Exhibit 99.1

EXECUTIVE SUMMARY

Summary

This section gives you a quick overview of highlights from our circular and key results for 2014.

Please read the rest of the document for complete information on Goldcorp’s results, compensation programs and governance initiatives important to you.

Goldcorp: 2014 Results

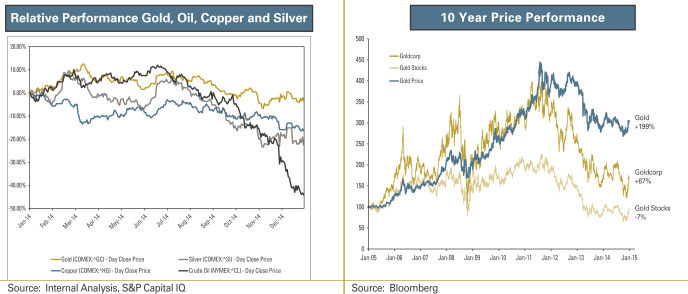

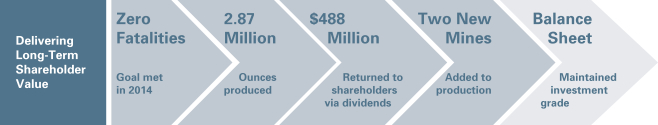

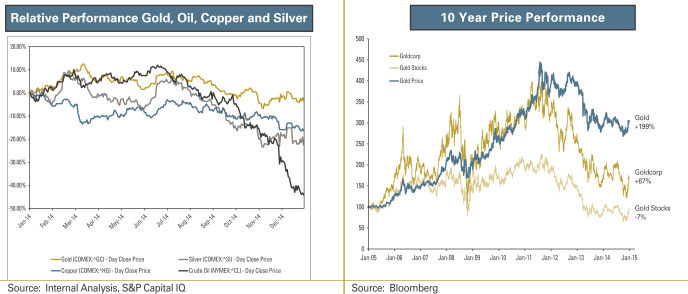

The gold mining industry has faced significant challenges over the last three years. Commodity price declines have continued, making cost management and balance sheet strength key success factors. Goldcorp focuses on safe, sustainable operations and creating long-term value for all of our stakeholders.

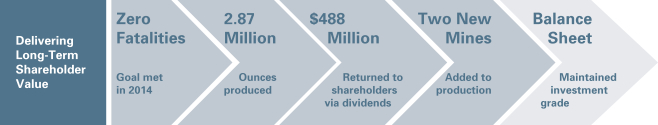

Business Performance

| › | | Achieved our primary objective of zero fatalities |

| › | | Record gold production of 2.87 million ounces1 |

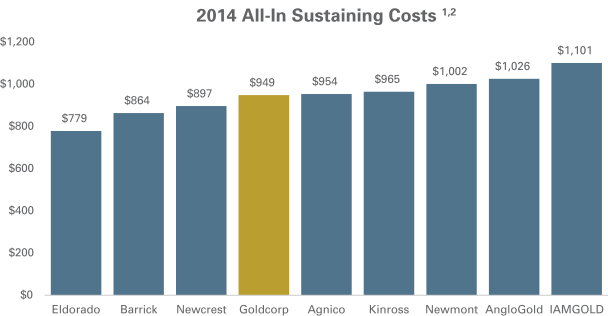

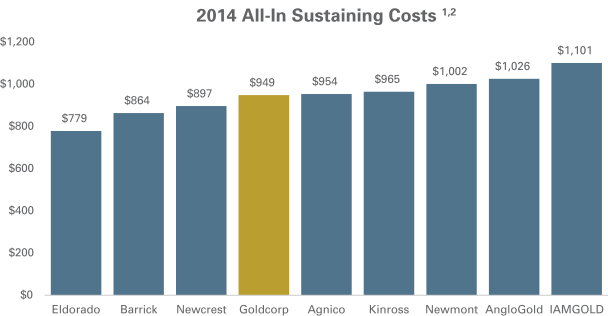

| › | | All-in sustaining costs (AISC)2 decreased by 8% to approximately $949 per ounce below the guidance range of between $950 – $1,000 per ounce (see page 50) |

| › | | Adjusted net earnings of $498 million, or $0.61 per share |

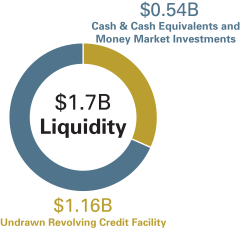

| › | | Adjusted operating cash flow of $1.4 billion |

| › | | Benefits realized from supply chain and Operating for Excellence (O4E) initiatives contributed to ongoing cash flow improvements |

| › | | Was added to the NASDAQ OMX CRD Global Sustainability Index |

| 1 | Goldcorp has included this non-GAAP performance measure on an attributable basis (Goldcorp’s ownership proportion of our joint ventures, Pueblo Viejo and Alumbrera). For further details regarding non-GAAP measures, please see “Non-GAAP Measures Advisory” on page 173. |

| 2 | This is a non-GAAP measure. For further details regarding non-GAAP financial measures, such as AISC, please see “Non-GAAP Measures Advisory” on page 173. |

| | | | | | |

| | i | | | Page - EXECUTIVE SUMMARY | |  |

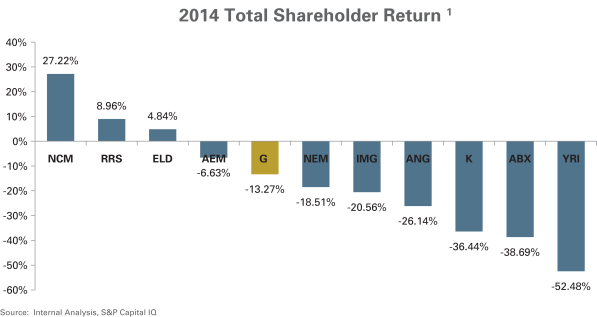

Shareholder Value Creation

| › | | Returned $488 million to shareholders through dividends |

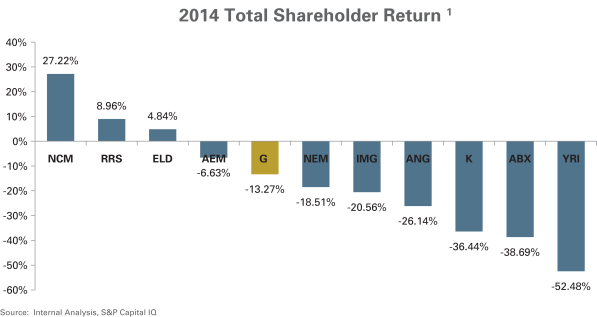

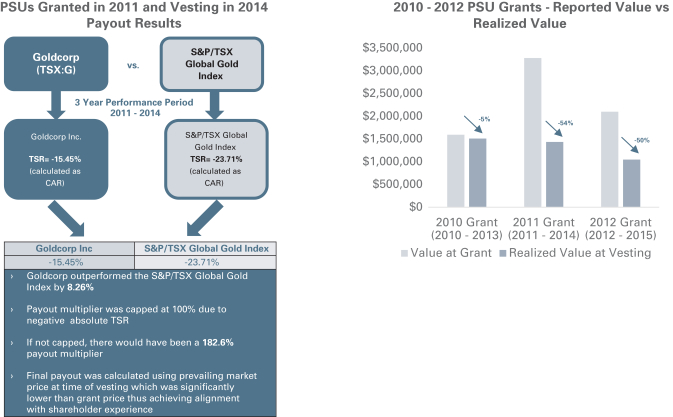

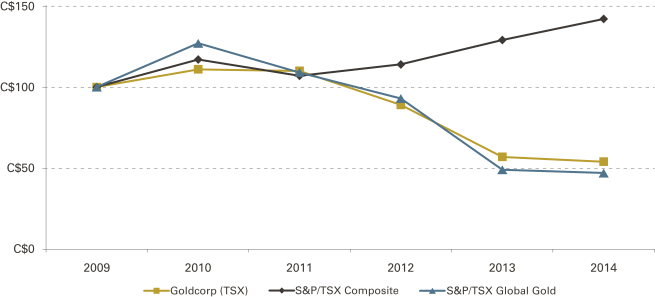

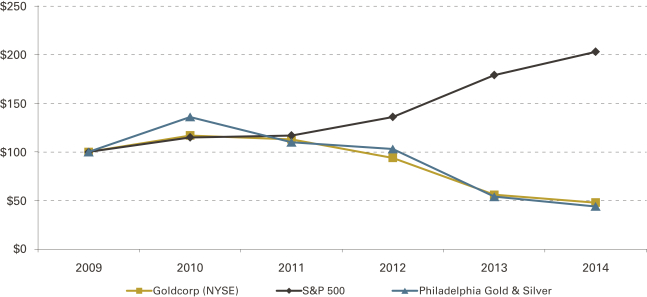

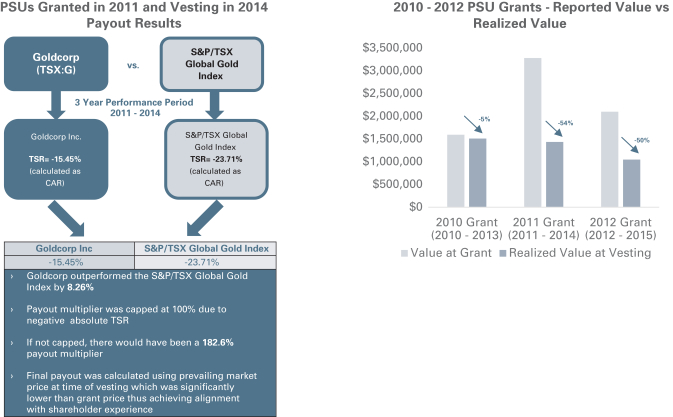

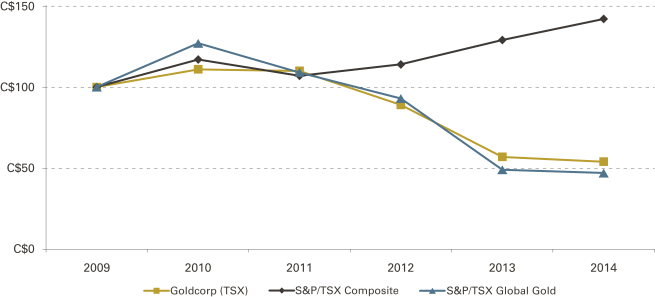

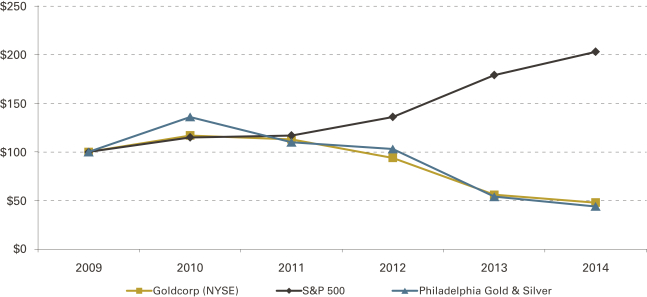

| › | | Attained Total Shareholder Return (TSR) 8.26 percentage points ahead of the S&P/TSX Global Gold Index for the performance period as defined in our performance share unit (PSU) plan1 |

| › | | Maintained a BBB+ rated balance sheet as rated by Standard and Poors (S&P), despite volatility within the gold sector |

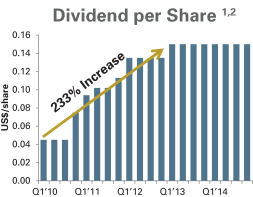

| › | | Provided a monthly dividend. Since the first quarter of 2010, our dividend has increased by 233% with a yield of 3.2% as at December 31, 2014 |

| › | | Achieved first gold production at the new Cerro Negro and Éléonore mines |

| › | | Divested the Marigold mine |

Underperformance

| › | | Our overall proven and probable reserves declined by 8% to 49.6 million ounces |

| › | | Exploration drilling at Cerro Negro remained suspended until the fourth quarter of 2014 when surface resource confirmation drilling resumed |

| › | | We did not attain our safe production target for mines managed by Goldcorp as a result of unexpected operational issues at the Los Filos and El Sauzal mines |

2014 Compensation Highlights

Some aspects of our operating performance fell below target in 2014 and our variable incentive programs ensured a strong link between pay and performance.

| › | | Froze base salaries for all executives |

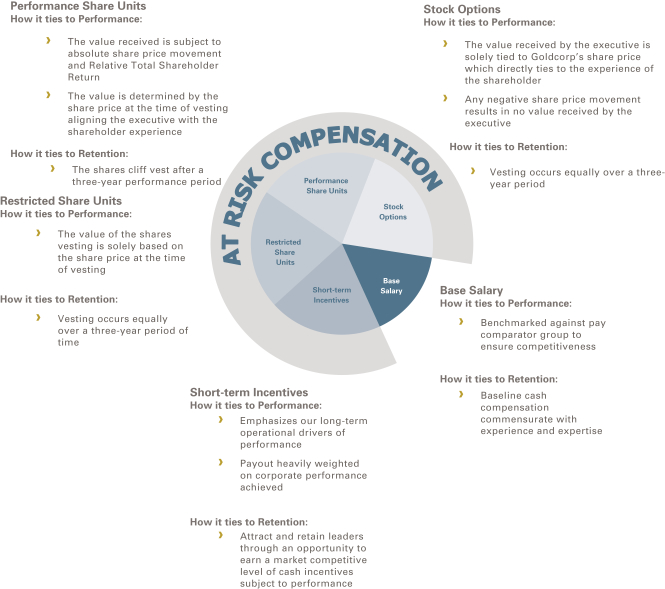

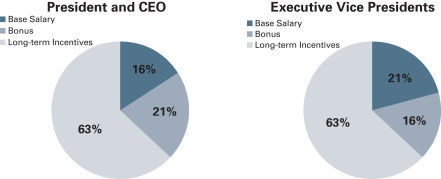

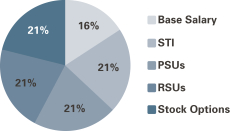

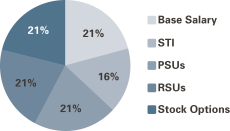

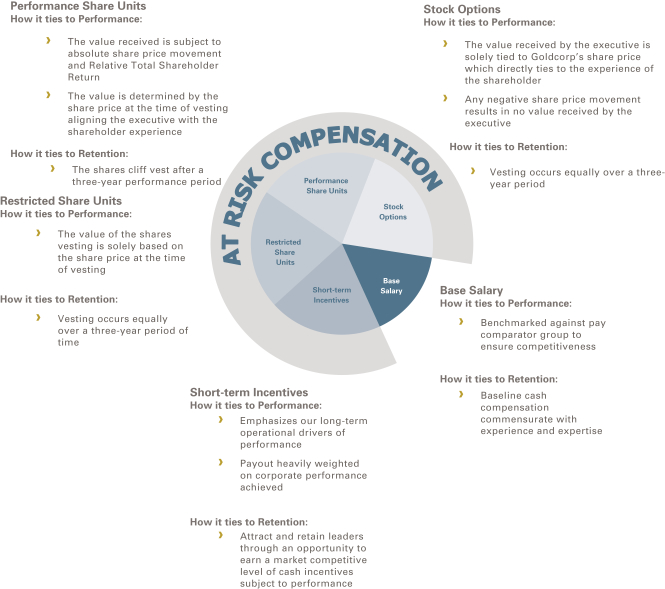

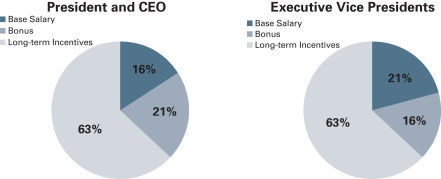

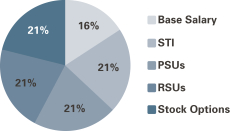

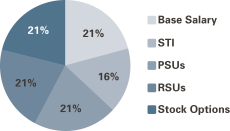

| › | | Ensured approximately 80% of compensation for executives was at-risk (84% for CEO and 79% for Executive Vice Presidents (EVPs)) |

| › | | Awarded 74% on corporate scorecard for achievements against performance metrics |

| › | | Committed to providing enhanced compensation disclosure |

2015 Executive Compensation Initiatives

Goldcorp is committed to continuously improving in all aspects of our business, from safety and operations, to alignment of executive compensation. In this light, we have already implemented the following initiatives related to 2015 pay programs. See page 38 for more information.

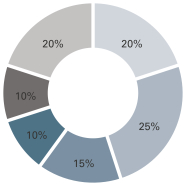

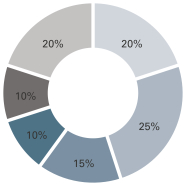

| › | | Performance share units in the long-term incentive plan mix increased to 50% (from 33%) for the CEO and Executive Vice Presidents (see page 61) |

| › | | Strategic initiatives component of short-term incentive plan based on more clearly articulated measures (see page 59) |

| › | | Froze base salaries for the CEO, Executive Vice Presidents, all officers from Vice President (VP) and up and Mine General Managers (MGMs) (see page 54) |

| › | | Clawback provisions extended to all Executive Vice Presidents, and now includes long-term incentives as well as short-term incentives (see page 45) |

| › | | Expanded share ownership requirements beyond Executive Vice Presidents to now include all Senior Vice Presidents (SVPs), Vice Presidents and Mine General Managers to align with shareholder interests |

| 1 | These PSUs were granted on March 8, 2011 and vested on February 6, 2014. The TSR was calculated using the Goldcorp and S&P/TSX Global Gold Index volume-weighted average prices for the 30 days prior to and including the date of grant and 30 days prior to and including the date of vesting. |

| | | | | | |

| | ii | | | Page - EXECUTIVE SUMMARY | |  |

Meeting Details

At this year’s meeting we are asking our shareholders to vote on the matters noted below. See page 10 for more information. The Board recommends you voteFOR all of these resolutions:

1. Election of directors

2. Appointment of Deloitte LLP as auditors for 2015

3. Repeal of By-Laws No.3 and No.4 to be replaced by Amended By-Law No.4

4. Amendments to restricted share unit plan

5. Advisory vote on approach to executive compensation (say on pay)

Board Nominees

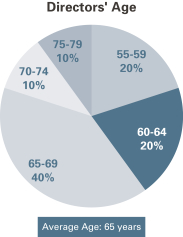

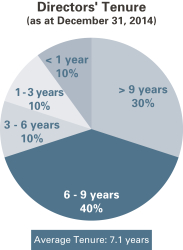

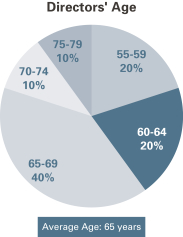

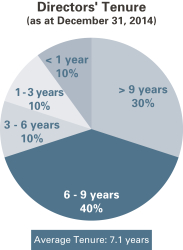

You are being asked to cast your vote for ten directors.Our directors are elected annually, individually and by majority vote.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Director

Since | | Occupation | | Independent1 | | Other

Public

Boards | | Committee Membership | | 2014

Votes

For |

| | | | | | | AC | | CC | | GNC | | SC | |

Bell | | 76 | | 2005 | | Independent director | | ü | | 1 | | | | | | ü | | Chair | | 99.53% |

Briscoe | | 60 | | 2006 | | President,

Briscoe Management | | ü | | 1 | | Chair | | | | | | ü | | 99.61% |

Dey | | 74 | | 2006 | | Chairman,

Paradigm Capital | | ü | | 1 | | | | ü | | Chair | | | | 99.05% |

Holtby | | 67 | | 2005 | | President and CEO,

Holtby Capital

Corporation | | ü | | 1 | | ü | | Chair | | ü | | | | 99.10% |

Jeannes | | 56 | | 2009 | | President and CEO,

Goldcorp | | x | | | | | | | | | | | | 99.62% |

Pelletier | | 69 | | 2014 | | Senior Technical Advisor,

ERM Consultants | | ü | | 1 | | | | | | ü | | ü | | 99.45% |

Reifel | | 62 | | 2006 | | President,

Chesapeake Gold | | ü | | 2 | | | | ü | | | | ü | | 99.34% |

Telfer | | 68 | | 2005 | | Chairman of Goldcorp | | x | | 2 | | | | | | | | | | 98.89% |

Treviño | | 55 | | 2012 | | President and CEO,

Softtek | | ü | | 1 | | ü | | | | ü | | | | 99.47% |

Williamson | | 67 | | 2006 | | Independent consultant | | ü | | 1 | | ü | | ü | | | | | | 99.55% |

| | 1. | Under applicable Canadian securities laws and New York Stock Exchange (NYSE) rules. |

| | | | | | |

| | iii | | | Page - EXECUTIVE SUMMARY | |  |

Dear Goldcorp Shareholder,

Your vote is important to us and we invite you to attend our annual and special meeting at 3:00 pm (Eastern Time) on April 30, 2015 at Sheraton Centre Toronto Hotel, Grand East Ballroom, 123 Queen Street West, Toronto, Ontario.

You will hear about our results for 2014 and our plans for the future. You will vote on your directors and other important items of business.

Finally, you will have the opportunity to meet the management team, the Board members and other shareholders.

Please read this document to learn more about the meeting, your director nominees, executive compensation and our governance practices.

Thank you for your participation and we look forward to seeing you at the meeting.

Sincerely,

“Ian W. Telfer”

Chairman of the Board

In this section you will also find:

| | |

| | |

Notice of meeting | | Page 2 |

| | |

General information | | Page 3 |

| | |

General voting information | | Page 5 |

| | |

Beneficial shareholder voting | | Page 7 |

| | |

Registered shareholder voting | | Page 8 |

|

INVITATION TO SHAREHOLDERS UNDERSTAND THE

ISSUES: Read this

document HAVE A SAY: Vote your

shares HEAR MORE: Attend the

meeting |

| | | | |

| | 1 | | | Page - INVITATION TO SHAREHOLDERS |

NOTICE OF MEETING

Annual and Special Meeting of the Shareholders of Goldcorp

| | |

| Date: | | Thursday, April 30, 2015 |

| |

| Time: | | 3:00 pm (Eastern Time) |

| |

| Place: | | Sheraton Centre Toronto Hotel, Grand East Ballroom, 123 Queen Street West, Toronto, ON |

The business of the meeting is to:

| | 1. | Receive the audited annual consolidated financial statements for 2014 |

| | 2. | Elect directors for the coming year |

| | 3. | Appoint Deloitte LLP as auditors and authorize the directors to fix their remuneration |

| | 4. | Consider a resolution approving the repeal of By-Law No.3 and By-Law No.4 to be replaced in their entirety by Amended By-Law No.4 |

| | 5. | Consider a resolution approving certain amendments to the restricted share unit plan |

| | 6. | Consider a non-binding advisory resolution on our approach to executive compensation |

| | 7. | Transact any other business |

You have a right to vote if you were a Goldcorp shareholder on March 18, 2015, our “record date”. Find out how to vote starting on page 5 and read more about Goldcorp in the rest of this document (called a circular).

The Board has, by resolution, fixed 3:00 p.m. (Eastern Time) on April 28, 2015, or no later than 48 hours before the time of any adjourned meeting (excluding Saturdays, Sundays and holidays), as the time before which proxies to be used or acted upon at the meeting or any adjournment thereof shall be deposited with Goldcorp’s transfer agent. The time limit for the deposit of proxies may be waived or extended by the chair of the meeting at his or her discretion, without notice.

By order of the Board of Directors,

“Ian W. Telfer”

Chairman of the Board

| | | | | | |

| | 2 | | | Page - INVITATION TO SHAREHOLDERS | |  |

GENERAL INFORMATION

Goldcorp

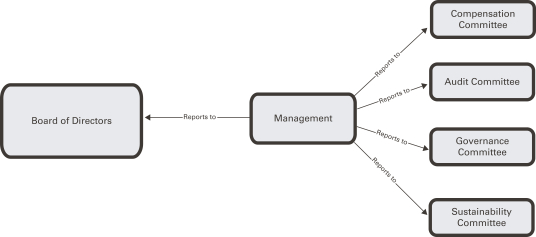

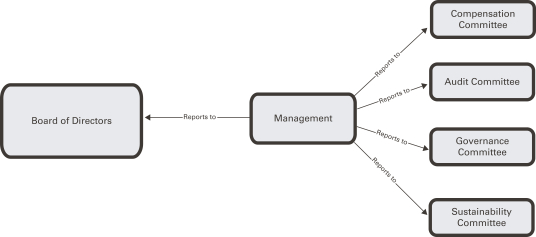

We use “we”, “us”, “our” and “Goldcorp” to refer to Goldcorp Inc. in this document. We abbreviate our committee names as follows:

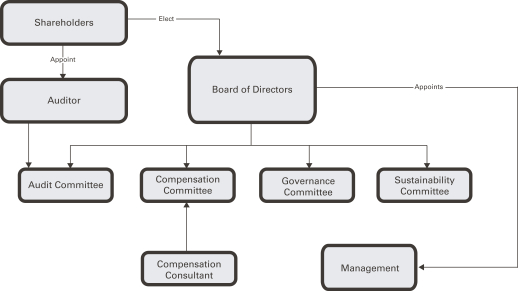

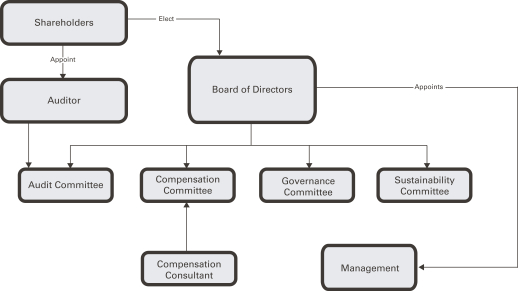

| › | | Audit Committee – AC or Audit Committee |

| › | | Compensation Committee – CC or Compensation Committee |

| › | | Governance and Nominating Committee – GNC or Governance Committee |

| › | | Sustainability, Environment, Health and Safety Committee – SC or Sustainability Committee |

Date of Information

Information is as of March 18, 2015, unless we note otherwise.

Exchange Rate

All amounts are shown in United States (US) dollars unless noted otherwise. For amounts converted to Canadian dollars (C$) we used the rate of C$1.00=$0.9054, unless noted otherwise. This is the Bank of Canada average annual exchange rate for the year ended December 31, 2014.

Common Shares Outstanding

Our common shares are traded on the Toronto Stock Exchange (TSX) under the symbol G and on the NYSE under the symbol GG. There were 829,324,142 common shares of Goldcorp outstanding at the close of business on March 18, 2015.

Owners of 10% or More of Our Common Shares

To the knowledge of the directors and officers, no person or company owns or controls 10% or more of our common shares.

Interests in Meeting Business and Material Transactions

Directors and officers who participate in the restricted share unit plan have an interest in the votes on this item. Other than that, since January 1, 2014, none of Goldcorp, our directors, director nominees and executive officers, or anyone associated or affiliated with any of them has a material interest in any item of business at the meeting. Amaterial interest is one that could reasonably interfere with the ability to make independent decisions.

No informed person of Goldcorp has or had during 2014 a material interest in a material transaction or proposed material transaction involving Goldcorp.

Mailing of Circular

This circular will be mailed on March 30, 2015 to each of our shareholders of record on March 18, 2015 who has previously requested paper copies of our disclosure documents. All other shareholders will only receive a notice with information on how to view the meeting materials electronically. See “Notice and Access” below.

We give meeting materials to brokers, intermediaries, custodians, nominees and fiduciaries and request the materials be sent to beneficial shareholders promptly. We will pay for the distribution of the meeting materials by clearing agencies and intermediaries to objecting beneficial shareholders.

Electronic Delivery

Shareholders can choose to receive meeting materials electronically rather than by paper. If you have already chosen to receive electronic copies, no paper materials will be sent to you. If you would like to receive future meeting materials electronically, please complete the enclosed form and return it as indicated on the form.

| | | | | | |

| | 3 | | | Page - INVITATION TO SHAREHOLDERS | |  |

If we don’t have an electronic document available or we chose not to send an electronic copy, a paper copy will be provided.

Notice and Access

We are delivering your meeting materials by providing you with a notice and posting the materials on our website atwww.goldcorp.com. The materials will be available on the website starting on March 30, 2015 and remain up for one full year. The meeting materials can also be accessed with our public filings onwww.sedar.com andwww.sec.gov. We will mail paper copies of the meeting materials to any shareholder who previously requested paper copies. If you received the notice only and would like a paper copy of the full materials please send us a request as set out below.

Additional Documents

We file an annual report and an annual information form with the Canadian securities regulators. In addition, our financial information is provided in our audited consolidated financial statements and management’s discussion and analysis (MD&A) for the year ended December 31, 2014. We will provide you, free of charge, a copy of our annual report, which includes our annual financial statements and MD&A, our annual information form and/or this circular on request. Please submit your request by:

| | |

| | (604) 696-3000 (ask for Manager, Corporate Communications) |

| |

| | info@goldcorp.com |

| |

| | Goldcorp Inc. |

| | 3400 Park Place |

| | 666 Burrard Street |

| | Vancouver, BC, Canada V6C 2X8 |

| |

| | Attention: Vice President, Regulatory Affairs and Corporate Secretary |

You can also get copies of any document required to be filed in Canada by:

| › | | Accessing our public filings atwww.sedar.com |

| › | | Going to “Reports and Filings” on our Investor Resources page atwww.goldcorp.com |

| | | | | | |

| | 4 | | | Page - INVITATION TO SHAREHOLDERS | |  |

GENERAL VOTING INFORMATION

Request for Proxies

Our management is soliciting your proxies for this meeting and is paying for the costs incurred. We have retained Kingsdale Shareholder Services (Kingsdale) to solicit proxies in Canada and the US and will pay their fees of approximately C$63,525 in addition to certain out-of-pocket expenses.

We are using primarily mail to communicate with you. However, our employees or Kingsdale may request your proxy by telephone, email, facsimile or personal interview.

Record Date

The record date for the meeting is March 18, 2015. If you held common shares on that date, you are entitled to receive notice of, attend and vote at the meeting. You may also be entitled to vote your common shares if you buy them from a registered shareholder and notify our transfer agent that you want to vote at the meeting at least 10 days before the meeting.

Voting Securities and Votes

The common shares are our only voting securities. Each common share entitles the holder to one vote at the meeting.

Quorum

We can only decide business at the meeting if we have aquorum – where two or more people attend the meeting and hold or represent by proxy at least 33 1⁄3% of our outstanding common shares that are entitled to vote.

Voting Instructions

If you specify how you want to vote on your proxy form or voting direction, your proxy holder has to vote that way. If you do not indicate how you want to vote, your proxy holder will decide for you.

If you appoint Ian W. Telfer, Chairman of the Board (Chairman), or Charles A. Jeannes, President and CEO, the representatives of Goldcorp set out in the enclosed proxy or voting direction, and do not specify how you want to vote, your common shares will be voted as follows:

| | |

Matter | | Voted |

Election of management nominees as directors | | FOR |

Appointment of Deloitte LLP as auditors | | FOR |

Repeal of By-Law No.3 and By-Law No.4 and confirmation of Amended By-Law No.4 in their place | | FOR |

Amendments to the Restricted Share Unit Plan | | FOR |

Approach to executive compensation | | FOR |

Approvals

A simple majority of votes cast at the meeting (50% plus one vote) is required to approve all of the items of business, including the non-binding advisory resolution on our approach to executive compensation.

Amendments or Other Business

If amendments or other business are properly brought up at the meeting, you (or your proxy holder, if you are voting by proxy) can vote as you see fit. We are not aware of any other business to be considered at the meeting or any changes to the current business.

| | | | | | |

| | 5 | | | Page - INVITATION TO SHAREHOLDERS | |  |

Vote Counting and Confidentiality

Votes by proxy are counted by our transfer agent, CST Trust Company (CST). Your vote is confidential, unless you clearly intend to communicate your vote to management or if there is a proxy contest or validation issue or as needed to comply with legal requirements.

New York Stock Exchange Rules

If your broker is subject to the NYSE rules, the broker has discretionary authority to vote common shares without instructions from beneficial owners (see more on this on page 7) only on matters considered “routine” by the NYSE, such as the ratification of Goldcorp’s independent registered chartered accountants. If you do not provide your voting instructions to the broker, the broker cannot vote your common shares for election of directors and other “non-routine matters” and such common shares will not be included in the votes “cast” for any such “non-routine” matter. Even without voting instructions to your broker, your common shares will be counted for quorum purposes.

Voting Questions

Our transfer agent is CST. Our co-agent in the US is American Stock Transfer & Trust Company LLC. Please contact them if you have any questions on how your votes are counted.

| | |

| | 1-800-387-0825 (toll free in North America) |

| | 416-682-3860 (collect from outside North America) |

| |

| | 1-888-249-6189 (fax from anywhere) |

| |

| | inquiries@canstockta.com |

| |

| | CST Trust Company |

| | PO Box 700, Station B |

| | Montreal, QC, Canada H3B 3K3 |

Other Questions

Please contact Kingsdale if you have any questions about the business items of the meeting or the information in this circular.

| | |

| | 1-800-775-4067 (toll free in North America) |

| | 416-867-2272 (collect from outside North America) |

| |

| | 1-886-545-5580 (fax from anywhere) |

| |

| | contactus@kingsdaleshareholder.com |

| |

| | Kingsdale Shareholder Services |

| | The Exchange Tower |

| | 130 King Street West, Suite 2950 |

| | Toronto, ON, Canada M5X 1E2 |

| | | | | | |

| | 6 | | | Page - INVITATION TO SHAREHOLDERS | |  |

BENEFICIAL SHAREHOLDER VOTING

Most shareholders are beneficial shareholders. You hold your common shares in the name of a nominee. That is, your share certificate was deposited with a bank, trust company, stock broker, trustee or some other institution. Here is how you can vote:

Voting Options

| | |

| | In person at the meeting – discussed below |

| |

| | By submitting a paper voting instruction form – discussed below |

| |

| | By telephone – see the enclosed voting instruction form |

| |

| | Via the internet – see the enclosed voting instruction form |

Voting in Person

If you plan to attend the meeting and wish to vote your common shares in person, insert your own name in the space on the enclosed voting instruction form. Then follow the signing and return instructions provided by your nominee. You may also nominate yourself as a proxy holder online, if available, by typing your name in the “Appointee” section on the electronic ballot.

Your vote will be taken and counted at the meeting, so do not indicate your votes on the form. Please register with CST when you arrive at the meeting.

Voting by Instruction

Whether or not you attend the meeting, you can appoint someone else to attend and vote as your proxy holder. Use the enclosed voting instruction form to do this. The people named in the enclosed voting instruction form are members of management and/or the Board.You have the right to choose another person to be your proxy holder by printing that person’s name in the space provided. Then complete the rest of the form, sign it and return it. Your votes can only be counted if the person you appointed attends the meeting and votes on your behalf.If you have voted on the voting instruction form, neither you nor your proxy holder may vote in person at the meeting, unless you revoke your voting instructions.

Return your completed voting instruction form in the envelope provided so that it arrives at least one business day prior to the proxy deposit deadline of 3:00 pm (Eastern Time) on April 28, 2015 or if the meeting is adjourned, at least 48 hours (excluding weekends and holidays) before the time set for the meeting to resume (cut off time). The time limit for the deposit of proxies may be waived or extended by the chair of the meeting at his discretion, without notice.

Revoking your Voting Instructions or Changing your Instructions

You may revoke your voting instructions before it is acted on. To revoke your voting instructions, contact your broker or service provider.

You may change your voting instructions by sending new instructions prior to the cut off time to revoke your vote. Your latest instructions will be the only valid instructions.

| | | | | | |

| | 7 | | | Page - INVITATION TO SHAREHOLDERS | |  |

REGISTERED SHAREHOLDER VOTING

If you have in your possession a physical share certificate with your name on it, you are a registered shareholder. Here is how you can vote:

Voting Options

Here’s where to go to find instructions to vote by these methods:

| | |

| | In person at the meeting – see below |

| |

| | By submitting a paper proxy form – see below |

| |

| | By telephone – see the enclosed proxy form |

| |

| | Via the internet – see the enclosed proxy form |

Voting in Person

If you plan to attend the meeting and want to vote your common shares in person, do not complete or return the enclosed proxy form.Your vote will be taken and counted at the meeting. Please register with CST when you arrive at the meeting.

Voting by Proxy

Whether or not you attend the meeting, you can appoint someone else to attend and vote as your proxy holder. Use the enclosed proxy form to do this. The people named in the enclosed proxy form are members of management and/or the Board.You have the right to choose another person to be your proxy holder by printing that person’s name in the space provided. Then complete the rest of the proxy form, sign it and return it. Your votes can only be counted if the person you appointed attends the meeting and votes on your behalf.If you have voted by completing the proxy form, neither you nor your proxy holder may vote in person at the meeting, unless you revoke your proxy.

Return your completed proxy form in the envelope provided so that it arrives by 3:00 pm (Eastern Time) on April 28, 2015 or if the meeting is adjourned, at least 48 hours (excluding weekends and holidays) before the time set for the meeting to resume (cut off time). The time limit for the deposit of proxies may be waived or extended by the chair of the meeting at his discretion, without notice.

Revoking your Proxy

You may revoke your proxy at any time before is it acted on. Deliver a written statement that you want to revoke your proxy to our Corporate Secretary before or on April 28, 2015 (or the last business day before the meeting if it is adjourned or postponed), or to the Chairman of the meeting on April 28, 2015.

Changing your Proxy

You may change the way you voted by proxy by sending a new proxy prior to the cut off time to revoke your vote. Your latest proxy will be the only one that is valid.

| | | | | | |

| | 8 | | | Page - INVITATION TO SHAREHOLDERS | |  |

In this section you can read about:

| | |

| | |

Financial statements | | Page 10 |

| | |

Election of directors | | Page 10 |

| | |

Appointment of auditors | | Page 11 |

| | |

| Repeal of By-Law No.3 and By-Law No.4 to be replaced in their entirety by Amended By-Law No.4 | | Page 12 |

| | |

Amendments to restricted share unit plan | | Page 13 |

| | |

Advisory vote on executive compensation | | Page 14 |

| | |

Other business | | Page 16 |

|

BUSINESS OF MEETING DIRECTOR NOMINEES: Elected by

majority vote

SAY ON EXECUTIVE COMPENSATION: Support our

pay for

performance

practices PLAN AMENDMENTS: Align to

shareholder

interests |

| | | | |

| | 9 | | | Page - BUSINESS OF MEETING |

BUSINESS OF MEETING

Financial Statements

Our consolidated financial statements for the year ended December 31, 2014 and the auditors’ report on those statements are included in the annual report and will be available at the meeting. The annual report is also filed onwww.sedar.com and available to you on request.

Election of Directors

The number of directors to be elected at the meeting is ten, as decided by the Board. Each director will hold office until the end of the next annual general meeting or until a successor is duly appointed or elected. Your director nominees are:

You can find more information on all of the nominees starting on page 18. Each of the nominees brings important skills and experience to the Board. Each nominee is eligible and is willing to serve if elected.

If for some reason a nominee is not available to serve at the time of the meeting (and we know of no reason this would occur), the people named in the enclosed proxy will vote for a substitute nominee if one is chosen by the Board.

We recommend that you vote FOR the election of these nominees.

The people named in the enclosed proxy will vote FOR these nominations unless you tell them to withhold your vote.

Majority Vote Policy

We have a majority vote policy. Unless there is a contested election, a director who receives more withhold votes than votes “for”, will immediately offer to resign. The Governance Committee will review the matter and recommend to the Board whether to accept the resignation. The resignation will be effective when accepted by the Board. The director will not participate in any deliberations on the matter.

We expect to accept the resignation unless there is some special circumstance that warrants the director stay on the Board. In any case, the Board shall determine whether or not to accept the resignation within 90 days of the relevant annual shareholders’ meeting and Goldcorp will promptly issue a news release with the Board’s decision. If the Board determines not to accept a resignation, the news release must fully state the reasons for that decision.

| | | | | | |

| | 10 | | | Page - BUSINESS OF MEETING | |  |

Appointment of Auditors

The Board recommends the appointment of Deloitte LLP as the auditors for Goldcorp for 2015. Deloitte LLP was first appointed as Goldcorp’s auditors on March 17, 2005. The directors will also be authorized to set the fees paid to the auditors.

Audit Fees Paid

| | | | | | | | |

| Type of Work | | 2013 fees ($) | | | 2014 fees ($) | |

Audit fees | | | 5,995,000 | | | | 5,912,000 | |

Audit-related fees | | | 119,000 | | | | 330,000 | |

Tax fees | | | 567,000 | | | | 411,000 | |

All other fees | | | 266,000 1 | | | | 752,000 2 | |

Total | | | 6,947,000 | | | | 7,405,000 | |

Notes:

| | 1. | For 2013, these fees relate to work regarding information technology leadership, mine safety and sustainability matters. |

| | 2. | For 2014, these fees are for work regarding information technology leadership, electronic data hosting, mine safety, scenario planning and sustainability matters. |

We recommend that you vote FOR the appointment of Deloitte LLP as our auditors.

More information, including the Audit Committee charter is available in our annual information form under the heading “Audit Committee”. See page 4 for how to access the form.

The people named in the enclosed proxy will vote FOR the appointment of Deloitte LLP as auditors unless you tell them to withhold your vote.

| | | | | | |

| | 11 | | | Page - BUSINESS OF MEETING | |  |

Repeal of By-Law No.3 and By-Law No.4 to be

Replaced in their Entirety by Amended By-Law No.4

On July 30, 2014, the Board approved a new By-Law No.4, replacing the previous By-Law No.3. Subsequently, on February 18, 2015, the Board repealed By-Law No.4 and approved an amended By-Law No.4 (Amended By-Law No.4) in order to align the by-law with recent updates to evolving industry guidelines.

In addition, in order to reflect updated guidance from institutional proxy services regarding advance notice by-laws which was issued immediately prior to the printing of this circular, the following provision was removed from Section 3.04 of the version of Amended By-Law No.4 that is being submitted to shareholders for their approval: “The Corporation may require any proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as an independent director of the Corporation or that could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such proposed nominee. Such information, if requested and received, will be made publicly available to all shareholders by the Corporation.”

We ask that all shareholders refer to the recently updated Amended By-Law No.4, the full text of which is provided in Schedule “A” of this circular, in their consideration of the repeal of By-Law No.3 and By-Law No.4 to be replaced in their entirety by Amended By-Law No.4.

Specific enhancements to Amended By-Law No.4 include:

| › | | The addition of an advance notice provision for the nomination of directors by shareholders in certain circumstances. This provision requires advance notice be given to Goldcorp if shareholders make nominations for persons to be elected to the Board unless the nomination is made by way of a requisition for meeting or a shareholder proposal made as provided for in theBusiness Corporations Act(Ontario) (OBCA). Among other things, the advance notice provision sets a deadline prior to any annual or special meeting of shareholders by which director nominations must be submitted to Goldcorp. It also sets out the information that a shareholder must include in the notice to Goldcorp. |

| › | | Allowing for the execution of written documents by officers and directors of Goldcorp by electronic means. |

| › | | Amended By-Law No.4 also includes other updates to bring it in line with current industry standards. |

A summary of the changes contained in Amended By-Law No.4 and the full text of Amended By-Law No.4 can be found at Schedule “A” on page 134.

We note that no director nominations were received pursuant to the advance notice provision of Amended By-Law No.4 as of the date of this circular. The only nominees for election at the meeting are the nominees listed above under “Election of Directors”.

We recommend that you vote FOR the repeal of By-Law No.3 and By-Law No.4 to be replaced in their entirety by Amended By-Law No.4.

The people named in the enclosed proxy will vote FOR the resolution to repeal By-Law No.3 and By-Law No.4 to be replaced in their entirety by Amended By-Law No.4 unless you tell them to vote against it.

| | | | | | |

| | 12 | | | Page - BUSINESS OF MEETING | |  |

The text of the resolution to be passed is set out below:

“Be it resolved that:

| | 1. | Amended By-Law No.4, in the form set out in Schedule “A” to Goldcorp’s management information circular dated March 18, 2015, is hereby confirmed and approved; |

| | 2. | By-Law No.3 and By-Law No.4 are hereby repealed as of the coming into force of Amended By-Law No.4; and |

| | 3. | any director or officer of Goldcorp is authorized, acting in the name of Goldcorp, to execute and deliver, under the seal of the company or otherwise, any other documents, and to do or cause to be done any other things that may be necessary or desirable to carry out the intent of this resolution.” |

Amendments to the Restricted Share Unit Plan

The Board recommends the following amendments to the restricted share unit plan:

| › | | Adding an annual equity award value limit on grants of restricted share units by Goldcorp to non-employee directors equal to $150,000 per non-employee director in order to align the restricted share unit plan with current practice. |

| › | | Revising the definition of “Termination” in the restricted share unit plan in order to clarify the treatment of restricted share units on termination of eligible employees. |

Further details regarding the amendments to the restricted share unit plan can be found at Schedule “B” on page 157.

We recommend that you vote FOR the amendments to the restricted share unit plan.

The people named in the enclosed proxy will vote FOR the resolution approving the amendments to the restricted share unit plan unless you tell them to vote against the amendments.

The text of the resolution to be passed is set out below:

“Be it resolved that:

| | 1. | the amendments to the restricted share unit plan as described in Goldcorp’s management information circular dated March 18, 2015 are hereby approved; and |

| | 2. | any director or officer of Goldcorp is authorized, acting in the name of Goldcorp, to execute and deliver, under the seal of the company or otherwise, any other documents, and to do or cause to be done any other things that may be necessary or desirable to carry out the intent of this resolution.” |

| | | | | | |

| | 13 | | | Page - BUSINESS OF MEETING | |  |

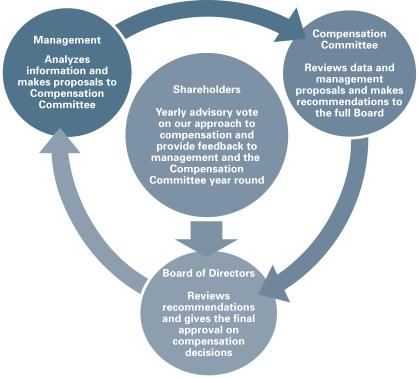

Advisory Vote on Executive Compensation

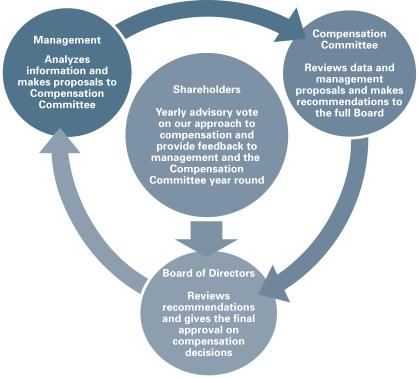

Since 2012, we have provided you with a say on pay vote regarding our executive compensation program. It helps us engage constructively, obtain meaningful feedback and ensure accountability for executive compensation.

Last year 74.8% of shareholders approved our approach to executive compensation. It was a lower number than we aspire to achieve. Based on the 2014 say on pay vote results (based on compensation paid to our executives during the year ended December 31, 2013), we engaged with our shareholders to understand their concerns:

| › | | Met with institutional shareholders to solicit their feedback and better understand how best to tailor our disclosure and provide you, our shareholders, with clear and comprehensive information about our performance and how this performance leads to pay outcomes supported by the design and governance of our executive compensation program |

| › | | Met with Institutional Shareholder Services, Inc. (ISS) and Glass, Lewis & Co., LLC (Glass Lewis) to understand any concerns they may have with our approach to executive compensation |

| › | | Discussions with stakeholders were focused primarily on our performance share unit plan and the metrics we use, as well as our overall pay for performance alignment |

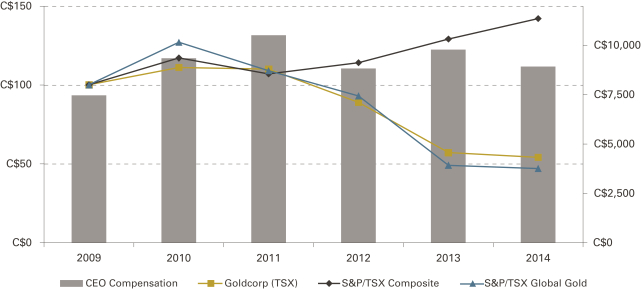

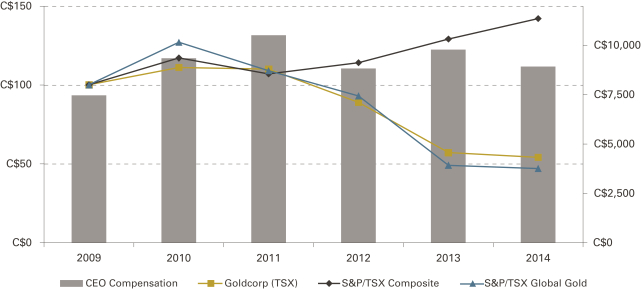

During our meetings with our shareholders, a first key message we heard was that they did not believe we adequately communicate how we measure performance against other large gold producers, and how our share price performance has, over time, consistently outperformed most of our peers. In this year’s executive compensation disclosure, we are more specific in describing and disclosing how we measure performance and how we compare Goldcorp’s performance with its most prevailing peers.

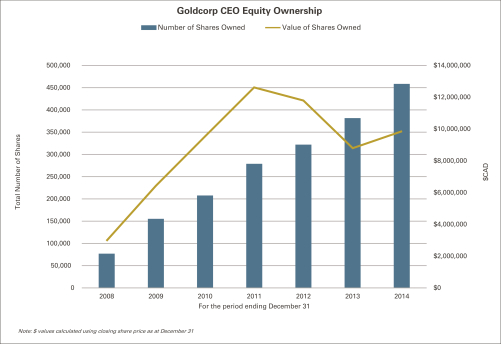

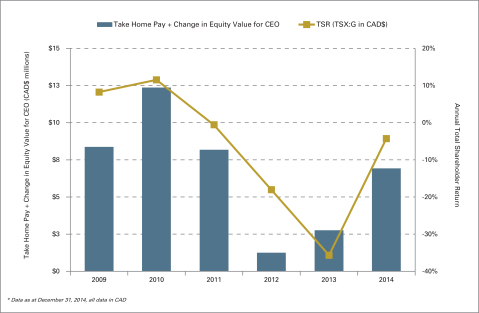

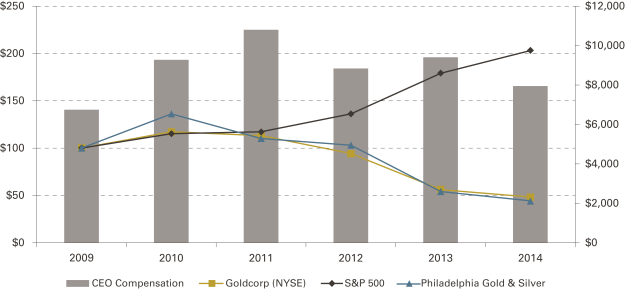

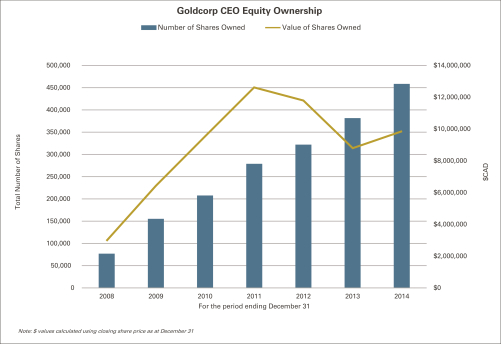

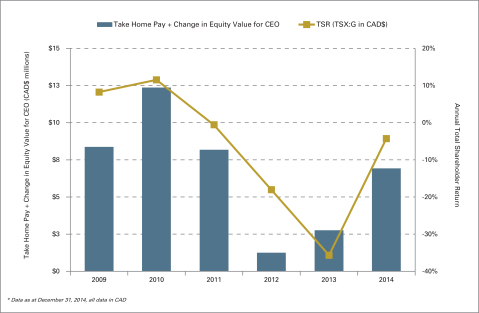

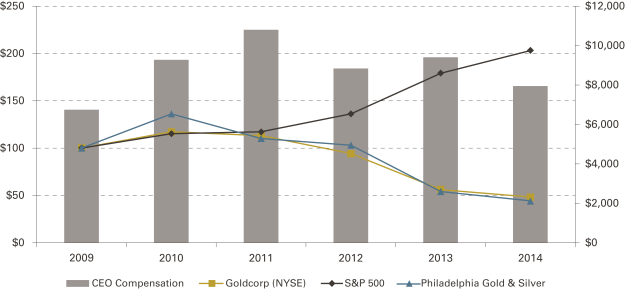

Another key message that emerged during our meetings with our shareholders was that we were unsuccessful in conveying just how closely linked our executives’ compensation (including that of our CEO) was to our shareholders’ experience. Please refer to our CEO Compensation section on page 70 for further information.

| | | | | | |

| | 14 | | | Page - BUSINESS OF MEETING | |  |

Below is a summary of the concerns we heard and addressed following our 2014 say on pay vote and the 2014 shareholders outreach exercise:

| | | | | | | | |

| | | | |

| | | |  | | | |  |

| | | | |

| Perceived disconnect between our executives’ pay and our performance | |  | | It is difficult to accurately measure how we performed against companies who do not operate in the same cyclical commodity market as we do | |  | | Disclosure of our “Performance Peer Group” to better highlight how we measure our performance against those in the same industry |

| | | | |

| Use of a single metric (Relative TSR) in our PSU plan | |  | | We believe Relative TSR provides the best indicator of performance and long-term value creation for shareholders because it best reflects the success of our strategy and relative performance in our sector | |  | | We will continue to review our PSU plan and ensure the metrics are in alignment with our strategy in order to maintain alignment with the shareholder experience |

| | | | |

| A portion of our short-term incentive goals are undisclosed and/or subjective | |  | | All goals that drive our corporate performance factor are pre-established, objective and quantified, but were not clearly disclosed | |  | | We improved our disclosure to more clearly articulate how the corporate score was assessed and included each executive’s personal goals that make up a portion of their annual incentive payments |

| | | | |

| Our clawback policy covers only our CEO and CFO | |  | | We recognize that the emerging best practice is to include all executives within the policy | |  | | We expanded our policy to include all EVPs and both short-term and long-term incentive compensation upon misconduct and material financial restatement |

| | | | |

| Our disclosure of our pay programs is not easy to understand | |  | | We want to ensure our shareholders and all our stakeholders understand our pay programs and how they align to our performance | |  | | We have overhauled our Compensation Discussion and Analysis (CD&A) in order to simplify and clarify the intents and mechanics of our pay programs |

Overall, our approach to executive compensation includes several market leading practices: those outlined above and others such as “double-trigger” vesting of long-term incentives upon a change of control, share ownership guidelines, an expanded clawback policy (see page 45), an anti-hedging policy and transparent, robust disclosure.

In the CD&A section (beginning on page 39), we provide more detail on how we measure and compare our performance and clearly demonstrate that should our share price decline, the pay our executives can actually receive declines as well.

This year we believe we clearly demonstrated how our pay aligns to performance and we anticipate your strong support. You can read more about how we pay for performance in our Letter to Shareholders on page 34.

| | | | | | |

| | 15 | | | Page - BUSINESS OF MEETING | |  |

The people named in the enclosed proxy will vote FOR the advisory resolution approving our approach to executive compensation unless you tell them to vote against it.

The text of the resolution to be passed is set out below:

We recommend that you vote FOR the adoption of this resolution to support our

approach to executive compensation.

“Be it resolved thaton an advisory basis, and not to diminish the role and responsibilities of the Board, the shareholders accept the Board’s approach to executive compensation disclosed in this management information circular dated March 18, 2015 delivered in advance of the meeting.”

Other Business

If other matters are properly brought up at the meeting, you (or your proxy holder, if you are voting by proxy) can vote as you see fit. We are not aware of any other items of business to be considered at the meeting.

| | | | | | |

| | 16 | | | Page - BUSINESS OF MEETING | |  |

In this section you can read about:

| | |

| | |

Director biographies | | Page 18 |

| | |

Director compensation | | Page 28 |

| | |

Additional information | | Page 32 |

|

DIRECTOR NOMINEES DIRECTORS: 80% independent DIVERSITY: 20% women DIRECTOR SHARE OWNERSHIP: 3 times annual

retainer and

after-tax value

of RSUs |

| | | | |

| | 17 | | | Page - DIRECTOR NOMINEES |

DIRECTOR BIOGRAPHIES

Following is a complete biography for each director nominee for election at the meeting. All other director information can be found in this section under the heading “Director Compensation” starting at page 28 or in the section entitled “Corporate Governance”. Market values of the common shares listed in the biographies below are calculated using the closing prices of the common shares on the TSX on December 31, 2014 and December 30, 2013 of C$21.51 and C$23.04, respectively, and converted to US dollars at the exchange rate of C$1.00 = $0.9054 and C$1.00 = $0.9710 for the years ended December 31, 2014 and December 31, 2013, respectively.

| | | | | | | | | | | | | | |

| | John P. Bell Age: 76 Home: British Columbia, Canada Director since: February 2005 Independent Member – Governance Committee Chair – Sustainability Committee Areas of expertise: › Environment, safety and sustainability › Human resources and compensation › Social, economic and foreign policy |

| Current occupation | | Independent director and Honorary Consul to the Ivory Coast |

| Career | | Mr. Bell is a former Canadian Ambassador to the Ivory Coast and Brazil. He also served as High Commissioner to Malaysia from 1993 to 1996. Mr. Bell was special advisor to the Canadian Minister of Foreign Affairs and Head of the Canadian Delegation on environmental issues during the lead-up to the Earth Summit in Rio de Janeiro in June 1992 and was Canada’s chief negotiator at the Earth Summit. Mr. Bell has been Chief Federal Negotiator for the Indian Affairs and has served on severalnot-for-profit boards of directors. |

| Education | | Bachelor of Commerce (1962) and an Honorary Doctorate of Laws (1998) from the University of British Columbia |

| Directorships | | Tahoe Resources Inc. (since 2010) |

| Memberships and awards | | Member of the National Association of Corporate Directors (NACD) in the US (since 2011) Member of the Institute of Corporate Directors (ICD) in Canada (since 2005) |

Background and experience | | Mr. Bell’s background as an ambassador and extensive experience with environmental and regulatory issues in Canada and throughout the world provide to management and the Board valuable insight into the international regulatory and policy developments affecting Goldcorp’s business. His depth of knowledge in matters relating to the environment and public policy add to the Board’s breadth of experience and further enhance our ability to improve and build upon our environmental and corporate social responsibility policies and activities. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Share Ownership as at December 31, 2014 and 2013 | |

| Year | | Common

shares | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 38,446 | | | Nil | | | | $748,742 | | | | $543,892 | | | | ü | | | | $319,995 | |

2013 | | 32,515 | | | Nil | | | | $727,420 | | | | $472,316 | | | | ü | | | | $266,076 | |

| | | | | | | | | | | | |

| Other matters | |

Membership | | Attendance | | Voting results | | Other boards | | | Interlocks | |

Board | | 100% | | 2014 – 99.53% for | | Tahoe Resources Inc. | | | Williamson | |

Governance | | 100% | | 2013 – 99.56% for | | | | | | |

Sustainability (Chair) | | 100% | | 2012 – 99.72% for | | | | | | |

| | | | | | |

| | 18 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Beverley A. Briscoe Age: 60 Home: British Columbia, Canada Director since: April 2006 Independent Chair – Audit Committee Member – Sustainability Committee Areas of expertise: › Accounting › Finance |

| Current occupation | | President of Briscoe Management Limited (since 2004) |

| Career | | Ms. Briscoe has extensive industry experience in the transportation and industrial equipment sector. Ms. Briscoe owned a transportation services company from 1997 to 2004 and worked in senior management positions in the heavy equipment industry as Vice President and General Manager of Wajax Industries Ltd. from 1994 to 1997 and as Vice President, Finance for the Rivtow Group of Companies from 1989 to 1994. She also worked as Chief Financial Officer for various operating divisions in The Jim Pattison Group in Canada and Switzerland from 1983 to 1989. She is the past Chair of the Industry Training Authority for BC (2003 – 2007) and past Chair of the BC Forest Safety Council (2008-2009). Ms. Briscoe is currently the Chair of the Audit Committee for the Office of the Superintendents of Financial Institutions. |

| Education | | Bachelor of Commerce degree from the University of British Columbia, 1977 |

| Directorships | | Ritchie Bros. Auctioneers Incorporated (Director since 2004, Chairwoman since 2014) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2005) Lifetime Achievement Award at the 12th Annual Influential Women in Business Awards (March 2011) ICD Fellowship Award (2012) |

Background and experience | | Ms. Briscoe is a Fellow of the Institute of Chartered Accountant and a Fellow of the ICD in Canada. She brings an important range of extensive and diverse financial, accounting and business experience to the Board. In addition, Ms. Briscoe’s experience managing financial and reporting matters benefits Goldcorp with respect to the issues overseen by the Audit Committee. |

| | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | Options | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 34,438 | | Nil | | | $670,685 | | | | $543,892 | | | | ü | | | | $322,495 | |

2013 | | 28,507 | | Nil | | | $637,754 | | | | $472,316 | | | | ü | | | | $273,076 | |

| | | | | | | | | | | | |

| Other matters |

Membership | | | Attendance | | | Voting results | | Other boards | | Interlocks |

Board | | | 100% | | | 2014 – 99.61% for | | Ritchie Bros. Auctioneers Incorporated | | None |

Audit (Chair) | | | 100% | | | 2013 – 99.60% for | | | |

Sustainability | | | 100% | | | 2012 – 99.79% for | | | |

| | | | | | |

| | 19 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Peter J. Dey Age: 74 Home: Ontario, Canada Director since: June 2006 Independent Member – Compensation Committee Chair – Governance Committee Areas of expertise: › Finance › Governance › Human Resources and Compensation › Mergers and Acquisitions |

| Current occupation | | Chairman of Paradigm Capital Inc., an independent investment dealer (since 2005) |

| Career | | Mr. Dey is a well-known senior corporate executive and an experienced corporate director. He is a former Chairman of the Ontario Securities Commission and former Chairman of Morgan Stanley Canada and he was a Senior Partner of Osler, Hoskin & Harcourt LLP. In 1994, he chaired the TSX Committee on Corporate Governance and has since been involved with developing global corporate governance standards as Chairman of the Private Sector Advisory Group of the Global Corporate Governance Forum. |

| Education | | Masters of Laws degree from Harvard University, a Bachelor of Laws degree from Dalhousie University and a Bachelor of Science degree from Queen’s University. |

| Directorships | | Granite REIT Inc. (since June 2012) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2006) Inaugural recipient of the Peter Dey, Excellence in Governance Award from the Canadian Society of Corporate Secretaries in 2013 |

Background and experience | | Mr. Dey’s intimate familiarity with all aspects of capital markets, financial transactions and domestic and international markets provides value and informed perspective to management and the Board. His legal experience and work with the TSX and other forums also provides Goldcorp with a significant and enhanced perspective on governance issues. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | | 35,312 | | | | Nil | | | $ | 687,707 | | | $ | 541,147 | | | ü | | | | $ | 321,495 | |

2013 | | | 32,166 | | | | Nil | | | $ | 719,613 | | | $ | 472,316 | | | ü | | | | $ | 269,076 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.05% for | | Granite REIT Inc. | | None |

Compensation | | 100% | | 2013 – 99.34% for | | | | |

Governance (Chair) | | 100% | | 2012 – 99.92% for | | | | |

| | | | | | |

| | 20 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Douglas M. Holtby Age: 67 Home: British Columbia, Canada Director since: February 2005 Independent Chair – Compensation Committee Member – Governance Committee Member – Audit Committee Areas of expertise: › Accounting › Consulting › Governance › Human Resources and Compensation › Mergers and Acquisitions › Private Equity |

| Current occupation | | Vice-Chairman of the Board and Lead Director (Vice-Chairman and Lead Director) of Goldcorp (since 2006) Chairman and Director of Silver Wheaton Corp. (since 2009 and 2006, respectively) President and Chief Executive Officer of Holtby Capital Corporation, a private investment company (since 1998) |

| Career | | From 1974 to 1989, Mr. Holtby was President of Allarcom Limited and from 1982 to 1989, he was President of Allarcom Pay Television Limited. From 1989 to 1996, he was President, Chief Executive Officer and a director of WIC Western International Communications Ltd. and Chairman of Canadian Satellite Communications Inc. From 1998 to 1999, he was a Trustee of ROB.TV and CKVU. |

| Education | | Institute of Chartered Accountants, Alberta, 1972 Chartered Accountant of British Columbia since 2008 |

| Directorships | | Silver Wheaton Corp. (since 2006) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2005) |

Background and experience | | Mr. Holtby is a Fellow of the Institute of Chartered Accountants (since 2008). His financial sophistication, accounting background, extensive investment and management experience, and business and strategic expertise significantly enhance the skill set of the Board and its committees. |

| | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common

shares | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 55,651 | | | Nil | | | $ | 1,083,812 | | | $ | 843,392 | | | ü | | | | $ | 425,495 | |

2013 | | 52,470 | | | Nil | | | $ | 1,173,850 | | | $ | 772,187 | | | ü | | | | $ | 364,805 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.10% for | | Silver Wheaton Corp. | | None |

Audit and Governance | | 100% | | 2013 – 99.55% for | | | | |

Compensation (Chair) | | 100% | | 2012 – 99.72% for | | | | |

| | | | | | |

| | 21 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Charles A. Jeannes Age: 56 Home: British Columbia, Canada Director since: May 2009 Non-Independent Areas of expertise: › Sustainability › Governance › Human Resources and Compensation › Mergers and Acquisitions › Mining and Exploration |

| Current occupation | | President and CEO of Goldcorp |

| Career | | Mr. Jeannes was appointed President and CEO of Goldcorp effective January 1, 2009. He previously held the role of Executive Vice President, Corporate Development from November 2006 until December 2008. From 1999 until the completion of the acquisition of Glamis Gold Ltd. (Glamis), he was Executive Vice President, Administration, General Counsel and Secretary of Glamis. Prior to joining Glamis, Mr. Jeannes worked for Placer Dome Inc. (Placer Dome), as Vice President of Placer Dome North America. He practiced law from 1983 until 1994 and has broad experience in mining transactions, public and private financing, permitting and international regulation. |

| Education | | Bachelor of Arts degree from the University of Nevada, 1980 Juris Doctor from the University of Arizona School of Law with honours, 1983 |

| Directorships | | None |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2014) Member of The International Council on Mining and Metals (since 2009) Member of World Gold Council (since 2009) Member of World Economic Forum (since 2014) Named 2013 CEO of the Year in BC by Business in Vancouver |

Background and experience | | Mr. Jeannes brings significant institutional knowledge of Goldcorp’s business to his role as a member of the Board and as the current President and CEO. His business, legal and transactional background, as well as his extensive experience in the mining industry, provides a direct benefit to the Board and valuable insight into all aspects of the management of Goldcorp. |

| | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 495,466 | | | $9,649,277 | | | $ | 5,432,400 | | | ü | | | | $ | 8,523,885 | |

2013 | | 438,319 | | | $9,806,003 | | | $ | 5,826,000 | | | ü | | | | $ | 9,898,797 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.62% for | | None | | None |

| | | | | 2013 – 99.45% for | | | | |

| | | | | 2012 – 99.73% for | | | | |

| | | | | | |

| | 22 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Clement A. Pelletier Age: 69 Home: British Columbia, Canada Director since: May 2014 Independent Member – Governance Committee Member – Sustainability Committee Areas of expertise: › Sustainability › Metallurgy › Mergers and Acquisitions |

| Current occupation | | Senior Technical Advisor with ERM Consultants (since 2014) |

| Career | | Mr. Pelletier is a process chemist/metallurgist by training with 14 years in industry and 34 years in resource-related mine/environmental consulting. During his early years he worked with Inco Limited in the mineral processing and extractive metallurgy area. Later, he worked with US Borax/Rio Tinto in the potash processing and underground mining area. In 1970, he joined Utah International for the development of the Island Copper Mine on Vancouver Island, British Columbia. Here he led the work on the implementation of an engineered system for the placement of tailing on the seafloor of Rupert Inlet. On this project, he led the first major environmental impact statement for a mine in British Columbia. At Island Copper he had a number of roles including Manager of Mining Services, Manager of Administration and Assistant Mine Manager and Manager of Business Development. Mr. Pelletier has managed the environmental engineering work for a number of Deep Sea Tailings Placement (DSTP) projects for clients including: BHP Billiton, Newmont Mining, Vale S.A./Inco Limited, Glencore Xstrata, Placer Dome/Barrick Gold, Teck, Rio Tinto Borax (formerly known as US Borax) and First Quantum Minerals. He has also managed a number of acid rock drainage studies, industrial water treatment studies, mine closures and qualitative risk assessments. He has managed large EIS and permitting for major projects such as the KSM Project, the Jansen Potash Project, Goro Nickel, the Voisey’s Bay Nickel Project, Escondida, the Ekati Diamond Mine and others. Since 1981 as founder and President of Rescan Group, Mr. Pelletier was involved in the evaluation and development of DSTP systems in Europe, the Americas, Africa and Southeast Asia. Mr. Pelletier has been retained as a consultant to a number of international mining companies, to assist with feasibility studies, conceptual design, project development, environmental licensing, project management, due diligence and risk assessments. |

| Education | | Bachelor of Science in Chemistry/Metallurgy, University of Saskatchewan, 1967 |

| Directorships | | Director of BioteQ Environmental Technologies Inc. (since 2000) |

| Memberships and awards | | Fellow of the Canadian Institute of Mining and Metallurgy (CIMM) CIMM Distinguished Lecturer Award and CIMM Silver Medal for Distinguished Service to Mining Industry Technology Transfer Award from the Indonesian Department of Minerals and Energy for DSTP Member of NACD in the US and Member of ICD in Canada (each since 2014) |

Background and experience | | Mr. Pelletier’s extensive experience in the industry and environmental and technical expertise provides valuable insight and makes him a significant resource to both the Board and management. |

| | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common

shares | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 10,931 | | | Nil | | | $ | 212,883 | | | $ | 543,892 | | | | N/A 1 | | | $ | 260,162 | |

2013 | | 5,000 | | | Nil | | | $ | 111,859 | | | | N/A | | | | N/A 1 | | | | N/A | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.62% | | BioteQ Environmental Technologies Inc. | | None |

Governance | | 100% | | 2013 – N/A | | | | |

Sustainability | | 100% | | 2012 – N/A | | | | |

Note:

| | 1. | Mr. Pelletier has until December 31, 2019 to satisfy the minimum shareholding requirement. |

| | | | | | |

| | 23 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | P. Randy Reifel Age: 62 Home: British Columbia, Canada Director since: November 2006 Independent Member – Compensation Committee Member – Sustainability Committee Areas of expertise: › Human Resources and Compensation › Mergers and Acquisitions › Mineral Exploration |

| Current occupation | | President of Chesapeake Gold Corp. (since 2012) |

| Career | | Mr. Reifel is President and a director of Chesapeake Gold Corp., a company that explores for precious metals in Mexico and Central America. Mr. Reifel was appointed to the Board in November 2006. Prior to that, he had been a director of Glamis since June 2002 following the acquisition of Francisco Gold Corp. In 1993, Mr. Reifel founded and served as President and a director of Francisco Gold Corp. which discovered the El Sauzal gold deposit in Mexico and the Marlin gold deposit in Guatemala. |

| Education | | Bachelor of Commerce degree from the University of British Columbia, 1976 Masters of Science degree in Business Administration from the University of British Columbia, 1978 |

| Directorships | | Chesapeake Gold Corp. (since 2002) Gunpoint Exploration Ltd. (since 2010) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2014) |

Background and experience | | Mr. Reifel’s extensive experience in the mining industry, coupled with his background in precious metals exploration and project development, combine to provide valuable industry insight and perspective to both the Board and management. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | | 4,042,244 | | | | Nil | | | $ | 78,723,324 | | | $ | 543,892 | | | ü | | | | $ | 317,495 | |

2013 | | | 4,036,313 | | | | Nil | | | $ | 90,299,749 | | | $ | 472,316 | | | ü | | | | $ | 250,076 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.10% for | | Chesapeake Gold Corp. Gunpoint Exploration Ltd. | | None |

Compensation | | 100% | | 2013 – 99.48% for | | | |

Sustainability | | 100% | | 2012 – 98.20% for | | | | |

| | | | | | |

| | 24 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Ian W. Telfer Age: 68 Home: British Columbia, Canada Director since: February 2005 Non-Independent Areas of expertise: › Accounting › Finance › Mergers and Acquisitions › Mining |

| Current occupation | | Chairman of Goldcorp (since 2006) |

| Career | | Mr. Telfer was appointed Chairman of Goldcorp effective November 15, 2006 and served as Chairman of the World Gold Council from December 2009 to June 2013. Prior to that he was President and CEO of Goldcorp since March 17, 2005 and Chairman and CEO of Wheaton River Minerals Ltd. prior to such time since September 2001. Mr. Telfer is also the co-founder and Director of Renaissance Oil Corp. |

| Education | | Bachelor of Arts degree from the University of Toronto, 1968 Masters in Business Administration from the University of Ottawa, 1976 |

| Directorships | | Renaissance Oil Corp. (since 2011) Catalyst Copper Corp. (since 2014) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2014) Inducted into the Canadian Mining Hall of Fame (January 2015) |

Background and experience | | Mr. Telfer has over 30 years of experience in the precious metals business. He has served as a director and/or officer of several Canadian and international companies. Mr. Telfer is a Fellow of the Institute of Chartered Accountants. Mr. Telfer’s extensive experience in the mining industry provides a direct benefit to both the functionality of the Board and to our shareholders. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | | 147,651 | | | | 503,333 | | | $ | 2,875,526 | | | $ | 2,829,892 | | | ü | | | | $ | 1,017,638 | |

2013 | | | 91,720 | | | | 553,333 | | | $ | 2,051,945 | | | $ | 3,087,000 | | | | No1 | | | $ | 1,079,420 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 98.89% for | | Renaissance Oil Corp. Catalyst Copper Corp. | | None |

| | | | | 2013 – 98.56% for | | | |

| | | | | 2012 – 98.74% for | | | | |

Note:

| | 1. | As of December 31, 2012, Mr. Telfer’s share ownership value had fallen below the minimum shareholding requirement due to a decrease in our share price. Under our policy, he had until December 31, 2014 to meet the minimum shareholding requirement again. On December 8, 2014, Mr. Telfer exercised 50,000 stock options in order to increase his shareholdings of Goldcorp to meet the minimum shareholding requirement. |

| | | | | | |

| | 25 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Blanca Treviño Age: 55 Home: Leon, Mexico Director since: February 2012 Independent Member – Audit Committee Member – Governance Committee Areas of expertise: › Information Technology › Finance › Human Resources and Compensation › Mergers and Acquisitions |

| Current occupation | | President and Chief Executive Officer of Softtek S.A. de C.V. (Softtek) |

| Career | | Under her leadership, Softtek has become a leading information technology services company in Latin America. As President, Ms. Treviño has positioned Softtek as a key part of Mexico, opening its doors to the US as a provider of information and technology (IT) services. This shaped what is known today as Nearshore, Softtek’s trademarked delivery model, and a term widely used in the industry to define outsourcing services provided by countries within close proximity. Ms. Treviño has been a board member for several universities and non-profit organizations. |

| Education | | Bachelor in Computer Science from the Instituto Tecnológico de Estudios Superiores de Monterrey (ITESM), 1981 |

| Directorships | | Director of Wal-Mart de México SAB de CV (since 2006) |

| Memberships and awards | | Member of NACD in the US (since 2012) Member of ICD in Canada (since 2014) Ms. Treviño was the first woman to be inducted into the prestigious IAOP (International Association of Outsourcing Providers) Outsourcing Hall of Fame Named one of the Top 25 Businesswomen by The Latin Business Chronicle Rising Star on Fortune’s list of the 50 Most Powerful Women Named Mexico’s Woman of the Year by the National Women of the Year Foundation (2014) |

Background and experience | | Throughout her 25-year career, Ms. Treviño has gained international recognition as a promoter of the IT services industry in and from emerging countries. To help increase the participation of Latin America in the IT field, Ms. Treviño has collaborated with various governments in the early strategies of development. She has also been a frequent presenter in national and international forums related to entrepreneurialism, IT and the role of women in business. She has participated in forums at the World Bank, Inter-American Development Bank, Kellogg School of Management, Harvard Business School and London Business School. Beyond the IT industry, she is identified by several media publications as one of the most influential executives in Mexico and Latin America. Ms. Treviño’s significant experience in the IT industry, coupled with her experience as an entrepreneur, bring important insight to both the Board and management. |

| | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 11,401 | | | Nil | | | $ | 222,036 | | | $ | 543,892 | | | | N/A 1 | | | $ | 293,495 | |

2013 | | 5,470 | | | Nil | | | $ | 122,374 | | | $ | 475,120 | | | | N/A 1 | | | $ | 240,330 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 91% | | 2014 – 99.47% for | | Wal-Mart de México SAB de CV | | None |

Audit | | 100% | | 2013 – 99.54% for | | | |

Governance | | 100% | | 2012 – 99.18% for | | | |

Note:

| | 1. | Ms. Treviño has until December 31, 2017 to satisfy the minimum shareholding requirement. |

| | | | | | |

| | 26 | | | Page - DIRECTOR NOMINEES | |  |

| | | | | | | | | | | | | | |

| | Kenneth F. Williamson Age: 67 Home: Ontario, Canada Director since: November 2006 Independent Member – Audit Committee Member – Compensation Committee Areas of expertise: › Finance › Human Resources and Compensation › Mergers and Acquisitions |

| Current occupation | | Independent consultant |

| Career | | Mr. Williamson was appointed to the Board in November 2006. Prior to that, Mr. Williamson had been a director of Glamis since 1999. He was Vice-Chairman, Investment Banking at Midland Walwyn/Merrill Lynch Canada Inc. from 1993 to 1998. Prior to that, he worked at Walwyn/Merrill in investment banking with increasing responsibility and titles since 1980. Mr. Williamson has been a director of a number of companies in the natural resource sector. |

| Education | | Bachelor of Applied Science (P.Eng.) degree from the University of Toronto, 1970 Masters in Business Administration from the University of Western Ontario, 1973 |

| Directorships | | Tahoe Resources Inc. (since 2010) |

| Memberships and awards | | Member of NACD in the US (since 2011) Member of ICD in Canada (since 2014) |

Background and experience | | Mr. Williamson has worked in the securities industry for more than 25 years, concentrating on financial services and the natural resource industries in the US and Europe. Mr. Williamson’s experience in the investment banking and natural resources industries, in both domestic and international markets, combined with his knowledge of commodities and securities markets, provides the Board with valuable insight and perspective on these issues. In addition, Mr. Williamson brings valuable financial expertise and understanding to the Board. |

| | | | | | | | | | | | | | | | | | | | | | |

| Share ownership as at December 31, 2014 and 2013 | |

| Year | | Common shares | | Options | | | Market value | | | Holding

requirement | | | Meets

requirement | | | Total

compensation | |

2014 | | 54,441 | | | Nil | | | $ | 1,060,247 | | | $ | 541,147 | | | ü | | | | $ | 309,995 | |

2013 | | 48,510 | | | Nil | | | $ | 1,085,258 | | | $ | 472,316 | | | ü | | | | $ | 250,076 | |

| | | | | | | | | | |

| Other matters |

Membership | | Attendance | | Voting results | | Other boards | | Interlocks |

Board | | 100% | | 2014 – 99.55% for | | Tahoe Resources Inc. | | Bell |

Audit | | 100% | | 2013 – 99.57% for | | | | |

Compensation | | 100% | | 2012 – 99.73% for | | | | |

| | | | | | |

| | 27 | | | Page - DIRECTOR NOMINEES | |  |

DIRECTOR COMPENSATION

Philosophy, Objectives and Process

The philosophy and benchmarking for director compensation is the same as for Goldcorp’s executive compensation, as discussed on page 51. Our objectives are to attract and retain directors of a quality and nature that will enhance our sustainable profitability and growth. Director compensation is intended to provide an appropriate level of remuneration considering the experience, responsibilities, time requirements and accountability of their roles.

The Board meets annually (usually prior to the annual meeting of shareholders) to receive recommendations from the Governance and Compensation Committees regarding the adequacy and form of directors’ compensation. The Compensation Committee believes that our approach to director compensation provides for competitive and reasonable compensation levels.

No changes have been made to the cash compensation paid to the directors of Goldcorp since 2011. In April 2014, the Governance and Compensation Committees made a recommendation to the Board to cap the dollar value of the restricted share units awarded to each non-executive director at $150,000 to align with current market practice. Shareholders will be asked to approve this amendment at the meeting. See “Business of Meeting – Amendments to Restricted Share Unit Plan”.

Fees and Retainers

All non-executive directors receive meeting fees, annual retainers, annual restricted share unit grants and travel expense disbursements for their service on the Board. Mr. Jeannes, who is an employee, does not receive any additional compensation for serving on the Board.

Mr. Dan Rovig retired from the Board on May 1, 2014, was paid the pro-rated amount of $33,333 as a retainer for the year ended December 31, 2014 and was not granted restricted share units in 2014.

Fees and Retainers

| | | | |

| Role | | Amount | | Individual |

Chairman | | $862,000 (C$1,000,000) annual retainer paid quarterly $150,000 equity award (5,931 RSUs) | | Telfer |

Vice-Chairman and Lead Director | | $200,000 annual retainer paid quarterly $150,000 equity award (5,931 RSUs) | | Holtby |

| Non-executive director annual retainer and RSUs | | $100,000 annual retainer paid quarterly $150,000 equity award (5,931 RSUs) | | Bell Briscoe Dey Pelletier Reifel Treviño Williamson |

Audit Committee Chair | | $20,000 | | Briscoe |

Compensation Committee Chair | | $20,000 | | Holtby |

Governance Committee Chair | | $10,000 | | Dey |

Sustainability Committee Chair | | $10,000 | | Bell |

Board meeting fee | | $1,500 per day for each Board or committee meeting attended | | All non-executive directors excluding Chairman |

Travel expenses | | $1,500 per day of travel to a maximum of two days per Board or committee meeting attended | | All non-executive directors excluding Chairman |

| | | | | | |

| | 28 | | | Page - DIRECTOR NOMINEES | |  |

Director Compensation Table

Non-Executive Director Compensation During 2014

| | | | | | | | | | | | | | | | | | | | | | |

| Director | | Fees Earned | | | Share-Based

Awards1 | | | Option-

Based

Awards | | Non-Equity

Incentive Plan

Compensation | | | All Other Compensation | | | Total | |

| | | ($) | | | ($) | | | ($) | | ($) | | | ($) | | | ($) | |

Bell | | | 170,000 | | | | 149,995 | | | Nil | | | Nil | | | | Nil | | | | 319,995 | |

Briscoe | | | 172,500 | | | | 149,995 | | | | | | Nil | | | | 322,495 | |

Dey | | | 171,500 | | | | 149,995 | | | | | | Nil | | | | 321,495 | |

Holtby | | | 275,500 | | | | 149,995 | | | | | | Nil | | | | 425,495 | |

Pelletier | | | 110,167 | | | | 149,995 | | | | | | Nil | | | | 260,162 | |

Reifel | | | 167,500 | | | | 149,995 | | | | | | Nil | | | | 317,495 | |

Rovig2 | | | 72,333 | | | | Nil | | | | | | Nil | | | | 72,333 | |

Telfer | | | 862,000 3 | | | | 149,995 | | | | | | 5,643 4 | | | | 1,017,638 | |

Treviño | | | 143,500 | | | | 149,995 | | | | | | Nil | | | | 293,495 | |

Williamson | | | 160,000 | | | | 149,995 | | | | | | Nil | | | | 309,995 | |

| Totals | | | 2,305,000 | | | | 1,349,955 | | | | | | 5,643 | | | | 3,660,598 | |

Notes:

| | 1. | These amounts represent the value of the RSUs granted to the respective non-executive director. These amounts were calculated by multiplying the number of RSUs granted (5,931 each) by $25.29 (based on the closing price of the common shares on the TSX on May 6, 2014 of C$27.54 and converted to US dollars at the exchange rate on May 6, 2014 of C$1.00 = $0.9183). |

| | 2. | Mr. Rovig retired from the Board on May 1, 2014. |

| | 3. | Converted to US dollars at the exchange rate on December 31, 2014 of C$1.00 = $0.8620. |

| | 4. | This amount represents benefit premiums paid by Goldcorp for Mr. Telfer. Mr. Telfer’s benefit premium was C$6,233 and converted to US dollars at the exchange rate for 2014 of C$1.00 = $0.9054. |

Fees Earned During 2014

Fees Earned by Non-Executive Directors During 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Board

Annual

Retainer | | | Committee

Chair

Retainer | | | Aggregate

Board Attendance

Fee 1 | | | Aggregate

Committee

Attendance

Fee 2 | | | Aggregate Mine

Site and

Workshop Fee 3 | | | Aggregate

Travel Fee | | | Total Fees | |

| | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

Bell | | | 100,000 | | | | 10,000 | | | | 16,500 | | | | 19,500 | | | | 9,000 | | | | 15,000 | | | | 170,000 | |

Briscoe | | | 100,000 | | | | 20,000 | | | | 16,500 | | | | 13,500 | | | | 7,500 | | | | 15,000 | | | | 172,500 | |

Dey | | | 100,000 | | | | 10,000 | | | | 16,500 | | | | 27,000 | | | | Nil | | | | 18,000 | | | | 171,500 | |

Holtby | | | 200,000 | | | | 20,000 | | | | 16,500 | | | | 27,000 | | | | 3,000 | | | | 9,000 | | | | 275,500 | |

Pelletier4 | | | 66,667 | | | | Nil | | | | 9,000 | | | | 18,000 | | | | 4,500 | | | | 12,000 | | | | 110,167 | |

Reifel | | | 100,000 | | | | Nil | | | | 16,500 | | | | 27,000 | | | | 9,000 | | | | 15,000 | | | | 167,500 | |

Rovig5 | | | 33,333 | | | | Nil | | | | 9,000 | | | | 13,500 | | | | 4,500 | | | | 12,000 | | | | 72,333 | |