Exhibit 99.1

TABLE OF CONTENTS

| | | | |

Notice of Meeting | | | Page 3 | |

General Information | | | Page 4 | |

General Voting Information | | | Page 6 | |

Beneficial Shareholder Voting | | | Page 8 | |

Registered Shareholder Voting | | | Page 9 | |

Business of Meeting | | | Page 11 | |

Director Biographies | | | Page 13 | |

Director Compensation | | | Page 18 | |

Additional Information | | | Page 21 | |

Human Resources & Compensation Committee Report | | | Page 22 | |

Letter to Shareholders | | | Page 25 | |

Compensation Discussion and Analysis | | | Page 28 | |

Termination and Change of Control Benefits | | | Page 56 | |

Shareholder Engagement | | | Page 60 | |

Governance Practices | | | Page 62 | |

Audit Committee | | | Page 76 | |

Human Resources & Compensation Committee | | | Page 77 | |

Governance Committee | | | Page 79 | |

Sustainability Committee | | | Page 80 | |

Schedule “A” – Key Policy Descriptions | | | Page 82 | |

Schedule “B” – Description of Goldcorp’s Equity Incentive Plans | | | Page 84 | |

Schedule “C” – Terms of Reference for the Board of Directors | | | Page 91 | |

Schedule “D” – Forward Looking Statement Advisory | | | Page 96 | |

2

NOTICE OF MEETING

Annual and Special Meeting of the Shareholders of Goldcorp

| | |

| Date: | | Thursday, April 26, 2017 |

| |

| Time: | | 3:00 p.m. (Vancouver Time) |

| |

| Place: | | Cassels Brock & Blackwell LLP, Suite 2200 HSBC Building, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 |

The business of the meeting is to:

| | 1. | Receive the audited annual consolidated financial statements for 2016 |

| | 2. | Elect directors for the coming year |

| | 3. | Appoint Deloitte LLP, Independent Registered Public Accounting Firm as auditors and authorize the directors to fix their remuneration |

| | 4. | Consider anon-binding advisory resolution on our approach to executive compensation |

| | 5. | Transact any other business |

You have a right to vote if you were a Goldcorp shareholder on March 13, 2017, our “record date”. Find out how to vote starting on page 6 of the accompanying disclosure document (called a circular). You can also read more about us in the circular.

The Board has, by resolution, fixed 3:00 p.m. (Vancouver Time) on April 24, 2017, or no later than 48 hours before the time of any adjourned meeting (excluding Saturdays, Sundays and holidays), as the time before which proxies to be used or acted upon at the meeting or any adjournment thereof shall be deposited with our transfer agent. The time limit for the deposit of proxies may be waived or extended by the chair of the meeting at their discretion, without notice.

By order of the Board of Directors,

“Ian W. Telfer”

Chairman of the Board

3

GENERAL INFORMATION

Goldcorp

We use “we”, “us”, “our” and “Goldcorp” to refer to Goldcorp Inc. in this document.

Date of Information

Information is as of March 13, 2017, unless we note otherwise.

Currency and Exchange Rate

Canadian dollars are reported as C$ and United States (US) dollars are reported as US$. For amounts converted to Canadian dollars (C$) we used the average rate of C$1.00 = US$0.7543, unless noted otherwise. This is the Bank of Canada average annual exchange rate for the year ended December 31, 2016.

Common Shares Outstanding

Our common shares are traded on the Toronto Stock Exchange (“TSX”) under the symbol G and on the New York Stock Exchange (“NYSE”) under the symbol GG. There were 855,354,408 common shares of Goldcorp outstanding at the close of business on March 13, 2017.

Owners of 10% or More of Our Common Shares

To the knowledge of the directors and executive officers, no person or company owns or controls 10% or more of our common shares.

Interests in Meeting Business and Material Transactions

Since January 1, 2016, none of Goldcorp, our directors, director nominees and executive officers, or anyone associated or affiliated with any of them, has a material interest in any item of business at the meeting. A material interest is one that could reasonably interfere with the ability to make independent decisions.

No informed person of Goldcorp, nor any proposed director or anyone associated or affiliated with any of them, has or had a direct or indirect material interest in any transaction since the beginning of Goldcorp’s most recently completed financial year or in any proposed transaction which has materially affected or would materially affect Goldcorp, or any of its subsidiaries or affiliates.

Mailing of Circular

This circular will be mailed on March 24, 2017 to each of our shareholders of record on March 13, 2017 who have previously requested paper copies of our disclosure documents. All other shareholders will only receive a notice with information on how to view the meeting materials electronically. See “Notice and Access” below.

We give meeting materials to brokers, intermediaries, custodians, nominees and fiduciaries and request the materials be sent to beneficial shareholders promptly. We will pay for the distribution of the meeting materials by clearing agencies and intermediaries to objecting beneficial shareholders.

Electronic Delivery

Shareholders can choose to receive meeting materials electronically rather than by paper. If you have already chosen to receive electronic copies, no paper materials will be sent to you. If you would like to receive future meeting materials electronically, please complete the enclosed form and return it as indicated on the form.

If we don’t have an electronic document available or we choose not to send an electronic copy, a paper copy will be provided.

Notice and Access

We are delivering your meeting materials by providing you with a notice and posting the materials on our website atwww.goldcorp.com. The materials will be available on the website starting on March 24, 2017 and will remain

4

available on the website for one full year. The meeting materials can also be accessed with our public filings onwww.sedar.com andwww.sec.gov. We will mail paper copies of the meeting materials to any shareholder who previously requested paper copies. If you received the notice only and would like a paper copy of the full materials please send us a request as set out below.

Additional Documents

We file an annual report and an annual information form with the Canadian securities regulators. In addition, our financial information is provided in our audited annual consolidated financial statements and management’s discussion and analysis (“MD&A”) for the year ended December 31, 2016. We will provide you with, free of charge, a copy of our annual report, which includes our annual audited financial consolidated statements and MD&A, our annual information form and/or this circular on request. Please submit your request by:

| | |

| | 1-800-567-6223 (Investor Line) |

| |

| | info@goldcorp.com |

| |

| | Goldcorp Inc. 3400 Park Place 666 Burrard Street Vancouver, BC, Canada V6C 2X8 Attention: Vice President, Diversity, Regulatory Affairs and Corporate Secretary |

You can also get copies of any document required to be filed by us in Canada, as well as additional information about Goldcorp, by:

| • | | Accessing our public filings on SEDAR atwww.sedar.com |

| • | | Going to “Reports and Filings” on our Investor Resources page atwww.goldcorp.com |

5

GENERAL VOTING INFORMATION

Request for Proxies

Our management is soliciting your proxies for this meeting and is paying for the costs incurred. We have engaged Kingsdale Advisors (“Kingsdale”) to provide strategic advisory and proxy solicitation services and will pay fees of approximately C$82,500 to Kingsdale for the services, in addition to certainout-of-pocket expenses. We may also reimburse brokers and other persons holding common shares in their name or in the name of nominees for their costs incurred in sending proxy materials to their principals in order to obtain their proxies.

We are using primarily mail to communicate with you. However, our employees or Kingsdale may request your proxy by telephone, email, facsimile or personal interview.

Additionally, Goldcorp may use Broadridge Financial Services (“Broadridge”) QuickVote™ service to assist beneficial shareholders with voting their shares. Beneficial shareholders may be contacted by Kingsdale to conveniently obtain voting instructions directly over the telephone. Broadridge then tabulates the results of all the instructions received and then provides the appropriate instructions respecting the shares to be represented at the meeting.

Record Date

The record date for the meeting is March 13, 2017. If you held common shares on that date, you are entitled to receive notice of, attend and vote at the meeting.

Voting Securities and Votes

The common shares are our only voting securities. Each common share entitles the holder to one vote at the meeting.

Quorum

We can only decide business at the meeting if we have a quorum – where two people attend the meeting and hold or represent by proxy at least 33 1⁄3% of our outstanding common shares that are entitled to vote.

Voting Instructions

If you specify how you want to vote on your proxy form or voting instruction form, your proxy holder has to vote that way. If you do not indicate how you want to vote, your proxy holder will decide for you.

If you appoint Ian W. Telfer, Chairman of the Board (Chairman), and Anna M. Tudela, Vice President, Diversity, Regulatory Affairs & Corporate Secretary, the representatives of Goldcorp set out in the enclosed proxy form or voting instruction form, and do not specify how you want to vote, your common shares will be voted as follows:

| | |

Matter | | Voted |

| Election of management nominees as directors | | FOR |

| Appointment of Deloitte LLP, Independent Registered Public Accounting Firm as auditors | | FOR |

| Approach to executive compensation | | FOR |

Approvals

A simple majority of votes cast at the meeting (50% plus one vote) is required to approve all of the items of business, including thenon-binding advisory resolution on our approach to executive compensation.

Amendments or Other Business

If amendments or other business are properly brought up at the meeting, you (or your proxy holder, if you are voting by proxy) can vote as you see fit. We are not aware of any other business to be considered at the meeting or any changes to the current business.

6

Vote Counting and Confidentiality

Votes by proxy are counted by our transfer agent, CST Trust Company (“CST”). Your vote is confidential, unless you clearly intend to communicate your vote to management or if there is a proxy contest or validation issue or as needed to comply with legal requirements.

New York Stock Exchange Rules

If your broker is subject to the NYSE rules, the broker has discretionary authority to vote common shares without instructions from beneficial owners only on matters considered “routine” by the NYSE, such as there-appointment of our independent registered chartered accountants. If you do not provide your voting instructions to the broker, the broker cannot vote your common shares for the election of directors and other“non-routine matters” and such common shares will not be included in the votes “cast” for any such“non-routine” matter. Even without voting instructions to your broker, your common shares will be counted for quorum purposes.

Voting Questions

Our transfer agent is CST. Ourco-agent in the US is American Stock Transfer & Trust Company LLC. Please contact them if you have any questions on how your votes are counted.

| | |

| | 1-800-387-0825 (toll free in North America) 416-682-3860 (collect from outside North America) |

| |

| | 1-888-249-6189 (fax from anywhere) |

| |

| | inquiries@canstockta.com |

| |

| | CST Trust Company PO Box 700, Station B Montreal, QC, Canada H3B 3K3 |

Other Questions

Please contact Kingsdale if you have any questions about the business items of the meeting or the information in this circular.

| | |

| | 1-800-775-4067 (toll free in North America) 416-867-2272 (collect from outside North America) |

| |

| | 1-886-545-5580 (fax from anywhere) |

| |

| | contactus@kingsdaleadvisors.com |

| |

| | Kingsdale Advisors The Exchange Tower 130 King Street West, Suite 2950 Toronto, ON, Canada M5X 1E2 |

7

BENEFICIAL SHAREHOLDER VOTING

Most shareholders are beneficial shareholders. You hold a beneficial interest if your share certificate was deposited with a bank, trust company, stock broker, trustee or some other institution. Here is how you can vote:

Voting Options

| | |

| | In person at the meeting – discussed below |

| |

| | By submitting a paper voting instruction form – discussed below |

| |

| | By telephone – enter your voting instructions by telephone at:1-800-474-7493 (English) or1-800-474-7501 (French) |

| |

| | By fax – fax to1-905-507-7793 |

| |

| | Via the internet – go towww.proxyvote.com and follow the instructions |

Voting in Person

If you plan to attend the meeting and wish to vote your common shares in person, insert your own name in the space on the enclosed voting instruction form. Then follow the signing and return instructions provided by your nominee. You may also nominate yourself as a proxy holder online, if available, by typing your name in the “Appointee” section on the electronic ballot.

Your vote will be taken and counted at the meeting, so do not indicate your votes on the form. Please register with CST when you arrive at the meeting.

Voting by Instruction

Whether or not you attend the meeting, you can appoint someone else to attend and vote as your proxy holder. Use the enclosed voting instruction form to do this. The people named in the enclosed voting instruction form are members of management and/or the Board.You have the right to choose another person to be your proxy holder by printing that person’s name in the space provided. Then complete the rest of the form, sign it and return it. Your votes can only be counted if the person you appointed attends the meeting and votes on your behalf.If you have voted on the voting instruction form, neither you nor your proxy holder may vote in person at the meeting, unless you revoke your voting instructions.

Beneficial shareholders should carefully follow the instructions of their nominee, including those regarding when and where the completed voting instruction form is to be delivered. Note that if you are a beneficial shareholder, your nominee will need your voting instructions sufficiently in advance of the proxy deposit deadline to enable your nominee to act on your instructions prior to the deadline. If you have any questions or require more information with respect to voting at the meeting, please contact our proxy solicitation agent, Kingsdale, by email atcontactus@kingsdaleadvisors.com or by telephone at1-800-775-4067 (toll free within North America) or416-867-2272 (outside of North America).

Revoking your Voting Instructions or Changing your Instructions

You may revoke your voting instructions before they are acted on. To revoke your voting instructions, contact your broker or service provider.

You may change your voting instructions by sending new instructions prior to your nominee’s cut off time to revoke your vote. Your latest instructions will be the only valid instructions.

8

REGISTERED SHAREHOLDER VOTING

If you have in your possession a physical share certificate with your name on it, you are a registered shareholder. Here is how you can vote:

Voting Options

Here’s where to go to find instructions to vote by these methods:

| | |

| | In person at the meeting – see below |

| |

| | Virtually through the LUMI meeting platform on the day of the meeting – see below |

| |

| | By submitting a paper proxy form – see below |

| |

| | By fax – fax to CST Trust Company at1-866-781-3111 (Canada or US) or1-416-368-2502 (outside North America) |

| |

| | Via the internet – go towww.cstvotemyproxy.com and follow the instructions. You will need the13-digit control number located on the proxy form |

Voting in Person

If you plan to attend the meeting and want to vote your common shares in person, do not complete or return the enclosed proxy form.Your vote will be taken and counted at the meeting. Please register with CST when you arrive at the meeting.

Voting Virtually

This year,registered shareholders and participants in Goldcorp’s employee share purchase plan (“ESPP”), have the ability to participate and vote in the meeting using the LUMI meeting platform (the “Virtual Platform”). Eligible registered shareholders and participants in Goldcorp’s ESPP may log in athttps://web.lumiagm.com/128226603, click on “I have a log in” and enter the13-digit control number found on the proxy accompanying this circular. The generic password to be entered is ”goldcorp”. During the meeting, you must ensure you are connected to the internet at all times in order to vote when the Chairman commences polling on the resolutions being put to the meeting. Therefore, it is your responsibility to ensure connectivity for the duration of the meeting. Virtual voting is not available to our beneficial shareholders at this time, however, beneficial shareholders wishing to attend the audio cast of the meeting may do so by going to https://web.lumiagm.com/128226603and registering as a guest.

If you are a beneficial shareholder (you hold your shares with a bank, trust company, stock broker, trustee or some other institution) you will be required to follow the procedures set forth under “Beneficial Shareholders Voting” on page 8.

Voting by Proxy

Whether or not you attend the meeting, you can appoint someone else to attend and vote as your proxy holder. Use the enclosed proxy form to do this. The people named in the enclosed proxy form are members of management and/or the Board.You have the right to choose another person to be your proxy holder by printing that person’s name in the space provided.Then complete the rest of the proxy form, sign it and return it. Your votes can only be counted if the person you appointed attends the meeting and votes on your behalf. If you have voted by completing the proxy form, neither you nor your proxy holder may vote in person at the meeting, unless you revoke your proxy.

Return your completed proxy form in the envelope provided so that it arrives by 3:00 p.m. (Vancouver Time) on April 24, 2017 or if the meeting is adjourned, at least 48 hours (excluding weekends and holidays) before the time set for the meeting to resume (cut off time). The time limit for the deposit of proxies may be waived or extended by the chair of the meeting at his discretion, without notice. If you have any questions or require more information with

9

respect to voting at the meeting, please contact our proxy solicitation agent, Kingsdale, by email atcontactus@kingsdaleshareholder.com or by telephone at1-800-775-4067 (toll free within North America) or416-867-2272 (outside of North America).

Revoking your Proxy

You may revoke your proxy at any time before is it acted on. Deliver a written statement that you want to revoke your proxy to our Vice President, Diversity, Regulatory Affairs & Corporate Secretary before or on April 24, 2017 (or the last business day before the meeting if it is adjourned or postponed), or to the Chairman on April 26, 2017.

Changing your Proxy

You may change the way you voted by proxy by sending a new proxy prior to the cut off time to revoke your vote. Your latest proxy will be the only one that is valid.

10

BUSINESS OF MEETING

Financial Statements

Our audited annual consolidated financial statements for the year ended December 31, 2016 and the auditors’ reports on those statements are included in the annual report and will be available at the meeting. The annual report is also filed onwww.sedar.com and www.sec.govand available to you on request.

Election of Directors

The number of directors to be elected at the meeting is nine, as decided by the Board. Each director will hold office until the end of the next annual general meeting or until a successor is duly appointed or elected. Your director nominees are:

| | | | | | |

| • | | Beverley A. Briscoe | | • | | Charles (Charlie) R. Sartain |

| | | |

| • | | Margot A. Franssen | | • | | Ian W. Telfer |

| | | |

| • | | David A. Garofalo | | • | | Blanca A. Treviño |

| | | |

| • | | Clement A. Pelletier | | • | | Kenneth F. Williamson |

| | | |

| • | | P. Randy Reifel | | | | |

You can find more information on all of the nominees starting on page 13. Each of the nominees brings important skills and experience to the Board. Each nominee is eligible and willing to serve if elected. If for some reason a nominee is not available to serve at the time of the meeting (and we know of no reason this would occur), the people named in the enclosed proxy will vote for a substitute nominee if one is chosen by the Board.

We note that no director nominations were received pursuant to the advance notice provision of ourby-laws as of the date of this circular. The only nominees for election at the meeting are the nominees listed above under “Election of Directors”.

Majority Vote Policy

We have a majority vote policy. Unless there is a contested election, a director who receives more withhold votes than votes “for” will immediately offer to resign. The Governance and Nominating Committee (the “Governance Committee”) will review the matter and recommend to the Board whether to accept the resignation. The resignation will be effective if and when accepted by the Board. The director will not participate in any deliberations on the matter.

We expect to accept the resignation unless there is some special circumstance that warrants the director to stay on the Board. In any case, the Board shall determine whether or not to accept the resignation within 90 days of the relevant annual shareholders’ meeting and we will promptly issue a news release with the Board’s decision. If the Board determines not to accept a resignation, the news release must fully state the reasons for that decision.

We recommend that you vote FOR the election of these nominees.

The people named in the enclosed proxy will vote FOR these nominations unless you tell them to withhold your vote.

Appointment of Auditors

The Board recommends the appointment of Deloitte LLP, Independent Registered Public Accounting Firm as our auditors for 2017. Deloitte LLP, Independent Registered Public Accounting Firm was first appointed as our auditors on March 17, 2005. The directors will also be authorized to set the fees paid to the auditors.

11

Audit Fees Paid

| | | | | | | | |

Type of Work | | 2015 fees

(C$) | | | 2016 fees

(C$) | |

Audit fees | | | 6,989,000 | 1 | | | 5,879,000 | |

Audit-related fees | | | 28,000 | | | | 278,000 | |

Tax fees | | | 362,000 | | | | 405,000 | |

All other fees | | | 325,000 | 2 | | | Nil | |

| | | | | | | | |

Total | | | 7,704,000 | | | | 6,562,000 | |

| | | | | | | | |

Notes:

| 1. | Fees for 2015 include fees billed in relation to the audit for the year ended December 31, 2014 billed in 2015 of C$988,000. |

| 2. | For 2015, these fees are for information technology leadership, electronic data hosting and mine safety. |

More information, including the Audit Committee charter is available in our annual information form under the heading “Audit Committee”. See page 5 for how to access the annual information form.

We recommend that you vote FOR the appointment of Deloitte LLP, Independent Registered Public Accounting Firm as our auditors.

The people named in the enclosed proxy will vote FOR the appointment of Deloitte LLP, Independent Registered Public Accounting Firm as auditors unless you tell them to withhold your vote.

Advisory Vote on Executive Compensation

Since 2012, we have provided you with a say on pay vote regarding our executive compensation program. This vote helps us engage constructively with our shareholders, obtain meaningful feedback and ensure accountability for executive compensation. Last year, a majority of shareholders voted in favour of our approach to executive compensation, with approximately 77.7% in favour. We strive to provide clear and concise disclosure regarding our approach to compensation, and to demonstrate how executive compensation is linked to our performance. You can read more about the changes we made in 2016 and 2017 to our executive compensation program in our Letter to Shareholders on page 25.

During 2016, we reviewed compensation assessment reports released by proxy advisory firms and policies and undertook research on good governance and disclosure, and provided shareholders with the opportunity to engage with us (see the “Shareholder Engagement” section for more information). As part of this process, we remain committed to clearly communicating how we measure performance and how our incentive plans are structured. We believe that compensation programs must be sound, fair, and competitive with the market and support our strategy and progress. In addition, we believe that we demonstrate how our pay aligns with performance and we ask for your continued support of our executive compensation program. You can read more about how we pay for performance in our compensation discussion and analysis (“CD&A”) on page 28.

The text of the resolution to be passed is:

“Be it resolved that on an advisory basis, and not to diminish the role and responsibilities of the Board of Directors that, the shareholders accept the approach to executive compensation disclosed in the Company’s management information circular delivered in advance of the April 26, 2017 annual and special meeting of shareholders.”

We recommend that you vote FOR the adoption of this resolution to support our approach to executive compensation.

The people named in the enclosed proxy will vote FOR the advisory resolution approving our approach to executive compensation unless you tell them to vote against it.

Other Business

If other matters are properly brought up at the meeting, you (or your proxy holder, if you are voting by proxy) can vote as you see fit. We are not aware of any other items of business to be considered at the meeting.

12

DIRECTOR BIOGRAPHIES

Following is a complete biography for each director nominee for election at the meeting. All other director information can be found in this section under the heading “Director Compensation” starting at page 18 or in the section entitled “Corporate Governance”.

Our Board - from left to right: Ken Williamson, Randy Reifel, Beverley Briscoe, David Garofalo, Ian Telfer, Margot Franssen, Peter Dey, Blanca Treviño, Clem Pelletier, and Charlie Sartain.

Beverley A. Briscoe

Age: 62 Home: British Columbia, Canada

Director since: April 2006

Vice Chair and Lead Independent Director

Member – Audit Committee

Member – Sustainability, Environment, Health and Safety Committee

Areas of expertise:

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 - 98.53% for |

Audit | | | 100 | % | | 2015 - 99.63% for |

Sustainability | | | 100 | % | | 2014 - 99.61% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 50,654 | | Meets

shareholding

requirement |

Options | | Nil | |

Value | | C$925,955 | |

Shareholding Requirement | | C$764,246 | |

Ms. Briscoe has extensive industry experience in the transportation and industrial equipment sector. Ms. Briscoe owned a transportation services company from 1997 to 2004 and worked in senior management positions in the heavy equipment industry as Vice President and General Manager of Wajax Industries Ltd. from 1994 to 1997 and as Vice President, Finance for the Rivtow Group of Companies from 1989 to 1994. She also worked as Chief Financial Officer for various operating divisions in The Jim Pattison Group in Canada and Switzerland from 1983 to 1989. She is the past Chair of the Industry Training Authority for BC (2003–2007) and past Chair of the BC Forest Safety Council (2008-2009). Ms. Briscoe also served as the Chair of the Audit Committee for the Office of the Superintendent of Financial Institutions (until 2016).

| | |

| Current occupation | | President of Briscoe Management Limited (since 2004), a consulting entity |

| |

| Education | | Bachelor of Commerce degree from the University of British Columbia, 1977 |

| |

| Public Directorships | | Ritchie Bros. Auctioneers Incorporated (Director since 2004, Chairwoman since 2014) |

| |

| Background and experience | | Ms. Briscoe is a Fellow of the Institute of Chartered Accountants and a Fellow of the ICD in Canada. She brings an important range of extensive and diverse financial, accounting and business experience to the Board. In addition, Ms. Briscoe’s experience managing financial and reporting matters benefits Goldcorp with respect to the issues overseen by the Audit Committee. |

Note:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

13

Margot A. Franssen, O.C.

Age: 64 Home: Ontario, Canada

Director since: May 2015

Independent

Member – Human Resources & Compensation Committee

Member – Sustainability, Environment, Health and Safety Committee

Areas of expertise:

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 99.14%2 for |

Compensation | | | 100 | % | | 2015 – n/a2 |

Sustainability | | | 100 | % | | 2014 – n/a2 |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 16,132 | | |

Options | | Nil | |

Value | | C$294,8931 | |

Shareholding Requirement | | n/a2 | |

Ms. Franssen is the founder and past-president of The Body Shop Canada (1989 to 2004). She has served on numerous boards, including the Canadian Imperial Bank of Commerce, Women’s College Hospital, and York University. From 2012 to 2014, she acted asCo-Chair of the National Task Force on Sex Trafficking of Canadian Girls, and for six years prior served as BoardCo-Chair of Canadian Women’s Foundation. In 2011, Ms. Franssen was a founding board member of Women Moving Millions, a global charitable organization committed to encouraging large-scale investments in initiatives that advance and empower women and girls worldwide. In 2016, Ms. Franssen founded The Canadian Centre to end Human Trafficking.

| | |

| Current occupation | | Independent Director |

| |

| Education | | Bachelor of Arts degree from York University. |

| |

| Background and experience | | Ms. Franssen combines pragmatic business leadership with a unique perspective on the relationship between corporations and their various stakeholders and communities. Her diverse experience in business and philanthropy positions her to provide valuable insight to the Board. |

Notes:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 31, 2016 of C$18.28 |

| 2. | Ms. Franssen was appointed to the Board on April 30, 2015 and has until December 31, 2020 to satisfy the minimum shareholding requirement. |

David A. Garofalo

Age: 51 Home: British Columbia, Canada

Director since April 2016

Non-Independent

Areas of expertise:

| • | | Mining and Industry Experience |

| • | | Mergers and Acquisitions |

| • | | Human Resources and Compensation |

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 98.79%2 for |

| | | | | | 2015 – n/a2 |

| | | | | | 2014 – n/a2 |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 50,123 | | |

Options | | Nil | |

Value | | C$916,2481 | |

Shareholding Requirement | | n/a2 | |

Mr.Garofalo joined Goldcorp as President and Chief Executive Officer effective February 29, 2016. Previously, Mr. Garofalo served as President and Chief Executive Officer and Director of Hudbay Minerals Inc. from July 2010 to December 2015. Before joining Hudbay, Mr. Garofalo served as Senior Vice President, Finance and Chief Financial Officer with Agnico Eagle Mines Limited (2006–2010) as well as Vice President, Finance and Chief Financial Officer (1999–2006) and Treasurer (1998).

| | |

| Current occupation | | President and Chief Executive Officer (“CEO”) of Goldcorp |

| |

| Education | | Institute of Chartered Accountants, Ontario, 1990 University of Toronto, Bachelor of Commerce (with distinction), 1988 |

| |

| Background and experience | | Mr. Garofalo brings significant experience in the natural resources sector to his role as a member of the Board and as the President and Chief Executive Officer. His business and transactional background, as well as his extensive experience in the mining industry, provides a direct benefit to the Board and valuable insight into all aspects of the management of Goldcorp. |

Notes:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

| 2. | Mr. Garofalo has until December 31, 2021 to satisfy the minimum shareholding requirement. |

14

Clement A. Pelletier

Age: 71 Home: British Columbia, Canada

Director since: May 2014

Independent

Member – Governance Committee

Chair – Sustainability Committee

Areas of expertise:

| • | | Mergers and Acquisitions |

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 99.13% for |

Governance | | | 100 | % | | 2015 – 99.57% for |

Sustainability | | | 100 | % | | 2014 – 99.45% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 27,063 | | Meets

shareholding

requirement |

Options | | Nil | |

Value | | C$662,5701 | |

Shareholding Requirement | | C$564,2492 | |

| | |

Mr. Pelletier is a process chemist/metallurgist by training with 14 years in industry and 35 years in resource-related mine/environmental consulting. During his early years he worked with Inco Limited in the mineral processing and extractive metallurgy area. Later, he worked with Rio Tinto Minerals (formerly U.S. Borax Inc.) in the potash processing and underground mining area. In 1970, he joined Utah International Inc. for the development of the Island Copper Mine on Vancouver Island, British Columbia. Mr. Pelletier has managed the environmental engineering work for a number of Deep Sea Tailings Placement (DSTP) projects for clients including: BHP Billiton Limited, Newmont Mining Corporation, Vale S.A./Inco Limited, Glencore plc, Placer Dome Inc./Barrick Gold Corporation, Teck Resources Limited, Rio Tinto Borax (formerly known as U.S. Borax Inc.) and First Quantum Minerals Ltd.. Since 1981, as founder and President of Rescan Group, Mr. Pelletier was involved in the evaluation and development of DSTP systems in Europe, the Americas, Africa and Southeast Asia. |

| Current occupation | | Independent Director |

| |

| Education | | Bachelor of Science in Chemistry/Metallurgy, University of Saskatchewan, 1967 |

| |

| Public Directorships | | Director of BioteQ Environmental Technologies Inc. (since 2000) |

| |

| Background and experience | | Mr. Pelletier’s extensive experience in the industry and environmental and technical expertise provides valuable insight and makes him a significant resource to both the Board and management. |

Note:

| 1. | The value of the common shares is calculated using the price per share at which Mr. Pelletier acquired the common shares held by him. |

P. Randy Reifel

Age: 64 Home: British Columbia, Canada

Director since: November 2006

Independent

Member – Human Resources & Compensation Committee

Member – Sustainability Committee

Areas of expertise:

| • | | Human Resources and Compensation |

| • | | Mergers and Acquisitions |

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 95.55% for |

Compensation | | | 100 | % | | 2015 – 98.17% for |

Sustainability | | | 100 | % | | 2014 – 99.34% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 4,058,376 | | Meets

shareholding

requirement |

Options | | Nil | |

Value | | C$74,187,1131 | |

Shareholding Requirement | | C$564,249 | |

| | | | | | |

| Mr. Reifel is President and a director of Chesapeake Gold Corp., a company that explores for precious metals in Mexico and Central America. Mr. Reifel was appointed to the Board in November 2006. Prior to that, he had been a director of Glamis Gold Ltd. since June 2002 following the acquisition of Francisco Gold Corp. In 1993, Mr. Reifel founded and served as President and a director of Francisco Gold Corp. which discovered the El Sauzal gold deposit in Mexico and the Marlin gold deposit in Guatemala. |

| | |

| Current occupation | | President of Chesapeake Gold Corp. (since 2012) |

| |

| Education | | Bachelor of Commerce degree from the University of British Columbia, 1976 Master of Science degree in Business Administration from the University of British Columbia, 1978 |

| |

| Public Directorships | | Chesapeake Gold Corp (since 2002) and Gunpoint Exploration (since 2010). Both companies are junior mining companies based in Vancouver, British Columbia. |

| |

| Background and experience | | Mr. Reifel’s over 30 years’ experience in the mining industry, coupled with his background in precious metals exploration and project development, combine to provide valuable industry insight and perspective to both the Board and management. |

Note:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

15

|

Charlie R Sartain Age: 55 Home: Brisbane, Australia Director since: January 2017 Independent Member – Human Resources and Compensation Committee Member – Sustainability Committee Areas of expertise: • Mining and Industry Experience • Environmental, Safety and Sustainability • M&A |

|

|

|

|

|

|

|

|

| | | | | | |

Membership1 | | Attendance1 | | | Voting results |

Board | | | — | | | 2016 - n/a |

Compensation | | | — | | | 2015 - n/a |

Sustainability | | | — | | | 2014 – n/a |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | Nil | | |

Options | | Nil | |

Value | | Nil | |

Shareholding Requirement | | n/a2 | |

| | | | | | |

| Mr. Sartain is a mining engineer with over 30 years of mining experience and is fluent in Spanish. Previously, he was the Chief Executive Officer of Xstrata’s global copper business from 2004 to 2013 and under his nine-year tenure grew the business to become one of the world’s leading copper producers with mining operations and projects spanning seven countries. He is currently a Member of the Senate of the University of Queensland, a Director and Chairman of the Advisory Board of the Sustainable Minerals Institute at the University of Queensland. and a Director of the Wesley Medical Research Institute. In 2013, Mr. Sartain was the recipient of the Queensland Resources Council Medal and in 2015 was the recipient of the AusIMM Institute Medal. Mr. Sartain is a member of the NACDand ICD. |

| |

| Current occupation | | Independent Director |

| |

| Education | | Bachelor of Engineering (Honours) from the University of Melbourne, Australia. |

| |

| Public Directorships | | Austin Engineering Ltd. (since April 2015) and ALS Limited (since February 2015). Both companies are listed on the Australian Stock Exchange. |

| |

| Background and experience | | Mr. Sartain has over 30 years of experience in the mining industry. He has served as a director and/or officer of several companies. |

Notes:

| 1. | Mr. Sartain was appointed to the Board subsequent to the year ended December 31, 2016. He has attended 100% of Board and relevant committee meetings since his appointment. |

| 2. | Mr. Sartain was appointed to the Board on January 1, 2017 and has until December 31, 2021 to satisfy the minimum shareholding requirement. |

|

Ian W. Telfer1 Age: 70 Home: British Columbia, Canada Director since: February 2005 Chairman -Non-Independent Areas of expertise: • Accounting • Finance • Mergers and Acquisitions • Mining |

|

|

|

|

|

|

|

|

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 97.17% for |

| | | | | | 2015 – 98.59% for |

| | | | | | 2014 – 98.89% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 200,866 | | Meets shareholding requirement |

Options | | Nil | |

Value | | C$3,671,8301 | |

Shareholding Requirement | | C$3,264,248 | |

| | | | | | |

Mr. Telfer was appointed Chairman of Goldcorp effective November 15, 2006 and served as Chairman of the World Gold Council from December 2009 to June 2013. Prior to that he was President and CEO of Goldcorp since March 17, 2005 and Chairman and CEO of Wheaton River Minerals Ltd. prior to such time since September 2001.Mr. Telfer is also theco-founder and Director of Renaissance Oil Corp. |

| Current occupation | | Chairman of Goldcorp (since 2006) |

| |

| Education | | Bachelor of Arts degree from the University of Toronto, 1968, Master in Business Administration from the University of Ottawa, 1976, Honorary Doctorate from the University of Ottawa, 2015 |

| |

| Public Directorships | | Renaissance Oil Corp. (since 2011) |

| |

| Background and experience | | Mr. Telfer has over 30 years of experience in the precious metals business. He has served as a director and/or officer of several Canadian and international companies. Mr. Telfer’s extensive experience in the mining industry provides a direct benefit to both the functionality of the Board and to our shareholders. |

Notes:

| 1. | Mr. Telfer entered into a settlement agreement with staff of the Ontario Securities Commission in September 2013 with respect to allegations that he acted contrary to the public interest in connection with a private share transaction in 2008. Mr. Telfer cooperated fully with staff and, pursuant to the settlement agreement, was reprimanded, gave certain undertakings and paid C$200,000 towards the costs of staff’s investigation. |

| 2. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

16

Blanca Treviño

Age: 57 Home: Leon, Mexico

Director since: February 2012

Independent

Member – Audit Committee

Member – Governance Committee

Areas of expertise:

| • | | Human Resources and Compensation |

| • | | Mergers and Acquisitions |

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 - 98.97% for |

Audit | | | 100 | % | | 2015 - 99.47% for |

Governance | | | 100 | % | | 2014 – 99.47% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 19,987 | | |

Options | | Nil | | |

Value | | C$365,3621 | | |

| | |

Shareholding Requirement | | n/a2 | | |

Ms. Treviño is the President and Chief Executive Officer of Softtek S.A. de C.V. (Softtek). Under her leadership, Softtek has become a leading information technology services company in Latin America. As President, Ms. Treviño has positioned Softtek as a key part of Mexico, opening its doors to the US as a provider of information and technology (IT) services. This shaped what is known today as Nearshore, Softtek’s trademarked delivery model, and a term widely used in the industry to define outsourcing services provided by countries within close proximity. Ms. Treviño has been a board member for several universities andnon-profit organizations over the past 13 years.

| | |

| Current occupation | | President and Chief Executive Officer of Softtek S.A. de C.V. (Softtek) |

| |

| Education | | Bachelor in Computer Science from the Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM) (1981) |

| |

| Public Directorships | | Wal-Mart de México SAB de CV (since 2006) |

| |

| Background and experience | | Frequent presenter in national and international forums related to entrepreneurialism, IT and the role of women in business. Identified by several media publications as one of the most influential executives in Mexico and Latin America. Ms. Treviño’s significant experience in the IT industry, coupled with her experience as an entrepreneur, bring important insight to both the Board and management. |

Notes:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

| 2. | Ms. Treviño has until December 31, 2017 to satisfy the minimum shareholding requirement. |

Kenneth F. Williamson

Age: 69 Home: Ontario, Canada

Director since: November 2006

Independent

Chair – Human Resources & Compensation Committee

Member – Audit Committee

Areas of expertise:

| • | | Human Resources and Compensation |

| • | | Mergers and Acquisitions |

| | | | | | |

Membership | | Attendance | | | Voting results |

Board | | | 100 | % | | 2016 – 97.63% for |

Compensation | | | 100 | % | | 2015 – 99.38% for |

Audit | | | 100 | % | | 2014 – 98.55% for |

| | | | |

Share ownership as at December 31, 2016 |

Common Shares | | 60,573 | | Meets

shareholding

requirement |

Options | | Nil | |

Value | | C$1,107,2741 | |

Shareholding Requirement | | C$534,792 | |

Mr. Williamson was appointed to the Board in November 2006. Prior to that, Mr. Williamson had been a director of Glamis Gold Ltd. since 1999. He was Vice-Chairman, Investment Banking at Midland Walwyn/Merrill Lynch Canada Inc. from 1993 to 1998. Prior to that, he worked at Walwyn/Merrill in investment banking with increasing responsibility and titles since 1980. Mr. Williamson has been a director of a number of companies in the natural resource sector.

| | |

| Current occupation | | Independent Director |

| |

| Education | | Bachelor of Applied Science (P.Eng.) degree from the University of Toronto, 1970 Master of Business Administration from the University of Western Ontario, 1973 |

| |

| Public Directorships | | Tahoe Resources Inc. (since 2010) |

| |

| Background and experience | | Mr. Williamson has worked in the securities industry for more than 25 years, concentrating on financial services and the natural resource industries in the US and Europe. Mr. Williamson’s experience in the investment banking and natural resources industries, in both domestic and international markets, combined with his knowledge of commodities and securities markets, provides the Board with valuable insight and perspective on these issues. In addition, Mr. Williamson brings valuable financial expertise and understanding to the Board. |

Note:

| 1. | The value of the common shares is calculated using the closing price of the common shares on the TSX on December 30, 2016 of C$18.28. |

17

DIRECTOR COMPENSATION

Philosophy, Objectives and Process

The philosophy and benchmarking for director compensation is the same as for our executive compensation. Our objectives are to attract and retain directors of a quality and nature that will enhance our long-term sustainable profitability and growth. Director compensation is intended to provide an appropriate level of remuneration considering the experience, responsibilities, time requirements and accountability of their roles.

In addition, we align the interests of our directors with our shareholders by requiring that members of the Board own a minimum number of our common shares. Eachnon-executive director must hold common shares with a value equal to three times the annual retainer andafter-tax equity compensation. For 2017 and beyond, members of the Board will be required to hold common shares with a value equal to three times the annual retainer andpre-tax equity compensation. See “Director Share Ownership” on page67 for more information.

The Board meets annually (typically in February) to receive recommendations from the Governance and Human Resources & Compensation Committees regarding the adequacy and form of directors’ compensation. The Human Resources and Compensation Committee (HRCC) believes that our approach to director compensation provides for competitive and reasonable compensation levels.

Director Compensation Program

In 2016, in order to align compensation paid to our directors with the methodology applied to executive compensation, the Board made the following changes to its compensation program: (i) retainers and meeting/travel fees remained at the same nominal dollar value but were paid in Canadian dollars rather than US dollars, resulting in a year-over-year reduction in cash director compensation of approximately 20% in Canadian dollar terms, and (ii) restricted share units (“RSUs”) were granted equal to the number of units granted in 2015, which resulted in a reduction in value of approximately 12% as the year-over-year share price decline was embedded directly in the value of the awards.

For 2017, to further align with the executive team the RSU grant was fixed at C$150,000 resulting in a year-over-year reduction in value of 11%.

Goldcorp’s official financial reporting currency is US dollars, however our primary currency for compensation purposes is Canadian dollars. As noted above, commencing in 2016, of our directors are paid in Canadian dollars. In order to provide more transparent and understandable disclosure, we have reported in Canadian dollars in select tables throughout this Director Compensation section (clearly noted as “C$”).

18

Fees and Retainers

Allnon-executive directors receive meeting fees, annual retainers, annual RSU grants and travel expense disbursements for their service on the Board. Neither Mr. Garofalo, nor Mr. Jeannes, the former CEO, received any additional compensation for serving on the Board.

Cash Fees Earned byNon-Executive Directors During 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Director | | Board Annual

Retainer | | | Committee

Chair

Retainer | | | Aggregate

Board

Attendance

Fee1 | | | Aggregate

Committee

Attendance

Fee2 | | | Aggregate

Mine

Site and

Workshop

Fee3 | | | Aggregate

Travel Fee | | | Total Fees | |

| | | (C$) | | | (C$) | | | (C$) | | | (C$) | | | (C$) | | | (C$) | | | (C$) | |

Bell4 | | | 33,333 | | | | 3,333 | | | | 4,500 | | | | 10,500 | | | | 4,500 | | | | 3,000 | | | | 59,166 | |

Briscoe | | | 166,666 | | | | 20,000 | | | | 13,500 | | | | 27,000 | | | | 7,500 | | | | 9,000 | | | | 243,666 | |

Dey5 | | | 100,000 | | | | 10,000 | | | | 13,500 | | | | 30,000 | | | | Nil | | | | 21,000 | | | | 174,500 | |

Franssen | | | 100,000 | | | | Nil | | | | 13,500 | | | | 33,000 | | | | 10,500 | | | | 24,000 | | | | 181,000 | |

Holtby4 | | | 66,666 | | | | 6,666 | | | | 4,500 | | | | 16,500 | | | | Nil | | | | Nil | | | | 94,332 | |

Pelletier | | | 100,000 | | | | 6,666 | | | | 13,500 | | | | 30,000 | | | | 12,000 | 6 | | | 10,500 | 6 | | | 172,666 | |

Reifel | | | 100,000 | | | | Nil | | | | 13,500 | | | | 30,000 | | | | 10,500 | | | | 9,000 | | | | 163,000 | |

Telfer7 | | | 1,000,000 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | 12,000 | | | | 1,012,000 | |

Treviño | | | 100,000 | | | | Nil | | | | 10,500 | | | | 16,500 | | | | Nil | | | | 6,000 | | | | 133,000 | |

Williamson | | | 100,000 | | | | 13,333 | | | | 13,500 | | | | 33,000 | | | | 6,000 | | | | 18,000 | | | | 183,833 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Totals | | | 1,866,665 | | | | 59,998 | | | | 100,500 | | | | 226,500 | | | | 51,000 | | | | 112,500 | | | | 2,417,663 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| 1. | Directors were compensated based on Board meetings held during the year ended December 31, 2016. |

| 2. | Includes committee meetings attended by invitation. |

| 3. | These include mine visits to Cerro Negro, Red Lake and Porcupine mines and Borden Project. |

| 4. | Mr. Bell and Mr. Holtby retired from the Board on April 28, 2016. |

| 5. | Mr. Dey is retiring and will not stand forre-election at the meeting. Includes missed payment for one day mine site fee and one day travel feel attended in Q4 2015. |

| 6. | Mr. Telfer attended six Board meetings and approximately 80% of committee meetings but did not receive additional compensation. |

TotalNon-Executive Director Compensation During 2016

| | | | | | | | | | | | | | | | | | | | |

| Director | | Fees Earned | | | Share-Based

Awards1 | | | Option-Based

Awards | | Non-Equity

Incentive Plan

Compensation | | All Other

Compensation | | | Total | |

| | | (C$) | | | (C$) | | | (C$) | | (C$) | | (C$) | | | (C$) | |

Bell2 | | | 59,166 | | | | 168,418 | | | NIL | | NIL | | | Nil | | | | 227,584 | |

Briscoe | | | 243,666 | | | | 168,418 | | | | | | Nil | | | | 412,084 | |

Dey3 | | | 174,500 | | | | 168,418 | | | | | | Nil | | | | 342,918 | |

Franssen | | | 181,000 | | | | 168,418 | | | | | | Nil | | | | 349,418 | |

Holtby2 | | | 94,332 | | | | 168,418 | | | | | | Nil | | | | 262,750 | |

Pelletier | | | 172,666 | | | | 168,418 | | | | | | Nil | | | | 341,084 | |

Reifel | | | 163,000 | | | | 168,418 | | | | | | Nil | | | | 331,418 | |

Telfer | | | 1,012,000 | | | | 168,418 | | | | | | 6,360 | 4 | | | 1,186,778 | |

Treviño | | | 133,000 | | | | 168,418 | | | | | | Nil | | | | 301,418 | |

Williamson | | | 183,833 | | | | 168,418 | | | | | | Nil | | | | 352,251 | |

| | | | | | | | | | | | | | | | | | |

Totals | | | 2,417,163 | | | | 1,684,180 | | | | | | 6,360 | | | | 4,107,703 | |

| | | | | | | | | | | | | | | | | | |

Notes:

| 1. | These amounts represent the grant date fair value of the RSUs granted to the respectivenon-executive director. These amounts were calculated by multiplying the number of RSUs granted (8,066 each) by the closing price of the common shares on the TSX on March 8, 2016 of C$20.88. The RSUs granted to the respectivenon-executive director vest immediately on the date of grant. |

| 2. | Mr. Bell and Mr. Holtby retired from the Board on April 28, 2016. |

| 3. | Mr. Dey is retiring and will not stand forre-election at the meeting. |

| 4. | This amount represents benefit premiums paid by Goldcorp on behalf of Mr. Telfer. |

19

Equity-Based Compensation Awards

In accordance with best practices guidelines, we stopped granting stock options (“options”) tonon-executive directors in 2005. No future option grants tonon-executive directors are planned.

Incentive plan awards – Value vested or earned during the year

| | | | | | | | |

| Director | | Option – based

awards – Value

vested during

the year | | Share-Based

Awards –

Value vested

during the

year1 | | | Non-equity

inventive plan

compensation

– Value vested

during the year |

| | | (C$) | | (C$) | | | (C$) |

Bell2 | | Nil | | | 168,418 | | | Nil |

Briscoe | | | | 168,418 | | |

Dey3 | | | | 168,418 | | |

Franssen | | | | 168,418 | | |

Holtby2 | | | | 168,418 | | |

Pelletier | | | | 168,418 | | |

Reifel | | | | 168,418 | | |

Telfer | | | | 168,418 | | |

Treviño | | | | 168,418 | | |

Williamson | | | | 168,418 | | |

| | | | | | |

Totals | | �� | | 1,684,180 | | |

| | | | | | |

Notes:

| 1. | These amounts represent the grant date fair value of the RSUs granted to the respectivenon-executive director. These amounts were calculated by multiplying the number of RSUs granted (8,066 each) by the closing price of the common shares on the TSX on March 8, 2016 of C$20.88. The RSUs granted to the respectivenon-executive director vest immediately on the date of grant. |

| 2. | Mr. Bell and Mr. Holtby retired from the Board on April 28, 2016. |

| 3. | Mr. Dey is retiring and will not stand forre-election at the meeting. |

Other Compensation Arrangements

Mr. Telfer’s employment agreement for serving as our Chairman provides for a retiring allowance of C$6,000,000.

In addition, he continues to be entitled to participate, at our expense, in our health and medical plans (or for equivalent coverage if not permitted under our current plans), until the earlier of obtaining alternate coverage under the terms of any new employment or the third anniversary of the termination date.

We pay benefit premiums on behalf of Mr. Telfer. The premiums paid during the year ended December 31, 2016 were C$6,360.

20

ADDITIONAL INFORMATION

Liability Insurance

We maintain an insurance policy for directors’ and officers’ liability. It provides coverage for costs incurred to defend and settle claims against directors or officers up to an annual limit of US$175 million. The cost of coverage for 2015 was approximately US$1.5 million. Directors and officers do not pay any portion of the premiums. No claims were made or became payable in 2016.

Fiduciary Liability Insurance

We maintain an insurance policy for directors’ and officers’ fiduciary liability. It provides coverage for costs incurred to defend and settle claims against us, our directors, officers and employees for breach of fiduciary duty regarding company sponsored plans, such as our savings and pension plans.

This policy has an annual limit of US$15 million with a US$100,000 deductible for each claim. The cost of coverage for 2016 was approximately US$35,000. Directors and officers do not pay any portion of the premiums. No claims were made or became payable in 2016.

Director and Officer Indebtedness

We do not make loans to our directors or officers. Accordingly, there are no loans outstanding to any of them.

21

HUMAN RESOURCES & COMPENSATION COMMITTEE REPORT

Annual Oversight of Executive Compensation

The HRCC is responsible for reviewing and recommending to the Board compensation policies and programs, and resulting compensation levels and incentive award outcomes for our named executive officers (“NEOs”). See page 77 for a description of the responsibilities, authority and operation of the HRCC, including the relevant skills and experience of each of the members of this independent committee of the Board.

The Board makes final decisions on overall executive compensation, including the CEO’s pay each year. It does so after receiving advice and recommendations from the HRCC. The Board also reviews and discusses the policies and processes followed by the HRCC in making its executive compensation recommendations. Executive officers, including the CEO, do not make recommendations on their own compensation packages.

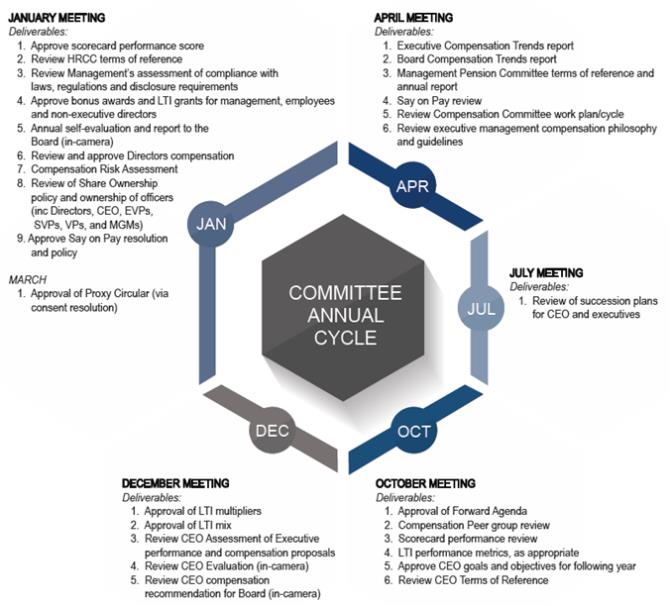

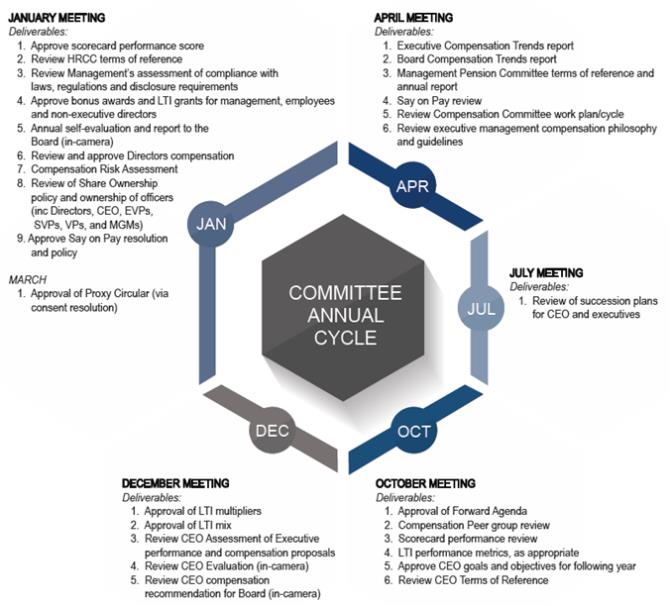

The HRCC, with support from its independent advisor and management, undertakes the following annual process:

22

In addition to the activities under the annual compensation cycle, the HRCC undertakes activities on anas-needed basis, including:

| • | | Reviewing appointment and/or discharge of any member of executive management. |

| • | | Approving new hire long-term incentive (“LTI”) grants for senior management. |

| • | | Approval of Supplemental Executive Retirement Plan (“SERP”) membership for new officers. |

| • | | Reviewing and considering amendments to long term incentive plans. |

| • | | Reviewing management organizational structure and CEO’s proposals for changes. |

| • | | Reviewing participation of management on external boards. |

| • | | Reviewing clawback policy. |

During 2016, the HRCC Chair, with support of Human Resources management, led several conference calls with our shareholders to discuss a variety of topics including organizational strategy changes,pay-for-performance alignment, peer groups, trends in executive compensation and there-design of our incentive plans to drive behaviour to grow net asset value. The HRCC and the Board considered the feedback provided by shareholders in reviewing our executive compensation programs. See page 60 for additional information about our shareholder engagement process and how we responded to the feedback.

The HRCC considers the feedback it received from various institutional investors as well as various outside groups such as the Canadian Coalition for Good Governance. Discussions with these third parties have focused on, among other things, the recent CEO change at the Company, the roles of the Chairman, Vice Chair and Lead Independent Director, as well as director evaluations and executive compensation matters.

We are committed to engagement with shareholders and third party groups to ensure constructive dialogue on pay for performance and comprehensive disclosure

Role of Compensation Consultants

Since 2011, the HRCC has retained Hugessen Consulting (“Hugessen”) to serve as the HRCC’s independent compensation consultant. Hugessen provides independent advice to the HRCC with respect to executive compensation and related governance matters.

In 2016, Hugessen provided the following services to the HRCC:

| • | | Provided advice on executive compensation matters and supported the HRCC’s annual review of Goldcorp’s pay philosophy, pay levels and mix, incentive plan design, and performance measurement practices. |

| • | | Provided input on management’s proposals with respect to executive compensation levels and design. |

| • | | Reviewed Goldcorp’s Pay Comparator Group (as defined below) and provided recommendations to ensure continued relevance of peers. |

| • | | Provided updates on compensation, governance and regulatory trends. |

| • | | Reviewed the market competitiveness of the NEOs’ compensation for 2017 compensation decisions. |

| • | | Supported drafting of 2016 CD&A and supported there-design and drafting of the 2017 CD&A. |

Each year, Hugessen provides a letter to the HRCC confirming its independence and affirming that no consultant at Hugessen has any business, professional or commercial relationship with Goldcorp or any member of executive management that would impair its independence. The Committee reviews Hugessen’s performance at least annually, and has the authority to retain and terminate its independent advisor.

23

Additionally, management retained Willis Towers Watson (formerly Towers Watson) to provide compensation advice and other related services. Willis Towers Watson was initially retained in 2007.

During 2016, Willis Towers Watson provided the following services:

| • | | Reviewed the market competitiveness of the NEOs’ compensation for 2016 compensation decisions. |

| • | | Provided a report reviewing the market competitiveness of the 2016 Board’s compensation. |

| • | | Prepared a document summarizing trends in governance and executive compensation. |

| • | | Reviewed and commented on the management information circular. |

| • | | Supported drafting of 2016 CD&A and supported there-drafting of the 2017 CD&A. |

| • | | Supported there-design of the performance share unit (“PSU”) plan. |

| • | | Updated the compensation program risk assessment. |

| • | | Analyzed thepay-for-performance alignment of our NEOs compared to our Pay Comparator Group. |

Compensation Consultant Fees

| | | | | | | | |

Hugessen Consulting: | | 2016 Fees

(C$) | | | 2015 Fees

(C$) | |

Executive compensation-related fees | | | 277,448 | | | | 261,324 | |

All Other fees | | | Nil | | | | Nil | |

| | | | | | | | |

Total | | | 277,448 | | | | 261,324 | |

| | | | | | | | |

| | | | | | | | |

Willis Towers Watson: | | 2016 Fees

(C$) | | | 2015 Fees

(C$) | |

Executive compensation-related fees | | | 106,253 | | | | 199,981 | |

All Other fees | | | 129,285 | 1 | | | 49,542 | |

| | | | | | | | |

Total | | | 235,538 | | | | 249,523 | |

| | | | | | | | |

Note:

| 1. | During 2016 Willis Towers Watson was appointed as an advisor to the Management Pension Committee and the fees relate to supporting the management of Goldcorp’s defined contribution pension plan, supplemental pension plan and employee benefits plans in Canada. |

24

LETTER TO SHAREHOLDERS

Fellow Shareholders,

Your Board, on the recommendation of our Human Resources and Compensation Committee (HRCC) is committed to ensuring our executive pay programs are designed to pay for performance, while allowing Goldcorp to attract and retain the talent that is essential to delivering against our long-term strategy. We also remain committed to providing clear and comprehensive disclosure to help you understand how (i) our compensation plans are structured, (ii) we assess performance, and (iii) this performance leads to pay outcomes that are aligned with your experience as shareholders. We have enhanced our disclosure to provide you with the information you need to make an informed vote.

Our Performance in 2016

In 2016 we appointed a new CEO, David Garofalo, who strengthened our senior management team and reorganized and refocused the organization to drive net asset value growth. This past year was an important year. It was a transition year where we took strategic actions to restore momentum and growth at Goldcorp. We made significant progress and remain committed to delivering sustainable and long-term value for our shareholders. In 2016 we:

| | • | | Achieved gold production of 2.873 million ounces, in line with our guidance. |

| | • | | Achievedall-in sustaining costs of $856 per ounce, at the low end of our guidance. |

| | • | | Maintained our growth pipeline by acquiring Kaminak Gold Corporation and its Coffee gold project in the Yukon. |

| | • | | Announced major strategic projects across our existing portfolio including the Dome Century project at our Porcupine camp and expansion projects at Peñasquito and Musselwhite. |

| | • | | Remained focused on reducing costs, restructured and decentralized our organizational model and identified 60% of our $250 million target in sustainable efficiencies to be implemented throughout our organization by 2018. |

At Goldcorp, safety remains our primary corporate objective. Our strategy is to create and maintain a culture of safety and health in the workplace, as embodied in our safety vision, “Safe Enough for Our Families”. We strive to equip our employees with the tools, training and attitudes needed for continual safety awareness. From our operations to our corporate offices, we strive to achieve Zero Fatalities and keep people safe from injury. We delivered a mixed safety performance in 2016. On the positive side, we experienced an 11% decrease in our all injury frequency rate (based on 200,000 hours) and a 4% decrease in our lost-time injury frequency rate. We did however, experience a fatality at our Marlin Mine in April, 2016. Following this tragedy, we launched a safety focusedon-the-job training program, “StepIn”, as we realize our systems and processes are only as good as the leadership and commitment we demonstrate on the job.

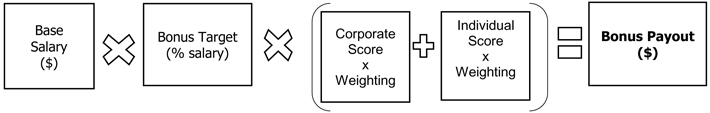

In light of the continued weakness in our share price performance during 2016 and our results being lower than our expectations, the Board agreed with the recommendation of Mr. Garofalo and the HRCC to a corporate performance score for the year ended December 31, 2016 at 55% (calculated per the corporate scorecard) as detailed on pages 33 to 35.

2016 CEO Transition and Governance Best Practices

In line with his employment agreement, upon his retirement in 2016, Mr. Jeannes, our former CEO, was not awarded any 2016 grants of LTI, retirement bonus or additional compensation. We have reported the compensation received by Mr. Jeannes in 2016 in the “Summary Compensation Table” on page 52.

25

To further align his compensation arrangements with governance best practices, Mr. Garofalo’s employment agreement contains the following enhancements:

| | • | | Severance in the event of termination either without cause or upon a change of control at two times base salary and target bonus (compared to three times for our former CEO). |

| | • | | Non-compete andnon-solicit clauses that are effective forone-year following his exit from Goldcorp for any reason. |

| | • | | Restriction against selling any Goldcorp shares forone-year following voluntary resignation, retirement or termination for cause. |

| | • | | Target LTI multiplier is set at three times his base salary, (compared to four times base salary for our former CEO). |

In 2016, Mr. Garofalo was granted aone-time make-whole equity award valued at C$4.58 million in the form of restricted share units to compensate him for his 2015 bonus and equity grants forfeited upon his departure from his former employer. The restricted equity award vests in three equal annual installments that commenced in March 2016 and is subject to forfeiture in certain circumstances. No other equity awards or LTIs were granted to Mr. Garofalo in 2016.

To demonstrate his commitment to Goldcorp and you, our shareholders, in August 2016 Mr. Garofalo also purchased 43,000 Goldcorp common shares at a total cost of C$1,011,960 using his personal savings.

2016 Say on Pay & Shareholder Engagement

We believe that engaging and communicating directly with shareholders and other stakeholders is important for providing timely and meaningful feedback. Goldcorp has in place policies and long-standing shareholder outreach programs and routinely interacts with shareholders on a number of matters, including executive compensation. The Board considers all constructive feedback regarding executive compensation.

At last year’s annual and special meeting of shareholders held on April 28, 2016, the advisory “say on pay” resolution received the support of 77.7% of the votes cast, compared to 89.2% in 2015.

Following the 2016 AGM, the Chair of our HRCC met with a number of shareholders who asked for clarification on our compensation and performance peer groups, our pay philosophy and the introduction of additional metrics to our long-term incentive programs. We considered and incorporated shareholder feedback, as appropriate, into our 2017 compensation program design and made enhancements to further link our compensation programs with our strategy, performance and the long-term interests of our shareholders as further discussed below.

At the 2017 annual general meeting of shareholders to be held on April 26, 2017, we will again hold an annual advisory vote to approve executive compensation. The Board will continue to engage with you, our shareholders, and consider the results from this year’s advisory vote on executive compensation. Please refer to the Advisory Vote on Executive Compensation section on page 12. Please also see page 60 for more information about our shareholder engagement program.

Compensation Changes for 2017 and Beyond

As part of our ongoing review of our compensation programs following consultations with our shareholders, and consistent with our commitment to performance, the Board approved a number of enhancements to our LTI program which strengthens the alignment between our strategy, pay and performance and addresses feedback from shareholders.

26

There are four meaningful changes that will be effective for compensation in 2017:

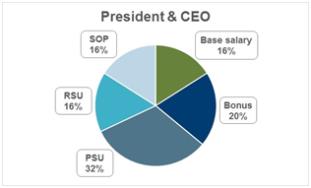

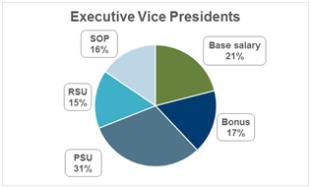

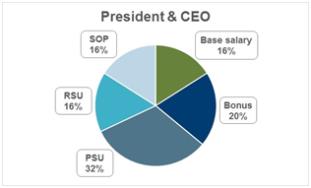

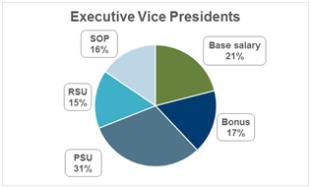

| | • | | Long Term Incentive Target Multipliers - For the Chief Executive Officer, the LTI multiplier has been reduced and set at 300% of base salary (compared to four times target for the former CEO). For Executive Vice Presidents (“EVPs”), the LTI multipliers have been reduced and set at 225% of base salary (compared to three times target in prior years). |

| | • | | Change in Long Term Incentive Grant Philosophy –Value of awards will also be subject to a -/+25% modifier to providefront-end performance conditioning enabling the value of the grant to be aligned with performance. |

| | • | | Mix of Long Term Incentive - Increased the level of performance share units in our long-term incentive plan mix to 75% (from 50%) for the CEO and Executive Vice Presidents to align with our strategy and shareholder interests. To accommodate the shift in long term incentive mix, stock options were removed from the 2017 long term incentive grants. |

| | • | | Performance Share Unit (PSU) Plan Design Enhancements - Given our realigned focus on growing net asset value we have reinforced this critical success factor with the addition of a net asset value metric to our performance share unit plan for the 2017 PSU grants. In addition, within the PSU plan the retained Total Shareholder Return metric will now be measured against a select peer group of companies replacing the S&P/TSX Global Gold Index. We believe that having a smaller performance peer group which is subject to similar commodity cycles, operations, operating priorities and external market forces provides a more accurate determination of how we performed relative to our immediate peers. |

In 2016, the Board changed the currency denomination of their own compensation from United States dollars to Canadian dollars resulting in a year-over-year cash fee reduction of approximately 20%. For 2017, the restricted share unit grants were capped at C$150,000 which resulted in a year-over-year reduction in value of 11%.

Please refer to pages 18 and 42 for additional details.

Conclusion

Despite the sustained lower gold price environment and the pressures on our share price, we oversee a capable executive team that is optimistic about the future of Goldcorp. Overall, our portfolio of assets and strategic progress in 2016, a transformative year for us, make us confident about our strength, momentum and long-term strategic positioning.

The Board and the executive team remain committed to delivering superior growth and performance for you, our shareholders. The Board is also committed to linking executive compensation and shareholder value. We are confident that the changes to our LTI program enhances this alignment and ensures the experience of our executives is consistent with that of shareholders. We will continually review and, where appropriate, improve our compensation and disclosure practices.

On behalf of the Board and the Human Resources and Compensation Committee, we thank you for taking the time to read our disclosure and encourage you to vote in favour of our approach to executive compensation.

Sincerely,

| | |

| |

| “Ian W. Telfer” | | “Kenneth F. Williamson” |

| |

| Chairman of the Board | | Chair of the Human Resources and Compensation Committee |

Note:

| 1. | Fornon-GAAP performance measures, such asall-in sustaining costs, see our management’s discussion and analysis for the year ended December 31, 2016. |

27

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

The following CD&A details the compensation programs in which our NEOs participated for the year ended December 31, 2016. For the purposes of this discussion, the following individuals are the NEOs of Goldcorp:

| | |

Name | | Title |

| David A. Garofalo | | President and CEO |

| Russell D. Ball | | EVP, Chief Financial Officer (“CFO”) and Corporate Development |

| George R. Burns | | Former EVP and Chief Operating Officer (“COO”) (until December, 2016) |

| Charlene A. Ripley | | EVP and General Counsel |

| Brent G.J. Bergeron | | EVP, Corporate Affairs and Sustainability |

| Charles A. Jeannes | | Former President and CEO (retired April, 2016) |

| Lindsay A. Hall | | Former EVP and CFO (until March, 2016) |

Mr. Jeannes and Mr. Hall did not receive any bonus or LTIP grants for 2016, and accordingly, are only disclosed in the summary compensation table for amounts paid in 2016 and are not included in the discussions on performance, achievements and grants. As Mr. Burns resigned from Goldcorp subsequent to the year end, he has been included in the various discussions on performance, achievements and grants.

Note on Currency

Our official financial reporting currency is US dollars, however our primary currency for compensation purposes is Canadian dollars. All of our NEOs are paid in Canadian dollars for cash compensation, and awarded Canadian-denominated equity LTI awards. In order to provide more transparent and understandable disclosure, we have reported in Canadian dollars in select tables throughout the CD&A (clearly noted as “C$”). In all other cases, dollar values are reported in US dollars, converted from Canadian dollars using the average 2016 exchange rate of C$1.00 = US0.7543.

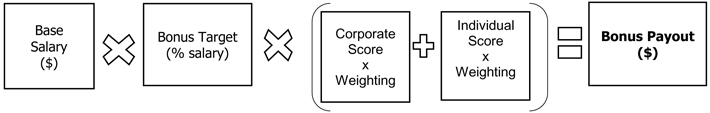

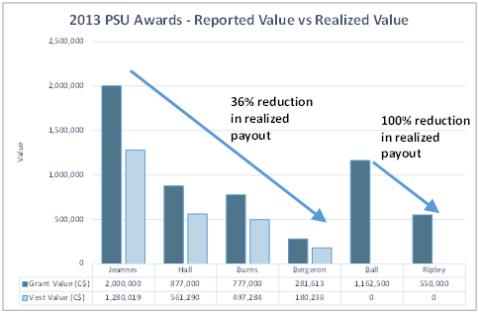

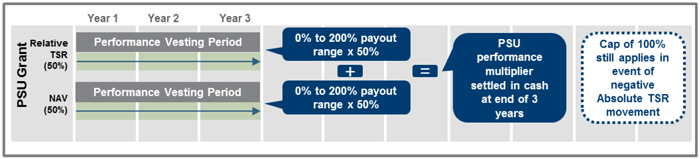

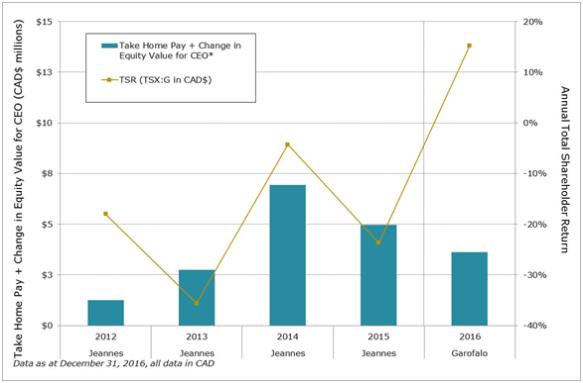

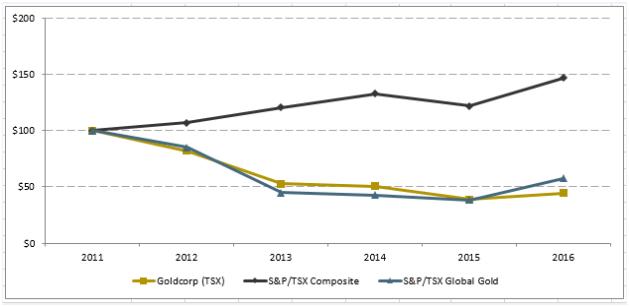

Compensation Philosophy and Principles