UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

225 South Lake Avenue, Suite 216 Pasadena, CA | | 91101 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr. 225 South Lake Avenue, Suite 216 Pasadena, CA 91101 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2018 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2018

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 7 | | | Expense Examples | |

| | 8 | | | Alternative Energy Fund | |

| | 16 | | | Asia Focus Fund | |

| | 23 | | | Asia Pacific Dividend Builder Fund | |

| | 30 | | | China & Hong Kong Fund | |

| | 37 | | | Dividend Builder Fund | |

| | 48 | | | Global Energy Fund | |

| | 58 | | | Global Innovators Fund | |

| | 67 | | | Renminbi Yuan & Bond Fund | |

| | 72 | | | Statements of Assets and Liabilities | |

| | 74 | | | Statements of Operations | |

| | 76 | | | Statements of Changes in Net Assets | |

| | 81 | | | Financial Highlights | |

| | 90 | | | Notes to Financial Statements | |

| | 103 | | | Report of Independent Registered Public Accounting Firm | |

| | 106 | | | Trustee and Officer Information | |

| | 109 | | | Privacy Notice | |

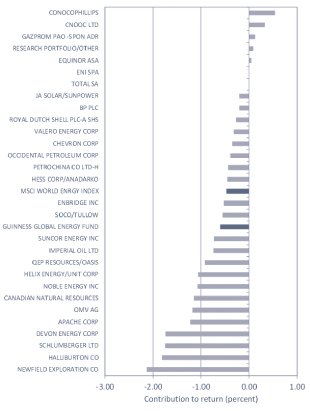

| | 110 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten-years and since inception periods through December 31, 2018. Also included in the table is the expense ratio data from the most recent prospectus dated May 1, 2018.

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | Since Inception | | Expense Ratio | |

Alternative Energy Fund (March 31, 2006) | | | -15.49 | % | | | -5.47 | % | | | -8.49 | % | | | -6.22 | % | | | -10.77 | % | | | 2.74 | % gross; 1.98% net | |

Asia Focus Fund (April 29, 1996) | | | -20.45 | % | | | 8.52 | % | | | 2.87 | % | | | 7.60 | % | | | 2.65 | % | | | 2.22 | % gross 1.98% net | |

Asia Pacific Dividend Builder Fund

(March 31, 2006) | | | -16.42 | % | | | 7.53 | % | | | 5.27 | % | | | 10.60 | % | | | 4.93 | % | | | 3.48 | % gross; 1.12% net | |

China & Hong Kong Fund (June 30, 1994) | | | -20.21 | % | | | 6.93 | % | | | 2.07 | % | | | 8.08 | % | | | 6.51 | % | | | 1.64 | % | |

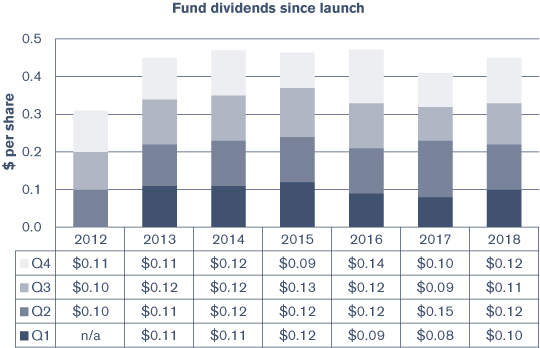

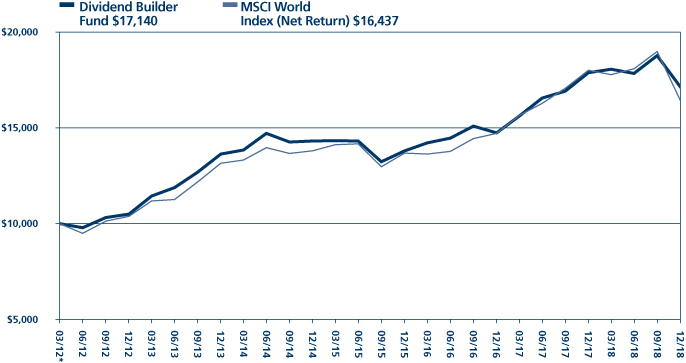

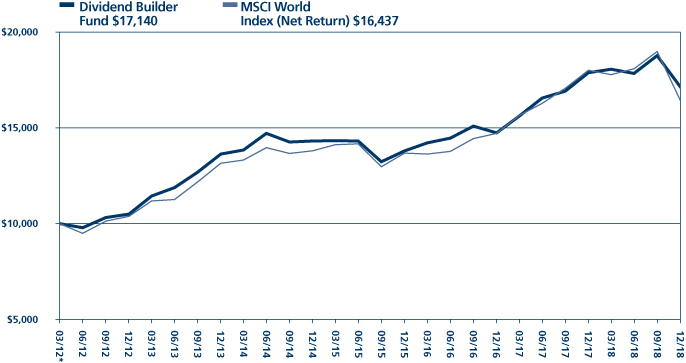

Dividend Builder Fund (March 30, 2012) | | | -4.14 | % | | | 7.51 | % | | | 4.69 | % | | | — | | | | 8.29 | % | | | 2.06 | % Gross; 0.68% net | |

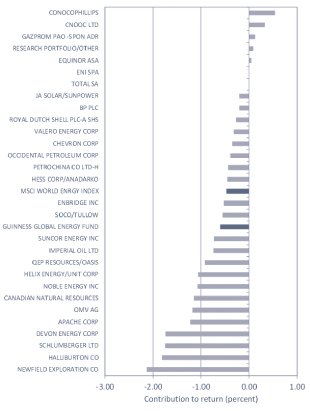

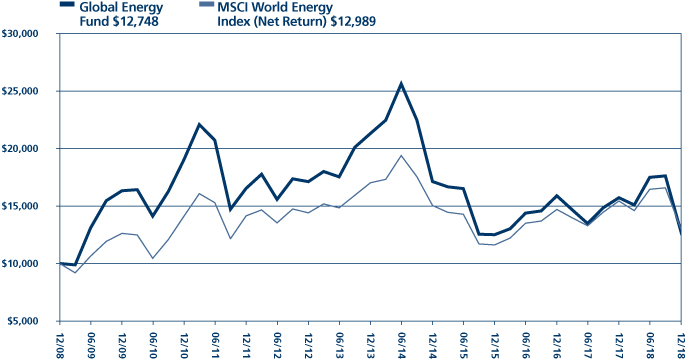

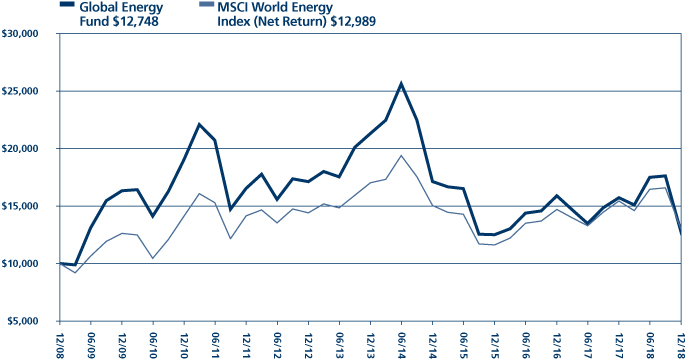

Global Energy Fund (June 30, 2004) | | | -18.92 | % | | | 0.63 | % | | | -9.77 | % | | | 2.46 | % | | | 4.81 | % | | | 1.62 | % gross 1.45% net | |

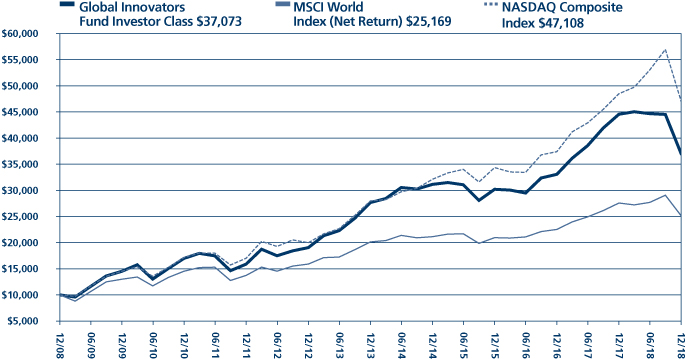

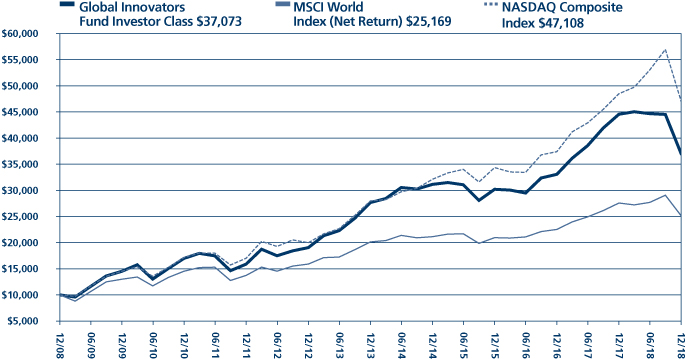

Global Innovators Fund Investor Class

(December 15, 1998) | | | -16.80 | % | | | 7.08 | % | | | 6.03 | % | | | 14.00 | % | | | 6.83 | % | | | 1.33 | % gross; 1.24% net | |

Global Innovators Fund Institutional Class

(December 31, 2015) | | | -16.59 | % | | | 7.35 | % | | | 6.19 | % | | | 14.09 | % | | | 6.87 | % | | | 1.17 | % gross; 0.99% net | |

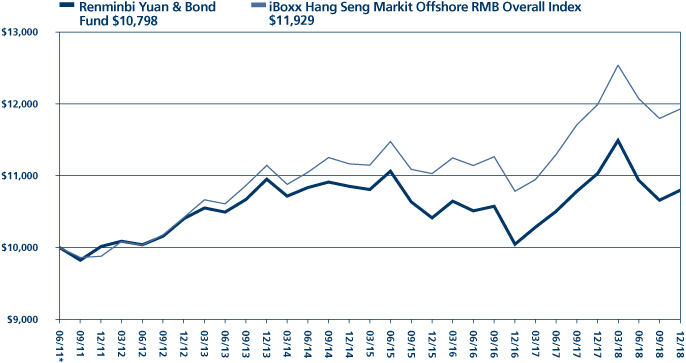

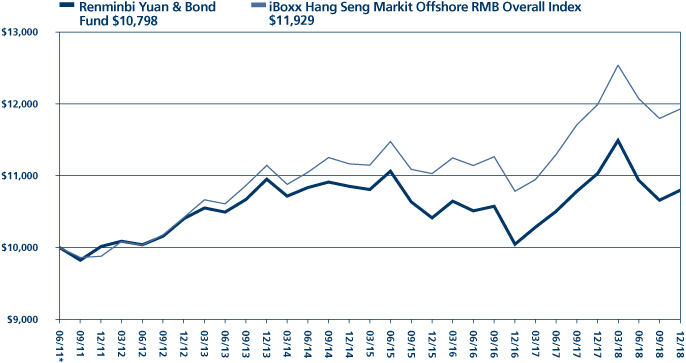

Renminbi Yuan & Bond Fund (June 30, 2011) | | | -2.12 | % | | | 1.21 | % | | | -0.29 | % | | | — | | | | 1.02 | % | | | 4.17 | % gross; 0.90% net | |

Periods of greater than one year are average annualized returns; one year and shorter period returns are actual returns. All returns are for the periods ended December 31, 2018.

Performance data shown for the Global Innovators, Institutional Class (GINNX), prior to its launch date on December 31, 2015, uses performance data from the Global Innovators, Investor Class (IWIRX).

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Expense ratios are from the most recent prospectus (dated May 1, 2018) and are from the most recent audited financials (period ended December 31, 2017) at the time that prospectus was completed.

4

Dear Guinness Atkinson Funds Shareholders,

You don't need us to tell you that 2018 was a bad year. Maybe that was to be expected given the returns over the previous ten years which were mostly positive in the aftermath of the financial crisis. As a result, all of the Guinness Atkinson Funds were down for the year. In this letter a year ago we were remarking that the MSCI World Index didn't experience a single negative month for calendar year 2017. 2018 will be remembered for its high levels of volatility and for a particularly nasty fourth quarter.

The best performing Guinness Atkinson Fund was the Renminbi Yuan & Bond Fund which produced a negative 2.12% return for the year. This was followed by the Dividend Builder which produced a total return of negative 4.14% for the year. The laggard in the family for the year was the Asia Focus Fund, down 20.45%. We noted a year ago that the worst performing Guinness Atkinson Fund for 2016 was the best performing of the group for 2017. That may not be a very good predictor for 2018 but it is worth noting that these calendar year figures can look very different year over year. You can see from the longer-term performance periods for the Funds that despite the 2018 setback most of the Funds have done quite well over the longer-term periods.

The longer-term performance is what, we hope, is of most importance to our shareholders. We've written about having a long-term outlook in past letters with some consistency – and indeed we manage the Funds with generally low levels of turnover and practice a buy and hold philosophy.

Fortunately, global markets have begun 2019 with a spring in their step. And while we are not great fans of the volatility or negative returns, we know the major themes that underpin the Guinness Atkinson Funds are still in place. We believe the world has an energy problem with growing demand and a need to switch to alternative energy. We believe that Asia and China will continue on their path to become economic powers and centers of influence that a region that one might expect given that one-third of the world's population is based in Asia. We believe innovative companies have a competitive edge and that competitive edge can be seen in their financial results.

Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to each Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and we are hopeful that 2019 will be significantly better that 2018.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds.

Sincerely, | | | |

| |

| |

Timothy Guinness | | James Atkinson | |

The views in this letter and in the commentaries delivered by our portfolio managers, were as of December 31, 2018 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the Funds' investment methodology and do not constitute investment advice. Portfolio manager views may change at any time and should not be considered a forecast or guarantee of future events or investment results. We do not have any obligation to, and we do not, update or alter forward-looking statements contained in this report. Forward-looking statements include predictions, projections and other statements describing expectations about future events. There is no guarantee that forward-looking statements will prove accurate.

5

Morningstar Ratings Through December 31, 2018

Fund | | Category | | Overall | | 3-year | | 5-year | | 10-year | |

Alternative Energy | | Foreign Small/ | | | 1 | * | | | 1 | * | | | 1 | * | | | 1 | * | |

| | Mid Value | | | (53 | funds) | | | (53 | funds) | | | (43 | funds) | | | (22 | funds) | |

Asia Focus | | Pacific/Asia | | | 2 | ** | | | 4 | **** | | | 2 | ** | | | 1 | * | |

| | ex-Japan | | | (81 | funds) | | | (81 | funds) | | | (60 | funds) | | | (29 | funds) | |

Asia Pacific Dividend | | Pacific/Asia | | | 4 | **** | | | 3 | *** | | | 5 | ***** | | | 4 | **** | |

Builder | | ex-Japan | | | (81 | funds) | | | (81 | funds) | | | (60 | funds) | | | (29 | funds) | |

China & Hong Kong | | China Region | | | 3 | *** | | | 4 | **** | | | 3 | *** | | | 2 | ** | |

| | | | | (81 | funds) | | | (81 | funds) | | | (73 | funds) | | | (41 | funds) | |

Dividend Builder | | World Stock | | | 4 | **** | | | 4 | **** | | | 4 | **** | | | — | | |

| | | | | (729 | funds) | | | (729 | funds) | | | (618 | funds) | | | |

Global Energy | | Energy Equity | | | 3 | *** | | | 4 | **** | | | 3 | *** | | | 3 | *** | |

| | | | | (91 | funds) | | | (91 | funds) | | | (76 | funds) | | | (58 | funds) | |

Global Innovators | | Large Blend | | | 3 | *** | | | 2 | ** | | | 2 | ** | | | 4 | **** | |

| | | | | (1,208 | funds) | | | (1,208 | funds) | | | (1,071 | funds) | | | (805 | funds) | |

Renminbi Yuan & Bond | | Emerging Markets | | | 3 | *** | | | 1 | * | | | 4 | **** | | | — | | |

| | Local Currency Bond | | | (69 | funds) | | | (69 | funds) | | | (56 | funds) | | | |

Morningstar Ratings Disclosure

Global Innovators Fund ratings shown were given for the Investor Share Class.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual issuer volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investment diversified among various sectors.

Past performance is not a guarantee of future results. The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

©2019 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

6

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees (applicable to the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund); and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2018 to December 31, 2018.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/18) | | Ending

Account

Value

(12/31/18) | | Expenses Paid

During Period*

(07/01/18 to

12/31/18) | | Expense Ratios

During Period*

(07/01/18 to

12/31/18) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 874.10 | | | $ | 9.35 | | | | 1.98 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 835.90 | | | $ | 9.21 | | | | 1.99 | %† | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.17 | | | $ | 10.11 | | | | 1.99 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 896.30 | | | $ | 5.31 | | | | 1.11 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.65 | | | | 1.11 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 821.70 | | | $ | 6.75 | | | | 1.47 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.79 | | | $ | 7.48 | | | | 1.47 | % | |

Guinness Atkinson Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 960.70 | | | $ | 3.36 | | | | 0.68 | %† | |

Guinness Atkinson Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | %† | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 728.70 | | | $ | 6.32 | | | | 1.45 | %† | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.90 | | | $ | 7.38 | | | | 1.45 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Actual | | $ | 1,000.00 | | | $ | 830.00 | | | $ | 5.81 | | | | 1.26 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.85 | | | $ | 6.41 | | | | 1.26 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class Actual | | $ | 1,000.00 | | | $ | 831.20 | | | $ | 4.66 | | | | 1.01 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.11 | | | $ | 5.14 | | | | 1.01 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 987.20 | | | $ | 4.81 | | | | 0.96 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.37 | | | $ | 4.89 | | | | 0.96 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (365) (to reflect the one-half year period).

†Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

7

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND for the period ended December 31, 2018

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

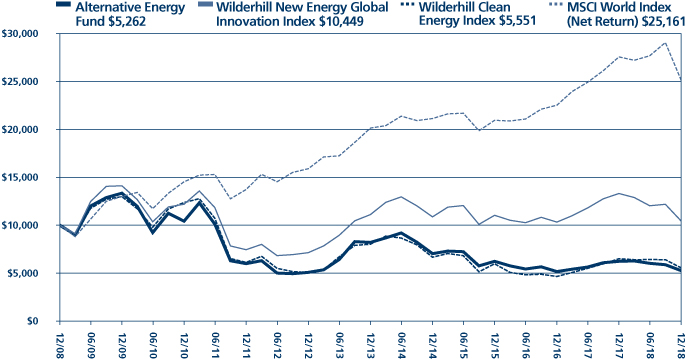

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

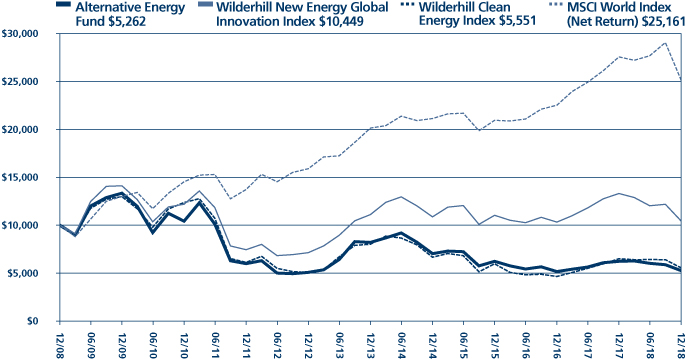

Fund | | | -15.49 | % | | | -5.47 | % | | | -8.49 | % | | | -6.22 | % | |

Benchmark Indices: | |

Wilderhill Clean Energy Index | | | -14.57 | % | | | -2.38 | % | | | -7.08 | % | | | -5.71 | % | |

Wilderhill New Energy Global Innovation Index | | | -19.12 | % | | | -1.05 | % | | | -0.90 | % | | | 0.44 | % | |

MSCI World Index (Net Return) | | | -8.71 | % | | | 6.30 | % | | | 4.56 | % | | | 9.66 | % | |

For the Fund's current one-year expense ratios, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

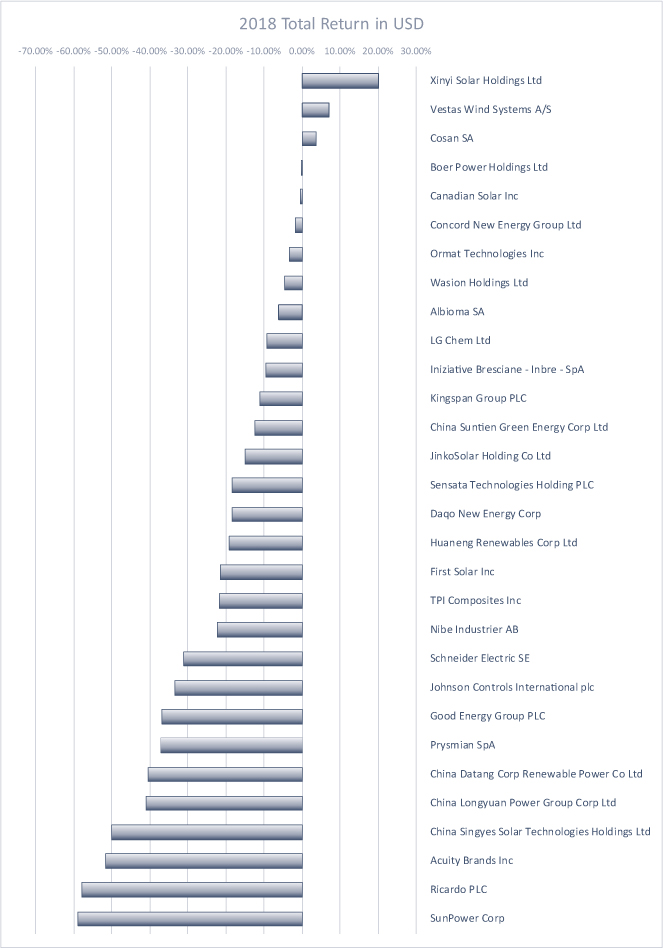

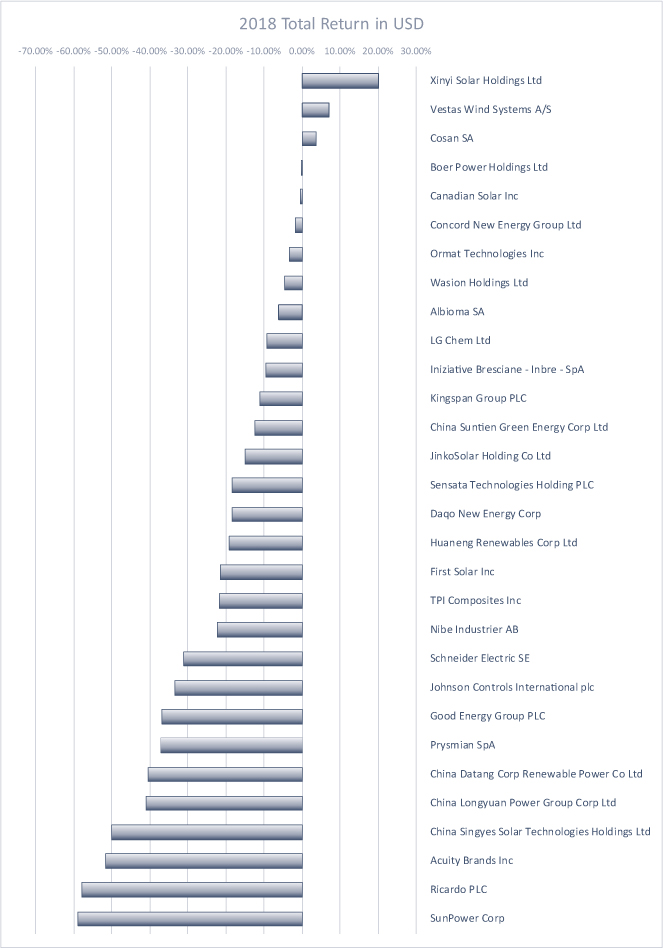

The Fund was down 15.49% in 2018. The Fund was particularly weak in the second half of 2018 when weakness in the broad markets weighed on the portfolio. The Fund was down 3.31% for the first half of the year and down 12.59% for the second half of the year. The Fund outperformed the Wilderhill New Energy Index which was down 19.12% in 2018, and underperformed against the Wilderhill Clean Energy Index, which was down 14.57% in 2018.

The Fund's renewables holdings performed materially worse than the Fund's holdings that related to the consumption of energy. Within the renewables holdings the grid and renewable installation equipment manufacturers materially underperformed. The overarching driver of the weak fund performance was the weakness in global equity markets.

The Fund's holdings related to consumption can be broadly divided into those which relate to displacement of fossil fuel consumption and those that relate to electrification of consumption. Building efficiency improvements create displacement of energy consumption and the fund's holding in Nibe, who are the leading global provider of heat pumps were one of the fund's few positive performance. Johnson Controls and Acuity Brands were relatively weak, particularly in the fourth quarter as concerns about the US economy weighed on stocks. Kingspan, the insulation manufacturer was flat for the year. Cosan is (among other things) a leading distributor of ethanol in the Brazilian market and suffered from strikes and weak Brazilian equity markets.

Electrification is exemplified by Battery and Electric Vehicle companies. The Fund's holding in Tianneng Power International, a Chinese vehicle battery producer performed well and was well sold in the middle of the year. LG Chem's battery business is moving towards profitability but saw some weakness amid concerns about how long it will take to get there. Sensata are potential beneficiaries of the shift to electric vehicles as leading providers of electric sensors, but suffered along with the whole US market. Ricardo was a disappointment. As a provider of engineering services to the automotive industry, they should be a key facilitator for companies looking to improve engine efficiency and shift to electric, but weak second half results weighed on the stock.

The Fund's exposure to renewables is split between generating companies and equipment manufacturers. The Fund holds five Chinese renewable asset owners which between them did not contribute significantly to the weak fund performance. This reflects improving payment timing in China and a move to lower levels of curtailment of renewable production. The other generation holdings are in biomass, geothermal and hydroelectricity. Despite the geothermal company, Ormat running into operational problems relating to volcanic eruption at a facility in Hawaii, it has performed in line with the rest of the portfolio.

The Fund has had exposure to wind, solar and grid equipment manufacturing companies in 2018. The wind companies – TPI Composites and Vestas have been bright spots of performance for 2018, reflecting solid balance sheets and good operational performance. This is in marked contract to the solar manufacturers who have suffered from the surprise withdrawal by China of a number of its subsidy supports, which caused major weakness in stock prices. Grid equipment companies were relatively weak in 2018, with Prysmian struggling to digest its General Cable acquisition and Schneider Electric underperforming amid concerns in a slowdown in general infrastructure spending that is not necessarily warranted. Wasion, the Chinese metering company performed well as previously delayed contracts were executed leading to better earnings.

8

Performance chart shows the performance of companies held in the portfolio at the end of 2018 over the period held in the portfolio. Source: Bloomberg, Guinness Atkinson.

9

2. Activity

In the first quarter the Fund sold its positions in Boralex, Senvion and JA Solar, replacing them with Acuity Brands, Vestas and Daqo.

The Fund sold its position in Boralex base on a view that the stock was fully valued. Boralex operates in Canada and France, where favourable feed-in tariff levels for new projects are being replaced by competitive auction pricing which is likely to lead to deterioration in returns on future projects.

The Fund acquired a position in Acuity Brands based on its low valuation and attractive market positioning. Acuity Brands provides lighting and building efficiency solutions, where evolving technologies including LEDs offer an attractive growth trajectory.

The Fund sold its position in Senvion based on relative valuation and concerns about deterioration of the German market for wind turbines. The Fund had acquired the position in Senvion due to the large discount that it traded at compared to its peer group.

The Fund replaced the position in Senvion with a position in Vestas which had seen stock price weakness despite a leading market position and scoring well in the Fund's screening.

In the second quarter, the Fund was the beneficiary of two buyout offers. The Fund sold its position in JA Solar as a result of a management buyout and replaced it with a position in Daqo, a Chinese polysilicon supplier. Daqo has strengthened its balance sheet over the last two years with high levels of operating cashflow and capital raises. Within the silicon market Daqo is focusing on the raw materials for mono-crystalline silicon solar cells, a subsector of the solar module market that is set to grow at a faster rate than the overall solar market and relies on higher purity polysilicon.

The Fund sold its position in Mytrah Energy which was bought out by its chairman. The offered price was at a 64% premium to the closing price at the time of announcement.

The Fund sold its position in Tianneng Power International. This bicycle battery business in China had reached the valuation targeted on acquiring the position. Furthermore there were concerns about price competition in their core market as witnessed by weak trading at competitors.

In the third quarter the Fund acquired a position in Albioma, an international biomass energy producer in the Francophone world.

The Fund made no changes to portfolio membership in the fourth quarter but benefited from judicious rebalancing.

3. Portfolio Position

The Fund's largest country exposures were to China, the United States, Canada, Italy, the United Kingdom and Brazil. With China contributing half of the annual installations of wind and solar, over three-quarters of solar manufacturing capacity and over half of wind turbine manufacturing capacity, investing in China is a key part of the current investment opportunity.

At the end of 2018, the Fund held 27.16% in companies that produce power, 25.68% in companies that manufacture and install renewable installations, 13.19% in companies that improve building efficiency and 11.78% in electric grid related companies. The smaller exposures are to Electric Vehicles (6.33%), Renewables Developers (3.53%), Battery companies (3.33%) and Biofuels (3.29%) and Green Utility companies (1.34%).

4. Outlook

While sector and global equity markets performance was weak in 2018, there are good signs that the outlook for the alternative energy sector is improving. Renewables are becoming cost competitive without subsidies and volumes installed continue to grow. At the point where subsidies fall away, the growth should no longer be constrained by falling and sclerotic government support. Despite the surprise removal of subsidies for solar in China, they are actively supporting unsubsidised, often on site generation projects and there are good signs that the Chinese solar market is already recovering from this shock. The wind market continues to evolve, with offshore wind becoming materially more important for a number of manufacturers. Most importantly the markets for both wind and solar are now truly global, which again provides a better support base and more opportunities for best practises to be learnt and exported internationally.

While biofuels are not a global growth story, there remain attractive investment opportunities in specific regions and also provides a meaningful displacement for fossil fuels where implemented. The areas of most potential excitement continue to be batteries and electric vehicles. The rest of the car manufacturing world are catching up with Tesla (not owned) and it still remains to be

10

seen which car companies will create the successful vehicle models and technical innovations that expand the opportunity to the mass market. There are a number of attractive investment opportunities in companies that are model agnostic and will be part of the overall shift.

The Fund remains well positioned for growth of the alternative energy sector, and there are signs that the sector is maturing to provide investment opportunities with sustainable earnings growth. Thank you for your support.

Edward Guinness

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The Wilderhill New Energy Global Innovation Index is a modified US dollar-weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index is a modified equal US dollar-weighted index of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. These indices are unmanaged, not available for investment and do not incur expenses. The MSCI World Index (Net Return) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay. This index is unmanaged, not available for investment and does not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

11

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2018

| One Year | | Five Years | | Ten Years | |

| | -15.49 | % | | | -8.49 | % | | | -6.22 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

The Wilderhill New Energy Global Innovation Index is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. The MSCI World Index (Net Return) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay.

12

FUND HIGHLIGHTS at December 31, 2018

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | 30 | |

Portfolio Turnover: | | 36.5% | |

% of Stocks in Top 10: | | 37.3% | |

Fund Manager: | | | |

Edward Guinness | | | |

Top 10 Holdings (% of net assets) | | | | Industry Breakdown (% of net assets) | | | |

Wasion Group Holdings Ltd. | | | 4.0 | % | | Efficiency | | | 35.7 | % | |

China Suntien Green Energy Corp. Ltd. - H Shares | | | 3.8 | % | | Solar | | | 27.1 | % | |

Albioma SA | | | 3.8 | % | | Wind | | | 26.2 | % | |

JinkoSolar Holding Co., Ltd. - ADR | | | 3.7 | % | | Geothermal | | | 3.7 | % | |

China Datang Corp. Renewable Power Co., Ltd. - H Shares | | | 3.7 | % | | Biofuel | | | 3.4 | % | |

Ormat Technologies Inc. | | | 3.7 | % | | Hydro | | | 2.5 | % | |

Huaneng Renewables Corp. Ltd. - H Shares | | | 3.7 | % | | | | | | | |

Nibe Industrier AB - B Shares | | | 3.7 | % | | | | | | | |

China Singyes Solar Technologies Holdings Ltd. | | | 3.6 | % | | | | | | | |

Sensata Technologies Holding | | | 3.6 | % | | | | | | | |

13

SCHEDULE OF INVESTMENTS

at December 31, 2018

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 98.6% | | Value | |

Biofuel: 3.4% | | | |

| | 31,000 | | | Cosan SA Industria e Comercio | | $ | 267,628 | | |

Efficiency: 35.7% | | | |

| | 2,300 | | | Acuity Brands Inc. | | | 264,385 | | |

| | 1,274,000 | | | Boer Power Holdings* | | | 102,425 | | |

| | 8,502 | | | Johnson Controls International PLC | | | 252,085 | | |

| | 6,240 | | | Kingspan Group PLC | | | 268,154 | | |

| | 870 | | | LG Chem Ltd. | | | 270,381 | | |

| | 27,975 | | | Nibe Industrier AB - B Shares | | | 287,627 | | |

| | 13,236 | | | Prysmian SpA | | | 257,187 | | |

| | 28,470 | | | Ricardo PLC | | | 227,376 | | |

| | 4,140 | | | Schneider Electric SE | | | 284,450 | | |

| | 6,400 | | | Sensata Technologies Holding* | | | 286,976 | | |

| | 644,000 | | | Wasion Group Holdings Ltd. | | | 313,344 | | |

| | | | | | | | 2,814,390 | | |

Geothermal: 3.7% | | | |

| | 5,559 | | | Ormat Technologies Inc. | | | 290,736 | | |

Hydro: 2.5% | | | |

| | 9,144 | | | Iniziative Bresciane - Inbre - SpA† | | | 199,058 | | |

Solar: 27.1% | | | |

| | 13,700 | | | Albioma SA | | | 297,255 | | |

| | 19,000 | | | Canadian Solar Inc.* | | | 272,460 | | |

| | 1,045,400 | | | China Singyes Solar Technologies Holdings Ltd.† | | | 287,033 | | |

| | 10,500 | | | Daqo New Energy Corp.* | | | 245,700 | | |

| | 6,100 | | | First Solar Inc.* | | | 258,976 | | |

| | 29,800 | | | Jinkosolar Holdings Co., Ltd. - ADR* | | | 294,722 | | |

| | 41,550 | | | SunPower Corp. - Class B* | | | 206,504 | | |

| | 774,200 | | | Xinyi Solar Holdings Ltd. | | | 271,351 | | |

| | | | | | | | 2,134,001 | | |

The accompanying notes are an integral part of these financial statements.

14

Shares | | COMMON STOCKS: 98.6% (Continued) | | Value | |

Wind: 26.2% | | | |

| | 2,448,000 | | | China Datang Corp. Renewable Power Co., Ltd. - H Shares | | $ | 291,241 | | |

| | 408,000 | | | China Longyuan Power Group Corp. - H Shares | | | 277,607 | | |

| | 1,179,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 302,345 | | |

| | 6,670,000 | | | Concord New Energy Group Ltd. | | | 261,549 | | |

| | 91,167 | | | Good Energy Group PLC† | | | 108,648 | | |

| | 1,084,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 288,645 | | |

| | 10,900 | | | TPI Composites Inc.* | | | 267,922 | | |

| | 3,565 | | | Vestas Wind Systems A/S | | | 270,085 | | |

| | | | | | | | 2,068,042 | | |

| | | | | Total Common Stocks

(cost $11,310,533) | | | 7,773,855 | | |

| | | | | Total Investments in Securities

(cost $11,310,533): 98.6% | | | 7,773,855 | | |

| | | | | Other Assets less Liabilities: 1.4% | | | 113,721 | | |

| | | | | Net Assets: 100.0% | | $ | 7,887,576 | | |

* Non-income producing security.

ADR - American Depository Receipt

PLC - Public Limited Company

† The Advisor has determined these securities to be Illiquid. As of December 31, 2018, the total market value of these illiquid securities represent 7.5% of net assets. The total market value of these illiquid securities is $594,739.

The accompanying notes are an integral part of these financial statements.

15

GUINNESS ATKINSON ASIA FOCUS FUND for the period ended December 31, 2018

1. Performance

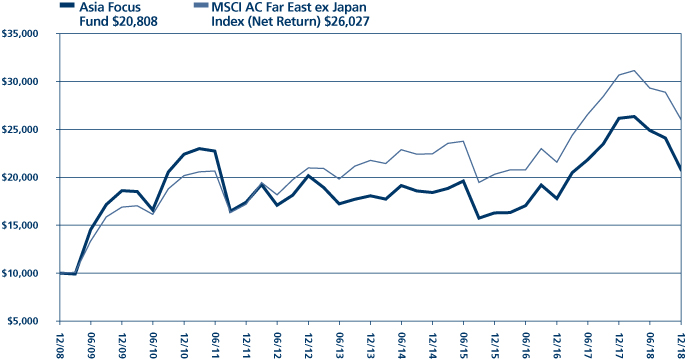

AVERAGE ANNUAL TOTAL RETURNS

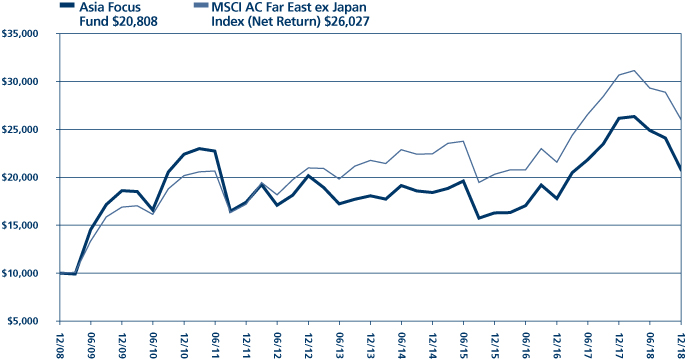

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -20.45 | % | | | 8.52 | % | | | 2.87 | % | | | 7.60 | % | |

Benchmark Index: | |

MSCI AC Far East ex Japan Index (Net Return) | | | -15.14 | % | | | 8.61 | % | | | 3.64 | % | | | 10.03 | % | |

(All performance data given in USD terms)

For the Fund's current one-year expense ratio, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

After a strong year 2017 for Asian equities, in 2018, Asian markets fell 15.14% (as measured by the MSCI AC Far East ex Japan Index). The Fund underperformed in the weaker market conditions, falling 20.45%.

The best-performing sector in 2018, as measured by the sector indices within the MSCI AC Far East ex Japan Index in USD terms – and the only one to generate a positive return – was Utilities +5%. Other sectors that performed relatively well were Energy – 2%, Communication Services – 6%, Real Estate – 9%, and Financials – 9%. Weaker sectors were Consumer Discretionary – 32%, Information Technology – 21%, Health Care – 17%, Materials – 13%, Industrials – 12%, and Consumer Staples – 11%.

All countries in the region (as measured by their respective MSCI country indices) fell, with Thailand – 5% falling the least, closely followed by Malaysia – 6%, Hong Kong – 8% and Taiwan – 8%. The worst performing countries were Korea – 21%, China – 19% and Philippines – 16%.

In the case of China and Korea, much of the weakness is attributable to the rise in trade tensions witnessed over the course of the year, particularly in respect of the US-China trade relationship. The dispute, which essentially began with the imposition of tariffs over imported steel and aluminium in the US, escalated over the course of the year with the imposition of tariffs by the US on a much greater array of goods, accompanied by the threat to increase tariff rates at the beginning of 2019. China reciprocated by targeting imports of US agricultural products. Trade talks continued in an on-off fashion throughout the latter part of the year, but failed to quell the uncertainty in the markets. As the tariffs began to take effect, activity was initially pulled forwards, but then slowed signs of slowing towards the end of the year – this was one of the significant contributing factors behind the market sell-offs in the fourth quarter.

Ongoing negotiations are complex – the narrative from the US side has shifted from wanting to address the overall trade imbalance to tackling a variety of issues: intellectual property transfer, market access, and state subsidisation. But we expect China to continue to fight for its own interests fiercely. China is approaching a delicate point in its economic development, as what were demographic tailwinds are gradually shifting to becoming headwinds, as the population ages over time. Made in China 2025, and the associated advances in industrial capabilities, are the Chinese authorities' efforts to move up the income curve in order to combat the changing composition of its population.

Our Technology holdings were generally weak, particularly those companies operating in the smartphone supply chain. Technology was the best performing sector last year, so to some extent this represents giving back some of the gains made in 2017, as investors scaled back their overly-optimistic projections. The companies also suffered as a result of weaker demand for smartphones, a theme that was observed early in the year, and continued throughout. A hoped-for source of demand from the latest iPhone product cycle released in the Autumn ultimately proved rather lacklustre and disappointed relative to expectations. Nevertheless, we are positive on these companies' prospects for two reasons. First, we expect the next wave of new features and technologies (5G and folding screens, for example) to serve as a catalyst for future phone upgrades and stronger consumer demand. Second, the companies we are investing in are often the market leaders in their respective niches, and as such command a degree of pricing power (see our comments on AAC below).

16

The best performing stock this year was Novatek Microelectronics, which rose 28%. The company is a designer of integrated circuits, used primarily in flat-screen displays, in a variety of applications including TVs, tablets, smartphones and cars. Novatek has recently benefited from greater adoption of its chips within TFT panels especially for Touch and Display Driver integrated chips. Competitors have struggled this year but Novatek's leading position has enabled it to obtain priority at chip foundries, where capacity has been tight. They have also been able to pass on higher raw materials costs and so reported higher margins than the market expected.

The weakest stock in the portfolio was Li & Fung, which fell 67%. The company faced a difficult year. It has been making progress in in its restructuring programme, but this is being worked on at a time when the environment for some its main customers has been poor. US retailers have been closing stores to reduce their footprint, and correspondingly have reduced stock levels. Trade tensions have added an extra dimension of uncertainty and the market is not prepared to take a chance on a business in this segment that is in transition. However, Li & Fung specialised in diversified supply chains and complex supply chain management and so there is scope for the company to benefit as higher tariffs prompt businesses to make changes to their existing supply chains. Conditions are likely to remain tough. As long as trade tensions linger, we expect some of Li & Fung's customers to be cautious about taking on new supply chain solutions. At the same time, the company remains committed to re-modelling its digital platform which it sees as essential to the long-term prosperity of the business, but it will mean incurring extra costs. In this case, what is good for the company in the long term may not be so good for the shares in the short term.

AAC Technologies was weak, also falling 67%, following last year in which the stock was among our best performers. Earnings forecasts have been cut and are expected to be 20% down on last year. The share price fall has been exacerbated by its high valuation. It was one of the few stocks in the portfolio that included a significant portion of future growth expectations in its valuation which has now come out. While we are confident in the company and its operational outlook, we ought to have been more alive to this risk. At this point we continue to hold on and add. It is a company in the smartphone supply chain which, due to its constant innovation, has real pricing power. For example, in 2018 AAC has been promoting its new "Super Linear Structure" (SLS) product which produces greater audio volume for the same sized speaker. These products have an average selling price that is 30-50% higher than existing products.

2. Portfolio Position

Compared to the benchmark, on a sector basis the Fund is most overweight in Information Technology and Health Care, with a 6% overweight to both sectors. The Fund is also 3% overweight Utilities and 2% overweight Consumer Discretionary stocks. The Fund is most underweight Real Estate and Financials, with underweights of 7% and 6%, respectively.

On a country basis the Fund is overweight Australia, Thailand, China (including Macau) and Taiwan. The Fund is underweight Hong Kong, Korea, Indonesia, Philippines and Singapore.

3. Outlook

The fund trades (on a price to earnings basis) at a level we believe to represent a compelling valuation, both on an absolute basis (trading at 10.4x 2018 earnings and 9.9x 2019 earnings) and on a relative basis (trading at a discount to the benchmark on both historic and forecast earnings).

Sentiment towards Asian markets is undeniably weak, and valuations are at levels not seen for several years. The difference this time is that economies are coming from a period of strength, and despite some recent weakness in earnings estimates, respectable levels of growth at the portfolio level are still forecast for 2019 and 2020.

If Asian corporations continue to report earnings that meet market expectations, then the prospects for investors look bright. Valuations at these levels augur for attractive shareholder returns in future. The main risks are a significant decline in Chinese economic activity, or potentially a wider global economic slowdown. Nevertheless, Asian equities appear attractive, particularly in the context of higher valuations elsewhere in the world.

Edmund Harriss

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more

17

exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC (All Country) Far East ex Japan Index (Net Return) is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay. This index is unmanaged, not available for investment and does not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

18

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2018

| One Year | | Five Years | | Ten Years | |

| | -20.45 | % | | | 2.87 | % | | | 7.60 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East ex-Japan Index (Net Return) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance of the Far East region excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay.

19

FUND HIGHLIGHTS at December 31, 2018

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | 35 | |

Portfolio Turnover: | | 32.0% | |

% of Stocks in Top 10: | | 34.3% | |

Fund Manager: | | | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 3.7% | | Sonic Healthcare Ltd. | | 3.4% | |

Hanon Systems | | 3.6% | | DBS Group Holdings Ltd. | | 3.4% | |

Electricity Generating PCL/Foreign | | 3.4% | | QUALCOMM Inc. | | 3.4% | |

NetEase Inc. - ADR | | 3.4% | | China Construction Bank Corp. - H Shares | | 3.3% | |

Corporate Travel Management Ltd. | | 3.4% | | Glow Energy PCL /Foreign | | 3.3% | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | 15.5% | | Public Thoroughfares | | 3.1% | |

Semiconductor Components - Integrated Circuits | | 10.2% | | Optical Supplies | | 3.0% | |

Electric - Generation | | 6.7% | | Building & Construction Products - Miscellaneous | | 2.9% | |

Electronic Component Miscellaneous | | 4.6% | | E-Commerce/Services | | 2.8% | |

Auto/Truck Parts & Equipment | | 3.6% | | Internet Application Software | | 2.8% | |

Entertainment Software | | 3.4% | | Web Portals | | 2.7% | |

Travel Services | | 3.4% | | Auto - Cars/Light Trucks | | 2.6% | |

MRI/Medical Diagnostic Imaging | | 3.4% | | Photo Equipment & Supplies | | 2.4% | |

Investment Management/Advisor Sevices | | 3.2% | | Pharmaceuticals | | 2.4% | |

Building Products - Cement/Aggregates | | 3.2% | | Metal Processors & Fabricators | | 2.3% | |

Oil Company - Integrated | | 3.2% | | Distribution/Wholesale | | 2.3% | |

Tobacco | | 3.2% | | Schools | | 2.2% | |

Electronic Components - Semiconductor | | 3.1% | | | | | |

20

SCHEDULE OF INVESTMENTS

at December 31, 2018

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 98.2% | | Value | |

Australia: 6.8% | | | |

| | 34,090 | | | Corporate Travel Management Ltd. | | $ | 515,604 | | |

| | 33,141 | | | Sonic Healthcare Ltd. | | | 515,200 | | |

| | | | | | | | 1,030,804 | | |

China: 39.5% | | | |

| | 40,000 | | | AAC Technologies Holdings Inc. | | | 231,796 | | |

| | 98,000 | | | Anhui Conch Cement Co., Ltd. - H Shares | | | 475,189 | | |

| | 5,400 | | | Autohome Inc. | | | 422,442 | | |

| | 2,600 | | | Baidu Inc.* | | | 412,360 | | |

| | 610,000 | | | China Construction Bank Corp. - H Shares | | | 503,598 | | |

| | 888,000 | | | China Lesso Group Holdings Ltd. | | | 443,399 | | |

| | 113,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 414,679 | | |

| | 640,200 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 440,877 | | |

| | 220,000 | | | Geely Automobile Holdings Ltd. | | | 387,502 | | |

| | 2,200 | | | NetEase Inc. - ADR | | | 517,814 | | |

| | 6,000 | | | New Oriental Education & Technology Group Inc. - ADR | | | 328,860 | | |

| | 11,200 | | | Noah Holdings Ltd.* | | | 485,184 | | |

| | 422,000 | | | Shenzhen Expressway Co., Ltd. - H Shares | | | 465,322 | | |

| | 10,500 | | | Tencent Holdings Ltd. | | | 420,274 | | |

| | 3 | | | Tencent Music Entertainment Group | | | 36 | | |

| | | | | | | | 5,949,332 | | |

Hong Kong: 4.7% | | | |

| | 2,155,000 | | | Li & Fung Ltd. | | | 338,329 | | |

| | 556,000 | | | Sino Biopharmaceutical Ltd. | | | 364,523 | | |

| | | | | | | | 702,852 | | |

Malaysia: 3.1% | | | |

| | 78,300 | | | Public Bank Bhd | | | 468,894 | | |

Singapore: 3.4% | | | |

| | 29,279 | | | DBS Group Holdings Ltd. | | | 508,250 | | |

South Korea: 9.9% | | | |

| | 56,100 | | | Hanon Systems | | | 542,223 | | |

| | 5,210 | | | KT&G Corp. | | | 474,472 | | |

| | 13,550 | | | Samsung Electronics Co., Ltd. | | | 469,426 | | |

| | | | | | | | 1,486,121 | | |

Taiwan: 17.6% | | | |

| | 48,000 | | | Catcher Technology Co., Ltd. | | | 350,909 | | |

| | 212,000 | | | Elite Material Co., Ltd. | | | 453,445 | | |

| | 3,500 | | | Largan Precision Co., Ltd. | | | 366,672 | | |

| | 102,000 | | | Novatek Microelectronics Corp. | | | 472,897 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 6 | | |

| | 26,000 | | | St Shine Optical Co., Ltd. | | | 456,061 | | |

| | 75,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 549,405 | | |

| | | | | | | | 2,649,395 | | |

The accompanying notes are an integral part of these financial statements.

21

Shares | | COMMON STOCKS: 98.2% (Continued) | | Value | |

Thailand: 9.8% | | | |

| | 68,100 | | | Electricity Generating PCL/Foreign | | $ | 518,287 | | |

| | 178,700 | | | Glow Energy PCL/Foreign | | | 488,731 | | |

| | 336,000 | | | PTT PCL/Foreign | | | 474,929 | | |

| | | | | | | | 1,481,947 | | |

United States: 3.4% | | | |

| | 8,900 | | | QUALCOMM Inc. | | | 506,499 | | |

| | | | | Total Common Stocks

(cost $12,293,583) | | | 14,784,094 | | |

| | | | | Total Investments in Securities

(cost $12,293,583): 98.2% | | | 14,784,094 | | |

| | | | | Other Assets less Liabilities: 1.8% | | | 274,398 | | |

| | | | | Net Assets: 100.0% | | $ | 15,058,492 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

22

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND for the period ended December 31, 2018

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -16.42 | % | | | 7.53 | % | | | 5.27 | % | | | 10.60 | % | |

Benchmark Index: | |

MSCI AC Pacific ex Japan Index (Net Return) | | | -14.51 | % | | | 7.94 | % | | | 2.90 | % | | | 9.81 | % | |

(All performance data given in USD terms)

For the Fund's current one-year expense ratio, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund fell 16.42% in 2018 compared to the benchmark which fell 14.51%. The Fund was ahead of the benchmark at the end of October, but the last two months saw a significant rise in volatility and ended the year with a sharp sell-off.

When considering the performance of the portfolio we think in terms of the contributions from profits, dividends and valuation multiples (of earnings) to the total return. There was a continual tension between performance drivers during the year; macro conditions competed with underlying operating performance from individual companies for dominance.

In the second and fourth quarters, macro factors won out with China trade issues and Federal Reserve interest rate policy being major issues. In these periods the Fund did not defend as well as we normally expect and instead, we saw a compression in stock valuations. In the other periods, when macro concerns were dialled down, the operating performances of the underlying companies, which support profits and dividends, reasserted themselves as performance drivers and the Fund outperformed.

The major talking points for Asia centered for the most part, as ever, on China. Chinese economic growth is on a decelerating glidepath, as it should be as the economy shifts from investment-led to consumption and services-led growth. The perennial question is whether this is a process which can be managed alongside unwinding of debt built up during the investment phase, without significant disruption. The process has been made more difficult by the sharp rise in trade tensions but despite gloomy forecasts, China continues to do so effectively.

The technology sector has also had a more difficult year, especially in hardware manufacturing and assembly. The focus has been on smartphones and slower sales for Apple, especially in China. However, the smartphone picture in China is not so straightforward: Apple blamed weaker Chinese sales on a slowing Chinese economy, but the suspicion is this more of an Apple problem than a China problem. Smartphone sales volume in China declined last year but local Chinese smartphone brands did much better than Apple. We note the big improvements in the build quality of these devices leaving consumers less willing to pay Apple's premium pricing. Regardless of reasoning however, stocks in the Apple supply chain did not do well in 2018 and for the Fund this meant AAC Technologies, Catcher Technology and Hon Hai Precision fell heavily especially at the end of the year.

There were twenty-two stocks out of thirty-six holdings which out-performed in 2018 drawn from retail, ship building, technology, banking, real estate, telecommunications and energy operating in Australia, China, Malaysia, Singapore, Taiwan and Thailand. In all cases, for outperformers and underperformers alike, we have selected companies whose superior profitability has been sustained for many years and whose stock prices under-value the persistence of profitability that we believe is likely.

2. Portfolio Changes

We made two changes to the portfolio, both during the first half of the year. The first switch we made was to sell Relo Holdings in Japan (held December 2013 – April 2018) and to buy Corporate Travel Management in Australia.

Relo, the one Japanese-listed stock in the portfolio, had been an excellent performer in the fund, but the yield contribution from the stock had fallen to a low level as the stock price had risen, accompanied by an increase in valuation multiples. While we thought the prospects for the company were good, we felt there were more attractive opportunities from an income and valuation perspective.

23

ASIA PACIFIC DIVIDEND BUILDER FUND

Corporate Travel Management (CTM) is an Australian company that provides travel management services for corporate clients in Australia, the US, Europe and Asia. In its most recent half-year results the company reported 15% growth in revenue and 32% growth in underlying EBITDA (earnings before interest, tax, depreciation and amortization). The dividend was also increased 25%. We like the client proposition that CTM offers: reducing travel costs for its clients while making it easier to arrange and manage bookings. The founder and Managing Director owns a significant equity stake in the business. As with Relo, we expect a significant proportion of our total return as shareholders to come from continued earnings growth in the business, leading to growth in the income stream from dividends.

The second switch we made was to sell LPN Development in Thailand (held March 2013 – April 2018*) and to buy Public Bank in Malaysia.

LPN Development had been a disappointing performer in recent times. The company, a Thai real estate developer centred around Bangkok, reported poor 2017 results, and had seen downgrades to 2018 earnings over a sustained period. LPN struggled with a build-up of inventory, a slower level of new project launches and a difficult market environment for condos. With doubts surrounding the company's ability to adapt its strategy to circumstances we decided there were better opportunities elsewhere, and we sold the position.

In its place, we purchased Public Bank, a pure-play Malaysian bank exposed to improving consumer confidence in the country. The bank has generated good returns on equity since 1999, following the Asian crisis. Public Bank provides a modest dividend yield, but one that has been growing at a steady rate over the last six years, which we find attractive. Expectations of faster earnings growth, with positive revisions to estimates, were also supportive of our decision to buy.

3. Portfolio Position

The portfolio is overweight Consumer Discretionary, Real Estate, Financials, Information Technology and Health Care. It is underweight Industrials, Consumer Staples, Energy, and Communication Services. The Fund has no exposure to Materials or Utilities. On a country basis it is overweight Taiwan and Thailand, and underweight China, Indonesia, South Korea and Australia. The Fund also holds two positions in US listed stocks (Aflac and Qualcomm) which derive over 50% of revenues from the region. It is worth emphasising that our focus on individual stock selection means these exposures are an outcome rather than the product of a top-down allocation process.

4. Outlook

We believe the outlook for Asia, and for stocks more broadly, favors an active approach focused on identifying companies that can demonstrate sustainable competitive advantages that they can convert into superior profitability over time. We think that buying into companies that could benefit from favourable macro conditions, or in other words depend on factors outside their control to make money, will be a riskier proposition over the next few years.

The Asian region offers structural themes (consumption, life-style upgrading, rising manufacturing skills) that will continue to develop despite the current trade dispute between the US and China. However, the capture of these long-term themes is best done through investment in companies that have demonstrated a long-term track record of turning these into superior profitability and delivered dividend growth, in our opinion.

If Asian corporations continue to report earnings that meet market expectations, then the prospects for investors look bright. Valuations at these levels augur for attractive shareholder returns in future. The main risks are a significant decline in Chinese economic activity, or potentially a wider global economic slowdown. Nevertheless, Asian equities appear attractive, particularly in the context of higher valuations elsewhere in the world.

Edmund Harriss

The Fund invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning its assets may be invested in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to

*Trade executed with a price limit over the course of 20 trading days

24

ASIA PACIFIC DIVIDEND BUILDER FUND

individual stock volatility than diversified funds. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC Pacific ex-Japan Index (Net Return) is a market capitalization weighted index that monitors the performance of stocks from the Pacific region, excluding Japan. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay. The index is unmanaged and not available for investment, and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and it is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

25

ASIA PACIFIC DIVIDEND BUILDER FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2018

| One Year | | Five Years | | Ten Years | |

| | -16.42 | % | | | 5.27 | % | | | 10.60 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific ex-Japan Index (Net Return) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region including Japan. Net Return reflects deduction for withholding tax but reflects no deduction for fees and expenses. Net Return is net of local withholding taxes that any investor would pay.

26

FUND HIGHLIGHTS at December 31, 2018

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

# of Holdings in Portfolio: | | 36 | |

Portfolio Turnover: | | 23.4% | |

% of Stocks in Top 10: | | 29.6% | |

Fund Manager: | | | |

Edmund Harriss | |

Top 10 Holdings (% of net assets) | | | | | | | |

Novatek Microelectronics Corp. | | | 3.1 | % | | China Construction Bank Corp. - H Shares | | | 2.9 | % | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.0 | % | | China Mobile Ltd. | | | 2.9 | % | |

DBS Group Holdings Ltd. | | | 3.0 | % | | Hanon Systems | | | 2.9 | % | |

Delta Electronics Thailand PCL/Foreign | | | 3.0 | % | | Tisco Financial Group PCL/Foreign | | | 2.9 | % | |

St Shine Optical Co., Ltd. | | | 3.0 | % | | China Lilang Ltd. | | | 2.9 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 19.5 | % | | Life/Health Insurance | | | 2.7 | % | |

Electronic Component - Miscellaneous | | | 10.3 | % | | REITS - Diversified | | | 2.7 | % | |

Semiconductor Components - Integrated Circuits | | | 8.8 | % | | Retail - Consumer Electronics | | | 2.7 | % | |

REITS - Shopping Centers | | | 5.4 | % | | Travel Services | | | 2.6 | % | |

Optical Supplies | | | 3.0 | % | | Investment Management/Advisor Sevices | | | 2.6 | % | |

Cellular Telecommunications | | | 2.9 | % | | Tobacco | | | 2.6 | % | |

Auto/Truck Parts & Equipment | | | 2.9 | % | | Oil Company - Integrated | | | 2.6 | % | |

Diversified Financial Services | | | 2.9 | % | | Textile - Products | | | 2.6 | % | |

Retail - Apparel/Shoe | | | 2.9 | % | | Computers | | | 2.5 | % | |

Shipbuilding | | | 2.8 | % | | Photo Equipment & Supplies | | | 2.5 | % | |

MRI/Medical Diagnostic Imaging | | | 2.8 | % | | Distribution/Wholesale | | | 2.3 | % | |

Retail - Jewelry | | | 2.8 | % | | Metal Processors & Fabricators | | | 2.3 | % | |

27

SCHEDULE OF INVESTMENTS

at December 31, 2018

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Shares | | COMMON STOCKS: 97.7% | | Value | |

Australia: 10.7% | | | |

| | 7,280 | | | Corporate Travel Management Ltd. | | $ | 110,109 | | |

| | 5,336 | | | Janus Henderson Group PLC | | | 109,080 | | |

| | 7,137 | | | JB Hi-Fi Ltd. | | | 110,728 | | |

| | 7,498 | | | Sonic Healthcare Ltd. | | | 116,562 | | |

| | | | | | | | 446,479 | | |

China: 21.9% | | | |

| | 17,000 | | | AAC Technologies Holdings Inc. | | | 98,513 | | |

| | 148,000 | | | China Construction Bank Corp. - H Shares | | | 122,184 | | |

| | 141,000 | | | China Lilang Ltd. | | | 118,946 | | |

| | 29,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 106,422 | | |

| | 162,680 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 112,030 | | |

| | 12,500 | | | China Mobile Ltd. | | | 120,252 | | |

| | 162,000 | | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 115,621 | | |

| | 129,600 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 118,056 | | |

| | | | | | | | 912,024 | | |

Hong Kong: 13.1% | | | |

| | 30,500 | | | BOC Hong Kong Holdings Ltd. | | | 113,000 | | |

| | 623,000 | | | Li & Fung Ltd. | | | 97,809 | | |

| | 11,000 | | | Link REIT/The | | | 111,299 | | |

| | 41,000 | | | Luk Fook Holdings International Ltd. | | | 116,251 | | |

| | 120,000 | | | Pacific Textiles Holdings Ltd. | | | 106,717 | | |

| | | | | | | | 545,076 | | |

Malaysia: 2.8% | | | |

| | 19,500 | | | Public Bank Bhd | | | 116,774 | | |

Singapore: 8.4% | | | |

| | 60,000 | | | Ascendas Real Estate Investment Trust - REIT | | | 113,027 | | |

| | 68,400 | | | CapitaLand Mall Trust - REIT | | | 113,225 | | |

| | 7,164 | | | DBS Group Holdings Ltd. | | | 124,359 | | |

| | | | | | | | 350,611 | | |

South Korea: 5.5% | | | |

| | 12,440 | | | Hanon Systems | | | 120,236 | | |

| | 1,190 | | | KT&G Corp. | | | 108,373 | | |

| | | | | | | | 228,609 | | |

Taiwan: 21.3% | | | |

| | 16,000 | | | Asustek Computer Inc. | | | 104,964 | | |

| | 13,000 | | | Catcher Technology Co., Ltd. | | | 95,038 | | |

| | 46,000 | | | Elite Material Co., Ltd. | | | 98,389 | | |

| | 46,517 | | | Hon Hai Precision Industry Co., Ltd. | | | 107,184 | | |

| | 1,000 | | | Largan Precision Co., Ltd. | | | 104,764 | | |

| | 28,000 | | | Novatek Microelectronics Corp. | | | 129,815 | | |

| | 7,000 | | | St Shine Optical Co., Ltd. | | | 122,786 | | |

| | 17,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 124,532 | | |

| | | | | | | | 887,472 | | |

The accompanying notes are an integral part of these financial statements.

28

Shares | | COMMON STOCKS: 97.7% (Continued) | | Value | |

Thailand: 8.5% | | | |

| | 57,800 | | | Delta Electronics Thailand PCL/Foreign | | $ | 123,432 | | |

| | 76,500 | | | PTT PCL/Foreign | | | 108,131 | | |

| | 50,000 | | | Tisco Financial Group PCL/Foreign | | | 120,096 | | |

| | | | | | | | 351,659 | | |

United States: 5.5% | | | |

| | 2,500 | | | Aflac Inc. | | | 113,900 | | |

| | 2,000 | | | QUALCOMM Inc. | | | 113,820 | | |

| | | | | | | | 227,720 | | |

| | | | | Total Common Stocks

(cost $4,399,992) | | | 4,066,424 | | |

| | | | | Total Investments in Securities

(cost $4,399,992): 97.7% | | | 4,066,424 | | |

| | | | | Other Assets less Liabilities: 2.3% | | | 94,143 | | |

| | | | | Net Assets: 100.0% | | $ | 4,160,567 | | |

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

29

GUINNESS ATKINSON CHINA & HONG KONG FUND for the period ended December 31, 2018

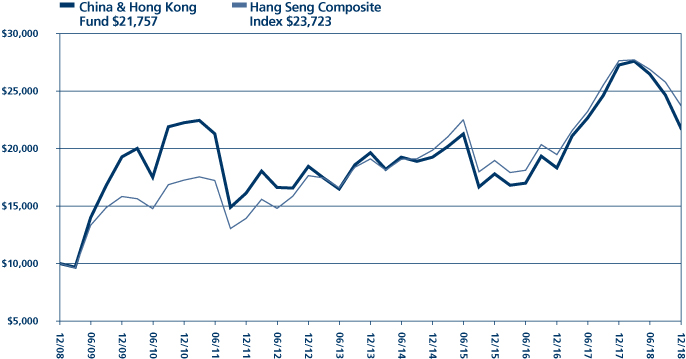

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

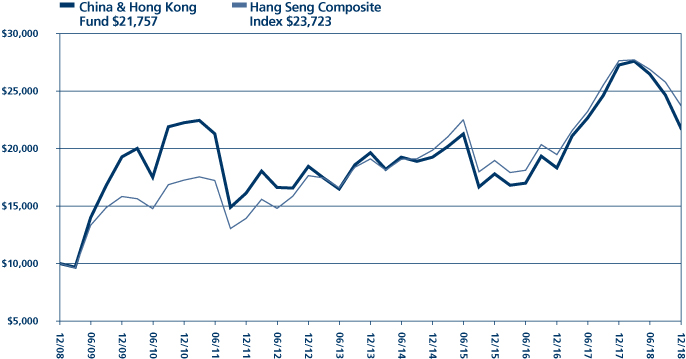

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -20.21 | % | | | 6.93 | % | | | 2.07 | % | | | 8.08 | % | |

Benchmark Index: | |

Hang Seng Composite Index | | | -14.15 | % | | | 7.76 | % | | | 4.43 | % | | | 9.02 | % | |

For the Fund's current one-year expense ratio, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

In 2018 the Fund fell 20.21% compared to the Hang Seng Composite Index which fell 14.15%.

This was a turbulent year for equity and bond markets. Political policy unpredictability and uncertainty has been evident in all regions with the US, of course, being the most influential. In financial markets, the US Federal Reserve has shown its determination to normalise interest rates and has been remarkably successful. Since the middle of 2017 there have been eight increases, from 0.5% to 2.5%, and underlying economic growth in the US does not appear to have suffered significantly in the process. The strength of the US dollar in 2018 was a surprise compared to market expectations at the start of the year and can be attributed in part to rising US interest rates (thereby narrowing the gap between the US and elsewhere) but also to a lack of confidence in prospects for Europe and China.

The Chinese economy is slowing down. This is inevitable if China is to rebalance away from the old investment-led model to one led by consumption. However, the ongoing trade dispute as well as the consequences of the deleveraging campaign meant economic activity significantly decelerated in the second half of 2018, by more than the rebalancing process implies. The official Purchasing Managers' Index (PMI), an indicator of economic activity, weakened over the course of the year and fell below 50.0 in December, indicating contracting economic activity. Industrial profit growth, year-on-year, decelerated in the second half of the year and turned slightly negative in November for the first time since 2015.

The government has responded to the slowdown with looser fiscal and monetary policy. Tax rules have been changed to encourage consumption; for example, personal allowances increased and deductions permitted for expenses like education and healthcare. The deleveraging campaign has slowed in order to reduce stress on small and medium businesses, some of whom are finding it harder to obtain credit from large state-owned banks. The required reserve ratio was cut several times over the year. But this is no broad based monetary easing as was the case following the financial crisis. The government does not want banks to lend for speculative purposes. For example, in December the National Reform and Development Commission (NDRC) announced that large firms could issue bonds to help refinance their debt. But there are several criteria that must be met: the liabilities to total assets ratio must be less than 85%; the firm cannot invest the proceeds into property development; the firm cannot raise funds in defined industries with excess capacity. The intention here is clear – the economy needs support but there the mistakes of the past cannot be repeated. Policymakers are aware of the trade-off between looser monetary policy and greater financial risks, and we believe are erring on the side of caution.

The Fund's performance for 2018 has been disappointing but we must compare what the share price of our holdings is implying against the actual conditions of our businesses. This involves looking at the historical return on capital that our businesses have achieved against the market implied return. For many of our holdings we are seeing big disconnects and much of this may have been driven by the valuation compression for stocks which did particularly well in 2017. Based on estimated 2019 earnings, the fund's discount to the broader market is 31%, its widest in recent years. We expect this gap to close over time.

The best performing stocks were Shenzhen Expressway, CNOOC and China Overseas Land & Investment. Shenzhen Expressway operates toll roads in the provinces of Guangdong, Hunan, Hubei and Jiangsu. It reported third results which showed continued growth across the vast majority of its roads. CNOOC, one of China's largest oil companies, benefited from rising oil prices for most of the year. The rise over the first three quarters compensated for the weaker fourth quarter when oil prices fell, meaning relative to the performance of weak Chinese markets, CNOOC was an outperformer. China Overseas Land & Investment (COLI) is one of

30