FACE

AMOUNT | | RATING(a) | SECURITY | | VALUE | |

|

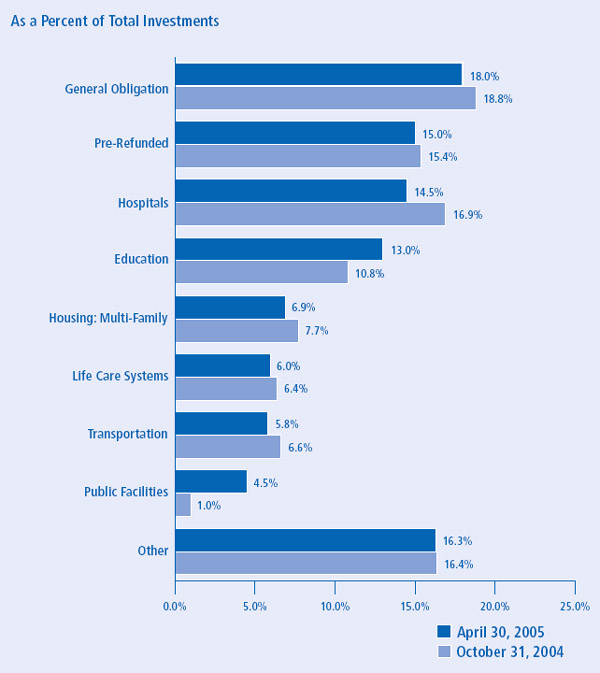

| Pre-Refunded (f) — 15.1% | | | |

| $ | 500,000 | | AA- | Clackamas County GO, Canby School District No. 86, School | | | |

| | | | | Board Guaranty, (Call 6/15/10 @100), 5.250% due 6/15/20 | $ | 550,460 | |

| | 360,000 | | AA- | Clackamas County, Service District No. 1, Sewer Revenue, | | | |

| | | | | (Call 10/1/06 @100), 6.375% due 10/1/14 | | 378,252 | |

| | 300,000 | | Aaa* | Deschutes County GO, Administrative School District No. 1, | | | |

| | | | | Series A, FSA-School Board Guaranty, Series A, | | | |

| | | | | (Call 6/15/11 @ 100), 5.500% due 6/15/18 | | 337,851 | |

| | 500,000 | | AAA | Jackson County GO, Central Point School District No. 6, | | | |

| | | | | FGIC-School Board Guaranty, (Call 6/15/10 @ 100), | | | |

| | | | | 5.250% due 6/15/20 | | 550,460 | |

| | 1,000,000 | | AAA | Klamath Falls Wastewater Revenue, AMBAC-Insured, | | | |

| | | | | (Call 6/1/10 @ 100), 5.500% due 6/1/25 (c) | | 1,113,370 | |

| | | | | Lane County GO: | | | |

| | 500,000 | | AAA | Bethel School District No. 52, FGIC-Insured, | | | |

| | | | | (Call 12/1/06 @ 100), 6.400% due 12/1/09 | | 528,165 | |

| | 500,000 | | Aaa* | Multnomah-Clackamas Counties GO, Centennial School District | | | |

| | | | | No. 28-302, FGIC-School Board Guaranty, | | | |

| | | | | (Call 6/15/11 @100), 5.000% due 6/15/21 | | 549,310 | |

| | 500,000 | | AA- | Multnomah County GO, Reynolds School District No. 7, School | | | |

| | | | | Board Guaranty, (Call 6/15/11 @ 100), 5.125% due 6/15/20 | | 552,755 | |

| | 500,000 | | AAA | Oregon State Department of Administrative Services, COP, | | | |

| | | | | Series A, AMBAC-Insured, (Call 5/1/10 @ 101), | | | |

| | | | | 6.250% due 5/1/17 (g) | | 577,360 | |

| | | | | Oregon State Department of Transportation, Highway User | | | |

| | | | | Tax Revenue: | | | |

| | 500,000 | | AA+ | Call 11/15/12 @ 100, 5.375% due 11/15/20 | | 556,325 | |

| | | | | Series A: | | | |

| | 1,000,000 | | AA+ | Call 11/15/12 @ 100, 5.500% due 11/15/18 (c) | | 1,143,470 | |

| | 1,000,000 | | AA+ | Call 11/15/12 @ 100, 5.500% due 11/15/20 (c) | | 1,143,470 | |

| | 500,000 | | AA+ | Tri-County Metropolitan Transportation District Oregon Revenue, | | | |

| | | | | Series A, (Call 8/1/10 @ 100), 5.375% due 8/1/20 | | 554,615 | |

| | 500,000 | | Aaa* | Washington County GO, Forest Grove School District No. 15, | | | |

| | | | | FSA-School Board Guaranty, (Call 6/15/11 @100), | | | |

| | | | | 5.000% due 6/15/21 | | 549,310 | |

|

| | | | | | | 9,085,173 | |

|

| Public Facilities — 4.5% | | | |

| | 500,000 | | AAA | Oregon State Bond Bank Revenue, Economic & Community | | | |

| | | | | Development Department, Series B, MBIA-Insured, | | | |

| | | | | 5.500% due 1/1/26 | | 537,640 | |

| | | | | Oregon State Department of Administrative Services, FSA-Insured, | | | |

| | | | | Series A: | | | |

| | 1,000,000 | | AAA | COP, 5.000% due 5/1/30 | | 1,049,730 | |

| | 1,025,000 | | AAA | Lottery Revenue, Refunding, 5.000% due 4/1/15 (c) | | 1,127,756 | |

|

| | | | | | | 2,715,126 | |

|