shareholder

Mid-cap growth stocks slowed their advance in the first half of 2015 but still managed to move higher. We are happy to report that our portfolio performed even better, recording a more substantial gain relative to its benchmark and peers than we would have expected at the start of the year. Our longtime shareholders will not be surprised to find us looking at the market with considerable unease, as we sense the party on Wall Street has gone on too long. Frothy conditions are not widespread but do exist in some precincts of the equity market, and the threat of a reckoning from years of extraordinarily easy monetary policy have made us somewhat cautious. We continue to reduce our positions in some of our strongest-performing but riskier holdings.

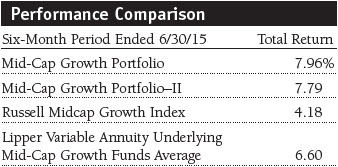

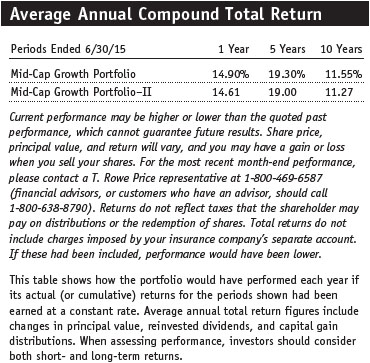

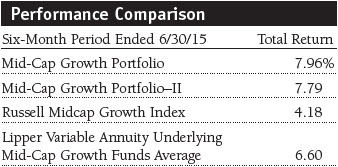

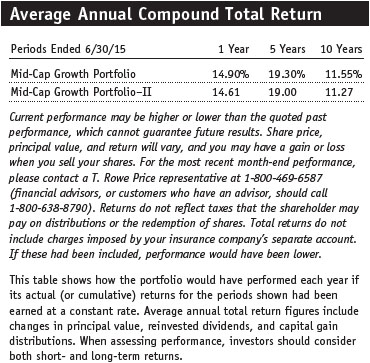

The Mid-Cap Growth Portfolio returned 7.96% in the first half of 2015; the Mid-Cap Growth Portfolio–II returned 7.79% over that same period. Our portfolio handily outperformed its benchmark and Lipper peers. The portfolio remained favorably ranked relative to its competitors over all time periods. (Based on cumulative total return, Lipper ranked the Mid-Cap Growth Portfolio 10 of 106, 10 of 103, 13 of 99, and 5 of 79 funds in the variable annuity underlying mid-cap growth funds category for the 1-, 3-, 5-, and 10-year periods ended June 30, 2015, respectively. Lipper ranked the Mid-Cap Growth Portfolio–II 19 of 106, 17 of 103, 20 of 99, and 10 of 79 funds in the variable annuity underlying mid-cap growth funds category for the 1-, 3-, 5-, and 10-year periods ended June 30, 2015, respectively. Past performance cannot guarantee future results.)

The market continued to advance in the first half of 2015, even as warning lights flashed that its fuel tanks were running low. As in early 2014, U.S. economic growth came to a standstill as the year began. Unseasonably cold weather in much of the country was again partially to blame, but the slowdown in the oil patch and a West Coast port strike also took a toll. Of more direct concern to investors, corporate earnings growth stalled as global economic growth remained tepid, energy sector profits plunged, and the strong U.S. dollar weighed on overseas earnings. By March and April, however, it became obvious that the U.S. economy was again enjoying a spring thaw, with employers continuing to add to payrolls and many employees finally enjoying substantial real wage gains. Higher wages could mean increased pressure on corporate profit margins, which have reached record levels in recent years.

Absent profit growth, it became increasingly evident that exceptionally easy monetary policy was fueling much of the market’s momentum. Fed officials once stated they would begin to raise interest rates off of historic lows when the unemployment rate reached 6.5% but have continued to remain on the sidelines as the rate ticked down to 5.3% by the end of June. Policymakers moved the goal posts, stating that they would wait for inflation to move closer to a 2% target, itself an exceptionally arbitrary goal. Investors appeared to celebrate when the first rate increase, widely expected by June, was pushed back at least until September. Even if the Fed does raise rates in the fall, various officials have appeared to suggest that any increase would be “one and done”—a single, modest increase followed by a pause to see how the economy and markets react.

Regular readers of these letters should not be surprised that our view of the Fed’s inaction is not enthusiastic. Indeed, ultra-low interest rates continue to inflate asset bubbles around the globe, from real estate (a Monaco penthouse was reportedly on the market for $400 million) to art (a Gaugin is rumored to have sold for a record $300 million) to bond prices (German bond yields turned negative early in the year; investors were actually paying the German government to keep their money). The effect of very low rates has been hurtful to many retirees and savers who need to live on low-risk interest income. We believe that ultra-loose monetary policies encourage the misallocation of capital by favoring slow-growth borrowers, such as large corporations and governments over small businesses, and may have actually hindered economic growth. The great financial crisis erupted almost seven years ago, and one would think that the process of normalizing interest rates would be well underway by now. Furthermore, suppressing interest rates at zero so long into an economic recovery may hamstring policymakers should the economy unexpectedly weaken.

While the torrent of cheap money may have affected stock prices less than asset categories such as art and real estate, it has still had a considerable impact. As we mentioned, some of the liquidity has found its way into the private venture market, where investors have bid untested and oftentimes unprofitable companies to stratospheric valuations. Cheap money has also fostered an ongoing boom in mergers and acquisitions (M&A), which has reached its highest level of activity since the eve of the financial crisis in 2007. While there is always uncertainty about the future, we are in the midst of a grand and extraordinary monetary experiment, where the short-term risk-free rate of return is nearly zero—or below zero when investors paid for the privilege of loaning money to certain European governments this spring.

In recent months, investors have been crowding into the stocks of the fastest-growing companies in favored industries, driving valuations in some market segments to levels we would consider frothy. Biotechnology and subsets of the technology and consumer sectors have been ground zero for many of the excesses, a pattern evident in the performance of the Russell Midcap Growth Index in the first half of the year. Health care stocks, heavily represented by biotech firms, rose over 16% in the period, while technology shares gained over 6%. Energy shares fell 2%. With moderate economic growth and corporate profits under pressure, investors favored growth stocks in early 2015, and the Russell Midcap Growth Index dramatically outpaced its value counterpart.

Portfolio Review

Given this backdrop, it is hardly surprising that many of the portfolio’s top performers resulted from the bubbly M&A environment. Several of our health care holdings received takeover offers in the first half of 2015, and the sector was the largest contributor in the period. Injectable drug specialist Hospira surged early in the year following the announcement of it being acquired by Pfizer; we trimmed our position in the aftermath. Similarly, biotech firm Pharmacyclics announced that it was being bought at a significant premium by AbbVie. The acquisitions of health care equipment maker CareFusion and life sciences firm Covance were announced in late 2014, but the stocks recorded some modest additional gains before we liquidated the positions in the first half of this year. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Information technology, another locus of M&A activity, was the second-best contributor to our results. The portfolio’s top overall contributor for the period was programmable chipmaker Altera, which surged on the announcement of a takeover by Intel. We have a particular emphasis on technology services firms and longtime holdings Fiserv and Global Payments were also significant gainers, while we harvested some of our profits in open-source software leader Red Hat. We had a notable disappointment in Rackspace Hosting, however, whose Web services business has suffered from heavy competition from Amazon and Microsoft. We are hopeful that Rackspace’s efforts to ally with these giants instead will eventually pay off.

Industrial stocks generally performed poorly in the period, but the relatively good gains we enjoyed in the segment were a major factor in our outperforming the benchmark. The industrials sector has long been an area of emphasis for us, exemplified by the performance of our top contributor Pall. We initiated a position in this filtration maker four years ago when an executive we knew from another holding, fluid controls firm IDEX, took over as CEO. Pall’s stock surged in May when it announced that it was being acquired by another former longtime investment, diversified machinery giant Danaher. Kansas City Southern weighed on results as falling demand for transporting commodities and problems in its Mexican operations caused its stock to fall.

The portfolio has only modest exposure to the hard-hit energy sector, but many of our leading detractors were clustered in the segment. CONSOL Energy was hurt by both the slump in natural gas prices, which may prove temporary, and the downturn in the coal market, which seems likely to be more lasting. Range Resources, Cimarex Energy, and Pioneer National Resources also weighed on returns. We have continued to trim our exposure to energy as new discoveries exert downward pressure on the cost curve in a world that is already awash in oil and gas.

The performance of our consumer discretionary holdings is worth noting because of the large boost it provided to our results. Our standout performer here was media giant Netflix, which has led the migration from conventional television to on-demand viewing on mobile devices. The company continued to demonstrate impressive subscriber growth in both the U.S. and in international markets while developing successful original content. We reduced our position as the stock powered ahead, however. Moreover, we have generally grown increasingly cautious about consumer firms, especially those catering to the higher-end consumers who have been the driving force behind the sector but appear to be losing some steam. Lower- and middle-income consumers, who have not participated to the same extent in this recovery, may begin to benefit from higher levels of employment and rising wages. Such an economic recalibration would be a very healthy development for the U.S. economy.

Investment Strategy and Outlook

In our last two letters, we have warned shareholders that our relatively cautious, value-conscious stance might cause the portfolio to underperform in the months ahead should the market remain effervescent. While we are happy to have been wrong, it is probably a warning that we will continue to reiterate as long as the bull market’s momentum remains intact. The mid-cap growth universe is particularly susceptible to periods of “irrational exuberance” (a term from the 1990s that a new generation of investors may not even remember), and our reluctance to emphasize highflying stocks has periodically led us to lag the market.

The current market is most certainly not a bubble—stock valuations are only somewhat expensive—but it does bear an uncomfortable similarity to past periods of market excesses. So-called concept stocks, whose valuations are based on potential rather than profit, are outperforming as investors increasingly turn to unconventional valuation methodologies to justify stock prices. Silicon Valley’s new acronym—FOMO, or fear of missing out—speaks volumes about the mind-set used to justify valuations for some firms. Simply put, the current environment makes us somewhat queasy.

Mix bullishness with cheap money and the result has been the highest level of M&A activity in the history of the portfolio. This presents us with a conundrum. Some of our smartest management teams and Boards are looking at the long bull market, the record-low costs of capital, and the attendant frothy valuations and choosing to be sellers, not buyers. While this does reward our portfolio holders in a short period of time, it is very difficult to find replacements for these holdings that meet our criteria for investment, especially at prices we like. We are also skeptical of many of these deals on the acquirer’s side, as the return on many of them promises to be very low or even destructive to value over the long term. A handful of our portfolio holdings have announced large acquisitions themselves, challenging our investment theses and faith in their acumen.

We are struck by how much the investment environment has changed in just six years. Extreme risk aversion has been replaced by nearly blind faith and obliviousness to risk—a complacency that may persist but could also reverse suddenly if conditions change. In our view, the prudent course is to continue to adhere to the disciplined investment process that has served us well for years while maintaining exposure to strong companies that are likely to thrive when normalcy returns.

Respectfully submitted,

Brian W.H. Berghuis

Chairman of the portfolio’s Investment Advisory Committee

John F. Wakeman

Executive vice president of the portfolio

July 21, 2015

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing its investment program.

As with all stock and bond mutual funds, the portfolio’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. The financial markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. The stocks of mid-cap companies entail greater risk and are usually more volatile than the shares of larger companies. In addition, growth stocks can be volatile for several reasons. Since they usually reinvest a high proportion of earnings in their own businesses, they may lack the dividends usually associated with value stocks that can cushion their decline in a falling market. Also, since investors buy these stocks because of their expected superior earnings growth, earnings disappointments often result in sharp price declines.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper Inc.

Russell Midcap Growth Index: An unmanaged index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecast growth values.

Russell Midcap Value Index: An unmanaged index that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecast growth values.

Note: Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

Portfolio Highlights

Portfolio Highlights

Performance and Expenses

T. Rowe Price Mid-Cap Growth Portfolio

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies. Please note that the fund has two classes of shares: the original share class and II Class. II Class shares are sold through financial intermediaries, which are compensated for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

Financial Highlights

T. Rowe Price Mid-Cap Growth Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

Financial Highlights

T. Rowe Price Mid-Cap Growth Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

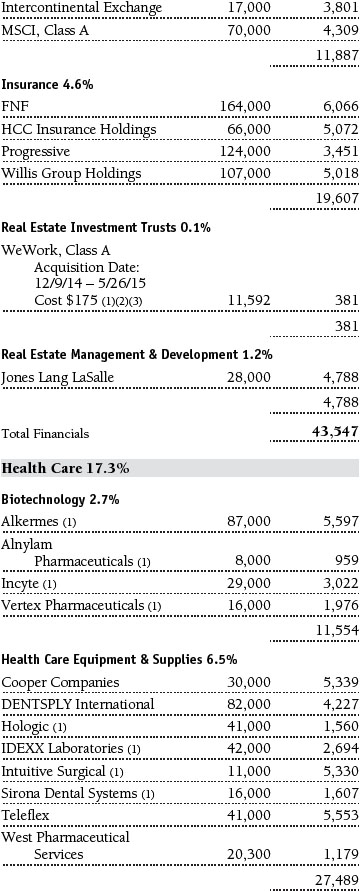

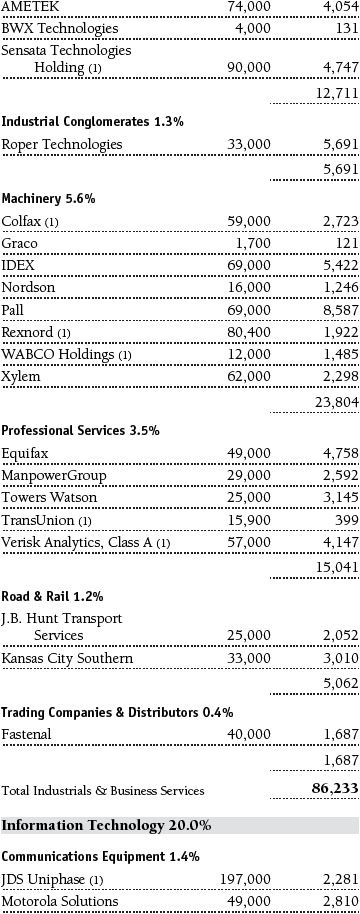

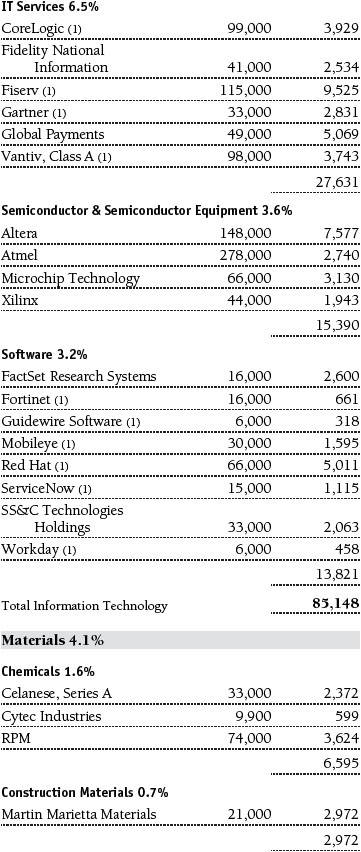

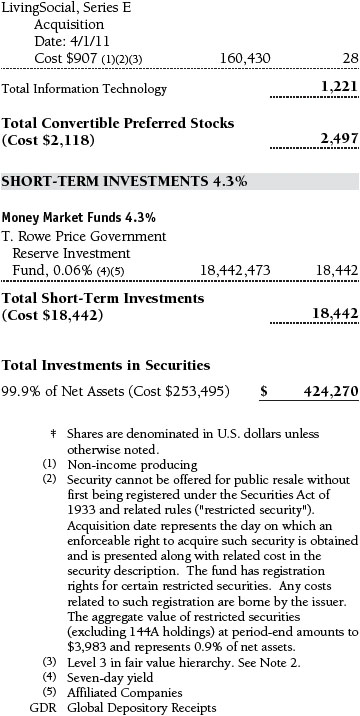

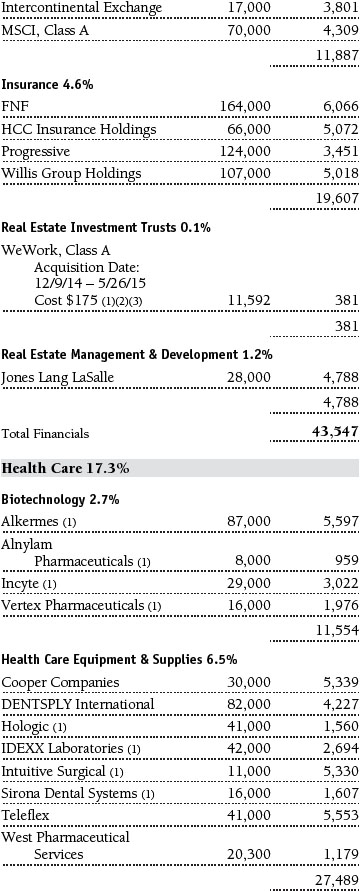

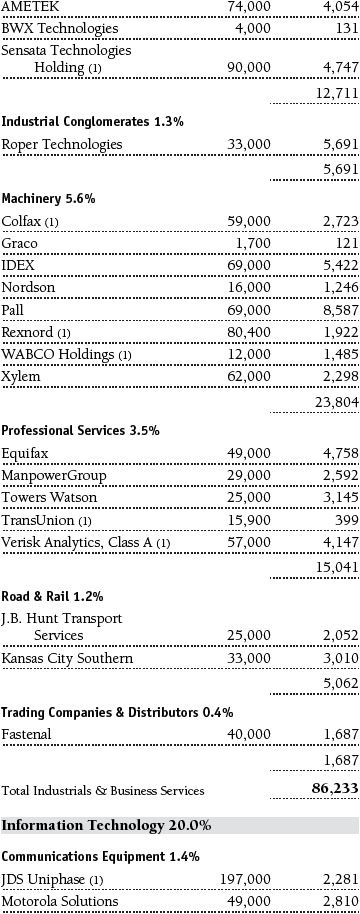

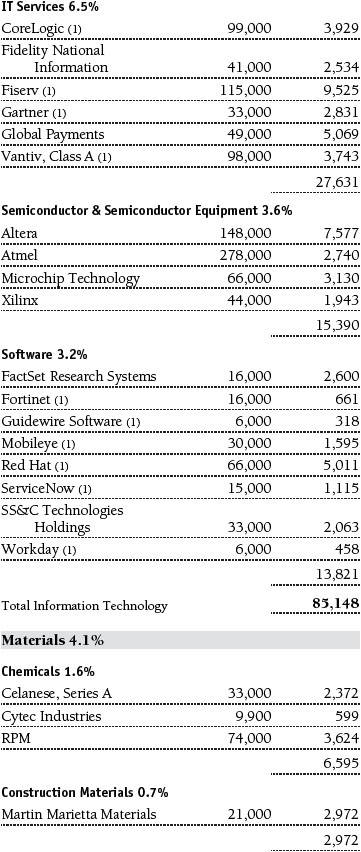

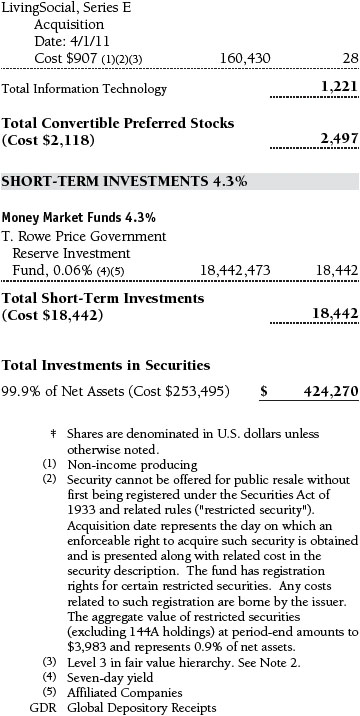

Portfolio of Investments‡

T. Rowe Price Mid-Cap Growth Portfolio

June 30, 2015 (Unaudited)

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

T. Rowe Price Mid-Cap Growth Portfolio

June 30, 2015 (Unaudited)

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

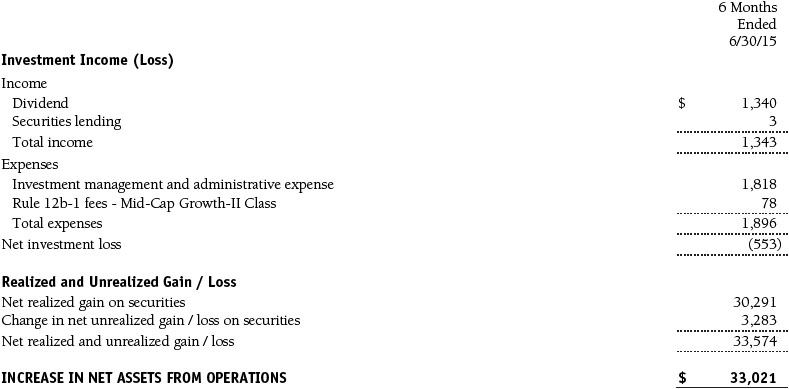

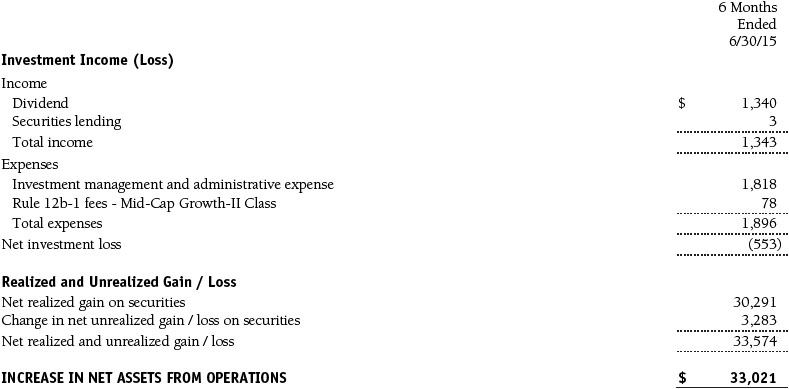

Statement of Operations

T. Rowe Price Mid-Cap Growth Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets

T. Rowe Price Mid-Cap Growth Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

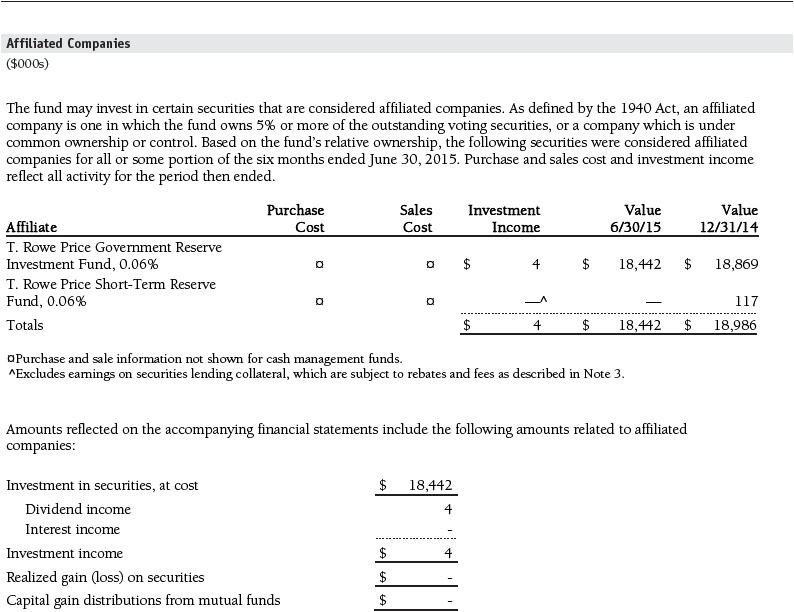

Notes to Financial Statements

T. Rowe Price Mid-Cap Growth Portfolio

June 30, 2015 (Unaudited)

T. Rowe Price Equity Series, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Mid-Cap Growth Portfolio (the fund) is a diversified, open-end management investment company established by the corporation. Shares of the fund currently are offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies. The fund seeks to provide long-term capital appreciation by investing in mid-cap stocks with potential for above-average earnings growth. The fund has two classes of shares: the Mid-Cap Growth Portfolio original share class (Mid-Cap Growth Class), offered since December 31, 1996, and the Mid-Cap Growth Portfolio–II (Mid-Cap Growth–II Class), offered since April 30, 2002. Mid-Cap Growth–II Class shares are sold through financial intermediaries, which it compensates for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including but not limited to ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Class Accounting Mid-Cap Growth–II pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Investment income, investment management and administrative expense, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $2,000 for the six months ended June 30, 2015.

New Accounting Guidance In June 2014, FASB issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The ASU is effective for interim and annual reporting periods beginning after December 15, 2014. Adoption will have no effect on the fund’s net assets or results of operations.

In May 2015, FASB issued ASU No. 2015-07, Fair Value Measurement (Topic 820), Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent). The ASU removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient and amends certain disclosure requirements for such investments. The ASU is effective for interim and annual reporting periods beginning after December 15, 2015. Adoption will have no effect on the fund’s net assets or results of operations.

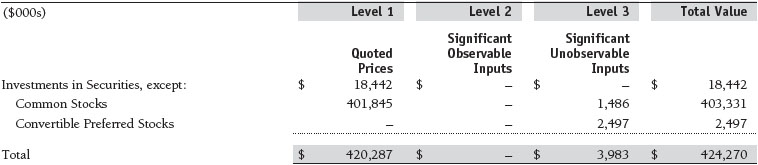

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) has been established by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board; is chaired by the fund’s treasurer; and has representation from legal, portfolio management and trading, operations, and risk management.

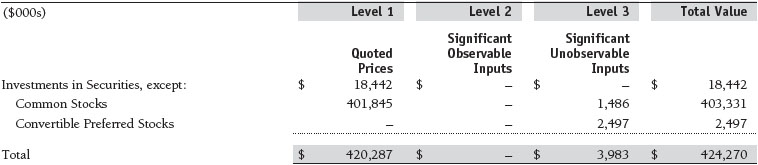

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices. Actively traded domestic equity securities generally are categorized in Level 1 of the fair value hierarchy. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants; transaction information can be reliably obtained; and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

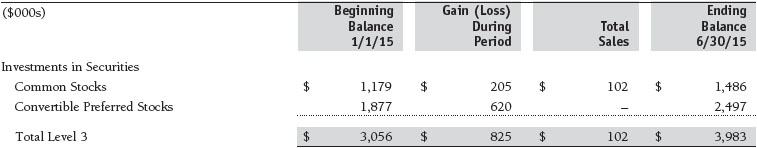

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on June 30, 2015:

There were no material transfers between Levels 1 and 2 during the six months ended June 30, 2015.

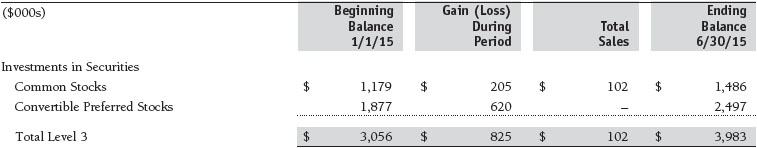

Following is a reconciliation of the fund’s Level 3 holdings for the six months ended June 30, 2015. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at June 30, 2015, totaled $825,000 for the six months ended June 30, 2015.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Securities Lending The fund may lend its securities to approved brokers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities, valued at 102% to 105% of the value of the securities on loan. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested by the lending agent(s) in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At June 30, 2015, there were no securities on loan.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $49,892,000 and $86,931,000, respectively, for the six months ended June 30, 2015.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

At June 30, 2015, the cost of investments for federal income tax purposes was $254,643,000. Net unrealized gain aggregated $169,627,000 at period-end, of which $174,241,000 related to appreciated investments and $4,614,000 related to depreciated investments.

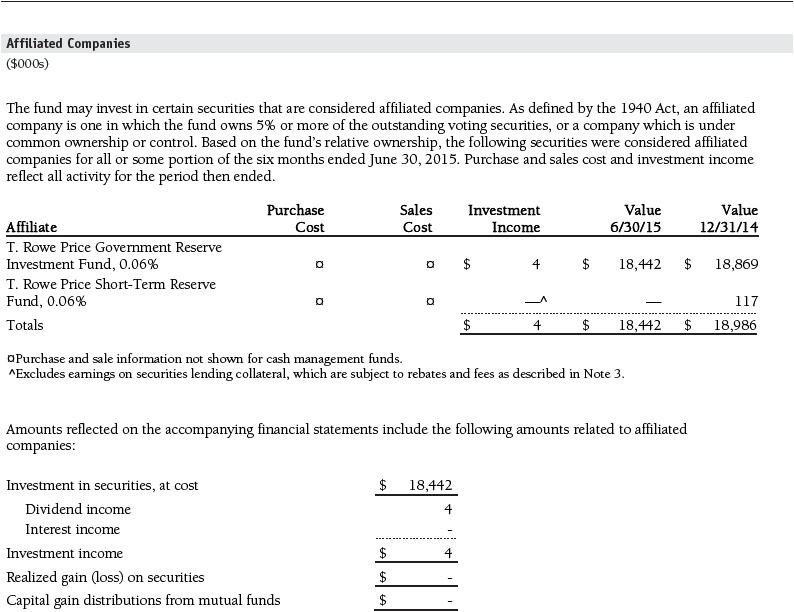

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 0.85% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management, shareholder servicing, transfer agency, accounting, and custody services provided to the fund, as well as fund directors’ fees and expenses. Interest, taxes, brokerage commissions, and extraordinary expenses are paid directly by the fund.

The fund may invest in the T. Rowe Price Reserve Investment Fund, the T. Rowe Price Government Reserve Investment Fund, or the T. Rowe Price Short-Term Reserve Fund (collectively, the Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The Price Reserve Investment Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Investment Funds pay no investment management fees.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Social Responsibility” at the top of our corporate homepage. Next, click on the words “Conducting Business Responsibly” on the left side of the page that appears. Finally, click on the words “Proxy Voting Policies” on the left side of the page that appears.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above to reach the “Conducting Business Responsibly” page. Click on the words “Proxy Voting Records” on the left side of that page, and then click on the “View Proxy Voting Records” link at the bottom of the page that appears.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 13, 2015, the portfolio’s Board of Directors (Board), including a majority of the fund’s independent directors, approved the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor). In connection with its deliberations, the Board requested, and the Advisor provided, such information as the Board (with advice from independent legal counsel) deemed reasonably necessary. The Board considered a variety of factors in connection with its review of the Advisory Contract, also taking into account information provided by the Advisor during the course of the year, as discussed below:

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board reviewed the fund’s three-month, one-year, and year-by-year returns, as well as the fund’s average annualized total returns over the 3-, 5-, and 10-year periods, and compared these returns with a wide variety of previously agreed-upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the applicable fund’s portfolio transactions. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing T. Rowe Price mutual funds. The Board also reviewed estimates of the profits realized from managing the fund in particular, and the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. The Board noted that, under the Advisory Contract, the fund pays the Advisor a single fee based on the fund’s average daily net assets that includes investment management services and provides for the Advisor to pay all expenses of the fund’s operations except for interest, taxes, portfolio transaction fees, and any nonrecurring extraordinary expenses that may arise. The Board concluded that, based on the profitability data it reviewed and consistent with this single-fee structure, the Advisory Contract provided for a reasonable sharing of any benefits from economies of scale with the fund.

Fees

The Board was provided with information regarding industry trends in management fees and expenses, and the Board reviewed the fund’s single-fee structure for the Investor Class and II Class in comparison with fees and expenses of other comparable funds based on information and data supplied by Lipper. For these purposes, the Board assumed that the fund’s management fee rate was equal to the single fee less the fund’s operating expenses. The information provided to the Board indicated that the fund’s management fee rate was above the median for comparable funds. The information also indicated that the total expense ratio for the Investor Class was below the median for comparable funds, and the total expense ratio for the II Class was above the median for comparable funds.

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the mutual fund business is generally more complex from a business and compliance perspective than the institutional business and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price mutual funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder). The independent directors were advised throughout the process by independent legal counsel.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Equity Series, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date August 17, 2015 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date August 17, 2015 | | |

| |

| |

| By | /s/ Catherine D. Mathews |

| | Catherine D. Mathews |

| | Principal Financial Officer |

| |

| Date August 17, 2015 | | |