As filed with the U.S. Securities and Exchange Commission on September 8, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08352

LKCM Funds

(Exact name of registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and 1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Item 1. Reports to Stockholders.

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

LKCM

FUNDS

LKCM Small Cap Equity Fund

LKCM Small-Mid Cap Equity Fund

LKCM Equity Fund

LKCM Balanced Fund

LKCM Fixed Income Fund

LKCM International Equity Fund

Semi-Annual Report

June 30, 2022

Dear Fellow Shareholders:

We report the following performance information for the LKCM Funds for indicated periods ended June 30, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Funds | | Inception

Date | | NAV @

6/30/22 | | Net

Expense

Ratio*, ** | | Gross

Expense

Ratio** | | Six Month

Total

Return

Ended

6/30/22 | | One Year

Total

Return

Ended

6/30/22 | | Five Year

Average

Annualized

Return

Ended

6/30/22 | | Ten Year

Average

Annualized

Return

Ended

6/30/22 | | Avg.

Annual

Total

Return

Since

Incept. |

LKCM Small Cap Equity Fund | | | | 07/14/1994 | | | | $ | 16.20 | | | | | 1.00% | | | | | 1.03% | | | | | -24.79% | | | | | -26.77% | | | | | 7.98% | | | | | 8.26% | | | | | 9.87% | |

Russell 2000® Index(1) | | | | | | | | | | | | | | | | | | | | | | | | -23.43% | | | | | -25.20% | | | | | 5.17% | | | | | 9.35% | | | | | 8.63% | |

LKCM Small-Mid Cap Equity Fund | | | | 05/02/2011 | | | | $ | 8.57 | | | | | 1.00% | | | | | 1.74% | | | | | -21.88% | | | | | -20.37% | | | | | 10.11% | | | | | 8.72% | | | | | 7.13% | |

Russell 2500® Index(2) | | | | | | | | | | | | | | | | | | | | | | | | -21.81% | | | | | -21.00% | | | | | 7.04% | | | | | 10.49% | | | | | 8.78% | |

LKCM Equity Fund | | | | 01/03/1996 | | | | $ | 31.32 | | | | | 0.80% | | | | | 0.96% | | | | | -19.05% | | | | | -13.02% | | | | | 11.03% | | | | | 11.70% | | | | | 8.86% | |

S&P 500® Index(3) | | | | | | | | | | | | | | | | | | | | | | | | -19.96% | | | | | -10.62% | | | | | 11.31% | | | | | 12.96% | | | | | 9.08% | |

LKCM Balanced Fund | | | | 12/30/1997 | | | | $ | 24.45 | | | | | 0.80% | | | | | 0.96% | | | | | -15.91% | | | | | -11.51% | | | | | 6.99% | | | | | 8.45% | | | | | 6.59% | |

S&P 500® Index(3) | | | | | | | | | | | | | | | | | | | | | | | | -19.96% | | | | | -10.62% | | | | | 11.31% | | | | | 12.96% | | | | | 7.70% | |

Bloomberg U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | | | | | | -6.77% | | | | | -7.28% | | | | | 1.13% | | | | | 1.45% | | | | | 3.92% | |

LKCM Fixed Income Fund | | | | 12/30/1997 | | | | $ | 10.29 | | | | | 0.50% | | | | | 0.78% | | | | | -4.68% | | | | | -5.43% | | | | | 1.03% | | | | | 1.46% | | | | | 3.72% | |

Bloomberg U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | | | | | | -6.77% | | | | | -7.28% | | | | | 1.13% | | | | | 1.45% | | | | | 3.92% | |

LKCM International Equity Fund | | | | 05/01/2019 | | | | $ | 10.86 | | | | | 1.00% | | | | | 1.40% | | | | | -25.10% | | | | | -22.41% | | | | | N/A | | | | | N/A | | | | | 3.12% | |

MSCI/EAFE® Index(5) | | | | | | | | | | | | | | | | | | | | | | | | -19.25% | | | | | -17.33% | | | | | N/A | | | | | N/A | | | | | 1.71% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if Luther King Capital Management Corporation, the Funds’ investment adviser, had not waived a portion of its management fee and/or reimbursed certain expenses of the Funds. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Funds. The Funds impose a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

| * | Luther King Capital Management Corporation, the Funds’ investment adviser, has contractually agreed to waive all or a portion of its management fee and/or reimburse expenses of each Fund to maintain the expense ratios designated in the Funds’ prospectus through May 1, 2023. This expense limitation excludes interest, taxes, brokerage commissions, indirect fees and expenses related to investments in other investment companies, including money market funds, and extraordinary expenses. Investment performance, which is based on the net expense ratio, reflects fee waivers, if any, in effect during the relevant period. In the absence of such waivers, total return would be reduced. LKCM waived management fees and/or reimbursed expenses for each Fund during the six months ended June 30, 2022. |

| ** | Expense ratios above are as reported in the Funds’ current prospectus dated May 1, 2022. Expense ratios reported for other periods in the financial highlights of this report may differ. |

| (1) | The Russell 2000® Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

| (2) | The Russell 2500® Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. |

| (3) | The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market. |

| (4) | The Bloomberg U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued. |

| (5) | The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI/EAFE® Index”) is an unmanaged index composed of large-cap and mid-cap securities across 21 European and Pacific Basin countries. The MSCI/EAFE® Index is a recognized international index and is weighted by market capitalization. |

Note: The indices defined above are not available for direct investment and the index performance therefore does not include fees, expenses or taxes.

1H2022 Review

The Federal Reserve is battling broad-based inflation and has indicated a willingness to take significant actions in an effort to restore price stability. Since the beginning of the year, financial conditions have been tightening as capital markets have internalized the Federal Reserve’s anti-inflation campaign. We believe the tightening of financial conditions, including, among others, increased borrowing costs and a rising U.S. dollar, have amplified the risk of a potential recession. While the magnitude of the Federal Reserve’s financial tightening may be historically smaller than that of other cycles, the pace of its tightening efforts has been rapid, contributing in part to the historically large swings in asset values observed during the first half of 2022.

Although we believe the need for more restrictive monetary policy that seeks to reduce inflation threatens the current economic expansion, the crucial underpinnings of the economy remain solid in our view. For example, we believe that most consumers have historically low household debt-to-income ratios, significantly higher bank deposits than in the period preceding the pandemic, and experienced rapid wage growth. Even as consumer pessimism towards the economy appears to grow, consumers in the aggregate appear relatively well positioned for an economic downturn in our view. In addition, we believe that companies are likely to post record

2

earnings this year as many firms have passed along rising input costs to their customers. However, we believe the trajectory of future corporate earnings ultimately will depend heavily on whether or not the economy enters a recession.

The first half of 2022 has been marked by the worst start for the S&P 500® Index since 1970, declining 19.96% for the six months ended June 30, 2022. The NASDAQ Index, which is primarily comprised of growth-oriented companies, corrected even harder during the first half of 2022, declining 29.22% for the six months ended June 30, 2022 and marking its worst first half on record. We believe the performance of equities in the second half of 2022 will depend greatly on the shifting outlook for inflation, interest rates, and corporate profits.

These developments, among others, have caused many Americans to become increasingly worried about a potential recession. The closely watched monthly University of Michigan Consumer Sentiment Index dates to 1966 and seeks to assess near-time consumer attitudes on business climate, personal finance, and spending. The recent June 2022 reading of this index was the lowest reading on record. The University of Michigan commentary indicates that approximately 79% of consumers expect difficult times in the year ahead for business conditions. We believe that it is not only consumers who are anxious about the current economic environment, but also corporate executives and lawmakers who appear to be expressing similar concerns. Regardless of what economic data suggest about the current health of the economy, we believe that consumers are generally pessimistic about future business and market conditions.

We believe the odds that the current economic expansion falters have steadily increased during the past several months. The Federal Reserve has clearly and unequivocally declared its intent to fight inflation in our view, having increased its benchmark interest rate by 0.25% in March 2022, 0.50% in May 2022, and 0.75% in June 2022. The last time the Federal Reserve increased its benchmark rate by 0.75% was November 1994. Interestingly, we believe that period marked the last time the Federal Reserve successfully engineered a so-called soft economic landing, which generally involves the Federal Reserve increasing its benchmark interest rate to reduce inflation while not simultaneously triggering a recession.

Financial conditions have historically had a significant influence on the spending, saving, and investment plans of businesses and households. The Federal Reserve has historically used its monetary tools, primarily its benchmark interest rate, in an effort to influence financial conditions. In our view, four of the primary financial conditions the Federal Reserve seeks to influence are the level of interest rates at different maturities, credit spreads, the U.S. dollar, and equity market levels. We believe each of these items directly influences the economy, and the interplay of these elements collectively encourages or discourages economic behavior. For example, the overall level of interest rates is a key component of mortgage rates and corporate borrowing costs. With housing prices rapidly increasing year-over-year, the Federal Reserve appears anxious to cool the upward pressure on the housing component of inflation. We believe the recent rise in mortgage rates should cool the sharp increase in residential real estate activity and values.

The global energy crisis continues to spur headline inflation, and more critically, is applying further supply side pressure on the global economy in our view. We believe that manufacturing facilities in Europe that produce steel, fertilizer, and chemicals are facing significant challenges from surging electricity costs, and European natural gas futures have risen to levels roughly ten times higher than a year ago. In our view, energy rationing is likely in parts of Europe if Russia further curtails energy exports. Domestically, we have encountered similar challenges with gasoline prices rising over 60% over the past twelve months and high electricity costs contributing to pressure on consumers and businesses.

Examining the recessions that have occurred since World War II, we believe the equity market has historically begun to discount a recession on average seven months prior to the official start of the recession. In our view, the sequence of events each cycle is remarkably consistent with the equity market generally peaking prior to the recession and then generally bottoming prior to the end of the recession. A notable exception to this view was the 2000 recession when the market bottomed following the conclusion of the recession. During the first half of 2022, the decline in the S&P 500® Index appears based in part on the impact of both higher interest rates and mounting recession concerns. If a recession were to materialize, we would anticipate a decline in corporate earnings. In our view, the worst periods of earnings contractions have historically been accompanied by concentrated sector weakness, although major losses in specific sectors do not necessarily communicate the breadth or narrowness of the economic contraction. For example, only one sector of the market accounted for almost half of the earnings decline in 1990 (autos), 2001 (technology), and 2008 (financials). Today we do not believe that we currently see any one sector of the economy that could trigger the magnitude of earnings decline that occurred in these three earnings drawdown periods.

Many asset values have historically taken their cues from the anticipated direction of monetary policy. We believe these values certainly include the Treasury market, as yields on 1- to 3-year Treasury bonds historically have begun to rise ahead of the Federal Reserve’s monetary policy actions. We believe the outlook for intermediate to longer-term bond yields is cloudier because inflation expectations are a key component of longer-term bond yields. In our view, the concern for inflation is the key reason why the return on the 10-Year Treasury note fell 11.34% during the first half of 2022.

2H2022 Outlook

High inflation is contributing to consumer uneasiness in our view. The record low June 2022 reading of the University of Michigan Consumer Sentiment Index eclipsed the previous low in November 2008. We believe the economy, however, faces the opposite set of problems it confronted in 2008. Fourteen years ago, we believe that demand was too weak, there were not enough jobs, and deflation was a concern. Today, we believe the economy is overheating, there are nearly two job openings per unemployed worker, and inflation is at a forty-year high. In our view, the challenge for policymakers is to strike a balance between the appropriate amount of tightening to lower

3

inflation, while preserving the economic expansion. We believe the equity market has already digested the unfolding economic slowdown, and if the current slowdown presages a recession, then the equity market may have to reprice lower as corporate earnings will likely be at risk.

LKCM Equity Fund

The LKCM Equity Fund returned -19.05% for the six months ended June 30, 2022, as compared to the -19.96% return for the S&P 500® Index, the Fund’s benchmark. The Fund’s relative performance benefited from strong sector allocation decisions, particularly the Fund’s underweight positions in the Communication Services and Consumer Discretionary sectors and overweight positions in the Energy and Industrials sectors. The Fund’s stock selection decisions in the Industrials, Healthcare and Information Technology sectors detracted from the Fund’s relative performance. We believe that the Fund benefits from the efforts of our experienced portfolio management and proprietary internal research teams. We remain committed to our investment strategy for the Fund that focuses on investments in companies that we believe are high quality and have solid balance sheets and cash flows and we believe the Fund remains well-positioned for the anticipated economic and capital market environment.

LKCM Balanced Fund

The LKCM Balanced Fund returned -15.91% for the six months ended June 30, 2022, as compared to the -19.96% return for the S&P 500® Index and the -6.77% return for the Bloomberg Intermediate Government/Credit Bond Index. The Fund’s equity portfolio benefited from an overweight position in the Energy sector and an underweight position in the Consumer Discretionary sector relative to the benchmark, as well as solid stock selection in the Information Technology and Materials sectors relative to the benchmark. Stock selection decisions in the Healthcare and Financials sectors detracted from the Fund’s relative performance during the period. While the Fund’s fixed income portfolio generated a negative return during the first half of 2022 as interest rates moved dramatically higher, our long-standing strategy of maintaining a relatively short duration was beneficial for returns relative to the longer duration benchmark. The Fund’s fixed income portfolio remains focused on investments in high quality bonds with intermediate maturities. We believe the Fund remains well-positioned for the anticipated economic and capital market environment.

LKCM Fixed Income Fund

The first half of 2022 produced negative returns across the bond market regardless of quality or tenor although lower quality and longer duration issues generally fared the worst. The 10-year Treasury, down 11.34% for the six months ended June 30, 2022, produced its worst first half total return in its history. In this environment, the LKCM Fixed Income Fund returned -4.68% on a total return basis during the six months ended June 30, 2022 compared to its benchmark, the Bloomberg Intermediate Government/Credit Bond Index, which returned -6.77% during this period. During the first half of 2022, Treasury yields rose sharply with portions of the curve inverting at times as it flattened significantly. This flattening of the curve was largely the result of the Federal Reserve tightening monetary policy by increasing the federal funds rate a total of 1.50% during this period after maintaining aggressively easy policy while inflation continued to accelerate. The Federal Reserve also began the process of quantitative tightening by beginning to reduce the size of its balance sheet, which had grown to unprecedented levels during the pandemic. Both extraordinarily accommodative monetary and fiscal policy created outsized demand while pandemic-induced supply chain bottlenecks continued to suppress supply, ultimately leading to the very definition of inflation of “too much money chasing too few goods.” Within this backdrop fixed income securities were negatively impacted by rising rates with shorter-duration securities outperforming their longer-duration counterparts and higher quality issues outperforming lower-quality issues. While the Fund’s defensive duration posture of 2.6 years relative to the 4.1 year duration of the benchmark was additive to the Fund’s relative performance, the Fund’s overweight position in corporate bonds detracted from relative performance as credit spreads widened. The Fund remains focused on investments in the short-to-intermediate sector in an effort to reduce interest rate risk and on investment-grade corporate bonds with strong underlying company fundamentals in an effort to mitigate credit risk and achieve a sustainable cash flow stream.

LKCM International Equity Fund

The LKCM International Equity Fund returned -25.10% for the six months ended June 30, 2022, as compared to the -19.25% return for the MSCI EAFE® Index, the Fund’s benchmark. Strong stock selection in the Materials, Energy and Consumer Staples sectors relative to the benchmark partially offset some of the negative stock selection effect in other sectors. The Fund’s underweight position in the Consumer Discretionary sector and overweight position in the Energy sector benefited the Fund’s performance relative to the benchmark. The positive attribution from our sector allocation decisions relative to the benchmark were partially offset by our overweight position in the Industrials sector and our underweight position in the Utilities sector. The Fund’s performance relative to the benchmark was strong during the second quarter of 2022, which partially offset the Fund’s relative underperformance during the first quarter of 2022. The Fund suffered during the first quarter of 2022 from an acute deflation in valuation metrics for growth-oriented companies relative to more value-oriented constituents in the benchmark. We believe the current investment environment remains challenging with economic uncertainty and persistent inflation, along with less accommodative central bank policies in many developed markets, weighing on the shorter-term outlook. Geopolitical and global challenges have also presented additional considerations as Russia threatens energy restrictions and China wrestles with overextended property markets. Our investment strategy and discipline for the Fund is anchored with a long-term investment horizon and focus on companies that we believe are high quality companies with strategic advantages, strong balance sheets and attractive returns on invested capital, which we believe have generally outperformed the benchmark over multiple market cycles. We continue to believe that the Fund is well-positioned for the remainder of 2022.

4

LKCM Small Cap Equity Fund

The LKCM Small Cap Equity Fund returned -24.79% for the six months ended June 30, 2022, as compared to the -23.43% return for the Russell 2000® Index, the Fund’s benchmark. Solid stock selection in the Communication Services and Financials sectors relative to the benchmark partially offset some of the negative stock selection effect in other sectors. The Fund benefited from the sector allocation decisions relative to the benchmark, including an underweight position in the Healthcare sector and overweight positions in the Energy, Consumer Staples and Industrials sectors. The positive attribution from our sector allocation decisions relative to the benchmark were partially offset by our underweight position in the Utilities sector. The Fund’s performance relative to the benchmark was strong during the second quarter of 2022, which partially offset the Fund’s relative underperformance during the first quarter of 2022. We believe the current investment environment remains challenging with economic uncertainty and persistent inflation, along with a less accommodative Federal Reserve, weighing on the shorter-term outlook. Our investment strategy and discipline for the Fund is anchored with a long-term investment horizon and focus on companies that we believe are high quality companies with strategic advantages, strong balance sheets and attractive returns on invested capital, which we believe have generally outperformed the benchmark over multiple market cycles, which we believe have generally outperformed the benchmark over multiple market cycles. We believe the Fund remains well-positioned for the anticipated economic and capital market environment.

LKCM Small-Mid Cap Equity Fund

The LKCM Small-Mid Cap Equity Fund returned -21.88% for the six months ended June 30, 2022, as compared to the -21.81% return for the Russell 2500® Index, the Fund’s benchmark. The Fund’s relative performance benefited from an overweight position in the Energy sector, which was partially offset by the Fund’s underweight position in the Utilities sector. Stock selection decisions in the Healthcare and Industrials sectors detracted from the Fund’s relative performance, which was partially offset by strong stock selection in the Financials sector. We remain committed to our investment strategy that focuses on companies that we believe are high quality and have solid cash flows, balance sheets and management teams. We believe the Fund remains well-positioned for the anticipated economic and capital market environment.

J. Luther King, Jr., CFA, CIC

August 1, 2022

The information provided herein represents the opinion of J. Luther King, Jr., CFA, CIC and is not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Please refer to the Schedule of Investments found on pages 8-22 of the report for more information on Fund holdings. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any securities.

Mutual fund investing involves risk. Principal loss is possible. Past performance is not a guarantee of future results. Investments in equity securities are subject to market risks and significant fluctuations in value. Small and medium capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure, and, historically, their stocks have experienced a greater degree of market volatility than stocks on average. Non-U.S. investments carry potential risks not associated with domestic investments, including currency exchange rate fluctuations, political and financial instability, less liquidity, greater volatility, different regulatory and financial reporting standards, and delays in transaction settlement. Investments in debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Investments in mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. These and other risks are discussed in the Funds’ summary and statutory prospectuses.

Earnings growth is not a measure of future performance.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as S&P Global. The firm evaluates a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

Investors should consider the investment objective, risks and charges and expenses of a Fund carefully before investing. Each Fund’s summary prospectus and prospectus contain this and other information about the Fund. Investors can obtain a summary prospectus and/or the prospectus by calling 1-800-688-LKCM. The summary prospectus and/or prospectus should be read carefully before investing in a Fund.

Quasar Distributors, LLC, distributor.

5

LKCM Funds Expense Example — June 30, 2022 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (01/01/2022-06/30/2022).

ACTUAL EXPENSES

The third and fourth columns of the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the fourth column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC (doing business as U.S. Bank Global Fund Services), the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the Funds within 30 days of purchase, unless otherwise determined by the Funds in their discretion. To the extent the Funds invest in shares of other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The fifth and sixth columns of the table below provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the fifth and sixth columns of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical (5% return

before expenses) |

| | | Fund’s

Annualized

Expense

Ratio(1) | | Beginning

Account Value

01/01/2022 | | Ending

Account Value

06/30/2022 | | Expenses

Paid

During

Period(1) | | Ending

Account Value

06/30/2022 | | Expenses

Paid

During

Period(1) |

LKCM Small Cap Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 752.10 | | | | $ | 4.34 | | | | $ | 1,019.84 | | | | $ | 5.01 | |

LKCM Small-Mid Cap Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 781.20 | | | | $ | 4.42 | | | | $ | 1,019.84 | | | | $ | 5.01 | |

LKCM Equity Fund | | | | 0.80 | % | | | $ | 1,000.00 | | | | $ | 809.50 | | | | $ | 3.59 | | | | $ | 1,020.83 | | | | $ | 4.01 | |

LKCM Balanced Fund | | | | 0.80 | % | | | $ | 1,000.00 | | | | $ | 840.90 | | | | $ | 3.65 | | | | $ | 1,020.83 | | | | $ | 4.01 | |

LKCM Fixed Income Fund | | | | 0.50 | % | | | $ | 1,000.00 | | | | $ | 953.20 | | | | $ | 2.42 | | | | $ | 1,022.32 | | | | $ | 2.51 | |

LKCM International Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 749.00 | | | | $ | 4.34 | | | | $ | 1,019.84 | | | | $ | 5.01 | |

| (1) | Expenses are equal to the annualized net expense ratio for the Fund, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

6

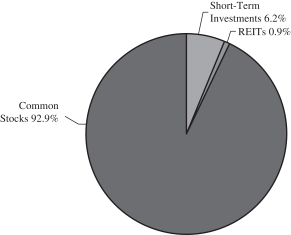

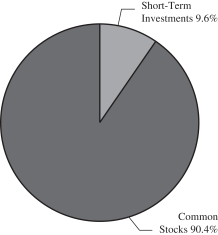

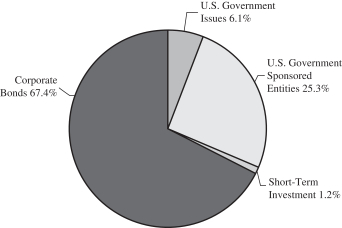

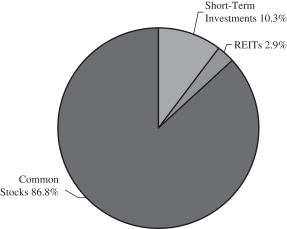

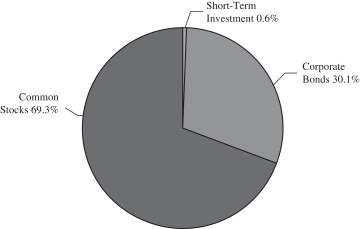

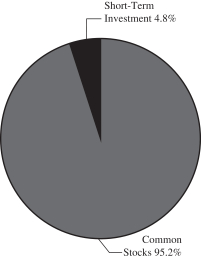

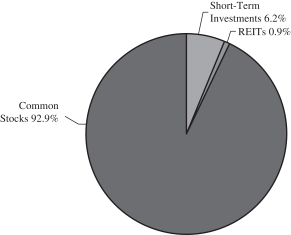

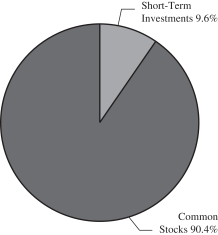

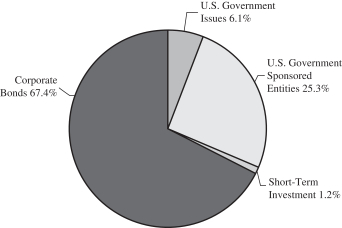

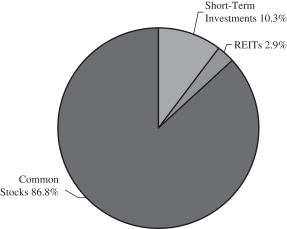

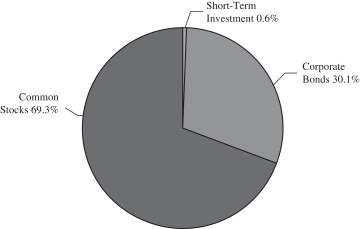

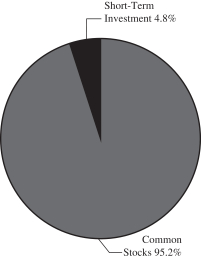

ALLOCATION OF PORTFOLIO HOLDINGS — LKCM Funds — June 30, 2022 (Unaudited)

Percentages represent market value as a percentage of total investments.

LKCM Small Cap Equity Fund

LKCM Equity Fund

LKCM Fixed Income Fund

LKCM Small-Mid Cap Equity Fund

LKCM Balanced Fund

LKCM International Equity Fund

7

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 93.1% | | Shares | | Value |

| Aerospace & Defense - 3.6% | | | | |

Hexcel Corp. | | | | 35,325 | | | | $ | 1,847,851 | |

Mercury Systems, Inc. (a) | | | | 42,800 | | | | | 2,753,324 | |

Triumph Group, Inc. (a) | | | | 111,098 | | | | | 1,476,492 | |

| | | | | | | | | | |

| | | | | | | | | 6,077,667 | |

| | | | | | | | | | |

| Auto Components - 0.8% | | | | |

Fox Factory Holding Corp. (a) | | | | 16,290 | | | | | 1,311,996 | |

| | | | | | | | | | |

| Banks - 8.9% | | | | |

Cadence Bank | | | | 114,529 | | | | | 2,689,141 | |

Comerica, Inc. | | | | 31,215 | | | | | 2,290,557 | |

Cullen/Frost Bankers, Inc. | | | | 21,375 | | | | | 2,489,119 | |

Glacier Bancorp, Inc. | | | | 43,655 | | | | | 2,070,120 | |

Pinnacle Financial Partners, Inc. | | | | 35,705 | | | | | 2,581,828 | |

Seacoast Banking Corp. of Florida | | | | 92,175 | | | | | 3,045,462 | |

| | | | | | | | | | |

| | | | | | | | | 15,166,227 | |

| | | | | | | | | | |

| Beverages - 3.1% | | | | |

Celsius Holdings, Inc. (a) | | | | 48,000 | | | | | 3,132,480 | |

Primo Water Corp. (b) | | | | 160,000 | | | | | 2,140,800 | |

| | | | | | | | | | |

| | | | | | | | | 5,273,280 | |

| | | | | | | | | | |

| Biotechnology - 0.8% | | | | |

Neogen Corp. (a) | | | | 55,450 | | | | | 1,335,790 | |

| | | | | | | | | | |

| Building Products - 3.1% | | | | |

CSW Industrials, Inc. | | | | 17,750 | | | | | 1,828,783 | |

PGT Innovations, Inc. (a) | | | | 101,185 | | | | | 1,683,718 | |

Zurn Elkay Water Solutions Corp. | | | | 60,995 | | | | | 1,661,504 | |

| | | | | | | | | | |

| | | | | | | | | 5,174,005 | |

| | | | | | | | | | |

| Chemicals - 3.6% | | | | |

Avient Corp. | | | | 40,000 | | | | | 1,603,200 | |

Ecovyst, Inc. | | | | 315,000 | | | | | 3,102,750 | |

Ferroglobe Representation & Warranty Insurance Trust (a)(c) | | | | 302,970 | | | | | — | |

Quaker Chemical Corp. | | | | 9,340 | | | | | 1,396,517 | |

| | | | | | | | | | |

| | | | | | | | | 6,102,467 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 1.1% | | | | |

Driven Brands Holdings Inc. (a) | | | | 68,000 | | | | | 1,872,720 | |

| | | | | | | | | | |

| Communications Equipment - 1.1% | | | | |

Lumentum Holdings, Inc. (a) | | | | 23,330 | | | | | 1,852,869 | |

| | | | | | | | | | |

| Construction & Engineering - 1.6% | | | | |

NV5 Global, Inc. (a) | | | | 23,342 | | | | | 2,724,945 | |

| | | | | | | | | | |

| Construction Materials - 0.8% | | | | |

Eagle Materials, Inc. | | | | 11,875 | | | | | 1,305,537 | |

| | | | | | | | | | |

| Energy Equipment & Services - 1.1% | | | | |

Weatherford International Public Limited Co. (a)(b) | | | | 86,789 | | | | | 1,837,323 | |

| | | | | | | | | | |

| Food Products - 1.3% | | | | |

Utz Brands, Inc. | | | | 158,661 | | | | | 2,192,695 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 4.8% |

Alphatec Holdings, Inc. (a) | | | | 232,000 | | | | | 1,517,280 | |

Cerus Corp. (a) | | | | 325,000 | | | | | 1,719,250 | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Health Care Equipment & Supplies - 4.8%, Continued |

Enovis Corp. (a) | | | | 28,500 | | | | $ | 1,567,500 | |

Omnicell, Inc. (a) | | | | 7,500 | | | | | 853,125 | |

STAAR Surgical Co. (a) | | | | 35,000 | | | | | 2,482,550 | |

| | | | | | | | | | |

| | | | | | | | | 8,139,705 | |

| | | | | | | | | | |

| Health Care Providers & Services - 6.6% | | | | |

HealthEquity, Inc. (a) | | | | 44,000 | | | | | 2,701,160 | |

Medpace Holdings, Inc. (a) | | | | 19,750 | | | | | 2,955,982 | |

Progyny, Inc. (a) | | | | 53,370 | | | | | 1,550,399 | |

R1 RCM Inc. (a) | | | | 106,100 | | | | | 2,223,856 | |

U.S. Physical Therapy, Inc. | | | | 16,015 | | | | | 1,748,838 | |

| | | | | | | | | | |

| | | | | | | | | 11,180,235 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 4.4% | | | | |

Everi Holdings, Inc. (a) | | | | 148,000 | | | | | 2,413,880 | |

Playa Hotels & Resorts NV (a)(b) | | | | 269,190 | | | | | 1,849,335 | |

Red Rock Resorts, Inc. - Class A | | | | 67,500 | | | | | 2,251,800 | |

Wingstop, Inc. | | | | 12,855 | | | | | 961,169 | |

| | | | | | | | | | |

| | | | | | | | | 7,476,184 | |

| | | | | | | | | | |

| Household Durables - 0.8% | | | | |

Sonos, Inc. (a) | | | | 78,500 | | | | | 1,416,140 | |

| | | | | | | | | | |

| Insurance - 2.2% | | | | |

Goosehead Insurance, Inc. - Class A | | | | 10,595 | | | | | 483,874 | |

Palomar Holdings, Inc. (a) | | | | 50,000 | | | | | 3,220,000 | |

| | | | | | | | | | |

| | | | | | | | | 3,703,874 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.0% | | | | |

Magnite, Inc. (a) | | | | 200,000 | | | | | 1,776,000 | |

| | | | | | | | | | |

| IT Consulting & Services - 3.6% | | | | |

LiveRamp Holdings, Inc. (a) | | | | 70,135 | | | | | 1,810,184 | |

Perficient Inc. (a) | | | | 25,450 | | | | | 2,333,510 | |

Repay Holdings Corp. (a) | | | | 145,000 | | | | | 1,863,250 | |

| | | | | | | | | | |

| | | | | | | | | 6,006,944 | |

| | | | | | | | | | |

| Leisure Equipment & Products - 2.0% | | | | |

Callaway Golf Company (a) | | | | 115,000 | | | | | 2,346,000 | |

YETI Holdings, Inc. (a) | | | | 25,535 | | | | | 1,104,899 | |

| | | | | | | | | | |

| | | | | | | | | 3,450,899 | |

| | | | | | | | | | |

| Machinery - 7.7% | | | | |

Alamo Group, Inc. | | | | 17,135 | | | | | 1,995,028 | |

Altra Industrial Motion Corp. | | | | 49,000 | | | | | 1,727,250 | |

ESAB Corp. (a) | | | | 37,000 | | | | | 1,618,750 | |

Evoqua Water Technologies Corp. (a) | | | | 55,250 | | | | | 1,796,177 | |

Helios Technologies, Inc. | | | | 35,295 | | | | | 2,338,294 | |

ITT, Inc. | | | | 20,375 | | | | | 1,370,015 | |

Watts Water Technologies, Inc. - Class A | | | | 17,525 | | | | | 2,152,771 | |

| | | | | | | | | | |

| | | | | | | | | 12,998,285 | |

| | | | | | | | | | |

| Marine - 1.7% | | | | |

Kirby Corp. (a) | | | | 46,370 | | | | | 2,821,151 | |

| | | | | | | | | | |

| Media & Entertainment - 1.5% | | | | |

Nexstar Media Group, Inc. - Class A | | | | 16,000 | | | | | 2,606,080 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

8

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Oil, Gas & Consumable Fuels - 6.8% | | | | |

CNX Resources Corp. (a) | | | | 180,000 | | | | $ | 2,962,800 | |

HF Sinclair Corp. | | | | 91,625 | | | | | 4,137,785 | |

Magnolia Oil & Gas Corp. - Class A | | | | 145,000 | | �� | | | 3,043,550 | |

Northern Oil and Gas, Inc. | | | | 55,000 | | | | | 1,389,300 | |

| | | | | | | | | | |

| | | | | | | | | 11,533,435 | |

| | | | | | | | | | |

| Personal Products - 1.5% | | | | |

BellRing Brands, Inc. (a) | | | | 101,375 | | | | | 2,523,224 | |

| | | | | | | | | | |

| Professional Services - 1.5% | | | | |

Upwork, Inc. (a) | | | | 125,760 | | | | | 2,600,717 | |

| | | | | | | | | | |

| Real Estate Development - 0.7% | | | | |

FirstService Corp. (b) | | | | 9,995 | | | | | 1,211,394 | |

| | | | | | | | | | |

| Software - 6.9% | | | | |

ACI Worldwide, Inc. (a) | | | | 70,000 | | | | | 1,812,300 | |

Altair Engineering, Inc. - Class A (a) | | | | 36,190 | | | | | 1,899,975 | |

Model N, Inc. (a) | | | | 63,650 | | | | | 1,628,167 | |

Nutanix, Inc. - Class A (a) | | | | 78,000 | | | | | 1,141,140 | |

Q2 Holdings, Inc. (a) | | | | 35,000 | | | | | 1,349,950 | |

Sprout Social, Inc. - Class A (a) | | | | 38,250 | | | | | 2,221,178 | |

Workiva Inc. (a) | | | | 24,520 | | | | | 1,618,075 | |

| | | | | | | | | | |

| | | | | | | | | 11,670,785 | |

| | | | | | | | | | |

| Software & Services - 0.8% | | | | |

Alarm.com Holdings, Inc. (a) | | | | 22,430 | | | | | 1,387,520 | |

| | | | | | | | | | |

| Specialty Retail - 2.8% | | | | |

Academy Sports and Outdoors, Inc. | | | | 53,000 | | | | | 1,883,620 | |

Leslie’s, Inc. (a) | | | | 97,000 | | | | | 1,472,460 | |

Petco Health & Wellness Co, Inc. (a) | | | | 96,000 | | | | | 1,415,040 | |

| | | | | | | | | | |

| | | | | | | | | 4,771,120 | |

| | | | | | | | | | |

| Technology Hardware, Storage & Peripherals - 1.3% | | |

Avid Technology, Inc. (a) | | | | 84,585 | | | | | 2,194,981 | |

| | | | | | | | | | |

| Thrifts & Mortgage Finance - 1.7% | | | | |

Home BancShares, Inc. | | | | 137,301 | | | | | 2,851,742 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 1.9% | | |

Global Industrial Co. | | | | 65,265 | | | | | 2,203,999 | |

Textainer Group Holdings Ltd. (b) | | | | 35,000 | | | | | 959,350 | |

| | | | | | | | | | |

| | | | | | | | | 3,163,349 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $131,833,382) | | | | | | | | | 157,711,285 | |

| | | | | | | | | | |

| | | | | | | | | | |

| REITS - 0.9% | | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.9% | | |

Pebblebrook Hotel Trust | | | | 92,000 | | | | | 1,524,440 | |

| | | | | | | | | | |

TOTAL REITS

(Cost $2,195,070) | | | | | | | | | 1,524,440 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 6.2% | | Shares | | Value |

| Money Market Funds - 6.2% | | | | |

Fidelity Investments Money Market Government Portfolio - Class I, 1.21% (d) | | | | 324,409 | | | | $ | 324,409 | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 1.38% (d) | | | | 5,120,409 | | | | | 5,120,409 | |

MSILF Government Portfolio, 1.39% (d) | | | | 5,120,409 | | | | | 5,120,409 | |

| | | | | | | | | | |

| | | | | | | | | 10,565,227 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $10,565,227) | | | | | | | | | 10,565,227 | |

| | | | | | | | | | |

Total Investments - 100.2%

(Cost $144,593,679) | | | | | | | | | 169,800,952 | |

Liabilities in Excess of Other Assets - (0.2)% | | | | | (326,731 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 169,474,221 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | Securities for which market quotations are not readily available. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Trustees. Level 3 security. |

| (d) | The rate quoted is the annualized seven-day yield of the Fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

9

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 87.0% | | Shares | | Value |

| Aerospace & Defense - 1.8% | | | | |

Axon Enterprise, Inc. (a) | | | | 2,925 | | | | $ | 272,522 | |

| | | | | | | | | | |

| Banks - 5.7% | | | | |

Cadence Bank | | | | 10,270 | | | | | 241,139 | |

Cullen/Frost Bankers, Inc. | | | | 2,735 | | | | | 318,491 | |

Zions Bancorp N.A. | | | | 5,940 | | | | | 302,346 | |

| | | | | | | | | | |

| | | | | | | | | 861,976 | |

| | | | | | | | | | |

| Biotechnology - 3.8% | | | | |

Charles River Laboratories International, Inc. (a) | | | | 1,205 | | | | | 257,834 | |

Natera, Inc. (a) | | | | 2,480 | | | | | 87,891 | |

Neogen Corp. (a) | | | | 9,330 | | | | | 224,760 | |

| | | | | | | | | | |

| | | | | | | | | 570,485 | |

| | | | | | | | | | |

| Building Products - 4.5% | | | | |

Builders FirstSource, Inc. (a) | | | | 3,350 | | | | | 179,895 | |

CSW Industrials, Inc. | | | | 2,050 | | | | | 211,212 | |

Trex Co., Inc. (a) | | | | 2,035 | | | | | 110,745 | |

Zurn Elkay Water Solutions Corp. | | | | 6,560 | | | | | 178,694 | |

| | | | | | | | | | |

| | | | | | | | | 680,546 | |

| | | | | | | | | | |

| Capital Markets - 3.4% | | | | |

LPL Financial Holdings, Inc. | | | | 2,820 | | | | | 520,234 | |

| | | | | | | | | | |

| Chemicals - 2.8% | | | | |

FMC Corp. | | | | 2,510 | | | | | 268,595 | |

Quaker Chemical Corp. | | | | 1,028 | | | | | 153,707 | |

| | | | | | | | | | |

| | | | | | | | | 422,302 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 2.4% | | | | |

Driven Brands Holdings Inc. (a) | | | | 13,185 | | | | | 363,115 | |

| | | | | | | | | | |

| Construction & Engineering - 2.0% | | | | |

WillScot Mobile Mini Holdings Corp. (a) | | | | 9,210 | | | | | 298,588 | |

| | | | | | | | | | |

| Construction Materials - 1.6% | | | | |

Eagle Materials, Inc. | | | | 2,160 | | | | | 237,470 | |

| | | | | | | | | | |

| Containers & Packaging - 1.7% | | | | |

Crown Holdings, Inc. | | | | 2,710 | | | | | 249,781 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 1.8% | | | | |

Trimble, Inc. (a) | | | | 4,565 | | | | | 265,820 | |

| | | | | | | | | | |

| Food Products - 1.6% | | | | |

Utz Brands, Inc. | | | | 17,510 | | | | | 241,988 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 4.2% | | |

Enovis Corp. (a) | | | | 4,328 | | | | | 238,040 | |

Omnicell, Inc. (a) | | | | 1,925 | | | | | 218,969 | |

STAAR Surgical Co. (a) | | | | 2,390 | | | | | 169,522 | |

| | | | | | | | | | |

| | | | | | | | | 626,531 | |

| | | | | | | | | | |

| Health Care Providers & Services - 1.5% | | | | |

R1 RCM Inc. (a) | | | | 10,770 | | | | | 225,739 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.4% | | | | |

Wingstop, Inc. | | | | 2,755 | | | | | 205,991 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Insurance - 2.6% | | | | |

Palomar Holdings, Inc. (a) | | | | 6,035 | | | | $ | 388,654 | |

| | | | | | | | | | |

| IT Consulting & Services - 7.3% | | | | |

Black Knight, Inc. (a) | | | | 6,880 | | | | | 449,883 | |

Broadridge Financial Solutions, Inc. | | | | 2,775 | | | | | 395,576 | |

Perficient Inc. (a) | | | | 2,775 | | | | | 254,440 | |

| | | | | | | | | | |

| | | | | | | | | 1,099,899 | |

| | | | | | | | | | |

| Leisure Equipment & Products - 3.7% | | | | |

Pool Corp. | | | | 1,000 | | | | | 351,230 | |

YETI Holdings, Inc. (a) | | | | 4,640 | | | | | 200,773 | |

| | | | | | | | | | |

| | | | | | | | | 552,003 | |

| | | | | | | | | | |

| Machinery - 2.3% | | | | |

ESAB Corp. (a) | | | | 2,628 | | | | | 114,975 | |

ITT, Inc. | | | | 3,470 | | | | | 233,323 | |

| | | | | | | | | | |

| | | | | | | | | 348,298 | |

| | | | | | | | | | |

| Marine - 1.9% | | | | |

Kirby Corp. (a) | | | | 4,790 | | | | | 291,424 | |

| | | | | | | | | | |

| Media - 1.9% | | | | |

Cable One, Inc. | | | | 226 | | | | | 291,386 | |

| | | | | | | | | | |

| Media & Entertainment - 2.0% | | | | |

Nexstar Media Group, Inc. - Class A | | | | 1,840 | | | | | 299,699 | |

| | | | | | | | | | |

| Multiline Retail - 0.8% | | | | |

Five Below, Inc. (a) | | | | 1,040 | | | | | 117,967 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 7.8% | | | | |

CNX Resources Corp. (a) | | | | 21,400 | | | | | 352,244 | |

Diamondback Energy Inc. | | | | 2,535 | | | | | 307,115 | |

HF Sinclair Corp. | | | | 8,130 | | | | | 367,151 | |

Marathon Oil Corp. | | | | 6,620 | | | | | 148,818 | |

| | | | | | | | | | |

| | | | | | | | | 1,175,328 | |

| | | | | | | | | | |

| Personal Products - 1.6% | | | | |

BellRing Brands, Inc. (a) | | | | 9,955 | | | | | 247,780 | |

| | | | | | | | | | |

| Pharmaceuticals - 1.7% | | | | |

Horizon Therapeutics PLC (a)(b) | | | | 3,135 | | | | | 250,048 | |

| | | | | | | | | | |

| Real Estate Development - 1.8% | | |

FirstService Corp. (b) | | | | 2,245 | | | | | 272,094 | |

| | | | | | | | | | |

| Real Estate Management & Development - 1.4% | | |

Colliers International Group, Inc. (b) | | | | 1,990 | | | | | 218,323 | |

| | | | | | | | | | |

| Software - 4.6% | | | | |

Altair Engineering, Inc. - Class A (a) | | | | 3,950 | | | | | 207,375 | |

Paylocity Holding Corp. (a) | | | | 1,725 | | | | | 300,875 | |

Sprout Social, Inc. - Class A (a) | | | | 3,120 | | | | | 181,178 | |

| | | | | | | | | | |

| | | | | | | | | 689,428 | |

| | | | | | | | | | |

| Specialty Retail - 3.7% | | | | |

Academy Sports and Outdoors, Inc. | | | | 7,520 | | | | | 267,260 | |

Leslie’s, Inc. (a) | | | | 19,210 | | | | | 291,608 | |

| | | | | | | | | | |

| | | | | | | | | 558,868 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

10

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Trading Companies & Distributors - 1.7% | | | | |

Watsco, Inc. | | | | 1,045 | | | | $ | 249,567 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $12,265,308) | | | | 13,093,854 |

| | | | | | | | | | |

| | | | | | | | | | |

| REITS - 3.0% | | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.4% | | |

Camden Property Trust | | | | 1,580 | | | | | 212,479 | |

| | | | | | | | | | |

| Real Estate Management & Development - 1.6% | | |

DigitalBridge Group, Inc. (a) | | | | 47,130 | | | | | 229,994 | |

| | | | | | | | | | |

TOTAL REITS

(Cost $588,140) | | | | | | | | | 442,473 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 10.3% | | | | |

| Money Market Funds - 10.3% | | | | |

Fidelity Investments Money Market Government Portfolio - Class I, 1.21% (c) | | | | 454,817 | | | | | 454,817 | |

First American Government Obligations Fund - Class Z, 1.26% (c) | | | | 180,773 | | | | | 180,772 | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 1.38% (c) | | | | 454,817 | | | | | 454,817 | |

MSILF Government Portfolio, 1.39% (c) | | | | 454,817 | | | | | 454,817 | |

| | | | | | | | | | |

| | | | | | | | | 1,545,223 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,545,223) | | | | | | | | | 1,545,223 | |

| | | | | | | | | | |

Total Investments - 100.3%

(Cost $14,398,671) | | | | | | | | | 15,081,550 | |

Liabilities in Excess of Other Assets - (0.2)% | | | | | (38,096 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 15,043,454 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security is issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the Fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

11

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 90.5% | | Shares | | Value |

| Aerospace & Defense - 2.0% | | | | |

Honeywell International, Inc. | | | | 50,000 | | | | $ | 8,690,500 | |

| | | | | | | | | | |

| Banks - 5.1% | | | | |

Bank of America Corp. | | | | 160,000 | | | | | 4,980,800 | |

Comerica, Inc. | | | | 100,000 | | | | | 7,338,000 | |

Cullen/Frost Bankers, Inc. | | | | 65,000 | | | | | 7,569,250 | |

Glacier Bancorp, Inc. | | | | 60,000 | | | | | 2,845,200 | |

| | | | | | | | | | |

| | | | | | | | | 22,733,250 | |

| | | | | | | | | | |

| Beverages - 3.9% | | | | |

The Coca-Cola Co. | | | | 95,000 | | | | | 5,976,450 | |

Keurig Dr Pepper, Inc. | | | | 110,000 | | | | | 3,892,900 | |

PepsiCo, Inc. | | | | 45,000 | | | | | 7,499,700 | |

| | | | | | | | | | |

| | | | | | | | | 17,369,050 | |

| | | | | | | | | | |

| Biotechnology - 2.1% | | | | |

Amgen, Inc. | | | | 28,000 | | | | | 6,812,400 | |

Neogen Corp. (a) | | | | 100,000 | | | | | 2,409,000 | |

| | | | | | | | | | |

| | | | | | | | | 9,221,400 | |

| | | | | | | | | | |

| Chemicals - 6.6% | | | | |

Air Products & Chemicals, Inc. | | | | 25,000 | | | | | 6,012,000 | |

DuPont de Nemours, Inc. | | | | 85,000 | | | | | 4,724,300 | |

Ecolab, Inc. | | | | 45,000 | | | | | 6,919,200 | |

FMC Corp. | | | | 110,000 | | | | | 11,771,100 | |

| | | | | | | | | | |

| | | | | | | | | 29,426,600 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 3.9% | | | | |

Cintas Corp. | | | | 16,000 | | | | | 5,976,480 | |

Waste Connections, Inc. (b) | | | | 90,000 | | | | | 11,156,400 | |

| | | | | | | | | | |

| | | | | | | | | 17,132,880 | |

| | | | | | | | | | |

| Computers & Peripherals - 3.0% | | | | |

Apple, Inc. | | | | 96,000 | | | | | 13,125,120 | |

| | | | | | | | | | |

| Construction Materials - 1.2% | | | | |

Martin Marietta Materials, Inc. | | | | 18,000 | | | | | 5,386,320 | |

| | | | | | | | | | |

| Diversified Financials - 1.7% | | | | |

JPMorgan Chase & Co. | | | | 68,000 | | | | | 7,657,480 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 2.5% | | |

Franklin Electric Co., Inc. | | | | 85,000 | | | | | 6,227,100 | |

Rockwell Automation, Inc. | | | | 25,000 | | | | | 4,982,750 | |

| | | | | | | | | | |

| | | | | | | | | 11,209,850 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.5% | | |

National Instruments Corp. | | | | 75,000 | | | | | 2,342,250 | |

Trimble, Inc. (a) | | | | 150,000 | | | | | 8,734,500 | |

| | | | | | | | | | |

| | | | | | | | | 11,076,750 | |

| | | | | | | | | | |

| Electronic Equipment, Instruments & Components - 1.7% |

Teledyne Technologies, Inc. (a) | | | | 20,000 | | | | | 7,502,200 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 1.8% |

Alcon, Inc. (b) | | | | 60,000 | | | | | 4,193,400 | |

Stryker Corp. | | | | 20,000 | | | | | 3,978,600 | |

| | | | | | | | | | |

| | | | | | | | | 8,172,000 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Household Durables - 1.2% | | | | |

Newell Brands, Inc. | | | | 290,000 | | | | $ | 5,521,600 | |

| | | | | | | | | | |

| Household Products - 2.5% | | | | |

Kimberly-Clark Corp. | | | | 50,000 | | | | | 6,757,500 | |

The Procter & Gamble Co. | | | | 30,000 | | | | | 4,313,700 | |

| | | | | | | | | | |

| | | | | | | | | 11,071,200 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.2% | | | | |

Amazon.com, Inc. (a) | | | | 50,000 | | | | | 5,310,500 | |

| | | | | | | | | | |

| IT Consulting & Services - 1.1% | | | | |

PayPal Holdings, Inc. (a) | | | | 70,000 | | | | | 4,888,800 | |

| | | | | | | | | | |

| Life Sciences Tools & Services - 4.0% | | | | |

Danaher Corp. | | | | 35,750 | | | | | 9,063,340 | |

Thermo Fisher Scientific, Inc. | | | | 15,575 | | | | | 8,461,586 | |

| | | | | | | | | | |

| | | | | | | | | 17,524,926 | |

| | | | | | | | | | |

| Machinery - 6.9% | | | | |

Generac Holdings, Inc. (a) | | | | 35,000 | | | | | 7,370,300 | |

IDEX Corp. | | | | 20,000 | | | | | 3,632,600 | |

The Toro Co. | | | | 80,000 | | | | | 6,063,200 | |

Valmont Industries, Inc. | | | | 40,000 | | | | | 8,985,200 | |

Xylem, Inc. | | | | 60,000 | | | | | 4,690,800 | |

| | | | | | | | | | |

| | | | | | | | | 30,742,100 | |

| | | | | | | | | | |

| Marine - 1.5% | | | | |

Kirby Corp. (a) | | | | 110,000 | | | | | 6,692,400 | |

| | | | | | | | | | |

| Media & Entertainment - 2.2% | | | | |

Alphabet, Inc. - Class A (a) | | | | 4,500 | | | | | 9,806,670 | |

| | | | | | | | | | |

| Metals & Mining - 1.8% | | | | |

Newmont Goldcorp Corp. | | | | 130,000 | | | | | 7,757,100 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 5.6% | | | | |

Chevron Corp. | | | | 42,500 | | | | | 6,153,150 | |

ConocoPhillips | | | | 100,000 | | | | | 8,981,000 | |

Coterra Energy, Inc. | | | | 384,000 | | | | | 9,903,360 | |

| | | | | | | | | | |

| | | | | | | | | 25,037,510 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 0.5% | | | | |

Kimbell Royalty Partners, LP | | | | 130,000 | | | | | 2,038,400 | |

| | | | | | | | | | |

| Personal Products - 1.1% | | | | |

The Estee Lauder Cos., Inc. - Class A | | | | 20,000 | | | | | 5,093,400 | |

| | | | | | | | | | |

| Pharmaceuticals - 5.3% | | | | |

Merck & Co., Inc. | | | | 80,000 | | | | | 7,293,600 | |

Pfizer, Inc. | | | | 130,000 | | | | | 6,815,900 | |

Zoetis, Inc. | | | | 53,500 | | | | | 9,196,115 | |

| | | | | | | | | | |

| | | | | | | | | 23,305,615 | |

| | | | | | | | | | |

| Road & Rail - 1.2% | | | | |

Union Pacific Corp. | | | | 24,000 | | | | | 5,118,720 | |

| | | | | | | | | | |

| Semiconductor & Semiconductor Equipment - 1.1% | | |

Intel Corp. | | | | 125,000 | | | | | 4,676,250 | |

| | | | | | | | | | |

| Software - 10.7% | | | | |

Adobe, Inc. (a) | | | | 25,000 | | | | | 9,151,500 | |

Microsoft Corp. | | | | 85,000 | | | | | 21,830,550 | |

Oracle Corp. | | | | 120,000 | | | | | 8,384,400 | |

The accompanying notes are an integral part of these financial statements.

12

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Software - 10.7%, Continued | | | | |

Roper Technologies, Inc. | | | | 20,000 | | | | $ | 7,893,000 | |

| | | | | | | | | | |

| | | | | | | | | 47,259,450 | |

| | | | | | | | | | |

| Software & Services - 1.9% | | | | |

Akamai Technologies, Inc. (a) | | | | 90,000 | | | | | 8,219,700 | |

| | | | | | | | | | |

| Specialty Retail - 1.9% | | | | |

The Home Depot, Inc. | | | | 30,000 | | | | | 8,228,100 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 0.9% | | |

Fortress Transportation and Infrastructure Investors LLC | | | | 200,000 | | | | | 3,868,000 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $217,730,259) | | | | | | | | | 400,863,841 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 9.6% | | |

| Money Market Funds - 9.6% | | | | |

Fidelity Investments Money Market Government Portfolio - Class I, 1.21% (c) | | | | 13,385,751 | | | | | 13,385,751 | |

First American Government Obligations Fund - Class Z, 1.26% (c) | | | | 2,561,250 | | | | | 2,561,249 | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 1.38% (c) | | | | 13,385,751 | | | | | 13,385,751 | |

MSILF Government Portfolio, 1.39% (c) | | | | 13,385,751 | | | | | 13,385,751 | |

| | | | | | | | | | |

| | | | | | | | | 42,718,502 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $42,718,502) | | 42,718,502 |

| | | | | | | | | | |

Total Investments - 100.1%

(Cost $260,448,761) | | | | 443,582,343 |

Liabilities in Excess of Other Assets - (0.1)% | | | | | (428,631 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 443,153,712 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the Fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

13

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS - 69.3% | | Shares | |

Value |

| Aerospace & Defense - 2.2% | | | | |

Honeywell International, Inc. | | | | 5,700 | | | | $ | 990,717 | |

L3Harris Technologies, Inc. | | | | 5,850 | | | | | 1,413,945 | |

| | | | | | | | | | |

| | | | | | | | | 2,404,662 | |

| | | | | | | | | | |

| Banks - 3.3% | | | | |

Bank of America Corp. | | | | 47,900 | | | | | 1,491,127 | |

Cullen/Frost Bankers, Inc. | | | | 11,600 | | | | | 1,350,820 | |

Zions Bancorp N.A. | | | | 15,100 | | | | | 768,590 | |

| | | | | | | | | | |

| | | | | | | | | 3,610,537 | |

| | | | | | | | | | |

| Beverages - 2.3% | | | | |

The Coca-Cola Co. | | | | 21,400 | | | | | 1,346,274 | |

PepsiCo, Inc. | | | | 7,550 | | | | | 1,258,283 | |

| | | | | | | | | | |

| | | | | | | | | 2,604,557 | |

| | | | | | | | | | |

| Biotechnology - 1.0% | | | | |

Charles River Laboratories International, Inc. (a) | | | | 5,250 | | | | | 1,123,342 | |

| | | | | | | | | | |

| Chemicals - 6.0% | | | | |

Air Products and Chemicals, Inc. | | | | 6,000 | | | | | 1,442,880 | |

Corteva, Inc. | | | | 18,858 | | | | | 1,020,972 | |

DuPont de Nemours, Inc. | | | | 12,658 | | | | | 703,532 | |

Ecolab, Inc. | | | | 5,700 | | | | | 876,432 | |

FMC Corp. | | | | 13,900 | | | | | 1,487,439 | |

Linde PLC (b) | | | | 3,900 | | | | | 1,121,367 | |

| | | | | | | | | | |

| | | | | | | | | 6,652,622 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 3.2% | | | | |

Cintas Corp. | | | | 3,700 | | | | | 1,382,061 | |

Waste Connections, Inc. (b) | | | | 10,400 | | | | | 1,289,184 | |

Waste Management, Inc. | | | | 5,550 | | | | | 849,039 | |

| | | | | | | | | | |

| | | | | | | | | 3,520,284 | |

| | | | | | | | | | |

| Communications Equipment - 1.4% | | | | |

QUALCOMM, Inc. | | | | 12,300 | | | | | 1,571,202 | |

| | | | | | | | | | |

| Computers & Peripherals - 2.0% | | | | |

Apple, Inc. | | | | 15,950 | | | | | 2,180,684 | |

| | | | | | | | | | |

| Construction Materials - 1.0% | | | | |

Martin Marietta Materials, Inc. | | | | 3,800 | | | | | 1,137,112 | |

| | | | | | | | | | |

| Diversified Financials - 2.5% | | | | |

JPMorgan Chase & Co. | | | | 13,000 | | | | | 1,463,930 | |

Moody’s Corp. | | | | 4,650 | | | | | 1,264,661 | |

| | | | | | | | | | |

| | | | | | | | | 2,728,591 | |

| | | | | | | | | | |

| Diversified Telecommunication Services - 1.2% | | |

Verizon Communications, Inc. | | | | 26,341 | | | | | 1,336,806 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 1.7% | | | | |

Emerson Electric Co. | | | | 12,800 | | | | | 1,018,112 | |

Rockwell Automation, Inc. | | | | 4,175 | | | | | 832,119 | |

| | | | | | | | | | |

| | | | | | | | | 1,850,231 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 0.9% | | |

Trimble, Inc. (a) | | | | 16,750 | | | | | 975,353 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | |

Value |

| Electronic Equipment, Instruments & Components - 1.0% |

Teledyne Technologies, Inc. (a) | | | | 2,950 | | | | $ | 1,106,575 | |

| | | | | | | | | | |

| Food & Drug Retailing - 1.0% | | | | |

Walmart, Inc. | | | | 9,100 | | | | | 1,106,378 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 2.3% | | | | |

Alcon, Inc. (b) | | | | 17,900 | | | | | 1,251,031 | |

PerkinElmer, Inc. | | | | 9,350 | | | | | 1,329,757 | |

| | | | | | | | | | |

| | | | | | | | | 2,580,788 | |

| | | | | | | | | | |

| Household Durables - 0.7% | | | | |

Newell Brands, Inc. | | | | 40,000 | | | | | 761,600 | |

| | | | | | | | | | |

| Household Products - 2.3% | | | | |

Colgate-Palmolive Co. | | | | 16,100 | | | | | 1,290,254 | |

Kimberly-Clark Corp. | | | | 6,000 | | | | | 810,900 | |

The Procter & Gamble Co. | | | | 3,250 | | | | | 467,317 | |

| | | | | | | | | | |

| | | | | | | | | 2,568,471 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.2% | | | | |

Amazon.com, Inc. (a) | | | | 12,200 | | | | | 1,295,762 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.6% | | | | |

Broadridge Financial Solutions, Inc. | | | | 9,450 | | | | | 1,347,097 | |

PayPal Holdings, Inc. (a) | | | | 6,100 | | | | | 426,024 | |

Visa, Inc. - Class A | | | | 5,650 | | | | | 1,112,429 | |

| | | | | | | | | | |

| | | | | | | | | 2,885,550 | |

| | | | | | | | | | |

| Life Sciences Tools & Services - 2.5% | | | | |

Danaher Corp. | | | | 5,100 | | | | | 1,292,952 | |

Thermo Fisher Scientific, Inc. | | | | 2,600 | | | | | 1,412,528 | |

| | | | | | | | | | |

| | | | | | | | | 2,705,480 | |

| | | | | | | | | | |

| Machinery - 1.5% | | | | |

Fortive Corp. | | | | 9,350 | | | | | 508,453 | |

Xylem, Inc. | | | | 14,800 | | | | | 1,157,064 | |

| | | | | | | | | | |

| | | | | | | | | 1,665,517 | |

| | | | | | | | | | |

| Media & Entertainment - 3.4% | | | | |

Alphabet, Inc. - Class C (a) | | | | 750 | | | | | 1,640,587 | |

The Walt Disney Co. (a) | | | | 13,700 | | | | | 1,293,280 | |

Meta Platforms, Inc. (a) | | | | 5,175 | | | | | 834,469 | |

| | | | | | | | | | |

| | | | | | | | | 3,768,336 | |

| | | | | | | | | | |

| Metals & Mining - 1.0% | | | | |

Newmont Goldcorp Corp. | | | | 18,100 | | | | | 1,080,027 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 5.7% | | |

Chevron Corp. | | | | 8,395 | | | | | 1,215,428 | |

ConocoPhillips | | | | 15,600 | | | | | 1,401,036 | |

Coterra Energy, Inc. | | | | 24,000 | | | | | 618,960 | |

EOG Resources, Inc. | | | | 4,450 | | | | | 491,458 | |

Kinder Morgan, Inc. | | | | 80,000 | | | | | 1,340,800 | |

Pioneer Natural Resources Co. | | | | 5,650 | | | | | 1,260,402 | |

| | | | | | | | | | |

| | | | | | | | | 6,328,084 | |

| | | | | | | | | | |

| Personal Products - 1.0% | | | | |

The Estee Lauder Cos., Inc. - Class A | | | | 4,600 | | | | | 1,171,482 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | |

Value |

| Pharmaceuticals - 3.6% | | | | |

Abbott Laboratories | | | | 10,000 | | | | $ | 1,086,500 | |

Merck & Co., Inc. | | | | 16,300 | | | | | 1,486,071 | |

Zoetis, Inc. | | | | 8,026 | | | | | 1,379,589 | |

| | | | | | | | | | |

| | | | | | | | | 3,952,160 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 1.3% | | | | |

American Tower Corp. | | | | 5,500 | | | | | 1,405,745 | |

| | | | | | | | | | |

| Road & Rail - 1.0% | | | | |

Union Pacific Corp. | | | | 5,275 | | | | | 1,125,052 | |

| | | | | | | | | | |

| Software - 5.2% | | | | |

Adobe, Inc. (a) | | | | 1,850 | | | | | 677,211 | |

Microsoft Corp. | | | | 6,750 | | | | | 1,733,602 | |

Oracle Corp. | | | | 16,500 | | | | | 1,152,855 | |

Roper Technologies, Inc. | | | | 2,600 | | | | | 1,026,090 | |

Salesforce, Inc. (a) | | | | 6,850 | | | | | 1,130,524 | |

| | | | | | | | | | |

| | | | | | | | | 5,720,282 | |

| | | | | | | | | | |

| Software & Services - 1.0% | | | | |

Akamai Technologies, Inc. (a) | | | | 12,800 | | | | | 1,169,024 | |

| | | | | | | | | | |

| Specialty Retail - 1.2% | | | | |

The Home Depot, Inc. | | | | 5,000 | | | | | 1,371,350 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 1.1% | | | | |

NIKE, Inc. - Class B | | | | 12,000 | | | | | 1,226,400 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $49,571,584) | | | | | | | | | 76,690,046 | |

| | | | | | | | | | |

| | | | | | | | | | |

| CORPORATE BONDS - 30.2% | | Principal

Amount | | |

| Aerospace & Defense - 1.9% | | | | |

Honeywell International, Inc.: | | | | | | | | | | |

2.300%, 08/15/2024 | | | | | | | | | | |

Callable 07/15/2024 | | | $ | 250,000 | | | | | 245,676 | |

1.350%, 06/01/2025 | | | | | | | | | | |

Callable 05/01/2025 | | | | 750,000 | | | | | 707,598 | |

L3Harris Technologies, Inc. | | | | | | | | | | |

3.850%, 06/15/2023 | | | | | | | | | | |

Callable 05/15/2023 | | | | 900,000 | | | | | 899,558 | |

Raytheon Technologies Corp. | | | | | | | | | | |

3.700%, 12/15/2023 | | | | | | | | | | |

Callable 09/15/2023 | | | | 250,000 | | | | | 249,677 | |

| | | | | | | | | | |

| | | | | | | | | 2,102,509 | |

| | | | | | | | | | |

| Banks - 1.8% | | | | |

Comerica Bank | | | | | | | | | | |

2.500%, 07/23/2024 | | | | 300,000 | | | | | 291,887 | |

Comerica, Inc. | | | | | | | | | | |

3.700%, 07/31/2023 | | | | | | | | | | |

Callable 06/30/2023 | | | | 475,000 | | | | | 475,104 | |

The Bank of New York Mellon Corp. | | | | | | | | | | |

2.200%, 08/16/2023 | | | | | | | | | | |

Callable 06/16/2023 | | | | 200,000 | | | | | 198,105 | |

| | | | | | | | | | |

| CORPORATE BONDS | | Principal

Amount | | |

| Banks - 1.8%, Continued | | | | |

Truist Bank: | | | | | | | | | | |

3.200%, 04/01/2024 | | | | | | | | | | |

Callable 03/01/2024 | | | $ | 250,000 | | | | $ | 249,235 | |

4.050%, 11/03/2025 | | | | | | | | | | |

Callable 09/03/2025 | | | | 385,000 | | | | | 388,355 | |

3.300%, 05/15/2026 | | | | | | | | | | |

Callable 04/15/2026 | | | | 400,000 | | | | | 386,519 | |

| | | | | | | | | | |

| | | | | | | | | 1,989,205 | |

| | | | | | | | | | |

| Beverages - 1.0% | | | | |

Keurig Dr Pepper, Inc. | | | | | | | | | | |

2.550%, 09/15/2026 | | | | | | | | | | |

Callable 06/15/2026 | | | | 750,000 | | | | | 699,765 | |

PepsiCo, Inc. | | | | | | | | | | |

2.375%, 10/06/2026 | | | | | | | | | | |

Callable 07/06/2026 | | | | 435,000 | | | | | 417,513 | |

| | | | | | | | | | |

| | | | | | | | | 1,117,278 | |

| | | | | | | | | | |

| Biotechnology - 1.1% | | | | |

AbbVie, Inc. | | | | | | | | | | |

3.200%, 05/14/2026 | | | | | | | | | | |

Callable 02/14/2026 | | | | 600,000 | | | | | 579,019 | |

Amgen, Inc.: | | | | | | | | | | |

3.625%, 05/22/2024 | | | | | | | | | | |

Callable 02/22/2024 | | | | 250,000 | | | | | 249,923 | |

2.600%, 08/19/2026 | | | | | | | | | | |

Callable 05/19/2026 | | | | 450,000 | | | | | 426,993 | |

| | | | | | | | | | |

| | | | | | | | | 1,255,935 | |

| | | | | | | | | | |

| Chemicals - 1.0% | | | | |

Air Products and Chemicals, Inc. | | | | | | | | | | |

1.850%, 05/15/2027 | | | | | | | | | | |

Callable 03/15/2027 | | | | 675,000 | | | | | 615,719 | |

Ecolab, Inc. | | | | | | | | | | |

2.700%, 11/01/2026 | | | | | | | | | | |

Callable 08/01/2026 | | | | 500,000 | | | | | 481,751 | |

| | | | | | | | | | |

| | | | | | | | | 1,097,470 | |

| | | | | | | | | | |

| Communications Equipment - 1.2% | | | | |

Cisco Systems, Inc. | | | | | | | | | | |

2.200%, 09/20/2023 | | | | | | | | | | |

Callable 07/20/2023 | | | | 750,000 | | | | | 744,257 | |

QUALCOMM, Inc. | | | | | | | | | | |

2.900%, 05/20/2024 | | | | | | | | | | |

Callable 03/20/2024 | | | | 600,000 | | | | | 598,221 | |

| | | | | | | | | | |

| | | | | | | | | 1,342,478 | |

| | | | | | | | | | |

| Computers & Peripherals - 0.3% |

Apple, Inc.: | | | | | | | | | | |

2.500%, 02/09/2025 | | | | 250,000 | | | | | 245,686 | |

3.200%, 05/13/2025 | | | | 55,000 | | | | | 55,195 | |

| | | | | | | | | | |

| | | | | | | | | 300,881 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

15

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| June 30, 2022 (Unaudited) |

| | | | | | | | | | |

| CORPORATE BONDS | | Principal

Amount | | Value |

| Consumer Finance - 0.9% | | | | |

American Express Co.: | | | | | | | | | | |

3.700%, 08/03/2023 | | | | | | | | | | |

Callable 07/03/2023 | | | $ | 300,000 | | | | $ | 301,345 | |

3.000%, 10/30/2024 | | | | | | | | | | |

Callable 09/29/2024 | | | | 650,000 | | | | | 639,954 | |

| | | | | | | | | | |

| | | | | | | | | 941,299 | |

| | | | | | | | | | |

| Diversified Financials - 0.8% | | | | |

JPMorgan Chase & Co.: | | | | | | | | | | |

3.375%, 05/01/2023 | | | | 225,000 | | | | | 225,132 | |

3.875%, 02/01/2024 | | | | 275,000 | | | | | 277,128 | |

3.875%, 09/10/2024 | | | | 200,000 | | | | | 200,008 | |

3.200%, 06/15/2026 | | | | | | | | | | |

Callable 03/15/2026 | | | | 200,000 | | | | | 193,558 | |

| | | | | | | | | | |

| | | | | | | | | 895,826 | |

| | | | | | | | | | |

| Diversified Telecommunication Services - 1.1% |

AT&T, Inc. | | | | | | | | | | |

1.700%, 03/25/2026 | | | | | | | | | | |

Callable 03/25/2023 | | | | 250,000 | | | | | 229,105 | |