Stephens Inc. Fall 2008 Investment Conference New York City www.eaglematerials.com NYSE: EXP Exhibit 99.1 |

2 Forward Looking Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and generally arise when the Company is discussing its beliefs, estimates or expectations. These statements are not historical facts or guarantees of future performance but instead represent only the Company’s beliefs at the time the statements were made regarding future events which are subject to significant risks, uncertainties and other factors many of which are outside the Company’s control. Actual results and outcomes may differ materially from what is expressed or forecast in such forward-looking statements. The principal risks and uncertainties that may affect the Company’s actual performance include the following: the cyclical and seasonal nature of the Company’s business; public infrastructure expenditures; adverse weather conditions; restrictive covenants contained in our debt agreements; availability of raw materials; changes in energy costs including, without limitation, increases in natural gas and oil; changes in the cost and availability of transportation; unexpected operational difficulties, equipment failures and catastrophic events; inability to timely execute announced capacity expansions; governmental regulation and changes in governmental and public policy (including climate change regulation); changes in economic conditions specific to any one or more of the Company’s markets; competition; announced increases in capacity in the gypsum wallboard and cement industries; changes in demand for residential housing construction or commercial construction; environmental liabilities; general economic conditions; and interest rates. For example, increases in interest rates, decreases in demand for construction materials or increases in the cost of energy (including natural gas and oil) could affect the revenues and operating earnings of our operations. In addition, changes in national and regional economic conditions and levels of infrastructure and construction spending could also adversely affect the Company’s results of operations. These and other factors are described in the Annual Report on Form 10-K for the Company for the fiscal year ended March 31, 2008 and in its quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2008. These reports are filed with the Securities and Exchange Commission and may be obtained free of charge through the website maintained by the SEC at www.sec.gov. All forward-looking statements made in this presentation are made as of the date hereof, and the risk that actual results will differ materially from expectations expressed in this presentation will increase with the passage of time. The Company undertakes no duty to update any forward-looking statement to reflect future events or changes in the Company’s expectations. |

3 1. Eagle at a Glance 2. Industry Outlook 3. Bridge Over Troubled Waters |

4 New residential construction continues to weaken Non-residential construction’s near term outlook is weak Public construction remains healthy in some of our markets With these headwinds why Eagle? Why now? Eagle is the best positioned player in our industries Low-cost producer Remains profitable at cyclical troughs Strong present and future cash flows Significant growth in cash flow when construction rebounds Current market valuation presents rare opportunity Current Market Environment |

5 We Continue to Outperform the Group * 8.7% 8.7% 10.0% 12.2% 13.2% 14.7% 15.8% 19.8% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% USG St. Gobain (1) TXI (2) CRH (1) Cemex Vulcan Eagle Martin Marietta Lafarge SA EBIT Margins (TTM as of 9/30/08) • Based on comparison of EBIT Margins (TTM) for each of the listed companies (1) TTM as of 6/30/08 (2) TTM as of 8/31/08 n/a Median: 12.7% |

6 Financial Highlights ($ in millions) $429 $503 $617 $860 $922 $750 $0 $200 $400 $600 $800 $1,000 $1,200 2003 2004 2005 2006 2007 2008 For Fiscal Year Ending March 31 * Before Corporate G&A Revenues Operating Earnings * $102 $115 $172 $264 $330 $184 $0 $100 $200 $300 $400 2003 2004 2005 2006 2007 2008 |

7 1. Eagle at a Glance 2. Industry Outlook 3. Bridge Over Troubled Waters |

8 |

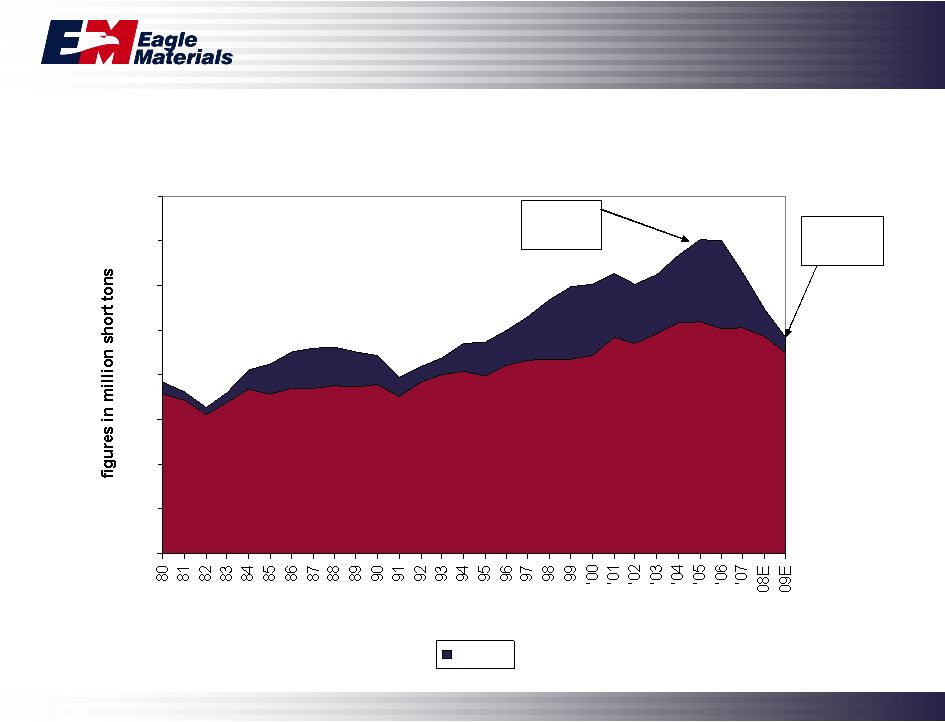

9 U.S. Cement Industry Update Current Supply/Demand Dynamics Demand anticipated to decline approximately 10% in calendar 2009 Due to the decline in demand, there have been several recent announcements of plant closures and delayed expansions U.S. capacity approximately 85% foreign-owned and majority of imports controlled by foreign multi-nationals Imports of foreign cement have been reduced to geographic requirements |

10 Source: PCA Data and Company estimates U.S. Cement Industry – Consumption 0 20 40 60 80 100 120 140 160 Calendar Year Imports 30% imports 7% imports |

11 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Landed price of Asian imports to U.S. Handymax - Southeast Asia to U.S. Gulf Cost of imported cement Source: Portland Cement Association; Company estimates Asian Financial Crisis (through September 2008) |

12 Public Construction Spending – Value Put in Place Source: Portland Cement Association (Projection from Fall 2008). $50 $100 $150 $200 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008E 2009E Infrastructure Bill? |

13 Private Non-Residential Construction Spending – Value Put in Place $0 $50 $100 $150 $200 $250 $300 $350 Source: U.S. Bureau of the Census; PCA (Projection from Fall 2008) -23% |

14 Our Cement Operations Eagle Operations Overview Approximately 3.1 million tons of capacity 3.1% market share (12th in North America) Low cost producer Exceptional customer service Eagle plans to expand its production capacity by nearly 30% to 4.0 million tons Cement Plants Cement Terminals Markets Served |

15 Our Cement Production and Cost 1,200 1,400 1,600 1,800 2,000 2,200 2,400 2,600 2,800 3,000 3,200 FY92 FY93 FY94 FY95 FY96 FY97 FY98 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 * FY08 $0 $20 $40 $60 $80 Total Manufactured Tons Produced (L) Manufactured Cost per Equivalent Ton (R) * - Includes effect of downtime for Illinois Cement start-up Energy costs up 50% Since FY04 |

16 |

17 Wallboard Industry Update Wallboard demand expected to be approximately 25 billion square feet (BSF) in calendar 2008 (down 31% from the 2005 peak) We expect demand to decline another 10% - 12% in calendar 2009 Wallboard production capacity increases are essentially complete All new plants were built in the East Wallboard production capacity currently significantly greater than wallboard demand causing very low industry capacity utilization Wallboard pricing bottomed in Summer 2008 and has rebounded approximately 20% |

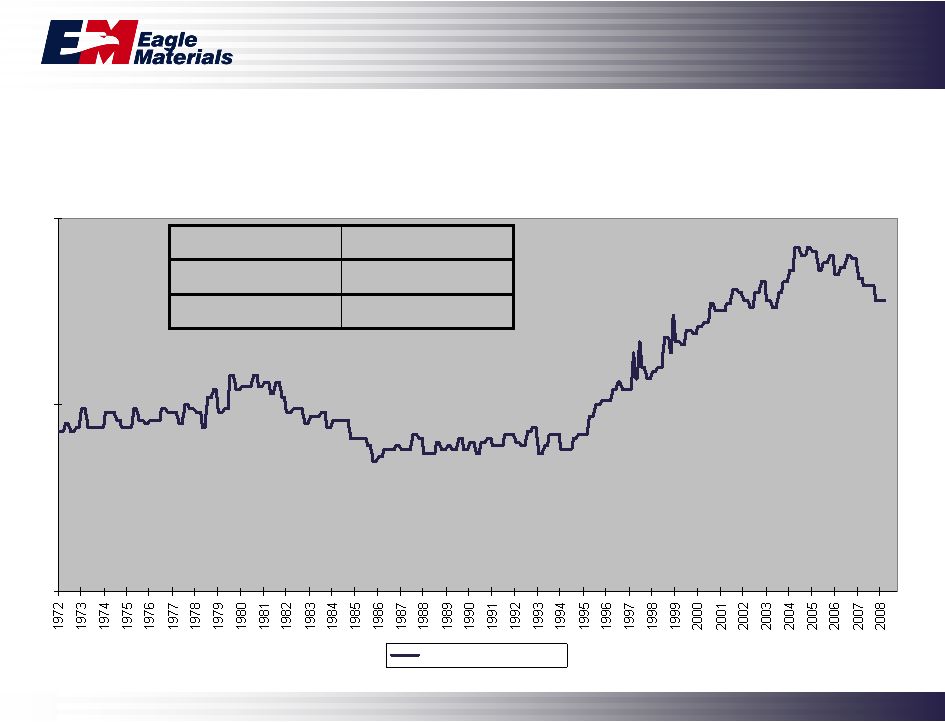

18 Residential Construction Near Term Outlook Currently, very low pace of new home construction Overhang of new and existing homes continues to put downward pressure on new housing starts Access to 30-year fixed-rate traditional mortgages is limited and interest rates are elevated Foreclosures still loom as a risk to add to inventory • ARM resets • Increased unemployment Home prices continue to decline in bubble markets • Very depressed in outlying metropolitan bubble markets Bottom Line – Residential real estate has not yet bottomed |

19 U.S Single Family Housing Starts – 1972-2008E 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 Source: U.S Bureau of the Census; Eagle estimates |

20 U.S Single Family Building Permits – 1972-2008E 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 Source: U.S Bureau of the Census; Eagle estimates |

21 Home Supply – 1972 - 2008 (through August) 0 2 4 6 8 10 12 14 0.00% 0.50% 1.00% 1.50% 2.00% New Homes Months Supply (L) New Homes for Sale as % of Total Housing Stock (R) Source: U.S Bureau of the Census |

22 Home Ownership Rates – 1972 - 2008 (through March) 60.00% 65.00% 70.00% Home Ownership Rates Source: U.S. Bureau of the Census 11.0 million SF homes rented 75.6 million Owner occupied 110.7 million Total occupied homes |

23 Annual Housing Affordability Index – 1975-2008 (Sept) 0 20 40 60 80 100 120 140 160 Source: National Association of Realtors The affordability index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home |

24 |

25 Competitive Landscape 38 BSF 26 BSF 24 BSF Industry Capacity 8 12 13 Number of Companies USG National Koch (GP) St. Gobain (BPB) American Lafarge Temple Pabco USG National GP LaFarge Continental Celotex James Hardie Briar American Republic Temple Pabco USG National GP Domtar Celotex James Hardie Briar American Eagle Republic Temple Standard Pabco 29% 22% 14% 12% 9% 7% 4% 3% 31% 22% 19% 2% 1% 5% 5% 3% 4% 2% 4% 2% 32% 23% 11% 6% 5% 5% 3% 3% 2% 2% 5% 1% 2% 2008 Capacity Share 1997 Capacity Share 1992 Capacity Share |

26 Wallboard Industry Capacity Expansions INDUSTRY CAPACITY ADDITIONS CAPACITY CLOSURES (includes 1 BSF of unspecified closures) EAGLE PLANTS Capacity Summary (in BSF) 37.8 Current (5.3) Closures 5.2 Additions 37.9 1/1/07 |

27 Wallboard Utilization Outlook (numbers in billion square feet) 66% 37.8 25.1 0.4 10.0 7.4 7.3 CY 2008E 80% 37.9 30.2 0.4 10.8 7.8 11.2 CY 2007 94% 37.2 35.0 0.4 10.6 7.6 16.4 CY 2006 58% 37.8 22.0 0.3 9.6 6.2 5.9 CY 2009E Average annual industry utilization Ending annual capacity Total Mfd Housing Repair & Remodel New Commercial New Residential Consumption Estimates: |

28 Eagle’s Wallboard Operations American Gypsum Operations Overview 18-year history Nearly 4.0 billion square feet of capacity 9% market share (5th in U.S.) Lowest cost producer Exceptional customer service Premium quality Wallboard Plants Reload/Distribution Yards Core Markets Served |

29 American Gypsum’s Wallboard Production and Cost 0.0 0.5 1.0 1.5 2.0 2.5 3.0 $0 $15 $30 $45 $60 $75 $90 Total BSF Produced Production Cost / MSF * * Before SG&A ** Includes effect from start-up of new plant in Georgetown, South Carolina |

30 |

31 Gypsum Paperboard Industry Update Nearly 100% vertically integrated One notable exception – CertainTeed – • 40% of Republic Paperboard’s capacity supplies 65% of CertainTeed’s U.S. paper needs Most industry capacity high cost cylinder machines producing high basis weight gypsum liner OCC costs are trending down |

32 Eagle’s Gypsum Paperboard Overview Original design capacity of 220,000 tons has been increased to 320,000 tons Republic produces light-weight gypsum paperboard 15% lighter than gypsum industry average Superior wallboard conversion characteristics Produces uniform cross-directional strength, weight and moisture profile 40% of capacity consumed internally, 30% sold through long-term sales contract with CertainTeed, 30% sold in spot linerboard market |

33 |

34 Concrete and Aggregates Industry Update Over 3 billion tons per year of aggregates produced annually in the U.S. Top 6 aggregates companies have 38% market share; more than double from 18% in 1980 Large multi-nationals are consolidating Over 460 million cubic yards per year of ready-mix concrete produced annually in the U.S. Top 6 Concrete companies have 23% market share Downturn in construction market causing lower concrete and aggregates demand Recent heightened emphasis on America’s ailing infrastructure, combined with ailing U.S. economy has Congress reviewing new infrastructure plans |

35 Eagle’s Operations Overview Strong competitive position in local markets Capacity • Aggregates – 5.5 million tons • Concrete – 850,000 cubic yards Complimentary to Eagle’s Cement business Organic growth opportunities Vast aggregates reserves of over 1 billion tons in Northern California Exceptional customer service Our Concrete and Aggregates Operation |

36 Construction Demand Drivers New Residential, 37% New Non- Residential, 26% Repair and Remodel, 36% Other, 1% • Public Infrastructure • New Residential Construction • Commercial Construction • Repair and Remodel Construction Public Infrastructure, 58% New Non- Residential, 18% New Residential, 17% Other, 6% American Gypsum’s Wallboard Eagle’s Cement |

37 1. Eagle at a Glance 2. Industry Outlook 3. Bridge Over Troubled Waters |

38 |

39 Eagle’s Bridge over Troubled Waters Increased infrastructure spending Strong cash flow from low-cost operations during difficult times Premium quality products Exceptional customer service Strong long-term customer relationships Low overhead Smart, hard working, technologically proficient employees These bridges, combined with well designed growth plans, position Eagle for significant growth when construction markets improve |

40 Eagle Materials Inc. Question & Answer |

41 Contact Information Mark Dendle, Executive Vice President and CFO Telephone: 214-432-2011 Email: mdendle@eaglematerials.com Craig Kesler, Vice President - Investor Relations and Corporate Development Telephone: 214-432-2013 Email: ckesler@eaglematerials.com Steve Rowley, President and CEO Telephone: 214-432-2020 Email: srowley@eaglematerials.com Eagle Materials Inc. NYSE: EXP www.eaglematerials.com |