UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08340

Greater India Portfolio

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

June 30, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

Greater India Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about the Greater India Portfolio (the "Fund") for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php and selecting Greater India Fund. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Greater India Portfolio | $50 | 0.93% |

Key Fund Statistics

| Total Net Assets | $290,180,297 |

| # of Portfolio Holdings | 64 |

| Portfolio Turnover Rate | 15% |

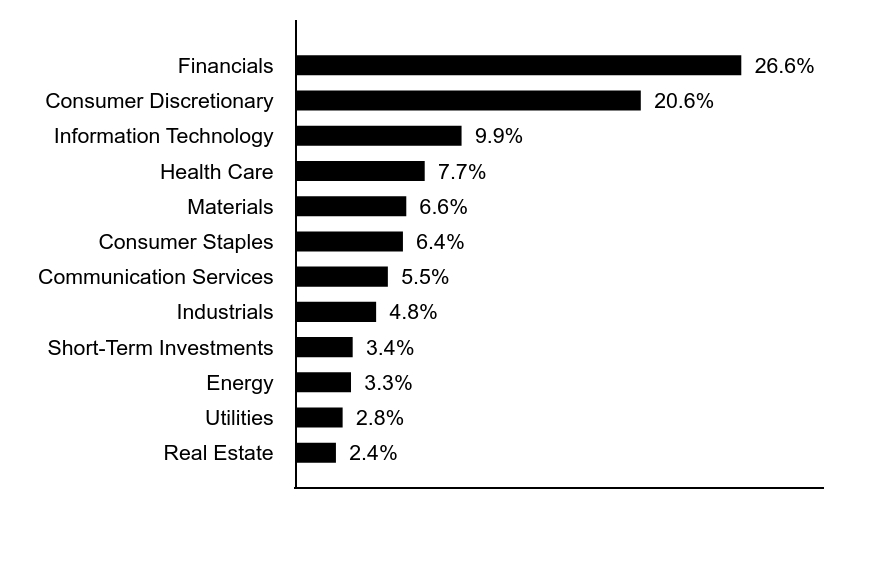

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

| Real Estate | 2.4% |

| Utilities | 2.8% |

| Energy | 3.3% |

| Short-Term Investments | 3.4% |

| Industrials | 4.8% |

| Communication Services | 5.5% |

| Consumer Staples | 6.4% |

| Materials | 6.6% |

| Health Care | 7.7% |

| Information Technology | 9.9% |

| Consumer Discretionary | 20.6% |

| Financials | 26.6% |

Top Ten Holdings (% of total investments)Footnote Referencea

| ICICI Bank Ltd. | 8.2% |

| Infosys Ltd. | 5.5% |

| Bharti Airtel Ltd. | 4.4% |

| Mahindra & Mahindra Ltd. | 4.3% |

| Axis Bank Ltd. | 4.1% |

| Bajaj Finance Ltd. | 3.4% |

| Reliance Industries Ltd. | 3.3% |

| Sun Pharmaceutical Industries Ltd. | 3.1% |

| Trent Ltd. | 3.1% |

| Zomato Ltd. | 2.6% |

| Total | 42.0% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php and select Greater India Fund.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Gr. India Port.-TSR-SAR

(b) Not applicable.

Item 2. Code of Ethics

Not required in this filing.

Item 3. Audit Committee Financial Expert

Not required in this filing.

Item 4. Principal Accountant Fees and Services

Not required in this filing.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| (b) | Not applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

| Common Stocks — 101.4% |

| Security | Shares | Value | |

| India — 100.5% | |||

| Automobile Components — 3.2% | |||

| Samvardhana Motherson International Ltd. | 1,987,466 | $ 4,541,383 | |

| Sona BLW Precision Forgings Ltd.(1) | 296,815 | 2,276,170 | |

| Tube Investments of India Ltd. | 48,603 | 2,474,544 | |

| $ 9,292,097 | |||

| Automobiles — 7.9% | |||

| Mahindra & Mahindra Ltd. | 381,246 | $ 13,086,337 | |

| Maruti Suzuki India Ltd. | 45,783 | 6,596,260 | |

| TVS Motor Co. Ltd. | 111,342 | 3,146,692 | |

| $ 22,829,289 | |||

| Banks — 15.6% | |||

| AU Small Finance Bank Ltd.(1) | 381,281 | $ 3,061,073 | |

| Axis Bank Ltd. | 832,439 | 12,600,996 | |

| Bank of Baroda | 737,263 | 2,426,454 | |

| ICICI Bank Ltd. | 1,737,370 | 24,957,677 | |

| IDFC First Bank Ltd.(2) | 2,209,801 | 2,175,711 | |

| $ 45,221,911 | |||

| Building Products — 0.6% | |||

| Kajaria Ceramics Ltd. | 109,134 | $ 1,851,964 | |

| $ 1,851,964 | |||

| Capital Markets — 1.0% | |||

| 360 ONE WAM Ltd. | 162,787 | $ 1,920,516 | |

| Angel One Ltd. | 30,357 | 948,301 | |

| $ 2,868,817 | |||

| Chemicals — 0.5% | |||

| Navin Fluorine International Ltd. | 31,401 | $ 1,343,580 | |

| $ 1,343,580 | |||

| Construction Materials — 1.1% | |||

| Shree Cement Ltd. | 9,845 | $ 3,286,623 | |

| $ 3,286,623 | |||

| Consumer Finance — 5.7% | |||

| Bajaj Finance Ltd. | 121,393 | $ 10,350,494 | |

| Security | Shares | Value | |

| Consumer Finance (continued) | |||

| Cholamandalam Investment & Finance Co. Ltd. | 257,020 | $ 4,366,950 | |

| Five-Star Business Finance Ltd.(2) | 204,755 | 1,942,955 | |

| $ 16,660,399 | |||

| Consumer Staples Distribution & Retail — 0.3% | |||

| Medplus Health Services Ltd.(2) | 124,280 | $ 1,015,548 | |

| $ 1,015,548 | |||

| Electrical Equipment — 1.9% | |||

| KEI Industries Ltd. | 41,349 | $ 2,185,783 | |

| Suzlon Energy Ltd.(2) | 5,044,050 | 3,183,189 | |

| $ 5,368,972 | |||

| Financial Services — 2.4% | |||

| Jio Financial Services Ltd.(2) | 1,028,318 | $ 4,402,205 | |

| REC Ltd. | 386,356 | 2,432,947 | |

| $ 6,835,152 | |||

| Food Products — 1.9% | |||

| Tata Consumer Products Ltd. | 420,029 | $ 5,520,730 | |

| $ 5,520,730 | |||

| Health Care Providers & Services — 1.9% | |||

| Apollo Hospitals Enterprise Ltd. | 74,077 | $ 5,486,868 | |

| $ 5,486,868 | |||

| Hotels, Restaurants & Leisure — 3.2% | |||

| Devyani International Ltd.(2) | 611,229 | $ 1,205,835 | |

| Zomato Ltd.(2) | 3,342,381 | 7,990,548 | |

| $ 9,196,383 | |||

| Household Durables — 2.7% | |||

| Dixon Technologies India Ltd. | 39,202 | $ 5,620,198 | |

| Whirlpool of India Ltd. | 89,820 | 2,135,364 | |

| $ 7,755,562 | |||

| Independent Power and Renewable Electricity Producers — 3.0% | |||

| NHPC Ltd. | 2,114,326 | $ 2,544,738 | |

| NTPC Ltd. | 1,337,796 | 6,085,054 | |

| $ 8,629,792 | |||

| Industrial Conglomerates — 1.5% | |||

| Siemens Ltd. | 48,164 | $ 4,447,823 | |

| $ 4,447,823 | |||

| Security | Shares | Value | |

| Insurance — 3.3% | |||

| Go Digit General Insurance Ltd.(2) | 362,485 | $ 1,469,284 | |

| PB Fintech Ltd.(2) | 130,495 | 2,182,613 | |

| SBI Life Insurance Co. Ltd.(1) | 335,346 | 5,991,191 | |

| $ 9,643,088 | |||

| Interactive Media & Services — 1.2% | |||

| Info Edge India Ltd. | 42,033 | $ 3,424,082 | |

| $ 3,424,082 | |||

| IT Services — 9.5% | |||

| Coforge Ltd. | 63,693 | $ 4,123,951 | |

| Infosys Ltd. | 897,299 | 16,838,242 | |

| Persistent Systems Ltd. | 76,063 | 3,892,907 | |

| Zensar Technologies Ltd. | 304,723 | 2,714,089 | |

| $ 27,569,189 | |||

| Machinery — 1.0% | |||

| Grindwell Norton Ltd. | 91,435 | $ 3,001,122 | |

| $ 3,001,122 | |||

| Metals & Mining — 4.6% | |||

| APL Apollo Tubes Ltd. | 162,725 | $ 3,039,670 | |

| Hindalco Industries Ltd. | 826,211 | 6,832,978 | |

| Vedanta Ltd. | 663,326 | 3,608,235 | |

| $ 13,480,883 | |||

| Oil, Gas & Consumable Fuels — 3.5% | |||

| Reliance Industries Ltd. | 267,537 | $ 10,020,891 | |

| $ 10,020,891 | |||

| Paper and Forest Products — 0.7% | |||

| Century Textiles & Industries Ltd. | 69,120 | $ 1,895,167 | |

| $ 1,895,167 | |||

| Personal Care Products — 4.4% | |||

| Colgate-Palmolive (India) Ltd. | 103,649 | $ 3,519,613 | |

| Emami Ltd. | 247,535 | 2,042,073 | |

| Godrej Consumer Products Ltd. | 444,754 | 7,313,281 | |

| $ 12,874,967 | |||

| Pharmaceuticals — 6.2% | |||

| Gland Pharma Ltd.(1)(2) | 102,735 | $ 2,244,795 | |

| Mankind Pharma Ltd.(2) | 16,866 | 428,826 | |

| Pfizer Ltd. | 23,805 | 1,300,302 | |

| Sun Pharmaceutical Industries Ltd. | 521,388 | 9,487,751 | |

| Security | Shares | Value | |

| Pharmaceuticals (continued) | |||

| Suven Pharmaceuticals Ltd.(2) | 130,316 | $ 1,242,741 | |

| Torrent Pharmaceuticals Ltd. | 94,639 | 3,160,118 | |

| $ 17,864,533 | |||

| Real Estate Management & Development — 2.5% | |||

| Godrej Properties Ltd.(2) | 156,944 | $ 6,004,670 | |

| Oberoi Realty Ltd. | 57,093 | 1,207,113 | |

| $ 7,211,783 | |||

| Specialty Retail — 3.6% | |||

| Metro Brands Ltd. | 79,338 | $ 1,166,500 | |

| Trent Ltd. | 143,367 | 9,399,341 | |

| $ 10,565,841 | |||

| Textiles, Apparel & Luxury Goods — 1.0% | |||

| Kalyan Jewellers India Ltd. | 501,033 | $ 3,016,457 | |

| $ 3,016,457 | |||

| Wireless Telecommunication Services — 4.6% | |||

| Bharti Airtel Ltd. | 767,821 | $ 13,329,938 | |

| $ 13,329,938 | |||

| Total India (identified cost $170,344,534) | $291,509,451 | ||

| United States — 0.9% | |||

| IT Services — 0.9% | |||

| Cognizant Technology Solutions Corp., Class A | 40,464 | $ 2,751,552 | |

| Total United States (identified cost $2,808,984) | $ 2,751,552 | ||

| Total Common Stocks (identified cost $173,153,518) | $294,261,003 | ||

| Short-Term Investments — 3.6% |

| Security | Shares | Value | |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 5.22%(3) | 10,450,552 | $ 10,450,552 | |

| Total Short-Term Investments (identified cost $10,450,552) | $ 10,450,552 | ||

| Total Investments — 105.0% (identified cost $183,604,070) | $304,711,555 | ||

| Other Assets, Less Liabilities — (5.0)% | $(14,531,258) | ||

| Net Assets — 100.0% | $290,180,297 | ||

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets. | |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At June 30, 2024, the aggregate value of these securities is $13,573,229 or 4.7% of the Portfolio's net assets. |

| (2) | Non-income producing security. |

| (3) | May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of June 30, 2024. |

| Futures Contracts | |||||

| Description | Number of Contracts | Position | Expiration Date | Notional Amount | Value/Unrealized Appreciation (Depreciation) |

| Equity Futures | |||||

| NSE IFSC Nifty 50 Index | 167 | Long | 7/25/24 | $8,052,914 | $80,913 |

| $80,913 | |||||

| June 30, 2024 | |

| Assets | |

| Unaffiliated investments, at value (identified cost $173,153,518) | $294,261,003 |

| Affiliated investments, at value (identified cost $10,450,552) | 10,450,552 |

| Deposits for derivatives collateral — futures contracts | 385,770 |

| Foreign currency, at value (identified cost $850,931) | 850,966 |

| Dividends receivable | 366,968 |

| Dividends receivable from affiliated investments | 31,816 |

| Receivable for investments sold | 237,541 |

| Receivable for foreign taxes | 43,182 |

| Trustees' deferred compensation plan | 23,307 |

| Total assets | $306,651,105 |

| Liabilities | |

| Payable for variation margin on open futures contracts | $8,510 |

| Payable to affiliates: | |

| Investment adviser fee | 192,022 |

| Trustees' fees | 3,765 |

| Trustees' deferred compensation plan | 23,307 |

| Accrued foreign capital gains taxes | 16,143,286 |

| Accrued expenses | 99,918 |

| Total liabilities | $16,470,808 |

| Net Assets applicable to investors' interest in Portfolio | $290,180,297 |

| Six Months Ended | |

| June 30, 2024 | |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $209,605) | $675,799 |

| Dividend income from affiliated investments | 200,891 |

| Interest income | 6,745 |

| Total investment income | $883,435 |

| Expenses | |

| Investment adviser fee | $1,065,817 |

| Trustees’ fees and expenses | 7,790 |

| Custodian fee | 52,670 |

| Legal and accounting services | 38,443 |

| Miscellaneous | 3,987 |

| Total expenses | $1,168,707 |

| Deduct: | |

| Waiver and/or reimbursement of expenses by affiliates | $5,574 |

| Total expense reductions | $5,574 |

| Net expenses | $1,163,133 |

| Net investment loss | $(279,698) |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment transactions (net of foreign capital gains taxes of $1,296,099) | $7,985,517 |

| Futures contracts | 543,420 |

| Foreign currency transactions | (87,178) |

| Net realized gain | $8,441,759 |

| Change in unrealized appreciation (depreciation): | |

| Investments (including net increase in accrued foreign capital gains taxes of $4,999,045) | $34,706,025 |

| Futures contracts | 55,638 |

| Foreign currency | 9,762 |

| Net change in unrealized appreciation (depreciation) | $34,771,425 |

| Net realized and unrealized gain | $43,213,184 |

| Net increase in net assets from operations | $42,933,486 |

| Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, 2023 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment loss | $(279,698) | $(44,329) |

| Net realized gain | 8,441,759 | 12,068,019 |

| Net change in unrealized appreciation (depreciation) | 34,771,425 | 29,355,611 |

| Net increase in net assets from operations | $42,933,486 | $41,379,301 |

| Capital transactions: | ||

| Contributions | $25,973,940 | $31,982,220 |

| Withdrawals | (7,935,822) | (31,356,983) |

| Net increase in net assets from capital transactions | $18,038,118 | $625,237 |

| Net increase in net assets | $60,971,604 | $42,004,538 |

| Net Assets | ||

| At beginning of period | $229,208,693 | $187,204,155 |

| At end of period | $290,180,297 | $229,208,693 |

| Six Months Ended June 30, 2024 (Unaudited) | Year Ended December 31, | |||||

| Ratios/Supplemental Data | 2023 | 2022 | 2021 | 2020 | 2019 | |

| Ratios (as a percentage of average daily net assets): | ||||||

| Expenses | 0.93%(1)(2) | 0.97%(2) | 0.97%(2) | 0.95% | 0.93% | 0.98% |

| Net investment income (loss) | (0.22)%(1) | (0.02)% | (0.32)% | (0.39)% | (0.12)% | 0.07% |

| Portfolio Turnover | 15%(3) | 34% | 17% | 33% | 26% | 21% |

| Total Return | 18.13%(3) | 21.29% | (14.39)% | 24.76% | 14.14% | 11.17% |

| Net assets, end of period (000’s omitted) | $290,180 | $229,209 | $187,204 | $284,153 | $229,025 | $216,812 |

| (1) | Annualized. |

| (2) | Includes a reduction by the investment adviser of a portion of its adviser fee due to the Portfolio’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the six months ended June 30, 2024 and the years ended December 31, 2023 and 2022). |

| (3) | Not annualized. |

| Average Daily Net Assets | Annual Fee Rate |

| Up to $500 million | 0.850% |

| $500 million but less than $1 billion | 0.800% |

| $1 billion but less than $2.5 billion | 0.775% |

| $2.5 billion but less than $5 billion | 0.750% |

| $5 billion and over | 0.730% |

| Aggregate cost | $184,917,302 |

| Gross unrealized appreciation | $121,121,125 |

| Gross unrealized depreciation | (1,245,959) |

| Net unrealized appreciation | $119,875,166 |

| Fair Value | ||

| Derivative | Asset Derivative(1) | Liability Derivative |

| Futures contracts | $80,913 | $ — |

| (1) | Only the current day's variation margin on open futures contracts is reported within the Statement of Assets and Liabilities as Receivable or Payable for variation margin on open futures contracts, as applicable. |

| Derivative | Realized Gain (Loss) on Derivatives Recognized in Income(1) | Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income(2) |

| Futures contracts | $543,420 | $55,638 |

| (1) | Statement of Operations location: Net realized gain (loss): Futures contracts. |

| (2) | Statement of Operations location: Change in unrealized appreciation (depreciation): Futures contracts. |

| Name | Value, beginning of period | Purchases | Sales proceeds | Net realized gain (loss) | Change in unrealized appreciation (depreciation) | Value, end of period | Dividend income | Shares, end of period |

| Short-Term Investments | ||||||||

| Liquidity Fund | $5,091,586 | $46,551,732 | $(41,192,766) | $ — | $ — | $10,450,552 | $200,891 | 10,450,552 |

| • | Level 1 – quoted prices in active markets for identical investments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments) |

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks: | ||||

| Communication Services | $ — | $ 16,754,020 | $ — | $ 16,754,020 |

| Consumer Discretionary | — | 62,655,629 | — | 62,655,629 |

| Consumer Staples | — | 19,411,245 | — | 19,411,245 |

| Energy | — | 10,020,891 | — | 10,020,891 |

| Financials | 1,469,284 | 79,760,083 | — | 81,229,367 |

| Health Care | — | 23,351,401 | — | 23,351,401 |

| Industrials | — | 14,669,881 | — | 14,669,881 |

| Information Technology | 2,751,552 | 27,569,189 | — | 30,320,741 |

| Materials | — | 20,006,253 | — | 20,006,253 |

| Real Estate | — | 7,211,783 | — | 7,211,783 |

| Utilities | — | 8,629,792 | — | 8,629,792 |

| Total Common Stocks | $ 4,220,836 | $290,040,167* | $ — | $294,261,003 |

| Short-Term Investments | $10,450,552 | $ — | $ — | $ 10,450,552 |

| Total Investments | $14,671,388 | $ 290,040,167 | $ — | $304,711,555 |

| Futures Contracts | $ — | $ 80,913 | $ — | $ 80,913 |

| Total | $14,671,388 | $ 290,121,080 | $ — | $304,792,468 |

| * | Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of trading in their applicable foreign markets. |

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract

The information is included in Item 7 of this Form N-CSR.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders

No material changes.

Item 16. Controls and Procedures

| (a) | It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| (b) | There have been no changes in the registrant’s internal controls over financial reporting during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation

Not applicable.

Item 19. Exhibits

| (a)(1) | Registrant’s Code of Ethics – Not applicable (please see Item 2). | |

| (a)(2)(i) | Principal Financial Officer’s Section 302 certification. | |

| (a)(2)(ii) | Principal Executive Officer’s Section 302 certification. | |

| (b) | Combined Section 906 certification. | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Greater India Portfolio | ||

| By: | /s/ R. Kelly Williams, Jr. | |

| R. Kelly Williams, Jr. | ||

| Principal Executive Officer | ||

| Date: | August 23, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ James F. Kirchner | |

| James F. Kirchner | ||

| Principal Financial Officer | ||

| Date: | August 23, 2024 | |

| By: | /s/ R. Kelly Williams, Jr. | |

| R. Kelly Williams, Jr. | ||

| Principal Executive Officer | ||

| Date: | August 23, 2024 | |