|

Exhibit 99.1

|

Annual Investor Day

March 24, 2016 • New York City

Exhibit 99.1

Forward Looking Statements

Forward Looking Statement: With the exception of the historical information contained in this presentation, the matters described herein contain forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve a number of risks and uncertainties that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability of raw materials, currency and other risks associated with international trade, the Company’s dependence on certain major customers, and other risk factors and cautionary statements listed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on 10-K for the fiscal year ended December 31, 2015.

With respect to any non-GAAP financial measures included in the following presentation, the accompanying information required by SEC Regulation G can be found in the “Investor Relations” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Disclaimer: NN disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

www.nninc.com

2

Presenters

Richard Holder

President & Chief Executive Officer

James Dorton

Senior Vice President & Chief Financial Officer

Robbie Atkinson

Corporate Treasurer & Investor Relations Mgr.

Chris Qualters

Vice President & Chief Commercial Officer

John Manzi

Senior Vice President/GM Precision Engineered Products Group

Warren Veltman

Senior Vice President/GM Autocam Precision Components Group

Jeff Manzagol

Senior Vice President/GM Metal Bearing Components Group

www.nninc.com

3

Agenda

1 Strategic Review

2 Sales Strategy

3 End Markets Discussion

4 Debt Structure Overview

5 Financial Performance

6 The NN Operating System

7 Summary / Q&A

www.nninc.com

4

Strategic Review

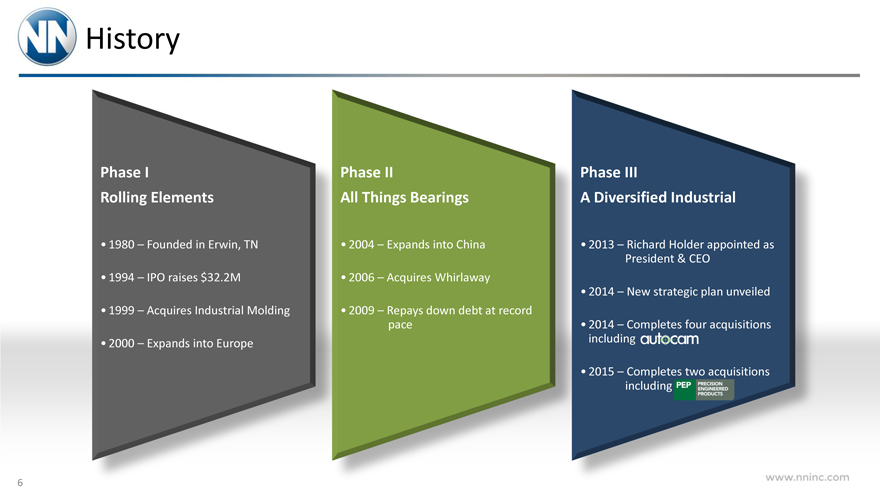

History

Phase I

Rolling Elements

1980 – Founded in Erwin, TN

1994 – IPO raises $32.2M

1999 – Acquires Industrial Molding

2000 – Expands into Europe

Phase II

All Things Bearings

2004 – Expands into China

2006 – Acquires Whirlaway

2009 – Repays down debt at record pace

Phase III

A Diversified Industrial

2013 – Richard Holder appointed as President & CEO

2014 – New strategic plan unveiled

2014 – Completes four acquisitions including

2015 – Completes two acquisitions including

PDP PRECISION ENGINEERED PRODUCTS

www.nninc.com

6

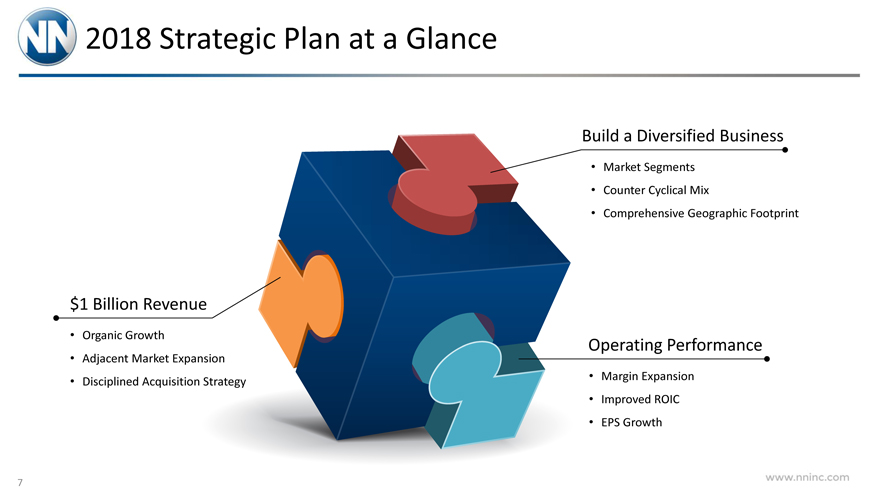

2018 Strategic Plan at a Glance

$1 Billion Revenue

Organic Growth

Adjacent Market Expansion

Disciplined Acquisition Strategy

Build a Diversified Business

Market Segments

Counter Cyclical Mix

Comprehensive Geographic Footprint

Operating Performance

Margin Expansion

Improved ROIC

EPS Growth

www.nninc.com

7

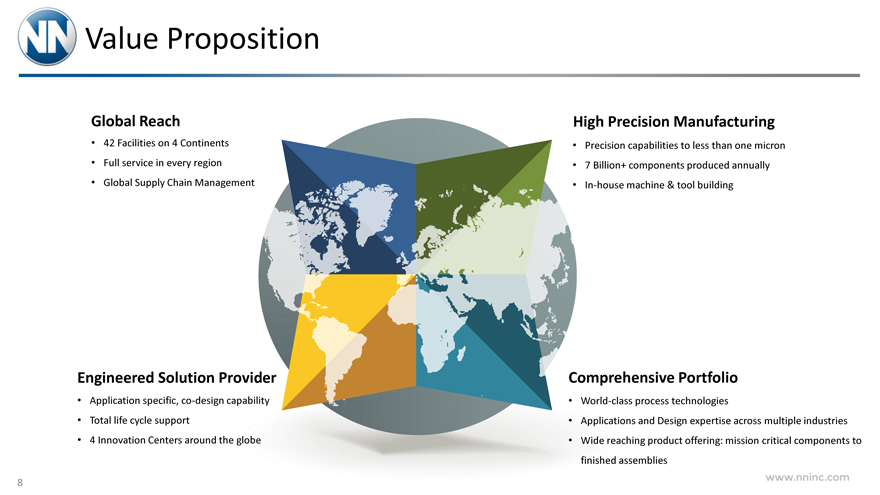

Value Proposition

Global Reach

42 Facilities on 4 Continents

Full service in every region

Global Supply Chain Management

High Precision Manufacturing

Precision capabilities to less than one micron

7 Billion+ components produced annually

In-house machine & tool building

Engineered Solution Provider

Application specific, co-design capability

Total life cycle support

4 Innovation Centers around the globe

Comprehensive Portfolio

World-class process technologies

Applications and Design expertise across multiple industries

Wide reaching product offering: mission critical components to finished assemblies

www.nninc.com

8

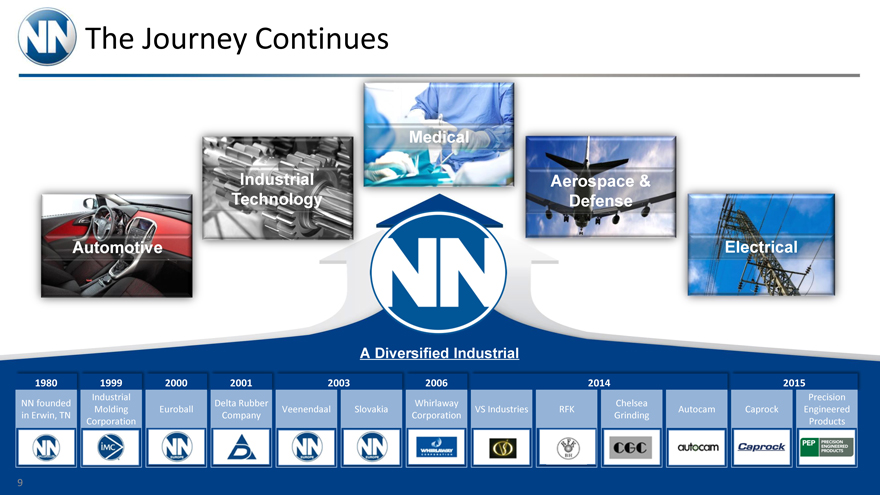

The Journey Continues

Automotive

Industrial Technology

Medical

Aerospace & Defense

Electrical

A Diversified Industrial

1980 1999 2000 2001 2003 2006 2014 2015

Industrial Precision NN founded Delta Rubber Whirlaway Chelsea Molding Euroball Veenendaal Slovakia VS Industries RFK Autocam Caprock Engineered in Erwin, TN Company Corporation Grinding Corporation Products

9

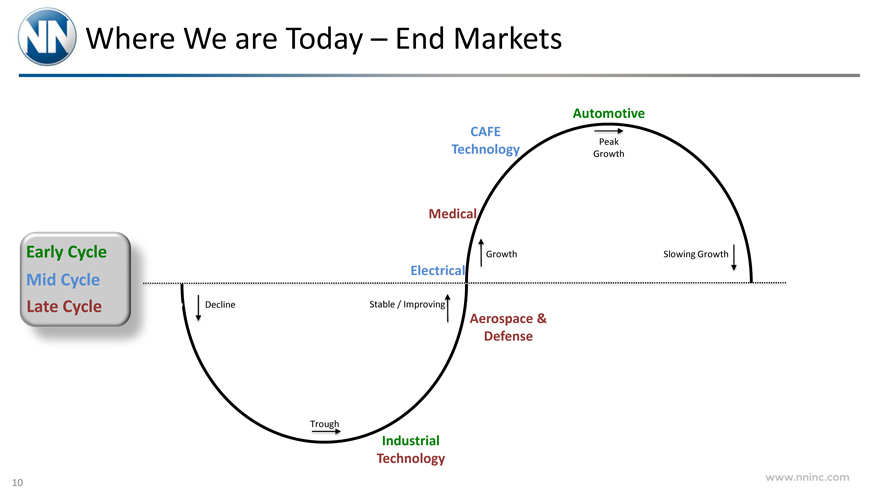

Where We are Today – End Markets

Early Cycle Mid Cycle Late Cycle

CAFE Technology

Automotive

Peak

Growth

Medical

Growth

Electrical

Stable / Improvin

Aerospace & Defense

Decline

Trough

Industrial Technology

Slowing Growt

www.nninc.com

10

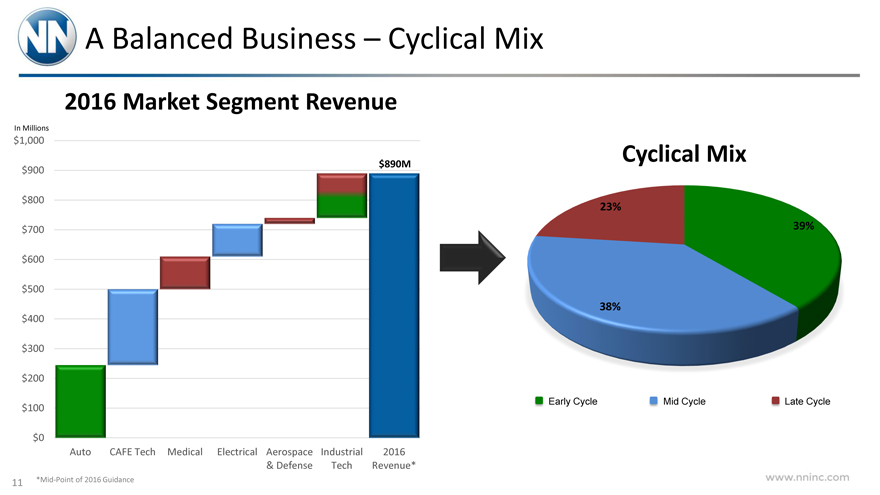

A Balanced Business – Cyclical Mix

2016 Market Segment Revenue

In Millions

$1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0

$890M

Auto CAFE Tech Medical Electrical Aerospace Industrial 2016

& Defense Tech Revenue*

*Mid-Point of 2016 Guidance

Cyclical Mix

23%

39%

38%

Early Cycle Mid Cycle Late Cycle

www.nninc.com

11

Balanced Strategic Global Footprint

Revenue Breakdown* 60% United States 10% Asia

25% Europe

5% Latin America

*Mid-Point of 2016 Guidance

42 Manufacturing Facilities on Four Continents

www.nninc.com

12

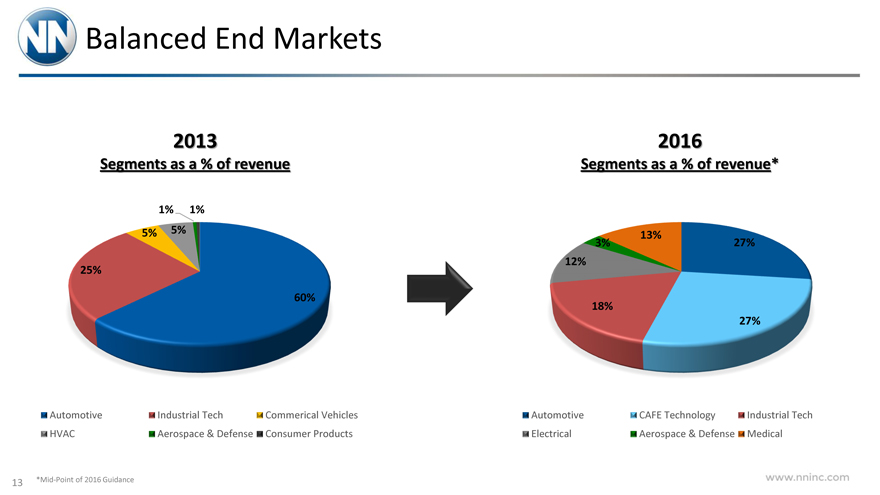

Balanced End Markets

2013

Segments as a % of revenue

1% 1%

5% 5% 25%

60%

Automotive Industrial Tech Commerical Vehicles HVAC Aerospace & Defense Consumer Products

2016

Segments as a % of revenue*

13%

3% 27% 12%

18%

27%

Automotive CAFE Technology Industrial Tech Electrical Aerospace & Defense Medical

*Mid-Point of 2016 Guidance

www.nninc.com

13

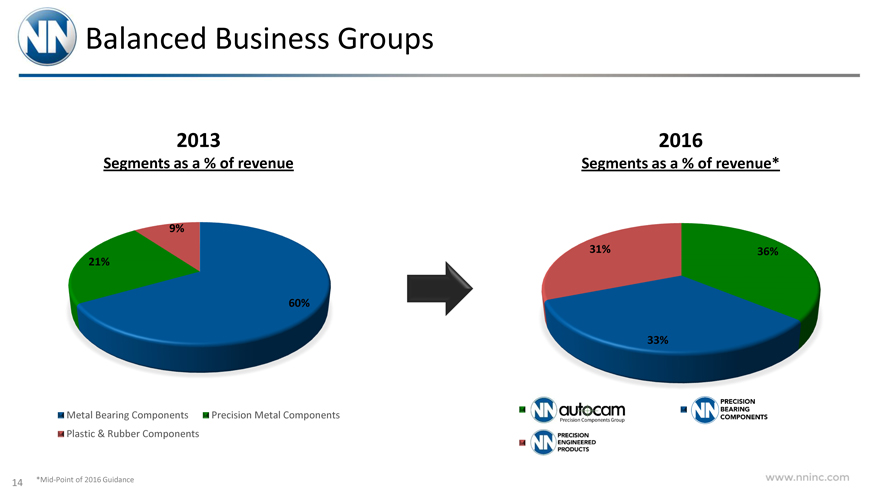

Balanced Business Groups

2013

Segments as a % of revenue

9%

21%

60%

Metal Bearing Components Precision Metal Components Plastic & Rubber Components

*Mid-Point of 2016 Guidance

2016

Segments as a % of revenue*

31% 36%

33%

www.nninc.com

14

Sales Strategy

The World of “More”

Global Mega Trend:

We live in a world that demands More

Technology advancements are needed to achieve the next levels of More

More drives our business today and will continue to do so well into the future

www.nninc.com

16

Our Customers are working on the Next Big Thing

Their new products and technologies need to satisfy the “More”

New product technologies are pushing beyond known boundaries

Requiring unprecedented precision levels

The NN global platform of design, process, and optimization technologies across many industries

Making the seemingly impossible….Possible

Engineered solutions through

www.nninc.com

17

Engineered Solutions: How we go to market

R&D:

“The Next Big Thing”

In-Depth Customer Relationships

Development, Validation & Continuous Improvement

Integral part of our customer project teams

Leverage technology platform: Engineered Solutions

Identify technical gaps: Process & Design analysis

www.nninc.com

18

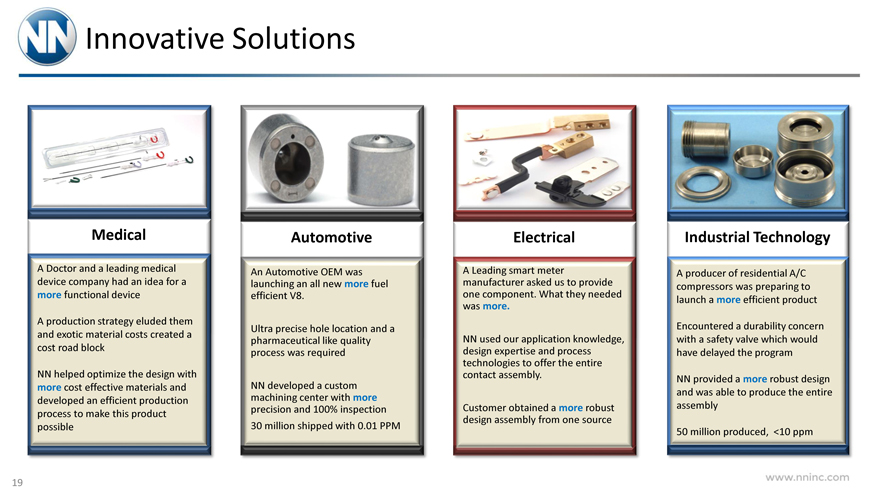

Innovative Solutions

Medical

A Doctor and a leading medical device company had an idea for a more functional device

A production strategy eluded them and exotic material costs created a cost road block

NN helped optimize the design with more cost effective materials and developed an efficient production process to make this product possible

Automotive

An Automotive OEM was launching an all new more fuel efficient V8.

Ultra precise hole location and a pharmaceutical like quality process was required

NN developed a custom machining center with more precision and 100% inspection 30 million shipped with 0.01 PPM

Electrical

A Leading smart meter manufacturer asked us to provide one component. What they needed was more.

NN used our application knowledge, design expertise and process technologies to offer the entire contact assembly.

Customer obtained a more robust design assembly from one source

Industrial Technology

A producer of residential A/C compressors was preparing to launch a more efficient product

Encountered a durability concern with a safety valve which would have delayed the program

NN provided a more robust design and was able to produce the entire assembly

50 million produced, <10 ppm

www.nninc.com

19

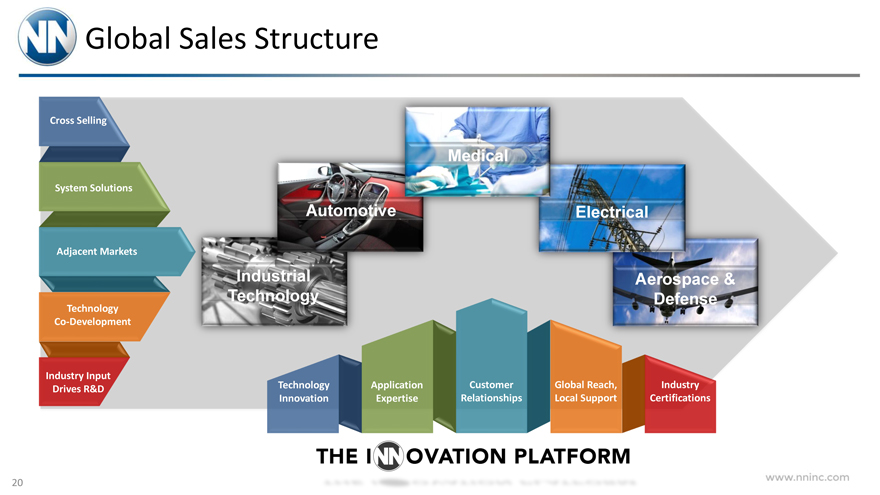

Global Sales Structure

Cross Selling System Solutions Adjacent Markets

Technology Co-Development

Industry Input Drives R&D

Industrial Technology

Automotive

Medical

Electrical

Aerospace & Defense

Technology Innovation

Application Expertise

Customer Relationships

Global Reach, Local Support

Industry Certifications

THE INNOVATION PLATFORM

www.nninc.com

20

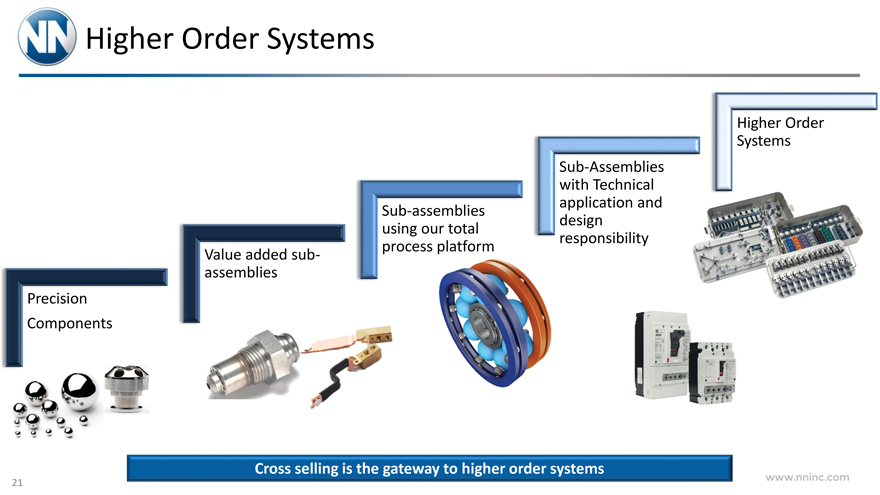

Higher Order Systems

Precision Components

Value added sub-assemblies

Sub-assemblies using our total process platform

Sub-Assemblies with Technical application and design responsibility

Higher Order Systems

Cross selling is the gateway to higher order systems

www.nninc.com

21

End Markets Discussion

Medical & Electrical

Precision Engineered Products – Group Introduction

Manufactures highly engineered plastic and metal components, assemblies and finished devices

Acquired by NN in October 2015

Group Headquarters: Attleboro, MA

19 manufacturing operations with locations in: United States Dominican Republic Mexico China

Former NN Precision Plastics Group rolled under PEP

Specializes in material sciences

Medical Innovation Center

Diversified end markets focused on Medical & Electrical

PRECISION ENGINEERED PRODUCTS

John Manzi

Senior Vice President/GM Precision Engineered Products Group

www.nninc.com

24

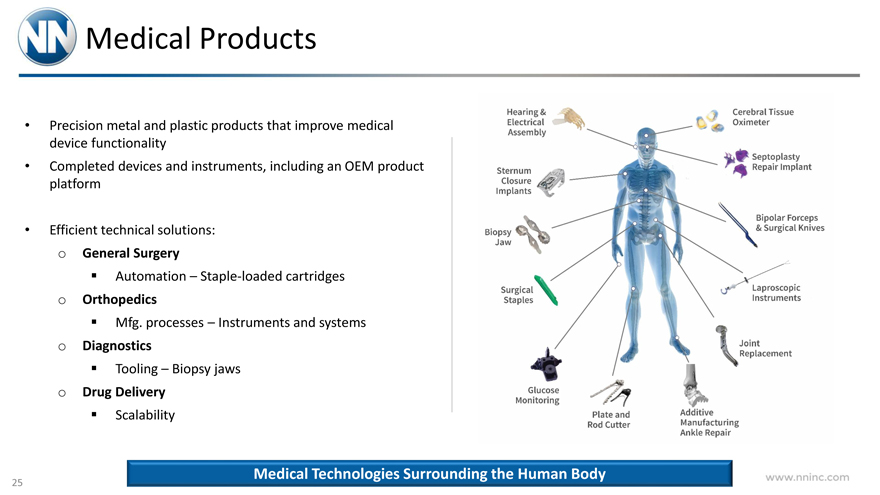

Medical Products

Precision metal and plastic products that improve medical device functionality

Completed devices and instruments, including an OEM product platform

Efficient technical solutions: o General Surgery

Automation – Staple-loaded cartridges o Orthopedics

Mfg. processes – Instruments and systems o Diagnostics

Tooling – Biopsy jaws o Drug Delivery

Scalability

Hearing & Electrical Assemble

Cerebral Tissue Oximeter

Sternum Closure Implants

Septoplasty Repair Implant

Biopsy Jaw

Bipolar Forceps & Surgical Knives

Surgical Staples

Laproscopic Instruments

Joint Replacement

Glucose Monitaring

Plate and Rod Cutter

Additive Manufacturing Ankle Repair

Medical Technologies Surrounding the Human Body

www.nninc.com

25

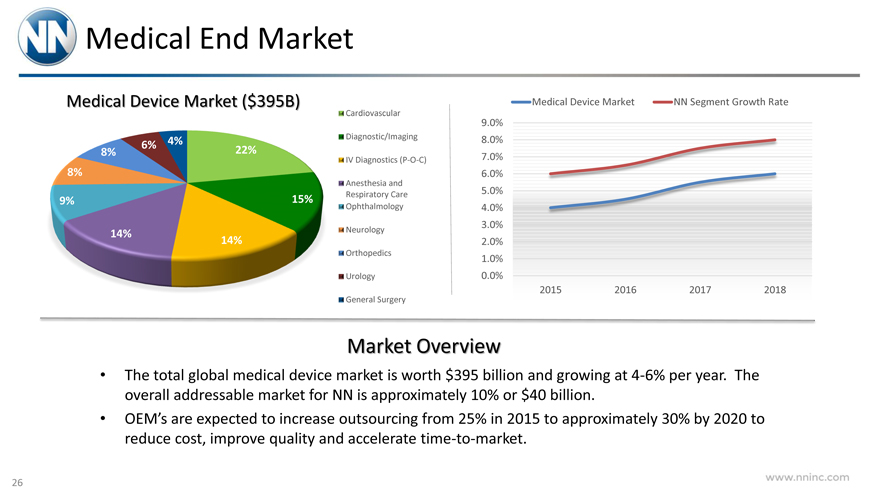

Medical End Market

Medical Device Market ($395B)

Cardiovascular Diagnostic/Imaging IV Diagnostics (P-O-C)

Anesthesia and Respiratory Care Ophthalmology

Neurology Orthopedics Urology General Surgery

Medical Device Market NN Segment Growth Rate

9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%

2015 2016 2017 2018

Market Overview

The total global medical device market is worth $395 billion and growing at 4-6% per year. The overall addressable market for NN is approximately 10% or $40 billion.

OEM’s are expected to increase outsourcing from 25% in 2015 to approximately 30% by 2020 to reduce cost, improve quality and accelerate time-to-market.

www.nninc.com

26

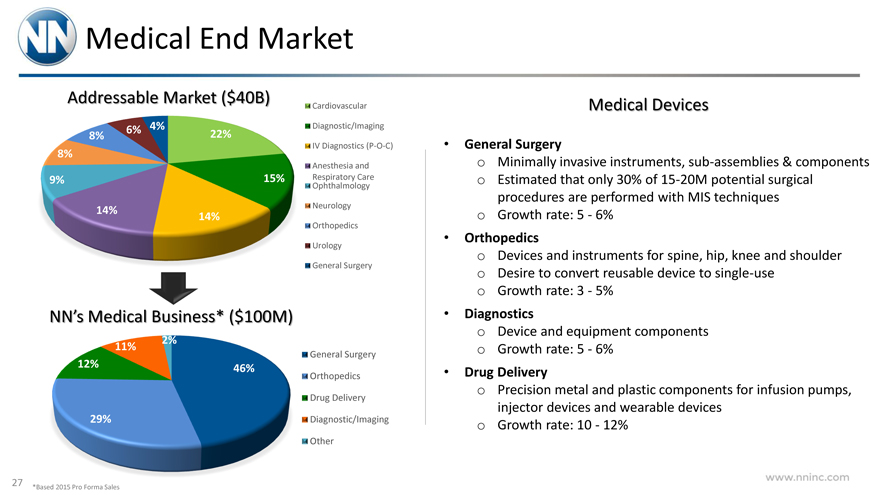

Medical End Market

Addressable Market ($40B)

6% 4%

8% 22% 8%

9% 15%

14%

14%

Cardiovascular Diagnostic/Imaging IV Diagnostics (P-O-C)

Anesthesia and Ophthalmology Respiratory Care Neurology

Orthopedics Urology General Surgery

NN’s Medical Business* ($100M)

2% 11%

12% 46%

29%

General Surgery Orthopedics Drug Delivery Diagnostic/Imaging Other

Medical Devices

General Surgery o Minimally invasive instruments, sub-assemblies & components o Estimated that only 30% of 15-20M potential surgical procedures are performed with MIS techniques o Growth rate: 5—6%

Orthopedics o Devices and instruments for spine, hip, knee and shoulder o Desire to convert reusable device to single-use o Growth rate: 3—5%

Diagnostics o Device and equipment components o Growth rate: 5—6%

Drug Delivery o Precision metal and plastic components for infusion pumps, injector devices and wearable devices o Growth rate: 10—12%

*Based 2015 Pro Forma Sales

www.nninc.com

27

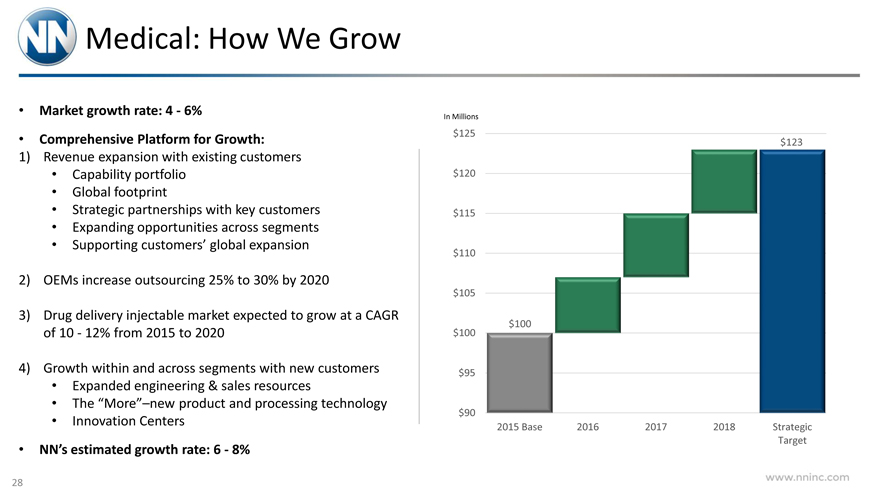

Medical: How We Grow

Market growth rate: 4—6%

Comprehensive Platform for Growth:

1) Revenue expansion with existing customers

Capability portfolio

Global footprint

Strategic partnerships with key customers

Expanding opportunities across segments

Supporting customers’ global expansion

2) OEMs increase outsourcing 25% to 30% by 2020

3) Drug delivery injectable market expected to grow at a CAGR of 10—12% from 2015 to 2020

4) Growth within and across segments with new customers

Expanded engineering & sales resources

The “More”–new product and processing technology

Innovation Centers

NN’s estimated growth rate: 6—8%

In Millions

$125 $120 $115 $110 $105 $100 $95 $90

$123

$100

2015 Base 2016 2017 2018 Strategic Target

www.nninc.com

28

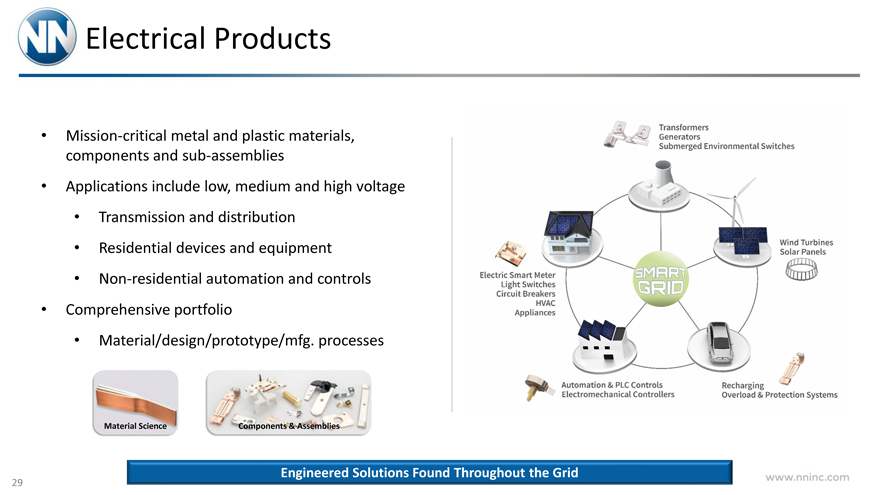

Electrical Products

Mission-critical metal and plastic materials, components and sub-assemblies

Applications include low, medium and high voltage

Transmission and distribution

Residential devices and equipment

Non-residential automation and controls

Comprehensive portfolio

Material/design/prototype/mfg. processes

Material Science

Components & Assemblies

Engineered Solutions Found Throughout the Grid

Transformers Generators Submerged Environment Switches

Electric Smart Meter Light Switches Circuit Breakers HVAC Appliances

Wind Turbines Solar Panels

Automation & PLC Controls Electromechanical Controllers

Recharging Overload & Protection Systems

www.nninc.com

29

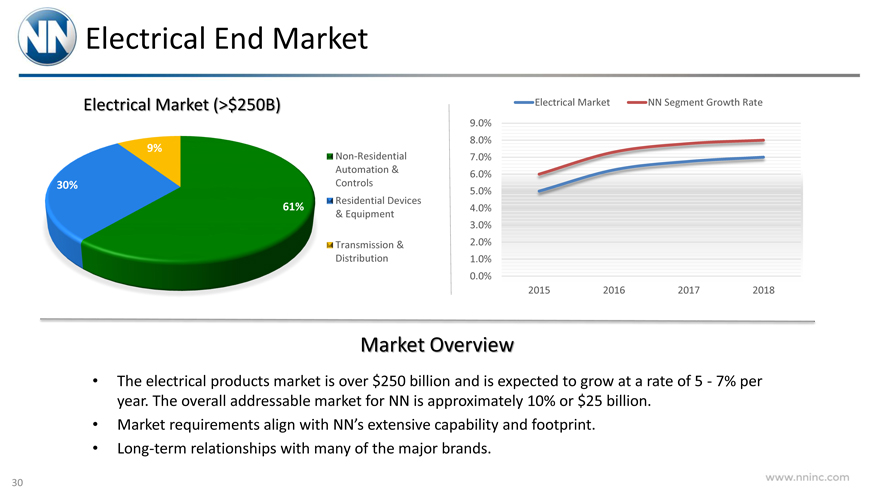

Electrical End Market

Electrical Market (>$250B)

9%

30%

61%

Non-Residential Automation & Controls Residential Devices

& Equipment

Transmission & Distribution

Non-Residential Automation & Controls Residential Devices

& Equipment

Transmission & Distribution

9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%

2015 2016 2017 2018

Market Overview

The electrical products market is over $250 billion and is expected to grow at a rate of 5—7% per year. The overall addressable market for NN is approximately 10% or $25 billion.

Market requirements align with NN’s extensive capability and footprint.

Long-term relationships with many of the major brands.

www.nninc.com

30

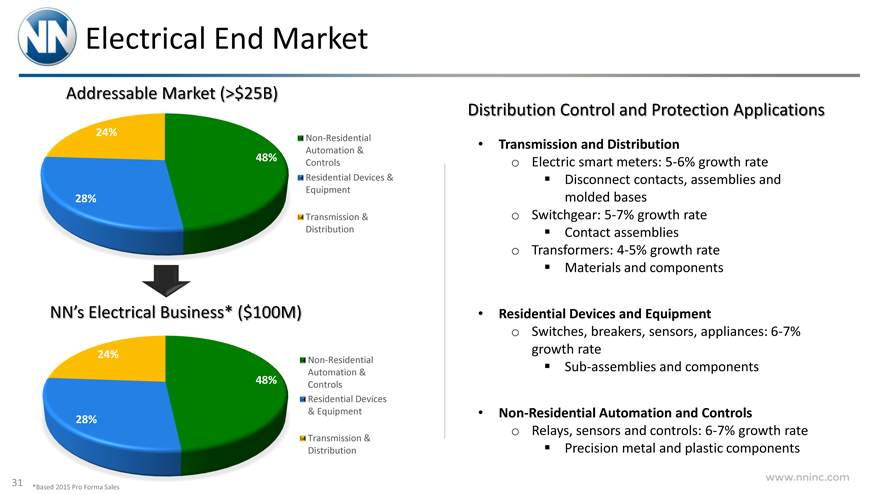

Electrical End Market

Addressable Market (>$25B)

24%

48%

28%

Non-Residential Automation & Controls Residential Devices & Equipment

Transmission & Distribution

NN’s Electrical Business* ($100M)

24%

48%

28%

Non-Residential Automation & Controls Residential Devices

& Equipment

Transmission & Distribution

Distribution Control and Protection Applications

Transmission and Distribution o Electric smart meters: 5-6% growth rate Disconnect contacts, assemblies and molded bases o Switchgear: 5-7% growth rate Contact assemblies o Transformers: 4-5% growth rate Materials and components

Residential Devices and Equipment o Switches, breakers, sensors, appliances: 6-7% growth rate Sub-assemblies and components

Non-Residential Automation and Controls o Relays, sensors and controls: 6-7% growth rate Precision metal and plastic components

www.nninc.com

31 *Based 2015 Pro Forma Sales

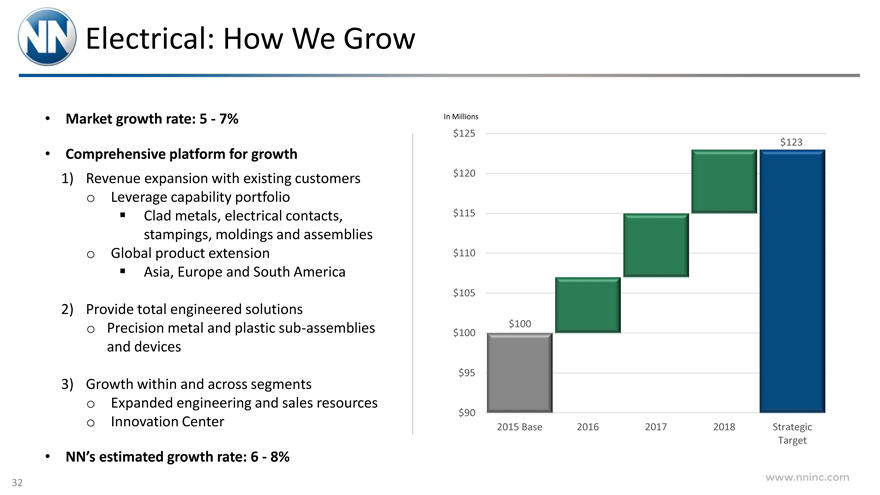

Electrical: How We Grow

Market growth rate: 5—7%

Comprehensive platform for growth

1) Revenue expansion with existing customers o Leverage capability portfolio Clad metals, electrical contacts, stampings, moldings and assemblies o Global product extension Asia, Europe and South America

2) Provide total engineered solutions o Precision metal and plastic sub-assemblies and devices

3) Growth within and across segments o Expanded engineering and sales resources o Innovation Center

NN’s estimated growth rate: 6—8%

In Millions

$125 $120 $115 $110 $105 $100 $95 $90

$123

$100

2015 Base 2016 2017 2018 Strategic

Target

www.nninc.com

32

Industrial Technology & Aerospace

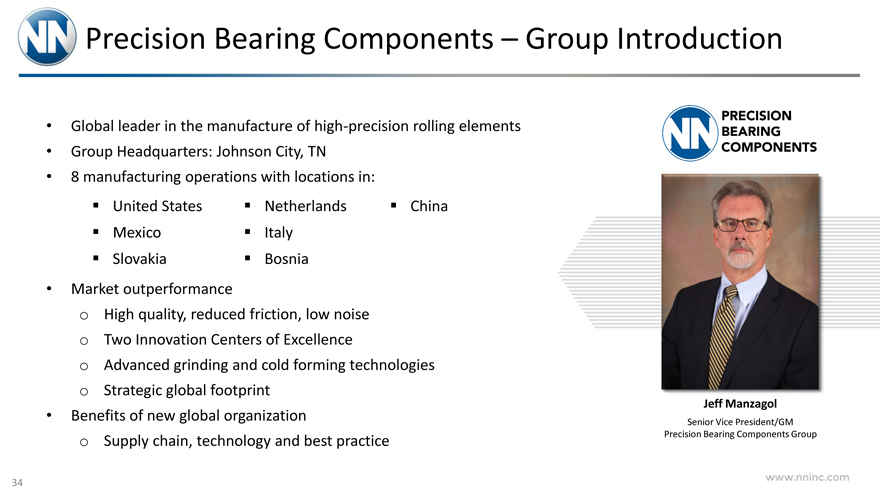

Precision Bearing Components – Group Introduction

Global leader in the manufacture of high-precision rolling elements

Group Headquarters: Johnson City, TN

8 manufacturing operations with locations in:

United States Netherlands China Mexico Italy Slovakia Bosnia

Market outperformance o High quality, reduced friction, low noise o Two Innovation Centers of Excellence o Advanced grinding and cold forming technologies o Strategic global footprint

Benefits of new global organization o Supply chain, technology and best practice

PRECISION BEARING COMPONENTS

Jeff Manzagol

Senior Vice President/GM Precision Bearing Components Group

www.nninc.com

34

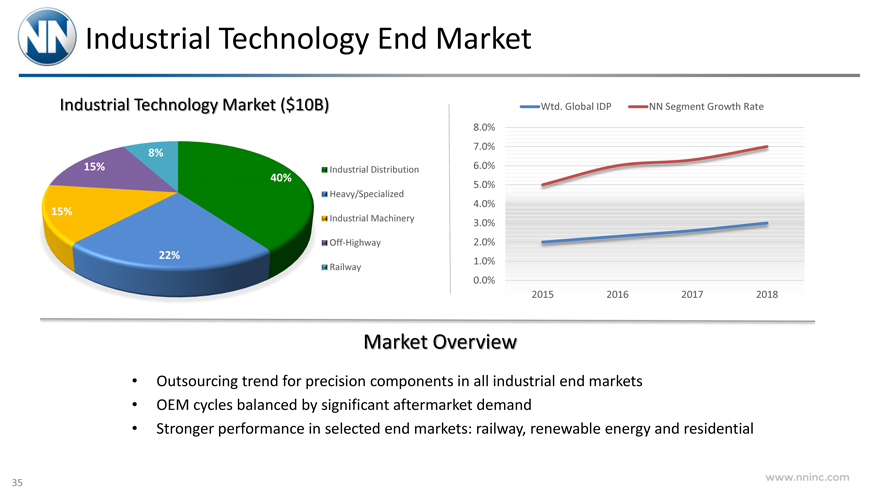

Industrial Technology End Market

Industrial Technology Market ($10B)

8% 15%

40%

15%

22%

Industrial Distribution Heavy/Specialized Industrial Machinery Off-Highway Railway

Wtd. Global IDP NN Segment Growth Rate

8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%

2015 2016 2017 2018

Market Overview

Outsourcing trend for precision components in all industrial end markets

OEM cycles balanced by significant aftermarket demand

Stronger performance in selected end markets: railway, renewable energy and residential

www.nninc.com

35

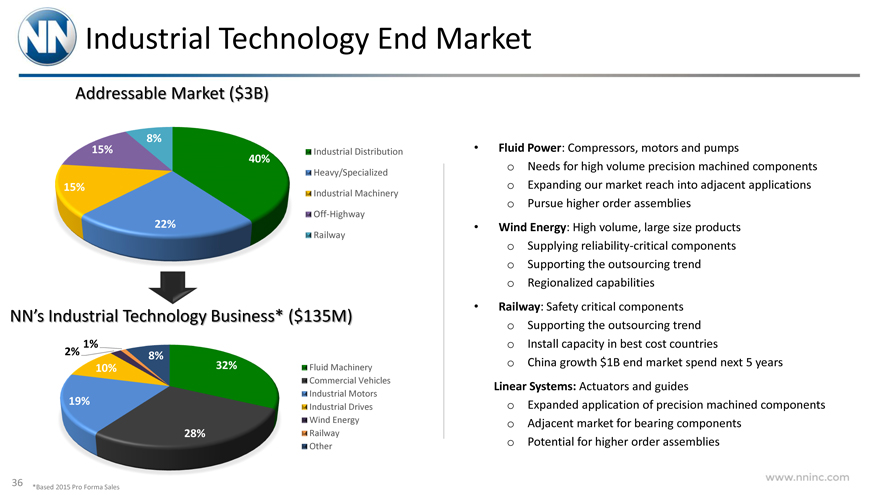

Industrial Technology End Market

Addressable Market ($3B)

8% 15%

40%

15%

22%

Industrial Distribution Heavy/Specialized Industrial Machinery Off-Highway Railway

NN’s Industrial Technology Business* ($135M)

1%

2% 8% 32% 10%

19%

28%

Fluid Machinery Commercial Vehicles Industrial Motors Industrial Drives Wind Energy Railway Other

Fluid Power: Compressors, motors and pumps o Needs for high volume precision machined components o Expanding our market reach into adjacent applications o Pursue higher order assemblies

Wind Energy: High volume, large size products o Supplying reliability-critical components o Supporting the outsourcing trend o Regionalized capabilities

Railway: Safety critical components o Supporting the outsourcing trend o Install capacity in best cost countries o China growth $1B end market spend next 5 years Linear Systems: Actuators and guides o Expanded application of precision machined components o Adjacent market for bearing components o Potential for higher order assemblies

www.nninc.com

36 *Based 2015 Pro Forma Sales

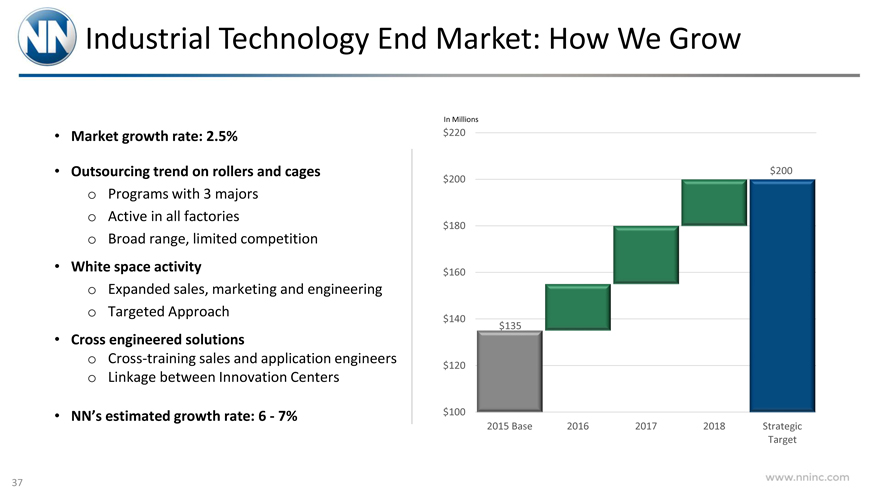

Industrial Technology End Market: How We Grow

Market growth rate: 2.5%

Outsourcing trend on rollers and cages o Programs with 3 majors o Active in all factories o Broad range, limited competition

White space activity o Expanded sales, marketing and engineering o Targeted Approach

Cross engineered solutions o Cross-training sales and application engineers o Linkage between Innovation Centers

NN’s estimated growth rate: 6—7%

In Millions

$220 $200 $180 $160 $140 $120 $100

$200

$135

2015 Base 2016 2017 2018 Strategic

Target

www.nninc.com

37

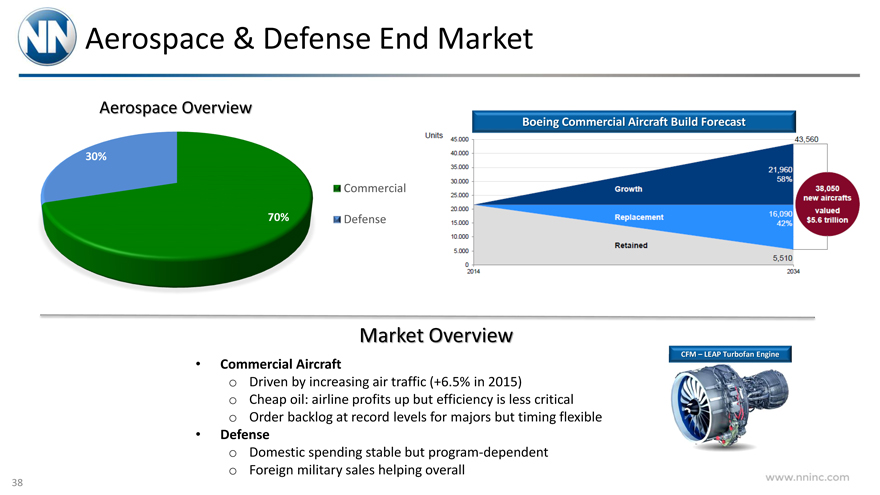

Aerospace & Defense End Market

Aerospace Overview

30%

70%

Commercial

Defense

Boeing Commercial Aircraft Build Forecast

Units 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 2014

Growth Replacement Retained 43,560 21,960 58% 38,050 new aircrafts valued $5.6 trillion 16,090 42% 5,510 2034 Market Overview

Commercial Aircraft o Driven by increasing air traffic (+6.5% in 2015) o Cheap oil: airline profits up but efficiency is less critical o Order backlog at record levels for majors but timing flexible

Defense o Domestic spending stable but program-dependent o Foreign military sales helping overall

CFM – LEAP Turbofan Engine

www.nninc.com

38

Aerospace & Defense: How We Grow

PEP acquisition provides market presence o Regulatory certifications o Customer access

NN capabilities fit market needs o High precision o Exacting quality standards o Manufacture complex parts & assemblies o Design & technical collaboration resources o Global footprint

Industry demand and technical drivers provide opportunities to expand our business

www.nninc.com

39

Automotive

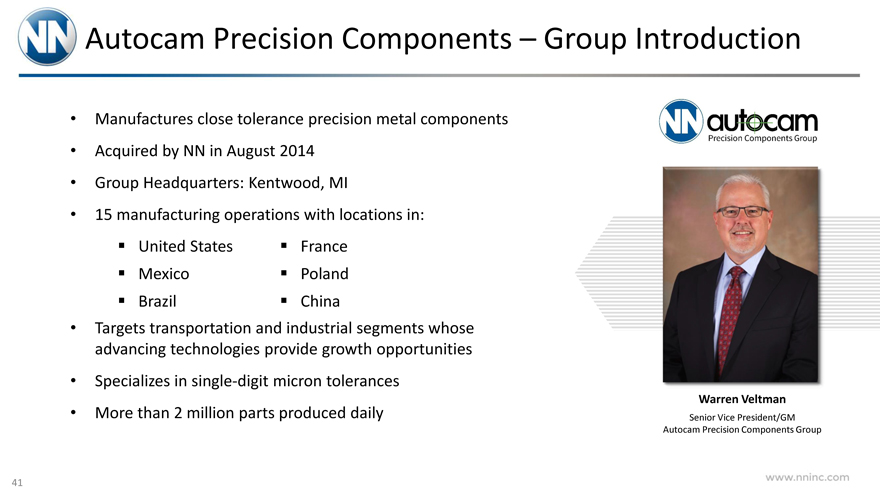

Autocam Precision Components – Group Introduction

Manufactures close tolerance precision metal components

Acquired by NN in August 2014

Group Headquarters: Kentwood, MI

15 manufacturing operations with locations in: United States France Mexico Poland Brazil China

Targets transportation and industrial segments whose advancing technologies provide growth opportunities

Specializes in single-digit micron tolerances

More than 2 million parts produced daily

Autocam Precision Components Group

Warren Veltman

Senior Vice President/GM Autocam Precision Components Group

www.nninc.com

41

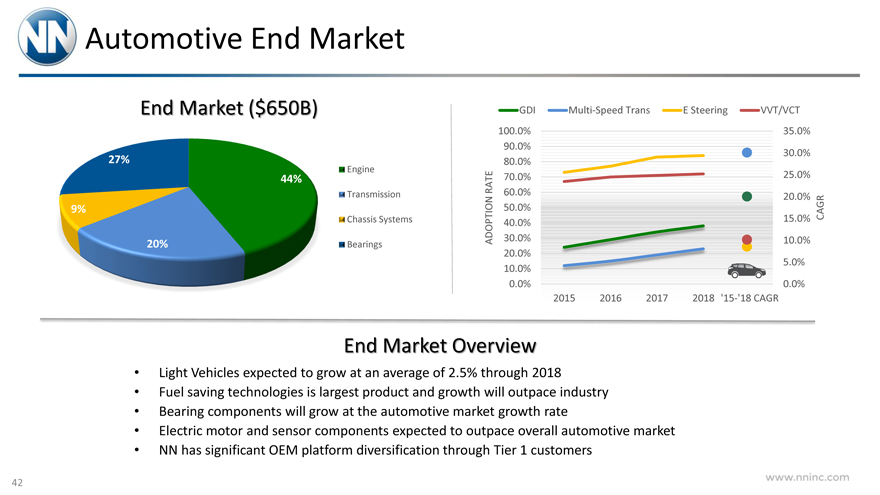

Automotive End Market

End Market ($650B)

27%

44% 9% 20%

Engine Transmission Chassis Systems Bearings

GDI Multi-Speed Trans E Steering VVT/VCT

ADOPTION RATE

100.0% 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0%

35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

CAGR

2015 2016 2017 2018 ‘15-‘18 CAGR

End Market Overview

Light Vehicles expected to grow at an average of 2.5% through 2018

Fuel saving technologies is largest product and growth will outpace industry

Bearing components will grow at the automotive market growth rate

Electric motor and sensor components expected to outpace overall automotive market

NN has significant OEM platform diversification through Tier 1 customers

www.nninc.com

42

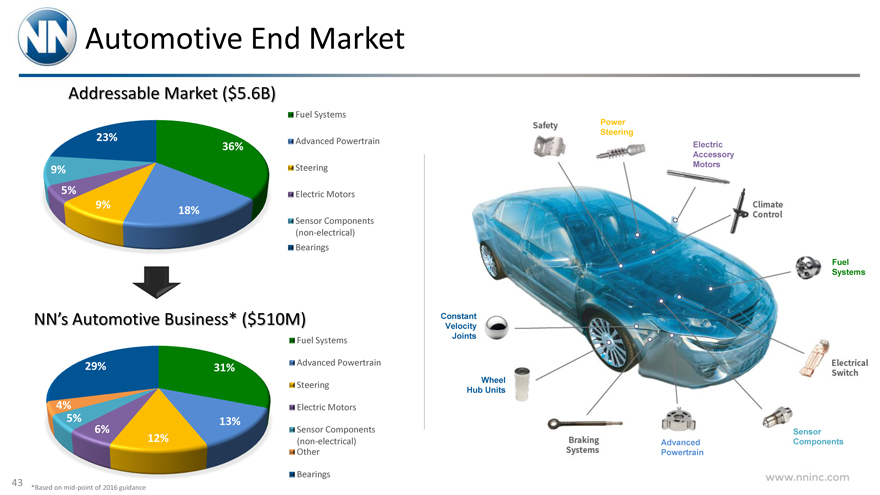

Automotive End Market

Addressable Market ($5.6B)

23%

36% 9% 5%

9% 18%

Fuel Systems

Advanced Powertrain Steering Electric Motors

Sensor Components (non-electrical) Bearings

NN’s Automotive Business* ($510M)

29% 31%

4%

5% 13% 6% 12%

Fuel Systems

Advanced Powertrain Steering Electric Motors

Sensor Components (non-electrical) Other

Bearings

Safety Power Steering Electric Accessory Motors Climate Control Fuel Systems Electrical Switch Sensor Components Advanced Powertrain Braking Systems Wheel Hub Units Constant Velocity Joints

www.nninc.com

43

*Based on mid-point of 2016 guidance

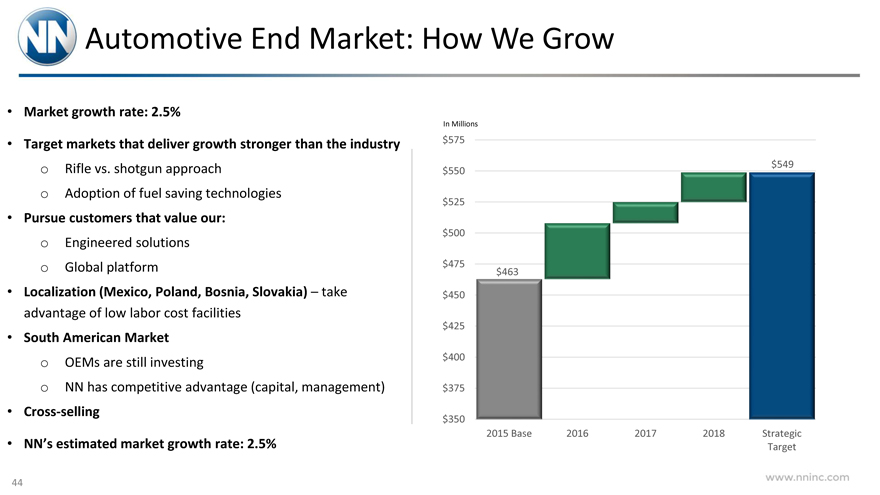

Automotive End Market: How We Grow

Market growth rate: 2.5%

Target markets that deliver growth stronger than the industry o Rifle vs. shotgun approach o Adoption of fuel saving technologies

Pursue customers that value our: o Engineered solutions o Global platform

Localization (Mexico, Poland, Bosnia, Slovakia) – take advantage of low labor cost facilities

South American Market o OEMs are still investing o NN has competitive advantage (capital, management)

Cross-selling

NN’s estimated market growth rate: 2.5%

In Millions

$575 $550 $525 $500 $475 $450 $425 $400 $375 $350

$549

$463

2015 Base 2016 2017 2018 Strategic

Target

www.nninc.com

44

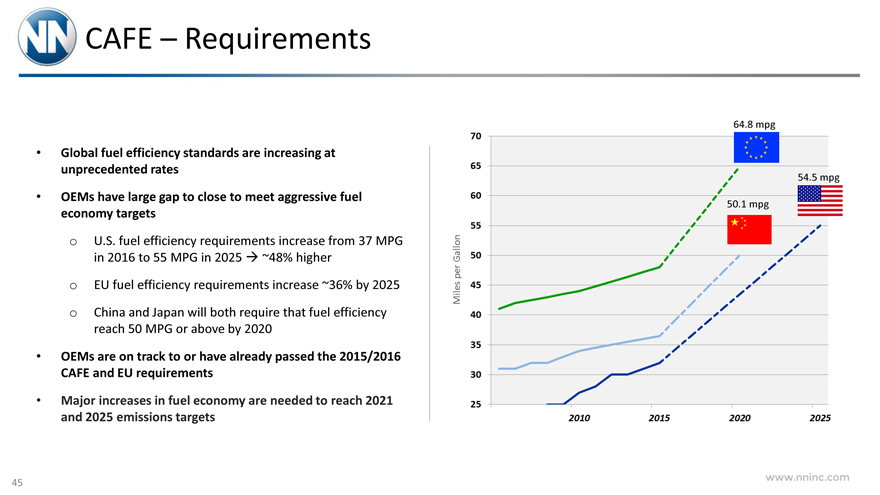

CAFE – Requirements

Global fuel efficiency standards are increasing at unprecedented rates

OEMs have large gap to close to meet aggressive fuel economy targets o U.S. fuel efficiency requirements increase from 37 MPG in 2016 to 55 MPG in 2025 ~48% higher o EU fuel efficiency requirements increase ~36% by 2025 o China and Japan will both require that fuel efficiency reach 50 MPG or above by 2020

OEMs are on track to or have already passed the 2015/2016 CAFE and EU requirements

Major increases in fuel economy are needed to reach 2021 and 2025 emissions targets

Miles per Gallon 70 65 60 55 50 45 40 35 30 25 64.8 mpg 54.5 mpg 50.1 mpg 2010 2015 2020 2025

www.nninc.com

45

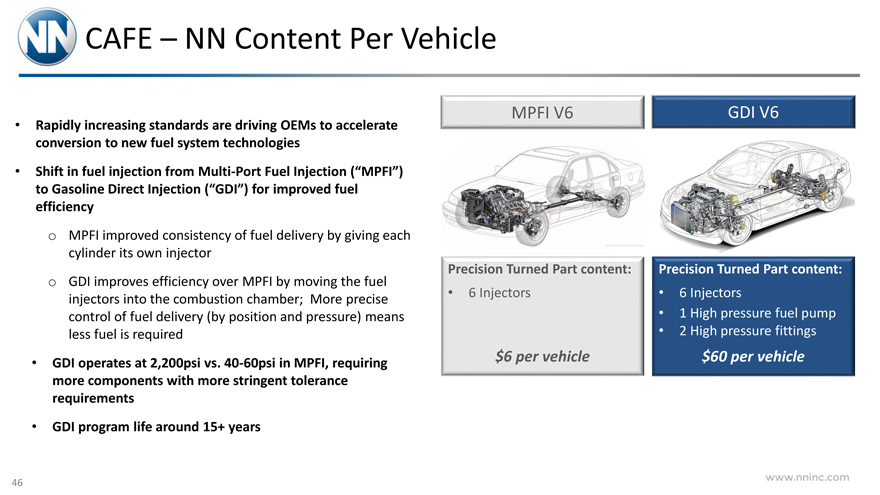

CAFE – NN Content Per Vehicle

Rapidly increasing standards are driving OEMs to accelerate conversion to new fuel system technologies

Shift in fuel injection from Multi-Port Fuel Injection (“MPFI”) to Gasoline Direct Injection (“GDI”) for improved fuel efficiency o MPFI improved consistency of fuel delivery by giving each cylinder its own injector o GDI improves efficiency over MPFI by moving the fuel injectors into the combustion chamber; More precise control of fuel delivery (by position and pressure) means less fuel is required

GDI operates at 2,200psi vs. 40-60psi in MPFI, requiring more components with more stringent tolerance requirements

GDI program life around 15+ years

MPFI V6 GDI V6

Precision Turned Part content:

6 Injectors

$6 per vehicle

Precision Turned Part content:

6 Injectors

1 High pressure fuel pump

2 High pressure fittings

$60 per vehicle

www.nninc.com

46

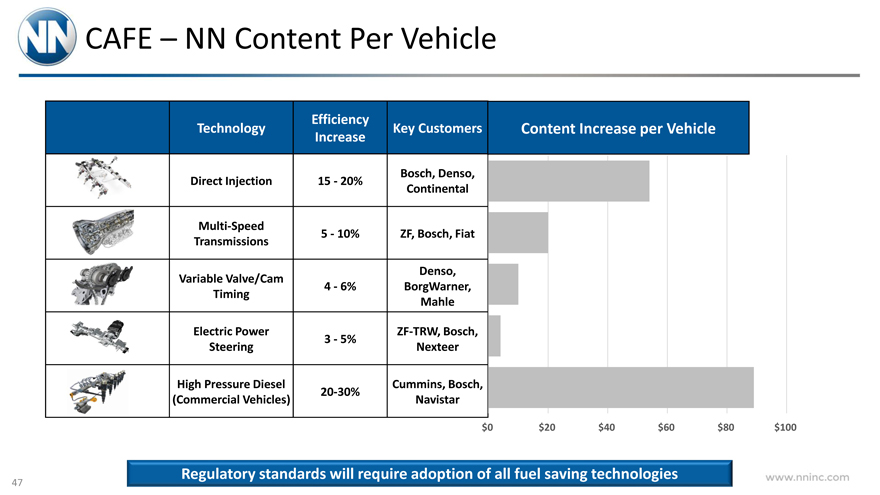

CAFE – NN Content Per Vehicle

Technology

Direct Injection

Multi-Speed Transmissions

Variable Valve/Cam Timing

Electric Power Steering

High Pressure Diesel (Commercial Vehicles)

Efficiency Increase

15—20%

5—10%

4—6%

3—5% 20-30%

Key Customers

Bosch, Denso, Continental

ZF, Bosch, Fiat

Denso, BorgWarner, Mahle

ZF-TRW, Bosch, Nexteer

Cummins, Bosch, Navistar

Content Increase per Vehicle

$0 $20 $40 $60 $80 $100

Regulatory standards will require adoption of all fuel saving technologies

www.nninc.com

47

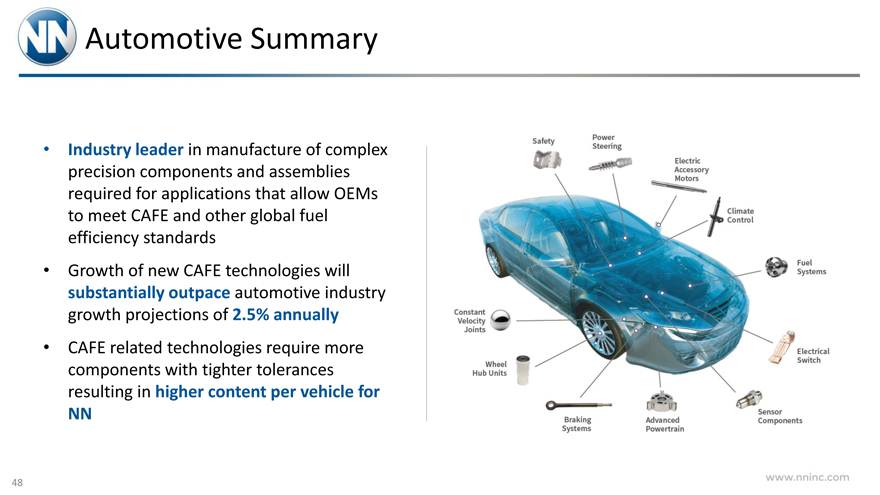

Automotive Summary

Industry leader in manufacture of complex precision components and assemblies required for applications that allow OEMs to meet CAFE and other global fuel efficiency standards

Growth of new CAFE technologies will substantially outpace automotive industry growth projections of 2.5% annually

CAFE related technologies require more components with tighter tolerances resulting in higher content per vehicle for NN

Safety Power Steering Electric Accessory Motors Climate Control Fuel Systems

Electrical Switch Sensor Components Advanced Powertrain Braking Systems Wheel Hub Units Constant Velocity Joints

www.nninc.com

48

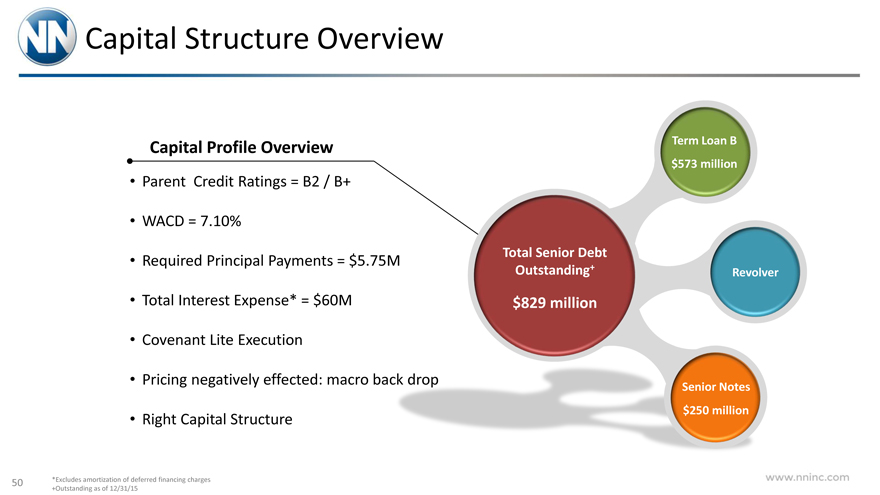

Capital Structure Overview

Capital Structure Overview

Capital Profile Overview

Parent Credit Ratings = B2 / B+

WACD = 7.10%

Required Principal Payments = $5.75M

Total Interest Expense* = $60M

Covenant Lite Execution

Pricing negatively effected: macro ba

Right Capital Structure

Total Senior Debt Outstanding+

$829 million

Term Loan B $573 million

Revolver

Senior Notes $250 million

www.nninc.com

50 *Excludes amortization of deferred financing charges +Outstanding as of 12/31/15

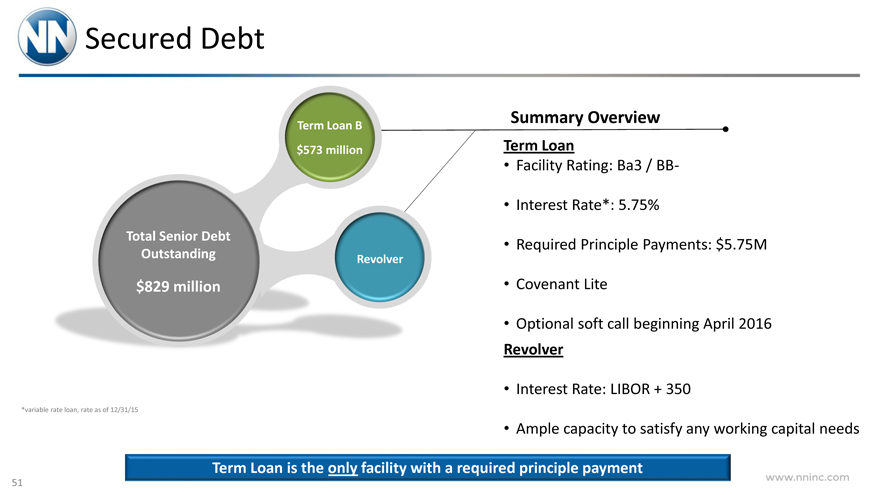

Secured Debt

Total Senior Debt Outstanding

$829 million

Term Loan B $573 million

Revolver

*variable rate loan, rate as of 12/31/15

Summary Overview

Term Loan

Facility Rating: Ba3 / BB-

Interest Rate*: 5.75%

Required Principle Payments: $5.75M

Covenant Lite

Optional soft call beginning April 2016

Revolver

Interest Rate: LIBOR + 350

Ample capacity to satisfy any working capital needs

Term Loan is the only facility with a required principle payment

www.nninc.com

51

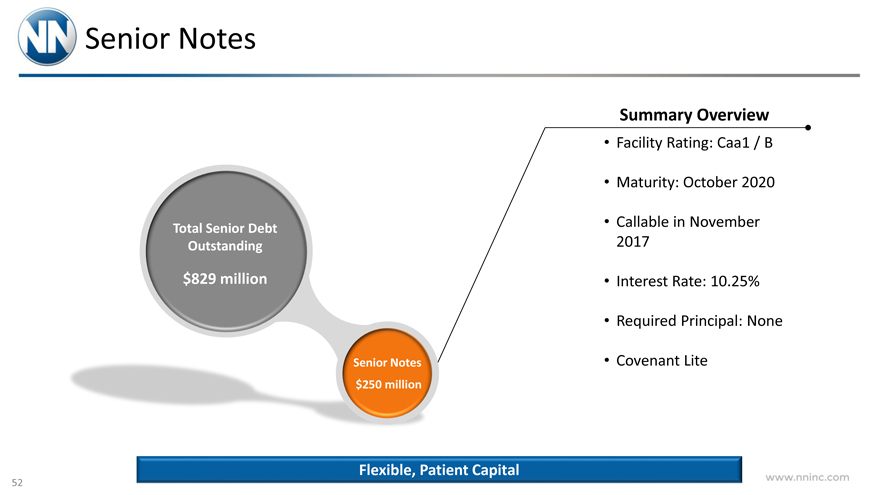

Senior Notes

Total Senior Debt Outstanding

$829 million

Senior Notes $250 million

Summary Overview

Facility Rating: Caa1 / B

Maturity: October 2020

Callable in November 2017

Interest Rate: 10.25%

Required Principal: None

Covenant Lite

Flexible, Patient Capital

www.nninc.com

52

De-Leveraging Profile

$ In Millions

$900 $800 $700 $600 $500 $400 $300 $200 $100

$0

Net Debt Outstanding

5.50x

5.00x

4.50x

4.00x

3.50x

3.00x

2.50x

2.00x

Leverage

YE 2015 2016 2017 2018

Notes Term Loan Leverage

Institutional focus on deleveraging

Flexible call provisions & ratings increases can speed up deleveraging

Free cash flow will be directed to debt repayment

With no EBITDA growth we are still less than 3.5x levered at that end of 2018.

www.nninc.com

53

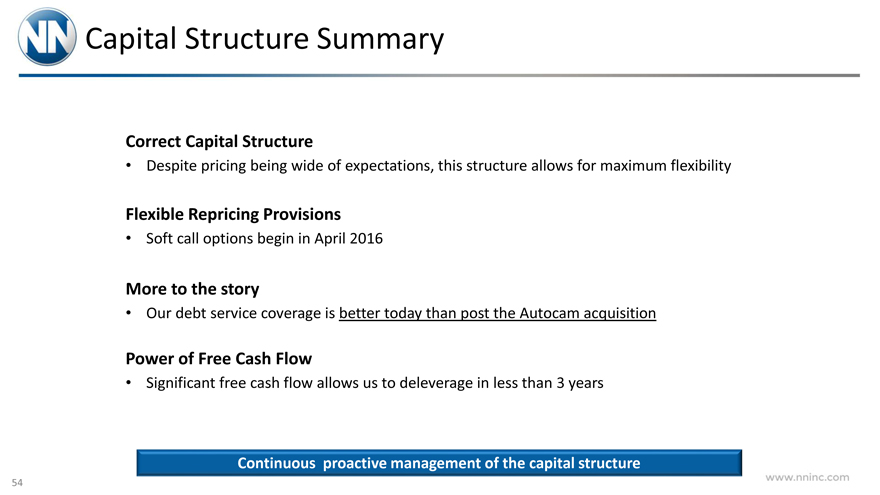

Capital Structure Summary

Correct Capital Structure

Despite pricing being wide of expectations, this structure allows for maximum flexibility

Flexible Repricing Provisions

Soft call options begin in April 2016

More to the story

Our debt service coverage is better today than post the Autocam acquisition

Power of Free Cash Flow

Significant free cash flow allows us to deleverage in less than 3 years

Continuous proactive management of the capital structure

www.nninc.com

54

Financial Performance

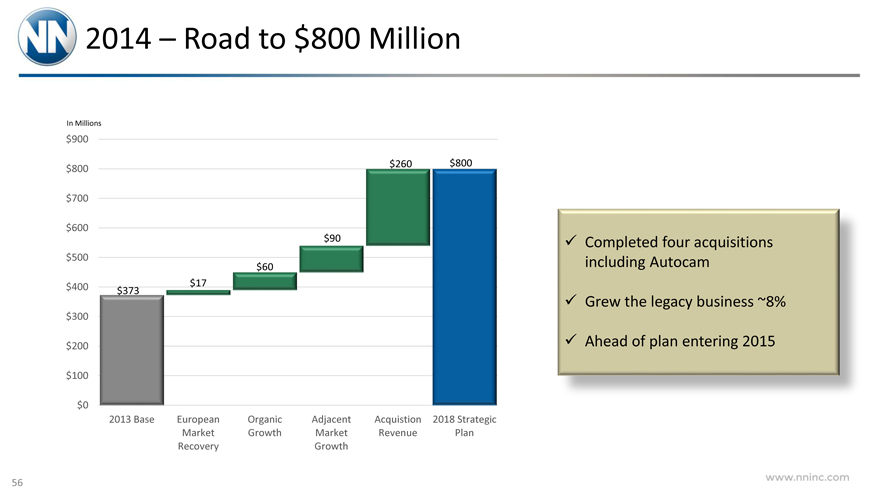

2014 – Road to $800 Million

In Millions

$900 $800 $700 $600 $500 $400 $300 $200 $100 $0

$260 $800

$90

$60 $17 $373

2013 Base European Organic Adjacent Acquistion 2018 Strategic Market Growth Market Revenue Plan Recovery Growth

Completed four acquisitions including Autocam

Grew the legacy business ~8%

Ahead of plan entering 2015

www.nninc.com

56

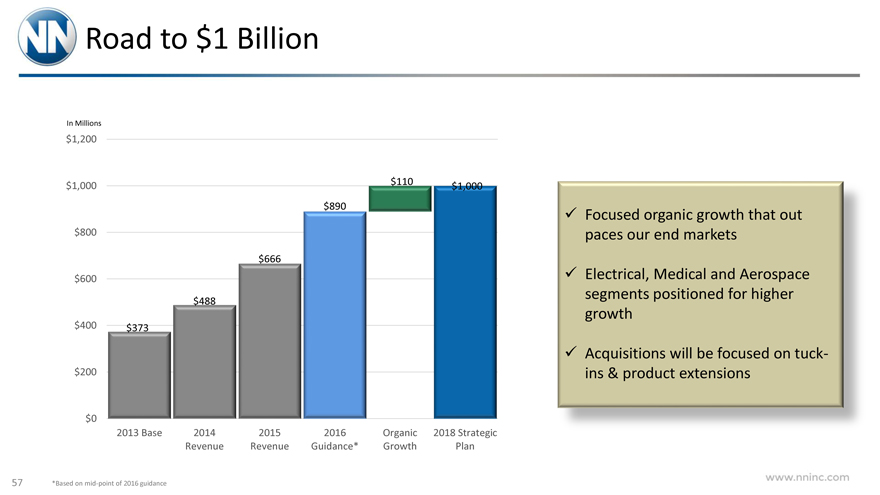

Road to $1 Billion

In Millions

$1,200 $1,000 $800 $600 $400 $200 $0

$110 $1,000 $890

$666

$488

$373

2013 Base 2014 2015 2016 Organic 2018 Strategic Revenue Revenue Guidance* Growth Plan

Focused organic growth that out paces our end markets

Electrical, Medical and Aerospace segments positioned for higher growth

Acquisitions will be focused on tuck-ins & product extensions

www.nninc.com

57 *Based on mid-point of 2016 guidance

2013—2018 Strategic Targets

EPS CAGR

Sales CAGR

ROIC

32% Gross Margin

22% EBITDA Margin

18% Operating Margin*

26%

20%

13%-16%

www.nninc.com

58 *Top to bottom of economic cycle range

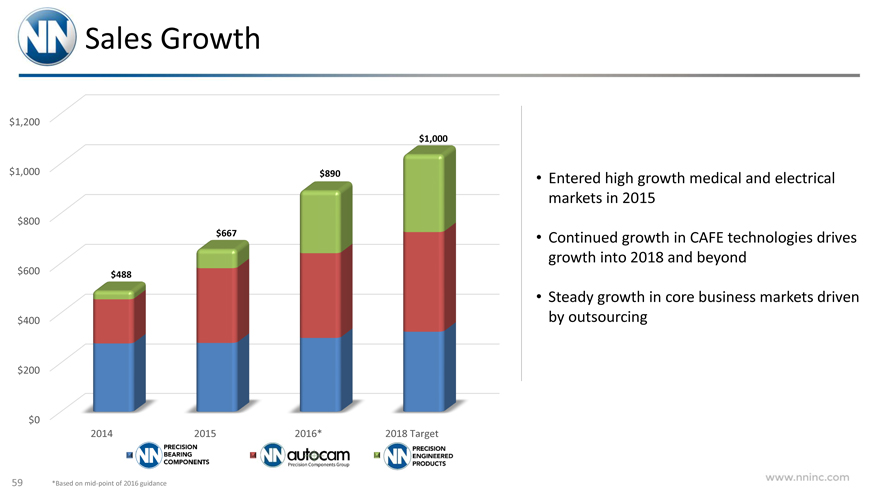

Sales Growth

$1,200 $1,000 $800 $600 $400 $200 $0

$1,000

$890

$667

$488

2014 2015 2016* 2018 Target

PRECISION BEARING COMPONENTS AUTOCAM Precision Components Group PRECISION ENGINEERED PRODUCTS • Entered high growth medical and electrical markets in 2015

Continued growth in CAFE technologies drives growth into 2018 and beyond

Steady growth in core business markets driven by outsourcing

www.nninc.com

59 *Based on mid-point of 2016 guidance

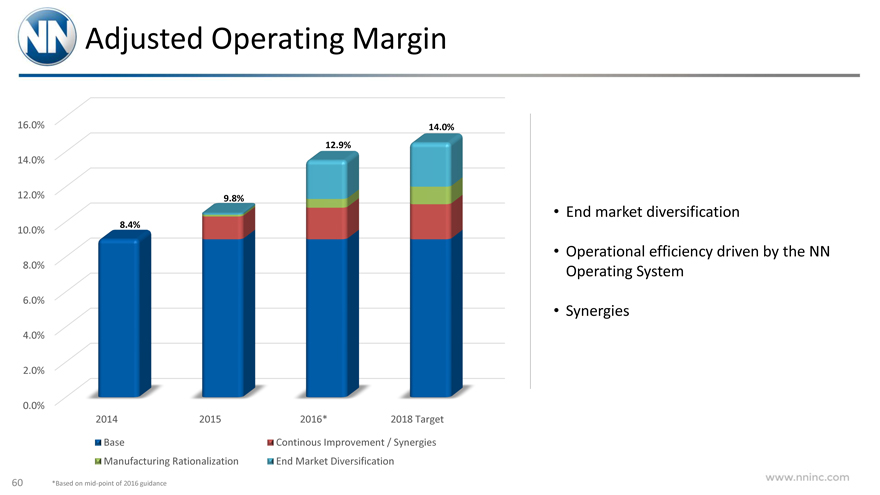

Adjusted Operating Margin

16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0%

14.0%

12.9%

9.8%

8.4%

2014 2015 2016* 2018 Target Base Continous Improvement / Synergies Manufacturing Rationalization End Market Diversification

End market diversification

Operational efficiency driven by the NN Operating System

Synergies

www.nninc.com

60 *Based on mid-point of 2016 guidance

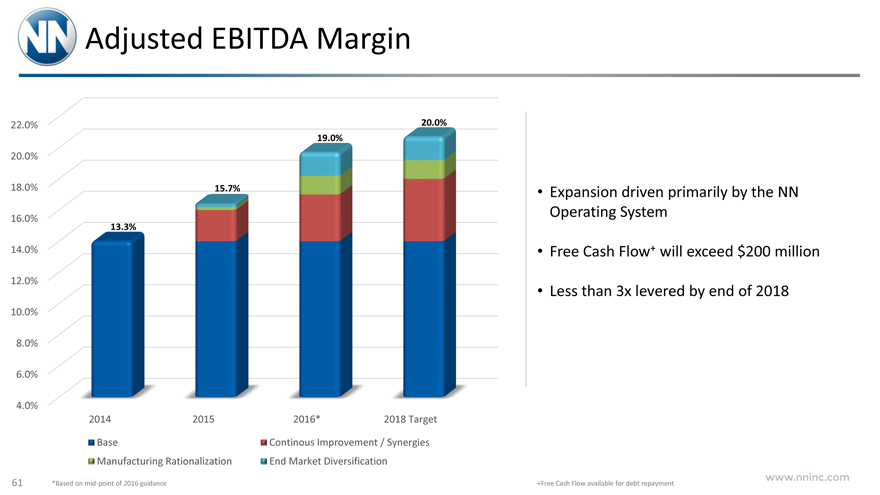

Adjusted EBITDA Margin

22.0% 20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0%

20.0% 19.0%

15.7%

13.3%

2014 2015 2016* 2018 Target Base Continous Improvement / Synergies Manufacturing Rationalization End Market Diversification

Expansion driven primarily by the NN Operating System

Free Cash Flow+ will exceed $200 million

Less than 3x levered by end of 2018

www.nninc.com

61 *Based on mid-point of 2016 guidance

+Free Cash Flow available for debt repayment

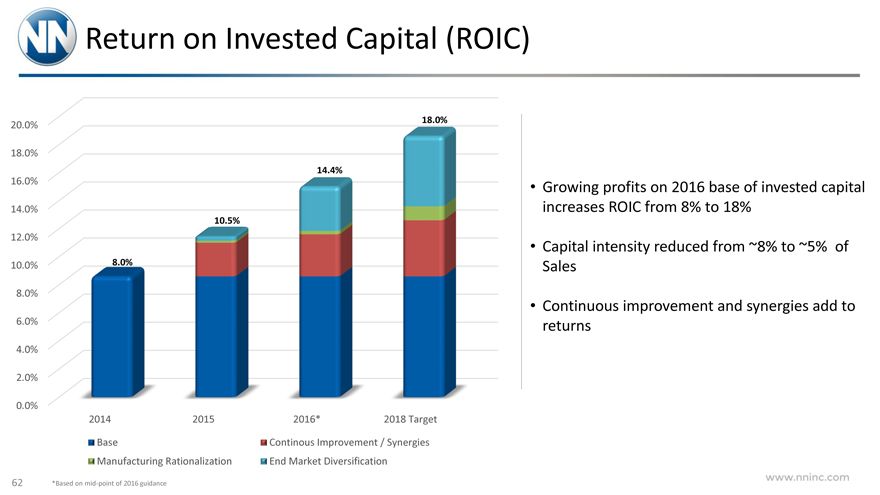

Return on Invested Capital (ROIC)

20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0%

18.0%

14.4%

10.5%

8.0%

2014 2015 2016* 2018 Target Base Continous Improvement / Synergies Manufacturing Rationalization End Market Diversification

Growing profits on 2016 base of invested capital increases ROIC from 8% to 18%

Capital intensity reduced from ~8% to ~5% of Sales

Continuous improvement and synergies add to returns

www.nninc.com

62 *Based on mid-point of 2016 guidance

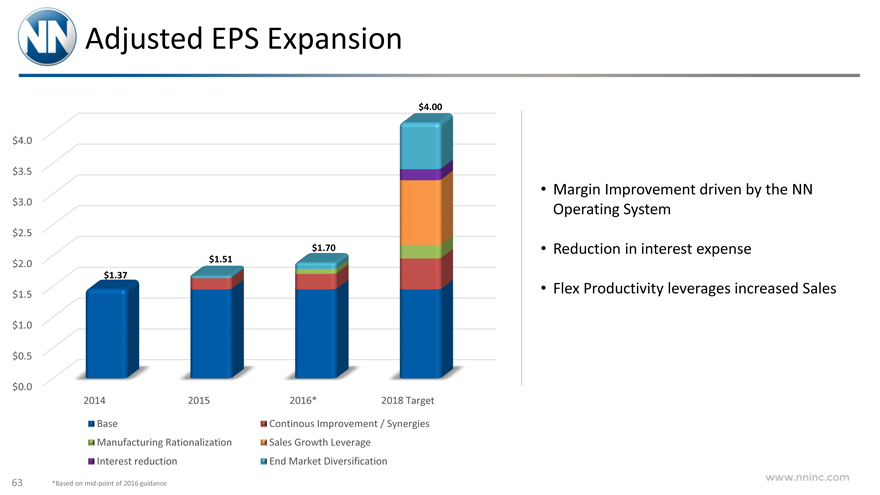

Adjusted EPS Expansion

$4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

$4.00

$1.70

$1.51

$1.37

2014 2015 2016* 2018 Target Base Continous Improvement / Synergies Manufacturing Rationalization Sales Growth Leverage Interest reduction End Market Diversification

Margin Improvement driven by the NN Operating System

Reduction in interest expense

Flex Productivity leverages increased Sales

www.nninc.com

63 *Based on mid-point of 2016 guidance

The NN Operating System

Premise of the NN Operating System

Integrated Operating Company

Common methodologies delivering near & long term value

Flex Productivity

Maximizing performance no matter the market conditions

Leverage Technology

One Platform, one company

Prescriptive Processes

Disciplined execution of the operating plan

A Disciplined & Flexible Operation

www.nninc.com

65

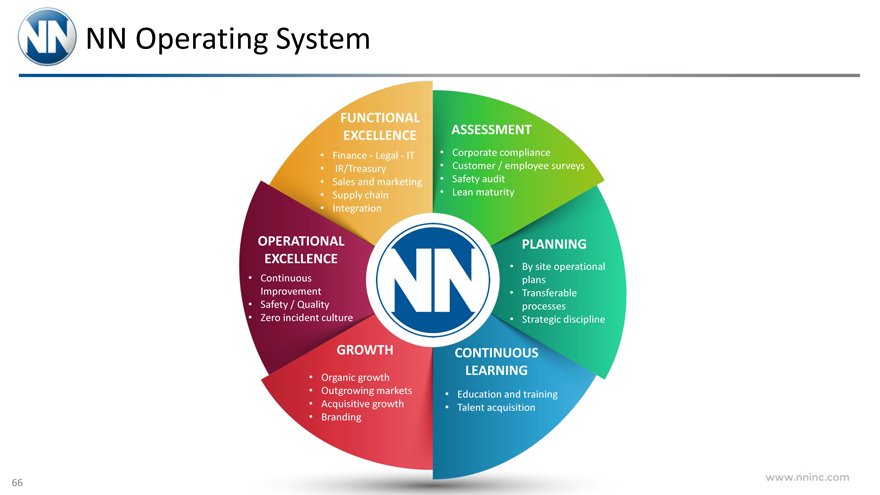

NN Operating System

FUNCTIONAL EXCELLENCE

Finance—Legal—IT

IR/Treasury

Sales and marketing

Supply chain

Integration

ASSESSMENT

Corporate compliance

Customer / employee surveys

Safety audit

Lean maturity

OPERATIONAL EXCELLENCE

Continuous Improvement

Safety / Quality

Zero incident culture

PLANNING

By site operational plans

Transferable processes

Strategic discipline

GROWTH

Organic growth

Outgrowing markets

Acquisitive growth

Branding

CONTINUOUS LEARNING

Education and training

Talent acquisition

www.nninc.com

66

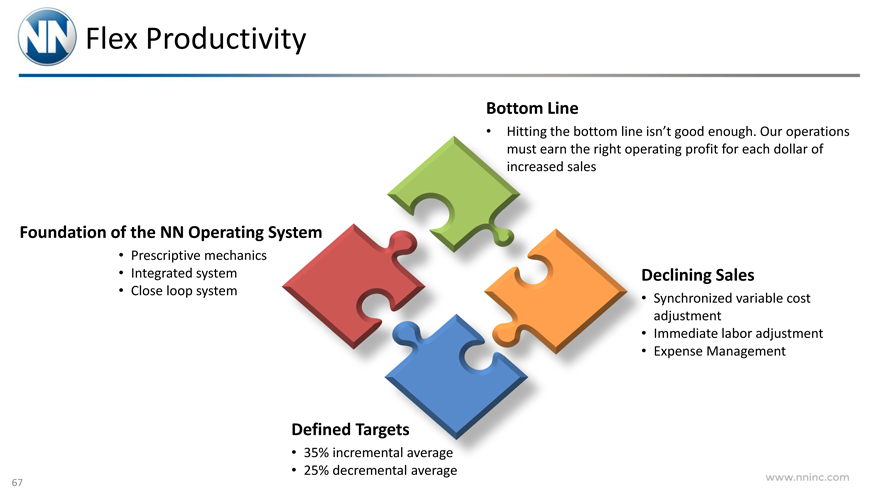

Flex Productivity

Foundation of the NN Operating System

Prescriptive mechanics

Integrated system

Close loop system

Bottom Line

Hitting the bottom line isn’t good enough. Our operations must earn the right operating profit for each dollar of increased sales

Declining Sales

Synchronized variable cost adjustment

Immediate labor adjustment

Expense Management

Defined Targets

35% incremental average

25% decremental average

www.nninc.com

67

Summary / Q&A

2016 – A Year of Transformation

Leverage the NN Operating System across the entire platform

Integrate PEP on the platform

Remain focused on our Strategic Plan objectives

Continued progress on our operating & financial targets

De-Leveraging a priority

Our strong free cash flow will lead the charge

Transform our Sales Platform

Deliver engineered solutions across the entire portfolio

Focused on becoming a well-oiled machine

www.nninc.com

69

Who We Are

Engineered Solutions…

Automotive Industrial Technology Medical Aerospace Electrical

Inspired by innovation

www.nninc.com

70