As filed with the Securities and Exchange Commission on January 7, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08348

LORD ASSET MANAGEMENT TRUST

(Exact name of Registrant as specified in charter)

440 South LaSalle Street

Chicago, Illinois 60605-1028

(Address of principal executive offices) (Zip code)

Thomas S. White

Thomas White International, Ltd.

440 South LaSalle Street

Chicago, Illinois 60605-1028

(Name and address of agent for service)

(312) 663-8300

Registrant’s telephone number, including area code

Date of fiscal year end: 10/31

Date of reporting period: 11/01/11 – 10/31/12

Item 1. Reports to Stockholders.

ANNUAL REPORT

OCTOBER 31, 2012

THE INTERNATIONAL FUND

THE EMERGING MARKETS FUND

THE AMERICAN OPPORTUNITIES FUND

| | |

| | Thomas White International Fund

Best International Multi-Cap Core Fund 10-Years ended 11/30/2011 Among 26 funds for risk adjusted performance |

Visit our websites, and travel country to country as we chronicle the world’s transformation into an exciting global marketplace.

www.thomaswhite.com

Experience the enhanced features of our Thomas White Global Investing website, and explore the panorama of trends, economic indicators and policy changes shaping our ever-changing global marketplace.

www.thomaswhitefunds.com

Please visit the Thomas White Funds website, designed to provide you with easy access to important information on our three fund offerings including performance, rankings and commentaries.

www.thomaswhite.com/for-financial-professionals/

The Thomas White Financial Professional website serves the financial advisor community with exclusive insights, such as emerging market white papers, and in-depth product information on all of our strategies.

A Lipper Fund Award is awarded to one fund in each Lipper classification for achieving the strongest trend of consistent risk-adjusted performance against its classification peers over a three, five or ten-year period. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledge that they have not relied upon any warranty, condition, guarantee, or representation made by Lipper. Any use of the data for analyzing, managing, or trading financial instruments is at the user’s own risk. This is not an offer to buy or sell securities. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service.

(This page is not part of the Annual Report.)

CONTENTS

THOMAS S. WHITE, JR.

The Funds’ Chairman and Portfolio Manager

ThomasWhite is the Funds’ Chairman of the Board of Trustees and Portfolio Manager. He has 46 years of investment experience, dating back to 1966 when he began his career at Goldman Sachs. Tom’s interests have always been global. As a boy he grew up around the world, living and traveling throughout Europe, North America and the Far East before graduating from Duke University with an economics degree in 1965. Over his forty-six years as an investment manager, he has been with Lehman Brothers, Blyth Eastman Dillon and Morgan Stanley, where he spent

14 years as a Managing Director. While at Morgan Stanley, Tom served as Chief Investment Officer for the firm’s U.S. value-style equity group.Thomas White International, Ltd. was founded in 1992. It was initially named Lord Asset Management until 1997. Mr. White directs the management of portfolios in Europe, Africa, North America, Latin America, Japan and Asia. He is the senior professional in a team of seasoned security analysts who have been with the firm for many years. The firm’s research division produces monthly valuations covering over 3,000 companies in 45 countries.

www.thomaswhitefunds.com

Message to Shareholders

December 28, 2012

Dear Shareholders and Friends,

We are delighted to welcome all of our many new shareholders and their investment advisors. You have joined a growing number of individuals and organizations who have entrusted Thomas White International to manage a portion of their investments. Given our growth in assets under management, we continue to expand the number of our professionals, including adding analysts to our research team located in Chicago and Bangalore, India. These well-trained individuals search around the clock to discover the undervalued investment opportunities that drive our performance.

Thomas White International is just as committed to supporting the investment advisors who work closely with our shareholders. We recognize their need to have access to our professionals and stay aware of our market strategy and stock selection. To keep our shareholders aware of significant world trends, we publish numerous reports analyzing the countries and industries our analysts cover. Their emerging

market reports regularly feature powerful business leaders, describing how they’ve overcome the challenges in these countries to build successful businesses. The reports are available to read and subscribe to on our popular website “Thomas White Global Investing” at www.thomaswhite.com.

Economic Outlook: Developed Country Policies Have Only Produced Slow Growth.

While growth in most of the emerging market countries quickly recovered after 2008, policy efforts over the last four years to stimulate a normal economic recovery in the developed countries have not been successful. In the United States, the Federal Reserve (Fed), having early on lowered the federal funds rate to near 0%, now has a program buying $40B agency mortgage-backed securities monthly and the monthly purchases of $45B Treasury securities with longer maturities. Moreover, the Fed has adopted full employment as a second official mission objective, stating that its current aggressive stance will continue until U.S. unemployment falls to 6.5%.

| | |

| 2 | | www.thomaswhitefunds.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Developed Markets | | | Emerging Markets | |

| | | | | World | | | USA | | | Europe# | | | Japan | | | China | | | India | | | Brazil | | | Russia | |

| Country | | 2012* | | | 100% | | | | 21.80% | | | | 21.00% | | | | 6.40% | | | | 16.40% | | | | 6.40% | | | | 2.90% | | | | 3.50% | |

GDP Weight

(% of World) | | Rank | | | - | | | | 1 | | | | 2 | | | | 4 | | | | 3 | | | | 5 | | | | 9 | | | | 7 | |

| World Population | | Rank | | | - | | | | 4 | | | | 3 | | | | 12 | | | | 1 | | | | 2 | | | | 6 | | | | 10 | |

| World Land Mass | | Rank | | | - | | | | 3 | | | | 7 | | | | 64 | | | | 4 | | | | 8 | | | | 5 | | | | 1 | |

| Economic Growth | | 2008 | | | 2.80% | | | | -0.30% | | | | 0.40% | | | | -1.00% | | | | 9.60% | | | | 6.90% | | | | 5.20% | | | | 5.20% | |

| (Annual Rate) | | 2009 | | | -0.60% | | | | -3.10% | | | | -4.40% | | | | -5.50% | | | | 9.20% | | | | 5.90% | | | | -0.30% | | | | -7.80% | |

| | | 2010 | | | 5.10% | | | | 2.40% | | | | 2.00% | | | | 4.50% | | | | 10.40% | | | | 10.10% | | | | 7.50% | | | | 4.30% | |

| | | 2011 | | | 3.80% | | | | 1.80% | | | | 1.40% | | | | -0.80% | | | | 9.20% | | | | 6.80% | | | | 2.70% | | | | 4.30% | |

| | | 2012 | | | 3.30% | | | | 2.20% | | | | -0.40% | | | | 2.20% | | | | 7.80% | | | | 4.90% | | | | 1.50% | | | | 3.70% | |

| | | 2013 | | | 3.60% | | | | 2.10% | | | | 0.20% | | | | 1.20% | | | | 8.20% | | | | 6.00% | | | | 4.00% | | | | 3.80% | |

| Govt Fiscal | | 2008 | | | -2.20% | | | | -6.70% | | | | -2.10% | | | | -4.10% | | | | -0.70% | | | | -8.70% | | | | -1.30% | | | | 4.90% | |

| Surplus/Deficit | | 2009 | | | -7.40% | | | | -13.30% | | | | -6.40% | | | | -10.40% | | | | -3.10% | | | | -10.00% | | | | -3.00% | | | | -6.30% | |

| (Annual Rate) | | 2010 | | | -6.00% | | | | -11.20% | | | | -6.20% | | | | -9.40% | | | | -1.50% | | | | -9.40% | | | | -2.70% | | | | -3.50% | |

| | | 2011 | | | -4.60% | | | | -10.10% | | | | -4.10% | | | | -9.80% | | | | -1.20% | | | | -9.00% | | | | -2.60% | | | | 1.60% | |

| | | 2012 | | | -4.20% | | | | -8.70% | | | | -3.30% | | | | -10.00% | | | | -1.30% | | | | -9.50% | | | | -2.10% | | | | 0.50% | |

| | | 2013 | | | -3.50% | | | | -7.30% | | | | -2.60% | | | | -9.10% | | | | -1.00% | | | | -9.10% | | | | -1.60% | | | | 0.20% | |

| Govt Debt to GDP | | 2008 | | | 66% | | | | 76% | | | | 70% | | | | 192% | | | | 17% | | | | 74% | | | | 64% | | | | 8% | |

(% of GDP) | | 2009 | | | 76% | | | | 90% | | | | 80% | | | | 210% | | | | 18% | | | | 74% | | | | 77% | | | | 11% | |

| | | 2010 | | | 80% | | | | 99% | | | | 85% | | | | 215% | | | | 34% | | | | 68% | | | | 65% | | | | 12% | |

| | | 2011 | | | 80% | | | | 103% | | | | 88% | | | | 230% | | | | 26% | | | | 67% | | | | 65% | | | | 12% | |

| | | 2012 | | | 81% | | | | 107% | | | | 94% | | | | 237% | | | | 22% | | | | 68% | | | | 64% | | | | 11% | |

| | | 2013 | | | 81% | | | | 112% | | | | 95% | | | | 245% | | | | 20% | | | | 67% | | | | 61% | | | | 10% | |

*A country’s weight within the world economy is based on 2012 Purchasing Power Parity (source International Monetary Fund).

#Euro Area

2012-13 are Oct 2012 IMF projections.

Will the Aggressive Central Bank Actions Now in Place in Europe, Japan and by the Federal Reserve Eventually Stimulate Growth?

Since their peak on March 31, 2008, Federal Reserve data shows U.S. mortgage debt has

declined every quarter and is now down 11% to $1.140 trillion. Total consumer debt, which also includes auto loans, student debt and credit cards, is up $176 billion, so combined consumer debt is down 7% to $955B. As consumption represents 70% of

| | | | |

| www.thomaswhitefunds.com | | | 3 | |

U.S. Gross Domestic Product (GDP) growth, this shows consumer spending is the main reason for the slow recovery.

Debt levels over the same period at state and local governments are up 5% to $156B and business debt rose 9% to $998B. The Federal government’s debt increased a record $6.313 trillion dollars over last 18 quarters! This represents what the Treasury had to borrow from the Fed to fund its deficit spending over this period. The U.S. Treasury had no choice but to have the Fed buy these bonds since foreign holdings of U.S. debt only rose $96B. This explains why the Federal Reserve’s ownership of Treasury securities has risen so sharply since 2008.

We Feel the Government’s Aggressive Deficit Spending, Which Has Been Financed by Expanding the Leverage at the Federal Reserve Bank, Will Produce a Decade of Below Average Growth with Low Inflation.

Why has such a massive amount of government spending over the last 4 years only resulted in a disappointing 1-2% GDP growth? The primary reason is that 95% of the spending went into supporting an excessive level of consumption promised by the politicians even though the country’s revenues could not justify these expenditures. We believe this money should have been spent as investments in the country’s infrastructure, in scientific research and in improving educational standards. Without investing in the nation’s future, as is done in Asia and the Scandinavian countries, the U.S. standard of living will likely continue to fall.

Given we do not see any immediate changes in the government’s priorities, we project sluggish U.S. growth will continue in 2013 and inflation will remain under 2%. Moreover, our intuition tells us that the enormous amount of debt created over this period may eventually produce a number of unintended consequences involving either deflation or high inflation. A more prudent strategy would be to face reality and convince the country’s citizens that they would be better off in the long-run to endure the short-term pain of cutting consumer support and the ensuing mounting debt, and in turn, invest some of that money saved in areas that would generate growth and employment.

Our Portfolio Strategy

Most of the central banks in the developed countries are now aggressively attempting to stimulate their economies. Using quantitative easing, they are pushing down longer-term interest rates as the shorter maturities are already near zero. With limited capital gains potential left in investment grade fixed income, we feel that a certain amount of the growing liquidity generated by the central banks’ actions will find its way into the global stock markets.

We feel that investors will be well served owning sound companies doing business globally. While equities are the most volatile asset class, history shows they have produced superior, inflation-adjusted returns over the long term. Well-run companies with prudent balance sheets have demonstrated the ability to survive a wide range of economic and business storms and come back more valuable than before. By being

| | |

| 4 | | www.thomaswhitefunds.com |

able to handle these challenging times better than their weaker competitors, these companies should be able to use their advantages in scale, lower costs and greater access to capital to increase market share in their industries and acquire valuable companies or divisions at fire sale prices. Like us, company managers with long-term horizons recognize that difficult environments can offer exceptional buying opportunities.

Your Portfolio Manager and Many Members of Our Research Team Are Fellow Fund Shareholders.

As do many in our firm, I have 100% of my stock market exposure in the Thomas White Funds, including the International Fund, the Emerging Markets Fund and the American Opportunities Fund.

All of us at Thomas White International wish you a happy holiday season and a prosperous New Year.

Thomas S. White, Jr.

Chairman and Portfolio Manager

| | | | |

| www.thomaswhitefunds.com | | | 5 | |

Past performance is not a guarantee of future results.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible.

Diversification does not assure a profit nor protect against loss in a declining market.

Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding of the Fund.

The Thomas White Funds are distributed by Quasar Distributors, LLC.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One cannot invest directly in an index.

Cash flow: Measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Investment grade: Bonds that are judged by a registered nationally recognized statistical rating organization rating agency as having a relatively low risk of default.

| | |

| 6 | | www.thomaswhitefunds.com |

INTERNATIONAL STOCK MARKET PERFORMANCE

The MSCI World Index has had a more consistent performance pattern over the last 40 years than any of its regional sub-indices.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MSCI

INDICES

(US$) | | The regional performance order in each 5-year period is

shown as rank #1 (best) to #5 (worst) as of October 31, 2012. | |

5-YEAR

RETURN

PERIODS | | MSCI

WORLD | | | MSCI AC

WORLD1 | | | EUROPE* | | | USA | | | JAPAN | | | PACIFIC

EX-JAPAN* | | | EMERGING1 | |

| 1970-1974 | | | -1.3% | | | | | | | | -0.9% (#2) | | | | -3.4% (#3) | | | | 16.0% (#1) | | | | -6.2% (#4) | | | | | |

| | | | | | | | |

| 1975-1979 | | | 16.0% | | | | | | | | 18.9% (#2) | | | | 13.3% (#4) | | | | 18.8% (#3) | | | | 27.5% (#1) | | | | | |

| | | | | | | | |

| 1980-1984 | | | 12.4% | | | | | | | | 6.1% (#3) | | | | 14.5% (#2) | | | | 17.0% (#1) | | | | 4.1% (#4) | | | | | |

| | | | | | | | |

| 1985-1989 | | | 28.0% | | | | 28.1% | | | | 32.3% (#3) | | | | 19.8% (#5) | | | | 41.4% (#2) | | | | 22.4% (#4) | | | | 52.2% (#1) | |

| | | | | | | | |

| 1990-1994 | | | 4.2% | | | | 4.7% | | | | 7.0% (#4) | | | | 9.2% (#3) | | | | -3.4% (#5) | | | | 15.3% (#2) | | | | 20.9% (#1) | |

| | | | | | | | |

| 1995-1999 | | | 20.2% | | | | 19.2% | | | | 22.5% (#2) | | | | 29.7% (#1) | | | | 2.1% (#5) | | | | 5.0% (#3) | | | | 2.0% (#4) | |

| | | | | | | | |

| 2000-2004 | | | -2.0% | | | | -1.8% | | | | 0.4% (#3) | | | | -3.2% (#4) | | | | -6.3% (#5) | | | | 6.6% (#1) | | | | 4.6% (#2) | |

| | | | | | | | |

| 2005-2009 | | | 2.6% | | | | 3.6% | | | | 4.5% (#3) | | | | 0.7% (#4) | | | | -0.7% (#5) | | | | 11.7% (#2) | | | | 15.9% (#1) | |

| | | | | | | | |

| 2010-20122 | | | 6.8% | | | | 6.3% | | | | 2.2% (#4) | | | | 11.1% (#1) | | | | -0.1% (#5) | | | | 7.4% (#2) | | | | 3.1% (#3) | |

| 1970-20122 | | | 9.3% | | | | | | | | 10.2% | | | | 9.6% | | | | 9.0% | | | | 10.1% | | | | | |

| | | | | | | | |

| 1988-20122 | | | 7.1% | | | | 7.3% | | | | 8.7% | | | | 9.8% | | | | -0.4% | | | | 10.4% | | | | 12.6% | |

Source: MSCI

*Developed Markets

1Data beginning January 1, 1988

2Returns through October 31, 2012

Past performance is not a guarantee of future results

History shows that regional returns are random in their timing, with no area holding a monopoly on performance. Note the 1970-2012 regional return range of 9.0% to 10.2% are all close to the 9.3% MSCI World Index return.

Observe that the MSCI World Index has enjoyed a more consistent pattern of returns over this period than most of its sub-indices. This is because regional bull and bear markets have tended to offset one another. The MSCI AC World Index, started in 1988, has outperformed the World Index due to the new added emerging markets stocks, but retained the

latter’s pattern of more consistent returns due to its even broader diversification.

Investors who invest globally by owning Thomas White’s American Opportunities, International and Emerging Markets Funds could benefit from the potential for smoother performance inherent in the Funds’ portfolios as they are diversified across industries, countries and currencies.

In falling market environments, less volatile performance can encourage investors to stay the course. This should help promotes success in reaching one’s long-term investment goals.

Diversification does not assure a profit nor protect against loss in a declining market.

| | | | |

| www.thomaswhitefunds.com | | | 7 | |

THE WORLD HAS CHANGED

The number of stocks in the world has surged 109% since the end of the Cold War in 1989. As of October 2012, America’s 4,977 exchange-traded stocks now only represent 10.77% of the 46,231 stocks on the world’s 52 exchanges.1

| | | | | | | | | | | | |

| The Growth of World Stock Markets: Regional Weights |

| 1960 to October 31, 20122 | | 1960 | | 1970 | | 1980 | | 1990 | | 2000 | | 2012 |

| Developed Markets | | 99.9% | | 99.8% | | 99.2% | | 97% | | 96% | | 77% |

| | | | | | | |

United States | | 72% | | 66% | | 57% | | 43% | | 51% | | 38% |

| | | | | | | |

Canada | | 3% | | 2% | | 3% | | 2% | | 2% | | 4% |

| | | | | | | |

Europe | | 22% | | 22% | | 23% | | 25% | | 28% | | 23% |

| | | | | | | |

Asia Pacific | | 3% | | 8% | | 16% | | 27% | | 15% | | 12% |

| | | | | | | |

| Emerging Markets | | 0.1% | | 0.2% | | 0.8% | | 3% | | 4% | | 23% |

| The World Market | | 100% | | 100% | | 100% | | 100% | | 100% | | 100% |

Market Value ($ trillions) | | $0.5 | | $2.0 | | $4.1 | | $8.2 | | $26.9 | | $40.0 |

1World Federation of Exchanges, Focus-October 2012

2Source: Thomas White International, Ltd.

Globalization has spurred growth in every region of the world. International stocks now represent over half of the total world stock market value, including, for example, Sony, Nokia, Toyota, BMW, L’Oreal, Unilever, Heineken, Volvo, Nestle, UBS, Volkswagen, Honda and Royal Dutch Shell. Emerging market companies include Samsung, LG and Hyundai.

Given their quality, diversity and long-term growth potential, it only makes common sense that investors search for opportunities worldwide. The Thomas

White American Opportunities, International and Emerging Markets Funds are managed by the same portfolio manager and analysts who adhere to an identical valuation-oriented investment style. The three portfolios complement one another in that, when combined, they seek to have the profile of the MSCI All-Country World Index.

Shareholders who want to adopt a global investment strategy for their savings and investment program should consider owning all three Thomas White Funds.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of fund holdings, please refer to the Schedule of Investments section of this report.

| | |

| 8 | | www.thomaswhitefunds.com |

| | |

| THOMAS WHITE INTERNATIONAL FUND | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Average Annual Returns as of October 31, 2012 (Unaudited) | | | | | | | |

| Class | | Sales Charge | | | | 6 month | | | YTD | | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | | | Since

Inception (6/28/1994)* | |

| Investor Class shares (TWWDX) | | No sales charge | | | | | 2.15% | | | | 13.05% | | | | 8.25% | | | | 6.17% | | | | -4.40% | | | | 10.53% | | | | 7.71% | |

| Class I shares1 (TWWIX) | | No sales charge | | | | | 2.25% | | | | 13.17% | | | | 8.37% | | | | 6.21% | | | | -4.38% | | | | 10.54% | | | | 7.72% | |

| Class A shares2 (TWWAX) | | Maximum 5.75% initial sales charge | | With sales charge | | | -3.68% | | | | 6.62% | | | | 2.10% | | | | 4.13% | | | | -5.51% | | | | 9.88% | | | | 7.37% | |

| | | | | Excluding sales charge | | | 2.22% | | | | 13.14% | | | | 8.34% | | | | 6.20% | | | | -4.39% | | | | 10.54% | | | | 7.72% | |

| Class C shares3 (TWWCX) | | Maximum 1% deferred sales charge | | With sales charge | | | 1.11% | | | | 12.01% | | | | 7.22% | | | | 6.16% | | | | -4.41% | | | | 10.52% | | | | 7.71% | |

| | | | | Excluding sales charge | | | 2.11% | | | | 13.01% | | | | 8.22% | | | | 6.16% | | | | -4.41% | | | | 10.52% | | | | 7.71% | |

| MSCI All Country World ex US Index4 | | N/A | | | | | 1.21% | | | | 10.81% | | | | 3.98% | | | | 3.74% | | | | -5.08% | | | | 9.31% | | | | 5.06% | |

* The inception date of the Investor Class Shares.

1 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

2 Performance figures for Class A shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

3 Performance figures for Class C shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

4 The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of 44 countries, which includes developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced.

Mutual fund investing involves risk. Principal loss is possible. Investing in international markets may involve additional risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are greater for emerging markets.

| | | | |

| www.thomaswhitefunds.com | | | 9 | |

| | |

| THOMAS WHITE INTERNATIONAL FUND | | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Sales

Charge | | Deferred

Sales

Charge | | Administrative

Services

Fee | | 12b-1 Fees | | Operating

Expenses

(annualized) 1 | | Prospectus

Gross

Annual

Operating

Expense2 | | Prospectus

Net Annual

Operating

Expense2,3 |

| Investor Class | | N/A | | N/A | | Up to 0.25% | | N/A | | 1.31% (Year ended Oct 31, 2012) | | 1.43% | | 1.24% |

| Class I | | N/A | | N/A | | N/A | | N/A | | 0.99% (Aug 31, 2012 through Oct 31, 2012) | | 1.18% | | 0.99% |

| Class A | | 5.75% | | N/A | | Up to 0.25% | | 0.25% | | 1.49% (Aug 31, 2012 through Oct 31, 2012) | | 1.68% | | 1.49% |

| Class C | | N/A | | 1.00% within 15 months | | N/A | | 1.00% | | 1.99% (Aug 31, 2012 through Oct 31, 2012) | | 2.18% | | 1.99% |

1In the absence of the expense reimbursement for the International Fund, the ratio of expenses to average net assets would have been 1.37% for Investor Class shares, 1.45% for Class I shares, 1.66% for Class A shares and 2.16% for Class C shares.

2Gross Annual Operating Expense and Net Annual Operating Expense are based on the most recent prospectus and may differ from other expense ratios appearing in this report.

3The Advisor has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class, Class I, Class A and Class C shares exceed (as a percentage of average daily net assets) 1.24%, 0.99%, 1.49% and 1.99%, respectively. The fee deferral/expense reimbursement agreement expires February 28, 2014. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees.

| | | | | | | | |

| | | | | |

| | | NAV | | Net Assets | | Redemption Fee | | Portfolio Turnover (Year ended October 31, 2012) |

| Investor Class | | $16.55 | | $540.1 million | | 2.00% within 60 days | | 66% |

| Class I | | $16.56 | | $106.6 million | | |

| Class A | | $16.56 | | $519 | | |

| Class C | | $16.56 | | $518 | | |

| | |

| 10 | | www.thomaswhitefunds.com |

OCTOBER 31, 2012

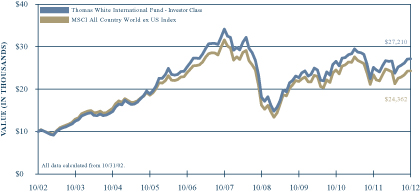

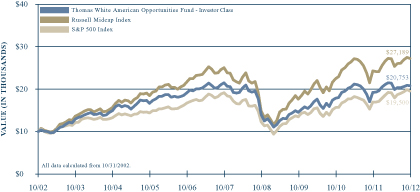

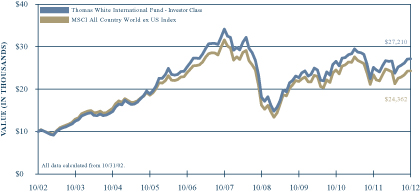

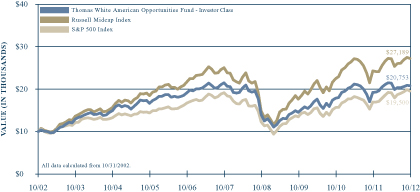

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Investor Class shares and its benchmark, the MSCI All Country World ex US Index, for the past 10 years through October 31, 2012. It assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative ten year return was +172.10% for the Fund’s Investor Class shares and +143.62% for the benchmark. The one-year return for the Fund’s Investor Class shares was +8.25%. The Fund’s Investor Class shares average annual total return since inception was +7.71%. The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of 44 countries, which includes developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower.

| | | | |

| www.thomaswhitefunds.com | | | 11 | |

| | |

| THOMAS WHITE INTERNATIONAL FUND | | |

Portfolio Manager: Thomas S. White, Jr.

The Thomas White International Fund primarily invests in equity securities of companies located in the world’s developed countries outside of the U.S. There may also be a portion of the Fund’s assets invested in companies from emerging market countries.

Performance Review

The Thomas White International Fund Investor Class shares returned +2.15% for the six-month period ended October 31, 2012, compared to +1.21% for the Fund’s benchmark, the MSCI All Country World ex US Index. The Fund’s Investor Class shares returned +8.25%, +6.17%, -4.40%, and +10.53% for the 1-, 3-, 5-, and 10-year periods ended October 31, 2012 against +3.98%, +3.74%, -5.08%, and +9.31%, respectively, for the benchmark. Since its inception on June 28, 1994, the Fund’s Investor Class shares have returned +7.71% annualized while the benchmark index returned +5.06% for the same period.

Aggressive Monetary Policy Steps Help Revive Sentiment

A healthy recovery in September helped international equities offset the steep decline during the month of May, and record moderate returns for the six-month review period ended October 31, 2012. Investor sentiment at the beginning of the review period was negatively affected by the unrelenting fears about the fiscal crisis and a deeper recession in Europe, as well as a slowdown in economic growth rates across the globe. However, extraordinary policy steps by the U.S. Federal Reserve, the European Central Bank (ECB), the Bank of Japan, and other central banks, as well as moderate recovery in economic signals, helped revive investor confidence towards the end of the review period.

More than two years after the problems surfaced, the European fiscal crisis still lingers on in the absence of a comprehensive solution. As a result, several countries in the region remain in a recession, dragging down the pace of global economic growth. The political consensus of last year to solve the crisis appeared fragile as political parties opposed to austerity measures gained in popularity and rose to power in select countries earlier this year. However, both sides have become more accommodative in recent months and have rekindled expectations of an agreement that will be broadly acceptable. Proposals to forge a closer fiscal union and to entrust the supervision of the region’s largest banks to the ECB have gained wide acceptance.

Growth rates and most other economic data fell short of forecasts during the first few months of the review period as consumer sentiment turned more subdued across major economies, including the large emerging markets. Industrial output declined in most developed countries as manufacturers reacted to weaker demand, both domestic and overseas. Economic conditions weakened across emerging markets as well, mostly due to the appreciable decline in exports to Europe. Nevertheless, global factory output saw a moderate recovery towards the end of the review period while exports from countries such as China and Korea appear to have stabilized. Further, corporate earnings and cash flows have remained relatively healthy so far.

| | |

| 12 | | www.thomaswhitefunds.com |

OCTOBER 31, 2012

Portfolio Review

During the six-month review period, the International Fund outperformed its benchmark index every month except August and September. Emerging markets underperformed in August and restricted Fund’s relative returns, as the Fund usually maintains a higher exposure to emerging market equities when compared to the benchmark. In September, the gains in emerging markets were led by select countries such as India where the Fund has a lower exposure. Healthcare and financial sectors outperformed during the review period, while energy and materials sectors lagged as oil and commodity prices corrected.

Hong Kong based manufacturer of home appliances and power tools Techtronic Industries Company Limited (+59.88%), which derives the bulk of its revenues from the developed countries, contributed the most to Fund returns during the review period, on signs of improving demand in major markets such as the U.S. Finnish lender Pohjola Bank Plc (+26.44%) benefited as the Nordic countries have been relatively less affected by the European crisis, and the bank reiterated that earnings for the fiscal year 2012 will be substantially higher than the previous year. Hong Kong based diversified conglomerate Jardine Strategic Holdings Ltd (+13.35%) benefited from the positive trends in the company’s key automobile business in Indonesia as well as sustained demand in the Hong Kong property market. German manufacturer of pharmaceuticals and chemicals Merck KGaA (+16.30%) outperformed as the company sustained its earnings growth and lifted guidance for the full year. The company has announced a cost

restructuring exercise and also issued healthy revenue and earnings guidance for the year 2014. French manufacturer of stationery and shaving products Societe BIC S.A. (+16.44%) added value as the company announced a digital education solution for schools, in partnership with Intel Corp., and maintained its earnings guidance for the current year. European reinsurer Hannover Re (+21.91%) outperformed as the company reported strong earnings growth for the third quarter and issued guidance for the current year and 2013 that were above expectations.

ALS Limited (-46.12%), an Australian company that provides technical testing and inspection services to the mining sector detracted the most from Fund returns during the review period on concerns of a slowdown in mining activity as global demand for materials has become more subdued. Indonesian distributor of heavy equipment PT United Tractors Tbk (-29.89%) declined as the sales outlook for mining equipment in that country has been negatively affected by slower global demand for coal. Chinese car manufacturer Dongfeng Motor Group Co. Ltd. (-32.63%) was negatively affected over concerns of slower demand growth in its domestic market. German luxury car manufacturer BMW AG (-13.15%) underperformed due to concerns about a slowdown in demand in key markets such as China, even as its home market in Europe remains weak. Brazilian miner Vale S.A. (-17.96%) and Chinese oil and gas producer and refiner China Petroleum & Chemical Corporation (-10.08%) underperformed as energy and materials prices corrected on a subdued global demand outlook.

| | | | |

| www.thomaswhitefunds.com | | | 13 | |

THOMAS WHITE INTERNATIONAL FUND

While Global Outlook Has Stabilized, Significant Risks Remain

The readiness of leading central banks to expand the scope of monetary policy interventions has been the most significant factor driving the revival in investor sentiment since September. While the U.S. Federal Reserve has committed to keeping its benchmark rate at the current record low until mid-2015 as well as restarting its program to buy mortgage backed securities, the ECB has offered unlimited purchase of bonds issued by the troubled countries in the region. The Bank of Japan and the Bank of England have also expanded their quantitative easing programs. As well, central banks in emerging market countries, such as China, Brazil, and Korea, have pursued interest rate cuts, while rates are on hold in most others. Until economic signals turn more robust, it is expected that most central banks are likely to maintain their current policy stances that favor expansion.

The relatively healthy U.S. consumer demand, helped by a moderate revival in the housing sector and labor market, has also helped lift some of the dark clouds over the global economy. While this is not likely to fully offset the slump in European demand, countries that export manufactured goods are expected to see better stability in their overseas shipments. However, resource exporters appear unlikely to benefit as commodity prices have corrected. Nevertheless, lower energy and commodity prices could offer further support to consumer sentiment in the developed countries, though higher food prices are likely to cause concerns in emerging economies.

While global economic trends appear to be stabilizing, the European fiscal and banking crises as well as the prospect of a ‘fiscal cliff’ in the U.S. remain significant risks, in our opinion. Though fears about a collapse of the euro have been somewhat mitigated by the ECB’s extraordinary policy measures, the region remains in a recession. Unless a deeper banking union is established and a framework for closer fiscal integration is accepted by all the Euro-zone countries, a recovery from the recession will likely be delayed and Europe will possibly remain vulnerable to further financial shocks. In the U.S., lawmakers are under pressure to come up with an agreement that will avoid the tax increases and government spending cuts expected early next year. Failure to do so would likely invite significant negative economic consequences, not just for the U.S. but also for the rest of the world.

While we have no ability to foresee the choices policymakers might make, we are encouraged by the earnings and cash flow stability of prudently managed companies that have conservative balance sheets. These businesses have been relatively less affected by the subdued economic trends, and some of them are taking advantage of the downturn to strengthen their market share and expand into new segments and geographies. Our diligent research process continues to focus on identifying and keeping track of these businesses, which we believe will offer attractive long-term investment opportunities. Thank you for your confidence in the Thomas White International Fund.

| | |

| 14 | | www.thomaswhitefunds.com |

OCTOBER 31, 2012

| | | | |

| www.thomaswhitefunds.com | | | 15 | |

Portfolio Country and Industry Allocation as of October 31, 2012 (Unaudited)

| | | | |

| | |

| Country Allocation | | % of TNA | |

| Australia | | | 4.1% | |

| Belgium | | | 0.8% | |

| Brazil | | | 2.3% | |

| Canada | | | 4.6% | |

| China | | | 3.5% | |

| Czech Republic | | | 0.3% | |

| Denmark | | | 1.3% | |

| Finland | | | 2.3% | |

| France | | | 3.8% | |

| Germany | | | 12.1% | |

| Hong Kong | | | 5.7% | |

| India | | | 0.4% | |

| Indonesia | | | 1.4% | |

| Israel | | | 0.5% | |

| Italy | | | 0.7% | |

| Japan | | | 11.1% | |

| Malaysia | | | 1.0% | |

| Mexico | | | 2.5% | |

| Netherlands | | | 1.3% | |

| Norway | | | 3.6% | |

| Philippines | | | 0.5% | |

| Russia | | | 2.2% | |

| Singapore | | | 3.1% | |

| South Africa | | | 4.8% | |

| South Korea | | | 5.4% | |

| Sweden | | | 2.7% | |

| | | | |

| | |

| Country Allocation | | % of TNA | |

| Switzerland | | | 0.4% | |

| Taiwan | | | 0.8% | |

| Thailand | | | 2.4% | |

| Turkey | | | 0.7% | |

| United Kingdom | | | 11.4% | |

| United States | | | 0.3% | |

| Cash & Other | | | 2.0% | |

| | | | |

| | |

| Industry Allocation | | % of TNA | |

| Automobiles & Components | | | 4.8% | |

| Banks | | | 12.6% | |

| Capital Goods | | | 9.2% | |

| Commercial & Professional Services | | | 1.6% | |

| Consumer Durables & Apparel | | | 3.6% | |

| Consumer Services | | | 2.6% | |

| Diversified Financials | | | 2.9% | |

| Energy | | | 9.5% | |

| Food & Staples Retailing | | | 0.4% | |

| Food, Beverage & Tobacco | | | 6.2% | |

| Health Care Equipment & Services | | | 3.1% | |

| Household & Personal Products | | | 1.8% | |

| Insurance | | | 6.1% | |

| Materials | | | 4.9% | |

| Pharmaceuticals, Biotechnology & Life Sciences | | | 3.7% | |

| Real Estate | | | 2.5% | |

| Retailing | | | 4.5% | |

| Semiconductors & Semiconductor Equipment | | | 4.7% | |

| Software & Services | | | 1.3% | |

| Technology Hardware & Equipment | | | 1.0% | |

| Telecommunication Services | | | 5.5% | |

| Transportation | | | 2.3% | |

| Utilities | | | 3.2% | |

| Cash & Other | | | 2.0% | |

TNA - Total Net Assets

Fund holdings and industry allocations are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of fund holdings, please refer to the Schedule of Investments section of this report.

| | |

| Thomas White International Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

COMMON

STOCKS (96.7%) | | | | | | | | | | |

|

| |

| AUSTRALIA (4.1%) | | | | | | | | | | | | |

| | Australia and New Zealand Banking Group Limited + | | Banks | | | 423,500 | | | | $11,165,770 | |

| | Coca-Cola Amatil Limited + | | Food, Beverage & Tobacco | | | 260,700 | | | | 3,633,893 | |

| | Insurance Australia Group Limited + | | Insurance | | | 753,000 | | | | 3,581,606 | |

| | Sonic Healthcare Limited + | | Health Care Equipment & Services | | | 300,000 | | | | 4,033,946 | |

| | Telstra Corporation Limited + | | Telecommunication Services | | | 872,400 | | | | 3,750,474 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 26,165,689 | |

|

| |

| BELGIUM (0.8%) | | | | | | | | | | | | |

| | UCB S.A. + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 84,000 | | | | 4,899,507 | |

|

| |

| BRAZIL (2.0%) | | | | | | | | | | | | |

| | Cia de Saneamento Basico do Estado de Sao Paulo | | Utilities | | | 244,500 | | | | 10,350,365 | |

| | Cia de Saneamento de Minas Gerais-COPASA | | Utilities | | | 120,100 | | | | 2,834,787 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,185,152 | |

|

| |

| CANADA (4.6%) | | | | | | | | | | | | |

| | Alimentation Couche-Tard Inc. | | Retailing | | | 62,300 | | | | 3,060,263 | |

| | BCE Inc. | | Telecommunication Services | | | 84,400 | | | | 3,689,516 | |

| | Canadian National Railway Company | | Transportation | | | 68,000 | | | | 5,871,660 | |

| | Canadian Pacific Railway Limited | | Transportation | | | 35,500 | | | | 3,265,822 | |

| | Husky Energy Inc. | | Energy | | | 111,700 | | | | 3,025,267 | |

| | Pacific Rubiales Energy Corp. | | Energy | | | 108,000 | | | | 2,540,095 | |

| | Royal Bank of Canada | | Banks | | | 148,700 | | | | 8,477,575 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 29,930,198 | |

|

| |

| CHINA (3.5%) | | | | | | | | | | | | |

| | Bank of China Limited + | | Banks | | | 6,310,000 | | | | 2,595,123 | |

| | China Minsheng Banking Corp., Ltd. # + | | Banks | | | 5,702,000 | | | | 5,179,187 | |

| | China Overseas Land & Investment Ltd. + | | Real Estate | | | 1,782,000 | | | | 4,663,613 | |

| | Dongyue Group Limited # + | | Materials | | | 3,068,000 | | | | 1,742,179 | |

| | Lenovo Group Limited # + | | Technology Hardware & Equipment | | | 7,710,000 | | | | 6,193,133 | |

| | PICC Property and Casualty Company Limited * + | | Insurance | | | 1,965,400 | | | | 2,606,591 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 22,979,826 | |

|

| |

| CZECH REPUBLIC (0.3%) | | | | | | | | | | |

| | Philip Morris CR a.s. + | | Food, Beverage & Tobacco | | | 4,100 | | | | 2,196,537 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | |

| 16 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2012 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| DENMARK (1.3%) | | | | | | | | | | | | |

| | DSV A/S + | | Transportation | | | 116,800 | | | | $2,624,623 | |

| | Topdanmark A/S * + | | Insurance | | | 28,200 | | | | 5,728,630 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,353,253 | |

|

| |

| FINLAND (2.3%) | | | | | | | | | | | | |

| | Nokian Renkaat Oyj + | | Automobiles & Components | | | 64,800 | | | | 2,695,008 | |

| | Pohjola Bank PLC + | | Diversified Financials | | | 573,400 | | | | 7,821,572 | |

| | Sampo Oyj + | | Insurance | | | 146,900 | | | | 4,604,078 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,120,658 | |

|

| |

| FRANCE (3.8%) | | | | | | | | | | | | |

| | Christian Dior + | | Consumer Durables & Apparel | | | 52,750 | | | | 7,572,412 | |

| | Compagnie Generale des Etablissements Michelin + | | Automobiles & Components | | | 43,000 | | | | 3,704,259 | |

| | Societe B I C + | | Commercial & Professional Services | | | 82,000 | | | | 10,009,290 | |

| | Sodexo + | | Consumer Services | | | 45,500 | | | | 3,509,172 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 24,795,133 | |

|

| |

| GERMANY (11.1%) | | | | | | | | | | | | |

| | adidas AG + | | Consumer Durables & Apparel | | | 74,100 | | | | 6,312,838 | |

| | BASF SE + | | Materials | | | 98,050 | | | | 8,124,447 | |

| | Bayer Aktiengesellschaft + | | Materials | | | 82,600 | | | | 7,193,318 | |

| | Bayerische Motoren Werke Aktiengesellschaft + | | Automobiles & Components | | | 57,500 | | | | 4,579,635 | |

| | Brenntag AG + | | Capital Goods | | | 24,800 | | | | 3,125,672 | |

| | Fresenius SE & Co KGaA + | | Health Care Equipment & Services | | | 87,600 | | | | 9,991,575 | |

| | Hannover Ruckversicherung AG + | | Insurance | | | 114,400 | | | | 8,046,941 | |

| | Merck KGaA + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 70,800 | | | | 9,047,963 | |

| | Munich Re Group + | | Insurance | | | 24,800 | | | | 3,985,870 | |

| | SAP AG + | | Software & Services | | | 112,900 | | | | 8,224,575 | |

| | Volkswagen Aktiengesellschaft + | | Automobiles & Components | | | 17,000 | | | | 3,313,944 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 71,946,778 | |

|

| |

| HONG KONG (5.7%) | | | | | | | | | | |

| | Cheung Kong (Holdings) Limited + | | Real Estate | | | 577,000 | | | | 8,535,055 | |

| | Cheung Kong Infrastructure Holdings Limited + | | Utilities | | | 824,000 | | | | 4,826,140 | |

| | Jardine Strategic Holdings Limited + | | Capital Goods | | | 400,000 | | | | 14,543,970 | |

| | SJM Holdings Limited + | | Consumer Services | | | 1,682,000 | | | | 3,655,901 | |

| | Techtronic Industries Company Limited + | | Consumer Durables & Apparel | | | 2,653,000 | | | | 5,022,141 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 36,583,207 | |

|

| |

| INDIA (0.4%) | | | | | | | | | | | | |

| | Tata Motors Limited ADR # | | Automobiles & Components | | | 97,800 | | | | 2,361,870 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 17 | |

| | |

| Thomas White International Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| INDONESIA (1.4%) | | | | | | | | | | |

| | Indo Tambangraya Megah Tbk PT + | | Energy | | | 499,500 | | | | $2,110,399 | |

| | PT Bank Mandiri (Persero) Tbk. + | | Banks | | | 2,654,000 | | | | 2,273,134 | |

| | PT Bank Negara Indonesia (Persero) Tbk + | | Banks | | | 4,782,000 | | | | 1,916,796 | |

| | PT United Tractors Tbk + | | Capital Goods | | | 1,298,000 | | | | 2,830,199 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,130,528 | |

|

| |

| ISRAEL (0.5%) | | | | | | | | | | | | |

| | Teva Pharmaceutical Industries Limited ADR | | Pharmaceuticals, Biotechnology & Life Sciences | | | 76,500 | | | | 3,092,130 | |

|

| |

| ITALY (0.7%) | | | | | | | | | | | | |

| | Eni S.p.A. + | | Energy | | | 193,000 | | | | 4,423,924 | |

|

| |

| JAPAN (11.1%) | | | | | | | | | | | | |

| | Aisin Seiki Co., Ltd. + | | Automobiles & Components | | | 74,500 | | | | 2,169,158 | |

| | Asahi Group Holdings, Ltd. + | | Food, Beverage & Tobacco | | | 154,100 | | | | 3,512,613 | |

| | Dainippon Sumitomo Pharma Co., Ltd. + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 259,200 | | | | 2,975,689 | |

| | Daito Trust Construction Co., Ltd. + | | Real Estate | | | 32,300 | | | | 3,261,719 | |

| | East Japan Railway Company + | | Transportation | | | 47,800 | | | | 3,280,502 | |

| | ITOCHU Corporation + | | Capital Goods | | | 603,700 | | | | 6,027,411 | |

| | Japan Tobacco Inc. + | | Food, Beverage & Tobacco | | | 103,000 | | | | 2,845,095 | |

| | JGC Corporation + | | Capital Goods | | | 102,000 | | | | 3,509,783 | |

| | Miraca Holdings Inc. + | | Health Care Equipment & Services | | | 75,000 | | | | 3,171,203 | |

| | Mitsubishi Corporation + | | Capital Goods | | | 203,000 | | | | 3,626,703 | |

| | Mizuho Financial Group, Inc. + | | Banks | | | 3,347,000 | | | | 5,228,388 | |

| | Nippon Telegraph and Telephone Corporation + | | Telecommunication Services | | | 149,100 | | | | 6,806,396 | |

| | Osaka Gas Co., Ltd. + | | Utilities | | | 649,000 | | | | 2,673,295 | |

| | Seven & I Holdings Co., Ltd. + | | Food & Staples Retailing | | | 82,800 | | | | 2,552,833 | |

| | Shimano, Inc. + | | Consumer Durables & Apparel | | | 68,400 | | | | 4,306,658 | |

| | Sumitomo Corporation + | | Capital Goods | | | 310,200 | | | | 4,217,748 | |

| | Taisei Corporation + | | Capital Goods | | | 1,174,000 | | | | 3,236,653 | |

| | Toyota Industries Corporation + | | Automobiles & Components | | | 111,000 | | | | 3,172,931 | |

| | Unicharm Corporation + | | Household & Personal Products | | | 93,000 | | | | 5,033,404 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 71,608,182 | |

|

| |

| MALAYSIA (1.0%) | | | | | | | | | | |

| | AMMB Holdings Berhad + | | Diversified Financials | | | 1,225,000 | | | | 2,565,842 | |

| | Axiata Group Berhad + | | Telecommunication Services | | | 1,917,500 | | | | 4,105,729 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,671,571 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | |

| 18 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2012 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| MEXICO (2.5%) | | | | | | | | | | | | |

| | Alfa, S.A.B. de C.V. | | Capital Goods | | | 1,750,000 | | | | $3,215,595 | |

| | America Movil, S.A.B. de C.V. | | Telecommunication Services | | | 2,650,000 | | | | 3,361,578 | |

| | Grupo Financiero Banorte, S.A.B. de C.V. | | Banks | | | 763,700 | | | | 4,246,018 | |

| | Grupo Mexico, S.A.B. de C.V. | | Materials | | | 808,259 | | | | 2,592,552 | |

| | Mexichem, S.A.B. de C.V. | | Materials | | | 568,400 | | | | 2,817,257 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 16,233,000 | |

|

| |

| NETHERLANDS (1.3%) | | | | | | | | | | |

| | ASML Holding N.V. + | | Semiconductors & Semiconductor Equipment | | | 109,200 | | | | 6,010,334 | |

| | Tenaris S.A. + | | Energy | | | 141,700 | | | | 2,662,041 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,672,375 | |

|

| |

| NORWAY (3.6%) | | | | | | | | | | | | |

| | Seadrill Limited # + | | Energy | | | 154,800 | | | | 6,271,632 | |

| | Statoil ASA + | | Energy | | | 469,000 | | | | 11,587,984 | |

| | Telenor ASA + | | Telecommunication Services | | | 272,500 | | | | 5,350,845 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 23,210,461 | |

|

| |

| PHILIPPINES (0.5%) | | | | | | | | | | |

| | Universal Robina Corporation + | | Food, Beverage & Tobacco | | | 1,668,000 | | | | 2,909,326 | |

|

| |

| RUSSIA (2.2%) | | | | | | | | | | | | |

| | Lukoil OAO GDR + | | Energy | | | 112,200 | | | | 6,801,969 | |

| | OAO Tatneft GDR + | | Energy | | | 139,333 | | | | 5,418,143 | |

| | Otkrytoe aktsionernoe obschestvo Gazprom neft GDR # + | | Energy | | | 89,700 | | | | 2,219,454 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 14,439,566 | |

|

| |

| SINGAPORE (3.1%) | | | | | | | | | | | | |

| | Jardine Cycle & Carriage Limited + | | Retailing | | | 225,000 | | | | 9,045,062 | |

| | Keppel Corporation Limited + | | Capital Goods | | | 286,000 | | | | 2,487,471 | |

| | Singapore Telecommunications Limited + | | Telecommunication Services | | | 1,197,000 | | | | 3,148,697 | |

| | United Overseas Bank Limited + | | Banks | | | 340,000 | | | | 5,071,702 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,752,932 | |

|

| |

| SOUTH AFRICA (4.8%) | | | | | | | | | | |

| | Aspen Pharmacare Holdings Ltd. + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 210,000 | | | | 3,826,224 | |

| | Foschini Group Ltd. + | | Retailing | | | 155,600 | | | | 2,261,539 | |

| | Imperial Holdings Limited + | | Retailing | | | 158,300 | | | | 3,594,091 | |

| | Life Healthcare Group Holdings Ltd + | | Health Care Equipment & Services | | | 787,400 | | | | 2,977,157 | |

| | MTN Group Limited + | | Telecommunication Services | | | 87,600 | | | | 1,578,511 | |

| | Remgro Limited + | | Diversified Financials | | | 376,400 | | | | 6,444,682 | |

| | Sasol Limited + | | Energy | | | 41,600 | | | | 1,773,519 | |

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 19 | |

| | |

| Thomas White International Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| SOUTH AFRICA (CONT.) | | | | | | | | | | |

| | Tiger Brands Limited + | | Food, Beverage & Tobacco | | | 116,500 | | | | $3,705,886 | |

| | Woolworths Holdings Limited + | | Retailing | | | 652,000 | | | | 4,915,885 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 31,077,494 | |

|

| |

| SOUTH KOREA (5.4%) | | | | | | | | | | |

| | Daelim Industrial Co., Ltd. + | | Capital Goods | | | 37,500 | | | | 2,601,649 | |

| | Hyundai Marine & Fire Insurance Co., Ltd. + | | Insurance | | | 125,600 | | | | 4,054,672 | |

| | Hyundai Motor Company + | | Automobiles & Components | | | 22,100 | | | | 4,536,802 | |

| | KIA Motors Corp. + | | Automobiles & Components | | | 36,000 | | | | 1,995,928 | |

| | Samsung Electronics Co., Ltd. + | | Semiconductors & Semiconductor Equipment | | | 17,825 | | | | 21,441,495 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 34,630,546 | |

|

| |

| SWEDEN (2.7%) | | | | | | | | | | | | |

| | SKF AB + | | Capital Goods | | | 223,300 | | | | 5,040,363 | |

| | Svenska Handelsbanken AB + | | Banks | | | 154,900 | | | | 5,314,780 | |

| | Swedbank AB + | | Banks | | | 379,100 | | | | 7,030,262 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 17,385,405 | |

|

| |

| SWITZERLAND (0.4%) | | | | | | | | | | |

| | ABB Ltd. + | | Capital Goods | | | 158,900 | | | | 2,871,553 | |

|

| |

| TAIWAN (0.8%) | | | | | | | | | | | | |

| | Cheng Shin Rubber Industry Co Ltd + | | Automobiles & Components | | | 1,003,200 | | | | 2,507,838 | |

| | Taiwan Semiconductor Manufacturing Co Ltd ADR # | | Semiconductors & Semiconductor Equipment | | | 182,000 | | | | 2,893,800 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,401,638 | |

|

| |

| THAILAND (2.4%) | | | | | | | | | | | | |

| | Advanced Info Service Public Company Limited + | | Telecommunication Services | | | 540,000 | | | | 3,461,261 | |

| | Bangkok Bank Public Company Limited + | | Banks | | | 351,800 | | | | 2,021,692 | |

| | Krung Thai Bank Public Company Limited + | | Banks | | | 975,000 | | | | 572,456 | |

| | PTT Exploration and Production Public Company Limited + | | Energy | | | 1,171,100 | | | | 6,342,751 | |

| | The Siam Commercial Bank Public Company Limited + | | Banks | | | 623,700 | | | | 3,276,238 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,674,398 | |

|

| |

| TURKEY (0.7%) | | | | | | | | | | | | |

| | Haci omer Sabanci Holding A.S. + | | Diversified Financials | | | 414,800 | | | | 2,188,782 | |

| | Koc Holding A.S. + | | Capital Goods | | | 480,165 | | | | 2,254,996 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,443,778 | |

|

| |

| UNITED KINGDOM (11.4%) | | | | | | | | | | |

| | BHP Billiton Plc + | | Materials | | | 293,300 | | | | 9,385,152 | |

| | BP P.L.C. + | | Energy | | | 909,800 | | | | 6,499,442 | |

| | British American Tobacco p.l.c. + | | Food, Beverage & Tobacco | | | 262,800 | | | | 13,039,557 | |

The accompanying notes are an integral part of these financial statements

| | |

| 20 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2012 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| UNITED KINGDOM (CONT.) | | | | | | | | | | |

| | Compass Group PLC + | | Consumer Services | | | 239,900 | | | | $2,636,180 | |

| | HSBC Holdings PLC + | | Banks | | | 583,900 | | | | 5,749,092 | |

| | Imperial Tobacco Group PLC + | | Food, Beverage & Tobacco | | | 166,400 | | | | 6,291,840 | |

| | Prudential Public Limited Company + | | Insurance | | | 515,100 | | | | 7,078,164 | |

| | Standard Chartered PLC + | | Banks | | | 406,675 | | | | 9,647,139 | |

| | WH Smith PLC # + | | Retailing | | | 628,800 | | | | 6,321,641 | |

| | Whitbread PLC + | | Consumer Services | | | 73,900 | | | | 2,808,154 | |

| | William Hill PLC + | | Consumer Services | | | 750,200 | | | | 4,097,858 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 73,554,219 | |

|

| |

| UNITED STATES (0.3%) | | | | | | | | | | |

| | Philip Morris International Inc. | | Food, Beverage & Tobacco | | | 21,600 | | | | 1,912,896 | |

|

| |

| Total Common Stocks | | | | (Cost $538,032,195) | | | | | | | 625,613,730 | |

| | | | | | | | | | | | |

|

| |

| PREFERRED STOCKS (1.3%) | | | | | | | | | | | | |

|

| |

| BRAZIL (0.3%) | | | | | | | | | | | | |

| | Banco Bradesco S.A. | | Banks | | | 122,900 | | | | 1,936,338 | |

|

| |

| GERMANY (1.0%) | | | | | | | | | | | | |

| | Henkel AG & Co. KGaA + | | Household & Personal Products | | | 81,800 | | | | 6,532,135 | |

|

| |

| Total Preferred Stocks | | | | (Cost $8,284,759) | | | | | | | 8,468,473 | |

| | | | | | | | | | | | |

|

| |

SHORT TERM

INVESTMENT (3.0%) | | | | | | | | | | |

| | | | |

| HELD AS COLLATERAL FOR SECURITIES LENDING | | Northern Institutional Liquid Asset Portfolio | | | | | 19,382,904 | | | | $19,382,904 | |

|

| |

| Total Short Term Investment | | | | (Cost $19,382,904) | | | | | | | 19,382,904 | |

|

| |

| Total Investments | | 101.0% | | (Cost $565,699,858) | | | | | | | $653,465,107 | |

Other Assets,

Less Liabilities | | (1.0)% | | | | | | | | | (6,745,168 | ) |

| Total Net Assets: | | 100.0% | | | | | | | | | $646,719,939 | |

|

| |

| * | Non-Income Producing Securities |

| # | All or a portion of securities on loan at October 31, 2012 - See Note 1 (g) to Financial Statements |

| + | Fair Valued Security - See Note 1(a) to Financial statements |

ADR - American Depository Receipt

GDR - Global Depositary Receipt

Industry classifications shown in the Schedule of Investments are based off of the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 21 | |

| | |

| Thomas White International Fund | | |

The following table summarizes the inputs used, as of October 31, 2012, in valuing the Fund’s assets:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | | $------- | | | | $26,165,689 | | | | $------- | | | | $26,165,689 | |

| Belgium | | | ------- | | | | 4,899,507 | | | | ------- | | | | 4,899,507 | |

| Brazil | | | 13,185,152 | | | | ------- | | | | ------- | | | | 13,185,152 | |

| Canada | | | 29,930,198 | | | | ------- | | | | ------- | | | | 29,930,198 | |

| China | | | ------- | | | | 22,979,826 | | | | ------- | | | | 22,979,826 | |

| Czech Republic | | | ------- | | | | 2,196,537 | | | | ------- | | | | 2,196,537 | |

| Denmark | | | ------- | | | | 8,353,253 | | | | ------- | | | | 8,353,253 | |

| Finland | | | ------- | | | | 15,120,658 | | | | ------- | | | | 15,120,658 | |

| France | | | ------- | | | | 24,795,133 | | | | ------- | | | | 24,795,133 | |

| Germany | | | ------- | | | | 71,946,778 | | | | ------- | | | | 71,946,778 | |

| Hong Kong | | | ------- | | | | 36,583,207 | | | | ------- | | | | 36,583,207 | |

| India | | | 2,361,870 | | | | ------- | | | | ------- | | | | 2,361,870 | |

| Indonesia | | | ------- | | | | 9,130,528 | | | | ------- | | | | 9,130,528 | |

| Israel | | | 3,092,130 | | | | ------- | | | | ------- | | | | 3,092,130 | |

| Italy | | | ------- | | | | 4,423,924 | | | | ------- | | | | 4,423,924 | |

| Japan | | | ------- | | | | 71,608,182 | | | | ------- | | | | 71,608,182 | |

| Malaysia | | | ------- | | | | 6,671,571 | | | | ------- | | | | 6,671,571 | |

| Mexico | | | 16,233,000 | | | | ------- | | | | ------- | | | | 16,233,000 | |

| Netherlands | | | ------- | | | | 8,672,375 | | | | ------- | | | | 8,672,375 | |

| Norway | | | ------- | | | | 23,210,461 | | | | ------- | | | | 23,210,461 | |

| Philippines | | | ------- | | | | 2,909,326 | | | | ------- | | | | 2,909,326 | |

| Russia | | | ------- | | | | 14,439,566 | | | | ------- | | | | 14,439,566 | |

| Singapore | | | ------- | | | | 19,752,932 | | | | ------- | | | | 19,752,932 | |

| South Africa | | | ------- | | | | 31,077,494 | | | | ------- | | | | 31,077,494 | |

| South Korea | | | ------- | | | | 34,630,546 | | | | ------- | | | | 34,630,546 | |

| Sweden | | | ------- | | �� | | 17,385,405 | | | | ------- | | | | 17,385,405 | |

| Switzerland | | | ------- | | | | 2,871,553 | | | | ------- | | | | 2,871,553 | |

| Taiwan | | | 2,893,800 | | | | 2,507,838 | | | | ------- | | | | 5,401,638 | |

| Thailand | | | ------- | | | | 15,674,398 | | | | ------- | | | | 15,674,398 | |

| Turkey | | | ------- | | | | 4,443,778 | | | | ------- | | | | 4,443,778 | |

| United Kingdom | | | ------- | | | | 73,554,219 | | | | ------- | | | | 73,554,219 | |

| United States | | | 1,912,896 | | | | ------- | | | | ------- | | | | 1,912,896 | |

| Total Common Stocks | | | $69,609,046 | | | | $556,004,684 | | | | $------- | | | | $625,613,730 | |

| Preferred Stocks | | | | | | | | | | | | | | | | |

| Brazil | | | $1,936,338 | | | | $------- | | | | $------- | | | | $1,936,338 | |

| Germany | | | ------- | | | | 6,532,135 | | | | ------- | | | | 6,532,135 | |

| Total Preferred | | | 1,936,338 | | | | 6,532,135 | | | | ------- | | | | 8,468,473 | |

| Short Term Investments | |

| 19,382,904

|

| | | ------- | | | | ------- | | | | 19,382,904 | |

| Total Investments | | | $90,928,288 | | | | $562,536,819 | | | | $------- | | | | $653,465,107 | |

For more information on valuation inputs, please refer to the accompanying Notes to Financial Statements.

The Fund’s assets assigned to Level 2 include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. In addition, no transfers in and/or out between Levels 1, 2 or 3 were observed.

The accompanying notes are an integral part of these financial statements

| | |

| 22 | | www.thomaswhitefunds.com |

| | |

| THOMAS WHITE EMERGING MARKETS FUND | | |

| | | | | | | | | | | | | | | | | | | | |

| |

| Average Annual Returns as of October 31, 2012 (Unaudited) | |

| Class | | Sales Charge | | | | 6 month | | | YTD | | | 1 Yr | | | Since Inception (6/28/2010)* | |

| Investor Class shares (TWEMX) | | No sales charge | | | | | -0.04% | | | | 11.95% | | | | 7.21% | | | | 6.59% | |

Class I shares1

(TWIIX) | | No sales charge | | | | | 0.01% | | | | 12.00% | | | | 7.26% | | | | 6.61% | |

Class A shares2

(TWIAX) | | Maximum 5.75% initial sales charge | | With sales charge | | | -5.81% | | | | 5.45% | | | | 0.96% | | | | 3.90% | |

| | | | | Excluding sales charge | | | -0.11% | | | | 11.88% | | | | 7.14% | | | | 6.56% | |

Class C shares3

(TWICX) | | Maximum 1% deferred sales charge | | With sales charge | | | -1.12% | | | | 10.84% | | | | 6.10% | | | | 6.55% | |

| | | | | Excluding sales charge | | | -0.14% | | | | 11.84% | | | | 7.10% | | | | 6.55% | |

| MSCI Emerging Markets Index4 | | N/A | | | | | -1.25% | | | | 11.30% | | | | 2.63% | | | | 4.56% | |

* The inception date of the Investor Class Shares.

1 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

2 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

3 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

4 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced.

Mutual fund investing involves risk. Principal loss is possible. Investing in international markets may involve additional risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are greater for emerging markets.

| | | | |

| www.thomaswhitefunds.com | | | 23 | |

| | |

| THOMAS WHITE EMERGING MARKETS FUND | | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Sales

Charge | | Deferred

Sales

Charge | | Administrative

Services

Fee | | 12b-1 Fees | | Operating

Expenses

(annualized) 1 | | Prospectus

Gross

Annual

Operating

Expense2 | | Prospectus

Net Annual

Operating

Expense2,3 |

| Investor Class | | N/A | | N/A | | Up to 0.25% | | N/A | | 1.46% (Year ended Oct 31, 2012) | | 1.95% | | 1.34% |

| Class I | | N/A | | N/A | | N/A | | N/A | | 1.09% (Aug 31, 2012 through Oct 31, 2012) | | 1.70% | | 1.09% |

| Class A | | 5.75% | | N/A | | Up to 0.25% | | 0.25% | | 1.59% (Aug 31, 2012 through Oct 31, 2012) | | 2.20% | | 1.59% |

| Class C | | N/A | | 1.00%

within 15

months | | N/A | | 1.00% | | 2.09% (Aug 31, 2012 through Oct 31, 2012) | | 2.70% | | 2.09% |

1 In the absence of the expense reimbursement for the Emerging Markets Fund, the ratio of expenses to average net assets would have been 1.96% for Investor Class shares, 3.31% for Class I shares, 2.32% for Class A shares and 2.85% for Class C shares.

2 Gross Annual Operating Expense and Net Annual Operating Expense are based on the most recent prospectus and may differ from other expense ratios appearing in this report.

3 The Advisor has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class, Class I, Class A and Class C shares exceed (as a percentage of average daily net assets) 1.34%, 1.09%, 1.59% and 2.09%, respectively. The fee deferral/expense reimbursement agreement expires February 28, 2014. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees.

| | | | | | | | |

| | | | | |

| | | NAV | | Net Assets | | Redemption Fee | | Portfolio Turnover (Year ended October 31, 2012) |

| Investor Class | | $11.21 | | $29.6 million | | 2.00% within 60 days | | 54% |

| Class I | | $11.21 | | $956 thousand | | |

| Class A | | $11.20 | | $527 | | |

| Class C | | $11.21 | | $526 | | |

| | |

| 24 | | www.thomaswhitefunds.com |

OCTOBER 31, 2012

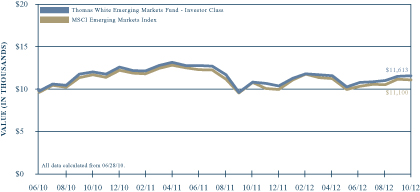

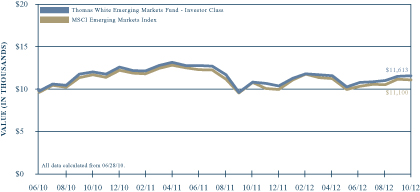

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Investor Class shares and its benchmark, the MSCI Emerging Markets Index, since inception on June 28, 2010 through October 31, 2012. It assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative return since inception was +16.13% for the Fund’s Investor Class shares and +11.00% for the benchmark. The one-year return for the Fund’s Investor Class shares was +7.21%. The Fund’s Investor Class shares average annual total return since inception was +6.59%. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower.

| | | | |

| www.thomaswhitefunds.com | | | 25 | |

| | |

| THOMAS WHITE EMERGING MARKETS FUND | | |

Portfolio Manager: Thomas S. White, Jr.

The Thomas White Emerging Markets Fund invests primarily in securities of companies located in or whose businesses are closely associated with the world’s emerging markets countries.

Performance Review

During the trailing six-month period ended October 31, 2012, the Thomas White Emerging Markets Fund Investor Class shares returned -0.04%, compared to -1.25% for its benchmark, the MSCI Emerging Markets Index. The Fund’s Investor Class shares returned +7.21% during the trailing 1-year period, outperforming the benchmark which returned +2.63%. Since its inception on June 28, 2010, the Fund’s Investor Class shares have returned +6.59% annualized, against +4.56% for the benchmark index.

Policy Actions Help Ease Economic Growth Concerns

Emerging market equities started the review period with a significant price correction in May, on heightened concerns over a substantial decline in economic growth rates in these countries. Until the first quarter of this year, the downside risks to emerging market economic growth were considered relatively low. It was expected that domestic demand, boosted by favorable fiscal and monetary measures, would help these countries to mostly offset the weak external environment. However, as recessionary conditions persisted in Europe, several emerging market countries have been facing weaker than expected economic trends. The slowdown has been most severe among resource exporting countries such as Brazil, as a weaker global demand outlook led to a correction in commodity prices.

Expectations of more aggressive fiscal and monetary measures helped revive optimism in June. Several emerging countries have announced tax breaks and other fiscal measures to support industrial manufacturers as well as exporters. In addition, central banks in these countries have lowered interest rates or have held their rates steady, with the notable exception of Russia where interest rates were hiked in September on inflation concerns. The Brazilian central bank has been the most aggressive, cutting its benchmark to a record low. In countries such as India, where persistent inflation risks have restricted policy options, the central bank has repeatedly lowered the reserve requirements of banks to boost credit demand.

Monetary policy actions by the U.S. Federal Reserve and the European Central Bank helped emerging market equities recover further in September, though the gains were not sufficient to fully erase the decline in May. An extended period of record low interest rates and extraordinarily large liquidity infusions in the developed world are expected to drive increased capital inflows into emerging market assets. Despite the recent cuts, interest rate differentials between emerging markets and the developed countries remain sizeable, and continue to attract investment flows into emerging market debt. In addition, companies in emerging countries continue to see healthy

| | |

| 26 | | www.thomaswhitefunds.com |

OCTOBER 31, 2012

earnings growth and relatively stable cash flows, though the pace of growth has moderated.

Portfolio Review

Strong relative returns during the months of June, August, and October helped the Emerging Markets Fund outperform its benchmark during the six-month review period. The Fund lagged the index marginally in May, when the markets saw a sharp decline. In September, the gains in emerging markets were led by select countries such as India where the Fund has a lower exposure than its benchmark. The industrial and healthcare sectors outperformed the most during the review period, while the materials and energy sectors lagged.

Mexican industrial conglomerate Alfa SAB de CV (+29.06%), which manufactures automobile parts, petrochemicals, and food products, contributed the most to Fund returns during the review period, as demand growth in its domestic market remains buoyant and automobile exports from the country continue to rise. Hong Kong based manufacturer of home appliances and power tools Techtronic Industries Company Limited (+49.77%) outperformed on signs of improving demand in major developed markets such as the U.S. Diversified Turkish industrial conglomerates Koc Holdings AS (+32.91%) and Haci Omer Sabanci Holding AS (+28.87%) gained as economic trends have turned healthier. Koc Holdings announced significantly large capital investment plans for the next year to expand existing capacity and to seek possible acquisitions. Mexican bank Grupo Financiero Banorte SAB de CV (+15.17%)

benefited from expectations of sustained credit growth, especially in consumer credit, which the country’s banking regulator expects to be around 15% for the current year. A pension fund co-owned by Banorte has acquired the Mexican pension fund assets of a Spanish bank to emerge as the country’s leading retirement assets manager. Korean insurer Hyundai Marine and Fire Insurance Co. (+25.96%) , expected to benefit from a government proposal to allow low cost health indemnity policies, also added value during the review period.