UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Under §240.14a-12 |

|

Brightpoint, Inc. |

| (Name of Registrant as Specified in Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | | | |

| | (2) | | Form, schedule or registration statement no.: |

| | | | |

| | (3) | | Filing party: |

| | | | |

| | (4) | | Date filed: |

| | | | |

On Monday July 2, 2012, at 12:05 a.m. Eastern Daylight Time, Brightpoint, Inc. (the “Company”) issued the following message to employees regarding the transaction discussed in the Company’s 8-K, which was filed with the U.S. Securities and Exchange Commission on July 2, 2012.

The text of the message is below:

[Brightpoint Logo]

BrightPoint TEAM:

Today is an important day in BrightPoint’s history, and I want to share this news with you.

A press release was issued this morning announcing the pending acquisition of BrightPoint by Ingram Micro. In addition to enhancing Ingram Micro’s position as the world’s largest technology distributor, our decision to merge with Ingram Micro will create a leading global provider of device lifecycle services and solutions for the mobility industry. Together, our companies will be better positioned to grow globally and provide greater value and compelling opportunities to our customers, vendor partners, shareholders, employees, and other stakeholders.

You may be asking yourself “why merge with another company now”? You have all heard me talk about how the wireless industry is innovative, dynamic, and competitive. In order to remain a leader and the partner of choice in our industry, we must constantly study the marketplace, look for opportunities, and stay ahead of the trends. Our success is not based solely on our ability to change, but on our ability to change faster and smarter than our competition.

One trend that has driven the evolution of our industry, and BrightPoint’s success, is technological convergence. We have studied the end-to-end supply chain of the wireless and information technology (“IT”) industries and have seen the convergence of the industries from the desktop to the laptop to smartphones to mobile computing. This has been a natural progression and the capabilities of the products we handle continue to increase. As the convergence of wireless and IT accelerates, the winner will be the company with the greatest global scale, best IT systems, most talented workforce, strongest capital structure, and is the low cost provider.

As we continued to execute upon our strategy, and studied the convergence of the wireless and IT industries, we determined the fastest way to enhance our relevance and accelerate our growth was to combine with a leading global technology company. Through our numerous interactions with Ingram Micro over the years, we concluded that uniting our two companies makes excellent financial and strategic sense.

The combination of BrightPoint and Ingram Micro is a natural fit. We have a complementary product portfolio and market presence and share a common heritage and passion for innovation, partnership, and excellent customer service. We also share a commitment to our communities and environment with each company being recognized with green awards. For these, and many other reasons, this is the right time for this transaction. I believe strongly that Ingram Micro is the best partner for our business and employees going forward, and I am excited about the prospect of BrightPoint becoming part of a Fortune 100 company.

I realize this news is unexpected, and I certainly appreciate that it will cause uncertainty about what this means for you. We will work to address that uncertainty as quickly as possible, but please understand it will take some time. I believe that this merger will create excellent career opportunities that come with being part of a larger organization. How we respond individually, and collectively, to this opportunity will influence our future success. As soon as more information is available, we will share it with you. For now, you should rest assured there will be no immediate changes. For example, several members of our senior leadership team have committed to assuming senior leadership roles with the new company. Our Regional Presidents, Mark Howell for the Americas, Bruce Thomlinson for APAC and Anurag Gupta for EMEA will be responsible for the mobility operations of the new company, and I have agreed to serve in a senior advisory role to Alain Monie, Ingram Micro’s CEO.

Before BrightPoint and Ingram Micro can combine, certain conditions such as shareholder and regulatory approvals must be obtained. We anticipate the transaction will close in the fourth quarter of 2012. Until the transaction is completed, each company will continue to operate independently. For this reason, it is critical for each of you to remain focused on your day-to-day responsibilities so that we can continue to deliver the same high-value services our customers expect from BrightPoint.

Attached is the press release from this morning’s announcement. I know you will have many questions in the days ahead, and we will do our best to ensure that they are addressed. We will also provide additional updates as they become available on how our operations will be combined and successfully integrated. Should you receive a question from a customer or vendor partner about the transaction, please refer the question to either your regional president or to me. Please do not try to answer a question to which you are uncertain of the answer. Let the customer or vendor know that you will forward the question to the appropriate person and someone else within the organization will get back to them with the answer. Should you receive a question from an investor or the media, please refer them to Tom Ward at +1 (317) 707-2745 or tom.ward@brightpoint.com.

This is an important, critical time for our company and an emotional day for me. I am excited about the future and have fond memories of how we got to this point today. These last 20 plus years have been an incredible experience, and I am excited about what we will accomplish together going forward. I thank you for your continued support and for your contributions to our success.

Best regards,

Bob

Note: The foregoing internal message should not be shared with customers, vendors and other business partners. It is for internal purposes only.

Additional Information and Where to Find It

BrightPoint intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement and intends to furnish or file other materials with the SEC in connection with the proposed merger. The definitive proxy statement will be sent or given to the shareholders of BrightPoint and will contain important information about the proposed merger and related matters. BEFORE MAKING ANY VOTING DECISION, BRIGHTPOINT’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THOSE OTHER MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BRIGHTPOINT AND THE PROPOSED MERGER. The proxy statement and other relevant materials (when they become available), and any other documents filed by BrightPoint with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from BrightPoint by contacting BrightPoint’s Investor Relations by telephone at (317) 707-2745, or by mail at BrightPoint, Inc., 7635 Interactive Way, Suite 200, Indianapolis, Indiana, 46278, Attention: Investor Relations, or by going to BrightPoint’s Investor Relations page on its corporate website at www.BrightPoint.com.

Participants in the Solicitation

BrightPoint and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BrightPoint in connection with the proposed merger. Information regarding the interests of these directors and executive officers in the merger will be included in the proxy statement described above. Additional information regarding these directors and executive officers is included in BrightPoint’s proxy statement for its 2012 Annual Meeting of Shareholders, which was filed with the SEC on March 23, 2012, and in BrightPoint’s Annual Report on Form 10-K for the year ended December 31, 2011, which was filed with the SEC on February 29, 2012.

On Monday July 2, 2012, Brightpoint, Inc. (the “Company”) issued the following message to customers and vendors regarding the transaction discussed in the Company’s 8-K, which was filed with the U.S. Securities and Exchange Commission on July 2, 2012.

The text of the message is below:

[Brightpoint logo]

July 2, 2012

Dear BrightPoint [Customer/Partner],

I want to take this opportunity to communicate with you directly regarding some exciting news for BrightPoint. Earlier today, we announced the signing of a definitive merger agreement for Ingram Micro Inc. to acquire Brightpoint, Inc. I strongly believe the Ingram Micro-BrightPoint combination will further enhance our value-add to your business.

As we continued to execute upon our strategy, and studied the convergence of the wireless and information technology industries, we determined the fastest way to enhance our relevance and serve our [customers/partners] even better, was to combine with a global technology leader. After evaluating many options, our Board of Directors concluded that a transaction with Ingram Micro was the best way to achieve that objective.

This merger offers many potential benefits to BrightPoint [customers/partners]. BrightPoint and Ingram Micro share the same core values of delivering innovative, high-value products and services to our [customers/partners]. Over the past 30 years, Ingram Micro has established itself as the world’s largest technology distributor. The mobility industry is strategically important to them and they have developed a modest position in the market. Ingram Micro is dedicated to preserving the unique strengths and talents of BrightPoint, while creating a new, stronger company to support your needs. If you are not familiar with Ingram Micro, I invite you to visit the company’s Web site at www.ingrammicro.com to learn more about their industry leadership and proven track record for achieving powerful business results.

Together, Ingram Micro and BrightPoint will form a leading global provider of device lifecycle services and solutions for the mobility industry giving you access to expanded reach and partnering capabilities in the rapidly growing mobility market. In addition, our combination will increase the portfolio of mobility products, services and solutions, as well as marketing, technical support, and sales resources available to you. You will have the opportunity to benefit from Best-in-Class capabilities across the wireless device lifecycle, an unrivaled geographic reach, and a one-stop shop for all of your mobility needs.

Before our two companies can combine, certain conditions, such as shareholder and regulatory approvals, must be obtained and then an integration process will begin once the acquisition closes. As a valued and loyal [customers/partners], the management of Ingram Micro and BrightPoint are committed to a smooth and successful transition with a continued focus on excellent customer service.

Our leadership team is excited about the future for our combined companies, and it is important to note that [insert Regional President name here] will continue to lead the mobility business in the [insert region name here] region.

To read today’s announcement, please reference the press release located on our website at www.BrightPoint.com. Should you have any immediate questions or concerns, please reach out to your direct BrightPoint relationship manager. (LIST CONTACT FOR THE REGION (PHONE AND E-MAIL)

We are pleased to call you our partner and be one of the first to share this exciting news with you. On behalf of BrightPoint and Ingram Micro, I want to thank you for your support, and I look forward to continuing a strong, long-lasting partnership with your company in the future.

Sincerely,

[Regional President]

Title

Additional Information and Where to Find It

BrightPoint intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement and intends to furnish or file other materials with the SEC in connection with the proposed merger. The definitive proxy statement will be sent or given to the shareholders of BrightPoint and will contain important information about the proposed merger and related matters. BEFORE MAKING ANY VOTING DECISION, BRIGHTPOINT’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THOSE OTHER MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BRIGHTPOINT AND THE PROPOSED MERGER. The proxy statement and other relevant materials (when they become available), and any other documents filed by BrightPoint with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from BrightPoint by contacting BrightPoint’s Investor Relations by telephone at (317) 707-2745, or by mail at BrightPoint, Inc., 7635 Interactive Way, Suite 200, Indianapolis, Indiana, 46278, Attention: Investor Relations, or by going to BrightPoint’s Investor Relations page on its corporate website at www.BrightPoint.com.

Participants in the Solicitation

BrightPoint and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BrightPoint in connection with the proposed merger. Information regarding the interests of these directors and executive officers in the merger will be included in the proxy statement described above. Additional information regarding these directors and executive officers is included in BrightPoint’s proxy statement for its 2012 Annual Meeting of Shareholders, which was filed with the SEC on March 23, 2012, and in BrightPoint’s Annual Report on Form 10-K for the year ended December 31, 2011, which was filed with the SEC on February 29, 2012.

On Monday July 2, 2012, Brightpoint, Inc. (the “Company”) participated in a conference call regarding the transaction discussed in the Company’s 8-K, which was filed with the U.S. Securities and Exchange Commission on July 2, 2012.

A copy of the presentation used during this conference call is below.

|

110908_1 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Ingram Micro Announces Acquisition of BrightPoint Creates A Leading Global Mobility Product, Services, Solutions Platform July 2, 2012 |

|

110908_2 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Certain comments made during today’s presentations and discussions may be characterized as forward-looking statements under the Private Securities Litigation Reform Act of 1995. Those comments are based on management’s expectations, but there are risks that could cause actual results to differ materially from expectations. Important risk factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, without limitation: our ability to timely complete the transaction, if at all; our ability to complete the transaction considering the various closing conditions, including those conditions related to regulatory approvals and shareholder approval; the financial performance of BrightPoint and Ingram Micro through the completion of the merger; BrightPoint’s business may not perform as expected due to transaction-related uncertainty or other factors; the ability of BrightPoint and Ingram Micro to retain relationships with customers, vendors and carriers; management’s ability to execute its plans, strategies and objectives for future operations, including the execution of integration plans; growth of the mobility industry; and our ability to achieve the expected benefits and manage the expected costs of the transaction. Additional information concerning these risks may be found in the Company’s 2011 Annual Report on Form 10-K and in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2012, under “Item 1A” and in future filings with the SEC. Copies are available from the SEC, the Company web site or Ingram Micro Investor Relations. Ingram Micro disclaims any duty to update any forward-looking statements. Forward-Looking Statements Forward-Looking Statements Forward-Looking Statements |

|

110908_3 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. World’s largest technology distributor Leading pure-play mobility provider Global Mobility Leader Ingram Micro BrightPoint Price: – $9.00 per share, or approximately $840M, including the value of $186 million of BrightPoint’s estimated debt (net of cash), as of June 30, 2012 – All cash transaction – Expect to fund transaction with existing credit facilities and cash Financial Impact: – $55M+ in expected annual cost synergies and efficiencies by 2014 – Expected to be accretive to annual earnings per share by at least $0.18 for 2013 and $0.35 for 2014, which excludes one-time charges and integration costs Expect to close by the end of 2012 Transaction Overview Transaction Overview 2 |

|

110908_4 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. World’s largest technology distributor – Provider of complete IT solutions – Growing logistics business Suppliers – 1,300 vendors – Spanning technology spectrum Customers – 190,000 value-added resellers – Primarily small to medium sized businesses Truly global distributor – Serving 145 countries – Operations in North America, Europe, Asia-Pacific, Latin America 2011 Revenue by Geography (1) North America Asia-Pacific Latin America EMEA Historical Revenue ($M) (1) $29,515 $34,589 $36,328 2009 2010 2011 Ingram Micro Overview Ingram Micro Overview 3 Source 1. Company’s 2011 10K filing 42% 31% 22% 5% |

|

110908_5 VARs: SMB, Enterprise & Government More than 1,300 Vendors More than 190,000 Resellers Ability to combine a wide array of technologies and products to create the optimum complete solution eTail Retail Sales and Marketing Financing Technical Support Inventory Management Vendor Relations Managed Services Ingram Micro: Providing the Integral Ingram Micro: Providing the Integral Bridge Between Vendors and Resellers Bridge Between Vendors and Resellers 4 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. |

|

110908_6 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Source 1. IDC Research 2. The “Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2011–2016” Mobility market offers sustainable growth globally, with multiple drivers Growth expected to outpace other technology sectors Smartphone & tablet markets offer large “emerging” opportunities By the end of 2012, the number of mobile- connected devices will exceed the number of people on Earth (2) Large and Growing Mobility Market Large and Growing Mobility Market 5 Global Handset and Tablet Market ($B) (1) US Smartphone Users (M users) (1) Worldwide Tablet Sales (M units) (1) |

|

110908_7 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Acquisition of BrightPoint is well-aligned with Ingram Micro’s stated strategic initiatives and long-term financial goals Accelerates entry in strategically important, high-growth mobility market – Expanding presence in mobility market has been a focus of Ingram Micro and the acquisition of BrightPoint accomplishes this to an extent that would have been challenging to achieve on its own Significantly augments Ingram Micro’s capabilities in higher-value mobility logistics and services Consolidation play with significant opportunity to drive cost synergies and efficiencies across the combined businesses Opportunity to leverage relationships with vendor partners, network operators and mobile virtual network operators, service providers and customers through: – Ingram Micro’s position as world’s largest distribution company – BrightPoint’s position as a leading provider of mobility products, services and solutions – Strong balance sheet – Combined companies’ broader product and services portfolio and expanded geographic reach Strategically Compelling Transaction Strategically Compelling Transaction 6 |

|

110908_8 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. BrightPoint Overview BrightPoint Overview $4.7B in mobility distribution revenues (1) $544M in high value product lifecycle logistics and services (1) End-to-end supply chain with customized solutions 4,000 employees Leading pure-play mobility services and solutions provider Leading pure-play mobility services and solutions provider 7 (1) For the 2011 year; from Company 2011 10K filing “...is delivering device lifecycle services.” |

|

110908_9 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. BrightPoint’s Strong Blue Chip BrightPoint’s Strong Blue Chip Customer Base Customer Base 8 Over 25,000 B2B Customers with More Than 100,000 Points of Sale |

|

110908_10 BrightPoint’s Significant Growth BrightPoint’s Significant Growth Drivers Drivers Business operations in 24 countries – Sales into 75 countries High growth – 18% CAGR by units handled over past 6 years (1) – Industry 6 year CAGR is 12% (2) Significant growth drivers – Ongoing replacement cycle – Emerging smartphone and tablet markets – Convergence of telecommunications, computing and media BrightPoint Wireless Devices Handled BrightPoint Wireless Devices Handled (total (total 112M 112M units units in in 2011) 2011) (3) (3) Historical Historical Revenue Revenue ($M) ($M) (3) (3) Logistics Services Distribution 9 $3,166 $3,593 $5,244 2009 2010 2011 79% 21% Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Source 1. Company reports 2. Average of industry analysts’ estimates 3. Company 2011 10K filing |

|

110908_11 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. BrightPoint’s Diversified Service BrightPoint’s Diversified Service Offerings Offerings 10 • Procure • Launch • Promote • Distribute • Finance • Forecast • Manage Channels & Vendors • Manage Orders • Monitor • Report • Program • Assemble • Brand • Activate • Return • Triage • Repair • Recycle • Re-Sell • Warehouse • Transport • Support Tier 2 Services |

|

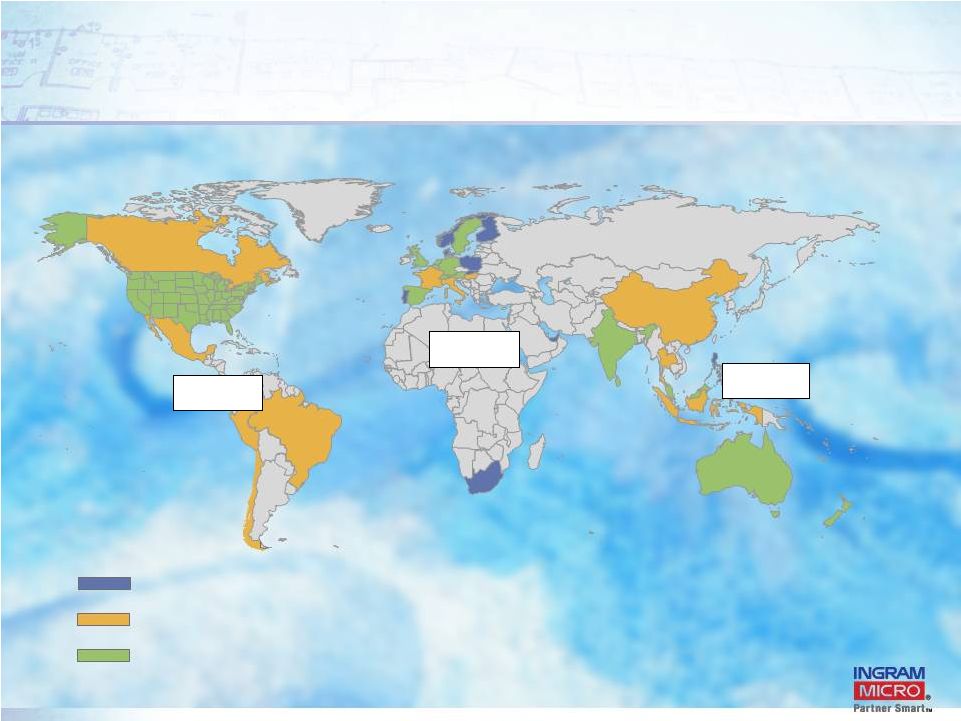

110908_12 Expanded Global Footprint Expanded Global Footprint (1) Combined companies percentage of 2011 total revenue by region from companies’ respective 2011 10K filings Ingram Micro Beacon Both 43% (1) 33% (1) 24% (1) Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. |

|

110908_13 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. Excellent strategic fit Provides immediate scale in rapidly-growing mobility market Expands Ingram Micro's suite of high-value logistics services and solutions Opportunity to drive meaningful synergies and efficiencies Supports Ingram Micro’s longer-term growth and profitability targets Meets return-on-investment criteria for creating shareholder value Summary Summary 12 Creates a global leading mobility distribution and value-added services and solutions provider |

|

110908_14 Proprietary information of Ingram Micro Inc. — Do not distribute or duplicate without Ingram Micro's express written permission. BrightPoint intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement and intends to furnish or file other materials with the SEC in connection with the proposed merger. The definitive proxy statement will be sent or given to the shareholders of BrightPoint and will contain important information about the proposed merger and related matters. BEFORE MAKING ANY VOTING DECISION, BRIGHTPOINT’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THOSE OTHER MATERIALS CAREFULLY AND IN THEIR ENTIRE TY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BRIGHTPOINT AND THE PROPOSED MERGER. The proxy statement and other relevant materials (when they become available), and any other documents filed by BrightPoint with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from BrightPoint by contacting BrightPoint’s Investor Relations by telephone at (317) 707-2745, or by mail at BrightPoint, Inc., 7635 Interactive Way, Suite 200, Indianapolis, Indiana, 46278, Attention: Investor Relations, or by going to BrightPoint’s Investor Relations page on its corporate website at www.BrightPoint.com. Participants in the Solicitation BrightPoint and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BrightPoint in connection with the proposed merger. Information regarding the interests of these directors and executive officers in the merger will be included in the proxy statement described above. Additional information regarding these directors and executive officers is included in BrightPoint’s proxy statement for its 2012 Annual Meeting of Shareholders, which was filed with the SEC on March 23, 2012, and in BrightPoint’s Annual Report on Form 10-K for the year ended December 31, 2011, which was filed with the SEC on February 29, 2012. Additional Information and Where to Find It Additional Information and Where to Find It Additional Information and Where to Find It |