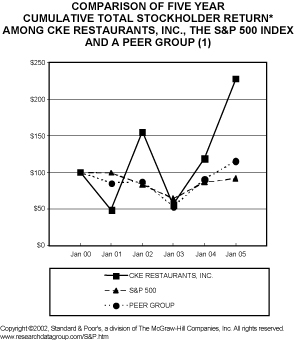

The Stock Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that CKE specifically incorporates this information by reference, and shall not otherwise be deemed filed under such.

TRANSACTIONS WITH OFFICERS AND DIRECTORS

Carl N. Karcher. CKE leases certain land and buildings, which include the Anaheim corporate offices of CKE, its distribution center and one restaurant in Carl Karcher Plaza, located at 401 West Carl Karcher Way, Anaheim, California, from the Karcher Partners, L.P. (“Karcher Partners”). The General Partner of Karcher Partners is the Carl N. Karcher and Margaret M. Karcher Trust (the “Trust”), of which Carl N. Karcher is co-trustee. The term of the lease expires in April 2008, and CKE has the option to renew the lease for one additional five-year term. The current rent under this lease is: (a) $15,580 per month and 6.5% of annual gross sales in excess of $2,436,369 for the restaurant; (b) $79,099 per month for the distribution center, subject to adjustment every five years; and (c) $24,832 per month for the corporate offices, subject to adjustment every five years. CKE also leases two adjacent parcels of land in Carl Karcher Plaza from the Trust which are being utilized by CKE for additional office space and distribution center parking and storage. The rent is $6,942 per month for one parcel and $7,971 per month for the other parcel, both subject to adjustment every five years. The term for both leases expires in April 2008. CKE has the option to renew each of these leases for one additional five-year term. The aggregate rents paid by CKE to the Trust for the corporate offices and adjacent facilities, including one restaurant in Carl Karcher Plaza, during fiscal 2005 were $1,647,877. In addition, CKE had two leases with the Trust with respect to two restaurant properties. The minimum monthly rental is the greater of $6,799 or 5.5% of annual gross sales in one of the leases. The minimum monthly rental for improvements of $2,871 or 4% of annual gross sales, whichever is greater, and a fixed monthly rental of $6,183 for the land in the other lease, which expired in May 2004. The remaining lease expires in May 2010. The aggregate rents paid by CKE to the Trust for these two restaurant properties during fiscal 2005 were $134,834.

In January 1994, CKE entered into an employment agreement with Carl N. Karcher, which was amended on November 1, 1997, January 1, 2004 and January 1, 2005. In fiscal 2005, Mr. Karcher was paid an aggregate of $451,998, consisting of (a) $402,885 base salary, (b) $8,581 in life insurance premiums, (c) $4,996 reimbursement for medical costs, (d) $25,384 in matching contributions for CKE’s employee stock purchase plan, and (e) a $10,152 auto allowance. Mr. Karcher’s employment agreement, as amended on January 1, 2005, provides that Mr. Karcher will receive an annual amount of $300,000, which will decrease by $25,000 each successive year until 2009, when he will be paid an annual amount of $210,000 until his death. Mrs. Karcher, if she survives her husband, will be paid an annual amount of $150,000 until her death. Mr. and Mrs. Karcher are entitled to medical, dental and vision benefits until their deaths, and Mr. Karcher is entitled to transportation to and from all Company related events, an office with an assistant, and payment of certain club dues until his death. On May 11, 2004, Carl N. Karcher tendered his resignation as a member of the Board of Directors effective upon Carl L. Karcher’s election as a member of the class of directors whose terms expire in 2006.

JCK, Inc. (“JCK”) is a franchisee of CKE and currently operates 14 Carl’s Jr. restaurants. Joseph C. Karcher is the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of JCK. JCK, pursuant to a Development Agreement with CKE, is obligated to develop and franchise one additional Carl’s Jr. restaurant by 2005. JCK paid an aggregate of $5,000 to CKE in franchise fees in fiscal 2005. In connection with the operation of its 14 franchised restaurants, JCK regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $3,563,276. During fiscal 2005, JCK paid royalty fees of $524,093, and advertising and promotional fees of $663,986, for all 14 restaurants combined.

Wiles Restaurants, Inc. (“Wiles”) is a franchisee of CKE and currently operates 13 Carl’s Jr. restaurants, two of which are Carl’s Jr./Green Burrito dual-brand restaurants. Anne M. Wiles is the daughter of Carl N. Karcher, a partner in Karcher Partners and an affiliate of Wiles. Wiles paid an aggregate of $11,250 to CKE in franchise fees in fiscal 2005. In connection with the operation of its 13 franchised restaurants, Wiles regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $5,113,158. During fiscal 2005, Wiles paid royalty fees of $615,696, including royalty fees paid to CKE for its Carl’s Jr./Green Burrito dual-brand restaurants, and advertising and promotional fees of $768,402, for all 13 restaurants combined. Wiles is also a lessee of CKE with respect to two restaurant locations. Minimum monthly rental payments range from $7,174 to $11,699 or 5.5% to 8% of annual gross sales of the restaurant. The leases expire from November 2008 to August 2011. The rents paid under these leases during fiscal 2005 totaled $257,552.

21

Sierra Surf Connection, Inc. (“SSC”) is a franchisee of CKE and currently operates 10 Carl’s Jr. restaurants. Anne M. Wiles is the daughter of Carl N. Karcher, a partner in Karcher Partners and an affiliate of SSC. In connection with the operation of its 10 franchised restaurants, SSC regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $1,524,503. During fiscal 2005, SSC paid royalty fees of $392,575, and advertising and promotional fees of $607,964, for all 10 restaurants combined. SSC is also a lessee of CKE with respect to one restaurant location. Rental payments equal 5% of the annual gross sales of the restaurant, or minimum monthly rental of $4,805. The lease expires in January 2008. The rents paid under this lease during fiscal 2005 totaled $72,662.

Estrella del Rio Grande, Inc. (“Estrella”) is a franchisee of CKE and currently operates one Carl’s Jr. restaurant. Anne M. Wiles is the daughter of Carl N. Karcher, a partner in Karcher Partners and an affiliate of Estrella. Estrella paid CKE an aggregate of $15,000 in franchise fees and $10,000 in development fees in fiscal 2005. In connection with the operation of its franchised restaurant, Estrella regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $184,454. During fiscal 2005, Estrella paid royalty fees of $13,193, and advertising and promotional fees of $34,558, for its one restaurant.

MJKL Enterprises, L.L.C. (“MJKL”) is a franchisee of CKE and currently operates 42 Carl’s Jr. restaurants, 16 of which are Carl’s Jr./Green Burrito dual-brand restaurants. Margaret LeVecke is the daughter of Carl N. Karcher, a partner in Karcher Partners and an affiliate of MJKL. MJKL is obligated, pursuant to a Development Agreement with CKE, to develop and franchise nine additional Carl’s Jr. restaurants at varying times by 2008. MJKL paid CKE an aggregate of $105,000 in franchise and $50,000 in development fees in fiscal 2005. In connection with the operation of its 42 restaurants, MJKL regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $12,493,282. During fiscal 2005, MJKL paid royalty fees of $1,166,906 and advertising and promotional fees of $1,423,129, for all 42 restaurants combined. MJKL is also a lessee or sublessee of CKE with respect to 21 restaurant locations, five of which were terminated in fiscal 2005. Monthly rental payments vary from $3,000 to $12,849 and/or a percentage of the annual gross sales of the restaurants ranging from 4% to 8%. The leases expire at varying times between June 2005 and December 2014. Rents paid during fiscal 2005 under these leases totaled $1,188,796.

Bernard Karcher Investments, Inc. (“BKI”) is a franchisee of CKE and currently operates 11 Carl’s Jr. restaurants. Bernard W. Karcher is the brother of Carl N. Karcher and an affiliate of BKI. In connection with the operation of its 11 franchised restaurants, BKI regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $4,784,572. During fiscal 2005, BKI paid royalty fees of $633,480, and advertising and promotional fees of $777,088, for all 11 restaurants combined. BKI is also a lessee of CKE with respect to two restaurant locations. Rental payments equal $11,520, or a percentage ranging from 7.5% to 9.5% of the annual gross sales of the restaurant ranging in excess of $1 to $900,000. The leases expire at varying times between January 2006 to September 2012. The rents paid under these leases during fiscal 2005 totaled $243,616.

B&J, L.L.C. (“B&J”) is a franchisee of CKE and currently operates nine Carl’s Jr. restaurants. Bernard W. Karcher is the brother of Carl N. Karcher and an affiliate of B&J. In connection with the operation of its nine franchised restaurants, B&J regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $3,942,837. During fiscal 2005, B&J paid royalty fees of $487,526, and advertising and promotional fees of $636,448, for all nine restaurants combined. B&J is also a sublessee of CKE with respect to one restaurant location. Rental payments equal the greater of $4,290 per month or 4% of the annual gross sales of the restaurant. The lease expires in January 2018. Total rents paid under this lease during fiscal 2005 totaled $64,613.

Carl L. Karcher. CLK, Inc. (“CLK”) is a franchisee of CKE and currently operates 28 Carl’s Jr. restaurants, nine of which are Carl’s Jr./Green Burrito dual-brand restaurants. Carl L. Karcher is a director of CKE, the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of CLK. CLK paid an aggregate of $25,000 to CKE in franchise fees in fiscal 2005. In connection with the operation of its 28 franchised restaurants, CLK

22

regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $12,750,665. During fiscal 2005, CLK paid royalty fees of $1,616,884, including royalties fees paid to CKE for the Green Burrito dual-brand restaurants, and advertising and promotional fees of $1,885,175, for all 28 restaurants combined. CLK is also a lessee or sublessee of CKE with respect to 13 restaurant locations, two of which terminated in fiscal 2005. Rental payments equal a percentage of the annual gross sales of the restaurants ranging from 5.5 % to 10%, or minimum monthly rentals ranging from $4,447 to $11,255. The leases expire at varying times between December 2005 and August 2011. The rents paid under these leases during fiscal 2005 totaled $1,075,303.

CLK New-Star, L.P. (“New-Star”) is a franchisee of CKE and currently operates five Carl’s Jr. restaurants. Carl L. Karcher is a director of CKE, the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of New-Star. New-Star, pursuant to a Development Agreement with CKE, is obligated to develop and franchise ten additional Carl’s Jr. restaurants at varying times by 2011. In connection with the operation of its five franchised restaurants, New Star purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $9,208. During fiscal 2005, New Star paid royalty fees of $245,348, and advertising and promotional fees of $408,422, for its five restaurants combined.

Border Star de Mexico, S. de R.L. de C.V. (“BSM”) is a licensee of CKE and currently operates four Carl’s Jr. restaurants. Carl L. Karcher is a director of CKE, the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of BSM. BSM, pursuant to a Development Agreement with CKE, is obligated to develop and franchise one additional Carl’s Jr. restaurant by March 2005. BSM paid an aggregate of $50,000 to CKE in development fees in fiscal 2005. In connection with the operation of its four franchised restaurants, BSM regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $698,922. During fiscal 2005, BSM paid royalty fees of $90,159, for its four restaurants combined.

KWK Foods, L.L.C. (“KWK”) is a franchisee of CKE and currently operates 17 Carl’s Jr. restaurants, one of which is a Carl’s Jr./Green Burrito dual-brand restaurant. Carl L. Karcher is a director of CKE, the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of KWK. Joseph C. Karcher is the son of Carl N. Karcher, a partner in Karcher Partners and an affiliate of KWK. Gary Wiles is the son-in-law of Carl N. Karcher and an affiliate of KWK. KWK, pursuant to a Development Agreement with CKE, is obligated to develop and franchise two additional Carl’s Jr. restaurants at varying times within 2005. In connection with the operation of its 17 franchised restaurants, KWK regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $3,612,931. During fiscal 2005, KWK paid royalty fees of $689,924, including royalties paid to CKE for its Green Burrito dual-brand restaurant, and advertising and promotional fees of $915,685, for all 17 restaurants combined. KWK was also a sublessee of CKE with respect to three restaurant locations during fiscal 2005. Rental payments equal 1% of annual gross sales of the restaurant in excess of $900,000, or minimum monthly rentals ranging from $5,101 to $9,410. The leases expire at varying times between September 2015 and February 2018. Total rents paid under these leases during fiscal 2005 totaled $251,578.

Daniel D. (Ron) Lane. M & N Foods, L.L.C. (“M&N”) is a franchisee of CKE and currently operates 24 Carl’s Jr. restaurants, seven of which are Carl Jr./Green Burrito dual-brand restaurants. Daniel D. (Ron) Lane is a director of CKE and an affiliate of M&N. Pursuant to a Development Agreement with CKE, M&N is obligated to develop and franchise five additional Carl’s Jr. restaurants at varying times by 2008. In connection with the operation of its 24 restaurants, M&N regularly purchases food and other products from CKE on the same terms and conditions as other franchisees. During fiscal 2005, these purchases totaled approximately $10,217,870. During fiscal 2005, M&N paid royalty fees of $1,368,114, including royalty fees paid to CKE for its Carl’s Jr./Green Burrito dual-brand restaurants, and advertising and promotional fees of $1,771,829. M&N was also a lessee or sublessee of CKE with respect to its 24 restaurant locations during fiscal 2005. Rental payments equal a percentage of the annual gross sales of the restaurants ranging from 0% to 5%, or minimum monthly rentals ranging from $2,958 to $14,984. The leases expire at varying times between February 2007 and November 2022. Rents paid under these leases during fiscal 2005 totaled $2,339,524.

23

Daniel E. Ponder, Jr. Ponder Enterprises, Inc. (“PEI”) is a franchisee of Hardee’s and currently operates 12 Hardee’s restaurants. Daniel E. Ponder, Jr. is a director of CKE and President and Chairman of the Board of PEI. During fiscal 2005, PEI paid CKE royalty fees of $385,456 for all 12 restaurants combined. PEI was also a sublessee of CKE with respect to one of its restaurant locations during fiscal 2005. Rental payments equal 1% of the annual gross sales of the restaurant in excess of $600,000, or minimum monthly rental of $669. The lease expires in November 2008. Total rent paid under this lease during fiscal 2005 aggregated $8,694.

CKE has a limited-term guarantee with an independent third party on behalf of certain of its Carl’s Jr. franchisees. CKE agreed to guarantee the payment obligations of SSC, BKI and KWK under these arrangements in fiscal 2005 up to a maximum amount of $260,641.

Restaurants leased from related parties generally were constructed by CKE on land purchased or leased by CKE. The properties were then sold to these parties and leased back by CKE. CKE believes that these sale and leaseback arrangements are at rental rates generally similar to those with unaffiliated third parties. The foregoing franchise and lease arrangements are on terms generally similar to those with unaffiliated parties.

In fiscal 2002, CKE entered into Stock Purchase and Loan Plan Agreements (“Loan Plan Agreements”) in accordance with the terms of the CKE Restaurants, Inc. Employee and Non-employee Director Stock Purchase and Loan Plan (the “Loan Plan”) with certain employees and members of its Board of Directors, whereby CKE lent the participants funds with which to purchase shares of the common stock of the Company in accordance with the provisions of the Loan Plan Agreements. The participants entered into promissory notes (the “Notes”) in favor of CKE in amounts set forth below, at a rate of 6%, all due and payable five years from the date of the Note. The Notes are prepayable, in whole or in part, at any time without penalty. In the event any shares acquired by the participant pursuant to a Loan Plan Agreement are sold, pledged, or otherwise transferred, the interest rate on the Note will immediately be adjusted to the then prime rate of interest as reported in The Wall Street Journal or similar publication, plus 4% (the “Disposition Rate”), and the participant will thereupon be required to make payments under the Note pursuant to a payment schedule to be attached to the Note reflecting the Disposition Rate. In the event of the participant’s death, disability or retirement, the entire unpaid principal balance of the Note and all accrued but unpaid interest shall become due and payable on the second anniversary of such event. In the event of the termination of the participant’s employment or directorship with the Company, the entire unpaid principal balance of the Note and all accrued but unpaid interest shall become due and payable 30 days following the date of termination. In the event of a default of any payment when due, the entire unpaid principal balance and all accrued but unpaid interest shall, at the option of the holder of the Note, become immediately due and payable. Following the enactment of the Sarbanes-Oxley ban on personal loans to directors and executive officers, in fiscal 2003, Messrs. Foley and Willey paid their outstanding balances in full. In fiscal 2005, the rest of the participating directors and executive officers paid their outstanding balances in full. No additional loans will be made under the Loan Plan.

CKE is party to arrangements with related parties that are not required to be disclosed in this Proxy Statement, but which are discussed in CKE’s Annual Report on Form 10-K.

PROPOSAL 2 — APPROVAL OF 2005 OMNIBUS INCENTIVE COMPENSATION PLAN

The Board of Directors has unanimously approved the 2005 Omnibus Incentive Compensation Plan (the “2005 Plan”), subject to stockholder approval at the Annual Meeting.

Description of the 2005 Plan

CKE’s 2005 Plan is an “omnibus” stock plan consisting of a variety of equity vehicles to provide flexibility in implementing equity awards, including incentive stock options, non-qualified stock options, restricted stock grants, unrestricted stock grants, stock appreciation rights and stock units. Participants in the 2005 Plan may be granted any one of the equity awards or any combination thereof, as determined by the Board of Directors. The following is a summary of the principal provisions of the 2005 Plan. This summary is qualified in its entirety by reference to the full text of the 2005 Plan, which is attached as Annex A to this Proxy Statement.

24

Purpose of the 2005 Plan. The purpose of the 2005 Plan is to further align the interests of employees and directors with those of the stockholders by providing incentive compensation opportunities tied to the performance of the common stock of the Company and by promoting increased ownership of the common stock by such individuals. The 2005 Plan is also intended to advance the interests of the Company and its stockholders by attracting, retaining and motivating key personnel upon whose judgment, initiative and effort the successful conduct of our business is largely dependent.

Shares Reserved for Issuance. We have reserved 2,500,000 shares of common stock for issuance under the 2005 Plan. As of May 3, 2005, there were 59,011,932 shares of Company common stock outstanding.

Limits on Awards. A maximum of 2,500,000 shares of common stock may be issued and sold under all awards, restricted and unrestricted, granted under the 2005 Plan. Of such aggregate limit, the maximum number of shares of common stock that may be issued under (i) incentive stock option awards shall be 2,500,000 shares, and (ii) all awards of restricted stock, stock units and stock awards, in the aggregate, shall be 750,000 shares. The maximum number of shares of common stock that may be subject to stock options, stock appreciation rights, restricted stock, stock units and stock awards, in the aggregate, granted to any one Participant (as defined below) during any single fiscal year period shall be 375,000 shares; provided, however, that the Company reserves the right to exceed this limitation in connection with any new hire of a Named Executive Officer if the Board of Directors determines that it is in the best interests of the Company to do so, but in no event shall this limitation exceed 475,000 shares. The foregoing limitations shall each be applied on an aggregate basis taking into account awards granted to a Participant under the 2005 Plan as well as awards of the same type granted to a Participant under any other equity-based compensation plan of the Company or any affiliate thereof.

Shares of common stock issued and sold under the 2005 Plan may be either authorized but unissued shares or shares held in the Company’s treasury. To the extent that any award involving the issuance of shares of common stock is forfeited, cancelled, repurchased by or returned to the Company for failure to satisfy vesting requirements or other conditions of the award, or otherwise terminates without an issuance of shares of common stock being made thereunder, the shares of common stock covered thereby will no longer be counted against the foregoing maximum share limitations and may again be made subject to awards under the 2005 Plan pursuant to such limitations. Any awards or portions thereof that are settled in cash and not in shares of common stock shall not be counted against the foregoing maximum share limitations. Any shares exchanged by a participant or withheld from a participant as full or partial payment to the Company of the exercise price or the tax withholding upon exercise or payment of an award will not be returned to the number of shares available for issuance under the 2005 Plan.

Administration. The Company’s Board of Directors shall delegate administration of the 2005 Plan to a committee comprised of no fewer than two members of the Board of Directors (the “Committee”). Each Committee member shall satisfy the requirements for (i) an “independent director” for purposes of CKE’s Corporate Governance Guidelines and the Compensation Committee Charter, (ii) an “independent director” under rules adopted by the NYSE, (iii) a “non-employee director” for purposes of Rule 16b-3 of the Exchange Act, and (iv) an “outside director” under Section 162(m) of the Internal Revenue Code.

The Committee shall have such powers and authority as may be necessary or appropriate to carry out the functions of the Committee as described in the 2005 Plan. Subject to the express limitations of the 2005 Plan, the Committee shall have authority in its discretion to determine the persons to whom, and the time or times at which, awards may be granted, the number of shares, units or other rights subject to each award, the exercise, base or purchase price of an award (if any), the time or times at which an award will become vested, exercisable or payable, the performance goals and other conditions of an award, the duration of the award and all other terms of the award. The Committee may prescribe, amend and rescind rules and regulations relating to the 2005 Plan. All interpretations, determinations and actions by the Committee shall be final, conclusive and binding upon all parties. Additionally, the Committee may delegate to one or more officers of the Company the ability to grant and determine terms and conditions of awards under the 2005 Plan to certain employees, and the Committee may delegate to any appropriate officer or employee of the Company responsibility for performing certain ministerial functions under the 2005 Plan.

25

Eligibility. Any person who is an employee of CKE or any affiliate thereof, any person to whom an offer of employment with CKE has been extended, as determined by the Committee, or any person who is a non-employee director is eligible to be designated by the Committee to receive awards and become a participant under the 2005 Plan (a “Participant” or the “Participants”).

Types of Plan Awards

CKE’s 2005 Plan includes the following equity compensation awards: incentive stock options, non-qualified stock options, restricted stock awards, unrestricted stock awards, stock appreciation rights and stock units, which are described below.

Stock Options. Stock options granted under the 2005 Plan may be either incentive stock options or non-qualified stock options, subject to the provisions of Section 422 of the Internal Revenue Code.

The exercise price per share of a stock option shall not be less than the fair market value of the Company’s common stock on the date the option is granted, provided that the Committee may in its discretion specify for any stock option an exercise price per share that is higher than the fair market value of the Company’s common stock on the date the option is granted. The exercise price is payable in cash, shares of CKE stock owned by the Participant exercising the option, through a broker-assisted cashless exercise or otherwise as provided by the Committee. The Committee shall determine the period during which a vested stock option may be exercised, provided that the maximum term of a stock option shall be ten years from the date the option is granted. Except as otherwise provided by the Committee, no stock option may be exercised at any time during the term thereof unless the Participant is then in the service of the Company or one of its affiliates.

Generally, a Participant’s right to exercise a stock option granted under the 2005 Plan expires, and such option terminates, (i) twelve months after termination of service if service ceased due to disability, (ii) eighteen months after termination of service if service ceased at a time when the Participant was eligible to elect immediate commencement of retirement benefits at a specified retirement age under a pension plan to which the Company or any of its affiliates had made contributions, (iii) eighteen months after termination of service if the Participant died while in the service of the Company or any of its affiliates, or (iv) three months after termination of service if service ceased for any other reason.

All stock options are nontransferable except (i) upon the Participant’s death or (ii) in the case of non-qualified stock options only, for the transfer of all or part of the stock option to a Participant’s “family member” (as defined for purposes of the Form S-8 registration statement under the Securities Act of 1933), as may be approved by the Committee in its discretion at the time of the proposed transfer.

Subject to anti-dilution adjustment provisions in the 2005 Plan, without the prior approval of CKE’s stockholders, evidenced by a majority of votes cast, neither the Committee nor the Board of Directors shall cause the cancellation, substitution or amendment of a stock option that would have the effect of reducing the exercise price of such a stock option previously granted under the 2005 Plan, or otherwise approve any modification to such a stock option that would be treated as a “repricing” under the then applicable rules, regulations or listing requirements adopted by the NYSE.

Stock Appreciation Rights. A stock appreciation right entitles a Participant, upon settlement, to receive a payment based on the increase of the value of CKE stock from the time the stock appreciation right is granted until the time it is exercised (or settled). Stock appreciation rights may be granted on a basis that allows for the exercise of the right by the Participant or that provides for the automatic payment of the right upon a specified date or event. Stock appreciation rights shall be exercisable or payable at such time or times and upon conditions as may be approved by the Committee, provided that the Committee may accelerate the exercisability or payment of a stock appreciation right at any time.

A stock appreciation right may be granted without any related stock option and may be subject to such vesting and exercisability requirements as specified by the Committee in an award agreement. Such vesting and exercisability requirements may be based on the continued service of the Participant with the Company or its affiliates for a specified time period (or periods) or on the attainment of specified performance goals established

26

by the Committee in its discretion. A stock appreciation right will be exercisable or payable at such time or times as determined by the Committee, provided that the maximum term of a stock appreciation right shall be ten years from the date the right is granted. The base price of a stock appreciation right granted without any related stock option shall be determined by the Committee in its sole discretion; provided, however, that the base price per share of any such freestanding stock appreciation right shall not be less than 100 percent of the fair market value of the shares of common stock of the Company on the date the right is granted.

A stock appreciation right may be granted in tandem with a stock option, either at the time of grant or at any time thereafter during the term of the stock option. A tandem stock option/stock appreciation right will entitle the holder to elect, as to all or any portion of the number of shares subject to such stock option/stock appreciation right, to exercise either the stock option or the stock appreciation right, resulting in the reduction of the corresponding number of shares subject to the right so exercised as well as the tandem right not so exercised. A stock appreciation right granted in tandem with a stock option hereunder shall have a base price per share equal to the per share exercise price of the stock option, which under the 2005 Plan shall not be less than 100 percent of the fair market value of the shares of common stock of the Company on the date the right is granted, and will be vested and exercisable at the same time or times that a related stock option is vested and exercisable and will expire no later than the time at which the related stock option expires.

A stock appreciation right will entitle the holder, upon exercise or other payment of the stock appreciation right, as applicable, to receive an amount determined by multiplying: (i) the excess of the fair market value of a share of common stock of the Company on the date of exercise or payment of the stock appreciation right over the base price of such stock appreciation right, by (ii) the number of shares as to which such stock appreciation right is exercised or paid. Payment of the amount determined under the foregoing may be made, as approved by the Committee and set forth in the award agreement, in shares of common stock valued at their fair market value on the date of exercise or payment, in cash, or in a combination of shares of common stock and cash, subject to applicable tax withholding requirements. Awards made under the 2005 Plan involving deferrals of income, including stock appreciation rights, must satisfy the requirements of Section 409A of the Internal Revenue Code to avoid adverse tax consequences to Participants. These requirements include limitations on election timing, including the timing of exercise of stock appreciation rights, acceleration of payments, and distributions of awards and award proceeds. The Company intends to structure any awards under the 2005 Plan, including awards of stock appreciation rights, to meet the applicable tax law requirements in Internal Revenue Code Section 409A in order to avoid these adverse tax consequences.

Subject to anti-dilution adjustment provisions in the 2005 Plan, without the prior approval of CKE’s stockholders, evidenced by a majority of votes cast, neither the Committee nor the Board of Directors shall cause the cancellation, substitution or amendment of a stock appreciation right that would have the effect of reducing the base price of such a stock appreciation right previously granted under the 2005 Plan, or otherwise approve any modification to such a stock appreciation right that would be treated as a “repricing” under the then applicable rules, regulations or listing requirements adopted by the NYSE.

Restricted Stock Awards. Restricted stock awards represent shares of CKE stock granted subject to restrictions on transfer and vesting requirements as determined by the Committee. The terms of a restricted stock award may require the Participant to pay a purchase price for the shares, or the Committee may provide that no payment is required. The restrictions imposed on shares granted under a restricted stock award shall lapse in accordance with the vesting requirements specified by the Committee in the award agreement, provided that the Committee may accelerate the vesting of a restricted stock award at any time. Such vesting requirements may be based on the continued service of the Participant with the Company or its affiliates for a specified time period (or periods) or on the attainment of specified performance goals established by the Committee in its discretion. If the vesting requirements of a restricted stock award are not satisfied prior to the termination of the Participant’s service, the award shall be forfeited and the shares of common stock subject to the award shall be returned to the Company. If the Participant paid for the restricted shares, then upon a termination of a Participant’s service the Company shall have the right to repurchase any restricted shares for the original purchase paid by the Participant.

27

Shares granted under any restricted stock award may not be transferred, assigned or made subject to any encumbrance, pledge or charge until all applicable restrictions are removed or have expired, unless otherwise allowed by the Committee. Failure to satisfy any applicable restrictions shall result in the subject shares of the restricted stock award being forfeited and returned to the Company (or repurchased by the Company, if the Participant paid for the restricted shares).

Subject to the provisions of the 2005 Plan and the applicable award agreement, the Participant shall have all rights of a stockholder with respect to the shares granted to the Participant under a restricted stock award, including the right to vote the shares and receive all dividends and other distributions paid or made with respect thereto. The Committee may provide in an award agreement for the payment of dividends and distributions to the Participant at such times as paid to stockholders generally or at the times of vesting or other payment of the restricted stock award.

Stock Unit Awards. A recipient of a stock unit award is entitled to receive a payment based on the fair market value of the Company’s common stock on the applicable date of delivery or other time period of determination, as specified by the Committee. A stock unit award shall be subject to such restrictions and conditions as the Committee shall determine. A stock unit award may be granted together with a dividend equivalent right with respect to the shares of common stock subject to the award, which may be accumulated and may be deemed reinvested in additional stock units, as determined by the Committee in its discretion.

On the date the award is granted, the Committee shall in its discretion determine any vesting requirements with respect to a stock unit award, which shall be set forth in the award agreement, provided that the Committee may accelerate the vesting of a stock unit award at any time. A stock unit award may also be granted on a fully-vested basis.

A stock unit award shall become payable to a Participant at the time or times determined by the Committee and set forth in the award agreement, which may be upon or following the vesting of the award. Payment of a stock unit award may be made, at the discretion of the Committee, in cash or in shares of common stock of the Company, or in a combination thereof, subject to applicable tax withholding requirements. Any cash payment of a stock unit award shall be made based upon the fair market value of one share of the common stock of the Company, multiplied by the number of stock units granted, determined at such time as provided by the Committee. Depending on their terms, stock unit awards may be subject to Internal Revenue Code Section 409A, which in certain circumstances will result in adverse tax consequences to Participants. The Company intends to structure any stock unit awards under the 2005 Plan to meet the applicable tax law requirements of Internal Revenue Code Section 409A in order to avoid these consequences.

To the extent that the Committee elects to make payments for stock unit awards in stock, the Participant shall not have any rights as a stockholder with respect to the shares subject to a stock unit award until such time as shares of common stock are delivered to the Participant pursuant to the terms of the award agreement.

Stock Awards. A stock award granted to a Participant represents shares of the Company’s common stock that are issued without restrictions on transfer and other incidents of ownership and free of forfeiture conditions, except as otherwise provided in the 2005 Plan and the award agreement. A stock award may be granted for past services, in lieu of bonus or other cash compensation, as directors’ compensation or for any other valid purpose as determined by the Committee. The Committee may, in connection with any stock award, require the payment of a specified purchase price.

Subject to the provisions of the 2005 Plan and the applicable award agreement, upon the issuance of the common stock under a stock award the Participant shall have all rights of a stockholder with respect to the shares of common stock, including the right to vote the shares and receive all dividends and other distributions paid or made with respect thereto.

28

Change in Control

Awards under the 2005 Plan are subject to special provisions upon the occurrence of a “change in control” (as defined in the 2005 Plan) transaction with respect to the Company. Under the 2005 Plan, if within 12 months of a change in control there occurs a “triggering event” (as defined in the 2005 Plan), (i) each outstanding stock option and stock appreciation right, to the extent that it shall not otherwise have become vested and exercisable, shall automatically become fully and immediately vested and exercisable, without regard to any otherwise applicable vesting requirement, (ii) each restricted stock award shall become fully and immediately vested and all forfeiture and transfer restrictions thereon, and all of the Company’s repurchase rights with respect to such restricted shares, shall lapse, and (iii) each outstanding stock unit award shall become immediately and fully vested and payable.

Section 162(m) Awards

Awards of options and stock appreciation rights granted under the 2005 Plan will automatically qualify for the “performance-based compensation” exception under Internal Revenue Code Section 162(m) pursuant to their expected terms. Awards of restricted stock, stock units and stock awards may qualify under Section 162(m) of the Internal Revenue Code if the terms of the award state, in terms of an objective formula or standard, the method of computing the amount of compensation payable under the award and preclude discretion to increase the amount of compensation payable under the terms of the award.

Term of 2005 Plan

The 2005 Plan shall terminate on March 22, 2015, which is the tenth anniversary of the date of its adoption by the Board of Directors. The Board of Directors may, in its discretion and at any earlier date, terminate the 2005 Plan. Notwithstanding the foregoing, no termination of the 2005 Plan shall adversely affect any award theretofore granted without the consent of the Participant or the permitted transferee of the award.

New Plan Benefits

Future awards to our employees and directors are discretionary. Therefore, the benefits that may be received by our employees and directors if the Company’s stockholders approve the 2005 Plan cannot be determined at this time. In addition, because the value of the common stock issuable under aspects of the 2005 Plan will depend on the fair market value of the Company’s common stock at future dates, it is not possible to determine exactly the benefits that might be received by Participants under the 2005 Plan.

Summary of Federal Income Tax Consequences of the 2005 Plan

The following is a brief summary of certain federal income tax consequences of participation in the 2005 Plan. The summary should not be relied upon as being a complete statement of all possible federal income tax consequences. Federal tax laws are complex and subject to change. Participation in the 2005 Plan may also have consequences under state and local tax laws which vary from the federal tax consequences described below. For such reasons, we recommend that each Participant consult his or her personal tax advisor to determine the specific tax consequences applicable to him or her.

Incentive Stock Options. No taxable income will be recognized by a Participant under the 2005 Plan upon either the grant or the exercise of an incentive stock option. Instead, a taxable event will occur upon the sale or other disposition of the shares acquired upon exercise of an incentive stock option, and the tax treatment of the gain or loss realized will depend upon how long the shares were held before their sale or disposition. If a sale or other disposition of the shares received upon the exercise of an incentive stock option occurs more than (i) one year after the date of exercise of the option and (ii) two years after the date of grant of the option, the holder will recognize long-term capital gain or loss at the time of sale equal to the full amount of the difference between the proceeds realized and the exercise price paid. However, a sale, exchange, gift or other transfer of legal title of such stock (other than certain transfers upon the Participant’s death) before the expiration of either of the one-year or two-year periods described above will constitute a “disqualifying disposition.” A disqualifying disposition involving a sale or exchange will result in ordinary income to the Participant in an amount equal to the lesser of

29

(i) the fair market value of the stock on the date of exercise minus the exercise price or (ii) the amount realized on disposition minus the exercise price. If the amount realized in a disqualifying disposition exceeds the fair market value of the stock on the date of exercise, the gain realized in excess of the amount taxed as ordinary income as indicated above will be taxed as capital gain. A disqualifying disposition as a result of a gift will result in ordinary income to the Participant in an amount equal to the difference between the exercise price and the fair market value of the stock on the date of exercise. Any loss realized upon a disqualifying disposition will be treated as a capital loss. Capital gains and losses resulting from disqualifying dispositions will be treated as long-term or short-term depending upon whether the shares were held for more or less than the applicable statutory holding period (which currently is more than one year for long-term capital gains). The Company will be entitled to a tax deduction in an amount equal to the ordinary income recognized by the Participant as a result of a disposition of the shares received upon exercise of an incentive stock option.

The exercise of an incentive stock option may result in an “adjustment” for purposes of the “alternative minimum tax.” Alternative minimum tax is imposed on an individual’s income only if the amount of the alternative minimum tax exceeds the individual’s regular tax for the year. For purposes of computing alternative minimum tax, the excess of the fair market value on the date of exercise of the shares received on exercise of an incentive stock option over the exercise price paid is included in alternative minimum taxable income in the year the option is exercised. A Participant who is subject to alternative minimum tax in the year of exercise of an incentive stock option may claim as a credit against the Participant’s regular tax liability in future years the amount of alternative minimum tax paid which is attributable to the exercise of the incentive stock option. This credit is available in the first year following the year of exercise in which the Participant has regular tax liability.

Non-Qualified Stock Options. Generally, no taxable income is recognized by a Participant upon the grant of a non-qualified stock option if at the time of grant the exercise price for such option is equal to or greater than the fair market value of the stock to which such option relates. Upon exercise, however, the Participant will recognize ordinary income in the amount by which the fair market value of the shares purchased, on the date of exercise, exceeds the exercise price paid for such shares. The income recognized by the Participant who is an employee of CKE be subject to income tax withholding by CKE out of the Participant’s current compensation. If such compensation is insufficient to pay the taxes due, the Participant will be required to make a direct payment to us for the balance of the tax withholding obligation. We will be entitled to a tax deduction equal to the amount of ordinary income recognized by the Participant, provided that certain reporting requirements are satisfied. If the exercise price of a non-qualified stock option is paid by the Participant in cash, the tax basis of the shares acquired will be equal to the cash paid plus the amount of income recognized by the Participant as a result of such exercise. If the exercise price is paid by delivering shares of our common stock already owned by the Participant or by a combination of cash and already-owned shares, there will be no current taxable gain or loss recognized by the Participant on the already-owned shares exchanged (however, the Participant will nevertheless recognize ordinary income to the extent that the fair market value of the shares purchased on the date of exercise exceeds the price paid, as described above). The new shares received by the Participant, up to the number of the old shares exchanged, will have the same tax basis and holding period as the Participant’s basis and holding period in the old shares. The balance of the new shares received will have a tax basis equal to any cash paid by the Participant plus the amount of income recognized by the Participant as a result of such exercise, and will have a holding period commencing with the date of exercise. Upon the sale or disposition of shares acquired pursuant to the exercise of a non-qualified stock option, the difference between the proceeds realized and the Participant’s basis in the shares will be a capital gain or loss and will be treated as long-term capital gain or loss if the shares have been held for more than the applicable statutory holding period (which is currently more than one year for long-term capital gains).

Restricted Stock. If no election is made under Section 83(b) of the Internal Revenue Code and repurchase rights are retained by CKE, a taxable event will occur on each date the Participant’s ownership rights vest (e.g., when our repurchase rights expire) as to the number of shares that vest on that date, and the holding period for capital gain purposes will not commence until the date the shares vest. The Participant will recognize ordinary income on each date shares vest in an amount equal to the excess of the fair market value of such shares on that date over the amount paid for such shares. Any income recognized by a Participant who is an employee will be subject to income tax withholding by us out of the Participant’s current compensation. If such compensation is

30

insufficient to cover the amount to be withheld, the Participant will be required to make a direct payment to us for the balance of the tax withholding obligation. We are entitled to a tax deduction in an amount equal to the ordinary income recognized by the Participant. The Participant’s basis in the shares will be equal to the purchase price, if any, increased by the amount of ordinary income recognized. If instead an Internal Revenue Code Section 83(b) election is made within 30 days after the date of transfer, or if no repurchase rights are retained by us, then the Participant will recognize ordinary income on the date of purchase in an amount equal to the excess of the fair market value of such shares on the date of purchase over the purchase price paid for such shares.

Stock Appreciation Rights. Generally, no taxable income is recognized by a Participant receiving a stand alone non-vested stock appreciation right payable in cash at the time the stock appreciation right is granted where the base value is equal to the fair market value of CKE’s stock and the Participant is required to exercise the stock appreciation right at the time it becomes vested. Upon exercise, if the Participant receives the appreciation inherent in the stock appreciation right in cash, the cash will be taxed as ordinary income to the Participant at the time it is received so long as the right is exercised as it becomes vested. If the Participant receives the appreciation inherent in a stock appreciation right in stock, the spread between the then current market value and the base price will be taxed as ordinary income to the Participant at the time it is received. If a stock appreciation right payable in cash is not required to be exercised as it becomes vested, then such right may subject a Participant to certain adverse tax consequences under Internal Revenue Code Section 409A, discussed below.

We are not entitled to a federal income tax deduction upon the grant or termination of a stock appreciation right. However, upon the settlement of a stock appreciation right, we are entitled to a deduction equal to the amount of ordinary income the Participant is required to recognize as a result of the settlement.

Stock Unit Awards. Stock unit awards are generally includable in income in the year received or made available to the Participant without substantial limitations or restrictions. However, depending on their terms, stock unit awards may be subject to Internal Revenue Code Section 409A, discussed below, which in certain circumstances will result in adverse tax consequences to Participants. Generally, we will be entitled to deduct the amount the Participant includes in income as a compensation expense in the year of payment.

Deferred Compensation. As noted above in the description of the 2005 Plan, any deferrals made under the 2005 Plan, including awards granted under the plan that are considered to be deferred compensation, must satisfy the requirements of Internal Revenue Code Section 409A to avoid adverse tax consequences to Participants, which include the current inclusion of deferred amounts in income and interest and a surtax on any amount included in income. The Section 409A requirements include limitations on election timing, acceleration of payments, and distributions. Section 409A applies to certain stock appreciation rights, stock unit awards, discounted stock options, and other awards that provide the Participant with an opportunity to defer to recognition of income. We intend to structure any awards under the 2005 Plan to meet the applicable tax law requirements under Internal Revenue Code Section 409A in order to avoid its adverse tax consequences.

Tax Withholding. Participants are responsible for payment of any taxes or similar charges required by law to be withheld from an award or an amount paid in satisfaction of an award, which shall be paid by the Participant on or prior to the payment or other event that results in taxable income in respect of an award. The award agreement may specify the manner in which the withholding obligation shall be satisfied with respect to the particular type of award.

31

Equity Compensation Plan Information

The following table provides information relating to our equity compensation plans as of January 31, 2005.

Plan Category

| | | | Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

Equity Compensation

Plans (Excluding

Securities Reflected

in Column (a))

|

|---|

| | | | (a)

| | (b)

| | (c)

|

|---|

| Equity compensation plans approved by stockholders | | | | | 8,993,347 | | | $ | 11.14 | | | | 847,736 | |

| Equity compensation plans not approved by stockholders | | | | | 673,871 | | | $ | 7.90 | | | | 57,669 | |

| Total | | | | | 9,667,218 | | | $ | 10.92 | | | | 905,405 | |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

FOR THE APPROVAL OF THE 2005 OMNIBUS INCENTIVE COMPENSATION PLAN.

PROPOSAL 3 — APPROVAL OF AMENDMENT TO 1994 EMPLOYEE STOCK PURCHASE PLAN

The Board of Directors has unanimously approved an amendment to the 1994 Employee Stock Purchase Plan (the “ESPP”), subject to stockholder approval at the Annual Meeting.

Description of the ESPP

Our ESPP was adopted by the Board of Directors on September 27, 1994 and approved by the stockholders on June 21, 1995. The ESPP was subsequently amended on May 2, 1996 and again on March 31, 2003. This summary is qualified in its entirety by reference to the full text of the ESPP, which is attached as Annex B to this Proxy Statement.

Purpose of the ESPP. The purpose of the ESPP is to encourage a sense of proprietorship on the part of employees of CKE and its subsidiaries by assisting such employees in making regular purchases of shares of the Company’s common stock, and thus to benefit the Company by increasing such employees’ interest in the growth of the Company and its subsidiaries and in such entities’ financial success.

Shares Reserved for Issuance. We reserved 2,907,000 shares of common stock for issuance under the ESPP. Approximately 104,075 shares of common stock remain available for issuance. If the stockholders approve this amendment to the ESPP, an additional 1,000,500 shares will become available for issuance under the ESPP.

Administration. The Company’s Board of Directors shall delegate administration of the ESPP to a committee appointed by the Board of Directors. All questions of interpretation and/or application of the ESPP shall be determined by such committee. All interpretations, determinations and actions by the committee shall be final, conclusive and binding upon all parties.

Eligibility. Any person who has reached the age of majority and is an employee of CKE or a subsidiary thereof (i) on an hourly basis as a restaurant employee for at least 30 hours per week and has been so employed continuously during the preceding one (1) year; (ii) on an hourly basis as a non-restaurant employee for at least 30 hours per week and has been so employed continuously during the preceding one (1) year; or (iii) is exempt from the overtime and minimum wage requirements under federal and state laws and has been so employed continuously during the preceding 90 days is eligible to participate in the ESPP (an “ESPP Participant” or the “ESPP Participants”).

32

Approximately 30,817 employees are eligible to participate in the ESPP and 446 have elected to do so. Through fiscal year-end, a total of 2,803,425 shares of the Company’s common stock have been purchased by CKE and participants in the ESPP since the adoption of the ESPP.

Offering Dates. Shares of the Company’s common stock shall be offered pursuant to the ESPP in offering periods coinciding with CKE’s fiscal quarters.

Purchase and Delivery of Shares. Following the acceptance by CKE of an employee’s enrollment form, CKE shall direct a financial institution to open and maintain an account in the name of such employee and to purchase shares of the Company’s common stock on behalf of such employee as permitted under the ESPP.

Since the inception of the ESPP in 1994, CKE employees have contributed from their own money an aggregate of $8,679,006, and the Company has provided matching contributions for the benefit of these employees in the aggregate amount of $3,471,402. These contributions have purchased 1,595,778 and 643,184 shares, respectively. All of these shares, both utilizing the employees’ contributions and the Company’s contributions, have been purchased in the open-market by the financial institution designated by CKE to maintain and administer an account in the name of each ESPP Participant. It is our preference and intention to continue to fulfill our matching obligations by contributing cash for the purpose of purchasing shares in the open-market. However, if the Board of Directors believes that, in satisfying any matching obligations the Company has under the ESPP, it is in the best interests of the Company to contribute authorized but unissued shares rather than cash to purchase shares in the open-market, the Company reserves the right to do so.

Matching Contribution

For those ESPP Participants that are neither officers nor directors of CKE, CKE will make a matching contribution equal to either one-third of the number of shares purchased on behalf of the participant or one-third of the dollar amount contributed by such participant, at CKE’s sole discretion, less withholding taxes associated therewith. For ESPP Participants that are either officers or directors of CKE, CKE will make a matching contribution equal to either one-half of the number of shares purchased on behalf of the participant or one-half of the dollar amount contributed by such participant, at CKE’s sole discretion, less withholding taxes associated therewith.

Capital Changes

If there are any changes in the capitalization of CKE, such as through mergers, consolidations, reorganizations, recapitalizations, stock splits or stock dividends, appropriate adjustments will be made by CKE in the number of shares of its common stock subject to purchase under the ESPP.

Number of Shares Purchased

Given that the number of shares that may be purchased under the ESPP is determined, in part, by the common stock’s market value at the end of an offering period and that participation in the ESPP is voluntary on the part of employees, the actual number of shares that may be purchased by any individual is not determinable. For illustrative purposes, the following table sets forth for each of the Company’s executive officers and directors the number of shares of common stock purchased during the 2005 fiscal year under the ESPP and the average price per share paid for such shares.

Name of Individual or Group

| | | | Number

of shares

purchased

| | Average

per share

purchase price

|

|---|

| Andrew F. Puzder | | | | | 17,962 | | | $ | 11.38 | |

| E. Michael Murphy | | | | | 435 | | | $ | 11.49 | |

| John J. Dunion | | | | | 1,056 | | | $ | 10.23 | |

| Theodore Abajian | | | | | 5,208 | | | $ | 12.25 | |

| Brad R. Haley | | | | | 1,136 | | | $ | 11.82 | |

| Renea S. Hutchings | | | | | 3,263 | | | $ | 11.86 | |

33

Amendment and Termination

The Board of Directors may amend or terminate the ESPP at any time. If the ESPP is terminated, each ESPP Participant shall be entitled to receive as promptly as possible from CKE all payroll deductions attributable to him or her which have not been used for purchase of common stock under the ESPP, but such ESPP Participant shall not be entitled to the benefit of any future matching contributions with respect to such deductions, interest or otherwise for any past offering period.

Tax Consequences

The ESPP is not intended to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code. To the extent an ESPP Participant receives shares of the common stock of the Company for a price less than its fair market value, the ESPP Participant will recognize income equal to such difference. The ESPP provides for the purchase of shares to be made at fair market value; therefore, there should be no income to the ESPP Participant upon the purchase of shares of common stock of the Company.

CKE will be required to withhold federal income tax with respect to the matching contributions made by the Company or its subsidiary. These amounts will be withheld at the end of the period that the shares purchased with the matching contribution are subject to forfeiture. Such amounts will be withheld from the remainder of the base earnings (as defined in the ESPP) of the ESPP Participant and not from amounts placed in the ESPP Participant’s account.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE AMENDMENT TO THE 1994 EMPLOYEE STOCK PURCHASE PLAN.

34

INDEPENDENT PUBLIC ACCOUNTANTS

KPMG LLP (“KPMG”) audited the Company’s consolidated financial statements for the fiscal year ended January 31, 2005. A representative of KPMG will attend the Annual Meeting and will be available to respond to appropriate questions.

The Company has not formally retained an independent accounting firm to audit our consolidated financial statements for the fiscal year ending January 31, 2006, or to conduct reviews of the Company’s quarterly financial statements for the first three quarters of fiscal 2006. However, the Company expects KPMG to review our financial statements for the first quarter of fiscal 2006 in a manner similar to that in which KPMG has conducted its review of the Company’s quarterly financial statements in prior fiscal years.

The Audit Committee’s Charter provides that the Audit Committee, or a designated member thereof, must pre-approve services to be performed by the Company’s independent registered public accounting firm. In accordance with that requirement, the Audit Committee pre-approved the engagements of KPMG pursuant to which it provided the audit, tax and the other services described below for the fiscal year ended January 31, 2005.

Fees Paid to Independent Auditors

The following table presents fees for professional audit services rendered by KPMG LLP for audit of the Company’s annual financial statements for fiscal 2005 and fiscal 2004, and fees billed for other services rendered by KPMG LLP.

Name

| | | | 2005

| | Percentage of 2005

Services Approved by

Audit Committee

| | 2004

| | Percentage of 2004

Services Approved by

Audit Committee

|

|---|

| Audit Fees (1) | | | | $ | 1,961,582 | | | | 100 | % | | $ | 725,600 | | | | 100 | % |

| Audit-Related Fees (2) | | | | | — | | | | 100 | % | | $ | 47,890 | | | | 100 | % |

| Tax Fees (3) | | | | $ | 10,370 | | | | 100 | % | | $ | 44,343 | | | | 100 | % |

| (1) | | Audit services consist of the audit of annual financial statements, audit of the effectiveness of our internal control over financial reporting as of January 31, 2005 as required by Section 404 of the Sarbanes-Oxley Act, SAS 100 quarterly reviews, review of UFOC/registration statements and issuance of comfort letters and consents. |

| (2) | | Audit-related fees consist principally of the audit of CKE’s pension plan and ERISA compliance. |

| (3) | | Tax services consist of tax compliance and tax planning advice to fully owned subsidiary, Carl Karcher Enterprises, Inc. |

35

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor.

Prior to engagement of the independent auditor for the next year’s audit, management will submit an aggregate of services expected to be rendered during that year for each of four categories of services to the Audit Committee for approval.

1. Audit services include audit work performed in the preparation of financial statements, as well as work that generally only the independent auditor can reasonably be expected to provide, including comfort letters, statutory audits, and attest services and consultation regarding financial accounting and/or reporting standards.

2. Audit-related services include assurance and related services that are traditionally performed by the independent auditor, including due diligence related to mergers and acquisitions, employee benefit plan audits and special procedures required to meet certain regulatory requirements.

3. Tax services include all services performed by the independent auditor’s tax personnel, except those services specifically related to the audit of the financial statements, and include fees in the areas of tax compliance, tax planning and tax advice.

4. Other fees are those associated with services not captured in the other categories. The Company generally does not request such services from the independent auditor.

Prior to engagement, the Audit Committee pre-approves these services by category of service. The fees are budgeted and the Audit Committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent auditor for additional services not contemplated in the original pre-approval. In those instances, the Audit Committee requires specific pre-approval before engaging the independent auditor.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

Auditor Independence

The Audit Committee has considered whether the independent auditor’s provision of non-audit services to the Company is compatible with maintaining the auditor’s independence and has concluded that the provision of such non-audit services does not compromise the independence of KPMG LLP.

36

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is comprised of three non-management directors and operates pursuant to a written Charter that is available on our website at www.ckr.com. During fiscal 2005, the Audit Committee held 11 meetings. The Audit Committee’s purpose is to (a) assist the Board of Directors in its oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the Company’s independent auditors’ qualifications and independence, and (iv) the performance of the Company’s internal audit function and independent auditors; (b) to decide whether to appoint, retain or terminate the Company’s independent auditors and to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors; and (c) to prepare this Report. The Board of Directors has determined, upon the recommendation of the Nominating & Corporate Governance Committee, that each member of the Audit Committee is “independent” within the meaning of the rules of both the NYSE and the SEC. The Board of Directors has also determined that each member is financially literate and has accounting or related financial management expertise, as such qualifications are defined under the rules of the NYSE, and that Mr. Ammerman is an “audit committee financial expert” within the meaning of the rules of the SEC.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles and the establishment and effectiveness of internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for performing an independent audit of the financial statements in accordance with generally accepted auditing standards. The independent auditors have free access to the Audit Committee to discuss any matters they deem appropriate.

In performing its oversight role, the Audit Committee has considered and discussed the audited financial statements with management and the independent auditors. The Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. The Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect, and has discussed with the auditors the auditors’ independence. All non-audit services performed by the independent auditors must be specifically pre-approved by the Audit Committee or a member thereof.

During fiscal 2005, the Audit Committee performed all of its duties and responsibilities under the then applicable Charter of the Audit Committee. In addition, based on the reports and discussions described in this Report, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Company for fiscal 2005 be included in its Annual Report on Form 10-K for the Company’s fiscal year ended January 31, 2005.

Dated: May 20, 2005

AUDIT COMMITTEE

/s/

Douglas K. Ammerman (Chairman)

Peter Churm

Byron Allumbaugh

Frank P. Willey (member during fiscal 2005)

The report of the Audit Committee of the Board of Directors shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that CKE specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

37

OTHER MATTERS

Other Business

Presented by Management. Management does not know of any matter to be acted upon at the Meeting other than the matters described above, but if any other matter properly comes before the Meeting, the persons named on the enclosed proxy card will vote thereon in accordance with their best judgment.

Presented by Stockholders. As no nominations and/or proposals were timely submitted to the Company, there are no matters proposed by stockholders which are to be acted/voted upon.

FUTURE STOCKHOLDER PROPOSALS

Any stockholder who intends to present a proposal at the annual meeting in the year 2006 must deliver the proposal to the Corporate Secretary at 6307 Carpinteria Avenue, Suite A, Carpinteria, California 93013:

1. Not later than January 31, 2006, if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8(e)(2) under the Securities Exchange Act of 1934, as amended. As the rules of the SEC make clear, simply submitting a proposal does not guarantee its inclusion.

2. Not later than March 30, 2006 (based on a tentative Annual Meeting date of June 28, 2006), if the proposal is submitted pursuant to CKE’s bylaws, in which case we are not required to include the proposal in our proxy materials.

Any notice to the Secretary must include as to each matter the stockholder proposes to bring before the meeting: (a) a brief description of the business desired to be brought before the meeting and the reason for conducting such business at the annual meeting, (b) the name and record address of the stockholder proposing such business, (c) the class and number of shares of CKE which are beneficially owned by the stockholder, and (d) any material interest of the stockholder in such business. In addition, the stockholder making such proposal shall promptly provide any other information reasonably requested by CKE.

Policies on Reporting of Concerns Regarding Accounting and Other Matters and on Communicating with Non-Management Directors

We have adopted policies on reporting of concerns regarding accounting and other matters and on communicating with our non-management directors. Any person, whether or not an employee, who has a concern about the conduct of the Company or any of our people, including with respect to our accounting, internal accounting controls or auditing issues, may communicate that concern to Hilary Burkemper, our Compliance Officer, at hburkemper@ckr.com, or the Audit Committee of the Board of Directors at auditcommittee@ckr.com, or, to maintain anonymity, by sending correspondence to the private mail box address at CKE Restaurants, Inc., Audit Committee, 6307 Carpinteria Avenue, Suite A, Carpinteria, California 93013. Any interested party, whether or not an employee, who wishes to communicate directly with the presiding director of the executive sessions of our non-management directors, or with our non-management directors as a group, may contact Hilary Burkemper at (805) 745-7500.

38

ANNEX A

CKE Restaurants, Inc.

2005 Omnibus Incentive Compensation Plan

(Adopted by the Board of Directors on March 22, 2005)

Table of Contents

| | | | Page

|

|---|

| 1. Purpose | | | | | 1 | |

| |

| 2. Definitions | | | | | 1 | |

| |

| 3. Administration | | | | | 2 | |

| 3.1 Committee Members | | | | | 2 | |

| 3.2 Committee Authority | | | | | 2 | |

| 3.3 Delegation of Authority | | | | | 3 | |

| 3.4 Grants to Non-Employee Directors | | | | | 3 | |

| |

| 4. Shares Subject to the Plan | | | | | 3 | |

| 4.1 Maximum Share Limitations | | | | | 3 | |

| 4.2 Individual Participant Limitations | | | | | 3 | |

| 4.3 Adjustments | | | | | 4 | |

| |

| 5. Participation and Awards | | | | | 4 | |

| 5.1 Designations of Participants | | | | | 4 | |

| 5.2 Determination of Awards | | | | | 4 | |

| |

| 6. Stock Options | | | | | 4 | |

| 6.1 Grant of Stock Options | | | | | 4 | |

| 6.2 Exercise Price | | | | | 4 | |

| 6.3 Vesting of Stock Options | | | | | 4 | |

| 6.4 Term of Stock Options | | | | | 4 | |

| 6.5 Termination of Service | | | | | 5 | |

| 6.6 Stock Option Exercise; Tax Withholding | | | | | 5 | |

| 6.7 Limited Transferability of Nonqualified Stock Options | | | | | 5 | |

| 6.8 Additional Rules for Incentive Stock Options | | | | | 5 | |

| (a) Eligibility | | | | | 5 | |

| (b) Annual Limits | | | | | 5 | |

| (c) Termination of Employment | | | | | 6 | |

| (d) Other Terms and Conditions; Nontransferability | | | | | 6 | |

| (e) Disqualifying Dispositions | | | | | 6 | |

| 6.9 Repricing Prohibited | | | | | 6 | |

| |

| 7. Stock Appreciation Rights | | | | | 6 | |

| 7.1 Grant of Stock Appreciation Rights | | | | | 6 | |

| 7.2 Freestanding Stock Appreciation Rights | | | | | 6 | |

| 7.3 Tandem Stock Option/Stock Appreciation Rights | | | | | 6 | |

| 7.4 Payment of Stock Appreciation Rights | | | | | 7 | |

| 7.5 Repricing Prohibited | | | | | 7 | |

| 7.6 Compliance with Code Section 409A | | | | | 7 | |

| |

| 8. Restricted Stock Awards | | | | | 7 | |

| 8.1 Grant of Restricted Stock Awards | | | | | 7 | |

| 8.2 Vesting Requirements; Repurchase Rights | | | | | 7 | |

| 8.3 Restrictions | | | | | 7 | |

| 8.4 Rights as Shareholder | | | | | 7 | |

| 8.5 Section 83(b) Election | | | | | 8 | |

i

Table of Contents

(continued)

| | | | Page

|

|---|

| |

| 9. Stock Unit Awards | | | | | 8 | |

| 9.1 Grant of Stock Unit Awards | | | | | 8 | |

| 9.2 Vesting of Stock Unit Awards | | | | | 8 | |

| 9.3 Payment of Stock Unit Awards | | | | | 8 | |

| 9.4 No Rights as Shareholder | | | | | 8 | |

| 9.5 Compliance with Code Section 409A | | | | | 8 | |

| |

| 10. Stock Awards | | | | | 8 | |

| 10.1 Grant of Stock Awards | | | | | 8 | |

| 10.2 Rights as Shareholder | | | | | 8 | |

| |

| 11. Change in Control | | | | | 8 | |

| 11.1 Effect of Change in Control | | | | | 8 | |

| 11.2 Definitions | | | | | 9 | |

| (a) Cause | | | | | 9 | |

| (b) Change in Control | | | | | 9 | |

| (c) Constructive Termination | | | | | 10 | |

| (d) Triggering Event | | | | | 10 | |