As filed with the Securities and Exchange Commission on 8-31-2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-8352

LKCM Funds

(Exact name of registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and 1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

| Item 1. | Report to Stockholders. |

LKCM

FUNDS

LKCM Small Cap Equity Fund

LKCM Small-Mid Cap Equity Fund

LKCM Equity Fund

LKCM Balanced Fund

LKCM Fixed Income Fund

Semi-Annual Report

June 30, 2018

Dear Fellow Shareholders:

We report the following performance information for the LKCM Funds for indicated periods ended June 30, 2018:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Funds | | Inception

Dates | | | NAV @

6/30/18 | | | Net

Expense

Ratio*, ** | | | Gross

Expense

Ratio** | | | Six Month

Total

Return

Ended

6/30/18 | | | One Year

Total

Return

Ended

6/30/18 | | | Five Year

Average

Annualized

Return

Ended

6/30/18 | | | Ten Year

Average

Annualized

Return

Ended

6/30/18 | | | Avg.

Annual

Total

Return

Since

Incept. | |

LKCM Equity Fund - | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 1/3/96 | | | $ | 27.37 | | | | 0.81% | | | | 1.00% | | | | 5.19% | | | | 16.04% | | | | 11.27% | | | | 10.02% | | | | 8.69% | |

S&P 500 Index(1) | | | | | | | | | | | | | | | | | | | 2.65% | | | | 14.37% | | | | 13.42% | | | | 10.17% | | | | 8.82% | |

LKCM Small Cap Equity Fund - | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 7/14/94 | | | $ | 20.37 | | | | 1.00% | | | | 1.10% | | | | 10.47% | | | | 20.75% | | | | 9.29% | | | | 9.14% | | | | 10.70% | |

Russell 2000 Index(2) | | | | | | | | | | | | | | | | | | | 7.66% | | | | 17.57% | | | | 12.46% | | | | 10.60% | | | | 9.73% | |

LKCM Small Cap Equity Fund - | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adviser Class | | | 6/5/03 | | | $ | 18.91 | | | | 1.25% | | | | 1.35% | | | | 10.39% | | | | 20.41% | | | | 9.02% | | | | 8.87% | | | | 9.67% | |

Russell 2000 Index(2) | | | | | | | | | | | | | | | | | | | 7.66% | | | | 17.57% | | | | 12.46% | | | | 10.60% | | | | 10.32% | |

LKCM Small-Mid Cap Equity Fund - | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 5/2/11 | | | $ | 11.23 | | | | 1.00% | | | | 1.76% | | | | 5.94% | | | | 21.95% | | | | 9.11% | | | | N/A | | | | 7.02% | |

Russell 2500 Index(3) | | | | | | | | | | | | | | | | | | | 5.46% | | | | 16.24% | | | | 12.29% | | | | N/A | | | | 11.03% | |

LKCM Balanced Fund | | | 12/30/97 | | | $ | 22.45 | | | | 0.80% | | | | 1.02% | | | | 1.69% | | | | 8.19% | | | | 8.70% | | | | 8.41% | | | | 6.56% | |

S&P 500 Index(1) | | | | | | | | | | | | | | | | | | | 2.65% | | | | 14.37% | | | | 13.42% | | | | 10.17% | | | | 7.15% | |

Bloomberg Barclays Capital U.S. Intermediate Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | -0.97% | | | | -0.58% | | | | 1.60% | | | | 3.08% | | | | 4.38% | |

LKCM Fixed Income Fund | | | 12/30/97 | | | $ | 10.48 | | | | 0.50% | | | | 0.80% | | | | -0.81% | | | | -0.28% | | | | 1.51% | | | | 3.47% | | | | 4.19% | |

Bloomberg Barclays Capital U.S. Intermediate Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | -0.97% | | | | -0.58% | | | | 1.60% | | | | 3.08% | | | | 4.38% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. The Funds impose a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

| * | Luther King Capital Management Corporation, the Funds’ investment adviser, has contractually agreed to waive all or a portion of its management fee and/or reimburse expenses of each Fund to maintain designated expense ratios through May 1, 2019. This expense limitation excludes interest, taxes, brokerage commissions, indirect fees and expenses related to investments in other investment companies, including money market funds, and extraordinary expenses. Investment performance reflects fee waivers, if any, in effect during the relevant period. In the absence of such waivers, total return would be reduced. Investment performance is based upon the net expense ratio. LKCM waived management fees and/or reimbursed expenses for each Fund during the six months ended June 30, 2018. |

| ** | Expense ratios above are as of May 1, 2018, as reported in the Funds’ current prospectus. Expense ratios reported for other periods in the financial highlights of this report may differ. |

| (1) | The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market. |

| (2) | The Russell 2000® Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

| (3) | The Russell 2500® Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. |

| (4) | The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued. |

Note: The indices defined above are not available for direct investment and the index performance therefore does not include fees, expenses or taxes.

1H2018 Review and Outlook

For much of the past year “synchronized global growth” has been an apt description of the global economy. With an economic growth tailwind, central bankers in the U.S., Europe, and Japan have been keen to withdraw overly-accommodative monetary policy in anticipation of the next economic downturn. More recently, however, economic growth outside the U.S. appears to be decelerating, making the reduction of accommodative monetary policy more of a risk for global growth. The ability of global economic growth to resynchronize appears to be made more uncertain by the presence of rising protectionism related to trade. For the moment, the U.S. increasingly appears to be the primary engine of global economic growth. Following an annualized rate of 2.0% growth in real Gross Domestic Product (GDP) in the first quarter of 2018, GDP grew by annualized rate of 4.1% in the second quarter of 2018.

2

Increasingly, investor focus appears to have shifted towards emerging market economies, which had benefited significantly in recent years from broad global growth. In recent years, these markets have revived global trade, manufacturing, and commodity prices. Despite more restrictive monetary policy, particularly in the U.S., the value of the U.S. dollar fell last year, aiding emerging market debt denominated in U.S. dollars. Recently, however, we believe the positive backdrop for emerging markets appears to have deteriorated with a rising U.S. dollar, slowing global growth, and greater protectionism.

Domestically, we believe the U.S. economy has yet to feel the full impact of fiscal stimulus. We believe the sustainability of a fiscally-induced economic expansion largely will depend on the prospect for productivity-increasing investments, which would lift the economy’s growth potential. There are specific provisions of the 2017 tax legislation which target accelerated investment by companies, and our outlook for productivity-enhancing capital expenditures remains positive, as we believe this is increasingly important to sustained economic growth. We believe that late cycle stimulative fiscal policy in the form of lower tax rates supports above-trend economic growth, but this stimulus occurs at a time when the economy’s excess capacity appears to have shrunk considerably. This combination could well result in inflationary wage pressure and rising input costs for companies.

The rate of economic growth in the U.S. rose during the second quarter of 2018 in contrast to the softening of the other remaining ten largest global economies during the same period. A similar slowing of global economic growth occurred in 2015 and caused the Federal Reserve to slow its intended pace of monetary tightening. In contrast, the Federal Reserve is unlikely in our view to abandon its current plans which call for two additional interest rate increases of 0.25% each later this year. The economic output gap, or the difference between economic output and potential economic output, has narrowed over the past two years. As a result, we believe the U.S. economy no longer has spare capacity. When taken in tandem with a 48-year low in the unemployment rate of 3.75% in May 2018, it is unlikely in our view that the Federal Reserve will slow its pace of monetary tightening. As a result, we believe the risk of a monetary policy error, or over-tightening in a slowing economy, has risen. We believe this risk is particularly true if economic growth outside the U.S. continues to slow or there is a further escalation of tariffs.

The degree to which the U.S. should be concerned over its existing trade deficit has quickly become a central economic question in our view. One line of reasoning is that the current trade deficit, which is the result of importing more goods than our country exports, has led to less domestic manufacturing and therefore fewer manufacturing jobs. The Trump administration has elected to erect new tariffs or raise the level of existing tariffs in an effort to level the playing field and protect domestic manufacturing. The inherent challenge is that countries impacted by newly enacted U.S. tariffs are naturally inclined to react in kind by altering their trade policies. This process is made more complex since it is difficult to calibrate the impact of trade tariffs, and the economic impact is not linear. This concept is highlighted by the complex web known as the global manufacturing supply chain. China, for example, assembles a great number of goods comprised of components imported from other countries, such as memory chips and digital displays. If Chinese imports were to experience a 10% decline, we believe Taiwan, Malaysia, and South Korea would suffer a markedly larger blow to their domestic economies relative to China.

The Trump administration’s protectionist rhetoric appears to have a three-pronged purpose. First, it was evident early in his presidential campaign that President Trump intended to defend U.S. manufacturing. Second, the administration appears to view the North American Free Trade Agreement (NAFTA) as less favorable to the U.S. than to Mexico or Canada. Finally, it is apparent there are increasing concerns by the administration over the theft of U.S. corporate intellectual property. In our view, the pursuit of trade protectionism on a larger scale would eventually trim domestic economic growth and create detrimental knock-on effects such as lowering business confidence at a time the economy needs further productivity-enhancing capital investment.

We believe the U.S. economy remains on its gradual progression through a typical business cycle, albeit longer than average, as the underpinnings remain solid in our view. However, late-cycle dynamics such as tighter labor markets appear to have begun to push wages higher, allowing the Federal Reserve to remain on the path to tighter monetary policy. The effect is a traditional flattening of the yield curve that has resulted over the past year. Meanwhile, other late-cycle warning flags, such as deteriorating credit conditions reflected by widening credit spreads, are not yet evident in our view. Similarly, we believe pressure from rising wages to date is not compressing corporate profit margins, which is typical of a mature business cycle. In our view, the later stages of the business cycle are usually reflected in the equity market by a narrowing of market leadership, with investors bidding growth stocks higher in pursuit of continued growth as the broad economy begins to cool.

LKCM Equity Fund

The LKCM Equity Fund returned 5.19% for the six months ended June 30, 2018 which outpaced the return of 2.65% for the Fund’s benchmark, the S&P 500® Index, for the same period. The Fund benefited from being underweight the Consumer Staples sector relative to the benchmark, although overweight positions in the Industrials and Materials sectors and an underweight position in the Information Technology sector detracted from the Fund’s relative performance. Positive stock selection in the Industrials, Financials and Consumer Discretionary sectors enhanced the Fund’s returns during the first half of 2018. We believe the Fund is well positioned with its continued emphasis on higher quality companies that we believe are reasonably valued relative to their earnings growth rates, and we anticipate the Fund’s holdings will demonstrate continued improvement from any economic expansion during the second half of this year.

3

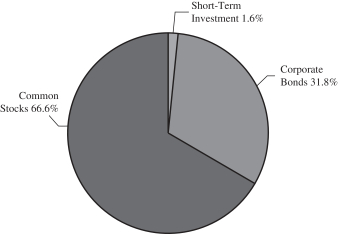

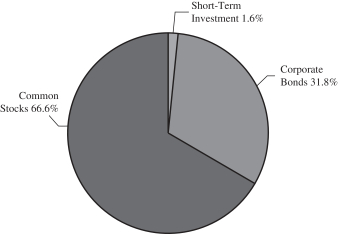

LKCM Balanced Fund

The LKCM Balanced Fund returned 1.69% for the six months ended June 30, 2018 against the 2.65% return for the S&P 500® Index and the -0.97% return for the Bloomberg Barclays Intermediate Government/Credit Bond Index. Both the equity and fixed income portfolios of the Fund generated strong returns relative to their benchmarks during the first half of 2018. Stock selection in the Industrials and Materials sectors added to the Fund’s relative performance during the first half of 2018 as investor focus shifted towards companies that are likely to benefit from improving economic conditions. Stock selection in the Financials, Energy and Healthcare sectors was also solid during the first half of 2018. The rise in interest rates during the first half of 2018 created a challenging environment for fixed income investors, as reflected by the negative return of the Bloomberg Barclays Intermediate Government/Credit Bond Index during this period. However, the modest average maturity within the Fund’s fixed income portfolio was beneficial during the first half of 2018 and served to limit the Fund’s fixed income downside during the period. As of June 30, 2018, the Fund’s asset mix consisted of approximately 66.5% in equity securities, 31.8% in fixed income securities, and 1.7% in cash and cash equivalents.

LKCM Fixed Income Fund

The LKCM Fixed Income Fund outperformed its benchmark, the Bloomberg Barclays Intermediate Government/Credit Bond Index, during the six months ended June 30, 2018, declining 0.81% versus a 0.97% decline for the benchmark. During this period, yields rose across the curve and the yield curve flattened substantially as the Federal Reserve continued to tighten monetary policy by increasing the federal funds rate and continuing balance sheet run off, which they initiated in October. In this environment, where shorter-duration securities outperformed their longer-duration counterparts, the Fund’s duration of approximately 2.9 years was additive to performance relative to the 3.9 year duration for the benchmark. The Fund’s overweight position in corporate bonds relative to the benchmark detracted from performance during the first half of 2018 as U.S. Treasury and government agency securities outperformed corporate bonds as credit spreads widened across each investment-grade credit rating sector. Within this backdrop, the Fund remains largely focused on short-to-intermediate investment-grade corporate bonds with strong underlying credit fundamentals to mitigate interest rate risk and credit risk in an environment where the Federal Reserve continues to gradually tighten monetary policy, inflation remains subdued and economic growth improves.

LKCM Small Cap Equity Fund

The LKCM Small Cap Equity Fund – Institutional Class outperformed its benchmark, the Russell 2000® Index, during the six months ended June 30, 2018, returning 10.47% compared to the 7.66% return for the benchmark. During the first half of 2018, stock selection for the Fund was additive to the Fund’s relative performance, while sector allocation decisions for the Fund were essentially neutral to the Fund’s relative performance. The Fund benefited from positive stock selection in the Information Technology, Consumer Discretionary and Healthcare sectors relative to the benchmark, which more than offset the stock selection drag in the Industrials and Materials sectors. The Fund’s overweight position in the Information Technology sector benefited the Fund’s relative performance, which was offset by an overweight allocation in the Industrials sector and an underweight allocation in the Real Estate sector. We believe the Fund remains positioned for continued economic growth (overweight Technology and Industrials sectors) and higher interest rates (underweight Real Estate and Utilities). We also believe our investment strategy for the Fund of investing in higher quality, competitively advantaged companies with viable strategies to increase the value of their businesses will continue to be beneficial for the Fund’s shareholders.

LKCM Small-Mid Cap Equity Fund

The LKCM Small-Mid Cap Equity Fund outperformed its benchmark, Russell 2500® Index, during the six months ended June 30, 2018, returning 5.94% compared to the 5.46% return for the benchmark. During the first half of 2018, stock selection for the Fund was additive to the Fund’s relative performance, while sector allocation decisions for the Fund were essentially neutral to the Fund’s relative performance. The Fund benefited from positive stock selection in the Information Technology, Financials and Consumer Discretionary sectors relative to the benchmark, which more than offset the stock selection drag in the Industrials and Materials sectors. The Fund’s overweight position in the Information Technology sector benefited the Fund’s relative performance, which was offset by an overweight allocation in the Industrials sector. We believe the Fund remains positioned for continued economic growth (overweight Technology and Industrials sectors) and higher interest rates (underweight Real Estate and Utilities). We also believe our investment strategy for the Fund of investing in higher quality, competitively advantaged companies with viable strategies to increase the value of their businesses will continue to be beneficial for the Fund’s shareholders.

J. Luther King, Jr., CFA, CIC

August 6, 2018

4

The information provided herein represents the opinion of J. Luther King, Jr., CFA, CIC and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Please refer to the Schedule of Investments found on pages 9-21 of the report for more information on Fund holdings. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any securities.

Mutual fund investing involves risk. Principal loss is possible. Past performance is not a guarantee of future results. Small and medium capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure, and, historically, their stocks have experienced a greater degree of market volatility than stocks on average. Investments in debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Investments in mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. These risks are discussed in the Funds’ summary and statutory prospectuses.

Earnings growth is not a measure of future performance.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

5

LKCM Funds Expense Example — June 30, 2018 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/18-6/30/18).

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the LKCM Small Cap Equity, Small-Mid Cap Equity, Equity, Balanced and Fixed Income Funds within 30 days of purchase, unless otherwise determined by the Funds in their discretion. To the extent the Funds invest in shares of other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | LKCM Small Cap Equity Fund – Institutional Class | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 1,104.70 | | | $ | 5.22 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.01 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | LKCM Small Cap Equity Fund – Adviser Class | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 1,103.90 | | | $ | 6.52 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,018.60 | | | $ | 6.26 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | LKCM Small-Mid Cap Equity Fund | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 1,059.40 | | | $ | 5.11 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.01 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

6

| | | | | | | | | | | | |

| | | LKCM Equity Fund | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 1,051.90 | | | $ | 4.07 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,020.83 | | | $ | 4.01 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | LKCM Balanced Fund | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 1,016.90 | | | $ | 4.00 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,020.83 | | | $ | 4.01 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | LKCM Fixed Income Fund | |

| | | Beginning

Account Value

1/1/18 | | | Ending

Account Value

6/30/18 | | | Expenses Paid

During Period*

1/1/18–6/30/18 | |

Actual | | $ | 1,000.00 | | | $ | 991.90 | | | $ | 2.47 | |

Hypothetical (5% return before expense) | | $ | 1,000.00 | | | $ | 1,022.32 | | | $ | 2.51 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

7

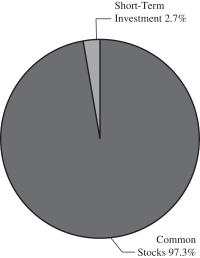

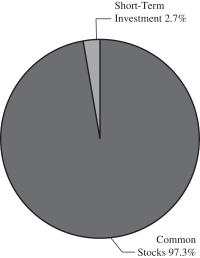

ALLOCATION OF PORTFOLIO HOLDINGS — LKCM Funds — June 30, 2018 (Unaudited)

Percentages represent market value as a percentage of total investments.

LKCM Small Cap Equity Fund

LKCM Equity Fund

LKCM Fixed Income Fund

LKCM Small-Mid Cap Equity Fund

LKCM Balanced Fund

8

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 97.9% | | Shares | | Value |

| Aerospace & Defense - 1.1% | | | | |

Mercury Systems, Inc. (a) | | | | 60,020 | | | | $ | 2,284,361 | |

| | | | | | | | | | |

| Banks - 9.8% | | | | |

BancorpSouth Bank | | | | 84,154 | | | | | 2,772,874 | |

Cadence BanCorporation | | | | 90,490 | | | | | 2,612,446 | |

CBTX, Inc. | | | | 45,440 | | | | | 1,501,792 | |

Glacier Bancorp, Inc. | | | | 50,460 | | | | | 1,951,793 | |

Green Bancorp, Inc. | | | | 84,060 | | | | | 1,815,696 | |

LegacyTexas Financial Group, Inc. | | | | 58,955 | | | | | 2,300,424 | |

Pinnacle Financial Partners, Inc. | | | | 41,965 | | | | | 2,574,553 | |

Seacoast Banking Corp of Florida (a) | | | | 83,040 | | | | | 2,622,403 | |

Texas Capital Bancshares, Inc. (a) | | | | 25,260 | | | | | 2,311,290 | |

| | | | | | | | | | |

| | | | | | | | | 20,463,271 | |

| | | | | | | | | | |

| Biotechnology - 4.5% | | | | |

Charles River Laboratories International,

Inc. (a) | | | | 27,555 | | | | | 3,093,324 | |

Ligand Pharmaceuticals Incorporated (a) | | | | 14,280 | | | | | 2,958,388 | |

Neogen Corporation (a) | | | | 43,080 | | | | | 3,454,585 | |

| | | | | | | | | | |

| | | | | | | | | 9,506,297 | |

| | | | | | | | | | |

| Building Products - 4.5% | | | | |

American Woodmark Corporation (a) | | | | 14,650 | | | | | 1,341,207 | |

Builders FirstSource, Inc. (a) | | | | 134,795 | | | | | 2,465,401 | |

CSW Industrials, Inc. (a) | | | | 43,690 | | | | | 2,309,016 | |

Patrick Industries, Inc. (a) | | | | 8,470 | | | | | 481,520 | |

PGT, Inc. (a) | | | | 111,121 | | | | | 2,316,873 | |

Trex Company, Inc. (a) | | | | 8,310 | | | | | 520,123 | |

| | | | | | | | | | |

| | | | | | | | | 9,434,140 | |

| | | | | | | | | | |

| Capital Markets - 0.4% | | | | |

BGC Partners Inc. - Class A | | | | 73,960 | | | | | 837,227 | |

| | | | | | | | | | |

| Chemicals - 2.3% | | | | |

Ferro Corporation (a) | | | | 103,545 | | | | | 2,158,913 | |

Ferroglobe PLC (b) | | | | 225,490 | | | | | 1,932,450 | |

Ferroglobe Representation & Warranty Insurance Trust (a)(b) | | | | 302,970 | | | | | — | |

GCP Applied Technologies Inc. (a) | | | | 23,795 | | | | | 688,865 | |

| | | | | | | | | | |

| | | | | | | | | 4,780,228 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 1.3% | | | | |

Healthcare Services Group, Inc. | | | | 62,745 | | | | | 2,709,957 | |

| | | | | | | | | | |

| Communications Equipment - 1.1% | | | | |

Finisar Corporation (a) | | | | 15,000 | | | | | 270,000 | |

Infinera Corporation (a) | | | | 201,980 | | | | | 2,005,661 | |

| | | | | | | | | | |

| | | | | 2,275,661 |

| | | | | | | | | | |

| Construction & Engineering - 1.7% | | | | |

EMCOR Group, Inc. | | | | 33,520 | | | | | 2,553,554 | |

MasTec Inc. (a) | | | | 21,130 | | | | | 1,072,347 | |

| | | | | | | | | | |

| | | | | | | | | 3,625,901 | |

| | | | | | | | | | |

| Construction Materials - 1.1% | | | | |

Summit Materials, Inc. - Class A (a) | | | | 88,814 | | | | | 2,331,368 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Consumer Finance - 1.5% | | | | |

FirstCash, Inc. | | | | 34,450 | | | | $ | 3,095,332 | |

| | | | | | | | | | |

Electronic Equipment, Instruments &

Components - 2.4% | | | | |

Littelfuse, Inc. | | | | 11,770 | | | | | 2,685,678 | |

Mesa Laboratories, Inc. | | | | 10,670 | | | | | 2,252,224 | |

| | | | | | | | | | |

| | | | | | | | | 4,937,902 | |

| | | | | | | | | | |

| Energy Equipment & Services - 0.9% | | | | |

Mammoth Energy Services, Inc. (a) | | | | 53,210 | | | | | 1,807,012 | |

| | | | | | | | | | |

| Food & Drug Retailing - 0.5% | | | | |

Sprouts Farmers Market, Inc. (a) | | | | 43,595 | | | | | 962,142 | |

| | | | | | | | | | |

| Food Products - 1.4% | | | | |

Freshpet, Inc. (a) | | | | 13,525 | | | | | 371,261 | |

Hostess Brands, Inc. (a) | | | | 98,940 | | | | | 1,345,584 | |

J & J Snack Foods Corp. | | | | 7,370 | | | | | 1,123,704 | |

| | | | | | | | | | |

| | | | | | | | | 2,840,549 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 5.5% | | |

Cantel Medical Corp. | | | | 32,335 | | | | | 3,180,470 | |

K2M Group Holdings Inc. (a) | | | | 80,000 | | | | | 1,800,000 | |

LeMaitre Vascular, Inc. | | | | 51,670 | | | | | 1,729,912 | |

PRA Health Sciences, Inc. (a) | | | | 10,242 | | | | | 956,193 | |

STAAR Surgical Co. (a) | | | | 121,390 | | | | | 3,763,090 | |

| | | | | | | | | | |

| | | | | | | | | 11,429,665 | |

| | | | | | | | | | |

| Health Care Providers & Services - 3.9% | | |

HealthEquity, Inc. (a) | | | | 48,435 | | | | | 3,637,468 | |

Omnicell, Inc. (a) | | | | 47,640 | | | | | 2,498,718 | |

U.S. Physical Therapy, Inc. | | | | 21,805 | | | | | 2,093,280 | |

| | | | | | | | | | |

| | | | | | | | | 8,229,466 | |

| | | | | | | | | | |

| Health Care Technology - 0.3% | | | | |

Teladoc, Inc. (a) | | | | 9,910 | | | | | 575,276 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.8% | | | | |

Planet Fitness, Inc. - Class A (a) | | | | 62,410 | | | | | 2,742,295 | |

Wingstop Inc. | | | | 20,130 | | | | | 1,049,176 | |

| | | | | | | | | | |

| | | | | | | | | 3,791,471 | |

| | | | | | | | | | |

| Insurance - 0.5% | | | | |

Trupanion, Inc. (a) | | | | 26,535 | | | | | 1,024,251 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.0% | | | | |

Nutrisystem, Inc. | | | | 56,785 | | | | | 2,186,223 | |

| | | | | | | | | | |

| Internet Software & Services - 11.8% | | | | |

Alarm.com Holdings, Inc. (a) | | | | 57,770 | | | | | 2,332,752 | |

Carbonite, Inc. (a) | | | | 73,660 | | | | | 2,570,734 | |

Cornerstone OnDemand, Inc. (a) | | | | 48,025 | | | | | 2,277,826 | |

Coupa Software, Inc. (a) | | | | 72,520 | | | | | 4,513,645 | |

Euronet Worldwide, Inc. (a) | | | | 22,710 | | | | | 1,902,417 | |

New Relic, Inc. (a) | | | | 19,800 | | | | | 1,991,682 | |

Stamps.com Inc. (a) | | | | 13,015 | | | | | 3,293,446 | |

The Trade Desk Inc. - Class A (a) | | | | 23,865 | | | | | 2,238,537 | |

Twilio Inc. - Class A (a) | | | | 64,570 | | | | | 3,617,211 | |

| | | | | | | | | | |

| | | | | | | | | 24,738,250 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

9

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| IT Consulting & Services - 1.9% | | | | |

Acxiom Corporation (a) | | | | 71,521 | | | | $ | 2,142,054 | |

FireEye, Inc. (a) | | | | 114,145 | | | | | 1,756,691 | |

| | | | | | | | | | |

| | | | | | | | | 3,898,745 | |

| | | | | | | | | | |

| IT Services - 0.7% | | | | |

Cass Information Systems, Inc. | | | | 21,545 | | | | | 1,482,727 | |

| | | | | | | | | | |

| Machinery - 5.2% | | | | |

Barnes Group Inc. | | | | 26,185 | | | | | 1,542,296 | |

John Bean Technologies Corporation | | | | 23,610 | | | | | 2,098,929 | |

Kennametal Inc. | | | | 73,195 | | | | | 2,627,701 | |

Lindsay Corporation | | | | 11,300 | | | | | 1,095,987 | |

Rexnord Corporation (a) | | | | 64,070 | | | | | 1,861,874 | |

Watts Water Technologies, Inc. - Class A | | | | 22,015 | | | | | 1,725,976 | |

| | | | | | | | | | |

| | | | | | | | | 10,952,763 | |

| | | | | | | | | | |

| Marine - 1.6% | | | | |

Kirby Corporation (a) | | | | 40,145 | | | | | 3,356,122 | |

| | | | | | | | | | |

| Media - 1.4% | | | | |

Criteo SA - ADR (a)(b) | | | | 42,545 | | | | | 1,397,603 | |

Nexstar Media Group, Inc. - Class A | | | | 21,635 | | | | | 1,588,009 | |

| | | | | | | | | | |

| | | | | | | | | 2,985,612 | |

| | | | | | | | | | |

| Metals & Mining - 1.3% | | | | |

Carpenter Technology Corporation | | | | 51,155 | | | | | 2,689,218 | |

| | | | | | | | | | |

| Multiline Retail - 2.6% | | | | |

Five Below, Inc. (a) | | | | 16,985 | | | | | 1,659,604 | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 52,125 | | | | | 3,779,063 | |

| | | | | | | | | | |

| | | | | | | | | 5,438,667 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 4.7% | | | | |

Matador Resources Company (a) | | | | 82,725 | | | | | 2,485,886 | |

Oasis Petroleum Inc. (a) | | | | 126,230 | | | | | 1,637,203 | |

PDC Energy, Inc. (a) | | | | 19,405 | | | | | 1,173,032 | |

Ring Energy Inc (a) | | | | 173,675 | | | | | 2,191,779 | |

SRC Energy Inc. (a) | | | | 202,710 | | | | | 2,233,864 | |

| | | | | | | | | | |

| | | | | | | | | 9,721,764 | |

| | | | | | | | | | |

| Pharmaceuticals - 0.6% | | | | |

Cambrex Corp. (a) | | | | 22,659 | | | | | 1,185,066 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 2.2% | | | | |

First Industrial Realty Trust, Inc. | | | | 64,015 | | | | | 2,134,260 | |

Life Storage, Inc. | | | | 25,000 | | | | | 2,432,750 | |

| | | | | | | | | | |

| | | | | | | | | 4,567,010 | |

| | | | | | | | | | |

| Road & Rail - 1.1% | | | | |

Genesee & Wyoming Inc. - Class A (a) | | | | 27,525 | | | | | 2,238,333 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Software - 5.0% | | | | |

ACI Worldwide, Inc. (a) | | | | 86,610 | | | | $ | 2,136,669 | |

Envestnet, Inc. (a) | | | | 60,116 | | | | | 3,303,374 | |

Fair Isaac Corporation (a) | | | | 13,575 | | | | | 2,624,319 | |

RealPage, Inc. (a) | | | | 43,400 | | | | | 2,391,340 | |

| | | | | | | | | | |

| | | | | | | | | 10,455,702 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 3.6% | | |

Columbia Sportswear Company | | | | 33,121 | | | | | 3,029,578 | |

Oxford Industries, Inc. | | | | 32,790 | | | | | 2,720,914 | |

Steven Madden Ltd. | | | | 34,690 | | | | | 1,842,039 | |

| | | | | | | | | | |

| | | | | | | | | 7,592,531 | |

| | | | | | | | | | |

| Thrifts & Mortgage Finance - 2.3% | | | | |

Banc of California, Inc. | | | | 113,145 | | | | | 2,211,985 | |

Home BancShares Inc. | | | | 118,721 | | | | | 2,678,346 | |

| | | | | | | | | | |

| | | | | | | | | 4,890,331 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 4.4% | | |

DXP Enterprises Inc/TX (a) | | | | 54,495 | | | | | 2,081,709 | |

MSC Industrial Direct Co., Inc. - Class A | | | | 22,395 | | | | | 1,900,216 | |

Systemax, Inc. | | | | 15,460 | | | | | 530,742 | |

Textainer Group Holdings Ltd. (a)(b) | | | | 140,370 | | | | | 2,231,883 | |

Triton International Limited (b) | | | | 81,935 | | | | | 2,512,127 | |

| | | | | | | | | | |

| | | | | | | | | 9,256,677 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $142,711,178) | | | | | | | | | 204,577,218 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.7% | | |

| Money Market Fund - 2.7% | | | | |

Invesco Short-Term Investments Trust-Government & Agency Portfolio - Institutional Shares, 1.81% (c) | | | | 5,653,818 | | | | | 5,653,818 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $5,653,818) | | | | | 5,653,818 | |

| | | | | | | | | | |

Total Investments - 100.6%

(Cost $148,364,996) | | | | | | | | | 210,231,036 | |

Liabilities in Excess of Other Assets - (0.6)% | | | | | (1,199,681 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 209,031,355 | |

| | | | | | | | | | |

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

10

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 97.9% | | Shares | | Value |

| Aerospace & Defense - 4.6% | | | | |

HEICO Corporation | | | | 5,159 | | | | $ | 376,228 | |

Hexcel Corporation | | | | 3,865 | | | | | 256,559 | |

Mercury Systems, Inc. (a) | | | | 4,040 | | | | | 153,762 | |

| | | | | | | | | | |

| | | | | | | | | 786,549 | |

| | | | | | | | | | |

| Banks - 6.3% | | | | |

LegacyTexas Financial Group, Inc. | | | | 6,775 | | | | | 264,360 | |

Pinnacle Financial Partners, Inc. | | | | 3,865 | | | | | 237,118 | |

SVB Financial Group (a) | | | | 1,095 | | | | | 316,192 | |

Texas Capital Bancshares, Inc. (a) | | | | 2,815 | | | | | 257,573 | |

| | | | | | | | | | |

| | | | | | | | | 1,075,243 | |

| | | | | | | | | | |

Biotechnology - 5.3% | | | | | | | | | | |

Charles River Laboratories International,

Inc. (a) | | | | 2,660 | | | | | 298,612 | |

Ligand Pharmaceuticals Incorporated (a) | | | | 1,550 | | | | | 321,113 | |

Neogen Corporation (a) | | | | 3,645 | | | | | 292,293 | |

| | | | | | | | | | |

| | | | | | | | | 912,018 | |

| | | | | | | | | | |

Building Products - 1.6% | | | | | | | | | | |

Builders FirstSource, Inc. (a) | | | | 14,715 | | | | | 269,137 | |

| | | | | | | | | | |

Capital Markets - 3.4% | | | | | | | | | | |

Lazard Ltd. - Class A (b) | | | | 6,320 | | | | | 309,111 | |

SEI Investments Company | | | | 4,290 | | | | | 268,211 | |

| | | | | | | | | | |

| | | | | | | | | 577,322 | |

| | | | | | | | | | |

| Chemicals - 3.0% | | | | |

CF Industries Holdings, Inc. | | | | 7,285 | | | | | 323,454 | |

FMC Corporation | | | | 2,245 | | | | | 200,276 | |

| | | | | | | | | | |

| | | | | | | | | 523,730 | |

| | | | | | | | | | |

Commercial Services & Supplies - 1.4% | | | | | | | | | | |

Healthcare Services Group, Inc. | | | | 5,749 | | | | | 248,299 | |

| | | | | | | | | | |

Construction & Engineering - 1.5% | | | | | | | | | | |

EMCOR Group, Inc. | | | | 3,400 | | | | | 259,012 | |

| | | | | | | | | | |

Construction Materials - 0.8% | | | | | | | | | | |

Summit Materials, Inc. - Class A (a) | | | | 5,025 | | | | | 131,906 | |

| | | | | | | | | | |

Consumer Finance - 2.0% | | | | | | | | | | |

FirstCash, Inc. | | | | 3,915 | | | | | 351,763 | |

| | | | | | | | | | |

Diversified Financials - 2.8% | | | | | | | | | | |

MSCI Inc. | | | | 2,905 | | | | | 480,574 | |

| | | | | | | | | | |

Electronic Equipment, Instruments &

Components - 4.8% | | | | | | |

FLIR Systems, Inc. | | | | 6,185 | | | | | 321,435 | |

Littelfuse, Inc. | | | | 1,540 | | | | | 351,397 | |

Trimble Inc. (a) | | | | 4,855 | | | | | 159,438 | |

| | | | | | | | | | |

| | | | | | | | | 832,270 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 3.6% | | |

Cantel Medical Corp. | | | | 3,485 | | | | | 342,784 | |

PRA Health Sciences, Inc. (a) | | | | 2,955 | | | | | 275,879 | |

| | | | | | | | | | |

| | | | | | | | | 618,663 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

Health Care Providers & Services - 3.1% | | | | | | |

HealthEquity, Inc. (a) | | | | 4,705 | | | | $ | 353,345 | |

Omnicell, Inc. (a) | | | | 3,450 | | | | | 180,953 | |

| | | | | | | | | | |

| | | | | | | | | 534,298 | |

| | | | | | | | | | |

Internet Software & Services - 7.9% | | | | | | | | | | |

Akamai Technologies, Inc. (a) | | | | 4,570 | | | | | 334,661 | |

Euronet Worldwide, Inc. (a) | | | | 2,865 | | | | | 240,001 | |

Stamps.com Inc. (a) | | | | 1,465 | | | | | 370,718 | |

Twilio Inc. - Class A (a) | | | | 7,435 | | | | | 416,509 | |

| | | | | | | | | | |

| | | | | | | | | 1,361,889 | |

| | | | | | | | | | |

IT Consulting & Services - 1.2% | | | | | | | | | | |

Acxiom Corporation (a) | | | | 7,110 | | | | | 212,945 | |

| | | | | | | | | | |

Leisure Equipment & Products - 3.5% | | | | | | | | | | |

Polaris Industries Inc. | | | | 2,455 | | | | | 299,952 | |

Pool Corporation | | | | 2,035 | | | | | 308,302 | |

| | | | | | | | | | |

| | | | | | | | | 608,254 | |

| | | | | | | | | | |

Machinery - 2.5% | | | | | | | | | | |

John Bean Technologies Corporation | | | | 670 | | | | | 59,563 | |

Kennametal Inc. | | | | 5,610 | | | | | 201,399 | |

Rexnord Corporation (a) | | | | 6,005 | | | | | 174,505 | |

| | | | | | | | | | |

| | | | | | | | | 435,467 | |

| | | | | | | | | | |

Marine - 1.7% | | | | | | | | | | |

Kirby Corporation (a) | | | | 3,495 | | | | | 292,182 | |

| | | | | | | | | | |

Metals & Mining - 2.6% | | | | | | | | | | |

Ferroglobe PLC (b) | | | | 17,590 | | | | | 150,746 | |

Reliance Steel & Aluminum Co. | | | | 3,315 | | | | | 290,195 | |

| | | | | | | | | | |

| | | | | | | | | 440,941 | |

| | | | | | | | | | |

Multiline Retail - 2.6% | | | | | | | | | | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 6,110 | | | | | 442,975 | |

| | | | | | | | | | |

Oil & Gas & Consumable Fuels - 5.8% | | | | | | | | | | |

Diamondback Energy Inc. | | | | 2,040 | | | | | 268,403 | |

Matador Resources Company (a) | | | | 10,300 | | | | | 309,515 | |

WPX Energy Inc. (a) | | | | 22,845 | | | | | 411,895 | |

| | | | | | | | | | |

| | | | | | | | | 989,813 | |

| | | | | | | | | | |

Real Estate Investment Trusts - 3.5% | | | | | | | | | | |

First Industrial Realty Trust, Inc. | | | | 8,215 | | | | | 273,888 | |

Life Storage, Inc. | | | | 3,395 | | | | | 330,368 | |

| | | | | | | | | | |

| | | | | | | | | 604,256 | |

| | | | | | | | | | |

Road & Rail - 1.2% | | | | | | | | | | |

Genesee & Wyoming Inc. - Class A (a) | | | | 2,455 | | | | | 199,641 | |

| | | | | | | | | | |

Software - 9.5% | | | | | | | | | | |

Envestnet, Inc. (a) | | | | 5,205 | | | | | 286,015 | |

Fair Isaac Corporation (a) | | | | 1,895 | | | | | 366,342 | |

Fortinet Inc. (a) | | | | 6,010 | | | | | 375,204 | |

Guidewire Software Inc. (a) | | | | 4,085 | | | | | 362,666 | |

Proofpoint, Inc. (a) | | | | 2,120 | | | | | 244,457 | |

| | | | | | | | | | |

| | | | | | | | | 1,634,684 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

11

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

Specialty Retail - 1.8% | | | | | | | | | | |

Tiffany & Co. | | | | 2,300 | | | | $ | 302,680 | |

| | | | | | | | | | |

Textiles, Apparel & Luxury Goods - 3.9% | | | | | | |

Columbia Sportswear Company | | | | 3,350 | | | | | 306,425 | |

Michael Kors Holdings Ltd. (a)(b) | | | | 5,480 | | | | | 364,968 | |

| | | | | | | | | | |

| | | | | | | | | 671,393 | |

| | | | | | | | | | |

Thrifts & Mortgage Finance - 1.4% | | | | | | | | | | |

Home BancShares Inc. | | | | 10,850 | | | | | 244,776 | |

| | | | | | | | | | |

Trading Companies & Distributors - 4.6% | | | | | | |

MSC Industrial Direct Co., Inc. -

Class A | | | | 2,875 | | | | | 243,944 | |

Triton International Limited (b) | | | | 7,810 | | | | | 239,455 | |

Watsco, Inc. | | | | 1,765 | | | | | 314,664 | |

| | | | | | | | | | |

| | | | | | | | | 798,063 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $12,257,002) | | | | | | | | | 16,840,743 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.2% | | |

Money Market Fund - 2.2% | | | | | | | | | | |

Invesco Short-Term Investments Trust-Government & Agency Portfolio - Institutional Shares, 1.81% (c) | | | | 372,640 | | | | | 372,640 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $372,640) | | | | | 372,640 | |

| | | | | | | | | | |

Total Investments - 100.1%

(Cost $12,629,642) | | | | | | | | | 17,213,383 | |

Liabilities in Excess of Other Assets - (0.1)% | | | | | (14,589 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 17,198,794 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

12

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 95.2% | | Shares | | Value |

Aerospace & Defense - 2.5% | | | | | | | | | | |

Honeywell International Inc. | | | | 60,000 | | | | $ | 8,643,000 | |

| | | | | | | | | | |

Banks - 9.2% | | | | | | | | | | |

Bank of America Corporation | | | | 385,000 | | | | | 10,853,150 | |

Comerica Incorporated | | | | 126,000 | | | | | 11,455,920 | |

Cullen/Frost Bankers, Inc. | | | | 65,000 | | | | | 7,035,600 | |

Glacier Bancorp, Inc. | | | | 60,000 | | | | | 2,320,800 | |

| | | | | | | | | | |

| | | | | | | | | 31,665,470 | |

| | | | | | | | | | |

Beverages - 2.6% | | | | | | | | | | |

The Coca-Cola Company | | | | 80,000 | | | | | 3,508,800 | |

PepsiCo, Inc. | | | | 49,000 | | | | | 5,334,630 | |

| | | | | | | | | | |

| | | | | | | | | 8,843,430 | |

| | | | | | | | | | |

Biotechnology - 2.1% | | | | | | | | | | |

Amgen Inc. | | | | 40,000 | | | | | 7,383,600 | |

| | | | | | | | | | |

Chemicals - 5.0% | | | | | | | | | | |

DowDuPont Inc. | | | | 90,000 | | | | | 5,932,800 | |

Ecolab Inc. | | | | 30,000 | | | | | 4,209,900 | |

FMC Corporation | | | | 80,000 | | | | | 7,136,800 | |

| | | | | | | | | | |

| | | | | | | | | 17,279,500 | |

| | | | | | | | | | |

Commercial Services & Supplies - 3.2% | | | | | | | | | | |

Cintas Corporation | | | | 20,000 | | | | | 3,701,400 | |

Waste Connections, Inc. (b) | | | | 97,500 | | | | | 7,339,800 | |

| | | | | | | | | | |

| | | | | | | | | 11,041,200 | |

| | | | | | | | | | |

Computers & Peripherals - 2.3% | | | | | | | | | | |

Apple Inc. | | | | 42,500 | | | | | 7,867,175 | |

| | | | | | | | | | |

Construction Materials - 1.3% | | | | | | | | | | |

Martin Marietta Materials, Inc. | | | | 20,000 | | | | | 4,466,600 | |

| | | | | | | | | | |

Diversified Financials - 3.1% | | | | | | | | | | |

JPMorgan Chase & Co. | | | | 102,000 | | | | | 10,628,400 | |

| | | | | | | | | | |

Diversified Telecommunication Services - 0.9% | | | | | | |

AT&T Inc. | | | | 100,590 | | | | | 3,229,945 | |

| | | | | | | | | | |

Electrical Equipment & Instruments - 4.5% | | | | | | |

Emerson Electric Co. | | | | 80,000 | | | | | 5,531,200 | |

Franklin Electric Co., Inc. | | | | 85,000 | | | | | 3,833,500 | |

Roper Technologies, Inc. | | | | 23,000 | | | | | 6,345,930 | |

| | | | | | | | | | |

| | | | | | | | | 15,710,630 | |

| | | | | | | | | | |

Electronic Equipment & Instruments - 3.1% | | | | | | |

Littelfuse, Inc. | | | | 18,000 | | | | | 4,107,240 | |

National Instruments Corporation | | | | 55,000 | | | | | 2,308,900 | |

Trimble Inc. (a) | | | | 135,000 | | | | | 4,433,400 | |

| | | | | | | | | | |

| | | | | | | | | 10,849,540 | |

| | | | | | | | | | |

Health Care Equipment & Supplies - 6.6% | | | | | | |

Danaher Corporation | | | | 75,000 | | | | | 7,401,000 | |

PerkinElmer, Inc. | | | | 100,000 | | | | | 7,323,000 | |

Thermo Fisher Scientific Inc. | | | | 40,000 | | | | | 8,285,600 | |

| | | | | | | | | | |

| | | | | | | | | 23,009,600 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

Household Products - 1.5% | | | | | | | | | | |

Kimberly-Clark Corporation | | | | 50,000 | | | | $ | 5,267,000 | |

| | | | | | | | | | |

Internet & Catalog Retail - 2.5% | | | | | | | | | | |

Amazon.com, Inc. (a) | | | | 5,000 | | | | | 8,499,000 | |

| | | | | | | | | | |

Internet Software & Services - 7.7% | | | | | | | | | | |

Akamai Technologies, Inc. (a) | | | | 90,000 | | | | | 6,590,700 | |

Alarm.com Holdings, Inc. (a) | | | | 67,000 | | | | | 2,705,460 | |

Alphabet, Inc. - Class A (a) | | | | 7,000 | | | | | 7,904,330 | |

Facebook, Inc. - Class A (a) | | | | 35,000 | | | | | 6,801,200 | |

LogMeIn, Inc. | | | | 25,000 | | | | | 2,581,250 | |

| | | | | | | | | | |

| | | | | | | | | 26,582,940 | |

| | | | | | | | | | |

IT Consulting & Services - 1.8% | | | | | | | | | | |

PayPal Holdings, Inc. (a) | | | | 75,000 | | | | | 6,245,250 | |

| | | | | | | | | | |

Machinery - 4.9% | | | | | | | | | | |

Generac Holdings, Inc. (a) | | | | 108,000 | | | | | 5,586,840 | |

The Toro Company | | | | 74,000 | | | | | 4,458,500 | |

Valmont Industries, Inc. | | | | 45,000 | | | | | 6,783,750 | |

| | | | | | | | | | |

| | | | | | | | | 16,829,090 | |

| | | | | | | | | | |

Marine - 1.1% | | | | | | | | | | |

Kirby Corporation (a) | | | | 45,000 | | | | | 3,762,000 | |

| | | | | | | | | | |

Oil & Gas & Consumable Fuels - 7.4% | | | | | | | | | | |

Cabot Oil & Gas Corporation | | | | 170,000 | | | | | 4,046,000 | |

ConocoPhillips | | | | 62,000 | | | | | 4,316,440 | |

EOG Resources, Inc. | | | | 65,000 | | | | | 8,087,950 | |

Occidental Petroleum Corporation | | | | 110,000 | | | | | 9,204,800 | |

| | | | | | | | | | |

| | | | | | | | | 25,655,190 | |

| | | | | | | | | | |

Personal Products - 1.2% | | | | | | | | | | |

The Estee Lauder Companies Inc. - Class A | | | | 30,000 | | | | | 4,280,700 | |

| | | | | | | | | | |

Pharmaceuticals - 7.0% | | | | | | | | | | |

AbbVie Inc. | | | | 65,000 | | | | | 6,022,250 | |

Johnson & Johnson | | | | 38,000 | | | | | 4,610,920 | |

Merck & Co., Inc. | | | | 80,000 | | | | | 4,856,000 | |

Pfizer Inc. | | | | 115,000 | | | | | 4,172,200 | |

Zoetis Inc. | | | | 53,500 | | | | | 4,557,665 | |

| | | | | | | | | | |

| | | | | | | | | 24,219,035 | |

| | | | | | | | | | |

Road & Rail - 1.2% | | | | | | | | | | |

Kansas City Southern | | | | 40,000 | | | | | 4,238,400 | |

| | | | | | | | | | |

Software - 6.7% | | | | | | | | | | |

Adobe Systems Incorporated (a) | | | | 40,265 | | | | | 9,817,009 | |

Envestnet, Inc. (a) | | | | 65,000 | | | | | 3,571,750 | |

Microsoft Corporation | | | | 100,000 | | | | | 9,861,000 | |

| | | | | | | | | | |

| | | | | | | | | 23,249,759 | |

| | | | | | | | | | |

| Specialty Retail - 3.4% | | | | |

The Home Depot, Inc. | | | | 40,000 | | | | | 7,804,000 | |

Tiffany & Co. | | | | 30,000 | | | | | 3,948,000 | |

| | | | | | | | | | |

| | | | | | | | | 11,752,000 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Textiles, Apparel & Luxury Goods - 2.4% | | |

VF Corporation | | | | 100,000 | | | | $ | 8,152,000 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $182,551,228) | | | | | | | | | 329,350,454 | |

| | | | | | | | | | |

| | | | | | | | | | |

| U.S. GOVERNMENT ISSUE - 2.9% | | Principal

Amount | | |

| U.S. Treasury Note - 2.9% | | | | |

1.500%, 05/31/2019 | | | $ | 10,000,000 | | | | | 9,925,586 | |

| | | | | | | | | | |

TOTAL U.S. GOVERNMENT ISSUE

(Cost $9,925,945) | | | | | 9,925,586 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.0% | | Shares | | |

| Money Market Fund - 2.0% | | | | |

Invesco Short-Term Investments Trust-Government & Agency Portfolio - Institutional Shares, 1.81% (c) | | | | 6,961,541 | | | | | 6,961,541 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $6,961,541) | | | | | 6,961,541 | |

| | | | | | | | | | |

Total Investments - 100.1%

(Cost $199,438,714) | | | | | 346,237,581 | |

Liabilities in Excess of Other Assets - (0.1)% | | | | | (213,711 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 346,023,870 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

14

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 66.6% | | Shares | | Value |

| Aerospace & Defense - 1.5% | | | | |

Honeywell International Inc. | | | | 5,100 | | | | $ | 734,655 | |

Rockwell Collins, Inc. | | | | 4,300 | | | | | 579,124 | |

| | | | | | | | | | |

| | | | | | | | | 1,313,779 | |

| | | | | | | | | | |

| Banks - 5.0% | | | | |

Bank of America Corporation | | | | 38,500 | | | | | 1,085,315 | |

Comerica Incorporated | | | | 10,100 | | | | | 918,292 | |

Cullen/Frost Bankers, Inc. | | | | 5,900 | | | | | 638,616 | |

SunTrust Banks, Inc. | | | | 11,500 | | | | | 759,230 | |

Zions Bancorporation | | | | 17,500 | | | | | 922,075 | |

| | | | | | | | | | |

| | | | | | | | | 4,323,528 | |

| | | | | | | | | | |

| Beverages - 1.7% | | | | |

The Coca-Cola Company | | | | 17,600 | | | | | 771,936 | |

PepsiCo, Inc. | | | | 6,700 | | | | | 729,429 | |

| | | | | | | | | | |

| | | | | | | | | 1,501,365 | |

| | | | | | | | | | |

| Biotechnology - 1.5% | | | | |

Celgene Corporation (a) | | | | 6,700 | | | | | 532,114 | |

Charles River Laboratories International, Inc. (a) | | | | 6,800 | | | | | 763,368 | |

| | | | | | | | | | |

| | | | | | | | | 1,295,482 | |

| | | | | | | | | | |

| Capital Markets - 1.1% | | | | |

SEI Investments Company | | | | 14,500 | | | | | 906,540 | |

| | | | | | | | | | |

| Chemicals - 5.6% | | | | |

Air Products and Chemicals, Inc. | | | | 5,100 | | | | | 794,223 | |

DowDuPont Inc. | | | | 16,076 | | | | | 1,059,730 | |

Ecolab Inc. | | | | 4,800 | | | | | 673,584 | |

FMC Corporation | | | | 11,200 | | | | | 999,152 | |

GCP Applied Technologies Inc. (a) | | | | 16,000 | | | | | 463,200 | |

Praxair, Inc. | | | | 5,500 | | | | | 869,825 | |

| | | | | | | | | | |

| | | | | | | | | 4,859,714 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 1.5% | | | | |

Cintas Corporation | | | | 3,500 | | | | | 647,745 | |

Waste Management, Inc. | | | | 7,900 | | | | | 642,586 | |

| | | | | | | | | | |

| | | | | | | | | 1,290,331 | |

| | | | | | | | | | |

| Computers & Peripherals - 1.5% | | | | |

Apple Inc. | | | | 7,150 | | | | | 1,323,536 | |

| | | | | | | | | | |

| Construction Materials - 1.0% | | | | |

Martin Marietta Materials, Inc. | | | | 3,900 | | | | | 870,987 | |

| | | | | | | | | | |

| Containers & Packaging - 0.4% | | | | |

Ball Corporation | | | | 8,800 | | | | | 312,840 | |

| | | | | | | | | | |

| Diversified Financials - 2.3% | | | | |

JPMorgan Chase & Co. | | | | 9,000 | | | | | 937,800 | |

Moody’s Corporation | | | | 6,000 | | | | | 1,023,360 | |

| | | | | | | | | | |

| | | | | | | | | 1,961,160 | |

| | | | | | | | | | |

| Diversified Telecommunication Services - 1.5% |

AT&T Inc. | | | | 26,739 | | | | | 858,589 | |

Verizon Communications Inc. | | | | 8,641 | | | | | 434,729 | |

| | | | | | | | | | |

| | | | | | | | | 1,293,318 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Electrical Equipment - 0.9% | | | | |

Rockwell Automation, Inc. | | | | 4,500 | | | | $ | 748,035 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 1.4% |

National Instruments Corporation | | | | 12,300 | | | | | 516,354 | |

Trimble Inc. (a) | | | | 22,200 | | | | | 729,048 | |

| | | | | | | | | | |

| | | | | | | | | 1,245,402 | |

| | | | | | | | | | |

| Food & Drug Retailing - 1.6% | | | | |

Walgreens Boots Alliance, Inc. | | | | 11,400 | | | | | 684,171 | |

Walmart, Inc. | | | | 8,100 | | | | | 693,765 | |

| | | | | | | | | | |

| | | | | | | | | 1,377,936 | |

| | | | | | | | | | |

| Food Products - 0.9% | | | | |

Mondelez International Inc. - Class A | | | | 19,800 | | | | | 811,800 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 3.7% |

Danaher Corporation | | | | 9,600 | | | | | 947,328 | |

Medtronic, PLC (b) | | | | 7,600 | | | | | 650,636 | |

PerkinElmer, Inc. | | | | 11,600 | | | | | 849,468 | |

Thermo Fisher Scientific, Inc. | | | | 3,700 | | | | | 766,418 | |

| | | | | | | | | | |

| | | | | | | | | 3,213,850 | |

| | | | | | | | | | |

| Household Durables - 0.7% | | | | |

Whirlpool Corporation | | | | 3,900 | | | | | 570,297 | |

| | | | | | | | | | |

| Household Products - 2.0% | | | | |

Colgate-Palmolive Company | | | | 11,600 | | | | | 751,796 | |

Kimberly-Clark Corporation | | | | 6,600 | | | | | 695,244 | |

The Procter & Gamble Company | | | | 3,500 | | | | | 273,210 | |

| | | | | | | | | | |

| | | | | | | | | 1,720,250 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.4% | | | | |

Amazon.com, Inc. (a) | | | | 700 | | | | | 1,189,860 | |

| | | | | | | | | | |

| Internet Software & Services - 4.0% | | | | |

Akamai Technologies, Inc. (a) | | | | 12,500 | | | | | 915,375 | |

Alphabet, Inc. - Class A (a) | | | | 250 | | | | | 282,298 | |

Alphabet, Inc. - Class C (a) | | | | 625 | | | | | 697,281 | |

Facebook, Inc. - Class A (a) | | | | 4,600 | | | | | 893,872 | |

LogMeIn, Inc. | | | | 6,000 | | | | | 619,500 | |

| | | | | | | | | | |

| | | | | | | | | 3,408,326 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.0% | | | | |

PayPal Holdings, Inc. (a) | | | | 11,400 | | | | | 949,278 | |

Visa Inc. - Class A | | | | 5,600 | | | | | 741,720 | |

| | | | | | | | | | |

| | | | | | | | | 1,690,998 | |

| | | | | | | | | | |

| Machinery - 0.8% | | | | |

Fortive Corporation | | | | 9,100 | | | | | 701,701 | |

| | | | | | | | | | |

| Marine - 0.9% | | | | |

Kirby Corporation (a) | | | | 9,000 | | | | | 752,400 | |

| | | | | | | | | | |

| Media - 1.1% | | | | |

CBS Corporation - Class B | | | | 3,600 | | | | | 202,392 | |

The Walt Disney Company | | | | 6,700 | | | | | 702,227 | |

| | | | | | | | | | |

| | | | | | | | | 904,619 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

15

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Oil & Gas & Consumable Fuels - 6.1% | | |

Anadarko Petroleum Corporation | | | | 9,500 | | | | $ | 695,875 | |

Cabot Oil & Gas Corporation | | | | 25,900 | | | | | 616,420 | |

Chevron Corporation | | | | 5,795 | | | | | 732,662 | |

ConocoPhillips | | | | 11,400 | | | | | 793,668 | |

EOG Resources, Inc. | | | | 6,000 | | | | | 746,580 | |

Exxon Mobil Corporation | | | | 6,727 | | | | | 556,525 | |

Pioneer Natural Resources Company | | | | 2,600 | | | | | 492,024 | |

WPX Energy Inc. (a) | | | | 35,000 | | | | | 631,050 | |

| | | | | | | | | | |

| | | | | | | | | 5,264,804 | |

| | | | | | | | | | |

| Pharmaceuticals - 5.2% | | |

Abbott Laboratories | | | | 16,000 | | | | | 975,840 | |

AbbVie Inc. | | | | 11,000 | | | | | 1,019,150 | |

Merck & Co., Inc. | | | | 9,800 | | | | | 594,860 | |

Pfizer Inc. | | | | 17,100 | | | | | 620,388 | |

Zoetis Inc. | | | | 14,400 | | | | | 1,226,736 | |

| | | | | | | | | | |

| | | | | | | | | 4,436,974 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 0.5% | | |

American Tower Corporation | | | | 3,200 | | | | | 461,344 | |

| | | | | | | | | | |

| Road & Rail - 0.5% | | |

Union Pacific Corporation | | | | 3,000 | | | | | 425,040 | |

| | | | | | | | | | |

| Software - 4.9% | | |

Adobe Systems Incorporated (a) | | | | 4,300 | | | | | 1,048,383 | |

Citrix Systems, Inc. (a) | | | | 4,000 | | | | | 419,360 | |

Microsoft Corporation | | | | 11,000 | | | | | 1,084,710 | |

Oracle Corporation | | | | 15,400 | | | | | 678,524 | |

RealPage, Inc. (a) | | | | 18,500 | | | | | 1,019,350 | |

| | | | | | | | | | |

| | | | | | | | | 4,250,327 | |

| | | | | | | | | | |

| Specialty Retail - 1.4% | | |

The Home Depot, Inc. | | | | 4,300 | | | | | 838,930 | |

O’Reilly Automotive, Inc. (a) | | | | 1,400 | | | | | 382,998 | |

| | | | | | | | | | |

| | | | | | | | | 1,221,928 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 2.0% | | |

NIKE, Inc. - Class B | | | | 11,600 | | | | | 924,288 | |

VF Corporation | | | | 9,500 | | | | | 774,440 | |

| | | | | | | | | | |

| | | | | | | | | 1,698,728 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $38,295,308) | | | | | | | | | 57,347,199 | |

| | | | | | | | | | |

| | | | | | | | | | |

| CORPORATE BONDS - 31.8% | | Principal

Amount | | |

| Aerospace & Defense - 0.3% | | | | |

Rockwell Collins, Inc. | | | | | | | | | | |

3.700%, 12/15/2023 | | | | | | | | | | |

Callable 09/15/2023 | | | $ | 250,000 | | | | | 249,173 | |

| | | | | | | | | | |

| Air Freight & Logistics - 1.1% | | |

FedEx Corp. | | | | | | | | | | |

2.700%, 04/15/2023 | | | | 425,000 | | | | | 409,514 | |

United Parcel Service, Inc. | | | | | | | | | | |

2.450%, 10/01/2022 | | | | 600,000 | | | | | 581,732 | |

| | | | | | | | | | |

| | | | | | | | | 991,246 | |

| | | | | | | | | | |

| | | | | | | | | | |

| CORPORATE BONDS | | Principal

Amount | | Value |

| Banks - 2.7% | | | | |

Bank of America Corporation: | | | | | | | | | | |

2.625%, 10/19/2020 | | | $ | 400,000 | | | | $ | 395,211 | |

2.625%, 04/19/2021 | | | | 250,000 | | | | | 245,693 | |

The Bank of New York Mellon Corporation: | | | | | | | | | | |

2.450%, 11/27/2020 | | | | | | | | | | |

Callable 10/27/2020 | | | | 350,000 | | | | | 344,413 | |

2.500%, 04/15/2021 | | | | | | | | | | |

Callable 03/15/2021 | | | | 200,000 | | | | | 196,398 | |

BB&T Corporation | | | | | | | | | | |

2.250%, 02/01/2019 | | | | | | | | | | |

Callable 01/02/2019 | | | | 115,000 | | | | | 114,719 | |

Comerica Incorporated | | | | | | | | | | |

2.125%, 05/23/2019 | | | | | | | | | | |

Callable 04/23/2019 | | | | 435,000 | | | | | 432,212 | |

Wells Fargo & Company: | | | | | | | | | | |

2.150%, 01/15/2019 | | | | 200,000 | | | | | 199,351 | |

2.125%, 04/22/2019 | | | | 150,000 | | | | | 149,172 | |

Wells Fargo Bank, National Association | | | | | | | | | | |

1.750%, 05/24/2019 | | | | 250,000 | | | | | 247,793 | |

| | | | | | | | | | |

| | | | | | | | | 2,324,962 | |

| | | | | | | | | | |

| Beverages - 0.5% | | |

PepsiCo, Inc. | | | | | | | | | | |

3.000%, 08/25/2021 | | | | 415,000 | | | | | 416,052 | |

| | | | | | | | | | |

| Biotechnology - 1.3% | | |

Amgen Inc.: | | | | | | | | | | |

2.200%, 05/22/2019 | | | | | | | | | | |

Callable 04/22/2019 | | | | 100,000 | | | | | 99,471 | |

2.125%, 05/01/2020 | | | | | | | | | | |

Callable 04/01/2020 | | | | 100,000 | | | | | 98,352 | |

2.700%, 05/01/2022 | | | | | | | | | | |

Callable 03/01/2022 | | | | 325,000 | | | | | 315,967 | |

Celgene Corporation | | | | | | | | | | |

3.625%, 05/15/2024 | | | | | | | | | | |

Callable 02/15/2024 | | | | 250,000 | | | | | 244,220 | |

Gilead Sciences, Inc. | | | | | | | | | | |

2.050%, 04/01/2019 | | | | 335,000 | | | | | 333,430 | |

| | | | | | | | | | |

| | | | | | | | | 1,091,440 | |

| | | | | | | | | | |

| Chemicals - 0.6% | | |

Ecolab Inc.: | | | | | | | | | | |

2.000%, 01/14/2019 | | | | 250,000 | | | | | 249,080 | |

2.250%, 01/12/2020 | | | | 100,000 | | | | | 98,786 | |

3.250%, 01/14/2023 | | | | | | | | | | |

Callable 11/14/2022 | | | | 200,000 | | | | | 197,694 | |

| | | | | | | | | | |

| | | | | | | | | 545,560 | |

| | | | | | | | | | |

| Communications Equipment - 1.0% | | |

Cisco Systems, Inc.: | | | | | | | | | | |

2.125%, 03/01/2019 | | | | 250,000 | | | | | 249,399 | |

2.200%, 02/28/2021 | | | | 275,000 | | | | | 269,906 | |

QUALCOMM Incorporated | | | | | | | | | | |

2.250%, 05/20/2020 | | | | 350,000 | | | | | 344,997 | |

| | | | | | | | | | |

| | | | | | | | | 864,302 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2018 (Unaudited) |

| | | | | | | | | | |

| CORPORATE BONDS | | Principal

Amount | | Value |

| Computers & Peripherals - 1.0% | | |

Apple Inc. | | | | | | | | | | |

2.850%, 05/06/2021 | | | $ | 500,000 | | | | $ | 499,004 | |

International Business Machines Corporation | | | | | | | | | | |

2.250%, 02/19/2021 | | | | 350,000 | | | | | 342,589 | |

| | | | | | | | | | |

| | | | | | | | | 841,593 | |

| | | | | | | | | | |

| Consumer Finance - 0.3% | | |

American Express Credit Corporation 2.600%, 09/14/2020 | | | | | | | | | | |

Callable 08/14/2020 | | | | 300,000 | | | | | 296,346 | |

| | | | | | | | | | |

| Diversified Financials - 0.7% | | |

JPMorgan Chase & Co.: | | | | | | | | | | |

2.400%, 06/07/2021 | | | | | | | | | | |

Callable 05/07/2021 | | | | 400,000 | | | | | 389,869 | |

3.375%, 05/01/2023 | | | | 225,000 | | | | | 219,903 | |

| | | | | | | | | | |

| | | | | | | | | 609,772 | |

| | | | | | | | | | |

| Diversified Telecommunication Services - 1.6% | | |

AT&T Inc. | | | | | | | | | | |

2.450%, 06/30/2020 | | | | | | | | | | |

Callable 05/30/2020 | | | | 725,000 | | | | | 714,379 | |

Verizon Communications Inc.: | | | | | | | | | | |

3.000%, 11/01/2021 | | | | | | | | | | |

Callable 09/01/2021 | | | | 455,000 | | | | | 447,930 | |

2.450%, 11/01/2022 | | | | | | | | | | |

Callable 08/01/2022 | | | | 200,000 | | | | | 190,899 | |

| | | | | | | | | | |

| | | | | | | | | 1,353,208 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 1.7% | | |

Emerson Electric Co.: | | | | | | | | | | |

2.625%, 02/15/2023 | | | | | | | | | | |

Callable 11/15/2022 | | | | 400,000 | | | | | 388,377 | |

3.150%, 06/01/2025 | | | | | | | | | | |

Callable 03/01/2025 | | | | 200,000 | | | | | 195,151 | |

Rockwell Automation, Inc. | | | | | | | | | | |

2.050%, 03/01/2020 | | | | | | | | | | |

Callable 02/01/2020 | | | | 288,000 | | | | | 283,201 | |

Roper Technologies, Inc. | | | | | | | | | | |

2.800%, 12/15/2021 | | | | | | | | | | |

Callable 11/15/2021 | | | | 600,000 | | | | | 586,447 | |

| | | | | | | | | | |

| | | | | | | | | 1,453,176 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 0.3% | | |

Trimble Inc. | | | | | | | | | | |

4.150%, 06/15/2023 | | | | | | | | | | |

Callable 05/15/2023 | | | | 250,000 | | | | | 249,473 | |

| | | | | | | | | | |

| Food & Drug Retailing - 1.1% | | |

Costco Wholesale Corporation | | | | | | | | | | |

2.250%, 02/15/2022 | | | | 400,000 | | | | | 388,397 | |

Walgreens Boots Alliance, Inc.: | | | | | | | | | | |

3.300%, 11/18/2021 | | | | | | | | | | |

Callable 09/18/2021 | | | | 325,000 | | | | | 323,189 | |

3.800%, 11/18/2024 | | | | | | | | | | |

Callable 08/18/2024 | | | | 250,000 | | | | | 246,785 | |

| | | | | | | | | | |

| | | | | | | | | 958,371 | |

| | | | | | | | | | |

| | | | | | | | | | |

| CORPORATE BONDS | | Principal

Amount | | Value |

| Health Care Equipment & Supplies - 1.5% | | |

Danaher Corporation | | | | | | | | | | |

2.400%, 09/15/2020 | | | | | | | | | | |

Callable 08/15/2020 | | | $ | 400,000 | | | | $ | 395,356 | |

Medtronic, Inc. | | | | | | | | | | |

2.500%, 03/15/2020 | | | | 300,000 | | | | | 297,992 | |

Thermo Fisher Scientific, Inc. | | | | | | | | | | |

3.150%, 01/15/2023 | | | | | | | | | | |

Callable 10/15/2022 | | | | 600,000 | | | | | 587,350 | |

| | | | | | | | | | |

| | | | | | | | | 1,280,698 | |

| | | | | | | | | | |

| Health Care Providers & Services - 0.6% | | |

CVS Health Corporation: | | | | | | | | | | |

2.250%, 12/05/2018 | | | | | | | | | | |

Callable 11/05/2018 | | | | 175,000 | | | | | 174,541 | |

2.125%, 06/01/2021 | | | | | | | | | | |

Callable 05/01/2021 | | | | 400,000 | | | | | 384,785 | |

| | | | | | | | | | |

| | | | | | | | | 559,326 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 0.3% | | |

McDonald’s Corporation: | | | | | | | | | | |

2.750%, 12/09/2020 | | | | | | | | | | |

Callable 11/09/2020 | | | | 200,000 | | | | | 198,764 | |

3.625%, 05/20/2021 | | | | 100,000 | | | | | 101,247 | |

| | | | | | | | | | |

| | | | | | | | | 300,011 | |

| | | | | | | | | | |

| Household Durables - 0.9% | | |

Newell Brands, Inc.: | | | | | | | | | | |

2.150%, 10/15/2018 | | | | 400,000 | | | | | 399,130 | |

3.150%, 04/01/2021 | | | | | | | | | | |