QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Wave Systems Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

WAVE SYSTEMS CORP.

480 Pleasant Street

Lee, Massachusetts 01238

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 23, 2005

TO THE STOCKHOLDERS OF WAVE SYSTEMS CORP.:

Notice is hereby give that the 2005 Annual Meeting of Stockholders of Wave Systems Corp. (the "Company") will be held at 4 p.m. on Monday, May 23, 2005 at The New York Helmsley Hotel, 212 East 42nd Street, New York, New York, for the following purposes:

1. To re-elect John E. Bagalay, Jr., Nolan Bushnell, George Gilder, John E. McConnaughy, Jr. and Steven Sprague as directors of the Company to hold office until the next Annual Meeting and until their successors are duly elected and qualified;

2. To consider and act upon a proposed amendment to the Company's Restated Certificate of Incorporation to increase the number of authorized shares of Class A Common Stock that the Company is authorized to issue from 120,000,000 to 150,000,000;

3. To ratify the action of the Board of Directors in establishing the 2004 Employee Stock Purchase Plan;

4. To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on April 11, 2005 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting of Stockholders and at any adjournments or postponements thereof.

| | | By Order of the Board of Directors, |

|

|

|

| | | Gerard T. Feeney

Secretary |

Lee, Massachusetts

April 27, 2005 | | |

YOUR VOTE IS IMPORTANT

If you do not expect to attend the Annual Meeting, or if you do plan to attend but wish to vote by proxy, please complete, sign, date and return promptly the enclosed proxy card in the enclosed postage-paid envelope.

WAVE SYSTEMS CORP.

480 Pleasant Street

Lee, Massachusetts 01238

PROXY STATEMENT

2005 ANNUAL MEETING OF STOCKHOLDERS

to be held on May 23, 2005

General

This Proxy Statement is being furnished to the holders of the common stock, $.01 par value per share (the "Common Stock") of Wave Systems Corp., a Delaware corporation (the "Company"), in connection with the solicitation by the Board of Directors of proxies for use at the 2005 Annual Meeting of Stockholders to be held on, May 23, 2005 (the "Annual Meeting") commencing at 4 p.m., at The New York Helmsley Hotel, 212 East 42nd Street, New York, New York, and at any adjournments or postponements thereof. The matters to be considered and acted upon at the meeting are described below in this Proxy Statement.

The principal executive offices of the Company are located at 480 Pleasant Street, Lee, Massachusetts 01238. The approximate mailing date of this Proxy Statement and the accompanying proxy is May 2, 2005.

Voting Rights and Votes Required

Only stockholders of record at the close of business on April 11, 2005 will be entitled to notice of, and to vote at, the Annual Meeting. As of such record date, the Company had outstanding 80,866,707 shares of Class A Common Stock and 175,725 shares of Class B Common Stock. Each stockholder is entitled to one vote for each share of Common Stock held on the matters to be considered at the Annual Meeting. The holders of a majority of the outstanding shares of Common Stock will constitute a quorum for the transaction of business at the meeting. Shares of Common Stock present in person, or represented by proxy (including shares of Common Stock, which abstain or do not vote, with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the meeting.

The affirmative vote of the holders of a plurality of the shares of Common Stock present or represented at the meeting is required for the election of directors. The affirmative vote of a majority of the total votes present in person or by proxy and entitled to vote at the Annual Meeting is required for ratification of the action of the Board of Directors in establishing the 2004 Employee Stock Purchase Plan. The affirmative vote of the holders of the majority of shares of Common Stock entitled to vote at the Annual Meeting is required for the approval of the proposal to amend the Restated Certificate of Incorporation of the Company.

Abstentions with regard to the election of the nominees for director will be excluded entirely from the vote and will have no effect on the outcome. Abstentions with regard to the ratification of the action of the Board of Directors in establishing the 2004 Employee Stock Purchase Plan and the approval of the proposal to amend the Restated Certificate of Incorporation of the Company will be treated as shares of Common Stock that are present and entitled to vote for purposes of determining the number of shares of Common Stock present and entitled to vote with respect to such matters, but will not be counted as a vote in favor of such matters. Accordingly, an abstention from voting on either of such matters will have the same legal effect as a vote against such matters. If a broker or nominee holding stock in "street name" indicates on the proxy that it does not have discretionary authority to vote as to a particular matter, including the 2004 Employee Stock Purchase Plan, those shares of Common Stock will not be considered as present and entitled to vote with respect to such matter.

The accompanying proxy may be revoked at any time before it is exercised by giving a later proxy, notifying the Secretary of the Company in writing, or voting in person at the meeting.

STOCKHOLDERS OF THE COMPANY ARE REQUESTED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. SHARES OF COMMON STOCK REPRESENTED BY A PROPERLY EXECUTED PROXY RECEIVED PRIOR TO THE VOTE AT THE ANNUAL MEETING AND NOT REVOKED WILL BE VOTED AT THE ANNUAL MEETING AS DIRECTED BY THE PROXY. IT IS NOT ANTICIPATED THAT ANY MATTERS OTHER THAN THOSE SET FORTH IN THE PROXY STATEMENT WILL BE PRESENTED AT THE ANNUAL MEETING. IF OTHER MATTERS ARE PRESENTED, PROXIES WILL BE VOTED IN ACCORDANCE WITH THE DISCRETION OF THE PROXY HOLDERS.

The Company's Annual Report, including financial statements for the fiscal year ended December 31, 2004, has been mailed to stockholders concurrent with the mailing of this Proxy Statement. The Annual Report, however, is not part of the proxy solicitation material.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information about securities authorized for issuance under the Company's equity compensation plans.

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a)

| | Weighted average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 12,282,056 | | $ | 3.88 | | 5,955,897 |

The Company's equity compensation plans not approved by security holders |

|

508,250 |

|

|

1.16 |

|

2,666,115 |

| | |

| |

| |

|

Total Company plans |

|

12,790,306 |

|

$ |

3.77 |

|

8,622,012 |

Wavexpress equity compensation plans not approved by security holders(1) |

|

1,302,829 |

|

$ |

1.21 |

|

1,169,394 |

- (1)

- The Wavexpress equity compensation plan provides grants of options to purchase shares of Wavexpress common stock. Accordingly, the Wavexpress equity plans have no dilutive effect on the existing shareholders of Wave.

The Company's equity compensation plans not approved by security holders are comprised of the following:

In November 2004, the Board of Directors approved an Employee Stock Purchase Plan (the "Plan") which will be voted on by security holders at the Annual Meeting scheduled in May 2005. The purpose of the Plan is to provide employees of the Company with an opportunity to purchase Class A Common Stock of the Company at a purchase price equal to 85% of the Fair Market Value of a Share on the Offering Commencement Date or on the Offering Termination Date, whichever is lower. Each Offering Period will begin on December 1 or June 1 and end on the next following May 31 or November 30, respectively. For the current Offering Period, the Fair Market Value on December 1, 2004 was $0.90 per share (that day's closing price). After calculating the estimated current Offering

2

Period employee contributions by 85% of $0.90, approximately 333,885 shares of common stock are expected to be purchased on May 31 2005.

In connection with an agreement that the Company entered into with nClose, Inc., an outside software development firm, on January 2, 2004 the Company issued a warrant to purchase 30,000 shares of Class A Common Stock at an exercise price of $1.00 per share, pursuant to an individual compensation plan with nClose. Also, in connection with the same agreement, on April 30, 2004 an additional warrant was issued to nClose, Inc. to purchase 35,000 shares of Class A Common Stock at an exercise price of $1.00 per share. The warrants are currently exercisable and expire on January 2, 2009 and April 30, 2009, respectively. No additional warrants are required to be granted pursuant to the individual compensation plan for nClose.

In connection with an agreement that Wave entered into with an outside sales representative, in 2003 Wave issued warrants to purchase 44,365 shares of Class A Common Stock at prices ranging from $0.95 to $1.45 per share, pursuant to an individual compensation plan with the sales representative. No additional warrants are required to be granted pursuant to the individual compensation plan for the sales representative. These warrants are currently exercisable and expire January 1, 2013 through April 30, 2013.

In connection with a software development agreement that Wave entered into with Archon Technologies, Inc. ("Archon"), Wave issued to Archon a warrant to purchase 50,000 shares of Class A Common Stock at $3.48 per share, pursuant to an individual compensation plan with Archon (the "Archon Plan"). The warrant became exercisable on November 9, 2002, and expires on November 9, 2007. No additional warrants are required to be granted pursuant to the Archon Plan.

As a result of the successful placement of 350 shares of Series B preferred stock, in 1996 a consultant from Digital Media Group, Inc. ("Digital Media") was issued warrants by Wave to purchase 15,000 shares of Class A Common Stock at a price of $3.09 per share, pursuant to an individual compensation plan with Digital Media (the "Digital Media Plan"). No additional warrants are required to be granted pursuant to the Digital Media Plan. These warrants are currently exercisable and expire on March 1, 2006.

The following table sets forth certain information concerning the beneficial ownership of the Company's Class A and Class B Common Stock as of April 7, 2005 (except as otherwise noted) by (i) each stockholder who is known by the Company to own beneficially more than five percent of the outstanding Class A or Class B Common Stock, (ii) each director of the Company, (iii) each of the executive officers of the Company named in the Summary Compensation Table below, and (iv) all directors and executive officers of the Company as a group. Holders of Class A Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders of the Company. Holders of Class B Common Stock are entitled to one vote per share on all matters submitted to a vote of the stockholders, except that holders of Class B Common Stock will have five votes per share in cases where one or more directors are nominated for election by persons other than the Company's Board of Directors and where there is a vote on any merger, consolidation or other similar transaction, which is not recommended by the Company's Board of Directors. In addition, holders of Class B Common Stock will have five votes per share on all matters submitted to a vote of the stockholders in the event that any person or group of persons acquires beneficial ownership of 20% or more of the

3

outstanding voting securities of the Company. Shares of Class B Common Stock are convertible into shares of Class A Common Stock on a one-for-one basis at the option of the holder.

Beneficial Owner(1)

| | Number of Shares

of Class A

Common Stock

Owned(2)

| | Percent

of

Class

| | Number of Shares

of Class B

Common Stock

Owned

| | Percent

of

Class

| | Percent of All

Outstanding Common

Stock(3)

|

|---|

| Steven Sprague(4) | | 2,350,326 | | 2.8 | | 42,102 | | 24.0 | | 2.8 |

| John E. Bagalay, Jr.(5) | | 146,000 | | * | | 0 | | * | | * |

| Nolan Bushnell(6) | | 62,000 | | * | | 0 | | 1.1 | | * |

| George Gilder(7) | | 253,000 | | * | | 2,000 | | * | | * |

| John E. McConnaughy, Jr.(8) | | 187,250 | | * | | 0 | | * | | * |

| Gerard T. Feeney(9) | | 985,000 | | 1.2 | | 0 | | * | | 1.2 |

| All executive officers and directors as a group (6 persons)(10) | | 3,983,576 | | 4.7 | | 44,102 | | 25.1 | | 4.7 |

- *

- Less than one percent.

- (1)

- Each individual has sole voting and investment power, except as otherwise indicated.

- (2)

- Includes shares of Class A Common Stock issuable upon the conversion of Class B Common Stock.

- (3)

- In circumstances where the Class B Common Stock has five votes per share, the percentages of total voting power would be as follows: Steven Sprague, 3.0%; John E. Bagalay, Jr., less than 1%; Nolan Bushnell, less than 1%; George Gilder, less than 1%; John E. McConnaughy, Jr., less than 1%; Gerard T. Feeney, 1.2%, and all Executive Officers and directors as a group, 4.9%.

- (4)

- Includes 1,996,172 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days. Also includes 37,102 shares of Class B Common Stock held in trust for the benefit of Mr. Steven Sprague's family, and for which Mr. Steven Sprague is a trustee, 7,000 shares of Class A Common Stock held jointly by Mr. Sprague and his spouse, Judith Sprague and 223,500 shares of Class A Common Stock beneficially owned by Mr. Sprague through a limited partnership under which Mr. Sprague shares voting and investment rights with Mr. Peter J. Sprague, Chairman and CEO of Wavexpress and other members of Mr. Sprague's immediate family. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (5)

- Includes 142,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (6)

- Includes 62,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (7)

- Includes 222,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (8)

- Includes 60,000 shares of Class A Common Stock that are subject to options presently exercisable. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

4

- (9)

- Includes 885,000 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days. The beneficial owner's mailing address is c/o Wave Systems Corp., 480 Pleasant Street, Lee, MA 01238.

- (10)

- Includes 3,367,172 shares of Class A Common Stock that are subject to options presently exercisable or exercisable within 60 days.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, five directors are to be elected, each to hold office until the next annual meeting of stockholders and until his respective successor has been duly elected and qualified. If no direction is given to the contrary, all proxies received by the Board of Directors will be voted "FOR" the election as directors of each of the following nominees. In the event that any nominee declines or is unable to serve, the proxy solicited herewith may be voted for the election of another person in his stead at the discretion of the proxies. The Board of Directors has no reason to believe that any of the nominees will not be available to serve. Set forth below is the name and age of each nominee, their position with the Company, if any, the year in which each first became a director, the principal occupation and employment of each over the last five years and other directorships, if any. Each nominee is currently a director of the Company.

The Board of Directors recommends that the Stockholders vote "FOR"the election of each of the nominees.

Information Regarding the Nominees for Director

Name

| | Age

| | Business Experience and Principal Occupation or

Employment During Past 5 Years; Positions held with Wave

Systems Corp.; Other Directorships

| | Director

Since

|

|---|

| John E. Bagalay, Jr., Ph.D.(1)(2)(3)(4) | | 71 | | Chairman of the Company since March 2003; Director of Special Projects in the Life Sciences at the Boston University Technology Commercialization Institute since November 2003; Senior Advisor to the Chancellor of Boston University from January 1998 to November 2003; Chief Executive Officer of Eurus Technologies, Inc., from January 1999 to December 1999 and Chief Financial Officer of Eurus International, Limited (formerly known as Eurus Technologies, Inc.) since January 1999; President and CEO of Cytogen Corporation from January 1998 to January 1999 and Chief Financial Officer from October 1997 to September 1998; former General Counsel of Lower Colorado River Authority, Texas Commerce Bancshares, Inc. and Houston First Financial Group; Director of Cytogen Corporation. Mr. Bagalay's term as director expires in 2005. | | 1993 |

Nolan Bushnell(3) |

|

62 |

|

Chairman, Chief Executive Officer and director of uWink, Inc. since December 1999, where he is involved in the development of streaming media distribution models for Internet entertainment. Mr. Bushnell's term as director expires in 2005. |

|

1999 |

| | | | | | | |

5

George Gilder(4) |

|

65 |

|

Chairman of the Executive Committee of the Company since 1996; Senior Fellow at the Discovery Institute in Seattle, Washington; author of several books, includingLife After Television, Microcosm, The Spirit of Enterprise, Wealth and Povertyand most recentlyTelecosm; contributing editor toForbes Magazine; Chairman of Gilder Technology Group, Inc. (publisher of monthly technology reports); former chairman of the Lehrman Institute Economic Roundtable; former Program Director for the Manhattan Institute; recipient of White House award for Entrepreneurial Excellence from President Reagan. Mr. Gilder's term as director expires in 2005. |

|

1993 |

John E. McConnaughy, Jr.(1)(2)(3)(4)(5) |

|

76 |

|

Chairman and Chief Executive Officer of JEMC Corporation; Director of Levcor International, Inc., Allis Chalmers Energy, Inc., Positron Corp., Overhill Farms, Inc. and Consumer Portfolio Services, Inc. Mr. McConnaughy is also Chairman of the Board of Trustees of the Strang Clinic and the Chairman Emeritus of the Board of the Harlem School of the Arts. Mr. McConnaughy's term as director expires in 2005. |

|

1988 |

Steven Sprague |

|

41 |

|

President and Chief Executive Officer of the Company since March 2000; President and Chief Operating Officer of the Company from May 1996 to March 2000; Chief Executive Officer of Wavexpress from July 2001 until March 2003, Chairman of the Board of Directors of Wavexpress, from October 1999 until March 2003, director of Wavexpress and Vice President and director of Specialty Broadcast Networks, Inc. |

|

1997 |

Biographical Information Regarding Executive Officer Who Is Not a Director

Name

| | Age

| | Business Experience and Principal Occupation or

Employment During Past 5 Years; Positions held with

Wave Systems Corp.; Other Directorships

| | Officer

Since

|

|---|

| Gerard T. Feeney | | 46 | | Secretary of the Company since February 1999; Senior Vice President of Finance and Administration and Chief Financial Officer of the Company since June 1998; Vice President of Finance and Operations and Chief Financial Officer of Xionics Document Technologies, Inc., from 1991 to 1998. | | 1998 |

- (1)

- Member of Nominating Committee.

- (2)

- Member of Compensation Committee.

6

- (3)

- Member of Audit Committee.

- (4)

- Member of Executive Committee.

- (5)

- Independent Audit Committee financial expert.

The Board of Directors and Its Committees

The Board of Directors met six times during 2004. Nolan Bushnell missed three of the six meetings of the Board of Directors, and also missed three of the six audit committee meetings. All other board and committee members attended at least 75% of board and committee meetings. The Board Committees include a separately-designated standing Audit Committee, a Compensation Committee, a Nominating Committee and an Executive Committee. The Company strongly encourages each director to attend the Annual Meeting. Four of the Company's directors attended the 2004 Annual Meeting of Stockholders.

The members of the Audit Committee are Messrs. McConnaughy, Bagalay and Bushnell, each of whom is independent, as independence is defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards and free from relationships that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment as a committee member. The Board of Directors has determined that the Audit Committee has at least one financial expert. Mr. McConnaughy is a financial expert and is independent, as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act of 1934, as amended (the "Exchange Act"). The Audit Committee reviews the services provided by the Company's independent auditors, consults with the independent auditors on audits and proposed audits of the Company, and reviews the need for internal auditing procedures and the adequacy of the Company's internal control systems. In 2004, the Audit Committee held six meetings.

The members of the Compensation Committee are Messrs. McConnaughy and Bagalay. The Compensation Committee administers the Company's stock option plans, reviews and recommends compensation levels of the Company's executive officers. In 2004, the Compensation Committee held two meetings.

The members of the Nominating Committee are Messrs. Bagalay and McConnaughy, each of whom is independent, as independence is defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards. The Nominating Committee establishes procedures for identifying potential candidates for appointment or election as directors, reviews and makes recommendations regarding the criteria for Board membership, and proposes nominees for election at the annual meetings and candidates to fill Board vacancies. The procedures for identifying potential candidates include soliciting recommendations from the Board of Directors as well as from other sources familiar with the Company's industry and then researching the background and experience of such recommendations. In identifying candidates to recommend for election to the Board of Directors, the Nominating Committee considers the following criteria (i) personal and professional integrity, ethics and values, (ii) experience in corporate governance, (iii) experience in the Company's industry, (iv) experience as a board member of another public company, and (v) practical and mature business judgment. The Nominating Committee will consider recommendations for nominees from any stockholder who is entitled to vote for the election of directors. Stockholders should send recommendations of candidates for nomination for the 2006 slate of directors, in writing, no later than

7

December 31, 2005, to the Company's Secretary, 480 Pleasant Street, Lee, Massachusetts 01238. Recommendations must be accompanied by the consent of the individual being recommended to be nominated, to be elected and to serve. The Nominating Committee evaluates nominees made by stockholders the same way it does any other nominees, as described above. The Nominating Committee has a charter. The charter can be found on the Company's Internet website atwww.wave.com. The submission also should include a statement of the candidate's business experience and other business affiliations. In 2004, the Nominating Committee held one meeting.

Stockholders may send communications to the Board of Directors by mail to the Chairman of the Board, c/o Wave Systems Corp., 480 Pleasant Street, Lee, Massachusetts 01238. Each communication will then be presented to the entire Board of Directors at the next meeting of the Board of Directors.

The members of the Executive Committee are Messrs. Bagalay, Gilder and McConnaughy. The Executive Committee assists the Chairman of the Company in the absence of a meeting of all members of the Board of Directors. The Executive Committee brings material matters to the attention of the Board of Directors and prepares the deliberation process of the Board of Directors, thus accelerating vital decisions for the Company. However, the Board of Directors did not delegate its full power to the Executive Committee and asked that the Executive Committee include all members of the Board of Directors in major decisions affecting the Company. In 2004, the Executive Committee held no meetings.

Director Compensation

Under the Company's compensation arrangement for its directors, each director who is not an employee of the Company received cash compensation of $30,000 for serving on the Board of Directors in 2004 and was paid $1,000 for each meeting attended. In addition, each director who served on the Audit and/or Compensation Committees received an additional $5,000 for each committee upon which he served. The Chairman of the Board of Directors received an additional $15,000, over and above his director and committee fees for serving in such capacity for 2004.

Under the Company's Non-Employee Directors Stock Option Plan, each director who is not an employee of the Company receives an initial grant of options to purchase 12,000 shares of Class A Common Stock at the time the director is appointed to the Board of Directors and an annual grant to purchase 10,000 shares of Class A Common Stock at fair market value upon re-election after the annual meeting of the stockholders. Options granted pursuant to the Non-Employee Directors Stock Option Plan vest the day following the grant, and terminate upon the earliest to occur of (i) three months after the optionee ceases to be a director of the Company, (ii) one year after the death or disability of the optionee and (iii) ten years after the date of grant. If there is a change of control of the Company, all outstanding stock options will become immediately exercisable. Each director was granted options to purchase 10,000 shares of the Company's Class A Common Stock, under the Non-Employee Directors Stock option plan during 2004.

8

AUDIT COMMITTEE REPORT

The audit committee is governed by a written charter adopted by the Board of Directors.

Report to Stockholders

The Audit Committee met with members of the Company's management team and independent auditors to review and discuss the audited financial statements, as well as the unaudited quarterly financial statements. The Audit Committee received from the independent auditors, disclosures regarding the auditors' independence required by Independence Standard No. 1. In addition, the Audit Committee discussed with the auditors the auditors' independence and other matters required to be discussed by Statement on Auditing Standards No. 61. Based on the foregoing meetings and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K.

Aggregate fees billed to the Company for the annual audit and the quarterly reviews of the consolidated financial statements for the fiscal years ended December 31, 2004 and 2003 totaled $239,600 and $206,333, respectively. Aggregate fees billed to the Company for the audit of the Company's internal controls over financial reporting for the fiscal years ended December 31, 2004 and 2003 totaled $140,000 and $0, respectively.

Aggregate fees billed to the Company for services rendered by the Company's independent accountants for audit-related services for calendar year 2004 were $52,360 and $79,567 for calendar year 2003. Audit-related services consisted of audits of the financial statements of the Company's employee benefit plans, review of registration statements and issuance of consents. All audit-related services were approved in advance by the Company's audit committee.

Fees for tax services billed to the Company by its independent auditors totaled $26,800 for the calendar year 2004 and $26,850 for calendar year 2003. Tax services consisted of completion of the Company's federal and state tax returns. All tax services were approved in advance by the Company's audit committee.

There were no other services provided by the independent auditors.

The Audit Committee's policies and procedures with respect to all services provided by its independent auditors require pre-approval of such services pursuant to a written engagement letter. Services may not commence until such an engagement letter is signed by the chairman of the Audit Committee, or alternatively approved by a quorum of the Audit Committee.

The Audit Committee believes that the provision of non-audit services during the 2004 fiscal year does not affect the accountants' ability to maintain independence with respect to the Company.

| | | Audit Committee |

|

|

John E. McConnaughy, Jr.

John E. Bagalay, Jr.

Nolan Bushnell |

9

EXECUTIVE COMPENSATION

The following table sets forth information with respect to the compensation paid or awarded by the Company to the Chief Executive Officer and the other executive officers whose cash compensation exceeded $100,000. (collectively, the "Named Executive Officers") for services rendered in all capacities during 2004, 2003 and 2002.

| |

| |

| |

| | Long-Term

Compensation Awards

|

|---|

| |

| | Annual Compensation

|

|---|

Name and Principal Position

| |

| | Number of Shares

Underlying

Options(#)

|

|---|

| | Year

| | Salary($)

| | Bonus($)

|

|---|

Steven Sprague(1)

President and Chief Executive Officer | | 2004

2003

2002 | | 250,000

250,000

250,000 | | 168,750

200,000

161,500 | | 262,500

225,000

252,500 |

Gerard T. Feeney(2)

Senior Vice President, Chief Financial Officer and Secretary |

|

2004

2003

2002 |

|

185,000

185,000

185,000 |

|

35,000

281,399

102,000 |

|

162,750

135,000

150,000 |

- (1)

- Mr. Steven Sprague was elected President and Chief Executive Officer of the Company on June 26, 2000. Previously, Mr. Sprague was President and Chief Operating Officer of the Company from May 23, 1996 until he was elected Chief Executive Officer.

- (2)

- Mr. Gerard T. Feeney was hired as Senior Vice President, Finance and Administration and Chief Financial Officer on June 8, 1998 and was elected Secretary on February 25, 1999. Mr. Feeney's bonus of $281,399 that was paid in 2003 was used to pay off his outstanding loan with the Company.

10

The following table sets forth certain information regarding options granted during the fiscal year ended December 31, 2004, by the Company to the Named Executive Officers.

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1)

|

|---|

| | Number of

Shares

Underlying

Options

Granted(#)

| |

| |

| |

|

|---|

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Steven Sprague | | 225,000 | | 9.6 | % | $ | 1.68 | | 1/02/14 | | 237,722 | | 602,435 |

| Steven Sprague | | 37,500 | | 1.6 | % | | 0.81 | | 11/15/14 | | 19,103 | | 48,410 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 262,500 | | 11.2 | % | | | | | | 256,825 | | 650,845 |

Gerard T. Feeney |

|

135,000 |

|

5.8 |

% |

$ |

1.68 |

|

1/02/14 |

|

142,633 |

|

361,461 |

| Gerard T. Feeney | | 27,750 | | 1.2 | % | | 0.81 | | 11/15/14 | | 14,136 | | 35,823 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 162,750 | | 7.0 | % | | | | | | 156,769 | | 397,284 |

- (1)

- The potential realizable value of the options reported above was calculated by assuming 5% and 10% compounded annual rates of appreciation of the Common Stock from the date of grant of the options until the expiration of the options, based upon the market price on the date of grant. These assumed annual rates of appreciation were used in compliance with the rules of the Securities and Exchange Commission and are not intended to forecast future price appreciation of the Common Stock.

Fiscal Year-End Option Value Table

The following table sets forth information regarding the aggregate number and value of options held by the Named Executive Officers as of December 31, 2004, and the aggregate number and value of options exercised by the Named Executive Officers during 2004.

| |

| |

| | Number of

Shares Underlying

Unexercised Options at December 31, 2004(#)

| | Value of Unexercised

In-the-Money Options at December 31, 2004(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Received(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Steven Sprague | | -0- | | -0- | | 1,996,172 | | 263,333 | | $ | 27,328 | | $ | 22,875 |

| Gerard T. Feeney | | -0- | | -0- | | 885,000 | | 162,750 | | | 12,600 | | | 15,458 |

- (1)

- The last reported bid price for the Company's Class A Common Stock on December 31, 2004 was $1.14 per share. Value is calculated on the basis of the difference between the respective option exercise prices and $1.14, multiplied by the number of shares of Common Stock underlying the respective options.

Employment Contracts

Since November 1998, the Company has had an employment agreement with Steven Sprague that provides that Mr. Sprague shall serve as President and Chief Executive Officer of the Company for consecutive one-year terms unless either party provides written notice to the other of its/his intention not to renew the contract not less than sixty (60) days prior to the expiration of the then current term. The employment agreement provides that Mr. Sprague will be paid a minimum base salary of $185,000 per year, subject to increase from time to time, as determined by action of the Board of Directors upon recommendation by the Compensation Committee. The Board of Directors increased Mr. Sprague's

11

base salary to $250,000 on March 25, 2000. The employment agreement also provides that Mr. Sprague will be entitled to an annual bonus. The annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of President and Chief Executive Officer. See "Report of the Compensation Committee—Base Salaries and Bonuses for 2003." In the event that Mr. Sprague's employment is terminated without cause or in certain other circumstances, Mr. Sprague will be paid a lump sum in an amount equal to three (3) years' annual base salary then in effect, and continue health insurance and other benefits for a period equal to the remaining Term of Employment then in effect. This employment agreement also contains a two-year post termination covenant not to compete.

Since June 1998, the Company also has had an employment agreement with Gerard T. Feeney that provides that Mr. Feeney shall serve as Senior Vice President, Finance and Administration and Chief Financial Officer of the Company for consecutive one- year terms unless either party provides written notice to the other of its/his intention not to renew the contract not less than sixty (60) days prior to the expiration of the then current term. The employment agreement provides that Mr. Feeney will be paid a minimum base salary of $160,000 per year, subject to increase from time to time, as determined by action of the Board of Directors upon recommendation by the Compensation Committee. The Board of Directors increased Mr. Feeney's base salary to $185,000 on January 1, 2000. The employment agreement also provides that Mr. Feeney will be entitled to an annual bonus. The annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of Chief Financial Officer. See "Report of the Compensation Committee—Base Salaries and Bonuses for 2003." In the event that Mr. Feeney's employment is terminated without cause or in certain other circumstances, Mr. Feeney will be paid a lump sum in an amount equal to one year's annual base salary then in effect, and a guaranteed portion of bonus, benefits and similar relocation package. However, in the event Mr. Feeney secures employment elsewhere during the one-year period subsequent to termination, severance pay will stop once employment has begun with the new employer. In addition, Mr. Feeney's options will continue to vest for at least one year from the termination date and for the portion of time greater than one year and up to his next anniversary-vesting period. This employment agreement also contains a two-year post termination covenant not to compete.

Compensation Interlocks and Insider Participation

None of the members of the Compensation Committee of the Company were, or are, officers or employees of the Company, nor was any executive officer of the Company a director or member of the compensation committee of any entity, of which an executive officer or director of such entity served on the Compensation Committee or as a director of the Company. None of the members of the Compensation Committee of the Company had, or have, any relationship with the Company, which would require disclosure under "Certain Relationships and Related Transactions" herein.

Report of the Compensation Committee

General

The Compensation Committee of the Board of Directors is comprised of non-employee directors. The current members of the Compensation Committee are Messrs. McConnaughy and Bagalay. The Compensation Committee reviews and recommends to the Board of Directors compensation levels for the Company's executive officers, and administers the Company's stock option plans including the awarding of grants thereunder.

12

Compensation Philosophy

The goals of the Company's compensation policy are to attract, retain and reward executive officers who contribute to the Company's overall success. The Company attempted to accomplish this goal by offering contractual compensation at the time the executives were hired that was competitive in the security, software and services industries, to motivate executives to achieve the Company's business objectives and to align the interests of officers with the long-term interests of stockholders. The Company has not made such comparisons to the other companies in their industry when evaluating compensation levels since the executives were hired.

Forms of Compensation

The Company provides its executive officers with a compensation package consisting of base salary, fixed and incentive bonuses and participation in benefit plans generally available to other employees. In setting the incentive portion of the compensation, the Compensation Committee considers individual performance and the financial position of the Company. When the fixed portion of the compensation was set in 1998, the Compensation Committee considered market information regarding compensation paid by other emerging companies in the Company's industry. The Compensation Committee has not made such comparisons since the fixed portions of the compensation were set.

Base Salary. Salaries for the Company's executive officers were initially set based on negotiation with individual executive officers at the time of recruitment and with reference to salaries for comparable positions in the Company's industry for individuals of similar education and background to the executive officers being recruited. Salaries are generally reviewed annually by the Compensation Committee and are subject to increases based on the Compensation Committee's determination that the individual's level of contribution to the Company has increased since their salary had last been reviewed.

Bonuses. According to the employment contracts with both the Chief Executive Officer and Chief Financial Officer, the annual bonus is comprised of two portions:fixed andincentive. The fixed portion of the bonus is guaranteed and calculated to be equal to 50% of each year's annual salary. The incentive portion of the bonus is based on proper execution of the role of each officer. Incentive bonus payments to employees other than the Chief Executive Officer are determined subjectively by the Compensation Committee, in consultation with the Chief Executive Officer, based on the employee's performance of his or her responsibilities. The incentive bonus is not based on the Company's financial performance nor are there any stated objectives or stipulations that the employee must meet. The Compensation Committee also looks at the Company's available funds. The Chief Executive Officer's incentive bonus is determined by the Compensation Committee, without participation by the Chief Executive Officer, based on the same factors.

Long-Term Incentives. Longer-term incentives are provided through the Company's stock option plans, which reward executives and other employees through the growth in value of the Company's Common Stock. The Compensation Committee believes that employee equity ownership is highly motivating, provides a major incentive for employees to build stockholder value and serves to align the interests of employees with those of stockholders. Grants of stock options to executive officers are based upon each officer's relative position, responsibilities, historical and expected contributions to the Company, and the officer's existing stock ownership and previous option grants, with primary weight given to the executive officers' relative rank and responsibilities. Initial stock option grants designed to recruit an executive officer to join the Company may be based on negotiations with the officer and with reference to historical option grants to existing officers. Stock options are granted at an exercise price equal to the market price of the Company's Common Stock on the date of grant and will provide value to the executive officers only when the market price of the Common Stock increases over the exercise price.

13

The Company has not established a policy with regard to Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") since the Company has not and does not currently anticipate paying cash compensation in excess of $1 million per annum to any employee. The Company intends to administer its stock option plans in accordance with Section 162(m) of the Code.

Consistent with the provisions of the Sarbanes-Oxley Act of 2002, the Company has adopted a written policy prohibiting future loans to officers and directors.

As part of the Company's compensation policy, the Company awarded a $168,750 bonus to Mr. Steven Sprague, President and Chief Executive Officer, comprised of a fixed bonus portion of $125,000 and an incentive bonus portion of $43,750; and $35,000 to Mr. Gerard T. Feeney, Senior Vice President, Chief Financial Officer and Secretary.

Compensation of the Chief Executive Officer

The Chief Executive Officer received a base salary of $250,000 and a $125,000 fixed portion of a bonus, which was set in his 1998 employment contract, and later adjusted by the Board of Directors. An incentive bonus for $43,750 was paid to the Chief Executive Officer based on his success in developing customer relations that had not existed in the past. The Chief Executive Officer received a grant of 262,500 options. The Compensation Committee believes that Chief Executive Officer's compensation was appropriately based upon his performance.

| | | Respectfully submitted, |

|

|

Compensation Committee |

|

|

John E. McConnaughy, Jr.

John E. Bagalay, Jr. |

Certain Relationships and Related Transactions

Loans Receivable from Director/Officers

Prior to the enactment of the Sarbanes-Oxley Act of 2002, a loan was granted to an officer to allow him to satisfy certain personal financial obligations that would otherwise have required him to liquidate some of his holdings of the Company's shares of Common Stock. All loans to officers were paid in full, resulting in a balance of $0 as of December 31, 2003. Details with respect to the officer loan are as follows:

On March 26, 2001 the Company made a personal loan to Mr. Gerard T. Feeney, Senior Vice President, Chief Financial Officer and Secretary of the Company as evidenced by a demand note for $250,000, which sum was due and payable to the Company on March 26, 2002 and bore interest at a rate per annum equal to 1% over the prime interest rate. Interest on the loan accrued monthly and was payable at maturity. The terms of the loan were substantially equivalent to market terms at that time. The due date of the demand note was subsequently extended until March 26, 2003. As of March 26, 2003 the loan balance, including accrued interest thereon was $281,399. On March 27, 2003, the Compensation Committee approved a bonus in an amount equal to Mr. Feeney's obligations with respect to such loan and accrued interest. Proceeds of this bonus were used to repay the loan and all interest accrued on such loan. The bonus was granted during the year so that Mr. Feeney could repay his loan, rather than at fiscal year-end when bonuses are usually awarded. The factors used in granting this bonus were the amount of the loan, the ability to repay the loan and the impact that non-repayment of the loan would have on Mr. Feeney's abilities to fulfill his duties for the Company.

14

The Company will no longer award bonuses to executive officers or directors in order for them to repay outstanding loans because there are no outstanding loans to any current executive officers or directors and the Sarbanes-Oxley Act of 2002 prohibits any future such loans. The largest aggregate amount outstanding with respect to indebtedness of Mr. Feeney during the year ended December 31, 2003 was $281,399.

Consistent with the provisions of the Sarbanes-Oxley Act of 2002, the Company has adopted a written policy prohibiting future loans to officers and directors (see "Compensation Committee Report" above).

Specialty Broadcast Networks

In August 2001, the Company loaned $150,000 to Specialty Broadcast Networks ("SBN") pursuant to an unsecured convertible term note. SBN's business is to create new video and Internet content networks and aggregate this content into commercially viable web sites and interactive networks. The loan was made to SBN to fund initial operations. The largest aggregate amount due the Company under the note during 2004 was $172,648, including accrued interest of $22,648. The Company also entered into a stock purchase agreement pursuant to which the Company acquired a 50% stake in SBN, for a nominal amount. Steven Sprague is a director and executive officer of SBN. The note bears interest at a rate per annum equal to the prime rate and is convertible into shares of SBN common stock. Interest on the note accrues monthly. As of April 7, 2005 the loan balance, including accrued interest thereon was approximately $174,826. The note together with accrued interest was due and payable no later than April 30, 2004. The Company believes the outstanding loan to be uncollectible at this time. The Company's commitment to make further loans to SBN pursuant to the note expired on February 3, 2002, and the Company has made no further loans to SBN.

Compensation to Related Parties

In March 2003, Mr. Peter Sprague, the founder and former Chairman of the Company, was appointed Chairman and Chief Executive Officer of Wavexpress. Total compensation paid to Mr. Sprague from both Wavexpress and the Company was $175,667, $185,000 and $385,391 for the years ended December 31, 2004, 2003 and 2002, respectively. Mr. Sprague was also granted options to purchase 119,350 shares of Class A Common Stock in 2004 (100,000 shares with a strike price of $1.68 and 19,350 with a strike price of $0.81), options to purchase 180,000 shares of Class A Common Stock in 2003 with a strike price of $1.00 and options to purchase 200,000 shares of Class A Common Stock in 2002 with a strike price of $2.01. In addition, Mr. Sprague received $397,200 in compensation from the exercise of options representing 243,667 shares which were exercised and sold in 2003. Mr. Peter Sprague is the father of the Company's President and Chief Executive Officer, Steven Sprague.

On November 1, 1999, Michael Sprague became an employee of Wavexpress and was paid $150,000, $143,750 and $125,319 for the years ended December 31, 2004, 2003 and 2002, respectively. Michael Sprague was also granted options to purchase 22,500 shares of Class A Common Stock in each of the years ended December 31, 2004 and 2003 with a strike price of $1.68 and $0.81, respectively. Michael Sprague is the brother of Steven Sprague and the son of the Company's founder and former Chairman, Peter Sprague.

15

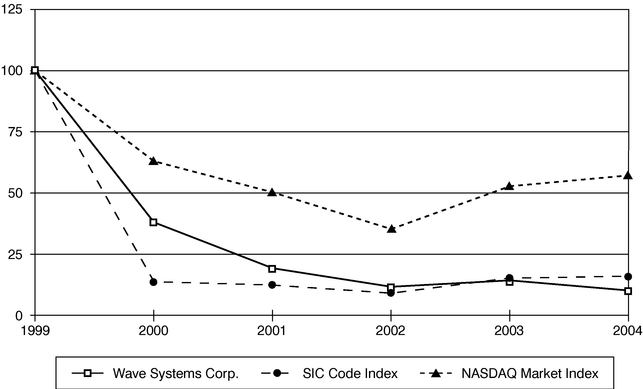

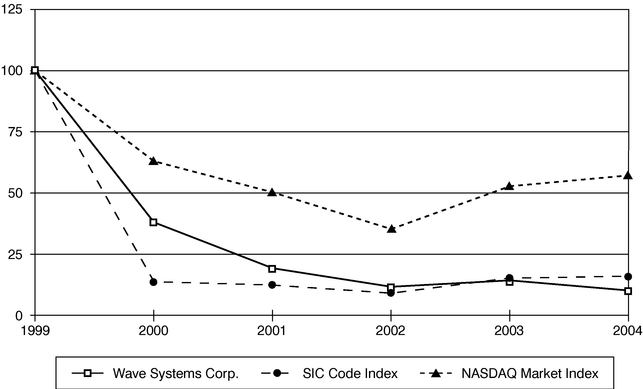

Performance Graph

The following line graph compares the Company's cumulative total return to stockholders with the cumulative total return of the Nasdaq Market Value Index and the Computer Related Services SIC Code Index from December 31, 1999 through December 31, 2004. These comparisons assume the investment of $100 on December 31, 1999 and the reinvestment of dividends. The stock performance on the graph is not necessarily indicative of future stock price performance.

Wave Systems Corp.

Comparison of Cumulative Total Return to Stockholders

December 31, 1999 through December 31, 2004

| | Wave Systems

| | Peer Group

(SIC Code 7379)

| | NASDAQ Market

|

|---|

| 12/31/99 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

| 12/31/00 | | $ | 37.70 | | $ | 13.23 | | $ | 62.85 |

| 12/31/01 | | $ | 18.76 | | $ | 11.80 | | $ | 50.10 |

| 12/31/02 | | $ | 11.14 | | $ | 8.47 | | $ | 34.95 |

| 12/31/03 | | $ | 13.74 | | $ | 14.75 | | $ | 52.55 |

| 12/31/04 | | $ | 9.58 | | $ | 15.47 | | $ | 56.97 |

16

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons owning more than ten percent of a registered class of the Company's equity securities ("Reporting Persons"), to file with the Securities and Exchange Commission (the "Commission") reports of ownership and changes in ownership of equity securities of the Company. Such persons are also required to furnish the Company with copies of all such forms.

Based solely on its review of copies of such forms received by it, the Company believes that, for the year ended December 31, 2004, the Reporting Persons met all applicable Section 16(a) filing requirements.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF CLASS A COMMON STOCK FROM 120,000,000 TO 150,000,000

The Board of Directors recommends that the shareholders approve the proposal to amend the Restated Certificate of Incorporation of the Company to increase the number of authorized shares of Class A Common Stock from 120 million to 150 million shares. At April 7, 2005, 80,866,707 shares of Class A Common Stock were outstanding. There is no proposal to increase the number of shares of Class B Common Stock or Preferred Stock. If the proposed amendment is adopted, the first paragraph of Article Four of the Company's Restated Certificate of Incorporation will be amended to read as follows:

FOURTH. (1) The total number of shares of stock which the Corporation shall have authority to issue is One Hundred Sixty-Five Million (165,000,000) shares divided into the following classes:

(a) One Hundred Fifty Million (150,000,000) shares of Class A Common Stock with a par value of one cent ($0.01) per share;

(b) Thirteen Million (13,000,000) shares of Class B Common Stock with a par value of one cent ($0.01) per share; and

(c) Two Million (2,000,000) shares of Preferred Stock with a par value of one cent ($0.01) per share.

The increase in authorized shares of Class A Common Stock would permit the Company to (i) sell shares of Class A Common Stock for cash, (ii) continue the issuance of additional options, and shares of Class A Common Stock upon exercise thereof, in connection with the Company's Stock Option Plans, and any amendment thereto, and (iii) use the Class A Common Stock for other purposes, without the delay and expense of calling a special meeting of shareholders for such purpose. The Company might also use the additional shares to frustrate a third-party transaction providing an above market premium that is favored by a majority of the independent shareholders. If the proposed increase in the amount of authorized shares of Class A Common Stock is approved, the shares of Class A Common Stock could be issued by action of the Board of Directors, at any time and for any purpose, without the expense and delay of further approval or action by the shareholders, subject to the provisions of the Restated Certificate of Incorporation and other applicable legal requirements. If the proposed increase in the amount of authorized shares of Class A Common Stock is not approved, the Company will not be able to raise additional funds through the sale of it's Class A Common Stock or securities convertible into or exchangeable for Class A Common Stock, as may be required. The Company currently plans to issue shares of Class A Common Stock in connection with the Company's stock option plans. The Company will also attempt to raise additional funds through the sale of Class A Common Stock or securities convertible into or exchangeable for Class A Common Stock by

17

the end of the fiscal year, if possible. There are no current plans or arrangements regarding any offering.

The issuance of additional shares of Class A Common Stock in transactions with current holders of shares of Class A Common Stock or other related parties and under certain circumstances whereby ownership may become concentrated in a related party could have the effect of discouraging or impeding an unfriendly attempt to acquire control of the Company. Shares of Class A Common Stock could be issued to persons, firms or entities known to be more favorable to management, thus creating possible voting impediments and assisting management to retain their positions. Also, the holders of the Company's Class B Common Stock are entitled to five (5) votes per each share in the event there is an attempt to acquire control of the Company. Furthermore, the options that have been granted under each of the Company's compensation plans automatically vest when there is a change of control of the Company. Finally, the Company has blank check preferred, which allows it to issue preferred stock with terms attached that could make the Company an unattractive takeover target. The Board of Directors is unaware of any pending or proposed effort to take control of the Company or to change management and there have been no contacts or negotiations with the Board of Directors in this connection.

Shareholders have no preemptive rights to purchase any additional shares of Class A Common Stock that may be issued. Accordingly, the issuance of additional shares of Class A Common Stock would likely reduce the percentage interest of current shareholders in the total outstanding shares of Common Stock. The terms of the additional shares of Class A Common Stock will be identical to those of the currently outstanding Class A Common Stock.

The financial statements of the Company for the year ended December 31, 2004, supplementary financial information, management's discussion and analysis of financial condition and results of operations, and quantitative and qualitative disclosures about market risk are herby incorporated by reference from the Company's 2004 annual report filed on Form 10-K on March 16, 2005.

RECOMMENDATION AND VOTE

An affirmative vote of the holders of the majority of shares of Common Stock entitled to vote at the Annual Meeting is required for the approval of the proposal to amend the Restated Certificate of Incorporation of the Company to increase the number of authorized shares of Class A Common Stock from 120 million to 150 million shares of Class A Common Stock.

The Board of Directors deems proposal No. 2 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" this proposed amendment to the Restated Certificate of Incorporation.

PROPOSAL NO. 3

2004 EMPLOYEE STOCK PURCHASE PLAN

The Board of Directors approved on November 15, 2004, subject to the ratification by stockholders, the establishment of the 2004 Employee Stock Purchase Plan. The purpose of the Plan is to provide employees of the Company an opportunity to purchase Class A Common Stock of the Company. It is the intention of the Company to have the Plan qualify as an Employee Stock Purchase Plan under Section 423 of the Internal Revenue Code.

Employees can elect to participate in the Plan and have payroll deductions made from each paycheck, in an amount not less than 1 percent (1%) and not greater than fifteen percent (15%) during a six month period (beginning on either June 1 or December 1 and ending on the next November 30 or May 31, respectively). Any person who is employed by the Company (or a designated subsidiary, as determined by the Board of Directors) as of the beginning of any such six month offering period is

18

eligible to participate in the Plan for such period. The applicable percentage for payroll deductions is to be set forth in a subscription agreement between the participant and the Company filed with the Company's payroll office not less than two business days prior to the beginning of the applicable six month offering period. All payroll deductions are to be credited to the employee's account under the Plan. Unless the participant withdraws from the Plan as described below, at the end of each six month period, the accumulated payroll deductions are used to purchase shares of Class A Common Stock at a discount to the fair market value of the Class A Common Stock (85% of the fair market value on the first day of the offering period or the last day of the offering period, whichever is lower (with some exceptions)). Participants are subject to any tax withholdings that may be required by applicable law.

A participant may withdraw all, but not less than all, of the contributions credited to his or her account under the plan at any time prior the last business day of the then current six month offering period (whereupon his or her option for such offering period will be automatically terminated). Upon any termination of a participant's employment, or upon certain significant interruptions in service as an employee, all amounts credited to the participant will be returned to him or her and such employee's participation in the Plan will be terminated. No interest is to accrue on the contributions of a participant in the plan. Participants have no interest or voting rights with respect to any shares covered under the Plan until the option to purchase such shares is exercised in accordance with the provisions of the Plan.

If shares received by a participant are disposed of within two years of the first day of the applicable six month offering period, or within one year after the end of such period, the participant will be treated for federal income tax purposes as having received ordinary compensation income at the time of such disposition in an amount equal to the excess of the fair market value of the shares on the last day of such six month offering period over the total price paid for the shares. The remainder of the gain or loss, if any, will be treated as a capital gain or loss. If a participant disposes of shares after the expiration of such two-year and one-year holding periods, the participant will be treated as having received compensation income only to the extent of an amount equal to the lesser of (a) the excess fair market value of the shares at the time of such disposition over the purchase price paid for such shares and (b) 15% of the fair market value of the shares on the first day of the applicable six month offering period. Participants are advised to consult a tax adviser concerning tax implication of the purchase and sale of stock under the Plan.

The maximum number of shares of Class A Common Stock available under the Plan is 3,000,000, subject to annual increases equal to at least 3,000,000 shares or such other amount determined by the Board of Directors beginning in 2006. Funds received by the Company under the Plan for the purchase of shares of Class A Common Stock can be used for any corporate purpose.

The Plan is effective upon the adoption by the Board of Directors and will continue for a period of 10 years, unless the stockholders of the Company fail to ratify the Plan. The Board of Directors may, at any time and for any reason, terminate or amend the Plan. A copy of the plan is attached hereto.

The Board of Directors deems Proposal No. 3 to be in the best interests of the Company and its shareholders and recommends that the shareholders vote "FOR" approval of the 2004 Employee Stock Purchase Plan.

19

OTHER MATTERS

Representatives of KPMG LLP, the Company's independent public accountants, are expected to be present at the meeting. The representatives will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

As of the date of this Proxy Statement, the Board of Directors does not know of any other matters, which may come before the Annual Meeting. If any other matters properly come before the meeting, the accompanying proxy confers discretionary authority with respect to any such matters, and the persons named in the accompanying proxy intend to vote in accordance with their best judgment on such matters.

All expenses in connection with the solicitation of proxies will be borne by the Company. In addition to this solicitation, officers, directors and regular employees of the Company, without any additional compensation, may solicit proxies by mail, telephone or personal contact. The Altman Group may be retained to assist in the solicitation of proxies for a negotiated fee plus reasonable out-of-pocket expenses. The Company will, upon request, reimburse brokerage houses and other nominees for their reasonable expenses in sending proxy materials to their principals.

The prompt return of your proxy will be appreciated and helpful in obtaining the necessary vote. Therefore, whether or not you expect to attend the Annual Meeting, please sign the proxy and return it in the enclosed envelope.

20

STOCKHOLDER PROPOSALS

Stockholder proposals for inclusion in the proxy materials for the 2006 Annual Meeting should be addressed to the Company's Secretary, Gerard T. Feeney, 480 Pleasant Street, Lee, Massachusetts 01238 and must be received by January 2, 2006. In addition, the Company's By-laws currently require that for business to be properly brought before an annual meeting by a stockholder, regardless of whether included in the Company's proxy statement, the stockholder must give written notice of his or her intention to propose such business to the Secretary of the Company, which notice must be delivered to, or mailed and received at, the Company's principal executive offices not less than sixty (60) days and not more than ninety (90) days prior to the scheduled annual meeting (except that if less than seventy (70) days' notice of the date of the scheduled annual meeting is given, notice by the stockholder may be delivered or received not later than the tenth (10th) day following the day on which such notice of the date of the scheduled annual meeting is given). Such notice must set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting, (ii) the name and address of the stockholder proposing such business, (iii) the class and number of shares of Common Stock which are beneficially owned by the stockholder and (iv) any material interest of the stockholder in such proposal. The By-laws further provide that the chairman of the annual meeting may refuse to permit any business to be brought before an annual meeting without compliance with the foregoing procedures.

| | | By Order of the Board of Directors, |

|

|

|

| | | Gerard T. Feeney

Secretary |

|

|

Wave Systems Corp.

Lee, Massachusetts |

| April 27, 2005 | | |

The Company will provide without charge to each person solicited hereby, upon the written request of any such person, a copy of the Company's Annual Report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission (without exhibits). The Annual Report on Form 10-K is incorporated herein by reference. Requests should be made to Wave Systems Corp., Attention: Mr. Gerard T. Feeney, 480 Pleasant Street, Lee, Massachusetts 01238.

21

WAVE SYSTEMS CORP.

2004 EMPLOYEE STOCK PURCHASE PLAN

The following constitute the provisions of the 2004 Employee Stock Purchase Plan of Wave Systems Corp.

1. Purpose

The purpose of the Plan is to provide employees of the Company and its Designated Subsidiaries with an opportunity to purchase Common Stock of the Company. It is the intention of the Company to have the Plan qualify as an "Employee Stock Purchase Plan" under Section 423 of the Code. The provisions of the Plan shall, accordingly, be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

2. Definitions

2.1. Acquisition means a merger or consolidation of the Company with and into another person or the sale, transfer, or other disposition of all or substantially all of the Company's assets to one or more persons (other than any wholly-owned subsidiary of the Company) in a single transaction or series of related transactions.

2.2. Board means the Board of Directors of the Company.

2.3. Code means the Internal Revenue Code of 1986, as amended.

2.4. Common Stock means the Common Stock, par value $.01 per share, of the Company.

2.5. Company means Wave Systems Corp., a Delaware corporation.

2.6. Compensation means all regular straight time compensation including commissions but shall not include payments for overtime, shift premium, incentive compensation, incentive payments, bonuses and other irregular or infrequent compensation or benefits.

2.7. Continuous Status as an Employee means the absence of any interruption or termination of service as an Employee. Continuous Status as an Employee shall not be considered interrupted in the case of (i) sick leave; (ii) military leave; (iii) any other leave of absence approved by the Administrator,provided, that such leave is for a period of not more than 90 days, unless reemployment upon the expiration of such leave is guaranteed by contract or statute, or unless provided otherwise pursuant to Company policy adopted from time to time; or (iv) in the case of transfers between locations of the Company or between the Company and its Designated Subsidiaries.

2.8. Contributions means all amounts credited to the account of a participant pursuant to the Plan.

2.9. Designated Subsidiaries means the Subsidiaries which have been or will be designated by the Board from time to time in its sole discretion as eligible to participate in the Plan.

2.10. Employee means any person, including an Officer, who is customarily employed for at least 20 hours per week and more than five months in a calendar year by the Company or one of its Designated Subsidiaries.

2.11. Exchange Act means the Securities Exchange Act of 1934, as amended.

2.12. Offering Commencement Date means the first business day of each Offering Period of the Plan.

2.13. Offering Period means any of the periods, generally of six months duration, as set forth in Section 4.

2.14. Officer means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

2.15. Offering Termination Date means the last business day of each Offering Period of the Plan.

2.16. Parent means a parent corporation of the Company, whether now or hereafter existing, as defined by Section 424(a) of the Code.

2.17. Plan means this Employee Stock Purchase Plan.

2.18. Purchase Price means with respect to an Offering Period an amount equal to 85% of the Fair Market Value (as defined in Section 7.2 below) of a Share on the Offering Commencement Date or on the Offering Termination Date, whichever is lower;provided, however, that (i) if there is an increase in the number of Shares available for issuance under the Plan as a result of a stockholder-approved amendment to the Plan, (ii) all or a portion of such additional Shares are to be issued with respect to the Offering Period underway at the time of such increase ("Additional Shares"), and (iii) the Fair Market Value of a Share of Common Stock on the date of such increase (the"Approval Date Fair Market Value") is higher than the Fair Market Value on the Offering Commencement Date for such Offering Period, then in such instance the Purchase Price with respect to Additional Shares shall be 85% of the Approval Date Fair Market Value or the Fair Market Value of a Share of Common Stock on the Offering Termination Date, whichever is lower.

2.19. Securities Act means the Securities Act of 1933, as amended.

2.20. Share means a share of Common Stock, as adjusted in accordance with Section 18 of the Plan.

2.21. Subsidiary means a subsidiary corporation of the Company, whether now or hereafter existing, as defined in Section 424(f) of the Code.

Other terms are defined in the following sections:

Term

| | Section

|

|---|

| Administrator | | 13.2 |

| Fair Market Value | | 7.2 |

| New Offering Termination Date | | 18.2 |

| Reserves | | 18.1 |

3. Eligibility

3.1. Eligible Persons. Any person who is an Employee as of the Offering Commencement Date of a given Offering Period shall be eligible to participate in such Offering Period under the Plan, subject to the requirements of Section 5.1 and the limitations imposed by Section 423(b) of the Code.

3.2. Certain Restrictions. Any provisions of the Plan to the contrary notwithstanding, no Employee shall be granted an option under the Plan (i) if, immediately after the grant, such Employee (taking into account stock which would be attributed to such Employee pursuant to Section 424(d) of the Code) would own capital stock of the Company and/or hold outstanding options to purchase stock possessing five percent or more of the total combined voting power or value of all classes of stock of the Company or of any Parent or Subsidiary of the Company, or (ii) if such option would permit his or her rights to purchase stock under all employee stock purchase plans (described in Section 423 of the Code) of the Company and its Parent or Subsidiaries to accrue at a rate which exceeds Twenty-Five Thousand Dollars ($25,000) of the Fair Market Value (as defined in Section 7.2 below) of such stock (determined at the time such option is granted) for each calendar year in which such option is outstanding at any time.

4. Offering Periods

Each Offering Period will begin on December 1 or June 1 and end on the next following November 30 or May 31, respectively. At any time and from time to time, the Board may change the

2

duration and/or the frequency of Offering Periods with respect to future Offering Periods or suspend operation of the Plan with respect to Offering Periods not yet commenced.

5. Participation

5.1. Subscription Agreement. An eligible Employee may become a participant in the Plan by completing a subscription agreement on the form provided by the Company and filing it with the Company's payroll office at least two business days prior to the applicable Offering Commencement Date, unless a later time for filing the subscription agreement is set by the Board for all eligible Employees with respect to a given Offering Period. The subscription agreement shall set forth the percentage of the participant's Compensation (subject to Section 6.1 below) to be paid as Contributions pursuant to the Plan.

5.2. Timing of Payroll Deductions. Payroll deductions shall commence on the first payroll following the Offering Commencement Date and shall end on the last payroll paid on or prior to the Offering Termination Date of the Offering Period to which the subscription agreement is applicable, unless sooner terminated by the participant as provided in Section 10.

5.3. Tax Withholding. Each participant who purchases shares of Common Stock under the Plan shall thereby be deemed to have agreed that the Company or the Subsidiary that employs the participant shall be entitled to withhold, from any other amounts that may be payable to the participant at or around the time of the purchase, such federal, state, local and foreign income, employment and other taxes which may be required to be withheld under applicable laws. In lieu of such withholding, the Company or such Subsidiary may require the participant to remit such taxes to the Company or such Subsidiary as a condition of the purchase.

6. Method of Payment of Contributions