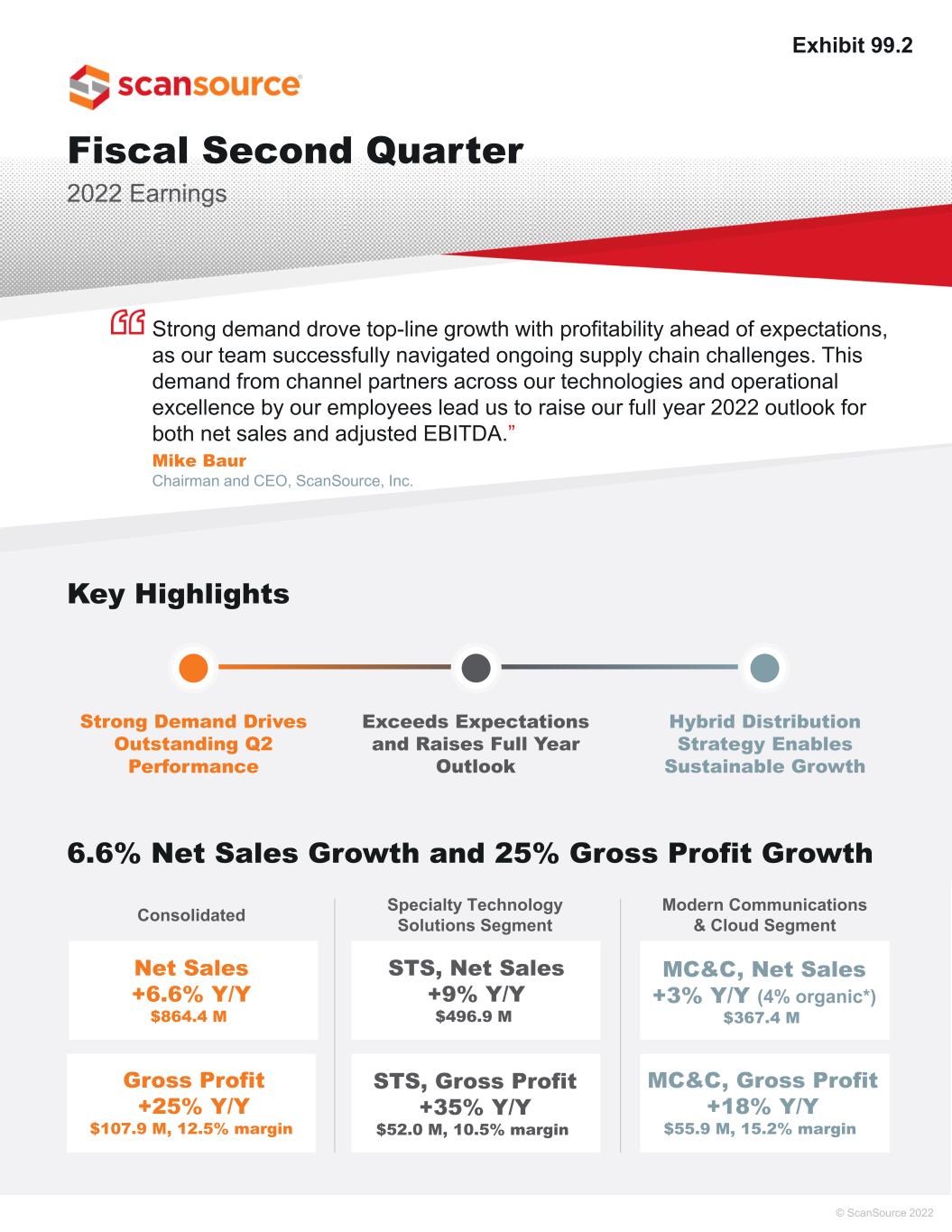

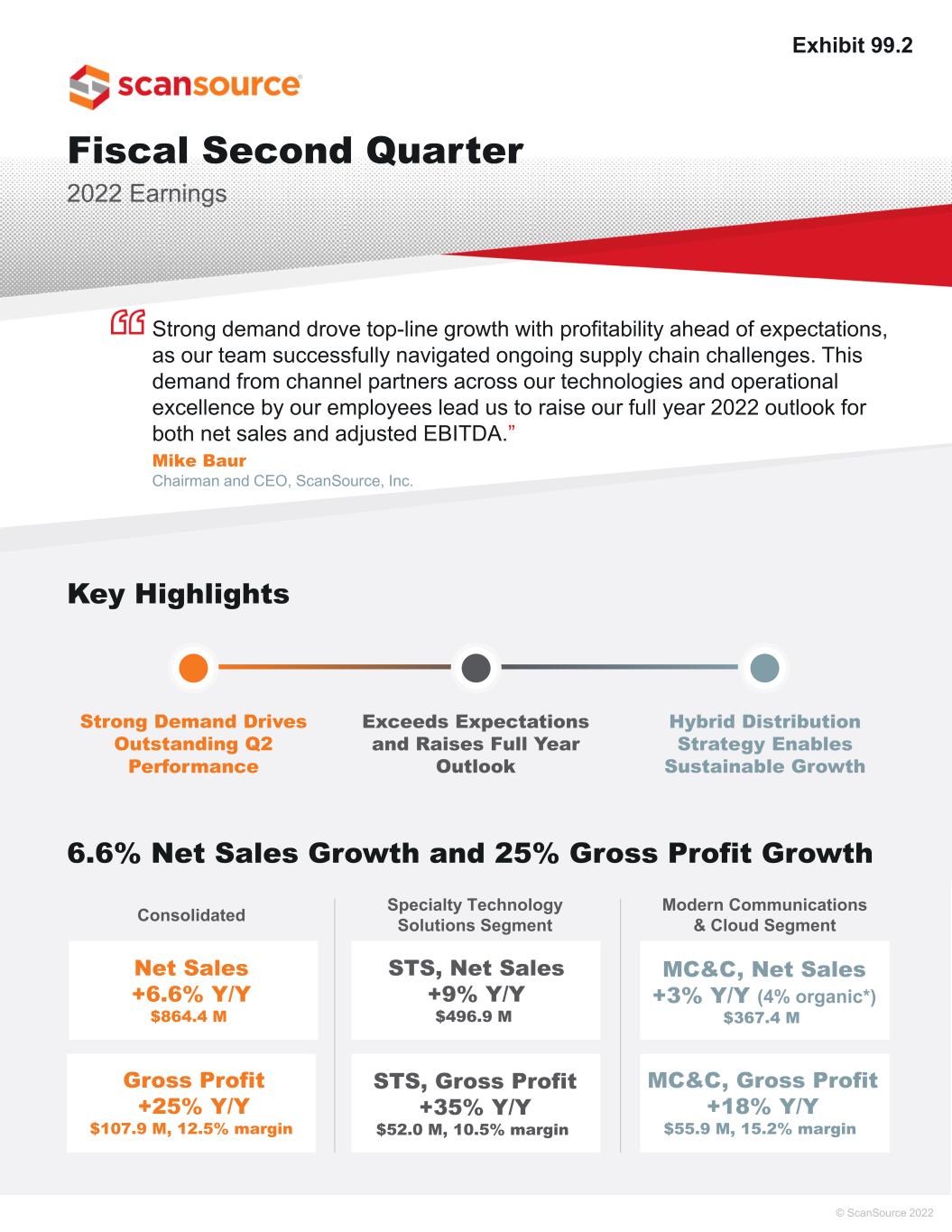

Fiscal Second Quarter 2022 Earnings Strong demand drove top-line growth with profitability ahead of expectations, as our team successfully navigated ongoing supply chain challenges. This demand from channel partners across our technologies and operational excellence by our employees lead us to raise our full year 2022 outlook for both net sales and adjusted EBITDA.” Mike Baur Chairman and CEO, ScanSource, Inc. Key Highlights 6.6% Net Sales Growth and 25% Gross Profit Growth Hybrid Distribution Strategy Enables Sustainable Growth Exceeds Expectations and Raises Full Year Outlook Net Sales +6.6% Y/Y $864.4 M Strong Demand Drives Outstanding Q2 Performance © ScanSource 2022 Consolidated Specialty Technology Solutions Segment Gross Profit +25% Y/Y $107.9 M, 12.5% margin Modern Communications & Cloud Segment STS, Net Sales +9% Y/Y $496.9 M MC&C, Net Sales +3% Y/Y (4% organic*) $367.4 M STS, Gross Profit +35% Y/Y $52.0 M, 10.5% margin MC&C, Gross Profit +18% Y/Y $55.9 M, 15.2% margin Exhibit 99.2

* Non‐GAAP measure TTM represents trailing‐12 months; ROIC represents return on invested capital For further financial data, non‐GAAP financial disclosures and cautionary language regarding forward‐looking statements, please refer to the following pages and ScanSource’s fiscal year 2022 second quarter news release issued on February 8, 2022, which accompanies this presentation and is available at www.scansource.com in the Investor Relations section. Second Quarter Metrics Reflect Operational Excellence Focused Execution of Value Creation Strategy Solid Financial Foundation for Growth Fiscal Year 2022 Outlook updated as of February 8, 2022 (replaces previously provided guidance) $0.89 Per Share GAAP Diluted EPS $1.02 Per Share, +57% Y/Y Non-GAAP Diluted EPS* All-time quarterly record $42.5M Adjusted EBITDA* +43% Y/Y $(74.3)M TTM Operating Cash Flow As expected, working capital for growth 17.6% ROIC* Highest quarter in over 5 years 4.92% Adjusted EBITDA Margin* 1.1x net debt to TTM adjusted EBITDA Target range: 1x to 2x 5.7x inventory turns 5-qtr range: 5.7x to 6.9x Paid for inventory days of (0.5) 5-qtr range: (11.8) to 2.2 64 days sales outstanding 5-qtr range: 60 to 64 Leader in Hybrid Distribution Deep Partnerships Margin Expansion Attractive Return Potential Digital Growth Opportunities © ScanSource 2022 At Least 7% Net Sales Growth At Least $148M +25% Y/Y Adjusted EBITDA* 2

Forward-Looking Statements This Earnings Infographic and supporting materials contain certain comments that are “forward- looking” statements, including statements about our FY22 outlook, growth opportunities and our operating strategies that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future events and other statements that are not descriptions of historical facts. Forward-looking information is inherently subject to risks and uncertainties. Any number of factors could cause actual results to differ materially from anticipated or forecasted results, including but not limited to, the failure to hire and retain quality employees, risk to our business from a cyber-security attack, the failure to manage and implement our organic growth strategy, impact of the COVID-19 pandemic on our operations and financial condition and the potential prolonged economic weakness brought on by COVID-19, a failure of our IT systems, credit risks involving our larger customers and suppliers, changes in interest and exchange rates and regulatory regimes impacting our international operations, loss of our major customers, termination of our relationship with key suppliers or a significant modification of the terms under which we operate with a key supplier, changes in our operating strategy, and other factors set forth in the “Risk Factors” contained in our annual report on Form 10-K for the year ended June 30, 2021, and subsequent reports on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”). Although ScanSource believes the expectations in its forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement. ScanSource disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. Non-GAAP Financial Information In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP operating income, non-GAAP operating income margin, non-GAAP net income, non-GAAP diluted EPS, non-GAAP net sales, non-GAAP gross profit, non-GAAP gross margin, non- GAAP SG&A expenses, adjusted EBITDA, ROIC and net sales less impacts from foreign currency translation and acquisitions (organic growth). A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the following supporting materials and in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. 3

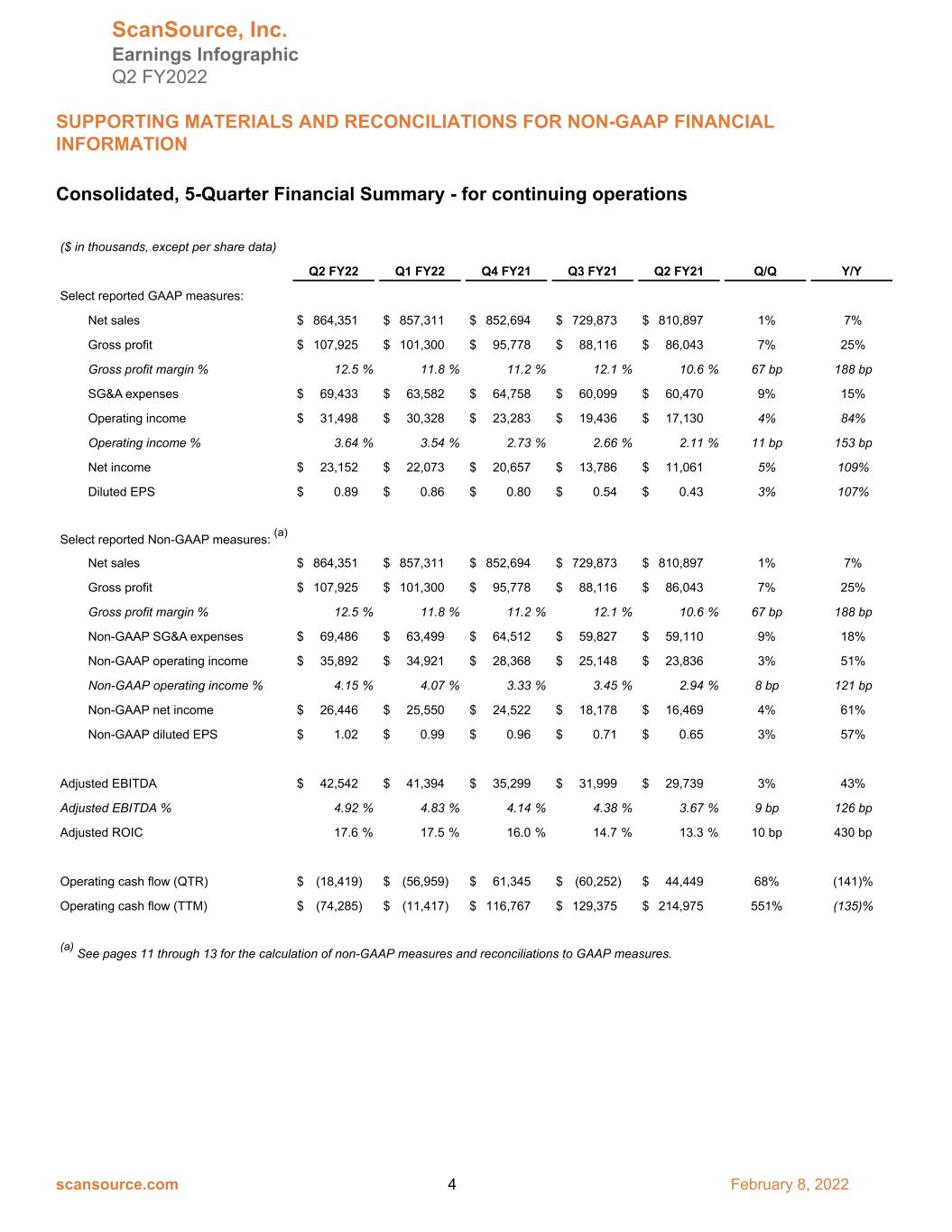

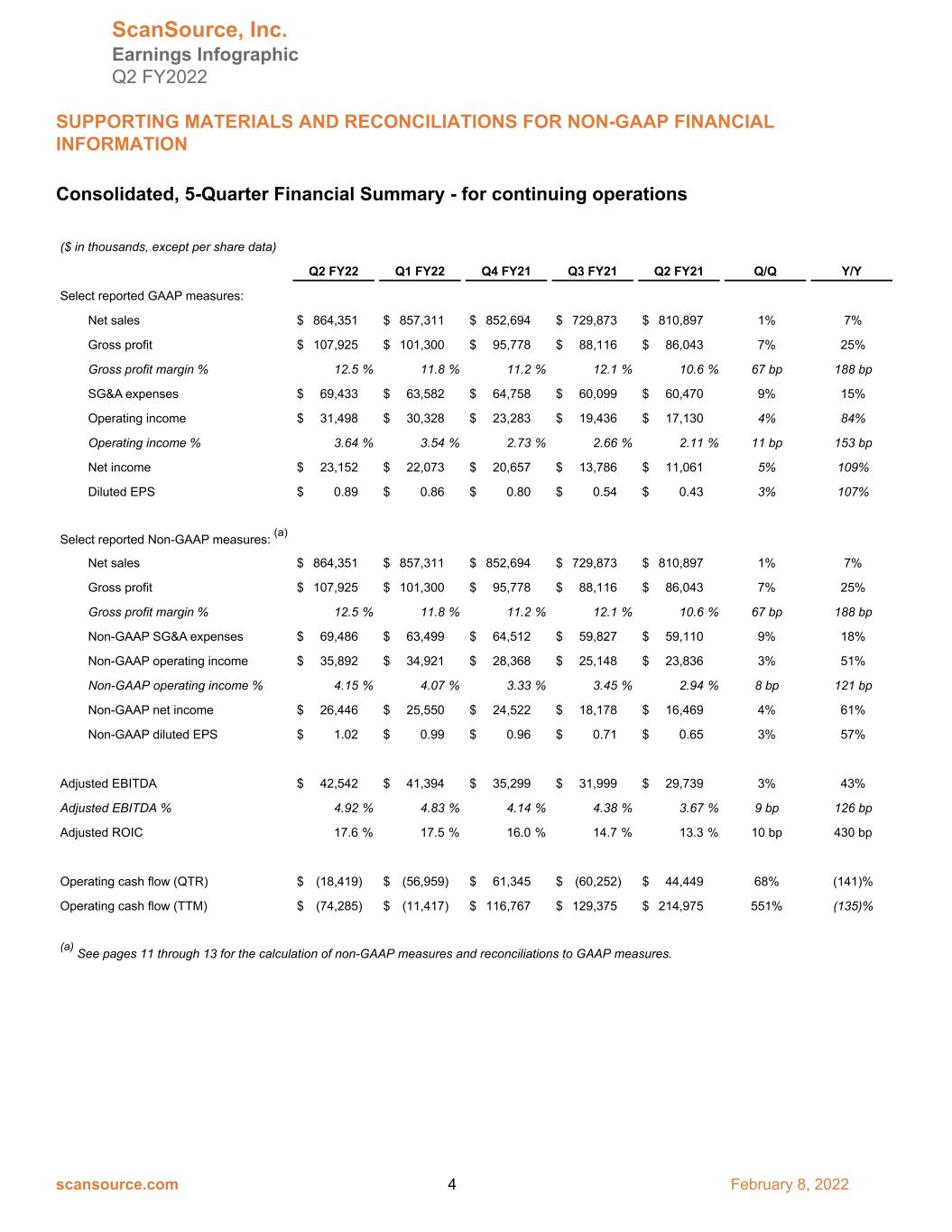

Consolidated, 5-Quarter Financial Summary - for continuing operations ($ in thousands, except per share data) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Q/Q Y/Y Select reported GAAP measures: Net sales $ 864,351 $ 857,311 $ 852,694 $ 729,873 $ 810,897 1% 7% Gross profit $ 107,925 $ 101,300 $ 95,778 $ 88,116 $ 86,043 7% 25% Gross profit margin % 12.5 % 11.8 % 11.2 % 12.1 % 10.6 % 67 bp 188 bp SG&A expenses $ 69,433 $ 63,582 $ 64,758 $ 60,099 $ 60,470 9% 15% Operating income $ 31,498 $ 30,328 $ 23,283 $ 19,436 $ 17,130 4% 84% Operating income % 3.64 % 3.54 % 2.73 % 2.66 % 2.11 % 11 bp 153 bp Net income $ 23,152 $ 22,073 $ 20,657 $ 13,786 $ 11,061 5% 109% Diluted EPS $ 0.89 $ 0.86 $ 0.80 $ 0.54 $ 0.43 3% 107% Select reported Non-GAAP measures: (a) Net sales $ 864,351 $ 857,311 $ 852,694 $ 729,873 $ 810,897 1% 7% Gross profit $ 107,925 $ 101,300 $ 95,778 $ 88,116 $ 86,043 7% 25% Gross profit margin % 12.5 % 11.8 % 11.2 % 12.1 % 10.6 % 67 bp 188 bp Non-GAAP SG&A expenses $ 69,486 $ 63,499 $ 64,512 $ 59,827 $ 59,110 9% 18% Non-GAAP operating income $ 35,892 $ 34,921 $ 28,368 $ 25,148 $ 23,836 3% 51% Non-GAAP operating income % 4.15 % 4.07 % 3.33 % 3.45 % 2.94 % 8 bp 121 bp Non-GAAP net income $ 26,446 $ 25,550 $ 24,522 $ 18,178 $ 16,469 4% 61% Non-GAAP diluted EPS $ 1.02 $ 0.99 $ 0.96 $ 0.71 $ 0.65 3% 57% Adjusted EBITDA $ 42,542 $ 41,394 $ 35,299 $ 31,999 $ 29,739 3% 43% Adjusted EBITDA % 4.92 % 4.83 % 4.14 % 4.38 % 3.67 % 9 bp 126 bp Adjusted ROIC 17.6 % 17.5 % 16.0 % 14.7 % 13.3 % 10 bp 430 bp Operating cash flow (QTR) $ (18,419) $ (56,959) $ 61,345 $ (60,252) $ 44,449 68% (141)% Operating cash flow (TTM) $ (74,285) $ (11,417) $ 116,767 $ 129,375 $ 214,975 551% (135)% (a) See pages 11 through 13 for the calculation of non-GAAP measures and reconciliations to GAAP measures. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 4 February 8, 2022

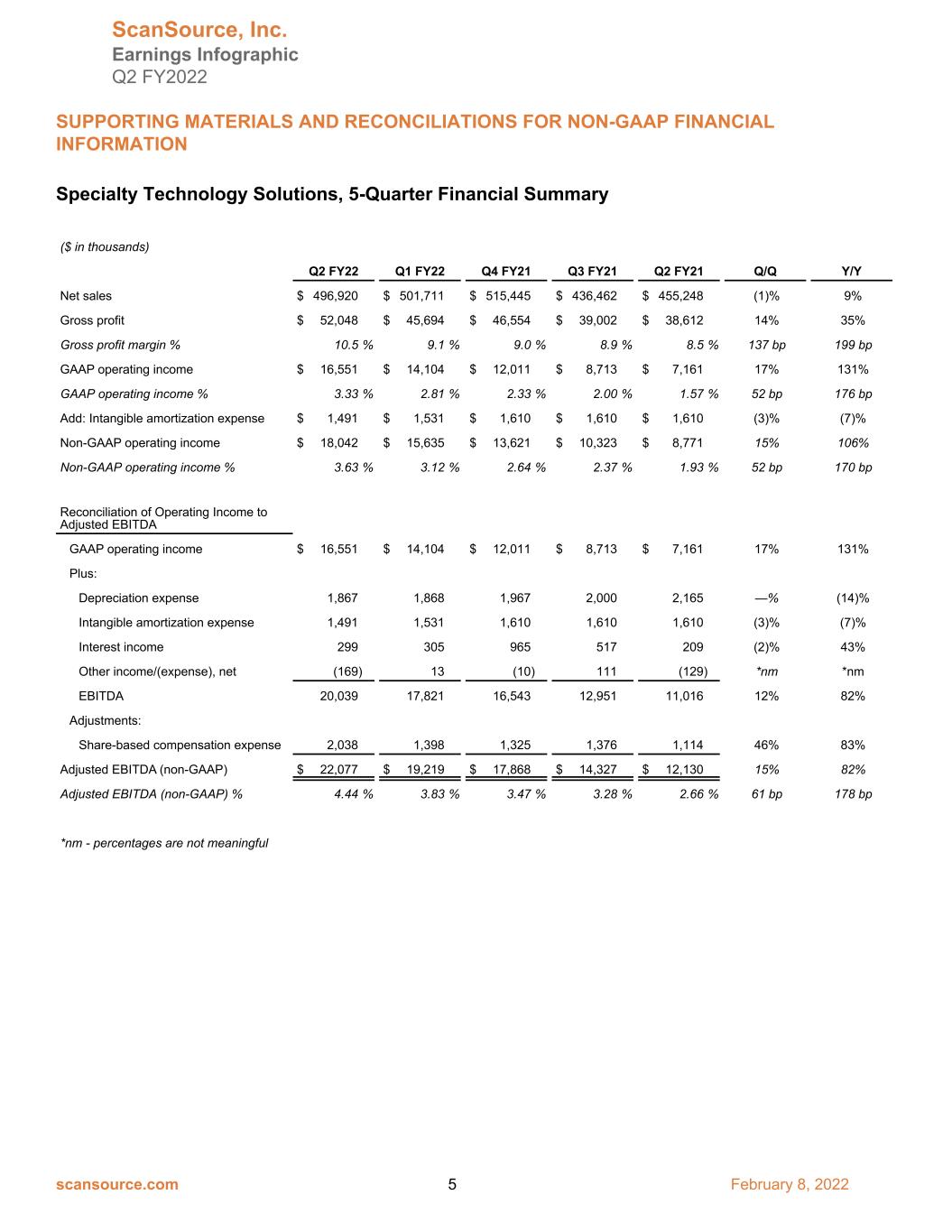

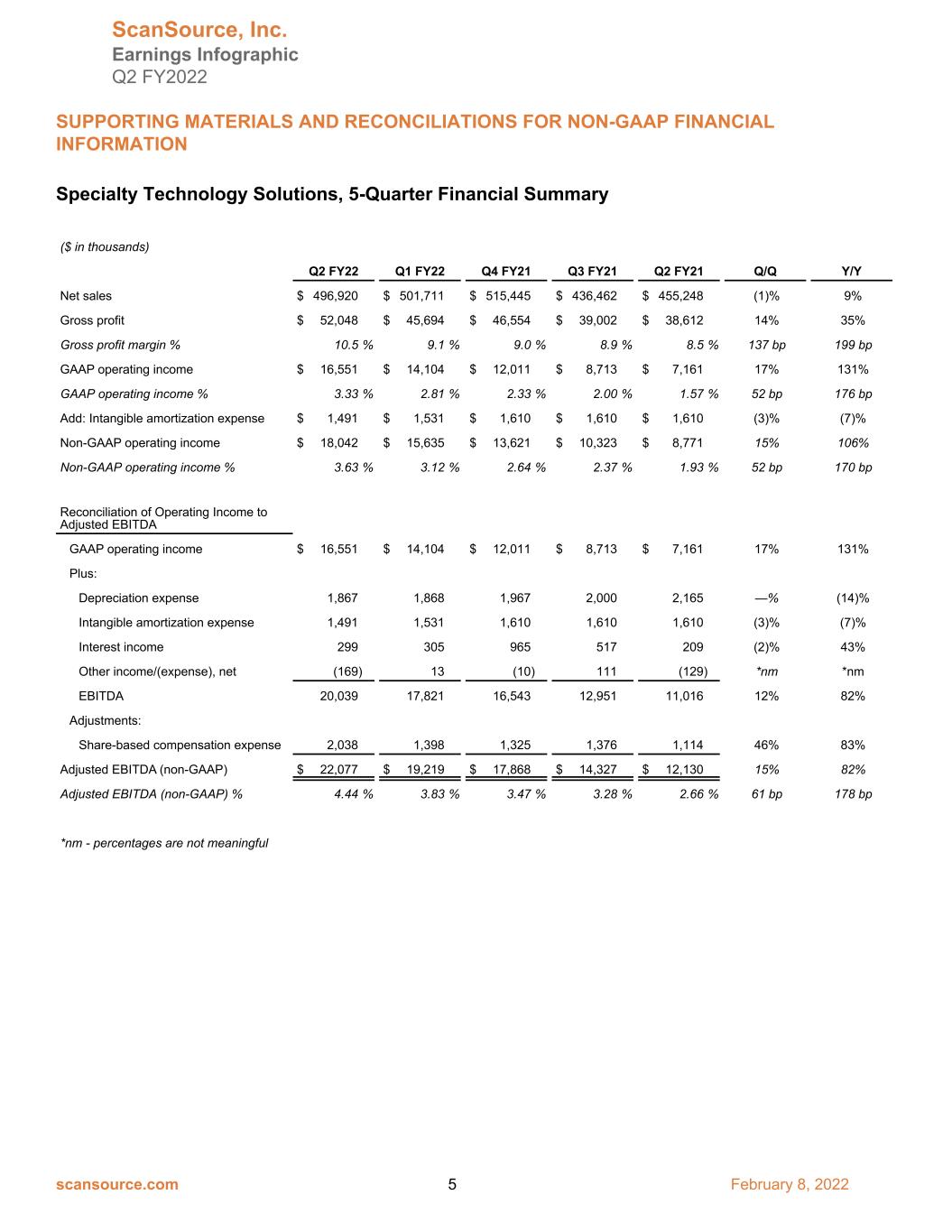

Specialty Technology Solutions, 5-Quarter Financial Summary ($ in thousands) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Q/Q Y/Y Net sales $ 496,920 $ 501,711 $ 515,445 $ 436,462 $ 455,248 (1)% 9% Gross profit $ 52,048 $ 45,694 $ 46,554 $ 39,002 $ 38,612 14% 35% Gross profit margin % 10.5 % 9.1 % 9.0 % 8.9 % 8.5 % 137 bp 199 bp GAAP operating income $ 16,551 $ 14,104 $ 12,011 $ 8,713 $ 7,161 17% 131% GAAP operating income % 3.33 % 2.81 % 2.33 % 2.00 % 1.57 % 52 bp 176 bp Add: Intangible amortization expense $ 1,491 $ 1,531 $ 1,610 $ 1,610 $ 1,610 (3)% (7)% Non-GAAP operating income $ 18,042 $ 15,635 $ 13,621 $ 10,323 $ 8,771 15% 106% Non-GAAP operating income % 3.63 % 3.12 % 2.64 % 2.37 % 1.93 % 52 bp 170 bp Reconciliation of Operating Income to Adjusted EBITDA GAAP operating income $ 16,551 $ 14,104 $ 12,011 $ 8,713 $ 7,161 17% 131% Plus: Depreciation expense 1,867 1,868 1,967 2,000 2,165 —% (14)% Intangible amortization expense 1,491 1,531 1,610 1,610 1,610 (3)% (7)% Interest income 299 305 965 517 209 (2)% 43% Other income/(expense), net (169) 13 (10) 111 (129) *nm *nm EBITDA 20,039 17,821 16,543 12,951 11,016 12% 82% Adjustments: Share-based compensation expense 2,038 1,398 1,325 1,376 1,114 46% 83% Adjusted EBITDA (non-GAAP) $ 22,077 $ 19,219 $ 17,868 $ 14,327 $ 12,130 15% 82% Adjusted EBITDA (non-GAAP) % 4.44 % 3.83 % 3.47 % 3.28 % 2.66 % 61 bp 178 bp *nm - percentages are not meaningful ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 5 February 8, 2022

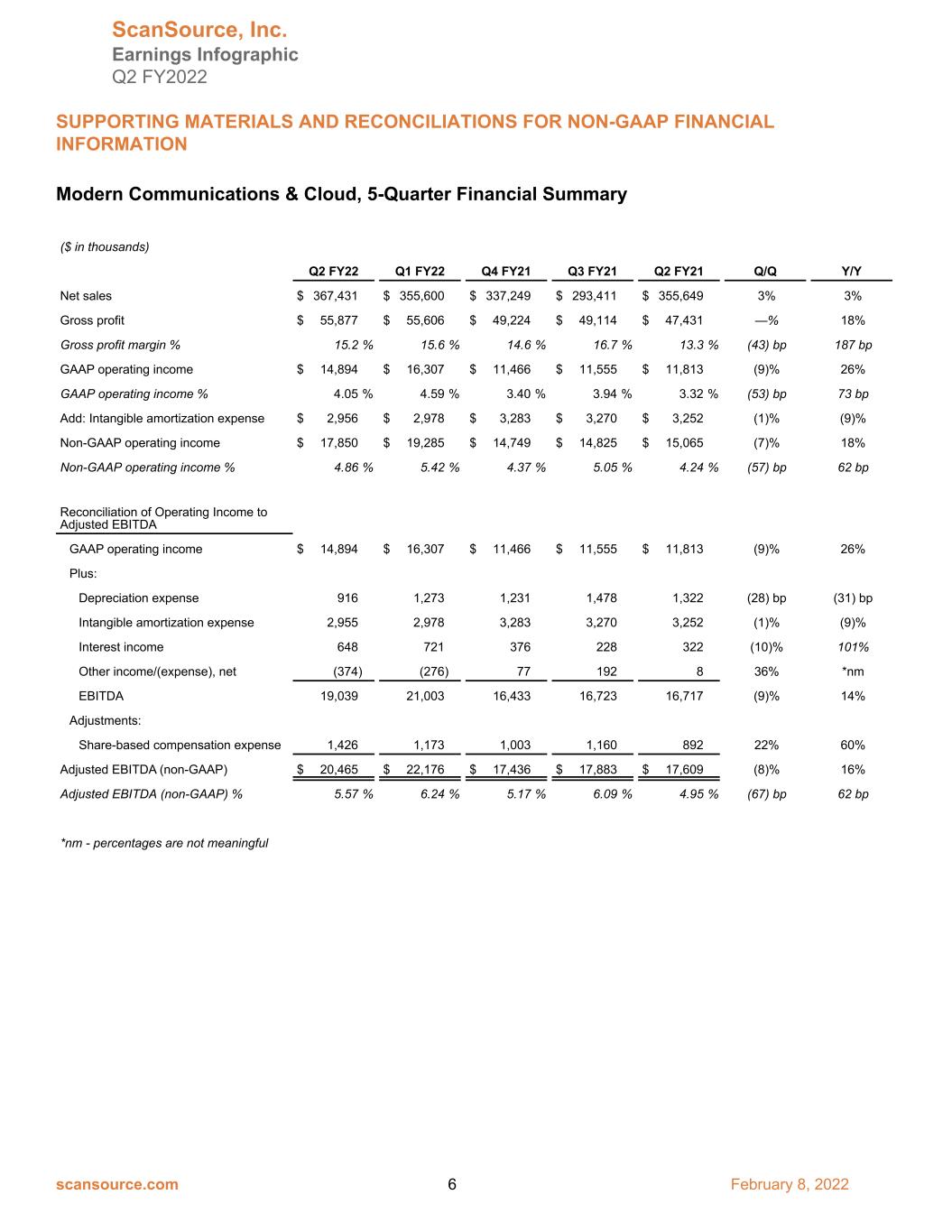

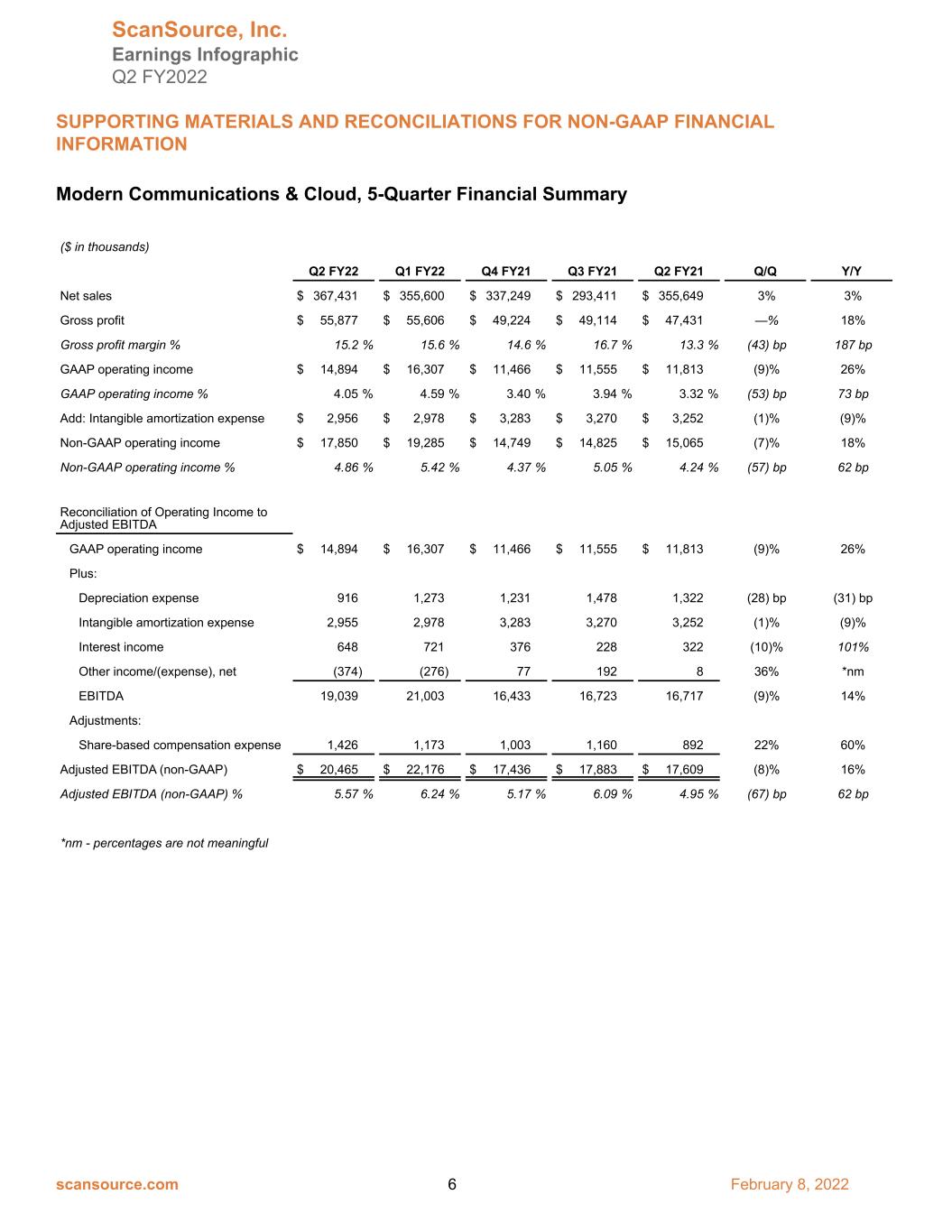

Modern Communications & Cloud, 5-Quarter Financial Summary ($ in thousands) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Q/Q Y/Y Net sales $ 367,431 $ 355,600 $ 337,249 $ 293,411 $ 355,649 3% 3% Gross profit $ 55,877 $ 55,606 $ 49,224 $ 49,114 $ 47,431 —% 18% Gross profit margin % 15.2 % 15.6 % 14.6 % 16.7 % 13.3 % (43) bp 187 bp GAAP operating income $ 14,894 $ 16,307 $ 11,466 $ 11,555 $ 11,813 (9)% 26% GAAP operating income % 4.05 % 4.59 % 3.40 % 3.94 % 3.32 % (53) bp 73 bp Add: Intangible amortization expense $ 2,956 $ 2,978 $ 3,283 $ 3,270 $ 3,252 (1)% (9)% Non-GAAP operating income $ 17,850 $ 19,285 $ 14,749 $ 14,825 $ 15,065 (7)% 18% Non-GAAP operating income % 4.86 % 5.42 % 4.37 % 5.05 % 4.24 % (57) bp 62 bp Reconciliation of Operating Income to Adjusted EBITDA GAAP operating income $ 14,894 $ 16,307 $ 11,466 $ 11,555 $ 11,813 (9)% 26% Plus: Depreciation expense 916 1,273 1,231 1,478 1,322 (28) bp (31) bp Intangible amortization expense 2,955 2,978 3,283 3,270 3,252 (1)% (9)% Interest income 648 721 376 228 322 (10)% 101% Other income/(expense), net (374) (276) 77 192 8 36% *nm EBITDA 19,039 21,003 16,433 16,723 16,717 (9)% 14% Adjustments: Share-based compensation expense 1,426 1,173 1,003 1,160 892 22% 60% Adjusted EBITDA (non-GAAP) $ 20,465 $ 22,176 $ 17,436 $ 17,883 $ 17,609 (8)% 16% Adjusted EBITDA (non-GAAP) % 5.57 % 6.24 % 5.17 % 6.09 % 4.95 % (67) bp 62 bp *nm - percentages are not meaningful ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 6 February 8, 2022

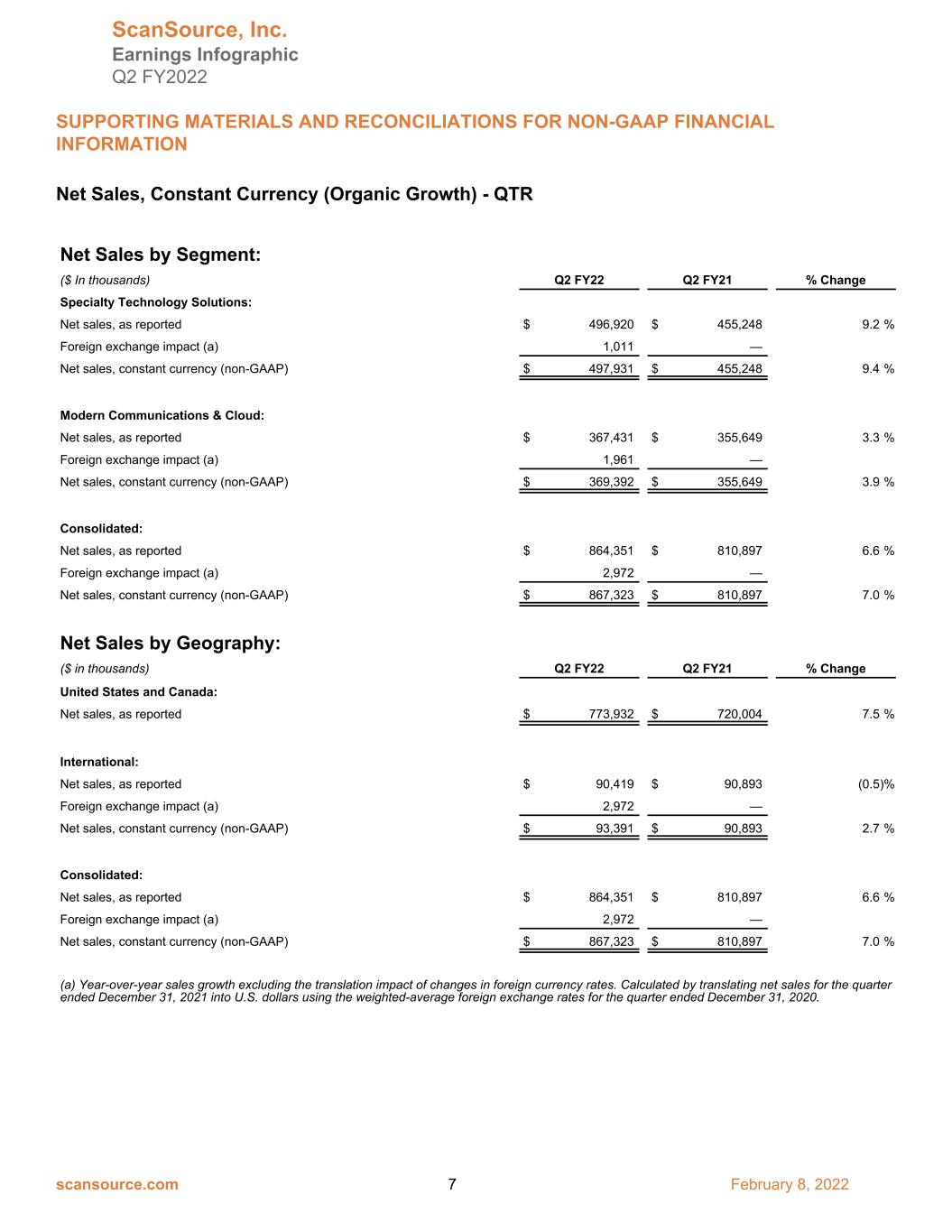

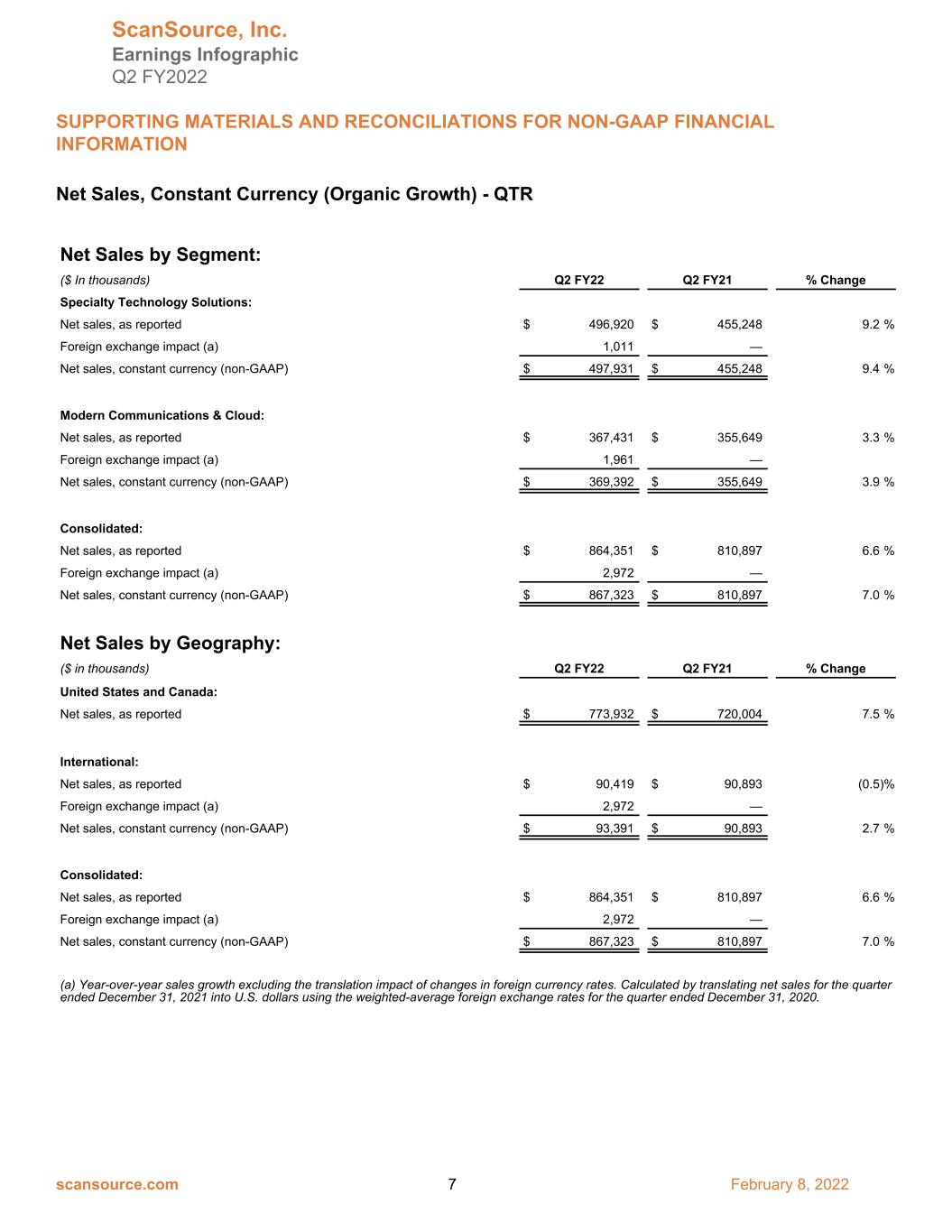

Net Sales, Constant Currency (Organic Growth) - QTR Net Sales by Segment: ($ In thousands) Q2 FY22 Q2 FY21 % Change Specialty Technology Solutions: Net sales, as reported $ 496,920 $ 455,248 9.2 % Foreign exchange impact (a) 1,011 — Net sales, constant currency (non-GAAP) $ 497,931 $ 455,248 9.4 % Modern Communications & Cloud: Net sales, as reported $ 367,431 $ 355,649 3.3 % Foreign exchange impact (a) 1,961 — Net sales, constant currency (non-GAAP) $ 369,392 $ 355,649 3.9 % Consolidated: Net sales, as reported $ 864,351 $ 810,897 6.6 % Foreign exchange impact (a) 2,972 — Net sales, constant currency (non-GAAP) $ 867,323 $ 810,897 7.0 % Net Sales by Geography: ($ in thousands) Q2 FY22 Q2 FY21 % Change United States and Canada: Net sales, as reported $ 773,932 $ 720,004 7.5 % International: Net sales, as reported $ 90,419 $ 90,893 (0.5) % Foreign exchange impact (a) 2,972 — Net sales, constant currency (non-GAAP) $ 93,391 $ 90,893 2.7 % Consolidated: Net sales, as reported $ 864,351 $ 810,897 6.6 % Foreign exchange impact (a) 2,972 — Net sales, constant currency (non-GAAP) $ 867,323 $ 810,897 7.0 % (a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for the quarter ended December 31, 2021 into U.S. dollars using the weighted-average foreign exchange rates for the quarter ended December 31, 2020. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 7 February 8, 2022

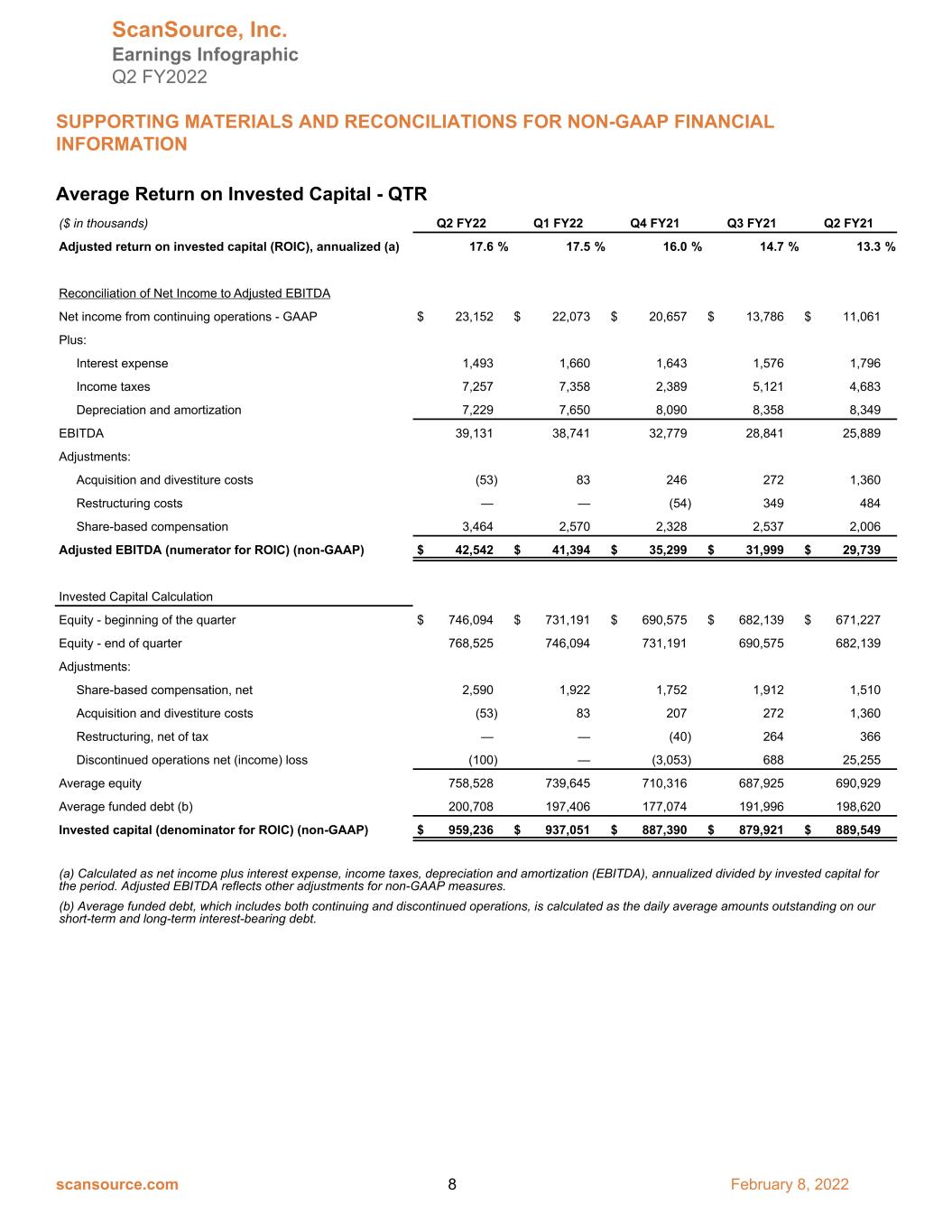

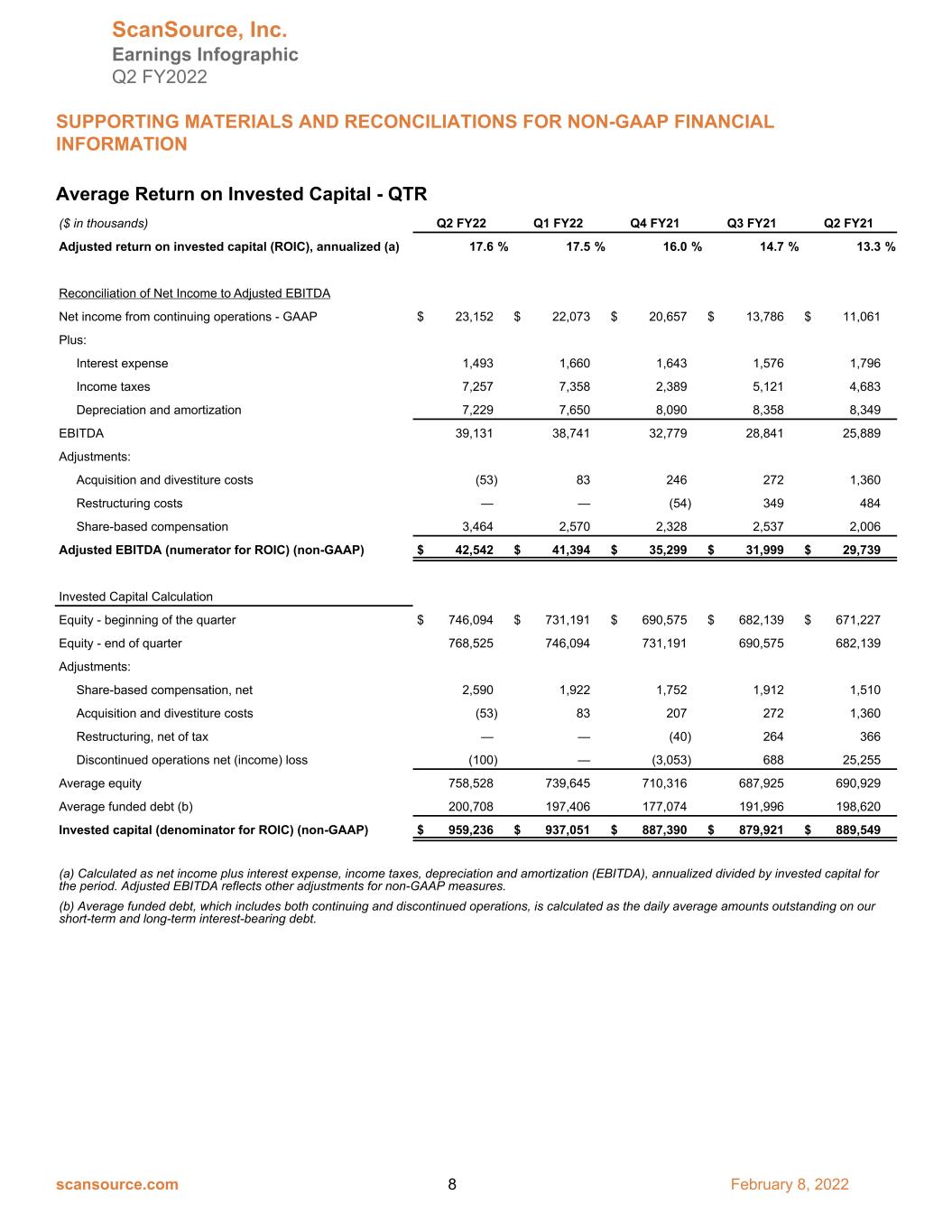

Average Return on Invested Capital - QTR ($ in thousands) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Adjusted return on invested capital (ROIC), annualized (a) 17.6 % 17.5 % 16.0 % 14.7 % 13.3 % Reconciliation of Net Income to Adjusted EBITDA Net income from continuing operations - GAAP $ 23,152 $ 22,073 $ 20,657 $ 13,786 $ 11,061 Plus: Interest expense 1,493 1,660 1,643 1,576 1,796 Income taxes 7,257 7,358 2,389 5,121 4,683 Depreciation and amortization 7,229 7,650 8,090 8,358 8,349 EBITDA 39,131 38,741 32,779 28,841 25,889 Adjustments: Acquisition and divestiture costs (53) 83 246 272 1,360 Restructuring costs — — (54) 349 484 Share-based compensation 3,464 2,570 2,328 2,537 2,006 Adjusted EBITDA (numerator for ROIC) (non-GAAP) $ 42,542 $ 41,394 $ 35,299 $ 31,999 $ 29,739 Invested Capital Calculation Equity - beginning of the quarter $ 746,094 $ 731,191 $ 690,575 $ 682,139 $ 671,227 Equity - end of quarter 768,525 746,094 731,191 690,575 682,139 Adjustments: Share-based compensation, net 2,590 1,922 1,752 1,912 1,510 Acquisition and divestiture costs (53) 83 207 272 1,360 Restructuring, net of tax — — (40) 264 366 Discontinued operations net (income) loss (100) — (3,053) 688 25,255 Average equity 758,528 739,645 710,316 687,925 690,929 Average funded debt (b) 200,708 197,406 177,074 191,996 198,620 Invested capital (denominator for ROIC) (non-GAAP) $ 959,236 $ 937,051 $ 887,390 $ 879,921 $ 889,549 (a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average funded debt, which includes both continuing and discontinued operations, is calculated as the daily average amounts outstanding on our short-term and long-term interest-bearing debt. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 8 February 8, 2022

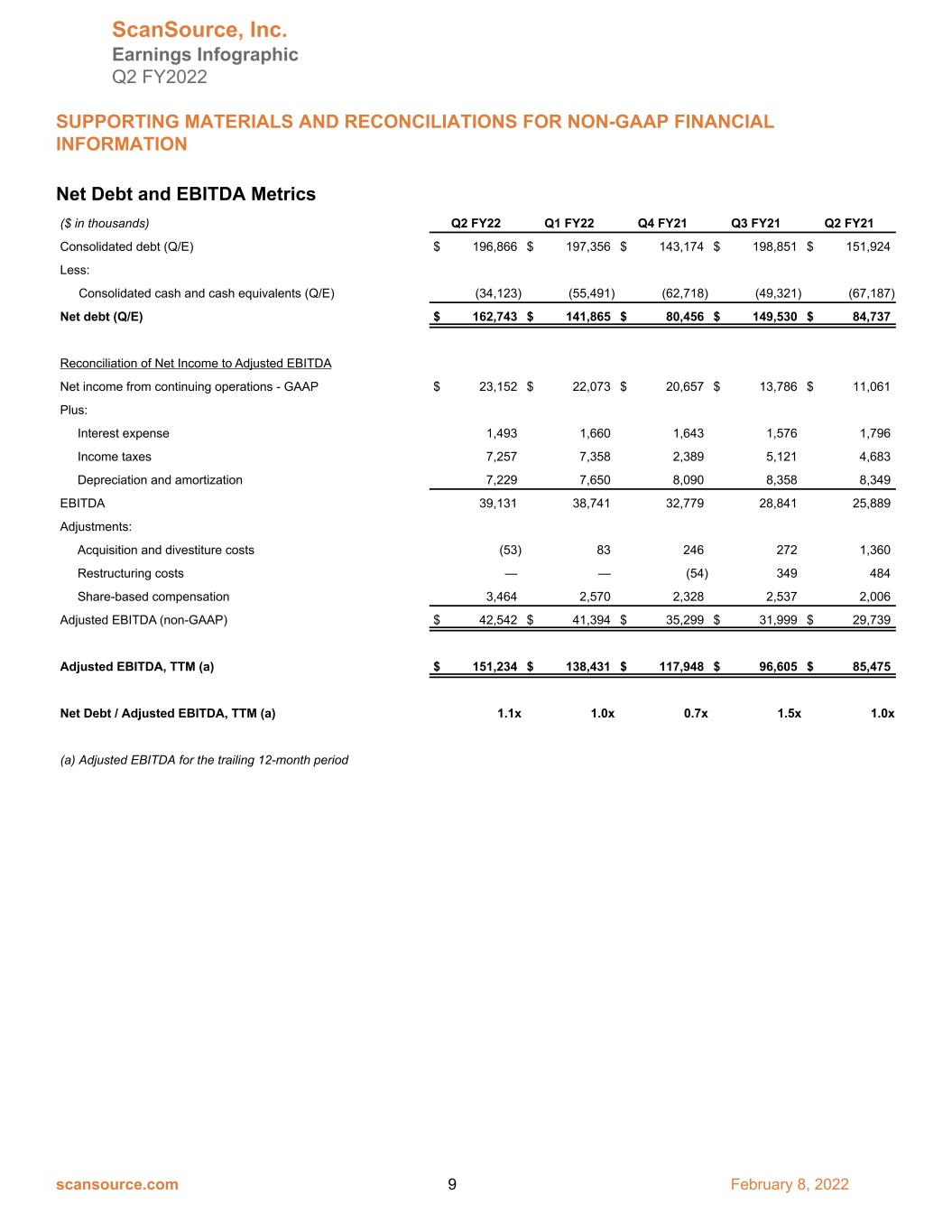

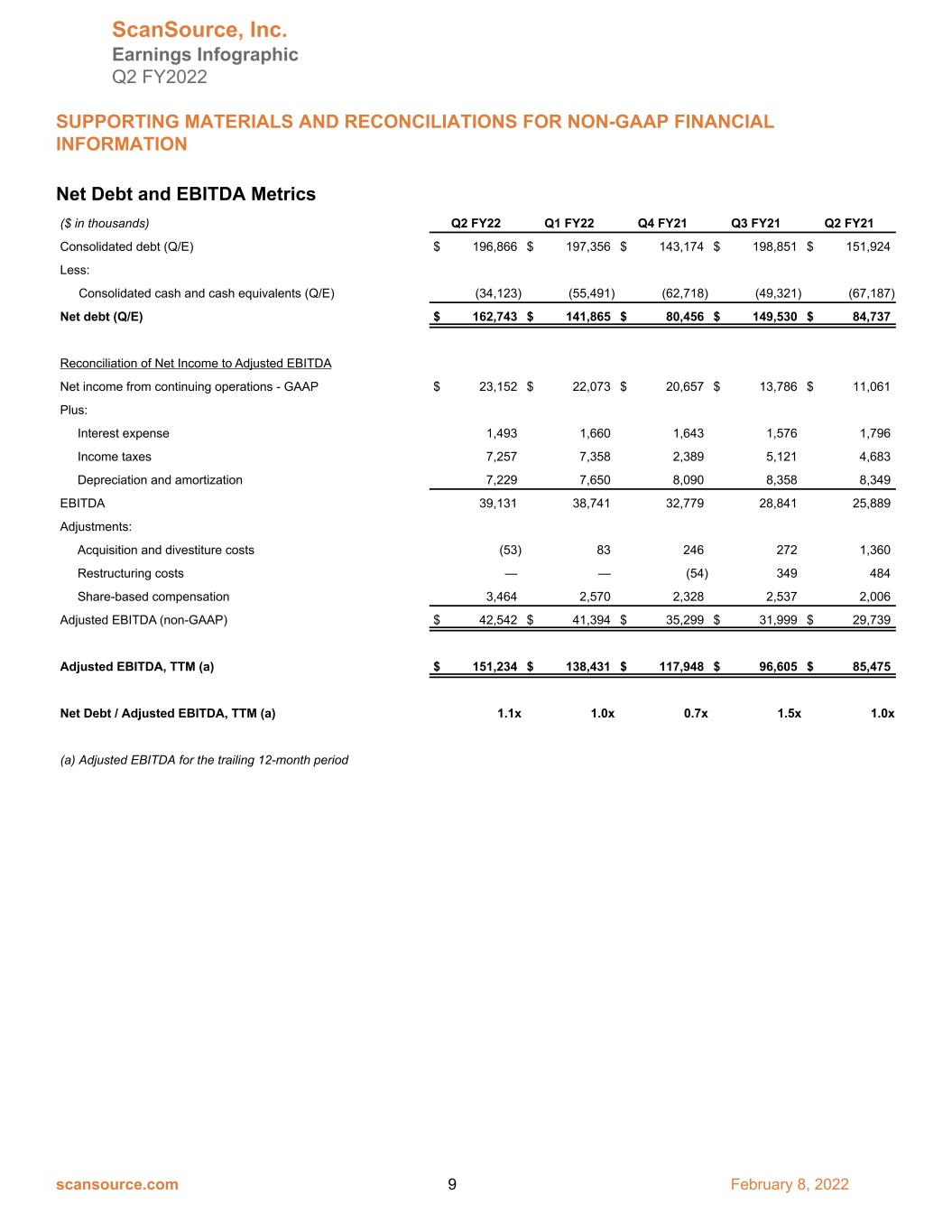

Net Debt and EBITDA Metrics ($ in thousands) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Consolidated debt (Q/E) $ 196,866 $ 197,356 $ 143,174 $ 198,851 $ 151,924 Less: Consolidated cash and cash equivalents (Q/E) (34,123) (55,491) (62,718) (49,321) (67,187) Net debt (Q/E) $ 162,743 $ 141,865 $ 80,456 $ 149,530 $ 84,737 Reconciliation of Net Income to Adjusted EBITDA Net income from continuing operations - GAAP $ 23,152 $ 22,073 $ 20,657 $ 13,786 $ 11,061 Plus: Interest expense 1,493 1,660 1,643 1,576 1,796 Income taxes 7,257 7,358 2,389 5,121 4,683 Depreciation and amortization 7,229 7,650 8,090 8,358 8,349 EBITDA 39,131 38,741 32,779 28,841 25,889 Adjustments: Acquisition and divestiture costs (53) 83 246 272 1,360 Restructuring costs — — (54) 349 484 Share-based compensation 3,464 2,570 2,328 2,537 2,006 Adjusted EBITDA (non-GAAP) $ 42,542 $ 41,394 $ 35,299 $ 31,999 $ 29,739 Adjusted EBITDA, TTM (a) $ 151,234 $ 138,431 $ 117,948 $ 96,605 $ 85,475 Net Debt / Adjusted EBITDA, TTM (a) 1.1x 1.0x 0.7x 1.5x 1.0x (a) Adjusted EBITDA for the trailing 12-month period ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 9 February 8, 2022

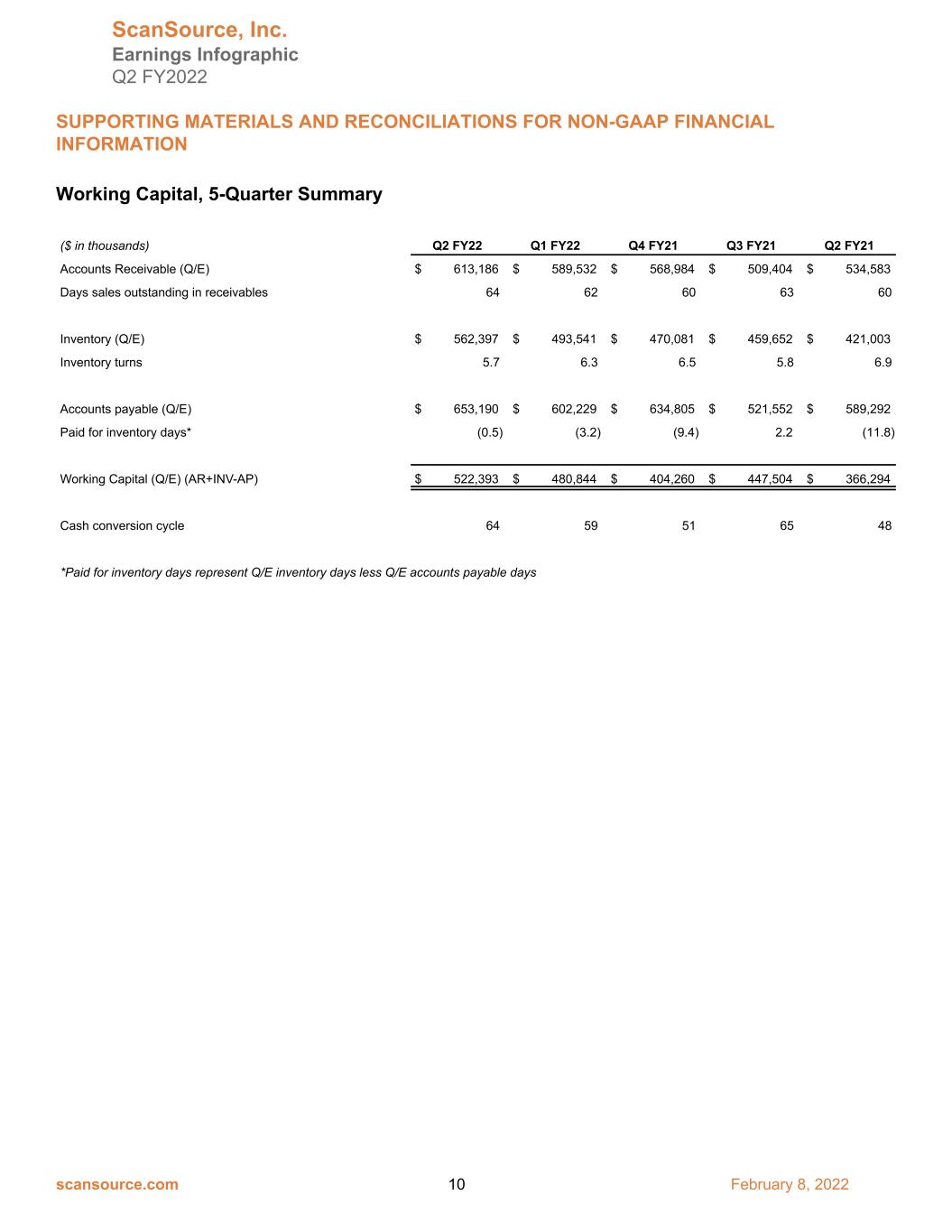

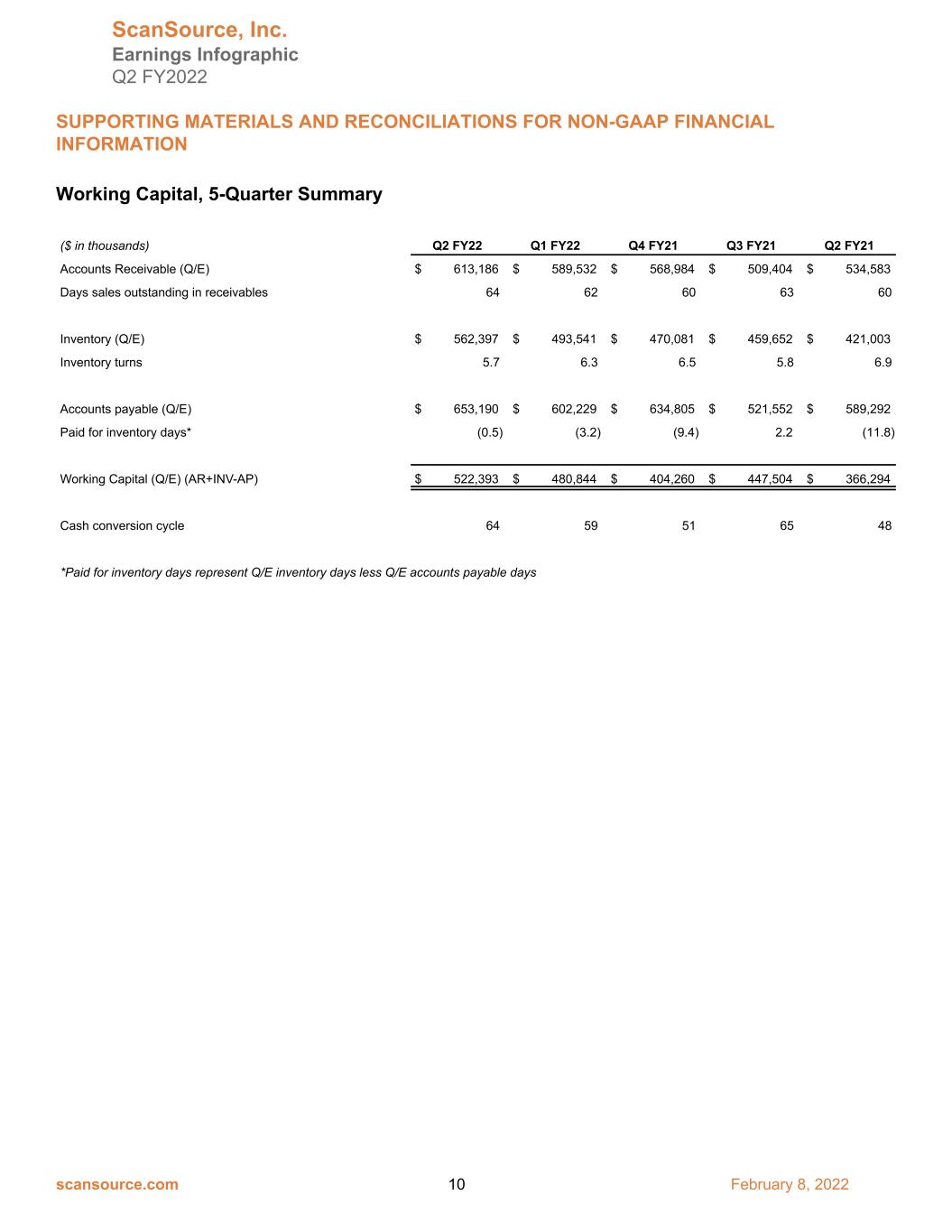

Working Capital, 5-Quarter Summary ($ in thousands) Q2 FY22 Q1 FY22 Q4 FY21 Q3 FY21 Q2 FY21 Accounts Receivable (Q/E) $ 613,186 $ 589,532 $ 568,984 $ 509,404 $ 534,583 Days sales outstanding in receivables 64 62 60 63 60 Inventory (Q/E) $ 562,397 $ 493,541 $ 470,081 $ 459,652 $ 421,003 Inventory turns 5.7 6.3 6.5 5.8 6.9 Accounts payable (Q/E) $ 653,190 $ 602,229 $ 634,805 $ 521,552 $ 589,292 Paid for inventory days* (0.5) (3.2) (9.4) 2.2 (11.8) Working Capital (Q/E) (AR+INV-AP) $ 522,393 $ 480,844 $ 404,260 $ 447,504 $ 366,294 Cash conversion cycle 64 59 51 65 48 *Paid for inventory days represent Q/E inventory days less Q/E accounts payable days ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 10 February 8, 2022

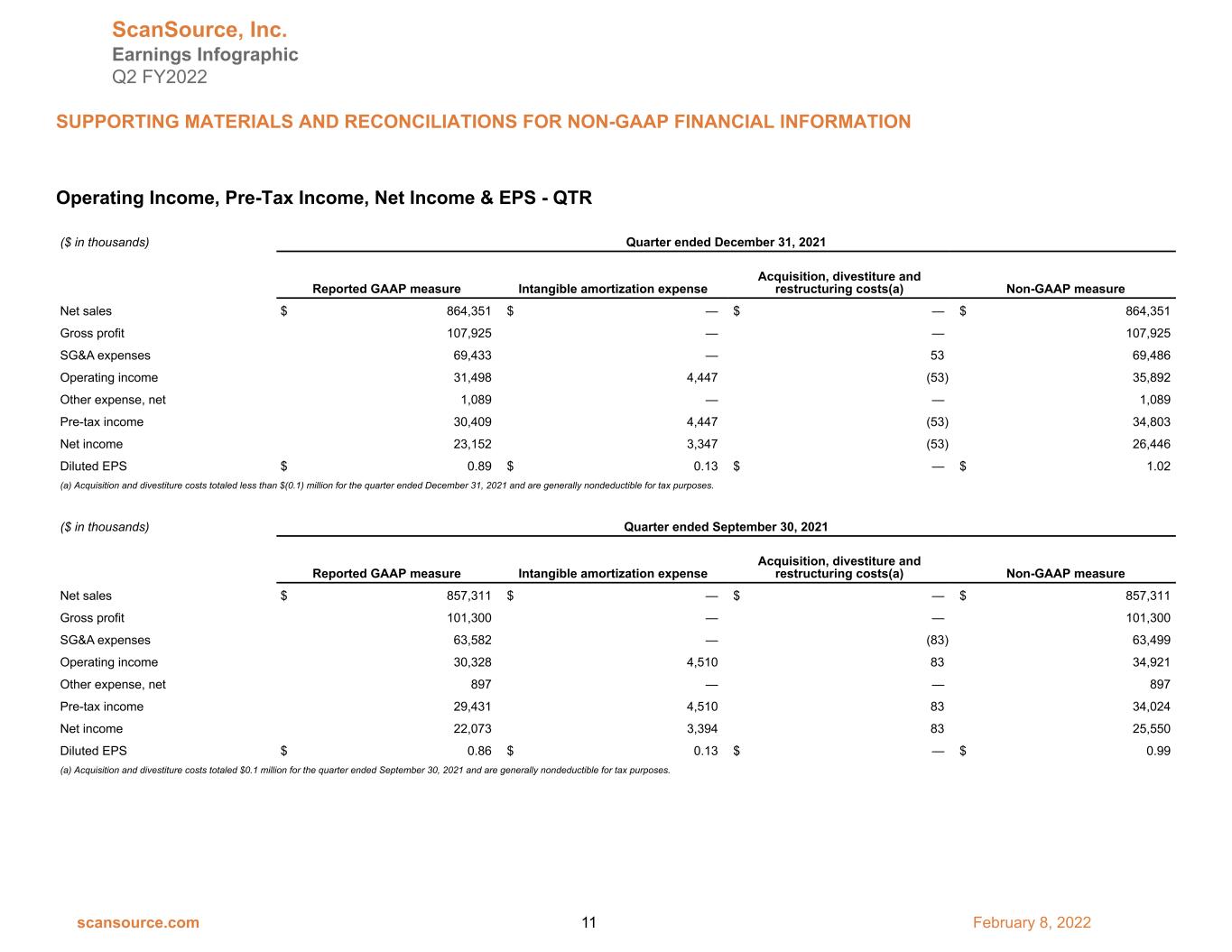

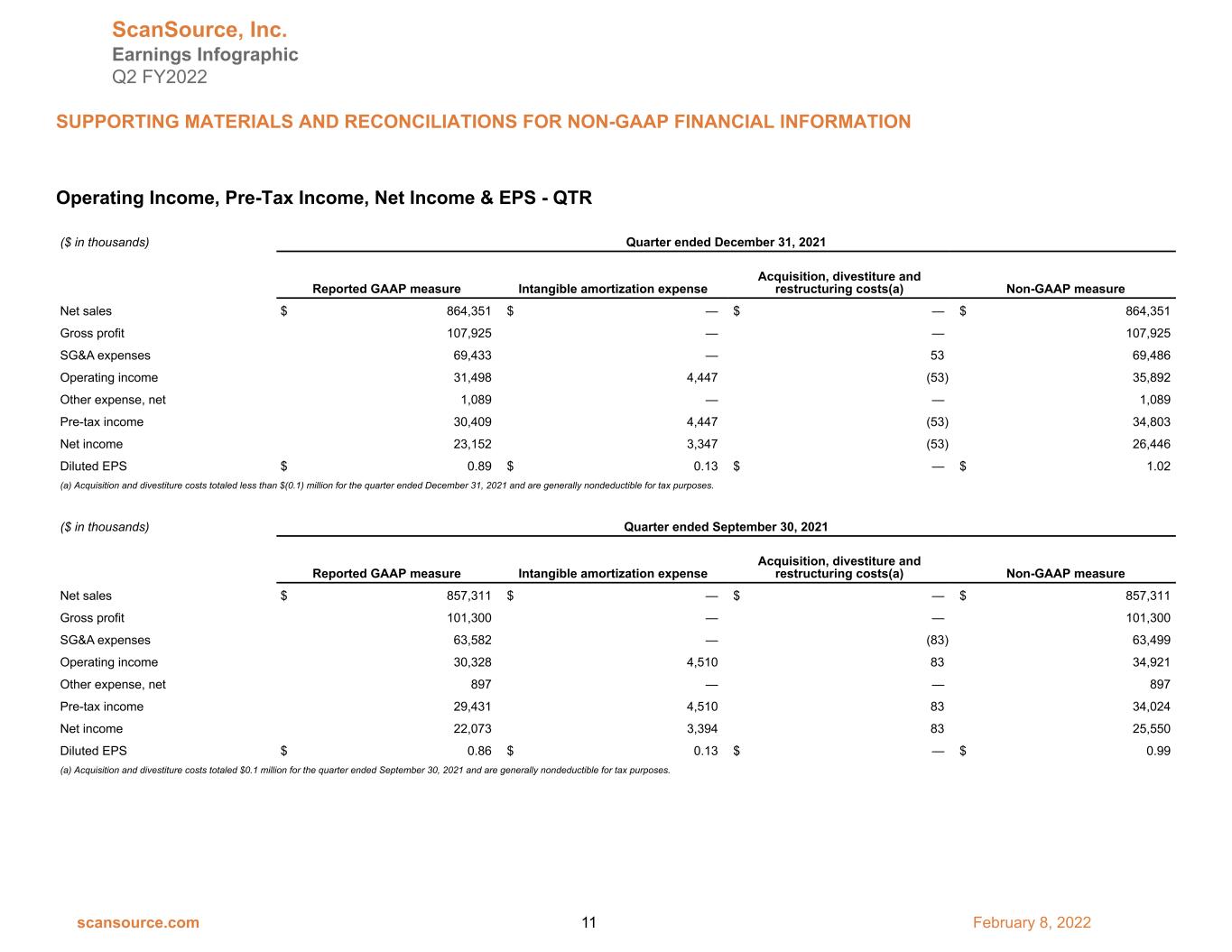

Operating Income, Pre-Tax Income, Net Income & EPS - QTR ($ in thousands) Quarter ended December 31, 2021 Reported GAAP measure Intangible amortization expense Acquisition, divestiture and restructuring costs(a) Non-GAAP measure Net sales $ 864,351 $ — $ — $ 864,351 Gross profit 107,925 — — 107,925 SG&A expenses 69,433 — 53 69,486 Operating income 31,498 4,447 (53) 35,892 Other expense, net 1,089 — — 1,089 Pre-tax income 30,409 4,447 (53) 34,803 Net income 23,152 3,347 (53) 26,446 Diluted EPS $ 0.89 $ 0.13 $ — $ 1.02 (a) Acquisition and divestiture costs totaled less than $(0.1) million for the quarter ended December 31, 2021 and are generally nondeductible for tax purposes. ($ in thousands) Quarter ended September 30, 2021 Reported GAAP measure Intangible amortization expense Acquisition, divestiture and restructuring costs(a) Non-GAAP measure Net sales $ 857,311 $ — $ — $ 857,311 Gross profit 101,300 — — 101,300 SG&A expenses 63,582 — (83) 63,499 Operating income 30,328 4,510 83 34,921 Other expense, net 897 — — 897 Pre-tax income 29,431 4,510 83 34,024 Net income 22,073 3,394 83 25,550 Diluted EPS $ 0.86 $ 0.13 $ — $ 0.99 (a) Acquisition and divestiture costs totaled $0.1 million for the quarter ended September 30, 2021 and are generally nondeductible for tax purposes. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 11 February 8, 2022

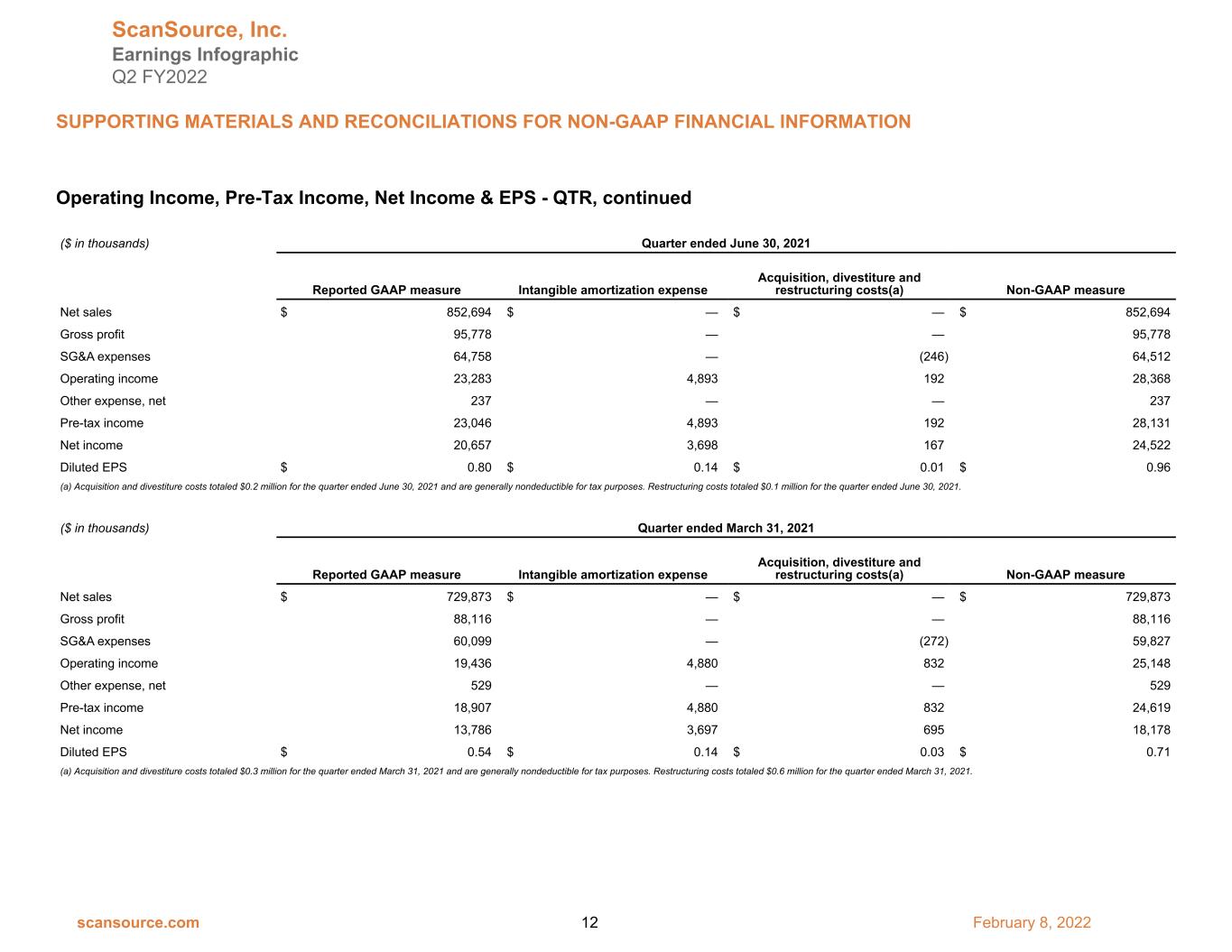

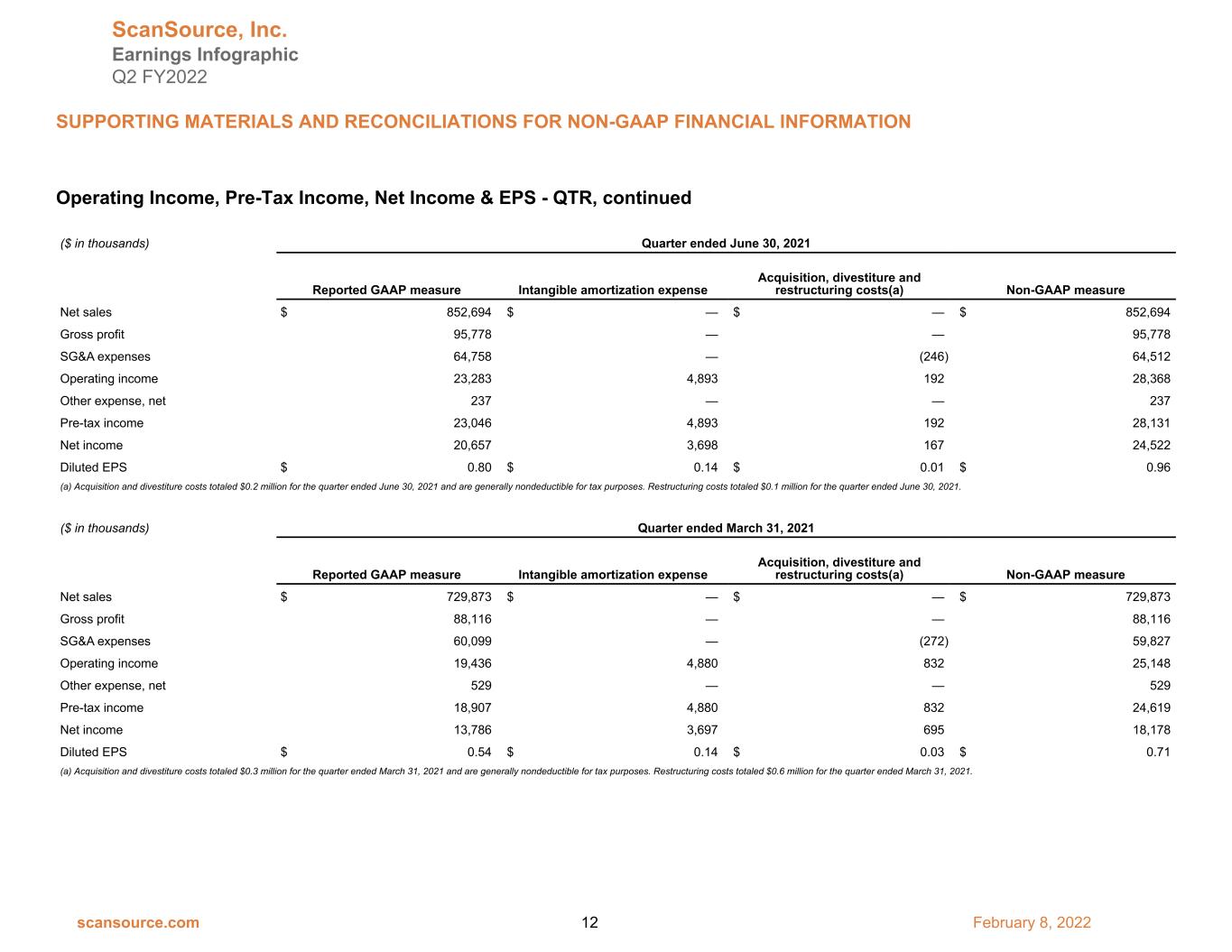

Operating Income, Pre-Tax Income, Net Income & EPS - QTR, continued ($ in thousands) Quarter ended June 30, 2021 Reported GAAP measure Intangible amortization expense Acquisition, divestiture and restructuring costs(a) Non-GAAP measure Net sales $ 852,694 $ — $ — $ 852,694 Gross profit 95,778 — — 95,778 SG&A expenses 64,758 — (246) 64,512 Operating income 23,283 4,893 192 28,368 Other expense, net 237 — — 237 Pre-tax income 23,046 4,893 192 28,131 Net income 20,657 3,698 167 24,522 Diluted EPS $ 0.80 $ 0.14 $ 0.01 $ 0.96 (a) Acquisition and divestiture costs totaled $0.2 million for the quarter ended June 30, 2021 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.1 million for the quarter ended June 30, 2021. ($ in thousands) Quarter ended March 31, 2021 Reported GAAP measure Intangible amortization expense Acquisition, divestiture and restructuring costs(a) Non-GAAP measure Net sales $ 729,873 $ — $ — $ 729,873 Gross profit 88,116 — — 88,116 SG&A expenses 60,099 — (272) 59,827 Operating income 19,436 4,880 832 25,148 Other expense, net 529 — — 529 Pre-tax income 18,907 4,880 832 24,619 Net income 13,786 3,697 695 18,178 Diluted EPS $ 0.54 $ 0.14 $ 0.03 $ 0.71 (a) Acquisition and divestiture costs totaled $0.3 million for the quarter ended March 31, 2021 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.6 million for the quarter ended March 31, 2021. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 12 February 8, 2022

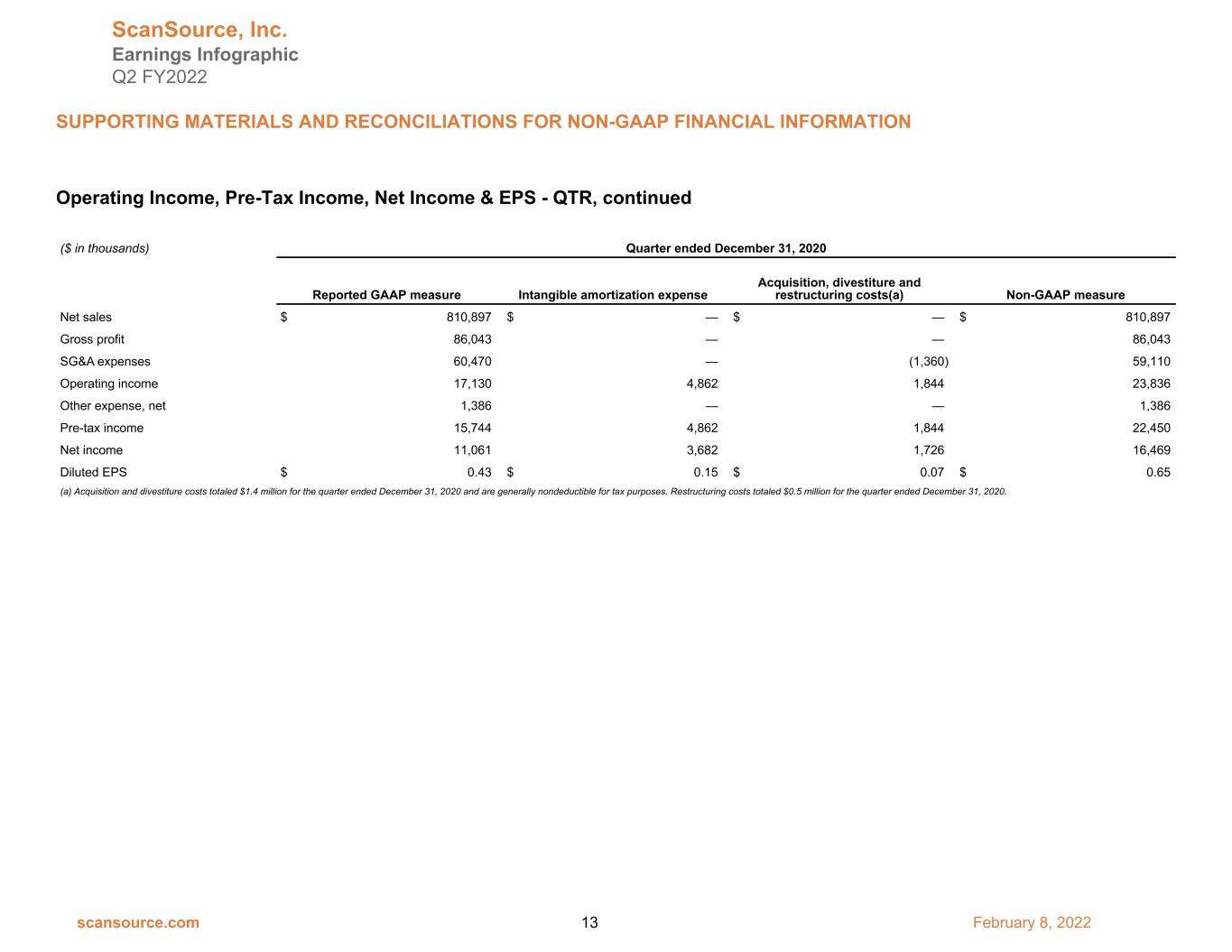

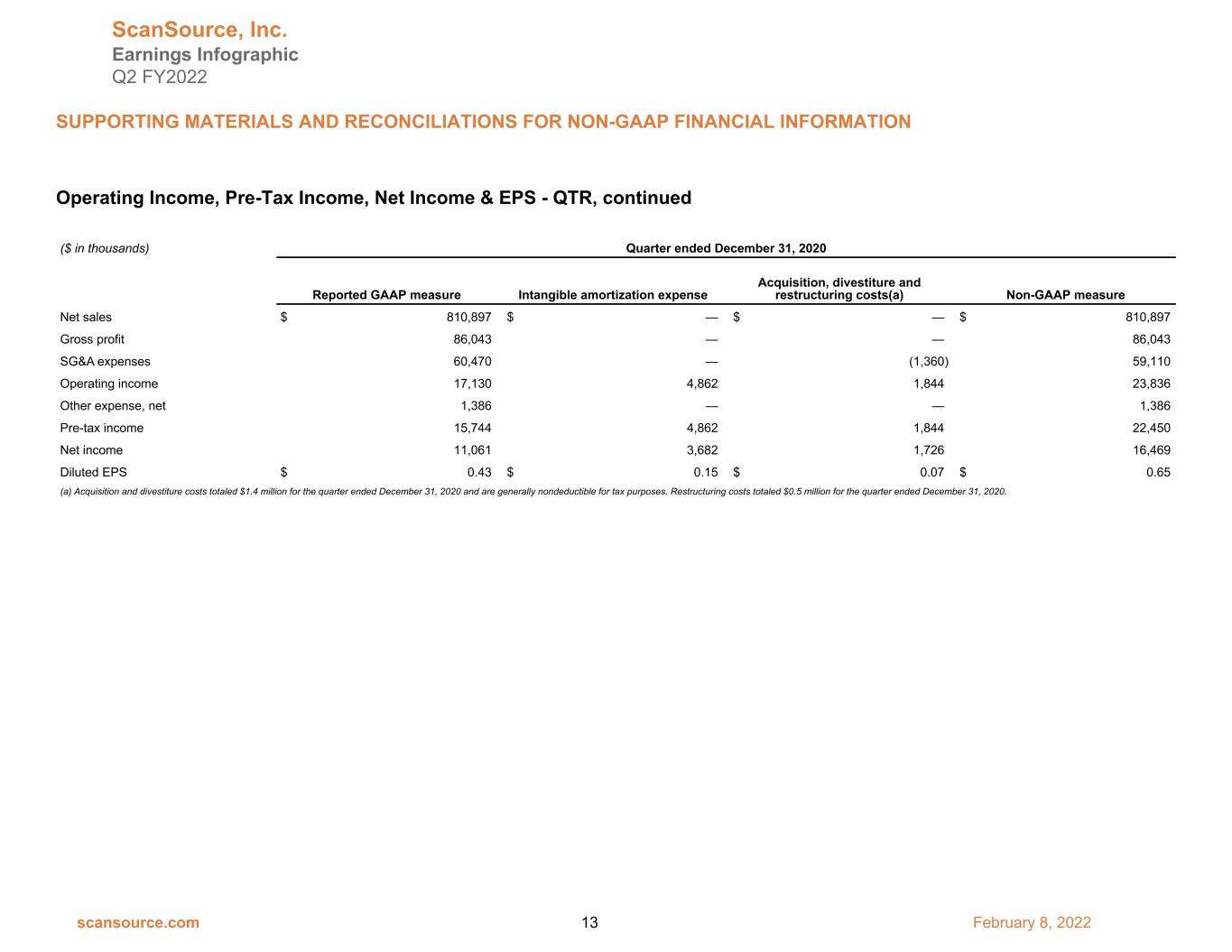

Operating Income, Pre-Tax Income, Net Income & EPS - QTR, continued ($ in thousands) Quarter ended December 31, 2020 Reported GAAP measure Intangible amortization expense Acquisition, divestiture and restructuring costs(a) Non-GAAP measure Net sales $ 810,897 $ — $ — $ 810,897 Gross profit 86,043 — — 86,043 SG&A expenses 60,470 — (1,360) 59,110 Operating income 17,130 4,862 1,844 23,836 Other expense, net 1,386 — — 1,386 Pre-tax income 15,744 4,862 1,844 22,450 Net income 11,061 3,682 1,726 16,469 Diluted EPS $ 0.43 $ 0.15 $ 0.07 $ 0.65 (a) Acquisition and divestiture costs totaled $1.4 million for the quarter ended December 31, 2020 and are generally nondeductible for tax purposes. Restructuring costs totaled $0.5 million for the quarter ended December 31, 2020. ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 13 February 8, 2022

FY22 Annual Financial Outlook Reconciliation FY22 Outlook GAAP, operating income At least $105 million Intangible amortization $18 million Depreciation expense $13 million Share-based compensation expense $12 million Adjusted EBITDA (non-GAAP) At least $148 million ScanSource, Inc. Earnings Infographic Q2 FY2022 SUPPORTING MATERIALS AND RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION scansource.com 14 February 8, 2022