QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Wave Systems Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

N/A

|

| | | (2) | | Aggregate number of securities to which transaction applies:

N/A

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

|

| | | (4) | | Proposed maximum aggregate value of transaction:

N/A

|

| | | (5) | | Total fee paid:

N/A

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

N/A

|

| | | (2) | | Form, Schedule or Registration Statement No.:

N/A

|

| | | (3) | | Filing Party:

N/A

|

| | | (4) | | Date Filed:

N/A

|

WAVE SYSTEMS CORP.

480 Pleasant Street

Lee, Massachusetts 01238

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held , 2003

TO THE STOCKHOLDERS OF WAVE SYSTEMS CORP.:

Notice is hereby given that a Special Meeting of Stockholders of Wave Systems Corp. (the "Company") will be held at on at , , for the following purposes:

1. To consider and act upon a proposal to ratify the appointment of KPMG LLP as the Company's independent auditors for the year ending December 31, 2003;

2. To ratify the action of the Board of Directors in amending the 1994 Employee Stock Option Plan to increase the number of shares of Class A Common Stock authorized for issuance thereunder from 13,000,000 to 15,500,000;

3. To ratify the action of the Board of Directors in amending the 1994 Employee Stock Option Plan to extend the termination date thereof from January 1, 2004 to January 1, 2009;

4. To approve the issuance of shares of Class A Common Stock in excess of 19.99% of the number of shares of Class A Common Stock outstanding prior to April 30, 2003, upon conversion and exercise of shares of Series H Convertible Preferred Stock and the related Warrants and upon payment of dividends accruing on such Series H Convertible Preferred Stock; and

5. To transact such other business as may properly come before the Special Meeting or at any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on , 2003 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Special Meeting of Stockholders and at any adjournments or postponements thereof.

|

|

By Order of the Board of Directors,

|

| | | Gerard T. Feeney

Secretary |

Lee, Massachusetts

September , 2003 |

|

|

YOUR VOTE IS IMPORTANT

If you do not expect to attend the Special Meeting, or if you do plan to attend but wish to vote by proxy, please complete, sign, date and return promptly the enclosed proxy card in the enclosed postage-paid envelope.

WAVE SYSTEMS CORP.

480 Pleasant Street

Lee, Massachusetts 01238

PRELIMINARY PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

to be held on , 2003

General

This Proxy Statement is being furnished to the holders of the common stock, $.01 par value per share (the "Common Stock") of Wave Systems Corp., a Delaware corporation (the "Company"), in connection with the solicitation by the Board of Directors of proxies for use at a Special Meeting of Stockholders to be held on , 2003 (the "Special Meeting") commencing at at , , , and at any adjournments or postponements thereof. The matters to be considered and acted upon at the meeting are described below in this Proxy Statement.

The principal executive offices of the Company are located at 480 Pleasant Street, Lee, Massachusetts 01238. The approximate mailing date of this Proxy Statement and the accompanying proxy is September , 2003.

Voting Rights and Votes Required

Only stockholders of record at the close of business on August 1, 2003 will be entitled to notice of, and to vote at, the Special Meeting. As of such record date, the Company had outstanding 53,009,884 shares of Class A Common Stock and 314,225 shares of Class B Common Stock. Each stockholder is entitled to one vote for each share of Common Stock held on the matters to be considered at the Special Meeting. The holders of a majority of the outstanding shares of Common Stock will constitute a quorum for the transaction of business at the meeting. Shares of Common Stock present in person, or represented by proxy (including shares of Common Stock which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the meeting.

The affirmative vote of a majority of the total votes present in person or by proxy and entitled to vote at the Special Meeting is required for approval of the proposals to ratify the appointment of KPMG LLP as the Company's independent auditors for the year ending December 31, 2004, and to approve the amendments to the 1994 Employee Stock Option Plan to increase the number of shares of Class A Common Stock authorized for issuance thereunder, and to extend the termination date thereof. Also, the affirmative vote of a majority of the total votes cast in person or by proxy on the proposal to approve the issuance of shares of Class A Common Stock in excess of 19.99% of the number of shares of Class A Common Stock outstanding prior to April 30, 2003 upon conversion of shares of Series H Convertible Preferred Stock, upon exercise of the related warrants and upon payment of dividends accruing on such Series H Convertible Preferred Stock is required for approval of this proposal.

Abstentions with regard to the appointment of the independent auditors, the amendments to the 1994 Employee Stock Option Plan and the issuance of shares of Class A Common Stock in excess of 19.99% will be treated as shares of Common Stock that are present and entitled to vote for purposes of determining the number of shares of Common Stock present and entitled to vote with respect to those particular matters, but will not be counted as a vote in favor of such matter. Accordingly, an abstention from voting on any of those matters will have the same legal effect as a vote against such matter. If a broker or nominee holding stock in "street name" indicates on the proxy that it does not have discretionary authority to vote as to a particular matter, including the proposals to amend the

1994 Employee Stock Option Plan, those shares of Common Stock will not be considered as present and entitled to vote with respect to such matter.

The accompanying proxy may be revoked at any time before it is exercised by giving a later proxy, notifying the Secretary of the Company in writing, or voting in person at the meeting.

STOCKHOLDERS OF THE COMPANY ARE REQUESTED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. SHARES OF COMMON STOCK REPRESENTED BY A PROPERLY EXECUTED PROXY RECEIVED PRIOR TO THE VOTE AT THE SPECIAL MEETING AND NOT REVOKED WILL BE VOTED AT THE SPECIAL MEETING AS DIRECTED BY THE PROXY. IT IS NOT ANTICIPATED THAT ANY MATTERS OTHER THAN THOSE SET FORTH IN THE PROXY STATEMENT WILL BE PRESENTED AT THE SPECIAL MEETING. IF OTHER MATTERS ARE PRESENTED, PROXIES WILL BE VOTED IN ACCORDANCE WITH THE DISCRETION OF THE PROXY HOLDERS.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information about securities authorized for issuance under the Company's equity compensation plans.

Plan Category

| | Number of Securities to be issued upon exercise of outstanding options warrants and rights

(a)

| | Weighted Average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 9,215,997 | | $ | 5.87 | | 1,670,370 |

Wave equity compensation plans not approved by security holders |

|

129,365 |

|

|

4.00 |

|

— |

| | |

| |

| |

|

| |

Total Company plans |

|

9,345,362 |

|

$ |

5.84 |

|

1,670,370 |

WaveXpress equity compensation plans not approved by security holders(1) |

|

1,402,841 |

|

$ |

1.21 |

|

1,069,382 |

- (1)

- The WaveXpress equity compensation plans provide grants of options to purchase shares of WaveXpress Common Stock. Accordingly the WaveXpress equity plans have no dilutive effect on the existing shareholders of Wave.

Wave Equity compensation plans not approved by security holders are comprised of the following:

In connection with a software development agreement that the Company entered into with Archon Technologies, Inc. ("Archon"), the Company issued to Archon a warrant to purchase 50,000 shares of Class A Common Stock at $3.48 per share, pursuant to an individual compensation plan with Archon (the "Archon Plan"). The warrant became exercisable on November 9, 2002, and expires on November 9, 2007. No additional warrants are required to be granted pursuant to the Archon Plan.

A director of WaveXpress, Inc. ("WaveXpress"), a joint venture between the Company and Sarnoff Corporation, was granted a warrant to purchase 10,000 shares of Class A Common Stock at $10.00 per share, pursuant to an individual compensation plan with the director, upon acceptance of an offer to serve on WaveXpress' board. This warrant is currently exercisable and expires on August 24, 2004. No additional warrants are required to be granted pursuant to this individual compensation plan.

As a result of the successful placement of 350 shares of Series B preferred stock, a consultant from Digital Media Group, Inc. ("Digital Media") was issued warrants by the Company to purchase 15,000

2

Class A Common Stock at a price of $3.09 per share, pursuant to an individual compensation plan with Digital Media (the "Digital Media Plan"). No additional warrants are required to be granted pursuant to the Digital Media Plan. These warrants are currently exercisable and expire on March 1, 2006.

In connection with a consulting agreement that the Company entered into with the William Morris Agency, Inc. ("William Morris"), the Company issued William Morris a warrant to purchase 10,000 shares of Class A Common Stock at $14.73 per share, pursuant to an individual compensation plan with William Morris (the "William Morris Plan"). No additional warrants are required to be granted pursuant to the William Morris Plan. This warrant is currently exercisable and expires on March 31, 2004.

In connection with an agreement that the Company entered into with an outside sales representative, the Company issued warrants to purchase 44,365 shares of Class A Common Stock at prices ranging from $0.95 to $1.45 per share, pursuant to an individual compensation plan with the sales representative. No additional warrants are required to be granted pursuant to the individual compensation plan for the sales representative. These warrants are currently exercisable and expire January 1, 2013 through April 30, 2013.

The following table sets forth certain information concerning the beneficial ownership of the Company's Class A and Class B Common Stock as of August 15, 2003 (except as otherwise noted) by (i) each stockholder who is known by the Company to own beneficially more than five percent of the outstanding Class A or Class B Common Stock, (ii) each director of the Company, (iii) each of the executive officers of the Company named in the Summary Compensation Table below, and (iv) all directors and executive officers of the Company as a group. Holders of Class A Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders of the Company. Holders of Class B Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders, except that holders of Class B Common Stock will have five votes per share in cases where one or more directors are nominated for election by persons other than the Company's Board of Directors and where there is a vote on any merger, consolidation or other similar transaction which is not recommended by the Company's Board of Directors. In addition, holders of Class B Common Stock will have five votes per share on all matters submitted to a vote of the stockholders in the event that any person or group of persons acquires beneficial ownership of 20% or more of the outstanding voting securities of the Company. Shares of Class B Common Stock are convertible into shares of Class A Common Stock on a one-for-one basis at the option of the holder.

Beneficial Owner (1)

| | Number of Shares of Class A Common Stock Owned(2)

| | Percent of Class

| | Number of Shares of Class B Common Stock Owned

| | Percent of Class

| | Percent of All Outstanding Common Stock(3)

|

|---|

| Peter J. Sprague(4), (12) | | 1,405,334 | | 2.2 | | 151,000 | | 48.1 | | 2.5 |

| John E. Bagalay, Jr.(5) | | 126,000 | | * | | 0 | | * | | * |

| Nolan Bushnell(6) | | 56,316 | | * | | 4,316 | | 1.4 | | * |

| George Gilder(7) | | 208,000 | | * | | 2,000 | | * | | * |

| John E. McConnaughy, Jr.(8) | | 66,750 | | * | | 0 | | * | | * |

| Steven Sprague(9), (12) | | 1,872,826 | | 3.2 | | 42,102 | | 13.4 | | 3.3 |

| Gerard T. Feeney(10) | | 700,000 | | 1.2 | | 0 | | * | | 1.2 |

| All executive officers and directors as a group (7 persons)(11) | | 4,211,726 | | 7.0 | | 199,418 | | 63.5 | | 7.4 |

- *

- Less than one percent.

- (1)

- Each individual or entity has sole voting and investment power, except as otherwise indicated.

- (2)

- Includes shares of Class A Common Stock issuable upon the conversion of Class B Common Stock.

3

- (3)

- In circumstances where the Class B Common Stock has five votes per share, the percentages of total voting power would be as follows: Peter J. Sprague, 3.4%; John E. Bagalay, Jr., less than 1%; Nolan Bushnell, less than 1%; George Gilder, less than 1%; John E. McConnaughy, Jr., less than 1%; Steven Sprague, 3.5%; Gerard T. Feeney, 1.2%; and all Executive Officers and directors as a group, 8.6%.

- (4)

- Includes 878,833 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238. Mr. Sprague resigned as a director and officer of the Company, effective March 31, 2003.

- (5)

- Includes 122,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (6)

- Includes 52,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (7)

- Includes 202,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (8)

- Includes 40,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (9)

- Includes 1,518,672 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days. Also includes 37,102 shares of Class B Common Stock held in trust for the benefit of Mr. Steven Sprague's family, and for which Mr. Steven Sprague is a trustee. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (10)

- Includes 600,000 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (11)

- Includes 3,413,505 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days.

- (12)

- Includes 223,500 shares of Common Stock beneficially owned by Mr. Steven Sprague and Mr. Peter J. Sprague in which voting and investment rights are shared.

Aggregate fees billed to the Company for the annual audit and the quarterly reviews of the consolidated financial statements for the last fiscal year totaled $209,790.

Aggregate fees billed to the Company for services rendered by the Company's independent accountants for audit-related services were $86,200. Audit-related services consisted of audits of the financial statements of the Company's employee benefit plan, review of, and assistance with, registration statements, Form 10-Q and Form 10-K filings and amendments thereto, issuance of consents and accounting advice. Non-audit fees billed to the Company by its independent auditors totaled $30,600 and consisted of tax compliance services. The audit committee believes that the provision of non-audit services during the 2002 fiscal year does not affect the accountants' ability to maintain independence with respect to the Company.

4

EXECUTIVE COMPENSATION

The following table sets forth information with respect to the compensation paid or awarded by the Company to the Chief Executive Officer and the other executive officers whose cash compensation exceeded $100,000. (collectively, the "Named Executive Officers") for services rendered in all capacities during 2002, 2001 and 2000.

| |

| |

| |

| | Long-Term

Compensation Awards

|

|---|

| |

| | Annual Compensation

|

|---|

Name and Principal Position

| |

| | Number of Shares

Underlying Options(#)

|

|---|

| | Year

| | Salary($)

| | Bonus($)

|

|---|

Peter J. Sprague(1)

Former Chairman | | 2002

2001

2000 | | $

| 185,000

185,000

185,000 | | $

| 200,391

105,000

150,000 | | 200,000

200,000

100,000 |

Steven Sprague(2)

President and Chief Executive Officer |

|

2002

2001

2000 |

|

|

250,000

250,000

250,000 |

|

|

161,500

175,000

250,000 |

|

252,500

250,000

500,000 |

Gerard T. Feeney(3)

Senior Vice President, Chief Financial Officer and Secretary |

|

2002

2001

2000 |

|

|

185,000

185,000

185,000 |

|

|

102,000

105,000

150,000 |

|

150,000

150,000

100,000 |

- (1)

- Mr. Peter Sprague was awarded a bonus of $150,000 that was paid in 2000 and was fully applied to his outstanding loans with the Company. In 2002 Mr. Sprague was awarded a bonus of approximately $174,000 that was applied in full to his outstanding loan with the Company. Such bonus was not awarded at fiscal year end as is the Company's usual practice. Mr. Sprague resigned as an officer and director of the Company, effective March 31, 2003.

- (2)

- Mr. Steven Sprague was elected President and Chief Executive Officer of the Company on June 26, 2000. Previously, Mr. Sprague was President and Chief Operating Officer of the Company from May 23, 1996 until he was elected Chief Executive Officer.

- (3)

- Mr. Gerard T. Feeney was hired as Senior Vice President, Finance and Administration and Chief Financial Officer on June 8, 1998 and was elected Secretary on February 25, 1999.

The following table sets forth certain information regarding options granted during the fiscal year ended December 31, 2002 by the Company to the Named Executive Officers.

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1)

|

|---|

| | Number of

Shares

Underlying

Options

Granted (#)

| |

| |

| |

|

|---|

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Peter J. Sprague | | 200,000 | | 12.4 | % | $ | 2.01 | | 2/1/12 | | $ | 252,816 | | $ | 640,684 |

| Steven Sprague | | 252,500 | | 15.7 | % | $ | 2.01 | | 2/1/12 | | | 319,180 | | | 808,864 |

| Gerard T. Feeney | | 150,000 | | 9.3 | % | $ | 2.01 | | 2/1/12 | | | 189,612 | | | 480,513 |

- (1)

- The potential realizable value of the options reported above was calculated by assuming 5% and 10% compounded annual rates of appreciation of the Common Stock from the date of grant of the options until the expiration of the options, based upon the market price on the date of grant. These assumed annual rates of appreciation were used in compliance with the rules of the Securities and Exchange Commission and are not intended to forecast future price appreciation of the Common Stock.

5

The following table sets forth information regarding the aggregate number and value of options held by the Named Executive Officers as of December 31, 2002, and the aggregate number and value of options exercised by the Named Executive Officers during 2002.

| |

| |

| | Number of

Shares Underlying

Unexercised Options at December 31, 2002(#)

| | Value of Unexercised

In-The-Money Options at December 31, 2002($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Received

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Peter J. Sprague | | -0- | | $ | -0- | | 955,833 | | 366,667 | | $ | 32,693 | | $ | -0- |

| Steven Sprague | | -0- | | | -0- | | 1,366,172 | | 585,833 | | | 66,227 | | | -0- |

| Gerard T. Feeney | | -0- | | | -0- | | 466,667 | | 283,333 | | | -0- | | | -0- |

- (1)

- The last reported bid price for the Company's Class A Common Stock on December 31, 2002 was $1.33 per share. Value is calculated on the basis of the difference between the respective option exercise prices and $1.33, multiplied by the number of shares of Common Stock underlying the respective options.

Since November 1998, the Company has had an employment agreement with Steven Sprague that provides that Mr. Sprague shall serve as President and Chief Executive Officer of the Company for consecutive one-year terms unless either party provides written notice to the other of its/his intention not to renew the contract not less than sixty (60) days prior to the expiration of the then current term. The employment agreement provides that Mr. Sprague will be paid a minimum base salary of $185,000 per year subject to increase from time to time as determined by action of the Board of Directors. The employment agreement also provides that Mr. Sprague will be entitled to an annual bonus. The annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of President and Chief Executive Officer. See "Report of the Compensation Committee—Base Salaries and Bonuses for 2002". In the event that Mr. Sprague's employment is terminated without cause or in certain other circumstances, Mr. Sprague will be paid a lump sum in an amount equal to three (3) years' annual base salary then in effect, and continue health insurance and other benefits for a period equal to the remaining Term of Employment then in effect. This employment agreement also contains a two-year post termination covenant not to compete.

Since June 1998, the Company also has had an employment agreement with Gerard T. Feeney that provides that Mr. Feeney shall serve as Senior Vice President, Finance and Administration and Chief Financial Officer of the Company for consecutive one-year terms unless either party provides written notice to the other of its/his intention not to renew the contract not less than sixty (60) days prior to the expiration of the then current term. The employment agreement provides that Mr. Feeney will be paid a minimum base salary of $160,000 per year subject to increase from time to time as determined by action of the Board of Directors. The employment agreement also provides that Mr. Feeney will be entitled to an annual bonus. The annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of Chief Financial Officer. See "Report of the Compensation Committee—Base Salaries and Bonuses for 2002". In the event that Mr. Feeney's employment is terminated without cause or in certain other circumstances, Mr. Feeney will be paid a lump sum in an amount equal to one year's annual base salary then in effect, and a guaranteed portion of bonus, benefits and similar relocation package. However, in the event Mr. Feeney secures employment elsewhere during the one-year period subsequent to termination, severance pay will stop once employment has begun with the new employer. In addition, Mr. Feeney's

6

options will continue to vest for at least one year from the termination date and for the portion of time greater than one year and up to his next anniversary-vesting period. This employment agreement also contains a two-year post termination covenant not to compete.

Compensation Interlocks and Insider Participation

None of the members of the Compensation Committee of the Company were officers or employees of the Company, nor was any executive officer of the Company a director or member of the compensation committee of any entity, of which an executive officer or director of such entity served on the Compensation Committee or as a director of the Company. None of the members of the Compensation Committee of the Company had any relationship with the Company which would require disclosure under "Certain Relationships and Related Transactions" herein.

Report of the Compensation Committee

General

The Compensation Committee of the Board of Directors (the "Committee") is comprised of non-employee directors. The current members of the Committee are Messrs. McConnaughy and Bagalay. The Committee reviews and recommends to the Board of Directors compensation levels for the Company's executive officers, and administers the Company's stock option plans including the awarding of grants thereunder.

Compensation Philosophy

The goals of the Company's compensation policy are to attract, retain and reward executive officers who contribute to the Company's overall success. The Company attempted to accomplish this goal by offering contractual compensation at the time the executives were hired that was competitive in the security, software and services industries, to motivate executives to achieve the Company's business objectives and to align the interests of the officers with the long-term interests of stockholders. The Company no longer makes such comparisons to other companies in their industry when setting compensation.

Forms of Compensation

The Company provides its executive officers with a compensation package consisting of base salary, fixed and incentive bonuses and participation in benefit plans generally available to other employees. In setting the incentive portion of the compensation, the Compensation Committee considers individual performance and the financial position of the Company. When the fixed portion of the compensation was set in 1998, the Compensation Committee considered market information regarding compensation paid by other emerging companies in the Company's industry. The Compensation Committee no longer makes such comparisons.

Base Salary. Salaries for the Company's executive officers were initially set based on negotiation with individual executive officers at the time of recruitment and with reference to salaries for comparable positions in the Company's industry for individuals of similar education and background to the executive officers being recruited. Salaries are generally reviewed annually by the Compensation Committee and are subject to increases based on the Compensation Committee's determination that the individual's level of contribution to the Company has increased since their salary had last been reviewed.

Bonuses. According to the employment contracts with both the Chief Executive Officer and Chief Financial Officer, the annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of each officer. Incentive bonus

7

payments to employees other than the Chief Executive Officer are determined subjectively by the Compensation Committee, in consultation with the Chief Executive Officer, based on the employee's performance of his or her responsibilities. The incentive bonus is not based on the Company's financial performance nor are there any stated objectives or stipulations that the employee must meet. The Compensation Committee also looks at the Company's available funds. The Chief Executive Officer's incentive bonus is determined by the Compensation Committee, without participation by the Chief Executive Officer, based on the same factors.

Long-Term Incentives. Longer-term incentives are provided through the Company's stock option plans, which reward executives and other employees through the growth in value of the Company's stock. The Compensation Committee believes that employee equity ownership is highly motivating, provides a major incentive for employees to build stockholder value and serves to align the interests of employees with those of stockholders. Grants of stock options to executive officers are based upon each officer's relative position, responsibilities, historical and expected contributions to the Company, and the officer's existing stock ownership and previous option grants, with primary weight given to the executive officers' relative rank and responsibilities. Initial stock option grants designed to recruit an executive officer to join the Company may be based on negotiations with the officer and with reference to historical option grants to existing officers. Stock options are granted at an exercise price equal to the market price of the Company's common stock on the date of grant and will provide value to the executive officers only when the market price of the common stock increases over the exercise price.

The Company has not established a policy with regard to Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") since the Company has not and does not currently anticipate paying cash compensation in excess of $1 million per annum to any employee. The Company intends to administer its stock option plans in accordance with Section 162(m) of the Code.

Consistent with the provisions of the Sarbanes-Oxley Act of 2002, the Company has adopted a written policy prohibiting future loans to officers and directors.

Base Salaries and Bonuses for 2002

As part of the Company's compensation policy the Company awarded the following bonuses to the Named Executive Officers: $200,391 to Mr. Peter J. Sprague, former Chairman, of which $174,000 had no connection with corporate performance and was applied in full to his outstanding loan with the Company and $26,391 was an incentive bonus awarded in relative conformity with prior years' bonuses; $161,500 to Mr. Steven Sprague, President and Chief Executive Officer, comprised of a fixed bonus portion of $125,000 and an incentive bonus portion of $36,500; and $102,000 to Mr. Gerard T. Feeney, Senior Vice President, Chief Financial Officer and Secretary, comprised of a fixed bonus portion of $92,500 and an incentive bonus portion of $9,500 awarded in relative conformity with prior years' bonuses. Mr. Steven Sprague was also granted options in 2002 to purchase 252,500 shares of Common Stock.

Compensation of the Chief Executive Officer

The Chief Executive Officer received a base salary of $250,000 and a $125,000 fixed portion of a bonus which was set in his 1998 employment contract. An incentive bonus of $36,500 was paid to the Chief Executive Officer based on his success in developing customer relations that had not existed in the past. The Chief Executive Officer received a grant of 252,500 options in line with prior years' stock option grants for a similar level of performance by the Company. The Committee believes that CEO compensation was appropriately based upon the Company's financial position and performance.

| | | Respectfully submitted, |

|

|

Compensation Committee |

|

|

John E. McConnaughy, Jr.

John E. Bagalay, Jr. |

8

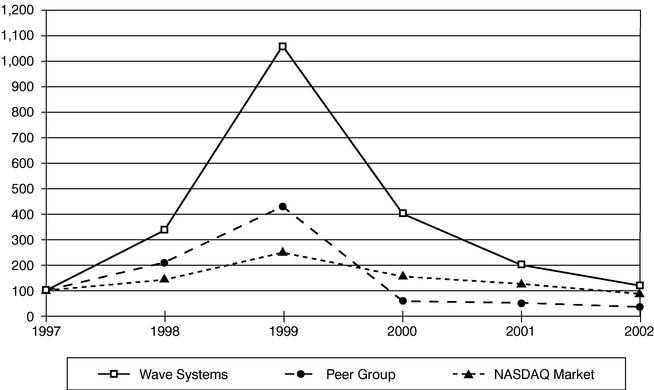

Performance Graph

The following line graph compares the Company's cumulative total return to stockholders with the cumulative total return of the Nasdaq Market Value Index and the Computer Related Services SIC Code Index from December 31, 1997 through December 31, 2002. These comparisons assume the investment of $100 on December 31, 1997 and the reinvestment of dividends. The stock performance on the graph is not necessarily indicative of future stock price performance.

Wave Systems Corp.

Comparison of Cumulative Total Return to Stockholders

December 31, 1997 through December 31, 2002

| | Wave Systems

| | Peer Group

(SIC Code 7379)

| | NASDAQ Market

|

|---|

| 12/31/97 | | 100.00 | | 100.00 | | 100.00 |

| 12/31/98 | | 336.03 | | 210.72 | | 141.01 |

| 12/31/99 | | 1061.01 | | 430.60 | | 248.72 |

| 12/31/00 | | 399.94 | | 56.95 | | 156.35 |

| 12/31/01 | | 199.09 | | 50.80 | | 124.64 |

| 12/31/02 | | 118.21 | | 36.45 | | 86.94 |

9

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires the Company's directors and executive officers, and persons owning more than ten percent of a registered class of the Company's equity securities, to file with the Securities and Exchange Commission (the "Commission") reports of ownership and changes in ownership of equity securities of the Company. Such persons are also required to furnish the Company with copies of all such forms.

Mr. Steven Sprague filed one report on Form 4 in an untimely manner. Four transactions that occurred on September 3, 2002 and one transaction on September 4, 2002 were not reported on Form 4 until September 11, 2002. Other than that, based solely upon a review of the copies of such forms furnished to the Company and, in certain cases, written representations that no Form 5 filings were required, the Company believes that, with respect to the 2002 fiscal year, all required Section 16(a) filings were made on a timely basis.

PROPOSAL NO. 1

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has appointed KPMG LLP to act as the Company's independent auditors for the year ending December 31, 2003, subject to the ratification of such appointment by the stockholders at the Special Meeting. If no direction is given to the contrary, all proxies received by the Board of Directors will be voted "FOR" ratification of the appointment of KPMG LLP as the Company's independent auditors for the year ending December 31, 2003.

Representatives of KPMG LLP are expected to be present at the Special Meeting and will be available to respond to appropriate questions from stockholders and to make a statement if they desire to do so.

RECOMMENDATION AND VOTE

An affirmative vote of the holders of a majority of the shares of Common Stock present or represented at the meeting is required to ratify the appointment of the independent auditors.

The Board of Directors deems proposal No. 1 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" this proposed amendment to ratify the appointment of KPMG LLP as the Company's independent auditors for the current fiscal year.

SUMMARY OF THE 1994 EMPLOYEE STOCK OPTION PLAN, AS AMENDED

The following summary of material features of the 1994 Employee Stock Option Plan, as amended (the "1994 Employee Plan"), is qualified in its entirety by reference to the full text of the 1994 Employee Plan, as amended, a copy of which is attached hereto as EXHIBIT 1.

GENERAL

The 1994 Employee Plan permits the Company to grant ISOs and NQSOs to salaried officers and other key employees, and terminates on January 1, 2004, which will be extended until January 1, 2009 if the 2003 Amendment B is approved. No options may be granted after the Termination Date. The 1994 Employee Plan covers a maximum of 13,000,000 shares of Class A Common Stock, which will be increased to a total of 15,500,000 if the 2003 Amendment A is approved (subject to share adjustments as described below), which may be either authorized and unissued shares of Class A Common Stock or shares of Common Stock held in the Company's treasury. When an option lapses, expires, terminates or is forfeited, the related shares of Class A Common Stock may be available for distribution in connection with future options. Adjustments may be made in the number of shares of Class A

10

Common Stock reserved under the 1994 Employee Plan, in the option price and in the number of shares of Class A Common Stock subject to stock options, in the event of a merger, reorganization, consolidation, recapitalization or stock dividend, and in the event of certain other changes described in the 1994 Employee Plan, as amended, or any other changes in the Company's corporate structure that affect the Class A Common Stock or has an effect similar to any of the foregoing. No employee may be granted options covering, in the aggregate, more than 500,000 shares of Class A Common Stock in any fiscal year of the Company (subject to adjustment as provided above).

Because grants under the 1994 Employee Plan, as amended, are discretionary, the Company cannot now determine the number of options to be received by any particular current executive officer, by all current executive officers as a group or by non-executive officer employees or directors as a group. The number of such options and awards shall be determined by the Compensation Committee, pursuant to the terms of the 1994 Employee Plan, as amended by the 2003 Amendment. It is currently estimated that there are 100 employees eligible to participate in the 1994 Employee Plan, as amended. For information concerning the ownership of options by the Named Executive Officers, see "Executive Compensation" above.

ADMINISTRATION

The 1994 Employee Plan, as amended, is administered by the Compensation Committee. The Compensation Committee is comprised of directors who are non-employee directors within the meaning of Rule 16b-3 promulgated under the Exchange Act. The Compensation Committee has the sole and complete discretion, subject to the terms of the 1994 Employee Plan, as amended, to (i) select the individuals from among the eligible employees of the Company and its subsidiaries to whom options may be granted, (ii) determine the type of options to be granted and the terms and conditions of any options granted, and (iii) determine the number of shares of Class A Common Stock subject to each option granted. In addition, the Compensation Committee is authorized to interpret the 1994 Employee Plan, as amended, to make and rescind rules and regulations related thereto, and to make all determinations necessary or advisable for the administration of the 1994 Employee Plan, as amended.

STOCK OPTIONS

Stock options granted under the 1994 Employee Plan, as amended, may be either ISOs or NQSOs. The aggregate fair market value (determined as of the time of the grant of an ISO) of the Class A Common Stock with respect to which ISOs are exercisable for the first time by a single optionee during any calendar year under the Plan and any other stock option plan of the Company may not exceed $100,000.

The exercise price for stock options shall be determined by the Compensation Committee and shall be set forth in an option agreement entered into with the optionee, provided, however, that the exercise price for an option shall not be less than the fair market value of a share of Class A Common Stock on the date of grant (110% in the case of an ISO granted to a 10% or more stockholder). On May 30, 2003, the last reported bid price for the Company's Class A Common Stock, was $0.84 per share.

The Compensation Committee is to specify the time or times at which such options will be exercisable, except that the termination date for any stock option shall not exceed 10 years from the date of grant (five years in the case of an ISO granted to a 10% or more stockholder). Options may be exercised within three months following the retirement of an optionee and within twelve months following the death or disability of an optionee; provided, that no option may be exercised following the period of exercisability set forth in the agreement related thereto.

11

Stock options may be exercised by an optionee in whole or in part by giving notice to the Company and the exercise price therefore may be paid by delivering cash or shares of unrestricted Common Stock having a fair market value equal to the cash exercise price of the options being exercised. Optionees may also utilize a cashless exercise feature that will enable them to exercise their options without a concurrent payment of the option price, provided that the purchased option shares are immediately sold by a designated broker and the option price is paid directly to the Company out of the sale proceeds. Options granted under the 1994 Employee Plan, as amended, may, at the discretion of the Compensation Committee or the Board of Directors give the option holder the right to acquire a reload option (the "Reload Option") to purchase the number of shares of Class A Common Stock tendered by an optionee in exercising a stock option. The exercise price of the Reload Option shall equal the fair market value of the Class A Common Stock on the date of the grant of the Reload Option.

Stock options are nontransferable other than by will or by the laws of descent and distribution, and stock options are exercisable during the optionee's lifetime only by the optionee.

CHANGE OF CONTROL

In the event of a "Change of Control," as defined in the 1994 Employee Plan, as amended, all options outstanding shall be immediately and fully exercisable and shall become fully vested.

AMENDMENTS

The Board of Directors may terminate, suspend or amend the 1994 Employee Plan, as amended, provided that such amendment, suspension, or termination may not affect the validity of the then outstanding options, and provided further that the Board may not, without the approval of stockholders (i) increase the maximum number of shares of Class A Common Stock which may be issued pursuant to the provisions of the 1994 Employee Plan, as amended, (ii) change the class of individuals eligible to receive options under the 1994 Employee Plan, as amended, (iii) materially increase the benefits accruing to participants under the 1994 Employee Plan, as amended, or (iv) extend the term of the 1994 Employee Plan, as amended.

WITHHOLDING TAXES

The 1994 Employee Plan, as amended, provides that the Company may deduct from any distribution to an employee an amount equal to all federal, state and local income taxes or other amounts as may be required by law to be withheld.

FEDERAL INCOME TAX CONSEQUENCES

The following general description of federal income tax consequences is based upon current statutes, regulations and interpretations. This description is not intended to address specific tax consequences applicable to individual participants.

INCENTIVE STOCK OPTIONS

No regular income tax consequences result from the grant of an ISO or the exercise of an ISO by the employee, provided the employee continues to hold the stock acquired on the exercise of an ISO for the requisite holding periods described below. The employee will be taxed only upon the sale or disposition of the stock acquired under an ISO and the gain recognized at that time will be long-term capital gain. The holding period requirements necessary for ISO treatment are as follows: (i) such shares may not be disposed of within two years from the date the ISO is granted, and (ii) such shares must be held for at least one year from the date the shares are transferred to the employee upon the exercise of the ISO. In addition, to receive ISO treatment, the option holder generally must be an

12

employee of the Company or a subsidiary of the Company from the date the stock option is granted until three months before the date of exercise.

If an employee disposes of stock acquired upon exercise of an ISO before expiration of the applicable holding periods, the employee will be taxed at ordinary income tax rates on the date of disposition measured by the lesser of; (i) the fair market value of the stock on the date of exercise of the ISO minus the option price or (ii) the amount realized on disposition minus the option price, and the Company will receive a corresponding income tax deduction. In the case of a sale where a loss, if sustained, would be recognized, the amount of the optionee's income, and the amount of the Company's corresponding expense deduction, will not exceed the difference between the sale price and the adjusted basis of the shares.

The amount by which the fair market value of shares of Class A Common Stock received upon exercise of an ISO exceeds the option price constitutes an item of tax preference that may be subject to the alternative minimum tax. If an employee is subject to the alternative minimum tax as a result of the exercise of an ISO, for purposes of calculating the gain on a disposition of the stock solely for purposes of the alternative minimum tax, the amount treated as a preference item will be added to his or her tax basis for the stock. Gain realized by an employee upon the disposition of stock acquired through the exercise of an ISO is taxable in the year of disposition, but such income is not subject to income tax withholding if the requisite holding periods have been satisfied. If either of the holding periods is not satisfied, however, the disposition of the stock may result in taxable income to the employee as additional compensation that is subject to withholding.

NON-QUALIFIED STOCK OPTIONS

With regard to NQSOs, the employee will recognize ordinary income at the time of the exercise of the option in an amount equal to the difference between the exercise price and the fair market value of the shares of Class A Common Stock received on the date of exercise. Such income will be subject to withholding. When the employee disposes of shares of Class A Common Stock acquired upon the exercise of the option, any amount received in excess of the fair market value of the shares of Class A Common Stock on the date of exercise will be treated as long-term or short-term capital gain, depending upon the holding period of the shares of Class A Common Stock. If the amount received upon sale is less than the fair market value of the shares of Class A Common Stock on the date of exercise, the loss will be treated as long-term or short-term capital loss, depending upon the holding period of the shares of Class A Common Stock.

Section 162(m) of the Code generally prohibits the Company from deducting compensation of a "covered employee" to the extent the compensation exceeds $1,000,000 per year. For this purpose, "covered employee" means the Chief Executive Officer of the Company and the four other highest compensated officers of the Company. Certain performance-based compensation (including, under certain circumstances, stock option compensation) will not be subject to, and will be disregarded in applying, the $1,000,000 deduction limitation. It is the Company's intention that options granted under the 1994 Employee Plan, as amended, qualify as "performance-based" compensation under Section 162(m).

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TO THE 1994 EMPLOYEE STOCK OPTION PLAN TO

INCREASE THE NUMBER OF SHARES OF CLASS A COMMON STOCK AUTHORIZED

FOR ISSUANCE THEREUNDER FROM 13,000,000 TO 15,500,000

The Board of Directors adopted on May 22, 2003, subject to approval by the stockholders, an amendment and restatement (the "2003 Amendment A") to the Company's 1994 Employee Stock Option Plan (the "1994 Employee Plan"). The 2003 Amendment A will only increase, by a total of

13

2,500,000, the number of shares of Class A Common Stock reserved for issuance under the 1994 Employee Plan. The Company has in the past used, and intends to continue to use, stock options as an incentive device to motivate and compensate its salaried officers and other key employees, and believes that equity incentives represented by stock options enhance the Company's ability to attract and retain the best available personnel. There are no current plans, proposals or arrangements to award any of these additional options. As of August 15, 2003, options to purchase an aggregate of 3,942,507 shares of Class A Common Stock had been exercised under the 1994 Employee Plan, and options to purchase 7,983,833 shares of Class A Common Stock were outstanding under the 1994 Employee Plan. Accordingly, only 1,073,660 shares remained available for future grants under the 1994 Employee Plan as of such date.

Under the terms of the 1994 Employee Plan, the Company is authorized to grant stock options that qualify as incentive stock options ("ISOs") under Section 422 of the Code and non-qualified stock options ("NQSOs") to salaried officers and other key employees of the Company and its subsidiaries who are in a position to affect materially the profitability and growth of the Company and its subsidiaries, for up to an aggregate of 13,000,000 shares of Class A Common Stock. See above for a summary of certain features of the 1994 Employee Plan, as amended.

RECOMMENDATION AND VOTE

An affirmative vote of the holders of a majority of shares of Common Stock present in person or by proxy and entitled to vote at the Special Meeting is required to approve the adoption of the 2003 Amendment A.

The Board of Directors deems Proposal No. 2 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" approval of the 2003 Amendment A.

PROPOSAL NO. 3

APPROVAL OF AN AMENDMENT TO THE 1994 EMPLOYEE STOCK OPTION PLAN

TO EXTEND THE TERMINATION DATE

The Board of Directors adopted on May 22, 2003, subject to approval by the stockholders, an additional amendment and restatement (the "2003 Amendment B") to the 1994 Employee Plan. The 2003 Amendment B will only extend the termination date, as defined in Article XXI of the 1994 Employee Plan, from January 1, 2004 to January 1, 2009. Currently, because the 1994 Employee Plan terminates on January 1, 2004, the Company will not be able to provide future stock option grants under the 1994 Employee Plan to its key employees subsequent to that date. Accordingly, the Company has adopted the 2003 Amendment B, and seeks stockholder approval for such amendment so that it may continue to grant stock options to its key employees subsequent to January 1, 2004.

RECOMMENDATION AND VOTE

An affirmative vote of the holders of a majority of shares of Common Stock present in person or by proxy and entitled to vote at the Special Meeting is required to approve the adoption of the 2003 Amendment B.

The Board of Directors deems Proposal No. 3 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" approval of the 2003 Amendment B.

14

PROPOSAL NO. 4

TO APPROVE THE ISSUANCE OF SHARES OF CLASS A COMMON STOCK IN EXCESS OF 19.99% OF THE NUMBER OF SHARES OF CLASS A COMMON STOCK OUTSTANDING PRIOR TO APRIL 30, 2003, UPON CONVERSION OF SHARES OF SERIES H CONVERTIBLE PREFERRED STOCK, UPON EXERCISE OF THE RELATED WARRANTS AND UPON PAYMENT OF DIVIDENDS ACCRUING ON SUCH SERIES H CONVERTIBLE PREFERRED STOCK

On April 30, 2003 (the "Original Issuance Date"), the Company issued 548.50 shares of its Series H Convertible Preferred Stock, par value $0.01 per share (the "Series H Stock"), in a private placement to a group of accredited investors for an aggregate purchase price of $5,485,000 (the "Financing").

The Series H Stock is initially convertible into 7,217,105 shares of the Company's Class A Common Stock at an initial conversion price of $0.76 per share. Pursuant to the terms of two Series H Convertible Preferred Stock Purchase Agreements, each dated as of April 30, 2003 among the Company and the purchasers identified therein (the "Purchase Agreements"), the conversion price will be proportionately decreased upon a stock split of the outstanding Class A Common Stock by the Company. The conversion price will be proportionately increased if the Company combines the outstanding Class A Common Stock. In the event the Company issues stock dividends, the conversion price shall be adjusted so that the holders of the Series H Stock shall receive upon conversion thereof, the number of additional shares of Class A Common Stock they would have received had their Series H Stock been converted into Class A Common Stock beforehand. Proportional adjustments are also made to the conversion price upon reclassifications, exchanges or substitutions of the Class A Common Stock. If the Company sells additional shares of Class A Common Stock or its equivalent at a price per share less than the current conversion price, such conversion price shall be adjusted using a weighted average basis for adjustment.

Dividends on the Series H Stock accrue on the initial liquidation preference amount of each share ($10,000) at an annual rate of 10%, increasing to 12% on April 30, 2004. Subject to certain conditions, each share of Series H Stock carries a mandatory conversion provision whereby if the closing bid on the Company's Class A Common Stock exceeds $1.90 for 15 of 20 consecutive trading days, the Series H Stock shall automatically convert into Class A Common Stock at the conversion price then in effect.

Also pursuant to the Purchase Agreements, the holders of the Series H Stock have the right of first offer and refusal in any subsequent offer or sale to, or exchange with any third party of Class A Common Stock or any securities convertible, exercisable or exchangeable into Class A Common Stock, except under certain circumstances. If the Company does a private equity or equity linked financing within the one year period after April 30, 2003, the holders of the Series H Stock may exchange the Series H Stock for the securities in such financing. Certain major transactions will give the holders of the Series H Stock the right to redeem the Series H Stock at a price per share equal to 100% of the liquidation preference amount plus accrued and unpaid dividends. These transactions include:

- •

- the consolidation, merger or other business combination of Wave with or into another entity;

- •

- the sale or transfer of more than 50% of Wave's assets other than the sale or transfer of inventory in the ordinary course of business, the sale or transfer of the stock or assets of WaveXpress, Inc. or the sale or transfer of the assets of SignOnline; or

- •

- acquisition by a third party of more than 50% of the outstanding shares of Class A Common Stock.

15

Certain triggering events will give the holders of the Series H Stock the right to redeem the Series H Stock at a price per share equal to 120% of the liquidation preference amount, plus any accrued and unpaid dividends. These triggering events include:

- •

- if the effectiveness of this registration statement lapses for a period of ten (10) consecutive trading days, and the shares of Class A Common Stock into which such holder's Series H Stock can be converted cannot be sold pursuant to Rule 144(k);

- •

- if the Class A Common Stock is delisted from The Nasdaq National Market, The Nasdaq SmallCap Market, OTC Bulletin Board, The New York Stock Exchange, Inc., The American Stock Exchange, Inc., or another securities exchange or quotation system for a period of five (5) consecutive days;

- •

- if Wave is unable to comply with proper requests for conversion of any Series H Stock into shares of Class A Common Stock; or

- •

- if Wave materially breaches any representation, warranty, covenant or other term or condition of the Purchase Agreements, or any other agreement delivered in connection with the Financing, unless the breach of representation, warranty, covenant or other term or condition is cured within ten (10) days.

The Company currently has no other commitments in place for future issuances of common stock or any other securities. The Company has a sufficient number of shares authorized in which to convert and exercise the Series H Securities up to the Share Cap set forth below.

Also, as part of the transaction, the Company issued to the investors related Warrants ("the Series H Warrants"). The Series H Warrants can initially be exercised for an aggregate of 3,608,553 shares of Class A Common Stock. The Series H Warrants have a five (5) year term and an initial exercise price equal to $1.13 per share. Commencing eighteen (18) months after April 30, 2003, the Company may call up to 100% of the Series H Warrants if the market value of its Class A Common Stock exceeds 250% of $1.13 (subject to adjustment pursuant to the terms of the Series H Warrants) for a minimum of fifteen (15) business days during any twenty (20) consecutive business day period. The number of shares of Class A Common Stock issuable upon conversion or exercise of the respective Series H Security as described in these paragraphs, is limited by the Share Cap set forth below.

Shareholders wishing further information concerning the rights, preferences and terms of the securities are referred to the full description thereof contained in the Company's Current Report on Form 8-K filed with the Commission on May 7, 2003 and the exhibits to such report.

Pursuant to Nasdaq Rule 4350(i), the Company must obtain shareholder approval for the issuance or potential issuance of securities representing twenty percent or more of its outstanding listed securities or twenty percent or more of the voting power outstanding before the issuance. Pursuant to the terms of the Purchase Agreements, the Company is required to solicit such shareholder approval for the issuance of shares of Class A Common Stock upon conversion of, or in lieu of, cash dividends on the Series H Stock and upon the exercise of the Series H Warrants. Accordingly, absent shareholder approval, the terms of the Purchase Agreements provide that the Company can issue up to 10,031,095 shares of Class A Common Stock (the "Share Cap") upon conversion and exercise of the Series H Securities and upon payment of dividends accruing on the Series H Stock. The Share Cap represents 19.99% of the shares of Class A Common Stock outstanding prior to the Original Issuance Date minus the shares of Class A Common Stock issuable upon the exercise of warrants issued to the placement agents and sub-placement agents for their services in connection with the issuance of the Series H Securities. If holders of the Series H Securities convert and/or exercise such securities for the number of shares of the Company's Class A Common Stock equal to the Share Cap, the holders of the Series H Stock would hold 16.06% of the Company's outstanding Common Stock. If the Company obtains shareholder approval, it will only be limited in the number of shares of Class A Common Stock

16

that could be issued upon conversion of, or in lieu of, cash dividends on the Series H Stock and upon exercise of the Series H Warrants by the amount of shares of Class A Common Stock authorized by the Restated Certificate of Incorporation and such issuance of shares of Class A Common Stock will no longer be subject to shareholder approval under Nasdaq Rule 4350(i). If all of the Series H Securities are converted and/or exercised, in the event that Proposal No. 4 is approved, the holders of the Series H Stock will obtain approximately 17.12% of the Company's outstanding Common Stock. Additionally, in the event dividends are declared on the Series H Stock and the Company elects to pay such dividends in shares of Class A Common Stock, the dilutive effect of such issuance of shares would be approximately 1% per year. IF THE COMPANY DOES NOT OBTAIN SHAREHOLDER APPROVAL AND, THEREFORE, CANNOT ISSUE SHARES OF CLASS A COMMON STOCK IN EXCESS OF THE SHARE CAP DUE TO RESTRICTIONS RELATING TO NASDAQ RULE 4350(i), THE COMPANY MAY, AS OF NOVEMBER 17, 2003, BE REQUIRED TO REDEEM THE SERIES H SECURITIES CONVERTIBLE INTO OR EXCHANGEABLE FOR CLASS A COMMON STOCK IN EXCESS OF THE SHARE CAP PURSUANT TO THE TERMS OF THE PURCHASE AGREEMENTS, IF ANY HOLDER OF SUCH SERIES H SECURITIES EXERCISES ITS OPTION TO CAUSE THE COMPANY TO REDEEM SUCH SERIES H SECURITIES

If Proposal No. 4 is not approved, the Company would be required to redeem approximately 40.26 shares of Series H Stock at the greater of the liquidation preference amount or the liquidation preference amount proportionately increased by increases in the market value of the Company's Common Stock plus any accrued and unpaid dividends.

An affirmative vote of a majority of the total votes cast on Proposal No. 4 in person or by proxy is required to approve the proposed issuance of shares of Class A Common Stock.

The Board of Directors deems Proposal No. 4 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" approval of the proposed issuance of shares of Class A Common Stock.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not know of any other matters, which may come before the Special Meeting. If any other matters properly come before the meeting, the accompanying proxy confers discretionary authority with respect to any such matters, and the persons named in the accompanying proxy intend to vote in accordance with their best judgment on such matters.

All expenses in connection with the solicitation of proxies will be borne by the Company. In addition to this solicitation, officers, directors and regular employees of the Company, without any additional compensation, may solicit proxies by mail, telephone or personal contact. The Altman Group may be retained to assist in the solicitation of proxies for a negotiated fee plus reasonable out-of-pocket expenses. The Company will, upon request, reimburse brokerage houses and other nominees for their reasonable expenses in sending proxy materials to their principals.

The prompt return of your proxy will be appreciated and helpful in obtaining the necessary vote. Therefore, whether or not you expect to attend the Special Meeting, please sign the proxy and return it in the enclosed envelope.

17

STOCKHOLDER PROPOSALS

Stockholder proposals for inclusion in the proxy materials for the 2004 Annual Meeting should be addressed to the Company's Secretary, Gerard T. Feeney, 480 Pleasant Street, Lee, Massachusetts 01238 and must be received by April 9, 2004. In addition, the Company's By-laws currently require that for business to be properly brought before an annual meeting by a stockholder, regardless of whether included in the Company's proxy statement, the stockholder must give written notice of his or her intention to propose such business to the Secretary of the Company, which notice must be delivered to, or mailed and received at, the Company's principal executive offices not less than sixty (60) days and not more than ninety (90) days prior to the scheduled annual meeting (except that if less than seventy (70) days' notice of the date of the scheduled annual meeting is given, notice by the stockholder may be delivered or received not later than the tenth (10th) day following the day on which such notice of the date of the scheduled annual meeting is given). Such notice must set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting, (ii) the name and address of the stockholder proposing such business, (iii) the class and number of shares of Common Stock which are beneficially owned by the stockholder; and (iv) any material interest of the stockholder in such proposal. The By-laws further provide that the chairman of the annual meeting may refuse to permit any business to be brought before an annual meeting without compliance with the foregoing procedures.

|

|

By Order of the Board of Directors,

|

| | | Gerard T. Feeney

Secretary |

|

|

Wave Systems Corp.

Lee, Massachusetts |

September , 2003 |

|

|

The Company will provide without charge to each person solicited hereby, upon the written request of any such person, a copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2002, as filed with the Securities and Exchange Commission (without exhibits). The Annual Report on Form 10-K is incorporated herein by reference. Requests should be made to Wave Systems Corp., Attention: Mr. Gerard T. Feeney, 480 Pleasant Street, Lee, Massachusetts 01238.

The Company's Current Report on Form 8-K, filed on May 7, 2003 is incorporated herein by reference.

18

WAVE SYSTEMS CORP.

AMENDED AND RESTATED 1994 EMPLOYEE STOCK OPTION PLAN

I. PURPOSE

Wave Systems Corp. (the "Company") desires to afford certain directors, officers and other key employees of the Company and its subsidiaries who are responsible for the continued growth of the Company an opportunity to acquire a proprietary interest in the Company, and thus to create in such persons interest in and a greater concern for the welfare of the Company.

The stock options offered pursuant to this 1994 Stock Option Plan (the "Plan") are a matter of separate inducement and are not in lieu of any salary or other compensation for services.

The Company, by means of the Plan, seeks to retain the services of persons now holding key positions and to secure the services of persons capable of filling such positions.

The options granted under the Plan may be designated as either incentive stock options ("Incentive Options") within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or options that do not meet the requirements for Incentive Options ("Non-Qualified Options") but the Company makes no warranty as to the qualification of any option as an Incentive Option.

II. AMOUNT OF STOCK SUBJECT TO THE PLAN

The total number of shares of Class A common stock of the Company which may be purchased pursuant to the exercise of options granted under the Plan shall not exceed, in the aggregate, 15,500,000 shares of the authorized Class A common stock, $0.01 par value, per share, of the Company (the "Shares").

Shares, which may be acquired under the Plan, may be either authorized but unissued Shares or Shares of issued stock held in the Company's treasury, or both, at the discretion of the Company. If and to the extent that options granted under the Plan expire or terminate without having been exercised, new options may be granted with respect to the Shares covered by such expired or terminated option, provided that the grant and the terms of such new options shall in all respects comply with the provisions of the Plan.

III. ADMINISTRATION

The Board of Directors of the Company (the "Board of Directors") shall designate from among its members an option committee (the "Committee") to administer the Plan. The Committee shall consist of no fewer than three (3) members of the Board of Directors, each of whom shall be a "disinterested person" within the meaning of Rule 16b-3 (or any successor rule or regulation) promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Any or all powers and functions of the Committee may at any time and from time to time be exercised by the Board of Directors; provided, however, that, with respect to the participation in the Plan by persons who are members of the Board of Directors, such powers and functions of the Committee may be exercised by the Board of Directors only if, at the time of such exercise, all of the members of the Board of Directors acting in the particular matter, are "disinterested persons" within the meaning of Rule 16b-3 (or any successor rule or regulation).

Subject to the express provisions of the Plan, the Board of Directors or the Committee, as the case may be, shall have authority, in its discretion, to determine the persons to whom options shall be granted, the time when such options shall be granted, the number of Shares which shall be subject to each option, the purchase price of each Share which shall be subject to each option, the period(s) during which such options shall be exercisable (whether in whole or in part) and the other terms and provisions thereof. Each option granted under the Plan shall be evidenced by an agreement duly

executed on behalf of the Company. Each such agreement shall comply with and be subject to the terms and conditions of the Plan. Any such agreement may contain such other terms and conditions not inconsistent with the Plan as may be determined by the Board of Directors or the Committee, as the case may be.

Subject to the express provisions of the Plan, the Board of Directors or the Committee, as the case may be, also shall have authority to construe the Plan and options granted thereunder, to amend the Plan and options granted thereunder, to prescribe, amend and rescind rules and regulations relating to the Plan, to determine the terms and provisions of the respective options (which need not be identical) and to make all other determinations necessary or advisable for administering the Plan.

The determination of the Board of Directors or the Committee, as the case may be, on matters referred to in this Article III shall be conclusive.

The Board of Directors or the Committee, as the case may be, may employ such legal counsel, consultants and agents as it may deem desirable for the administration of the Plan and may rely upon any opinion received from any such counsel or consultant and any computation received from any such consultant or agent. Expenses incurred by the Board of Directors or the Committee in the engagement of such counsel, consultant or agent shall be paid by the Company. No member or former member of the Committee or of the Board of Directors shall be liable for any action or determination made in good faith with respect to the Plan or any option granted hereunder.

IV. ELIGIBILITY

Options may be granted only to directors, officers and key employees of the Company and its subsidiaries who are not members of the Committee; provided, that no person shall be eligible for any award if the granting of such award to such person would prevent the satisfaction by the Plan of the general exemptive conditions of Rule 16b-3. The term "key employees" shall include executives, supervisors, personnel and consultants and other employees of the Company or a subsidiary of the Company. No employee shall be granted stock options covering more than 100,000 Shares in any fiscal year of the Company (subject to adjustment as provided in Article XI).

An Incentive Option shall not be granted to any person who, at the time the option is granted, owns stock of the Company or any subsidiary or parent of the Company possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or of any subsidiary or parent of the Company (a "10% Shareholder") unless (i) the option price is at least one hundred ten percent (110%) of the fair market value per share (as defined in Article VI) of the stock subject to the option and (ii) the option is not exercisable after the fifth anniversary of the date of grant of the option. In determining stock ownership of an employee, the rules of Section 424(d) of the Code shall be applied, and the Board of Directors or the Committee, as the case may be, may rely on representations of fact made to it by the employee and believed by it to be true.

V. MAXIMUM ALLOTMENT OF INCENTIVE OPTIONS

If the aggregate fair market value of stock with respect to which Incentive Options are exercisable for the first time by an employee during any calendar year (under all stock option plans of the Company and any parent or any subsidiary of the Company) exceeds $100,000, any options which otherwise qualify as Incentive Options, to the extent of the excess, will be treated as Non-Qualified Options.

VI. OPTION PRICE AND PAYMENT

The price per Share under any option granted hereunder shall be such amount as the Board of Directors or the Committee, as the case may be, shall determine but, subject to Article IV above, such

2

price shall not be less than one hundred percent (100%) of the fair market value of the Shares subject to such option, as determined in good faith by the Board of Directors or the Committee, as the case may be, at the date the option is granted.

If the Shares are listed on a national securities exchange in the United States on the date any option is granted, the fair market value per Share shall be deemed to be the average of the high and low quotations at which such Shares are sold on such national securities exchange in the United States on the date next preceding the date upon which the option is granted, but if the Shares are not traded on such date, or such national securities exchange is not open for business on such date, the fair market value per Share shall be determined as of the closest preceding date on which such exchange shall have been open for business and the Shares were traded. If the Shares are listed on more than one national securities exchange in the United States on the date any such option is granted, the Committee shall determine which national securities exchange shall be used for the purpose of determining the fair market value per Share. If the Shares are not listed on a national securities exchange but are reported on the National Association of Securities Dealers Automated Quotation System ("NASDAQ"), the fair market value per share shall be deemed to be the average of the high and low prices on the date next preceding the date upon which the option is granted as reported by NASDAQ.

For purposes of this Plan, the determination by the Board of Directors or the Committee, as the case may be, of the fair market value of a Share shall be conclusive.

VII. TERM OF OPTIONS AND LIMITATIONS ON THE RIGHT OF EXERCISE

The term of each option will be for such period as the Board of Directors or the Committee, as the case may be, shall determine, provided that, except as otherwise provided herein, in no event may any option granted hereunder be exercisable more than ten (10) years from the date of grant of such option (five years in the case of an Incentive Option granted to a 10% Shareholder). Each option shall become exercisable in such installments and at such times as may be designated by the Board of Directors or the Committee, as the case may be, and set forth in the agreement related to the grant of options. To the extent not exercised, installments shall accumulate and be exercisable, in whole or in part, at any time after becoming exercisable, but not later than the date the option expires.

The Board of Directors or the Committee, as the case may be, shall have the right to accelerate, in whole or in part, from time to time, conditionally or unconditionally, rights to exercise any option granted hereunder.

To the extent that an option is not exercised within the period of exercisability specified therein, it shall expire as to the then unexercised part.

VIII. EXERCISE OF OPTIONS

- (a)