First Quarter 2024 Earnings Call May 7, 2024

2 Forward Looking Statement & Disclosures Except for specific historical information, many of the matters discussed in this presentation may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward- looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises, on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this presentation, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements. With respect to any non-GAAP financial measures included in the following presentation, the accompanying information required by SEC Regulation G can be found at the back of this presentation or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Harold Bevis President & Chief Executive Officer Mike Felcher SVP & Chief Financial Officer 3

4 ▪ Successful quarter, highlighted by year-over-year growth in volumes at profitable plants; some rationalized volume at underperforming plants; strong operational improvement of underperforming business areas, which is driving margin expansion; and continuation of new business wins at 3x market growth rates. ▪ Entering 2nd year of a significant step-change transformation, pleased with early results, increasing our goals. ▪ 3rd consecutive quarter of making and meeting commitments for adjusted EBITDA, free cash flow, and above- market rate of new business awards. ▪ Strong focus on operational improvements, culture change, and improving all plants & business areas, especially dilutive areas. ▪ Organic growth program working well overall, continuing at same pace. ▪ Confirming and slightly tightening, in part, the 2024 outlook, and currently in initial phases of creating 2025 improvement agenda and key initiatives, with lots of opportunities. Opening Comments

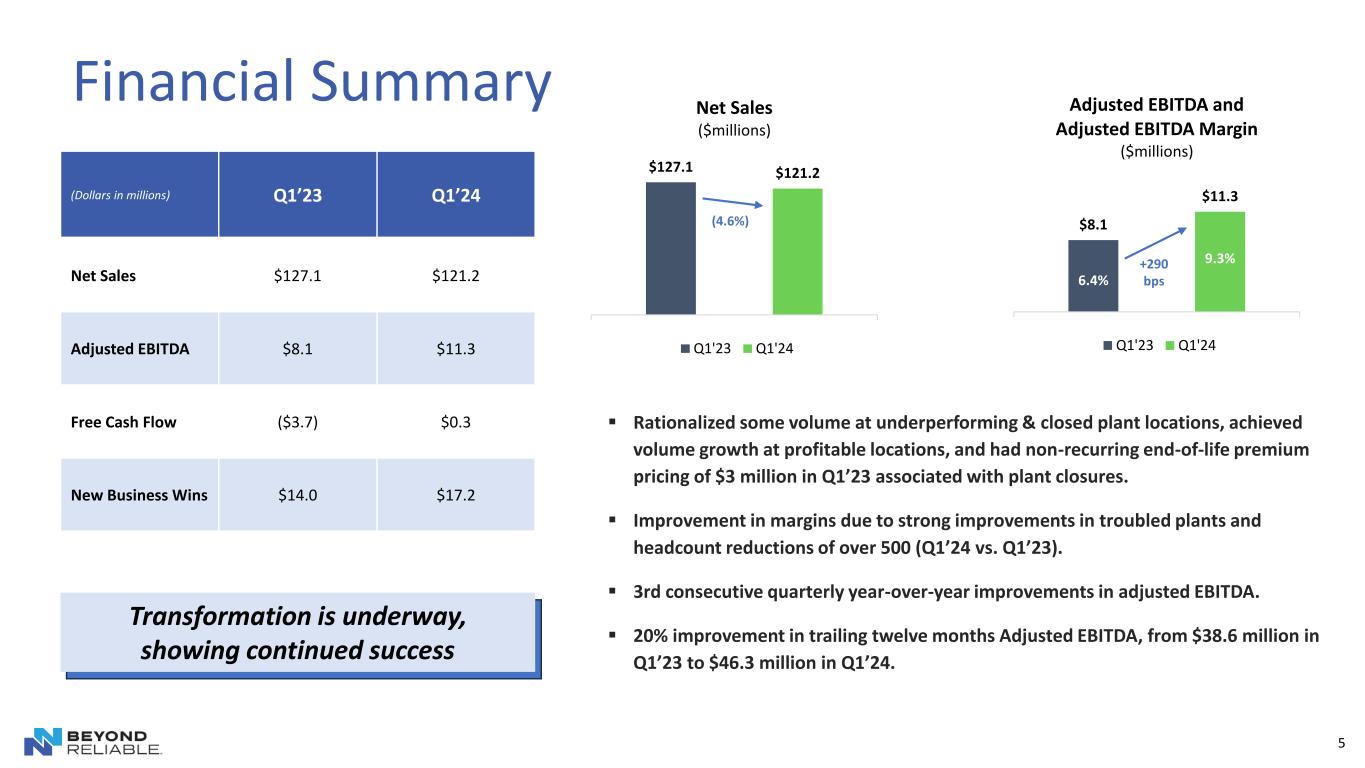

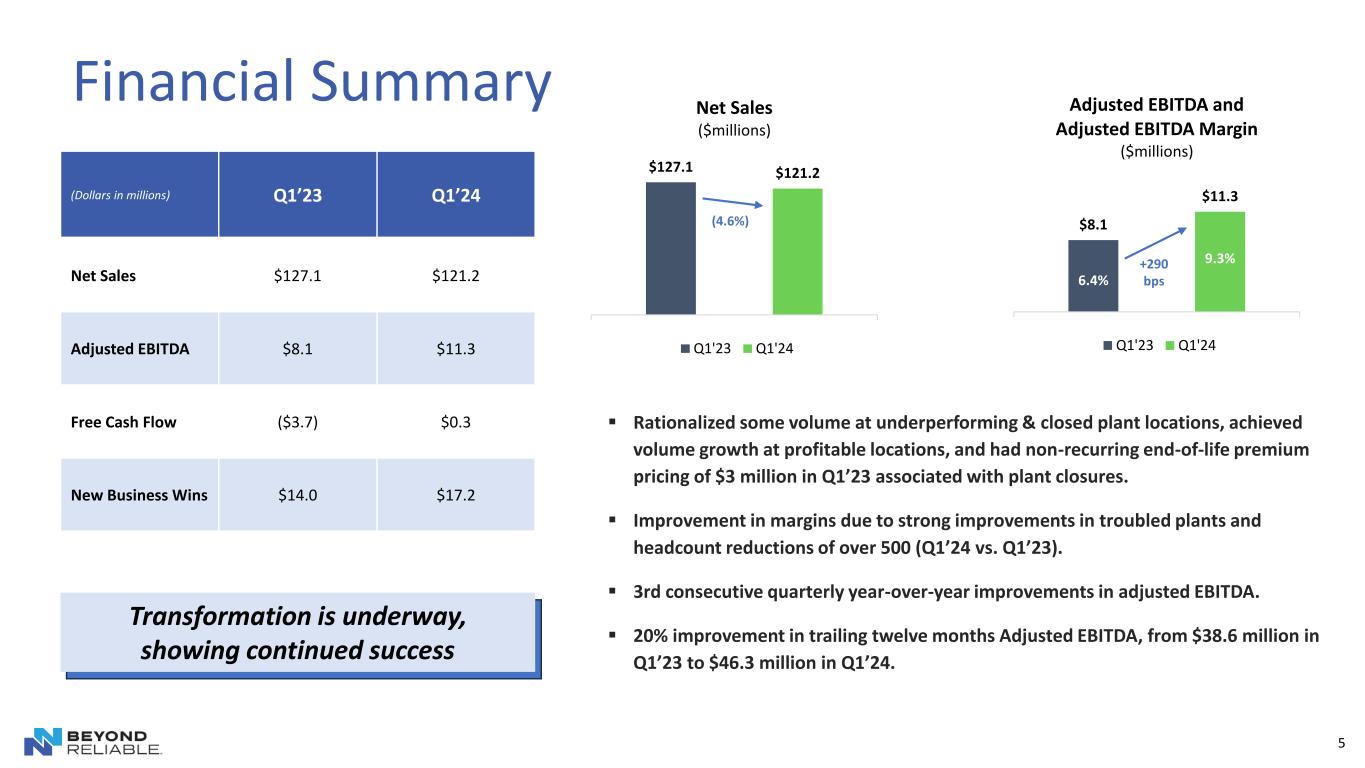

5 ▪ Rationalized some volume at underperforming & closed plant locations, achieved volume growth at profitable locations, and had non-recurring end-of-life premium pricing of $3 million in Q1’23 associated with plant closures. ▪ Improvement in margins due to strong improvements in troubled plants and headcount reductions of over 500 (Q1’24 vs. Q1’23). ▪ 3rd consecutive quarterly year-over-year improvements in adjusted EBITDA. ▪ 20% improvement in trailing twelve months Adjusted EBITDA, from $38.6 million in Q1’23 to $46.3 million in Q1’24. (Dollars in millions) Q1’23 Q1’24 Net Sales $127.1 $121.2 Adjusted EBITDA $8.1 $11.3 Free Cash Flow ($3.7) $0.3 New Business Wins $14.0 $17.2 Transformation is underway, showing continued success $127.1 $121.2 Net Sales ($millions) Q1'23 Q1'24 $8.1 $11.3 Adjusted EBITDA and Adjusted EBITDA Margin ($millions) Q1'23 Q1'24 6.4% 9.3% Financial Summary (4.6%) +290 bps

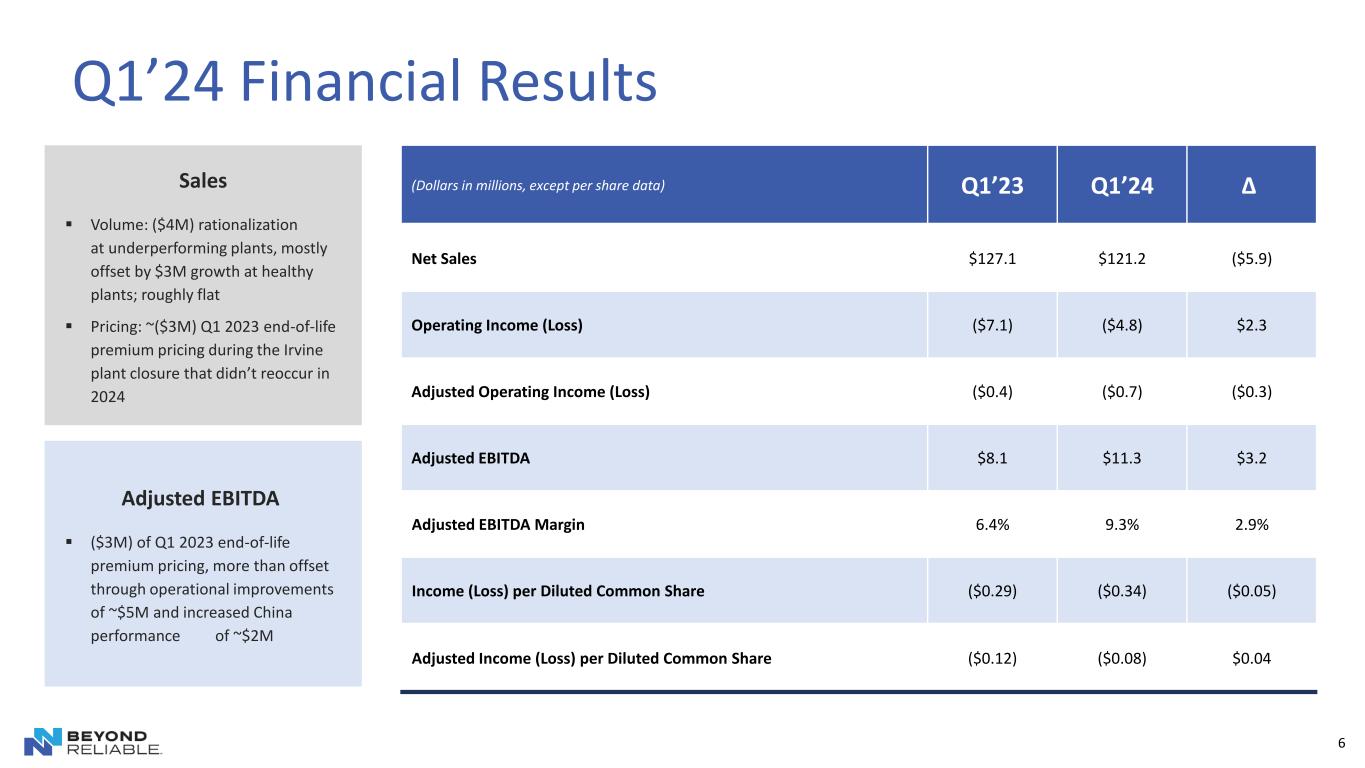

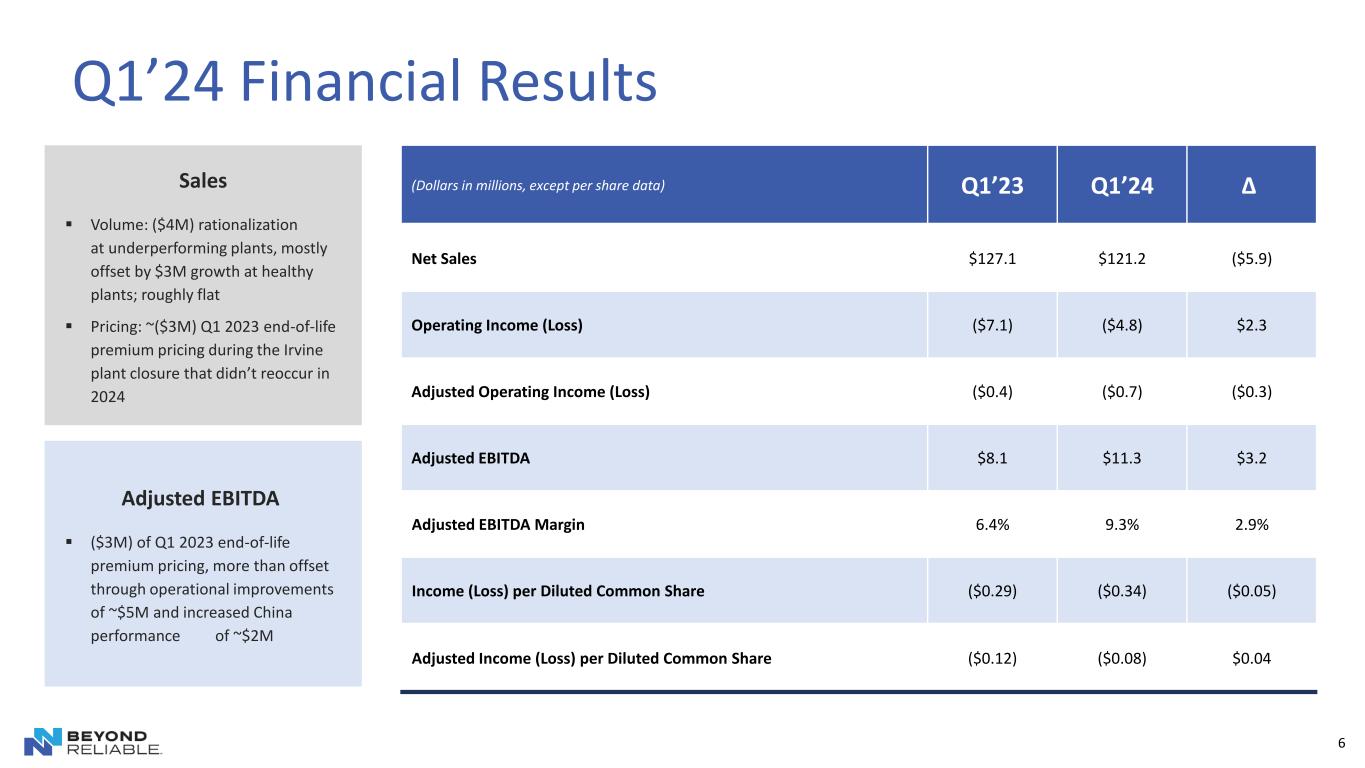

6 Sales ▪ Volume: ($4M) rationalization at underperforming plants, mostly offset by $3M growth at healthy plants; roughly flat ▪ Pricing: ~($3M) Q1 2023 end-of-life premium pricing during the Irvine plant closure that didn’t reoccur in 2024 (Dollars in millions, except per share data) Q1’23 Q1’24 Δ Net Sales $127.1 $121.2 ($5.9) Operating Income (Loss) ($7.1) ($4.8) $2.3 Adjusted Operating Income (Loss) ($0.4) ($0.7) ($0.3) Adjusted EBITDA $8.1 $11.3 $3.2 Adjusted EBITDA Margin 6.4% 9.3% 2.9% Income (Loss) per Diluted Common Share ($0.29) ($0.34) ($0.05) Adjusted Income (Loss) per Diluted Common Share ($0.12) ($0.08) $0.04 Adjusted EBITDA ▪ ($3M) of Q1 2023 end-of-life premium pricing, more than offset through operational improvements of ~$5M and increased China performance of ~$2M Q1’24 Financial Results

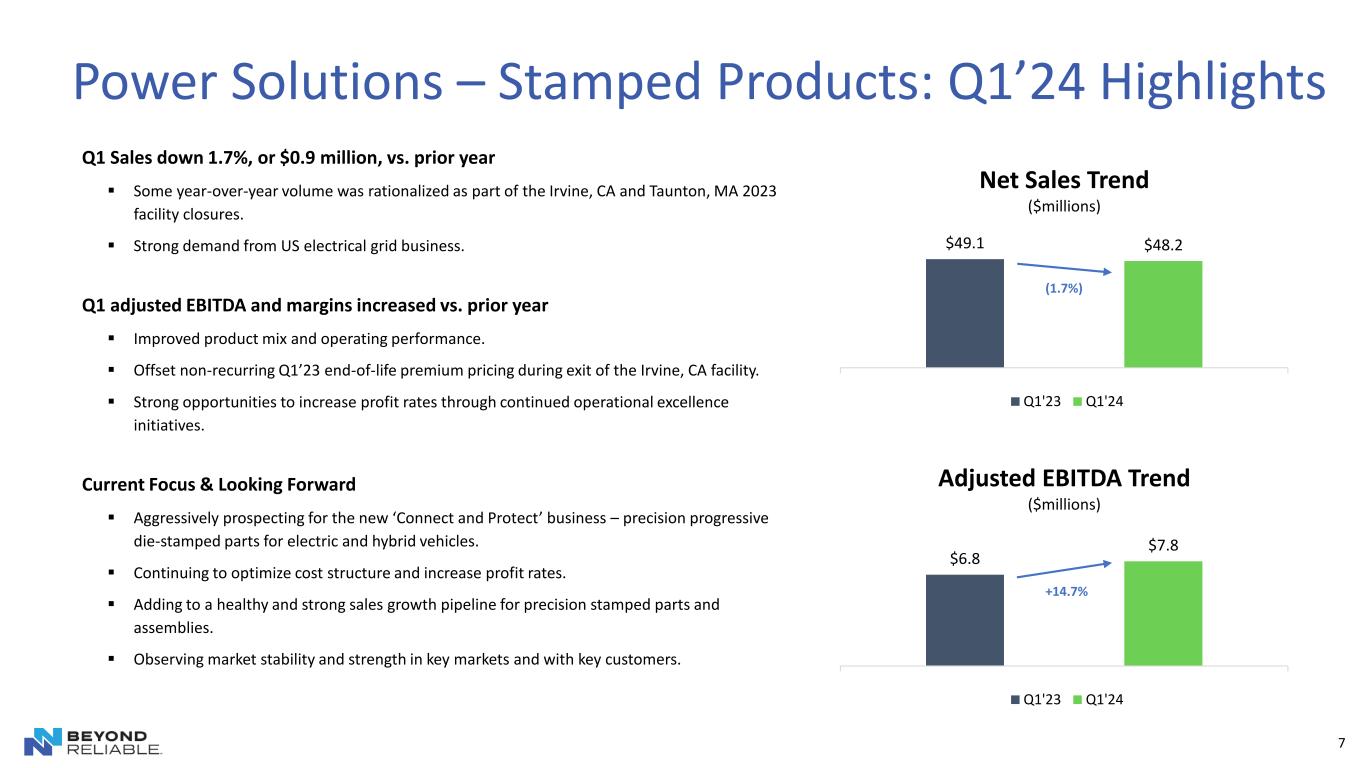

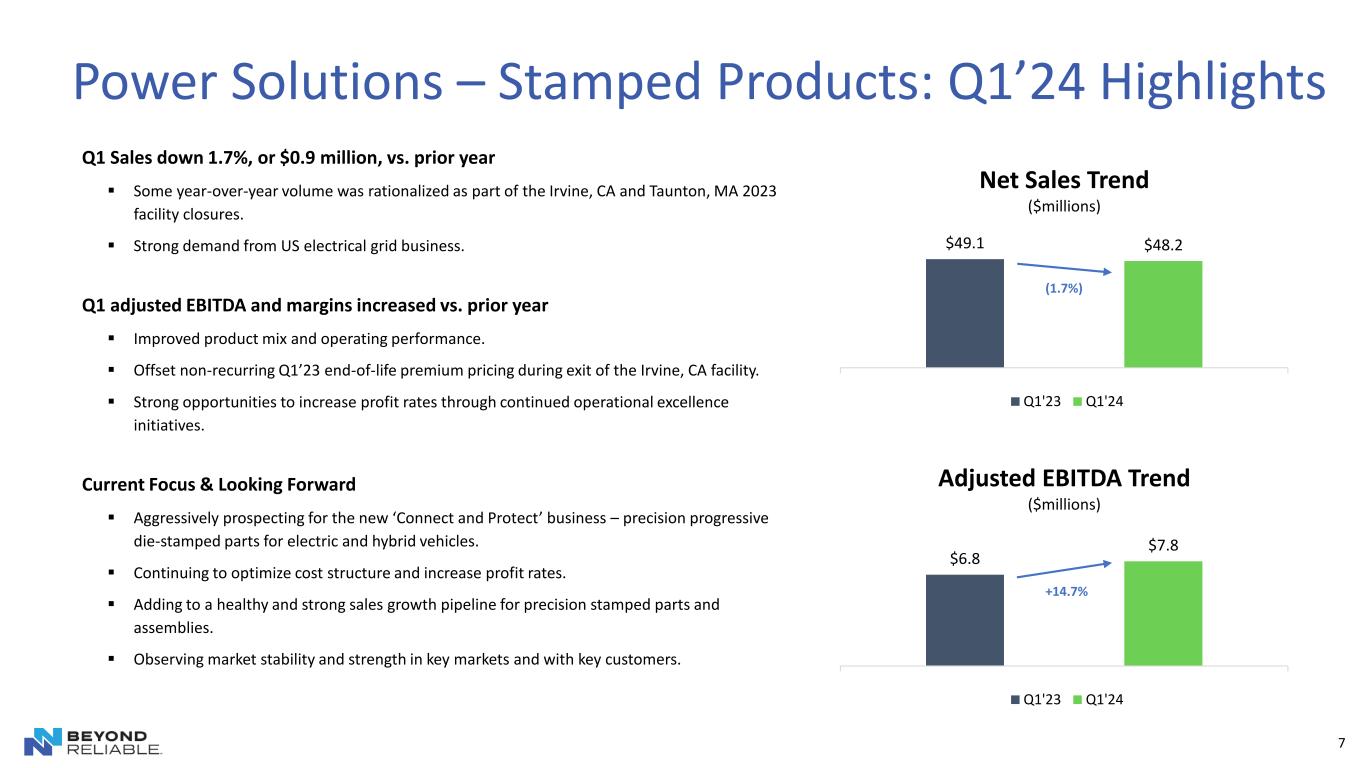

7 Q1 Sales down 1.7%, or $0.9 million, vs. prior year ▪ Some year-over-year volume was rationalized as part of the Irvine, CA and Taunton, MA 2023 facility closures. ▪ Strong demand from US electrical grid business. Q1 adjusted EBITDA and margins increased vs. prior year ▪ Improved product mix and operating performance. ▪ Offset non-recurring Q1’23 end-of-life premium pricing during exit of the Irvine, CA facility. ▪ Strong opportunities to increase profit rates through continued operational excellence initiatives. Current Focus & Looking Forward ▪ Aggressively prospecting for the new ‘Connect and Protect’ business – precision progressive die-stamped parts for electric and hybrid vehicles. ▪ Continuing to optimize cost structure and increase profit rates. ▪ Adding to a healthy and strong sales growth pipeline for precision stamped parts and assemblies. ▪ Observing market stability and strength in key markets and with key customers. Power Solutions – Stamped Products: Q1’24 Highlights $49.1 $48.2 Net Sales Trend ($millions) Q1'23 Q1'24 $6.8 $7.8 Adjusted EBITDA Trend ($millions) Q1'23 Q1'24 (1.7%) +14.7%

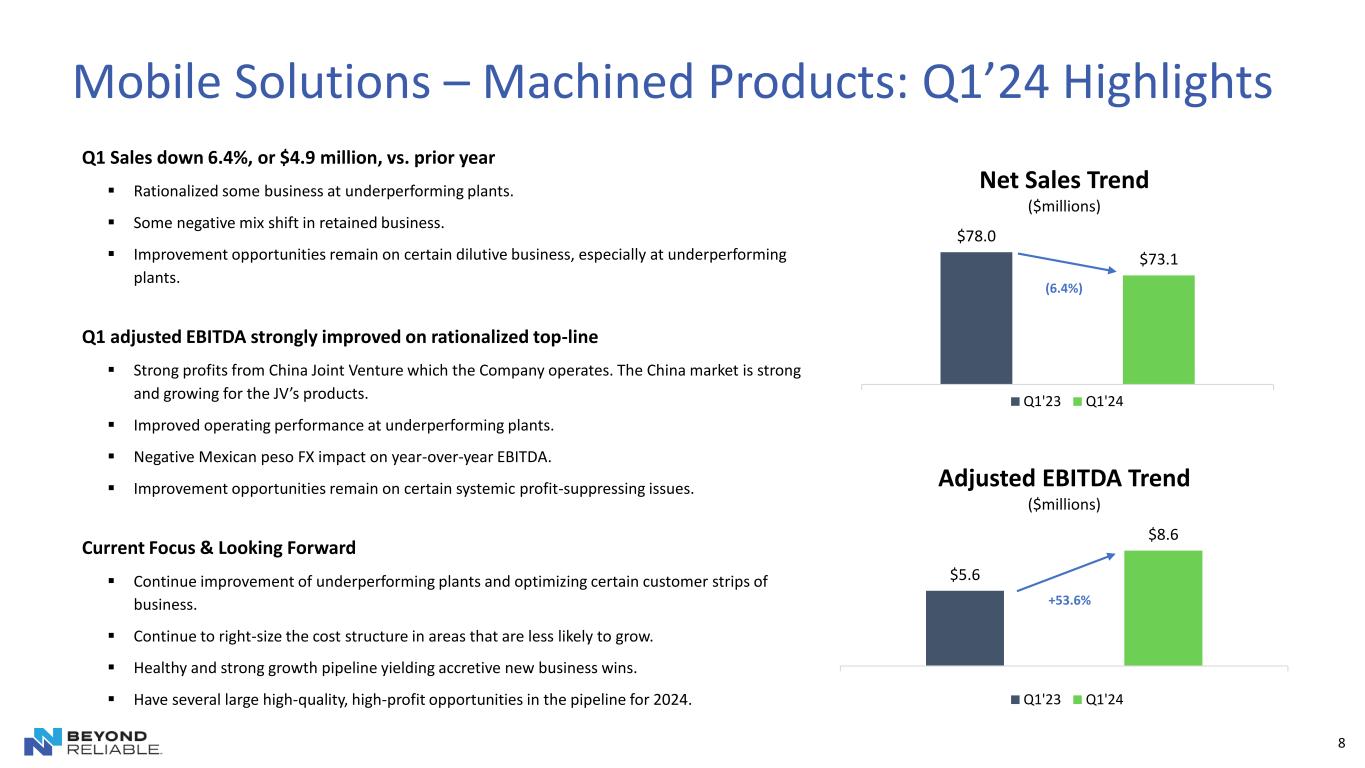

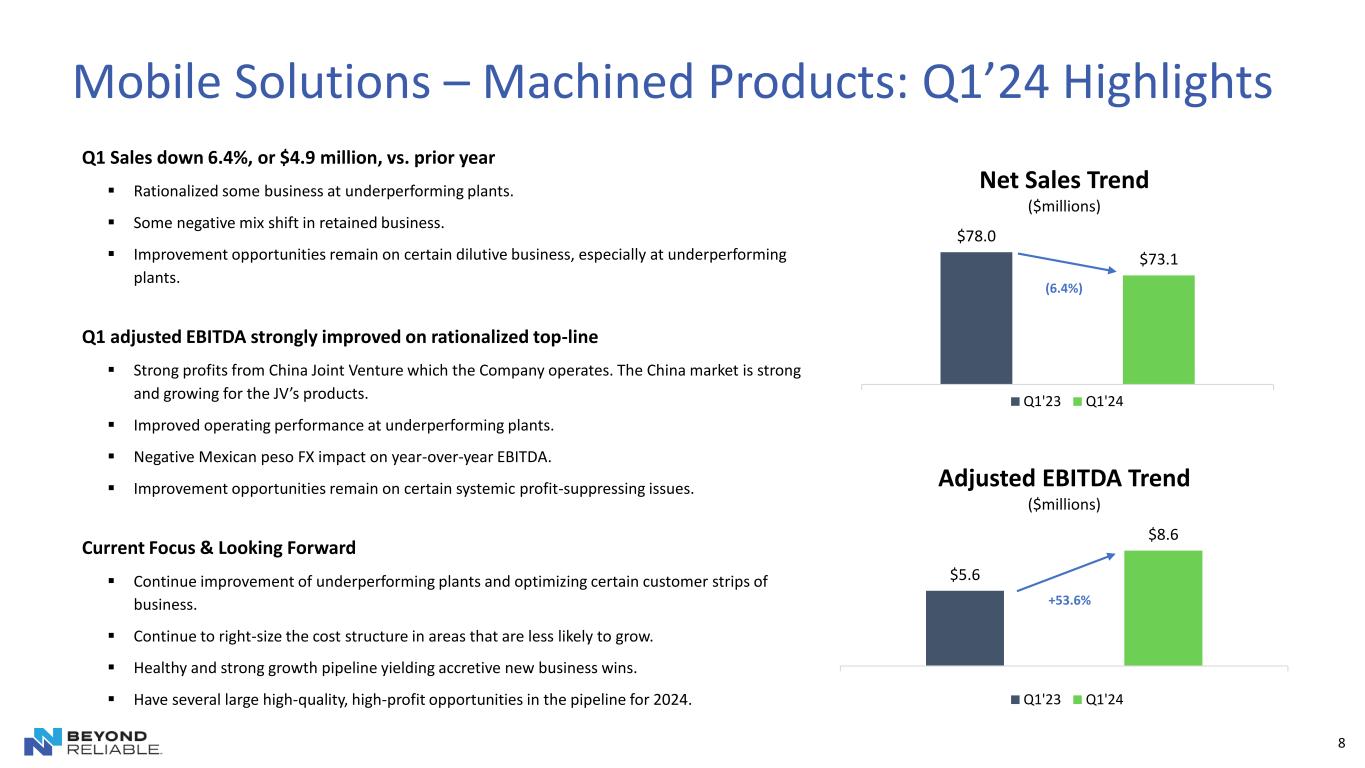

8 Q1 Sales down 6.4%, or $4.9 million, vs. prior year ▪ Rationalized some business at underperforming plants. ▪ Some negative mix shift in retained business. ▪ Improvement opportunities remain on certain dilutive business, especially at underperforming plants. Q1 adjusted EBITDA strongly improved on rationalized top-line ▪ Strong profits from China Joint Venture which the Company operates. The China market is strong and growing for the JV’s products. ▪ Improved operating performance at underperforming plants. ▪ Negative Mexican peso FX impact on year-over-year EBITDA. ▪ Improvement opportunities remain on certain systemic profit-suppressing issues. Current Focus & Looking Forward ▪ Continue improvement of underperforming plants and optimizing certain customer strips of business. ▪ Continue to right-size the cost structure in areas that are less likely to grow. ▪ Healthy and strong growth pipeline yielding accretive new business wins. ▪ Have several large high-quality, high-profit opportunities in the pipeline for 2024. Mobile Solutions – Machined Products: Q1’24 Highlights $78.0 $73.1 Net Sales Trend ($millions) Q1'23 Q1'24 $5.6 $8.6 Adjusted EBITDA Trend ($millions) Q1'23 Q1'24 (6.4%) +53.6%

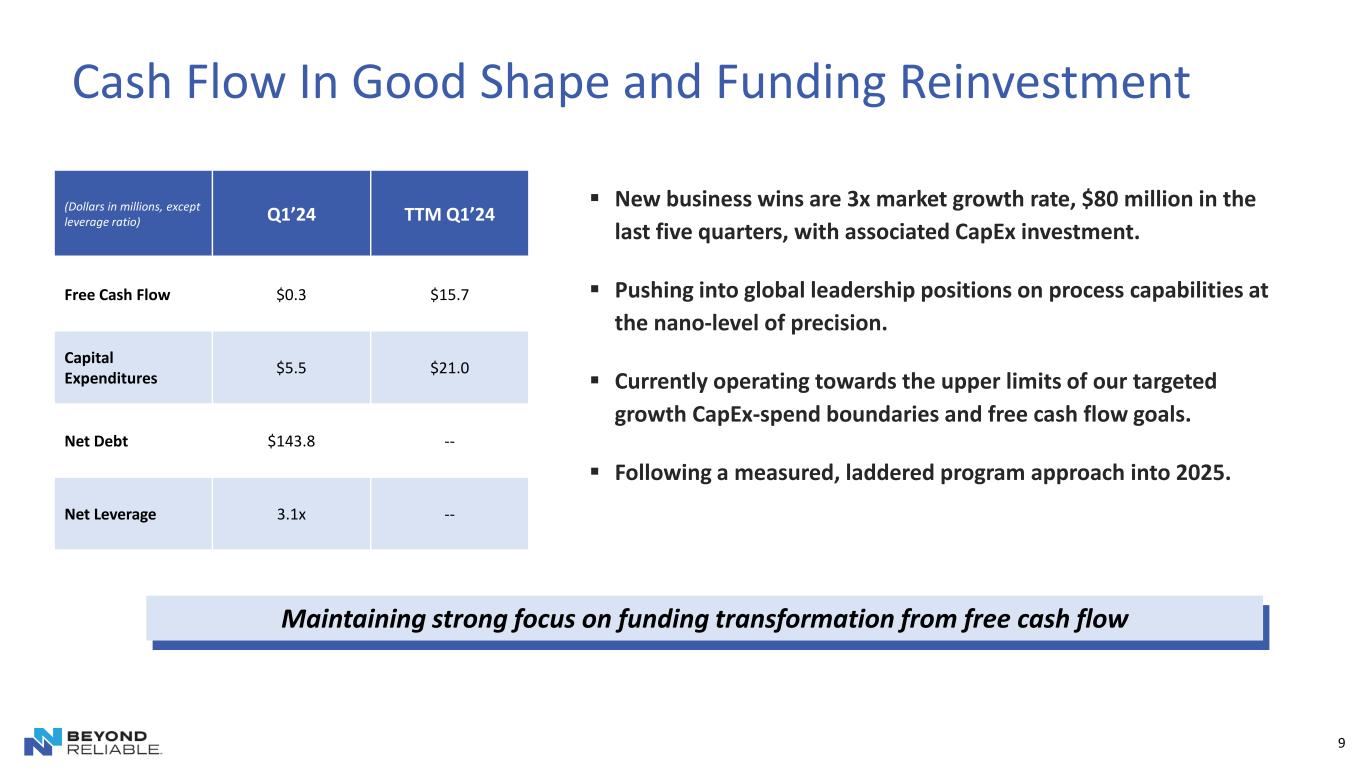

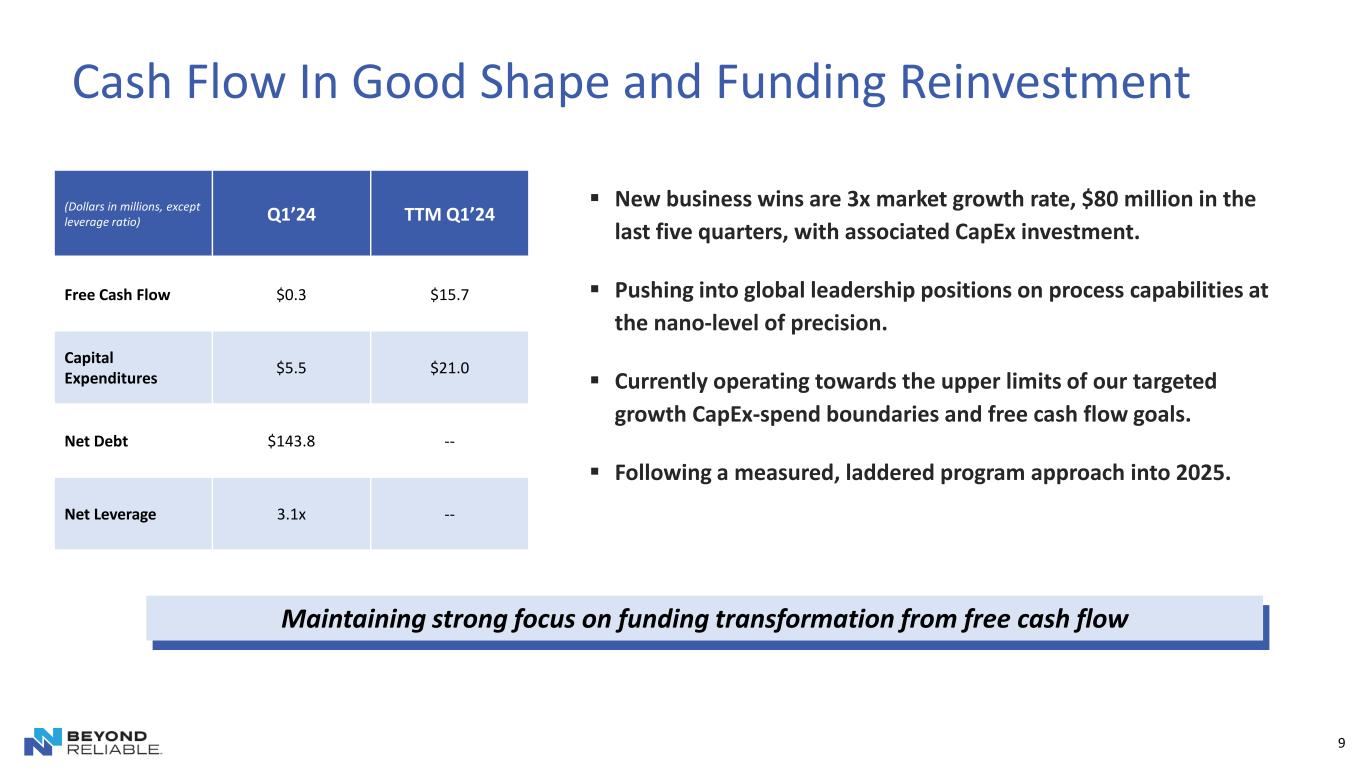

Cash Flow In Good Shape and Funding Reinvestment 9 Maintaining strong focus on funding transformation from free cash flow ▪ New business wins are 3x market growth rate, $80 million in the last five quarters, with associated CapEx investment. ▪ Pushing into global leadership positions on process capabilities at the nano-level of precision. ▪ Currently operating towards the upper limits of our targeted growth CapEx-spend boundaries and free cash flow goals. ▪ Following a measured, laddered program approach into 2025. (Dollars in millions, except leverage ratio) Q1’24 TTM Q1’24 Free Cash Flow $0.3 $15.7 Capital Expenditures $5.5 $21.0 Net Debt $143.8 -- Net Leverage 3.1x --

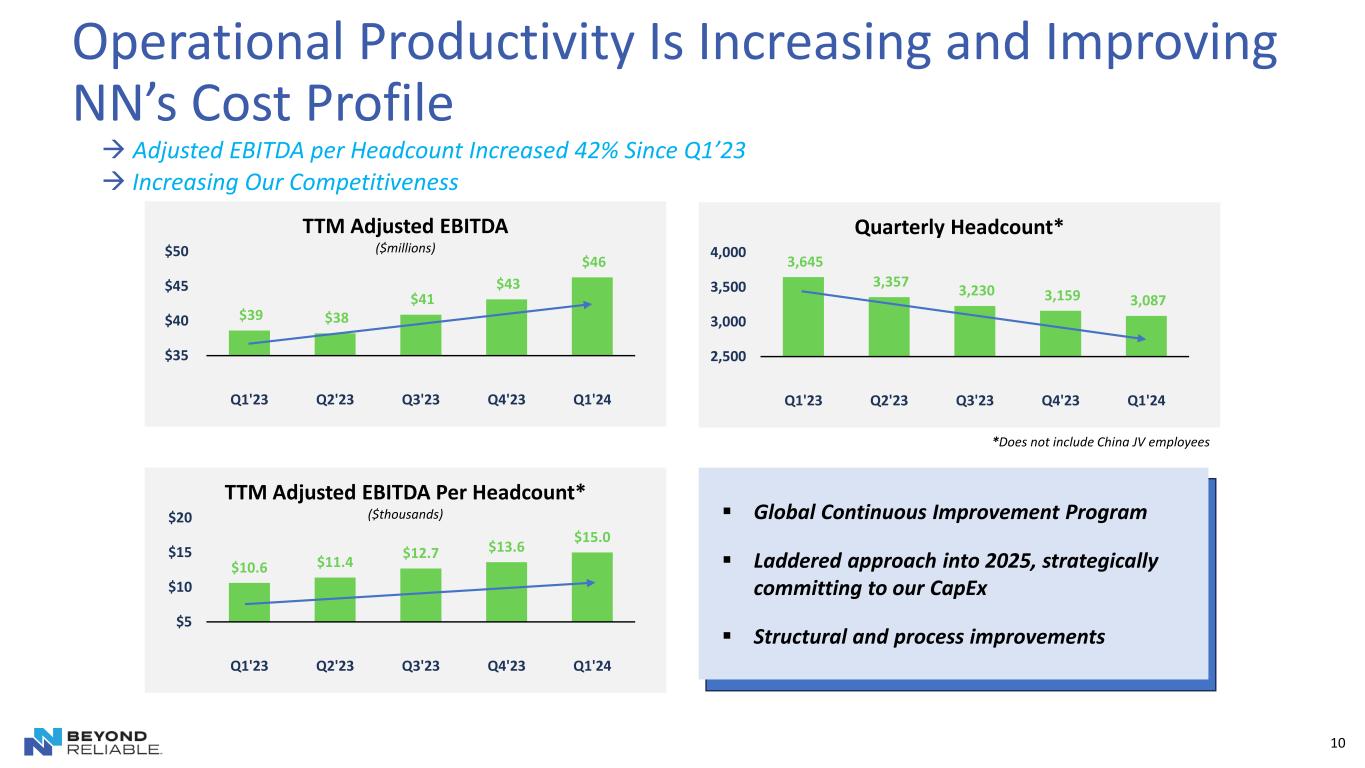

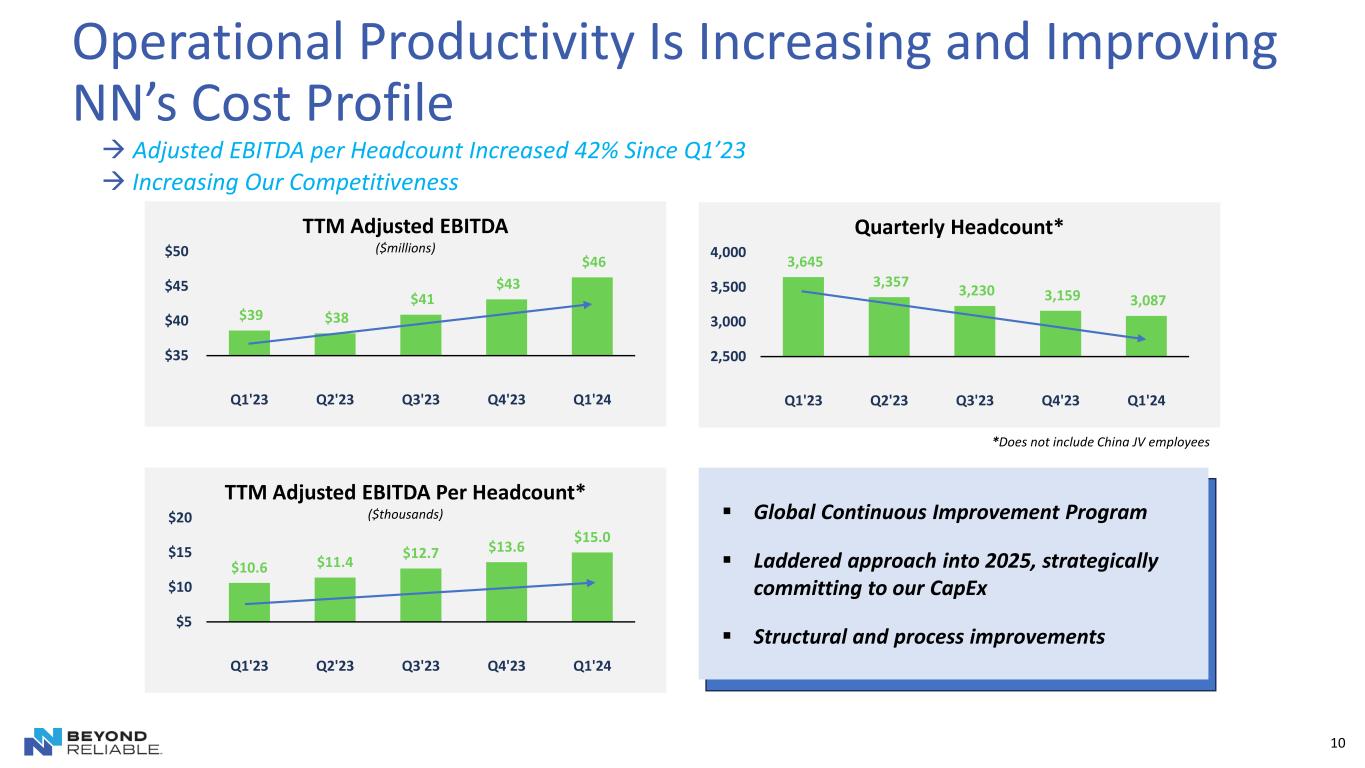

Operational Productivity Is Increasing and Improving NN’s Cost Profile 10 *Does not include China JV employees $39 $38 $41 $43 $46 $35 $40 $45 $50 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 TTM Adjusted EBITDA ($millions) 3,645 3,357 3,230 3,159 3,087 2,500 3,000 3,500 4,000 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Quarterly Headcount* $10.6 $11.4 $12.7 $13.6 $15.0 $5 $10 $15 $20 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 TTM Adjusted EBITDA Per Headcount* ($thousands) ▪ Global Continuous Improvement Program ▪ Laddered approach into 2025, strategically committing to our CapEx ▪ Structural and process improvements → Adjusted EBITDA per Headcount Increased 42% Since Q1’23 → Increasing Our Competitiveness

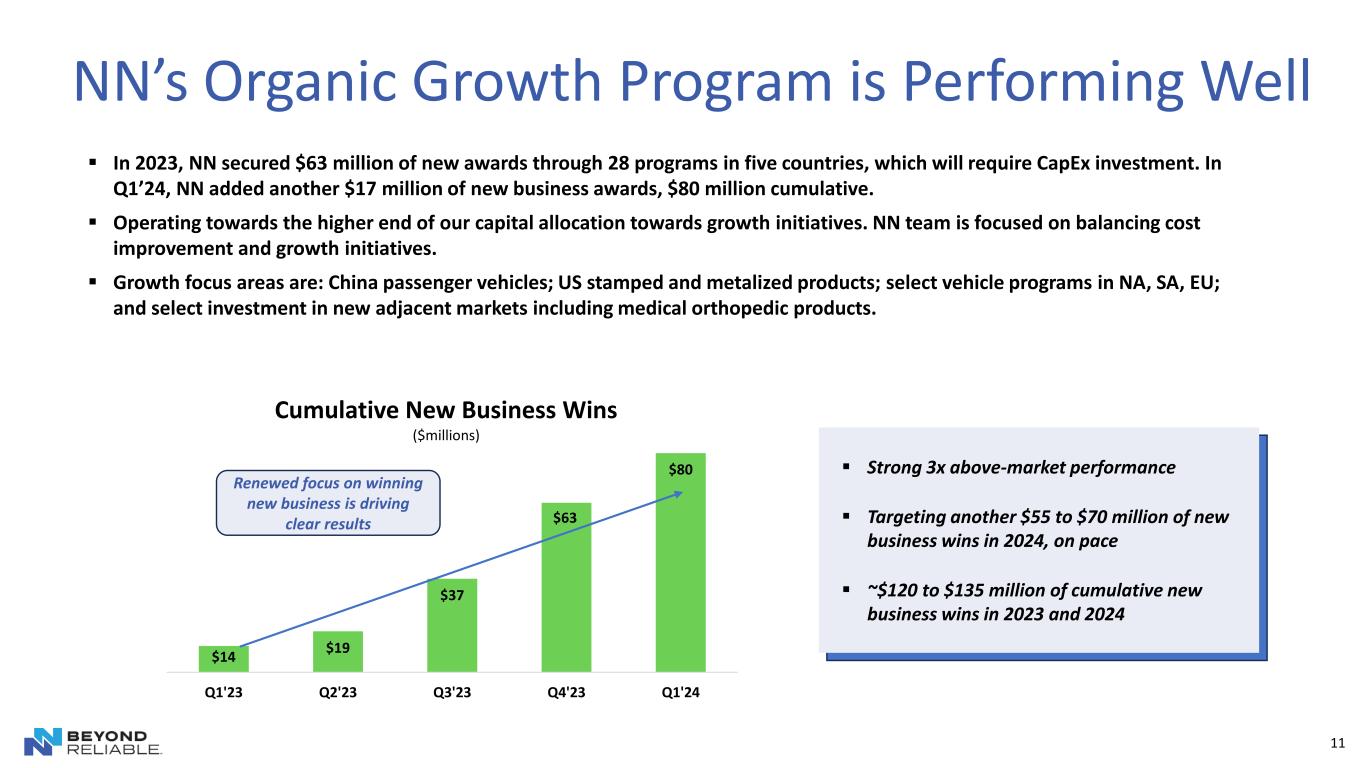

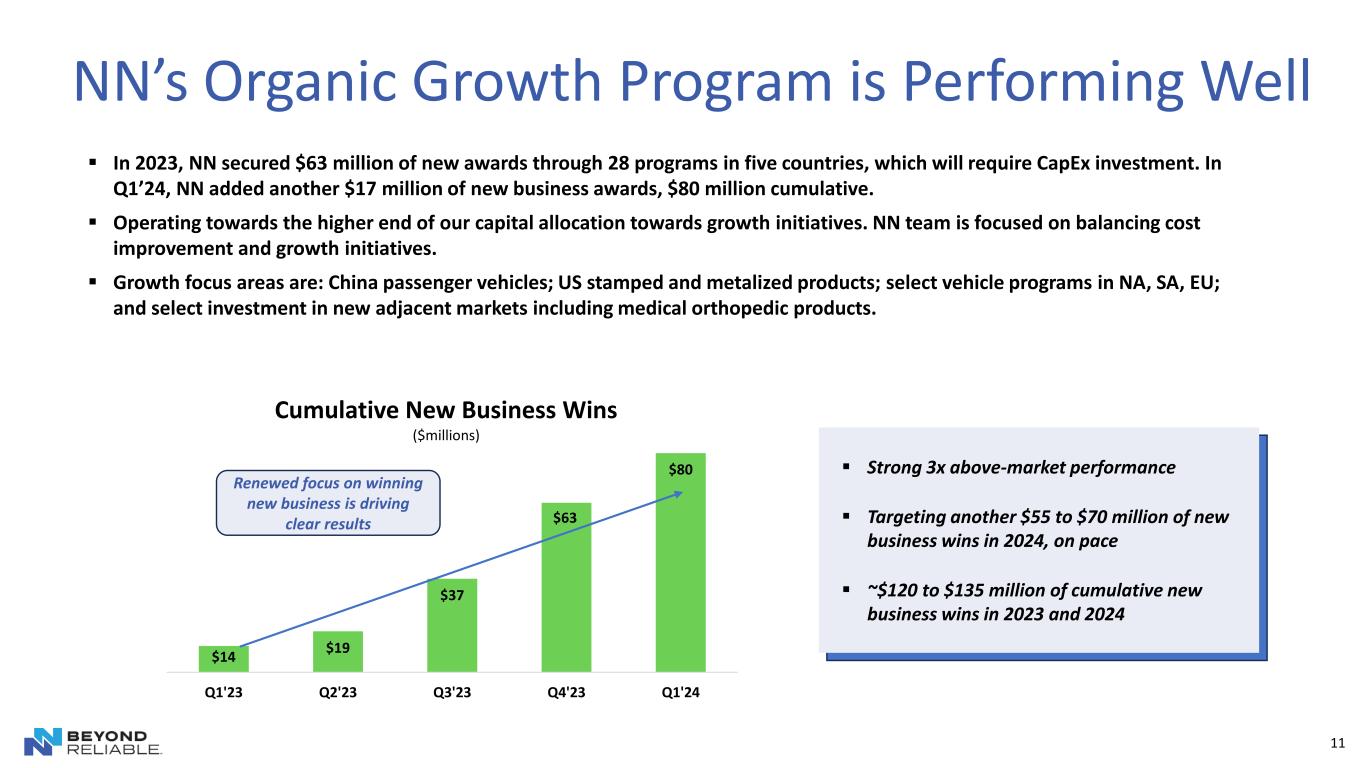

NN’s Organic Growth Program is Performing Well $14 $19 $37 $63 $80 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Cumulative New Business Wins ($millions) 11 ▪ In 2023, NN secured $63 million of new awards through 28 programs in five countries, which will require CapEx investment. In Q1’24, NN added another $17 million of new business awards, $80 million cumulative. ▪ Operating towards the higher end of our capital allocation towards growth initiatives. NN team is focused on balancing cost improvement and growth initiatives. ▪ Growth focus areas are: China passenger vehicles; US stamped and metalized products; select vehicle programs in NA, SA, EU; and select investment in new adjacent markets including medical orthopedic products. ▪ Strong 3x above-market performance ▪ Targeting another $55 to $70 million of new business wins in 2024, on pace ▪ ~$120 to $135 million of cumulative new business wins in 2023 and 2024 Renewed focus on winning new business is driving clear results

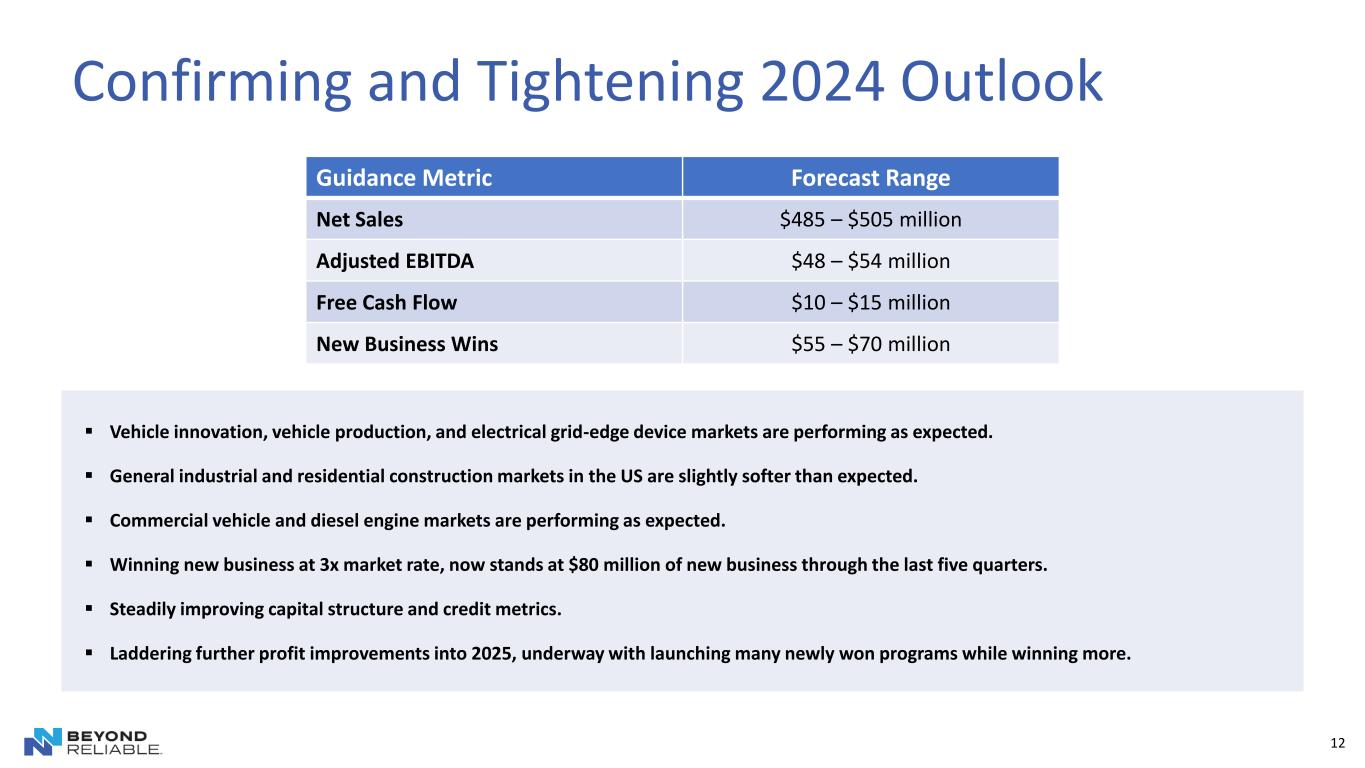

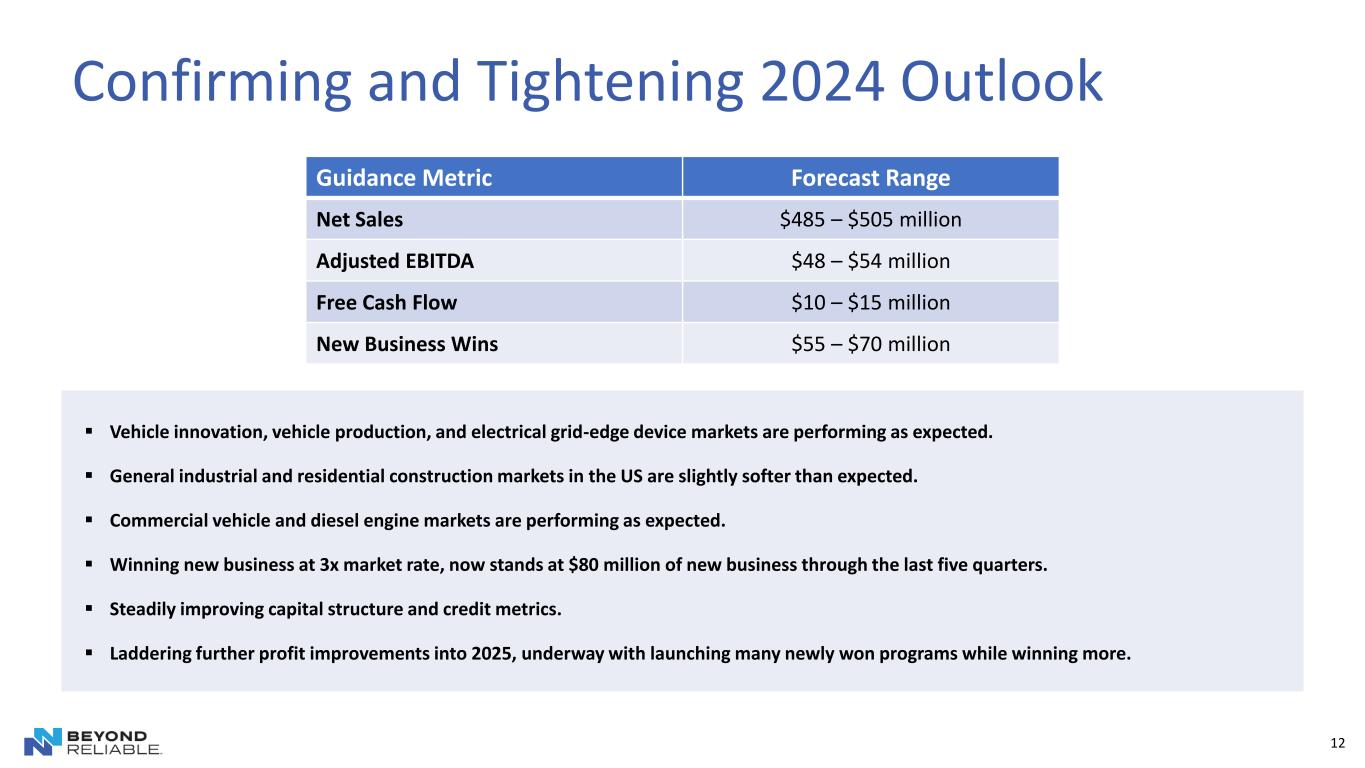

12 Confirming and Tightening 2024 Outlook Guidance Metric Forecast Range Net Sales $485 – $505 million Adjusted EBITDA $48 – $54 million Free Cash Flow $10 – $15 million New Business Wins $55 – $70 million ▪ Vehicle innovation, vehicle production, and electrical grid-edge device markets are performing as expected. ▪ General industrial and residential construction markets in the US are slightly softer than expected. ▪ Commercial vehicle and diesel engine markets are performing as expected. ▪ Winning new business at 3x market rate, now stands at $80 million of new business through the last five quarters. ▪ Steadily improving capital structure and credit metrics. ▪ Laddering further profit improvements into 2025, underway with launching many newly won programs while winning more.

Appendix 13

14 The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded, as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods. The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. (a) Non-GAAP adjusted EBITDA represents GAAP income (loss) from operations, adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. Non-GAAP Financial Measures Footnotes

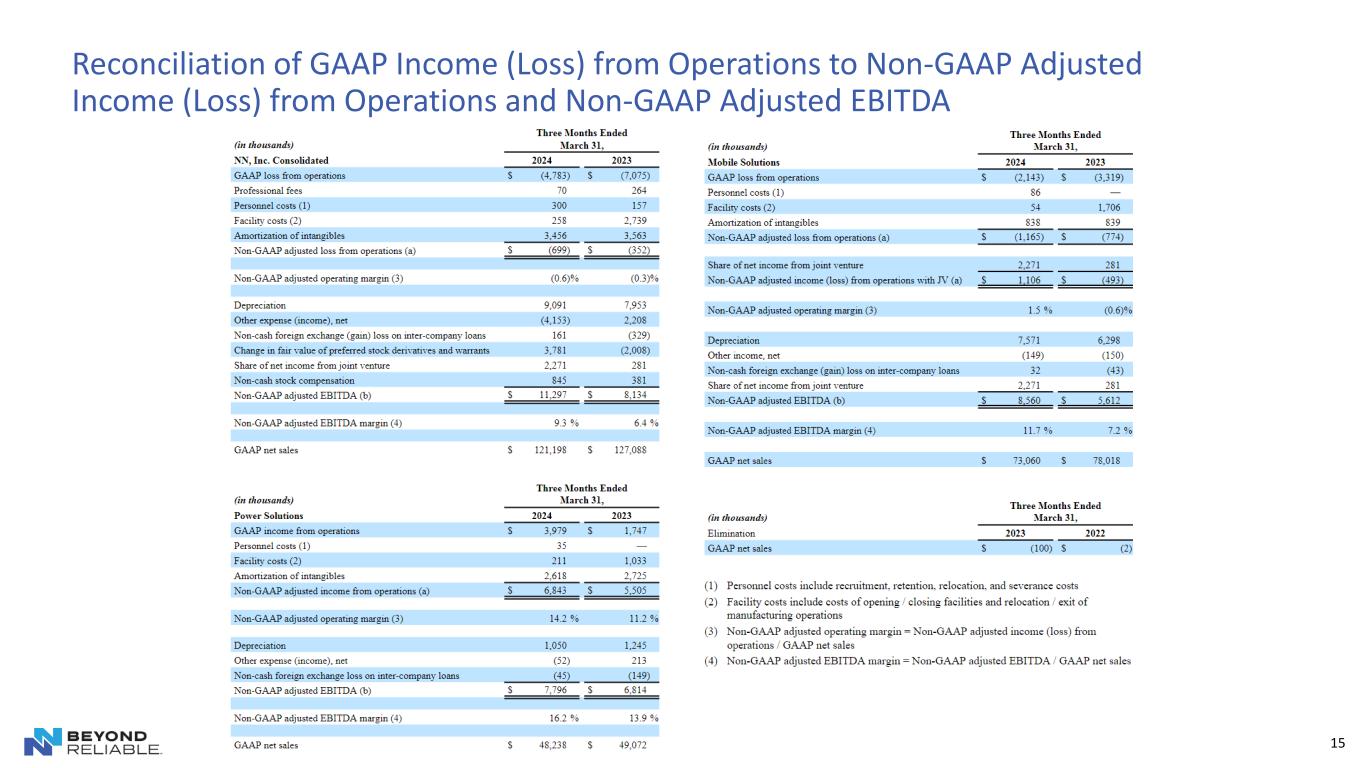

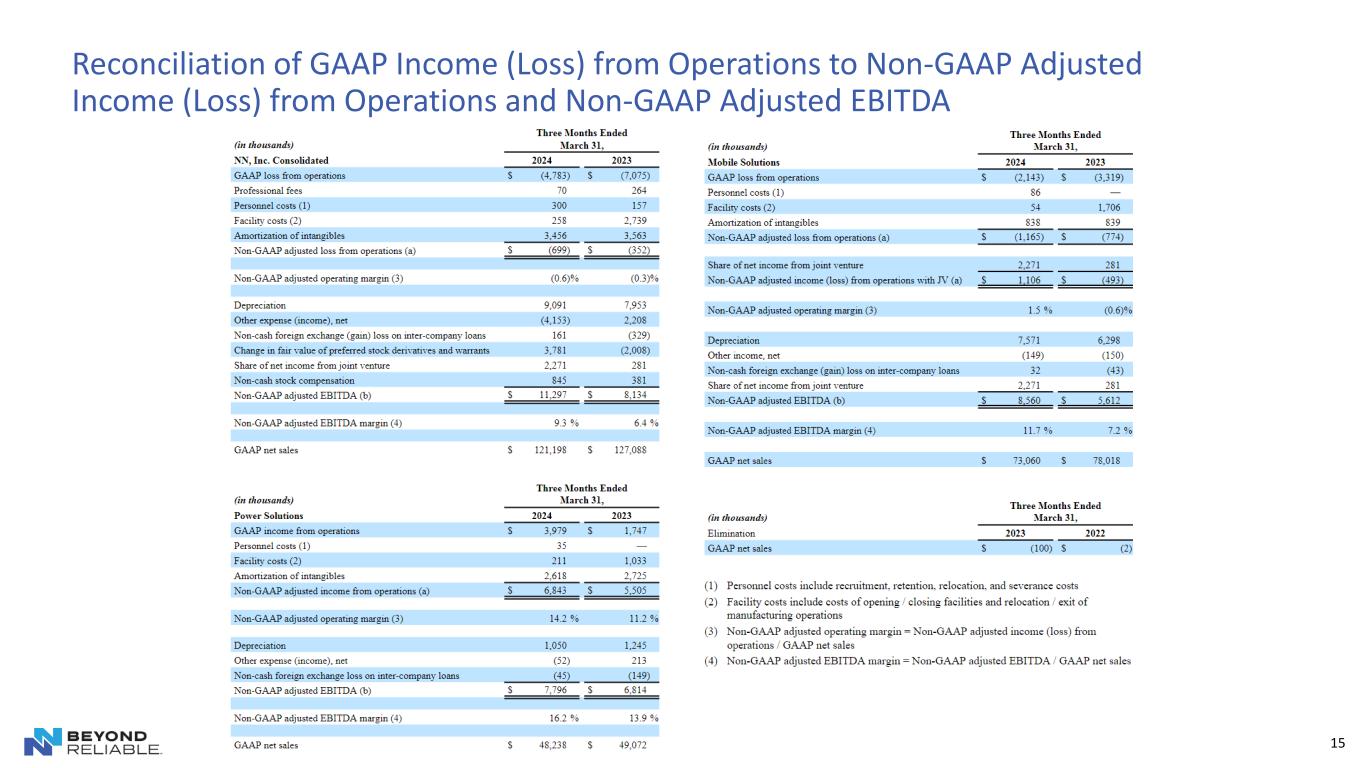

15 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA

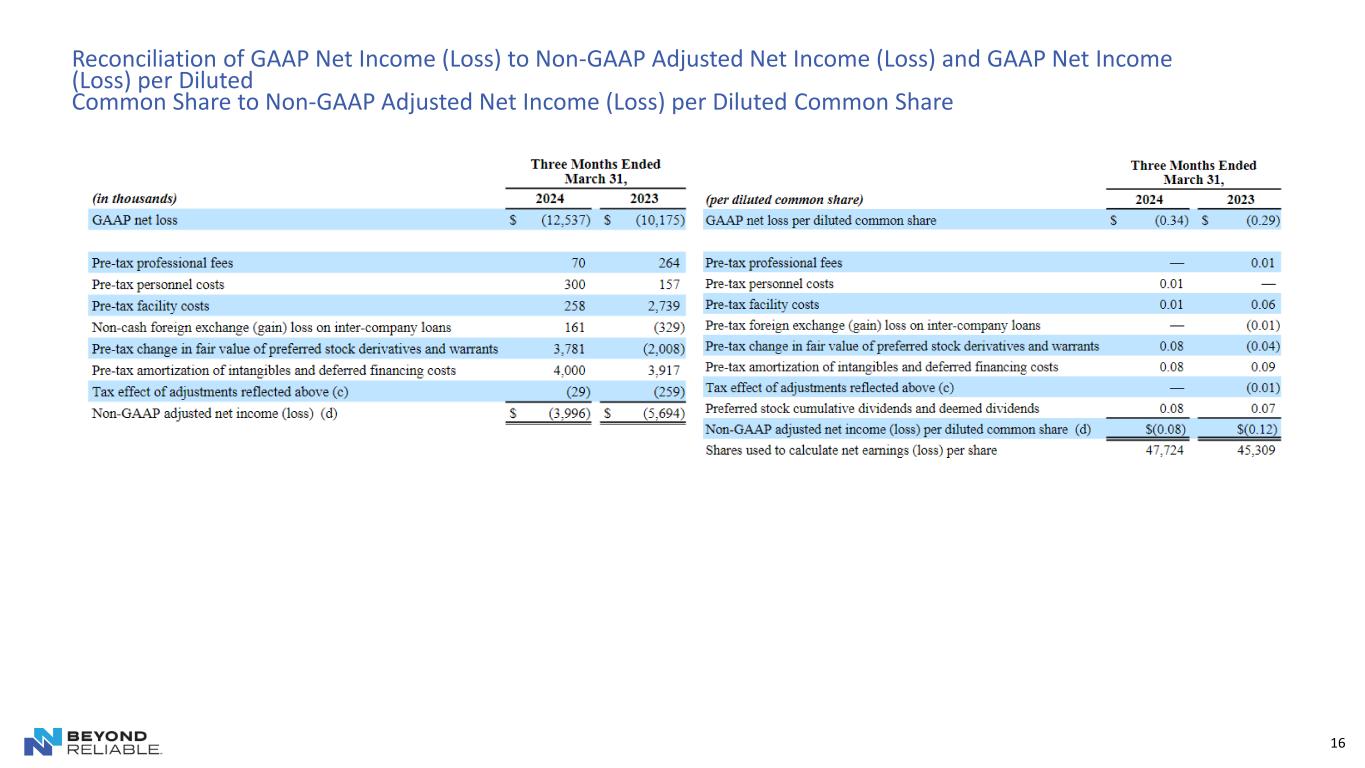

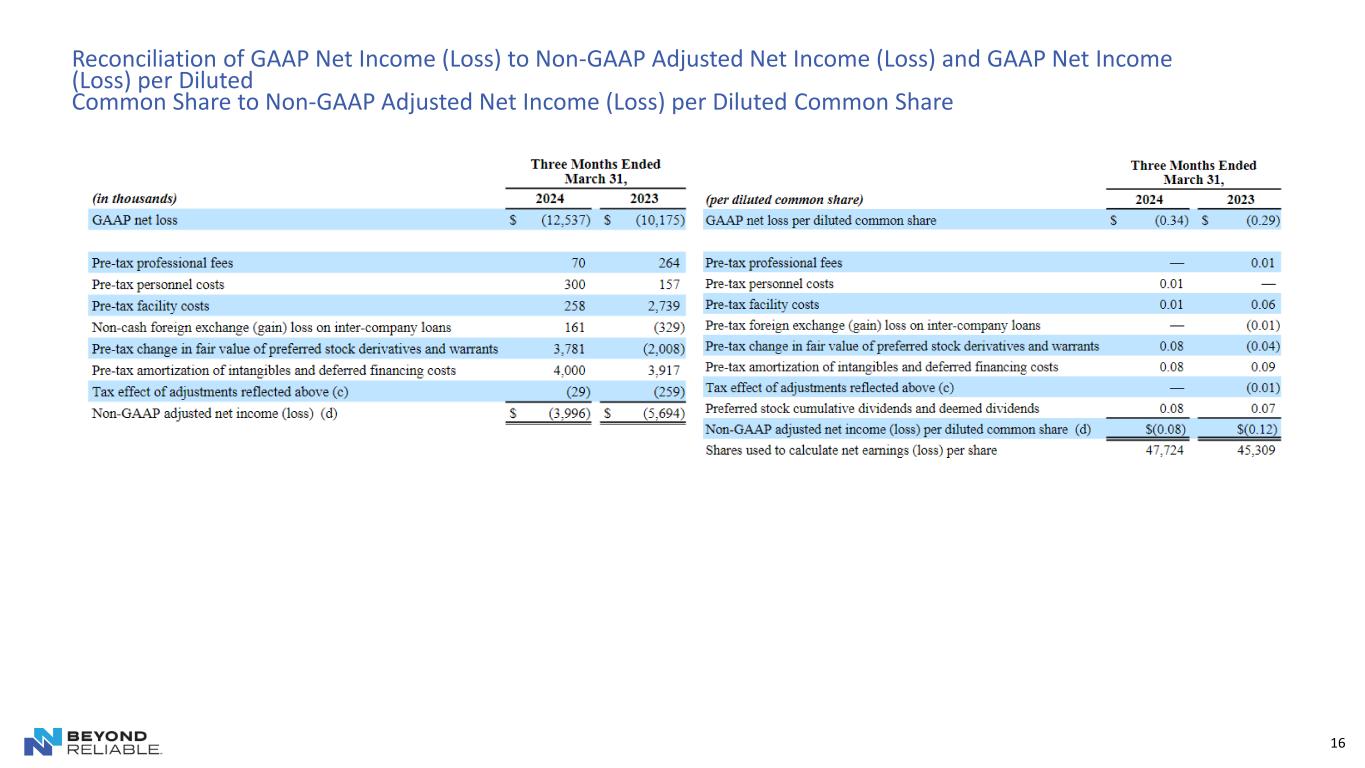

16 Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income (Loss) and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

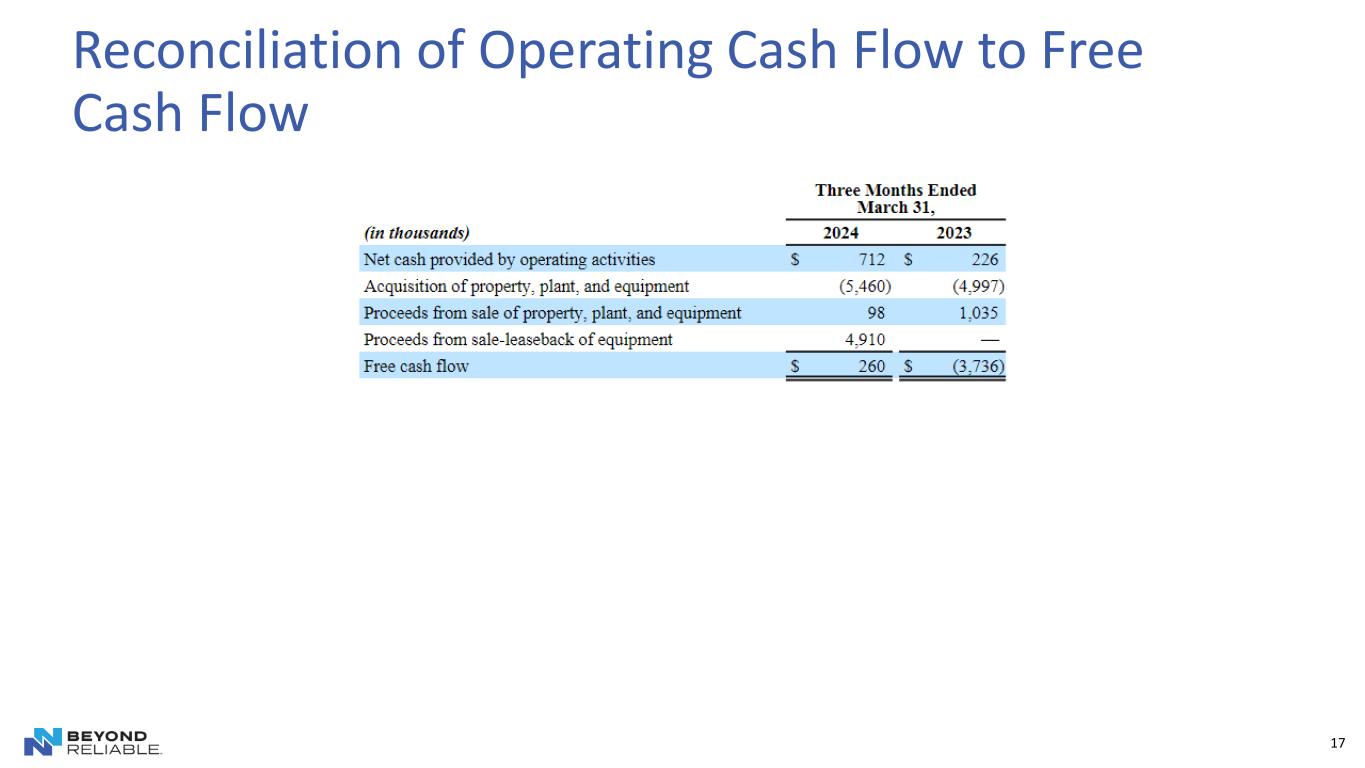

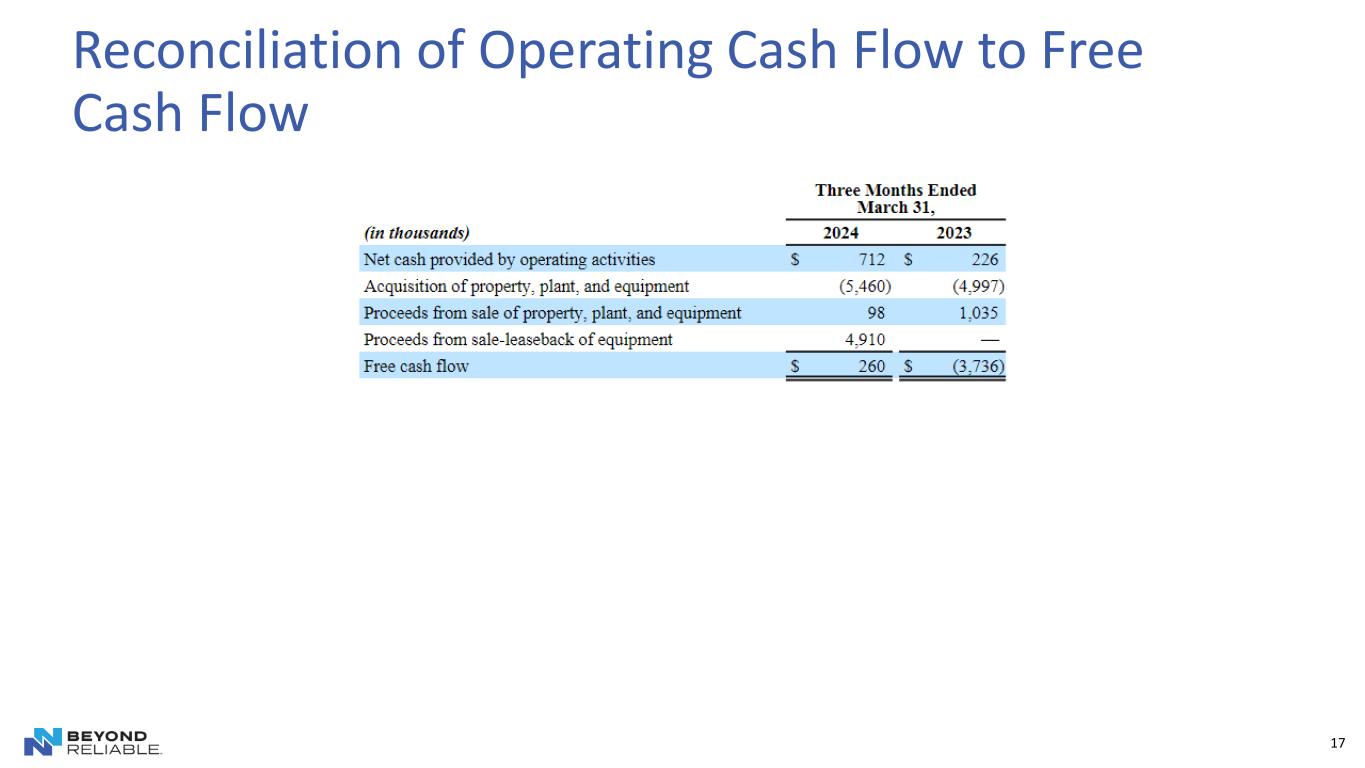

17 Reconciliation of Operating Cash Flow to Free Cash Flow

Thank You 18 Joe Caminiti or Stephen Poe, Investors Tim Peters, Media NNBR@alpha-ir.com 312-445-2870 Investor & Media Contacts