UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08386

American Heritage Growth Fund, Inc.

(Exact name of registrant as specified in charter)

845 Third Avenue

New York, NY 10022

(Address of principal executive offices) (Zip code)

Jonathan B. Reisman

6975 NW 62 Terrace

Parkland, FL 33067

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 397-3900

Date of fiscal year end: January 31

Date of reporting period: January 31, 2006

Item 1. Reports to Stockholders.

![[growthannual042006amended002.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended002.jpg)

| American Heritage Growth Fund, Inc. |

| |

Annual Report

January 31, 2006 |

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares or The American Heritage Growth Fund, Inc. Such offering is made only by prospectus, which includes details as to offering price and other material information.

The American Heritage Growth Fund, Inc.

![[growthannual042006amended004.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended004.jpg)

845 Third Avenue

New York City, NY 10022

Phone: (212) 397 – 3900

Fax: (212) 397 – 4036

Heiko H. Thieme

Chairman

July 2006

To our valued shareholders

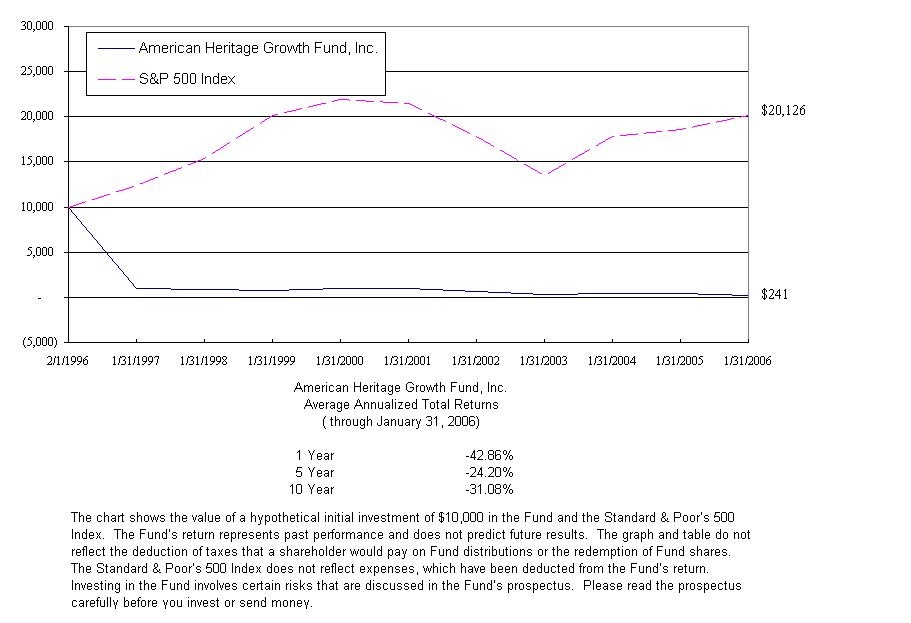

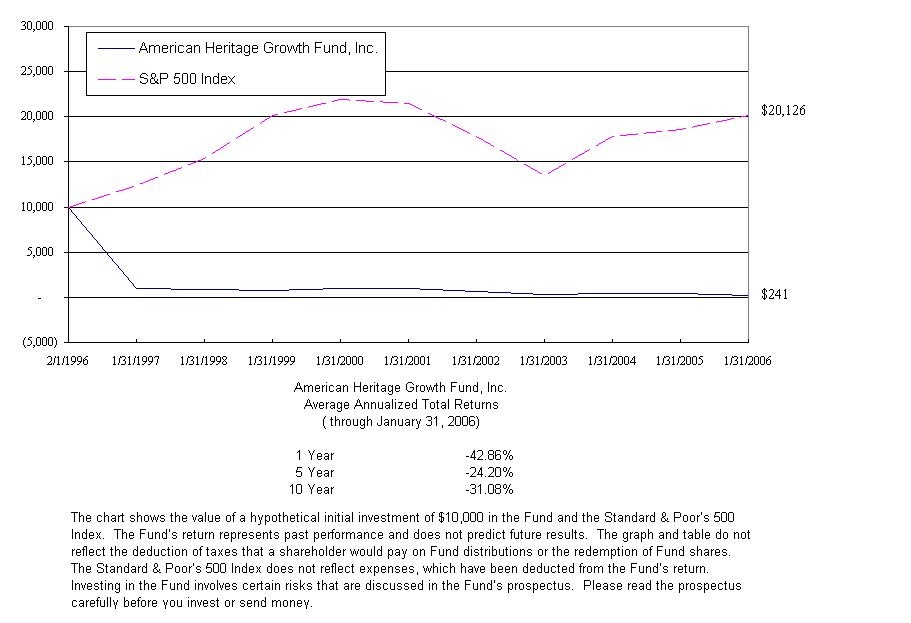

While the overall stock market as represented by the S&P 500 Index showed a total return during the past fiscal year of over 10 %, the American Heritage Growth Fund lost almost 47 % due to its concentration on technology and biotech companies.

However, during the first six months of this fiscal year, the Fund’s performance is slightly above the overall market averages.

Our strategy and primary focus remains largely unchanged.

The expense ratio of the Fund is extremely high due to the small size of the portfolio. Unless we receive additional funds this unfavorable ratio is unlikely to change.

As the manager and one of the major shareholders I appreciate your loyalty and thank you for your patience

Yours truly

![[growthannual042006amended006.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended006.jpg)

AMERICAN HERITAGE GROWTH FUND, INC.

Average Annual Total Return

AMERICAN HERITAGE GROWTH FUND, INC.

Industry Illustration

January 31, 2006 (Unaudited)

The following chart gives a visual breakdown of the Fund by the industry sectors |

the underlying securities represent as a percentage of the portfolio of investments. |

![[growthannual042006amended008.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended008.jpg)

AMERICAN HERITAGE GROWTH FUND, INC.

Statement of Assets and Liabilities

January 31, 2006

ASSETS |

Investments in securities, at market value | |

(Cost $141,694) (Note 1) | $ 108,786 |

Dividends and interest receivable | 174 |

| | |

TOTAL ASSETS | 108,960 |

| | |

LIABILITIES |

Payables: | |

Accrued Administrative Expenses | 8,810 | |

Accrued Taxes | 1,600 | |

Other Accrued Expenses | 1,518 |

| | |

TOTAL LIABILITIES | 11,928 |

| | |

NET ASSETS |

Net Assets (equivalent to $0.04 per | |

share based on 2,166,084 shares | |

of capital stock outstanding) (Note 4) | $ 97,032 |

| | |

Composition of net assets: | |

Paid in capital | 3,231,706 |

Accumulated net investment loss | (291,061) |

Accumulated net realized loss on | |

Investments | (2,810,705) |

Net unrealized depreciation on | |

Investments | (32,908) |

| | |

NET ASSETS, January 31, 2006 | $ 97,032 |

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Schedule of Investment in Securities

January 31, 2006

| | | |

| | Number of | |

| | Shares | Value |

| | | |

COMMON STOCKS & WARRANTS – 56.46% |

BASIC MATERIALS – 2.99% | | |

Canarc Resource Corp.* | 5,000 | 2,900 |

| | |

BUSINESS SERVICES – 3.97% | | |

BlastGard International, Inc. * | 5,000 | 2,000 |

Interep National Radio. * | 5,000 | 1,850 |

|

| 3,850 |

CONSUMER GOODS – 12.02% | | |

Tempur Pedic International, Inc.* | 1,000 | 11,660 |

| | | |

ENERGY – 3.19% | | |

Eden Energy Corp.* | 1,000 | 3,100 |

| | | |

HEALTHCARE - 19.81% | | |

Unigene Laboratories, Inc.* | 2,000 | 7,520 |

Millenia Hope, Inc.* | 20,000 | 1,500 |

Nexmed, Inc.* | 2,500 | 2,625 |

ViaCell, Inc.* | 500 | 2,640 |

Vioquest Pharmaceuticals, Inc.* | 2,500 | 1,900 |

Hythiam, Inc.* | 500 | 3,040 |

|

| 19,225 |

INDUSTRIALS – 6.03% | | |

Worldwater Corp.* | 15,000 | 5,850 |

| | | |

TECHNOLOGY – 8.45% | | |

Ecuity, Inc *. | 55,000 | 275 |

Powerhouse Technologies Group, Inc.* | 4,750 | 2,375 |

Simulations Plus, Inc.* | 1,500 | 5,550 |

|

| 8,200 |

| | | |

| | | |

TOTAL COMMON STOCKS |

| 54,785 |

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Schedule of Investment in Securities

January 31, 2006

(Continued)

CASH & EQUIVALENTS | | |

FIRST AMERICAN TREASURY | | |

FUND CL A 4.01% ** | 55.65% | 54,001 |

TOTAL INVESTMENTS | | |

(Cost $141,694) | 112.11% | 108,786 |

| | | |

LIABILITIES IN EXCESS OF | (12.11%) | (11,754) |

OTHER ASSETS | | |

| | | |

TOTAL NET ASSETS | 100.00% | $ 97,032 |

*

Non-income producing security.

** Variable Rate Security at January 31, 2006

+

Illiquid security.

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Statement of Operations

January 31, 2006

INVESTMENT INCOME: | |

Dividends | $32 |

Interest | 1,228 |

TOTAL INVESTMENT INCOME | 1,260 |

| | |

EXPENSES: | |

Investment advisory fees (Note 2) | 1,621 |

Fund Accounting / Transfer agent fees | 8,151 |

Audit fees | 13,010 |

Legal fees | 4,014 |

Custodian fees | 4,804 |

Registration | 0 |

Printing | 3,574 |

Taxes | 1,600 |

Insurance | 341 |

Directors Fees | 1,500 |

Other expenses | 1,788 |

TOTAL EXPENSES | 40,403 |

Less: waiver of investment | |

Expense Waiver | (1,621) |

NET EXPENSES | 38,782 |

Net investment loss | (37,522) |

| | |

NET REALIZED AND UNREALIZED | |

GAIN (LOSS) ON INVESTMENTS: | |

Net realized gain from investment | |

transactions | (29,105) |

Net change in unrealized | |

depreciation on investments | 15,954 |

Net realized and unrealized loss | |

on investments | (13,151) |

Net decrease in net assets | |

resulting from operations | $(50,673) |

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Statement of Changes in Net Assets

January 31, 2006

| | Year | Year |

| | ending | ending |

| | January 31 | January 31 |

| | 2006 | 2005 |

| | | |

NET INCREASE (DECREASE) IN NET | | |

ASSETS FROM OPERATIONS: | | |

Net investment loss | $(37,522) | $(17,088) |

Net realized gains (losses) from | | |

investment transactions | (29,105) | 31,269 |

Net change in unrealized appreciation | | |

(depreciation) on investments | 15,954 | (40,842) |

Net increase (decrease) in net assets | | |

resulting from operations | (50,673) | (26,661) |

Distributions to shareholders: | | |

Net investment income | 0 | 0 |

Net realized gains on investments | 0 | 0 |

Capital share transactions | | |

Proceeds from shares sold | 8 | 4,508 |

Payment for shares redeemed | (25,042) | (16,757) |

Net decrease from capital | | |

share transactions | (25,034) | (12,249) |

Net (decrease) | | |

in net Assets | (75,707) | (38,910) |

| | | |

NET ASSETS: | | |

Beginning of year | 172,739 | 211,649 |

End of year | $97,032 | $172,739 |

Undistributed Net Investment Losses of: | $(291,061) | $(253,539) |

| | | |

CAPITAL SHARE ACTIVITY | | |

Shares sold | 174 | 62,483 |

Shares redeemed | (420,816) | (242,938) |

Net decrease in shares outstanding | (420,642) | (180,455) |

Shares outstanding at the | | |

beginning of the period | 2,586,726 | 2,767,181 |

Shares outstanding at the | | |

end of the period | 2,166.084 | 2,586,726 |

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Notes to Financial Statements

January 31, 2006

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization

American Heritage Growth Fund, Inc. (the ""Fund'') was incorporated on February 14, 1994 and commenced operations on May 25, 1994. The Fund is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end investment company having an investment objective of seeking growth of capital. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles. Significant accounting policies of the Fund are as follows:

Security valuations

The Fund values investment securities, where reliable market quotations are available, at market value based on the last recorded sales price as reported on the principal securities exchange on which the security is traded, or if the security is not traded on an exchange, market value is based on the latest bid price. Portfolio securities for which reliable market quotations are not readily available are valued as the Board of Directors in good faith determines.

Federal income taxes

The Fund's policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all its taxable income to its shareholders. Therefore, no federal income tax provision is required.

Distribution to Shareholders

AMERICAN HERITAGE GROWTH FUND, INC.

Notes to Financial Statements

January 31, 2006

(Continued)

The Fund intends to distribute to shareholders substantially all of its net investment income, if any, and any net realized capital gains, if any, during each fiscal year. Any undistributed amounts for any fiscal year will be paid out of the subsequent year's distributions.

Option writing

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from the sale of securities. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transaction, as a realized loss.

Repurchase Agreements

The Fund may enter into a repurchase agreement as a money market alternative with respect to its otherwise uninvested cash. There is no limitation of the amount of repurchase agreements which may be entered into by the Fund. In connection with a repurchase agreement, the Fund will acquire a security and simultaneously agree to resell at a higher price. A repurchase agreement, therefore, involves a loan by the Fund, which loan is collateralized by the value of the underlying security. Delays or losses could result if the other party to the repurchase agreement defaults or becomes insolvent. All repurchase agreements entered into by the Fund will be fully collateralized by securities issued by the United States Government.

Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

AMERICAN HERITAGE GROWTH FUND, INC.

Notes to Financial Statements

January 31, 2006

(Continued)

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Other

The Fund follows industry practice and records security transactions on the trade date. The specific identification method is used in determining gains and losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

NOTE 2. INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS

The Fund has an investment advisory agreement with American Heritage Management Corporation (AHMC), whereby AHMC receives an annual fee of 1.25% of the Fund’s average net asset value, computed daily, and payable monthly. However, for the year ending January 31, 2006, AHMC agreed to waive its investment advisory fees which amounted to $1,621.

Heiko H. Thieme, the Fund’s Chairman of the Board of Directors and Chief Executive Officer, is also the Chairman of the Board of Directors, Chief Executive Officer, and Secretary of AHMC, of which he owns all of the outstanding shares.

During the fiscal years ended January 31, 2006 and January 31, 2005, Thieme Securities, Inc., which is wholly owned by Heiko H. Thieme, received brokerage commissions from the Fund of $2,290 and $3,320, respectively.

NOTE 3. INVESTMENTS

During the year ended January 31, 2006, purchases and sales of investment securities, other than short-term

AMERICAN HERITAGE GROWTH FUND, INC.

Notes to Financial Statements

January 31, 2006

(Continued)

investments, aggregated $356,761 and $405,468, respectively.

At January 31, 2006 the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

Gross Unrealized appreciation | $ 4,378 |

Gross Unrealized Depreciation | (37,286) |

Net Unrealized Appreciation | $(32,908) |

NOTE 4. CAPITAL SHARE TRANSACTIONS

As of January 31, 2006, there were 250,000,000 shares of $0.001 par value capital stock authorized and the total par value and paid in capital aggregated $3,231,706.

NOTE 5. INCOME TAX INFORMATION

The fund made no distributions to shareholders during the years ended January 31, 2006 and 2005.

As of January 31, 2006, the components of accumulated losses on a tax basis were as follows:

Undistributed Ordinary Loss | $ (291,061) |

Undistibuted Long-Term Capital Losses | (2,810,705) |

Total Undistributed Losses | (3,101,766) |

Unrealized Appreciation/Depreciation (net) | (32,908) |

Total Accumulated Earnings (losses) (net) | $(3,134,674) |

On January 31, 2006, the Fund had available for federal income tax purposes an unused capital loss carryover of approximately $383,000, which expires between 2006 and 2011.

AMERICAN HERITAGE GROWTH FUND, INC.

FINANCIAL HIGHLIGHTS AND RELATED

RATIO/SUPPLEMENTAL DATA

For a fund share outstanding throughout each period

| Year | Year | Year | Year | Year |

| | ending | ending | ending | ending | ending |

| January 31 | January 31 | January 31 | January 31 | January 31 |

| | 2006 | 2005 | 2004 | 2003 | 2002 |

Net asset value, beginning of period | $0.07 | 0.08 | 0.06 | $0.10 | $0.16 |

Income (loss) from investment operations: | | | | | |

Net investment income (loss) | (0.02) | (0.01) | (0.01) | (0.01) | (0.01) |

Net gains (losses) on securities (both | | | | | |

realized and unrealized) | (0.01) | 0.00 | 0.03 | (0.03) | (0.05) |

Total from investment operations | (0.03) | (0.01) | 0.02 | (0.04) | (0.06) |

Less distributions: | | | | | |

Dividends (from net investment | | | | | |

income) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Distributions (from capital gains) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Net asset value, end of period | $0.04 | $0.07 | $0.08 | $0.06 | $0.10 |

Total return | (42.86)% | (12.50)% | 33.33% | (40.00)% | (37.50)% |

Ratios/Supplemental data: | | | | | |

Net assets, end of period | $97,032 | $172,739 | $211,649 | $170,497 | $299,845 |

Ratio of expenses to average net assets | 31.19% | 9.50% | 11.47% | 18.77% | 14.70% |

Ratio of net loss to average net assets | (30.22)% | (9.03)% | (10.87)% | (18.66)% | (14.30)% |

Portfolio turnover rate | 448.94% | 256.71% | 1840.32% | 597.61% | 154.30% |

The accompanying notes are an integral part of these financial statements.

AMERICAN HERITAGE GROWTH FUND, INC.

Expense Illustration

January 31, 2006

Expense Example

As a shareholder of the American Heritage Growth Fund., you incur ongoing costs, including management fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, August 1, 2005 through January 31, 2006.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in these Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | Beginning Account Value | Ending Account Value | Expenses Paid During the Period* |

| | August 1, 2005 | January 31, 2006 | August 1,2005 to January 31, 2006 |

Actual | $1,000.00 | $666.67 | $159.53 |

Hypothetical (5% Annual Return before expenses) | $1,000.00 | $833.91 | $175.54 |

* Expenses are equal to the Fund's annualized expense ratio of 37.77%, multiplied by the average account value over the period, multiplied by 185/365 (to reflect the one-half year period). |

The accompanying notes are an integral part of these financial statements.

MEYLER & COMPANY, LLC

Certified Public Accountants

One Arin Park

1715 Highway 35

Middletown, NJ 07748

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Shareholders

American Heritage Growth Fund, Inc.

New York, NY

We have audited the accompanying statement of assets and liabilities of the American Heritage Growth Fund, Inc., including the schedule of investments in securities, as of January 31, 2006, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and the financial highlights based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights and related ratios/supplemental data are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of January 31, 2006, by correspondence with the custodian and the application of alternative auditing procedures for unsettled security transactions. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and the financial highlights referred to above present fairly, in all material respects, the financial position of the American Heritage Growth Fund, Inc. as of January 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with U. S. generally accepted accounting principles.

/s/ Meyler & Company, LLC

Middletown, NJ

March 29, 2006

ADDITIONAL INFORMATION

JANUARY 31, 2006 (UNAUDITED)

Portfolio Holdings – The Fund files a complete schedule of investments with the SEC for the first and third quarter of each fiscal year on Form N-Q. The Fund’s first and third fiscal quarters end on April 30 and October 31. The Form N-Q filing must be made within 60 days of the end of the quarter, and the Fund’s first Form N-Q was filed with the SEC on March 1, 2005. The Fund’s Forms N-Q are available on the SEC’s website at http://sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (call 1-800-732-0330 for information on the operation of the Public Reference Room). You may also obtain copies by calling the Fund at 1-800-292-2660, free of charge.

Proxy Voting - A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies during the most recent 12-month period ended June 30, are available without charge (1) upon request by calling the Fund at (800) 292-2660 and (2) from Fund documents filed on the SEC's website at www.sec.gov. A review of how the Fund voted on company proxies can be obtained at our transfer agent’s website, www.mutualss.com.

Additional Information - The Fund’s Statement of Additional Information ("SAI") includes additional information about the Fund’s directors and is available, without charge, upon request. You may call toll-free (800) 292-2660 to request a copy of the SAI or to make shareholder inquiries.

AMERICAN HERITAGE GROWTH FUND, INC.

Board of Directors

January 31, 2006

The Fund's Board of Directors is responsible for the management of the Fund. The following table sets forth certain information with respect to each member of the Fund's Board of Directors and each officer of the Fund. The Fund does not have an advisory board.

Name and Address |

Age |

Positions Held With the Fund |

Approximate Length of Time Served |

Principal Occupation(s) During the Past Five Years |

OTHER DIRECTORSHIPS |

Heiko H. Thieme* 845 Third Avenue New York, NY |

62 |

Chairman of the Board of Directors, Chief Executive Officer and Secretary |

11 years |

Chairman of the Board of Directors, Chief Executive Officer and Secretary of the Fund and The American Heritage Fund, Inc. Chief Executive Officer of American Heritage Management Corporation and Thieme Associates, Inc. (investment advisor). Chief Executive Officer of Thieme Securities, Inc. (broker-dealer) and Thieme Consulting, Inc. Chief Executive Officer of The Global Opportunity Fund Limited (foreign investment company) and their respective investment advisors. |

The American Heritage Fund, Inc. (AHF) |

| | | | | | |

| | | | | | |

| | | | | | |

Dr. Eugene Sarver 241 W. 97th St. New York, NY | 61 | Director | 11 years | Sole proprietor of Sarver International (financial and economic consulting) and Associate of Intercap Investments, Inc. |

AHF |

*Mr. Thieme is an “interested person” as defined in the Investment Company Act of 1940 because he is an executive officer of the Fund and owns all the outstanding equity securities of AHMC and Thieme Securities, Inc.

Mr. Thieme is the portfolio manager of the Fund and AHF. None of the Fund’s other directors oversees any portfolios in the fund complex..

Each of the Fund’s officers and directors serves until his respective successor is elected and qualifies or until his earlier removal or resignation.

Item 2. Code of Ethics.

(a)

As of the end of the period covered by this report, the registrant had not adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. The registrant did not adopt such a code because the Board of Directors did not believe it necessary due to the registrant’s small size and as it only has one executive officer.

(b), (c), (d), (e) and (f)

Not applicable.

Item 3. Audit Committee Financial Expert.

The registrant does not have an audit committee.

Item 4. Principal Accountant Fees and Services.

(a)

Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows:

Fiscal year ended January 31, 2005 - $11,250

Fiscal year ended January 31, 2006 - $11,250

(b)

Audit-Related Fees

The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of this Item are as follows:

Fiscal year ended January 31, 2005 - $ 0

Fiscal year ended January 31, 2006 - $ 0

(c)

Tax Fees

The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are as follows:

Fiscal year ended January 31, 2005 - $1,000

Fiscal year ended January 31, 2006 - $1,000

(d)

All Other Fees

The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are as follows:

Fiscal year ended January 31, 2005 - $ 0

Fiscal year ended January 31, 2006 - $ 0

(e)

Not applicable.

(f)

During audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.

(g)

The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant:

Fiscal year ended January 31, 2005 - $ 0

Fiscal year ended January 31, 2006 - $ 0

(h)

Not applicable.

Item 5. Audit Committee of Listed Registrants. Not applicable.

Item 6. Schedule of Investments. Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A or this Item.

Item 11. Controls and Procedures.

(a)

Based upon an evaluation of the effectiveness of of the registrant's disclosure controls and procedures within 90 days of the filing of this Report, the registrant's Chief Executive Officer and Chief Financial Officer has concluded that the disclosure controls and procedures were effective.

(b)

There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's second fiscal quarter of the period covered by this Report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

Item 12. Exhibits.

(a)(2)

Certification of the principal executive and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

American Heritage Growth Fund, Inc.

By /s/ Heiko H. Thieme

Heiko H. Thieme Chief Executive Officer

Date July 19, 2006

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ Heiko H. Thieme

Heiko H. Thieme Principal Executive and Principal Financial Officer

Date July 19, 2006

![[growthannual042006amended002.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended002.jpg)

![[growthannual042006amended006.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended006.jpg)

![[growthannual042006amended008.jpg]](https://capedge.com/proxy/N-CSRA/0001162044-06-000321/growthannual042006amended008.jpg)