ANNUAL INFORMATION FORM

For the fiscal year ended December 31, 2006

March 22, 2007

- i -

TABLE OF CONTENTS

PRELIMINARY NOTES

II

INCORPORATION OF FINANCIAL STATEMENTS AND MD&A

II

FORWARD LOOKING STATEMENTS

II

INFORMATION CONCERNING PREPARATION OF RESERVE AND RESOURCE ESTIMATES

II

GLOSSARY AND DEFINED TERMS

III

REPORTING CURRENCY

VIII

ITEM 1.

CORPORATE STRUCTURE

1

1.1

NAME AND INCORPORATION

1

1.2

INTERCORPORATE RELATIONSHIPS

1

ITEM 2.

GENERAL DEVELOPMENT OF THE BUSINESS

2

2.1

THREE YEAR HISTORY

2

2.2

SIGNIFICANT ACQUISITIONS

3

ITEM 3.

DESCRIPTION OF THE BUSINESS

3

3.1

GENERAL

3

3.2

RISK FACTORS

5

3.3

TABAKOTO / SEGALA, MALI

8

3.4

BISHA, ERITREA

12

ITEM 4.

DIVIDENDS

24

ITEM 5.

DESCRIPTION OF CAPITAL STRUCTURE

25

ITEM 6.

MARKET FOR SECURITIES

25

6.1

MARKET FOR SECURITIES

25

ITEM 7.

DIRECTORS AND OFFICERS

26

7.1

NAME, OCCUPATION AND SECURITY HOLDING

26

7.2

CORPORATE CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS

28

7.3

CONFLICTS OF INTEREST

29

7.4

AUDIT COMMITTEE

29

ITEM 8.

INTEREST OF MANAGEMENT

36

ITEM 9.

TRANSFER AGENTS AND REGISTRARS

36

ITEM 10.

MATERIAL CONTRACTS

36

ITEM 11.

INTERESTS OF EXPERTS

37

ITEM 12.

ADDITIONAL INFORMATION

37

12.1

ADDITIONAL INFORMATION

37

aif.doc

- ii -

PRELIMINARY NOTES

Incorporation of Financial Statements and MD&A

The following documents are incorporated by reference and form part of this annual information form (the “Annual Information Form” or “AIF”) which is prepared in accordance with Form 51-102F2. These documents may be accessed using the System for Electronic Documents Analysis and Retrieval (“SEDAR”) on the internet atwww.sedar.com:

1.

Consolidated financial statements for the year ended December 31, 2006, together with the auditors’ report thereon dated March 16, 2007;

2.

Management’s discussion and analysis (MD&A) for the year ended December 31, 2006.

Forward Looking Statements

This report contains forward-looking statements concerning anticipated developments on the Company’s mineral properties in Mali and Eritrea and in the Company’s other operations; planned exploration and development activities; the adequacy of the Company’s financial resources; financial projections, including, but not limited to, estimates of capital and operating costs, production, grades, processing rates, life of mine, metal prices, exchange rates, reclamation costs, net present value, internal rates of return and payback, and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible”, “budget” and similar expressions, or statements that even ts, conditions or results “will,” “may,” “could” or “should” occur or be achieved. Information concerning the interpretation of drill results and mineral resource and reserve estimates also may be deemed to be forward-looking statements, as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those described in this Annual Information Form.

The Company’s forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made and the Company assumes no obligation to update such forward-looking statements in the future. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Information Concerning Preparation of Reserve and Resource Estimates

All reserve and resource estimates included in this Annual Information Form have been prepared in accordance with Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy Classification System. These standards differ significantly from the requirements

aif.doc

- iii -

of the United States Securities and Exchange Commission, and reserve and resource information included herein may not be comparable to similar information concerning U.S. companies. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made, that according to definition is, “that part of a mineral deposit which could be economically and legally produced or extracted at the time of the reserve determination”. In addition, the term “resource” does not equate to the term “reserves”. The Securities and Exchange Commission’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” in documents filed with the Securities a nd Exchange Commission, unless such information is required to be disclosed by the law of the company’s jurisdiction of incorporation or of a jurisdiction in which its securities are traded. Accordingly, information concerning descriptions of mineralization and resources contained in this Annual Information Form may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the Securities and Exchange Commission.

Glossary and Defined Terms

The following is a glossary ofcertain mining terms used in this Annual Information Form.

Albite:

Sodium plagioclase.

Alluvial:

Sedimentary accumulations often as sand or gravel deposited or formed by the action of running water, as in a stream channel or alluvial fan.

Alteration:

Refers to process of changing primary rock minerals (such as quartz, feldspar and hornblende) to secondary minerals (quartz, carbonate, and clay minerals) by hydrothermal fluids (hot water).

Anticline:

Part of the fold or the flexure that forms an arch with the older rocks occupy the core of this arch and the younger rocks the outer portion.

Argillite:

Low grade metamorphic clay rich sedimentary rock (shale, mudstone, siltstone).

Arsenopyrite:

The common arsenic mineral and principal ore of arsenic; occurs in many sulphide ore deposits, particularly those containing lead, silver, and gold.

Block model:

The representation of geologic units using three-dimensional blocks of predetermined sizes.

Breccia:

A rock in which angular fragments are surrounded by a mass of fine-grained minerals.

CIM:

Canadian Institute of Mining and Metallurgy.

aif.doc

- iv -

Carbonatization:

The formation of carbonate minerals as calcite, dolomite, magnesite, ankerite, cerussite, malachite, etc.

Chlorite:

Light to dark-green, black; pearly, and vitreous mica whose general composition is that of a basic iron, magnesium, aluminum silicate (Mg, Fe)6(AlSi3)O13(OH)8.

Diorite:

A coarse-grained plutonic intermediate igneous rock, consisting essentially of intermediate plagioclase, and one or more of the ferromagnesian minerals (biotite, hornblende, augite).

Dolerite:

Fine to medium-grained gabbro, replaced in North America by diabase, usually occur as dykes.

Dyke:

A tabular igneous intrusion that cuts across the bedding or foliation of the country rock.

EM:

An instrument that measures the change in electro-magnetic conductivity of different geological units below the surface of the earth.

Feasibility study:

Group of reports that determine the economic viability of a given mineral occurrence.

Felsic:

An acronym word derived from feldspar and silica, and used to describe light-coloured silica minerals such as quartz, feldspar, and feldspathoids.

G/t or gpt:

Grams per metric tonne.

Gabbro:

A coarse-grained, plutonic basic (mafic) igneous rock consisting of basic plagioclase (labradorite to anorthosite), feldspar, Pyroxene (augite and/or hypersthene), olivine, hornblende, biotite, equivalent extrusive basalt

Geotechnical work:

Tasks that provide representative data of the geological rock quality in a known volume.

Gossan:

An iron-bearing weathered product overlying a sulphide deposit. It is formed by the oxidation of sulphides and the leaching-out of the sulphur and most metals, leaving hydrated iron oxides and rarely sulphates.

Gravity:

A methodology using instrumentation allowing the accurate measuring of the difference between densities of various geological units in situ.

aif.doc

- v -

Greywacke:

A sedimentary rocks with fine to coarse, angular to sub-angular particles which are mainly rock fragments (lithic fragments). They are usually poorly sorted and the cementing material is generally argillaceous.

Laterite:

Residual deposit formed under special climatic conditions in tropical regions, it consists essentially of hydrated iron oxides. The original rocks are mafic, ultramafic, and iron rich lithologies.

Long section:

A representative display of geology along the axis of mineralization.

Metasediments:

Metamorphic sedimentary rocks.

Mineral Reserve:

The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined and processed.

The terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, and “measured, indicated and inferred mineral resource” used in this Annual Information Form are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves Definitions and guidelines adopted by the CIM Council on August 20, 2000 as those definitions may be amended from time to time by CIM (the “CIM Standards”).

Under United States standards, a “mineral reserve” is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, where:

·

A “final” or “bankable” feasibility study is required to meet the requirements to designate reserves;

·

A historic three year average price is to be used in any reserve or cash flow analysis to designate reserves; and

·

To meet the “legal” part of the reserve definition, the primary environmental analysis or document should have been submitted to governmental authorities.

aif.doc

- vi -

Mineral reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit.

Under United States standards, proven or measured reserves are defined as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling and (c) the sites for inspection, sampling and measurement are spaced so closely and the geographic character is so well defined that size, shape, depth and mineral content of reserves are well established.

Under United States standards, probable or indicated reserves are defined as reserves for which quantity and grade and/or quality are computed from information similar to that of proven reserves (under United States standards), but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced, and the degree of assurance, although lower than that for proven mineral reserves, is high enough to assume continuity between points of observation. The degree of assurance, although lower than that for proven mineral reserves, is high enough to assume continuity between points of observation.

Mineral Resource:

A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

Inferred Mineral Resource:

That part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Indicated Mineral Resource:

That part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

Measured Mineral Resource:

That part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to

aif.doc

- vii -

allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

While the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, information contained in this report concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the Securities and Exchange Commission. “Indicated mineral resource” and “inferred mineral resource” have a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It can not be assumed that all or any part of an “indicated mineral resource” or “inferre d mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

Mineralization

An anomalous occurrence of metal or other commodity of value defined by any method of sampling (surface outcrops, drill core, underground channels). Under United States Securities and Exchange Commission standards, such a deposit does not qualify as a reserve until comprehensive evaluation, based on unit cost, grade, recoveries and other factors, concludes that the mineralization could be legally and economically produced or extracted at the time the reserve determination is made.

Mottled clay:

Spotted clay with different colour.

Multiple indicator kriging:

The probability in the distribution of values using deciles that are transformed to 1, if equal or less than the value or 0, if greater than the value, used to determine the average of a group of values.

Ore:

Rock, generally containing metallic or non-metallic materials, which can be mined and processed at a profit.

Porphyry:

An igneous rock characterized by visible crystals in a fine–grained matrix.

Pyrite:

An iron sulphide mineral (FeS2), the most common naturally occurring sulphide mineral.

Quartz diorite:

Diorite with quartz as usually accessory minerals (<10%).

Saprolite:

Clay and iron oxide rich weathered and altered rock.

aif.doc

- viii -

Silica:

SiO2 (quartz and chalcedony).

Sphalerite:

Zinc sulphide mineral (ZnS).

Strike:

The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface.

Sulphide (Sulfide):

A compound of sulphur (sulfur) and some other metallic element.

Supergene:

A word suggesting an origin literally “from above”. It is used almost exclusively for processes involving water, with or without dissolved material, percolating down from the surface. Typical supergene processes are solution, hydration, oxidation, deposition from solution, reactions of ions in solution with ions in existing minerals (replacement or enrichment).

Tailings:

Gangue minerals extracted from ore through various mineral processes and deposited in an enclosed ground storage area.

Trenching:

The mechanical or human excavation of ground material to expose material below surface.

VMS:

Volcanic hosted massive sulphides.

Reporting Currency

All dollar amounts are expressed in United States dollars unless otherwise indicated. The Company’s quarterly and annual financial statements are presented in United States dollars.

aif.doc

- 1 -

ITEM 1.

CORPORATE STRUCTURE

.1

Name and Incorporation

The head office of Nevsun Resources Ltd. (“Nevsun” or the “Company”) is located at 800-1075 West Georgia Street, Vancouver, British Columbia, V6E 3C9 and its registered and records office is located at 1000-840 Howe Street, Vancouver, British Columbia, V6Z 2M1.

The Company was incorporated in British Columbia under theCompanies Act (British Columbia) on July 19, 1965, originally under the name of Hogan Mines Ltd. Since inception the Company has undergone four name changes until December 19, 1991 when it adopted the name of Nevsun Resources Ltd. The Company is now governed by theBusiness Corporations Act (British Columbia).

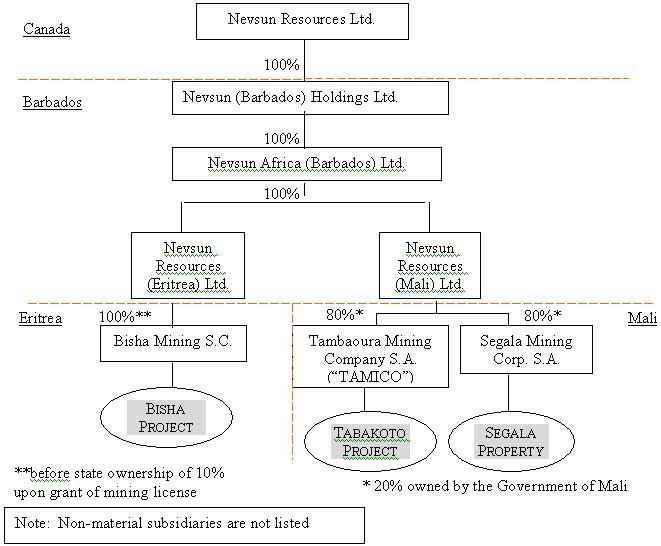

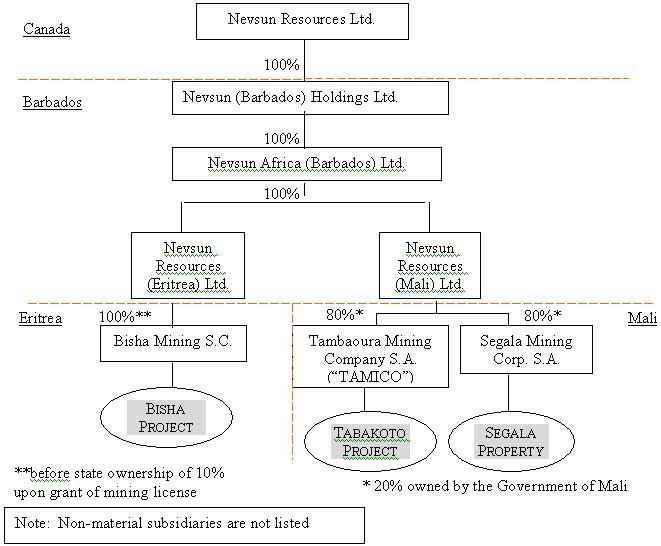

1.2

Intercorporate Relationships

- 2 -

ITEM 2.

GENERAL DEVELOPMENT OF THE BUSINESS

2.1

Three Year History

Nevsun is a gold and base metal mining and exploration company. The most significant activities impacting the Company during the past three years are:

1.

the development of the Company’s Tabakoto gold mine in Mali, West Africa to production in 2006, and

2.

the continued development of the Company’s gold-copper-zinc Bisha property in Eritrea, NE Africa, culminating in the completion of a feasibility study for mine construction, and a Social and Environmental Impact Assessment (SEIA).

In 2005 and 2006 a series of equity issues raised $82 million to allow the completion of building of the Tabakoto Mine and the advancement of the Bisha Project.

The Company is managed from its Canadian head office where a small team of professional staff provide direction and support for the Company’s Mali and Eritrea operations.

Mali

During 2004 and 2005 the Company’s principal activity in Mali was the construction of the Tabakoto mine. The construction contract for Tabakoto was awarded in May 2004 and construction carried on throughout 2005. In January 2006 the Company took over the final construction of the processing facilities as the contractor was not performing to schedule. Commissioning of the milling section of the process plant was completed in Q2 2006, milling softer near surface ore. Commissioning of the three stage crushing plant, needed to process the bulk of the ore body, was completed in Q3 2006.

The first gold pour was made at Tabakoto in late March 2006 and the first gold shipment was made in mid-May. The date of the first gold shipment is considered by the Malian government to be the start of operations. By year end 2006 the operations were capable of running at design tonnages.

Eritrea

By July 2004 the Company had drilled the original Bisha Main discovery to 25m centers along a 1200m strike of its extensive structure. The Bisha Main high grade gold oxide, supergene copper, and primary sulphide resources were published in October 2004.

During September 2004 a temporary stop-work order for all mineral exploration in the country was issued by the Government of Eritrea, while a review was made of the country’s mining code. In January 2005 the Company was requested to recommence work and has continued with full support of the Government.

- 3 -

In February 2005 the Company engaged an independent engineer, AMEC Americas, to carry out a feasibility study for the Bisha Project. In November 2006 AMEC completed a scoping study as a progress statement on the feasibility study. The Bisha Technical report outlining the scoping study was delivered by AMEC in December 2005. This scoping study identified a robust economic project over at least 10 years. The detailed feasibility study was completed in October 2006, followed by a Social and Environmental Impact Assessment (SEIA) in December 2006.

During 2007 the Company expects to receive a mining license for the Bisha Project. This will allow the Company to seek financing to build the Bisha Mine.

Sales and Refining

The gold dore bars from the Tabakoto Mine are regularly shipped for sale under contract to the Argor Hereaus gold refinery in Switzerland which refines gold to market delivery bars. The sale price for the product is regulated by daily spot gold prices on the London gold market.

End product uses for refined gold include fabrication and bullion investment, there are a large number of available gold purchasers, and the Company is not dependent on the sale of gold to any one customer.

When the Bisha Mine comes into production (current estimate during 2009) the first two years of production will be gold/silver as dore bars. Thereafter, the Bisha Mine will primarily be a copper and copper/zinc concentrate producer selling concentrate on the international markets, with by-product gold and silver contributing to the revenue stream. Copper and zinc are valued industrial metals used in many manufacturing industries.

2.2

Significant Acquisitions

During 2006 the Company was not involved in any significant acquisitions.

ITEM 3.

DESCRIPTION OF THE BUSINESS

3.1

General

The Company is a natural resource company engaged in the acquisition, exploration, development and production of mineral properties. Currently the Company’s portfolio is focussed on properties in Africa with gold and base metal (copper and zinc) resources/reserves. The Tabakoto Mine is the Company’s first gold mine.

The Company’s principal mineral properties include the Tabakoto and Segala properties located in Mali, West Africa, and the Bisha property located in Eritrea, North-East Africa. Commissioning of the Tabakoto mine occurred in stages in 2006, with full commercial production achieved during Q3 2006. After difficulties in achieving planned gold grade and

- 4 -

after a thorough review of operations, mine plan and taking into account historic gold prices as at December 31, 2006, the Company wrote off its investment in the Tabakoto property, plant and equipment. The Company’s MD&A and consolidated financial statements provide more discussion on this matter.

Methods of Production

The Tabakoto Mine currently comprises an open pit mining operation (the Tabakoto open pit) and a gold ore processing facility. A mining contractor, reporting to the Tabakoto mine management, is engaged in mining the open pit whilst the process plant and mine infrastructure are managed by Tambaoura Mining Company S.A. (“TAMICO”) staff. The ownership structure for TAMICO is 80% Nevsun and 20% Government of Mali. The process plant comprises three stage crushing, ball milling, gravity gold recovery, and carbon in leach gold recovery.

Future opportunities for Tabakoto operations include the mining of the Segala open pit on the adjoining Segala property (same share ownership as TAMICO) with the Segala ore being future feed for the Tabakoto plant, exploration within the Tabakoto and Segala license areas, and possible future underground mining below the Tabakoto open pit.

The Bisha feasibility study contemplates open pit mining of the Bisha Main Deposit using an owner operated mining fleet and processing facilities to initially process the gold oxide cap of a long term copper and then copper-zinc massive sulphide deposit.

Skill and Knowledge

The Company engages international and local national staff in its Malian and Eritrean operations. Original discovery work at Tabakoto and at Bisha utilised experienced international and national contract staff with on-site training of new national staff to replace contract staff. Progressing to mining operations in Mali, experienced international and national staff were engaged for senior and highly skilled positions and on site training was conducted for the general workforce. Mali has a well developed gold mining industry with trained mining related personnel. There is a conscious effort to employ and train employees from the population centres closest to the mine.

In Eritrea, the Company has already built a management team of skilled mining, environmental, financial and administrative personnel reporting to a country General Manager who is in charge of the development and future operations of the Bisha Project. A mix of international and national staff has been built up with a clear intent to train appropriate future national staff in all aspects of modern mining operations. Eritrea has a hard-working and well-educated workforce. Bisha, when in production, is expected to be the first of many modern mining operations in Eritrea. Training of local staff will be a priority – retraining in the case of skills already existing that can be applied to mining operations and training for new skills.

- 5 -

Employees

At December 31, 2006, the Company had 299 full time employees in Mali, 63 full time employees in Eritrea, and 10 full time employees associated with its Head Office in Canada.

Social and Environmental policies

The Company encourages in all of its operations a culture of environmental responsibility and awareness of the importance of health and safety. In January, 2006 the Company formed an Environmental, Health and Safety Committee which is committed to furthering these objectives.

In both Mali and Eritrea experienced environmental management staff report directly to the General Manager of the operations. In Mali, regular planning meetings are held between the Tabakoto management team and the local community and its leaders. In Eritrea, the Company has focused much of its feasibility development work on the local community through education and community awareness programs which have been an integral part of the Bisha Social and Environmental Impact Assessment.

3.2

Risk Factors

The operations of the Company are highly speculative due to the high-risk nature of its business, which is the acquisition, financing, exploration and development of mineral properties. The risks below are not the only ones facing the Company. Additional risks not currently known to the Company, or that the Company currently deems immaterial, may also impair the Company’s operations. If any of the following risks actually occur, the Company’s business, financial condition and operating results could be adversely affected.

Exploration risk. Exploration for mineral deposits involves significant risk that even a combination of careful evaluation, experience and knowledge may not eliminate. It is impossible to ensure that the Company’s exploration programs will establish economically recoverable reserves.

Development risk. Mineral property development is a speculative business and involves a high degree of risk. The marketability of natural resources that may be acquired or discovered by the Company will be affected by numerous factors beyond its control. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

Infrastructure risk. Mining, processing, development and exploration activities depend, to some degree, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants which affect capital and operating costs. Unusual or

- 6 -

infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations, financial condition and results of operations.

Commodity price risk. The price of gold and other metals can and has experienced volatile and significant price movements over short periods of time, and is affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies), interest rates, global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs, and governmental policies.

Reserve and resource estimate risk. The figures for reserves and resources presented herein are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Market fluctuations in the price of mineral commodities or increases in the costs to recover minerals may render the mining of ore reserves uneconomical and require the Company to take a write-down of the asset or to discontinue development or production. Moreover, short-term operating factors relating to the reserves, such as the need for orderly development of the ore body or the processing of new or different ore grades, may cause a mining operation to be unprofitable in any particular accounting period.

Prolonged declines in the market price of gold may render reserves containing relatively lower grades of gold mineralization uneconomic to exploit and could reduce materially the Company’s reserves and resources. Should such reductions occur, material write downs of the Company’s investment in mining properties or the discontinuation of development or production might be required, and there could be material delays in the development of new projects, increased net losses and reduced cash flow.

There are numerous uncertainties inherent in estimating quantities of mineral reserves and resources. The estimates are based on various assumptions relating to metal prices and exchange rates during the expected life of production, mineralization of the area to be mined, the projected cost of mining, and the results of additional planned development work. Actual future production rates and amounts, revenues, taxes, operating expenses, environmental and regulatory compliance expenditures, development expenditures and recovery rates may vary substantially from those assumed in the estimates. Any significant change in these assumptions, including changes that result from variances between projected and actual results, could result in material downward or upward revision of current estimates.

Operating risk. Mining operations generally involve a high degree of risk. Hazards such as unusual or unexpected formations and other conditions are involved. The Company may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities may have a material, adverse effect on the Company’s financial position.

- 7 -

Ownership risk. There is no guarantee that title to the properties in which the Company has an interest will not be challenged or impugned. These properties may be subject to prior unregistered agreements or transfers and title may be affected by undetected defects. There is no guarantee that any of the prospecting licences or exploration permits granted in connection with the properties will be renewed upon their normal expiry. If the Company fails to meet its contractual obligations with respect to a property, it may lose its rights or interests in the particular property.

Political risk. The Company’s material properties are located in Mali and Eritrea and may be subject to sovereign risks, including political and economic instability, government regulations relating to mining, military repression, currency fluctuations and inflation, all or any of which may impede the Company’s activities in those countries or may result in the impairment or loss of part or all of the Company’s interest in one or all of the properties.

Funding risk. Additional future funds may be required for further exploration programs, or if such exploration programs are successful, for the development of economic ore bodies and the placing of them in commercial production. Historically, the only sources for such funds has been the sale of equity capital and limited debt. There is no assurance that sources of financing will be available on acceptable terms or at all.

Share price risk. The market price of a publicly traded stock, particularly a junior resource issuer like the Company, is affected by many variables not directly related to the success of the Company, including the market for all junior resource sector shares, the breadth of the public market for the stock, and the attractiveness of alternative investment. The affect of these and other factors on the market price of the Common Shares on the exchanges in which the Company trades suggests that the Company’s shares will be volatile. The Company’s shares have traded in a range between Cdn $1.56 and Cdn $9.25 in the last four fiscal years.

Foreign operation risk. The Company conducts operations through foreign subsidiaries with operations in Barbados, Mali, Eritrea and Ghana, and substantially all of its assets are held in such entities. Accordingly, any limitation on the transfer of cash or other assets between the parent corporation and such entities, or among such entities, could restrict the Company’s ability to fund its operations efficiently. Any such limitations, or the perception that such limitations may exist now or in the future, could have an adverse impact on the Company’s valuation and stock price.

Currency risk. At present all of the Company’s activities are carried on outside of Canada. Accordingly, it is subject to risks associated with fluctuations of the rate of exchange of the Canadian dollar and foreign currencies.

Environmental risk. The Company’s operations may be subject to environmental regulations promulgated by the governments in the countries in which it operates from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas that could result in environmental pollution. A breach of such legislation may result in the imposition of fines

- 8 -

and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner that means standards and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments for proposed projects carry a heightened degree of responsibility for companies, directors, officers and employees. The cost of compliance with changes in government regulations has the potential to reduce the profitability of operations. The Company intends to fully comply with all environmental regulations in the countries in which the Company has operations and comply with prudent international standards.

Key executive risk. The Company is dependent on the services of key executives, including its President and Chief Executive Officer and a small number of highly skilled and experienced executives and personnel. Due to the relatively small size of the Company, the loss of these persons or the Company’s inability to attract and retain additional highly skilled employees may adversely affect its business and future operations.

Competition risk. The mineral exploration and mining business is competitive in all of its phases. The Company competes with numerous other companies and individuals, including competitors with greater financial, technical and other resources than the Company, in the search for and the acquisition of attractive mineral properties. The ability of the Company to acquire properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable properties for mineral exploration or development. There is no assurance that the Company will continue to be able to compete successfully with its competitors in acquiring such properties or prospects on terms it considers acceptable, if at all.

Mineral Properties

The Company has two material mineral properties, the Tabakoto/Segala properties located in Mali and the Bisha property located in Eritrea. The Tabakoto and Segala properties are separate but contiguous holdings. Ore from the Segala property will be processed through the Tabakoto plant.

3.3

Tabakoto / Segala, Mali

Tabakoto

The Tabakoto area was an area of intense local artisan mining activity for a number of years prior to Nevsun obtaining its first permit in the Tabakoto area in 1992. The Company purchased additional permits adjoining Tabakoto to increase the overall land package. The collection of exploration permits were converted to an exploitation permit in late 1999 and revised in 2002. The exploitation license area currently consists of 60 square kilometers.

Past work has consisted of geological mapping, soil sampling, geophysical surveys, diamond drilling and reverse circulation drilling. Several resource estimates have been calculated and

- 9 -

a pre-feasibility study was first prepared in 1998. Independent consultants have documented all of this work and reports are available at the Company’s corporate office in Vancouver.

The Tabakoto gold deposit is a high grade/low volume, structurally controlled, porphyry and quartz vein associated orebody, outlined through definition drilling programs along a strike length of 1650 meters to a subsurface depth of 350 meters.

The deposit occurs within the core of a tight, upright anticline (or anticline couple), whose axial surface dips steeply (70°-85°) eastward. The folded metasediments are monotonously intermixed such that no distinct marker units exist, and the anticline is defined strictly by common sedimentary facing directions. A suite of meter to decameter scale, intermediate to felsic (+/- quartz) feldspar-porphyritic dykes cuts the folded sequence along the length of the core of the anticline. The porphyritic dykes are concentrated within two main intrusive corridors in the northern portion of the deposit, namely a western corridor (15-30 meters wide) dominated by intermediate (diorite, quartz diorite) dykes and an eastern corridor (20-75 meters wide) dominated by felsic dykes. The corridors are generally about 40 meters apart (up to 80 meters in the north) and merge into one principal corridor (50-110 meters wide ) in the central part of the deposit. Brittle faults and gabbro-dolerite dykes transect the folded assembly.

The in-situ oxide zone, composed of saprolite with successive mottled clay zone and local laterite, ranges between 6-50 meters thick, and is overlain by a cap of locally lateritized alluvial material between 4-18 meters thick.

The dyke corridors and associated host rocks along the length of the anticlinal axis form the locus of preferential alteration (silicification. sericitization and/or carbonatization), intrusion of narrow (cm to dm scale) gold bearing (+/-albite, carbonate) quartz vein systems, development of quartz crackle vein and quartz flooded breccia zones, and development of fine to medium grained disseminated arsenopyrite with subordinate pyrite and free gold. Visible gold occurs statistically in all lithologies and gold grades range widely owing to a nugget effect. High grade zones of gold mineralization are related to the porphyritic dyke corridors, including the host metasediments, and the zones of alteration and fracturing associated with them, forming a north trending main mineralized zone ranging between 20-50 meters in width along the anticlinal axial trace. Cross and long sections depict a somewhat erratic pattern of high grade mineralization, yet infer the presence of moderately south plunging shoots or panels, likely governed by the intersection of brittle structures. NE trending cross structures, such as the major structure that transects the deposit at its south end and other zones cutting the central part of the deposit, also form the locus of porphyritic dyke injection, alteration and gold mineralization.

Tabakoto Mining Operations

The original Tabakoto feasibility mine production plan provided 3.18Mt of ore processed at a rate of 650,000 tonnes per annum and grading 5.45g/t gold to a depth of 210 meters and a 2g/t gold cut-off grade. Over 5 years the plan yielded approximately 536,747 ounces of gold at an average waste to ore ratio of 15.4:1 with ore and waste totalling 52 Mt.

- 10 -

The Tabakoto Mine is an open pit operation. The plant is a carbon leach facility with a design capacity of 650,000 tonnes annual mill throughput. The Company has not entered into any hedge contracts for gold production from the operations.

Mining commenced in late 2005 using a mining contractor. The construction contract for Tabakoto was awarded in May 2004. In January 2006 the Company took over the final construction of the processing facilities as the contractor was not performing to schedule. Commissioning of the milling section of the process plant was completed in April 2006, milling softer near surface ore. Commissioning of the three stage crushing plant, needed to process the bulk of the ore body, was completed in Q2 2006. By year end 2006 the operations were capable of running at design tonnages.

In May 2004 the Company proceeded with the construction of the Tabakoto mine. Construction took place over the ensuing twenty-one months, encountering a variety of project management, contractor and supply difficulties. The construction period took seven months longer than originally anticipated and as a result was significantly over its original construction budget.

In February 2007, the Company completed a review of all aspects of its Mali operations, including the geological model, mine plan and operating costs. The principal purpose of the review was to take into account the negative gold grade variances being observed between the original pre-production mining model for Tabakoto and the gold grades achieved during the actual mining operations. Based on its review, management has reduced the life of mine of Tabakoto by two hundred thousand ounces. The reduction results from a reduced grade for the project. The current projected grade through the end of the project is 3.9 g/t.

In March 2007, management also reviewed the carrying value of the Tabakoto Mine and related assets as part of its annual financial reporting process. In preparing its discounted cash flow analysis management used gold prices that declined over the next three years from $625/oz to $500/oz for revenues based on budgeted costs for the remainder of the life of mine. The Company concluded that in accordance with industry practice, a provision was required for impairment of the entire amount of the Tabakoto property ($81,116,202), which combined with other directly related items, resulted in a total charge to the Consolidated Statements of Operations and Deficit of $80,862,608.

The Company will continue to operate the Tabakoto Mine as a marginal gold operation with an option on rising gold prices. For 2007, the Company has budgeted for the following operations results:

| |

Tonnes milled | 706,000 |

Grade | 4.04 |

Recovery | 90% |

Ounces to be produced | 82,000 |

- 11 -

Segala

The Segala property is contiguous to the Tabakoto property and is subject to its own mining license over a 23 square kilometer area. It was acquired during 2002 at a value of approximately $10.6 million in the form of cash and shares which was paid over the following three years. Past work by former owners consisted of geological mapping, soil sampling, geophysical surveys, diamond drilling and reverse circulation drilling. Several resource estimates were calculated and a pre-feasibility study was prepared by a former owner in 1998.

The Segala gold deposit is a structurally controlled, alteration and mineralization associated deposit within the core of a tight, upright anticline trending ESE (approx. 110°), whose axial surface dips steeply (-80°) south. The folded metasediments (greywackes and argillites) display variable intensities of alteration including chlorite, carbonate, sericite and silica. A series of quartz stringers and veins intrude this package.

Gold mineralization is associated with later, narrow iron carbonate-quartz veins and stringers that intrude the silicified and carbonatized sediments. The veins and stringers usually display somewhat bleached selvages containing coarse to fine grained arsenopyrite crystals and finer disseminated to patchy pyrite (pyrite is also seen to replace arsenopyrite). Many of these stringers and veins are parallel to local foliation but there are others that are believed to be oriented northeast-southwest as well as north south. To a significantly lesser degree gold is also associated with fractured felsic and intermediate feldspar porphyry dykes. Mineralization appears to plunge steeply to the east.

The Main Zone has been defined over a strike length of at least 600 meters and attains widths of up to 40 meters. Higher grade gold zones occur within the mineralized envelope. The Northwest Zone located to the north and west of the Main Zone does not display the degree of alteration that is seen in the Main Zone. Consequently, the depth of oxidation is in the order of 40-60 meters as opposed to the Main Zone which has depths of oxidation ranging from 5 meters in the east to 25 meters in the west. The degree of iron carbonate and sericite alteration is significantly less and the mineralization associated with quartz veining is more subtle. Quartz veining and stringers are interpreted to trend both northeast, southwest and east west. The strike of the Northwest Zone appears to be parallel to the Main Zone. Northeast striking structures are suspected to play a significant role in emplacement of gold. Graphit ic/carbonaceous zones are noted to carry some gold values.

The mineral resource estimate for Segala was completed by Snowden using multiple indicator kriging to interpolate gold grades from composite drill hole samples into a three-dimensional grade block model constrained by solid models of the mineralization.

The resource is reported within mineralized envelope boundaries and is classified as Measured, Indicated and Inferred according to National Instrument 43-101, as listed in the table below. The Measured and Indicated resource estimated for the Segala deposit is 7.5 Mt at 3.36 g/t Au (based on a cut-off grade of 2.0 g/t Au). The Inferred resource is 1.2 Mt at 2.84 g/t Au (based on a cut-off grade of 2.0 g/t Au).

- 12 -

| | | |

Segala Mineral Resource Estimate 2.0g/t Au cut-off |

Category | Tonnes | Au | Au |

| Mt | g/t | kg |

Measured | 3.3 | 3.34 | 11,132 |

Indicated | 4.2 | 3.37 | 14,273 |

Measured + Indicated. | 7.5 | 3.36 | 25,405 |

Inferred | 1.2 | 2.84 | 3,414 |

During 2004 Snowden prepared a mineral reserve estimate based on $350/oz and $325/oz gold prices, together with cost estimates using the original Tabakoto feasibility study. As a result of the 2006 operations at Tabakoto and a review of the Tabakoto forward mine plan, the Company now considers the Snowden reserve estimate to be out of date and is considering test mining the Segala pit later in 2007 as a means of proving the viability of the Segala deposit as additional ore feed to the Tabakoto mill. Test mining would entail a trial mine program at Segala designed to obtain sufficient ore feed to campaign through the Tabakoto mill for a duration of about one month.

Management has determined it is not necessary to adjust the carrying value of Segala without the additional information the above noted work will provide.

12. Exploration and Development

The Company will be re-evaluating when to commence the Segala open pit mining for processing through the Tabakoto plant and when to commence exploration at Tabakoto and Segala to replace depleting reserves and resources.

3.4

Bisha, Eritrea

Project Description and Location

The Bisha Property consists of an exploration licence located 150 km west of Asmara, 43 km southwest of the regional town of Akurdat, and 50 km north of Barentu, the regional or Zone Administration Centre of the Gash-Barka District, in Eritrea, East Africa.

The Property is a single, contiguous exploration licence with dimensions of 14 km x 16 km (224 km2) located at approximate latitude 15°24'N and longitude 37°30'E. The UTM coordinates of the centre of the Property are 1,711,000 N and 340,000 E (UTM Zone 37).

The exploration license contains within it, the Bisha Deposit, which is a large precious metal (Au) and base metal rich (Cu, Zn) Volcanic Massive Sulphide (VMS) deposit. As well as two satellite deposits, the NW Zone and Harena. The NW Zone lies 1.2 km to the northwest of the Bisha deposit and Harena is located 9.5 km to the southwest of Bisha.

- 13 -

Nevsun, through its Eritrea subsidiary, Bisha Mining Share Company, holds the Exploration Licence. The State of Eritrea has an automatic right to a free carried 10% interest and has an option, under existing Eritrea mining laws, to acquire up to a further 20% interest by agreement with the licensee. During 2005, the Government advised the Company that it may alter its mining laws to allow it to increase its contributing interest to 30%. To the date of these financial statements no such change has been effected.

The Exploration Licence is valid until the earlier of either 13 May 2007 or the date when it is converted to a Mining Licence. The Exploration Licence may be converted to a Mining Licence upon the acceptance by the State of Eritrea of an appropriate Feasibility Study and Social and Environmental Impact Assessment (SEIA) report. The Company submitted both a Feasibility Study and a SEIA to the Government during Q4 2006.

The annual rental fee for the Exploration Licence is 53,200 Nakfa, and the annual licence renewal fee is 6,000 Nakfa (about US$3,500 and US$400 respectively).

Accessibility, Climate, Local Resources, Infrastructure & Physiography

Eritrea is located above the Horn of Africa on the continent’s east coast, between Sudan to the north and west, and Ethiopia and Djibouti to the south. Eritrea has an area of 124,320 km2and a 1,151 km coastline on the Red Sea, which separates the country from Saudi Arabia and Yemen (CIA, 2005) and an area of 124,320 km2.

There are over 350 islands located along the coast of Eritrea within the Red Sea and the Dahlak Archipelago.

The country is divided into three main geographical zones: (1) the fertile and intensively farmed mountainous central plateau that varies from 1,800 to 3,000 metres above sea level (“masl”); (2) the eastern escarpment and coastal plain which are mainly desert, and (3) semi-arid western lowlands. The Bisha property is located in the western lowlands.

Eritrea has no year-round rivers and the climate is temperate in the mountains and hot in the lowlands. Asmara, the capital, is located is about 2,300 masl (7,500 ft.). The maximum temperature is 26°C (80°F). The weather is usually sunny and dry, with the short or “belg” rains occurring between February to April and heavy or “meher” rains beginning in late June and ending in mid-September (US Department of State, 2005).

Asmara is serviced by regular international flights including flights out of Frankfurt, Cairo, Sanaa, Jeddah, Amsterdam, and Rome. There is a good network of paved roads connecting Asmara with the major regional centres of Keren, Massawa, Assab, Adi Quala and Barentu. Power generation from the Hirgigo diesel plant near Massawa supplies electrical power to Asmara and other major regional centres. Landline telephone service is available from larger towns and cellular service is available in Asmara and surrounding towns, including Keren. Access to the Bisha Exploration Licence is by paved road from Asmara to Akurdat, a distance by road of 181 km. From Akurdat access is via an all-weather unpaved road.

- 14 -

Comprehensive medical services are found in the larger towns with rudimentary medical clinics available in the smaller villages. Schools are located in most villages.

Exploration History and Drilling

Nevsun has no record of any previous exploration or mining activities on the property or surrounding areas prior to 1996. A single colonial mine, dating from the Italian era, is situated at Okreb, seven kilometers south of the village of Adi Ibrahim.

In June 1998, Nevsun signed the Bisha Area Prospecting Licence Agreement with the State of Eritrea that was converted to an Exploration Licence in June 1999 covering an area of 49 km2, later expanding to an area of 224 km2 in 2003. The Exploration Licence has been renewed such that its expiry date is now 13 May 2007, unless it is converted to a Mining Licence at an earlier date.

From 1998 to 1999, exploration activities consisted of reconnaissance-scale geological mapping, multi-element stream sediment sampling and limited “orientation” soil sampling, which showed the Bisha Gossan Zone to be highly anomalous in lead with significant values of copper, zinc and silver. Phelps Dodge Corp. completed a property examination in late 1999 and collected 10 grab samples of the gossan material. The samples returned anomalous gold values ranging up to 30.4 g/t Au.

Work was suspended between 1999 until 2002 due to the border war with Ethiopia.

In October 2002, Nevsun completed diamond-drilling program of six holes totalling 810.90 m at Bisha in order to test the geophysical and geochemical anomalies at the gossan outcrop area. The drilling was sufficient to confirm the presence of a volcanogenic massive sulphide deposit overlain by a supergene copper-enriched zone and a gold-enriched gossan cap.

Two phases of diamond drilling were completed in 2003 for a total of 18,619.26 m in 141 holes. Additional work conducted during this program included mapping, geochemical sampling, trenching, geophysics (airborne and ground), metallurgical testwork, petrographic work and bulk density measurements.

Further diamond drilling (163 holes totalling 28,879.50 m), RC drilling (33 holes totalling 1,814.40 m) and core/RC combination holes (9 holes totalling 591.70 m) were completed between January and June 2004. Additional work completed during this program included geophysical surveys, mapping, geochemical sampling, petrographic work, bulk density measurements, geotechnical work, environmental baseline work, and metallurgical testwork.

In September 2004 all companies in Eritrea with exploration licenses were requested by the Government of Eritrea to halt all mineral prospecting and exploration work and related activities in Eritrea until further notice. During this period the Government carried out a review of its mining code. In January 2005, the Government granted permission to resume work.

- 15 -

During 2005, Nevsun completed diamond drilling of 135 holes in three zones (86 holes in Bisha Main Zone, 22 holes in the Northwest Zone, 27 holes in the Harena Zone) totalling 18,053 m. The Bisha Main Zone drilling included 20 geotechnical and 8 metallurgical drill holes, drilled to provide further information on the deposit for use in the feasibility study.

In 2006, 8 diamond drill holes (1,680 m), including one deep drill hole at Bisha Main, three drill holes at the Bisha hangingwall copper zone and 4 drill holes at the NW zone satellite deposit were completed. These holes were not included in the database used for resource estimation in the Feasibility Study.

Geology and Mineralization

Bisha is a precious and base metal-rich volcanogenic massive sulphide (VMS) deposit. Pertinent deposit model types would be Noranda/Kuroko or bimodal-siliciclastic VMS deposits.

Four principal zones of mineralization within the Bisha Main Zone have developed through oxidation, leaching and reprecipitation of metals, and include: (1) a near-surface oxide/gossan; (2) a horizon that has been subjected to extreme acidification (acidified); (3) a supergene copper-enriched horizon; and (4) a primary massive sulphide horizon.

The massive sulphide lenses are oriented north-south, and the true thicknesses vary from 0 to 70 m. The deposit remains open down dip in several portions of the deposit and extensions at depth would add primary sulphide mineralization.

Metal zoning within the massive sulphide lenses appears to indicate an upward transition from Cu-rich to Zn-rich to barren pyrite and this confirms the interpretation that the sequence is right-way-up (west-facing).

The Bisha Main Zone mineralization consists of precious metal (Au, Ag) and base metal rich (Cu, Zn, Pb) massive sulphide lenses hosted by a bimodal sequence of weakly stratified, predominantly tuffaceous metavolcanic rocks (Nacfa Terrane greenstone belt). Host rocks are felsic lithologies (variably altered felsic lapilli and lapilli ash tuffs, crystal tuffs and minor felsic dykes), which also form the hanging wall stratigraphy and predominate overall.

Sampling and Analysis

Sampling programs at the Bisha Property included drill core samples, RC samples and various geochemical samples, which included: surface rock chip, trench, auger, pit, soil, and stream sediment sampling. Nevsun established detailed logging, sample collection, and sample preparation protocols for core and RC sampling, and implemented procedures for the collection of geotechnical data.

All trench, rock chip and geochemical samples, including soil and auger, stream sediment, pit and termite mound samples collected during the 2003 Phase I program were shipped to the Horn of Africa Preparation Laboratory, in Asmara, which provided preparation services for Genalysis Laboratory Services Pty (Genalysis) of Maddington, Australia. The preparation

- 16 -

laboratory produced pulp samples that were subsequently shipped to Genalysis in Australia for analysis. Following the 2003 Phase I program, geochemical and rock chip samples were shipped to ALS Chemex Ltd. (ALS Chemex), in Vancouver, Canada.

The primary laboratory used by Nevsun for analytical work on the drilling programs was ALS Chemex. Nevsun used the laboratory for both sample preparation and analyses from the initiation of the first drill program in 2002. During the 2002 and Phase I of the 2003 drilling program samples were shipped as half-core from the Bisha camp to Asmara and forwarded to ALS Chemex in Vancouver. After establishing a sample preparation facility designed and installed by ALS Chemex at camp in September 2003, Nevsun sent coarse crushed and split material (-2 mm) for core, RC, and rock samples to ALS Chemex for subsequent pulverization and analyses. All assay data contained in the database for resource estimation was assayed by ALS Chemex.

Both ALS Chemex and Genalysis are ISO registered and are internationally recognized facilities. ALS Chemex is registered to ISO 9001:2000 for the “provision of assay and geochemical analytical services” by BSI Quality Registrars. The National Association of Testing Authorities Australia has accredited Genalysis, following demonstration of its technical competence, to operate in accordance with ISO/IEC 17025 (1999), which includes the management requirements of ISO 9002:1994. The facility is accredited in the field of Chemical Testing for the tests, calibrations and measurements that are shown in the Scope of Accreditation issued by NATA (see Genalysis Website, 2004).

Security of Samples

The chain-of-custody for core samples collected and being shipped from site is as follows:

·

Core is transported to the Bisha camp by the drill contractors and placed in the core logging area

·

Logging and sample preparation area and Bisha camp is a fenced and guarded compound

·

Core samples are crushed and sub-sampled

·

Prepared samples are placed in sealed barrels

·

Each barrel has a list of samples written on the outside of the container

·

A sample submission form accompanies each barrel

·

Barrels are transported to Asmara in company-owned vehicles arranged by Nevsun.

The sample barrels are submitted to the Ministry of Mines for inspection and submission to customs, a customs seal is placed on the barrels and they are shipped via air transport directly to ALS Chemex in Vancouver, Canada.

- 17 -

Mineral Resource Estimate

The geological interpretation was completed by Nevsun based on lithologic, mineralogic and alteration features logged in drill core. The overall interpretation at Bisha changed little since AMEC’s initial resource estimate in 2004. The deposit has been subdivided into six mineralized domains: breccia, oxide, acid, supergene, primary Zn, and primary. Some of the domain contacts have been revised relative to the 2004 interpretation based on new drill hole information or revised interpretations. The general sizes of the domains and their positions relative to each other are consistent with the initial interpretations.

A 3D geological model was prepared in Gemcom® software to outline the six mineralized domains. The resource model was prepared in 2005 by AMEC using ordinary kriging for grade interpolation. The 2005 Bisha resource statement is based on 347 diamond and 9 reverse circulation pre-collar diamond drill holes covering a strike length of 1,200 m and to depths varying from surface to 380 m.

The classified Bisha mineral resource estimate is summarized by domain at various gold, copper and zinc cut-off grades in Table 1-1. The mineral resource estimate is compliant with CIM Definition Standards for Mineral Resources and Mineral Reserves as required by NI 43-101.

After resource modelling was completed, the model was condensed to three zones each of which requires a different recovery treatment process. The upper breccia, oxide, and acidified domains were combined into an “Oxide Zone”. The supergene domain became the “Supergene Zone”, and the two primary domains were combined into the “Primary Zone”. The resulting zones were then examined to determine the potential for selective mining of each zone and a series of pit phases were created to sequence the pit. A dilution factor was added to the mineralization based on the zones and their grades in each block.

- 18 -

| | | | | | | | | | | | | | | |

Table 1-1: Mineral Resource Estimate |

| | | | | Grade | | Metal |

Category | Domain | Cut-off | Tonnes

(kt) | | Au

(g/t) | Ag

(g/t) | Cu

(%) | Pb

(%) | Zn

(%) | | Au

(koz) | Ag

(koz) | Cu

(klb) | Pb

(klb) | Zn

(klb) |

Measured | Oxides | 0.5g/t Au | 764 | | 6.26 | 27.8 | 0.11 | 0.70 | 0.10 | | 154 | 683 | 1,885 | 11,873 | 1,760 |

| Supergene Cu | 0.5% Cu | 844 | | 0.77 | 43.6 | 5.03 | 0.17 | 0.24 | | 21 | 1,183 | 93,551 | 3,162 | 4,464 |

| Primary Zn | 2.0% Zn | 320 | | 0.84 | 68.5 | 1.11 | 0.52 | 12.29 | | 9 | 704 | 7,826 | 3,666 | 86,655 |

| Primary | 2.0% Zn | 4 | | 0.69 | 22.5 | 0.67 | 0.04 | 2.17 | | 0 | 3 | 52 | 3 | 169 |

| Primary | 0.5% Cu (< 2%Zn) | 87 | | 0.63 | 24.2 | 0.65 | 0.06 | 0.90 | | 2 | 67 | 1,241 | 115 | 1,718 |

| Subtotal | | 2,018 | | 2.95 | 41.4 | 2.43 | 0.44 | 2.19 | | 185 | 2,639 | 104,555 | 18,819 | 94,766 |

Indicated | Oxides | 0.5g/t Au | 4,036 | | 7.17 | 30.7 | 0.08 | 0.54 | 0.07 | | 930 | 3,981 | 7,118 | 48,047 | 6,228 |

| Supergene Cu | 0.5% Cu | 6,660 | | 0.71 | 30.9 | 3.83 | 0.10 | 0.10 | | 152 | 6,607 | 562,321 | 14,242 | 14,682 |

| Primary Zn | 2.0% Zn | 8,256 | | 0.76 | 59.2 | 1.06 | 0.34 | 9.07 | | 201 | 15,702 | 192,927 | 61,882 | 1,650,800 |

| Primary | 2.0% Zn | 1,659 | | 0.75 | 31.4 | 0.79 | 0.08 | 3.09 | | 40 | 1,675 | 28,894 | 2,926 | 113,015 |

| Primary | 0.5% Cu (< 2%Zn) | 4,657 | | 0.67 | 33.4 | 1.16 | 0.03 | 1.01 | | 100 | 5,001 | 119,105 | 3,080 | 103,704 |

| Subtotal | | 25,268 | | 2.00 | 42.2 | 1.74 | 0.28 | 3.93 | | 1,424 | 32,967 | 910,365 | 130,177 | 1,888,429 |

Meas+Ind | Oxides | 0.5g/t Au | 4,800 | | 7.02 | 30.2 | 0.09 | 0.57 | 0.08 | | 1,084 | 4,663 | 9,003 | 59,920 | 7,988 |

| Supergene Cu | 0.5% Cu | 7,503 | | 0.72 | 32.3 | 3.96 | 0.11 | 0.12 | | 173 | 7,790 | 655,871 | 17,403 | 19,146 |

| Primary Zn | 2.0% Zn | 8,576 | | 0.76 | 59.5 | 1.06 | 0.35 | 9.19 | | 210 | 16,406 | 200,754 | 65,549 | 1,737,456 |

| Primary | 2.0% Zn | 1,663 | | 0.75 | 31.4 | 0.79 | 0.08 | 3.09 | | 40 | 1,677 | 28,946 | 2,929 | 113,184 |

| Primary | 0.5% Cu (< 2%Zn) | 4,744 | | 0.67 | 33.2 | 1.15 | 0.03 | 1.01 | | 103 | 5,068 | 120,065 | 3,033 | 105,528 |

| Subtotal | | 27,286 | | 2.08 | 42.1 | 1.80 | 0.29 | 3.78 | | 1,610 | 35,605 | 1,014,639 | 148,834 | 1,983,300 |

Inferred | Oxides | 0.5g/t Au | 60 | | 2.85 | 17.5 | 0.03 | 0.06 | 0.02 | | 5 | 33 | 39 | 79 | 26 |

| Supergene Cu | 0.5% Cu | 206 | | 0.48 | 21.1 | 1.94 | 0.05 | 0.03 | | 3 | 140 | 8,820 | 214 | 123 |

| Primary Zn | 2.0% Zn | 6,803 | | 0.65 | 53.3 | 0.83 | 0.36 | 8.42 | | 142 | 11,658 | 124,485 | 53,993 | 1,262,847 |

| Primary | 2.0% Zn | 510 | | 0.62 | 36.5 | 1.02 | 0.05 | 3.29 | | 10 | 599 | 11,465 | 562 | 36,980 |

| Primary | 0.5% Cu (< 2%Zn) | 4,147 | | 0.68 | 37.3 | 0.99 | 0.02 | 0.87 | | 91 | 4,974 | 90,519 | 1,829 | 79,547 |

| Subtotal | | 11,726 | | 0.66 | 51.0 | 0.87 | 0.33 | 7.78 | | 252 | 17,404 | 235,328 | 56,677 | 1,379,523 |

- 19 -

Mineral Reserves

The proven and probable reserves are summarized in Table 1-2. These are considered to be “ore”, which by definition is economically recoverable. The metal prices used for the reserve estimation were: Au $400/oz, Cu $1.05/lb, Zn $0.50/lb, Ag $6.00/oz.

| | | | | |

Table 1-2: Proven and Probable Reserves |

Ore Type | Tonnage (kt) | Zn

(%) | Cu

(%) | Au

(g/t) | Ag

(g/t) |

Oxide | | | | | |

Proven | 663 | - | - | 6.87 | 28.93 |

Probable | 3,353 | - | - | 8.21 | 33.62 |

Combined | 4,016 | - | - | 7.99 | 32.85 |

Supergene | | | | | |

Proven | 808 | - | 5.10 | 0.81 | 44.74 |

Probable | 5,542 | - | 4.30 | 0.83 | 34.71 |

Combined | 6,350 | - | 4.40 | 0.83 | 35.98 |

Primary | | | | | |

Proven | 353 | 11.38 | 1.10 | 0.82 | 65.56 |

Probable | 9,360 | 7.05 | 1.15 | 0.76 | 53.57 |

Combined | 9,713 | 7.21 | 1.14 | 0.76 | 54.00 |

Total Combined | 20,079 | | | | |

Conventional open pit mining methods will be used, utilizing heavy duty highway trucks loaded by backhoe. The milling rate will be 5,500 t/d ore for approximately 10 years. The mining function will be performed by the owner with purchased equipment. Waste stripping will vary by year, starting at 20,000 t/d in Year 1 to a maximum of 40,000 t/d in Year 7 and subsequently decreasing to 4,000 t/d in Year 10. The average waste stripping rate is 23,000 t/d.

Mining occurs in eight phases: three phases target the oxide ore, two phases target the supergene ore, and the remaining three phases target the primary ore. Overlaps of the phases occur to balance waste stripping, ore feed, and equipment requirements.

Metallurgical Testwork and Process Plant Design

The Bisha mineral resource contains three ore types; the gold and silver bearing oxide cap, underlain by the secondary copper mineralized supergene ore, which is in turn underlain by the primary ore with chalcopyrite and sphalerite mineralization.

The metallurgical performances of the three ore types used for the Feasibility Study are summarized in Table 1-3.

- 20 -

| | | | | | |

Table 1-3: Metallurgical Performance of the Three Ore Types |

| %Au Recovery | %Ag Recovery | %Cu Grade | %Cu Recovery | %Zn Grade | %Zn Recovery |

Bullion from Oxide Ore | 87 | 36 | - | - | - | - |

Cu Concentrate from Supergene Ore | 56 | 54 | 30 | 92 | - | - |

Cu Concentrate from Primary Ore | 36 | 29 | 25 | 85 | 3.9 | 2.1 |

Zn Concentrate from Primary Ore | 9.6 | 22 | 0.3 | 3 | 55 | 83.5 |

The three ores will require different processing techniques and equipment. The current plan is to mine and process each zone in succession starting with the oxide zone. Before the oxide ore is exhausted the additional supergene ore process equipment will be installed and commissioned so that a smooth transition can be made from the oxide ore to the supergene ore. Similarly, before the supergene ore is exhausted, the additional equipment required to process the primary ore will be installed and commissioned to permit a smooth transition from supergene to primary ore. No interruption to production is anticipated or required when transitioning from one ore type to another.

The oxide ore will be processed by cyanide leaching and the supergene and primary ores will be processed by flotation. The crushing, grinding and tailing systems will be common for the three plants. In the first two years of production, gold and silver will be recovered by carbon-in-pulp (CIP), melted down into dore bars and flown to refiners. Production of copper concentrate will begin with a minor amount in Year 2, significant quantities for Years 3 to 5, and smaller quantities in Years 6 to 10. Zinc concentrate production occurs only in Years 6 to 10. A front-end loader will load the concentrate onto concentrate haulage trucks for transport to the company operated concentrate storage and load-out facility at the port of Massawa. At Massawa the concentrate will be off-loaded and conveyed into the holding sheds where it will be stored prior to loading onto ocean freighters for shipment to smelters.

Mine Waste and Water Management

Waste rock from the open pit will be placed in dumps adjacent to the pit. Waste rock with acid rock drainage potential will be placed to the west of the open pit, from where drainage will flow by gravity into the open pit for closure. Material with lesser or no acid drainage potential will be placed to the east of the open pit, from where drainage could be intercepted and pumped into the pit if necessary for closure. During operation, all waste dump drainage will be intercepted and used as mill process water or disposed in the tailings impoundment.

Tailings generated from the processes will be stored in an impoundment located in an area that provides the best available storage characteristics in terms of embankment construction requirements. The tailings impoundment site is underlain by low permeability bedrock which will limit seepage from the facility. The impoundment will be created by construction of a rockfill tailing dam abutting Adalawat ridge. The tailings will be thickened at the mill to reclaim as much water as possible and cyanide used in the mineral processing will be destroyed prior to pumping to the tailings impoundment.

- 21 -

Surface water flow in the project area is non-existent for much of the year; however river and stream flow can be significant during precipitation events. A diversion dyke constructed across the river course upstream (southeast) of the proposed pit will direct flow in the Fereketatet River away from the open pit during runoff events. This dyke will pond water upstream and enable the flow to follow a diversion channel to the adjacent Shatera River to the east.

Infrastructure

The major infrastructure required to develop the property includes an over-the-fence power supply, and a well farm for freshwater supply. The power generation system will consist of multiple containerized, diesel engine driven generation units which will be owned, operated and maintained by a third party supplier. Nevsun will supply fuel, lubricants and site preparation for these units. Freshwater will be supplied from groundwater. A well farm has been proposed 6.5 km southeast of the process plant site, along the base of the slope of the adjacent mountain range. This site has been selected because it is downstream of a significant precipitation catchment area and has potential for a relatively thick column of alluvial material which will collect and hold the runoff from the adjacent mountains.

The port site for the concentrate storage and loadout facility is planned for the site of an existing cement production facility at the Port of Massawa. The facility is adjacent to an existing jetty on the north shore of Khor Dakliyat Bay. The cement plant is owned by the Eritrean government and Nevsun has been informed that the site will be made available for use by Nevsun.

Socioeconomic and Environmental Assessment and Approval

The environmental assessment (EA) phase of this project commenced with baseline studies in 2004. The Terms of Reference (ToR) for the project Social and Environmental Impact Assessment (SEIA) was approved by the Eritrean Ministry of Energy and Mines in March 2006 and the SEIA was completed in December 2006. An update to the SEIA, which is being carried out by AMEC Americas Limited, includes socially responsible consultative studies and activities which are compliant with the April 2006 IFC Performance Standards on Social and Environmental Sustainability.

Capital Costs

·

The estimated capital cost to build each of the phases of this project is as follows:

·

Oxide phase – US$196.0 million (Preproduction capital)

·

Supergene phase – US$61.2 million (Funded from cash flow)

·

Primary ore phase – US$30.8 million (Funded from cash flow)

All costs are expressed in third quarter 2006 US dollars, with no allowance for escalation, interest during construction or taxes. The estimate covers the direct field costs of executing this project, plus the indirect costs associated with design, procurement, and construction efforts. The capital costs for each phase by area are summarized in Tables 1-4, 1-5 and 1-6.

- 22 -

Operating Costs

The mine operating cost estimate incorporates costs for operating and maintenance labour and staff, plus operating and maintenance supplies for each year, including preproduction. Operating and maintenance supplies are based on North American, Japanese and European supply and include an allowance for freight, shipping and delivery to the site.

The process operating costs assume the same annual processing rate of 2 million tonnes for all three ores. The breakdown of the process operating costs over the life of mine (LOM) is 4% for manpower, 41% for consumables and 55% for electrical power.

The bulk of the port site operating cost is associated with maintenance of the truck dump receiving and shiploading systems.

The general and administration (G&A) operating costs will include all costs not directly chargeable to the mining, process and port site concentrate storage and shiploading areas. The costs will include administrative personnel salaries, general office supplies, safety and training supplies, travel, contracted consultant services, insurance, permits, security, accommodations, building maintenance (excluding the process building and truck shop), environmental management and employee transportation.

The operating costs over the mine life are summarized in Table 1-7.

| |

Table 1-4: Summary of Capital Costs for Oxide Ore Phase by Area |

Oxide Ore Phase by Area | (US$M) |

Direct Costs | |

Mine | 23.3 |

Process Plant | 45.0 |

Site Preparation & Roads | 0.9 |

Utilities | 12.0 |

Ancillary Facilities | 17.9 |

Tailings | 10.4 |

Total Direct Costs | 109.5 |

Indirect Costs |

|

Project Costs | 43.9 |

Owner’s Costs | 12.7 |

Total Indirect Costs | 56.6 |

Subtotal | 166.1 |

Working Capital | 11.5 |

Contingency | 18.4 |

Total | 196.0 |

- 23 -

| |

Table 1-5: Summary of Capital Costs for Supergene Ore Phase by Area |

Supergene Ore Phase by Area | (US$M) |

Direct Costs |

|

Process Plant | 20.0 |

Ancillary Facilities | 0.2 |

Port & Copper Concentrate Loadout | 20.1 |

Total Direct Costs | 40.3 |