Filed by PAETEC Holding Corp. Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Commission File No.: 0-20763

Subject Company: McLeodUSA Incorporated

This filing relates to the proposed transaction pursuant to the terms of the Agreement and Plan of Merger, dated as of September 17, 2007, by and among PAETEC Holding Corp. (“PAETEC”), McLeodUSA Incorporated and PS Acquisition Corp., a wholly-owned subsidiary of PAETEC.

* * * *

PAETEC will file with the SEC a registration statement on Form S-4, which will contain a proxy statement/prospectus regarding the proposed merger transaction, as well as other relevant documents concerning the transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS AND THESE OTHER DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PAETEC, MCLEODUSA INCORPORATED AND THE PROPOSED TRANSACTION. A definitive proxy statement/prospectus will be sent to PAETEC’s stockholders seeking their approval of PAETEC’s issuance of shares in the transaction and to security holders of McLeodUSA Incorporated.Investors and security holders may obtain a free copy of the registration statement and proxy statement/prospectus (when available) and other documents filed by PAETEC with the SEC at the SEC’s web site at www.sec.gov. Free copies of PAETEC’s SEC filings are available on PAETEC’s web site at www.paetec.com and also may be obtained without charge by directing a request to PAETEC Holding Corp., One PAETEC Plaza, Fairport, New York 14450, Attn: Investor Relations.

PAETEC and its directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from PAETEC’s stockholders with respect to the proposed transaction. Information regarding PAETEC’s directors and executive officers is included in its annual report on Form 10-K filed with the SEC on April 2, 2007. More detailed information regarding the identity of potential participants and their direct or indirect interests in the transaction, by securities holdings or otherwise, will be set forth in the registration statement and proxy statement/prospectus and other documents to be filed with the SEC in connection with the proposed transaction.

Caring Culture | Open Communication | Unmatched Service | Personalized Solutions PAETEC and McLeodUSA The Emergence of the Nation’s Premier The Emergence of the Nation’s Premier Competitive Communications Provider Competitive Communications Provider |

Forward-Looking Statements Except for statements that present historical facts, this presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include PAETEC’s forecasts of the combined company’s total revenue, adjusted EBITDA, merger-related synergies and other financial results. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the combined company’s actual operating results, financial position, levels of activity or performance to be materially different from those expressed or implied by such forward- looking statements. Some of these risks, uncertainties and factors are discussed under the caption “Risk Factors” in PAETEC’s 2006 Annual Report on Form 10-K and in PAETEC’s subsequently filed SEC reports. PAETEC disclaims any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. |

Non-GAAP Financial Information This presentation refers to “Adjusted EBITDA,” which is not a measurement of financial performance prepared in accordance with GAAP and should not be considered as a substitute for the most comparable GAAP measures. Adjusted EBITDA, as defined by PAETEC, represents net income before interest, provision for taxes, depreciation and amortization, change in fair value of Series A convertible redeemable preferred stock conversion rights, stock-based compensation, loss on extinguishment of debt, leveraged recapitalization costs and integration/restructuring costs. Adjusted EBITDA, as defined by McLeodUSA, represents net loss before interest expense, depreciation, amortization, income from discontinued operations, gain on cancellation of debt, other non-operating income or expense, restructuring charges and adjustments, reorganization items, impairment charge and non-cash compensation. Information concerning management’s reasons for including these measures and quantitative reconciliations of the differences between historical Adjusted EBITDA to the most comparable GAAP measures are contained in PAETEC’s and McLeodUSA’s SEC filings and other publicly available information. |

Additional Information PAETEC will file with the SEC a registration statement on Form S-4, which will contain a proxy statement/prospectus regarding the proposed merger transaction, as well as other relevant documents concerning the transaction. PAETEC URGES INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS AND THESE OTHER DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PAETEC, MCLEODUSA AND THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the registration statement and proxy statement/ prospectus (when available) and other documents filed by PAETEC with the SEC at the SEC’s web site at www.sec.gov. Free copies of PAETEC’s SEC filings are available on PAETEC’s web site at www.paetec.com and also may be obtained without charge by directing a request to PAETEC Holding Corp., One PAETEC Plaza, Fairport, New York 14450, Attn: Investor Relations. PAETEC and its directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from PAETEC’s stockholders with respect to the proposed transaction. Information regarding the identity of potential participants and their direct or indirect interests, by securities holdings or otherwise, will be set forth in the registration statement and proxy statement/prospectus and other documents to be filed with the SEC in connection with the proposed transaction. |

Brief Facts Structure PAETEC and McLeodUSA to combine in a 100% tax-free stock-for-stock merger Exchange Ratio McLeodUSA shareholders receive 1.30 PAETEC shares for every share of McLeod that they own Listing / Ticker NASDAQ / PAET Company Name: PAETEC Holding Corp. Ownership 75% owned by PAETEC shareholders, 25% owned by McLeodUSA Shareholders on a fully diluted basis Headquarters PAETEC: Fairport, NY McLeodUSA: Cedar Rapids, IA Board of Directors 9 Seats for PAETEC 1 Voting Seat and 1 Observer Seat for McLeodUSA Management Chairman & CEO: Arunas A. Chesonis, Current PAETEC Chairman & CEO Synergies Transaction expected to generate $30 million in run-rate synergies Timing Transaction expected to close 1st Quarter 2008 |

McLeodUSA at a Glance Business Overview • Competitive communications provider targeting small and medium sized business in key verticals including: • Emergency services, medical, automotive, construction, education, financial, government, healthcare, hospitality, professional/legal, real estate, retail and transportation • Emerged from bankruptcy in January 2006 with new management team • Leadership: Royce Holland, CEO • LTM Revenue of $514 million and LTM adjusted EBITDA of $48 million (1) • Employees: approximately 1,500 • Markets served: 26 out of top 100 MSAs • Access line equivalents in use: 701,800 • Products: suite of data, voice, security and conferencing services plus customer premise equipment • Headquartered in Cedar Rapids, IA with major operations centers in Oklahoma and Texas • Operations in major metropolitan areas in 20 states The McLeodUSA Name McLeodUSA was founded by an Iowa school teacher, Clark McLeod, who entered into the long distance business. The company has since grown into one of the largest competitive local exchange carriers in the nation. (1) LTM – latest twelve month as of 6/30/07 |

PAETEC at a Glance Business Overview • Competitive communications provider targeting medium to large businesses in key verticals including: • Financial Services, Healthcare, Government, Higher Education, Hospitality, Manufacturing, Distribution, Professional Services & Retail • Merged with USLEC and became public in March 2007 • Leadership: Arunas Chesonis, CEO • LTM Revenue of $1.1 billion and adjusted pro forma EBITDA of $184 million (1) • Employees: approximately 2,300 • Markets Served: 56 out of top 100 MSAs (2) • Access line equivalents in use: 2,651,352 • Products: suite of data, voice, security and conferencing services plus communications software and customer premise equipment • Headquartered in Rochester, NY with major operations centers in Charlotte, NC, Mt. Laurel, NJ and Irvine, CA • Operations: in major metropolitan areas in 24 states Original employees proposed the unique name as an acronym for the family members of the founder and still current CEO: Pam Adam Erik Tessa Emma Chesonis The PAETEC Name (1) LTM – latest twelve month as of 6/30/07, excludes $6.5M of one-time costs associated with US LEC Merger (2) projected figures in 2008 |

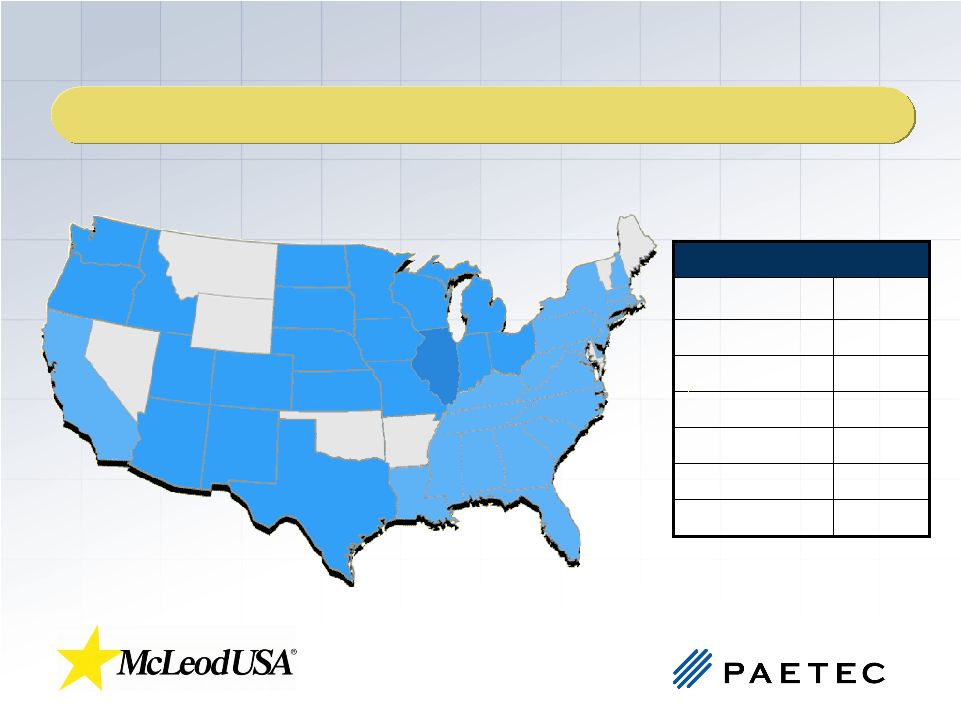

Combined Network Footprint The combined entity creates a coast-to-coast competitive communications provider with presence in 47 of the top 50 and 82 of the top 100 Metropolitan Statistical Areas (1) (1) Projected figures in 2008 13,000+ Intercity Route Miles 4,000+ Metro Route Miles 77 Voice Switches 39 Soft Switches 53 Backbone Routers 650 ILEC Colocations 3.4 Million Access Line Equivalents Key Combined Operating Data |

Benefits for Customers Nationwide Presence PAETEC will have a nationwide footprint with a leading presence in 82 of the top 100 MSAs (1) Enhanced Infrastructure A fiber based network spanning nearly 13,000 intercity fiber route miles and over 4,000 metro fiber route miles Expanded Local Service Approximately 3.4 million access lines across 44 states Broad Product Portfolio A extensive suite of data, voice and IP solutions nationally (1) Projected figures in 2008 Increased Coverage Expands on-net access for customers requiring nationwide IP based data, voice, and security solutions Business Continuity Improves network resiliency and offers more competitive solutions through an expanded fiber backbone and last mile connectivity One Stop Shop Simplifies procurement & management of data, local and long distance services from a single nationwide communications provider Personalized Solutions Offers innovative business communications solutions to address customer requirements Our number one priority is to continue to maintain Our number one priority is to continue to maintain the highest level of customer satisfaction the highest level of customer satisfaction |

Financial Highlights • Largest Competitive Local Communications Provider for Businesses in United States with $1.6B as of June 30, 2007 • Clear national alternative to AT&T, Verizon and Qwest • 13,000 Intercity Fiber Route Miles; 4,000 Metro Fiber Route Miles • In 2008, combined company is expected to cover 82 of top 100 Metropolitan Statistical Areas in US • Publicly Traded on NASDAQ under ticker symbol PAET • Adj. EBITDA : $263M (1) (1) LTM – latest twelve month as of 6/30/07, includes $30M of run-rate synergies and excludes $6.5M of one-time costs associated with the US LEC merger |

The Culture of PAETEC PAETEC’s culture is captured PAETEC’s culture is captured in four corporate values: in four corporate values: Caring Culture Caring Culture Open Communication Open Communication Unmatched Service Unmatched Service Personalized Solutions Personalized Solutions |

Caring Culture PAETEC is as passionate about making an impact on communities as business success Every employee’s photo, name and title are in CEO’s office to be memorized Recipient of 2005 American Business Ethics Award for Mid-Sized Company |

Weekly update conference call for all employees Weekly update conference call for all employees nationwide nationwide Annual employee surveys Annual employee surveys Customer Advisory Board meetings with Sr. Customer Advisory Board meetings with Sr. Executives in each city we serve Executives in each city we serve Open Communication |

Goal to answer all calls to customer service within Goal to answer all calls to customer service within 20 seconds by a live person 20 seconds by a live person Research firm, Atlantic-ACM, recognized PAETEC Research firm, Atlantic-ACM, recognized PAETEC as CLEC Best-in-Class Service Partner Award as CLEC Best-in-Class Service Partner Award Selling Power magazine Selling Power magazine named PAETEC as 2006 named PAETEC as 2006 Telecommunications Sales Telecommunications Sales Organization of the Year Organization of the Year Training Magazine recognized Training Magazine recognized PAETEC as one of top 125 PAETEC as one of top 125 training organizations in training organizations in the world the world Unmatched Service |

Precise, highly personalized solutions business-by- Precise, highly personalized solutions business-by- business business Frost & Sullivan honored PAETEC with Business Frost & Sullivan honored PAETEC with Business Development Strategy Award in 2006 Development Strategy Award in 2006 “Profit Assistant” “Profit Assistant” selling selling tool gives pricing power tool gives pricing power and decision making to and decision making to salespeople allowing salespeople allowing customized pricing and customized pricing and bundles bundles Personalized Solutions |

Caring Culture | Open Communication | Unmatched Service | Personalized Solutions PAETEC and McLeodUSA The Emergence of the Nation’s Premier The Emergence of the Nation’s Premier Competitive Communications Provider Competitive Communications Provider |