[ANNOTATED FORM N-CSR FOR ANNUAL REPORTS]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08346 |

|

Morgan Stanley Eastern Europe Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

1221 Avenue of the Americas 22nd Floor New York, NY | | 10020 |

(Address of principal executive offices) | | (Zip code) |

|

Ronald E. Robison

1221 Avenue of the Americas, 33rd Floor New York, New York 10020 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-221-6726 | |

|

Date of fiscal year end: | 12/31 | |

|

Date of reporting period: | 12/31/05 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Fund’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| 2005 Annual Report |

| |

| December 31, 2005 |

Morgan Stanley

Eastern Europe Fund, Inc.

Morgan Stanley

Investment Management Inc.

Investment Adviser

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Letter to Stockholders | Overview |

Performance

For the year ended December 31, 2005, the Morgan Stanley Eastern Europe Fund, Inc. (the “Fund”) had total returns, based on net asset value and market price per share of 29.25%, net of fees and 67.53%, respectively, compared to 46.10% for the Morgan Stanley Capital International (MSCI) Emerging Markets Eastern Europe Index (the “Index”), a composite index comprised of the market capitalization weighted MSCI local indices for Russia, Poland, the Czech Republic and Hungary. On December 31, 2005, the closing price of the Fund’s shares on the New York Stock Exchange was $34.59, representing a 19.7% premium to the Fund’s net asset value per share.

Factors Affecting Performance

• The Fund’s underweight allocation to Russia and energy stocks detracted from relative performance, as did stock selection in Poland. In contrast, an underweight country allocation to Hungary and overweight to Turkmenistan were the largest contributors to relative performance. Hungary remains plagued by high fiscal and current account deficits, known as a “twin deficit” problem. The situation has delayed Hungary’s targeted date for full adoption of the Euro, and has dampened investor sentiment.

• Overall, the Eastern European markets posted double-digit returns in 2005. During the year, the asset class benefited from attractive commodity prices, rising corporate earnings and strong economic fundamentals. Russia was the best performer in the Index, supported by high oil prices, a strong current account balance and large reserves.

Management Strategies

• We continued to focus on countries where gross domestic product growth, fiscal policy and reform agendas remain strong and on companies which we believe have strong management and earnings visibility.

• We increased the Fund’s position in Poland. Poland has now become our largest overweight in the Fund. Poland is our only relative overweight of the three Central European countries based on our analysis of attractive stock opportunities and positive macro-economic trends. Coming out of an economic recession, Poland has made strides from an export-led economy to a domestic-driven market. Among the Fund’s holdings in the country, select banking stocks appear to have attractive valuations and earnings growth potential.

• While we remain optimistic about Turkey, we have exited the market. Turkey maintains a high current account deficit and relatively low real yields, which could leave it vulnerable to a potential rise in U.S. interest rates and a stronger dollar.

• Based on our bottom-up and top-down analysis, we reduced the Fund’s underweight exposure to Russia by adding energy sector stocks to the portfolio.

• Hungary and the Czech Republic remain the Fund’s largest underweights.

Sincerely,

Ronald E. Robison

President and Principal Executive Officer

January 2006

The Fund announced in February 2006, that it will be managed by the Emerging Markets team. Current members of the team, all of Morgan Stanley Investment Management Inc., include Narayan Ramachandran, a Managing Director, Ruchir Sharma, a Managing Director, Paul Psaila, an Executive Director and Eric Carlson, an Executive Director.

2

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Portfolio of Investments | December 31, 2005 |

| | Shares | | Value

(000) | |

COMMON STOCKS (87.6%) | | | | | |

(Unless Otherwise Noted) | | | | | |

Hungary (5.4%) | | | | | |

Pharmaceuticals | | | | | |

Gedeon Richter Rt. | | 9,821 | | $ | 1,765 | |

Specialty Retail | | | | | |

Fotex Rt. | | (a)2,382,890 | | 3,877 | |

| | | | 5,642 | |

Poland (25.4%) | | | | | |

Commercial Banks | | | | | |

Bank Millennium S.A. | | 2,512,354 | | 4,060 | |

Bank Pekao S.A. | | 38,327 | | 2,059 | |

Powszechna Kasa Oszczednosci Bank Polski S.A. | | 243,715 | | 2,176 | |

| | | | 8,295 | |

Food & Staples Retailing | | | | | |

Central European Distribution Corp. | | (a)72,340 | | 2,904 | |

Food Products | | | | | |

Polski Koncern Miesny Duda S.A. | | (a)1,384,980 | | 4,647 | |

Media | | | | | |

Agora S.A. | | 79,423 | | 1,687 | |

TVN S.A. | | (a)245,777 | | 5,901 | |

| | | | 7,588 | |

Multiline Retail | | | | | |

Eurocash S.A. | | (a)1,834,041 | | 2,879 | |

| | | | 26,313 | |

Russia (54.5%) | | | | | |

Beverages | | | | | |

Baltika Brewery | | 151,264 | | 4,731 | |

Efes Breweries International N.V. GDR | | (a)(b)41,978 | | 1,194 | |

Efes Breweries International N.V. GDR | | (a)71,701 | | 2,040 | |

| | | | 7,965 | |

Distributors | | | | | |

Kalina | | 130,750 | | 4,932 | |

Kalina ADR | | 73,800 | | 2,784 | |

| | | | 7,716 | |

Electrical Equipment | | | | | |

Siloviye Mashiny | | (a)31,124,800 | | 2,406 | |

Food & Staples Retailing | | | | | |

Pyaterochka Holding N.V. GDR | | (a)339,368 | | 4,904 | |

Food Products | | | | | |

Lebedyansky JSC | | (a)72,300 | | 4,723 | |

Wimm-Bill-Dann Foods OJSC ADR | | (a)365,500 | | $ | 8,783 | |

| | | | 13,506 | |

Marine | | | | | |

Far Eastern Shipping Co. | | (a)10,709,900 | | 3,224 | |

Metals & Mining | | | | | |

Highland Gold Mining Ltd. | | 1,515,268 | | 6,400 | |

Oil, Gas & Consumable Fuels | | | | | |

NovaTek OAO | | (a)(b)102,415 | | 2,228 | |

Surgutneftegaz ADR | | 78,371 | | 4,271 | |

YUKOS ADR | | (a)473,263 | | 3,805 | |

| | | | 10,304 | |

| | | | 56,425 | |

Ukraine (2.3%) | | | | | |

Chemicals | | | | | |

Stirol Concern ADR | | (a)87,925 | | 2,415 | |

TOTAL COMMON STOCKS | | | | | |

(Cost $74,720) | | | | 90,795 | |

| | | | | |

| | Face

Amount

(000) | | | |

CORPORATE BOND (1.4%) | | | | | |

Russia (1.4%) | | | | | |

Wireless Telecommunication Services | | | | | |

MCSI Holding Ltd. (Secured Notes) 9.00%, 4/15/07 | | | | | |

(Cost $1,382) | | $ | (c)(e)1,486 | | 1,412 | |

SHORT-TERM INVESTMENT (15.3%) | | | | | |

United States (15.3%) | | | | | |

Repurchase Agreement | | | | | |

J.P. Morgan Securities, Inc., 4.05%, dated 12/30/05, due 1/3/06, | | | | | |

repurchase price $15,927 | | | | | |

(Cost $15,920) | | (d)15,920 | | 15,920 | |

TOTAL INVESTMENTS (104.3%) | | | | | |

(Cost $92,022) | | | | 108,127 | |

LIABILITIES IN EXCESS OF OTHER ASSETS (-4.3%) | | | | (4,500) | |

NET ASSETS (100%) | | | | $ | 103,627 | |

| | | | | | | |

The accompanying notes are an integral part of the financial statements. | 3 |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Portfolio of Investments (Cont’d) | December 31, 2005 |

(a) | | Non-income producing security. |

(b) | | 144A Security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid. |

(c) | | Security was valued at fair value — At December 31, 2005, the Fund held $1,412,000 of fair valued securities, representing 1.4% of net assets. |

(d) | | Represents the Fund’s undivided interest in a joint repurchase agreement which has a total value of $1,000,707,000. The repurchase agreement was fully collateralized by U.S. government agency securities at the date of this Portfolio of Investments as follows: Federal Farm Credit Bank: 2.00% to 7.35%, due 1/11/06 to 10/25/33; Federal Home Loan Mortgage Corp.: 1.88% to 7.22%, due 2/9/06 to 7/15/32; Federal National Mortgage Association: 2.50% to 7.25%, due 2/15/06 to 11/15/30, which had a total value of $1,020,741,791. The investment in the repurchase agreement is through participation in a joint account with affiliated parties pursuant to exemptive relief received by the Fund from the SEC. |

(e) | | Security has been deemed illiquid — At December 31, 2005. |

ADR | | American Depositary Receipt |

GDR | | Global Depositary Receipt |

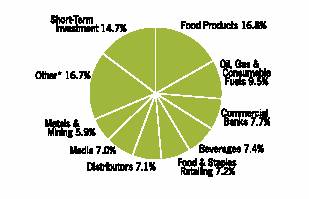

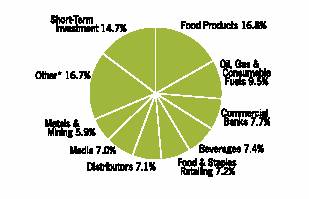

Graphic Presentation of Portfolio Holdings

The following graph depicts the Fund’s holdings by industry and/or security type, as a percentage of total investments.

* | Industries which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”. |

4 | The accompanying notes are an integral part of the financial statements. |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

| Financial Statements |

Statement of Assets and Liabilities | | December 31, 2005

(000) | |

Assets: | | | |

Investments, at Value (Cost $92,022) — Including Repurchase Agreement of $15,920 | | $ | 108,127 | |

Receivable for Investments Sold | | 24,651 | |

Dividends Receivable | | 21 | |

Interest Receivable | | 19 | |

Tax Reclaim Receivable | | 6 | |

Foreign Currency, at Value (Cost $@—) | | @— | |

Other Assets | | 3 | |

Total Assets | | 132,827 | |

Liabilities: | | | |

Payable For: | | | |

Dividends Declared | | 28,838 | |

Investment Advisory Fees | | 160 | |

Bank Overdraft Payable | | 72 | |

Custodian Fees | | 56 | |

Directors’ Fees and Expenses | | 11 | |

Administrative Fees | | 5 | |

Other Liabilities | | 58 | |

Total Liabilities | | 29,200 | |

Net Assets | | | |

Applicable to 3,586,281 Issued and Outstanding $0.01 | | | |

Par Value Shares (100,000,000 Shares Authorized) | | $ | 103,627 | |

Net Asset Value Per Share | | $ | 28.90 | |

Net Assets Consist of: | | | |

Common Stock | | $ | 36 | |

Paid-in Capital | | 75,218 | |

Undistributed Net Investment Income (Accumulated Net Investment Loss) | | (32) | |

Accumulated Net Realized Gain (Loss) | | 12,300 | |

Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Translations | | 16,105 | |

Net Assets | | $ | 103,627 | |

@ Amount is less than $500.

The accompanying notes are an integral part of the financial statements. | 5 |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

| Financial Statements |

Statement of Operations | | Year Ended

December 31, 2005

(000) | |

Investment Income | | | |

Dividends (Net of $78 of Foreign Taxes Withheld) | | $ | 974 | |

Interest | | 279 | |

Total Investment Income | | 1,253 | |

Expenses | | | |

Investment Advisory Fees (Note B) | | 1,830 | |

Custodian Fees (Note D) | | 326 | |

Administration Fees (Note C) | | 91 | |

Professional Fees | | 79 | |

Stockholder Reporting Expenses | | 51 | |

Stockholder Servicing Fees | | 14 | |

Directors’ Fees and Expenses | | 5 | |

Other Expenses | | 46 | |

Total Expenses | | 2,442 | |

Waiver of Administration Fees (Note C) | | (40 | ) |

Expense Offset (Note D) | | @— | |

Net Expenses | | 2,402 | |

Net Investment Income (Loss) | | (1,149 | ) |

Net Realized Gain (Loss) on: | | | |

Investments | | 42,382 | |

Foreign Currency Transactions | | (43 | ) |

Net Realized Gain (Loss) | | 42,339 | |

Change in Unrealized Appreciation (Depreciation) on: | | | |

Investments | | (7,025 | ) |

Foreign Currency Translations | | (13 | ) |

Change in Unrealized Appreciation (Depreciation) | | (7,038 | ) |

Total Net Realized Gain (Loss) and Change in Unrealized Appreciation (Depreciation) | | 35,301 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 34,152 | |

@ Amount is less than $500.

6 | The accompanying notes are an integral part of the financial statements. |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

| Financial Statements |

Statements of Changes in Net Assets | | Year Ended

December 31, 2005

(000) | | Year Ended

December 31, 2004

(000) | |

Increase (Decrease) in Net Assets | | | | | |

| | | | | |

Operations: | | | | | |

Net Investment Income (Loss) | | $ | (1,149 | ) | $ | (347 | ) |

Net Realized Gain (Loss) | | 42,339 | | 32,409 | |

Change in Unrealized Appreciation (Depreciation) | | (7,038 | ) | (404 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 34,152 | | 31,658 | |

Distributions from and/or in Excess of: | | | | | |

Net Realized Gains | | (37,791 | ) | (30,107 | ) |

Capital Share Transactions: | | | | | |

Shares Repurchased (20,430 shares in 2004) | | — | | (529 | ) |

Total Increase (Decrease) | | (3,639 | ) | 1,022 | |

Net Assets: | | | | | |

Beginning of Period | | 107,266 | | 106,244 | |

End of Period (Including Undistributed Net Investment Income (Accumulated Net Investment Loss) of $(32) and $(84), respectively) | | $ | 103,627 | | $ | 107,266 | |

The accompanying notes are an integral part of the financial statements. | 7 |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Selected Per Share Data and Ratios | Financial Highlights |

| | Year Ended December 31, | |

| | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

Net Asset Value, Beginning of Period | | $ | 29.91 | | $ | 29.46 | | $ | 20.40 | | $ | 18.55 | | $ | 15.80 | |

Net Investment Income (Loss) | | (0.32 | )† | (0.10 | )† | (0.06 | )† | (0.15 | )† | (0.21 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | 9.85 | | 8.91 | | 14.28 | | 2.45 | | 2.71 | |

Total from Investment Operations | | 9.53 | | 8.81 | | 14.22 | | 2.30 | | 2.50 | |

Distributions from and/or in Excess of: | | | | | | | | | | | |

Net Realized Gain | | (10.54 | ) | (8.39 | ) | (5.19 | ) | (0.58 | ) | — | |

Anti-Dilutive Effect of Share Repurchase Program | | — | | 0.03 | | 0.03 | | 0.13 | | 0.25 | |

Net Asset Value, End of Period | | $ | 28.90 | | $ | 29.91 | | $ | 29.46 | | $ | 20.40 | | $ | 18.55 | |

Per Share Market Value, End of Period | | $ | 34.59 | | $ | 27.63 | | $ | 25.49 | | $ | 17.17 | | $ | 15.93 | |

TOTAL INVESTMENT RETURN: | | | | | | | | | | | |

Market Value | | 67.53 | % | 43.21 | % | 76.64 | % | 11.17 | % | 30.71 | % |

Net Asset Value (1) | | 29.25 | % | 34.14 | % | 71.84 | % | 13.42 | % | 17.41 | % |

RATIOS, SUPPLEMENTAL DATA: | | | | | | | | | | | |

Net Assets, End of Period (Thousands) | | $ | 103,627 | | $ | 107,266 | | $ | 106,244 | | $ | 74,098 | | $ | 70,465 | |

Ratio of Expenses to Average Net Assets(2) | | 2.10 | % | 1.92 | % | 2.08 | % | 2.22 | % | 2.42 | % |

Ratio of Net Investment Income (Loss) to Average

Net Assets(2) | | (1.00 | )% | (0.30 | )% | (0.24 | )% | (0.70 | )% | (1.29 | )% |

Portfolio Turnover Rate | | 94 | % | 128 | % | 159 | % | 155 | % | 150 | % |

(2) Supplemental Information on the Ratios to Average Net Assets: | | | | | | | | | | | |

Ratios Before Expenses Waived by Administrator: | | | | | | | | | | | |

Ratio of Expenses to Average Net Assets | | 2.14 | % | 1.93 | % | N/A | | N/A | | N/A | |

Ratio of Net Investment Income (Loss) to Average Net Assets | | (1.04 | )% | (0.31 | )% | N/A | | N/A | | N/A | |

(1) Total investment return based on net asset value per share reflects the effects of changes in net asset value on the performance of the Fund during each period, and assumes dividends and distributions, if any, were reinvested. This percentage is not an indication of the performance of a stockholder’s investment in the Fund based on market value due to differences between the market price of the stock and the net asset value per share of the Fund.

† Per share amount is based on average shares outstanding.

8 | The accompanying notes are an integral part of the financial statements. |

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Notes to Financial Statements | December 31, 2005 |

Morgan Stanley Eastern Europe Fund, Inc. (the “Fund”) was incorporated in Maryland on February 3, 1994 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940 (the “1940 Act”), as amended. The Fund’s investment objective is long-term capital appreciation through investments primarily in equity securities.

A. Accounting Policies: The following significant accounting policies are in conformity with U.S. generally accepted accounting principles. Such policies are consistently followed by the Fund in the preparation of its financial statements. U.S. generally accepted accounting principles may require management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

1. Security Valuation: Securities listed on a foreign exchange are valued at their closing price. Unlisted securities and listed securities not traded on the valuation date for which market quotations are readily available are valued at the mean between the current bid and asked prices obtained from reputable brokers. Equity securities listed on a U.S. exchange are valued at the latest quoted sales price on the valuation date. Equity securities listed or traded on NASDAQ, for which market quotations are available, are valued at the NASDAQ Official Closing Price. Debt securities purchased with remaining maturities of 60 days or less are valued at amortized cost, if it approximates value.

All other securities and investments for which market values are not readily available, including restricted securities, and those securities for which it is inappropriate to determine prices in accordance with the aforementioned procedures, are valued at fair value as determined in good faith under procedures adopted by the Board of Directors (the “Directors”), although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s and, if necessary, available information concerning other securities in similar circumstances.

Most foreign markets close before the New York Stock Exchange (NYSE). Occasionally, developments that could affect the closing prices of securities and other assets may occur between the times at which valuations of such securities are determined (that is, close of the foreign market on which the securities trade) and the close of business on the NYSE. If these developments are expected to materially affect the value of the securities, the valuations may be adjusted to reflect the estimated fair value as of the close of the NYSE, as determined in good faith under procedures established by the Directors.

2. Repurchase Agreements: The Fund may enter into repurchase agreements under which the Fund lends excess cash and takes possession of securities with an agreement that the counterparty will repurchase such securities. In connection with transactions in repurchase agreements, a bank as custodian for the Fund takes possession of the underlying securities (collateral), with a market value at least equal to the amount of the repurchase transaction, including principal and accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to determine the adequacy of the collateral. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. In the event of default or bankruptcy by the counterparty to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

The Fund, along with other affiliated investment companies, may utilize a joint trading account for the purpose of entering into one or more repurchase agreements.

3. Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the mean of the bid and asked prices of such currencies against U.S. dollars last quoted by a major bank as follows:

• investments, other assets and liabilities at the prevailing rates of exchange on the valuation date;

• investment transactions and investment income at the financial statements or other available documents prevailing rates of exchange on the dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from

9

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Notes to Financial Statements (Cont’d) | December 31, 2005 |

changes in the market prices of the securities held at period end. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of securities sold during the period. Accordingly, realized and unrealized foreign currency gains (losses) due to securities transactions are included in the reported net realized and unrealized gains (losses) on investment transactions and balances.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from sales and maturities of foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of unrealized appreciation (depreciation) on investments and foreign currency translations in the Statement of Assets and Liabilities. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

A significant portion of the Fund’s net assets consist of securities of issuers located in emerging markets or which are denominated in foreign currencies. Changes in currency exchange rates will affect the value of and investment income from such securities. Securities in emerging markets involve certain considerations and risks not typically associated with investments in the United States. In addition to smaller size, lesser liquidity and greater volatility, certain securities’ markets in which the Fund may invest are less developed than the U.S. securities market and there is often substantially less publicly available information about these issuers. Further, emerging market issues may be subject to substantial governmental involvement in the economy and greater social, economic and political uncertainty. Accordingly, the price which the Fund may realize upon sale of securities in such markets may not be equal to its value as presented in the financial statements.

4. Derivatives: The Fund may use derivatives to achieve its investment objectives. The Fund may engage in transactions in futures contracts on foreign currencies, stock indices, as well as in options, swaps and structured notes. Consistent with the Fund’s investment objectives and policies, the Fund may use derivatives for non-hedging as well as hedging purposes.

Following is a description of derivative instruments that the Fund has utilized and their associated risks:

Foreign Currency Exchange Contracts: The Fund may enter into foreign currency exchange contracts generally to attempt to protect securities and related receivables and payables against changes in future foreign exchange rates and, in certain situations, to gain exposure to a foreign currency. A foreign currency exchange contract is an agreement between two parties to buy or sell currency at a set price on a future date. The market value of the contract will fluctuate with changes in currency exchange rates. The contract is marked-to-market daily and the change in market value is recorded by the Fund as unrealized gain or loss. The Fund records realized gains or losses when the contract is closed equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and is generally limited to the amount of unrealized gain on the contracts, if any, at the date of default. Risks may also arise from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

5. Other: Security transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses on the sale of investment securities are determined on the specific identified cost basis. Interest income is recognized on the accrual basis. Dividend income and distributions are recorded on the ex-dividend date (except certain dividends which may be recorded as soon as the Fund is informed of such dividends) net of applicable withholding taxes.

10

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Notes to Financial Statements (Cont’d) | December 31, 2005 |

B. Investment Advisory Fees: Morgan Stanley Investment Management Inc. (the “Adviser” or “MS Investment Management”) provides investment advisory services to the Fund under the terms of an Investment Advisory Agreement (the “Agreement”). Under the Agreement, the Adviser is paid a fee computed weekly and payable monthly at the annual rate of 1.60% of the Fund’s average weekly net assets.

C. Administration Fees: MS Investment Management also serves as Administrator to the Fund pursuant to an Administration Agreement. Under the Administration Agreement, the administration fee is 0.08% of the Fund’s average weekly net assets. MS Investment Management has agreed to limit the administration fee so that it will be no greater than the previous administration fee of 0.02435% of the Fund’s average weekly net assets plus $24,000 per annum. This waiver is voluntary and may be terminated at any time. For the year ended December 31, 2005, $40,000 of administration fees were waived pursuant to this arrangement. Under a sub-administration agreement between the Administrator and J.P. Morgan Investor Services Co. (“JPMIS”), a corporate affiliate of JPMorgan Chase Bank, N.A., JPMIS provides certain administrative services to the Fund. For such services, the Administrator pays JPMIS a portion of the fee the Administrator receives from the Fund. An employee of JPMIS is an officer of the Fund. Administration costs (including out-of-pocket expenses) incurred in the ordinary course of providing services under the agreement, except pricing services and extraordinary expenses, will be covered under the administration fee.

D. Custodian Fees: JPMorgan Chase Bank, N.A., (the “Custodian”) serves as Custodian for the Fund. The Custodian holds cash, securities, and other assets of the Fund as required by the 1940 Act. Custody fees are payable monthly based on assets held in custody, investment purchases and sales activity and account maintenance fees, plus reimbursement for certain out-of-pocket expenses.

The Fund has entered into an arrangement with its Custodian whereby credits realized on uninvested cash balances were used to offset a portion of the Fund’s expenses. These custodian credits are shown as “Expense Offset” on the Statement of Operations.

E. Federal Income Taxes: It is the Fund’s intention to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for Federal income taxes is required in the financial statements.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation as such income and/or gains are earned.

The tax character of distributions paid may differ from the character of distributions shown on the Statement of Changes in Net Assets due to short-term capital gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2005 and 2004 was as follows:

2005 Distributions

Paid From:

(000) | | 2004 Distributions

Paid From:

(000) | |

| | Long-term | | | | Long-term | |

Ordinary | | Capital | | Ordinary | | Capital | |

Income | | Gain | | Income | | Gain | |

$13,972 | | $23,819 | | $18,088 | | $12,019 | |

The amount and character of income and capital gain distributions to be paid by the Fund are determined in accordance with Federal income tax regulations, which may differ from U.S. generally accepted accounting principles. These book/tax differences are considered either temporary or permanent in nature.

Temporary differences are generally due to differing book and tax treatments for the timing of the recognition of gains and losses on certain investment transactions and the timing of the deductibility of certain expenses.

Permanent differences, primarily due to differing treatments of gains and losses related to foreign currency transactions and a reclass of the net operating loss, resulted in the following reclassifications among the components of net assets at December 31, 2005:

Increase (Decrease) | |

Accumulated

Undistributed

(Distributions in

Excess of) Net

Investment

Income (Loss)

(000) | | Accumulated

Net Realized

Gain (Loss)

(000) | | Paid-in

Capital

(000) | |

$ 1,201 | | $ (1,201) | | $ — | |

At December 31, 2005, the components of distributable earnings on a tax basis were as follows:

Undistributed

Ordinary Income

(000) | | Undistributed

Long-term Capital Gain

(000) | |

$ 10,044 | | $ 2,282 | |

At December 31, 2005, the U.S. Federal income tax cost basis of investments was $92,048,000 and, accordingly, net

11

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Notes to Financial Statements (Cont’d) | December 31, 2005 |

unrealized appreciation for U.S. Federal income tax purposes was $16,079,000 of which $18,032,000 related to appreciated securities and $1,953,000 related to depreciated securities.

Net capital, currency and passive foreign investment company losses incurred after October 31, and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year. For the year ended December 31, 2005, the Fund deferred to January 3, 2006, for U.S. Federal income tax purposes, post-October currency losses of $8,000.

F. Contractual Obligations: The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

G. Other: During the year ended December 31, 2005, the Fund made purchases and sales totaling approximately $104,531,000 and $149,954,000, respectively, of investment securities other than long-term U.S. Government securities and short-term investments. There were no purchases or sales of long-term U.S. Government securities.

During the year ended December 31, 2005, the Fund incurred $7,300 of brokerage commissions to Morgan Stanley & Co. Incorporated, an affiliated broker dealer.

Settlement and registration of securities transactions may be subject to significant risks not normally associated with investments in the United States. In certain markets, including Russia, ownership of shares is defined according to entries in the issuer’s share register. In Russia, there currently exists no central registration system and the share registrars may not be subject to effective state supervision. It is possible the Fund could lose its share registration through fraud, negligence or even mere oversight. In addition, shares being delivered for sales and cash being paid for purchases may be delivered before the exchange is complete. This may subject the Fund to further risk of loss in the event of a failure to complete the transaction by the counterparty.

On September 15, 1998, the Fund commenced a share repurchase program for purposes of enhancing stockholder value and reducing the discount at which the Fund’s shares traded from their net asset value. During the year ended December 31, 2005, the Fund did not repurchase any of its shares. Since the inception of the program, the Fund has repurchased 1,451,467 of its shares at an average discount of 16.86% from net asset value per share. The Fund expects to continue to repurchase its outstanding shares at such time and in such amounts as it believes will further the accomplishment of the foregoing objectives, subject to review by the Directors.

On December 15, 2005, the Officers of the Fund, pursuant to authority granted by the Directors declared a distribution of $8.0411 per share, derived from net realized gains, payable on January 6, 2006, to stockholders of record on December 23, 2005.

Federal Income Tax Information (Unaudited)

For the year ended December 31, 2005 qualified dividend income totaled $537,000.

For the year ended December 31, 2005, the Fund intends to pass through to stockholders foreign tax credits of approximately $123,000 and has derived gross income from sources within foreign countries in the amount of approximately $1,053,000.

The Fund hereby designates $23,819,000 as long-term capital gain dividends for the purpose of the dividend paid deduction on its federal income tax return.

Note to foreign stockholders: For the year ended December 31, 2005, the Fund designated and paid $12,355,000 as a qualified short-term capital gain dividend.

12

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Notes to Financial Statements (Cont’d) | December 31, 2005 |

Reporting to Stockholders (Unaudited)

Each Morgan Stanley Fund provides a complete schedule of portfolio holdings in its semi-annual and annual reports within 60 days of the end of the Fund’s second and fourth fiscal quarters by filing the schedule electronically with the Securities and Exchange Commission (SEC). The semi-annual reports are filed on Form N-CSRS and the annual reports are filed on Form N-CSR. Morgan Stanley also delivers the semi-annual and annual reports to Fund stockholders and makes these reports available on its public website, www.morganstanley.com\im. Each Morgan Stanley Fund also files a complete schedule of portfolio holdings with the SEC for the Fund’s first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to stockholders, nor are the reports posted to the Morgan Stanley public website. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC’s website, www.sec.gov. You may also review and copy them at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at 1(800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC’s email address (publicinfo@sec.gov) or by writing the Public Reference section of the SEC, Washington, DC 20549-0102.

Proxy Voting Policy and Procedures and Proxy Voting Record (Unaudited)

You may obtain a copy of the Fund’s Proxy Voting Policy and Procedures without charge, upon request, by calling toll free 1- 800-281-2715 or by visiting our website at www.morganstanley.com/im. It is also available on the Securities and Exchange Commission’s website at http:// www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 by calling 1-800-281- 2715. This information is also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

13

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Report of Independent Registered Public

Accounting Firm | December 31, 2005 |

To the Stockholders and Board of Directors of

Morgan Stanley Eastern Europe Fund, Inc.

We have audited the accompanying statement of assets and liabilities of Morgan Stanley Eastern Europe Fund, Inc. (the “Fund”), including the portfolio of investments, as of December 31, 2005, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits include consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2005, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Morgan Stanley Eastern Europe Fund, Inc. at December 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 13, 2006

14

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Director and Officer Information (unaudited) | December 31, 2005 |

Independent Directors:

Name, Age and Address of

Director | | Position(s)

Held with

Registrant | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s) During Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen

by

Director** | | Other Directorships Held by Director |

Michael Bozic (64)

c/o Kramer Levin Naftalis &

Frankel LLP

Counsel to the Independent

Directors

1177 Avenue of the

Americas

New York, NY 10036 | | Director | | Director since 2003 | | Private investor; Director or Trustee of the Retail Funds (since April 1994) and the Institutional Funds (since July 2003); formerly Vice Chairman of Kmart Corporation (December 1998-October 2000), Chairman and Chief Executive Officer of Levitz Furniture Corporation (November 1995-November 1998) and President and Chief Executive Officer of Hills Department Stores (May 1991-July 1995); formerly variously Chairman, Chief Executive Officer, President and Chief Operating Officer (1987-1991) of the Sears Merchandise Group of Sears Roebuck & Co. | | 197 | | Director of various business organizations. |

| | | | | | | | | | |

Edwin J. Garn (73)

1031 N. Chartwell Court

Salt Lake City, UT 84103 | | Director | | Director since 2003 | | Consultant; Director or Trustee of the Retail Funds (since January 1993) and the Institutional Funds (since July 2003); member of the Utah Regional Advisory Board of Pacific Corp. (Utility Company); formerly Managing Director of Summit Ventures LLC (2000-2004) (lobbying and consulting firm); United States Senator (R- Utah) (1974-1992) and Chairman, Senate Banking Committee (1980-1986), Mayor of Salt Lake City, Utah (1971- 1974), Astronaut, Space Shuttle Discovery (April 12-19, 1985), and Vice Chairman, Huntsman Corporation (Chemical Company). | | 197 | | Director of Franklin Covey (time management systems), BMW Bank of North America, Inc. (industrial loan corporation), Escrow Bank USA (industrial loan corporation), United Space Alliance (joint venture between Lockheed Martin and The Boeing Company) and Nuskin Asia Pacific (multi-level marketing); member of the board of various civic and charitable organizations. |

| | | | | | | | | | |

Wayne E. Hedien (71)

c/o Kramer Levin Naftalis &

Frankel LLP

Counsel to the Independent

Directors

1177 Avenue of the

Americas

New York, NY 10036 | | Director | | Director since 2003 | | Retired; Director or Trustee of the Retail Funds (since September 1997) and the Institutional Funds (since July 2003); formerly associated with the Allstate Companies (1966-1994), most recently as Chairman of The Allstate Corporation (March 1993-December 1994) and Chairman and Chief Executive Officer of its wholly-owned subsidiary, Allstate Insurance Company (July 1989- December 1994). | | 197 | | Director of the PMI Group Inc. (private mortgage insurance); Director and Vice Chairman of The Field Museum of Natural History; director of various other business and charitable organizations. |

| | | | | | | | | | |

Dr. Manuel H. Johnson (56)

c/o Johnson Smick

Group, Inc.

888 16th Street, NW

Suite 740

Washington, D.C. 20006 | | Director | | Director since 2003 | | Senior Partner, Johnson Smick International, Inc., a consulting firm; Chairman of the Audit Committee and Director or Trustee of the Retail Funds (since July 1991) and the Institutional Funds (since July 2003); Co- Chairman and a founder of the Group of Seven Council (G7C), an international economic commission; formerly Vice Chairman of the Board of Governors of the Federal Reserve System and Assistant Secretary of the U.S. Treasury. | | 197 | | Director of NVR, Inc. (home construction), Director of KFX Energy; Director of RBS Greenwich Capital Holdings (financial holdings company). |

| | | | | | | | | | |

Joseph J. Kearns (63)

c/o Kearns & Associates

LLC

PMB754

23852 Pacific Coast

Highway

Malibu, CA 90265 | | Director | | Director since 2001 | | President, Kearns & Associates LLC (Investment Consulting); Deputy Chairman of the Audit Committee and Director or Trustee of the Retail Funds (since July 2003) and the Institutional Funds (since August 1994); previously Chairman of the Audit Committee of the Institutional Funds (October 2001- July 2003); formerly CFO of the J. Paul Getty Trust. | | 198 | | Director of Electro Rent Corporation (equipment leasing), The Ford Family Foundation and the UCLA Foundation. |

| | | | | | | | | | |

Michael E. Nugent (69)

c/o Triumph Capital, L.P.

445 Park Avenue

New York, NY 10022 | | Director | | Director since 2001 | | General Partner of Triumph Capital, L.P., a private investment partnership; Chairman of the Insurance Committee and Director or Trustee of the Retail Funds (since July 1991) and the Institutional Funds (since July 2001); formerly Vice President, Bankers Trust Company and BT Capital Corporation (1984-1988). | | 197 | | None. |

| | | | | | | | | | |

Fergus Reid (73)

c/o Lumelite Plastics

Corporation

85 Charles Coleman Blvd.

Pawling, NY 12564 | | Director | | Director since 2000 | | Chairman of Lumelite Plastics Corporation; Chairman of the Governance Committee and Director or Trustee of the Retail Funds (since July 2003) and the Institutional Funds (since June 1992). | | 198 | | Trustee and Director of certain investment companies in the JP Morgan Funds complex managed by JPMorgan Investment Management

Inc. |

15

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Director and Officer Information (Cont’d) | December 31, 2005 |

Interested Directors:

Name, Age and Address of

Director | | Position(s)

Held with

Registrant | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s) During Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen

by

Director** | | Other Directorships Held by Director |

Charles A. Fiumefreddo (72)

c/o Morgan Stanley Funds

Harborside Financial Center

Plaza Two

Jersey City, NJ 07311 | | Chairman of the Board and Director | | Chairman and Director since 2003 | | Chairman and Director or Trustee of the Retail Funds (since July 1991) and the Institutional Funds (since July 2003); formerly Chief Executive Officer of the Retail Funds (until September 2002). | | 197 | | None. |

| | | | | | | | | | |

James F. Higgins (57)

c/o Morgan Stanley Funds

Harborside Financial Center

Plaza Two

Jersey City, NJ 07311 | | Director | | Director since 2003 | | Director or Trustee of the Retail Funds (since June 2000) and the Institutional Funds (since July 2003); Senior Advisor of Morgan Stanley (since August 2000); Director of Morgan Stanley Distributors Inc. and Dean Witter Realty Inc.; previously President and Chief Operating Officer of the Private Client Group of Morgan Stanley (May 1999-August 2000), and President and Chief Operating Officer of Individual Securities of Morgan Stanley (February 1997-May 1999). | | 197 | | Director of AXA Financial, Inc. and The Equitable Life Assurance Society of the United States (financial services). |

* | Each Director serves an indefinite term, until his or her successor is elected. |

** | The Fund Complex includes all funds advised by Morgan Stanley Investment Management Inc. and funds that have an investment advisor that is an affiliated entity of Morgan Stanley Investment Management Inc. (including, but not limited to, Morgan Stanley Investments LP and Morgan Stanley Investment Advisors Inc.). |

Officers:

Name, Age and Address of Executive Officer | | Position(s) Held

with Registrant | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) During Past 5 Years |

Ronald E. Robison (66)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | President and Principal Executive Officer | | President (since September 2005) and Principal Executive Officer (since July 2003) | | President (since September 2005) and Principal Executive Officer of funds in the Fund complex (since May 2003); Managing Director of Morgan Stanley & Co. Incorporated, Managing Director of Morgan Stanley; Managing Director, Chief Administrative Officer and Director of Morgan Stanley Investment Advisors Inc. and Morgan Stanley Services Company Inc.; Director of Morgan Stanley Trust; Managing Director and Director of Morgan Stanley Distributors Inc.; Executive Vice President and Principal Executive Officer of the Retail Funds (since April 2003) and the Institutional Funds (since July 2003); previously President and Director of the Institutional Funds (March 2001 – July 2003) and Chief Global Operations Officer and Managing Director of Morgan Stanley Investment Management Inc. |

| | | | | | |

J. David Germany (51)

Morgan Stanley Investment Management Ltd.

25 Cabot Square

Canary Wharf,

London, United Kingdom E144QA | | Vice President | | Vice President since February 2006 | | Managing Director and Chief Investment Officer - Global Fixed Income of Morgan Stanley Investment Management Inc., Morgan Stanley Investment Advisors Inc., and Van Kampen Asset Management. Managing Director and Director of Morgan Stanley Investment Management Ltd. Vice President (since February 2006) of the Morgan Stanley Retail Funds and Morgan Stanley Institutional Funds. |

| | | | | | |

Dennis F. Shea (52)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Vice President | | Vice President since February 2006 | | Managing Director and Chief Investment Officer - Global Equity of Morgan Stanley Investment Advisors Inc., Morgan Stanley Investment Management Inc. and Van Kampen Asset Management. Vice President (since February 2006) of the Morgan Stanley Retail Funds and Morgan Stanley Institutional Funds. Previously, Managing Director and Director of Global Equity Research at Morgan Stanley. |

16

| Morgan Stanley Eastern Europe Fund, Inc. |

| |

Director and Officer Information (Cont’d) | December 31, 2005 |

Officers: (cont’d)

Name, Age and Address of Executive Officer | | Position(s) Held with Registrant | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) During Past 5 Years |

Barry Fink (50)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Vice President | | Vice President since 2003 | | General Counsel (since May 2000) and Managing Director (since December 2000) of Morgan Stanley Investment Management; Managing Director (since December 2000) of Morgan Stanley Investment Advisors Inc. and Morgan Stanley Services Company Inc.; Vice President of the Retail Funds; Assistant Secretary of Morgan Stanley DW Inc.; Vice President of the Institutional Funds (since July 2003); Managing Director, Secretary and Director of Morgan Stanley Distributors Inc.; previously Secretary of the Retail Funds and General Counsel (February 1997- April 2004) of the Retail Funds; previously Secretary (1997-2006) and Director (1997-2005) of the Morgan Stanley Investment Advisors Inc. and the Morgan Stanley Services Company Inc.; and Secretary and Director of Morgan Stanley Distributors Inc. (1997-2005). |

| | | | | | |

Amy R. Doberman (43)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Vice President | | Vice President since July 2004 | | Managing Director and General Counsel, U.S. Investment Management; Managing Director (since July 2004) and Secretary (since February 2006) of Morgan Stanley Investment Management Inc. and Morgan Stanley Investment Advisors Inc., Managing Director and Secretary of Morgan Stanley Distributors Inc. (since February 2006); Managing Director (since February 2005) and Secretary (since February 2006) of Morgan Stanley Services Company Inc.; Vice President of the Institutional and Retail Funds (since July 2004); various positions with the Van Kampen Funds and certain of their service providers; previously, Managing Director and General Counsel – Americas, UBS Global Asset Management (July 2000-July 2004). |

| | | | | | |

Carsten Otto (42)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Chief Compliance Officer | | Chief Compliance Officer since 2004 | | Managing Director and U.S. Director of Compliance for Morgan Stanley Investment Management (since October 2004); Managing Director of Morgan Stanley Investment Advisors Inc. and Morgan Stanley Investment Management Inc.; formerly Assistant Secretary and Assistant General Counsel of the Morgan Stanley Retail Funds. |

| | | | | | |

Stefanie V. Chang (39)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Vice President | | Vice President since 2001 | | Executive Director of Morgan Stanley & Co. Incorporated, Morgan Stanley Investment Management Inc. and Morgan Stanley Investment Advisors Inc.; Vice President of the Institutional Funds (since December 1997) and the Retail Funds (since July 2003); various positions with the Van Kampen Funds; formerly practiced law with the New York law firm of Rogers & Wells (now Clifford Chance US LLP). |

| | | | | | |

James W. Garrett (37)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Treasurer and Chief Financial

Officer | | Treasurer since 2002 and Chief Financial Officer since 2003 | | Executive Director of Morgan Stanley & Co. Incorporated and Morgan Stanley Investment Management Inc.; Treasurer and Chief Financial Officer of the Institutional Funds; previously with PriceWaterhouse LLP (now PriceWaterhouseCoopers LLP). |

| | | | | | |

Michael J. Leary (40)

J.P. Morgan Investor Services Co.

73 Tremont Street

Boston, MA 02108 | | Assistant Treasurer | | Assistant Treasurer since

2003 | | Director and Vice President of Fund Administration, J.P. Morgan Investor Services Co. (formerly Chase Global Funds Company); formerly Audit Manager at Ernst & Young LLP. |

| | | | | | |

Mary E. Mullin (38)

Morgan Stanley Investment Management Inc.

1221 Avenue of the Americas

New York, NY 10020 | | Secretary | | Secretary since 2001 | | Executive Director of Morgan Stanley & Co. Incorporated, Morgan Stanley Investment Management Inc. and Morgan Stanley Investment Advisors Inc.; Secretary of the Institutional Funds and (since July 2003) the Retail Funds; formerly practiced law with the New York law firms of McDermott, Will & Emery and Skadden, Arps, Slate, Meagher & Flom LLP. |

* | Each Officer serves an indefinite term, until his or her successor is elected. |

| | | | | | | |

In accordance with Section 303A. 12(a) of the New York Stock Exchange Listed Company Manual, the Fund’s Annual CEO Certification certifying as to compliance with NYSE’s Corporate Governance Listing Standards was submitted to the Exchange on July 19, 2005.

The Fund’s Principal Executive Officer and Principal Financial Officer Certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 were filed with the Fund’s N-CSR and are available on the Securities and Exchange Commission’s Website at http://www.sec.gov.

17

| Morgan Stanley Eastern Europe Fund, Inc. |

Dividend Reinvestment and Cash Purchase Plan

Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”), each stockholder will be deemed to have elected, unless American Stock Transfer & Trust Company (the “Plan Agent”) is otherwise instructed by the stockholder in writing, to have all distributions automatically reinvested in Fund shares. Participants in the Plan have the option of making additional voluntary cash payments to the Plan Agent, annually, in any amount from $100 to $3,000, for investment in Fund shares.

Dividend and capital gain distributions will be reinvested on the reinvestment date in full and fractional shares. If the market price per share equals or exceeds net asset value per share on the reinvestment date, the Fund will issue shares to participants at net asset value or, if net asset value is less than 95% of the market price on the reinvestment date, shares will be issued at 95% of the market price. If net asset value exceeds the market price on the reinvestment date, participants will receive shares valued at market price. The Fund may purchase shares of its Common Stock in the open market in connection with dividend reinvestment requirements at the discretion of the Board of Directors. Should the Fund declare a dividend or capital gain distribution payable only in cash, the Plan Agent will purchase Fund shares for participants in the open market as agent for the participants.

The Plan Agent’s fees for the reinvestment of dividends and distributions will be paid by the Fund. However, each participant’s account will be charged a pro rata share of brokerage commissions incurred on any open market purchases effected on such participant’s behalf. A participant will also pay brokerage commissions incurred on purchases made by voluntary cash payments. Although stockholders in the Plan may receive no cash distributions, participation in the Plan will not relieve participants of any income tax which may be payable on such dividends or distributions.

In the case of stockholders, such as banks, brokers or nominees, that hold shares for others who are the beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the stockholder as representing the total amount registered in the stockholder’s name and held for the account of beneficial owners who are participating in the Plan.

Stockholders who do not wish to have distributions automatically reinvested should notify the Plan Agent in writing. There is no penalty for non-participation or withdrawal from the Plan, and stockholders who have previously withdrawn from the Plan may rejoin at any time. Requests for additional information or any correspondence concerning the Plan should be directed to the Plan Agent at:

Morgan Stanley Eastern Europe Fund, Inc.

American Stock Transfer & Trust Company

Dividend Reinvestment and Cash Purchase Plan

59 Maiden Lane

New York, New York 10038

1(800) 278-4353

18

Morgan Stanley Eastern Europe Fund, Inc.

Directors | | |

Charles A. Fiumefreddo | | Dennis F. Shea |

| | Vice President |

Michael Bozic | | |

Edwin J. Garn | | Barry Fink |

| | Vice President |

Wayne E. Hedien | | |

James F. Higgins | | Amy R. Doberman |

| | Vice President |

Dr. Manuel H. Johnson | | |

Joseph J. Kearns | | Stefanie V. Chang |

| | Vice President |

Michael Nugent | | |

Fergus Reid | | James W. Garrett |

| | Treasurer and Chief |

Officers | | Financial Officer |

Charles A. Fiumefreddo | | |

Chairman of the Board | | Carsten Otto |

| | Chief Compliance Officer |

Ronald E. Robison | | |

President and Principal | | Michael J. Leary |

Executive Officer | | Assistant Treasurer |

| | |

J. David Germany | | Mary E. Mullin |

Vice President | | Secretary |

Investment Adviser and Administrator |

Morgan Stanley Investment Management Inc. |

1221 Avenue of the Americas |

New York, New York 10020 |

|

Custodian |

JPMorgan Chase Bank, N.A. |

270 Park Avenue |

New York, New York 10017 |

|

Stockholder Servicing Agent |

American Stock Transfer & Trust Company |

59 Maiden Lane |

New York, New York 10038 |

1 (800) 278-4353 |

|

Legal Counsel |

Clifford Chance US LLP |

31 West 52nd Street |

New York, New York 10019 |

|

Independent Registered Public Accounting Firm |

Ernst & Young LLP |

200 Clarendon Street |

Boston, Massachusetts 02116 |

For additional Fund information, including the Fund’s net asset value per share and information regarding the investments comprising the Fund’s portfolio, please call 1(800) 221-6726 or visit our website at www.morganstanley.com/im.

© 2006 Morgan Stanley

IS06-00158I-Y12/05

Item 2. Code of Ethics.

(a) The Fund has adopted a code of ethics (the “Code of Ethics”) that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Fund or a third party.

(b) No information need be disclosed pursuant to this paragraph.

(c) The Fund has amended its Code of Ethics during the period covered by the shareholder report presented in Item 1 hereto to delete from the end of the following paragraph on page 2 of the Code the phrase “to the detriment of the Fund.”:

“Each Covered Officer must not use his personal influence or personal relationship improperly to influence investment decisions or financial reporting by the Fund whereby the Covered Officer would benefit personally (directly or indirectly).”

Additionally, Exhibit B was amended to remove Mitchell M. Merin as a covered officer.

(d) Not applicable.

(e) Not applicable.

(f)

(1) The Fund’s Code of Ethics is attached hereto as Exhibit A.

(2) Not applicable.

(3) Not applicable.

Item 3. Audit Committee Financial Expert.

The Fund’s Board of Directors has determined that it has two “audit committee financial experts” serving on its audit committee, each of whom are “independent” Directors: Dr. Manuel H. Johnson and Joseph J. Kearns. Under applicable securities laws, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Directors in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services.

(a)(b)(c)(d) and (g). Based on fees billed for the periods shown:

2005

| | Registrant | | Covered Entities(1) | |

Audit Fees | | $ | 70,970 | | N/A | |

| | | | | |

Non-Audit Fees | | | | | |

Audit-Related Fees | | $ | | $ | 235,000 | (2) |

Tax Fees | | $ | 2,835 | (3) | $ | 52,799 | (4) |

All Other Fees | | $ | | $ | 956,268 | (5) |

Total Non-Audit Fees | | $ | 2,835 | | $ | 1,244,067 | |

| | | | | |

Total | | $ | 73,805 | | $ | 1,244,067 | |

2004

| | Registrant | | Covered Entities(1) | |

Audit Fees | | $ | 67,590 | | N/A | |

| | | | | |

Non-Audit Fees | | | | | |

Audit-Related Fees | | $ | | $ | 115,000 | (2) |

Tax Fees | | $ | 2,700 | (3) | $ | 100,829 | (6) |

All Other Fees | | $ | | $ | 60,985 | (7) |

Total Non-Audit Fees | | $ | 2,700 | | $ | 276,814 | |

| | | | | |

Total | | $ | 70,290 | | $ | 276,814 | |

N/A- Not applicable, as not required by Item 4.

(1) Covered Entities include the Adviser (excluding sub-advisors) and any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Registrant.

(2) Audit-Related Fees represent assurance and related services provided that are reasonably related to the performance of the audit of the financial statements of the Covered Entities and funds advised by the Adviser or its affiliates, specifically attestation services provided in connection with a SAS 70 Report.

(3) Tax Fees represent tax advice and compliance services provided in connection with the review of the Registrant’s tax returns.

(4) Tax Fees represent tax advice services provided to Covered Entities, including research and identification of PFIC entities.

(5) All Other Fees represent attestation services provided in connection with performance presentation standards and a compliance review project performed.

(6) Tax Fees represent tax advice services provided to Covered Entities, including assistance in obtaining a private letter ruling and the research and identification of PFIC entit ies.

(7) All Other Fees represent attestation services provided in connection with performance presentation standards.

(e)(1) The audit committee’s pre-approval policies and procedures are as follows:

APPENDIX A

AUDIT COMMITTEE

AUDIT AND NON-AUDIT SERVICES

PRE-APPROVAL POLICY AND PROCEDURES

OF THE

MORGAN STANLEY RETAIL AND INSTITUTIONAL FUNDS

AS ADOPTED AND AMENDED JULY 23, 2004,(1)

1. Statement of Principles

The Audit Committee of the Board is required to review and, in its sole discretion, pre-approve all Covered Services to be provided by the Independent Auditors to the Fund and Covered Entities in order to assure that services performed by the Independent Auditors do not impair the auditor’s independence from the Fund.

The SEC has issued rules specifying the types of services that an independent auditor may not provide to its audit client, as well as the audit committee’s administration of the engagement of the independent auditor. The SEC’s rules establish two different approaches to pre-approving services, which the SEC considers to be equally valid. Proposed services either: may be pre-approved without consideration of specific case-by-case services by the Audit Committee (“general pre-approval”); or require the specific pre-approval of the Audit Committee or its delegate (“specific pre-approval”). The Audit Committee believes that the combination of these two approaches in this Policy will result in an effective and efficient procedure to pre-approve services performed by the Independent Auditors. As set forth in this Policy, unless a type of service has received general pre-approval, it will require specific pre-approval by the Audit Committee (or by any member of the Audit Committee to which pre-approval authority has been delegated)

(1) This Audit Committee Audit and Non-Audit Services Pre-Approval Policy and Procedures (the “Policy”), adopted as of the date above, supersedes and replaces all prior versions that may have been adopted from time to time.

if it is to be provided by the Independent Auditors. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval by the Audit Committee.

The appendices to this Policy describe the Audit, Audit-related, Tax and All Other services that have the general pre-approval of the Audit Committee. The term of any general pre-approval is 12 months from the date of pre-approval, unless the Audit Committee considers and provides a different period and states otherwise. The Audit Committee will annually review and pre-approve the services that may be provided by the Independent Auditors without obtaining specific pre-approval from the Audit Committee. The Audit Committee will add to or subtract from the list of general pre-approved services from time to time, based on subsequent determinations.

The purpose of this Policy is to set forth the policy and procedures by which the Audit Committee intends to fulfill its responsibilities. It does not delegate the Audit Committee’s responsibilities to pre-approve services performed by the Independent Auditors to management.

The Fund’s Independent Auditors have reviewed this Policy and believes that implementation of the Policy will not adversely affect the Independent Auditors’ independence.

2. Delegation

As provided in the Act and the SEC’s rules, the Audit Committee may delegate either type of pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

3. Audit Services

The annual Audit services engagement terms and fees are subject to the specific pre-approval of the Audit Committee. Audit services include the annual financial statement audit and other procedures required to be performed by the Independent Auditors to be able to form an opinion on the Fund’s financial statements. These other procedures include information systems and procedural reviews and testing performed in order to understand and place reliance on the systems of internal control, and consultations relating to the audit. The Audit Committee will approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope, Fund structure or other items.

In addition to the annual Audit services engagement approved by the Audit Committee, the Audit Committee may grant general pre-approval to other Audit services, which are those services that only the Independent Auditors reasonably can provide. Other Audit services may include statutory audits and services associated with SEC registration statements (on Forms N-1A, N-2, N-3, N-4, etc.), periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings.

The Audit Committee has pre-approved the Audit services in Appendix B.1. All other Audit services not listed in Appendix B.1 must be specifically pre-approved by the Audit

Committee (or by any member of the Audit Committee to which pre-approval has been delegated).

4. Audit-related Services

Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of the Fund’s financial statements and, to the extent they are Covered Services, the Covered Entities or that are traditionally performed by the Independent Auditors. Because the Audit Committee believes that the provision of Audit-related services does not impair the independence of the auditor and is consistent with the SEC’s rules on auditor independence, the Audit Committee may grant general pre-approval to Audit-related services. Audit-related services include, among others, accounting consultations related to accounting, financial reporting or disclosure matters not classified as “Audit services”; assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities; agreed-upon or expanded audit procedures related to accounting and/or billing records required to respond to or comply with financial, accounting or regulatory reporting matters; and assistance with internal control reporting requirements under Forms N-SAR and/or N-CSR.

The Audit Committee has pre-approved the Audit-related services in Appendix B.2. All other Audit-related services not listed in Appendix B.2 must be specifically pre-approved by the Audit Committee (or by any member of the Audit Committee to which pre-approval has been delegated).

5. Tax Services

The Audit Committee believes that the Independent Auditors can provide Tax services to the Fund and, to the extent they are Covered Services, the Covered Entities, such as tax compliance, tax planning and tax advice without impairing the auditor’s independence, and the SEC has stated that the Independent Auditors may provide such services.

Pursuant to the preceding paragraph, the Audit Committee has pre-approved the Tax Services in Appendix B.3. All Tax services in Appendix B.3 must be specifically pre-approved by the Audit Committee (or by any member of the Audit Committee to which pre-approval has been delegated).

6. All Other Services

The Audit Committee believes, based on the SEC’s rules prohibiting the Independent Auditors from providing specific non-audit services, that other types of non-audit services are permitted. Accordingly, the Audit Committee believes it may grant general pre-approval to those permissible non-audit services classified as All Other services that it believes are routine and recurring services, would not impair the independence of the auditor and are consistent with the SEC’s rules on auditor independence.

The Audit Committee has pre-approved the All Other services in Appendix B.4. Permissible All Other services not listed in Appendix B.4 must be specifically pre-approved by the Audit Committee (or by any member of the Audit Committee to which pre-approval has been delegated).

7. Pre-Approval Fee Levels or Budgeted Amounts

Pre-approval fee levels or budgeted amounts for all services to be provided by the Independent Auditors will be established annually by the Audit Committee. Any proposed services exceeding these levels or amounts will require specific pre-approval by the Audit Committee. The Audit Committee is mindful of the overall relationship of fees for audit and non-audit services in determining whether to pre-approve any such services.

8. Procedures

All requests or applications for services to be provided by the Independent Auditors that do not require specific approval by the Audit Committee will be submitted to the Fund’s Chief Financial Officer and must include a detailed description of the services to be rendered. The Fund’s Chief Financial Officer will determine whether such services are included within the list of services that have received the general pre-approval of the Audit Committee. The Audit Committee will be informed on a timely basis of any such services rendered by the Independent Auditors. Requests or applications to provide services that require specific approval by the Audit Committee will be submitted to the Audit Committee by both the Independent Auditors and the Fund’s Chief Financial Officer, and must include a joint statement as to whether, in their view, the request or application is consistent with the SEC’s rules on auditor independence.

The Audit Committee has designated the Fund’s Chief Financial Officer to monitor the performance of all services provided by the Independent Auditors and to determine whether such services are in compliance with this Policy. The Fund’s Chief Financial Officer will report to the Audit Committee on a periodic basis on the results of its monitoring. Both the Fund’s Chief Financial Officer and management will immediately report to the chairman of the Audit Committee any breach of this Policy that comes to the attention of the Fund’s Chief Financial Officer or any member of management.

9. Additional Requirements

The Audit Committee has determined to take additional measures on an annual basis to meet its responsibility to oversee the work of the Independent Auditors and to assure the auditor’s independence from the Fund, such as reviewing a formal written statement from the Independent Auditors delineating all relationships between the Independent Auditors and the Fund, consistent with Independence Standards Board No. 1, and discussing with the Independent Auditors its methods and procedures for ensuring independence.

10. Covered Entities

Covered Entities include the Fund’s investment adviser(s) and any entity controlling, controlled by or under common control with the Fund’s investment adviser(s) that provides ongoing services to the Fund(s). Beginning with non-audit service contracts entered into on or after May 6, 2003, the Fund’s audit committee must pre-approve non-audit services provided not only to the Fund but also to the Covered Entities if the engagements relate directly to the operations and financial reporting of the Fund. This list of Covered Entities would include:

Morgan Stanley Retail Funds

Morgan Stanley Investment Advisors Inc.

Morgan Stanley & Co. Incorporated

Morgan Stanley DW Inc.

Morgan Stanley Investment Management Inc.

Morgan Stanley Investment Management Limited

Morgan Stanley Investment Management Private Limited

Morgan Stanley Asset & Investment Trust Management Co., Limited

Morgan Stanley Investment Management Company

Van Kampen Asset Management

Morgan Stanley Services Company, Inc.

Morgan Stanley Distributors Inc.

Morgan Stanley Trust FSB

Morgan Stanley Institutional Funds

Morgan Stanley Investment Management Inc.

Morgan Stanley Investment Advisors Inc.

Morgan Stanley Investment Management Limited