UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-08382

Deutsche Strategic Income Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 11/30 |

| | |

| Date of reporting period: | 11/30/2016 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

November 30, 2016

Annual Report

to Shareholders

Deutsche Strategic Income Trust

Ticker Symbol: KST

Contents

3 Portfolio Management Review 10 Performance Summary 11 Important Notice 12 Investment Portfolio 32 Statement of Assets and Liabilities 33 Statement of Operations 35 Statement of Cash Flows 36 Statements of Changes in Net Assets 37 Financial Highlights 38 Notes to Financial Statements 51 Report of Independent Registered Public Accounting Firm 52 Tax Information 53 Shareholder Meeting Results 55 Dividend Reinvestment and Cash Purchase Plan 58 Advisory Agreement Board Considerations and Fee Evaluation 62 Board Members and Officers 67 Additional Information |

The fund's investment objective is to provide high current income.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Leverage results in additional risks and can magnify the effect of any gains or losses. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Management Review (Unaudited)

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when sold. Current performance may differ from performance data shown. Please visit deutschefunds.com for the fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Please refer to pages 10 through 11 for more complete performance information.

On July 13, 2016, the Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than December 31, 2018.

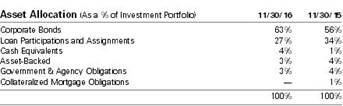

Investment Process The fund’s investment objective is to provide high current income. The fund seeks to achieve its objective by investing its assets in a combination of (1) lower-rated corporate fixed-income securities, (2) fixed-income securities of emerging markets and other foreign issuers, and (3) fixed-income securities of the U.S. government and its agencies and instrumentalities and private mortgage-backed issuers. |

Deutsche Strategic Income Trust returned 7.82% based on net asset value (NAV) for the one-year period ended November 30, 2016. The fund’s return based on the market price of its shares quoted on the New York Stock Exchange was 20.56%. The fund began the period trading at a 16.81% discount to net asset value, and it finished at a 6.98% discount. The fund’s peer group averaged a 11.7% discount at the beginning of the period, and it finished at a 8.7% discount.

High-yield bonds, as measured by the unmanaged, unleveraged BofA Merrill Lynch US High Yield Master II Constrained Index, returned 12.25%. Emerging-markets bonds, as gauged by the unmanaged, unleveraged JPMorgan EMBI Global Diversified Index, returned 7.19%.

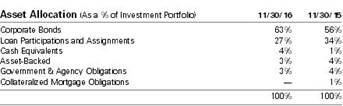

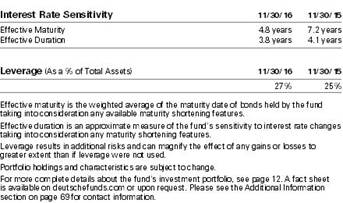

The fund maintained a leveraged position, meaning that it borrowed money as permitted under its investment policies and the Investment Company Act of 1940. The portfolio was approximately 27% leveraged at the close of the period, meaning the fund borrowed $20.5 million. In employing leverage, the fund uses a secured line of credit and then invests the proceeds. Leverage results in additional risks and can magnify the effect of any gains or losses.

| "The fund delivered strong absolute returns due to its emphasis on the credit sectors, but it lost some relative performance from its underweight positions in lower-quality securities." |

Domestic high-yield bonds produced significant gains in the past 12 months, with the strongest returns concentrated in the interval from March through August. In the initial months of the reporting period, the market lost ground due to the substantial downturn in energy and commodity prices, along with concerns about a potential global economic slowdown caused by weakening growth in China. In mid-February, these worries subsided and commodities experienced a sizable rebound. In addition, the accommodative monetary policies adopted by global central banks prompted investors to search for yield in riskier assets. Together, these positive shifts sparked a strong recovery in high yield and fueled a sharp decline in yield spreads. While the asset class gave up some ground in November as investors recalibrated their expectations for U.S. Federal Reserve Board (the Fed) policy in the wake of Donald Trump’s election, it nonetheless finished with a double-digit return on the strength of its earlier gains. CCC-rated issues outpaced the broader market for the full year, followed by Bs and BBs, respectively. The rally in commodity prices provided a substantial tailwind to CCCs due to the larger representation of energy and commodity-related issues in the credit tier.

Senior loans also posted healthy returns in the period, reflecting the hearty investor demand for higher-yielding securities from mid-February onward. While the asset class finished with a solid gain, it trailed high yield. Investors generally favored riskier securities in the past year, which worked against senior loans given that they are higher in the corporate capital structure. In addition, loans’ performance was depressed somewhat by above-average new issue supply.

As was the case with other higher-risk fixed-income asset classes, emerging-markets debt was supported by increasing commodity prices and investors’ appetite for higher-yielding assets. The emerging markets were further aided by the improvement in global economic conditions and encouraging political developments in select countries.

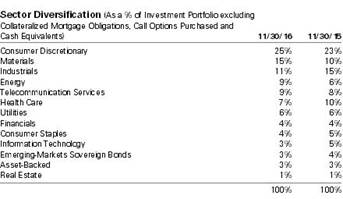

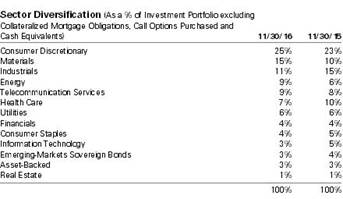

Performance Attribution

The fund delivered strong absolute returns due to its emphasis on the credit sectors, but it lost some relative performance from its underweight positions in lower-quality securities. In U.S. high yield, for instance, the fund held below-benchmark weightings in the energy sector and in lower-quality bonds rated CCC and below. We took a similarly risk-conscious approach in the emerging markets by tilting the portfolio toward more stable countries over those, such as Venezuela, that featured above-average risk. While this strategy detracted somewhat in the short term, we saw it as the most prudent approach at a time of elevated volatility and the presence of multiple risk factors.

The fund’s allocation to senior loans had an adverse impact on relative performance, as well. However, we added value via our weighting in emerging-markets corporate bonds, which outpaced sovereign debt by a healthy margin.

Among individual securities, the metals and mining company Teck Resources Ltd. was a leading contributor to fund performance. The company’s bonds were supported by the recovery in commodity prices, combined with its actions to reduce debt. The fund’s position in the oil and gas producer Continental Resources, Inc. also gained ground, as rising oil prices led to an improving investor sentiment regarding the long-term viability of lower-rated energy companies. Additionally, the bonds of KazAgro National Management Holding JSC, an agricultural holding company owned by Kazakhstan’s government, performed well thanks to accelerating gross domestic product growth and improving perceptions of the country’s sovereign risk.

While the portfolio was overweight in the energy exploration and production (E&P) subsector, our holdings in this area were largely focused on higher-quality issues. The portfolio’s corresponding underweight in lower-quality E&P issuers, such as Whiting Petroleum Corp., hurt returns as the strong recovery in oil pushed the price of many of these bonds — which had previously traded at a substantial discount — significantly higher. The hospital operator Community Health Systems, Inc., which reported weaker operating results and difficulty in divesting underperforming assets, was an additional detractor.

Outlook and Positioning

We see a number of reasons for continued optimism regarding the U.S. high-yield market. The use of new-issue proceeds was dominated by refinancing during the past year, which substantially reduced concerns about near-term maturities for high-yield issuers and contributed to decreasing default expectations. In addition, forecasts for modest global growth can support commodity prices and drive a search for yield that helps risk assets. We also believe the incoming administration may enact pro-growth economic policies, including lower corporate tax rates, reduced regulation and increased infrastructure spending, which we believe would support yield spreads at their current levels. Although it appears the Fed is likely to begin tightening policy, we also think that well-communicated, measured and data-driven Fed rate moves can provide a favorable backdrop for high yield when accompanied by accelerating growth.

Possible disruptions to this favorable outlook include more aggressive Fed actions, additional volatility in U.S. Treasuries and lingering geopolitical/macroeconomic issues, including the implementation of the United Kingdom’s decision to exit the European Union ("Brexit").

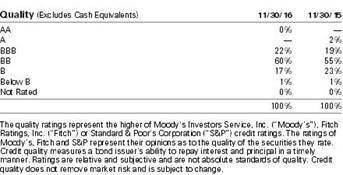

We retain a positive view on single-B-rated issues, which we believe offer the best risk-adjusted return potential in the U.S. high-yield market. The fund is underweight BBs, and we remain on the lookout for credits to reduce or sell in the CCC tier.

We think the likelihood of rising interest rates provides a positive context for leveraged loans. Credit fundamentals for loan issuers remain healthy, with a generally stable earnings outlook. Similar to high-yield bonds, recent refinancing activity has extended issuers’ debt maturity profiles and increased the odds that default rates will remain below historical averages.

We continue to hold a constructive view on emerging-markets sovereign debt, as strengthening commodity prices — combined with improving governance and economic fundamentals in many emerging nations — provides a supportive environment.

Portfolio Management

Gary Russell, CFA, Managing Director

Portfolio Manager of the fund. Began managing the fund in 2006.

— Joined Deutsche Asset Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

— Prior to that, he spent four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, he served as an officer in the US Army from 1988 to 1991.

— Head of US High Yield Bonds: New York.

— BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

Thomas R. Bouchard, Director

Portfolio Manager of the fund. Began managing the fund in 2016.

— Joined Deutsche Asset Management in 2006 with six years of industry experience. Prior to joining, served as a High Yield Investment Analyst at Flagship Capital Management. He also served as an officer in the US Army from 1989 to 1997.

— Portfolio Manager for High Yield Strategies: New York.

— BS, University of Wisconsin — Madison; MBA in Finance, Boston College; MA in Strategic Studies from US Army War College.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

The BofA Merrill Lynch US High Yield Master II Constrained Index tracks the performance of U.S. dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. domestic market.

The JPMorgan EMBI Global Diversified Index is an unmanaged, unleveraged index that tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-markets sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Yield spread refers to the excess yield various bond sectors offer over financial instruments with similar maturities. When spreads widen, yield differences are increasing between bonds in the two sectors being compared. When spreads narrow, the opposite is true.

Senior loans typically carry interest rates that reflect a spread above some reference rate, generally LIBOR (the London Interbank Offered Rate). Given the recent very low levels of short-term interest rates, in order to attract investors, many leveraged loans have incorporated LIBOR floors. A LIBOR floor requires that the reference rate applied to a loan meet a certain minimum regardless of actual LIBOR levels; however, the interest paid on such loans will not adjust upward until LIBOR rises above the level of the LIBOR floor.

Underweight means the fund holds a lower weighting in a given sector or security than the benchmark. Overweight means it holds a higher weighting.

Performance Summary November 30, 2016 (Unaudited)

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit deutschefunds.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

| Average Annual Total Returns as of 11/30/16 |

| Deutsche Strategic Income Trust | 1-Year | 5-Year | 10-Year |

| Based on Net Asset Value(a) | 7.82% | 7.21% | 7.73% |

| Based on Market Price(a) | 20.56% | 5.95% | 5.87% |

| JPMorgan Emerging Markets Bond Global Diversified Index(b) | 7.19% | 5.86% | 6.81% |

| BofA Merrill Lynch US High Yield Master II Constrained Index(c) | 12.25% | 7.46% | 7.36% |

| Credit Suisse High Yield Index(d) | 12.46% | 7.24% | 7.04% |

| Morningstar Closed-End High Yield Bond Funds Category (Based on Net Asset Value)(e) | 10.88% | 8.68% | 6.35% |

(a) Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. Expenses of the Fund include management fee, interest expense and other fund expenses. Total returns shown take into account these fees and expenses. The expense ratio of the Fund for the year ended November 30, 2016 was 2.24% (1.59% excluding interest expense).

(b) The JPMorgan Emerging Markets Bond Global Diversified Index is an unmanaged, unleveraged index that tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-market sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

(c) The BofA Merrill Lynch US High Yield Master II Constrained Index tracks the performance of U.S. dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. domestic market.

(d) The Credit Suisse High Yield Index is an unmanaged, unleveraged, trader-priced portfolio constructed to mirror the global high-yield debt market.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

On June 1, 2016, the BofA Merrill Lynch US High Yield Master II Constrained Index replaced the Credit Suisse High Yield Index as the fund’s comparative broad-based securities market index because the Advisor believes the BofA Merrill Lynch US High Yield Master II Constrained Index more closely reflects the fund’s investment strategies.

(e) Morningstar's Closed-End High Yield Bond Funds category represents high-yield bond portfolios that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End High Yield Bond Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category.

| Net Asset Value and Market Price |

| | As of 11/30/16 | As of 11/30/15 |

| Net Asset Value | $ 12.60 | $ 12.37 |

| Market Price | $ 11.72 | $ 10.29 |

| Premium (discount) | (6.98)% | (16.81)% |

Prices and net asset value fluctuate and are not guaranteed.

| Distribution Information |

Twelve Months as of 11/30/16: Income Dividends | $ .64 |

| Return of Capital | $ .01 |

| November Income Dividend | $ .0500 |

| Current Annualized Distribution Rate (Based on Net Asset Value) as of 11/30/16† | 4.76% |

| Current Annualized Distribution Rate (Based on Market Price) as of 11/30/16† | 5.12% |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on November 30, 2016. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed and will fluctuate. Distributions do not include return of capital or other non-income sources.

Important Notice

On July 13, 2016, the Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than December 31, 2018.

Investment Portfolio as of November 30, 2016

| | Principal Amount ($)(a) | Value ($) |

| | | | | |

| Corporate Bonds 85.8% |

| Consumer Discretionary 22.8% |

| 1011778 B.C. Unlimited Liability Co., 144A, 4.625%, 1/15/2022 | 40,000 | 40,650 |

| Adient Global Holdings Ltd., 144A, 4.875%, 8/15/2026 | | 200,000 | 192,000 |

| Allison Transmission, Inc., 144A, 5.0%, 10/1/2024 | | 150,000 | 151,125 |

| Ally Financial, Inc.: |

| | 3.25%, 2/13/2018 | | 265,000 | 266,457 |

| | 4.125%, 3/30/2020 | | 590,000 | 590,000 |

| | 5.75%, 11/20/2025 | | 200,000 | 198,000 |

| Altice Financing SA, 144A, 7.5%, 5/15/2026 | | 210,000 | 212,887 |

| Altice U.S. Finance I Corp., 144A, 5.5%, 5/15/2026 | | 210,000 | 207,900 |

| AMC Entertainment Holdings, Inc.: |

| | 5.875%, 2/15/2022 | | 80,000 | 83,452 |

| | 144A, 5.875%, 11/15/2026 | | 95,000 | 95,713 |

| AMC Networks, Inc., 5.0%, 4/1/2024 | | 265,000 | 265,662 |

| AmeriGas Finance LLC, 7.0%, 5/20/2022 | | 135,000 | 141,750 |

| Asbury Automotive Group, Inc., 6.0%, 12/15/2024 | | 295,000 | 297,212 |

| Ashtead Capital, Inc., 144A, 6.5%, 7/15/2022 | | 120,000 | 125,550 |

| Ashton Woods U.S.A. LLC, 144A, 6.875%, 2/15/2021 | | 130,000 | 124,800 |

| Beacon Roofing Supply, Inc., 6.375%, 10/1/2023 | | 55,000 | 58,438 |

| Block Communications, Inc., 144A, 7.25%, 2/1/2020 | | 155,000 | 157,712 |

| Boyd Gaming Corp., 6.875%, 5/15/2023 | | 50,000 | 53,125 |

| CalAtlantic Group, Inc., 5.25%, 6/1/2026 | | 239,000 | 231,830 |

| Caleres, Inc., 6.25%, 8/15/2023 | | 40,000 | 41,800 |

| CCO Holdings LLC: |

| | 144A, 5.125%, 5/1/2023 | | 120,000 | 122,925 |

| | 144A, 5.5%, 5/1/2026 | | 765,000 | 772,650 |

| | 144A, 5.875%, 4/1/2024 | | 105,000 | 111,169 |

| | 144A, 5.875%, 5/1/2027 | | 155,000 | 158,100 |

| Cequel Communications Holdings I LLC: |

| | 144A, 5.125%, 12/15/2021 | | 214,000 | 210,790 |

| | 144A, 6.375%, 9/15/2020 | | 140,000 | 142,800 |

| Churchill Downs, Inc., 144A, 5.375%, 12/15/2021 | | 50,000 | 51,750 |

| Clear Channel Worldwide Holdings, Inc., Series A, 7.625%, 3/15/2020 | | 20,000 | 18,700 |

| Cogeco Communications, Inc., 144A, 4.875%, 5/1/2020 | 10,000 | 10,300 |

| CSC Holdings LLC: |

| | 5.25%, 6/1/2024 | | 80,000 | 74,992 |

| | 144A, 5.5%, 4/15/2027 | | 310,000 | 305,931 |

| Dana, Inc.: |

| | 5.375%, 9/15/2021 | | 500,000 | 517,500 |

| | 5.5%, 12/15/2024 | | 55,000 | 55,413 |

| DISH DBS Corp.: |

| | 4.625%, 7/15/2017 | | 400,000 | 404,000 |

| | 6.75%, 6/1/2021 | | 30,000 | 32,250 |

| Dollar Tree, Inc.: |

| | 5.25%, 3/1/2020 | | 315,000 | 325,237 |

| | 5.75%, 3/1/2023 | | 105,000 | 112,087 |

| Fiat Chrysler Automobiles NV, 4.5%, 4/15/2020 | | 310,000 | 313,875 |

| Goodyear Tire & Rubber Co.: |

| | 5.0%, 5/31/2026 | | 130,000 | 129,025 |

| | 5.125%, 11/15/2023 | | 60,000 | 61,275 |

| Group 1 Automotive, Inc.: |

| | 5.0%, 6/1/2022 | | 150,000 | 146,250 |

| | 144A, 5.25%, 12/15/2023 | | 210,000 | 205,275 |

| Hanesbrands, Inc., 144A, 4.625%, 5/15/2024 | | 110,000 | 109,725 |

| HD Supply, Inc.: |

| | 144A, 5.25%, 12/15/2021 | | 85,000 | 89,675 |

| | 144A, 5.75%, 4/15/2024 | | 55,000 | 56,238 |

| Hot Topic, Inc., 144A, 9.25%, 6/15/2021 | | 25,000 | 26,250 |

| Lennar Corp., 4.75%, 11/15/2022 | | 150,000 | 152,625 |

| MDC Partners, Inc., 144A, 6.5%, 5/1/2024 | | 45,000 | 38,644 |

| Mediacom Broadband LLC, 6.375%, 4/1/2023 | | 155,000 | 162,750 |

| NCL Corp., Ltd., 144A, 4.625%, 11/15/2020 | | 85,000 | 86,063 |

| Nielsen Finance LLC, 144A, 5.0%, 4/15/2022 | | 45,000 | 45,900 |

| Penske Automotive Group, Inc.: |

| | 5.375%, 12/1/2024 | | 150,000 | 147,375 |

| | 5.5%, 5/15/2026 | | 85,000 | 81,926 |

| PulteGroup, Inc., 4.25%, 3/1/2021 | | 320,000 | 325,600 |

| Quebecor Media, Inc., 5.75%, 1/15/2023 | | 80,000 | 82,200 |

| Rivers Pittsburgh Borrower LP, 144A, 6.125%, 8/15/2021 | 25,000 | 25,438 |

| Sabre GLBL, Inc.: |

| | 144A, 5.25%, 11/15/2023 | | 20,000 | 20,250 |

| | 144A, 5.375%, 4/15/2023 | | 5,000 | 5,063 |

| Sally Holdings LLC, 5.625%, 12/1/2025 | | 150,000 | 155,625 |

| Seminole Hard Rock Entertainment, Inc., 144A, 5.875%, 5/15/2021 | | 50,000 | 49,250 |

| SFR Group SA: |

| | 144A, 6.0%, 5/15/2022 | | 290,000 | 292,175 |

| | 144A, 7.375%, 5/1/2026 | | 315,000 | 314,212 |

| Sirius XM Radio, Inc., 144A, 5.375%, 7/15/2026 | | 150,000 | 148,875 |

| Springs Industries, Inc., 6.25%, 6/1/2021 | | 115,000 | 118,128 |

| Starz LLC, 5.0%, 9/15/2019 | | 60,000 | 60,846 |

| Suburban Propane Partners LP, 5.75%, 3/1/2025 | | 45,000 | 45,225 |

| Tenneco, Inc., 5.0%, 7/15/2026 | | 110,000 | 108,112 |

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | | 95,000 | 93,575 |

| TRI Pointe Group, Inc.: |

| | 4.375%, 6/15/2019 | | 55,000 | 55,825 |

| | 4.875%, 7/1/2021 | | 610,000 | 620,675 |

| Unitymedia Hessen GmbH & Co., KG, 144A, 5.5%, 1/15/2023 | 300,000 | 307,500 |

| UPCB Finance IV Ltd., 144A, 5.375%, 1/15/2025 | | 305,000 | 300,614 |

| UPCB Finance VI Ltd., 144A, 6.875%, 1/15/2022 | | 152,000 | 158,080 |

| Viking Cruises Ltd.: |

| | 144A, 6.25%, 5/15/2025 | | 80,000 | 72,200 |

| | 144A, 8.5%, 10/15/2022 | | 80,000 | 81,600 |

| Virgin Media Secured Finance PLC, 144A, 5.5%, 8/15/2026 | 200,000 | 196,000 |

| WMG Acquisition Corp., 144A, 5.0%, 8/1/2023 | | 45,000 | 45,000 |

| | 12,497,596 |

| Consumer Staples 2.0% |

| Aramark Services, Inc.: |

| | 144A, 4.75%, 6/1/2026 | | 305,000 | 295,469 |

| | 5.125%, 1/15/2024 | | 60,000 | 61,600 |

| Cott Beverages, Inc.: |

| | 5.375%, 7/1/2022 | | 145,000 | 145,544 |

| | 6.75%, 1/1/2020 | | 55,000 | 56,925 |

| JBS U.S.A. LUX SA: |

| | 144A, 5.75%, 6/15/2025 | | 60,000 | 58,800 |

| | 144A, 7.25%, 6/1/2021 | | 205,000 | 211,150 |

| | 144A, 8.25%, 2/1/2020 | | 65,000 | 66,787 |

| Post Holdings, Inc., 144A, 6.75%, 12/1/2021 | | 45,000 | 47,993 |

| Smithfield Foods, Inc., 6.625%, 8/15/2022 | | 4,000 | 4,215 |

| The WhiteWave Foods Co., 5.375%, 10/1/2022 | | 120,000 | 132,300 |

| | 1,080,783 |

| Energy 11.4% |

| Antero Midstream Partners LP, 144A, 5.375%, 9/15/2024 | 70,000 | 71,400 |

| Antero Resources Corp.: |

| | 5.125%, 12/1/2022 | | 100,000 | 101,500 |

| | 5.375%, 11/1/2021 | | 85,000 | 87,231 |

| | 5.625%, 6/1/2023 | | 60,000 | 61,125 |

| Blue Racer Midstream LLC, 144A, 6.125%, 11/15/2022 | 65,000 | 63,375 |

| Carrizo Oil & Gas, Inc., 6.25%, 4/15/2023 | | 75,000 | 76,500 |

| Cheniere Corpus Christi Holdings LLC, 144A, 7.0%, 6/30/2024 | 100,000 | 106,500 |

| Continental Resources, Inc.: |

| | 4.5%, 4/15/2023 | | 50,000 | 48,625 |

| | 5.0%, 9/15/2022 | | 580,000 | 578,550 |

| Crestwood Midstream Partners LP, 6.25%, 4/1/2023 | | 40,000 | 40,600 |

| DCP Midstream Operating LP, 2.7%, 4/1/2019 | | 200,000 | 198,750 |

| Delek & Avner Tamar Bond Ltd., 144A, 5.082%, 12/30/2023 | 200,000 | 203,376 |

| Diamondback Energy, Inc., 144A, 4.75%, 11/1/2024 | | 130,000 | 130,162 |

| Energy Transfer Equity LP, 7.5%, 10/15/2020 | | 500,000 | 558,750 |

| EP Energy LLC, 144A, 8.0%, 11/29/2024 | | 50,000 | 51,500 |

| Gulfport Energy Corp.: |

| | 144A, 6.0%, 10/15/2024 | | 35,000 | 35,613 |

| | 6.625%, 5/1/2023 | | 30,000 | 31,350 |

| Hilcorp Energy I LP, 144A, 5.75%, 10/1/2025 | | 110,000 | 111,650 |

| Holly Energy Partners LP: |

| | 144A, 6.0%, 8/1/2024 | | 80,000 | 83,200 |

| | 6.5%, 3/1/2020 | | 45,000 | 46,076 |

| Laredo Petroleum, Inc., 6.25%, 3/15/2023 | | 90,000 | 91,575 |

| MEG Energy Corp.: |

| | 144A, 6.375%, 1/30/2023 | | 200,000 | 176,500 |

| | 144A, 6.5%, 3/15/2021 | | 200,000 | 180,000 |

| Murphy Oil Corp., 6.875%, 8/15/2024 | | 65,000 | 68,412 |

| Newfield Exploration Co.: |

| | 5.375%, 1/1/2026 | | 45,000 | 45,675 |

| | 5.75%, 1/30/2022 | | 80,000 | 82,800 |

| Oasis Petroleum, Inc.: |

| | 6.875%, 3/15/2022 | | 30,000 | 30,900 |

| | 6.875%, 1/15/2023 | | 10,000 | 10,250 |

| PDC Energy, Inc., 144A, 6.125%, 9/15/2024 | | 60,000 | 61,500 |

| Precision Drilling Corp., 144A, 7.75%, 12/15/2023 | | 40,000 | 40,600 |

| Range Resources Corp.: |

| | 4.875%, 5/15/2025 | | 165,000 | 155,925 |

| | 144A, 5.875%, 7/1/2022 | | 65,000 | 65,325 |

| Ras Laffan Liquefied Natural Gas Co., Ltd. II, 144A, 5.298%, 9/30/2020 | | 106,800 | 112,807 |

| Reliance Industries Ltd., 144A, 4.125%, 1/28/2025 | | 250,000 | 249,246 |

| Rice Energy, Inc., 7.25%, 5/1/2023 | | 15,000 | 15,750 |

| Sabine Pass Liquefaction LLC: |

| | 144A, 5.0%, 3/15/2027 | | 450,000 | 444,375 |

| | 5.625%, 2/1/2021 | | 260,000 | 275,600 |

| | 5.625%, 4/15/2023 | | 150,000 | 156,750 |

| | 144A, 5.875%, 6/30/2026 | | 155,000 | 163,719 |

| Sunoco LP: |

| | 5.5%, 8/1/2020 | | 50,000 | 50,250 |

| | 6.25%, 4/15/2021 | | 250,000 | 252,655 |

| | 6.375%, 4/1/2023 | | 45,000 | 45,113 |

| Tesoro Logistics LP: |

| | 5.25%, 1/15/2025 (b) | | 340,000 | 344,250 |

| | 6.125%, 10/15/2021 | | 30,000 | 31,388 |

| | 6.375%, 5/1/2024 | | 65,000 | 70,037 |

| Whiting Petroleum Corp.: |

| | 5.75%, 3/15/2021 | | 140,000 | 137,900 |

| | 6.25%, 4/1/2023 | | 70,000 | 68,337 |

| WPX Energy, Inc., 7.5%, 8/1/2020 | | 150,000 | 158,250 |

| | 6,271,722 |

| Financials 5.0% |

| AerCap Ireland Capital Ltd.: |

| | 3.95%, 2/1/2022 | | 200,000 | 202,500 |

| | 4.625%, 10/30/2020 | | 670,000 | 697,637 |

| Alliance Data Systems Corp., 144A, 5.25%, 12/1/2017 | | 95,000 | 95,713 |

| CIT Group, Inc.: |

| | 3.875%, 2/19/2019 | | 415,000 | 422,262 |

| | 5.0%, 5/15/2017 | | 80,000 | 80,900 |

| | 5.0%, 8/15/2022 | | 400,000 | 416,500 |

| CNO Financial Group, Inc.: |

| | 4.5%, 5/30/2020 | | 150,000 | 153,938 |

| | 5.25%, 5/30/2025 | | 45,000 | 44,944 |

| Corp. Financiera de Desarrollo SA, 144A, 4.75%, 2/8/2022 | 250,000 | 261,800 |

| Dana Financing Luxembourg Sarl, 144A, 6.5%, 6/1/2026 | 160,000 | 165,200 |

| E*TRADE Financial Corp.: |

| | 4.625%, 9/15/2023 | | 60,000 | 60,932 |

| | 5.375%, 11/15/2022 | | 50,000 | 52,988 |

| Neuberger Berman Group LLC, 144A, 5.875%, 3/15/2022 | 110,000 | 114,125 |

| | 2,769,439 |

| Health Care 5.0% |

| Alere, Inc., 144A, 6.375%, 7/1/2023 | | 60,000 | 60,525 |

| Endo Finance LLC: |

| | 144A, 5.375%, 1/15/2023 | | 80,000 | 69,800 |

| | 144A, 5.75%, 1/15/2022 | | 80,000 | 72,100 |

| Endo Ltd., 144A, 6.5%, 2/1/2025 | | 45,000 | 38,419 |

| Fresenius Medical Care U.S. Finance II, Inc., 144A, 6.5%, 9/15/2018 | | 45,000 | 47,700 |

| HCA, Inc.: |

| | 4.5%, 2/15/2027 | | 150,000 | 141,375 |

| | 4.75%, 5/1/2023 | | 300,000 | 302,250 |

| | 5.25%, 6/15/2026 | | 170,000 | 170,184 |

| | 6.5%, 2/15/2020 | | 340,000 | 370,175 |

| | 7.5%, 2/15/2022 | | 170,000 | 189,125 |

| Hologic, Inc., 144A, 5.25%, 7/15/2022 | | 30,000 | 31,125 |

| LifePoint Health, Inc.: |

| | 144A, 5.375%, 5/1/2024 | | 120,000 | 115,125 |

| | 5.5%, 12/1/2021 | | 105,000 | 107,362 |

| | 5.875%, 12/1/2023 | | 85,000 | 84,681 |

| Mallinckrodt International Finance SA: |

| | 144A, 4.875%, 4/15/2020 | | 25,000 | 24,500 |

| | 144A, 5.625%, 10/15/2023 | | 50,000 | 45,250 |

| Tenet Healthcare Corp.: |

| | 4.35%**, 6/15/2020 | | 60,000 | 60,000 |

| | 144A, 7.5%, 1/1/2022 (b) | | 70,000 | 71,969 |

| Valeant Pharmaceuticals International, Inc.: |

| | 144A, 5.375%, 3/15/2020 | | 110,000 | 92,400 |

| | 144A, 5.875%, 5/15/2023 | | 105,000 | 78,225 |

| | 144A, 6.125%, 4/15/2025 | | 305,000 | 225,700 |

| | 144A, 7.5%, 7/15/2021 | | 385,000 | 325,325 |

| | 2,723,315 |

| Industrials 8.6% |

| ADT Corp.: |

| | 3.5%, 7/15/2022 | | 55,000 | 51,837 |

| | 5.25%, 3/15/2020 | | 90,000 | 95,625 |

| | 6.25%, 10/15/2021 | | 155,000 | 167,012 |

| Air Lease Corp., 4.75%, 3/1/2020 | | 1,110,000 | 1,179,185 |

| Allegion PLC, 5.875%, 9/15/2023 | | 30,000 | 31,838 |

| Artesyn Embedded Technologies, Inc., 144A, 9.75%, 10/15/2020 | | 105,000 | 93,581 |

| Belden, Inc., 144A, 5.5%, 9/1/2022 | | 135,000 | 137,700 |

| Bombardier, Inc.: |

| | 144A, 5.75%, 3/15/2022 | | 130,000 | 113,750 |

| | 144A, 6.0%, 10/15/2022 | | 95,000 | 83,362 |

| | 144A, 8.75%, 12/1/2021 | | 36,000 | 35,730 |

| CNH Industrial Capital LLC: |

| | 3.25%, 2/1/2017 | | 335,000 | 335,419 |

| | 3.875%, 7/16/2018 | | 60,000 | 60,675 |

| Covanta Holding Corp., 5.875%, 3/1/2024 | | 85,000 | 82,875 |

| DigitalGlobe, Inc., 144A, 5.25%, 2/1/2021 | | 55,000 | 55,000 |

| DR Horton, Inc., 4.0%, 2/15/2020 | | 30,000 | 30,938 |

| EnerSys, 144A, 5.0%, 4/30/2023 | | 15,000 | 15,038 |

| Florida East Coast Holdings Corp., 144A, 6.75%, 5/1/2019 | 85,000 | 87,550 |

| FTI Consulting, Inc., 6.0%, 11/15/2022 | | 80,000 | 83,200 |

| Garda World Security Corp., 144A, 7.25%, 11/15/2021 | | 105,000 | 97,125 |

| Huntington Ingalls Industries, Inc.: |

| | 144A, 5.0%, 12/15/2021 | | 120,000 | 124,800 |

| | 144A, 5.0%, 11/15/2025 | | 60,000 | 61,350 |

| Kenan Advantage Group, Inc., 144A, 7.875%, 7/31/2023 | 80,000 | 76,800 |

| Manitowoc Foodservice, Inc., 9.5%, 2/15/2024 | | 43,000 | 49,020 |

| Masonite International Corp., 144A, 5.625%, 3/15/2023 | 65,000 | 66,137 |

| Moog, Inc., 144A, 5.25%, 12/1/2022 | | 50,000 | 50,875 |

| Novelis Corp.: |

| | 144A, 5.875%, 9/30/2026 | | 165,000 | 164,794 |

| | 144A, 6.25%, 8/15/2024 | | 85,000 | 87,975 |

| Oshkosh Corp.: |

| | 5.375%, 3/1/2022 | | 60,000 | 62,550 |

| | 5.375%, 3/1/2025 | | 240,000 | 247,200 |

| Ply Gem Industries, Inc., 6.5%, 2/1/2022 | | 145,000 | 148,563 |

| Prime Security Services Borrower LLC, 144A, 9.25%, 5/15/2023 | 10,000 | 10,750 |

| Spirit AeroSystems, Inc., 5.25%, 3/15/2022 | | 105,000 | 109,923 |

| Summit Materials LLC: |

| | 6.125%, 7/15/2023 | | 100,000 | 101,500 |

| | 8.5%, 4/15/2022 | | 45,000 | 49,556 |

| Titan International, Inc., 6.875%, 10/1/2020 | | 85,000 | 82,450 |

| United Rentals North America, Inc.: |

| | 5.5%, 5/15/2027 | | 55,000 | 54,989 |

| | 6.125%, 6/15/2023 | | 10,000 | 10,550 |

| | 7.625%, 4/15/2022 | | 43,000 | 45,473 |

| WESCO Distribution, Inc., 144A, 5.375%, 6/15/2024 | | 80,000 | 80,000 |

| XPO Logistics, Inc., 144A, 6.125%, 9/1/2023 | | 30,000 | 30,675 |

| ZF North America Capital, Inc., 144A, 4.0%, 4/29/2020 | | 150,000 | 155,250 |

| | 4,708,620 |

| Information Technology 3.4% |

| ACI Worldwide, Inc., 144A, 6.375%, 8/15/2020 | | 35,000 | 35,875 |

| Cardtronics, Inc., 5.125%, 8/1/2022 | | 50,000 | 50,500 |

| CDW LLC, 6.0%, 8/15/2022 | | 115,000 | 121,900 |

| Diamond 1 Finance Corp.: |

| | 144A, 4.42%, 6/15/2021 | | 195,000 | 200,654 |

| | 144A, 5.875%, 6/15/2021 | | 65,000 | 68,461 |

| EarthLink Holdings Corp., 7.375%, 6/1/2020 | | 95,000 | 100,403 |

| EMC Corp., 1.875%, 6/1/2018 | | 300,000 | 295,613 |

| Entegris, Inc., 144A, 6.0%, 4/1/2022 | | 55,000 | 57,200 |

| First Data Corp., 144A, 7.0%, 12/1/2023 | | 100,000 | 104,688 |

| Jabil Circuit, Inc., 5.625%, 12/15/2020 | | 105,000 | 111,562 |

| Match Group, Inc., 6.375%, 6/1/2024 | | 50,000 | 52,812 |

| Micron Technology, Inc., 144A, 7.5%, 9/15/2023 | | 170,000 | 187,850 |

| NCR Corp.: |

| | 5.875%, 12/15/2021 | | 20,000 | 20,875 |

| | 6.375%, 12/15/2023 | | 50,000 | 52,625 |

| NXP BV, 144A, 4.125%, 6/1/2021 | | 200,000 | 208,500 |

| Riverbed Technology, Inc., 144A, 8.875%, 3/1/2023 | | 45,000 | 46,913 |

| Western Digital Corp.: |

| | 144A, 7.375%, 4/1/2023 | | 45,000 | 48,600 |

| | 144A, 10.5%, 4/1/2024 | | 75,000 | 86,812 |

| | 1,851,843 |

| Materials 13.4% |

| AK Steel Corp.: |

| | 7.5%, 7/15/2023 | | 100,000 | 108,750 |

| | 7.625%, 5/15/2020 | | 100,000 | 102,500 |

| Anglo American Capital PLC: |

| | 144A, 4.125%, 9/27/2022 | | 200,000 | 200,500 |

| | 144A, 4.875%, 5/14/2025 | | 300,000 | 304,500 |

| Ardagh Packaging Finance PLC, 144A, 7.25%, 5/15/2024 | 200,000 | 209,000 |

| Ball Corp., 4.375%, 12/15/2020 | | 45,000 | 47,363 |

| Berry Plastics Corp., 5.5%, 5/15/2022 | | 160,000 | 166,400 |

| Cascades, Inc., 144A, 5.5%, 7/15/2022 | | 55,000 | 55,756 |

| Cemex SAB de CV, 144A, 6.5%, 12/10/2019 | | 200,000 | 210,000 |

| Chemours Co.: |

| | 6.625%, 5/15/2023 | | 60,000 | 59,250 |

| | 7.0%, 5/15/2025 | | 25,000 | 24,625 |

| Clearwater Paper Corp., 144A, 5.375%, 2/1/2025 | | 55,000 | 54,588 |

| Constellium NV, 144A, 7.875%, 4/1/2021 | | 250,000 | 268,750 |

| Eagle Materials, Inc., 4.5%, 8/1/2026 | | 85,000 | 83,512 |

| Freeport-McMoRan, Inc.: |

| | 2.3%, 11/14/2017 | | 225,000 | 224,437 |

| | 2.375%, 3/15/2018 | | 495,000 | 491,287 |

| Graphic Packaging International, Inc., 4.125%, 8/15/2024 | 220,000 | 212,850 |

| Greif, Inc., 7.75%, 8/1/2019 | | 230,000 | 253,862 |

| Hexion, Inc., 6.625%, 4/15/2020 | | 50,000 | 43,000 |

| Huntsman International LLC, 5.125%, 11/15/2022 | | 250,000 | 253,750 |

| Kaiser Aluminum Corp., 5.875%, 5/15/2024 | | 80,000 | 82,600 |

| Plastipak Holdings, Inc., 144A, 6.5%, 10/1/2021 | | 100,000 | 104,500 |

| Platform Specialty Products Corp.: |

| | 144A, 6.5%, 2/1/2022 | | 65,000 | 64,025 |

| | 144A, 10.375%, 5/1/2021 | | 50,000 | 54,625 |

| Reynolds Group Issuer, Inc.: |

| | 144A, 5.125%, 7/15/2023 | | 175,000 | 176,750 |

| | 5.75%, 10/15/2020 | | 920,000 | 946,450 |

| | 6.875%, 2/15/2021 | | 132,868 | 136,854 |

| | 144A, 7.0%, 7/15/2024 | | 20,000 | 21,113 |

| Sealed Air Corp.: |

| | 144A, 4.875%, 12/1/2022 | | 35,000 | 35,788 |

| | 144A, 5.125%, 12/1/2024 | | 15,000 | 15,225 |

| Teck Resources Ltd.: |

| | 3.75%, 2/1/2023 | | 250,000 | 237,500 |

| | 4.5%, 1/15/2021 | | 850,000 | 865,937 |

| | 144A, 8.0%, 6/1/2021 | | 160,000 | 175,744 |

| | 144A, 8.5%, 6/1/2024 | | 30,000 | 35,025 |

| Tronox Finance LLC: |

| | 6.375%, 8/15/2020 | | 275,000 | 250,594 |

| | 144A, 7.5%, 3/15/2022 | | 70,000 | 63,875 |

| United States Steel Corp., 144A, 8.375%, 7/1/2021 | | 185,000 | 204,425 |

| Valvoline, Inc., 144A, 5.5%, 7/15/2024 | | 45,000 | 46,631 |

| Volcan Cia Minera SAA, 144A, 5.375%, 2/2/2022 | | 420,000 | 400,575 |

| WR Grace & Co-Conn: |

| | 144A, 5.125%, 10/1/2021 | | 30,000 | 31,500 |

| | 144A, 5.625%, 10/1/2024 | | 15,000 | 15,900 |

| | 7,340,316 |

| Real Estate 1.9% |

| CyrusOne LP, (REIT), 6.375%, 11/15/2022 | | 110,000 | 115,225 |

| Equinix, Inc.: |

| | (REIT), 5.375%, 1/1/2022 | | 70,000 | 72,975 |

| | (REIT), 5.375%, 4/1/2023 | | 265,000 | 271,956 |

| | (REIT), 5.75%, 1/1/2025 | | 50,000 | 51,563 |

| | (REIT), 5.875%, 1/15/2026 | | 50,000 | 51,876 |

| Iron Mountain, Inc., 144A, (REIT), 4.375%, 6/1/2021 | | 60,000 | 61,350 |

| MPT Operating Partnership LP: |

| | (REIT), 5.25%, 8/1/2026 | | 20,000 | 18,750 |

| | (REIT), 6.375%, 2/15/2022 | | 110,000 | 112,887 |

| | (REIT), 6.375%, 3/1/2024 | | 105,000 | 107,625 |

| VEREIT Operating Partnership LP: |

| | (REIT), 4.125%, 6/1/2021 | | 125,000 | 128,125 |

| | (REIT), 4.875%, 6/1/2026 | | 50,000 | 51,250 |

| | 1,043,582 |

| Telecommunication Services 10.0% |

| Bharti Airtel International Netherlands BV, 144A, 5.125%, 3/11/2023 | | 200,000 | 208,599 |

| CenturyLink, Inc.: |

| | Series V, 5.625%, 4/1/2020 | | 40,000 | 41,650 |

| | Series T, 5.8%, 3/15/2022 | | 150,000 | 147,750 |

| | Series S, 6.45%, 6/15/2021 | | 165,000 | 170,259 |

| | Series W, 6.75%, 12/1/2023 | | 185,000 | 185,000 |

| | Series Y, 7.5%, 4/1/2024 | | 165,000 | 170,344 |

| CommScope, Inc.: |

| | 144A, 4.375%, 6/15/2020 | | 40,000 | 40,900 |

| | 144A, 5.0%, 6/15/2021 | | 95,000 | 96,188 |

| Digicel Ltd., 144A, 7.0%, 2/15/2020 | | 200,000 | 184,000 |

| Frontier Communications Corp.: |

| | 6.25%, 9/15/2021 | | 45,000 | 42,188 |

| | 7.125%, 1/15/2023 | | 235,000 | 203,863 |

| | 8.5%, 4/15/2020 | | 35,000 | 36,400 |

| | 10.5%, 9/15/2022 | | 195,000 | 201,338 |

| | 11.0%, 9/15/2025 | | 500,000 | 501,250 |

| Hughes Satellite Systems Corp., 7.625%, 6/15/2021 | | 90,000 | 96,750 |

| Intelsat Jackson Holdings SA, 144A, 8.0%, 2/15/2024 | | 186,000 | 187,395 |

| Level 3 Financing, Inc.: |

| | 5.375%, 8/15/2022 | | 215,000 | 218,762 |

| | 5.375%, 1/15/2024 | | 60,000 | 60,300 |

| | 6.125%, 1/15/2021 | | 60,000 | 62,100 |

| Millicom International Cellular SA, 144A, 6.0%, 3/15/2025 | 200,000 | 194,750 |

| Sprint Communications, Inc.: |

| | 144A, 7.0%, 3/1/2020 | | 85,000 | 91,428 |

| | 7.0%, 8/15/2020 | | 500,000 | 518,750 |

| Sprint Corp., 7.125%, 6/15/2024 | | 440,000 | 437,527 |

| T-Mobile U.S.A., Inc.: |

| | 6.0%, 4/15/2024 | | 351,000 | 368,550 |

| | 6.125%, 1/15/2022 | | 40,000 | 41,883 |

| | 6.375%, 3/1/2025 | | 151,000 | 161,381 |

| | 6.5%, 1/15/2026 | | 5,000 | 5,400 |

| | 6.625%, 11/15/2020 | | 65,000 | 66,463 |

| Telesat Canada, 144A, 8.875%, 11/15/2024 | | 80,000 | 81,700 |

| Wind Acquisition Finance SA, 144A, 6.5%, 4/30/2020 | | 80,000 | 83,328 |

| Windstream Services LLC: |

| | 7.75%, 10/15/2020 | | 90,000 | 91,575 |

| | 7.75%, 10/1/2021 | | 150,000 | 149,250 |

| Zayo Group LLC: |

| | 6.0%, 4/1/2023 | | 205,000 | 213,712 |

| | 6.375%, 5/15/2025 | | 139,000 | 144,560 |

| | 5,505,293 |

| Utilities 2.3% |

| Calpine Corp.: |

| | 5.375%, 1/15/2023 | | 85,000 | 82,060 |

| | 5.75%, 1/15/2025 | | 185,000 | 176,675 |

| Dynegy, Inc., 7.625%, 11/1/2024 | | 140,000 | 128,800 |

| NGL Energy Partners LP, 5.125%, 7/15/2019 | | 70,000 | 68,250 |

| NRG Energy, Inc.: |

| | 6.25%, 7/15/2022 | | 300,000 | 300,750 |

| | 6.25%, 5/1/2024 | | 285,000 | 275,737 |

| | 144A, 6.625%, 1/15/2027 | | 45,000 | 41,625 |

| | 144A, 7.25%, 5/15/2026 | | 160,000 | 156,400 |

| | 7.875%, 5/15/2021 | | 11,000 | 11,413 |

| Talen Energy Supply LLC, 144A, 4.625%, 7/15/2019 | | 35,000 | 33,294 |

| | 1,275,004 |

| Total Corporate Bonds (Cost $46,443,195) | 47,067,513 |

| |

| Asset-Backed 4.2% |

| Miscellaneous |

| Apidos CLO XXI, "C", Series 2015-21A, 144A, 4.229%**, 7/18/2027 | | 375,000 | 358,525 |

| Babson CLO Ltd., "D", Series 2015-2A, 144A, 4.496%**, 7/20/2027 | | 1,000,000 | 982,176 |

| Cumberland Park CLO Ltd., "D", Series 2015-2A, 144A, 4.096%**, 7/20/2026 | | 500,000 | 475,947 |

| Marea CLO Ltd., "DR", Series 2012-1A, 144A, 4.43%**, 10/15/2023 | | 500,000 | 497,925 |

| Total Asset-Backed (Cost $2,331,977) | 2,314,573 |

| |

| Government & Agency Obligations 4.1% |

| Other Government Related (c) 0.5% |

| VTB Bank OJSC, 144A, 6.315%, 2/22/2018 | | 265,000 | 274,974 |

| Sovereign Bonds 3.6% |

| Dominican Republic, 144A, 6.875%, 1/29/2026 | | 100,000 | 103,582 |

| KazAgro National Management Holding JSC, 144A, 4.625%, 5/24/2023 | | 250,000 | 225,427 |

| Perusahaan Penerbit SBSN, 144A, 4.325%, 5/28/2025 | | 200,000 | 200,760 |

| Republic of Argentina-Inflation Linked Bond, 5.83%, 12/31/2033 | ARS | 481 | 214 |

| Republic of Hungary, Series 19/A, 6.5%, 6/24/2019 | HUF | 11,600,000 | 44,761 |

| Republic of Panama, 9.375%, 1/16/2023 | | 665,000 | 849,537 |

| Republic of Sri Lanka: |

| | 144A, 5.125%, 4/11/2019 | | 200,000 | 202,766 |

| | 144A, 5.75%, 1/18/2022 | | 365,000 | 363,652 |

| | 1,990,699 |

| Total Government & Agency Obligations (Cost $2,263,906) | 2,265,673 |

| |

| Loan Participations and Assignments 36.8% |

| Senior Loans** |

| Consumer Discretionary 10.2% |

| 1011778 B.C. Unlimited Liability Co., Term Loan B2, 3.75%, 12/10/2021 | | 428,112 | 431,656 |

| Altice U.S. Finance I Corp., Term Loan B, 3.882%, 1/15/2025 | 407,310 | 409,941 |

| Atlantic Broadband Finance LLC, Term Loan B, 3.25%, 11/30/2019 | | 967,575 | 970,904 |

| Goodyear Tire & Rubber Co., Second Lien Term Loan, 3.86%, 4/30/2019 | | 465,000 | 469,417 |

| Hilton Worldwide Finance LLC: |

| | Term Loan B2, 3.084%, 10/25/2023 | | 815,108 | 821,833 |

| | Term Loan B1, 3.5%, 10/26/2020 | | 79,735 | 80,271 |

| Quebecor Media, Inc., Term Loan B1, 3.402%, 8/17/2020 | 931,250 | 930,477 |

| Seminole Tribe of Florida, Term Loan, 3.088%, 4/29/2020 | 800,300 | 803,469 |

| Visteon Corp., Term Delay Draw B, 3.546%, 4/9/2021 | | 700,000 | 704,375 |

| | 5,622,343 |

| Consumer Staples 2.8% |

| Albertson's LLC, Term Loan B6, 4.75%, 6/22/2023 | | 497,799 | 499,939 |

| Pinnacle Foods Finance LLC: |

| | Term Loan H, 3.25%, 4/29/2020 | | 716,533 | 720,656 |

| | Term Loan G, 3.387%, 4/29/2020 | | 317,792 | 319,660 |

| | 1,540,255 |

| Energy 0.6% |

| MEG Energy Corp., Term Loan, 3.75%, 3/31/2020 | | 340,501 | 321,561 |

| Financials 0.8% |

| Delos Finance Sarl, Term Loan B, 3.588%, 3/6/2021 | | 425,000 | 428,302 |

| Health Care 3.8% |

| AmSurg Corp., First Lien Term Loan B, 5.25%, 7/16/2021 | 215,050 | 215,408 |

| Community Health Systems, Inc.: |

| | Term Loan G, 3.75%, 12/31/2019 | | 72,107 | 68,425 |

| | Term Loan H, 4.0%, 1/27/2021 | | 132,676 | 125,710 |

| DaVita HealthCare Partners, Inc., Term Loan B, 3.5%, 6/24/2021 | 1,110,440 | 1,116,686 |

| Valeant Pharmaceuticals International, Inc.: |

| | Term Loan B, 5.0%, 2/13/2019 | | 282,607 | 280,488 |

| | Term Loan B, 5.25%, 12/11/2019 | | 267,114 | 264,944 |

| | 2,071,661 |

| Industrials 5.7% |

| BE Aerospace, Inc., Term Loan B, 3.863%, 12/16/2021 | | 834,545 | 837,779 |

| Ply Gem Industries, Inc., Term Loan, 4.0%, 2/1/2021 | | 603,647 | 608,555 |

| Sabre, Inc., Term Loan B, 4.0%, 2/19/2019 | | 493,885 | 498,105 |

| TransDigm, Inc., Term Loan F, 3.75%, 6/9/2023 | | 469,674 | 471,466 |

| Waste Industries U.S.A., Inc., Term Loan, 3.5%, 2/27/2020 | 692,965 | 695,996 |

| | 3,111,901 |

| Information Technology 1.1% |

| First Data Corp., Term Loan, 3.584%, 3/24/2021 | | 625,833 | 629,501 |

| Materials 5.2% |

| American Rock Salt Holdings LLC, First Lien Term Loan, 4.75%, 5/20/2021 | 728,238 | 707,392 |

| Axalta Coating Systems U.S. Holdings, Inc., Term Loan, 3.75%, 2/1/2020 | 433,678 | 436,319 |

| Berry Plastics Holding Corp.: |

| | Term Loan D, 3.5%, 2/8/2020 | | 725,564 | 728,778 |

| | Term Loan G, 3.5%, 1/6/2021 | | 304,001 | 305,245 |

| MacDermid, Inc., Term Loan, 5.0%, 6/7/2023 | | 509,257 | 514,668 |

| PolyOne Corp., Term Loan B, 3.5%, 11/11/2022 | | 163,764 | 165,810 |

| | 2,858,212 |

| Telecommunication Services 1.2% |

| DigitalGlobe, Inc., Term Loan B, 4.75%, 1/31/2020 | | 14,475 | 14,602 |

| Level 3 Financing, Inc.: |

| | Term Loan B2, 3.5%, 5/31/2022 | | 180,000 | 181,491 |

| | Term Loan B, 4.0%, 1/15/2020 | | 485,000 | 489,426 |

| | 685,519 |

| Utilities 5.4% |

| Calpine Corp., Term Loan B5, 3.59%, 5/27/2022 | | 1,831,813 | 1,839,598 |

| NRG Energy, Inc., Term Loan B, 3.5%, 6/30/2023 | | 1,108,289 | 1,112,583 |

| | 2,952,181 |

| Total Loan Participations and Assignments (Cost $20,182,337) | 20,221,436 |

| |

| Convertible Bond 0.2% |

| Materials |

| GEO Specialty Chemicals, Inc., 144A, 7.5% Cash, 7.5% PIK, 10/30/2018 (Cost $113,326) | 113,567 | 116,168 |

| |

| Preferred Security 0.3% |

| Materials |

| Hercules, Inc., 6.5%, 6/30/2029 (Cost $123,324) | | 175,000 | 170,625 |

| |

Shares | Value ($) |

| | | | | |

| Common Stocks 0.0% |

| Industrials 0.0% |

| Congoleum Corp.* | 2,000 | 400 |

| Quad Graphics, Inc. | 31 | 872 |

| | 1,272 |

| Materials 0.0% |

| GEO Specialty Chemicals, Inc.* | 11,502 | 4,517 |

| Total Common Stocks (Cost $19,550) | 5,789 |

| |

| Warrant 0.0% |

| Materials |

| Hercules Trust II, Expiration Date 3/31/2029* (Cost $20,981) | 95 | 501 |

| |

| Cash Equivalents 5.0% |

| Deutsche Central Cash Management Government Fund, 0.38% (d) (Cost $2,753,787) | 2,753,787 | 2,753,787 |

| | | | | |

| | % of Net Assets | Value ($) |

| | |

| Total Investment Portfolio (Cost $74,252,383)† | 136.4 | 74,916,065 |

| Other Assets and Liabilities, Net | 0.9 | 513,501 |

| Notes Payable | (37.3) | (20,500,000) |

| Net Assets | 100.0 | 54,929,566 |

* Non-income producing security.

** Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of November 30, 2016.

† The cost for federal income tax purposes was $74,453,761. At November 30, 2016, net unrealized appreciation for all securities based on tax cost was $462,304. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $1,299,101 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $836,797.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) When-issued security.

(c) Government-backed debt issued by financial companies or government sponsored enterprises.

(d) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

CLO: Collateralized Loan Obligation

JSC: Joint Stock Company

OJSC: Open Joint Stock Company

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

REIT: Real Estate Investment Trust

SBSN: Surat Berharga Syariah Negara (Islamic Based Government Securities)

| Currency Abbreviations |

ARS Argentine Peso HUF Hungarian Forint |

For information on the Fund's policy and additional disclosures, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of November 30, 2016 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total |

| |

| Fixed Income Investments (e) |

| | Corporate Bonds | $ — | $ 47,067,513 | $ — | $ 47,067,513 |

| | Asset-Backed | — | 2,314,573 | — | 2,314,573 |

| | Government & Agency Obligations | — | 2,265,673 | — | 2,265,673 |

| | Loan Participations and Assignments | — | 20,221,436 | — | 20,221,436 |

| | Convertible Bond | — | — | 116,168 | 116,168 |

| | Preferred Security | — | 170,625 | — | 170,625 |

| Common Stocks (e) | 872 | — | 4,917 | 5,789 |

| Warrant | — | — | 501 | 501 |

| Short-Term Investments | 2,753,787 | — | — | 2,753,787 |

| Total | $ 2,754,659 | $ 72,039,820 | $ 121,586 | $ 74,916,065 |

There have been no transfers between fair value measurement levels during the year ended November 30, 2016.

(e) See Investment Portfolio for additional detailed categorizations.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of November 30, 2016 |

| Assets |

Investments: Investments in non-affiliated securities, at value (cost $71,498,596) | $ 72,162,278 |

| Investment in Deutsche Central Cash Management Government Fund (cost $2,753,787) | 2,753,787 |

| Total investments in securities, at value (cost $74,252,383) | 74,916,065 |

| Cash | 15,855 |

| Foreign currency, at value (cost $16,736) | 15,284 |

| Receivable for investments sold — when-issued securities | 30,225 |

| Receivable for investments sold | 854,834 |

| Dividends receivable | 9 |

| Interest receivable | 837,398 |

| Foreign taxes recoverable | 279 |

| Other assets | 3,205 |

| Total assets | 76,673,154 |

| Liabilities |

| Payable for investments purchased — when-issued securities | 440,000 |

| Payable for investments purchased | 582,007 |

| Notes payable | 20,500,000 |

| Interest on notes payable | 8,658 |

| Accrued management fee | 39,716 |

| Accrued Trustees' fees | 1,523 |

| Other accrued expenses and payables | 171,684 |

| Total liabilities | 21,743,588 |

| Net assets, at value | $ 54,929,566 |

| Net Assets Consist of |

Net unrealized appreciation (depreciation) on: Investments | 663,682 |

| Foreign currency | (1,551) |

| Accumulated net realized gain (loss) | (4,953,504) |

| Paid-in capital | 59,220,939 |

| Net assets, at value | 54,929,566 |

| Net Asset Value |

| Net Asset Value per share ($54,929,566 ÷ 4,358,304 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | $ 12.60 |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the year ended November 30, 2016 |

| Investment Income |

Income: Interest | $ 3,891,076 |

| Dividends | 733 |

| Income distributions — Deutsche Central Cash Management Government Fund | 5,896 |

| Other income | 24,013 |

| Total income | 3,921,718 |

Expenses: Management fee | 459,592 |

| Services to shareholders | 4,932 |

| Custodian fee | 54,498 |

| Professional fees | 194,456 |

| Reports to shareholders | 65,605 |

| Trustees' fees and expenses | 8,365 |

| Interest expenses | 349,931 |

| Stock exchange listing fees | 19,440 |

| Other | 54,655 |

| Total expenses | 1,211,474 |

| Net investment income | 2,710,244 |

| Realized and Unrealized Gain (Loss) |

Net realized gain (loss) from: Investments | (1,424,071) |

| Swap contracts | 4,076 |

| Written options | 7,130 |

| Foreign currency | (1,390) |

| | (1,414,255) |

Change in net unrealized appreciation (depreciation): Investments | 2,449,895 |

| Swap contracts | (3,459) |

| Written options | (7,128) |

| Foreign currency | (505) |

| | 2,438,803 |

| Net gain (loss) | 1,024,548 |

| Net increase (decrease) in net assets resulting from operations | $ 3,734,792 |

The accompanying notes are an integral part of the financial statements.

Statement of Cash Flows

| for the year ended November 30, 2016 |

Increase (Decrease) in Cash: Cash Flows from Operating Activities |

| Net increase (decrease) in net assets resulting from operations | $ 3,734,792 |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) in operating activities: Purchases of long-term investments | (28,041,614) |

| Net purchases, sales and maturities of short-term investments | (1,731,771) |

| Net amortization of premium/(accretion of discount) | 9,448 |

| Proceeds from sales and maturities of long-term investments | 35,599,075 |

| (Increase) decrease in dividends receivable | (9) |

| (Increase) decrease in interest receivable | 36,551 |

| (Increase) decrease in other assets | (187) |

| (Increase) decrease in receivable for investments sold | (517,895) |

| Increase (decrease) in receivable for investments sold — when-issued securities | (30,225) |

| (Increase) decrease in upfront payments paid/received on credit default swap contracts | 6,565 |

| Increase (decrease) in written options, at value | (2) |

| Increase (decrease) in interest on notes payable | (15,045) |

| Increase (decrease) in payable for investments purchased | (5,340,049) |

| Increase (decrease) in payable for investments purchased — when-issued securities | 129,219 |

| Increase (decrease) in other accrued expenses and payables | 99,489 |

| Change in unrealized (appreciation) depreciation on investments | (2,449,895) |

| Change in unrealized (appreciation) depreciation on swap contracts | 3,459 |

| Net realized (gain) loss from investments | 1,424,071 |

| Cash provided (used) by operating activities | 2,915,977 |

| Cash Flows from Financing Activities |

| Net increase (decrease) in notes payable | 400,000 |

| Payment for shares repurchased | (612,777) |

| Distributions paid (net of reinvestment of distributions) | (2,836,880) |

| Cash provided (used) by financing activities | (3,049,657) |

| Increase (decrease) in cash | (133,680) |

| Cash at beginning of period (including foreign currency) | 164,819 |

| Cash at end of period (including foreign currency) | $ 31,139 |

| Supplemental Disclosure |

| Interest paid on notes | $ (364,976) |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| Increase (Decrease) in Net Assets | Years Ended November 30, |

| 2016 | 2015 |

Operations: Net investment income | $ 2,710,244 | $ 3,087,135 |

| Net realized gain (loss) | (1,414,255) | (3,082,994) |

| Change in net unrealized appreciation (depreciation) | 2,438,803 | (1,869,267) |

| Net increase (decrease) in net assets resulting from operations | 3,734,792 | (1,865,126) |

Distributions to shareholders from: Net investment income | (2,795,943) | (3,293,091) |

| Net realized gains | — | (693,005) |

| Return of capital | (40,937) | (222,267) |

| Total distributions | (2,836,880) | (4,208,363) |

Fund share transactions: Cost of shares repurchased | (596,297) | (724,067) |

| Increase (decrease) in net assets | 301,615 | (6,797,556) |

| Net assets at beginning of period | 54,627,951 | 61,425,507 |

| Net assets at end of period (including distributions in excess of net investment income of $0 and $18,098, respectively) | $ 54,929,566 | $ 54,627,951 |

| Other Information |

| Shares outstanding at beginning of period | 4,415,736 | 4,479,857 |

| Shares repurchased | (57,432) | (64,121) |

| Shares outstanding at end of period | 4,358,304 | 4,415,736 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| | |

Years Ended November 30, |

| 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per Share Data |

| Net asset value, beginning of period | $ 12.37 | $ 13.71 | $ 14.00 | $ 14.32 | $ 13.00 |

Income (loss) from investment operations: Net investment incomea | .62 | .69 | .83 | .92 | 1.08 |

| Net realized and unrealized gain (loss) | .24 | (1.11) | (.23) | (.14) | 1.43 |

| Total from investment operations | .86 | (.42) | .60 | .78 | 2.51 |

Less distributions from: Net investment income | (.64) | (.74) | (.96) | (1.10) | (1.19) |

| Net realized gains | — | (.16) | — | — | — |

| Return of capital | (.01) | (.05) | — | — | — |

| Total distributions | (.65) | (.95) | (.96) | (1.10) | (1.19) |

| NAV accretion resulting from repurchases of shares at a discount to NAVa | .02 | .03 | .07 | — | — |

| Net asset value, end of period | $ 12.60 | $ 12.37 | $ 13.71 | $ 14.00 | $ 14.32 |

| Market price, end of period | $ 11.72 | $ 10.29 | $ 12.01 | $ 13.07 | $ 14.26 |

| Total Return |

| Based on net asset value (%)b | 7.82 | (1.95) | 5.58 | 5.78 | 19.96 |

| Based on market price (%)b | 20.56 | (6.89) | (.93) | (.83) | 21.04 |

| Ratios to Average Net Assets and Supplemental Data |

| Net assets, end of period ($ millions) | 55 | 55 | 61 | 66 | 67 |

| Ratio of expenses (including interest expense) (%) | 2.24 | 1.80 | 1.83 | 1.85 | 1.94 |

| Ratio of expenses (excluding interest expense) (%) | 1.59 | 1.37 | 1.35 | 1.33 | 1.30 |

| Ratio of net investment income (%) | 5.01 | 5.33 | 5.88 | 6.50 | 7.77 |

| Portfolio turnover rate (%) | 37 | 48 | 70 | 72 | 45 |

| Total debt outstanding, end of period ($ thousands) | 20,500 | 20,100 | 26,500 | 28,000 | 29,500 |

| Asset coverage per $1,000 of debtc | 3,679 | 3,718 | 3,318 | 3,348 | 3,278 |

a Based on average shares outstanding during the period. b Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. c Asset coverage equals the total net assets plus borrowings of the Fund divided by the borrowings outstanding at period end. |

Notes to Financial Statements

A. Organization and Significant Accounting Policies

Deutsche Strategic Income Trust (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end, diversified management investment company organized as a Massachusetts business trust.

On July 13, 2016, the Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than December 31, 2018.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities and loan participations and assignments are valued at prices supplied by independent pricing services approved by the Fund's Board. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers and loan participations and assignments are valued at the mean of the most recent bid and asked quotations or evaluated prices, as applicable, obtained from broker-dealers. Certain securities may be valued on the basis of a price provided by a single source or broker-dealer. No active trading market may exist for some senior loans and they may be subject to restrictions on resale. The inability to dispose of senior loans in a timely fashion could result in losses. These securities are generally categorized as Level 2.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1 securities.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are categorized as Level 1. Over-the-counter written or purchased options are valued at prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer with which the option was traded. Over-the-counter written or purchased options are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. The Fund is approved to participate in securities lending, but had no securities on loan during the year ended November 30, 2016. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of its securities lending agreement. The Fund retains the benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market price. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the securities lending agreement. The Fund may invest the cash collateral into a joint trading account in affiliated money market funds managed by Deutsche Investment Management Americas Inc. Deutsche Investment Management Americas Inc. receives a management/administration fee (0.09% annualized effective rate as of November 30, 2016) on the cash collateral invested in Government & Agency Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction, it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. Additionally, the Fund may be required to post securities and/or cash collateral in accordance with the terms of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Loan Participations and Assignments. Loan Participations and Assignments are portions of loans originated by banks and sold in pieces to investors. These floating-rate loans ("Loans") in which the Fund invests are arranged between the borrower and one or more financial institutions ("Lenders"). These Loans may take the form of Senior Loans, which are corporate obligations often issued in connection with recapitalizations, acquisitions, leveraged buy outs and refinancing. The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of Loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship with only the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, or any rights of set off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Loans held by the Fund are generally in the form of Assignments, but the Fund may also invest in Participations. If affiliates of the Advisor participate in the primary and secondary market for senior loans, legal limitations may restrict the Fund's ability to participate in restructuring or acquiring some senior loans. All Loans involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

Statement of Cash Flows. Information on financial transactions which have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows represents the cash and foreign currency positions at the Fund's custodian bank at November 30, 2016.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders.

At November 30, 2016, the Fund had $4,752,000 of tax basis capital loss carryforwards, which may be applied against realized net taxable capital gains indefinitely, including short-term losses ($1,405,000) and long-term losses ($3,347,000).

The Fund has reviewed the tax positions for the open tax years as of November 30, 2016 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund are declared and distributed to shareholders monthly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to forward currency contracts, swap contracts, certain securities sold at a loss and premium amortization on debt securities. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

At November 30, 2016, the Fund's components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Capital loss carryforwards | $ (4,752,000) |

| Net unrealized appreciation (depreciation) on investments | $ 462,304 |

In addition, the tax character of distributions paid to shareholders by the Fund is summarized as follows:

| | Years Ended November 30, |

| | 2016 | 2015 |

| Distributions from ordinary income* | $ 2,795,943 | $ 3,293,091 |

| Distributions from long-term capital gains | $ — | $ 693,005 |

| Return of capital distributions | $ 40,937 | $ 222,267 |

* For tax purposes, short-term capital gain distributions are considered ordinary income distributions.