UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

21550 Oxnard Street, Suite 850 Woodland Hills, CA | | 91367 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr. 21550 Oxnard Street, Suite 850 Woodland Hills, CA 91367 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2014 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2014

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 7 | | | Expense Example | |

| | 8 | | | Alternative Energy Fund | |

| | 17 | | �� | Asia Focus Fund | |

| | 24 | | | Asia Pacific Dividend Builder Fund | |

| | 31 | | | China & Hong Kong Fund | |

| | 38 | | | Dividend Builder Fund | |

| | 46 | | | Global Energy Fund | |

| | 55 | | | Global Innovators Fund | |

| | 62 | | | Renminbi Yuan & Bond Fund | |

| | 69 | | | Statements of Assets and Liabilities | |

| | 71 | | | Statements of Operations | |

| | 73 | | | Statements of Changes in Net Assets | |

| | 76 | | | Financial Highlights | |

| | 84 | | | Notes to Financial Statements | |

| | 98 | | | Report of Independent Registered Public Accounting Firm | |

| | 99 | | | Trustee and Officer Information | |

| | 102 | | | Privacy Notice | |

| | 103 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten and from inception periods through December 31, 2014. Also included in the table is the expense ratio data from the most recent prospectus dated May 1, 2014.

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | From Inception | | Expense Ratio | |

Alternative Energy Fund (March 31, 2006) | | | -14.29 | % | | | 5.50 | % | | | -12.02 | % | | | — | | | | -12.44 | % | | | 2.13 | % gross; 2.00% net† | |

Asia Focus Fund (April 29, 1996) | | | 1.91 | % | | | 1.91 | % | | | -0.21 | % | | | 6.55 | % | | | 2.55 | % | | | 1.88 | % | |

Asia Pacific Dividend Builder Fund (March 31, 2006) | | | 9.04 | % | | | 9.66 | % | | | 6.98 | % | | | — | | | | 5.19 | % | | | 3.56 | % gross; 1.98% net† | |

China & Hong Kong Fund (June 30, 1994) | | | -1.97 | % | | | 6.09 | % | | | -0.03 | % | | | 7.97 | % | | | 7.19 | % | | | 1.54 | % | |

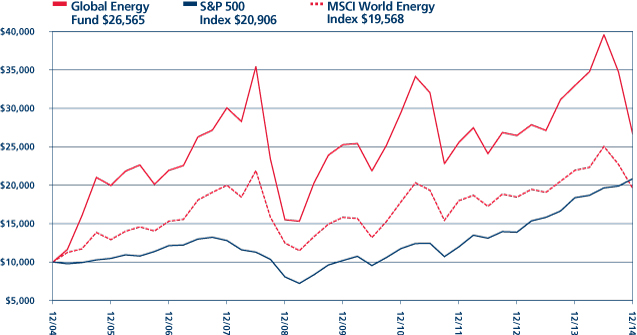

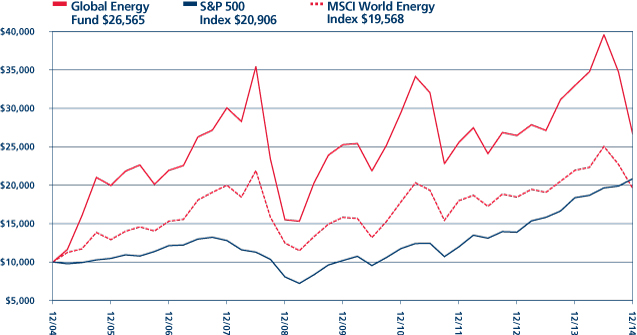

Global Energy Fund (June 30, 2004) | | | -19.63 | % | | | 1.18 | % | | | 0.97 | % | | | 8.09 | % | | | 9.75 | % | | | 1.35 | % | |

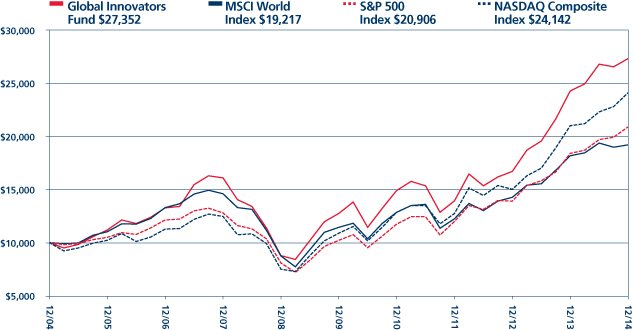

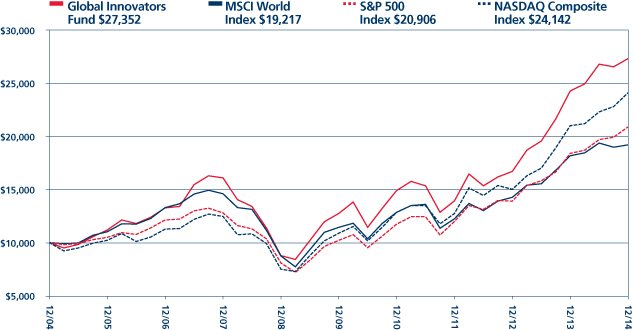

Global Innovators Fund (December 15, 1998) | | | 12.55 | % | | | 25.16 | % | | | 16.49 | % | | | 10.58 | % | | | 7.43 | % | | | 1.47 | % | |

Dividend Builder Fund (March 30, 2012) | | | 4.99 | % | | | — | | | | — | | | | — | | | | 13.86 | % | | | 5.47 | % gross; 0.68% net† | |

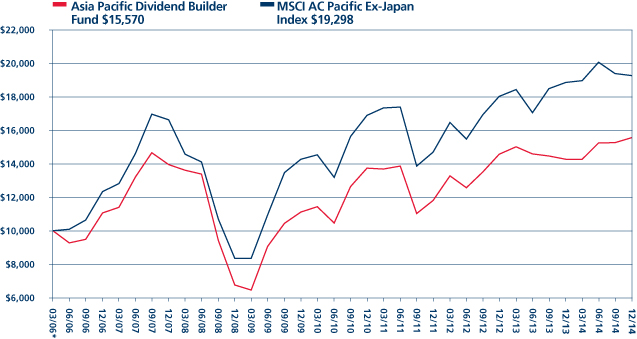

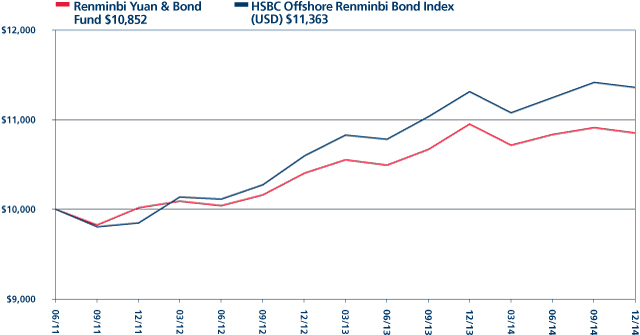

Renminbi Yuan & Bond Fund (June 30, 2011) | | | -0.92 | % | | | 2.71 | % | | | — | | | | — | | | | 2.36 | % | | | 0.97 | % gross; 0.90% net† | |

Periods of greater than one year are average annualized returns; one year and shorter period returns are actual returns. All returns are for the periods ending December 31, 2014.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

Each of the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund imposes a 2% redemption fee on shares held less than 30 days. Performance data quoted does not reflect this fee. If it had, total return would be lower.

Expense ratios are from the most recent prospectus (dated May 1, 2014) and are from the most recent audited financials (period ending December 31, 2013) at the time that prospectus was completed.

†All of the Guinness Atkinson Funds have an expense cap in place and the advisor is contractually obligated to cap the Funds' total expenses at least through June 30, 2015. For the Inflation Managed Dividend Fund, the advisor is contractually obligated to cap total expenses at least through March 31, 2016.

4

Dear Guinness Atkinson Funds Shareholders,

This past year was a bit of good news/bad news for the Guinness Atkinson Funds as exactly half of the Fund family produced positive returns and half produced negative returns. The standout performer for 2014 among the Guinness Atkinson Funds was the Global Innovators Fund, which produced a total return of 12.55% for the year. The Asia Pacific Dividend Builder (9.04%), the Dividend Builder Fund (4.99%), and the Asia Focus Fund (1.91%) all produced positive returns for the year. The Renminbi Yuan & Bond Fund (-0.92%), the China & Hong Kong Fund (-1.97%), the Alternative Energy Fund (-14.29%) and the Global Energy Fund (-19.63) all produced negative returns for the year.

As mentioned, the Global Innovators Fund was the top performing Guinness Atkinson Fund, but in fact it is the top performing Fund based on total return within its Lipper Category over all of the time periods shown in the table.

Time period ending December 31, 2014 | | Rank | | Number of funds in Lipper

Global Multi Cap Growth

Category | |

One year | | | 1 | | | | 500 | | |

Three year | | | 1 | | | | 466 | | |

Five year | | | 1 | | | | 399 | | |

Ten year | | | 1 | | | | 278 | | |

We believe this performance is in part due to the underlying assumption for the Fund, specifically that innovative companies outperform in the market place, satisfy consumers and, in the process, produce superior financial results and, ultimately superior stock market performance. In short, we believe that innovation matters.

We've written in past letters about the state of the human condition and we think it is worth a few words in this letter to repeat our view that over the long term it is difficult to argue that the human condition is as good as it has ever been and continues to improve. It may be difficult to square this factual view with the daily news coverage which seems to be increasingly focused on the negative. This negativity can lead to the conclusion that life on the planet and the human condition is extremely dire. But, in fact, that is not the case. Yes, we know there are any host of negative trends and circumstances around the globe but that doesn't change the facts regarding worldwide per capita GDP (rising and never higher than today); global longevity (rising and never higher than today); literacy rates (rising and never higher than today); access to information and communication (at all-time highs and rising) etc. We continue to repeat this theme because we find it hard to understand how long-term investors can be successful without a factually based world view. Of course events ebb and flow and there are short-term negative as well as positive influences and the markets tend to move up and down in the short-term. But the long-term story has been extremely clear: the human condition has improved massively over the last decade, quarter century, century and last three centuries. If you're a long-term investor (which is our sincere hope) we believe it is helpful to have a world view that is consistent with the facts.

Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to the Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and look forward to what will hopefully be a great 2015.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds.

Sincerely,

| |

| |

Timothy Guinness | | James Atkinson | |

Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. Each Lipper average represents a universe of Funds with similar investment objectives. Rankings for the period shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

5

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual stock volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investments diversified among various sectors.

6

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees; and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2014 to December 31, 2014.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/14) | | Ending

Account

Value

(12/31/14) | | Expenses Paid

During Period*

(07/01/14 to

12/31/14) | | Expense Ratios

During Period*

(07/01/14 to

12/31/14) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 765.10 | | | $ | 8.90 | | | | 2.00 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.12 | | | $ | 10.16 | | | | 2.00 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 962.00 | | | $ | 9.40 | | | | 1.90 | % | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.63 | | | $ | 9.65 | | | | 1.90 | % | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 10.08 | | | | 1.98 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 1,000.10 | | | $ | 7.06 | | | | 1.40 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.15 | | | $ | 7.12 | | | | 1.40 | % | |

Guinness Atkinson Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 973.00 | | | $ | 3.38 | | | | 0.68 | %† | |

Guinness Atkinson Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | %† | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 668.60 | | | $ | 5.55 | | | | 1.32 | % | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.55 | | | $ | 6.72 | | | | 1.32 | % | |

Guinness Atkinson Global Innovators Fund Actual | | $ | 1,000.00 | | | $ | 1,019.70 | | | $ | 6.36 | | | | 1.25 | % | |

Guinness Atkinson Global Innovators Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.36 | | | | 1.25 | % | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 1,001.50 | | | $ | 4.54 | | | | 0.90 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (365) (to reflect the one-half year period).

†Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

7

ALTERNATIVE ENERGY FUND for the period ended December 31, 2014

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(Actual) | | 3 Year | | 5 Year | | Since

Inception

(March 31, 2006) | |

Fund | | | -14.29 | % | | | 5.50 | % | | | -12.02 | % | | | -12.44 | % | |

Benchmark Index: | |

Wilderhill New Energy Global Innovation Index | | | -2.15 | % | | | 13.33 | % | | | -5.07 | % | | | -3.45 | % | |

Wilderhill Clean Energy Index | | | -16.93 | % | | | 2.85 | % | | | -12.49 | % | | | -14.36 | % | |

MSCI World Index | | | 5.62 | % | | | 16.23 | % | | | 10.94 | % | | | 5.76 | % | |

The Fund's expense ratio is 2.13% and net expense ratio is 2.00% per the Summary Prospectus dated May 1, 2014. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2015. To the extent that the Advisor waives fees, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Guinness Atkinson Alternative Energy Fund was down 14.29% in 2014. This compared to a fall in the Wilderhill New Energy Global Innovation Index of 2.15% and in the Wilderhill Clean Energy Index of 16.93%. The Fund therefore performed between its benchmark indices and along with its sector underperformed the MSCI World Index in 2014.

All the sub sectors invested in contributed to the underperformance in the year. The smaller wind utilities struggled with weak operating conditions for Greentech and a debt refinancing suffered by Theolia. Poor wind conditions held the Chinese wind utilities back and the weak Euro detracted from otherwise good performance from the larger cap wind utilities. The sale of the wind turbine holdings were notable bright points in the year.

The solar module manufacturers were weak over the year, partly as a result of the falling oil price and partly as a result of a perception of weaker demand than expected in China. The sale of SMA Solar and the holdings in Enphase and China Singyes were positive contributors.

The Fund's Peruvian ethanol investment, Maple Energy was sold at a loss owing to underperformance in ramping up the assets, as was the investment in Canadian Lithium mining company RB Energy.

Overall, the equal weighting of the portfolio has been effective in providing some cushion to specific stock issues.

8

2. Portfolio

Sector | | % of Assets | |

Solar | | | 26.64 | % | |

Wind | | | 44.46 | % | |

Efficiency | | | 10.00 | % | |

Geothermal | | | 3.02 | % | |

Hydro | | | 10.97 | % | |

Biomass Energy | | | 3.25 | % | |

Cash | | | 1.66 | % | |

| | | | 100.00 | % | |

Domicile | | % of Assets | |

Europe | | | 35.80 | % | |

North America | | | 21.00 | % | |

Asia | | | 35.19 | % | |

Latin America | | | 6.33 | % | |

Australasia | | | 0.00 | % | |

Cash | | | 1.68 | % | |

| | | | 100.00 | % | |

* region is as per company domicile.

The portfolio is quite concentrated in the wind and solar sectors, with 26.64% in solar and 44.46% in Wind. We believe these sectors have the best long-term growth potential of the alternative energy space.

Within the solar sector, we are invested in a mix of low cost Asian solar cell and module manufacturers, an installer and the leading manufacturer of microinverters.

For our wind exposure we are invested now mainly in wind farm developers and owners, with one investment in a small wind turbine manufacturer. The split is 22.03% in large wind utilities, 16.92% in small utilities and 4.01% in wind turbine manufacturers. In the long run there are good potential returns both from owning wind assets as the value in operating assets and pipelines of potential assets becomes recognized as per the valuations of the yieldcos.

Further investments are in a hydroelectric power producer in Latin America, Austrian and Italian hydropower utilities, a ground source heat pump company, and a Chinese metering company.

The Fund has 35.80% of its holdings in companies domiciled in Europe. North America accounts for 21.00% of the Fund. The Fund's 41.53% of emerging markets holdings is predominantly held in Chinese and Hong Kong domiciled companies, which account for 31.57% of the portfolio.

Mkt Cap $m | | Positions | | % of Assets | |

>1000 | | | 17 | | | | 49.84 | % | |

500-1000 | | | 4 | | | | 12.35 | % | |

250-500 | | | 2 | | | | 6.00 | % | |

100-250 | | | 2 | | | | 5.05 | % | |

50-100 | | | 6 | | | | 20.78 | % | |

<50 | | | 1 | | | | 4.31 | % | |

9

Position size | | Positions | | % of Assets | |

Full | | | 30 | | | | 101.96 | % | |

Half | | | 0 | | | | 0.00 | % | |

Research | | | 1 | | | | 0.45 | % | |

The liquidity of the Fund has improved slightly as the percentage of the Fund in companies with a market capitalization over US$1,000 million is 49.84% at the end of 2014. One holding is now in a company with a market capitalisation lower than $50 million – Carmanah Technologies. The Fund now has thirty full units and one research holding.

3. Activity

The Fund acquired a position in Mytrah Energy in the first quarter. Mytrah is an Indian wind utility with a strong development pipeline. The Fund's position in SMA Solar, the German solar inverter manufacturer was sold having performed very well and has been replaced by a position in Northern Power Systems, a manufacturer of small wind turbines.

As a result of the takeover bid from Nibe, the Fund has sold its position in Waterfurnace and replaced it with a position in a small Italian hydroelectric company called Iniziative Bresciane. While we have some concerns about the subsidy regime in Italy given Italy's weaker economy, we believe that small hydro installations will continue to be supported as the subsidy levels are amongst the lowest for any technology and installations are expected to last for 100 years or more. This company has a portfolio of 16 hydro installations today and are proposing to increase their portfolio with the capital they raised in their IPO.

In the third quarter the wind turbine manufacturing holdings – Vestas, Nordex and Gamesa were sold as valuations appeared stretched. We expect solid levels of wind installations and margin improvements, but not enough to merit premium valuations. The US market remains a risk and the Chinese market is difficult to penetrate for international players, leaving the main prospects for growth in other emerging markets. We expect these emerging markets to develop but not at high turbine prices.

The three holdings were replaced by positions in Enphase, Canadian Solar and Centrotec Sustainable. Enphase is the leading solar microinverter manufacturer. Microinverters improve solar installation performance and robustness and have the potential to become cheaper than conventional inverters. We are excited about their prospects. Canadian Solar is a leading Chinese module manufacturer who has been early to recognize the opportunity in becoming an installer and developer of projects while maintaining a strong cost position and balance sheet. Centrotec is a German heating system installer who is well placed for pending changes to German rules that will require boilers to be replaced after 30 years. The economics of installing their equipment is compelling without subsidies.

We have sold our holding in Itron and replaced it with a position in a leading Chinese metering provider – Wasion Group Holdings who traded on attractive valuations multiples.

We have sold the Fund's holding in RB Energy, the lithium mining company as it failed to hit production targets and after the quarter end the Fund's position in Maple Energy who faced similar problems. We have replaced them with a position in Cosan SA, a leading Brazilian biofuels company with less direct ethanol price exposure.

In the fourth quarter, the Theolia refinancing closed which resulted in the acquisition of traded warrants in the stock as well as additional shares acquired in the rights issue.

The overall effect has been to lower the earnings multiple on which the Fund trades and we believe positions the Fund well in the stream of future growth stories.

4. Outlook

After a 2014 where the sector digested the gains of 2013, we believe that the alternative energy sector has the potential to start delivering again for investors. The headwinds and uncertainty facing the sector remains significant but as these headwinds are overcome, the robustness of the sector to external threats is increasing.

There are few in the industry who predicted the fall in the oil price, the shale gas phenomenon in the US, falling wholesale power prices in both Europe and the US and the failure of carbon pricing. While in the long run finite supplies of fossil fuel exists, the unexpected growth in shale gas and oil over the last ten years in the US serve a timely reminder that more of those reserves are

10

likely to be extracted than expected and probably at lower prices. In the medium term, the oil and gas industry is likely to remain cyclical. It is therefore not likely to be rising fossil fuel prices that drive the switch to alternative energy, but the increasing economic competitiveness of alternative energy, with growth supported for energy security, environmental and climate change reasons.

In the US energy security has become less of a concern as a direct result of the increases in oil and gas production. However for much of the rest of the world, energy security concerns remain high. Much of Europe is dependent on Russia for natural gas and the Middle East for oil; Japan has almost no fossil fuel reserves of its own; China and India are dependent on fossil fuel imports to support continuing growth. The current economic problems that Russia is facing as a result of sanctions are not going away and are exacerbated by the low oil price. Saudi Arabia and the Gulf states may be rich enough to sustain a price war for several years, but the economic hardship in countries heavily reliant on oil exports for hard currency is likely to lead to political turmoil and unrest. For this reason the likelihood of political unrest that increases the oil price is significantly higher.

Environmental concerns are today the strongest driver of policy supportive of alternative energy. Pollution problems in China and India are creating a tangible health problem. With pollution alerts keeping residents indoors, fossil fuel emissions are causing a direct reduction in GDP. China has emerged as the strongest supporter of the renewable energy industry. It is already the largest installer annually of wind installations and is forecast to become the world's largest installer of solar installations in 2015 if it has not already done so in 2015. Underpinning that, the majority of solar module manufacturing is now carried out by Chinese companies and its leading wind turbine manufacturers are beginning to produce product that will be viable outside of China at a much lower cost than its international competitors.

Climate change remains an important if secondary driver of alternative policy. Barrack Obama has made climate change policies central to what he would like to achieve over the remainder of his last term in office and despite the best efforts of the Republican Party, climate change is still on the political agenda in the US. Further increases in support are seen in China and India albeit not just for climate change reasons. Policy in Europe has remained steadily in favour of action to address climate change, notwithstanding headline reductions in subsidy levels. However, Australia has taken a major step away from policy driven following the Liberal Party's 2013 election victory and Saudi Arabia has pushed back its targets for solar deployment.

A major development over the last two years has been the emergence of large "yieldcos" as financing vehicles for alternative energy installations. These have a low cost of capital and are providing a more certain home and pricing for plant under development. This is having a knock on effect for developers and for manufacturers who are now competing as developers and as a result stimulating demand. These yieldcos are bringing alternative energy towards the mainstream of energy and we are seeing both manufacturers and utilities respond with yieldco offerings of their own.

Utilities in the meantime are facing growing threats from alternative energy. In Germany, the levels of solar and wind installations have significantly reduced the amount that utilities earn from power plants that provide power to cover peaks in demand and with consumers increasingly generating their own electricity, they are seeing falls in demand for their power. Utilities will have to evolve and embrace these changes or they will not survive.

The long term direction of travel still appears to be towards electrification of the vehicle fleet. Over the next five years there are a large number of electric vehicles due to come to the market at costs that do not make them prohibitive, and increased adoption is likely to see an acceleration in engineering solutions to the charging problems that electric vehicles have. It is important to remember that electricity is much more widely available than petrol/gasoline in terms of number of locations as any building with a connection to the grid can become a "filling" station.

A further part of our vision of the long term future of energy is that we will hopefully be using significantly more energy, more efficiently. Improvements in efficiency can make a meaningful difference to lowering our energy consumption while supporting growing GDP and quality of life. We believe that in the long run rather than being perceived as an expensive source of energy, alternative energy costs will continue to fall over the long term which will enable us to consume more energy for the same cost while supporting higher levels of economic activity and advances in quality of life globally.

The cost of solar, wind, geothermal and hydropower has now reached a point where unsubsidised production of electricity is viable in an increasing number of locations and the costs continue to fall.

The long term outlook for alternative energy remains good. The key drivers remain in place: dwindling fossil fuel supplies; energy security concerns; environmental issues; and climate change. The reduced cost of alternative energy technologies is likely to

11

accelerate the growth of the alternative energy sector. We continue to position the fund to benefit from the long term growth of the sector.

Edward Guinness

The Funds invest in foreign securities which will involve political, economic and currency risks, greater volatility, and differences in accounting methods. The Funds are non-diversified meaning their assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Funds are more exposed to individual stock volatility than diversified funds. The Funds invest in smaller companies, which will involve additional risks such as limited liquidity and greater volatility.

The Wilderhill New Energy Global Innovation Index (NEX) is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. The MSCI World Energy Index is an unmanaged index composed of more than 1,400 stocks listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand, and the Far East. These indices are unmanaged, not available for investment and do not incur expenses.

Yieldcos in the alternative energy sector are companies set up specifically to hold constructed assets, paying out the cashflows from the assets in the form of dividends which provides investors with a yield.

Please refer to the Schedule of Investments for details on fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Management for the period stated and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Opinions, fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

12

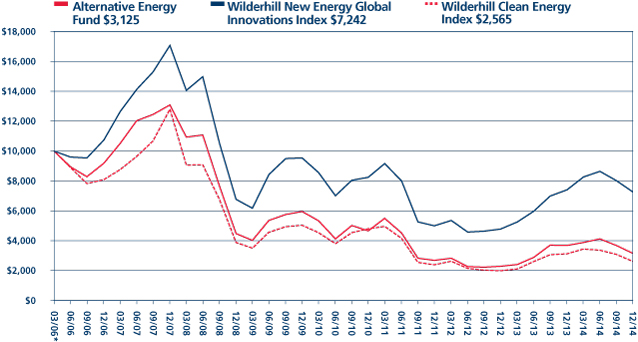

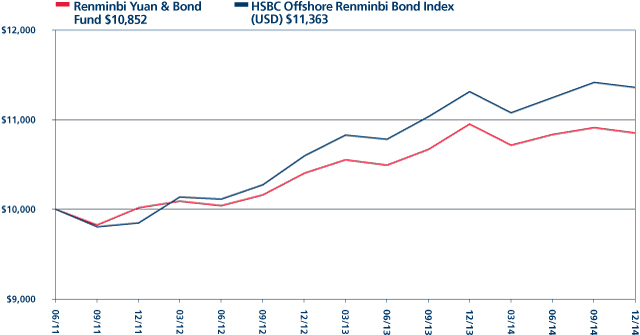

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2014

| One Year | | Five Year | | Since Inception

(03/31/06) | |

| | -14.29 | % | | | -12.02 | % | | | -12.44 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

The Wilderhill New Energy Global Innovations Index (NEX) is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation.

13

FUND HIGHLIGHTS at December 31, 2014

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | 32 | |

Portfolio Turnover: | | 42.3% | |

% of Stocks in Top 10: | | 39.9% | |

Fund Manager: | | | |

Edward Guinness | | | |

Top 10 Holdings (% of net assets) | | | | Industry Breakdown (% of net assets) | | | |

Theolia SA | | 6.2% | | Wind | | 44.3% | |

Iniziative Bresciane - Inbre - SpA | | 5.1% | | Solar | | 26.8% | |

Northern Power Systems Corp. | | 4.4% | | Hydro | | 11.0% | |

Good Energy Group PLC | | 4.3% | | Efficiency | | 10.1% | |

Mytrah Energy Ltd. | | 3.7% | | Biofuel | | 3.3% | |

Enphase Energy Inc. | | 3.4% | | Geothermal | | 3.0% | |

SunPower Corp. - Class B | | 3.3% | | | | | |

Cosan SA Industria e Comercio | | 3.3% | | | | | |

Trina Solar Ltd. - ADR | | 3.1% | | | | | | | |

Yingli Green Energy Holding Co., Ltd. - ADR | | 3.1% | | | | | | | |

14

SCHEDULE OF INVESTMENTS

at December 31, 2014

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 98.5% | | Value | |

Biofuel: 3.3% | | | |

| | 45,700 | | | Cosan SA Industria e Comercio | | $ | 495,992 | | |

Efficiency: 10.1% | | | |

| | 76,099 | | | Carmanah Technologies Corp.* | | | 190,607 | | |

| | 26,360 | | | CENTROTEC Sustainable AG | | | 455,329 | | |

| | 17,760 | | | Nibe Industrier AB - B Shares | | | 457,695 | | |

| | 456,000 | | | Wasion Group Holdings Ltd. | | | 423,942 | | |

| | | | | | | | 1,527,573 | | |

Geothermal: 3.0% | | | |

| | 16,959 | | | Ormat Technologies Inc. | | | 460,946 | | |

Hydro: 11.0% | | | |

| | 94,904 | | | Cia Energetica de Minas Gerais - ADR | | | 471,673 | | |

| | 27,750 | | | Iniziative Bresciane - Inbre - SpA* | | | 771,643 | | |

| | 23,550 | | | Verbund AG | | | 431,838 | | |

| | | | | | | | 1,675,154 | | |

Solar: 26.8% | | | |

| | 18,400 | | | Canadian Solar Inc.* | | | 445,096 | | |

| | 312,000 | | | China Singyes Solar Technologies Holdings Ltd. | | | 431,111 | | |

| | 35,900 | | | Enphase Energy Inc.* | | | 513,011 | | |

| | 53,900 | | | JA Solar Holdings Co., Ltd.* | | | 441,171 | | |

| | 23,800 | | | Jinkosolar Holdings Co - ADR* | | | 469,098 | | |

| | 224,000 | | | Renesola Ltd. - ADR* | | | 315,840 | | |

| | 19,450 | | | SunPower Corp. - Class B* | | | 502,393 | | |

| | 51,520 | | | Trina Solar Ltd. - ADR* | | | 477,075 | | |

| | 202,200 | | | Yingli Green Energy Holding Co., Ltd. - ADR* | | | 475,170 | | |

| | | | | | | | 4,069,965 | | |

Wind: 44.3% | | | |

| | 6,660 | | | Acciona S.A. | | | 447,139 | | |

| | 38,587 | | | Boralex Inc. - Class A | | | 426,788 | | |

| | 3,415,000 | | | China Datang Corp. Renewable Power Co. Ltd. - H Shares | | | 450,365 | | |

| | 437,000 | | | China Longyuan Power Group Corp. - H Shares | | | 450,175 | | |

| | 2,170,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 451,336 | | |

| | 68,760 | | | EDP Renovaveis SA | | | 447,034 | | |

| | 209,880 | | | Enel Green Power SpA | | | 436,062 | | |

| | 200,441 | | | Good Energy Group PLC | | | 659,180 | | |

| | 325,080 | | | Greentech Energy Systems* | | | 374,201 | | |

| | 1,358,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 437,201 | | |

| | 467,823 | | | Mytrah Energy Ltd.* | | | 554,154 | | |

| | 228,800 | | | Northern Power Systems Corp.* | | | 669,582 | | |

| | 1,459,628 | | | Theolia SA* | | | 936,098 | | |

| | | | | | | | 6,739,315 | | |

| | | | | Total Common Stocks

(cost $22,964,044) | | | 14,968,945 | | |

The accompanying notes are an integral part of these financial statements.

15

Shares | | WARRANTS: 0.3% | | Value | |

| | 946,050 | | | Theolia SA, Expiration 6/09/16, Excerise price 0.60 EUR | | $ | 52,659 | | |

| | | Total Warrants

(cost $0) | | | 52,659 | | |

| | | Total Investments in Securities

(cost $22,964,044): 98.8% | | | 15,021,604 | | |

| | | Other Assets less Liabilities: 1.2% | | | 179,982 | | |

| | | Net Assets: 100.0% | | $ | 15,201,586 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

16

ASIA FOCUS FUND for the period ended December 31, 2014

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 1.91 | % | | | 1.91 | % | | | -0.21 | % | | | 6.55 | % | |

Benchmark Index: | |

MSCI AC Far East Free Ex Japan Index | | | 3.13 | % | | | 9.51 | % | | | 6.14 | % | | | 9.69 | % | |

S&P 500 Index | | | 13.66 | % | | | 20.34 | % | | | 15.42 | % | | | 7.66 | % | |

The Fund's gross expense ratio is 1.88% per the Summary Prospectus dated May 1, 2014. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2015. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

The Fund ended the year up 1.91% compared to the benchmark index, the MSCI AC Far East Free Ex-Japan Index, which rose 3.13%.

Emerging markets had a weak fourth quarter with the majority of the losses experienced in December marked by falling oil prices, a collapse in the ruble and declines in most other currencies against the dollar. The Asian region performed relatively well in this environment when of the major market blocs (US, Europe and Emerging Markets) only the US made any gains, with S&P 500 Index up 4.92% and Dollar (currency) Index up 5.04%. Within the Asian region over the quarter China was the best performer with the MSCI China Index up 7.18%. The MSCI Hong Kong and Taiwan indices rose 2.96% and 1.63% respectively. The weakest markets were Korea, Malaysia and Thailand each down approximately 5% in dollar terms.

Sector performance over the period was led by Chinese financial stocks – banks, insurers and brokers all performed strongly rising almost 25% in aggregate. Chinese industrials and technology stocks in Taiwan and Korea also gained modestly. Energy, materials and consumer discretionary sectors were weak across the region. The poor performance of Korea, across almost all sectors, with exception of technology, leaves it one of the cheapest markets in the region alongside China.

The sudden drop in the oil price brings with it problems as well as opportunities. If read as a sign of slower economic growth and thus external demand then Asian exporters such as Korea, Taiwan, Malaysia and Singapore look especially exposed. If we also read through to the prices of other commodities such as iron ore, rubber, tin, zinc then this too will have an impact on Malaysia and Indonesia, as it has on Latin America.

However, we believe the benefits will soon outweigh the negatives: Indonesia's new president just scrapped the fuel subsidy on gasoline and significantly reduced the level on diesel. Lower oil prices now mean Indonesians are paying 10% less now for unsubsidized fuel than before the subsidy was removed. Furthermore, the government has freed up an estimated 14% of government spending, projected to be spent on fuel subsidies, to invest in infrastructure and to meet the target of creating 2 million new jobs.

The strength of the dollar and the implications for the substantial increase in corporate debt denominated in dollars throughout the emerging market world has also weighed on markets. There is an estimated $5.7 trillion of dollar debt outstanding across all Emerging markets ($3.1 trillion of bank loans and $2.6 trillion in bonds). The problem is not so acute at a national level in Asia ex-Japan which holds $5.6 trillion of dollar reserves (China $3.9 trn, Rest of Asia ex-Japan $1.7 trn) out of a world total of

17

$11.8 trillion of reserves. The risks are greater at the corporate level although China has an 'easy' option of slashing the 20% required reserve ratio requirement if needed. Nevertheless Emerging Market bonds have fallen as dollar liquidity lessens with the end of Quantitative Easing by the Federal Reserve and in anticipation of an imminent US interest rate rise, which is now the market consensus.

In the portfolio over the quarter there were significant contributions from Chinese banks (China Construction bank, China Merchants Bank, China Minsheng), from Chinese industrials (Anhui Conch Cement, Weichai Power) and from the China A share ETF. The Hong Kong segment of the portfolio fell 7% led by technology names and Li & Fung. Malaysia was mixed down 2% overall (in local currency terms Digi.com rose 5%, UMW auto fell 11%) as was Korea up 2.5% (Hyundai Mobis down 8% in local currency terms, Samsung Electronics up 12%). The Taiwanese segment of the portfolio with its technology exposure rose 9% while Thailand fell 6% in line with the market led lower by energy exposure. Currency weakness in December pulled the Malaysian Ringgit 6% lower against the dollar while the Singapore dollar, the Korean won and Taiwan dollar were 3.5% to 3.8% lower for the quarter as a whole.

2. Portfolio Position

In the first half of the year we cut Hong Kong and China exposure and increased the position in Taiwan. At the sector level we increased to consumer discretionary, financials and information technology funded by cuts to energy, industrials, materials and telecom services. At the stock level we added China Merchants Bank and China Minsheng Bank which were trading at a significant discount to book value. We added Dongfeng Motor, Li & Fung and Nagacorp in the consumer discretionary sector and in the technology segment we added Catcher and Tencent, the latter being funded by the sale of China Mobile. In the second half we sold out of Kunlun Energy in October on weaker performance from its Kazakhstan oil operations and because of ongoing gas price reform in China that is expected to benefit producers and end distributors at the expense of the pipeline operators.

3. Outlook

The macro-environment remains challenging for Asia, as ever. Export manufacturers face a lopsided demand position with US performing well, Europe looking progressively weaker and many emerging economies under pressure from lower commodity prices and a strong dollar. Japan's renewed efforts at Quantitative Easing following lackluster results to date and Europe's decision to join the party spells further currency disruption. China's economic slowdown is likely to exert additional drag although that is more likely to felt through commodities exports rather than manufactured goods. The outstanding amount of US dollar debt remains a matter of some concern as Asian currencies weaken, but unlike 1998 the bulk was issued by corporates rather than government.

Falling oil prices have come as an unexpected source of relief for Asia allowing the political room in countries like Malaysia, Indonesia, Thailand and India to cut back or scrap fuel subsidies. Malaysia and Indonesia in particular have been battling to bring down government spending and in the case of Indonesia allows for the new President's program for infrastructure investment to progress with greater speed than was expected. The difficulty in both Thailand and Indonesia is political. In Thailand the initial period of relief following the coup is now being replaced with some hard-headed realism: the democratic framework has not been fixed and the royal succession to a now-frail King adds to the uncertainty. In Indonesia, the new president has already shown his decisiveness and new government spending power should drive the domestic economy. However, the recent move to intervene in cement pricing, following the fuel subsidy cuts, shows his interventionist colors and lowers predictability.

China remains the cheapest market in the region, followed by South Korea although the latter has seen the heaviest downgrades to forecast earnings of any country in the region led by Samsung Electronics and Hyundai Group. In spite of political concerns Indonesia and Thailand offer some of the fastest earnings growth over the next two years along with the Philippines. From a sector perspective the fastest growth is to be found in the Chinese technology and consumer discretionary sectors.

Edmund Harriss January 2015

The Fund invests in foreign securities, which involve political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

18

The MSCI AC (All Country) Far East Free ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. The Dollar Index is a measure of the value of the United States dollar relative to other world currencies. The MSCI China Index is a free-float adjusted market capitalization weighted index that is designed to measure equity market performance of Chinese stocks available into international investors traded in China and Hong Kong. The MSCI Hong Kong Index is designed to measure the performance of the large and mid cap segments of the Hong Kong market and covers about 85% of the Hong Kong equity universe. The MSCI Taiwan Index is a free-float adjusted market capitalization weighted index that is designed to track the equity market performance of Taiwanese securities listed on Taiwan Stock Exchange and GreTai Securities Market. These indices are unmanaged, not available for investment and do not incur expenses.

Book Value is the net asset value of a company, calculated by total assets minus intangible assets (patents, goodwill) and liabilities.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

19

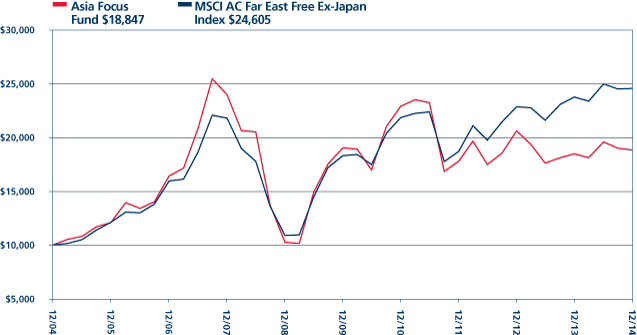

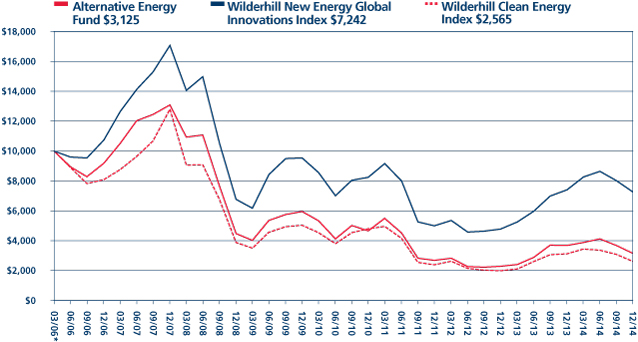

GUINNESS ATKINSON ASIA FOCUS FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2014

| One Year | | Five Year | | Ten Year | |

| | 1.91 | % | | | -0.21 | % | | | 6.55 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East Free ex-Japan Index (MSCI AC Far East Free ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance of the Far East excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses.

20

FUND HIGHLIGHTS at December 31, 2014

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | 39 | |

Portfolio Turnover: | | 23.2% | |

% of Stocks in Top 10: | | 36.1% | |

Fund Manager: | | | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 4.8 | % | | Lenovo Group Ltd. | | | 3.2 | % | |

Largan Precision Co., Ltd. | | | 4.6 | % | | Anhui Conch Cement Co Ltd. - H Shares | | | 3.2 | % | |

Samsung Electronics Co., Ltd. | | | 4.0 | % | | PetroChina Co Ltd. - H Shares | | | 3.2 | % | |

China Merchants Bank Co Ltd. - H Shares | | | 3.5 | % | | Novatek Microelectronics Corp. | | | 3.1 | % | |

China Minsheng Banking Corp Ltd. - H Shares | | | 3.4 | % | | China Construction Bank Corp. - H Shares | | | 3.1 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 11.8 | % | | Building Products - Air&Heating | | | 3.2 | % | |

Semiconductor Components - Integrated Circuits | | | 7.9 | % | | Exchange Traded Funds | | | 3.0 | % | |

Oil Company - Integrated | | | 6.0 | % | | Web Portals/ISP | | | 2.7 | % | |

Auto/Truck Parts & Equipment | | | 5.8 | % | | Electronic Component - Miscellaneous | | | 2.5 | % | |

Electric - Generation | | | 5.5 | % | | Building & Construction Products | | | 2.5 | % | |

Telecommunication Services | | | 5.0 | % | | Metal Processors & Fabricators | | | 2.4 | % | |

Oil Company - Exploration & Production | | | 4.8 | % | | Internet Application Software | | | 2.4 | % | |

Auto - Cars/Light Trucks | | | 4.7 | % | | Public Thoroughfares | | | 2.3 | % | |

Real Estate Operations/Development | | | 4.7 | % | | Distribution/Wholesale | | | 1.9 | % | |

Casino Hotels | | | 4.6 | % | | Non-Ferrous Metals | | | 1.0 | % | |

Photo Equipment & Supplies | | | 4.6 | % | | Coal | | | 1.0 | % | |

Electronic Components - Semiconductor | | | 4.0 | % | | Machinery | | | 0.5 | % | |

Computers | | | 3.2 | % | | Apparel Manufacturers | | | 0.3 | % | |

21

SCHEDULE OF INVESTMENTS

at December 31, 2014

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 98.3% | | Value | |

China: 45.0% | | | |

| | 94,000 | | | AAC Technologies Holdings Inc. | | $ | 499,539 | | |

| | 171,000 | | | Anhui Conch Cement Co Ltd. - H Shares | | | 637,719 | | |

| | 739,000 | | | China Construction Bank Corp. - H Shares | | | 601,456 | | |

| | 1,014,000 | | | China Lesso Group Holdings Ltd. | | | 494,033 | | |

| | 280,000 | | | China Merchants Bank Co Ltd. - H Shares | | | 698,755 | | |

| | 419,000 | | | CNOOC Ltd. | | | 566,796 | | |

| | 506,000 | | | China Minsheng Banking Corp Ltd. - H Shares | | | 659,850 | | |

| | 599,200 | | | db x-trackers CSI300 Index ETF | | | 588,023 | | |

| | 338,000 | | | Dongfeng Motor Group Co., Ltd. - H Shares | | | 472,500 | | |

| | 490,000 | | | Lenovo Group Ltd. | | | 638,817 | | |

| | 562,000 | | | PetroChina Co Ltd. - H Shares | | | 624,788 | | |

| | 696,000 | | | Shenzhen Expressway Co Ltd. - H Shares | | | 461,247 | | |

| | 521,000 | | | Soho China Ltd. | | | 366,333 | | |

| | 9,800 | | | Sohu.com Inc.* | | | 521,164 | | |

| | 32,500 | | | Tencent Holdings Ltd. | | | 466,321 | | |

| | 134,000 | | | Weichai Power Co., Ltd. - H Shares | | | 562,405 | | |

| | | | | | | | 8,859,746 | | |

Hong Kong: 9.3% | | | |

| | 380,000 | | | Chen Hsong Holdings | | | 103,168 | | |

| | 86,000 | | | Galaxy Entertainment Group Ltd. | | | 478,733 | | |

| | 322,000 | | | Global Brands Group Holding Ltd.* | | | 62,940 | | |

| | 39,398 | | | HSBC Holdings PLC | | | 374,824 | | |

| | 407,000 | | | Li & Fung Ltd. | | | 381,039 | | |

| | 532,000 | | | NagaCorp Ltd. | | | 433,527 | | |

| | | | | | | | 1,834,231 | | |

Indonesia: 1.8% | | | |

| | 129,000 | | | Indo Tambangraya Megah PT | | | 159,690 | | |

| | 666,000 | | | Vale Indonesia Tbk | | | 194,933 | | |

| | | | | | | | 354,623 | | |

Malaysia: 5.3% | | | |

| | 337,000 | | | DiGi.Com Bhd | | | 592,694 | | |

| | 144,000 | | | UMW Holdings Bhd | | | 451,377 | | |

| | | | | | | | 1,044,071 | | |

South Korea: 7.0% | | | |

| | 2,752 | | | Hyundai Mobis | | | 585,726 | | |

| | 656 | | | Samsung Electronics Co., Ltd. | | | 788,546 | | |

| | | | | | | | 1,374,272 | | |

Taiwan: 14.8% | | | |

| | 61,000 | | | Catcher Technology Co., Ltd. | | | 469,503 | | |

| | 12,000 | | | Largan Precision Co., Ltd. | | | 898,437 | | |

| | 110,000 | | | Novatek Microelectronics Corp. | | | 615,368 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 5 | | |

| | 214,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 944,324 | | |

| | | | | | | | 2,927,637 | | |

The accompanying notes are an integral part of these financial statements.

22

Shares | | COMMON STOCKS: 98.3% (Continued) | | Value | |

Thailand: 15.1% | | | |

| | 99,500 | | | Electricity Generating PCL/Foreign | | $ | 506,573 | | |

| | 216,000 | | | Glow Energy PCL/Foreign | | | 585,957 | | |

| | 1,778,000 | | | Jasmine International PCL/Foreign | | | 394,332 | | |

| | 824,000 | | | LPN Development PCL/Foreign | | | 547,656 | | |

| | 113,198 | | | PTT Exploration & Production PCL/Foreign | | | 383,967 | | |

| | 56,700 | | | PTT PCL/Foreign | | | 555,886 | | |

| | | | | | | | 2,974,371 | | |

| | | | | Total Common Stocks

(cost $15,659,482) | | | 19,368,951 | | |

| | | | | Total Investments in Securities

(cost $15,659,482): 98.3% | | | 19,368,951 | | |

| | | | | Other Assets less Liabilities: 1.7% | | | 345,006 | | |

| | | | | Net Assets: 100.0% | | $ | 19,713,957 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

23

ASIA PACIFIC DIVIDEND BUILDER FUND for the period ended December 31, 2014

1. Performance

ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Year | | 5 Year | | Since

Launch

(March 31, 2006) | |

Fund | | | 9.04 | % | | | 9.66 | % | | | 6.98 | % | | | 5.19 | % | |

Benchmark Index: | |

MSCI AC Pacific Ex Japan Index | | | 2.14 | % | | | 9.52 | % | | | 6.32 | % | | | 8.01 | % | |

S&P 500 Index | | | 13.66 | % | | | 20.34 | % | | | 15.42 | % | | | 7.70 | % | |

The Fund's gross expense ratio is 3.56% and net expense ratio is 1.98% per the Summary Prospectus dated May 1, 2014. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2015. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these imitations, total returns would have been lower.

The Fund ended the year up 9.04% compared to the benchmark index, the MSCI AC Pacific ex. Japan, which rose 2.14%. Thus the Fund outperformed the benchmark by 6.90%. The Fund outperformed mainly in the second half of the year as Asia Pacific equities fell.

The best performing stocks in our portfolio came from a variety of sectors and countries. Huabao, a chemicals company listed in Hong Kong, rose 57.19% during the year. The company is not well covered by analysts, but re-rated significantly during the year. Following a coup in Thailand, which filled the political vacuum of the previous 12 months, the stock market performed well, and our holding in Thai property company LPN Development returned 49.03%. China Minsheng was one of our Chinese bank holdings that outperformed towards the end of the year, increasing by 45.63%. Relo Holdings, a relocation agent and our only holding in Japan, gained 43.92%, also rising due to multiple expansion supported by a growing dividend payout.

St Shine was the worst performing stock, falling 39.98% over the year, after releasing weak sales figures, particularly from Japan where customers still carry high inventory. This issue is expected to be resolved by the second quarter of 2015. JB Hi-Fi announced a cautious outlook mid-way through the year, which contributed to the stock's -28.23% return over the period. Management is currently rolling out a new store format selling white goods, and we believe that this is an appropriate long term use of capital. CNOOC returned -24.86% as the oil price fell sharply in November and December. NagaCorp, who operates a casino in Cambodia, decreased by 18.41% as sentiment towards gaming stocks turned negative. (All figures quoted are total returns in USD).

The Fund aims to provide investors with exposure to Asian businesses or businesses based overseas that have significant exposure to the region which have demonstrated an ability to generate superior returns on capital over time as well as an ability and willingness to pay dividends.

We have refined the universe of potential investments to those stocks that have demonstrated an ability to sustain profitability through the business cycle by their competitive advantage, management efficiency, product development and distribution or a combination of those factors

This approach is one which we believe will generate a steadier performance than the broad market and that will outperform the broad market over time.

24

ASIA PACIFIC DIVIDEND BUILDER FUND

2. Activity

We made two changes to the portfolio during the year. In August, we sold our holding in water utility Thai Tap Water, and replaced it with an investment in electronics manufacturer Hon Hai Precision. Thai Tap Water performed well during year, along with utilities stocks in general, but we were concerned that expected growth in the company's operations would be slow to materialize. We purchased Hon Hai following the company's recent track record of improving margins by controlling labour costs. We expect Hon Hai, which trades at attractive valuation multiples, to grow as a result of the continuing popularity of Apple products, including the new iPhone 6.

In September, we sold our position in Vtech, and replaced it with a holding in AAC Technologies. Vtech offered an attractive dividend yield, but we were concerned that the company was not making sufficient investment in new product research and development in order to be able to grow its dividend in future. We replaced it in the portfolio with AAC Technologies, which makes electronic audio components for mobile telephones and other devices. We think the company has attractive growth prospects, and trades at a reasonable valuation.

3. Portfolio Position

The Fund's largest country exposures were to China, Taiwan, Hong Kong and Australia. Our weightings in Hong Kong and China reflect our belief that companies in these markets are undervalued, and represent attractive investment opportunities. By contrast, we have lower or no allocations to other countries, for example, Indonesia or the Philippines, because the companies that meet our screening criteria in these countries have valuations that are not, at present, sufficiently attractive.

The Fund's largest sector exposures are to Financials, Information Technology and Consumer Discretionary. Again, our allocation to financials is due to our belief that there is sufficient undervaluation present in the sector. We note that some sectors, for example, Materials, Energy and Utilities have historically had low representation in our universe – materials and energy are highly cyclical industries, while utility companies are often heavily regulated, and achieve lower returns.

4. Outlook

The fall in the oil price towards the end of 2014, which has continued in early 2015, has dominated events in financial markets. Brent crude has fallen from $115 in June 2014 to around $47 at time of writing. Along with these price movements, European economic data has been weak, with deflation again concerning investors. Against this macro backdrop, equity markets have been volatile, and Asia Pacific markets have been no exception.

However, despite short-term market volatility, we think that the Asian Pacific region offers investors excellent long-term prospects. The region has, and will continue to benefit from, favourable demographic characteristics, and rising levels of personal wealth. Developing Asian economies are increasingly switching from being driven by investment, to becoming more consumption-led – we believe this trend will result in favourable economic growth and attractive investment returns.

We believe that the Fund's portfolio is conservative and strikes a balance between growth and income. We therefore believe that the underlying companies will participate in regional growth but with less volatility. The portfolio is positioned to benefit from rising consumption growth not only in China but also around the region.

Asian companies tend to base their dividend payments on a fixed payout ratio, thus short term fluctuations in the dividend along with earnings and the business cycle are to be expected. However, we believe that over the long term, dividends will grow at a satisfactory rate.

Edmund Harriss

The Fund invests in foreign securities, which involve political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility.

25

ASIA PACIFIC DIVIDEND BUILDER FUND

The MSCI AC Pacific ex-Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance of the developed and emerging markets in the Pacific region, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged and not available for investment and do not incur expenses.

Market Capitalization (Market Cap) is the total value of the issued shares of a publicly traded company.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

26

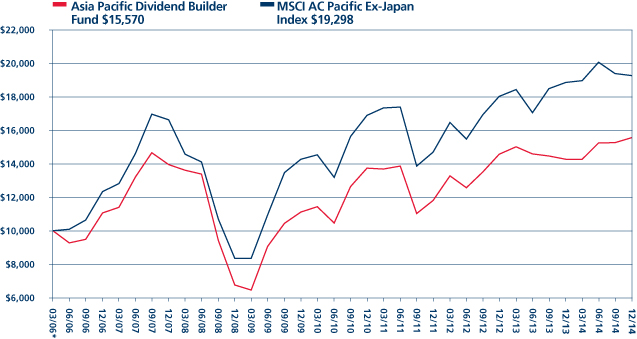

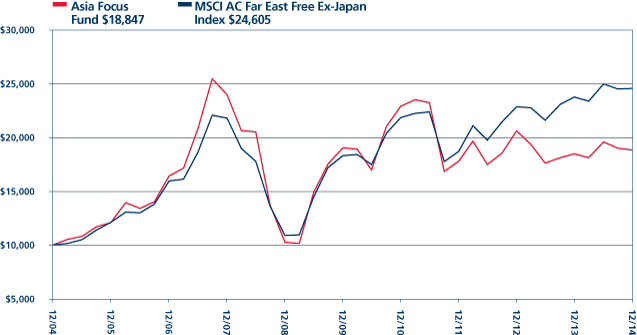

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2014

| One Year | | Five Year | | Since Inception

(03/31/06) | |

| | 9.04 | % | | | 6.98 | % | | | 5.19 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific Free ex-Japan Index (MSCI AC Pacific ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region including Japan.

27

FUND HIGHLIGHTS at December 31, 2014

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

# of Holdings in Portfolio: | | 38 | |

Portfolio Turnover: | | 15.8% | |

% of Stocks in Top 10: | | 30.7% | |

Fund Manager: | | | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Novatek Microelectronics Corp. | | | 3.2 | % | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 3.1 | % | |

China Merchants Bank Co., Ltd. - H Shares | | | 3.1 | % | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.0 | % | |

China Minsheng Banking Corp. Ltd. - H Shares | | | 3.1 | % | | QUALCOMM Inc. | | | 3.0 | % | |

BOC Hong Kong Holdings Ltd. | | | 3.1 | % | | Relo Holdings Inc. | | | 3.0 | % | |

China Construction Bank Corp. - H Shares | | | 3.1 | % | | NagaCorp Ltd. | | | 3.0 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 15.5 | % | | Textile - Products | | | 2.7 | % | |

Semiconductor Components - Integrated Circuits | | | 9.2 | % | | Computers | | | 2.7 | % | |

Electronic Component - Miscellaneous | | | 7.7 | % | | MRI/Medical Diagnostics Imaging | | | 2.7 | % | |

REITS - Shopping Centers | | | 5.6 | % | | Retail - Consumer Electronics | | | 2.6 | % | |

Apparel Manufacturers | | | 3.0 | % | | Chemicals - Specialty | | | 2.6 | % | |

Real Estate Management/Service | | | 3.0 | % | | Textile - Apparel | | | 2.6 | % | |

Casino Hotels | | | 3.0 | % | | Investment Management/Advisory Service | | | 2.6 | % | |

Retail - Jewelry | | | 2.9 | % | | Web Portals/ISP | | | 2.6 | % | |

Oil Company - Exploration & Production | | | 2.8 | % | | Optical Supplies | | | 2.4 | % | |

Shipbuilding | | | 2.8 | % | | Oil Company - Integrated | | | 2.4 | % | |

Telecommunication Services | | | 2.8 | % | | Tobacco | | | 2.3 | % | |

Real Estate Operations/Development | | | 2.8 | % | | Metal Processors & Fabricators | | | 2.3 | % | |

Cellular Telecommunications | | | 2.8 | % | | Distribution/Wholesale | | | 1.8 | % | |

REITS - Diversified | | | 2.7 | % | | | | | |

28

SCHEDULE OF INVESTMENTS

at December 31, 2014

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Shares | | COMMON STOCKS: 98.9% | | Value | |

Australia: 10.5% | | | |

| | 31,940 | | | Henderson Group PLC | | $ | 104,418 | | |

| | 16,300 | | | iiNET Ltd. | | | 104,085 | | |

| | 8,400 | | | JB Hi-Fi Ltd. | | | 107,653 | | |

| | 7,250 | | | Sonic Healthcare Ltd. | | | 108,877 | | |

| | | | | | | | 425,033 | | |

China: 33.9% | | | |

| | 19,000 | | | AAC Technologies Holdings Inc | | | 100,971 | | |

| | 153,000 | | | China Construction Bank Corp. - H Shares | | | 124,523 | | |

| | 169,000 | | | China Lilang Ltd. | | | 105,965 | | |

| | 51,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 127,273 | | |

| | 97,400 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 127,015 | | |

| | 9,500 | | | China Mobile Ltd. | | | 111,603 | | |

| | 20,000 | | | CNOOC Ltd | | | 27,055 | | |

| | 650 | | | CNOOC Ltd. - ADR | | | 88,036 | | |

| | 131,000 | | | Huabao International Holdings Ltd. | | | 106,933 | | |

| | 171,000 | | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 124,221 | | |

| | 84,000 | | | Pacific Textiles Holdings Ltd. | | | 111,110 | | |

| | 32,000 | | | Shenzhou International Group Holdings Ltd. | | | 105,640 | | |

| | 126,000 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 114,431 | | |

| | | | | | | | 1,374,776 | | |

Hong Kong: 14.0% | | | |

| | 38,000 | | | BOC Hong Kong Holdings Ltd. | | | 126,517 | | |

| | 80,000 | | | Global Brands Group Holdings Ltd.* | | | 15,637 | | |

| | 80,000 | | | Li & Fung Ltd. | | | 74,897 | | |

| | 18,500 | | | Link REIT/The | | | 115,483 | | |

| | 31,000 | | | Luk Fook Holdings International Ltd. | | | 116,090 | | |

| | 148,000 | | | NagaCorp Ltd. | | | 120,605 | | |

| | | | | | | | 569,229 | | |

Japan: 3.0% | | | |

| | 1,700 | | | Relo Holdings Inc. | | | 120,699 | | |

Malaysia: 2.8% | | | |

| | 64,900 | | | DiGi.Com Bhd | | | 114,142 | | |

Singapore: 5.5% | | | |

| | 62,000 | | | Ascendas Real Estate Investment Trust | | | 111,293 | | |

| | 72,000 | | | CapitaMall Trust | | | 110,789 | | |

| | | | | | | | 222,082 | | |

South Korea: 2.3% | | | |

| | 1,350 | | | KT&G Corp. | | | 93,611 | | |

The accompanying notes are an integral part of these financial statements.

29

Shares | | COMMON STOCKS: 98.9% (Continued) | | Value | |

Taiwan: 16.1% | | | |

| | 10,000 | | | Asustek Computer Inc. | | $ | 108,880 | | |

| | 12,000 | | | Catcher Technology Co., Ltd. | | | 92,361 | | |

| | 38,080 | | | Hon Hai Precision Industry Co., Ltd. | | | 105,008 | | |

| | 23,000 | | | Novatek Microelectronics Corp. | | | 128,668 | | |

| | 6,000 | | | St Shine Optical Co., Ltd. | | | 97,903 | | |

| | 28,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 123,557 | | |

| | | | | | | | 656,377 | | |

Thailand: 7.8% | | | |

| | 49,200 | | | Delta Electronics Thailand PCL/Foreign | | | 105,429 | | |

| | 171,500 | | | LPN Development PCL/Foreign | | | 113,984 | | |

| | 9,900 | | | PTT PCL/Foreign | | | 97,059 | | |

| | | | | | | | 316,472 | | |

United States: 3.0% | | | |

| | 1,640 | | | QUALCOMM Inc. | | | 121,901 | | |

| | | | | Total Common Stocks

(cost $3,554,997) | | | 4,014,322 | | |

| | | | | Total Investments in Securities

(cost $3,554,997): 98.9% | | | 4,014,322 | | |

| | | | | Other Assets less Liabilities: 1.1% | | | 45,966 | | |

| | | | | Net Assets: 100.0% | | $ | 4,060,288 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

30

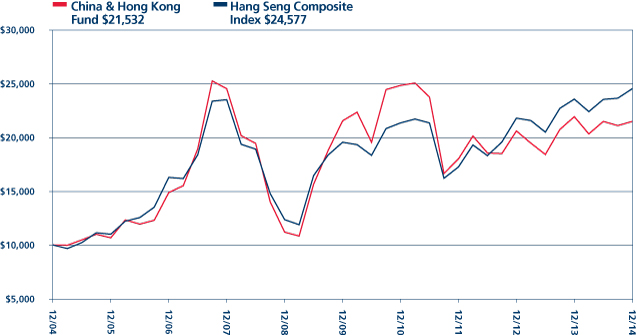

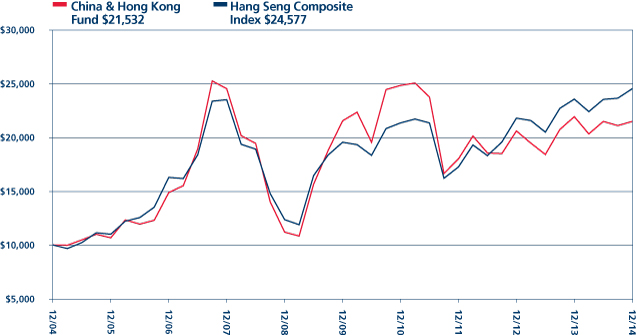

CHINA & HONG KONG FUND for the period ended December 31, 2014

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -1.97 | % | | | 6.09 | % | | | -0.03 | % | | | 7.97 | % | |

Benchmark Index: | |

Hang Seng Composite Index | | | 4.09 | % | | | 12.52 | % | | | 4.64 | % | | | 10.05 | % | |

S&P 500 Index | | | 13.66 | % | | | 20.34 | % | | | 15.42 | % | | | 7.66 | % | |

The Fund's expense ratio is 1.54% per the Summary Prospectus dated May 1, 2014. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2015. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these limitations, total returns would have been lower.

At the end of the first half of the year the Fund was down 1.97% compared to the Hang Seng Composite Index which rose 4.01%.

China's macro-economic backdrop remains difficult because of its interconnectedness, but not critical we believe. The effort to reduce investment and boost consumption is bound up with debt growth over the past few years which in turn in the result of poor capital allocation itself stemming from a financial system sorely in need of reform. The process of unpicking this, deleveraging, reducing excess capacity, re-pricing capital on a market basis all combine to slow economic growth. The government therefore faces the challenge of how to support growth in the short term without undermining its core efforts over the long term.