| |

Independent Technical Report

2016 Resources and Reserves Update

Bisha Mine, Eritrea | |

| | Prepared for

Nevsun Resources Ltd. |

| |  |

| | Prepared by

SRK Consulting (Canada) Inc.

Effective Date: 31 December 2016

Issue Date 09 August 2017

2CN010.024

|

| | Independent Technical Report

2016 Resources and Reserves Update

Bisha Mine, Eritrea |

| | Effective Date: 31 December 2016

Release Date: 09 August 2017 |

| | Prepared for | Prepared by |

| | Nevsun Resources Ltd.

760–669 Howe Street

Vancouver, BC V6C 0B4

Canada | SRK Consulting (Canada) Inc.

2200–1066 West Hastings Street

Vancouver, BC V6E 3X2

Canada |

| | Tel: +1 604 623 4700

Web: www.nevsun.com | Tel: +1 604 681 4196

Web: www.srk.com |

| | Project No: 2CN010.024

File Name: Bisha_2016R&R-Update_TechRep_2CN010-024_20170809_aan_cae |

| | Authored By

| | |

| | Philip Jankowski, MAusIMM (CP) | Dr. Anoush Ebrahimi, P.Eng | Dr. Adrian Dance, FAusIMM |

| | Bisha Mining Share Company | SRK Consulting (Canada) Inc. | SRK Consulting (Canada) Inc. |

| | | | |

| | Christopher Elliott, FAusIMM | Neil Winkelmann, FAusIMM | Cameron Scott, P.Eng |

| | SRK Consulting (Canada) Inc. | SRK Consulting (Canada) Inc. | SRK Consulting (Canada) Inc. |

| | | | |

| | Tom Whelan, CPA | | |

| | Nevsun Resources Ltd. | | |

| | | | |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page ii |

Important Notice

This report was prepared in accordance with NI 43-101 for Nevsun Resources Ltd. (Nevsun or the Company) by SRK Consulting (Canada) Inc. The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in SRK’s services, based on: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Nevsun subject to the terms and conditions of its contract with SRK and relevant securities legislation. The contract permits Nevsun to file this report as a Technical Report with Canadian securities regulatory authorities pursuant to National Instrument 43-101, Standards of Disclosure for Mineral Projects. The responsibility for this disclosure remains with Nevsun. The user of this document should ensure that this is the most recent Technical Report for the property as it is not valid if a new Technical Report has been issued.

This technical report contains certain non-International Financial Reporting Standards measures. Such measures have non-standardised meaning under International Financial Reporting Standards and may not be comparable to similar measures used by other issuers.

All amounts are expressed in U.S. dollars ($), unless otherwise indicated.

© 2017 SRK Consulting (Canada) Inc.

This document, as a collective work of content and the coordination, arrangement and any enhancement of said content, is protected by copyright vested in SRK Consulting (Canada) Inc.

Outside the purposes legislated under provincial securities laws or as otherwise stipulated in SRK’s client contract, this document shall not be reproduced in full or in any edited, abridged or otherwise amended from unless expressly agreed in writing by SRK.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page iii |

Executive Summary

Introduction

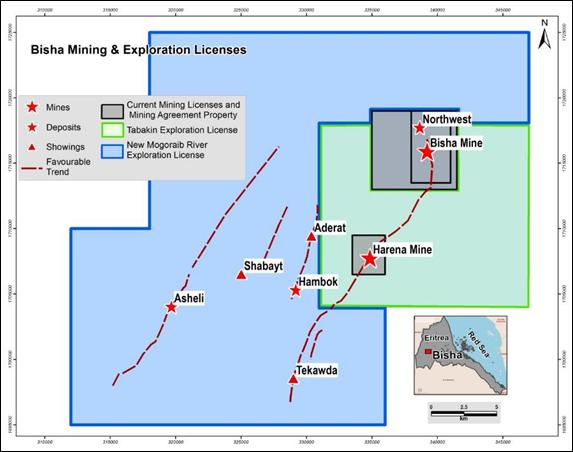

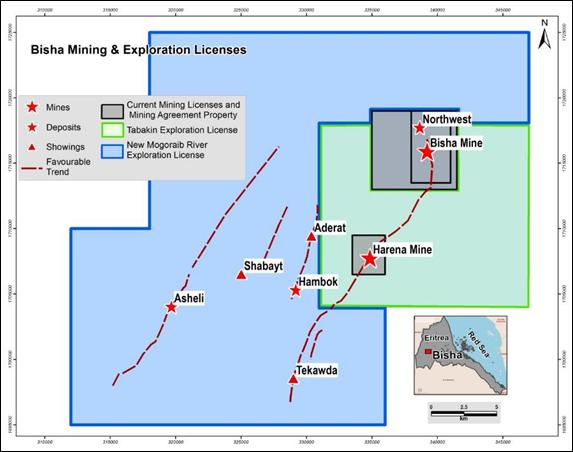

This technical report was prepared for Nevsun Resources Ltd. to summarise the results of the resource and reserve update of the Bisha Mine (Bisha, Mine or Project), located in Eritrea. Nevsun holds a 60% interest in the Project, through a 60% interest in Bisha Mining Share Company (BMSC). The Eritrean National Mining Corporation (ENAMCO) holds the remaining 40% interest. BMSC is the operator for the Bisha and Harena mining licences, the mining agreement area, Tabakin Exploration License (Tabakin EL) and Mogoraib River Exploration License (Mogoraib EL) exploration licences.

The contract with SRK Consulting permits Nevsun to file this report as a technical report with the Canadian securities regulatory authorities pursuant to NI 43-101, Standards of Disclosure for Mineral Projects. Except for the purposes legislated under provincial securities law, any other uses of this report by any third party is at that party’s sole risk. The responsibility for this disclosure remains with Nevsun. The user of this document should ensure that this is the most recent technical report for the property, as it is not valid if a new technical report has been issued. Summary of responsibilities by author is shown in Table ES1.

Table ES1: Areas of responsibilities

| Company | Area of Responsibility |

| BMSC | Mineral Resource Estimation, Quality Assurance/Quality Control (QA/QC), Geology |

| SRK | Mineral Reserve Estimate, Geotechnical Engineering, Open Pit Mine Designs, Production Schedule, Mining Costs, Recovery Methods, Processing Capital and Operating Costs, Economics, Site Infrastructure, Environmental and Permitting, Closure Costs |

| Nevsun | Marketing Studies and Contracts |

Property Description

The project is located on a flat to rolling, desert-like plain in the Gash-Barka Region of Eritrea, 237 km by road from the capital, Asmara by paved and all-weather unpaved roads. The principal port for concentrate export is Massawa, a further 113 km from Asmara.

The project area has a hot desert climate with an annual rainfall of 260 mm mainly falling from June to September. The main centre for mining and exploration support is Asmara.

Current onsite operation infrastructure comprises an open pit, process plant, tailings and waste-rock storage facilities, offices and warehouses, medical clinic, maintenance and laboratory facilities, fuel and reagent storage areas, diesel power plant, water supply borefields, and an airstrip. Container port and ship-loading facilities for concentrate are located at Massawa.

The property comprises two mining licences, one mining agreement area and two exploration licences. The licence title and length of terms for each of these are listed below:

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page iv |

- Bisha Mining Licence: 26 March 2008 to 11 December 2027

- Harena Mining Licence: 6 July 2012 to 5 July 2022

- Bisha Mining Agreement Area: 5 July 2012 to 11 December 2027

- New Mogoraib Exploration Licence: 25 July 2016 to 24 July 2021

- Tabakin Exploration Licence: 25 July 2016 to 24 July 2026

Under the terms of the mining agreement, BMSC has the exclusive right of land use in the Mining Licence Area that is granted within the mining agreement area. This right is subject to the acquisition and settlement of any third-party land-use rights by payment of compensation and/or relocation at the expense of BMSC.

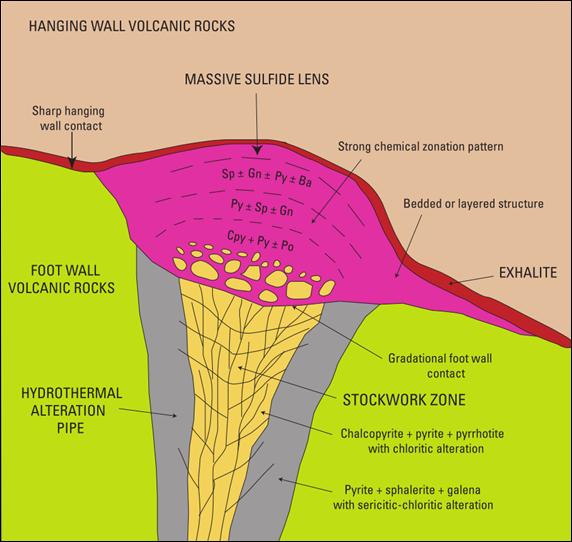

Geological Setting and Mineralisation

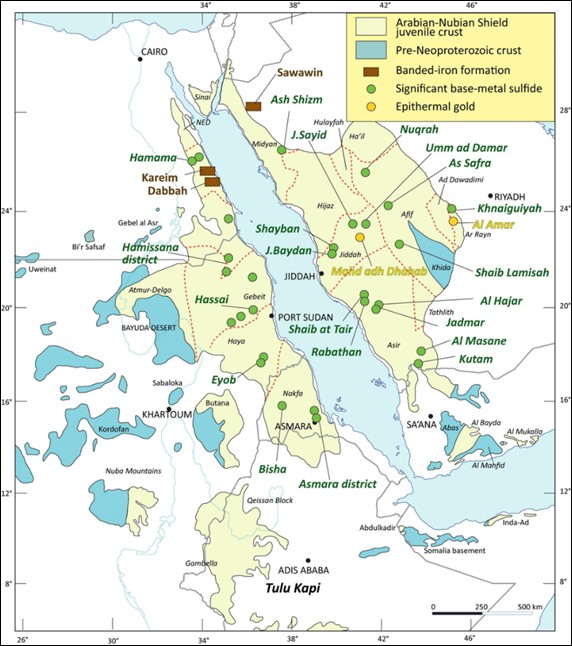

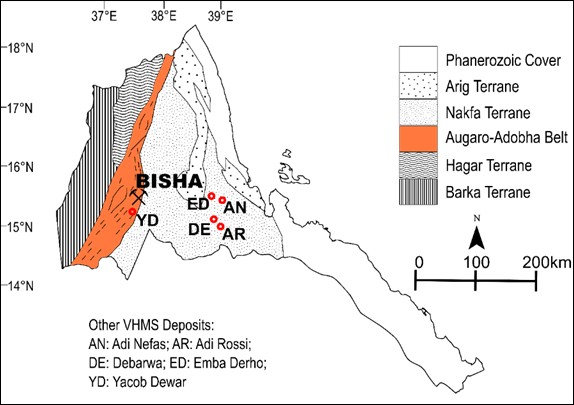

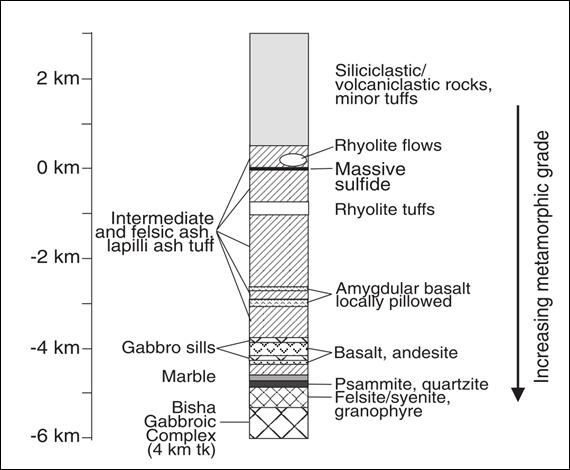

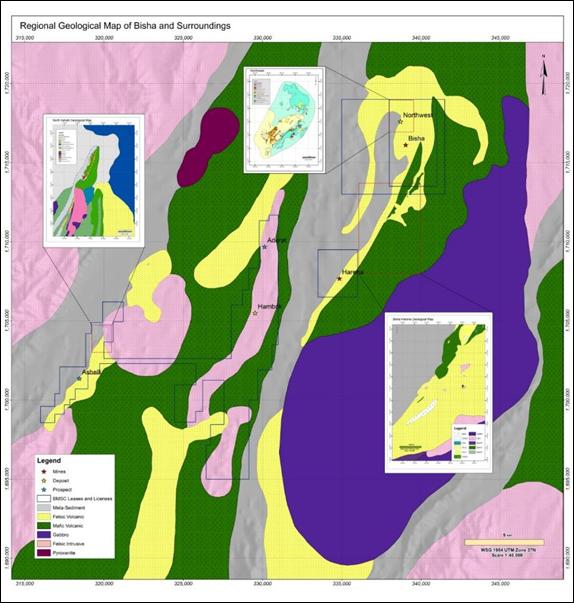

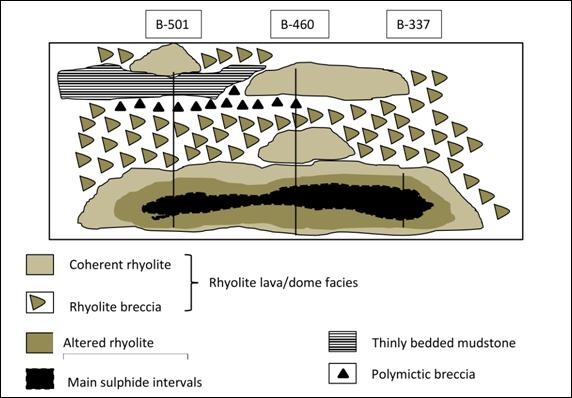

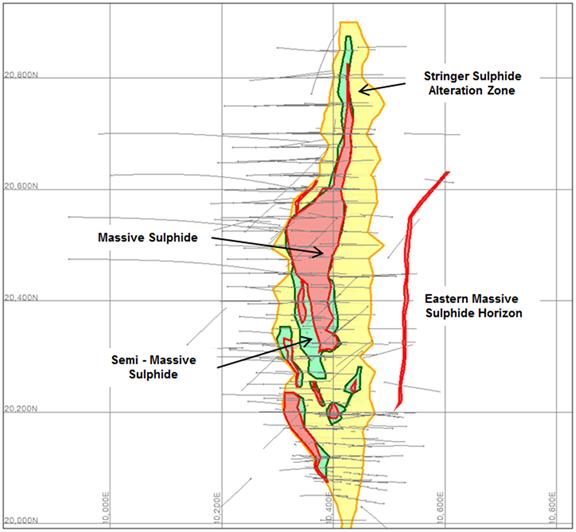

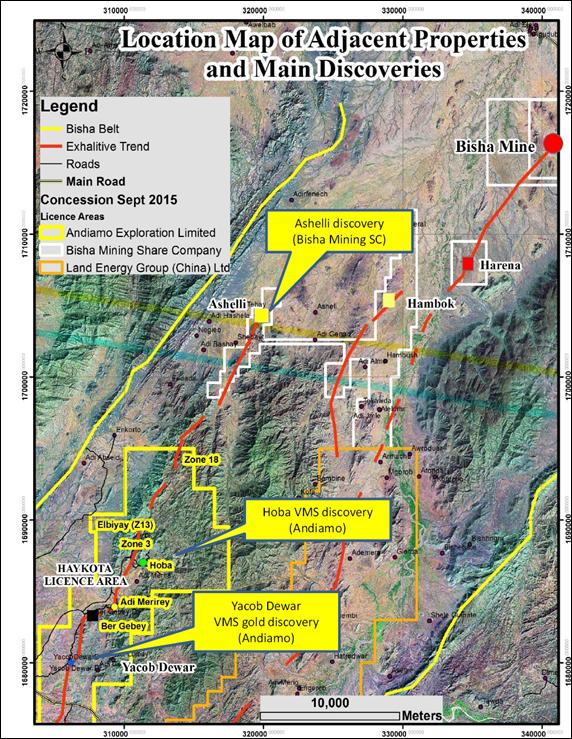

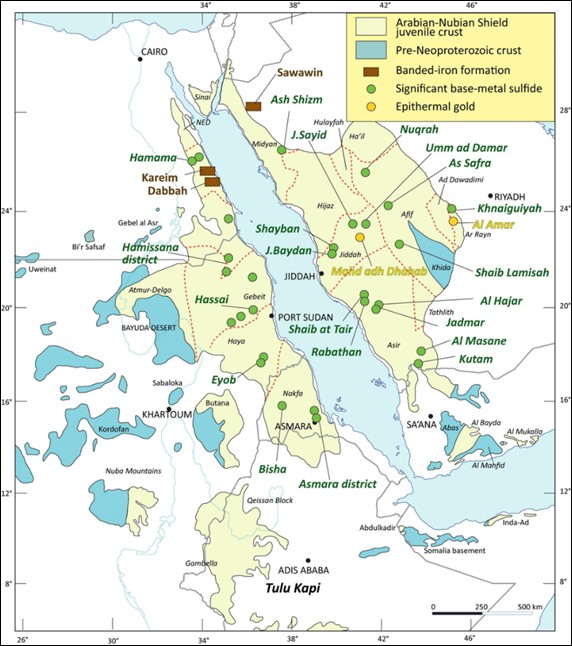

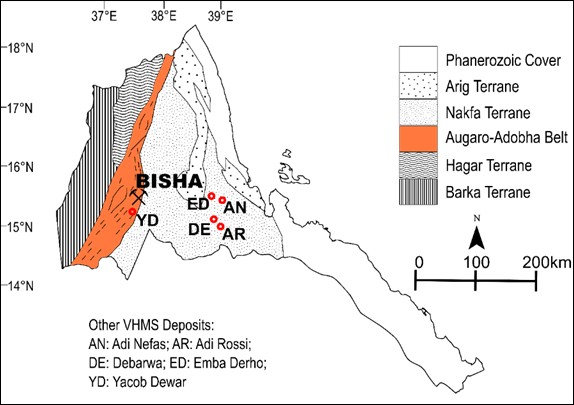

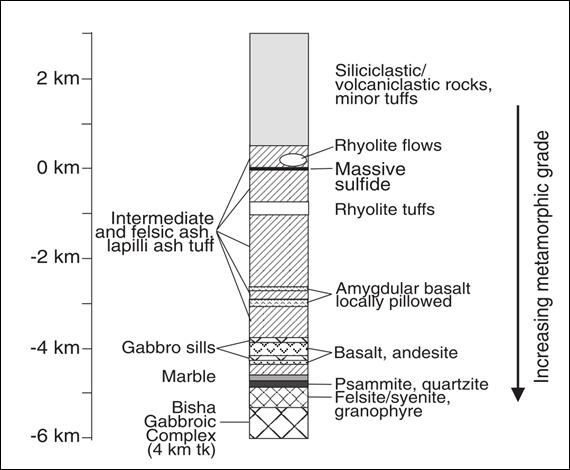

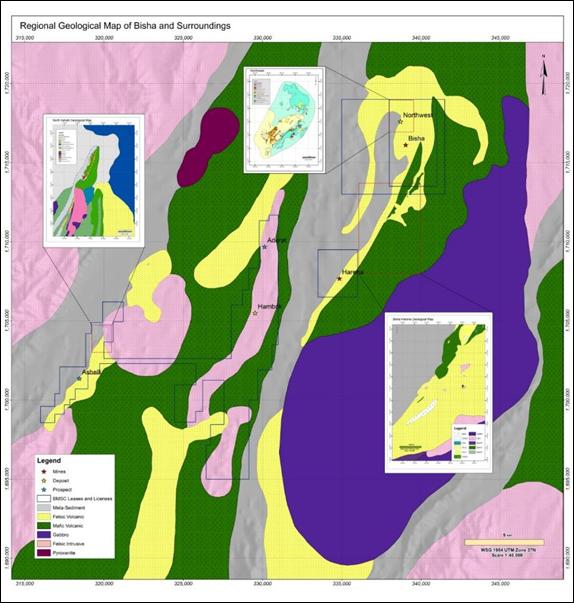

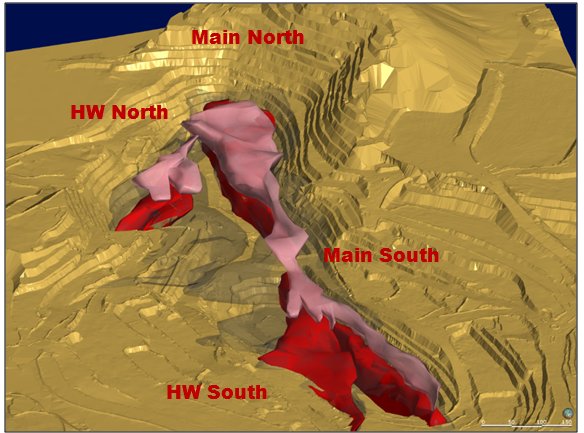

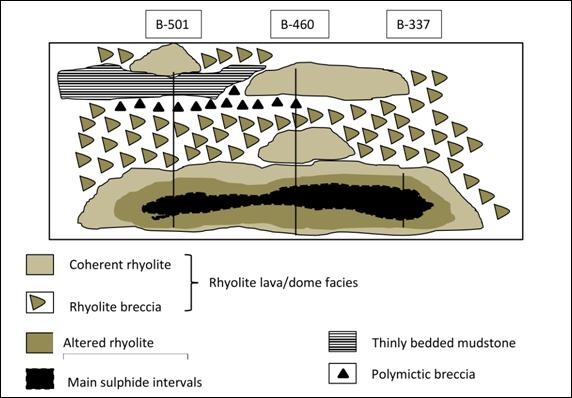

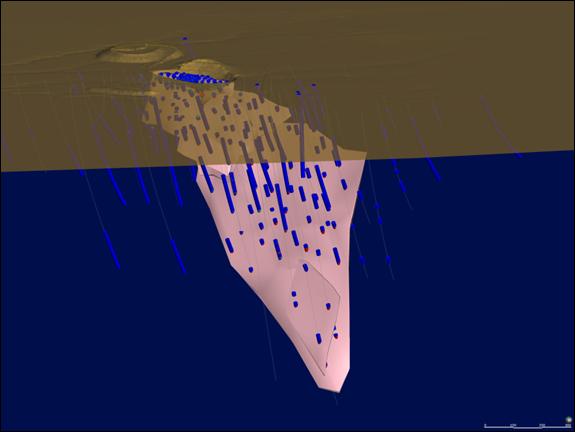

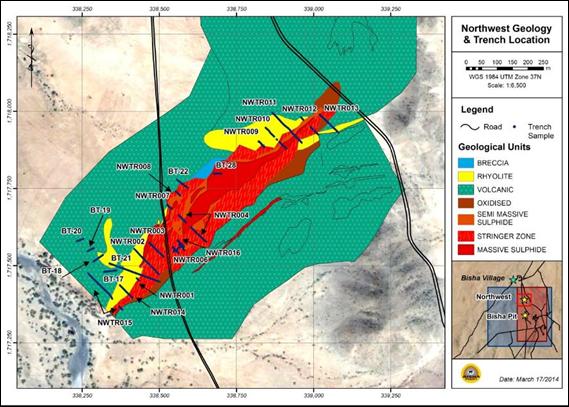

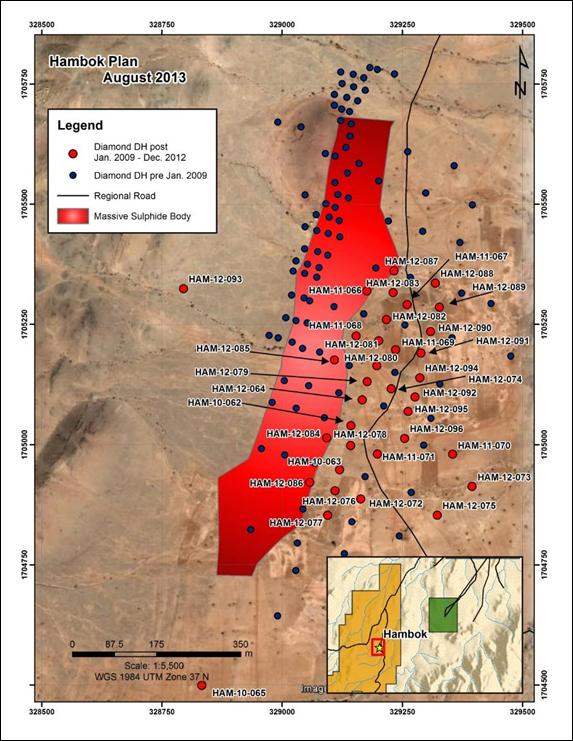

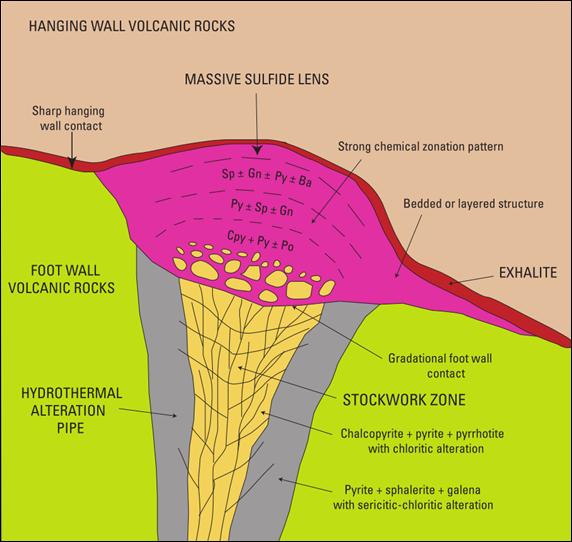

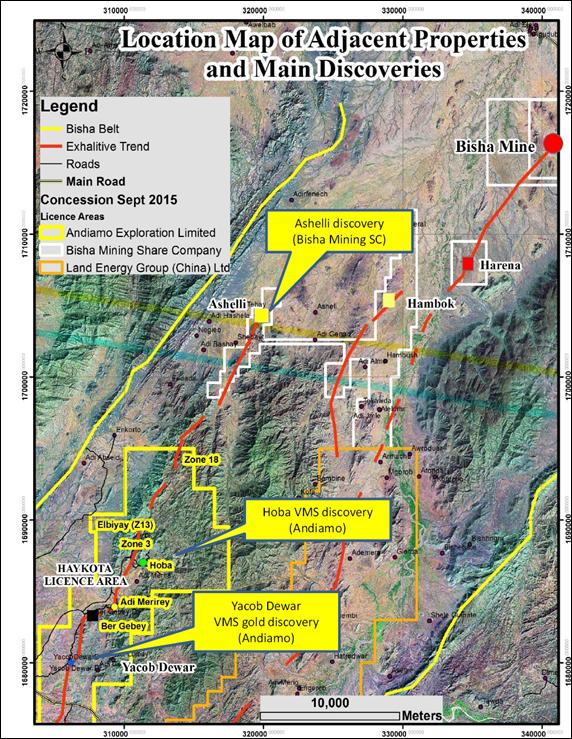

The project is located within the 0.85 Ga to 0.55 Ga Arabian-Nubian Shield (ANS) (Barrie et al., 2007). The ANS underlies an area of 1.4 million km2 in the Middle East and northern Africa, exposed on either side of the Red Sea and comprises a collage of volcanic arcs, granitoid intrusions, volcano-sedimentary basins, and shear zones (Johnson and Sloan, 2013). Over 50 Cu-Zn-Pb-Au volcanic-hosted massive sulfide deposits occur in the ANS, which in Eritrea includes the Bisha Main, Harena, Northwest, Hambok and Asheli deposits (all BMSC).

Mineral Resource Estimates

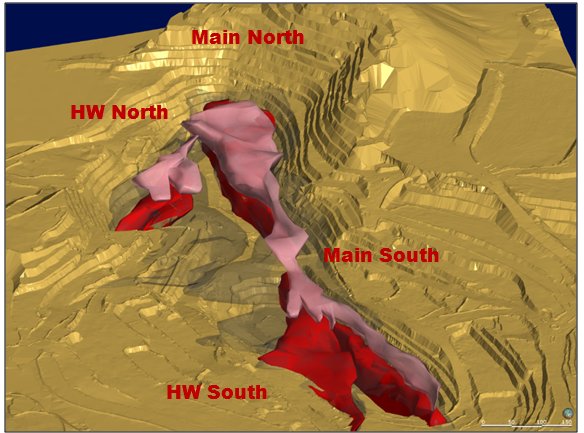

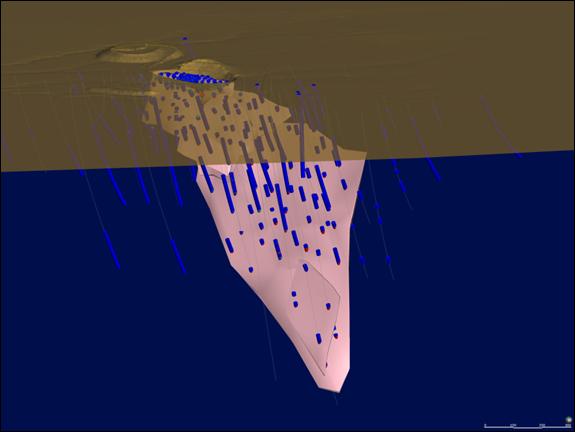

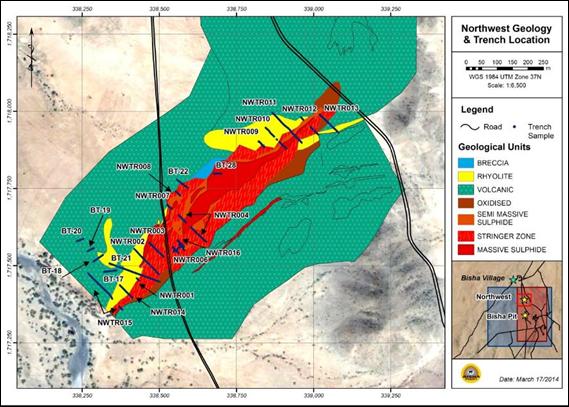

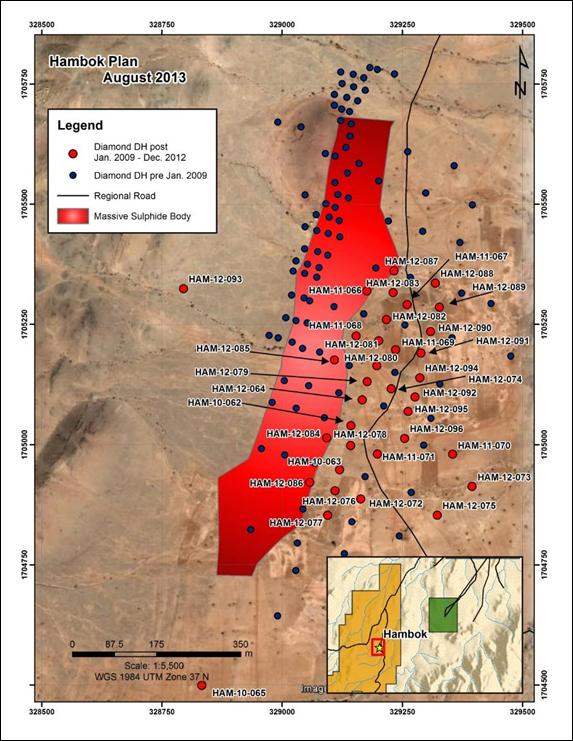

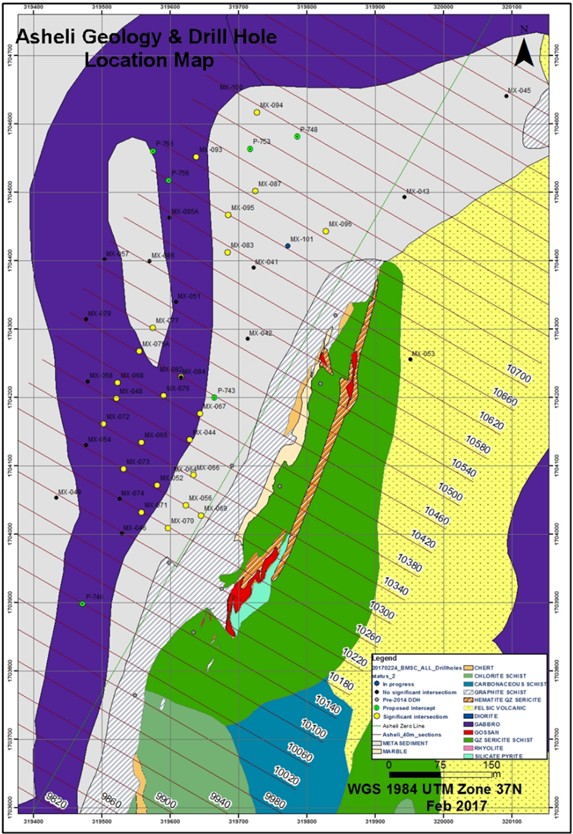

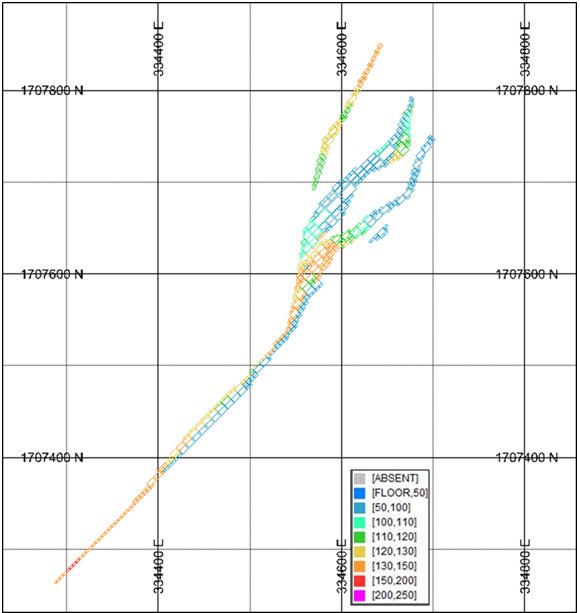

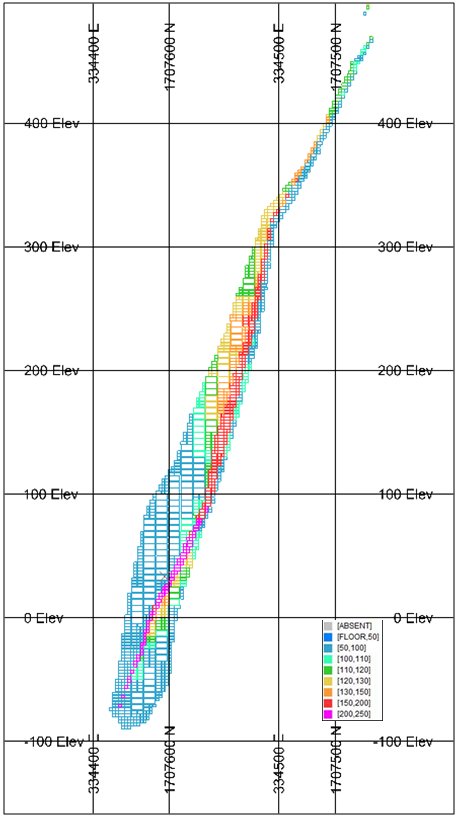

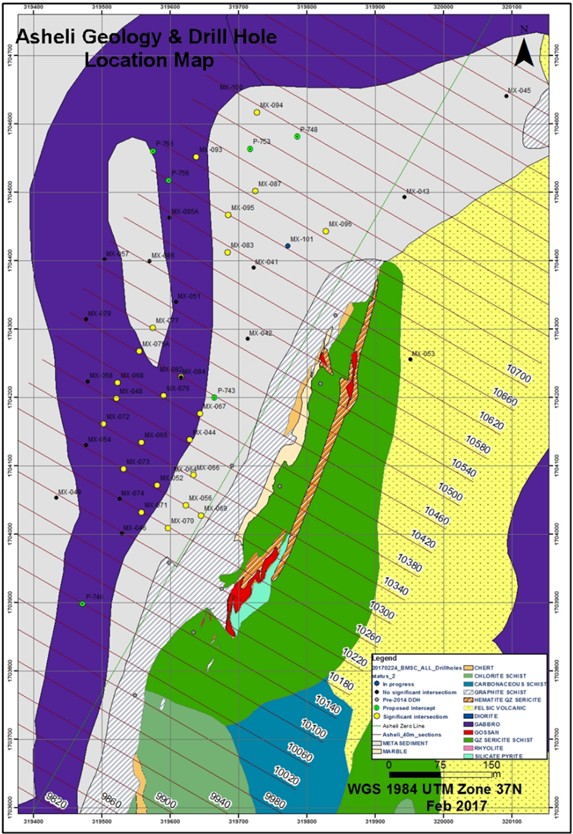

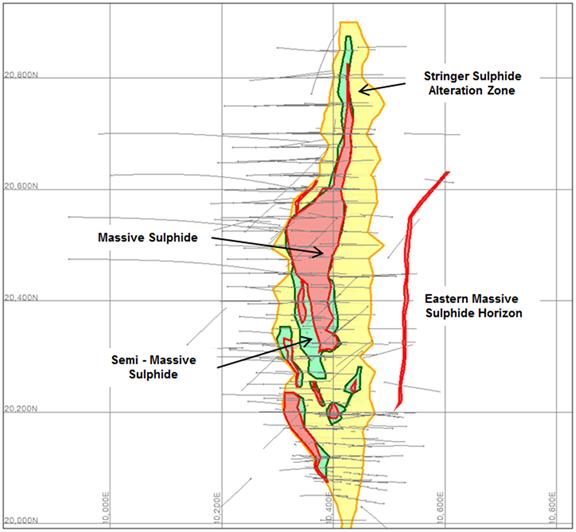

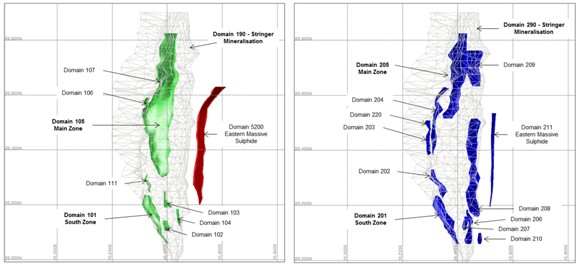

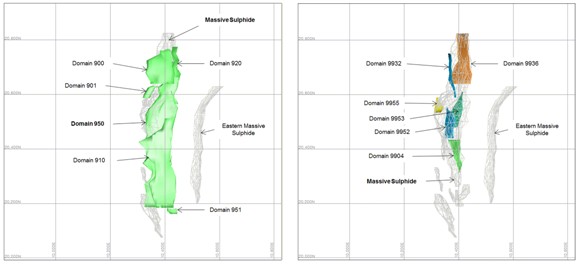

Mineral Resources are classified and reported in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). Mineral Resources are reported for the Bisha Main, Harena, Hambok, Northwest and Asheli deposits. At Bisha Main, 11,770 m of drilling in 21 holes was completed in 2016 testing the deposit below the proposed ultimate pit. This work has determined the down dip extent of the deposit. In 2016, 6,080 m of new drilling was completed at Harena continuing to extend the deposit to depth where it remains open. Asheli was discovered in June 2015 by Bisha as part of the Regional Exploration Program. In 2016, 12,918 m of drilling were completed in 28 holes resulting in the definition of a new inferred resource. Mineral Resources for Hambok and Northwest are unchanged since 2014.

Mineral Resource estimates for Bisha Main and Harena reported are inclusive of Mineral Reserves. Mineral Resources for the Bisha Project are summarised in Tables ES2 to ES7.

Table ES2: Consolidated Mineral Resource statement for Bisha Main, Harena, Asheli, Northwest and Hambok deposits, Eritrea, as of 31 December 2016

| Category | Quantity | Grade |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) |

| Measured | 1,300 | 6.37 | 1.09 | 0.9 | 42 |

| Indicated | 33,670 | 4.10 | 1.01 | 0.5 | 32 |

| Total M+I | 34,970 | 4.18 | 1.02 | 0.6 | 33 |

| Inferred (including stockpiles) | 33,790 | 4.74 | 1.01 | 0.8 | 25 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page v |

Table ES3: Mineral Resource statement for Bisha Main deposit, Eritrea, as of 31 December 2016

| Category | Quantity | Grade |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) |

| Open Pit |

| Measured | 1,300 | 6.37 | 1.09 | 0.9 | 42 |

| Indicated | 19,310 | 5.70 | 0.97 | 0.7 | 45 |

| Inferred | 790 | | 1.23 | 0.1 | 1 |

| Underground |

| Inferred | 1,460 | 7.44 | 0.73 | 0.9 | |

| Stockpiles |

| Measured | 2,850 | 3.63 | 1.34 | 1.3 | |

| Inferred | 510 | | 0.85 | 0.6 | |

| Notes to be read in conjunction with the Mineral Resource table: |

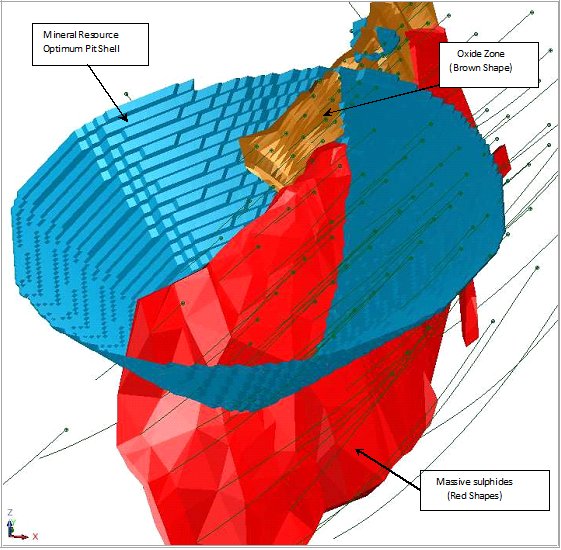

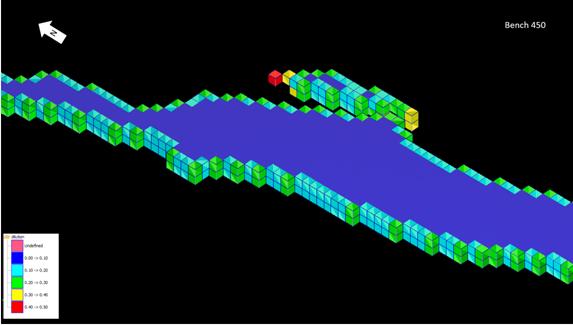

| (1) | Open Pit Mineral Resources are defined within an optimal Lerchs-Grossman (LG) pit shell, generated using commodity prices for zinc, copper, gold and silver of $1.20/lb Zn, $3.00/lb Cu, $1,265/oz Au and $21/oz Ag respectively using blocks of all Resource categories. The mining cost and total ore based cost (process, G&A and stockpile re-handle) applied were approximately 10% below the long-term view on costs with appropriate ore haulage costs for each satellite deposit. Overall pit slopes varied from 29° to 35.5° NSR cut-offs used were $40.00/t for Oxide and $41.00/t for Primary. |

| (2) | Net Smelter Return values were calculated for each block using all resource categories, commodity prices, recoveries, appropriate smelter terms and downstream costs. Metallurgical recoveries, supported by metallurgical testwork, were applied as follows: Oxide - recoveries of 75% and 22% were applied for gold and silver, respectively; Primary - recoveries to copper concentrate of 85%, 36% and 29% were applied for copper, gold and silver, respectively, and a zinc recovery to zinc concentrate of 85% was applied. |

| (3) | Open Pit Mineral Resources are reported within the pit shell generated using the specified commodity prices, using NSR block grade cut-offs derived as above. Tonnage is rounded to the nearest 10,000 tonnes and grades are rounded to two decimal places for copper and zinc, one decimal place for gold, and zero decimal places for silver. Contained metal for copper and zinc are rounded to the nearest million pounds. Contained metal for silver is rounded to the nearest 10,000 ounces and gold is rounded to the nearest 1,000 ounces. |

| (4) | Rounding may result in apparent summation differences between tonnes, grade and contained metal content. |

| (5) | Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper and zinc pounds as imperial pounds. |

| (6) | Underground Inferred Resources were derived by selecting contiguous blocks outside the optimised resource pit shell, with an NSR cut-off of $100/t, which represents the processing cost plus approximately $60/t mining cost. |

| (7) | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page vi |

Table ES4: Mineral Resource statement for Harena deposit, Eritrea, as of 31 December 2016

| Category | Quantity | Grade |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) |

| Open Pit |

| Indicated | 3,950 | 3.16 | 0.87 | 0.6 | 28 |

| Inferred | 2,040 | 2.06 | 0.82 | 0.7 | 28 |

| Underground |

| Inferred | 23,020 | 4.96 | 0.93 | 0.8 | 30 |

| Notes to be read in conjunction with the Mineral Resource table: |

| (1) | Open Pit Mineral Resources are defined within an optimal Lerchs-Grossman (LG) pit shell, generated using commodity prices for zinc, copper, gold and silver of $1.20/lb Zn, $3.00/lb Cu, $1,265/oz Au and $21/oz Ag respectively using blocks of all Resource categories. The mining cost and total ore based cost (process, G&A and stockpile rehandle) applied were approximately 10% below the long term view on costs with appropriate ore haulage costs for each satellite deposit. Overall pit slopes varied from 29° to 35.5° NSR cut-offs used were $40.00/t for Oxide and $41.00/t for Primary. |

| (2) | Net Smelter Return values were calculated for each block using all resource categories, commodity prices, recoveries, appropriate smelter terms and downstream costs. Metallurgical recoveries, supported by metallurgical testwork, were applied as follows: Oxide - recoveries of 75% and 22% were applied for gold and silver, respectively; Primary - recoveries to copper concentrate of 85%, 36% and 29% were applied for copper, gold and silver, respectively, and a zinc recovery to zinc concentrate of 85% was applied. |

| (3) | Open Pit Mineral Resources are reported within the pit shell generated using the specified commodity prices, using NSR block grade cut-off derived as above. Tonnage is rounded to the nearest 10,000 tonnes and grades are rounded to two decimal places for copper and zinc, one decimal place for gold, and zero decimal places for silver. Contained metal for copper and zinc are rounded to the nearest million pounds. Contained metal for silver is rounded to the nearest 10,000 ounces and gold is rounded to the nearest 1,000 ounces. |

| (4) | Rounding may result in apparent summation differences between tonnes, grade and contained metal content. |

| (5) | Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper and zinc pounds as imperial pounds. |

| (6) | Underground Inferred Resources were derived by selecting contiguous blocks outside the optimised resource pit shell, with an NSR cut-off of $100/t, which represents the processing cost plus approximately $60/t mining cost. |

| (7) | Stockpile tonnages and grades are based on surveyed volume and grade control estimated grades; Inferred stockpiles are those that do not have metallurgical testwork demonstrating they are treatable. |

| (8) | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

Table ES5: Inferred Mineral Resource statement for Asheli deposit, Eritrea as of 31 December 2016

| Zone | Quantity | Grade | NSR ($/t) |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) | (g/t As) | (% Pb) |

| Low Grade | 1,677 | 5.2 | 1.9 | 0.36 | 28 | 772 | 0.05 | $154 |

| High Grade | 723 | 16.6 | 1.9 | 0.39 | 33 | 734 | 0.14 | $301 |

| Total | 2,400 | 8.6 | 1.9 | 0.37 | 30 | 760 | 0.08 | $199 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page vii |

Table ES6: Mineral Resource statement for Northwest deposit, Eritrea, as of 31 December 2016

| Category | Quantity | Grade |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) |

| Indicated | | | | | |

| Supergene | 1,020 | | 1.47 | 0.2 | 10 |

| Primary | 2,530 | 1.08 | 1.04 | 0.3 | 13 |

| Inferred | | | | | |

| Oxide | 500 | | | 3.7 | 18 |

| Supergene | 100 | | 0.8 | 3.7 | 19 |

| Primary | 100 | 0.9 | 0.9 | 2.9 | 15 |

| Notes to be read in conjunction with the Resource tables for Northwest above: |

| (1) | No change has occurred Northwest since 2014 which used commodity prices for zinc, copper, gold and silver of $1.05/lb Zn, $3.35/lb Cu, $1,350/oz Au and $23/oz Ag, respectively. Open Pit Mineral Resources are defined within an optimal Lerchs-Grossman (LG) Pit Shell. The mining cost and total ore-based cost (process, G&A and stockpile re-handle) applied were approximately 10% below the long-term view on costs with appropriate ore haulage costs for each satellite deposit. Overall pit slopes varied from 39° to 45°. NSR cut-offs used were: $40.70/t for Oxide, $39.70/t for Supergene and Primary. |

| (2) | Net Smelter Return values were calculated for each block using all resource categories, commodity prices, recoveries, appropriate smelter terms and downstream costs. Metallurgical recoveries, supported by metallurgical testwork, were applied as follows: Oxide - recoveries of 88% and 22% were applied to gold and silver, respectively; Supergene - recoveries of 87%, 46% and 50% were applied for copper, gold and silver, respectively, and zinc has not been assigned a recovery as the values are isolated on the fringes of the deposit; Primary - recoveries to copper concentrate of 87%, 36% and 29% were applied for copper, gold and silver, respectively and recoveries to zinc concentrate of 81%, 36% and 29% were applied for zinc, gold and silver, respectively. |

| (3) | Open Pit Mineral Resources are reported within the pit shell generated using the specified commodity prices, using NSR block grade cut-off derived as above. Tonnage is rounded to the nearest 10,000 tonnes and grades are rounded to two decimal places for copper and zinc, one decimal place for gold and zero decimal places for silver. Tonnages and grades for the Inferred category are further rounded reflecting the uncertainty that attaches to this category. Contained metal for copper and zinc are rounded to the nearest 10,000 pounds. |

| (4) | Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content. |

| (5) | Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper and zinc pounds as imperial pounds. |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page viii |

Table ES7: Mineral Resource statement for Hambok deposit, Eritrea, as of 31 December 2016

| Category | Quantity | Grade |

| (000’s t) | (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) |

| Indicated | | | | | |

| Primary | 6,860 | 1.86 | 1.14 | 0.2 | 10 |

| Inferred | | | | | |

| Oxide | 20 | | | 1.5 | 17 |

| Notes to be read in conjunction with the Mineral Resource table for Hambok: |

| (1) | No change has occurred to Hambok since 2014, which used commodity prices for zinc, copper, gold and silver of $1.05/lb Zn, $3.35/lb Cu, $1,350/oz Au and $23/oz Ag, respectively. Mineral Resources are defined within an optimal Lerchs-Grossman (LG) Pit Shell. The mining cost and total ore-based cost (process, G&A and stockpile rehandle) applied were approximately 10% below the long-term view on costs with appropriate ore haulage costs for each satellite deposit. Overall pit slope was 40° (preliminary assessment). NSR cut-offs used were: $44.45/t for Oxide and $43.45/t for Primary. |

| (2) | Net Smelter Return values were calculated for each block using all resource categories, commodity prices, recoveries, appropriate smelter terms and downstream costs. Metallurgical recoveries, supported by metallurgical testwork, were applied as follows: Oxide - recoveries of 88% and 22% were applied to gold and silver, respectively; Primary - recoveries to copper concentrate of 88%, 87%, 36% and 29% were applied for copper, zinc, gold and silver, respectively. Preliminary metallurgical characterisation studies, but not full testing, have been completed for Hambok. |

| (3) | Mineral Resources are reported within the pit shell generated using the specified commodity prices, using NSR block grade cut-offs derived as above. Tonnage is rounded to the nearest 10,000 tonnes and grades are rounded to two decimal places for copper and zinc, one decimal place for gold and zero decimal places for silver. Contained metal for copper and zinc are rounded to the nearest 10,000 pounds. |

| (4) | Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content. |

| (5) | Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces, contained copper and zinc pounds as imperial pounds. |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page ix |

Mineral Reserve Estimates

The Mineral Reserve statement reported herein is a collaborative effort between SRK, BMSC and Nevsun. The resource model, topography, metallurgical information, geotechnical data, selling costs and commodity prices were provided by BMSC and Nevsun. SRK reviewed the resource model, metallurgical parameters and geotechnical report. In SRK’s opinion, the information provided is accepTable for supporting and reporting Mineral Reserves.

The Mineral Reserve determination is based on information collected by the mineral reserves QP, Dr. Anoush Ebrahimi, P. Eng., during several site visits, the last of which was conducted between 10 May 2017 and 20 May 2017. Additional information was provided by Nevsun and BMSC throughout the course of this study. Other information was obtained from the public domain. SRK has no reason to doubt the reliability of the information provided by BMSC and Nevsun.

This report is based on the following sources of information:

- Discussions with Bisha Mine personnel

- Inspection of the Bisha project area including Harena

- Review of the resource model, metallurgical and geotechnical report provided by BMSC

- Additional information from public domain sources

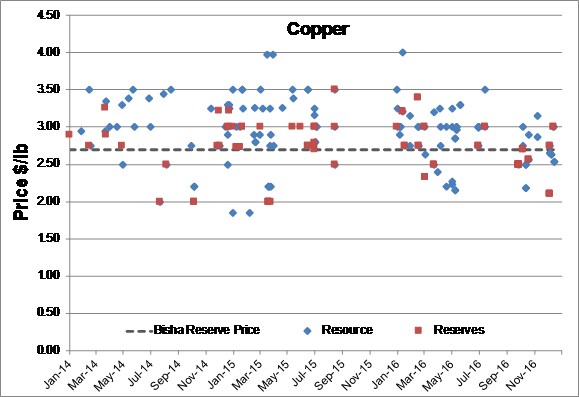

Factors that affect the Mineral Reserve estimates include, but are not limited to: dilution, commodity prices, offsite costs, metallurgical recoveries, pit slope designs, capital and operating cost estimates, and the effectiveness of managing environmental impacts. SRK believes these potential modifying factors have been adequately accounted for using the assumptions in this report by other QPs and experts. The main factors that affect the reserve estimation are as follows:

- Commodity prices, particularly zinc price

- Processing recoveries

- Ability to execute the mine plan based on the reserve estimate

Combined and reported individually by deposits, the Mineral Reserves are shown in Table ES8, Table ES9 and Table ES10.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page x |

Table ES8: Mineral Reserve statement for Bisha Main and Harena deposits, Eritrea, effective 31 December 2016

| Category | Quantity

(000’s t) | Grade | Contained Metal |

| (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) | '000 lbs Zn | '000 lbs Cu | '000 Ozs Au | '000 Ozs Ag |

| Proven | | | | | | | | | |

| Supergene | 12 | | 2.57 | 0.71 | 17 | | 675 | | 7 |

| Primary | 1,047 | 7.43 | 1.05 | 0.76 | 46 | 171,583 | 24,248 | 26 | 1,535 |

| Total Proven | 1,059 | | | | | 171,583 | 24,923 | 26 | 1,541 |

| Probable | | | | | | | | | |

| Supergene | | | | | | | | | |

| Primary | 8,532 | 6.00 | 1.05 | 0.68 | 45 | 1,128,788 | 196,688 | 186 | 12,293 |

| Total Probable | 8,532 | | | | | 1,128,788 | 196,688 | 186 | 12,293 |

| Total Reserve (P&P) |

| Supergene | 12 | | 2.57 | 0.71 | 17 | | 675 | | 7 |

| Primary | 9,579 | 6.16 | 1.05 | 0.69 | 45 | 1,300,371 | 220,936 | 212 | 13,827 |

| Total | 9,591 | | | | | 1,300,371 | 221,611 | 212 | 13,834 |

Table ES9: Mineral Reserve statement for Bisha Main deposit, Eritrea, effective 31 December 2016

| Category | Quantity

(000's t) | Grade | Contained Metal |

| (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) | '000 lbs Zn | '000 lbs Cu | '000 Ozs Au | '000 Ozs Ag |

| Proven |

| Supergene | 12 | | 2.57 | 0.71 | 17 | | 675 | | 7 |

| Primary | 1,047 | 7.43 | 1.05 | 0.76 | 46 | 171,583 | 24,248 | 26 | 1,535 |

| Total Proven | 1,059 | | | | | 171,583 | 24,923 | 26 | 1,541 |

| Probable |

| Supergene | | | | | | | | | |

| Primary | 6,304 | 6.91 | 1.15 | 0.74 | 50 | 1,058,963 | 195,149 | 150 | 10,539 |

| Total Probable | 6,304 | | | | | 1,058,963 | 197,204 | 150 | 10,539 |

| Total Reserve (P&P) |

| Supergene | 12 | | 2.57 | 0.71 | 17 | | 2,730 | | 7 |

| Primary | 7,351 | 6.98 | 1.14 | 0.74 | 50 | 1,230,546 | 219,397 | 176 | 12,074 |

| Total | 7,363 | | | | | 1,230,546 | 222,127 | 176 | 12,081 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xi |

Table ES10: Mineral Reserve statement for Harena deposit, Eritrea, effective 31 December 2016

| Category | Quantity

(000’s t) | Grade | Contained Metal |

| (% Zn) | (% Cu) | (g/t Au) | (g/t Ag) | '000 lbs Zn | '000 lbs Cu | '000 Ozs Au | '000 Ozs

Ag |

| Probable |

| Primary | 2,228 | 3.43 | 0.75 | 0.50 | 24 | 168,450 | 36,863 | 36 | 1,754 |

| Subtotal | 2,228 | 3.43 | 0.75 | 0.50 | 24 | 168,450 | 36,863 | 36 | 1,754 |

| Notes to be read in conjunction with the Mineral Reserve statement for all of reserve tables above: |

| (1) | NSR cut-off ($US/t): Supergene ore $39.12 and Primary ore, $37.22 at Bisha Main, and $39.78 at Harena. Mineral Reserves are defined within a mine plan, with phase designs guided by Lerch-Grossman (LG) Pit Shells, generated using commodity prices for copper, zinc, gold and silver of $2.70/lb, $1.00/lb, $1,200/oz, $18.00/oz respectively. The reference mining cost was $2.27/t, plus $0.015/t/5 m bench for ore and waste below reference elevations of 540 m amsl for Bisha Main. The total ore-based cost (process, G&A, stockpile and rehandle) is $39.12/t for supergene and $37.22/t primary ores. Harena ore-based costs include an additional $2.56/t overland ore haulage cost. Overall pit slopes varied from 38˚ to 44˚ for Bisha Main and from 29˚ to 36˚ for Harena. |

| (2) | Economic values for multi-metal, multi zones were modelled using Net Smelter Return values. Each block NSR value was calculated using diluted grades, commodity prices, recoveries and appropriate smelter terms and downstream costs. Metallurgical recoveries, supported by metallurgical testwork, were applied as follows: |

| | a. | Bisha Supergene zone: Recoveries of 85%, 54% and 74% were applied for copper, gold and silver respectively. Zinc has not been assigned a recovery. An arsenic recovery of 60% was applied for smelter penalty inclusion in the NSR calculation and cash flow analysis. |

| | b. | Bisha Main Primary zone: Two concentrates are produced from primary ore, copper and zinc concentrates. For copper concentre recoveries of 70%, 15% and 27% were applied for copper, gold and silver respectively. For zinc concentrate a 77% recovery has been applied to zinc. |

| | c. | Copper concentrate grade is 20%. |

| | d. | Zinc concentrate grade is 50%. |

| | e | Harena primary zone: recoveries to copper concentrate of 85%, 36% and 29% were applied for copper, gold and silver respectively. A zinc recovery to zinc concentrate of 85% was applied. |

| (3) | Mineral Reserves are reported within Bisha Main and Harena ultimate pit designs, using NSR block grade, where the marginal cut- off is the total ore based cost stated above. Tonnages are rounded to the nearest 1,000 tonnes. Grades for contained metals are rounded to two decimal places. |

| (4) | Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content. |

| (5) | Tonnage and grade measurements are in metrics units. Contained gold and silver ounces are reported as troy ounces, contained copper and zinc pounds as imperial pounds. |

| (6) | The life of mine strip ratios (by weight) for Bisha Main and Harena are 7.1:1 and 7.2:1 respectively. |

| (7) | 0.5 m "skin" of dilution is applied at ore/waste contacts. |

| (8) | 2% mining losses adjustments are made. |

| (9) | 31 December 2016 topography was used for this calculation. |

The Bisha Main Mineral Reserve estimate, contained herein and effective 31 December 2016, is based on information collected by SRK throughout the course of the project, which in turn reflects various technical and economic conditions at the time of reporting. These conditions can change significantly over relatively short periods of time. Consequently, actual results may be variable. This condition includes the amount of capital requirements that requires to satisfy the production rate required at mine.

This report includes technical information that requires calculations to derive sub-totals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, SRK does not consider them to be material.

Neither SRK nor the mineral reserves QP is an insider, associate or an affiliate of Nevsun, and neither SRK nor the mineral reserves QP nor any affiliate has acted as advisor to Nevsun, its subsidiaries or its affiliates in connection with this project. The results of the technical work by SRK are not dependent on any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xii |

Mining

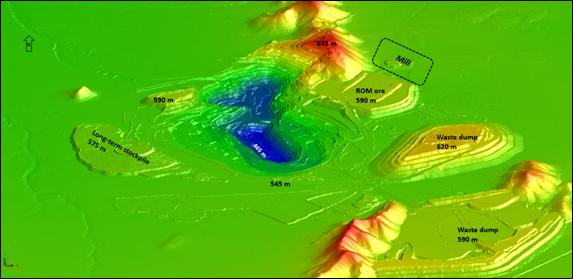

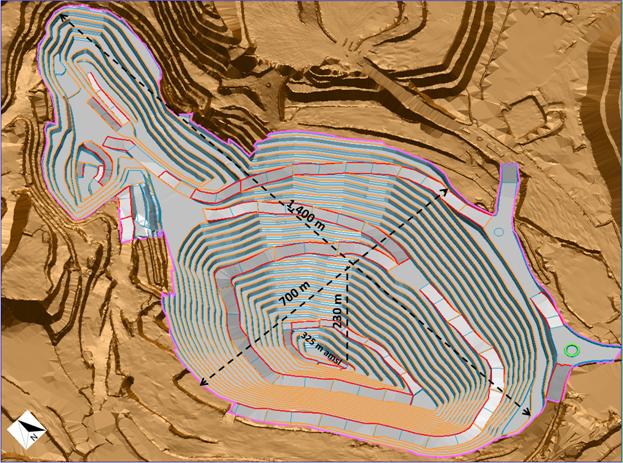

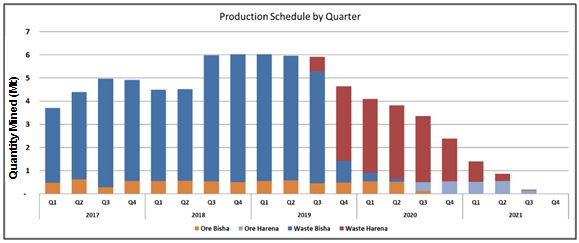

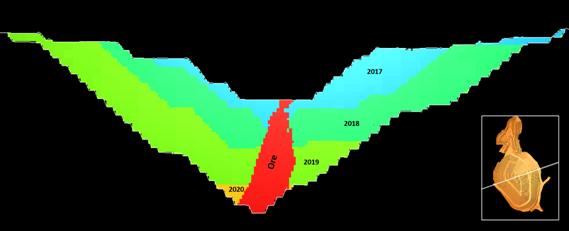

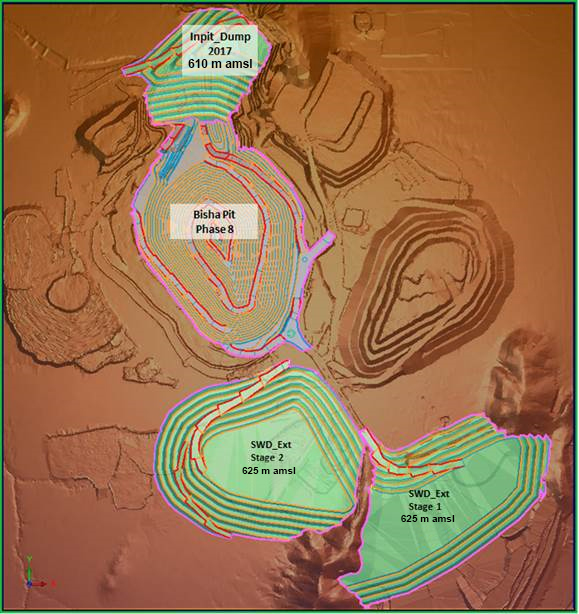

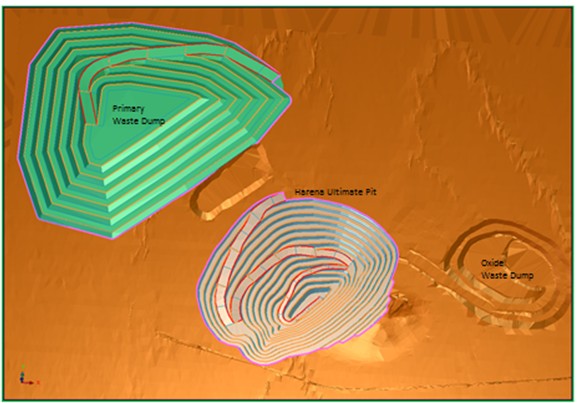

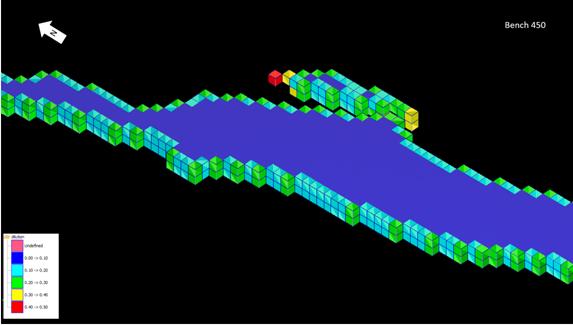

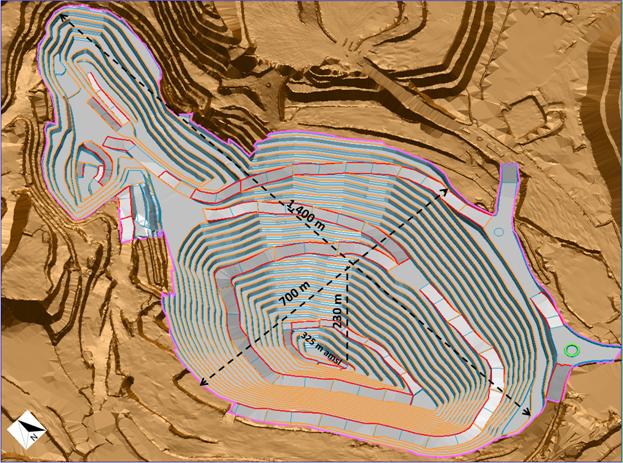

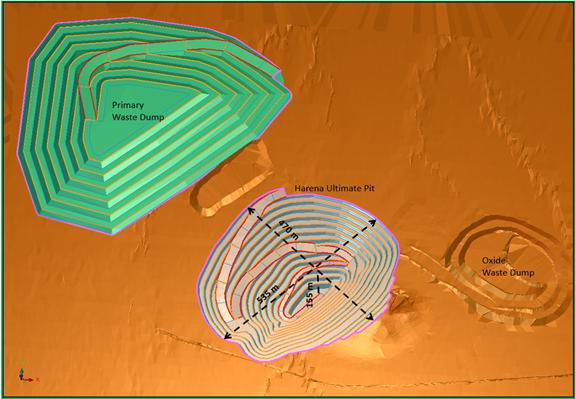

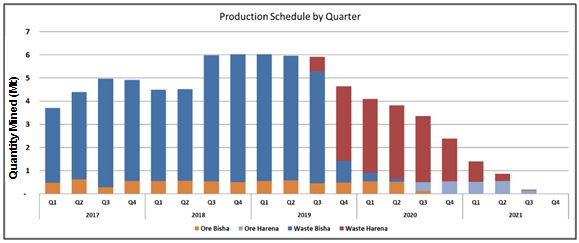

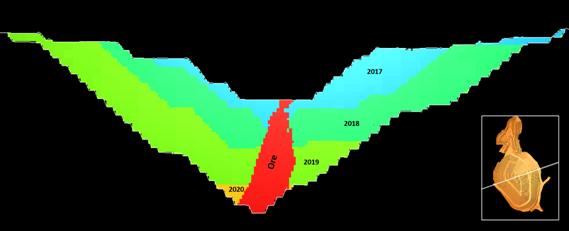

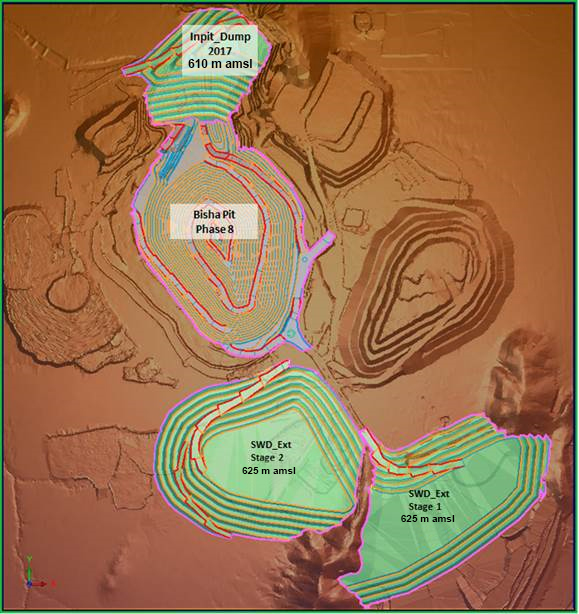

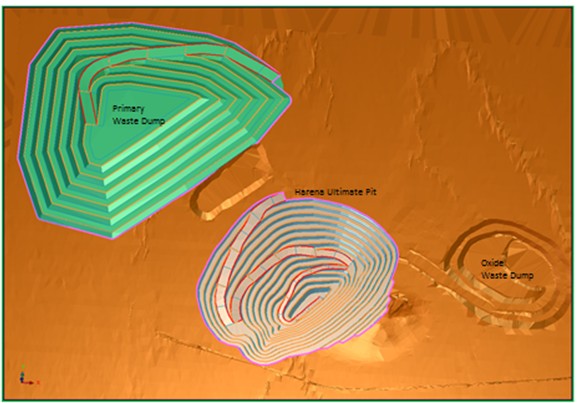

The Bisha project provides 9.6 Mt of mineable ore at 6.15% Zn, 1.05% Cu, 44.86 g/t Ag and 0.69 g/t Au. This amount of ore will be mined from Bisha Main and Harena pits and can supply the mill up to 2021 Q3.

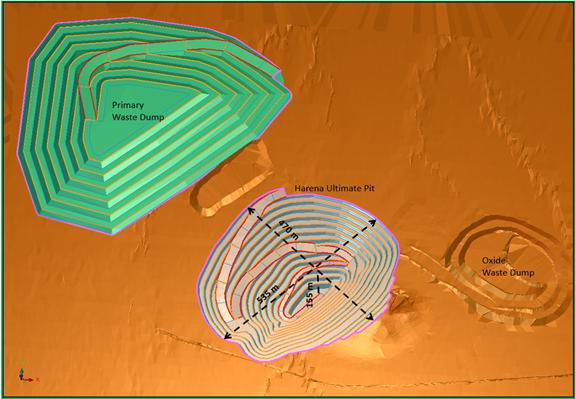

The Bisha Main and Harena deposits are mined as a conventional open pit operation. At Bisha Main, in-pit haulage for waste will be carried out using 65-tonne haulage trucks in 5 m benches. To control mining dilution and to increase selectivity, smaller excavators will be utilised for ore mining. Harena pit will be mined using the same mining fleet and also in 5 m benches.

Waste rock will be moved and hauled to multiple rock storage facilities based on their geochemical characteristics and period of operation. Some of the mineralised waste will be stockpiled near the pit so that it can be recovered if commodity prices increase from current levels.

The mining operation is conducted by the owner.

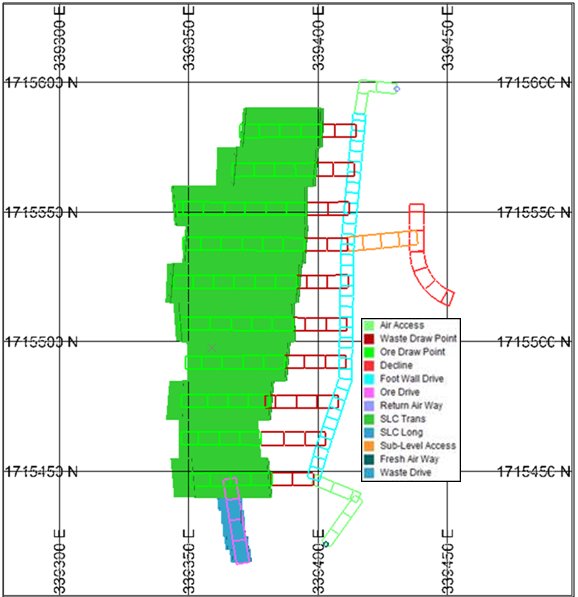

Underground Preliminary Economic Assessment

In addition to the mineral reserves defined at Bisha Main pit and Harena pit, SRK investigated the opportunity to exploit the resources located below the ultimate (reserve) pits using underground mining techniques.

The mine plans for Bisha Main underground and Harena underground are based on the same resource models as those used for the Bisha Main and Harena open pits, and do not include any mineralisation already included in the mineral reserve estimates.

Although this Preliminary Economic Assessment (PEA) exploits the mineral resource that has not be captured by the open pit reserves, the mineralised material and contained metal reported in this PEA must not be added to the open pit reserves nor used to infer an overall mine strategy.

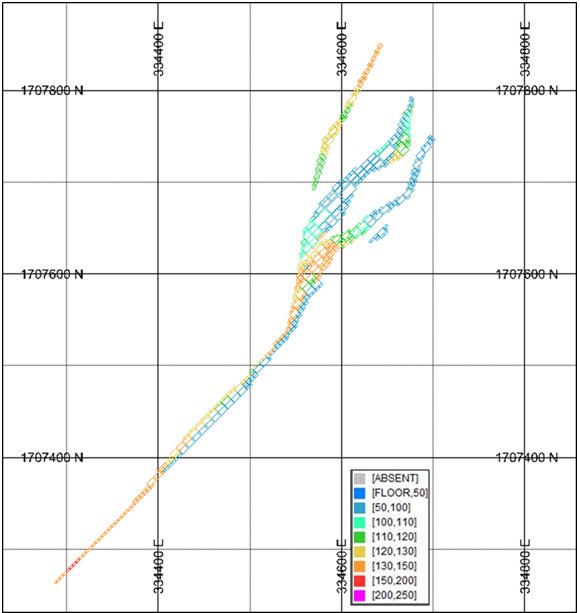

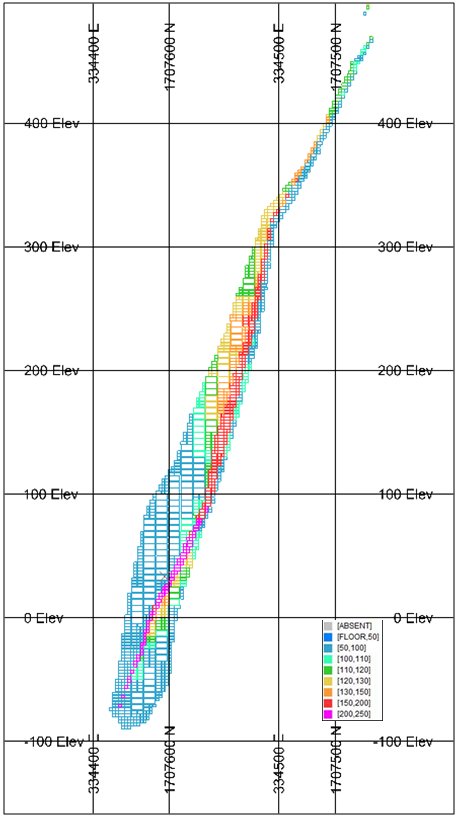

The proposed underground PEA is based on an eight year LOM mine plan at Bisha Main UG and about eleven years at Harena UG, with an overlapping production period of seven years. The combined estimated capital requirement for development of the two underground projects is approximately $265M including sustaining capital for the processing plant and TMF expansion.

The proposed underground operations would generate approximately three billion dollars in revenue before treatment/refining charges and royalty payments, and result in the post-tax NPV10% of approximately $84M.

This preliminary economic assessment is preliminary in nature, and includes inferred mineral resources that are considered too geologically speculative to have the economic considerations applied to them that would enable them to be categorised as mineral reserves, and there is no certainty that the preliminary economic assessment will be realised.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xiii |

Processing Plant

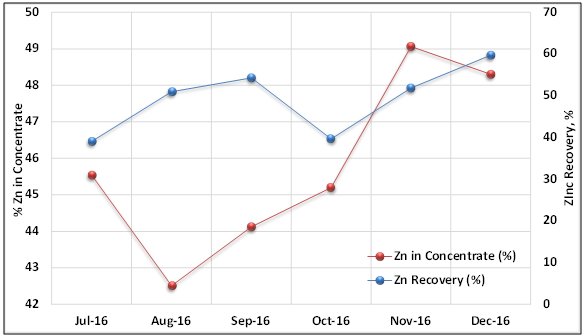

BMSC recently commissioned a Phase III expansion of the process plant that includes zinc flotation, zinc concentrate dewatering/handling as well as an upgrade of the two regrind mills.

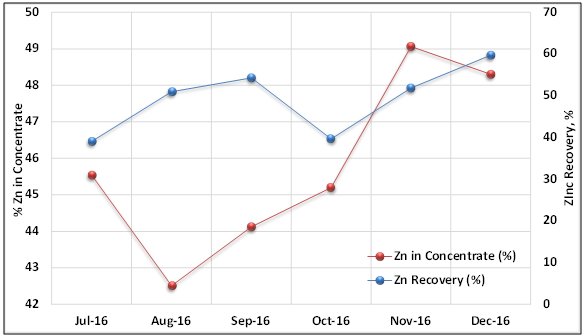

The plant expansion was commissioned in mid-2016 with an extended period of steady improvement occurring over the past nine months.

Issues with sphalerite activation were experienced by BMSC for most of 2016, resulting in a bulk concentrate being produced instead of a copper concentrate. Recent changes made by BMSC in the copper circuit operation have shown improvements in the copper concentrate quality.

Recently, a saleable copper concentrate has been produced with the quantity of bulk Cu-Zn concentrate diminishing steadily. Final concentrate zinc grade has been below 50% to the end of 2016; however, due to current market conditions and low impurity levels, the zinc concentrate is readily saleable.. Zinc recovery to the zinc concentrate has been steadily improving.

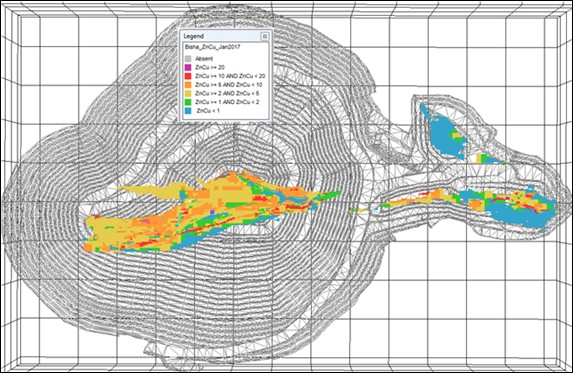

The current mine production plan shows Bisha Main Primary material as the sole source of plant feed. Harena Primary material will come on-line in 2020 after the depletion of Bisha Main material. Mill head grades for Bisha Main Primary material will remain steady (at a Zn/Cu ratio of around 6:1) while Harena head grades will be lower in 2020.

For both the Bisha Main and Harena deposits, most of mineralised material remaining is considered Primary zone, with both copper and zinc grade. The remaining Oxide material is being stockpiled for future consideration; minimal copper-only Supergene remains to be processed.

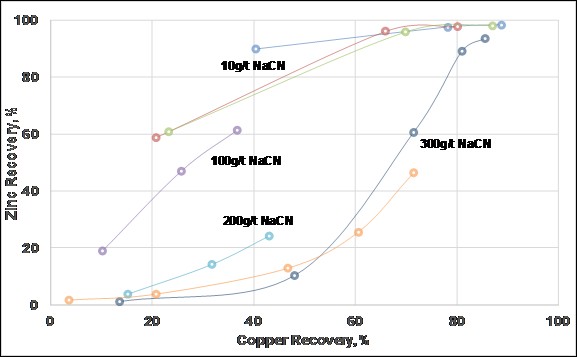

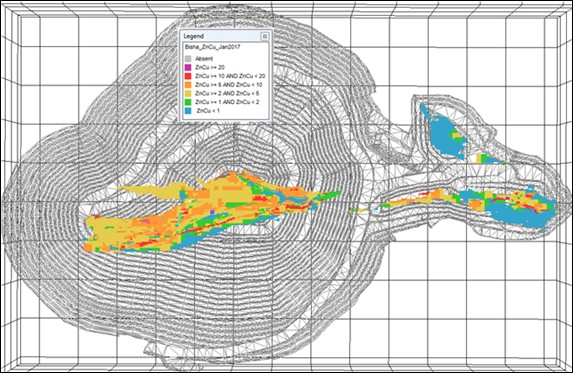

As of December 2016, the geometallurgical database results showed little/no correlation between CNCu estimates and the copper-zinc selectivity. However, BMSC is using the relative proportion of CNCu and ASCu as a guideline for mill feed blending. They are also actively seeking a modified method for sequential copper analysis that offers a more accurate estimate of copper-zinc selectivity. The same is true for non-sulphide metal ion content as measured by EDTA wash assays.

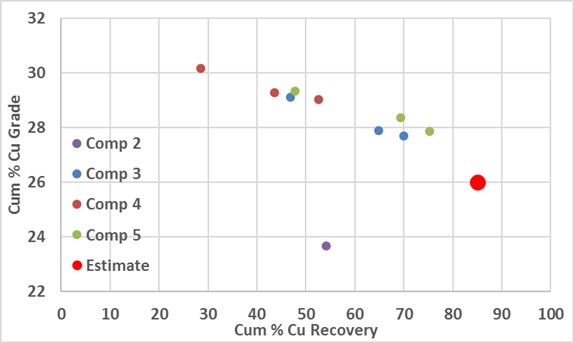

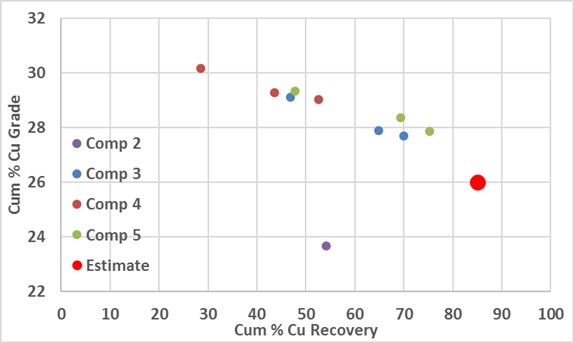

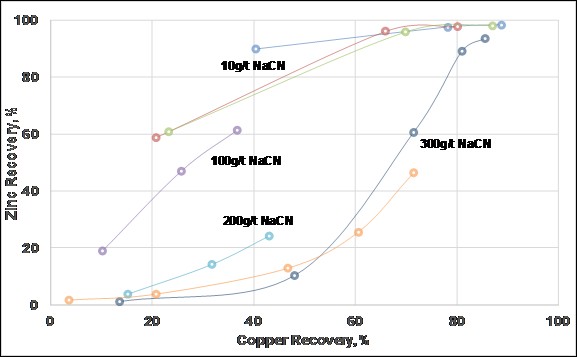

SRK and TS Technical Services reviewed the Primary material testwork results and made suggestions of estimated metallurgical performance, assuming separate campaign processing of material by Zn/Cu feed ratio or domains. This is because each metallurgical domain will require a particular set of copper rougher flotation conditions to generate both saleable copper and zinc concentrates.

In SRK’s opinion, almost all of the Primary material can generate a saleable copper concentrate, but with varying recovery. The same is true for the zinc concentrate, depending on the Zn/Cu feed ratio.

Issues remain with how BMSC can separately process campaigns of different Zn/Cu domains, including stockpiling material for extended periods. Limited information is available on the effect of sample weathering/oxidation but preliminary indications are it could be significant and at least, require a major change in reagent scheme to process such oxidised material.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xiv |

Capital and Operating Cost Estimates

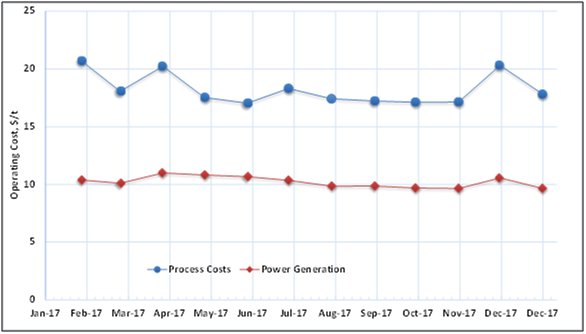

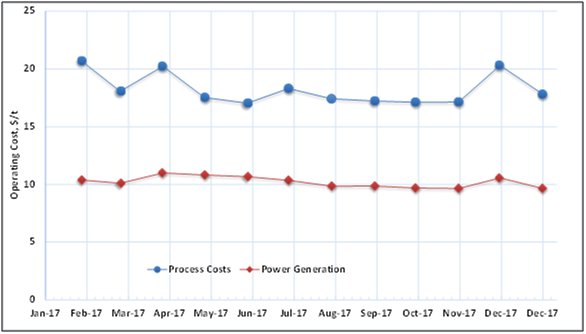

All cost estimates are shown in real (constant) 2017 US dollars and, no escalation has been applied to either operating or capital costs. The operating and capital costs are based on BMSC’s 2017 budget.

It is assumed that the Harena mine would operate under similar conditions as Bisha Main, using the same mining equipment and no processing plant modifications would be required for Harena ore.

Labour rates reflect current staffing and labour rates at the mine site, as used in the BMSC 2017 budget. The diesel price used for 2017 budget cost estimation is $0.55/L, delivered to site and the cost of electricity is $0.24 per kWh. Annual operating costs for Bisha Main are shown in Table ES11.

Table ES11: Bisha Main LOM site operating cost summary

| Description | LOM Total | 2017 | 2018 | 2019 | 2020 | 2021 |

| ($M) | ($M) | ($M) | ($M) | ($M) | ($M) |

| Open Pit Mining | 196 | 43 | 52 | 56 | 35 | 9 |

| Processing | 167 | 34 | 38 | 36 | 37 | 22 |

| Power Cost | 98 | 20 | 22 | 21 | 22 | 13 |

| General and Administrative | 119 | 25 | 25 | 25 | 25 | 19 |

| Total Operating Cost | 579 | 122 | 137 | 139 | 119 | 63 |

| Note: General and administration costs include the expenses of camps, environment, community and the office in Asmara |

All units of production for copper and zinc circuits are built and functioning as of December 2016. However, to maintain the production rate at 2.4 Mt per year, Bisha Main must invest additional capital, particularly in 2017, decreasing gradually to the end of mine life. Due to higher mining rates in the new production plans the mining fleet will be expanded. The mill is in relatively good condition, hence the requirement for low sustaining capital.

Table ES12 lists the total sustaining capital requirements for different sectors of the Bisha Main operation. Closure costs are estimated at $40M.

Table ES12: LOM sustaining capital and closure cost estimate

| Cost Categories | Cost

($M) |

| Mining equipment | 35 |

| Processing plant | 4 |

| Tailing dam | 14 |

| Technical and engineering | 9 |

| Total | 62 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xv |

Economic Analysis

The economic analysis of the Bisha Mine was undertaken in a Discounted Cash Flow (DCF) model in Microsoft Excel®. The model used real (constant) 2017 US dollars ($) as the primary currency. The model used mid-period annual discounting at a base case discount rate of 10% and a valuation date of 31 December 2016. Capital costs prior to 1 January, 2017 and debt financing were excluded from the analysis, as are sunk costs and interest payments.

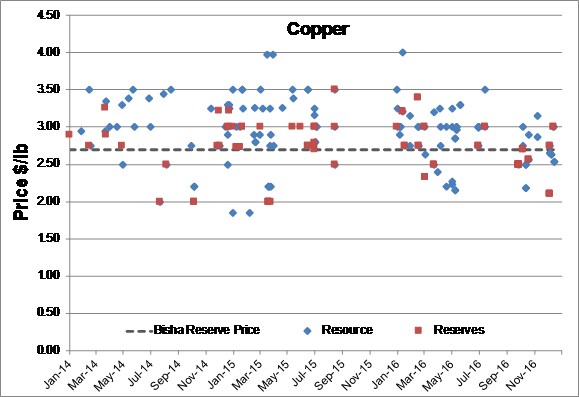

Base commodity prices used in the analysis were as follows:

- Zinc at $1.00 per pound

- Copper at $2.70 per pound

- Silver at $18.00 per troy ounce

- Gold at $1,200 per troy ounce

The analysis demonstrated the Bisha Mine was economically viable from a post-tax discounted cash flow perspective.

Project Access and Infrastructure

Regular international flights service Asmara, the capital city of Eritrea. Asmara is connected to the Property by a 237 km long road, 222 km of which are paved. The remaining 15 km consist of an all-weather unpaved road, which is currently being upgraded. The principal port for importation of heavy equipment is Massawa on the Red Sea coast, which is about 350 km from the Property by road.

The on-site and off-site infrastructure required to operate and support the operation of the Project in accordance with current requirements is in place.

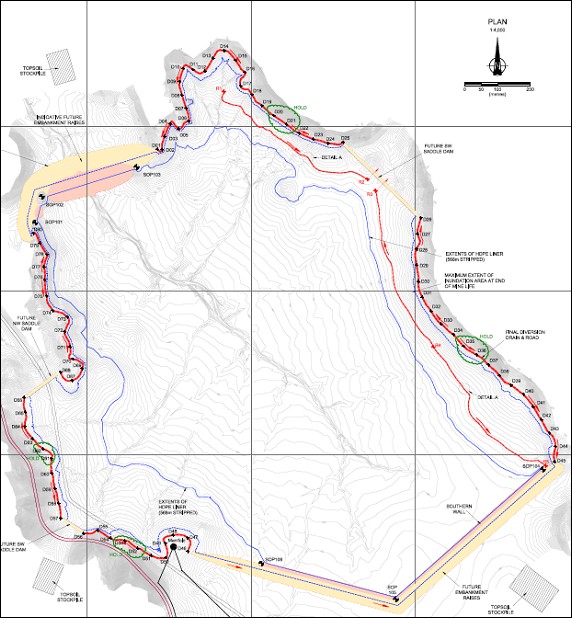

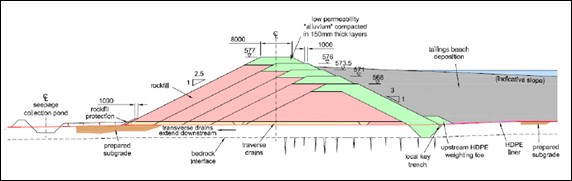

In general, the tailings management facility (TMF) is operating satisfactorily although, in order to maintain a suitable factor of safety, Knight-Piesold (KP, 2016b) has indicated the rate at which TMF water is reclaimed needs to be increased to the maximum possible extent. Provided the Knight-Piesold (KP) recommendations arising from their bi-annual audits are appropriately addressed, it will be possible for the TMF to be safely raised to levels required by the revised mine plan. However, current plan outlined in this document calls for a smaller quantity of tailings then was proposed for the original TMF design.

Groundwater pumped from water bores is the principal source of water for the Project and its processing needs. The groundwater resource significantly exceeds the required abstraction rate, suggesting the current abstraction is sustainable in the long term assuming current average conditions of recharge and groundwater flow. Due to the high rate of evaporation, the Project water balance is net negative; no water has been discharged to the environment in the past, nor is it expected to in the future.

Waste rock from the open pit falls into one of two geochemical categories controlled by lithological makeup: non-potentially acid generating (NAG) or potentially acid generating (PAG). Most of the waste rock is classified as PAG material. Identification of NAG material can only be done by testing. There is currently one NAG dump and one PAG dump on site. NAG material is being used for embankment construction at the TMF. Sufficient real estate exists to expand the waste dumps as required.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xvi |

Environmental and Permits

At this time, the Project has all necessary permits and authorisations to operate the mine.

Environmental issues identified in conjunction with the initial permitting process and ongoing regulatory oversight are being addressed by BMSC. Detailed monitoring plans are in place as part of the impact assessment process and to develop inputs to the final reclamation and closure of the site.

Final reclamation of the pit, waste rock facilities, yards, ROM pad and roads is estimated to cost approximately $7.5M. Reclamation of the TMF, which includes the costs for the placement of a 40 cm cover and the closure spillway, is estimated to be approximately $5.3M. Revegetation is estimated to be approximately $1.3M.

No salvage credits have been assumed for the closure costing.

Demolition and reclamation of the plant and other infrastructure is estimated to be approximately $8.6M. Closure and post closure monitoring costs for a period of 10 years (five years of TMF drain-down and five years of post-closure monitoring) is estimated at $0.5M.

The total reclamation cost is estimated at $40.0M including administrative costs and a 15% contingency. A review of that plan suggests that several important closure steps are missing, specifically a cover and final landform study for the waste dumps, a cover study for the TSF and the development of a social closure plan for the nearby communities. The cost of these studies amounts to approximately $0.3M.

Consistent with this closure cost estimate, Nevsun (2017) confirmed that BMSC has arranged an annually renewable environmental bond of $40M at a cost of 1% per annum. BMSC, in accordance with International Financial Reporting Standards, has accrued $38.3M in its financial records as of 31 March 2017, as a provision for reclamation, remediation, and post-closure monitoring.

Recommendations

Mineral Resource

- To upgrade the Inferred resource to Indicated at all five deposits, infill drilling to a nominal 50 m by 50 m spacing is required.

- To upgrade Indicated resources to Measured, close-spaced drilling (such as grade control drilling) is required. For the Harena, Asheli, Northwest and Hambok deposits, further metallurgical testwork is justified as well.

- Upgrade the Inferred stockpile resource category with additional metallurgical testwork.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xvi |

- Harena deposit remains open down-plunge and further extension drilling is highly likely to add Mineral Resources to this deposit.

- The cost estimate for these recommendations is approximately $25.5M.

Mining

- Obtain the necessary permits to establish a waste dump to the west of the Bisha Main pit. A waste dump in this area will reduce cycle times, and therefore costs, particularly for the waste stripped in the west zone.

- Review the geotechnical assessment for the south-east sector of the Bisha Main pit based on recent exposures in that area. The current geotechnical recommendations are complex and vary considerably with only a small variation in pit wall orientation. In SRK's opinion, there is opportunity to reduce the stripping ratio.

- Review the current procedures for grade control and short-term mine planning (GC&STMP) with a view to establishing a methodology that values the ore according to NSR and can respond relatively quickly to change in commodity process and processing performance.

- Currently, the ore is sorted on run-of-mine (ROM) pads, based on its quality/grade, prior to crushing. SRK recommends utilising the improved GC&STMP procedures (refer to earlier recommendation) to provide the confidence required for direct tipping to the crusher. This reduction in rehandle will reduce the operating costs.

- Consider increasing the width of the two-way haulage roads to at least 25 m (preferred 27 m). This will increase tire life (due to less frequent scrubbing of tire walls on bunds) and generally provide safer operating conditions.

- The cost estimate for these recommendations is about $0.3M.

Processing

SRK includes the following recommendations for future metallurgical testwork, based on a well-established set of metallurgical domains:

- Review of current sequential copper methods being used to estimate the secondary copper content.

- Investigate the effect of weathering/oxidation and methods to reduce the impact of medium to long-term stockpiling of Primary material.

- Sample and evaluate the performance of currently stockpiled Primary material.

- Investigate the effect of primary grind size on copper-zinc selectivity.

- Determine the optimal pH and reagent conditions for each metallurgical domain.

- Establish the sensitivity of results within each domain and whether campaign processing is required, optional or not necessary.

For the BMSC plant operation, SRK also recommends:

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xvii |

- A review of all plant measurements to confirm feed conditions are stable and process performance is somewhat predictable.

- Conduct a series of plant trials on a single metallurgical domain where prior lab testwork conditions are applied to the plant while processing the material, to compare lab versus plant performance.

- Minor upgrades to processing plant for water reticulation, pumps, etc.

- The cost estimate for these recommendations is about $0.3M to $0.5M, depending on the number of samples required to provide sufficient confidence in the outcome.

Key Project Risks

Mining

- Achieving the mining rate, that is a function of equipment availability, calculated in production schedule is an important and vital element for success of Bisha project. Failure in reaching to the production rate causes the operating cost to increase and poses the risk of losing the mineable reserve.

- Mineral Reserve calculated in this report is based on input parameters outlined in Section 14. These parameters included commodity prices and processing recoveries. Failure to achieve processing recoveries used in this report will cause the project to lose the income that eventually would affect the amount of Mineral Reserve.

Political

Albeit unlikely, there is a residual risk of unexpected governmental intervention that can lead to potentially significant impacts to a mining operation. An important action to mitigate this risk is to continue to maintain positive relationships with the regulatory agencies and local communities. Additional risk mitigation is available through the 40% interest in the Bisha mine that the Government of Eritrea holds via the ENAMCO.

Economics

As experienced during the Global Financial Crisis in 2008/2009 and during the economic downturn from 2014 to 2016, commodity prices are subject to overall global economic health. Any significant event that shakes consumer confidence in capital markets could lead to depressed commodity prices, resulting in lower than predicted project revenues.

Key Project Opportunities

Mining

Higher commodity prices will generate additional income that consequently can justify mining a larger pit in Bisha Main deposit.

Harena deposit contains some near surface inferred resources. More exploration drilling to confirm Mineral Resource at Harena may help to increase the Mineral Reserve for this deposit.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xix |

Processing

Work is ongoing at site to improve plant performance, with particular emphasis on copper-zinc selectivity. Methods to anticipate poor selectivity are being investigated including sequential copper tests to estimate the secondary copper content as well as non-sulphide metal ions that may be resulting in sphalerite activation.

In SRK’s opinion, well-defined, metallurgical domains need to be established, each with specific operating conditions needed to achieve reasonable selectivity and produce both a copper and zinc concentrate. This might be Zn/Cu feed grade ratios discussed in Section 12 or it might be another feed characteristic or proxy value. Due to the high variability in metallurgical response observed in the plant results to date and historical testwork, it seems reasonable to assume that campaigning of specific metallurgical domains without blending across domains, offers the greatest opportunity for consistent plant performance; this approach assumes oxidation of the stockpiled ore does not adversely impact processing recovery.

Economics

Any significant improvements in commodity prices, concentrate grades or metal recovery rates will lead to substantial increases in project NPV. An increase in production rate will also increase project value, albeit to a lesser extent. If any major project assumptions change due to ongoing work, the economic model should be reviewed and updated to determine the overall impact to project NPV.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xx |

Table of Contents

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170714_DRAFT_v07_FWB_aan_rev06 | July 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxi |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170714_DRAFT_v07_FWB_aan_rev06 | July 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170714_DRAFT_v07_FWB_aan_rev06 | July 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxiii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170714_DRAFT_v07_FWB_aan_rev06 | July 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xx |

Table of Contents

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxi |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxiii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxiv |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxv |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxvi |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxvii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxviii |

List of Figures

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxix |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxx |

List of Tables

| Table 1.1: Areas of responsibilities. | 35 |

| Table 1.2: List of authors and responsibilities. | 36 |

| Table 1.3: Site visit dates by QPs. | 38 |

| Table 3.1: BMSC mining tenements. | 44 |

| Table 3.2: New Mogoraib EL expenditure requirements. | 45 |

| Table 3.3: Tabakin EL expenditure requirements. | 45 |

| Table 4.1: Distances by road from Asmara to the property. | 49 |

| Table 5.1: Combined Mineral Resource statement for Bisha Main, Harena, Northwest and Hambok deposits, Eritrea, as of 31 December 2013. | 55 |

| Table 5.2: Bisha Main Stage I gold production. | 56 |

| Table 5.3: Bisha Main Stage II copper production. | 56 |

| Table 5.4: Bisha Main Stage III zinc production. | 56 |

| Table 7.1: Average grade and tonnage data for selected VMS camps. | 75 |

| Table 9.1: Bisha Main Deposit drilling analysis. | 81 |

| Table 9.2: Harena Deposit drilling analysis. | 82 |

| Table 9.3: Hambok Deposit drilling analysis. | 82 |

| Table 9.4: Northwest Deposit drilling analysis. | 82 |

| Table 9.5: Asheli Deposit drilling analysis. | 83 |

| Table 9.6: Other prospects drilling summary. | 83 |

| Table 10.1: Analytical laboratory assay techniques. | 86 |

| Table 10.2: Density testwork summary. | 87 |

| Table 10.3: Laboratory blanks analysis. | 88 |

| Table 10.4: Laboratory CRM analysis. | 88 |

| Table 11.1: Site visit dates by QPs. | 91 |

| Table 12.1: Harena rougher flotation results. | 95 |

| Table 12.2: Primary material metallurgical estimates. | 105 |

| Table 13.1: Mineral Resource statement for Bisha Main deposit, Eritrea, as of 31 December 2016. | 109 |

| Table 13.2: Mineral Resource statement for Bisha Main deposit, Eritrea, as of 31 December 2016. | 110 |

| Table 13.3: Mineral Resource statement for Harena deposit, Eritrea, as of 31 December 2016. | 111 |

| Table 13.4: Inferred Mineral Resource statement for Asheli deposit, Eritrea as of 31 December 2016. | 111 |

| Table 13.5: Mineral Resource statement for Northwest deposit, Eritrea, as of 31 December 2016. | 112 |

| Table 13.6: Mineral Resource statement for Hambok deposit, Eritrea, as of 31 December 2016. | 113 |

| Table 13.7: Database bisha201600825.mdb summary. | 113 |

| Table 13.8: Mean grade of each interpreted mineralised domain. | 115 |

| Table 13.9: Top cuts applied. | 116 |

| Table 13.10: Domain 100 resource variogram models, with sills (γ) and ranges (h) | 117 |

| Table 13.11: Domain 101 resource variogram models. | 117 |

| Table 13.12: Domain 102 resource variogram models. | 118 |

| Table 13.13: Domain 200 resource variogram models. | 118 |

| Table 13.14: Domain 201 resource variogram models. | 119 |

| Table 13.15: Domain 202 resource variogram models. | 119 |

| Table 13.16: Domain 203 resource variogram models. | 120 |

| Table 13.17: Domain 300 resource variogram models. | 120 |

| Table 13.18: Domain 301 resource variogram models. | 121 |

| Table 13.19: Domain 302 resource variogram models. | 121 |

| Table 13.20: Domain 303 resource variogram models. | 122 |

| Table 13.21: Domain 304 resource variogram models. | 122 |

| Table 13.22: Domain 400 resource variogram models. | 123 |

| Table 13.23: Domain 401 resource variogram models. | 123 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxi |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxii |

| Table 13.74: Gold variogram parameters. | 165 |

| Table 13.75: Silver variogram parameters. | 166 |

| Table 13.76: Arsenic variogram parameters. | 167 |

| Table 13.77: Block model definitions. | 167 |

| Table 13.78: Mineral Resource commodity prices. | 169 |

| Table 13.79: Mineral Resource statement for Northwest deposit, Eritrea, as of 31 December 2016. | 171 |

| Table 13.80: Hambok deposit drillhole summary table. | 172 |

| Table 13.81: Variogram parameters for Hambok estimation. | 177 |

| Table 13.82: Block model extents, massive sulphide-hosted mineralisation. | 178 |

| Table 13.83: Mineral Resource commodity prices. | 180 |

| Table 13.84: Mineral Resource statement for Hambok deposit, Eritrea, as of 31 December 2016. | 182 |

| Table 14.1: Commodity prices used for Mineral Reserve estimate. | 184 |

| Table 14.2: Methodology for estimating dilution. | 188 |

| Table 14.3: Results of pit optimisation. | 193 |

| Table 14.4: Mineral Reserve statement for Bisha Main and Harena deposits, Eritrea, as of 31 December 2016 | 197 |

| Table 14.5: Mineral Reserve statement for Bisha Main deposit, Eritrea, as of 31 December 2016. | 197 |

| Table 14.6: Mineral Reserve statement for Harena deposit, Eritrea, as of 31 December 2016. | 198 |

| Table 15.1: Mine design criteria. | 200 |

| Table 15.2: Bisha Main pit Mineral Reserves by phases. | 204 |

| Table 15.3: Production schedule for Bisha project | 208 |

| Table 15.4: List of major mining equipment and their requirements by period. | 211 |

| Table 16.1: Summary of major plant equipment (following Phase III expansion) | 218 |

| Table 16.2: Summary of plant consumables (2017 YTD) | 223 |

| Table 17.1: Dam crest elevation versus TMF storage capacity per stage. | 229 |

| Table 17.2: PAG/NAG waste rock quantity summary. | 232 |

| Table 20.1: Bisha LOM site operating cost summary. | 244 |

| Table 20.2: LOM sustaining capital cost estimate. | 244 |

| Table 20.3: Mining equipment purchase schedule ($M) | 245 |

| Table 20.4: Processing plant sustaining capital | 246 |

| Table 20.5: Mine operating costs. | 247 |

| Table 21.1: Summary LOM production schedule. | 249 |

| Table 21.2: Summary LOM revenue. | 250 |

| Table 21.3: Total project capital expenditures including mine closure. | 251 |

| Table 21.4: Total project operating expenditures. | 251 |

| Table 21.5: LOM average cost per tonne of ore. | 251 |

| Table 21.6: LOM royalty estimate. | 252 |

| Table 21.8: Project key performance indicators. | 252 |

| Table 21.9: NPV sensitivity to changing base commodity prices (Zn, Cu) and cost estimates. | 253 |

| Table 23.1: Bisha Main UG and Harena UG - ground support recommendations. | 259 |

| Table 23.2: Commodity price deck. | 260 |

| Table 23.3: Bisha Main UG - Processing recoveries. | 260 |

| Table 23.4: Bisha Main UG - Underground preliminary costs inputs for design parameters. | 261 |

| Table 23.5: Bisha Main UG - SLC stope geometries. | 261 |

| Table 23.6: Bisha Main UG - SLC stope geometries. | 264 |

| Table 23.7: Bisha Main UG - LOM development and production schedule. | 265 |

| Table 23.8: Bisha Main UG - Labour requirements. | 266 |

| Table 23.9: Bisha Main UG - Lateral development capital cost estimate. | 267 |

| Table 23.10: Bisha Main UG - Annual capital cost estimates. | 268 |

| Table 23.11: Bisha Main UG - Operating cost estimate. | 269 |

| Table 23.12: Bisha Main UG - Contractor annual mobile equipment costs. | 270 |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting | |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxiii |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page xxxiv |

Acronyms and Abbreviations

| Distance | | ppb | parts per billion |

| µm | micron (micrometre) | | s | second |

| mm | millimetre | | SG | specific gravity |

| cm | centimetre | | V | volt |

| m | metre | | W | watt |

| km | km | | Ω | ohm |

| ” or in | inch | | A | ampere |

| ’ or ft | foot | | K | Thousand |

| Area | | Ø | diameter |

| m2 | square metre | | Acronyms |

| km2 | square km | | ENAMCO | Eritrean National Mining Corporation |

| ha | hectare | | EL | Exploration Licence |

| Volume | | SRK | SRK Consulting (Canada) Inc. |

| L | litre | | CIM | Canadian Institute of Mining |

| m3 | cubic metre | | NI 43-101 | National Instrument 43-101 |

| lcm | loose cubic metre | | QP | Qualified Person |

| bcm | bank cubic metre | | KP | Knight Piésold |

| Mbcm | million bcm | | WSP | WSP Parsons Brinkerhoff |

| Mass | | ANS | Arabian-Nubian Shield |

| kg | kilogram | | AP | Accounts Payable |

| g | gram | | AR | Accounts Receivable |

| t | metric tonne | | BHEM | Borehole Time-Domain Electromagnetic |

| kt | kilotonne | | BMSC | Bisha Mining Share Company |

| lb | pound | | BOCO | Base of Complete Oxidation |

| Mt | megatonne | | COG | cut-off grade |

| oz | troy ounce | | CRM | certified reference materials |

| wmt | wet metric tonne | | DCF | Discounted Cash Flow |

| dmt | dry metric tonne | | EDTA | Ethylenediaminetetraacetic Acid |

| Pressure | | EIA | Environmental Impact Assessment |

| psi | pounds per square inch | | EM | Electromagnetic |

| Pa | pascal | | GC&STMP | grade control and short-term mine planning |

| kPa | kilopascal | | IRC | Impact Review Committee |

| MPa | megapascal | | LG | Lerchs-Grossman |

| Elements and Compounds | | LOM | life of mine |

| Au | Gold | | ML/ARD | Metal leaching/ acid rock drainage |

| Ag | Silver | | MSUL | Massive Sulphide |

| As | Arsenic | | Mtpa | million tonnes per annum |

| Cu | Copper | | NAG | Non-potentially acid generating |

| Fe | Iron | | NPV | net present value |

| S | Sulphur | | NSR | net smelter return |

| Zn | Zinc | | OK | Ordinary Kriging |

| CN | Cyanide | | PAG | Potentially acid generating |

| NaCN | sodium cyanide | | QKNA | Quantitative Kriging Neighbourhood Analysis |

| CNCu | cyanide-soluble copper | | RC | reverse circulation |

| Other | | RQD | Rock Quality Designation |

| °C | degree Celsius | | SI | System of Units |

| °F | degree Fahrenheit | | SMSX | Semi-massive Sulphide |

| elev | elevation | | TMF | Tailings Management Facility |

| m amsl | metres elev. above mean sea level | | TOFR | Top of Fresh Rock |

| hp | horsepower | | tpd | tonnes per day |

| hr | hour | | UG | underground |

| kW | kilowatt | | VMS | Volcanic hosted massive sulphide |

| kWh | kilowatt hour | | WRF | waste rock facility |

| M | Million or mega | | Conversion Factors |

| mph | miles per hour | | 1 tonne | 2,204.62 lb |

| ppm | parts per million | | 1 troy ounce | 31.1035 g |

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 35 |

| 1 | Introduction and Terms of Reference |

This technical report was prepared for Nevsun Resources Ltd. (Nevsun) to summarise the results of resource and reserve update on the Bisha Mine (Bisha, Mine or Project), located in Eritrea, Africa. Nevsun holds a 60% interest in the Project, through a 60% interest in Bisha Mining Share Company (BMSC). The Eritrean National Mining Corporation (ENAMCO) holds the remaining 40% interest. BMSC is the operator for the Bisha and Harena mining licences, the mining agreement area, Tabakin Exploration License (Tabakin EL) and Mogoraib River Exploration License (Mogoraib EL) exploration licences.

The contract with SRK Consulting permits Nevsun to file this report as a technical report with the Canadian securities regulatory authorities pursuant to NI 43-101, Standards of Disclosure for Mineral Projects. Except for the purposes legislated under provincial securities law, any other uses of this report by any third party is at that party’s sole risk. The responsibility for this disclosure remains with Nevsun. The user of this document should ensure that this is the most recent technical report for the property, as it is not valid if a new technical report has been issued.

Table 1.1: Areas of responsibilities

| | Company | Area of Responsibility |

| | BMSC | Mineral Resource Estimation, Quality Assurance/Quality Control (QA/QC), Geology, Geotechnical Engineering, Closure Costs |

| | SRK | Mineral Reserve Estimate, Open Pit and Underground Mine Designs, Mine Ventilation and Cooling, Production Schedule, Mining Costs, Recovery Methods, Processing Capital and Operating Costs, Economics, Site Infrastructure, Environmental and Permitting |

| | Nevsun | Marketing Studies and Contracts |

This report has been prepared by SRK with contributions from BMSC and Nevsun. This technical report was written by the authors shown in Table 1.2.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 36 |

| | Table 1.2: List of authors and responsibilities |

| | Author | Company | Area of Responsibility |

| | Chris Elliott, FAusIMM | SRK | Introduction and Terms of Reference, Reliance on Other Experts |

| | Adrian Dance, P.Eng, FAusIMM | SRK | Mineral Processing and Metallurgical Testing, Recovery Methods, Processing Capital and Operating Costs, relevant parts of Executive Summary and Conclusions and Recommendations |

| | Phil Jankowski, MAusIMM (CP) | BMSC | Property Description and Location, Accessibility, Climate, Local Resources, Infrastructure and Physiography, History, Geological Setting and Mineralisation, Deposit Types, Exploration, Drilling, Sample Preparation, Analyses, and Security, Data Verification, Mineral Resource Estimates |

| | Anoush Ebrahimi, P.Eng | SRK | Mineral Reserve Estimates, Mining Methods, Mining Capital and Operating Costs, relevant parts of Executive Summary and Conclusions and Recommendations |

| | Cameron Scott, P.Eng | SRK | Project Infrastructure, Environmental Studies, Permitting, and Social or Community Impact, Closure, relevant parts of Executive Summary and Conclusions and Recommendations |

| | Neil Winkelmann, FAusIMM | SRK | Economic Analysis, Other Relevant Data and Information, relevant parts of Executive Summary and Conclusions and Recommendations |

| | Tom Whelan, CPA | Nevsun | Marketing Studies and Contracts |

Any previous technical reports or literature used in the compilation of this report are referenced in the relevant text as necessary.

All units in this report are based on the International System of Units (SI), except industry standard units, such as troy ounces for the mass of precious metals.

This report uses abbreviations and acronyms common to the mineral industry. Definitions have been provided earlier in the report.

| 1.3 | Basis of Technical Report |

This technical report is an update of the technical report issued by AGP Mining Consultants Inc. (AGP) and Mineralurgy Pty. Ltd. (Mineralurgy) on 24 March 2014, and information collected by SRK during site visits performed by Dr. Anoush Ebrahimi and Mr. Neil Winkelmann during the first six month 2017, and on additional information provided by BMSC and Nevsun throughout the course of SRK’s investigations. SRK has no reason to doubt the reliability of the information provided. Nevsun filed a number of previous Technical Reports on the Bisha Mine:

| | - AGP Mining Consultants, Inc. Peter Munro, BAppSc., Mineralurgy Pty. Ltd. effective date: 31 December 2013, published 24 March 2014.

|

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 37 |

| | - AGP (2012). Bisha Polymetallic Operation, Eritrea, Africa, NI 43-101 Technical Report for Nevsun Resources Ltd., as of 31 August 2012.

- Thomas, D., Melnyk, J., Kozak, A., Khera, V. (2011). Nevsun Resources Limited, Bisha Polymetallic Operation Eritrea, Africa, NI 43-101 Technical Report to Nevsun Resources Ltd., effective date 1 January 2011, and revised 29 March 2011.

- Waller, S., Reddy, D., Melnyk, L. (2006). Nevsun Resources (Eritrea) Ltd, NI 43-101 Technical Report on the Feasibility Assessment, Bisha Property, Gash-Barka District, Eritrea: unpublished technical report to Nevsun Resources Ltd., effective date 5 October 2006.

- AMEC (2005). Nevsun Resources (Eritrea) Ltd. Bisha Property, Gash-Barka District, Eritrea, NI 43-101 Technical Report and Preliminary Assessment, 30 December 2005: unpublished technical report to Nevsun Resources Ltd., effective date 30 December 2005.

- AMEC (2004). Technical Report on the Bisha Property and Resource Estimate of the Bisha Deposit, Gash-Barka District, Eritrea, 1 October 2004: unpublished technical report to Nevsun Resources Ltd., effective date 18 November 2004.

- Barrie, C.T., and Giroux, G.H. (2009). Hambok Deposit, Mogoraib Exploration License, Gash- Barka District, Western Eritrea 43-101 Technical Report and Preliminary Resource Assessment Prepared for Sanu Resources Ltd.

|

| 1.4 | Qualifications of SRK and SRK Team |

The SRK Group comprises over 1,400 professionals, offering expertise in a wide range of resource engineering disciplines. The SRK Group’s independence is ensured by the fact that it holds no equity in any project and that its ownership rests solely with its staff. This fact permits SRK to provide its clients with conflict-free and objective recommendations on crucial judgment issues. SRK has a demonstrated track record in undertaking independent assessments of Mineral Resources and Mineral Reserves, project evaluations and audits, technical reports and independent feasibility evaluations to bankable standards on behalf of exploration and mining companies and financial institutions worldwide. The SRK Group has also worked with a large number of major international mining companies and their projects, providing mining industry consultancy service inputs.

In accordance with NI 43-101 guidelines, SRK has visited the Bisha Mine on a number of occasions since 2014 to review geology and exploration protocols.

For the purpose of this reserves update, the QPs listed in Table 1.3 visited the property during the dates indicated to review metallurgical data mining/production and infrastructure.

Mr Ebrahimi also conducted additional site visits in 2017 for the purpose of compiling this technical report.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 38 |

| | Table 1.3: Site visit dates by QPs |

| | Name | Dates |

| | Adrian Dance | Did not visit site for the purpose of this Technical Report |

| | Anoush Ebrahimi | 18 Oct 2016 to 24 Oct 2016 |

| | Cameron Scott | Did not visit site for the purpose of this Technical Report |

| | Neil Winkelmann | 27 May 2015 to 30 May 2015 |

SRK would like to acknowledge the support and collaboration provided by Nevsun and BMSC personnel for this assignment. Their collaboration was greatly appreciated and instrumental to the success of this project.

SRK’s opinion contained herein and effective 31 December, 2016, is based on information collected by SRK throughout the course of SRK’s investigations, which in turn reflect various technical and economic conditions at the time of writing. Given the nature of the mining business, these conditions can change significantly over relatively short periods of time. Consequently, actual results may be significantly more or less favourable.

This report may include technical information that requires subsequent calculations to derive sub-totals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, SRK does not consider them to be material.

SRK is not an insider, associate or an affiliate of Nevsun, and neither SRK nor any affiliate has acted as advisor to Nevsun, its subsidiaries or its affiliates in connection with this project. The results of the technical review by SRK are not dependent on any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 39 |

| 2 | Reliance on Other Experts |

The authors have relied upon information derived from the following letter, pertaining to mineral tenure, surface rights, permitting, environmental liabilities, and social issues:

| | - Nevsun, 2017, Re: Bisha Operation, letter from Chief Operating Officer of Nevsun to SRK Consultant (Canada) Inc., dated 29 June 2017.

|

The Qualified Persons (QPs) have not reviewed the mineral tenure, nor independently verified the legal status or ownership of the Project area or underlying property agreements. The QPs have relied upon information obtained from the above-mentioned document. This information is used in Sections 3.3, 3.3, and 3.4 of this report.

| 2.2 | Surface Rights and Permitting |

The QPs have relied on information regarding the status of the current Surface Rights, Road Access, and Permits through opinions and data supplied by BMSC experts through the above-mentioned document. This information is used in Sections 3.5 and 3.7 of this report.

| 2.3 | Environmental Liabilities |

The QPs relied on information regarding Environmental Liabilities through opinions and data supplied by BMSC experts through the above-mentioned document. This information is used in Section 19.2 and Section 19.3 of this report.

| 2.4 | Social and Community Impacts |

The QPs have relied on information regarding the status of Social and Community Impacts through opinions and data supplied by BMSC experts through the above-mentioned document. This information is used in Section 19.6 of this report.

| PJ/ABE/ADD/CCS/AAN/NMW/CAE | Bisha_2016R&R-Update_TechRep_2CN010-024_20170808_aan_cae | August 2017 |

| SRK Consulting |

| NI 43-101 Technical Report Bisha Mine 2016, Eritrea | Page 40 |

| 3 | Property Description and Location |