QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material under Rule 14a-12 |

SUPERGEN, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

SUPERGEN, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 29, 2002

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders (the "Annual Meeting") of SuperGen, Inc., a Delaware corporation (the "Company"), will be held on Wednesday, May 29, 2002 at 2:00 p.m., local time, at 4140 Dublin Boulevard, Dublin, California 94568 for the following purposes:

- 1.

- To elect six directors to serve for the ensuing year and until their successors are duly elected and qualified.

- 2.

- To ratify the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2002.

- 3.

- To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only holders of record of the Company's Common Stock at the close of business on April 15, 2002, the record date, are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, you are urged to sign and return the enclosed proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

Dublin, California

April 26, 2002

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE

SUPERGEN, INC.

PROXY STATEMENT

FOR

2002 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of SuperGen, Inc. ("We," "SuperGen," or the "Company") for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on Wednesday, May 29, 2002 at 2:00 p.m., local time, and at any adjournments thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company's headquarters located at 4140 Dublin Boulevard, Suite 200, Dublin, California 94568. The telephone number at that location is (925) 560-0100.

The proxy solicitation materials, which include the Proxy Statement, Proxy and the Company's 2001 Annual Report to Stockholders, were first mailed to all stockholders entitled to vote at the Annual Meeting on or about April 26, 2002.

Record Date

Stockholders of record at the close of business on April 15, 2002 (the "Record Date") are entitled to notice of and to vote at the meeting. As of the Record Date, 32,689,396 shares of the Company's Common Stock were issued and outstanding. No shares of preferred stock were outstanding.

Revocability of Proxies

Any Proxy given under this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company a written notice of revocation or a duly executed Proxy bearing a later date or by attending the meeting and voting in person.

Voting and Voting Procedures

Each stockholder is entitled to one vote for each share of Common Stock held on all matters to be voted on by the stockholders. Votes cast in person or by proxy will be tabulated by Mellon Investor Services, LLC., the Company's transfer agent.

Upon the execution and return of the enclosed form of proxy, the shares represented thereby will be voted in accordance with the terms of the proxy, unless the proxy is revoked. If no directions are indicated in such proxy, the shares represented thereby will be voted as follows:

- (i)

- "FOR" the election of each of the Company's nominees as a director, and

- (ii)

- "FOR" ratification of the appointment of Ernst & Young LLP as independent auditors for the Company for the fiscal year ending December 31, 2002.

Quorum; Abstentions; Broker Non-Votes

A majority of the outstanding shares of Common Stock entitled to vote on the Record Date, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting or any adjournments thereof. Shares that are voted "FOR" or "AGAINST" a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as votes eligible to be cast by the Common Stock present in person or

represented by proxy at the meeting and "entitled to vote on the subject matter" (the "Votes Cast") with respect to such matter.

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker "non-vote" are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum of shares is present at a meeting. Neither abstentions nor broker "non-votes" affect the election of directors as the vote required is a plurality of the votes duly cast, which means that only affirmative votes will affect the outcome of the election. Broker "non-votes" are not deemed to be Votes Cast. As a result, while abstentions are deemed to be Votes Cast and will have the effect of votes in opposition of a given proposal, broker "non-votes" are not included in the tabulation of the voting results on issues requiring approval of a majority of the Votes Cast and, therefore, do not have the effect of votes in opposition in such tabulations.

A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Costs of Solicitation of Proxies

We will bear the costs of soliciting proxies. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and employees, without additional compensation, personally or by telephone, letter, e-mail or facsimile.

Deadline for Receipt of Stockholder Proposals

Our stockholders may submit proposals that they believe should be voted upon at the Annual Meeting or nominate persons for election to our Board of Directors. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended ("Rule 14a-8"), some stockholder proposals may be eligible for inclusion in our 2003 Proxy Statement. Any such stockholder proposals must be submitted in writing to the attention of the Secretary, SuperGen, Inc., 4140 Dublin Boulevard, Suite 200, Dublin, California 94568, no later than December 27, 2002. Stockholders interested in submitting such a proposal are advised to contact knowledgeable legal counsel with regard to the detailed requirements of applicable securities laws. The submission of a stockholder proposal does not guarantee that it will be included in our 2003 Proxy Statement.

Alternatively, under our Bylaws, a nomination or a proposal that the stockholder does not seek to include in our 2003 Proxy Statement pursuant to Rule 14a-8 may be submitted in writing to the Secretary, SuperGen, Inc., 4140 Dublin Boulevard, Suite 200, Dublin, California 94568, for the 2003 Annual Meeting of Stockholders not less than 60 days prior to the meeting. Note, however, with respect to a proposal and in the event we provide less than 70 days notice or prior public disclosure to stockholders of the date of the 2003 Annual Meeting, any stockholder proposal or nomination not submitted pursuant to Rule 14a-8 must be submitted to us not later than the close of business on the tenth day following the day on which notice of the date of the 2003 Annual Meeting was mailed or public disclosure was made. For example, if we provide notice of our 2003 Annual Meeting on April 17, 2003, for a 2003 Annual Meeting on May 30, 2003, any such proposal or nomination will be considered untimely if submitted to us after April 27, 2003. For purposes of the above, "public disclosure" means disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service, or in a document publicly filed by us with the Securities and Exchange Commission (the "SEC"). As described in our Bylaws, the stockholder submission must include certain specified information concerning the proposal or nominee, as the case may be, and information as to the stockholder's ownership of our Common Stock. If a stockholder gives notice of such a proposal after the deadline computed in accordance with our Bylaws (the "Bylaw Deadline"),

2

the stockholder will not be permitted to present the proposal to the stockholders for a vote at the meeting.

SEC rules also establish a different deadline for submission of stockholder proposals that are not intended to be included in the Company's Proxy Statement with respect to discretionary voting (the "Discretionary Vote Deadline"). The Discretionary Vote Deadline for the 2003 annual meeting is March 12, 2003 (45 calendar days prior to the anniversary of the mailing date of this Proxy Statement). If a stockholder gives notice of such a proposal after the Discretionary Vote Deadline, the Company's proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at the Company's annual meeting.

Because the Bylaw Deadline is not capable of being determined until the Company publicly announces the date for its next annual meeting, it is possible that the Bylaw Deadline may occur after the Discretionary Vote Deadline. In such a case, a proposal received after the Discretionary Vote Deadline but before the Bylaw Deadline would be eligible to be presented at next year's annual meeting and the Company believes that its proxy holders would be allowed to use the discretionary authority granted by the proxy card to vote against the proposal at the meeting without including any disclosure of the proposal in the Proxy Statement relating to such meeting.

The Company has not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year's Annual Meeting. The enclosed proxy card grants the proxy holders discretionary authority to vote on any matter properly brought before the Annual Meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Our Board of Directors (the "Board") is currently composed of six members. The directors are elected to serve one-year terms and until their respective successors are elected and qualified. The Board has nominated the persons set forth below for election as directors. All of the nominees are current directors of the Company. Unless otherwise instructed, the holders of proxies solicited by this Proxy Statement will vote the proxies received by them for such nominees. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders will vote for a nominee designated by the present Board to fill the vacancy. We are not aware of any reason that any nominee will be unable or will decline to serve as a director.

Vote Required

The six nominees receiving the highest number of affirmative votes of the shares entitled to be voted shall be elected as directors of the Company. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum but have no other legal effect under Delaware law.

3

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF ALL NOMINEES FOR DIRECTOR NAMED BELOW.

Information Regarding Nominees

Name

| | Age

| | Principal Occupation

|

|---|

| Joseph Rubinfeld | | 69 | | President, Chief Executive Officer and Director of the Company |

| Denis Burger | | 58 | | Chairman and Chief Executive Officer, AVI BioPharma, Inc. |

| Thomas V. Girardi(1)(2) | | 62 | | Senior Partner, Girardi & Keese |

| Walter J. Lack(1)(2) | | 53 | | Managing Partner, Engstrom, Lipscomb & Lack |

| James S.J. Manuso(1) | | 53 | | General Partner, PrimeTech Partners |

| Daniel Zurr | | 56 | | President and Chief Executive Officer, Quark Biotech, Inc. |

- (1)

- Member of the Compensation Committee.

- (2)

- Member of the Audit Committee.

Joseph Rubinfeld, Ph.D. co-founded the Company in 1991. He has served as Chief Executive Officer, President and a director of the Company since its inception and was Chief Scientific Officer from inception until September 1997. Dr. Rubinfeld was one of the four initial founders of Amgen, Inc. in 1980 and served as Vice President and Chief of Operations until 1983. From 1987 to 1990, he was a Senior Director at Cetus Corporation. From 1968 to 1980, Dr. Rubinfeld was employed at Bristol-Myers Company International Division ("Bristol-Myers") in a variety of positions, most recently as Vice President and Director of Research and Development. While at Bristol-Myers, Dr. Rubinfeld was instrumental in licensing the original anticancer line of products for Bristol-Myers, including mitomycin and bleomycin. Prior to that time, Dr. Rubinfeld was a research scientist with several pharmaceutical and consumer product companies including Schering-Plough Corporation and Colgate-Palmolive Co. Dr. Rubinfeld is a member of the Board of Directors of AVI BioPharma, Inc. and Quark Biotech, Inc. He received his B.S. in chemistry from C.C.N.Y., and his M.A. and Ph.D. in chemistry from Columbia University. Dr. Rubinfeld has numerous patents and/or publications on a wide range of inventions and developments including the 10-second developer for Polaroid film, manufacture of cephalosporins, and the first commercial synthetic biodegradable detergent. In 1984, Dr. Rubinfeld received the Common Wealth Award for Invention.

Denis Burger, Ph.D. has served as a director of the Company since January 1996. Dr. Burger has served as Chairman and Chief Operating Officer of AVI BioPharma, Inc., a biotechnology company specializing in gene-targeted therapeutic and diagnostic products, since February 1992 and as Chief Executive Officer since February 1996. Dr. Burger was a co-founder of Epitope, Inc., a biotechnology company, and served as its Chairman from 1981 until 1990. He has also been the general partner of Sovereign Ventures, LLC, a biotechnology consulting and merchant banking venture, since 1991. Dr. Burger is a member of the Board of Directors of AVI BioPharma, Inc. and Trinity Biotech, PLC. He received his B.A. in Bacteriology and Immunology from the University of California, Berkeley, and his M.S. and Ph.D. in Microbiology and Immunology from the University of Arizona, Tucson.

Thomas V. Girardi has served as a director of the Company since May 2000. Mr. Girardi is senior partner of Girardi & Keese, a law firm specializing in major business litigation, where he has worked since 1964. Mr. Girardi has served as National President and Los Angeles Chapter President of the American Board of Trial Advocates, is a fellow of the International Academy of Trial Lawyers and the Inner Circle of Advocates, and is a member of the American Board of Professional Liability Lawyers, International Society of Barristers, and American Trial Lawyers Association. Mr. Girardi is also a member of the Board of Directors of Spectrum Laboratories, Inc. He received his B.S. and J.D. from Loyola Law School and an LLM from New York University.

4

Walter J. Lack has served as a director of the Company since February 2000. Mr. Lack is managing partner of Engstrom, Lipscomb & Lack, a Los Angeles, California law firm that he founded in 1974. Mr. Lack has acted as a special arbitrator for the Superior Court of the State of California since 1976 and for the American Arbitration Association since 1979. He is a member of the International Academy of Trial Lawyers and an Advocate of the American Board of Trial Advocates. Mr. Lack is also a member of the Board of Directors of HCC Insurance Holdings, Inc., Microvision Inc., and Spectrum Laboratories, Inc.

James S.J. Manuso, Ph.D. has served as a director of the Company since February 2001. Dr. Manuso is a co-founder and general partner of PrimeTech Partners, a biotechnology venture management partnership. He is also a co-founder and chairman of Advance Genetic Systems, Inc., a microarray technology and functional genomics company. Dr. Manuso co-founded and serves on the board of EvoRx, Inc., a company applyingin vivo directed molecular evolution technologies to the enhancement of drugs' cellular targeting, uptake and retention. Prior to co-founding PrimeTech Partners in 1998, Dr. Manuso was co-founder and President of Manuso, Alexander & Associates, Inc., management consultants and financial advisors to pharmaceutical and biotechnology companies. From 1974 to 1983, Dr. Manuso was acting Medical Director and Director of Health Care Planning and Development for The Equitable Companies. He also serves on the boards of Symbiontics, Inc. and Quark Biotech, Inc. Dr. Manuso earned a B.A. in Economics and Chemistry from New York University, a Ph.D. in Experimental Psychophysiology from The Graduate Faculty of the New School University, and an Executive MBA from Columbia Business School.

Daniel Zurr, Ph.D. has been a director of the Company since January 1994. Dr. Zurr currently serves as President, Chief Executive Officer, and director of Quark Biotech, Inc. Dr. Zurr served as Scientific Director and Business Development Director of the Pharmaceutical Division of Israel Chemicals, Ltd., an Israeli limited liability company, from 1984 to 1995. He also served as Director of Licensing at G.D. Searle & Company, Ltd., from 1980 to 1983. He was Chief Executive Officer of Plantex-Ikapharm, an Israeli pharmaceutical company, from 1975 to 1980. Dr. Zurr received his M.Sc. at the Hebrew University of Jerusalem and his Ph.D. from the Imperial College University of London in 1972.

Board Meetings and Committees

During the year ended December 31, 2001, the Board held four meetings. With the exception of Daniel Zurr, all of the directors attended 75% or more of the meetings of the Board and committees, if any, upon which such directors served.

The Board currently has two standing committees: an Audit Committee and a Compensation Committee. We have no nominating committee or committee performing similar functions.

Audit Committee. The Audit Committee is composed of two independent directors, as defined in the applicable listing standards of the Nasdaq National Market, Mr. Girardi and Mr. Lack. The Audit Committee reviews and monitors the corporate financial reporting and the internal and external audits of the Company, including, among other things, the audit and control functions, the results and scope of the annual audit and other services provided by the Company's independent accountants, and the Company's compliance with legal matters that have a significant impact on its financial reports. The Audit Committee held four meetings during fiscal year 2001. For more information regarding the functions performed by the Audit Committee, please see "Report of the Audit Committee," included in this Proxy Statement. The Audit Committee is governed by a written charter approved by the Board of Directors, a copy of which was filed as an appendix to the 2001 Proxy Statement.

Compensation Committee. The Compensation Committee is composed of Mr. Girardi, Dr. Manuso, and Mr. Lack. The Compensation Committee reviews the Company's executive

5

compensation policy, including equity compensation for senior executives of the Company, and makes recommendations to the Board regarding such matters. The Compensation Committee held one meeting during 2001. See "Report of the Compensation Committee of the Board of Directors" included in this Proxy Statement.

Director Compensation

All non-employee directors of the Company receive $1,000 in compensation for attendance at each meeting of the Board, and Board Committee members shall each receive $1,000 for each Board Committee meeting held on a day on which no Board meeting is held. Directors and Board Committee members are also reimbursed for all reasonable expenses incurred by them in attending Board and Committee meetings. We have also adopted the 1996 Directors' Stock Option Plan providing for stock options to be granted to certain non-employee directors. Under this plan, each new non-employee director who joins the Company is entitled to receive an option to purchase 50,000 shares of the Common Stock. All options granted under the plan will vest as to 20% of the shares upon grant and as to 20% of the shares each year thereafter, provided that the non-employee director shall continue to serve as a director on such date. Each option has a term of ten years from the date of grant. The exercise price per share for all options granted under the plan is 100% of the fair market value of our Common Stock on the date of grant.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board has appointed Ernst & Young LLP as independent auditors of the Company to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2002, and recommends that the stockholders vote for ratification of such appointment.

Ernst & Young LLP has audited our financial statements since March 1994. Fees for the last annual audit were $134,800 and all other fees were $113,508. Other fees included $12,300 for audit-related services for SEC registration statements and accounting consultation, and $101,208 for tax compliance and tax consultation services. No fees were paid relating to financial information systems design and implementation.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting, will have the opportunity to make a statement, and is expected to be available to respond to appropriate questions.

Vote Required

Ratification of the appointment of Ernst & Young LLP as our independent auditors will require the affirmative vote of a majority of the outstanding shares of Common Stock represented, in person or by proxy, and entitled to vote on this proposal. Abstentions will have the same effect as a vote against this proposal. Broker non-votes will not be counted as having been represented.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF APPOINTING ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT AUDITORS.

6

SHARE OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENT

To our knowledge, the following table sets forth the beneficial ownership of Common Stock of the Company as of March 31, 2002 for the following: (i) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of the Company's Common Stock; (ii) each of the Company's directors; (iii) each of the officers named in the Summary Compensation Table; and (iv) all directors and executive officers of the Company as a group.

Name

| | Shares

Beneficially

Owned(1)

| | Percentage

Beneficially

Owned(%)

|

|---|

Joseph Rubinfeld(2)

c/o SuperGen, Inc.

4140 Dublin Blvd., Suite 200

Dublin, CA 94568 | | 2,833,139 | | 8.4 |

Tako Ventures, LLC(3)

Lawrence Ellison

c/o Oracle Corporation

500 Oracle Parkway

Redwood Shores, CA 94065 | | 2,063,313 | | 6.0 |

| Denis Burger(4) | | 20,000 | | * |

| Thomas V. Girardi(5) | | 213,500 | | * |

| Walter J. Lack(5) | | 170,000 | | * |

| James S.J. Manuso(6) | | 34,470 | | * |

| Daniel Zurr(7) | | 40,000 | | * |

| Karl L. Mettinger(8) | | 39,861 | | * |

| Edward L. Jacobs(9) | | 43,126 | | * |

| All directors and executive officers as a group (8 persons)(10) | | 3,394,096 | | 10.0 |

- *

- Less than 1%.

- (1)

- The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire at May 30, 2002 through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares shown as beneficially owned. At March 31, 2002, there were 32,649,096 shares of our Common Stock outstanding.

- (2)

- Includes 1,627,500 shares held jointly by Joseph Rubinfeld and Loretta Kifer, husband and wife, 20,000 shares held individually by Joseph Rubinfeld, 49,000 shares held by Joseph Rubinfeld and Loretta Kifer as custodians under the California Uniform Transfers to Minors Act, 1,100,000 shares issuable upon exercise of options to purchase shares of Common Stock exercisable by Joseph Rubinfeld at May 30, 2002, and options to purchase 36,639 shares of Common Stock exercisable by Loretta Kifer at May 30, 2002.

- (3)

- Tako Ventures, LLC is an investment entity controlled by Lawrence J. Ellison, a former director of the Company. Includes 1,775,000 shares issuable upon exercise of warrants to purchase shares of Common Stock exercisable at May 30, 2002.

7

- (4)

- Represents 20,000 shares issuable upon exercise of stock options to purchase shares of Common Stock exercisable at May 30, 2002. Does not include 447,326 shares owned by AVI BioPharma, Inc. ("AVI"). Dr. Burger in his capacity as Chief Executive Officer of AVI does not have or share investment control over these shares owned by AVI.

- (5)

- Includes 30,000 shares issuable upon the exercise of stock options to purchase shares of Common Stock exercisable at May 30, 2002.

- (6)

- Includes 1,400 shares held individually by James Manuso, 60 shares held individually by Susan Manuso, his wife, 10 shares held by Susan Manuso as custodian under Uniform Grant to Minors Act, and 33,000 shares issuable upon the exercise of stock options to purchase shares of Common Stock exercisable by James Manuso at May 30, 2002.

- (7)

- Represents 40,000 shares issuable upon the exercise of stock options to purchase shares of Common Stock exercisable at May 30, 2002.

- (8)

- Represents 39,861 shares issuable upon the exercise of stock options to purchase shares of Common Stock exercisable at May 30, 2002.

- (9)

- Includes 41,667 shares issuable upon the exercise of a stock option to purchase shares of Common Stock exercisable at May 30, 2002. Mr. Jacobs resigned his position as Executive Vice President, Commercial Operations on January 31, 2001 and rejoined the Company in October 2001 as Chief Business Officer and Chief Financial Officer.

- (10)

- See footnotes (2) and (4) through (9). Includes 1,371,167 shares issuable upon the exercise of stock options to purchase shares of Common Stock held by directors and executive officers which are exercisable at May 30, 2002.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities ("10% of Class Stockholders") to file with the SEC reports of ownership on Form 3 and reports on changes in ownership on Form 4 or Form 5. Such executive officers, directors and 10% of Class Stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms that they file, except that a Form 4 for Karl Mettinger for March 2001 was filed late.

Based solely on its review of the copies of such forms received by the Company, or written representations from certain reporting persons that no Forms 5 were required for such persons, the Company believes that, through the Record Date, its executive officers, directors and 10% of Class Stockholders complied with all applicable Section 16(a) filing requirements.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company's Compensation Committee was formed in January of 1993 and is currently composed of Mr. Girardi, Mr. Lack, and Dr. Manuso, who are all directors of the Company. During 2001, no member of the Compensation Committee was an officer, employee or consultant of the Company.

8

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table sets forth certain information concerning total compensation received by the Chief Executive Officer and the other most highly compensated executive officers (collectively, the "Named Officers") for services rendered to the Company in all capacities during the last three fiscal years.

| | Annual Compensation

| | Long-Term Compensation Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Other Annual

Compensation

($)(1)

| | Bonus($)

| | Securities

Underlying

Options(#)

| | All Other

Compensation

($)

| |

|---|

Joseph Rubinfeld, Ph.D.

President and Chief Executive Officer | | 2001

2000

1999 | | 530,000

500,000

361,200 | | 8,438

8,050

7,500 | | 466,000

780,000

650,000 | | —

—

— | | 83,662

24,331

4,800 | (2)

|

Karl L. Mettinger, M.D.(3)

Senior Vice President, Chief Medical Officer | | 2001

2000

1999 | | 260,000

95,104

N/A | | —

—

N/A | | 22,900

12,500

N/A | | 24,500

60,500

N/A | | 5,100

18,652

N/A | (4)

|

Edward L. Jacobs(5)

Chief Business Officer and Chief Financial Officer | | 2001

2000

1999 | | 101,708

250,000

155,250 | | 3,977

6,780

6,303 | | 42,300

68,500

30,000 | | 100,000

15,000

85,000 | | 37,392

5,100

4,800 | (6)

|

- (1)

- Represents use of Company leased vehicles or automobile allowance.

- (2)

- Includes 401(k) contribution of $5,100, accrued vacation payment of $35,672, and life insurance premiums of $42,890.

- (3)

- Dr. Mettinger joined the Company in August 2000.

- (4)

- Represents 401(k) contribution.

- (5)

- Mr. Jacobs joined the Company in March 1999. He resigned his position in January 2001 and returned to the Company in October 2001.

- (6)

- Represents accrued vacation payment of $26,281 and relocation allowance of $11,111.

Option Grants in 2001

The following table shows, as to the Named Officers, information concerning stock options granted during 2001. We have never granted any stock appreciation rights.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term($)(3)

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of Total

Options

Granted to

Employees in

Fiscal Year(1)

| |

| |

|

|---|

Name

| | Exercise Price

Per Share($)(2)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Joseph Rubinfeld, Ph.D. | | — | | — | | — | | — | | — | | — |

| Karl L. Mettinger, M.D. | | 4,500

20,000 | | 0.7

3.3 | %

% | 8.09

8.69 | | 03/22/11

10/18/11 | | 22,906

109,302 | | 58,049

276,992 |

| Edward L. Jacobs | | 100,000 | | 16.5 | % | 7.03 | | 09/24/11 | | 442,113 | | 1,120,401 |

- (1)

- Based on a total of options to acquire 604,950 shares granted to employees in 2001.

9

- (2)

- Represents the fair market value on the date of grant as determined by the closing price of our Common Stock on the Nasdaq National Market.

- (3)

- The Potential Realizable Value is calculated based on the fair market value on the date of grant, which is equal to the exercise price of options granted in 2001, assuming that the stock appreciates in value from the date of grant until the end of the option term at the annual rates specified (5% and 10%). Potential Realizable Value is net of the option exercise price. The assumed rates of appreciation are specified in rules of the SEC and do not represent the Company's estimate or projection of future stock price. Actual gains, if any, resulting from stock option exercises and Common Stock holdings are dependent on the future performance of the Common Stock and overall stock market conditions, as well as the option holders' continued employment through the exercise/vesting period. The amounts reflected in this table may never be achieved.

Aggregated Option/SAR Exercises and Fiscal Year-End Option/SAR Values

The following table sets forth, as to the Named Officers, certain information concerning options exercised during 2001 and the number of shares subject to both exercisable and unexercisable stock options as of December 31, 2001. Also reported are values for unexercised "in-the-money" options, which values represent the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company's Common Stock as of December 31, 2001.

| |

| |

| | Number of Securities

Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End(1)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)

|

|---|

| | Exercisable(#)

| | Unexercisable(#)

| | Exercisable($)

| | Unexercisable($)

|

|---|

| Joseph Rubinfeld, Ph.D. | | — | | — | | 1,100,000 | | — | | 5,004,500 | | — |

| Karl L. Mettinger, M.D. | | — | | — | | 35,000 | | 50,000 | | 44,978 | | 118,249 |

| Edward L. Jacobs | | — | | — | | 31,250 | | 68,750 | | 227,813 | | 501,188 |

- (1)

- The value of underlying securities is based on the $14.32 per share closing price of the Company's Common Stock on December 31, 2001 (the last market trading day in 2001), minus the aggregate exercise price.

Employment Agreement and Change-in-Control Arrangement

We maintain an employment agreement with Dr. Joseph Rubinfeld (the "Employment Agreement"). The Employment Agreement, which became effective in March 2002 and provides for an employment term through December 31, 2003, provides for his employment as President and Chief Executive Officer at an annual base salary of at least $565,000. The base salary will be automatically adjusted on the one-year anniversary of its effective date at twice the percentage increase in the Consumer Price Index. The Employment Agreement also provides for an annual guaranteed bonus of $250,000 and an additional performance-based bonus of $250,000 to be paid based on achievement of criteria established by the Compensation Committee. Dr. Rubinfeld will also be eligible for additional salary or other incentive compensation as approved by the Compensation Committee. Under the Employment Agreement, Dr. Rubinfeld will be entitled to participate in Company's benefit plans for executive employees and will be entitled to not less than 20 days vacation per year.

The Employment Agreement also provides Dr. Rubinfeld with salary and bonus compensation if he is involuntarily terminated within twelve months of a change in control of the Company. In such an event, Dr. Rubinfeld is entitled to receive a lump sum payment equal to two times his then-current base salary, a lump sum payment of up to $500,000 in lieu of bonus payments, and full acceleration of any unvested stock options Dr. Rubinfeld holds.

10

CERTAIN TRANSACTIONS

Agreements with Abbott Laboratories

In December 1999, we entered into two agreements with Abbott Laboratories ("Abbott"), a Common Stock and Option Purchase Agreement and a Worldwide Sales, Distribution and Development Agreement relating to Orathecin™. Under these agreements, Abbott was to invest in shares of our common stock and would participate with us in the marketing and distribution of Orathecin. We would have co-promoted Orathecin with Abbott in the United States and Abbott had exclusive rights to market Orathecin outside of the United States. In the United States market, we would have shared profits from product sales equally with Abbott, while outside of the United States market, Abbott would have paid us royalties and transfers fees based on product sales. Abbott was obligated to purchase up to $81.5 million in shares of our common stock over a period of time. In addition, Abbott had an option to purchase up to 49% of the shares of our common stock outstanding at the time of the exercise at $85 per share. Abbott also had a right of first discussion with respect to our product portfolio and a right of first refusal to acquire us. In connection with these agreements, Abbott made a $26.5 million equity investment in January 2000 and a $2.5 million equity milestone payment in July 2001.

On March 4, 2002, SuperGen and Abbott mutually terminated the Common Stock and Option Purchase Agreement and the Worldwide Sales, Distribution and Development Agreement. We regained all marketing rights to Orathecin worldwide and are no longer obligated to share profits from product sales of Orathecin. Abbott no longer has the right or obligation to purchase the remaining aggregate amount of $52.5 million of shares of our common stock, no longer has the option to purchase up to 49% of our outstanding shares, no longer has the right of first discussion with respect to our product portfolio, and no longer has a right of first refusal to acquire us. In connection with this termination agreement, we agreed to reimburse Abbott for development work they completed on our behalf totaling $1.6 million.

In December 1999, we also entered into a Nipent distribution agreement with Abbott, which is still in effect. Beginning March 1, 2000, Abbott became the exclusive U.S. distributor of Nipent for a period of five years. We retain U.S. marketing rights for Nipent. Under this agreement, Abbott made a $5 million cash payment to the Company.

Agreements with AVI BioPharma, Inc.

Dr. Burger is the Chief Executive Officer of AVI BioPharma, Inc., and Dr. Rubinfeld is a member of the Board of Directors of AVI. In December 1999, we entered into an agreement with AVI. Under the terms of the agreement, we acquired one million shares of AVI common stock, which amounted to approximately seven and one half percent (7.5%) of AVI's outstanding common stock, for $2.5 million cash and 100,000 shares of our Common Stock at $28.25 per share. We also acquired exclusive negotiating rights for the United States market for Avicine, AVI's proprietary cancer vaccine currently in late-stage clinical testing against a variety of solid tumors. Avicine is a non-toxic immunotherapy that neutralizes the effect of a tumor-associated antigen on cancer cells, while stimulating the body's immune system to react against the foreign tumor.

In July 2000, we finalized an agreement with AVI to obtain the U.S. marketing rights for Avicine. We issued 347,826 shares of our Common Stock along with $5 million in cash to AVI as payment for our investment, in exchange for 1,684,211 shares of AVI common stock. As part of this agreement, we obtained the right of first discussion to all of AVI's oncology compounds and an option to acquire an additional 10% of AVI's Common Stock for $35.625 per share. This option is exercisable for a three-year period commencing on the earlier of the date the FDA accepts the NDA submitted for Avicine or the date on which the closing price of AVI's Common Stock exceeds the option exercise price.

11

Avicine will require significant additional expenditures to complete the clinical development necessary to gain marketing approval from the FDA and equivalent foreign regulatory agencies. As part of this agreement, we are obligated to make additional payments to AVI based on successful achievement of developmental, regulatory approval, and commercialization milestones over the next several years that could total $80 million. In 2001, we recorded $1.2 million in research and development expenses relating to our share of the development costs for Avicine. At December 31, 2001, this amount had not been paid to AVI and is presented on the balance sheet as Payable to AVI BioPharma, Inc.

Quark Biotech, Inc. Investment and Property Lease

In May 1997, we made an equity investment of $500,000 and acquired 125,000 shares of Series C Preferred Stock of Quark Biotech, Inc. ("QBI"), a privately-held development stage biotechnology company headquartered in Israel, representing less than 1% of the outstanding stock of QBI, and in September 1997 were issued a warrant to purchase 31,250 shares of Series D Preferred Stock. Dr. Rubinfeld, Dr. Manuso, and Dr. Zurr, directors of the Company, and Mr. Ellison (through Tako Ventures, LLC), a more than 5% stockholder of the Company, beneficially own an aggregate of 17,969,001 (for Dr. Rubinfeld, excluding the 125,000 shares held by our Company) shares, or approximately 78.7%, of QBI as of the Record Date. Dr. Rubinfeld, Dr. Manuso, and Dr. Zurr are also directors of QBI. Dr. Zurr is the President and Chief Executive Officer of QBI.

In January 2002, we leased approximately 2,500 square feet of the laboratory space at the SuperGen Pharmaceutical Research Institute to QBI for $8,550 per month, plus its pro-rata share of specified common expenses, for a one year term.

Management Indebtedness.

In November 2000, the Company loaned $124,000 to Dr. Mettinger. The loan is secured by a continuing security interest in real property owned by Dr. Mettinger. The loan has an annual interest rate of 5% and is due and payable on December 31, 2002.

In October 2001, the Company loaned $250,000 to Mr. Jacobs. The loan is secured by a continuing security interest in real property owned by Mr. Jacobs. The loan has an annual interest rate of 4% and is due and payable on December 31, 2003.

Employment of Certain Family Members

The Company employs a number of individuals who are immediate family members of Dr. Rubinfeld, President, Chief Executive Officer, and director of the Company. The employees, their relationship to Dr. Rubinfeld, and their annual aggregate salary and bonus amounts for the year ending December 31, 2001 are as follows: Joseph Iovino, son-in law, $115,400; Susan Iovino, daughter, $85,200; Loretta Kifer, wife, $121,962; Kevin Rolens, son-in-law, $105,100; Randee Rolens, daughter, $120,600; and Steven Rubinfeld, son, $198,853. None of these individuals are officers or directors of the Company.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

12

The Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Committee under generally accepted auditing standards. In addition, the Committee has discussed with the independent auditors the auditors' independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of non-audit services with the auditors' independence.

The Committee discussed with the Company's independent auditors the overall scope and plans for their audit. The Committee met with the independent auditors, with and without management present, and discussed the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Committee held four meetings during fiscal year 2001.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission. The Committee and the Board have also recommended, subject to stockholder approval, the selection of the Company's independent auditors.

AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

Thomas Girardi

Walter Lack

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board (the "Committee") consists of directors Thomas Girardi, Walter Lack, and James Manuso, none of whom is an employee or officer of the Company. The Committee was established in January 1993 and is responsible for reviewing and making recommendations to the Board regarding all forms of compensation to be provided to the executive officers and directors of SuperGen, including stock compensation and loans, and all bonus and stock compensation to all employees. The goal of the Committee is to ensure that our compensation practices are sufficient to attract the necessary talent to enable growth from a development stage company into one with commercialized products.

Compensation Committee Purposes

The Compensation Committee of the Board serves as an administrative arm of the Board to make decisions on behalf of the Board with respect to all forms of compensation to executive officers, and all bonus and stock compensation to employees.

Compensation for officers and key employees includes both cash and equity elements. Cash compensation consists of base salary, which is determined on the basis of the level of responsibility, expertise and experience of the employee, taking into account competitive conditions in the industry. In addition, cash bonuses may be awarded to officers and other key employees. Such bonuses are based on accomplishment of designated Company goals.

Ownership of the Company's Common Stock is a key element of executive compensation. Our officers and other employees are eligible to participate in the Company's Amended and Restated 1993 Stock Option Plan, which was adopted prior to our initial public offering in March 1996, and the 1998 Employee Stock Purchase Plan. The Plans permit the Board or a committee designated by the Board

13

to grant stock options to employees on such terms as the Board or such committee may determine. Employee option grants typically vest over a four-year period and thus require the employee's continuing efforts. The Committee believes that it is in the stockholders' interests to link employee compensation as closely as possible to equity appreciation and thus to share with the employees the benefits of their efforts on behalf of our success.

Description of 401(k) Plan

We also maintain a 401(k) Plan to provide retirement benefits through tax deferred salary deductions for all employees. We may make discretionary contributions, which will be allocated based upon the relative compensation of each participant with at least 1,000 hours of service during the plan year and who are employed on the last day of the plan year. Company contributions vest ratably over five years. For 2001, we have made a discretionary contribution at the rate of 3% of each eligible participant's salary as defined.

2001 Executive Compensation

Executive compensation for 2001 included base salary, cash bonuses, incentive stock option grants and other compensation. We issued cash bonuses in recognition of employees' prior service and contributions towards the achievement of Company goals. Compensation was established based on competitive compensation data and each executive's job responsibilities, level of experience, individual performance, and contribution to the business. In making its decisions, the Compensation Committee exercised its discretion and judgment based on these factors. No specific formula was applied to determine the weight of each factor.

Chief Executive Officer Compensation for 2001

Dr. Rubinfeld was paid a base salary of $530,000 during 2001. Dr. Rubinfeld's base salary for 2001 was established based on the Compensation Committee's evaluation of his job responsibilities, his experience, and his contribution to the business. The Compensation Committee also evaluated compensation paid to executives of peer companies and exercised its discretion and judgment without applying any specific formula or weight to the various factors. Dr. Rubinfeld was also paid a total of $466,000 in bonus payments for his performance during 2001. The bonuses paid to Dr. Rubinfeld were based on the Compensation Committee's evaluation of Dr. Rubinfeld's performance and his significant contribution to the Company's achievements during 2001.

Internal Revenue Code Section 162(m) Implications for Executive Compensation

The Committee is responsible for addressing issues raised by Section 162(m) of the Internal Revenue Code ("Section 162(m)"). This Section limits the Company's tax deduction for compensation paid to certain executive officers that does not qualify as "performance-based" to $1 million per executive officer. To qualify as performance-based under Section 162(m), compensation payments must be made pursuant to a plan that is administered by a committee of outside directors and must be based on achieving objective performance goals.

14

Summary

The Compensation Committee advises the Board regarding our cash and equity incentive programs for the purpose of attracting and retaining highly skilled executives who will promote our business goals and providing incentive for these persons to achieve goals, which are intended to build long-term stockholder value.

COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS

James Manuso, Chairman

Thomas Girardi

Walter Lack

15

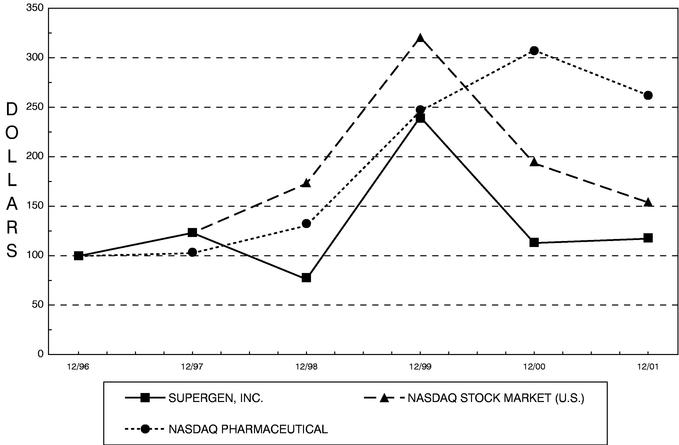

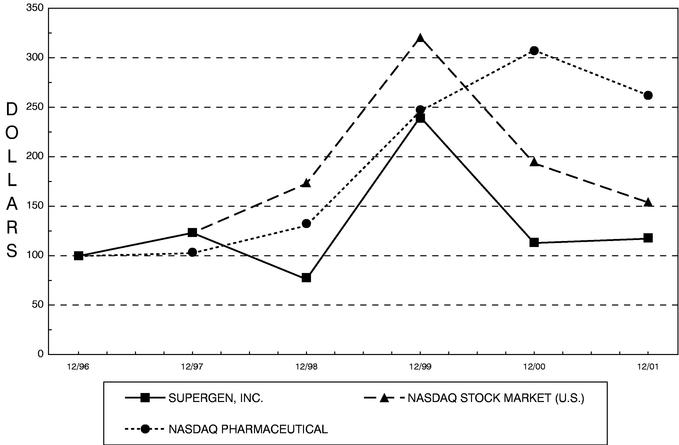

COMPANY STOCK PRICE PERFORMANCE GRAPH

The following graph compares our cumulative total stockholder return with those of the Nasdaq Composite Index and the Nasdaq Pharmaceutical Index. The graph assumes that $100 was invested on December 31, 1996 in the Company's Common Stock and in the Nasdaq Composite Index and the Nasdaq Pharmaceutical Index, including reinvestment of dividends. Note that historic stock price performance is not necessarily indicative of future stock price performance.

16

OTHER MATTERS

We know of no other matters to be submitted to the meeting. If any other matters properly come before the meeting, it is the intention of the persons named in the enclosed proxy card to vote the shares they represent as the Board may recommend.

It is important that your shares be represented at the meeting, regardless of the number of shares that you hold. You are therefore urged to execute and return, at your earliest convenience, the accompanying proxy card in the envelope which has been enclosed.

Dublin, California

April 26, 2002

17

SUPERGEN, INC.

2002 Annual Meeting of Stockholders

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of SuperGen, Inc., a Delaware corporation, hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 17, 2002 and hereby appoints Joseph Rubinfeld, its proxy and attorney-in-fact, with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2002 Annual Meeting of Stockholders of SuperGen, Inc. to be held on Wednesday, May 29, 2002, at 2:00 p.m. local time, at the Company's headquarters, 4140 Dublin Boulevard, Suite 200, Dublin, CA 94568 and at any adjournment(s) thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side, and, in their discretion, upon such other matter or matters which may properly come before the meeting and any adjournment(s) thereof.

THIS PROXY WILL BE VOTED AS DIRECTED, OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED "FOR" THE ELECTION OF THE SPECIFIED NOMINEES AS DIRECTORS, "FOR" EACH PROPOSAL LISTED, AND AS SAID PROXY DEEMS ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

CONTINUED AND TO BE SIGNED ON THE OTHER SIDE

FOLD AND DETACH HERE

You can now access your SuperGen account online.

Access your SuperGen stockholder account online via Investor ServiceDirectSM (ISD).

Mellon Investor Services LLC, agent for SuperGen, Inc., now makes it easy and convenient to get current information on your shareholder account. After a simple, and secure process of establishing a Personal Identification Number (PIN), you are ready to log in and access your account to:

| • View account status | | • View payment history for dividends |

| • View certificate history | | • Make address changes |

| • View book-entry information | | • Obtain a duplicate 1099 tax form |

| | | • Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

and follow the instructions shown on this page.

Step 1: FIRST TIME USERS—Establish a PIN

You must first establish a Personal Identification Number (PIN) online by following the directions provided in the upper right portion of the web screen as follows. You will also need your Social Security Number (SSN) available to establish a PIN.

Investor ServiceDirectSM is currently only available for domestic individual and joint accounts.

• SSN

• PIN

• Then click on theEstablish PIN button

Please be sure to remember your PIN, or maintain it in a secure place for future reference. | | Step 2: Log in for Account Access

You are now ready to log in. To access your account please enter your:

• SSN

• PIN

• Then click on theSubmit button

If you have more than one account, you will now be asked to select the appropriate account. | | Step 3: Account Status Screen

You are now ready to access your account information. Click on the appropriate button to view or initiate transactions.

• Certificate History

• Book-Entry Information

• Issue Certificate

• Payment History

• Address Change

• Duplicate 1099

|

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

Please mark your votes as indicated in this example /X/

| | | FOR

ALL

NOMINEES | | WITHHELD

FOR ALL

NOMINEES | | | | |

1. ELECTION OF DIRECTORS:

Nominees: Joseph Rubinfeld, Denis Burger, Thomas V. Girardi, Walter J. Lack, James S.J. Manuso, Daniel Zurr | | / / | | / / | | | | |

| | | Withheld for nominees listed below

(write nominee's name in space provided below): |

| | |

|

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

|

| 2. PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2002. | | / / | | / / | | / / | | |

Please disregard if you have previously provided your consent decision.

By checking the box to the right, I consent to future delivery of annual reports, proxy statements, prospectuses, and other materials and shareholder communications electronically via the internet at a web page which will be disclosed to me. I understand that the Company may no longer distribute printed materials to me from any future stockholder meeting until such consent is revoked. I understand that I may revoke my consent at any time by contacting the Company's transfer agent, Mellon Investor Services LLC, Ridgefield Park, NJ, and that costs normally associated with electronic delivery, such as usage and telephone charges as well as any costs I may incur in printing documents, will be my responsibility.

In their discretion, upon such other matter or matters which may properly come before the meeting and any adjournment(s) thereof.

THIS PROXY WILL BE VOTED AS DIRECTED, OR, IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED "FOR" THE ELECTION OF THE SPECIFIED NOMINEES AS DIRECTORS, "FOR" EACH PROPOSAL LISTED, AND AS SAID PROXY DEEMS ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

Signature(s) Dated , 2002

This Proxy should be marked, dated, signed by the stockholder(s) exactly as his or her name appears hereon, and returned promptly in the enclosed envelope. Persons signing in a fiduciary capacity should so indicate. If shares are held by joint tenants or as community property, both should sign.

FOLD AND DETACH HERE

You can view the SuperGen, Inc. 2001 Annual Report, the

December 31, 2001 Form 10-K, and the Proxy Statement on the

internet at www.supergen.com/financialinfo2001.

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 29, 2002PROXY STATEMENT FOR 2002 ANNUAL MEETING OF STOCKHOLDERSPROCEDURAL MATTERSPROPOSAL ONE ELECTION OF DIRECTORSPROPOSAL TWO RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSSHARE OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENTEXECUTIVE OFFICER COMPENSATIONCERTAIN TRANSACTIONSREPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORSREPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORSCOMPANY STOCK PRICE PERFORMANCE GRAPHOTHER MATTERS