| | | Per Corporate Unit | | | Total | |

Public Offering Price | | | $50.00 | | | $300,000,000 |

Underwriting Discounts and Commissions | | | $ | | | $ |

Proceeds, Before Expenses, to SJI | | | $ | | | $ |

Sole Book-Running Manager |

BofA Securities |

Structuring Agent |

| | | Per Corporate Unit | | | Total | |

Public Offering Price | | | $50.00 | | | $300,000,000 |

Underwriting Discounts and Commissions | | | $ | | | $ |

Proceeds, Before Expenses, to SJI | | | $ | | | $ |

Sole Book-Running Manager |

BofA Securities |

Structuring Agent |

| • | The purchase contract will obligate you to purchase from SJI, on April 1, 2024 (or if such day is not a business day, on the following business day), for a price of $50 in cash, the following number of shares of our common stock, subject to anti-dilution adjustments: |

| • | if the applicable market value, which is the average volume-weighted average price of our common stock for the trading days during the 20 consecutive scheduled trading-day period ending on the second scheduled trading day prior to April 1, 2024, subject to adjustment as described herein if a market disruption event occurs, equals or exceeds $ , shares of our common stock; |

| • | if the applicable market value is less than $ but greater than $ , a number of shares of our common stock equal to $50 divided by the applicable market value, rounded to the nearest ten thousandth of a share; and |

| • | if the applicable market value is less than or equal to $ , shares of our common stock. |

| • | SJI will pay you quarterly contract adjustment payments at a rate of % per year on the stated amount of $50 per Equity Unit, or $ per year, in respect of each purchase contract, subject to our right to defer these payments, as described in this prospectus supplement. No deferral period will extend beyond the purchase contract settlement date. The contract adjustment payments are payable quarterly on January 1, April 1, July 1, and October 1 of each year (except that if such date is not a business day, contract adjustment payments will be payable on the following business day, without adjustment), commencing on July 1, 2021. The contract adjustment payments will be subordinated to all of our existing and future “Priority Indebtedness” (as defined under “Description of the Remarketable Junior Subordinated Notes—Subordination”), and will be structurally subordinated to all liabilities of our subsidiaries. |

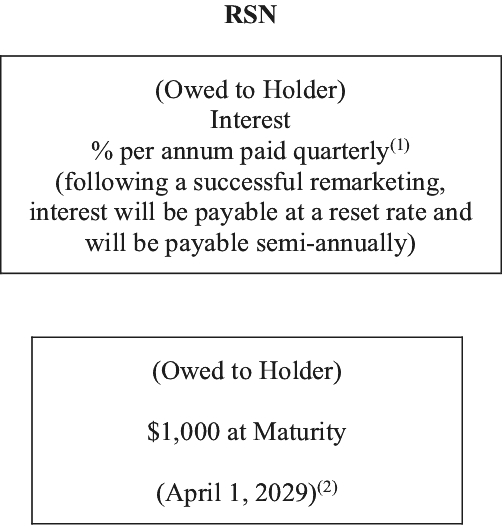

| • | The RSNs will initially bear interest at a rate of % per year. The RSNs will be subordinated to all of SJI’s existing and future “Priority Indebtedness” (as defined under “Description of the Remarketable Junior Subordinated Notes—Subordination”). In addition, the RSNs will be structurally subordinated to all liabilities of our subsidiaries. |

| • | We will have the right to defer interest payments on the RSNs one or more times for one or more consecutive interest periods without giving rise to an event of default; provided that no deferral period will extend beyond the purchase contract settlement date or the maturity date, as applicable. The RSNs will be remarketed in 2024 as described in this prospectus supplement. Following any successful remarketing of the RSNs, the interest rate on the RSNs will be reset, interest will be payable on a semi-annual basis and we will cease to have the ability to redeem the RSNs at our option or defer interest payments on the RSNs, all as described under “Description of the Purchase Contracts—Remarketing.” |

| • | Your ownership interest in the RSNs (or after a successful optional remarketing, your related ownership interest in the Treasury portfolio or, in certain circumstances, cash) or the Treasury securities, as the case may be, will be pledged to us to secure your obligation under the related purchase contract. |

| • | Other than during a blackout period (as defined under “Description of the Equity Units—Creating Treasury Units by Substituting a Treasury Security for an RSN”) or after a successful remarketing of the RSNs, you can create Treasury Units (“Treasury Units”) from Corporate Units by substituting Treasury securities for your pledged ownership interest in the RSNs comprising a part of the Corporate Units. You can also recreate Corporate Units from Treasury Units by substituting an undivided beneficial ownership interest in the RSNs for the Treasury securities previously pledged and comprising a part of your Treasury Units. |

| • | If there is a successful optional remarketing of the RSNs and, at such time, you hold Corporate Units, your applicable ownership interest in the Treasury portfolio purchased with the proceeds from the remarketing (or, in certain circumstances, cash) will be used to satisfy your payment obligation under the purchase contract. If there is a successful final remarketing of the RSNs and you hold Corporate Units, the proceeds from the remarketing will be used to satisfy your payment obligation under the purchase contract, unless you have elected to settle with separate cash. |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

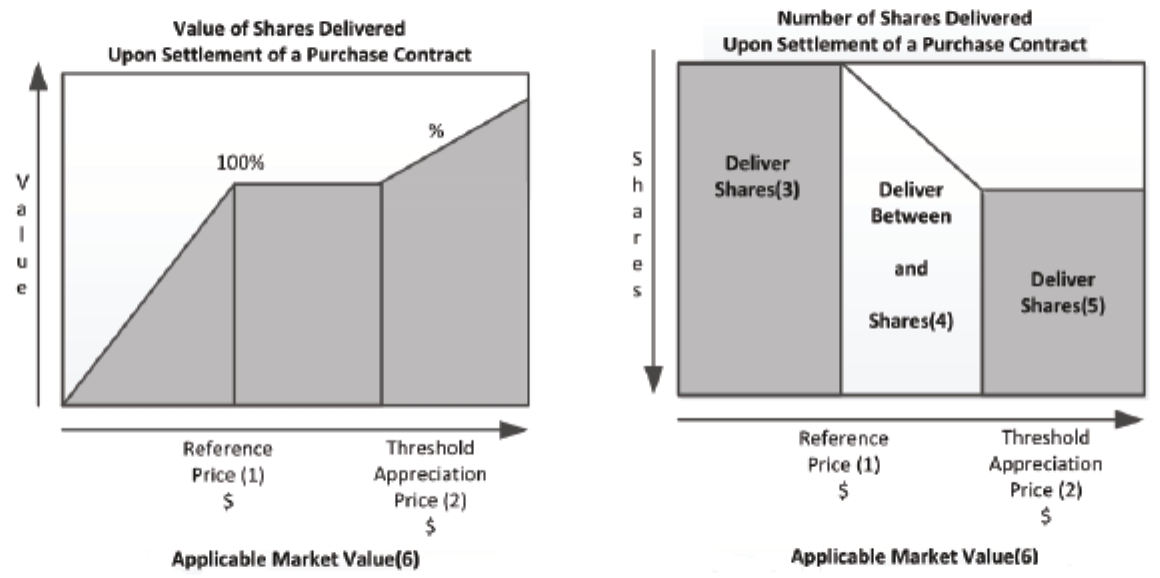

| • | if the applicable market value (as defined below) of our common stock is equal to or greater than the “threshold appreciation price” of $ , the settlement rate will be shares of our common stock (we refer to this settlement rate as the “minimum settlement rate”); |

| • | if the applicable market value of our common stock is less than the threshold appreciation price but greater than the “reference price” of $ , which will be the public offering price of our common stock in the concurrent common stock offering, the settlement rate will be a number of shares of our common stock equal to $50 divided by the applicable market value, rounded to the nearest ten thousandth of a share; and |

| • | if the applicable market value of our common stock is less than or equal to the reference price, the settlement rate will be shares of our common stock (we refer to this settlement rate as the “maximum settlement rate”). |

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the purchase contract settlement date in an aggregate amount at maturity equal to the principal amount of the RSNs underlying the undivided beneficial ownership interests in the RSNs included in the Corporate Units on the optional remarketing date; and |

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the purchase contract settlement date in an aggregate amount at maturity equal to the aggregate interest payment (assuming no reset of the interest rate) that would have been paid to the holders of the Corporate Units on the purchase contract settlement date on the principal amount of the RSNs underlying the undivided beneficial ownership interests in the RSNs included in the Corporate Units on the optional remarketing date. |

| • | quarterly cash payments consisting of their pro rata share of interest payments on the RSNs, at the rate of % per year, and |

| • | quarterly contract adjustment payments at the rate of % per year on the stated amount of $50 per Corporate Unit until the earliest of the occurrence of: |

| • | a termination event; |

| • | the purchase contract settlement date; |

| • | the fundamental change early settlement date (in the case of early settlement upon a fundamental change); or |

| • | the most recent contract adjustment payment date on or before any early settlement with respect to the related purchase contracts (in the case of early settlement other than upon a fundamental change). |

| (a) | the purchase contract settlement date, in the case of a deferral period beginning prior to the purchase contract settlement date; or |

| (b) | the maturity date, in the case of a deferral period beginning after the purchase contract settlement date. |

| • | the interest rate on the RSNs may be reset as described below and under “When will the interest rate on the RSNs be reset and what is the reset rate?” below; |

| • | interest will be payable on the RSNs semi-annually on April 1 and October 1 of each year; |

| • | the RSNs will cease to be redeemable at our option, and the provisions described under “Description of the Remarketable Junior Subordinated Notes—Redemption at Our Option” and “—Redemption Procedures” will no longer apply to the RSNs; and |

| • | we will cease to have the ability to defer interest payments on the RSNs, and the provisions described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments” will no longer apply to the RSNs. |

| • | you may not settle a purchase contract early; |

| • | you may not create Treasury Units; and |

| • | you may not recreate Corporate Units from Treasury Units. |

| • | settlement with respect to the remarketed RSNs will occur on the second business day following the optional remarketing date, unless the remarketed RSNs are priced after 4:30 p.m. New York City time on the optional remarketing date, in which case settlement will occur on the third business day following the optional remarketing date (we refer to such settlement date as the “optional remarketing settlement date”); |

| • | the interest rate on the RSNs will be reset by the remarketing agent in consultation with us on the optional remarketing date and will become effective on the optional remarketing settlement date; |

| • | the other modifications to the terms of the RSNs, as described under “What is a remarketing?” above will become effective; |

| • | after the optional remarketing settlement date, your Corporate Units will consist of a purchase contract and the applicable ownership interest in the Treasury portfolio or cash, as described above; and |

| • | you may no longer create Treasury Units or recreate Corporate Units from Treasury Units. |

| • | on an early settlement date as described under “Can I settle the purchase contract early?” above and under “What happens if there is early settlement upon a fundamental change?” below; |

| • | on the purchase contract settlement date if you own Corporate Units: |

| • | through the automatic application of the portion of the proceeds of a successful remarketing during the final remarketing period equal to the principal amount of the RSNs underlying the Corporate Units, as described under “What is a final remarketing?” above; or |

| • | in the case of a successful optional remarketing, through the automatic application of the portion of the proceeds from the Treasury portfolio or cash equal to the principal amount of the RSNs if the Treasury portfolio or cash has replaced the RSNs as a component of the Corporate Units as a result of a successful optional remarketing, as described under “What is an optional remarketing?” above; or |

| • | through cash settlement as described under “Do I have to participate in the remarketing?” above or through exercise of the put right or cash settlement as described under “What happens if the RSNs are not successfully remarketed?” above; or |

| • | on the purchase contract settlement date if you own Treasury Units through the automatic application of the proceeds of the interest in Treasury securities. |

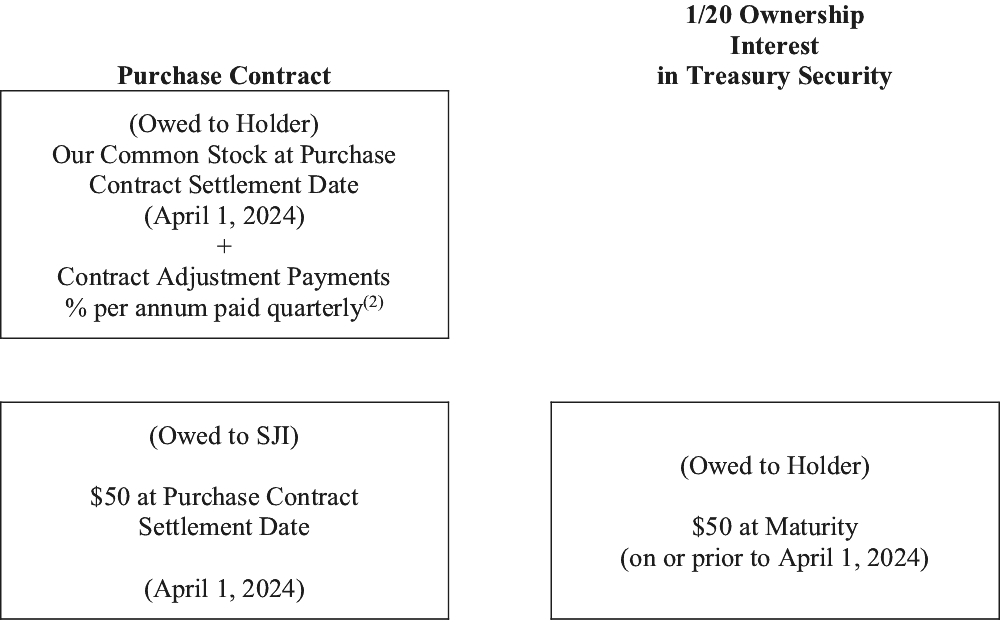

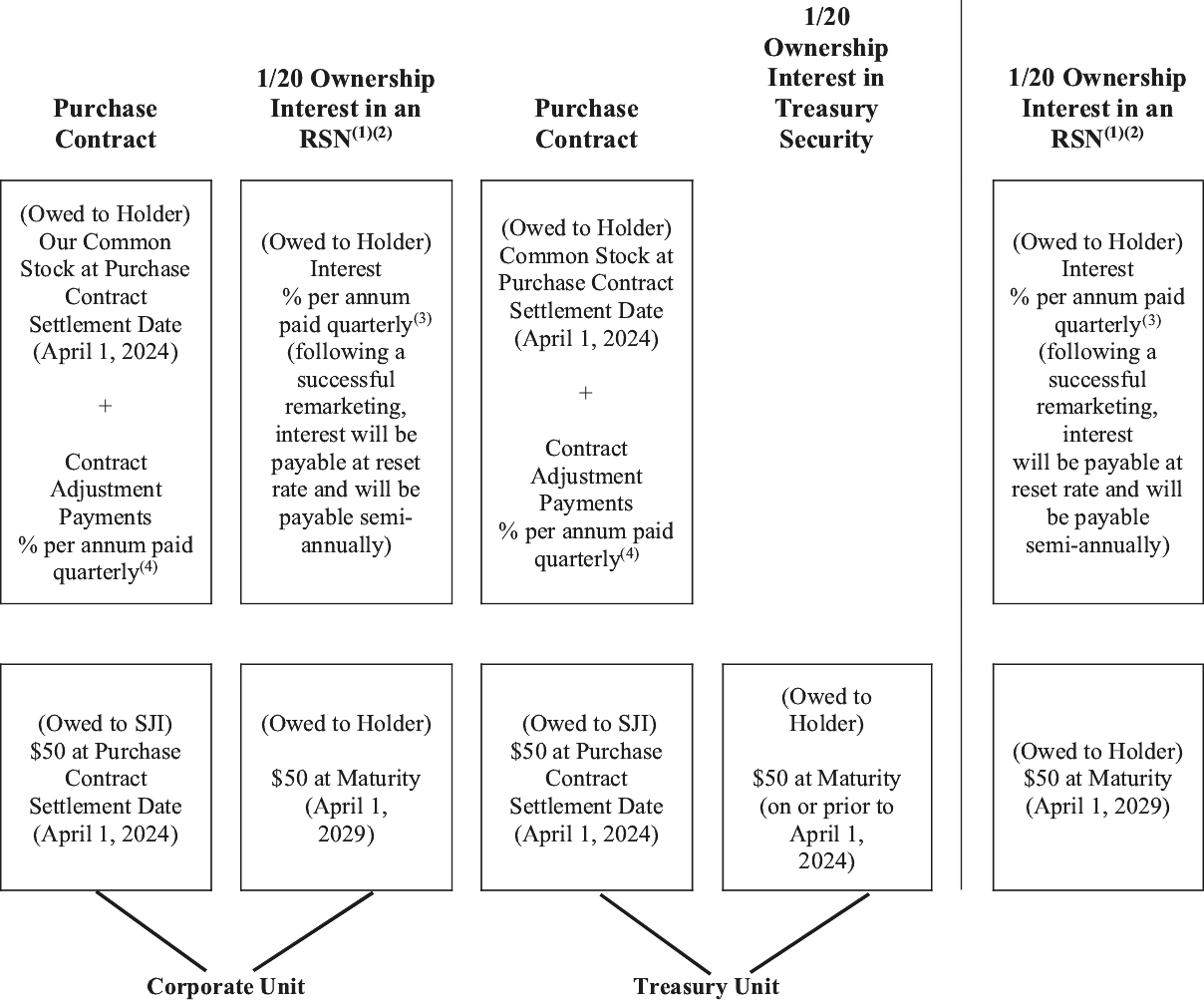

| (1) | Contract adjustment payments may be deferred as described under “Description of the Purchase Contracts—Contract Adjustment Payments” below. |

| (2) | Each owner of an undivided beneficial ownership interest in RSNs will be entitled to 1/20, or 5%, of each interest payment paid in respect of a $1,000 principal amount RSN. |

| (3) | Interest payments may be deferred as described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments” below. In connection with any successful remarketing of the RSNs, the interest deferral provisions will cease to apply to the RSNs. |

| (4) | RSNs will be issued in minimum denominations of $1,000, except in limited circumstances following a termination event. Each undivided beneficial ownership interest in RSNs represents a 1/20, or 5%, undivided beneficial ownership interest in an RSN having a principal amount of $1,000. |

| (1) | Treasury Units may only be created in integral multiples of 20 Corporate Units. As a result, the creation of 20 Treasury Units will release $1,000 principal amount of the RSNs held by the collateral agent. During a blackout period or following a successful remarketing, you may not create Treasury Units or recreate Corporate Units. |

| (2) | Contract adjustment payments may be deferred as described under “Description of the Purchase Contracts—Contract Adjustment Payments” below. |

| (1) | The “reference price” is $ . which will be the public offering price of our common stock in the concurrent common stock offering. |

| (2) | The “threshold appreciation price” is equal to $50 divided by the minimum settlement rate (such quotient rounded to the nearest $0.0001), which is $ and represents appreciation of approximately % over the reference price. |

| (3) | If the applicable market value of our common stock is less than or equal to the reference price of $ , shares of our common stock (subject to adjustment). |

| (4) | If the applicable market value of our common stock is greater than the reference price and less than the threshold appreciation price of $ , the number of shares of our common stock to be delivered to a holder of an Equity Unit will be calculated by dividing the stated amount of $50 by the applicable market value, rounded to the nearest ten thousandth of a share (subject to adjustment). |

| (5) | If the applicable market value of our common stock is greater than or equal to the threshold appreciation price, the number of shares of our common stock to be delivered to a holder of an Equity Unit will be shares (subject to adjustment). |

| (6) | The “applicable market value” means the average VWAP of our common stock for the trading days during the 20 consecutive scheduled trading-day period ending on the second scheduled trading day immediately preceding the purchase contract settlement date (subject to adjustment as described herein if a market disruption event occurs). |

| (1) | Interest payments may be deferred as described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments” and interest payment dates will be adjusted in a successful remarketing as described under “Description of the Remarketable Junior Subordinated Notes—Remarketing.” In connection with any successful remarketing of the RSNs, the interest deferral provisions will cease to apply to the RSNs. |

| (2) | Following any successful remarketing of the RSNs, the interest rate on the RSNs will be reset, interest will be payable on a semi-annual basis, and we will cease to have the ability to redeem the RSNs at our option or defer interest payments on the RSNs, all as described under “Description of the Purchase Contracts—Remarketing.” |

| (1) | Each holder will own a 1/20, or 5%, undivided beneficial ownership interest in, and will be entitled to a corresponding portion of each interest payment payable in respect of, an RSN having a principal amount of $1,000. |

| (2) | RSNs will be issued in minimum denominations of $1,000 and integral multiples thereof, except in limited circumstances following a termination event. Following any successful remarketing of the RSNs, the interest rate on the RSNs will be reset, interest will be payable on a semi-annual basis, and we will cease to have the ability to redeem the RSNs at our option or defer interest payments on the RSNs, all as described under “Description of the Purchase Contracts—Remarketing.” |

| (3) | Interest payments may be deferred as described in this prospectus supplement and interest payment dates will be adjusted in a successful remarketing as described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments.” In connection with any successful remarketing of the RSNs, the interest deferral provisions will cease to apply to the RSNs. |

| (4) | Contract adjustment payments may be deferred as described under “Description of the Purchase Contracts—Contract Adjustment Payments.” |

| • | Because the RSNs and the Treasury securities are issued in minimum denominations of $1,000, holders of Corporate Units may only create Treasury Units in integral multiples of 20 Corporate Units. |

| • | To create 20 Treasury Units, a holder separates 20 Corporate Units into their two components—20 purchase contracts and an RSN having a principal amount of $1,000—and then combines the purchase contracts with a Treasury security having a principal amount at maturity of $1,000 that matures on or prior to April 1, 2024. |

| • | The RSN, which is no longer a component of Corporate Units, is released from the pledge under the purchase contract and pledge agreement and delivered to the holder and is tradable as a separate security. |

| • | A holder owns the Treasury security that forms a part of the 20 Treasury Units but will pledge it to us through the collateral agent to secure its obligation under the related purchase contract. |

| • | The Treasury security together with the 20 purchase contracts constitute 20 Treasury Units. |

| • | During a blackout period or following a successful remarketing, you may not create Treasury Units or recreate Corporate Units. |

| • | Unless a blackout period is occurring or there has been a successful remarketing, the holder can also transform 20 Treasury Units and an RSN having a principal amount of $1,000 into 20 Corporate Units. Following that transformation, the Treasury security, which will no longer be a component of the Treasury Unit, will be released from the pledge under the purchase contract and pledge agreement and delivered to the holder and will be tradable as a separate security. |

Date | | | Event | |||

December 20, 2023 (five business days prior to the first day of the optional remarketing period) | | | We will, or we will request that the depository, notify holders of Corporate Units, Treasury Units and separate RSNs of our election to conduct an optional remarketing. Such notice will specify the first day of the optional remarketing period and the procedures to be followed in the optional remarketing. | |||

| | | | ||||

December 26, 2023 (two business days prior to the beginning of the optional remarketing period) | | | Last day prior to the optional remarketing to create Treasury Units from Corporate Units and recreate Corporate Units from Treasury Units (holders may once again be able to create and recreate units if the optional remarketing is not successful); | |||

| | | | ||||

| | | Last day prior to the optional remarketing for holders of Corporate Units to settle the related purchase contracts early (holders may once again be able to settle early if the optional remarketing is not successful or after the blackout period has concluded for such optional remarketing); and | ||||

| | | | ||||

| | | Last day for holders of separate RSNs to give notice of their election or to revoke their election to participate in the optional remarketing. | ||||

| | | | | |||

December 28, 2023 to March 14, 2024 | | | Optional remarketing period: | |||

| | | • | | | if the optional remarketing is successful, we will issue a press release on the business day after the optional remarketing date, the remarketing agent will purchase the Treasury portfolio and the settlement date for the optional remarketing will occur on the second business day following the optional remarketing date (unless the remarketed RSNs are priced after 4:30 p.m. New York City time on the optional remarketing date, in which case settlement will occur on the third business day following the optional remarketing date); and | |

| | | • | | | if the optional remarketing is not successful, we will issue a press release at the end of the optional remarketing period. | |

| | | | | |||

No later than March 15, 2024 (seven calendar days prior to the first day of the final remarketing period) | | | If there has not been a successful optional remarketing, we will request that the depository notify its participants holding Corporate Units, Treasury Units and separate RSNs of the final remarketing. Such notice will specify the final remarketing period and the procedures to be followed in the final remarketing. | |||

| | | | | |||

March 15, 2024 (seven calendar days prior to the first day of the final remarketing period) | | | First day for holders of Corporate Units to give notice of election to settle purchase contracts with separate cash. | |||

| | | | | |||

March 20, 2024 (two business days prior to the first day of the final remarketing period) | | | Last day to create Treasury Units from Corporate Units and recreate Corporate Units from Treasury Units if no successful optional remarketing has occurred; | |||

| | | Last day for holders of Corporate Units to give notice of election to settle the related purchase contracts with separate cash on the purchase contract | ||||

Date | | | Event | |||

| | | settlement date (holders may once again be able to settle the related purchase contracts with separate cash on the purchase contract settlement date if the final remarketing is not successful); | ||||

| | | | ||||

| | | Last day for holders of separate RSNs to give notice of their election or to revoke their election to participate in the final remarketing; and | ||||

| | | | ||||

| | | Last day for holders of Corporate Units or Treasury Units to settle the related purchase contracts early. | ||||

| | | | | |||

March 21, 2024 (one business day prior to the first day of the final remarketing period) | | | Last day for holders of Corporate Units who have elected to settle the related purchase contracts with separate cash on the purchase contract date to pay the purchase price (holders may once again be able to settle the related purchase contracts with separate cash on the purchase contract settlement date if the final remarketing is not successful). | |||

| | | | | |||

March 22, 2024 to March 28, 2024 (final remarketing period) | | | If there has not been a successful optional remarketing, we will attempt a remarketing during the final remarketing period. We may elect to postpone the final remarketing on any day other than one of the last three business days of the final remarketing period. | |||

| | | | | |||

March 28, 2024 (two business days prior to the purchase contract settlement date) | | | If the final remarketing has not been successful, last day for holders of Corporate Units to elect to settle the related purchase contracts with separate cash on the purchase contract settlement date. | |||

| | | | | |||

March 29, 2024 (one business day prior to the purchase contract settlement date) | | | If the final remarketing has not been successful, last day for holders of Corporate Units who have elected to settle the related purchase contracts with separate cash on the purchase contract settlement date to pay the purchase price. | |||

| | | | | |||

April 1, 2024 (or if such day is not a business day, the following business day) | | | Purchase contract settlement date and settlement date for any successful final remarketing of the RSNs. | |||

(In thousands except for per share data) | | | Historical South Jersey Industries, Inc. | ||||||

| | Year ended December 31, | ||||||||

| | 2020 | | | 2019 | | | 2018 | ||

Statements of consolidated income and statements of consolidated cash flows data: | | | | | | | |||

Total Operating Revenues | | | $1,541,383 | | | $1,628,626 | | | $1,641,338 |

Total Operating Expenses | | | 1,259,161 | | | 1,427,421 | | | 1,540,593 |

Operating Income | | | 282,222 | | | 201,205 | | | 100,745 |

Income from Continuing Operations | | | 157,297 | | | 77,189 | | | 17,903 |

Net Income | | | 157,042 | | | 76,917 | | | 17,663 |

Basic Earnings (Loss) per Common Share | | | 1.62 | | | 0.84 | | | 0.21 |

Diluted Earnings per Common Share | | | 1.62 | | | 0.84 | | | 0.21 |

Capital Expenditures | | | (486,451) | | | (504,212) | | | (341,120) |

Consolidated operating data: | | | | | | | |||

Economic Earnings(1) | | | $162,959 | | | $103,040 | | | $116,234 |

Economic Earnings per Share | | | $1.68 | | | $1.12 | | | $1.38 |

| (1) | We define Economic Earnings as: Income from Continuing Operations, (i) less the change in unrealized gains and plus the change in unrealized losses on non-utility derivative transactions; (ii) less income and plus losses attributable to noncontrolling interest; and (iii) less the impact of transactions, contractual arrangements or other events where management believes period to period comparisons of SJI’s operations could be difficult or potentially confusing. With respect to part (iii) of the definition of Economic Earnings, items excluded from Economic Earnings for the years ended December 31, 2020, 2019 and 2018 include impairment charges; the impact of pricing disputes with third parties; costs to acquire ETG and ELK; costs incurred and gains recognized on the acquisitions of Annadale (fuel cell projects) and EnerConnex; costs to prepare to exit the transaction service agreement (“TSA”); costs incurred and gains/losses recognized on sales of solar, Marina Thermal Facility (“MTF”) and ACB Energy Partners, LLC (“ACB”), ELK and SJE’s retail gas business; costs incurred to cease operations at three landfill gas-to-energy production facilities; customer credits related to the acquisition of ETG and ELK; Early Retirement Incentive Program (“ERIP”) costs; severance and other employee separation costs; and additional tax adjustments including a state deferred valuation allowance and a one-time tax expense resulting from SJG’s Stipulation of Settlement with the New Jersey Board of Public Utilities (“BPU”). See (A)-(H) in the table below. |

| • | The Economic Earnings contribution from gas utility operations at SJG increased $21.9 million to $109.3 million, primarily due to an increase in base rates as the BPU approved the settlement of SJG’s rate case petition in September 2020, along with customer growth and the roll-in to rates of infrastructure program investments. SJG’s utility margin also increased from its Conservation Incentive |

| • | The Economic Earnings contribution from on-site energy production at Marina increased $18.1 million to $15.7 million, primarily due to Investment Tax Credit (“ITC”) recorded on assets of recently acquired fuel cell and solar projects. These were partially offset with depreciation recorded on solar projects previously held for sale and the impact of less earnings from MTF/ACB due to its sale in February 2020 (see Note 1 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, incorporated by reference in this prospectus supplement). |

| • | The Economic Earnings contribution from the wholesale energy operations at SJRG increased $16.0 million to $24.8 million, primarily due to higher margins on daily energy trading activities, along with a refund received from a third party supplier as discussed in Note 1 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, incorporated by reference in this prospectus supplement. |

| • | The Economic Earnings contribution from gas utility operations at ETG increased $13.5 million to $47.7 million, primarily due to positive margins due to favorable changes in base rates resulting from the completion of ETG’s rate case in November 2019 (see Note 10 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, incorporated by reference in this prospectus supplement), along with customer growth and lower maintenance expenses. This was partially offset with higher operations and depreciation expenses. |

| • | Partially offsetting the above items is a $7.3 million increase in financing and interest costs at the SJI level (i.e. excluding SJG and ETG, as these are included in the Economic Earnings contributions noted above) during 2020 compared to 2019. These were primarily due to interest incurred on higher amounts of long-term debt outstanding, along with expenses incurred to terminate SJI’s interest rate swaps (see Note 16 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, incorporated by reference in this prospectus supplement). |

| | | Historical South Jersey Industries, Inc. | |||||||

| | | Year ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

Income from Continuing Operations | | | $157,297 | | | $77,189 | | | $17,903 |

Minus/Plus: | | | | | | | |||

Unrealized Mark-to-Market Losses/(Gains) on Derivatives* | | | (5,145) | | | 14,546 | | | (35,846) |

Loss Attributable to Noncontrolling Interest | | | 42 | | | — | | | — |

Loss on Property, Plant and Equipment(A) | | | — | | | 10,745 | | | 105,280 |

Net Losses from Legal Proceedings in a Pricing Dispute(B) | | | — | | | 2,366 | | | 5,910 |

Acquisition/Sale Costs(C) | | | 2,174 | | | 3,468 | | | 34,674 |

Customer Credits(D) | | | — | | | — | | | 15,333 |

ERIP and Other Postretirement Benefits (“OPEB”)(E) | | | — | | | — | | | 6,733 |

Other Costs(F) | | | 1,983 | | | 4,179 | | | — |

Income Taxes(G) | | | 527 | | | (9,423) | | | (33,753) |

Additional Tax Adjustments(H) | | | 6,081 | | | — | | | — |

Economic Earnings | | | $162,959 | | | $103,040 | | | $116,234 |

| | | Historical South Jersey Industries, Inc. | |||||||

| | | Year ended December 31, | |||||||

| | | 2020 | | | 2019 | | | 2018 | |

Earnings (Loss) per Share from Continuing Operations | | | $1.62 | | | $0.84 | | | $0.21 |

Minus/Plus: | | | | | | | |||

Unrealized Mark-to-Market Losses/(Gains) on Derivatives | | | (0.05) | | | 0.16 | | | (0.42) |

Loss on Property, Plant and Equipment(A) | | | — | | | 0.12 | | | 1.24 |

Net Losses from Legal Proceedings in a Pricing Dispute(B) | | | — | | | 0.02 | | | 0.07 |

Acquisition/Sale Costs(C) | | | 0.02 | | | 0.04 | | | 0.41 |

Customer Credits(D) | | | — | | | — | | | 0.18 |

ERIP and OPEB(E) | | | — | | | — | | | 0.08 |

Other Costs(F) | | | 0.02 | | | 0.04 | | | — |

Income Taxes(G) | | | 0.01 | | | (0.10) | | | (0.39) |

Additional Tax Adjustments(H) | | | 0.06 | | | — | | | — |

Economic Earnings per Share | | | $1.68 | | | $1.12 | | | $1.38 |

| | | 2020 | | | 2019 | | | 2018 | |

Income from Continuing Operations | | | $108,059 | | | $87,394 | | | $82,949 |

Plus: | | | | | | | |||

Additional Tax Adjustments(H) | | | 1,214 | | | — | | | — |

Economic Earnings | | | $109,273 | | | $87,394 | | | $82,949 |

| (A) | Represents impairment charges taken as follows: in 2019 on solar generating facilities along with the agreement to sell MTF and ACB, which were both driven by the expected purchase prices being less than the carrying value of the assets; and in 2018 on solar generating facilities, which was also primarily driven by the purchase price in the agreement to sell solar assets being less than the carrying amount of the assets, along with Landfill Gas-to-Energy (“LFGTE”) assets, which was primarily driven by the remaining carrying value of these assets no longer being recoverable. |

| (B) | Represents net losses, including interest, legal fees and the realized difference in the market value of the commodity (including financial hedges) resulting from a ruling in a legal proceeding related to a pricing dispute between SJI and a gas supplier that began in October 2014. |

| (C) | Represents the following: |

| • | Costs incurred in 2020 to acquire EnerConnex, Annadale, and four solar limited liability companies. |

| • | Gain recorded in 2020 on the step-acquisition of EnerConnex. |

| • | Costs incurred and gains/losses recognized in 2020 on the sales of MTF/ACB and ELK. |

| • | Costs incurred and gains recognized in all three periods on the sale of certain solar assets included in Assets Held for Sale in previous periods. The gains pertain to those projects that were not impaired in previous periods. |

| • | Costs incurred in 2018 on the agreement to acquire the assets of ETG and ELK, and costs incurred in 2019/2020 to prepare to exit the transaction services agreement. |

| • | Costs incurred in 2018 on the sale of the retail gas business of SJE. |

| (D) | Represents credits to ETG and ELK customers that were required as part of the ETG/ELK Acquisition. |

| (E) | Represents costs incurred on the Company’s ERIP as well as the benefit of amending the Company’s OPEB. |

| (F) | Represents severance and other employee separation costs, along with costs incurred to cease operations at three landfill gas-to-energy production facilities. |

| (G) | The income taxes on (A) through (F) above are determined using a combined average statutory tax rate applicable to each period presented. |

| (H) | Represents additional tax adjustments, primarily including a state deferred tax valuation allowance at SJI, and a one-time tax expense resulting from SJG’s Stipulation of Settlement with the BPU. |

| | | Historical South Jersey Industries, Inc. | ||||

| | | As of December 31, | ||||

(In thousands) | | | 2020 | | | 2019 |

Consolidated balance sheets data: | | | | | ||

Total assets | | | $6,689,148 | | | $6,365,340 |

Long-term debt | | | 2,776,400 | | | 2,070,086 |

Total equity | | | 1,666,876 | | | 1,423,785 |

| | | Historical South Jersey Industries, Inc. | |||||||

| | | Year ended December 31, | |||||||

(In thousands) | | | 2020 | | | 2019 | | | 2018 |

Operating Revenues: | | | | | | | |||

SJI Utilities: | | | | | | | |||

SJG Utility Operations | | | $571,787 | | | 569,226 | | | 548,000 |

ETG Utility Operations | | | 349,392 | | | 325,133 | | | 125,604 |

ELK Utility Operations | | | 4,793 | | | 7,949 | | | 3,302 |

Subtotal SJI Utilities | | | 925,972 | | | 902,308 | | | 676,906 |

Energy Group: | | | | | | | |||

Wholesale Energy Operations | | | 571,590 | | | 607,093 | | | 636,005 |

Retail Gas and Other Operations | | | — | | | — | | | 101,543 |

Retail Electric Operations | | | 34,005 | | | 81,193 | | | 176,945 |

Subtotal Energy Group | | | 605,595 | | | 688,286 | | | 914,493 |

Energy Services: | | | | | | | |||

On-Site Energy Production | | | 15,617 | | | 48,748 | | | 72,374 |

Appliance Service Operations | | | 1,978 | | | 2,042 | | | 1,957 |

Subtotal Energy Services | | | 17,595 | | | 50,790 | | | 74,331 |

Corporate & Services | | | 56,690 | | | 44,511 | | | 51,000 |

Subtotal | | | 1,605,852 | | | 1,685,895 | | | 1,716,730 |

Intersegment Sales | | | (64,469) | | | (57,269) | | | (75,392) |

Total Operating Revenues | | | $1,541,383 | | | $1,628,626 | | | $1,641,338 |

| • | disqualification of the indenture trustee for “conflicting interests,” as defined under the Trust Indenture Act; |

| • | provisions preventing a trustee that is also a creditor of the issuer from improving its own credit position at the expense of the security holders immediately prior to or after a default under such indenture; and |

| • | the requirement that the indenture trustee deliver reports at least annually with respect to certain matters concerning the indenture trustee and the securities. |

| • | energy prices or expected energy prices; |

| • | environmental costs, liabilities or initiatives; |

| • | regulatory changes; |

| • | weather and seasonal fluctuations in demand for natural gas and electricity; |

| • | adverse outcomes from litigation or government, regulatory or internal investigations; |

| • | changes in financial estimates and recommendations by securities analysts; |

| • | operating and stock price performance of other companies that investors may deem comparable; |

| • | changes in our credit rating; |

| • | quarterly or other periodic variations in operating results; |

| • | sales of stock by insiders; |

| • | general economic conditions; |

| • | natural disasters, terrorist attacks and pandemics; and |

| • | limitations on our ability to repurchase our common stock. |

| • | an actual basis as of December 31, 2020; |

| • | on an adjusted basis as of December 31, 2020 to give effect to this offering; and |

| • | on a further adjusted basis as of December 31, 2020 to give effect to the concurrent offerings. |

December 31, 2020 (in thousands) | | | Actual | | | As Adjusted | | | As Further Adjusted |

2018 Series A 3.70% Junior Subordinated Notes due 2031 | | | $287,500 | | | $ | | | $ |

Other long-term debt(1) | | | 2,631,701 | | | | | ||

Total long-term debt | | | 2,919,201 | | | | | ||

Shareholders’ equity(2): | | | | | | | |||

Common Stock: Par Value $1.25 per share; Authorized Shares: 220,000,000 shares; Outstanding Shares: 100,591,940 | | | 125,740 | | | | | ||

Premium on common stock | | | 1,218,000 | | | | | ||

Treasury stock (at par) | | | (321) | | | | | ||

Accumulated other comprehensive loss | | | (38,216) | | | | | ||

Retained earnings | | | 355,678 | | | | | ||

Total South Jersey Industries, Inc. Equity | | | 1,660,881 | | | | | ||

Noncontrolling Interest | | | 5,995 | | | | | ||

Total equity | | | 1,666,876 | | | | | ||

Total capitalization | | | $4,443,276 | | | $ | | | $ |

| (1) | Including $142,801,000 in current portion of long-term debt. |

| (2) | Unless otherwise indicated, the number of shares of our common stock presented in this prospectus supplement (i) excludes 42,515 shares of treasury stock; (ii) excludes approximately 1,927,274 shares of common stock issuable upon the exercise of outstanding restricted stock awards or reserved for issuance pursuant to future grants of awards under our equity compensation plans; and (iii) excludes any shares of common stock that will be issuable upon settlement of the purchase contracts comprising a part of the Equity Units. |

| • | a purchase contract under which: |

| • | the holder will agree to purchase from us, and we will agree to sell to the holder, on April 1, 2024 (or if such day is not a business day, the following business day), which we refer to as the “purchase contract settlement date,” or earlier upon early settlement, for $50, a number of shares of our common stock equal to the applicable settlement rate described under “Description of the Purchase Contracts—Purchase of Common Stock,” “Description of the Purchase Contracts—Early Settlement” or “Description of the Purchase Contracts—Early Settlement Upon a Fundamental Change,” as the case may be, plus, in the case of an early settlement upon a fundamental change, the number of make-whole shares; and |

| • | we will pay the holder quarterly contract adjustment payments at the rate of % per year on the stated amount of $50, or $ per year, subject to our right to defer such contract adjustment payments as described under “Description of the Purchase Contracts—Contract Adjustment Payments,” and |

| • | a 1/20, or 5%, undivided beneficial ownership interest in a $1,000 principal amount 2021 Series B % remarketable junior subordinated notes due 2029 issued by us, and under which we will pay to the holder 1/20, or 5%, of the interest payment on a $1,000 principal amount RSN at the initial rate of %, or $ per year per $1,000 principal amount of RSNs, subject to our right to defer such interest payments as described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments”; or |

| • | following a successful optional remarketing, the applicable ownership interest in a portfolio of U.S. Treasury securities, which we refer to as the “Treasury portfolio.” |

| (1) | a 1/20, or 5%, undivided beneficial ownership interest in $1,000 face amount of U.S. Treasury securities (or principal or interest strips thereof) included in the Treasury portfolio that mature on or prior to the purchase contract settlement date; and |

| (2) | for the scheduled interest payment occurring on the purchase contract settlement date, a % undivided beneficial ownership interest in $1,000 face amount of U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the purchase contract settlement date. |

| • | a purchase contract under which: |

| • | the holder will agree to purchase from us, and we will agree to sell to the holder, on the purchase contract settlement date, or earlier upon early settlement, for $50, a number of shares of our common stock equal to the applicable settlement rate, plus, in the case of an early settlement upon a fundamental change, the number of make-whole shares; and |

| • | we will pay the holder quarterly contract adjustment payments at the rate of % per year on the stated amount of $50, or $ per year, subject to our right to defer the contract adjustment payments; and |

| • | a 1/20, or 5%, undivided beneficial ownership interest in a Treasury security. |

| • | deposit with the collateral agent a Treasury security that has a principal amount at maturity of $1,000, which must be purchased in the open market at the expense of the Corporate Unit holder, unless otherwise owned by the holder; and |

| • | transfer to the purchase contract agent 20 Corporate Units, accompanied by a notice stating that the holder of the Corporate Units has deposited a Treasury security with the collateral agent, and directing that the purchase contract agent instruct the collateral agent to release the related RSN. |

| • | cancel the 20 Corporate Units; |

| • | transfer the related RSN to the holder; and |

| • | deliver 20 Treasury Units to the holder. |

| • | deposit with the collateral agent an RSN having a principal amount of $1,000, which must be purchased in the open market at the expense of the Treasury Unit holder, unless otherwise owned by the holder; and |

| • | transfer to the purchase contract agent 20 Treasury Units, accompanied by a notice stating that the holder of the Treasury Units has deposited an RSN having a principal amount of $1,000 with the collateral agent and directing that the purchase contract agent instruct the collateral agent to release the related Treasury security and to instruct the securities intermediary to transfer such Treasury security to the purchase contract agent for distribution to the holder, free and clear of our security interest. |

| • | cancel the 20 Treasury Units; |

| • | transfer the related Treasury security to the holder; and |

| • | deliver 20 Corporate Units to the holder. |

| (1) | If the applicable market value of our common stock is equal to or greater than the “threshold appreciation price” of $ , the settlement rate will be shares of our common stock (we refer to this settlement rate as the “minimum settlement rate”). |

| (2) | If the applicable market value of our common stock is less than the threshold appreciation price but greater than the “reference price” of $ , which will be the public offering price of our common stock in the concurrent common stock offering, the settlement rate will be a number of shares of our common stock equal to $50 divided by the applicable market value, rounded to the nearest ten thousandth of a share. |

| (3) | If the applicable market value of our common stock is less than or equal to the reference price of $ , the settlement rate will be shares of our common stock, which is equal to the stated amount divided by the reference price (we refer to this settlement rate as the “maximum settlement rate”). |

| • | any suspension of, or limitation imposed on, trading by the principal exchange or quotation system on which our common stock is listed or admitted for trading during the one-hour period prior to the close of trading for the regular trading session on such exchange or quotation system (or for purposes of determining VWAP any period or periods prior to 1:00 p.m. New York City time aggregating one half hour or longer) and whether by reason of movements in price exceeding limits permitted by the relevant exchange or quotation system or otherwise relating to our common stock or in futures or options contracts relating to our common stock on the relevant exchange or quotation system; or |

| • | any event (other than a failure to open or, except for purposes of determining VWAP, a closure as described below) that disrupts or impairs the ability of market participants during the one-hour period prior to the close of trading for the regular trading session on the principal exchange or quotation system on which our common stock is listed or admitted for trading (or for purposes of determining VWAP any period or periods prior to 1:00 p.m. New York City time aggregating one half hour or longer) in general to effect transactions in, or obtain market values for, our common stock on the relevant exchange or quotation system or futures or options contracts relating to our common stock on any relevant exchange or quotation system; or |

| • | the failure to open of the principal exchange or quotation system on which futures or options contracts relating to our common stock are traded or, except for purposes of determining VWAP, the closure of such exchange or quotation system prior to its respective scheduled closing time for the regular trading session on such day (without regard to after hours or other trading outside the regular trading session |

| • | a holder has settled early the related purchase contracts by delivery of cash to the purchase contract agent in the manner described under “—Early Settlement” or “—Early Settlement Upon a Fundamental Change”; |

| • | a holder of Corporate Units has settled the related purchase contracts with separate cash in the manner described under “—Notice to Settle with Cash”; or |

| • | an event described under “—Termination” has occurred; |

| • | in the case of Corporate Units where there has not been a successful optional or final remarketing, the holder will be deemed to have exercised its put right as described under “—Remarketing” (unless it shall have elected not to exercise such put right by delivering cash as described thereunder) and to have elected to apply the proceeds of the put price to satisfy in full the holder’s obligation to purchase our common stock under the related purchase contracts; |

| • | in the case of Corporate Units where the Treasury portfolio or cash has replaced the RSNs as a component of the Corporate Units following a successful optional remarketing, the portion of the proceeds of the applicable ownership interests in the Treasury portfolio when paid at maturity or an amount of cash equal to the stated amount of $50 per Corporate Unit will be applied to satisfy in full the holder’s obligation to purchase common stock under the related purchase contracts and any excess proceeds will be delivered to the purchase contract agent for the benefit of the holders of Corporate Units; |

| • | in the case of Corporate Units where the RSNs have been successfully remarketed during the final remarketing period, the portion of the remarketing proceeds sufficient to satisfy the holder’s obligation |

| • | in the case of Treasury Units, the proceeds of the related Treasury securities, when paid at maturity, will be applied to satisfy in full the holder’s obligation to purchase our common stock under the related purchase contracts and any excess proceeds will be delivered to the purchase contract agent for the benefit of the holders of Treasury Units. |

| • | irrevocably appointed the purchase contract agent as its attorney-in-fact to enter into and perform the related purchase contract and the purchase contract and pledge agreement in the name of and on behalf of such holder; |

| • | agreed to be bound by the terms and provisions of the Corporate Units or Treasury Units, as applicable, including, but not limited to, the terms of the related purchase contract and the purchase contract and pledge agreement, for so long as the holder remains a holder of Corporate Units or Treasury Units; |

| • | consented to and agreed to be bound by the pledge of such holder’s right, title and interest in and to its undivided beneficial ownership interest in RSNs, the portion of the Treasury portfolio (or cash) described in the first clause of the definition of “applicable ownership interest,” or the Treasury securities, as applicable, and the delivery of such collateral by the purchase contract agent to the collateral agent; and |

| • | agreed to the satisfaction of the holder’s obligations under the purchase contracts with the proceeds of the pledged undivided beneficial ownership in the RSNs, Treasury portfolio (or cash), Treasury securities or put price, as applicable, in the manner described above if the option to settle the purchase contracts through payment of separate cash is not elected. |

| • | you may not settle a purchase contract early; |

| • | you may not create Treasury Units; and |

| • | you may not recreate Corporate Units from Treasury Units. |

| • | the interest rate on the RSNs may be reset as described below and under “Description of the Remarketable Junior Subordinated Notes—Interest Rate Reset” below; |

| • | interest will be payable on the RSNs semi-annually on April 1 and October 1 of each year; |

| • | the RSNs will cease to be redeemable at our option, and the provisions described under “Description of the Remarketable Junior Subordinated Notes—Redemption at Our Option” and “—Redemption Procedures” will no longer apply to the RSNs; and |

| • | we will cease to have the ability to defer interest payments on the RSNs, and the provisions described under “Description of the Remarketable Junior Subordinated Notes—Option to Defer Interest Payments” will no longer apply to the RSNs. |

| • | settlement with respect to the remarketed RSNs will occur on the second business day following the optional remarketing date, unless the remarketed RSNs are priced after 4:30 p.m. New York City time on the optional remarketing date, in which case settlement will occur on the third business day following the optional remarketing date (we refer to such settlement date as the “optional remarketing settlement date”); |

| • | the interest rate on the RSNs will be reset by the remarketing agent in consultation with us on the optional remarketing date and will become effective on the optional remarketing settlement date, if applicable; |

| • | the other modifications to the terms of the RSNs, as described under “—Remarketing,” will become effective; |

| • | after the optional remarketing settlement date, your Corporate Units will consist of a purchase contract and the applicable ownership interest in the Treasury portfolio (or cash), as described herein; and |

| • | you may no longer create Treasury Units or recreate Corporate Units from Treasury Units. |

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the purchase contract settlement date in an aggregate amount at maturity equal to the principal amount of the RSNs underlying the undivided beneficial ownership interests in RSNs included in the Corporate Units on the optional remarketing date; and |

| • | U.S. Treasury securities (or principal or interest strips thereof) that mature on or prior to the purchase contract settlement date in an aggregate amount at maturity equal to the aggregate interest payment (assuming no reset of the interest rate) that would have been paid to the holders of the Corporate Units on the purchase contract settlement date on the principal amount of the RSNs underlying the undivided beneficial ownership interests in RSNs included in the Corporate Units on the optional remarketing date. |

| • | settlement with respect to the remarketed RSNs will occur on the purchase contract settlement date; |

| • | the interest rate of the RSNs will be reset by the remarketing agent in consultation with us, and will become effective on the reset effective date, which will be the purchase contract settlement date, as described under “Description of the Remarketable Junior Subordinated Notes—Interest Rate Reset” below; |

| • | the other modifications to the terms of the RSNs, as described under “—Remarketing,” will become effective; |

| • | the collateral agent will remit the portion of the proceeds it receives equal to the total principal amount of the RSNs underlying the Corporate Units to us to satisfy in full the Corporate Unit holders’ obligations to purchase common stock under the related purchase contracts, any excess proceeds attributable to RSNs underlying Corporate Units that were remarketed will be remitted to the purchase contract agent for distribution pro rata to the holders of such RSNs and proceeds from the final remarketing attributable to the separate RSNs remarketed will be remitted to the custodial agent for distribution pro rata to the holders of the remarketed separate RSNs; and |

| • | any accrued and unpaid interest on the RSNs, including any accrued and unpaid deferred interest (including compounded interest thereon), will be paid in cash by us on the purchase contract settlement date to the holders of such RSNs as of the relevant record date (whether or not such RSNs were remarketed in such successful final remarketing). |

| • | $50 times the number of purchase contracts being settled; plus |

| • | if the early settlement date occurs during the period from the close of business on any record date next preceding any contract adjustment payment date to the opening of business on such contract adjustment payment date, an amount equal to the contract adjustment payments payable on such contract adjustment payment date, unless we have elected to defer the contract adjustment payments payable on such contract adjustment payment date. |

| (1) | a “person” or “group” within the meaning of Section 13(d) of the Exchange Act has become the direct or indirect “beneficial owner,” as defined in Rule 13d-3 under the Exchange Act, of shares of our common stock representing more than 50% of the voting power of our common stock; |

| (2) | (A) we are involved in a consolidation with or merger into any other person, or any merger of another person into us, or any other similar transaction or series of related transactions (other than a merger, consolidation or similar transaction that does not result in the conversion or exchange of outstanding shares of our common stock), in each case, in which 90% or more of the outstanding shares of our common stock are exchanged for or converted into cash, securities or other property, greater than 10% of the value of which consists of cash, securities or other property that is not (or will not be upon or immediately following the effectiveness of such consolidation, merger or other transaction) common stock listed on the NYSE, the Nasdaq Global Select Market or the Nasdaq Global Market (or any of their respective successors) or (B) the consummation of any sale, lease or other transfer in one transaction or a series of related transactions of all or substantially all of our consolidated assets to any person other than one of our subsidiaries; |

| (3) | our common stock ceases to be listed on at least one of the NYSE, the Nasdaq Global Select Market and the Nasdaq Global Market (or any of their respective successors); or |

| (4) | our shareholders approve our liquidation, dissolution or termination. |

| • | in the case of a fundamental change described in clause (2) above where the holders of our common stock receive only cash in the fundamental change, the cash amount paid per share of our common stock; or |

| • | otherwise, the average of the closing prices of our common stock over the 20 trading-day period ending on the trading day immediately preceding the effective date of the fundamental change. |

| | | Stock Price on Effective Date | ||||||||||||||||||||||||||||||||||||||||

Effective Date | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ |

March , 2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

April 1, 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

April 1, 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

April 1, 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

| • | if the stock price is between two stock prices on the table or the effective date is between two effective dates on the table, the amount of make-whole shares will be determined by straight line interpolation between the make-whole share amounts set forth for the higher and lower stock prices and the two effective dates based on a 365-day year, as applicable; |

| • | if the stock price is in excess of $ per share (subject to adjustment in the same manner as the stock prices set forth in the second row of the table as described above), then the make-whole share amount will be zero; and |

| • | if the stock price is less than $ per share (subject to adjustment in the same manner as the stock prices set forth in the second row of the table as described above) (the “minimum stock price”), then the make-whole share amount will be determined as if the stock price equaled the minimum stock price, using straight line interpolation, as described above, if the effective date is between two effective dates on the table. |

| (i) | declare or pay any dividends on, or make any distributions on, or redeem, purchase or acquire, or make a liquidation payment with respect to, any shares of our capital stock; |

| (ii) | make any payment of principal of, or interest or premium, if any, on, or repay, repurchase or redeem any of our debt securities that rank on parity with, or junior to, the contract adjustment payments; or |

| (iii) | make any guarantee payments under any guarantee by us of securities of any of our subsidiaries if our guarantee ranks on parity with, or junior to, the contract adjustment payments. |

| (a) | purchases, redemptions or other acquisitions of our capital stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors, agents, consultants or independent contractors or a stock purchase or dividend reinvestment plan, or the satisfaction of our obligations pursuant to any contract or security outstanding on the date that the contract adjustment payment is deferred requiring us to purchase, redeem or acquire our capital stock; |

| (b) | any payment, repayment, redemption, purchase, acquisition or declaration of dividends described in clause (1) above as a result of a reclassification of our capital stock, or the exchange or conversion of all or a portion of one class or series of our capital stock, for another class or series of our capital stock; |

| (c) | the purchase of fractional interests in shares of our capital stock pursuant to the conversion or exchange provisions of our capital stock or the security being converted or exchanged, or in connection with the settlement of stock purchase contracts outstanding on the date that the contract adjustment payment is deferred; |

| (d) | dividends or distributions paid or made in our capital stock (or rights to acquire our capital stock), or repurchases, redemptions or acquisitions of capital stock in connection with the issuance or exchange of capital stock (or of securities convertible into or exchangeable for shares of our capital stock) and distributions in connection with the settlement of stock purchase contracts outstanding on the date that the contract adjustment payment is deferred; |

| (e) | redemptions, exchanges or repurchases of, or with respect to, any rights outstanding under a shareholder rights plan outstanding on the date that the contract adjustment payment is deferred or the declaration or payment thereunder of a dividend or distribution of or with respect to rights in the future; |

| (f) | payments on the RSNs, the 2018 RSNs, any trust preferred securities, subordinated debentures, junior subordinated debentures or junior subordinated notes, or any guarantees of any of the foregoing, in each case, that rank equal in right of payment to the contract adjustment payments, so long as the amount of payments made on account of such securities or guarantees and the purchase contracts is paid on all such securities and guarantees and the purchase contracts then outstanding on a pro rata basis in proportion to the full payment to which each series of such securities, guarantees or purchase contracts is then entitled if paid in full; provided that, for the avoidance of doubt, we will not be permitted under the purchase contract and pledge agreement to make contract adjustment payments in part; |

| (g) | purchases of any RSNs upon exercise of the put right upon a failed remarketing as described under “Description of the Remarketable Junior Subordinated Notes—Put Option upon Failed Remarketing” below or purchases of any 2018 RSNs upon exercise of a similar put right; or |

| (h) | any payment of deferred interest or principal on, or repayment, redemption or repurchase of, parity or junior securities that, if not made, would cause us to breach the terms of the instrument governing such parity or junior securities. |

| (1) | Stock Dividends. If we pay or make a dividend or other distribution on our common stock in common stock, each fixed settlement rate in effect at the opening of business on the day following the date fixed for the determination of stockholders entitled to receive such dividend or other distribution will be increased by dividing: |

| • | each fixed settlement rate by |

| • | a fraction, the numerator of which will be the number of shares of our common stock outstanding at the close of business on the date fixed for such determination and the denominator will be the sum of such number of shares and the total number of shares constituting the dividend or other distribution. |

| (2) | Stock Purchase Rights. If we issue to all or substantially all holders of our common stock rights, options, warrants or other securities (other than pursuant to a dividend reinvestment, share purchase or similar plan), entitling them to subscribe for or purchase shares of our common stock for a period expiring within 45 days from the date of issuance of such rights, options, warrants or other securities at a price per share of our common stock less than the current market price (as defined below) calculated as of the date fixed for the determination of stockholders entitled to receive such rights, options, warrants or other securities, each fixed settlement rate in effect at the opening of business on the day following the date fixed for such determination will be increased by dividing: |

| • | each fixed settlement rate by |

| • | a fraction, the numerator of which will be the number of shares of our common stock outstanding at the close of business on the date fixed for such determination plus the number of shares of our common stock which the aggregate consideration expected to be received by us upon the exercise of such rights, options, warrants or other securities would purchase at such current market price and the denominator of which will be the number of shares of our common stock outstanding at the close of business on the date fixed for such determination plus the number of shares of our common stock so offered for subscription or purchase. |

| (3) | Stock Splits; Reverse Splits; and Combinations. If outstanding shares of our common stock shall be subdivided, split or reclassified into a greater number of shares of common stock, each fixed settlement rate in effect at the opening of business on the day following the day upon which such subdivision, split or reclassification becomes effective shall be proportionately increased, and, conversely, in case outstanding shares of our common stock shall each be combined or reclassified into a smaller number of shares of common stock, each fixed settlement rate in effect at the opening of business on the day following the day upon which such combination or reclassification becomes effective shall be proportionately reduced. |

| (4) | Debt, Asset or Security Distributions. If we, by dividend or otherwise, distribute to all or substantially all holders of our common stock evidences of our indebtedness, assets or securities (but excluding any rights, options, warrants or other securities referred to in paragraph (2) above, any dividend or distribution paid exclusively in cash referred to in paragraph (5) below (in each case, whether or not an adjustment to the fixed settlement rates is required by such paragraph) and any dividend paid in shares of capital stock of any class or series, or similar equity interests, of or relating to a subsidiary or other business unit of ours in the case of a spin-off referred to below, or dividends or distributions referred to in paragraph (1) above), each fixed settlement rate in effect immediately prior to the close of business on the date fixed for the determination of stockholders entitled to receive such distribution shall be increased by dividing: |

| • | each fixed settlement rate by |

| • | a fraction, the numerator of which shall be the current market price of our common stock (as defined below) calculated as of the date fixed for such determination less the then fair market value (as determined in good faith by our board of directors) of the portion of the assets, securities or evidences of indebtedness so distributed applicable to one share of our common stock and the denominator of which shall be such current market price. |

| • | each fixed settlement rate by |

| • | a fraction, the numerator of which is the current market price of our common stock and the denominator of which is such current market price plus the fair market value, determined as described below, of those shares of capital stock or similar equity interests so distributed applicable to one share of common stock. |

| • | the 10th trading day from and including the effective date of the spin-off; or |

| • | if the spin-off is effected simultaneously with an initial public offering of the securities being distributed in the spin-off and the “ex date” (as defined in paragraph (6) below) for the spin-off occurs on or before the date that the initial public offering price of the securities being distributed in the spin-off is determined, the issue date of the securities being offered in such initial public offering. |

| (5) | Cash Distributions. If we, by dividend or otherwise, make distributions to all or substantially all holders of our common stock exclusively in cash during any quarterly period in an amount that exceeds $0.3025 per share per quarter in the case of a regular quarterly dividend (such per share amount being referred to as the “reference dividend”), then immediately after the close of business on the date fixed for determination of the stockholders entitled to receive such distribution, each fixed settlement rate in effect immediately prior to the close of business on such date will be increased by dividing: |

| • | each fixed settlement rate by |

| • | a fraction, the numerator of which will be equal to the current market price on the date fixed for such determination less the amount, if any, by which the per share amount of the distribution exceeds the reference dividend and the denominator of which will be equal to such current market price. |

| (6) | Tender and Exchange Offers. In the case that a tender offer or exchange offer made by us or any subsidiary for all or any portion of our common stock shall expire and such tender or exchange offer ( as amended through the expiration thereof) requires the payment to stockholders (based on the acceptance (up to any maximum specified in the terms of the tender offer or exchange offer) of purchased shares) of an aggregate consideration having a fair market value per share of our common stock that exceeds the closing price of our common stock on the trading day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender offer or exchange offer, then, immediately prior to the opening of business on the day after the date of the last time (which we refer to as the “expiration time”) tenders or exchanges could have been made pursuant to such tender offer or exchange offer (as amended through the expiration thereof), each fixed settlement rate in effect immediately prior to the close of business on the date of the expiration time will be increased by dividing: |

| • | each fixed settlement rate by |

| • | a fraction (1) the numerator of which will be equal to (a) the product of (i) the current market price on the date of the expiration time and (ii) the number of shares of common stock outstanding (including any tendered or exchanged shares) on the date of the expiration time less (b) the amount of cash plus the fair market value of the aggregate consideration payable to stockholders pursuant to the tender offer or exchange offer (assuming the acceptance by us of purchased shares (as defined below)), and (2) the denominator of which will be equal to the product of (x) the current market price on the date of the expiration time and (y) the result of (i) the number of shares of our common stock outstanding (including any tendered or exchanged shares) on the date of the expiration time less (ii) the number of all shares validly tendered, not withdrawn and accepted for payment on the date of the expiration time (such actually validly tendered or exchanged shares, up to any maximum acceptance amount specified by us in the terms of the tender offer or exchange offer, being referred to as the “purchased shares”). |

| • | upon the issuance of any shares of our common stock pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on our securities and the investment of additional optional amounts in shares of our common stock under any plan; |

| • | upon the issuance of options, restricted stock or other awards in connection with any present or future employment contract, executive compensation plan, benefit plan or other similar arrangement with or for the benefit of any one or more employees, officers, directors, consultants or independent contractors or the exercise of such options or other awards; |

| • | upon the issuance of any shares of our common stock pursuant to any option, warrant, right or exercisable, exchangeable or convertible security outstanding as of the date the Equity Units were first issued; |

| • | upon the purchase of any shares of our common stock pursuant to an open market share repurchase program or other buy-back transaction that is not a tender offer or exchange offer of the nature described in paragraph (6) above; |

| • | for a change in the par value or no par value of the common stock; or |

| • | for accumulated and unpaid contract adjustment payments. |

| • | any consolidation or merger of the Company with or into another person or of another person with or into the Company or a similar transaction (other than a consolidation, merger or similar transaction in which the Company is the continuing corporation and in which the shares of our common stock outstanding immediately prior to the merger or consolidation are not exchanged for cash, securities or other property of the Company or another person); |

| • | any sale, transfer, lease or conveyance to another person of the property of the Company as an entirety or substantially as an entirety, as a result of which the shares of our common stock are exchanged for cash, securities or other property; |

| • | any statutory exchange of the common stock of the Company with another corporation (other than in connection with a merger or acquisition); and |

| • | any liquidation, dissolution or termination of the Company (other than as a result of or after the occurrence of a termination event described below under “—Termination”). |

| (1) | at any time on or prior to the purchase contract settlement date, a decree or order by a court having jurisdiction in the premises shall have been entered adjudicating the Company a bankrupt or insolvent, or approving as properly filed a petition seeking reorganization arrangement, adjustment or composition of or in respect of the Company under the U.S. Bankruptcy Code or any other similar applicable federal or state law and such decree or order shall have been entered more than 90 days prior to the purchase contract settlement date and shall have continued undischarged and unstayed for a period of 90 consecutive days; |

| (2) | at any time on or prior to the purchase contract settlement date, a decree or order of a court having jurisdiction in the premises shall have been entered for the appointment of a receiver, liquidator, trustee, assignee, sequestrator or other similar official in bankruptcy or insolvency of the Company or of all or any substantial part of the Company’s property, or for the winding up or liquidation of the Company’s affairs, and such decree or order shall have been entered more than 90 days prior to the purchase contract settlement date and shall have continued undischarged and unstayed for a period of 90 consecutive days; or |

| (3) | at any time on or prior to the purchase contract settlement date, the Company shall institute proceedings to be adjudicated a bankrupt or insolvent, or shall consent to the institution of bankruptcy or insolvency proceedings against it, or shall file a petition or answer or consent seeking reorganization under the U.S. Bankruptcy Code or any other similar applicable federal or state law, or shall consent to the filing of any such petition, or shall consent to the appointment of a receiver, liquidator, trustee, assignee, sequestrator or other similar official of the Company or of all or any substantial part of the Company’s property, or shall make an assignment for the benefit of creditors, or shall admit in writing its inability to pay its debts generally as they become due. |

| • | in the case of Corporate Units, to substitute a Treasury security for the related RSN, as provided under “Description of the Equity Units—Creating Treasury Units by Substituting a Treasury Security for an RSN”; |

| • | in the case of Treasury Units, to substitute an RSN for the related Treasury security, as provided under “Description of the Equity Units—Recreating Corporate Units”; and |

| • | upon early settlement, settlement through the payment of separate cash or termination of the related purchase contracts. |

| • | to evidence the succession of another person to our obligations; |

| • | to add to the covenants for the benefit of holders or to surrender any of our rights or powers under the purchase contract and pledge agreement; |

| • | to evidence and provide for the acceptance of appointment of a successor purchase contract agent or a successor collateral agent or securities intermediary; |

| • | to make provision with respect to the rights of holders pursuant to the requirements applicable to reorganization events; |

| • | to cure any ambiguity or to correct or supplement any provisions that may be inconsistent with any other provision in the purchase contract and pledge agreement; or |

| • | to make such other provisions in regard to matters or questions arising under the purchase contract and pledge agreement or to make any other changes in the provisions of the purchase contract and pledge agreement, in each case, provided that such amendment does not adversely affect the interests of any holders of Equity Units; it being understood that any amendment made to conform the provisions of the purchase contract and pledge agreement to the description of such agreement, the Equity Units and the purchase contracts contained in the preliminary prospectus supplement for the Equity Units as supplemented and/or amended by the related pricing term sheet will be deemed not to adversely affect the interests of the holders. |

| • | subject to our right to defer contract adjustment payments, extend or delay any payment date; |

| • | impair the holders’ right to institute suit for the enforcement of a purchase contract or payment of any contract adjustment payments (including compounded contract adjustment payments); |

| • | except as required pursuant to any anti-dilution adjustment, reduce the number of shares of our common stock purchasable under a purchase contract, increase the purchase price of the shares of our common stock on settlement of any purchase contract, change the purchase contract settlement date or change the right to early settlement or fundamental change early settlement in a manner adverse to the holders; |

| • | increase the amount or change the type of collateral required to be pledged to secure a holder’s obligations under the purchase contract and pledge agreement; |

| • | impair the right of the holder of any purchase contract to receive distributions on the collateral, or otherwise adversely affect the holder’s rights in or to such collateral; |

| • | reduce any contract adjustment payments or any deferred contract adjustment payments (including compounded contract adjustment payments) or change any place where, or the coin or currency in which, any contract adjustment payment is payable; or |