- EGO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Eldorado Gold (EGO) 6-KCurrent report (foreign)

Filed: 27 Jan 25, 5:09pm

EXHIBIT 99.1

Lamaque Project, Québec, Canada

Technical Report

|

|

Technical Report

Lamaque Complex

Québec, Canada

UTM coordinates

Between 295,700 mE and 296,900 mE, and between 5,328,200 mN and 5,329,350 mN

Effective Date: December 31, 2024

Prepared by:

Eldorado Gold Corporation

1188 Bentall 5 - 550 Burrard Street

Vancouver, BC V6C 2B5

| Qualified Persons | Company |

| D Sutherland | Eldorado |

| J Simoneau | Eldorado |

| P Lind | Eldorado |

| J Thelland | Eldorado |

| P Groleau | Eldorado |

| M Bouanani | Eldorado |

| V Tran | Eldorado |

Lamaque Complex, Québec, Canada

Technical Report |

|

Table of Contents

1 | Summary. |

| 1-1 |

| |

| 1.1 | Introduction. |

| 1-1 |

|

| 1.2 | Contributors and Qualified Persons. |

| 1-4 |

|

| 1.3 | Reliance on Other Experts. |

| 1-4 |

|

| 1.4 | Property Description and Ownership. |

| 1-4 |

|

| 1.5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography. |

| 1-7 |

|

| 1.6 | History. |

| 1-7 |

|

| 1.7 | Geology and Mineralization. |

| 1-7 |

|

| 1.8 | Deposit Types. |

| 1-9 |

|

| 1.9 | Exploration. |

| 1-9 |

|

| 1.10 | Drilling, Sampling Method, Approach and Analyses. |

| 1-9 |

|

| 1.11 | Sample Preparation, Analyses and Security. |

| 1-10 |

|

| 1.12 | Data Verification. |

| 1-10 |

|

| 1.13 | Metallurgical Testing. |

| 1-10 |

|

| 1.14 | Mineral Resource Estimate. |

| 1-11 |

|

| 1.15 | Mineral Reserve Estimates. |

| 1-13 |

|

| 1.16 | Mining Methods. |

| 1-14 |

|

| 1.17 | Process Plant and Recovery Methods. |

| 1-15 |

|

| 1.18 | Infrastructure. |

| 1-15 |

|

| 1.19 | Market Studies and Contracts. |

| 1-16 |

|

| 1.20 | Environment and Permitting. |

| 1-16 |

|

| 1.21 | Capital and Operating Costs. |

| 1-17 |

|

| 1.22 | Financial Analysis. |

| 1-18 |

|

| 1.23 | Adjacent Properties. |

| 1-18 |

|

| 1.24 | Other Relevant Data and Information Opportunities. |

| 1-18 |

|

| 1.25 | Interpretation and Conclusion. |

| 1-21 |

|

| 1.26 | Recommendations. |

| 1-22 |

|

2 | Introduction. |

| 2-1 |

| |

| 2.1 | Principal Sources of Information. |

| 2-2 |

|

| 2.2 | Qualified Persons and Inspection on the Project |

| 2-2 |

|

| 2.3 | Site Visits. |

| 2-3 |

|

| 2.4 | Effective Date. |

| 2-3 |

|

| 2.5 | Abbreviations, Units, and Currencies. |

| 2-3 |

|

3 | Reliance on Other Experts. |

| 3-1 |

| |

| 3.1 | Property Agreements, Mineral Tenure, Surface Rights, and Royalties. |

| 3-1 |

|

| 3.2 | Political |

| 3-1 |

|

| 3.3 | Environmental, Permitting, Closure, Social, and Community. |

| 3-1 |

|

| 3.4 | Taxation. |

| 3-1 |

|

| 3.5 | Markets. |

| 3-1 |

|

4 | Property Description and Location. |

| 4-1 |

| |

| 4.1 | Location. |

| 4-1 |

|

| 4.2 | Property Description. |

| 4-1 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page ii |

Lamaque Complex, Québec, Canada

Technical Report |

|

5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography. |

| 5-1 |

| |

| 5.1 | Accessibility. |

| 5-1 |

|

| 5.2 | Climate. |

| 5-2 |

|

| 5.3 | Local Resources and Infrastructures. |

| 5-5 |

|

| 5.4 | Physiography. |

| 5-5 |

|

6 | History. |

| 6-1 |

| |

| 6.1 | History of the Sigma and Lamaque Mines. |

| 6-1 |

|

| 6.2 | Lamaque Project Exploration History. |

| 6-4 |

|

| 6.3 | Eldorado. |

| 6-6 |

|

7 | Geological Setting and Mineralization. |

| 7-1 |

| |

| 7.1 | Regional Geological Setting of the Abitibi Greenstone Belt |

| 7-1 |

|

| 7.2 | District Geology. |

| 7-2 |

|

| 7.3 | Local Geological Setting and Mineralization. |

| 7-5 |

|

8 | Deposit Types. |

| 8-1 |

| |

| 8.1 | Orogenic Gold Deposits. |

| 8-1 |

|

9 | Exploration. |

| 9-1 |

| |

| 9.1 | Property Scale Exploration. |

| 9-1 |

|

| 9.2 | South-West Target and Gabbro South. |

| 9-2 |

|

| 9.3 | Sigma East Extension. |

| 9-3 |

|

| 9.4 | Aumaque Block. |

| 9-3 |

|

| 9.5 | Secteur Nord. |

| 9-4 |

|

10 | Drilling. |

| 10-1 |

| |

11 | Sample Preparation, Analyses, and Security. |

| 11-1 |

| |

| 11.1 | Sample Preparation, Analyses. |

| 11-1 |

|

| 11.2 | Quality Assurance and Quality Control |

| 11-1 |

|

| 11.3 | Concluding Statement |

| 11-7 |

|

12 | Data Verification. |

| 12-1 |

| |

| 12.1 | Drill Data Handling and Security. |

| 12-1 |

|

| 12.2 | Data Verification by Qualified Persons. |

| 12-1 |

|

13 | Mineral Processing and Metallurgical Testing. |

| 13-1 |

| |

| 13.1 | Initial Testwork on Plug 4, Triangle, Parallel, and Fortune Composites. |

| 13-1 |

|

| 13.2 | Triangle Composite Testwork. |

| 13-5 |

|

| 13.3 | Triangle Zone Testwork. |

| 13-6 |

|

| 13.4 | Comminution Testwork. |

| 13-14 |

|

| 13.5 | Lower Triangle (Zones C8 through C10) and Ormaque. |

| 13-14 |

|

| 13.6 | Ormaque Metallurgical Testwork. |

| 13-17 |

|

| 13.7 | Results, Summary, and Conclusions. |

| 13-23 |

|

14 | Mineral Resource Estimates. |

| 14-1 |

| |

| 14.1 | Triangle Deposit |

| 14-1 |

|

| 14.2 | Parallel Deposit |

| 14-17 |

|

| 14.3 | Plug No. 4. |

| 14-27 |

|

| 14.4 | Ormaque Deposit |

| 14-30 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page iii |

Lamaque Complex, Québec, Canada

Technical Report |

|

15 | Mineral Reserve Estimates. |

| 15-1 |

| |

| 15.1 | Factors that May Affect Mineral Reserves. |

| 15-2 |

|

| 15.2 | Underground Resource Estimates. |

| 15-2 |

|

| 15.3 | Mineral Reserve Estimate. |

| 15-3 |

|

| 15.4 | Qualified Person Comment on Reserve Estimate. |

| 15-4 |

|

16 | Mining Methods. |

| 16-1 |

| |

| 16.1 | Introduction. |

| 16-1 |

|

| 16.2 | Mineable Resource Summary. |

| 16-2 |

|

| 16.3 | Mine Plan. |

| 16-2 |

|

| 16.4 | Underground Mine Design. |

| 16-11 |

|

| 16.5 | Mine Backfill |

| 16-17 |

|

| 16.6 | Productivity Rates. |

| 16-19 |

|

| 16.7 | Mine Development and Production Schedule. |

| 16-21 |

|

| 16.8 | Mine Equipment |

| 16-25 |

|

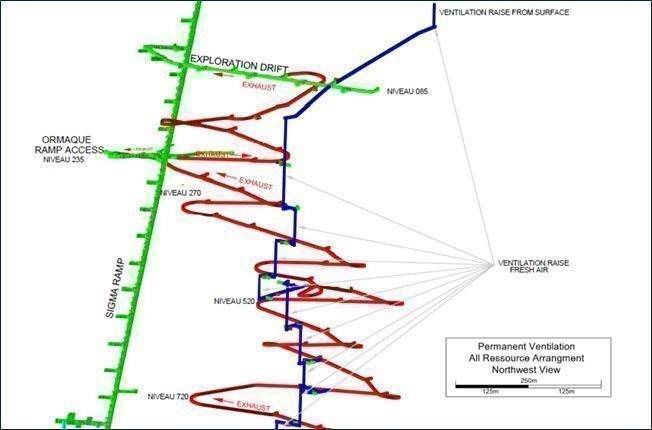

| 16.9 | Ventilation. |

| 16-26 |

|

| 16.10 | Geotechnical Assessment |

| 16-27 |

|

| 16.11 | Mine Services. |

| 16-34 |

|

17 | Recovery Methods. |

| 17-1 |

| |

| 17.1 | Introduction. |

| 17-1 |

|

| 17.2 | Metallurgical Recoveries. |

| 17-5 |

|

| 17.3 | Water Balance. |

| 17-5 |

|

| 17.4 | Process Equipment |

| 17-6 |

|

| 17.5 | Design Criteria. |

| 17-7 |

|

| 17.6 | Power Reagents and Consumables. |

| 17-8 |

|

| 17.7 | Plant Personnel |

| 17-9 |

|

| 17.8 | Plant Layout |

| 17-11 |

|

18 | Project Infrastructure. |

| 18-1 |

| |

| 18.1 | Site Access and Logistics. |

| 18-1 |

|

| 18.2 | Site Infrastructure. |

| 18-1 |

|

| 18.3 | Site Development |

| 18-2 |

|

| 18.4 | Local Infrastructure. |

| 18-4 |

|

| 18.5 | Triangle Mine Site. |

| 18-4 |

|

| 18.6 | Ormaque Mine - Infrastructure Additions. |

| 18-7 |

|

| 18.7 | Sigma Mill Complex. |

| 18-10 |

|

| 18.8 | Support Infrastructure. |

| 18-11 |

|

| 18.9 | Material Stockpiling. |

| 18-12 |

|

| 18.10 | Tailings Strategy. |

| 18-14 |

|

| 18.11 | Water Management |

| 18-18 |

|

| 18.12 | Paste Backfill Plant |

| 18-20 |

|

19 | Market Studies and Contracts. |

| 19-1 |

| |

| 19.1 | Market |

| 19-1 |

|

| 19.2 | Contracts. |

| 19-1 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page iv |

Lamaque Complex, Québec, Canada

Technical Report |

|

20 | Environmental Studies, Permitting and Social or Community Impact |

| 20-1 |

| |

| 20.1 | Regulations and Permitting. |

| 20-1 |

|

| 20.2 | Consultation Activities and Social Economic Setting. |

| 20-6 |

|

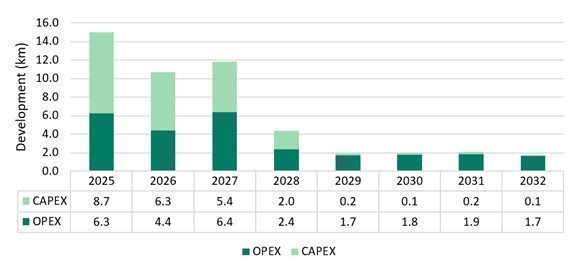

21 | Capital and Operating Costs. |

| 21-1 |

| |

| 21.1 | Mineral Reserve Capital Costs. |

| 21-1 |

|

| 21.2 | Mineral Reserve Operating Costs. |

| 21-4 |

|

22 | Economic Analysis. |

| 22-1 |

| |

| 22.1 | Reserve Economic Modelling Parameters. |

| 22-1 |

|

23 | Adjacent Properties. |

| 23-1 |

| |

24 | Other Relevant Data and Information. |

| 24-1 |

| |

| 24.1 | Summary. |

| 24-1 |

|

| 24.2 | Introduction. |

| 24-1 |

|

| 24.3 | Reliance on Other Expects. |

| 24-1 |

|

| 24.4 | Property Description and Location. |

| 24-1 |

|

| 24.5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography. |

| 24-1 |

|

| 24.6 | History. |

| 24-2 |

|

| 24.7 | Geological Setting and Mineralization. |

| 24-2 |

|

| 24.8 | Deposit Type. |

| 24-2 |

|

| 24.9 | Exploration. |

| 24-2 |

|

| 24.10 | Drilling. |

| 24-2 |

|

| 24.11 | Sample Preparation, Analyses and Security. |

| 24-2 |

|

| 24.12 | Data Verification. |

| 24-2 |

|

| 24.13 | Mineral Processing and Metallurgical Testing. |

| 24-2 |

|

| 24.14 | Mineral Resource Estimates. |

| 24-3 |

|

| 24.15 | Mineral Reserve Estimates. |

| 24-4 |

|

| 24.16 | Mining Methods. |

| 24-4 |

|

| 24.17 | Recovery Methods. |

| 24-8 |

|

| 24.18 | Project Infrastructure. |

| 24-8 |

|

| 24.19 | Market Studies and Contracts. |

| 24-10 |

|

| 24.20 | Environmental Studies, Permitting and Social or Community Impact |

| 24-10 |

|

| 24.21 | Capital and Operating Costs. |

| 24-10 |

|

| 24.22 | Economic Analysis. |

| 24-14 |

|

| 24.23 | Adjacent Properties. |

| 24-20 |

|

| 24.24 | Interpretation and Conclusions. |

| 24-20 |

|

| 24.25 | Life of Asset Strategy. |

| 24-20 |

|

| 24.26 | Risks and Opportunities. |

| 24-24 |

|

25 | Interpretation and Conclusions. |

| 25-1 |

| |

| 25.1 | Overview.. |

| 25-1 |

|

| 25.2 | Mineral Resources and Mineral Reserves. |

| 25-2 |

|

| 25.3 | Mining Methods. |

| 25-2 |

|

| 25.4 | Metallurgy. |

| 25-2 |

|

| 25.5 | Processing and Paste Backfill |

| 25-2 |

|

| 25.6 | Tailings Management Facility. |

| 25-3 |

|

| 25.7 | Environmental and Permitting. |

| 25-3 |

|

| 25.8 | Infrastructure. |

| 25-3 |

|

| 25.9 | Capital and Operating Costs, and Financial Modelling. |

| 25-3 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page v |

Lamaque Complex, Québec, Canada

Technical Report |

|

26 | Recommendations. |

| 26-1 |

| |

| 26.1 | Geology - Exploration. |

| 26-1 |

|

| 26.2 | Mining – Planning and Operational |

| 26-1 |

|

| 26.3 | Metallurgy and Processing. |

| 26-1 |

|

| 26.4 | Permitting and Closure. |

| 26-2 |

|

| 26.5 | Budget |

| 26-2 |

|

27 | References. |

| 27-1 |

| |

28 | Date and Signature Page. |

| 28-1 |

| |

|

|

|

|

|

|

2024 Technical Report |

| Page vi |

Lamaque Complex, Québec, Canada

Technical Report |

|

List of Figures

Figure 1‑1: Lamaque Complex Mill Production Comparisons. |

| 1-3 |

|

Figure 1‑2: Sigma Mill Gold Production Comparisons. |

| 1-3 |

|

Figure 1‑3: Location of the Lamaque Property with Respect to the City of Val-d’Or (Eldorado 2024) |

| 1-5 |

|

Figure 1‑4: Location of Property in Relation to Royalties (Eldorado 2024) |

| 1-6 |

|

Figure 1‑5: Geology of the Abitibi Greenstone Belt |

| 1-8 |

|

Figure 4‑1: Location of the Lamaque Complex in the Province of Québec (Eldorado, 2024) |

| 4-1 |

|

Figure 4‑2: Claim Map of the Lamaque Complex Near Val-d’Or, Québec, Canada (Eldorado, 2024) |

| 4-2 |

|

Figure 4‑3: Location of the Lamaque Complex with Respect to the City of Val-d’Or (Eldorado, 2024) |

| 4-6 |

|

Figure 4‑4: Location of Historical Properties in Relation to Royalties (Eldorado, 2024) |

| 4-8 |

|

Figure 5‑1: Access and Waterways of the Lamaque Complex and Region (Eldorado 2024) |

| 5-1 |

|

Figure 5‑2: Location and Access of the Lamaque Complex (Eldorado 2024) |

| 5-2 |

|

Figure 7‑1: Geology of the Abitibi Greenstone Belt |

| 7-2 |

|

Figure 7‑2: Simplified Geology of Lamaque and Bourlamaque Areas (based on Sauvé et al.,1993) |

| 7-4 |

|

Figure 7‑3: Geology of the Lamaque Complex Area (Eldorado 2024) |

| 7-7 |

|

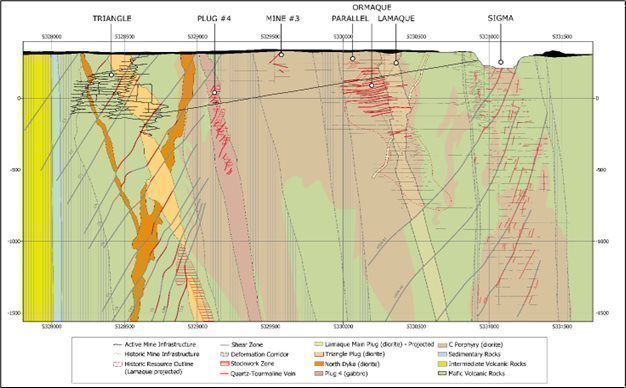

Figure 7‑4: Composite Section Looking West through the Triangle, Plug No. 4, Ormaque, Parallel, Lamaque and Sigma Deposits (Eldorado 2022) |

| 7-8 |

|

Figure 9‑1: Geology of the Lamaque Project Area (Eldorado 2024) |

| 9-2 |

|

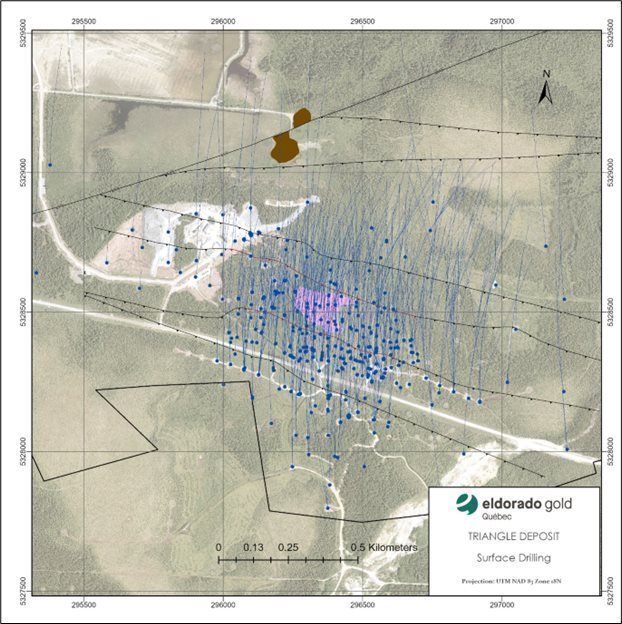

Figure 10‑1: Triangle Deposit Drillhole Location Map (Eldorado 2024) |

| 10-4 |

|

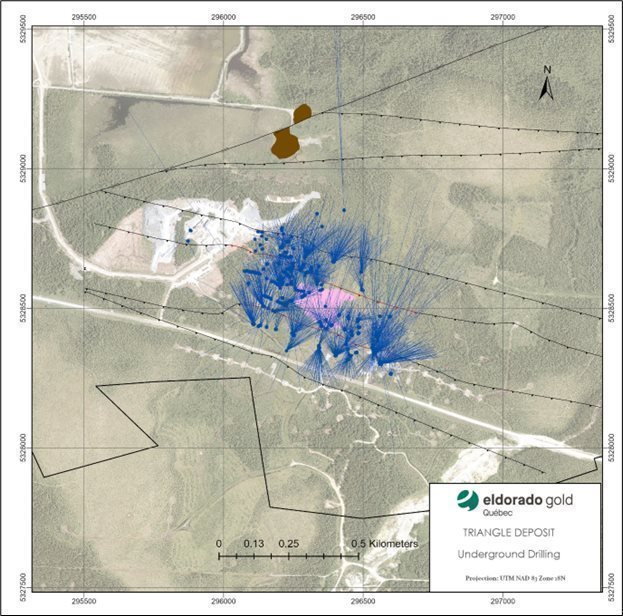

Figure 10‑2: Triangle Deposit Underground Drillhole Location Map (Eldorado 2024) |

| 10-5 |

|

Figure 10‑3: Plug No. 4 Deposit Drillhole Location Map (Eldorado 2024) |

| 10-6 |

|

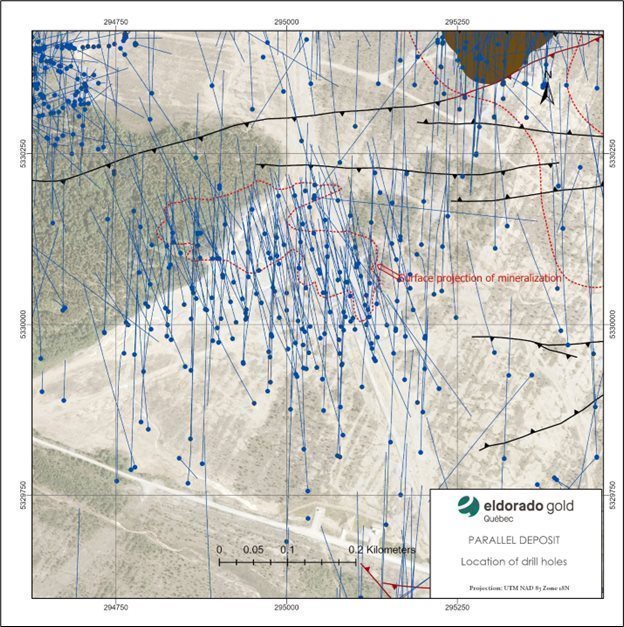

Figure 10‑4: Parallel Deposit Drillhole Location Map (Eldorado 2024) |

| 10-7 |

|

Figure 10‑5: Ormaque Deposit Drillhole Location Map (Eldorado 2024) |

| 10-8 |

|

Figure 11‑1: Lamaque Blank Data – 2019 to 2024 (Eldorado) |

| 11-2 |

|

Figure 11‑2: SRM Chart for Standard 26 (Oreas 216), 2017 to 2023 (Eldorado) |

| 11-4 |

|

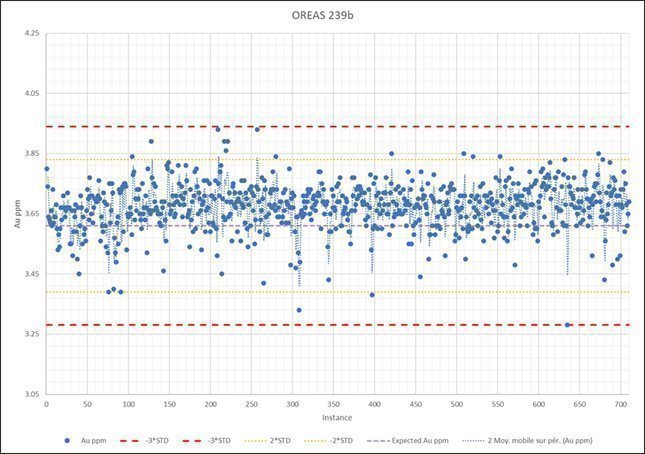

Figure 11‑3: SRM Chart for Standard 44 (Oreas 239b), 2023 to 2024 (Eldorado) |

| 11-5 |

|

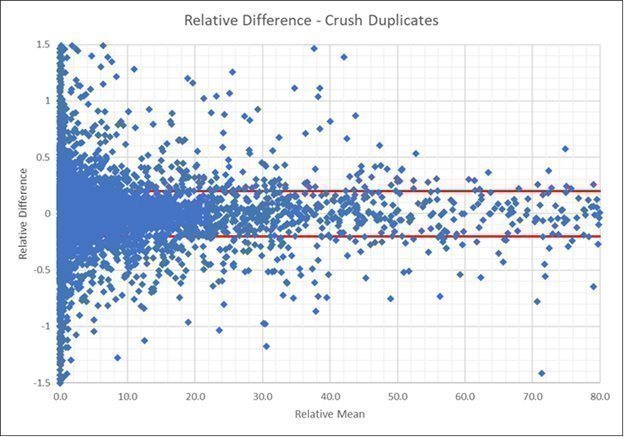

Figure 11‑4: Relative Difference Plot of Gold Duplicate Data, 2017 to 2024 (Eldorado) |

| 11-6 |

|

Figure 11‑5: Q-Q Plot for Gold Duplicate Data, 2017 to 2024 (Eldorado) |

| 11-7 |

|

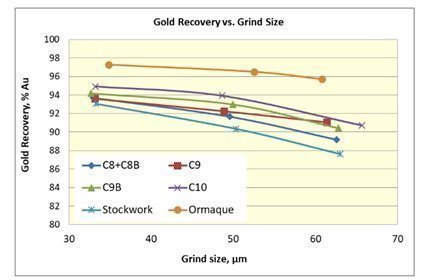

Figure 13‑1: Grind Size vs Gold Recovery. |

| 13-16 |

|

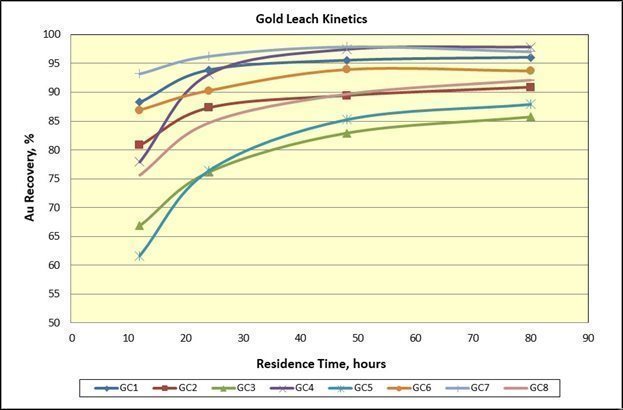

Figure 13‑2: Leach Kinetics for Ormaque Variability Samples. |

| 13-21 |

|

Figure 13‑3: Impact of Principal Variables on Ormaque Composite Recovery. |

| 13-22 |

|

Figure 14‑1: 3D View of the Modeled Resource Solids Associated with the Main Shear Zones and their Associated Splay Zones at Triangle (Eldorado 2024) |

| 14-2 |

|

Figure 14‑2: Lower Central Portion of C4 Zone Showing Block Model Grade and Composites (Eldorado 2024) |

| 14-10 |

|

Figure 14‑3: Upper Portion of C5 Shear Zone Showing Block Model Grades and Composites (Eldorado 2024) |

| 14-11 |

|

Figure 14‑4: C4-30 Splay Zone Showing Block Model Grades and Composites (Eldorado 2024) |

| 14-12 |

|

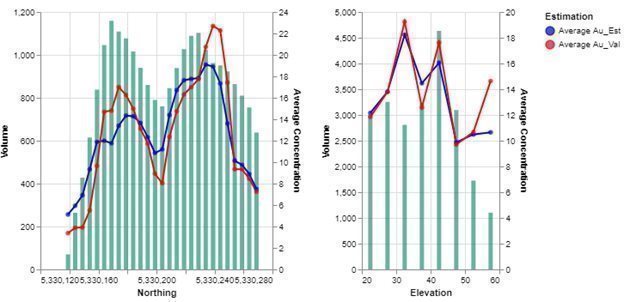

Figure 14‑5: Model Trend Plots Showing 5 m Binned Averages Along Elevations & Eastings for Kriged (Au) & Nearest Neighbour Gold Grade Estimates, C4 Main Zone, Triangle Deposit (Eldorado 2024) |

| 14-14 |

|

Figure 14‑6: Model Trend Plots Showing 5 m Binned Averages Along Elevations and Eastings for Kriged and Nearest Neighbour Gold Grade Estimates, C5 Main Zone, Triangle Deposit (Eldorado 2024) |

| 14-15 |

|

Figure 14‑7: 3D Sectional View Looking East of the Modeled Resource Solids Extension / Shear Zones at Parallel (Eldorado 2024) |

| 14-18 |

|

Figure 14‑8: 3D Plan View of the Modelled Resource Solids Extension / Shear Zones at Parallel (Eldorado 2024) |

| 14-19 |

|

Figure 14‑9: Zone 30 Showing Gold Composite Data and Gold Block Model (Eldorado 2024) |

| 14-22 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page vii |

Lamaque Complex, Québec, Canada

Technical Report |

|

Figure 14‑10: Zone 20 Showing Gold Composite Data and Gold Block Model (Eldorado 2024) |

| 14-23 |

|

Figure 14‑11: Model Trend Plots Showing 5 M Binned Averages Along Elevations and Eastings for Au (IDW) and Nearest Neighbour Gold Grade Estimates, Parallel Deposit (Eldorado 2024) |

| 14-25 |

|

Figure 14‑12: 3D Sectional View of the Modelled Resource Solids at Plug No. 4 (Eldorado 2024) |

| 14-28 |

|

Figure 14‑13: 3D Sectional View Looking North of the Modelled Resource Solids Associated with the Extension Zones at Ormaque (Eldorado 2024) |

| 14-31 |

|

Figure 14‑14: Zone E0100 Showing Gold Composite Data and Gold Block Model (Eldorado 2024) |

| 14-38 |

|

Figure 14‑15: Zone E070 Showing Gold Composite Data and Gold Block Model (Eldorado 2024) |

| 14-39 |

|

Figure 14‑16: Zone E260 Showing Gold Composite Data and Gold Block Model (Eldorado 2024) |

| 14-39 |

|

Figure 14‑17: Model Trend Plots Showing 5 m Binned Averages Along Elevations and Eastings for Kriged (Au) and Nearest Neighbour Gold Grade Estimates, E070 Zone, Ormaque Deposit (Eldorado 2024) |

| 14-42 |

|

Figure 14‑18: Model Trend Plots Showing 5 m Binned Averages Along Elevations and Eastings for Kriged (Au) and Nearest Neighbour Gold Grade Estimates, E090 Zone, Ormaque Deposit (Eldorado 2024) |

| 14-43 |

|

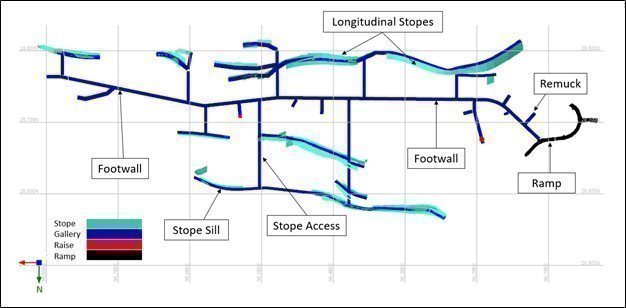

Figure 16‑1: Isometric View of the Lamaque Complex Deposits and Mine Planning Schematics (Eldorado 2024) |

| 16-1 |

|

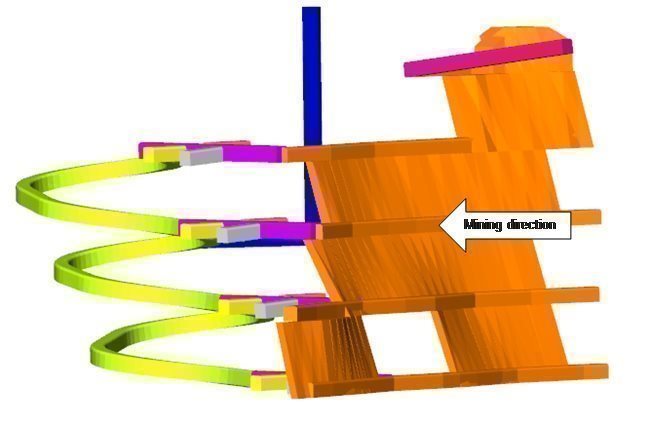

Figure 16‑2: Longitudinal Longhole Stoping (typical example, Eldorado 2024) |

| 16-4 |

|

Figure 16‑3: Sublevel plan view example of a PSLS (Eldorado 2024) |

| 16-5 |

|

Figure 16‑4: Primary-Secondary Transverse Longhole Stoping, (typical example, Eldorado 2024) |

| 16-6 |

|

Figure 16‑5: Illustration of Uppers Longhole Stoping (typical example, Eldorado 2024) |

| 16-7 |

|

Figure 16‑6: Illustration of a Sill Pillar (typical example, Eldorado 2024) |

| 16-8 |

|

Figure 16‑7: Typical DAF Mining Level (Eldorado 2024) |

| 16-9 |

|

Figure 16‑8: Plan View - Triangle Ramp Portal Location (Source: Google Earth, 2024 image) |

| 16-11 |

|

Figure 16‑9 Sigma-Triangle Decline Portal Location (Source: Google Earth, 2024 image) |

| 16-12 |

|

Figure 16‑10: Mine Design with Ramps and Existing Development in Black (Eldorado 2024) |

| 16-15 |

|

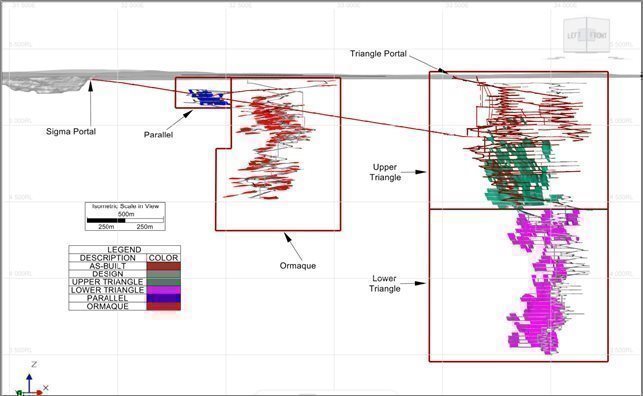

Figure 16‑11: Mining Zones, Looking North-East (Eldorado 2024) |

| 16-16 |

|

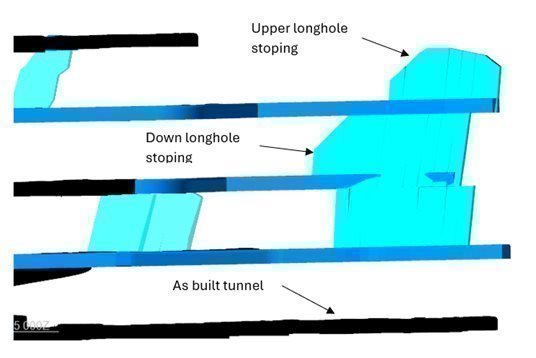

Figure 16‑12: Typical Triangle Sublevel Layout (Eldorado 2024) |

| 16-16 |

|

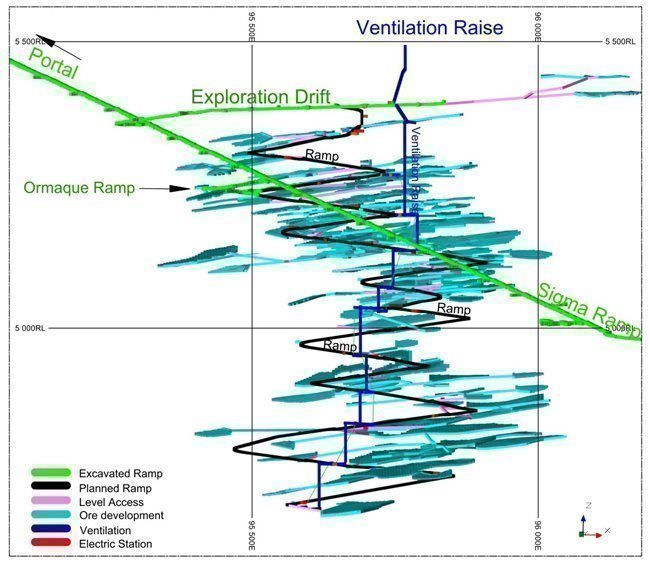

Figure 16‑13: Ormaque MI&I Design Longitudinal View Looking East (Eldorado 2024) |

| 16-17 |

|

Figure 16‑14: Ormaque Paste Reticulation Network (Eldorado 2024) |

| 16-19 |

|

Figure 16‑15: Conceptual Primary-Secondary Mining Sequence of Blocks (Eldorado 2024) |

| 16-21 |

|

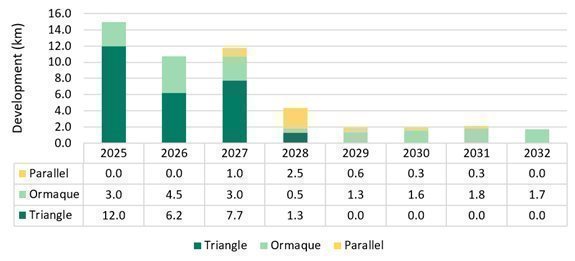

Figure 16‑16: Total Annual Development Metres by Deposit (Eldorado 2024) |

| 16-22 |

|

Figure 16‑17: Total Annual Development Metres by Cost Centre (Eldorado 2024) |

| 16-23 |

|

Figure 16‑18: Mines Production Profile (Eldorado 2024) |

| 16-24 |

|

Figure 16‑19: Distribution of Ounces by Mining Method (Eldorado 2024) |

| 16-24 |

|

Figure 16‑20: Ventilation Network for Lamaque Complex (Eldorado 2024) |

| 16-27 |

|

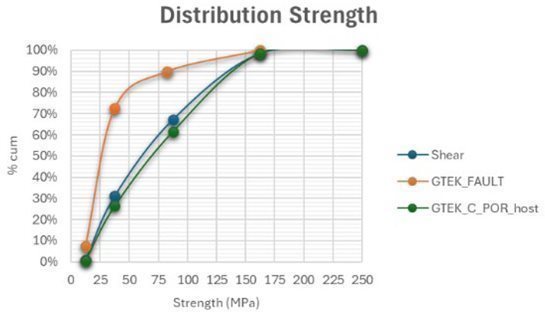

Figure 16‑21: Field Strength Distribution per Domain (Eldorado 2024) |

| 16-31 |

|

Figure 16‑22: UCS Lab Tests (Eldorado 2024) |

| 16-32 |

|

Figure 16‑23: RMR Distribution per Domain (Eldorado 2024) |

| 16-33 |

|

Figure 16‑24: Cross-section Showing Information used for Preliminary Structural Model (ASA Geotech 2024) |

| 16-33 |

|

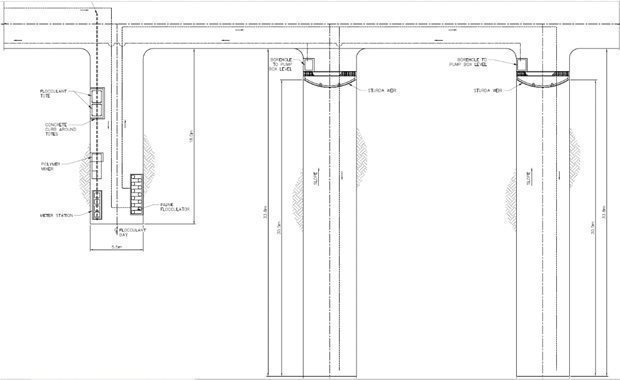

Figure 16‑25: Typical Decant Drifts (Eldorado 2024) |

| 16-35 |

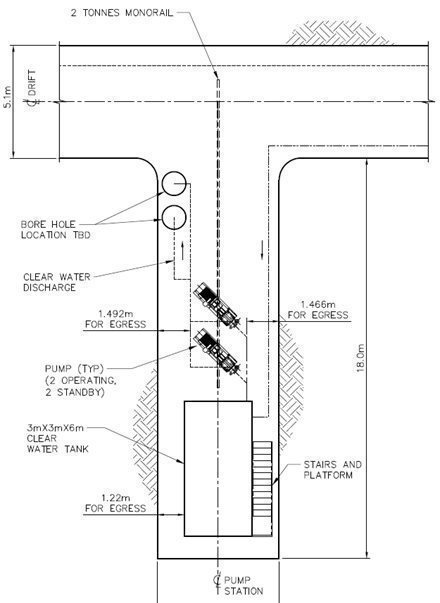

|

Figure 16‑26: Typical Primary Pump Station (Eldorado 2024) |

| 16-36 |

|

Figure 16‑27: Typical Borehole Sump (Eldorado 2024) |

| 16-37 |

|

Figure 17‑1: Sigma Mill Simplified Flowsheet (Eldorado 2024) |

| 17-2 |

|

Figure 17‑2: High-Level Mill Water Schematic (Eldorado 2024) |

| 17-6 |

|

Figure 17‑3: High-Level Mill Water Schematic – Future (Eldorado 2024) |

| 17-6 |

|

Figure 17‑4: Process Plant Aerial Photo (Google Earth 2023) |

| 17-11 |

|

Figure 18‑1: Triangle Mine Operation (Eldorado 2024) |

| 18-3 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page viii |

Lamaque Complex, Québec, Canada

Technical Report |

|

Figure 18‑2: Sigma Mill and Decline Portal (Eldorado 2024) |

| 18-3 |

|

Figure 18‑3: Ormaque Surface Infrastructure (Eldorado 2024) |

| 18-7 |

|

Figure 18‑4: Dewatering System Network (Eldorado 2024) |

| 18-9 |

|

Figure 18‑5: Ormaque Main Ventilation Network (Eldorado 2024) |

| 18-10 |

|

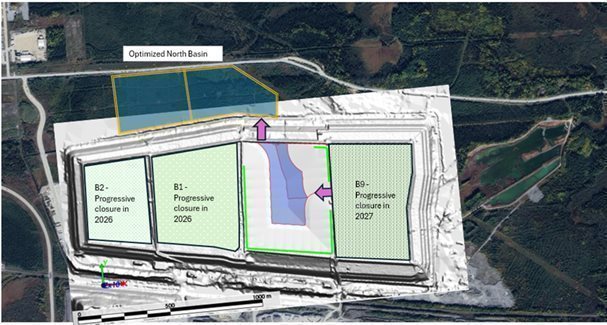

Figure 18‑6: Ormaque Waste Rock – Planned (Eldorado 2024) |

| 18-13 |

|

Figure 18‑7: View of the existing Sigma Tailings Storage Facility (Eldorado 2024) |

| 18-15 |

|

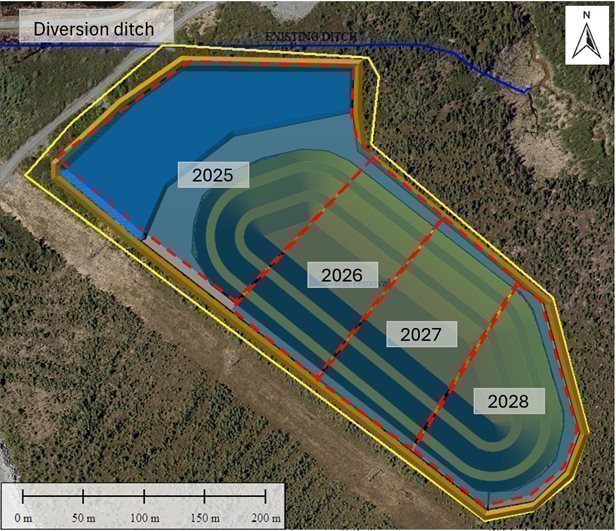

Figure 18‑8: Sigma Tailings Storage Facility Phase 7 (Eldorado 2024) |

| 18-16 |

|

Figure 18‑9: View of the existing Sigma Tailings Storage Facility at Completion (Eldorado 2024) |

| 18-17 |

|

Figure 18‑10: Lamaque TSF – Current Site Plan View (Eldorado 2024) |

| 18-18 |

|

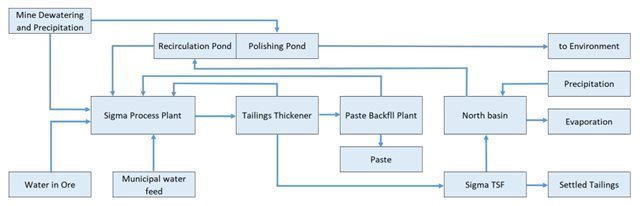

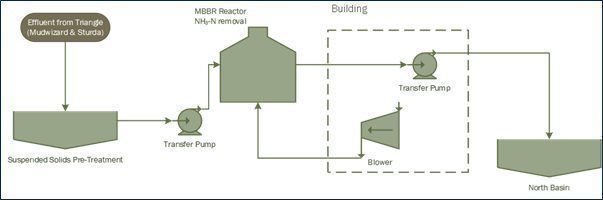

Figure 18‑11: Overall Water Management Schematic - Future State. |

| 18-19 |

|

Figure 18‑12: Conceptual Water Treatment for Ammonia Removal from Mine Dewatering (Eldorado 2024) |

| 18-20 |

|

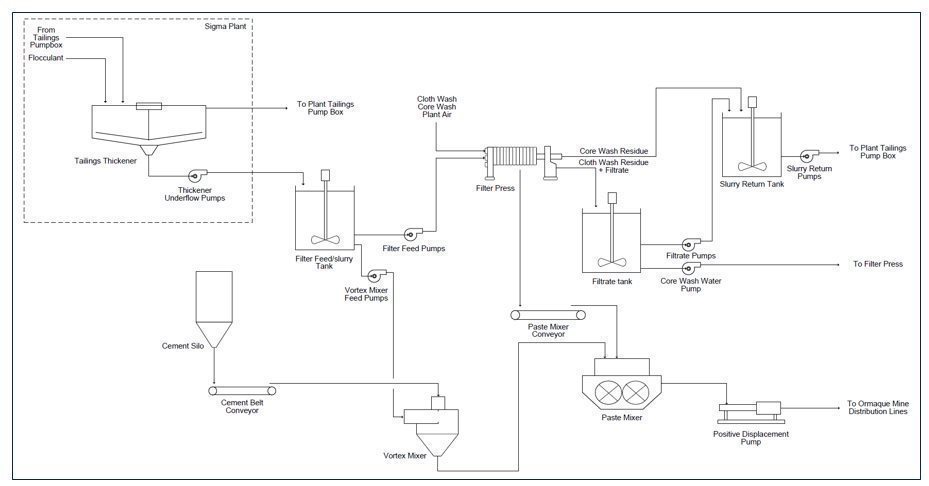

Figure 18‑13: Paste Plant Simplified Flowsheet (Eldorado 2024) |

| 18-22 |

|

Figure 18‑14: Proposed Ormaque Paste Backfill Reticulation Network (Eldorado 2024) |

| 18-23 |

|

Figure 22‑1: Annual Ore Processed and Gold Produced (Eldorado 2024) |

| 22-4 |

|

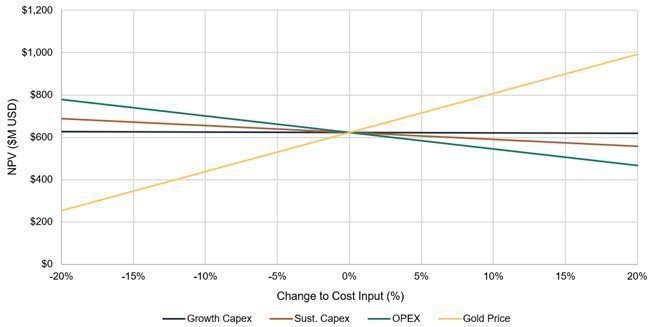

Figure 22‑2: Sensitivity of the Net Present Value (after-tax) to Cost Inputs (Eldorado 2024) |

| 22-7 |

|

Figure 22‑3: Recovery Sensitivity (Eldorado 2024) |

| 22-7 |

|

Figure 24‑1: Incremental Annual Mine Production Profile PEA LOM (Eldorado 2024) |

| 24-6 |

|

Figure 24‑2: Proposed Lamaque Tailings Storage Facility Plan View (Eldorado 2024) |

| 24-9 |

|

Figure 24‑3: Annual Mineralized Material Mined by Deposit, PEA Case (Eldorado 2024) |

| 24-16 |

|

Figure 24‑4: PEA Sensitivity of the Net Present Value (5% discount rate, after-tax) to Gold Price (Eldorado 2024) |

| 24-20 |

|

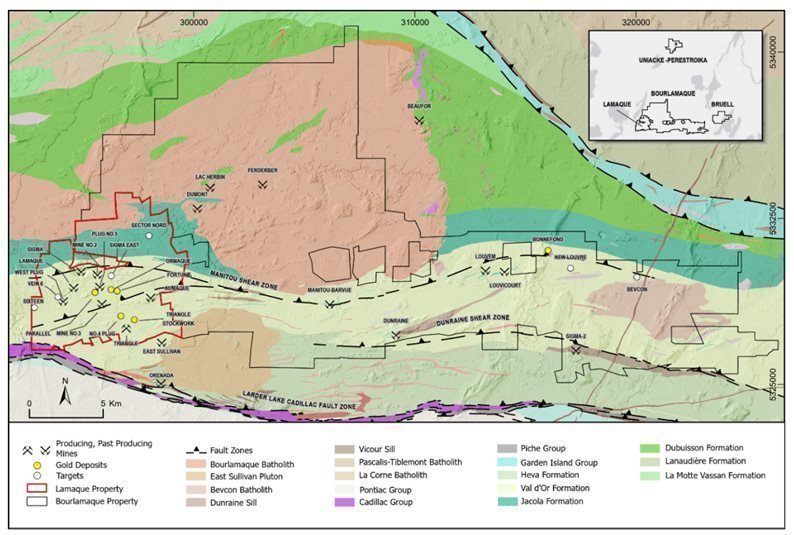

Figure 24‑5: Mineral Occurrences within the Lamaque Property and Bourlamaque Property (Eldorado 2024) |

| 24-22 |

|

List of Tables

Table 1‑1: Summary of Drilling on the Sigma-Lamaque Block Deposits. |

| 1-10 |

|

Table 1‑2: Triangle Mineral Resources, as of September 30, 2024. |

| 1-11 |

|

Table 1‑3: Parallel Mineral Resources, as of September 30, 2024. |

| 1-12 |

|

Table 1‑4: Plug No. 4 Mineral Resources, as of September 30, 2024. |

| 1-12 |

|

Table 1‑5: Ormaque Mineral Resources, as of September 30, 2024. |

| 1-13 |

|

Table 1‑6: Lamaque Complex Mineral Reserves as of September 30, 2024. |

| 1-14 |

|

Table 1‑7: Lamaque Complex Mineral Gold Production during Q4 2024. |

| 1-14 |

|

Table 1‑8: Capital Cost Estimate. |

| 1-17 |

|

Table 1‑9: Operating Cost Summary. |

| 1-17 |

|

Table 1‑10: Summary of Incremental Mineralized Material compared to Mineral Reserves. |

| 1-19 |

|

Table 1‑11: Longhole Mining Mucking Rates. |

| 1-19 |

|

Table 1‑12: PEA LOM Development Schedule. |

| 1-19 |

|

Table 1‑13: Growth Capital Items, PEA Case. |

| 1-20 |

|

Table 1‑14: Operating Cost Summary. |

| 1-20 |

|

Table 1‑15: Proposed Work Program and Budget |

| 1-22 |

|

Table 4‑1 Lamaque Project Mining Lease, Mining Concessions and Exploration Claims. |

| 4-3 |

|

Table 4‑2: Royalties Summary Table. |

| 4-7 |

|

Table 4‑3: Remediation and Reclamation Plans. |

| 4-9 |

|

Table 5‑1: Distribution of Annual Climate Data for the Period 1981 to 2010. |

| 5-3 |

|

Table 5‑2: Rainfall (mm) Depth-Duration-Frequency at Val-d’Or Airport (Period 1961 through 2017) |

| 5-4 |

|

Table 5‑3: Rainfall (mm) Depth-Duration-Frequency at Val-d’Or Airport (Period 1951 through 2016) |

| 5-4 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page ix |

Lamaque Complex, Québec, Canada

Technical Report |

|

Table 5‑4: Projections of Temperature and Precipitation in the Horizon of 2041 through 2070. |

| 5-4 |

|

Table 6‑1: Total 1935-1985 Production Figures for the Lamaque Mine Principal Mining Areas. |

| 6-2 |

|

Table 6‑2: Total Production from the Sigma and Lamaque Mines to End of May 2012. |

| 6-4 |

|

Table 6‑3: Indicated Mineral Resources, Integra Gold 2017 Technical Report |

| 6-5 |

|

Table 6‑4: Inferred Mineral Resources Estimate, Integra Gold 2017 Technical Report |

| 6-6 |

|

Table 6‑5: Lamaque Mineral Resource Estimate, as of December 31, 2017. |

| 6-6 |

|

Table 6‑6: Lamaque Project Mineral Reserve Estimates, as of December 31, 2017. |

| 6-7 |

|

Table 6‑7: Lamaque Project Mineral Resource Estimates, as of September 30, 2021. |

| 6-8 |

|

Table 6‑8: Lamaque Project Mineral Reserve Estimates as of September 30, 2021. |

| 6-8 |

|

Table 6‑9: Lamaque Complex Production, 2017 to 2023 (Eldorado, 2024) |

| 6-9 |

|

Table 10‑1: Summary of Triangle Deposit Drilling. |

| 10-1 |

|

Table 10‑2: Summary of Plug No. 4 Deposit Drilling (Resource Eligible Holes Only) |

| 10-1 |

|

Table 10‑3: Summary of Parallel Deposit Drilling. |

| 10-2 |

|

Table 10‑4: Summary of Ormaque Deposit Drilling. |

| 10-2 |

|

Table 11‑1: Standard Reference Material Samples Used at Lamaque Project, 2015 to 2024. |

| 11-3 |

|

Table 13‑1: Head Assays Summary. |

| 13-2 |

|

Table 13‑2: Gravity Concentration and Cyanide Leach - Conditions and Recoveries. |

| 13-3 |

|

Table 13‑3: Summary of Flotation Gold Recoveries Obtained. |

| 13-3 |

|

Table 13‑4: Summary of Chemical Assays. |

| 13-4 |

|

Table 13‑5: Gold Recovery by Flowsheet |

| 13-5 |

|

Table 13‑6: Triangle Zone Composites Head Assays Summary. |

| 13-5 |

|

Table 13‑7: Overall Gold Recovery Summary. |

| 13-6 |

|

Table 13‑8: Assembly of Composite Samples. |

| 13-7 |

|

Table 13‑9: Selected Head Assays from Triangle Deposit Samples. |

| 13-7 |

|

Table 13‑10: Rod Mill and Ball Mill Work Indexes. |

| 13-8 |

|

Table 13‑11: Ball Mill Work Index Variability Samples. |

| 13-8 |

|

Table 13‑12: Bond Ball Mill Work Index Drill Core Results. |

| 13-8 |

|

Table 13‑13: Baseline Leach Test Results. |

| 13-9 |

|

Table 13‑14: C1, C2, C4 and C5 Ore Samples Variability Test Results. |

| 13-11 |

|

Table 13‑15: Solids Liquid Separation Testing Sample Characteristics. |

| 13-12 |

|

Table 13‑16: Recommended Thickening Design Parameters. |

| 13-12 |

|

Table 13‑17: Thickener Underflow Apparent Viscosities and Yield Stress. |

| 13-13 |

|

Table 13‑18: Summary of Vacuum Filtration Test Results. |

| 13-13 |

|

Table 13‑19: Summary of Pressure Filtration Test Results. |

| 13-14 |

|

Table 13‑20: Comminution Testing Results. |

| 13-14 |

|

Table 13‑21: Summary of Selected Head Assay Results. |

| 13-15 |

|

Table 13‑22: Bond Ball Mill Work Index Results. |

| 13-15 |

|

Table 13‑23: Selected Carbon-In-Pulp Results, Baseline 35 mm P80. |

| 13-16 |

|

Table 13‑24: Selected E-GRG Results. |

| 13-17 |

|

Table 13‑25: Ormaque Metallurgical Samples. |

| 13-17 |

|

Table 13‑26: Host Rock (Waste) Samples. |

| 13-18 |

|

Table 13‑27: Head Characterization of Ormaque Samples. |

| 13-18 |

|

Table 13‑28: XRD Characterization of Ormaque Samples. |

| 13-18 |

|

Table 13‑29: Ormaque Composite Comminution Results. |

| 13-19 |

|

Table 13‑30: Ormaque Waste Rock Grindability Results. |

| 13-19 |

|

Table 13‑31: Extended Gravity Recoverable Gold (E-GRG) Results. |

| 13-19 |

|

Table 13‑32: Ormaque Variability Cyanidation Results. |

| 13-20 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page x |

Lamaque Complex, Québec, Canada

Technical Report |

|

Table 13‑33: Ormaque Composite Optimization Results. |

| 13-21 |

|

Table 13‑34: Acid Base Accounting Test Results. |

| 13-23 |

|

Table 14‑1: Triangle Deposit Composite Statistics for 1 m Uncapped Composite Au (g/t) Data. |

| 14-2 |

|

Table 14‑2: Triangle Deposit Composite Statistics for 1 m Capped Composite Au (g/t) Data. |

| 14-3 |

|

Table 14‑3: Variogram Parameters for Triangle Zones. |

| 14-5 |

|

Table 14‑4: Block Model Limits and Block Size. |

| 14-5 |

|

Table 14‑5: Estimation for Triangle Domains. |

| 14-6 |

|

Table 14‑6: Global Model Mean Gold (g/t) Values by Mineralized Domain, Triangle Deposit |

| 14-13 |

|

Table 14‑7: Triangle Mineral Resources, as of September 30, 2024. |

| 14-16 |

|

Table 14‑8: Triangle Mineral Resources, as of September 30, 2024. |

| 14-16 |

|

Table 14‑9: Parallel Deposit Composite Statistics for 1 m Uncapped Composite Au (g/t) Data. |

| 14-20 |

|

Table 14‑10: Parallel Deposit Composite Statistics for 1 m Capped Composite Au (g/t) Data. |

| 14-20 |

|

Table 14‑11: Block Model Limits and Block Size in Parallel Deposit |

| 14-21 |

|

Table 14‑12: Global by Mineralized Domain, Parallel Deposit Model Mean Gold Values. |

| 14-24 |

|

Table 14‑13: Parallel Mineral Resources, as of September 30, 2024. |

| 14-26 |

|

Table 14‑14: Plug No. 4 Assay Statistics by Zone (Uncapped Au (g/t) Data) |

| 14-28 |

|

Table 14‑15: Plug No. 4 Composite Statistics by Zone (Capped Au (g/t)) |

| 14-29 |

|

Table 14‑16: Plug No. 4 Mineral Resources, as of September 30, 2024. |

| 14-30 |

|

Table 14‑17: Ormaque Composite Statistics for 0.5 m Uncapped Composite Au (g/t) Data. |

| 14-32 |

|

Table 14‑18: Ormaque Composite Statistics for 0.5 m Capped Composites of Au (g/t) Data (70 g/t capping) |

| 14-33 |

|

Table 14‑19: Variogram Parameters for Ormaque Mineralization Zones. |

| 14-35 |

|

Table 14‑20: Block model Limits and block definitions. |

| 14-36 |

|

Table 14‑21: Estimation Plan for Ormaque Zones. |

| 14-36 |

|

Table 14‑22: Global Model Mean Gold Values by Mineralized Domain, Ormaque Deposit |

| 14-40 |

|

Table 14‑23: Ormaque Mineral Resources, as of September 30, 2024. |

| 14-44 |

|

Table 14‑24: Ormaque Mineral Resources breakdown by zone, as of September 30, 2024. |

| 14-44 |

|

Table 15‑1: Long Hole Cut-off Grade Definition (Triangle and Parallel deposits) |

| 15-1 |

|

Table 15‑2: Drift-And-Fill Cut-off Grade Definition (Ormaque deposit) |

| 15-1 |

|

Table 15‑3: Lamaque Complex Mineral Reserves as of September 30, 2024. |

| 15-4 |

|

Table 15‑4: Lamaque Complex Mineral Gold Production during Q4 2024. |

| 15-4 |

|

Table 16‑1: Mineralized and Waste Rock Average In-Situ Densities. |

| 16-2 |

|

Table 16‑2: Mine Design Criteria: Longitudinal Longhole Stoping. |

| 16-4 |

|

Table 16‑3: Mine Design Criteria: Transverse Longhole Stoping. |

| 16-6 |

|

Table 16‑4: Mine Design Criteria: Uppers Longhole Stoping. |

| 16-7 |

|

Table 16‑5: Mine Design Criteria: Sill Pillar Longhole Stoping. |

| 16-8 |

|

Table 16‑6: Drift-and-Fill Mining Criteria. |

| 16-10 |

|

Table 16‑7: External Dilution Factors. |

| 16-10 |

|

Table 16‑8: Mining Recovery Factors. |

| 16-10 |

|

Table 16‑9: Lateral Development Criteria. |

| 16-12 |

|

Table 16‑10: Vertical Development Criteria. |

| 16-13 |

|

Table 16‑11: Overbreak and Design Allowances. |

| 16-13 |

|

Table 16‑12: Development Quantities for Case 1. |

| 16-14 |

|

Table 16‑13: Development Quantities for Case 2. |

| 16-14 |

|

Table 16‑14: Effective Work Hours per Shift |

| 16-19 |

|

Table 16‑15: Development Advance Rates. |

| 16-20 |

|

Table 16‑16: Longhole Mining Mucking Rates. |

| 16-20 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page xi |

Lamaque Complex, Québec, Canada

Technical Report |

|

Table 16‑17: Annual Summary of Waste and Mineralized Tonnes. |

| 16-21 |

|

Table 16‑18: Life of Mine Development Schedule. |

| 16-22 |

|

Table 16‑19: Mine Production Schedule. |

| 16-23 |

|

Table 16‑20: Lamaque Complex Mobile Equipment List |

| 16-25 |

|

Table 16‑21: Geomechanical Properties of Triangle Diorite / Tuff. |

| 16-28 |

|

Table 16‑22: Hoek-Brown and Mohr-Coulomb parameters. |

| 16-29 |

|

Table 16‑23: Regional Natural Stresses. |

| 16-30 |

|

Table 16‑24: Major and Minor Structures Families. |

| 16-30 |

|

Table 16‑25: Ground Support Parameters. |

| 16-30 |

|

Table 17‑1: Major Equipment List |

| 17-6 |

|

Table 17‑2: Design Criteria. |

| 17-7 |

|

Table 17‑3: Consumption of Reagents and Consumables. |

| 17-9 |

|

Table 17‑4: Plant Personnel |

| 17-10 |

|

Table 18‑1: Paste Plant Design Criteria Summary. |

| 18-20 |

|

Table 20‑1: Remediation and Reclamation Plans. |

| 20-5 |

|

Table 21‑1: Capital Cost Estimate. |

| 21-1 |

|

Table 21‑2: Growth Capital Items. |

| 21-2 |

|

Table 21‑3: Sustaining Capital Items. |

| 21-3 |

|

Table 21‑4: Operating Cost Summary. |

| 21-4 |

|

Table 22‑1: Mineral Reserves Financial Model Parameters. |

| 22-2 |

|

Table 22‑2: Québec Mining Tax Rates. |

| 22-3 |

|

Table 22‑3: Financial Analysis Summary (Mineral Reserves) |

| 22-4 |

|

Table 22‑4: Cash Flow Model (Mineral Reserves) |

| 22-5 |

|

Table 22‑5: Production Cost Summary (Mineral Reserves LOM) |

| 22-6 |

|

Table 22‑6: Net Present Value (5%) Sensitivity Results (after-tax) |

| 22-6 |

|

Table 24‑1: Bond Ball Mill Work Index Results (75 μm closing screen) |

| 24-2 |

|

Table 24‑2: Lamaque Complex Mineral Resources. |

| 24-3 |

|

Table 24‑3: Summary of Incremental Mineralized Material in PEA Case. |

| 24-4 |

|

Table 24‑4: Longhole Mining Mucking Rates. |

| 24-5 |

|

Table 24‑5: Incremental Mineralized Material and Waste Rock Annual Summary PEA LOM. |

| 24-5 |

|

Table 24‑6: Incremental Development Schedule PEA LOM. |

| 24-5 |

|

Table 24‑7: Lamaque Complex Mobile Equipment List (PEA Case) |

| 24-7 |

|

Table 24‑8: Capital Cost Estimate. |

| 24-10 |

|

Table 24‑9: Growth Capital Items, PEA Case. |

| 24-11 |

|

Table 24‑10: Sustaining Capital Items. |

| 24-12 |

|

Table 24‑11: Operating Cost Summary. |

| 24-13 |

|

Table 24‑12: PEA Financial Model Parameters. |

| 24-15 |

|

Table 24‑13: PEA Financial Analysis Summary. |

| 24-17 |

|

Table 24‑14: PEA Cash Flow Model |

| 24-18 |

|

Table 24‑15: PEA Production Cost Summary. |

| 24-19 |

|

Table 24‑16: PEA Sensitivity Analysis (5%) Sensitivity Results (after-tax) |

| 24-19 |

|

Table 24‑17: Mineral Occurrences within the Lamaque Property and Bourlamaque Property. |

| 24-23 |

|

Table 24‑18: Risk Register |

| 24-24 |

|

Table 24‑19: Opportunity Register |

| 24-26 |

|

Table 26‑1: Proposed Work Program and Budget |

| 26-2 |

|

|

|

|

|

|

|

2024 Technical Report |

| Page xii |

Lamaque Complex, Québec, Canada

Technical Report |

|

Glossary

Units of Measure

Annum (year) |

| a |

|

Billion |

| B |

|

Centimeter |

| cm |

|

Cubic centimeter |

| cm3 |

|

Cubic feet per minute |

| cfm |

|

Cubic meter |

| m3 |

|

Day |

| d |

|

Days per year (annum) |

| d/a |

|

Degree |

| ° |

|

Degrees Celsius |

| °C |

|

Dollar (American) |

| US$ |

|

Dollar (Canadian) |

| CAD$ |

|

Feet |

| ft |

|

Gram |

| g |

|

Grams per litre |

| g/cm3 |

|

Grams per litre |

| g/L |

|

Grams per tonne |

| g/t |

|

Greater than |

| > |

|

Hectare (10,000 m2) |

| ha |

|

Horsepower |

| h |

|

Hour |

| h |

|

Hour per year (annum) |

| h/a |

|

Kilo (thousand) |

| k |

|

Kilogram |

| kg |

|

Kilograms per cubic meter |

| kg/m3 |

|

Kilograms per hour |

| kg/h |

|

Kilograms per square meter |

| kg/m2 |

|

Kilograms per tonne |

| kg/t |

|

Kilometer |

| km |

|

Kilometers per hour |

| km/h |

|

Kilopascal |

| kPa |

|

Kilotonne |

| kt |

|

Kilotonne per annum |

| ktpa |

|

Kilovolt |

| kV |

|

Kilowatt hour |

| kWh |

|

Kilowatt hours per tonne |

| kWh/t |

|

Kilowatt hours per annum |

| kWh/a |

|

Kilowatt |

| kW |

|

Less than |

| < |

|

Litre |

| L |

|

Litre per tonne |

| L/t |

|

Megavolt Ampere |

| MVA |

|

Megawatt |

| MW |

|

|

|

|

|

|

|

2024 Technical Report |

| Page xiii |

Lamaque Complex, Québec, Canada

Technical Report |

|

Meter |

| m |

|

Meter above Sea Level |

| masl |

|

Metric ton (tonne) |

| t |

|

Microns |

| µm |

|

Milligram |

| mg |

|

Milligrams per litre |

| mg/L |

|

Millilitre |

| mL |

|

Millimeter |

| mm |

|

Million cubic meters |

| Mm3 |

|

Million ounces |

| Moz |

|

Million Pascal |

| MPa |

|

Million tonnes per Annum |

| Mtpa |

|

Million tonnes |

| Mt |

|

Million |

| M |

|

Million Years |

| Ma |

|

Minutes |

| min |

|

Newton |

| N |

|

Newton per square meter (Pascal |

| N/m2 or Pa |

|

Ounce |

| oz |

|

Parts per billion |

| ppb |

|

Parts per million |

| ppm |

|

Horsepower Percent |

| % |

|

Percent by Weight |

| wt% |

|

Square centimeter |

| cm2 |

|

Square kilometer |

| km2 |

|

Square meter |

| m2 |

|

Thousand cubic feet per minute |

| kcfm |

|

Thousand tonnes |

| kt |

|

Three Dimensional |

| 3D |

|

Tonne |

| t |

|

Tonnes per day |

| t/d or tpd |

|

Tonnes per hour |

| tph |

|

Tonnes per cubic meter |

| t/m3 |

|

Tonnes per operating day |

| tpod |

|

Tonnes per operating hour |

| tpoh |

|

Tonnes per year (annum) |

| tpa |

|

Volt |

| V |

|

Watt |

| W |

|

Weight/volume |

| w/v |

|

Weight/weight |

| w/w |

|

|

|

|

|

|

|

2024 Technical Report |

| Page xiv |

Lamaque Complex, Québec, Canada

Technical Report |

|

Abbreviations

AA |

| atomic absorption |

AISC |

| all-in sustaining cost |

BAPE |

| Bureau des audiences publiques en Environnement |

BEV |

| battery electric vehicle |

BV |

| Bureau Veritas |

BWI |

| ball mill work index |

CEAA |

| Canadian Environmental Assessment Act 2012 |

CEAAg |

| Canadian Environmental Assessment Agency |

Century Mining |

| Century Mining Corporation Inc |

CIM |

| Canadian Institute of Mining |

CIP |

| carbon-in-pulp |

CN |

| Canadian National Railroad |

CNSC |

| Canadian Nuclear Safety Commission |

CoA |

| Certificate of Authorizations |

CRF |

| cemented rockfill |

CV |

| coefficients of variation |

DAF |

| drift and fill |

Dome Mines |

| Dome Mines Ltd |

EGQ |

| Eldorado Gold Québec |

EQA |

| Environment Quality Act |

ERP |

| emergency response plan |

ESA |

| environmental and social assessment |

FAR |

| fresh air raise |

G&A |

| general and administration |

GCMP |

| Geotechnical Ground Control Management Plan |

Geologica |

| Geologica Groupe-Conseil Inc |

Golden Pond |

| Golden Pond Resources Ltd |

IDF |

| Rainfall Depth-Duration-Frequency |

IRR |

| internal rate of return |

Kalahari |

| Kalahari Resources Ltd |

LHD |

| load haul dump |

LLCFZ |

| Larder Lake-Cadillac fault zone |

LLS |

| Longitudinal Longhole Stoping |

LOM |

| life of mine |

LV |

| low voltage |

McWatters |

| McWatters Mining Ltd |

MELCC |

| Ministère de l’environnement et Lutte Contre le Changement Climatiques |

MERN |

| Ministry of Energy and Natural Resources |

MFFP |

| Ministère de Forêts, Faune et Parcs |

MLC |

| mine load center |

MRE |

| Mineral Resource Estimate |

MV |

| medium voltage |

NFM |

| National Filter Media |

NI 43-101 |

| National Instrument 43-101 Standards of Disclosure for Mineral Projects |

NPV |

| net present value |

NSR |

| net smelter return |

NTS |

| Canadian National Topographical System |

OHS |

| Occupational Health and Safety |

OK |

| ordinary kriging |

PAX |

| Potassium Amyl Xanthat |

PEA |

| preliminary economic assessment |

PSLS |

| Primary-secondary longhole stoping |

QA/QC |

| quality assurance and control |

QMX |

| QMX Gold Corporation |

QP |

| qualified person |

|

|

|

|

|

|

2024 Technical Report |

| Page xv |

Lamaque Complex, Québec, Canada

Technical Report |

|

RRP |

| Reclamation and Remediation Plan |

Sigma Mine |

| Sigma Mines (Québec) Ltd |

SLS |

| solid-liquid separation |

SRM |

| standard reference materials |

TSF |

| Tailing Storage Facility |

Tundra |

| Tundra Gold Mines Inc |

VFD |

| Variable Frequency Drives |

VMS |

| volcanic massive sulfide |

YVO |

| Val-d’Or Regional Airport |

|

|

|

|

|

|

2024 Technical Report |

| Page xvi |

Lamaque Complex, Québec, Canada

Technical Report |

|

1 Summary

1.1 Introduction

Eldorado Gold Corporation (Eldorado), an international gold and base metal mining company based in Vancouver, British Columbia, owns the Lamaque Complex located in Québec, Canada through its wholly owned subsidiary, Eldorado Gold Québec (EGQ).

The Lamaque Property consists of 76 map designated claims (Exploration Claims (CDC), 1,452 ha), 10 mining concessions (Mining Concessions (CM), 2,325 ha) and one mining lease (Mining Lease (BM), 76 ha), all of which are in good standing at the time of this report.

The Project known as the Lamaque Complex is fully within the Lamaque Property boundaries.

The Lamaque Complex includes the following:

| · | Triangle mine (upper and lower zones), within the Triangle deposit |

| · | Sigma-Triangle decline (between the Sigma mill and level 0400 of the Triangle mine) |

| · | Future Ormaque mine within the Ormaque deposit |

| · | Parallel deposit (future mining operations) |

| · | Plug No. 4 deposit |

| · | Sigma mill |

| · | Sigma tailings storage facilities (Sigma TSF) |

| · | Infrastructure of the historic Sigma mine (surface pit and underground) |

| · | Mining infrastructure of the historic Lamaque mine (underground) |

| · | Historic Lamaque tailings storage facilities (Lamaque TSF) |

| · | Regional office |

| · | Exploration office and core yard |

Eldorado prepared this Technical Report to provide an overall update on the Lamaque Complex. This includes a feasibility-level evaluation assessing the evolution of the current operation based on an update of the Mineral Reserves for the Triangle and Parallel deposits and the addition of the inaugural Mineral Reserves from the Ormaque deposit. The Technical Report also presents a preliminary economic assessment (PEA) including additional Inferred Resources from Triangle and Ormaque in Section 24. This report has been prepared in accordance with Canadian Securities Administrators’ National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and its related 43-101F1.

The Inferred Mineral Resources considered within the PEA in this Technical Report bring to light the favourable extension of the mineralization in concordance with the existing mines. The Inferred Mineral Resources at Triangle and at Ormaque present an opportunity to potentially extend the mine life beyond 2032, as supported by current Mineral Reserves.

Upgrades and continuous improvements to the mining and processing infrastructure have enabled a steady increase in production as stated in the 2018 Technical Report, Lamaque Project (effective date March 21, 2018), referred to as the 2018 PFS and subsequent Technical Report on the Lamaque Project (Effective Date: December 31, 2021) referred to as the 2021 TR. Production has increased from 1,800 tonnes per day (tpd) to current throughput averaging 2,600 tpd. Metallurgical recoveries have achieved an average of 96.8% gold recovery to date, exceeding planned recoveries of 95% in the 2018 PFS.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-1 |

Lamaque Complex, Québec, Canada

Technical Report |

|

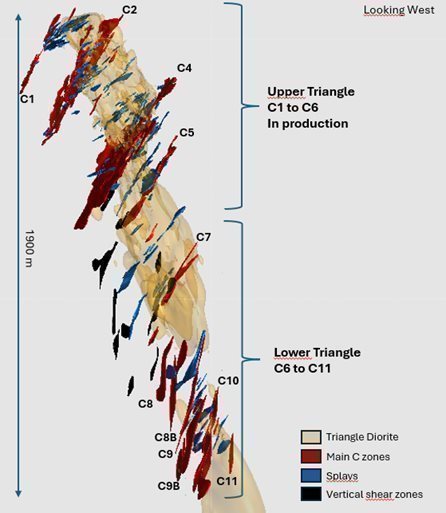

The Mineral Reserves in the Triangle deposit sit within and to the south of the North Dyke from surface to a depth of approximately 800 m and comprise the mineralized zones C1 through C5 and their associated splays in the upper mine. The lower zones in the Triangle deposit lies within and to the north of the North Dyke at depths of approximately 700 m to 1,800 m from surface and includes mineralized zones C6 though C10 and their associated splays. The lower Triangle deposit can be accessed from the bottom of the upper Triangle deposit with approximately 600 m of development. The Ormaque deposit is located 200 m east of the Sigma-Triangle decline. The Ormaque deposit is approximately 1.5 km south of the Sigma mill and 1.8 km north of the Triangle deposit. The Parallel deposit is located to the west of Ormaque, approximately 200 m west of the decline.

The PEA presented in Section 24 supporting the Triangle Inferred Mineral Resources and the Ormaque Inferred Mineral Resources considers the potential economic viability of developing the lower zones that comprise the Triangle and Ormaque Inferred Mineral Resources in conjunction with the main zones of the Triangle and Ormaque Mineral Reserves.

Readers should take care to differentiate the PEA from the economic analysis for the Triangle and Ormaque Mineral Reserves. The PEA only demonstrates the potential viability of Inferred Mineral Resources and are not as comprehensive as the economic analysis for the Mineral Reserves. The level of detail, precision, and confidence in outcomes between the economic analysis for Mineral Reserves and the PEA is significantly different.

The PEA is preliminary in nature and is based on numerous assumptions and the incorporation of Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves except as allowed for by National Instrument 43-101 in PEA studies. There is no guarantee that Inferred Mineral Resources can be converted to Indicated or Measured Mineral Resources and, as such, there is no guarantee that the economics described herein will be achieved. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Geological information and data for this report were obtained from the Lamaque Complex. Metallurgical testwork was completed by third party laboratories to support calculations and optimization of the process flowsheet. The underground mine designs and mining methods, tailings management and water management considered in conjunction with the inferred resources opportunities were designed from first principles to a PEA.

The gold price used in this study is US$2,000/oz Au for all models. Mineral Reserves contained in the Triangle, Ormaque and Parallel deposits were declared based on a gold price of US$1,450/oz.

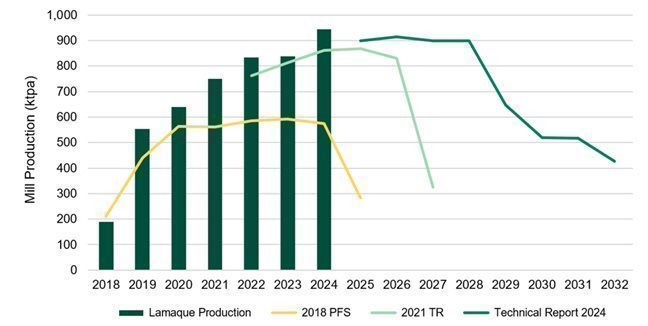

Comparisons of the Lamaque Complex milling production from the 2018 PFS, and 2021 TR Mineral Reserves, actual mine production, and planned 2024 Technical Report Mineral Reserves, show that the Lamaque Complex has exceeded metrics outlined in the original report in terms of both throughput and gold production.

Mill production through the end of 2024 reached 4.75 Mt versus a planned production of 3.51 Mt, reaching over 943 kt milled in 2024, which is 358 kt above the planned production in the 2018 PFS, and 81 kt above the 2021 TR as shown in Figure 1‑1.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-2 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Figure 1‑1: Lamaque Complex Mill Production Comparisons

Gold production from the Lamaque Complex has also exceeded the metrics set out in the 2018 PFS; gold produced from the Project through the end of 2024 was 991.5 koz Au versus planned production of 884.4 koz Au, with 2024 annual gold production reaching a record 196.5 koz as shown in Figure 1‑2.

Figure 1‑2: Sigma Mill Gold Production Comparisons

The current Mineral Reserves of 1,277 koz Au adds over 700 koz Au (after depletion) to the reserves stated in the 2021 TR; adding two years of mine life at the higher throughput.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-3 |

Lamaque Complex, Québec, Canada

Technical Report |

|

1.2 Contributors and Qualified Persons

The QPs responsible for preparing this Technical Report as defined in NI 43-101, and in compliance with 43-101F1 (the “Technical Report”) are:

| · | Mr. David Sutherland, P.Eng., Eldorado, author of items 1, 2, 3, 5, 12.2.1, 19, 20, 24.1, 24.2, 24.3, 24.5, 24.12, 24.19, 24.20, 24.24 through 24.26, 25, and 26 |

| · | Mr. Jacques Simoneau, P.Geo., Eldorado, author of items 4, 6, 7, 8, 9, 10, 11, 12.2.2, 23, 24.4, 24.6 through 24.11, and 24.23 |

| · | Mr. Peter Lind, Eng., P.Eng., Eldorado, author of items 12.2.3, 13, 17, 24.13, and 24.17 |

| · | Mr. Jessy Thelland, P.Geo., Eldorado, author of items 12.1, 12.2.4, 14, 15, 16, 21, 22, 24.14, 24.15, 24.16, 24.21, 24.22 |

| · | Mr. Philippe Groleau, Eng., Eldorado author of items 12.2.5, 15.3, 16, 18.6, 21, 24.15, and 24.16 specific to the Ormaque deposit. |

| · | Mr. Mehdi Bouanani, Eng., Eldorado author of items 12.2.6, and 18.1 through 18.5, 18.7 through 18.9, 18.13, and 24.18 |

| · | Mr. Vu Tran, Eng., Eldorado, author of items 12.2.7, 18.10, 18.11, 18.12, and 24.18.1 |

1.3 Reliance on Other Experts

Eldorado prepared this document with input from the Lamaque Complex staff, other well qualified individuals and experts.

The qualified persons are not experts concerning legal, political, environmental or tax matters relevant to the Technical Report; they have assumed and relied on a report, opinion or statements by information provided by Eldorado.

1.4 Property Description and Ownership

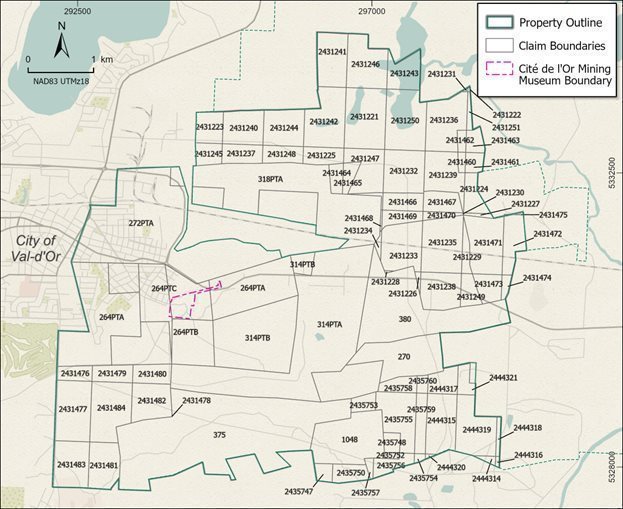

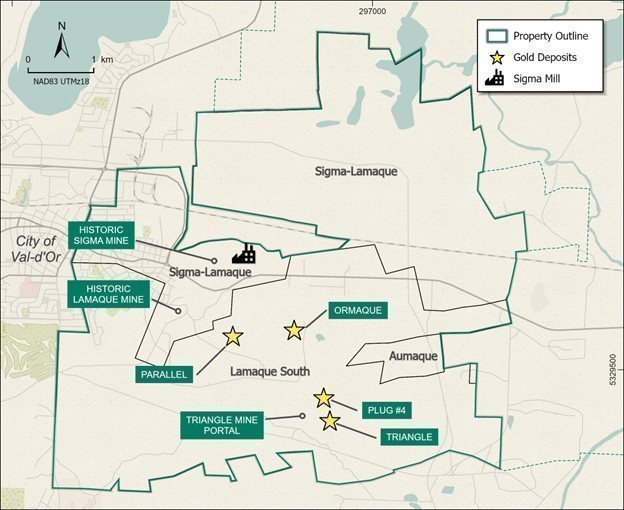

The Lamaque Complex is situated immediately east of the city of Val-d’Or in the province of Québec, Canada, approximately 550 km northwest of Montréal. The coordinates for the approximate centre of the Triangle deposit are latitude 48°4'38’’ N and longitude 77°44'4’’ W, and for the approximate centre of the Ormaque deposit are latitude 48°5'35’’ N and longitude 77°44'45’’ W. According to the Canadian National Topographical System (NTS), the complex is situated on map sheets 32C/04 and 32C/03, between UTM coordinates 295,700 mE and 296,900 mE, and between 5,328,200 mN and 5,329,350 mN (NAD83 projection, Zone 18N). Figure 1‑3 shows the Lamaque Property boundaries.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-4 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Figure 1‑3: Location of the Lamaque Property with Respect to the City of Val-d’Or (Eldorado 2024)

The Lamaque Property represent the amalgamation of three separate but contiguous property blocks of designated mining and exploration claims: Lamaque South, Sigma-Lamaque, and Aumaque (Figure 1‑4), previously registered to Integra Gold and Or Integra. In 2017, Eldorado acquired all the issued and outstanding shares of Integra Gold and became the sole owner of the Lamaque Complex. In July 2020, Integra Gold and Or Integra were merged into EGQ with all claims, mining concessions and the mining lease forming the Lamaque Complex being registered to EGQ.

The Lamaque Complex (the Project) is located on the Lamaque Property and includes the Triangle mine, Ormaque deposit, Parallel deposit, the Sigma mill, historical Sigma open pit and underground mine, all associated Sigma infrastructure, and the historical Lamaque open pit and underground mine.

The Triangle deposit is currently being mined via surface ramp access. The Sigma-Triangle decline links the 0425 Level of the Triangle mine to the Sigma mill daylighting on the first bench of the historic Sigma pit for mine to mill ore haulage.

The Lamaque Property has been the subject of several agreements in the past involving multiple companies. Although all the claims, mining concessions, and mining leases of the project are 100% owned by EGQ, several of these past agreements included royalties to various companies, a summary of which follows. Figure 1‑4 shows the location of where these royalties apply.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-5 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Figure 1‑4: Location of Property in Relation to Royalties (Eldorado 2024)

The group of claims and mining concessions from the Lamaque, Roc d’Or West, and Roc D’Or East historic properties are currently subject to a 1% NSR royalty to Osisko Royalties. A 2% NSR royalty exists on the small triangle shape claim known as the Roc d’Or East Extension property. This royalty came from a joint venture agreement between Kalahari Resources Inc. and Alexandria. In 2019, Kalahari fulfilled this agreement to earn 100% of the property over a 3-year period leaving the 2% NSR royalty to Alexandria which was purchased by Sandstorm in 2015. In 2020, Eldorado exercised the buyback of the 1% royalty on the Roc d’Or East Extension royalty owned by Sandstorm.

In December 2010, Integra acquired an option to earn a 100% interest in the historic Bourlamaque Property (2 claims; 16 hectares) in Bourlamaque Township, adjacent to the Lamaque Project. In addition to fulfilling the terms of the agreement, Integra also purchased the entire NSR royalty for CAD$5,000 on 30 April 2013.

In June 2011, Integra entered into an option agreement to acquire a 100% interest in the McGregor Property which is subject to a 2% NSR royalty, 0.6% of which is payable to Jean Robert, 0.6% to Les Explorations Carat and the remaining 0.8% to Albert Audet. One-half (1%) of this NSR royalty may be purchased for CAD$500,000.

In January 2012, Integra entered into an option agreement to acquire a 100% interest in the Donald Property which is subject to a 3% gross metal royalty payable to Les Entreprises Minière Globex Inc., one-third (1%) of which may be purchased for CAD$750,000.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-6 |

Lamaque Complex, Québec, Canada

Technical Report |

|

1.5 Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Sigma mill is accessed via the Provincial Highway 117, 1.4 km east of Val-d’Or. The Triangle mine site is accessed from the south of Val-d’Or, 3.7 km east along a private gravel service road, Voie de Service Goldex-Manitou. Roads are well maintained with year around access to the all the infrastructure of the Lamaque Complex.

The city of Val-d'Or has a humid continental climate that closely borders on a subarctic climate. Winters are cold and snowy, and summers are warm and damp. All requirements, including a sufficient hydro-electric power from the grid, and services from Val-d’Or, are available to support a mining operation. There is an ample supply of water at the Lamaque Complex to supply mining and milling operations. Also available locally is a skilled labor force with experienced mining and technical personnel.

The Abitibi region has a typical Canadian Shield type terrain characterized by low local relief with occasional hills and abundant lakes. The mine site is bordered to the north by a large unpopulated wooded area, a portion of which is currently used for tailings and waste rock disposal.

1.6 History

Val-d’Or has been a highly active mining area for a century, with significant mineral deposits present throughout the region. Gold has been produced from the historic Sigma and Lamaque mines starting in the early 1930’s. More recently, Eldorado acquired the Lamaque Complex through the purchase of Integra Gold Corp in 2017. Eldorado has been operating uninterruptedly since start of its commercial production on March 31, 2019, from ore mined at the Triangle deposit and processed at the refurbished Sigma mill.

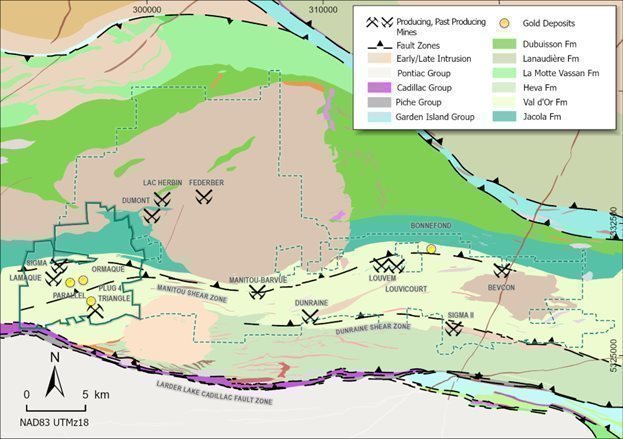

1.7 Geology and Mineralization

The Lamaque Project is located in the southeastern Abitibi Greenstone Belt of the Archean Superior Province in the Canadian Shield. The Abitibi Greenstone Belt, as shown in Figure 1‑5, comprises dominantly east-trending folded volcanic and metasedimentary rocks and intervening domes cored by plutonic rocks. Submarine mafic volcanic rocks dominate forming approximately 90% of the area. The Abitibi Greenstone Belt is intruded by numerous syn to late tectonic plutons composed mainly of syenite, gabbro, diorite, and granite with lesser lamprophyre and carbonatite dykes.

Regional stratigraphic correlation between the volcanic and sedimentary rocks is hampered by the fact that boundaries between lithostratigraphic units are commonly structural in nature and glacial cover is extensive in some areas. The Val-d’Or region is dominated by stratigraphic groups and formations that occur mostly within the Tisdale and Blake River assemblages.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-7 |

Lamaque Complex, Québec, Canada

Technical Report |

|

(modified from Ayer et al., 2005; Goutier and Melançon, 2007; Thurston et al., 2008)

Figure 1‑5: Geology of the Abitibi Greenstone Belt

The Larder Lake-Cadillac Fault Zone (LLCFZ) is the major fault in the region and defines the contact between the southward-facing volcanic successions of the Malartic Group and the younger folded, but dominantly northward-facing, graywacke-mudstone successions of the Pontiac Group to the south.

Most of the gold in the Lamaque Complex area is hosted by quartz-tourmaline-carbonate veins, which vary from shear hosted and/or extensional vein systems to complex stockworks zones.

The Triangle gold deposit was discovered in 2011 by drilling an isolated circular magnetic high anomaly in the south part of the project area. The volcaniclastic rocks in the Triangle deposit consist of feldspar phenocryst rich (fragments and matrix) lapilli-block tuffs of andesitic to basalt composition. The texture of the coarse-grained matrix is generally massive; however, grading can be observed locally. Fine grained beds are less common and turbidite facies have not been observed. Rare thin concordant lava flows, as well as complex and irregular subvolcanic intrusions, are intercalated within the volcaniclastic sequence. The tuffs lack penetrative schistosity but contain a stretching lineation and a weak flattening and alignment of fragments. The strong competency of the rocks surrounding the Triangle Plug coincides with a mineralogical change from Fe-Mg chlorite and paragonitic muscovite in the volcanic rocks to a Mg-dominant chlorite and muscovite with pervasive albite-quartz-epidote (magnetite-pyrite) in and around the plug.

The Triangle Plug is a chimney-shaped feldspar porphyritic diorite very similar in composition to the Main Plug at the Lamaque deposit. The Triangle Plug is composed of two different facies of the porphyritic diorite: a mafic facies composed of 25-40% hornblende pseudomorphs (now chlorite-altered) with minor chloritized biotite in the matrix, and a more felsic facies with less than 25% mafic minerals in the matrix. For both facies, the rock contains 10-30% medium-grained zoned feldspar phenocrysts. The Triangle Plug plunges at roughly 70° towards the NNE. At a depth of around 700 m below surface, the Triangle Plug cuts a large dyke called the North Dyke, which extends east-west for over 4 km and dips vertically. The North Dyke is also a feldspar porphyritic diorite that shares similarities to both facies of the Triangle Plug. The dyke has been traced to a depth of over 1,800 m below surface.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-8 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Gold mineralization in the Triangle deposit occurs primarily within quartz-tourmaline-carbonate-pyrite veins in the Triangle Plug and adjacent massive mafic lapilli-blocks tuffs.

Gold mineralization at the Parallel deposit is hosted within shear and extension veins hosted by the fine- to medium-grained C-porphyry diorite.

The Ormaque deposit is located immediately east of the Parallel deposit. The Ormaque vein system occurs within the C-porphyry at the contact with volcaniclastic rocks to the north. Gold mineralization occurs dominantly in gently south-dipping quartz-tourmaline-carbonate extension veins and localized breccia zones.

1.8 Deposit Types

The gold deposits in the Val-d’Or area are consistent with the orogenic gold model. Orogenic gold deposits are typically distributed along first-order compressional to transpressional crustal-scale fault zones that mark the convergent margins between major lithological and/or tectonic boundaries such as the Larder Lake–Cadillac Fault Zone.

Most orogenic gold deposits in Archean terranes are hosted in greenstone belts. In the Lamaque Project area, competency contrasts are the most important localizing host rock control. At Lamaque and Triangle the intersection of shear zones with late diorite to granodiorite plugs host the main gold-bearing veins, whereas at Sigma and Ormaque a syn-volcanic diorite (the C-porphyry) hosts mineralization near the sheared contact with the surrounding volcaniclastic rocks.

Orogenic gold deposits develop in response to shear failure, extensional failure and/or hybrid extensional shear failure. In the Lamaque Project area both shear veins and extension veins are widely recognized, and their identification is important to constrain vein geometries and ore shoots. In the Triangle deposits the main C vein structures are steeply dipping shear veins and host the bulk of the resource, whereas in the Ormaque deposit gently dipping extension veins contain most of the ore.

1.9 Exploration

Exploration in the Val-d’Or area has been on-going for nearly a century. Since the acquisition of Integra Gold Corp. by Eldorado in 2017, significant exploration activities occurred at Triangle as well as several other targets including Plug No. 4, Parallel, Aumaque, South Gabbro, Lamaque Deep, Vein No. 6, P5 Gap, Sigma East Extension, Sector Nord, amongst others. In January 2020, Eldorado announced the discovery of the Ormaque deposit. Eldorado continues to explore the Sigma-Lamaque property extensively.

1.10 Drilling, Sampling Method, Approach and Analyses

Drilling on the Triangle, Plug No. 4, Parallel, and Ormaque deposits amount to 6,631 completed drill holes totaling some 1,435,381 m summarized by deposit in Table 1‑1. The bulk of the drilling has been completed since 2015 when Eldorado took over the responsibilities for planning, core logging, interpretation and supervision and data validation of the diamond drill campaigns.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-9 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Table 1‑1: Summary of Drilling on the Sigma-Lamaque Block Deposits

Deposit | No. Completed Holes | No. Surface Holes | No. Underground Holes | Meters |

Triangle Deposit | 5,505 | 922 | 4,583 | 1,063,451 |

Plug No. 4 Deposit | 112 | 94 | 18 | 62,203 |

Parallel Deposit | 253 | 237 | 16 | 69,912 |

Ormaque Deposit | 761 | 288 | 473 | 239,815 |

TOTAL | 6,631 | 1,541 | 5,090 | 1,435,381 |

Drilling is done by wireline method with NQ sized core (47.6 mm nominal core diameter) or BQTK sized core (40.7 mm nominal core diameter. Geology and geotechnical data are collected from the core before sampling. All vein and shear zone occurrences are sampled with additional “bracket sampling” into unmineralized host rock on both sides of the veins or shear zones. Typically, about 50% of a hole is sampled. The core is cut at Eldorado’s core facility in Val-d’Or, Québec. For security and quality control, diamond drill core samples are catalogued on sample shipment memos, which are completed at the time the samples are being packed for shipment. Standards, duplicates, and blanks are inserted into the sample stream by Eldorado staff.

1.11 Sample Preparation, Analyses and Security

Sample preparation procedures including an initial crush to 10 mesh followed by a riffle split of a 250 g subsample which was pulverized to 85% passing 200 mesh. This subsample is sent for assay where a 30 g subsample is taken and fire-assayed with an atomic absorption (AA) spectrometry finish. During an exploration campaign any values greater than or equal to 5 g/t Au are reassayed by fire assay using a gravimetric finish. For resources conversion and infill drilling campaign, the gravimetric re-assay threshold is increased to 10.0 g/t. The sample batches contained QA/QC samples comprising standard reference materials (SRMs), duplicates and blanks.

It is the QPs opinion that the QA/QC results demonstrate that the assays contained in the database are sufficiently accurate and precise for resource estimation.

1.12 Data Verification

Checks to the entire drillhole database were undertaken and comparisons made between the digital database and original assay certificates. Eldorado concluded that the data supporting the Lamaque Project resource work is sufficiently free of error to be adequate for estimation.

The qualified persons have all completed data verification for their respective sections, as described in Section 12.

1.13 Metallurgical Testing

The metallurgical responses of ores from upper Triangle are well understood given six years of operating data and extensive metallurgical testwork that has been completed. Tests included chemical analyses, comminution test work, gravity concentration tests, whole ore cyanidation tests, carbon gold loading tests, cyanide destruction tests as wells as thickening, rheology, and filtration test work. High metallurgical recoveries (97%) are obtained with the upper Triangle ores and require a fine grind size (40 – 60 µm P80), long retention time (>70 hours), and high pH.

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-10 |

Lamaque Complex, Québec, Canada

Technical Report |

|

Recent testwork programs have focused on samples from lower Triangle zones (C6 through C10) and the Ormaque deposit. Testwork programs have been carried out by third-party commercial laboratories.

Compared to ore from Upper Triangle zones (C1 to C5), the Lower Triangle samples are slightly harder with a Bond Ball Mill work index of 12.8 kWh/t to 13.5 kWh/t. Recoveries from Lower Triangle are slightly lower than Upper Triangle, with an overall average recovery of 97% for Triangle. Overall, material from the C5 zone is harder than material from Ormaque as well as from the other zones in Upper and lower Triangle.

Samples tested from Ormaque indicate that the mineralized material is somewhat harder at 14.2 kWh/t and with metallurgical recoveries in line with upper Triangle (97%) ores. A higher proportion of coarse gravity-recoverable gold was noted with the Ormaque samples, which was also observed during the recent processing of the Ormaque bulk sample.

The bulk sample of Ormaque ore was excavated during Q3 and Q4 and has been processed at the Sigma mill in December. A total of 36,358 tonnes was mined at a sampled grade of 14.93g/t. Between December 2nd and December 12th, 28,405 tonnes were processed at the Sigma mill exclusively from the Ormaque deposit. The head grade was 15.3 g/t, producing 13,652 oz of gold with a recovery rate of 98%. Remaining bulk sampled material was processed in a blend with Triangle run-of-mine ore. The estimated grade from the resource model for the corresponding blocks that were mined was 10.1 g/t.

Recoveries from the Parallel deposit were assumed to be slightly lower, at 95%.

1.14 Mineral Resource Estimate

1.14.1 Triangle Deposit

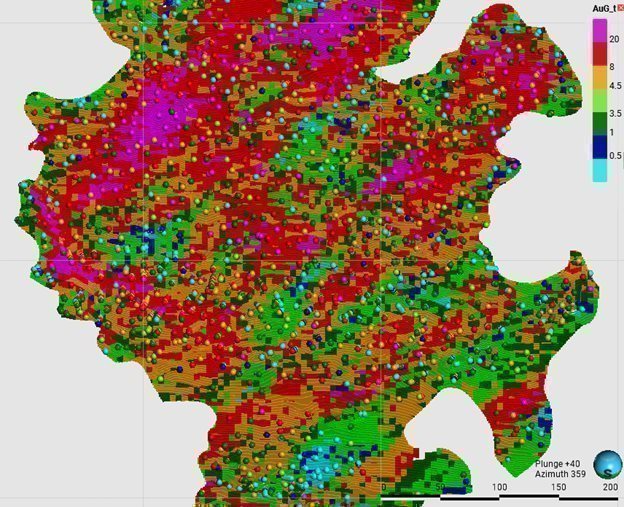

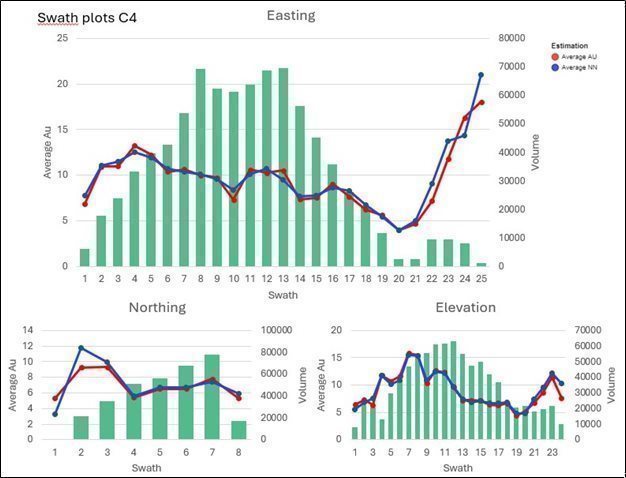

The Mineral Resource estimate for the Triangle deposit used data from both surface and underground diamond drillholes. The resource estimates were made from 3D block models created by utilizing the Seequent and Deswik suite of geological modelling and mine planning software. The parent block model cell size is 5 m east by 5 m north by 5 m high and is then sub-blocked to 1 m east by 1 m north with a variable height between 0.1 to 1 m.

The Mineral Resources of the Triangle deposit were classified using logic consistent with the CIM Definition Standards for Mineral Resources and Mineral Reserves referred to in NI 43-101. The mineralization of the project satisfies sufficient criteria to be classified into Measured, Indicated, and Inferred Mineral Resource categories.

The Mineral Resources for the Triangle deposit, as of September 30, 2024, are shown in Table 1‑2. The resources do not include 23 kt in surface stockpiles as of the end of September 2024. The Mineral Resources are reported within the constraining mineralized domain volumes that were created to control resource reporting and are based on a 3.0 g/t gold cut-off grade.

Table 1‑2: Triangle Mineral Resources, as of September 30, 2024

Deposit Name | Categories | Tonnes (x 1,000) | Grade Au (g/t) | Contained Au (oz × 1,000) |

Triangle Resources | Measured | 2,268 | 6.53 | 476 |

Indicated | 3,436 | 6.62 | 731 | |

Measured + Indicated | 5,704 | 6.58 | 1,207 | |

Inferred | 7,508 | 6.52 | 1,574 |

|

|

|

|

|

|

2024 Technical Report |

| Page | 1-11 |

Lamaque Complex, Québec, Canada

Technical Report |

|

1.14.2 Parallel Deposit

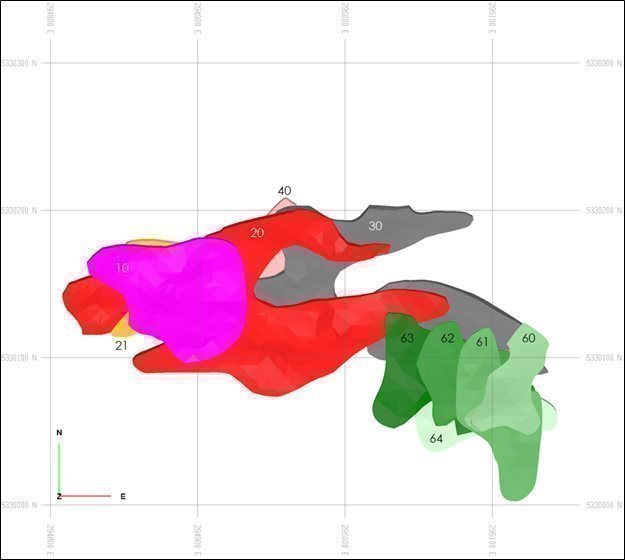

The Mineral Resource estimate for the Parallel deposit used data from surface diamond drillholes. The resource estimates were made from 3D block models created by utilizing commercial geological modelling and mine planning software. The block model cell size is 5 m east by 5 m north by 5 m high. The block model was not rotated.

The Mineral Resources of the Parallel deposit were classified using logic consistent with the CIM Definition Standards for Mineral Resources and Mineral Reserves referred to in NI 43-101. The mineralization of the project satisfies sufficient criteria to be classified into Indicated and Inferred Mineral Resource categories. Mineral Resources that are not Mineral Reserves have no demonstrated economic viability.

The Mineral Resources for the Parallel deposit, as of September 30, 2024, are shown in Table 1‑3. The Mineral Resources are reported within the constraining domain volumes that were created to control resource reporting and at a 3.0 g/t gold cut-off grade.

Table 1‑3: Parallel Mineral Resources, as of September 30, 2024

Deposit Name | Categories | Tonnes (× 1,000) | Grade Au (g/t) | Contained Au (oz × 1,000) |

Parallel | Indicated | 221 | 9.87 | 70.2 |

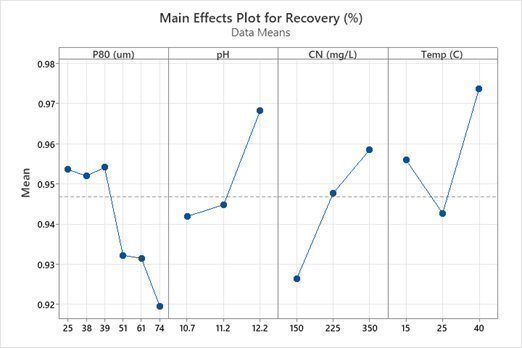

Inferred | 200 | 8.83 | 56.7 |