Low Cost Producer Sound Strategies Cyclic Tailwind Benefits Healthy Balance Sheet Strong Cash Flows Exceptional Track Record Autumn 2019 Exhibit 99.1

Forward-Looking Statements Forward-Looking Statements. This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and generally arise when the Company is discussing its beliefs, estimates or expectations. These statements are not historical facts or guarantees of future performance but instead represent only the Company's belief at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside the Company's control. Actual results and outcomes may differ materially from what is expressed or forecast in such forward-looking statements. The principal risks and uncertainties that may affect the Company's actual performance include the following: the cyclical and seasonal nature of the Company's business; public infrastructure expenditures; adverse weather conditions; the fact that our products are commodities and that prices for our products are subject to material fluctuation due to market conditions and other factors beyond our control; availability of raw materials; changes in energy costs including, without limitation, natural gas, coal and oil; changes in the cost and availability of transportation; unexpected operational difficulties, including unexpected maintenance costs, equipment downtime and interruption of production; material nonpayment or non-performance by any of our key customers; fluctuations in activity in the oil and gas industry, including the level of fracturing activities and the demand for frac sand; inability to timely execute announced capacity expansions; difficulties and delays in the development of new business lines; governmental regulation and changes in governmental and public policy (including, without limitation, climate change regulation); possible outcomes of pending or future litigation or arbitration proceedings; changes in economic conditions specific to any one or more of the Company's markets; competition; a cyber-attack or data security breach; announced increases in capacity in the gypsum wallboard, cement and frac sand industries; changes in the demand for residential housing construction or commercial construction; risks related to pursuit of acquisitions, joint ventures and other transactions; general economic conditions; and interest rates. For example, increases in interest rates, decreases in demand for construction materials or increases in the cost of energy (including, without limitation, natural gas, coal and oil) could affect the revenue and operating earnings of our operations. In addition, changes in national or regional economic conditions and levels of infrastructure and construction spending could also adversely affect the Company's result of operations. Finally, the proposed separation of our Heavy Materials and Light Materials businesses into two independent, publicly traded corporations is subject to various risks and uncertainties, and may not be completed on terms or timeline currently contemplated, or at all. These and other factors are described in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2019, and subsequent quarterly reports upon filing. These reports are filed with the Securities and Exchange Commission. All forward-looking statements made herein are made as of the date hereof, and the risk that actual results will differ materially from expectations expressed herein will increase with the passage of time. The Company undertakes no duty to update any forward-looking statement to reflect future events or changes in the Company's expectations.

Eagle Materials Company Overview Revenue (FYE March 31, $ in millions) Adjusted EBITDA1 & Margin (FYE March 31, $ in millions) Founded in 1963 as a subsidiary of Centex Corporation In 2004, Centex spun off Centex Construction Products which became Eagle Materials Inc. (NYSE: EXP) Diversified producer of basic building products used in residential, industrial, commercial and infrastructure construction Well-recognized as a low-cost producer through cycles Five geographically diverse business segments 40 production facilities / plants 40 distribution facilities No one customer accounts for 5% of revenue with top 10 customers representing less than 25% 100% of revenues are generated within the US 1 Adjusted EBITDA is a non-GAAP measure; see appendix for reconciliation

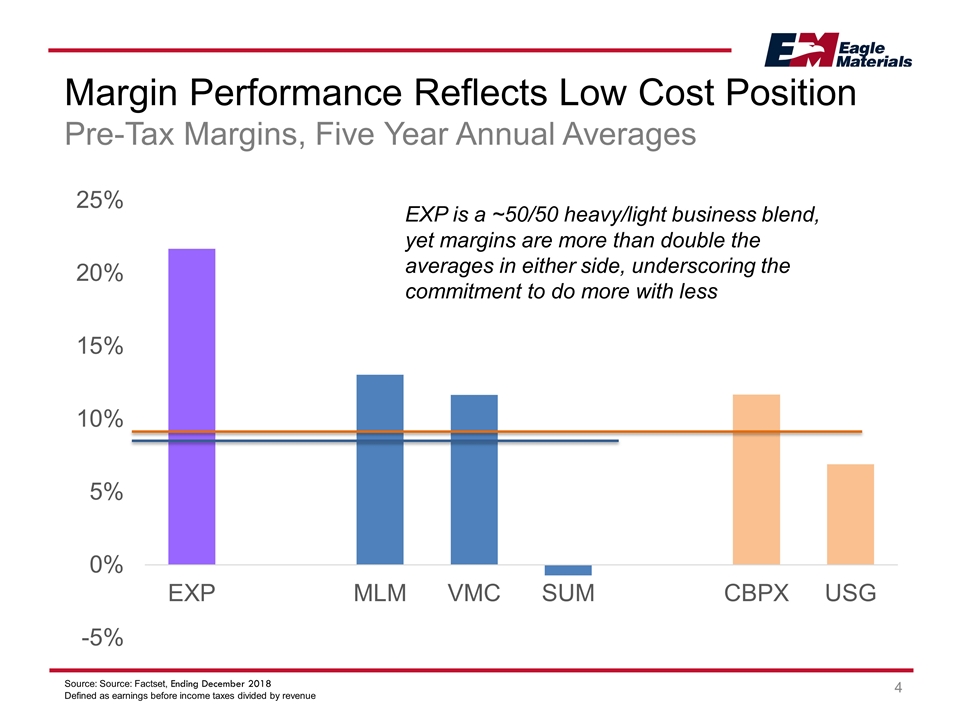

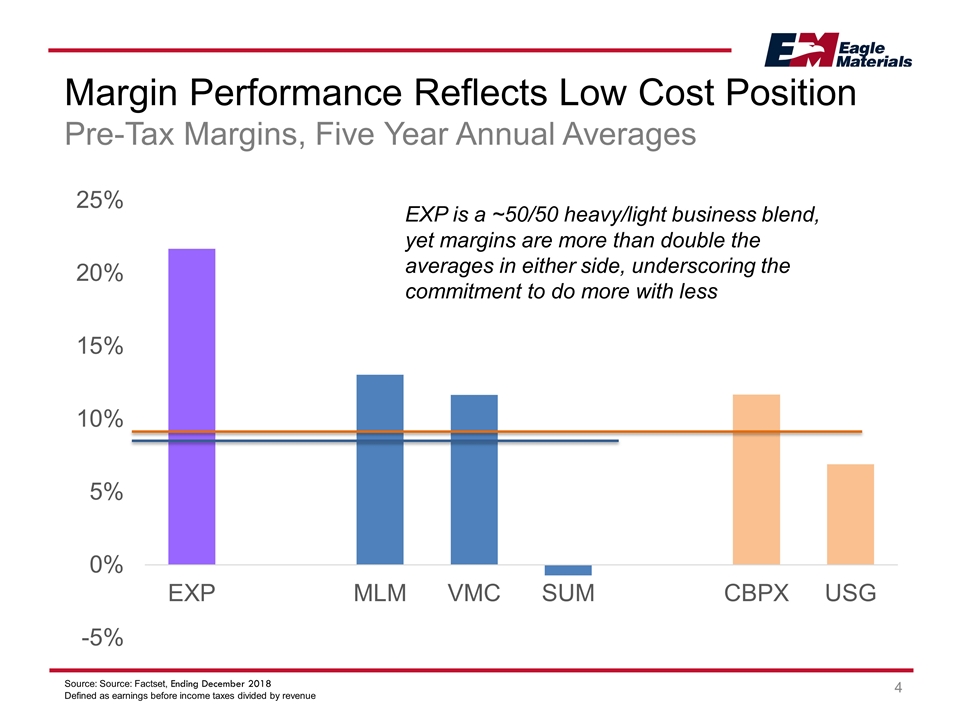

Margin Performance Reflects Low Cost Position Pre-Tax Margins, Five Year Annual Averages Source: Source: Factset, Ending December 2018 Defined as earnings before income taxes divided by revenue EXP is a ~50/50 heavy/light business blend, yet margins are more than double the averages in either side, underscoring the commitment to do more with less

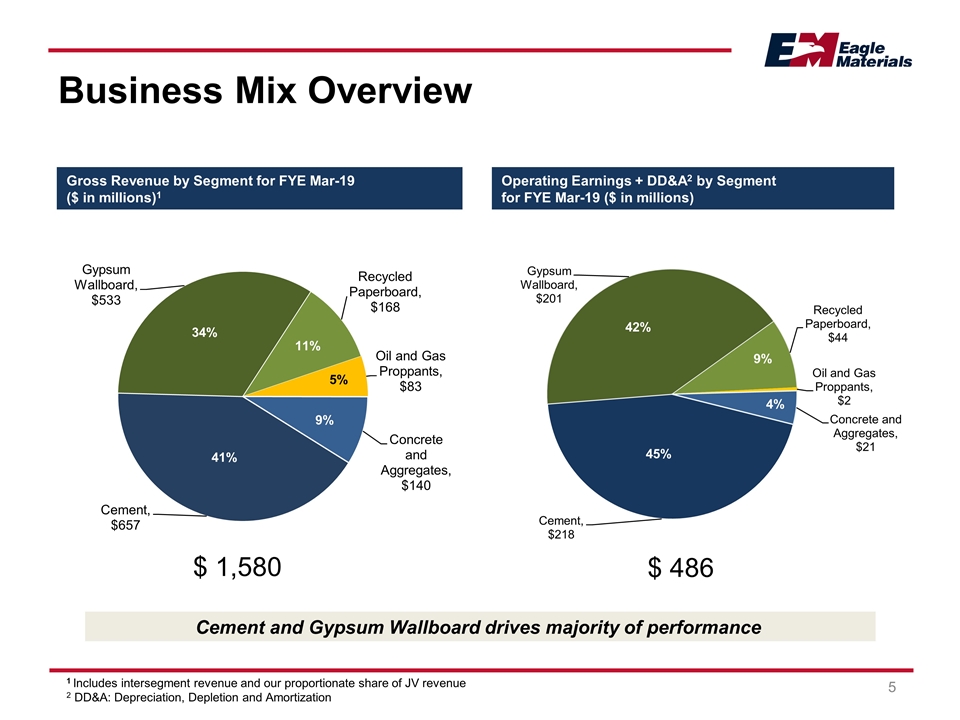

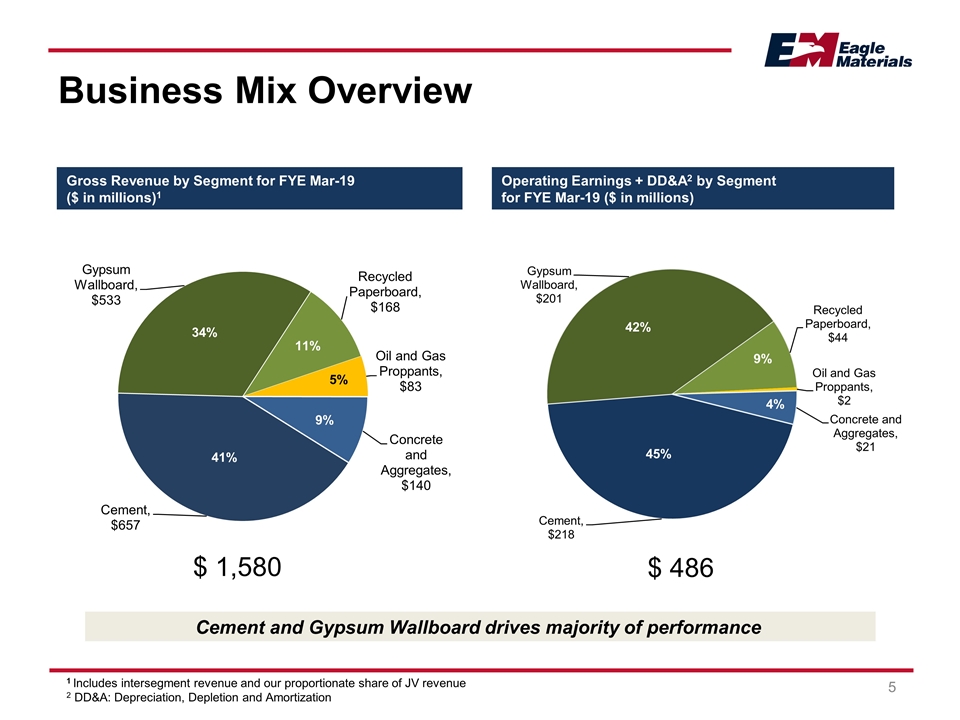

Business Mix Overview Gross Revenue by Segment for FYE Mar-19 ($ in millions)1 Operating Earnings + DD&A2 by Segment for FYE Mar-19 ($ in millions) 1 Includes intersegment revenue and our proportionate share of JV revenue 2 DD&A: Depreciation, Depletion and Amortization 34% 41% 9% 11% 5% 42% 45% 9% 4% Cement and Gypsum Wallboard drives majority of performance $ 1,580 $ 486

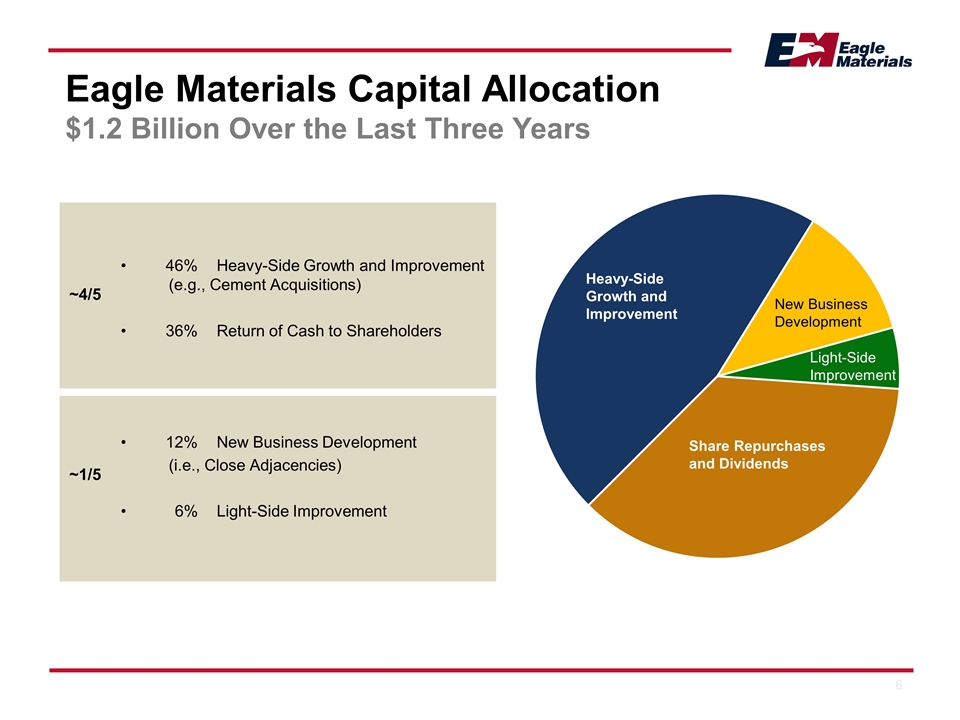

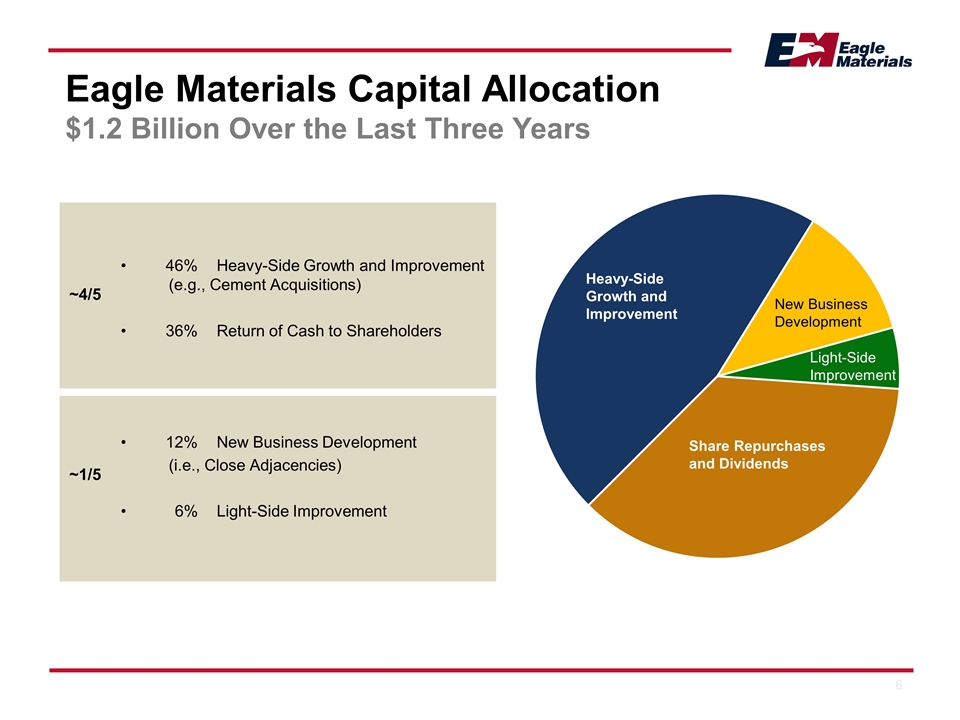

Eagle Materials Capital Allocation $1.2 Billion Over the Last Three Years 46%Heavy-Side Growth and Improvement (e.g., Cement Acquisitions) 36% Return of Cash to Shareholders 12% New Business Development (i.e., Close Adjacencies) 6%Light-Side Improvement Heavy-Side Growth and Improvement New Business Development Share Repurchases and Dividends Light-Side Improvement ~4/5 ~1/5

Cement 41% Note: Pie chart represents FYE Mar-19 Gross Revenue

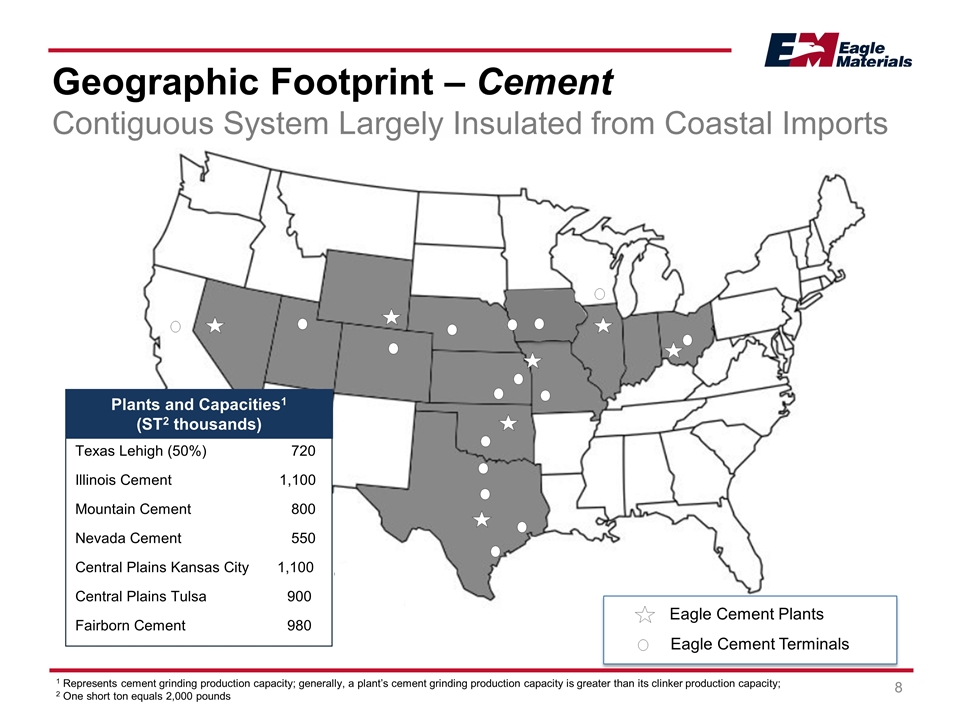

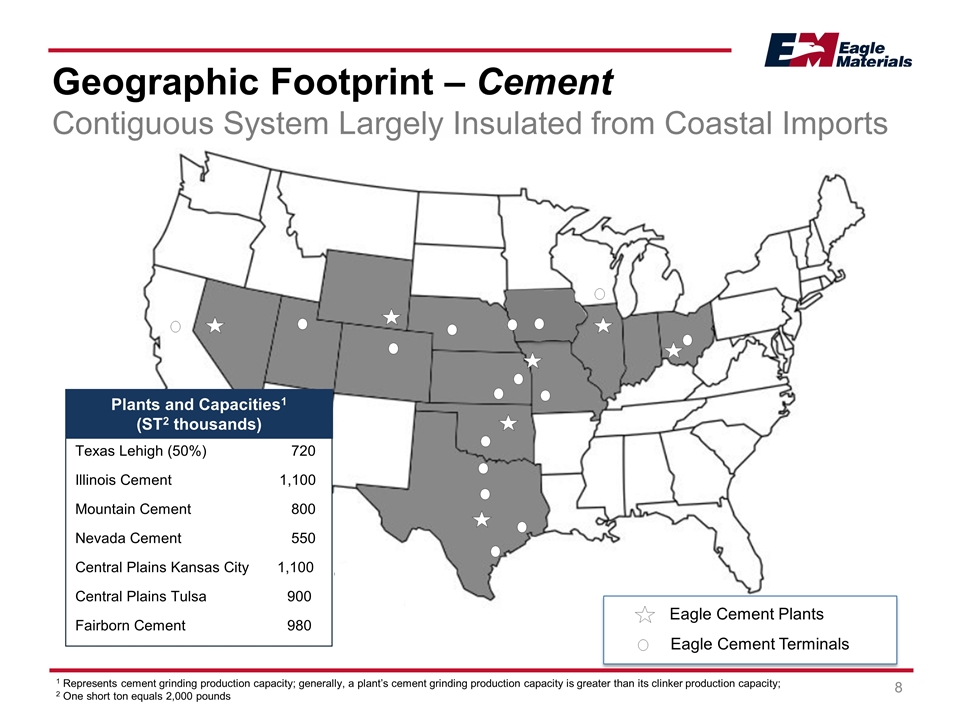

Geographic Footprint – Cement Contiguous System Largely Insulated from Coastal Imports Texas Lehigh (50%) 720 Illinois Cement 1,100 Mountain Cement 800 Nevada Cement 550 Central Plains Kansas City 1,100 Central Plains Tulsa 900 Fairborn Cement 980 1 Represents cement grinding production capacity; generally, a plant’s cement grinding production capacity is greater than its clinker production capacity; 2 One short ton equals 2,000 pounds Plants and Capacities1 (ST2 thousands) Eagle Cement Terminals Eagle Cement Plants

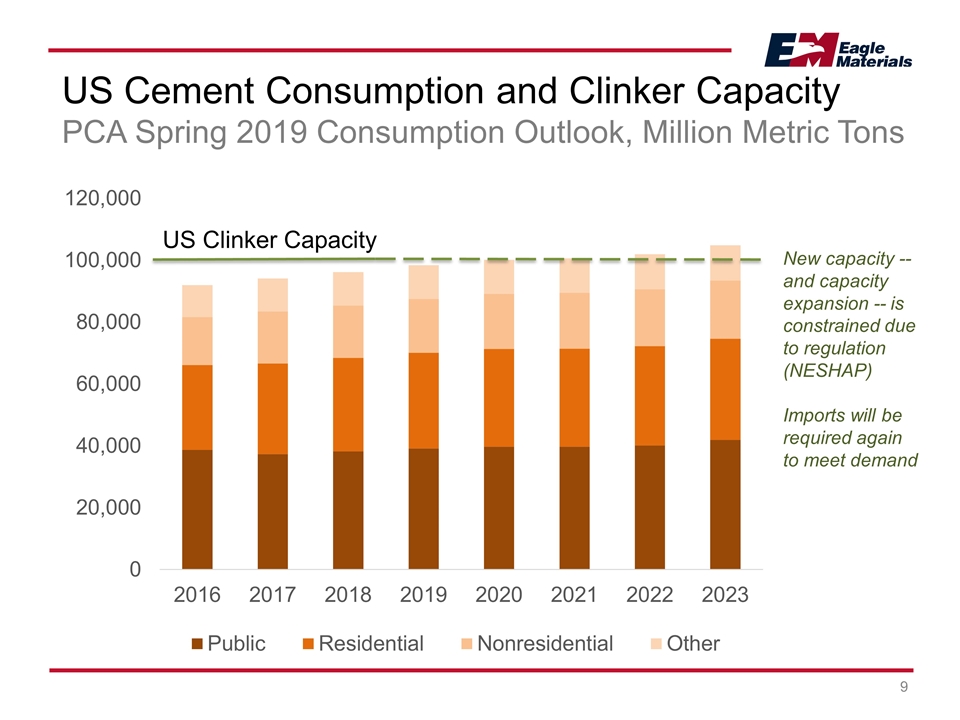

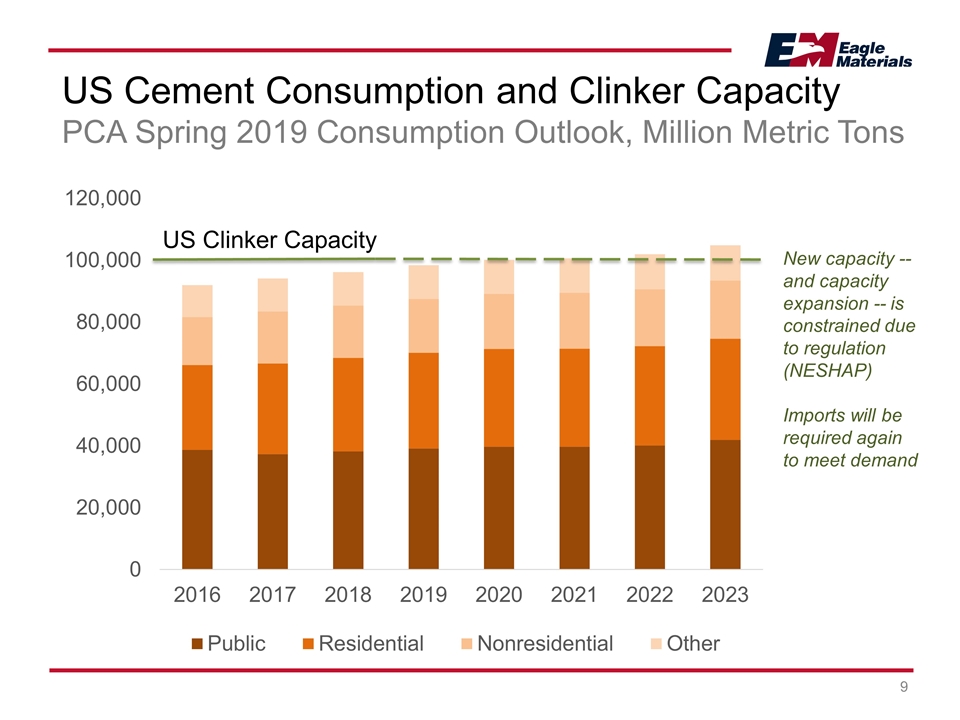

US Cement Consumption and Clinker Capacity PCA Spring 2019 Consumption Outlook, Million Metric Tons New capacity -- and capacity expansion -- is constrained due to regulation (NESHAP) Imports will be required again to meet demand US Clinker Capacity

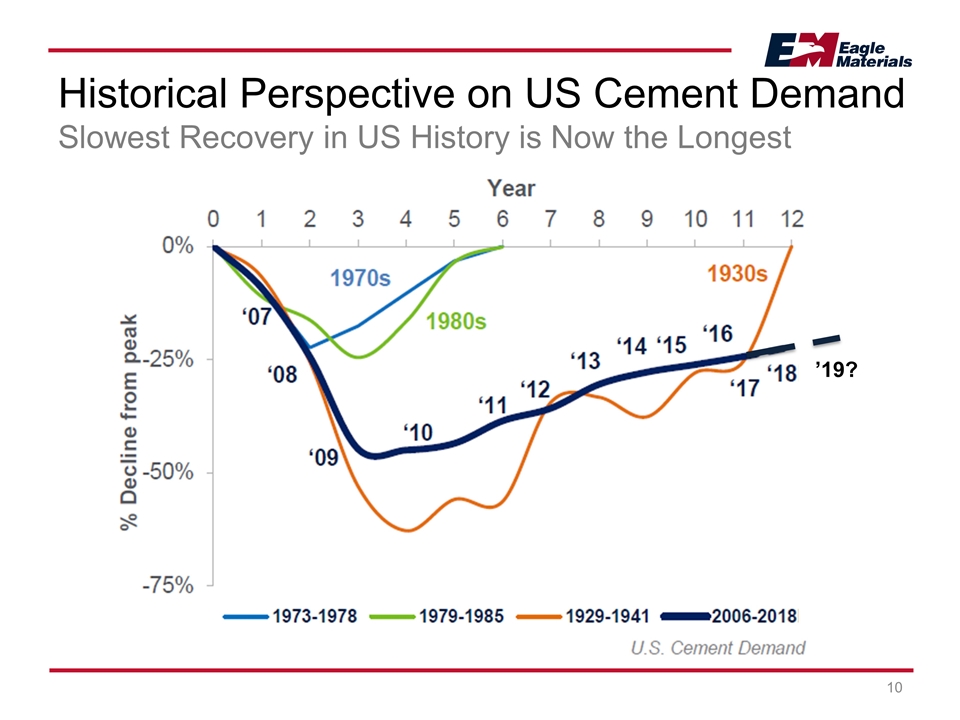

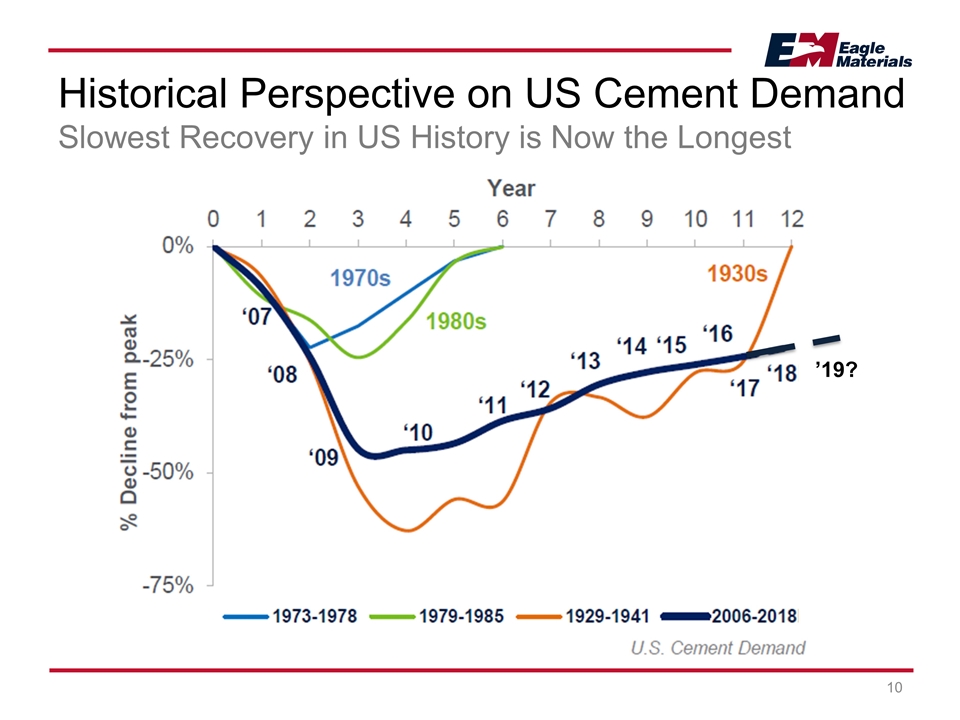

Historical Perspective on US Cement Demand Slowest Recovery in US History is Now the Longest ’19?

Gypsum Wallboard and Recycled Paperboard 34% 11% Note: Pie chart represents FYE Mar-19 Gross Revenue

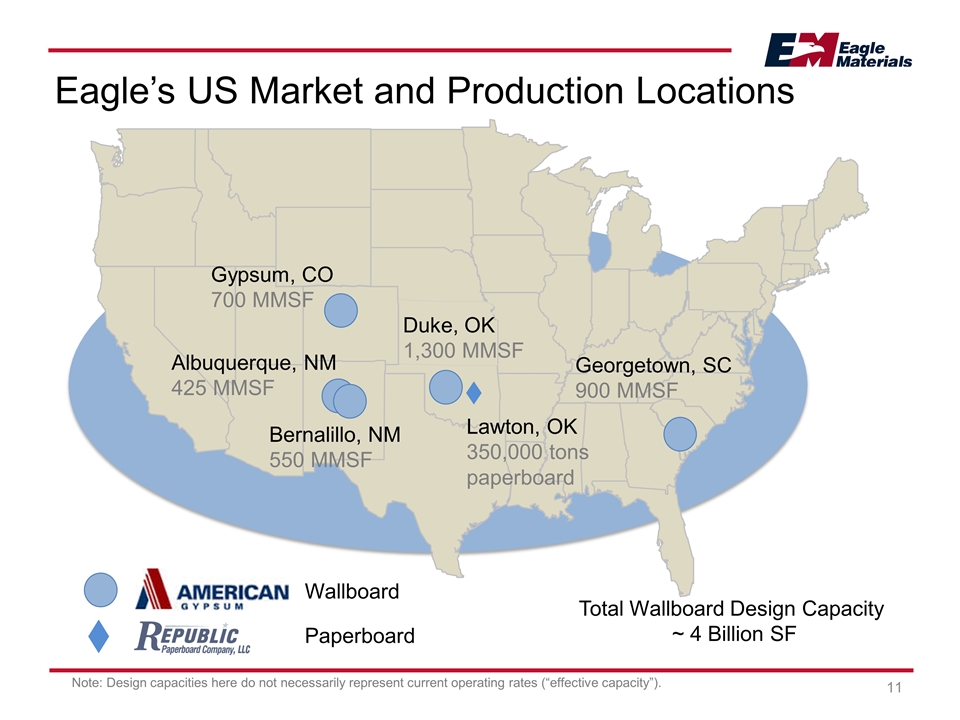

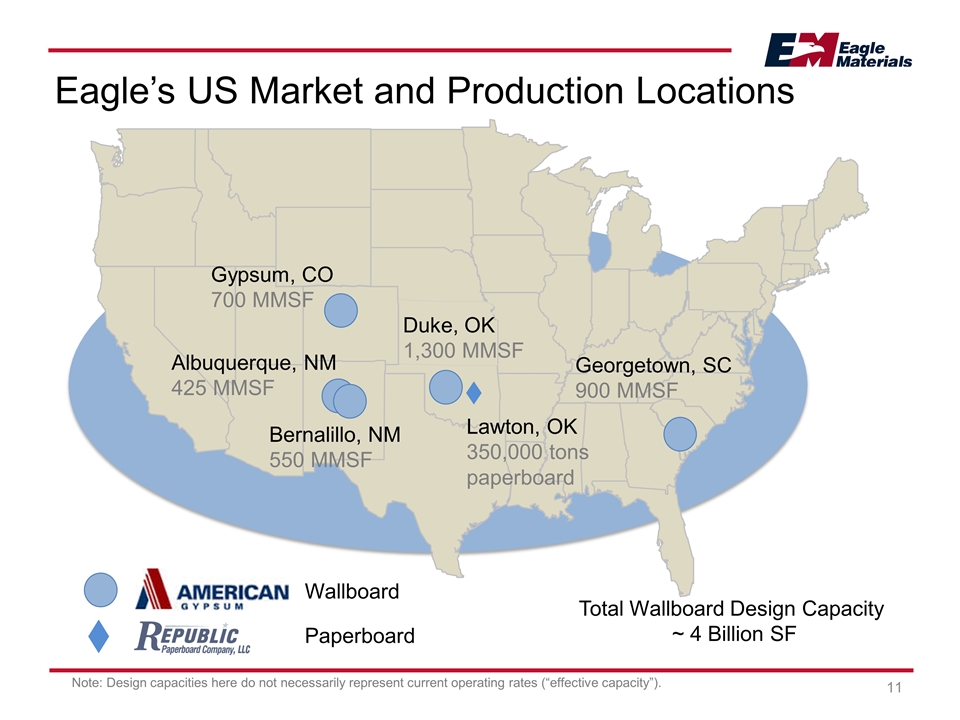

Eagle’s US Market and Production Locations Wallboard Paperboard Gypsum, CO 700 MMSF Albuquerque, NM 425 MMSF Duke, OK 1,300 MMSF Georgetown, SC 900 MMSF Lawton, OK 350,000 tons paperboard Bernalillo, NM 550 MMSF Note: Design capacities here do not necessarily represent current operating rates (“effective capacity”). Total Wallboard Design Capacity ~ 4 Billion SF 11

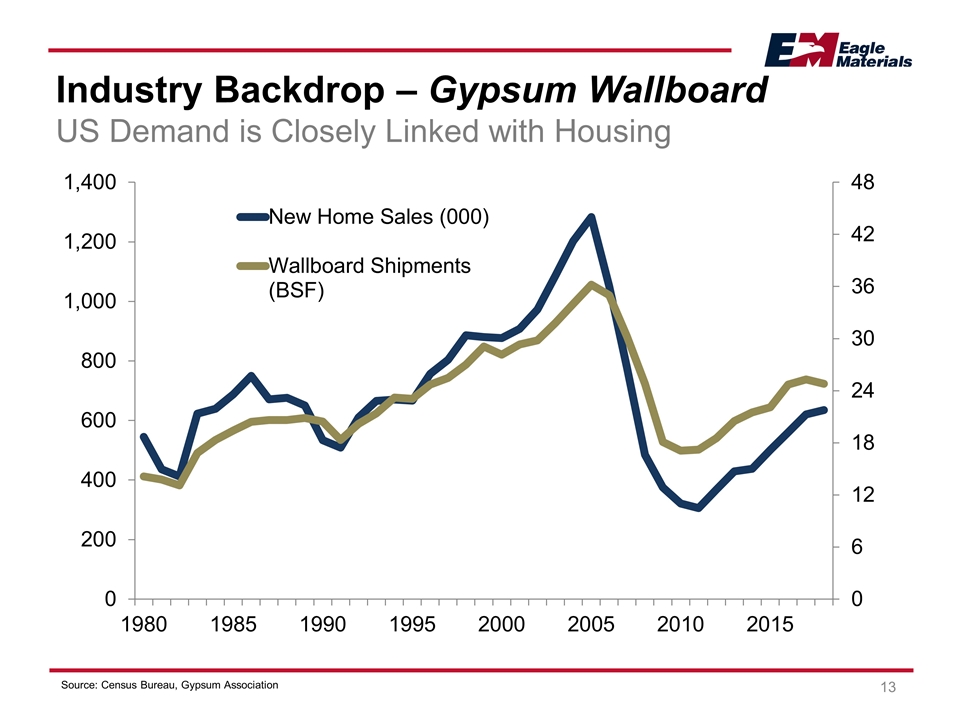

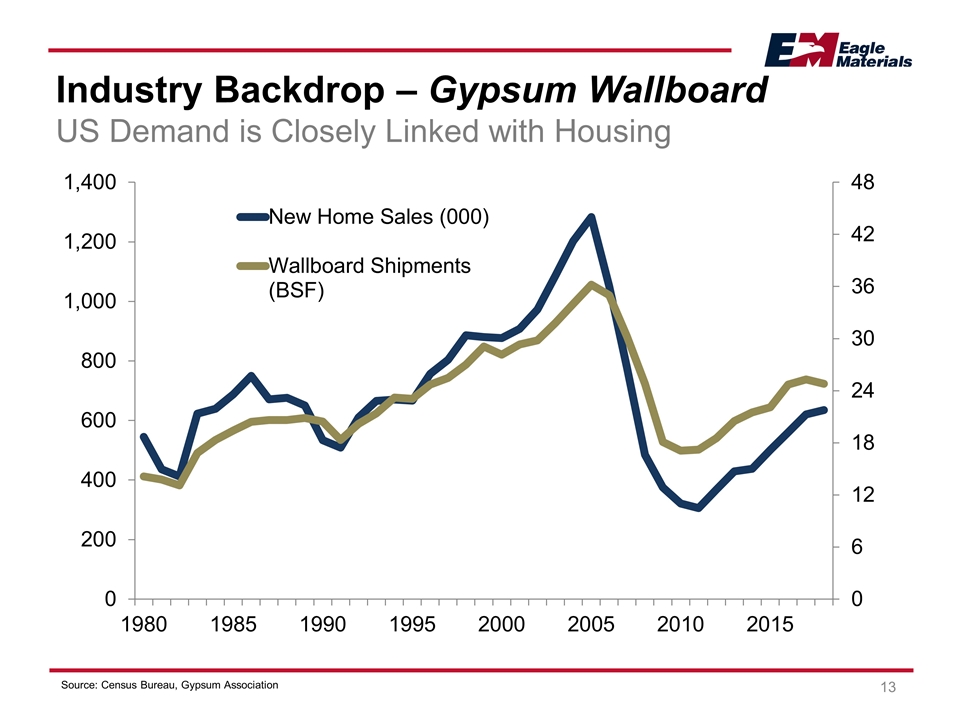

Industry Backdrop – Gypsum Wallboard US Demand is Closely Linked with Housing Source: Census Bureau, Gypsum Association

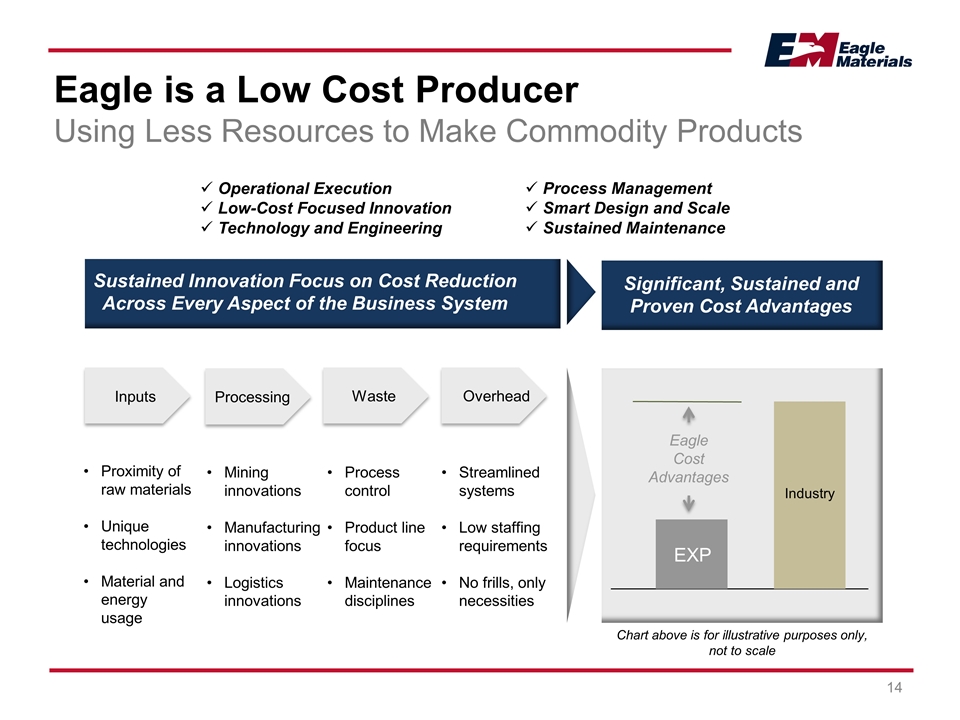

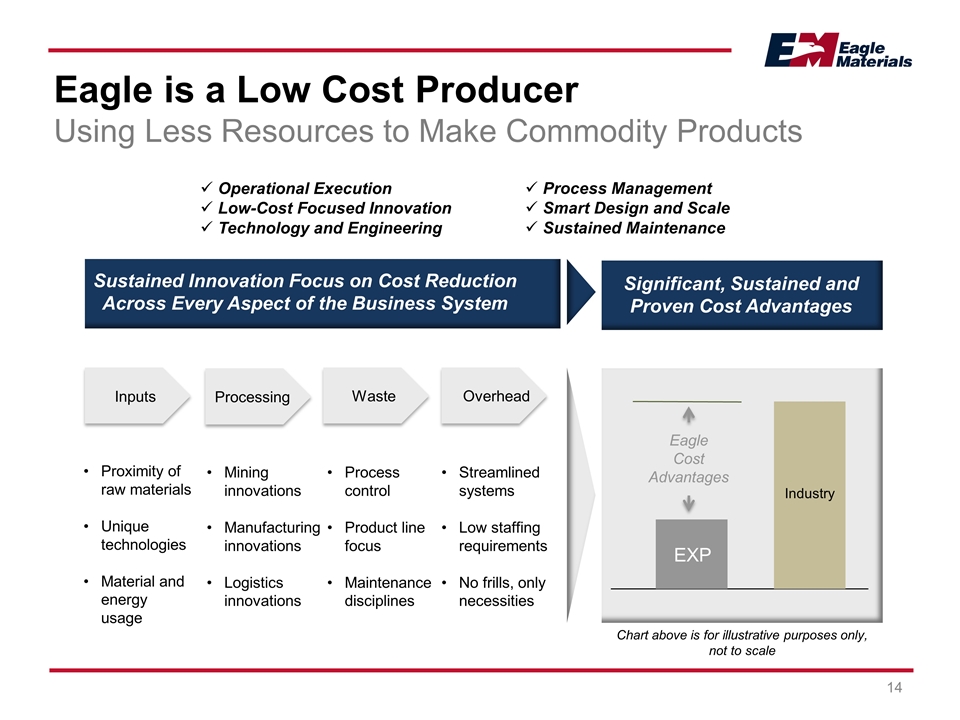

Significant, Sustained and Proven Cost Advantages Eagle Cost Advantages EXP Industry Sustained Innovation Focus on Cost Reduction Across Every Aspect of the Business System Inputs Waste Overhead Proximity of raw materials Unique technologies Material and energy usage Mining innovations Manufacturing innovations Logistics innovations Process control Product line focus Maintenance disciplines Streamlined systems Low staffing requirements No frills, only necessities Processing Operational Execution Low-Cost Focused Innovation Technology and Engineering Process Management Smart Design and Scale Sustained Maintenance Eagle is a Low Cost Producer Using Less Resources to Make Commodity Products Chart above is for illustrative purposes only, not to scale

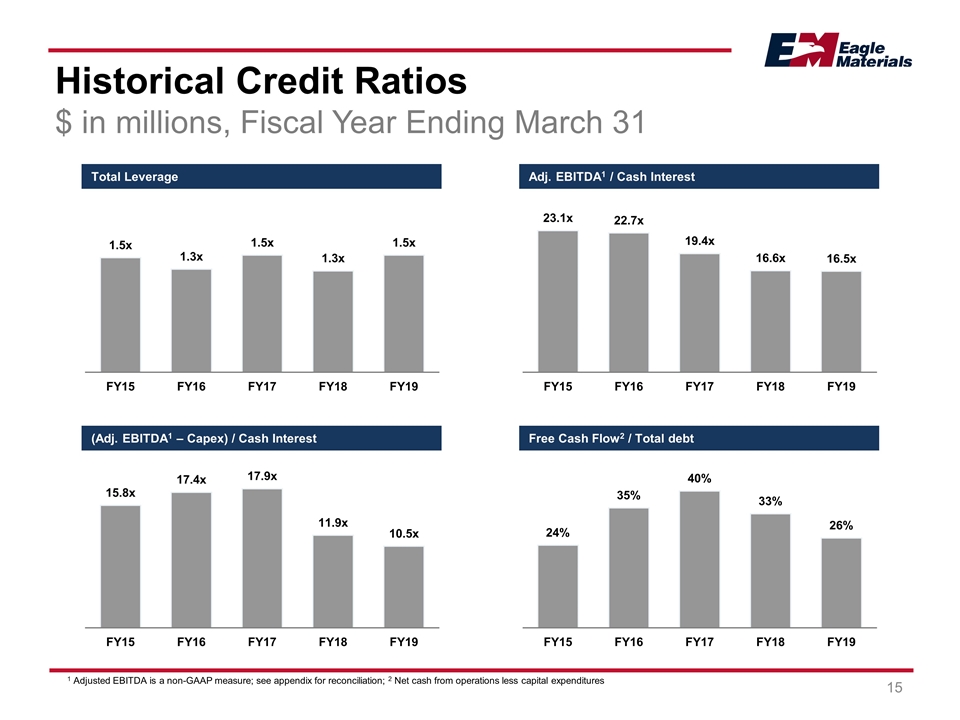

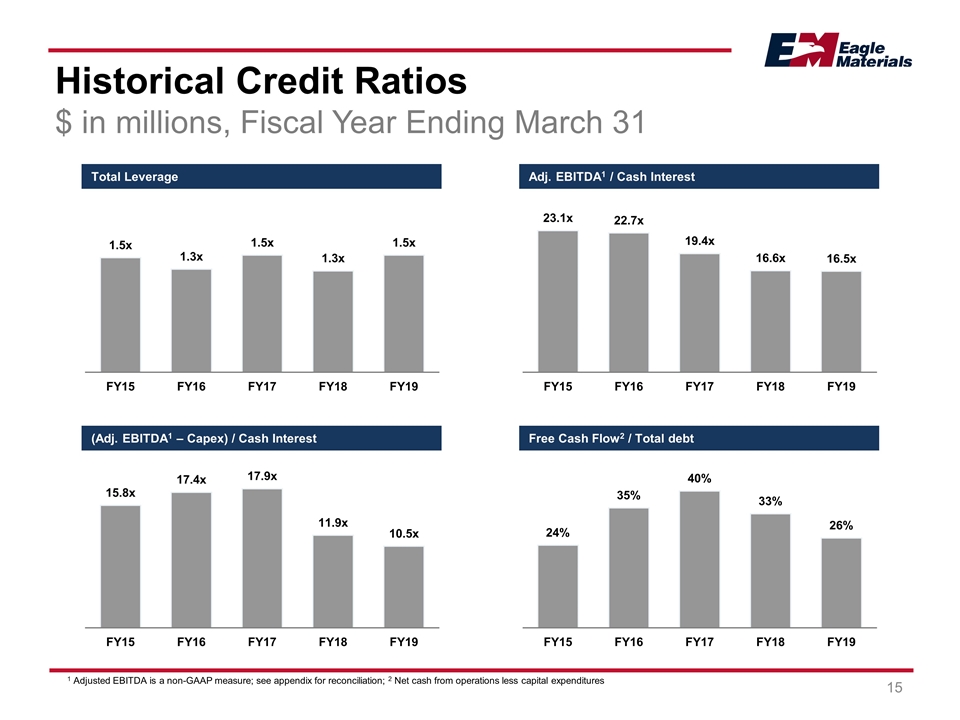

Total Leverage Adj. EBITDA1 / Cash Interest (Adj. EBITDA1 – Capex) / Cash Interest Free Cash Flow2 / Total debt 1 Adjusted EBITDA is a non-GAAP measure; see appendix for reconciliation; 2 Net cash from operations less capital expenditures Historical Credit Ratios $ in millions, Fiscal Year Ending March 31

Contact Information Craig Kesler Executive Vice President and CFO (214) 432-2013 ckesler@eaglematerials.com Bob Stewart Executive Vice President, Strategy, Corporate Development and Communications (214) 432-2040 bstewart@eaglematerials.com Eagle Materials Inc. NYSE: EXP www.eaglematerials.com 28

Appendix

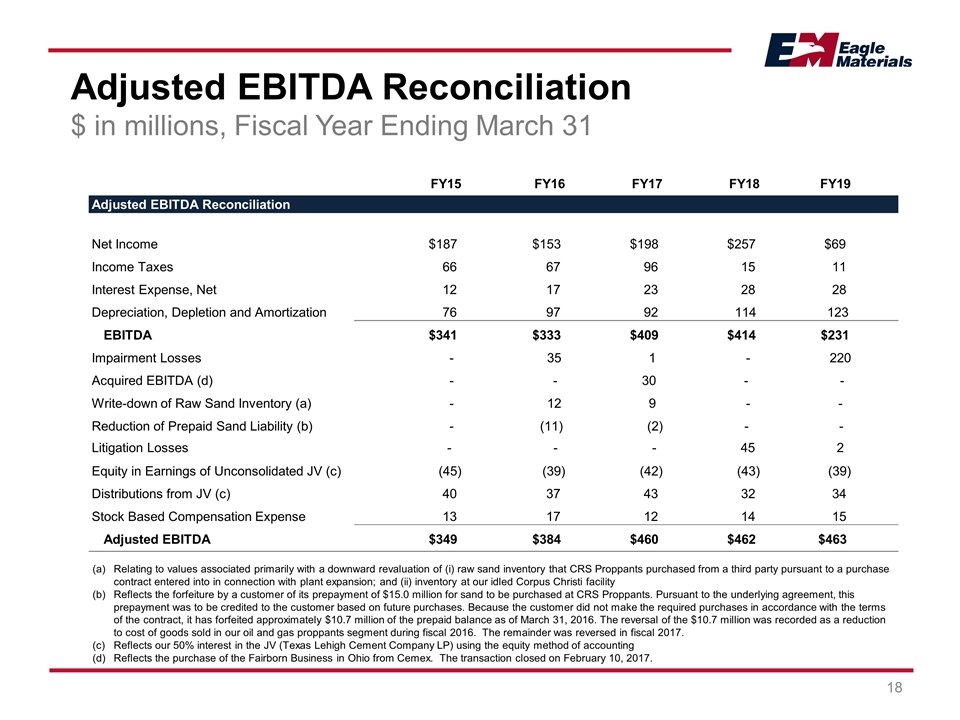

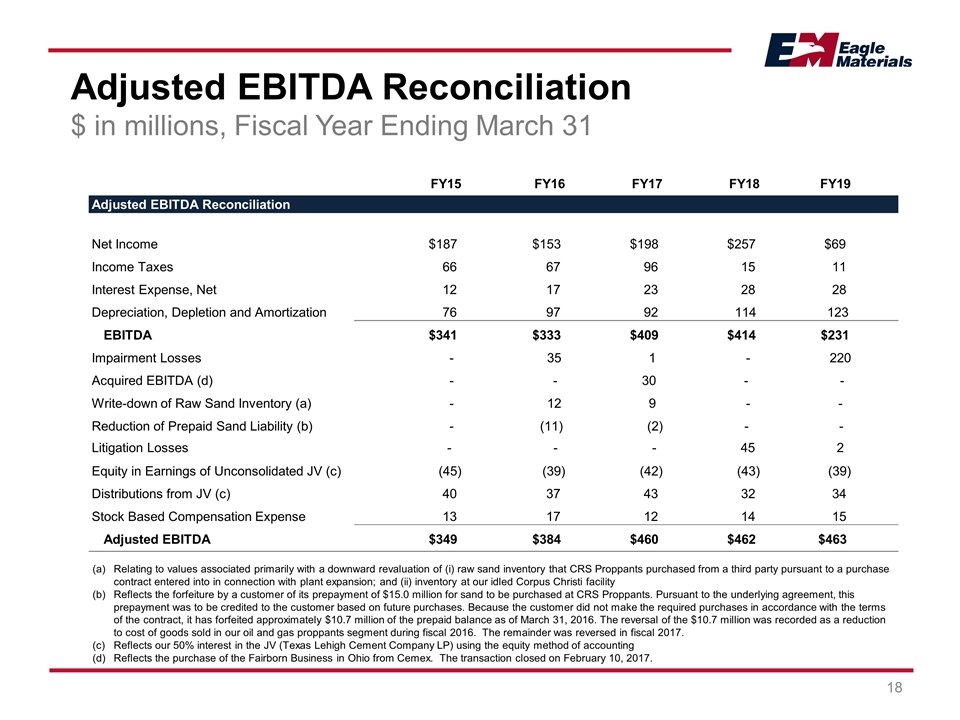

Adjusted EBITDA Reconciliation $ in millions, Fiscal Year Ending March 31 Relating to values associated primarily with a downward revaluation of (i) raw sand inventory that CRS Proppants purchased from a third party pursuant to a purchase contract entered into in connection with plant expansion; and (ii) inventory at our idled Corpus Christi facility Reflects the forfeiture by a customer of its prepayment of $15.0 million for sand to be purchased at CRS Proppants. Pursuant to the underlying agreement, this prepayment was to be credited to the customer based on future purchases. Because the customer did not make the required purchases in accordance with the terms of the contract, it has forfeited approximately $10.7 million of the prepaid balance as of March 31, 2016. The reversal of the $10.7 million was recorded as a reduction to cost of goods sold in our oil and gas proppants segment during fiscal 2016. The remainder was reversed in fiscal 2017. Reflects our 50% interest in the JV (Texas Lehigh Cement Company LP) using the equity method of accounting Reflects the purchase of the Fairborn Business in Ohio from Cemex. The transaction closed on February 10, 2017. FY15 FY16 FY17 Adjusted EBITDA Reconciliation Net Income $187 $153 $198 Income Taxes 66 67 96 Interest Expense, Net 12 17 23 Depreciation, Depletion and Amortization 76 97 92 EBITDA $341 $333 $409 Impairment Losses - 35 1 Acquired EBITDA (d) - - 30 Write-down of Raw Sand Inventory (a) - 12 9 Reduction of Prepaid Sand Liability (b) - (11) (2) Equity in Earnings of Unconsolidated JV (c) (45) (39) (42) Distributions from JV (c) 40 37 43 Stock Based Compensation Expense 13 17 12 Adjusted EBITDA $349 $384 $460 FY18 $257 15 28 114 $414 - - - - (43) 32 14 $462 FY19 $69 11 28 123 $231 220 - - (39) 34 15 $463 Litigation Losses - - - 45 2 -