|

Exhibit 99.2

|

Exhibit 99.2

Precision Engineered Products Acquisition

August 17, 2015

Forward-Looking Statements and Non-GAAP Financial Information

Forward Looking Statements: With the exception of the historical information contained in this presentation, the matters described herein contain forward looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements include statements regarding the proposed acquisition of Precision Engineered Products, Inc. (PEP), expected timetable for completing the acquisition, future financial and operating results, benefits and synergies of the acquisition, future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future. Forward looking statements involve a number of risks and uncertainties that may cause actual results to be materially different from such forward looking statements. Such factors include, among others, general economic conditions and economic conditions in the medical, automotive, electrical and industrial sector, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, availability of raw materials, currency and other risks associated with international trade, our dependence on certain major customers, the uncertainty of regulatory approvals, NN and PEP’s ability to satisfy the stock purchase agreement conditions and consummate the transaction on a timely basis or at all, NN’s ability to successfully integrate PEP’s operations and employees with NN’s existing business, the ability to realize anticipated growth, synergies and cost savings from the acquisition, PEP’s performance and maintenance of important business relationships, our ability to develop and successfully market new products and expand into new markets, our ability to successfully identify, consummate and integrate appropriate acquisitions and successfully complete divestitures and other dispositions, contingent liabilities related to acquisitions and divestitures, our compliance with applicable laws and regulations (including regulations relating to medical devices and the healthcare industry) and changes in applicable laws and regulations, our ability to effectively address cost reduction and other changes in the healthcare industry, risks relating to the potential impairment of goodwill and other intangible assets, tax audits and changes in our tax rate, income tax liabilities, litigation and other contingent liabilities including environmental, health and safety matters, risks relating to product defects, product liability and recalls, the impact of our debt obligations on our operations and liquidity, our ability to adjust purchases and manufacturing capacity to reflect market conditions, labor matters, international economic, political, legal, compliance and business factors, disruptions related to man made and natural disasters, security breaches or other disruptions of our information technology systems, and other risk factors and cautionary statements listed from time to time in our periodic reports filed with the Securities and Exchange Commission, including, but not limited to, our Annual Report on 10-K for the fiscal year ended December 31, 2014.

Disclaimer: NN disclaims any obligation to update any forward looking statements or to publicly announce the result of any revisions to any of the forward looking statements included herein or therein to reflect future events or developments.

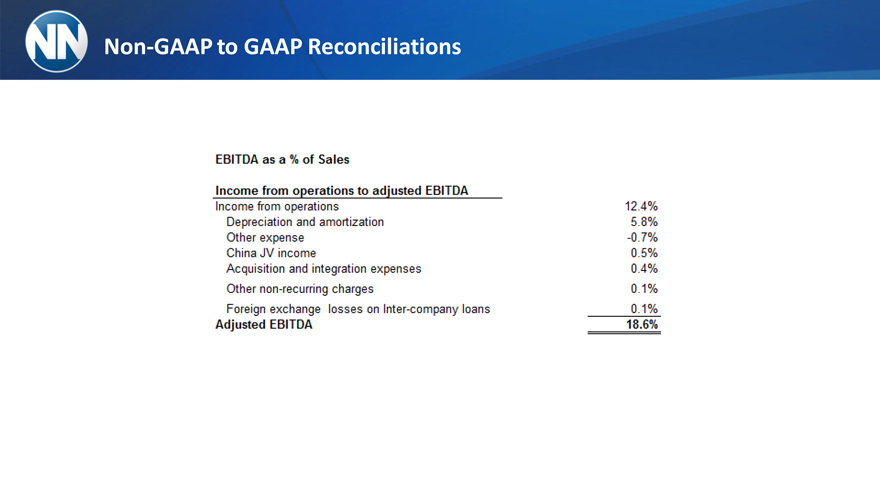

This presentation includes certain non-GAAP measures as defined by SEC rules. A reconciliation of those measures to the most directly comparable GAAP equivalent is provided at the end of this presentation.

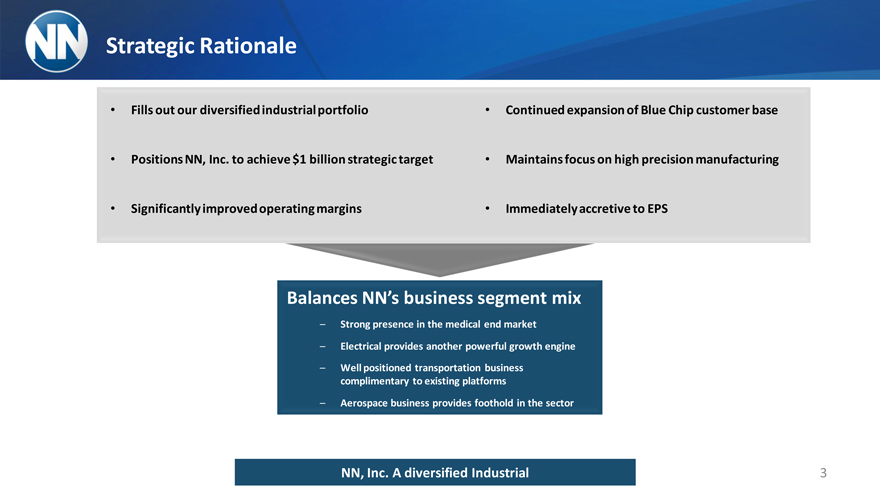

Strategic Rationale

Fills out our diversified industrial portfolio Continued expansion of Blue Chip customer base

Positions NN, Inc. to achieve $1 billion strategic target Maintains focus on high precision manufacturing

Significantly improved operating margins Immediately accretive to EPS

Balances NN’s business segment mix

– Strong presence in the medical end market

– Electrical provides another powerful growth engine

– Well positioned transportation business complimentary to existing platforms

– Aerospace business provides foothold in the sector

NN, Inc. A diversified Industrial 3

Precision Engineered Products

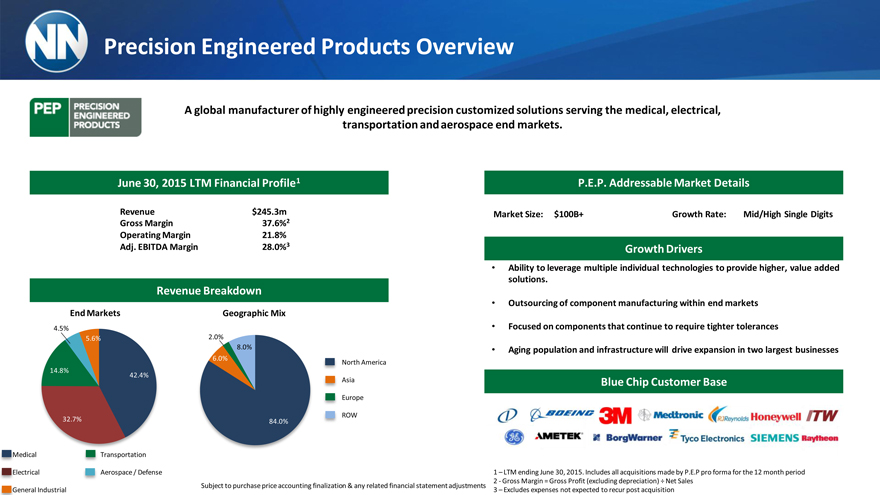

Precision Engineered Products Overview

A global manufacturer of highly engineered precision customized solutions serving the medical, electrical, transportation and aerospace end markets.

June 30, 2015 LTM Financial Profile1 P.E.P. Addressable Market Details

Revenue $245.3m Market Size: $100B+ Growth Rate: Mid/High Single Digits Gross Margin 37.6%2 Operating Margin 21.8% Adj. EBITDA Margin 28.0%3 Growth Drivers

Ability to leverage multiple individual technologies to provide higher, value added solutions.

Revenue Breakdown

Outsourcing of component manufacturing within end markets End Markets Geographic Mix

4.5% • Focused on components that continue to require tighter tolerances

5.6% 2.0%

8.0% • Aging population and infrastructure will drive expansion in two largest businesses

6.0%

North America 14.8% 42.4%

Asia Blue Chip Customer Base

Europe

ROW 32.7% 84.0%

edical Transportation

lectrical Aerospace / Defense 1 – LTM ending June 30, 2015. Includes all acquisitions made by P.E.P pro forma for the 12 month period

2—Gross Margin = Gross Profit (excluding depreciation) ÷ Net Sales

Subject to purchase price accounting finalization & any related financial statement adjustments eneral Industrial 3 – Excludes expenses not expected to recur post acquisition

Medical Snapshot

Medical-Grade Facilities

3 FDA-registered facilities (275,240 sq. ft.) FDA 21 CFR Part 820 Bridgeport, CT

Franklin, MA

Aurora, IL and Warsaw, IN 7 sites: ISO-13485:2003

Unmatched Device Capabilities

Class 8 clean rooms

Reusable surgical instruments assembly Disposable surgical device manufacturing technology Precision metal machining and orthopedic device production Design center located adjacent to major orthopedic medical device manufacturers BE-ST OEM brand available as scalable device platform

Robust Product Portfolio

Surgical Disposables

Other FDA- Compliant Devices

Biopsy Jaws

Diagnostic Equipment

Surgical Devices

Staple-Loaded Cartridges

6

Electrical Snapshot

Market Leading Position

Electrical controls products are used in electro-mechanical and industrial electronics markets

Leading provider of residential, commercial and industrial electrical contacts

Material science expertise with stamping and molding processes essential for electrical products

Defense against precious metal cost volatility through consignment purchases and pricing hedges

Established, powerful relationships with key electrical control customers

Strong, active dialogue with customers who seek expertise when developing electrical controls, assemblies and devices

Key Demand Drivers*

New Residential Construction Growth:

Improving economy, home price affordability and significant pent-up demand U.S. housing starts expected to reach 1.5 million starts in 2019 at a CAGR of 8.5%

Non-Residential Construction Growth:

Non-residential capital expenditures to grow at a CAGR of 5.3% to $583 billion in 2019

Increased Thermal Management Outsourcing:

Electronic manufacturers increasingly relying on custom-engineered thermal solutions to remove heat Global thermal management expected to grow at a 6.8% CAGR to $14.7 billion in 2019

Comprehensive Product Portfolio

Residential Electrical Connectivity

Commercial / Industrial Electrical Facility Connectivity

Other Industrial Controls and Switches

7

*P.E.P. Estimates

Transportation Snapshot

Leading Components Provider

Provides precision components, assemblies and contacts utilized in key commercial and industrial vehicle safety and sensor components Specializes in manufacturing high-volume, under-the-hood components by leveraging advanced, automated robotic systems to ensure 100% conformance to customer specifications Technology growth in safety sensors requiring complex optics, radio frequency and magnetics

Transportation OEMs actively seek PEP’s unique technology and manufacturing capabilities to address vehicle component and assemblies challenges Industry-leader in pressure relief disks used in various applications Precision bearing retainer and sprag technology

Key Demand Drivers*

Increased Light Vehicle Production:

Benefitting from a continued global economic recovery Global light vehicle production expected to grow at a CAGR of 3.2%

Growth in Vehicle Safety Sensors / Components:

Average onboard sensors per vehicle expected to grow from ~80 to nearly 200 by 2020

Commercial / Industrial Vehicle Growth:

Agricultural machinery industry hitting $175 billion by 2016, and construction machinery to reach $190 billion by 2017 Increased production of construction and industrial vehicles primarily driven by government funding and agriculture trends

Comprehensive Product Portfolio

Vehicle Electronics and Sensor Components

Vehicle Safety

Components and Assemblies

Industrial and Commercial Vehicle Components

*P.E.P. Estimates 8

Aerospace and Other Snapshot

Aerospace & Defense Capabilities

Aerospace & Defense:

Offers broad manufacturing capabilities and technical expertise in the A&D sector with a variety of engineered materials including:

Optical grade plastics Thermally conductive plastics Titanium Nickel Inconel Magnesium Gold electroplating Growing foreign threats leading to increase in global defense expenditures

Other Precision End Markets

Industrial and Consumer:

Consumer product components

Continued demand for evolving high-tech consumer products

Consumer demand for domestic manufactured products

Oil & Gas:

Oil & gas precision filter wire

Oil & gas products benefit from continued expansion of shale production in the U.S.

Increasing global demand for energy, particularly from developing economies

Comprehensive Product Portfolio

Titanium and stainless steel structural components

Gold-plated aluminum machined housing for communications device

Precision stamped, gold-plated component used in array radar system

Consumer components

Oil & gas screen wires

9

Combined Company

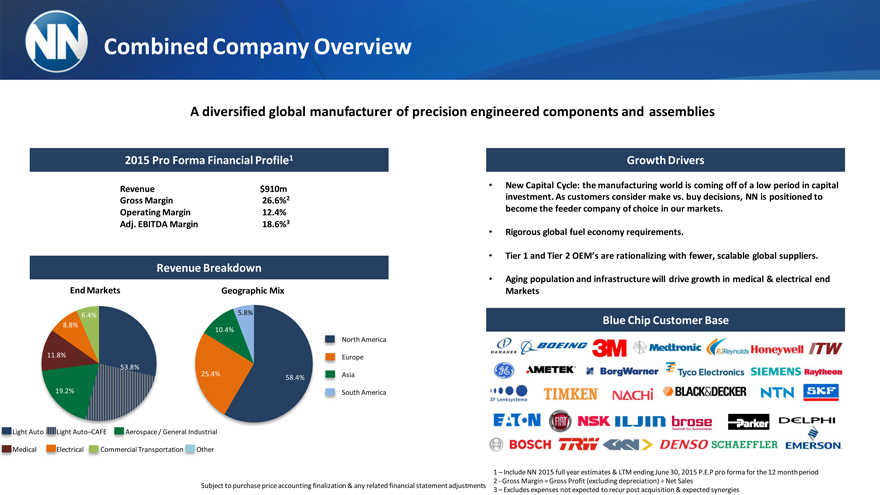

Combined Company Overview

A diversified global manufacturer of precision engineered components and assemblies

2015 Pro Forma Financial Profile1

Revenue $910m

Gross Margin 26.6%2

Operating Margin 12.4%

Adj. EBITDA Margin 18.6%3

Revenue Breakdown

End Markets Geographic Mix

6.4% 5.8%

8.8%

10.4%

North America

11.8% Europe 53.8%

25.4% Asia 58.4%

19.2% South America

ight Auto ight Auto–CAFE erospace / General Industrial

edical lectrical ommercial Transportation ther

Growth Drivers

New Capital Cycle: the manufacturing world is coming off of a low period in capital investment. As customers consider make vs. buy decisions, NN is positioned to become the feeder company of choice in our markets.

Rigorous global fuel economy requirements.

Tier 1 and Tier 2 OEM’s are rationalizing with fewer, scalable global suppliers.

Aging population and infrastructure will drive growth in medical & electrical end Markets

Blue Chip Customer Base

1 – Include NN 2015 full year estimates & LTM ending June 30, 2015 P.E.P pro forma for the 12 month period

2—Gross Margin = Gross Profit (excluding depreciation) ÷ Net Sales adjustments

3 – Excludes expenses not expected to recur post acquisition & expected synergies

Summary

Outstanding company with attractive end market portfolio that balances our business

Margin accretive with significant room for expansion

Immediately accretive to EPS

Strong free cash flow generation with significantly lower capital spending profile

Non-GAAP to GAAP Reconciliations

Non-GAAP to GAAP Reconciliations

Precision Engineered Products Acquisition

August 17, 2015