irpresentation88

1

Investor Presentation Trading Symbol | HTLF www.htlf.com

Lynn B. Fuller Chairman, President and CEO John K. Schmidt Chief Operating Officer Chief Financial Officer

Safe Harbor

This presentation may contain, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information currently available to management, are generally identifiable by the use of words such as believe, expect, anticipate, plan, intend, estimate, may, will, would, could, should or similar expressions. Additionally, all statements in this release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following: (i) the strength of the local and national economy; (ii) the economic impact of past and any future terrorist threats and attacks and any acts of war or threats thereof, (iii) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (iv) changes in interest rates and prepayment rates of the Company’s assets; (v) increased competition in the financial services sector and the inability to attract new customers; (vi) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (vii) the loss of key executives or employees; (viii) changes in consumer spending; (ix) unexpected results of acquisitions; (x) unexpected outcomes of existing or new litigation involving the Company; and (xi) changes in accounting policies and practices. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including other factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission.

2

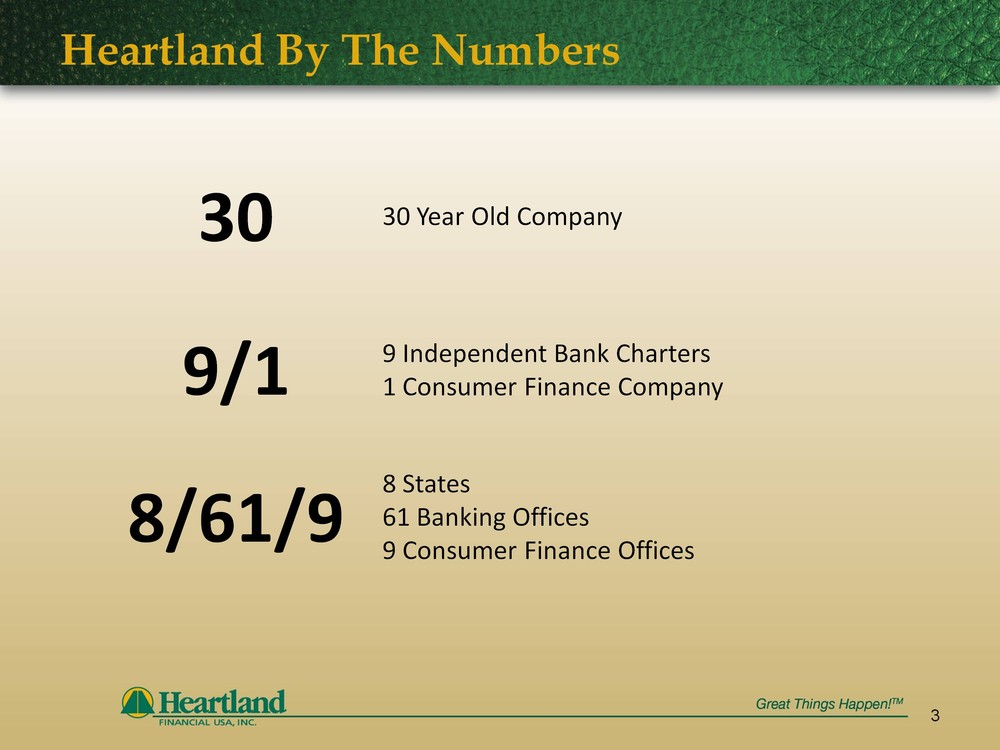

Heartland By The Numbers

3

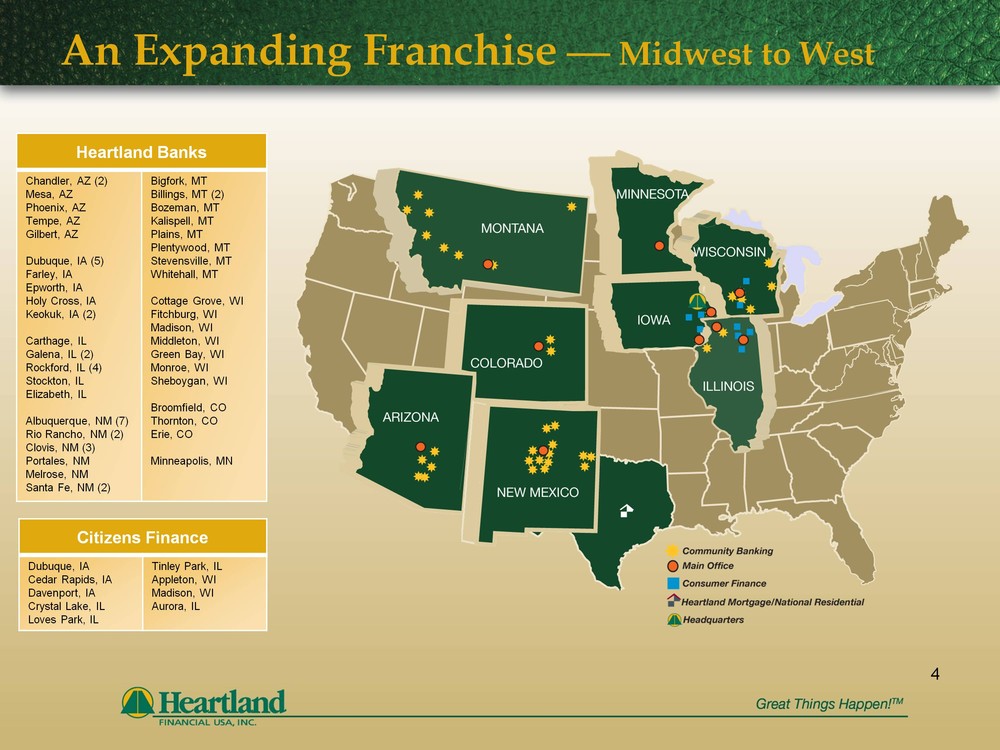

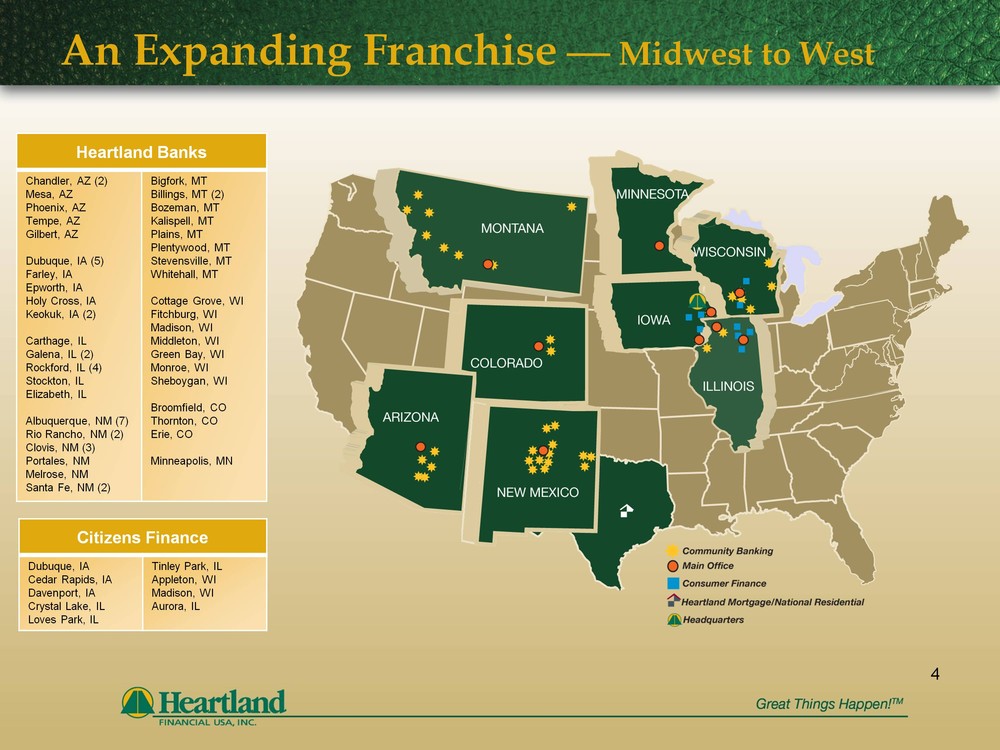

An Expanding Franchise Midwest to West

4

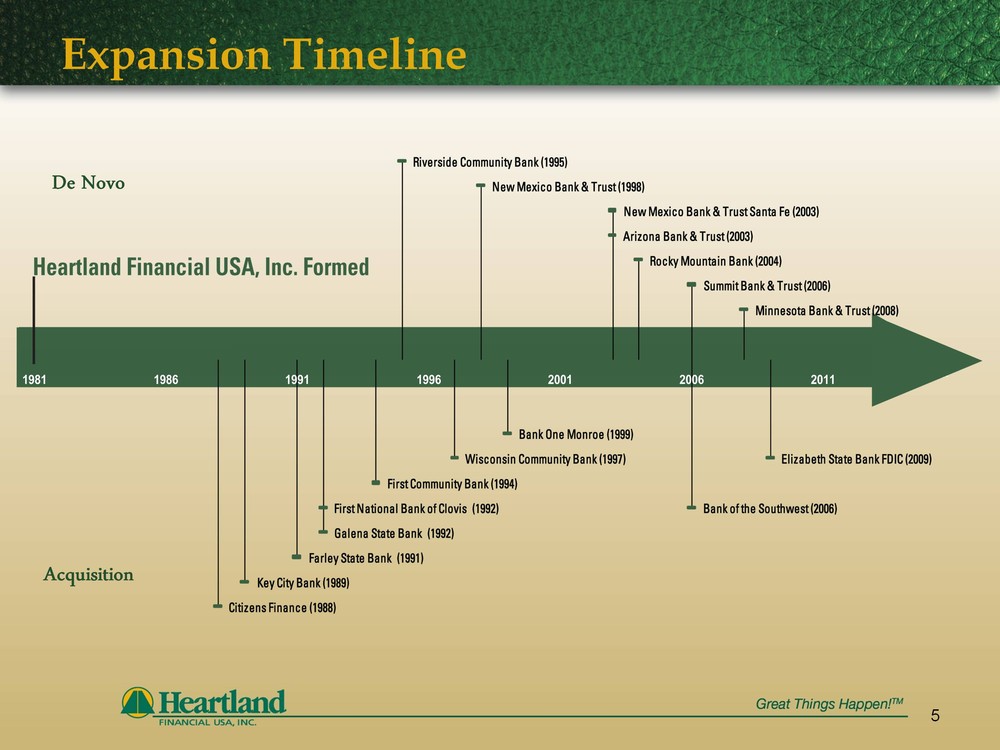

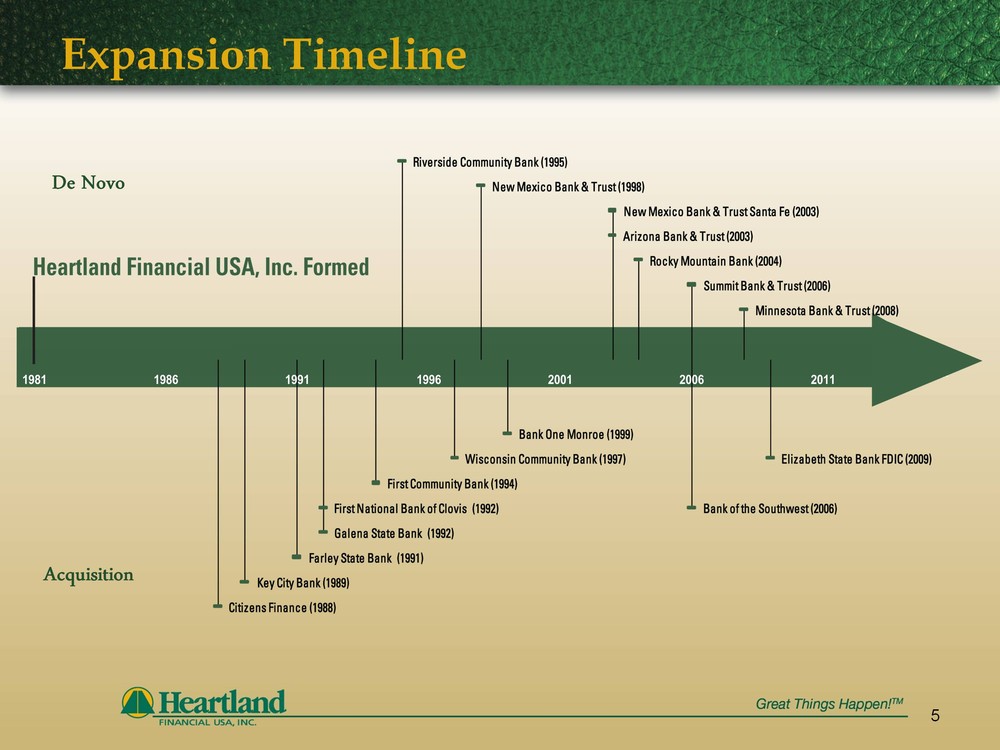

Expansion Timeline

5

De Novo

Acquisition

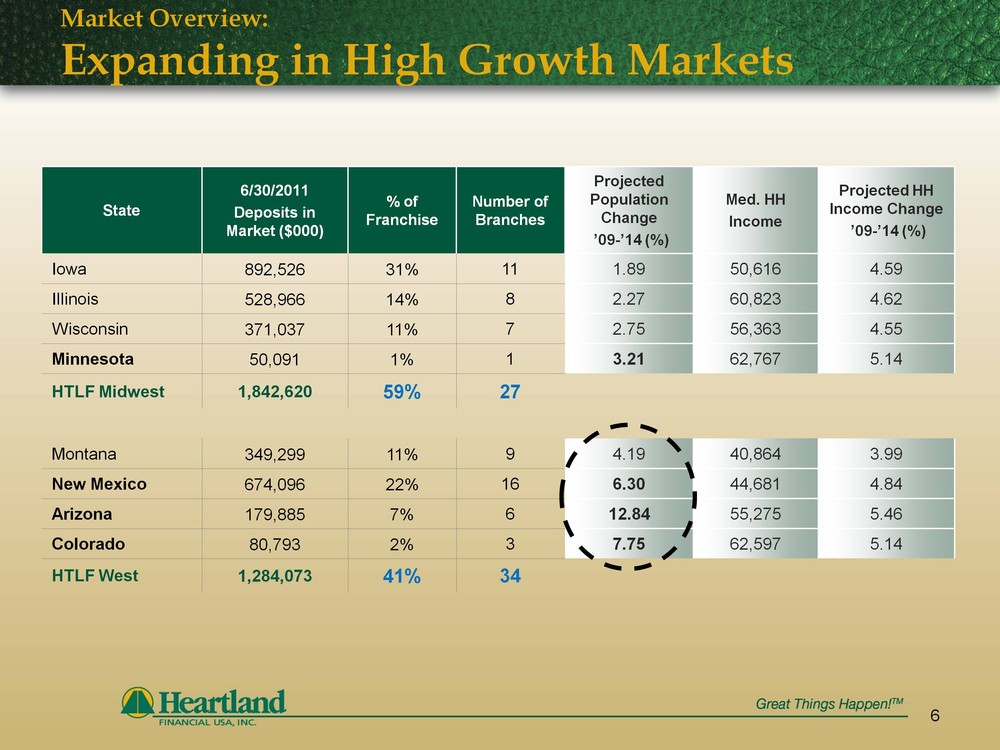

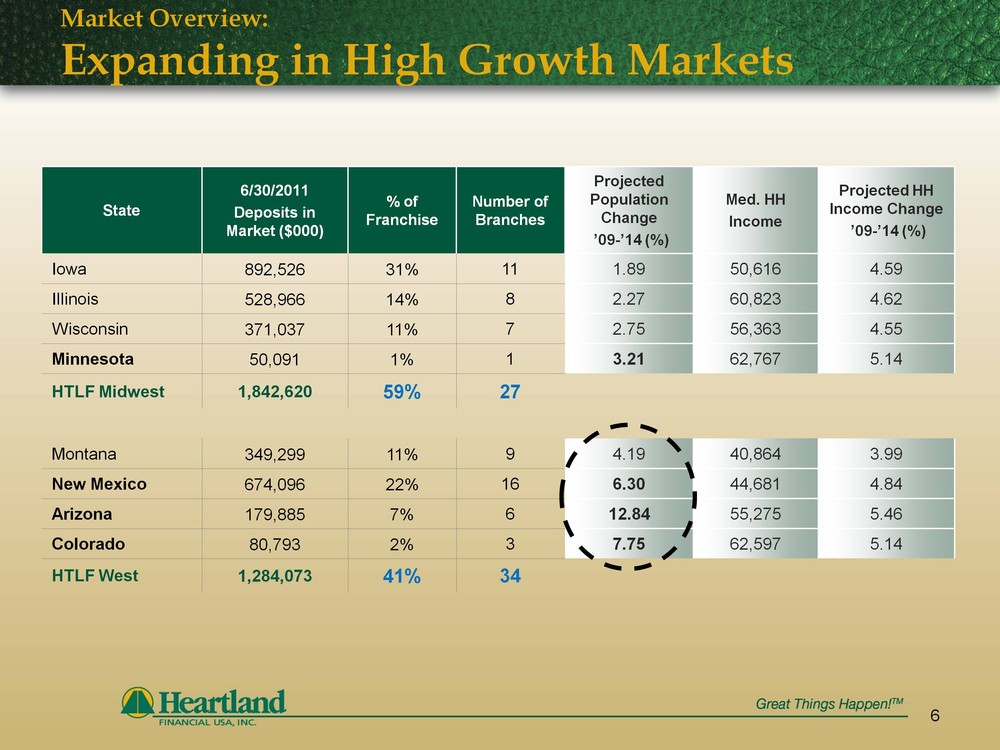

Market Overview: Expanding in High Growth Markets

6

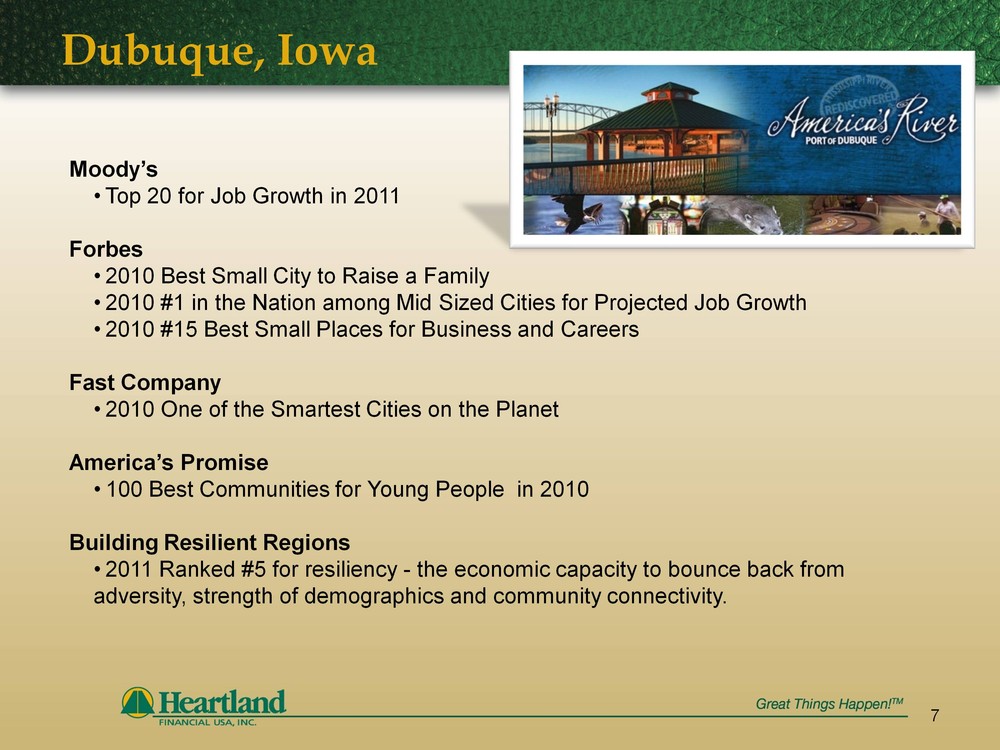

Dubuque, Iowa

Moody’s Top 20 for Job Growth in 2011 Forbes 2010 Best Small City to Raise a Family 2010 #1 in the Nation among Mid Sized Cities for Projected Job Growth 2010 #15 Best Small Places for Business and Careers Fast Company 2010 One of the Smartest Cities on the Planet America’s Promise 100 Best Communities for Young People in 2010 Building Resilient Regions 2011 Ranked #5 for resiliency - the economic capacity to bounce back from adversity, strength of demographics and community connectivity.

7

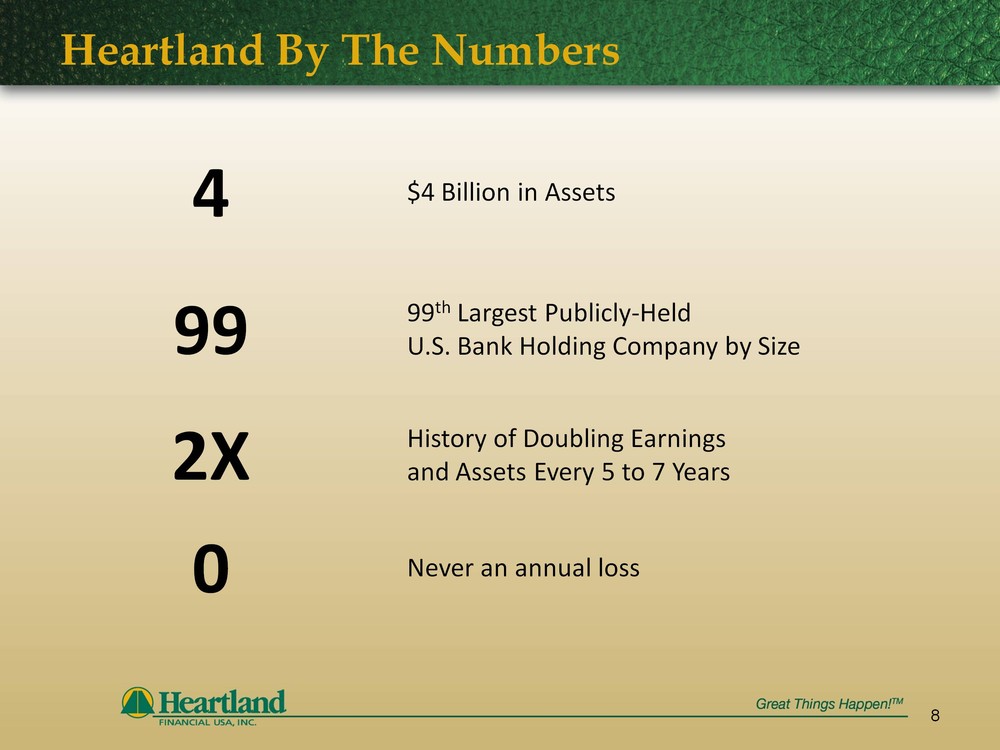

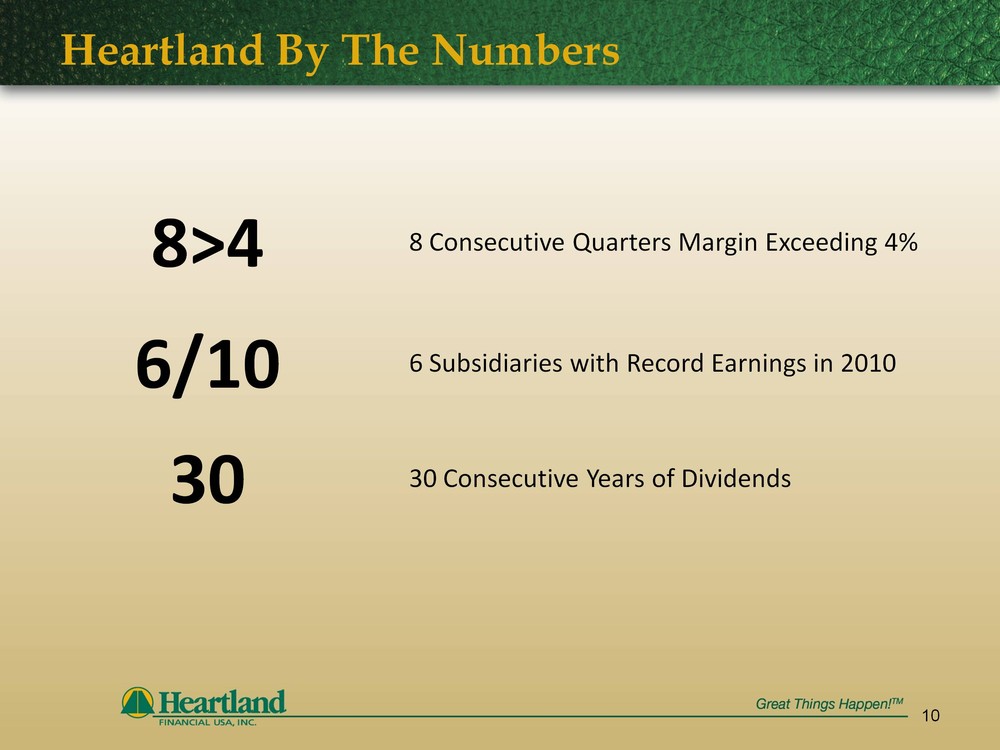

Heartland By The Numbers

8

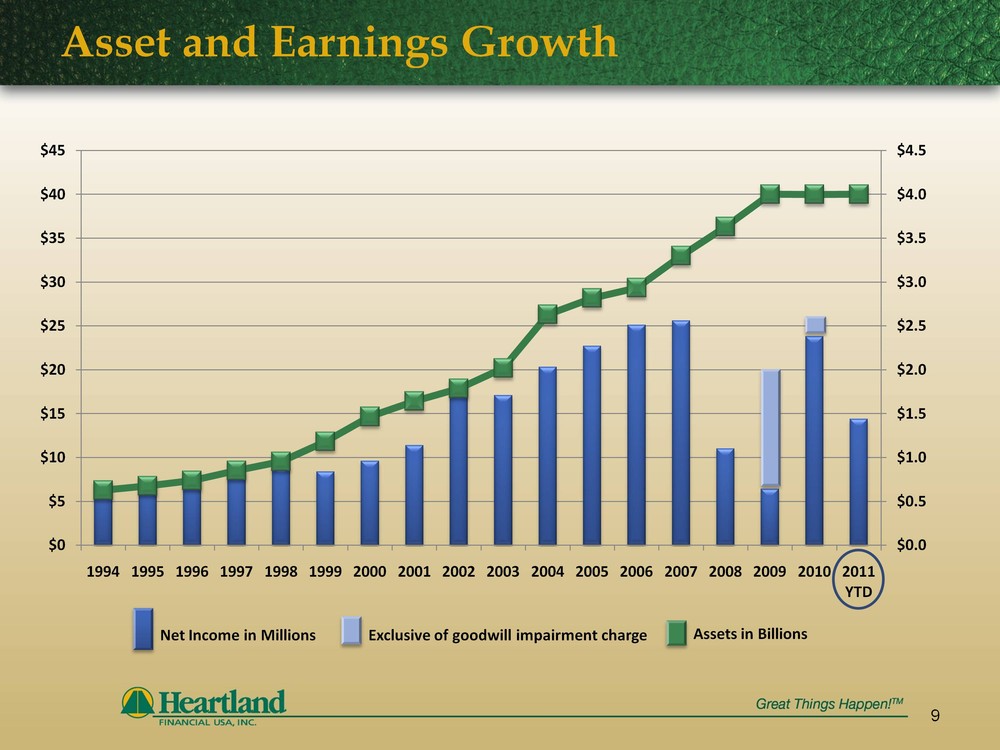

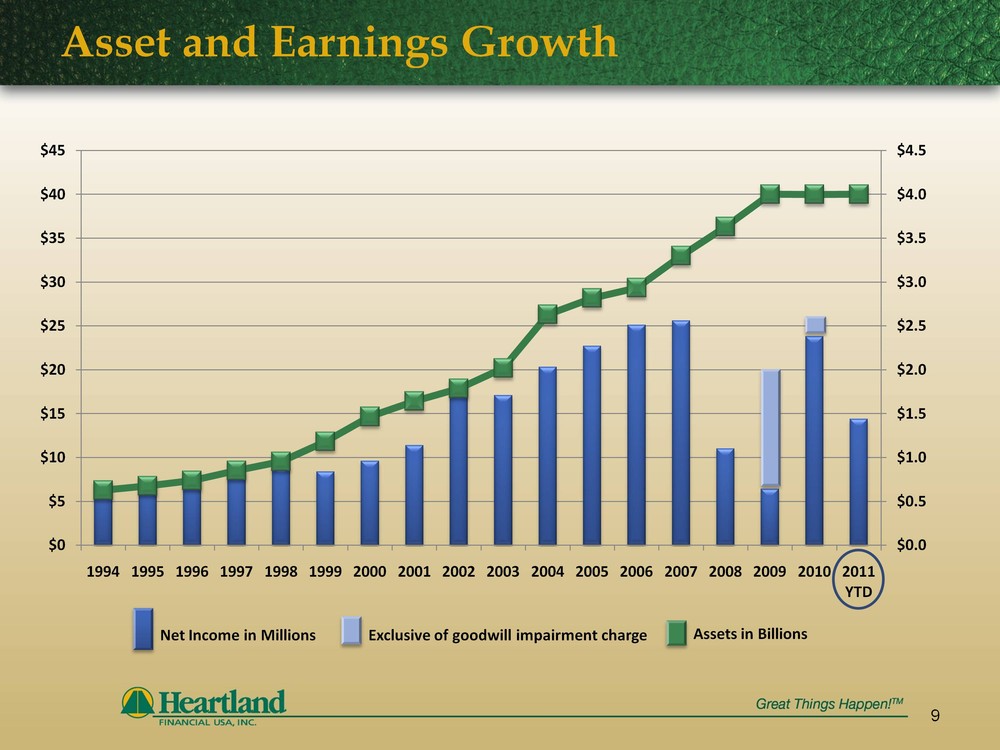

Asset and Earnings Growth

9

Heartland By The Numbers

10

History of Continuous Dividends

GOAL: 20%-30% Dividend Payout 1.5 %– 3.0% Dividend Yield

$0.28

$0.21

25% Change

$0.40

$0.40

As of December 31, 2010

30% Change

11

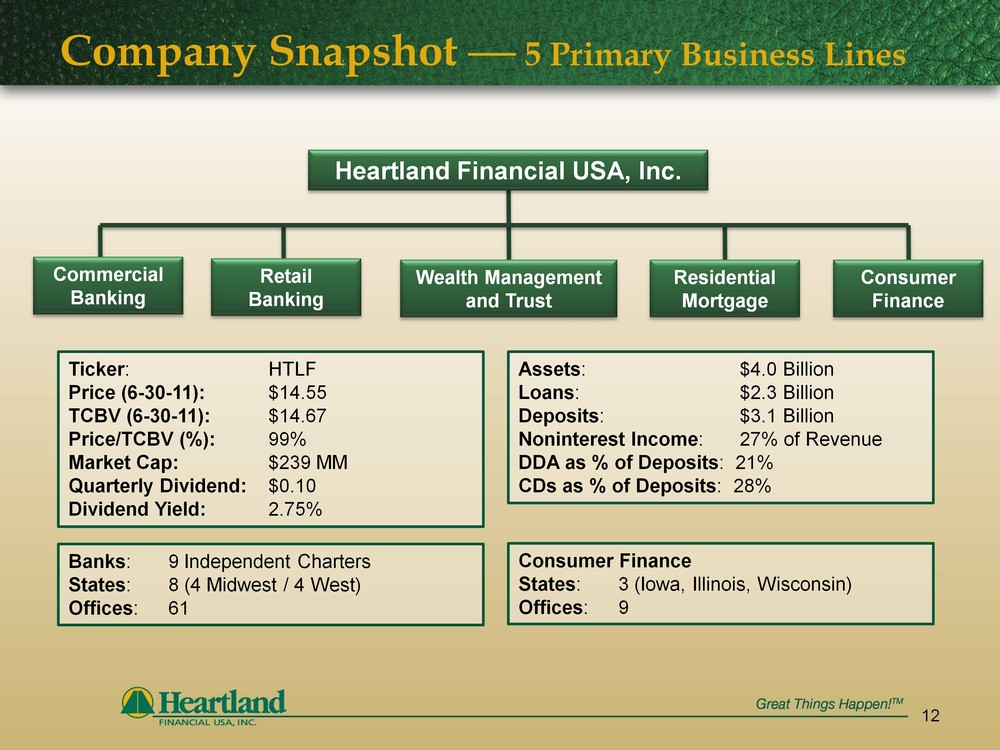

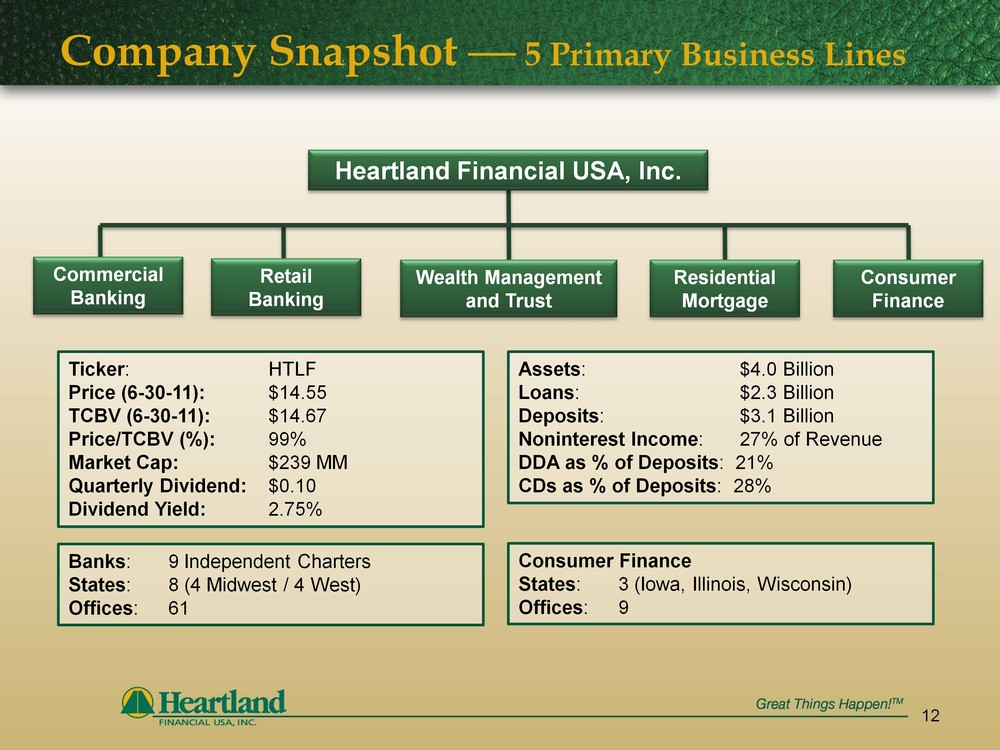

Company Snapshot 5 Primary Business Lines

Heartland Financial USA, Inc.

Commercial Banking

Retail Banking

Wealth Management and Trust

Consumer Finance

Residential Mortgage

Ticker: HTLF Price (6-30-11): $14.55 TCBV (6-30-11): $14.67 Price/TCBV (%): 99% Market Cap: $239 MM Quarterly Dividend: $0.10 Dividend Yield: 2.75%

Assets: $4.0 Billion Loans: $2.3 Billion Deposits: $3.1 Billion Noninterest Income: 27% of Revenue DDA as % of Deposits: 21% CDs as % of Deposits: 28%

Banks: 9 Independent Charters States: 8 (4 Midwest / 4 West) Offices: 61

Consumer Finance States: 3 (Iowa, Illinois, Wisconsin) Offices: 9

12

Primary Target Markets

Personal Accounts of Owners and Executives Employees of the Business Retail Accounts from Immediate Area

13

Three Core Pillars of Success

14

Highly Empowered, High-Touch Local Bank Delivery

Deeply rooted local leadership and boards Local decision-making Invested in local expertise Local brands and independent charters Commitment to exceptional experience, relationship building and value added delivery at competitive prices

Extensive Resources for Revenue Enhancement

Expanded commercial and retail products with focus on government guaranteed lending and treasury management Extensive “value menu” inclusive of wealth management, investment, insurance, leasing, mortgage and consumer financing Unique approach to consultative relationship building Highly trained and experienced staff

Customer--Transparent Backroom Cost Savings

Leading edge technology Efficient back-office support Leverage expertise across all banks gaining economies of scale Utilize best practices

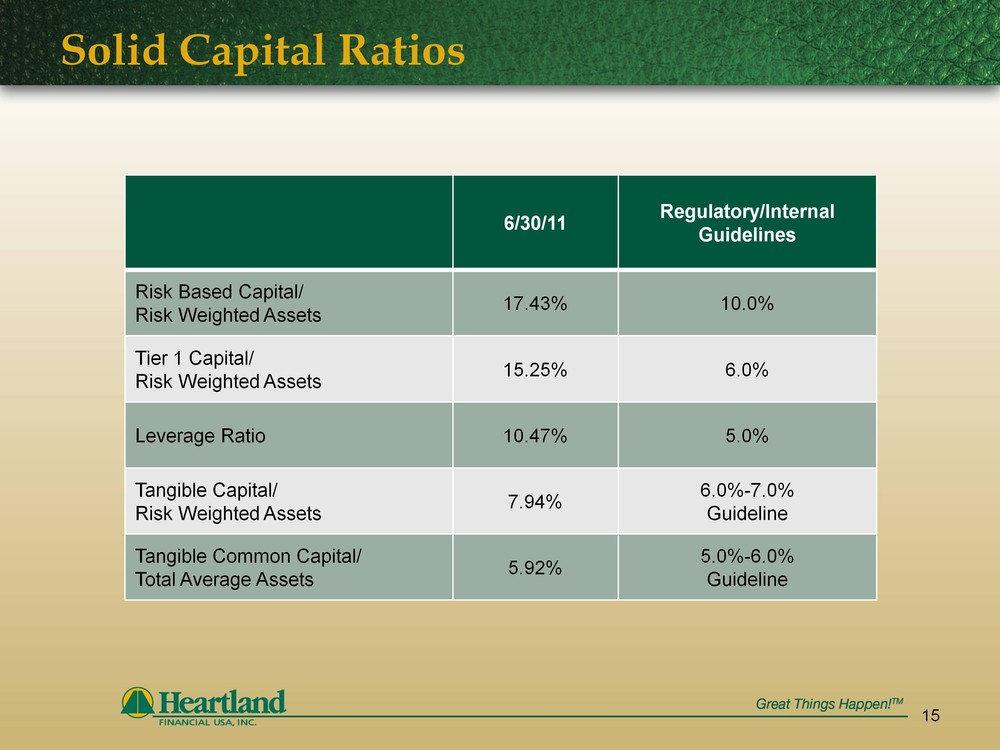

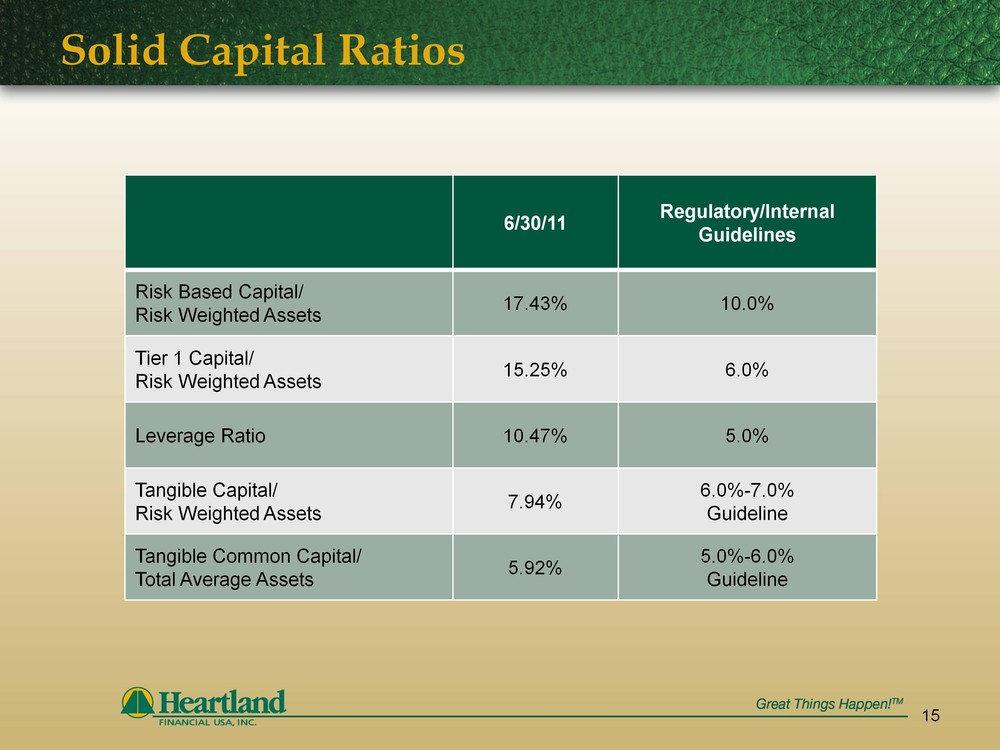

Solid Capital Ratios

15

Small Business Loan Fund

16

Application submitted Intend to pay off $81.7 million in TARP Vigorously pursuing loan growth Reduce the cost of non-common equity funding (TRUPS,TARP and other debt) currently fixed at 4.1% after tax

M & A

17

Opportunities abound across entire footprint Focus on expansion in existing markets to build scale IRR > 15% Commitment to shareholders for accretive transactions Improved share price will facilitate acquisitions

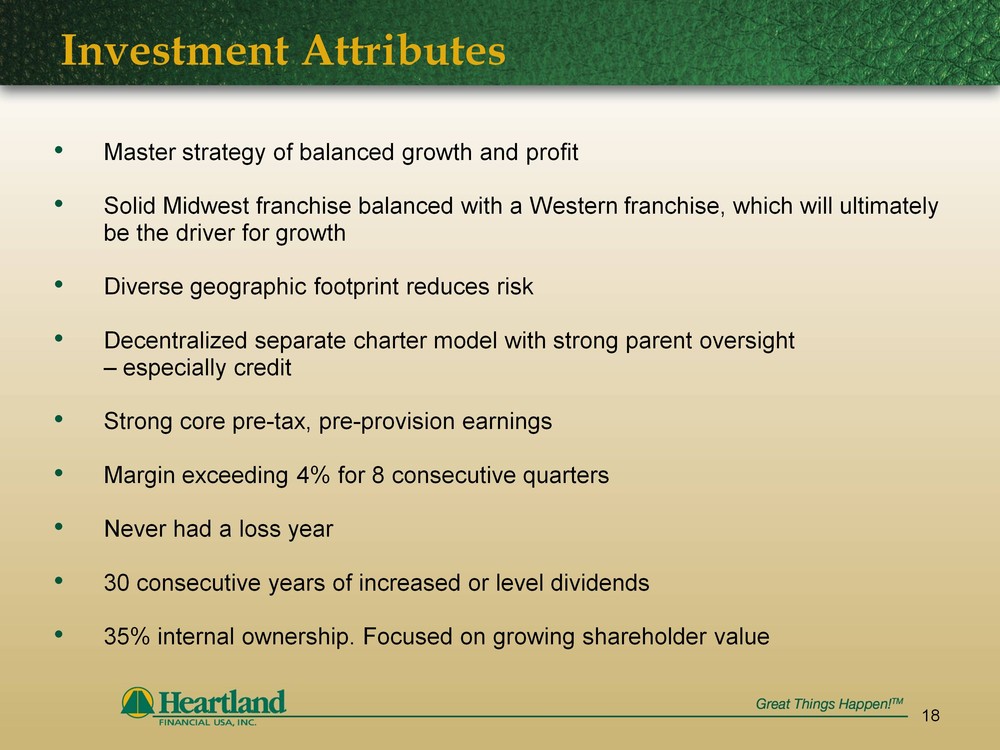

Investment Attributes

Master strategy of balanced growth and profit Solid Midwest franchise balanced with a Western franchise, which will ultimately be the driver for growth Diverse geographic footprint reduces risk Decentralized separate charter model with strong parent oversight – especially credit Strong core pre-tax, pre-provision earnings Margin exceeding 4% for 8 consecutive quarters Never had a loss year 30 consecutive years of increased or level dividends 35% internal ownership. Focused on growing shareholder value

18

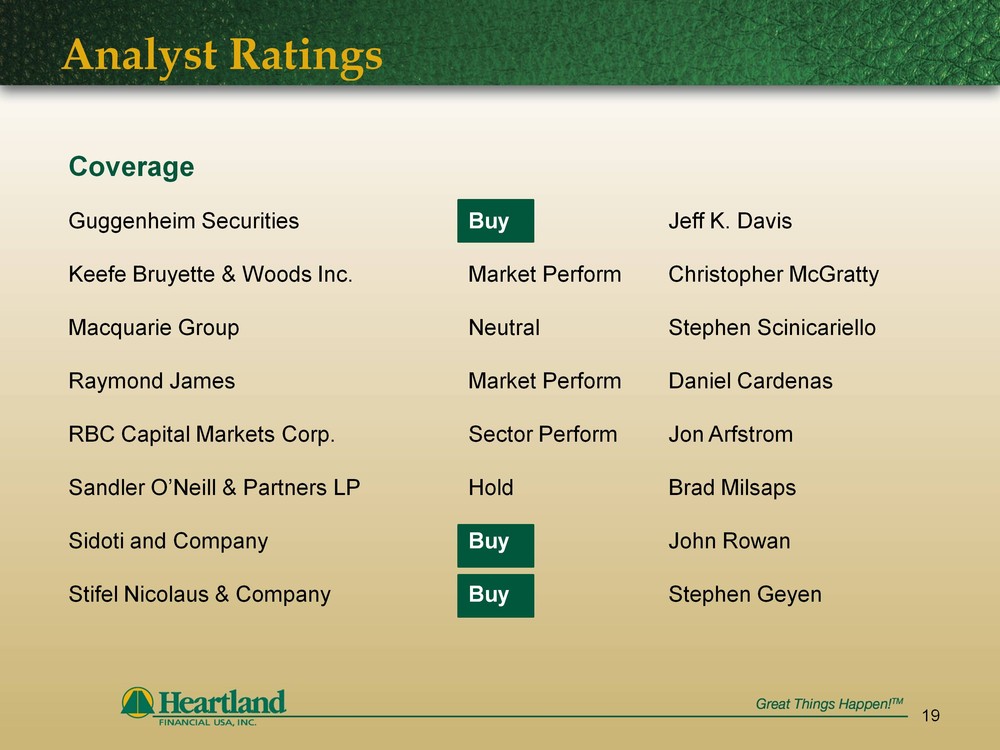

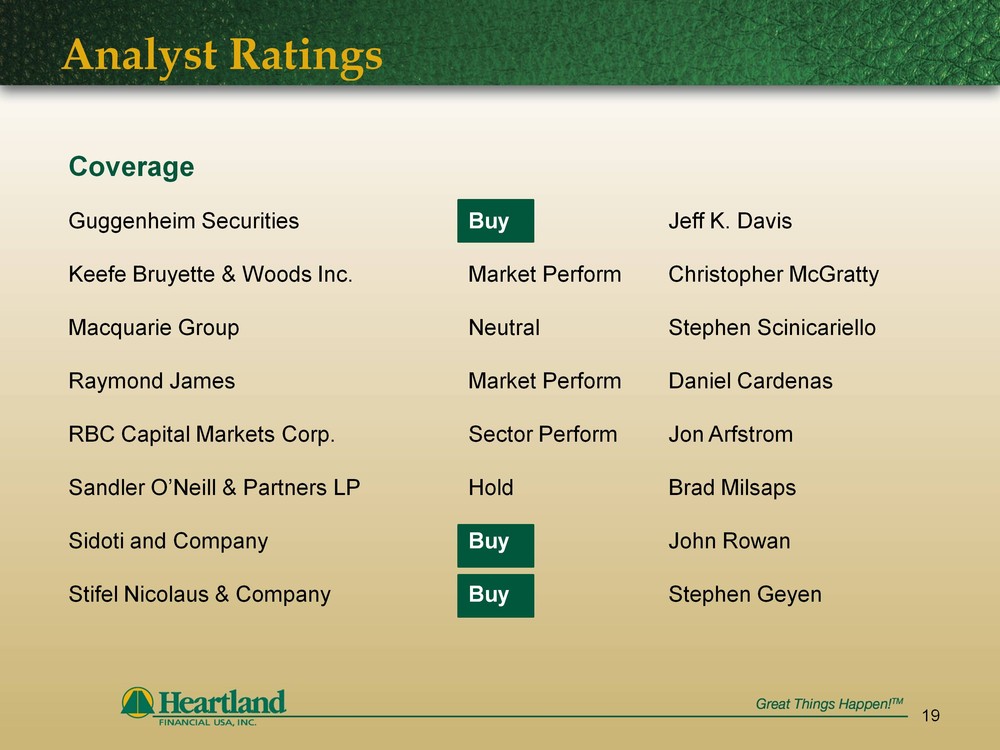

Analyst Ratings

Coverage Guggenheim Securities Buy Jeff K. Davis Keefe Bruyette & Woods Inc. Market Perform Christopher McGratty Macquarie Group Neutral Stephen Scinicariello Raymond James Market Perform Daniel Cardenas RBC Capital Markets Corp. Sector Perform Jon Arfstrom Sandler O’Neill & Partners LP Hold Brad Milsaps Sidoti and Company Buy John Rowan Stifel Nicolaus & Company Buy Stephen Geyen

19

Media Ratings

20

ABA Banking Journal Banking's Top Performers 2011, April Issue – “Banks, Savings Institutions and BHCs with Assets Over $3 Billion” Heartland ranked number 54 among 139 publicly-traded banks, thrifts and holding companies based on 2010 calendar year earnings. Bank Director Magazine Bank Performance Scorecard, Third Quarter 2011 Issue Heartland ranked number 105 among the 150 largest US publicly-traded banks and thrifts based on 2010 calendar year earnings.

21

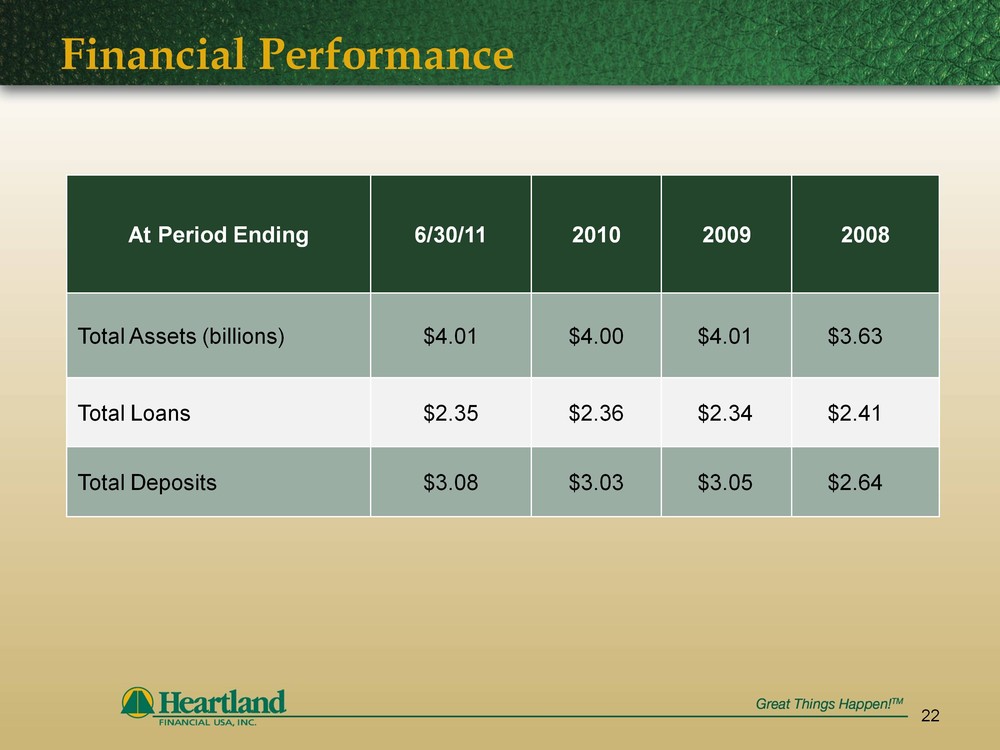

Financial Highlights

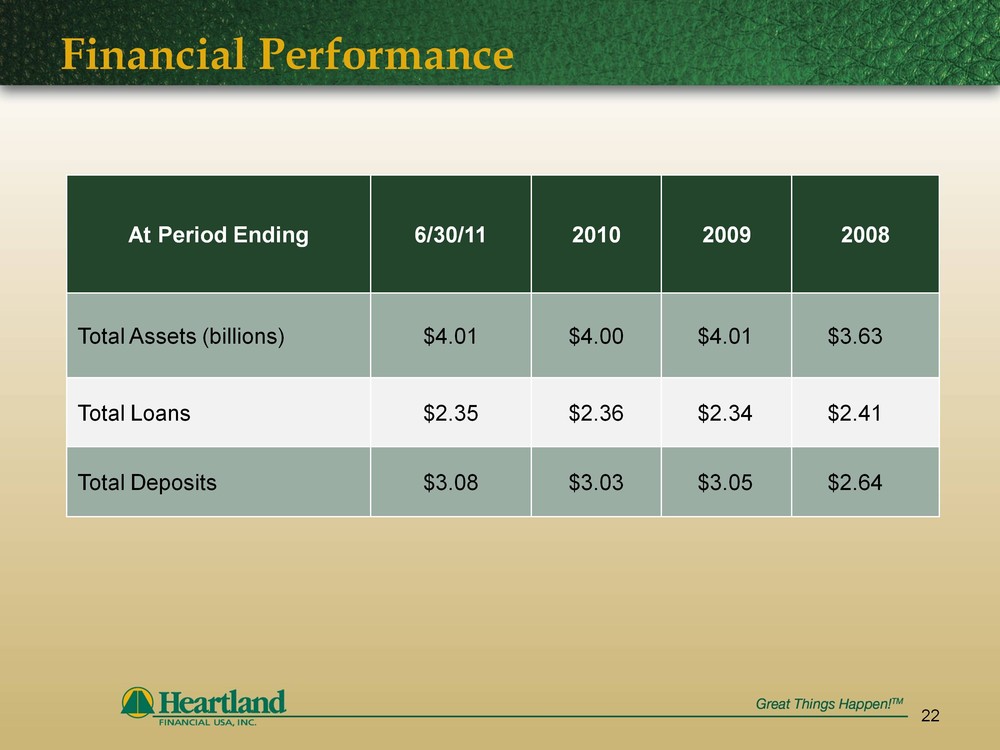

Financial Performance

22

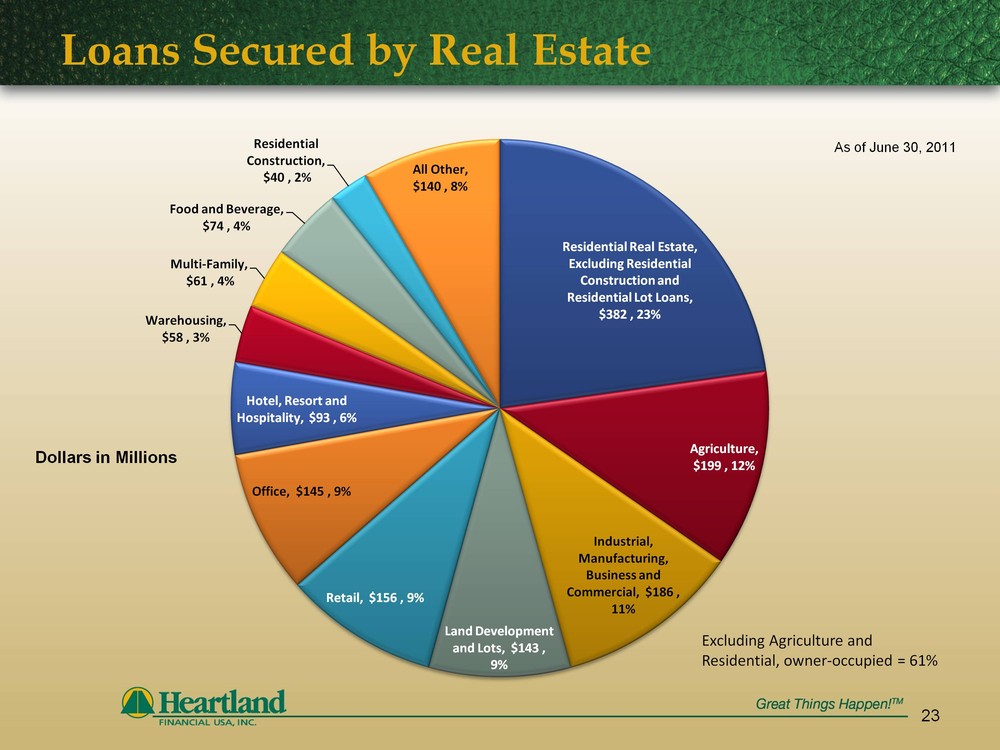

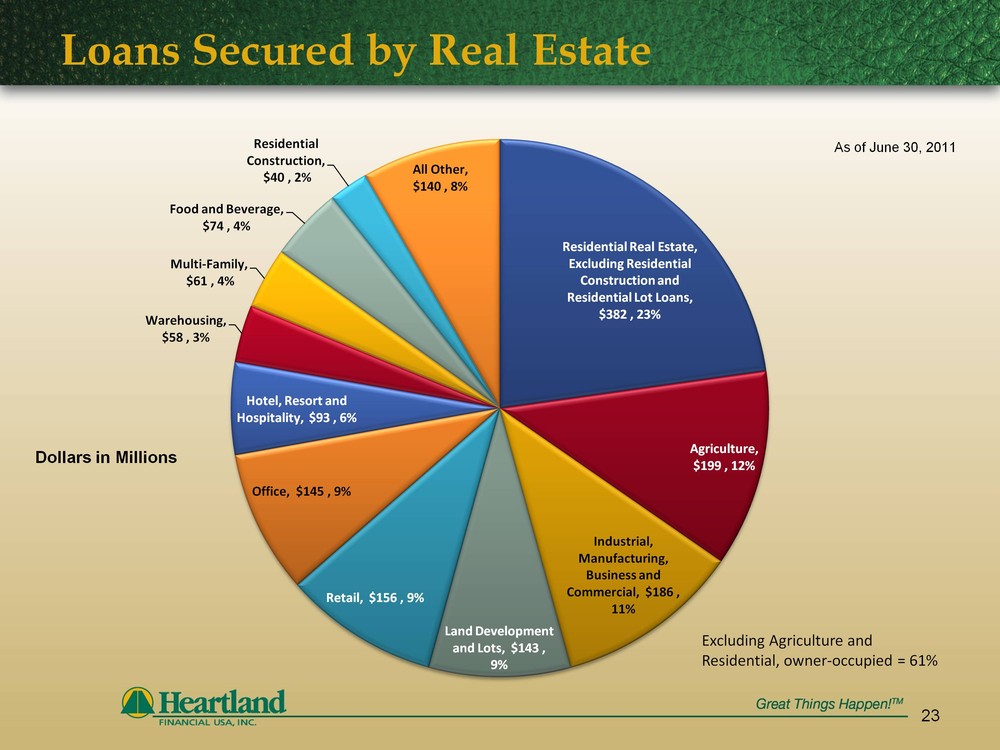

Loans Secured by Real Estate

23

Dollars in Millions

As of June 30, 2011

Excluding Agriculture and Residential, owner-occupied = 61%

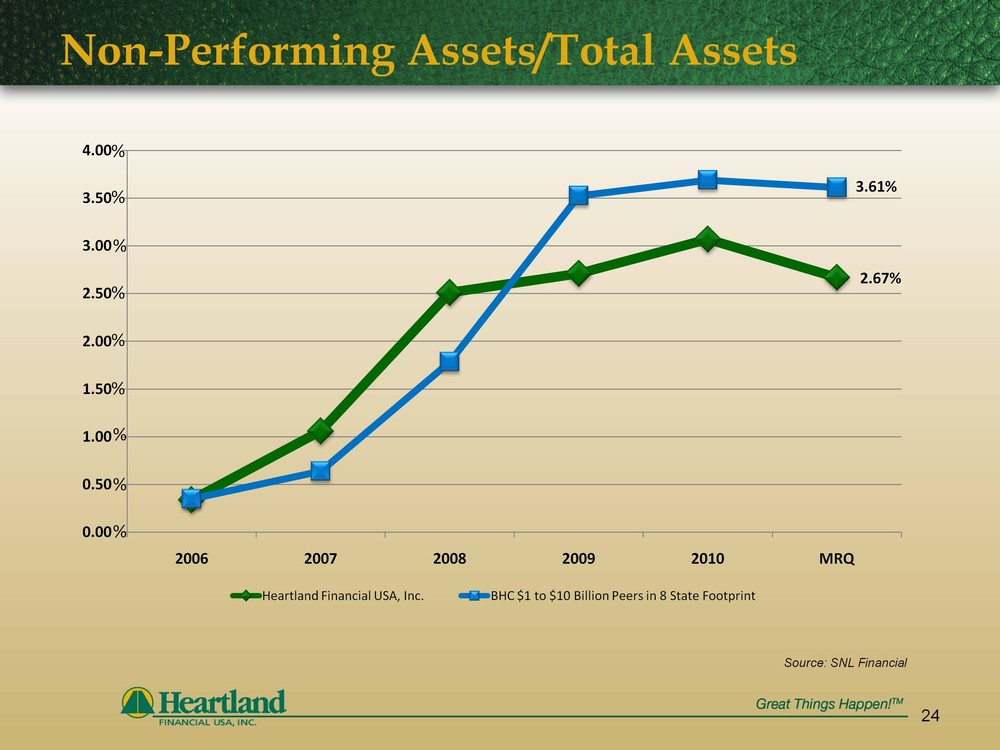

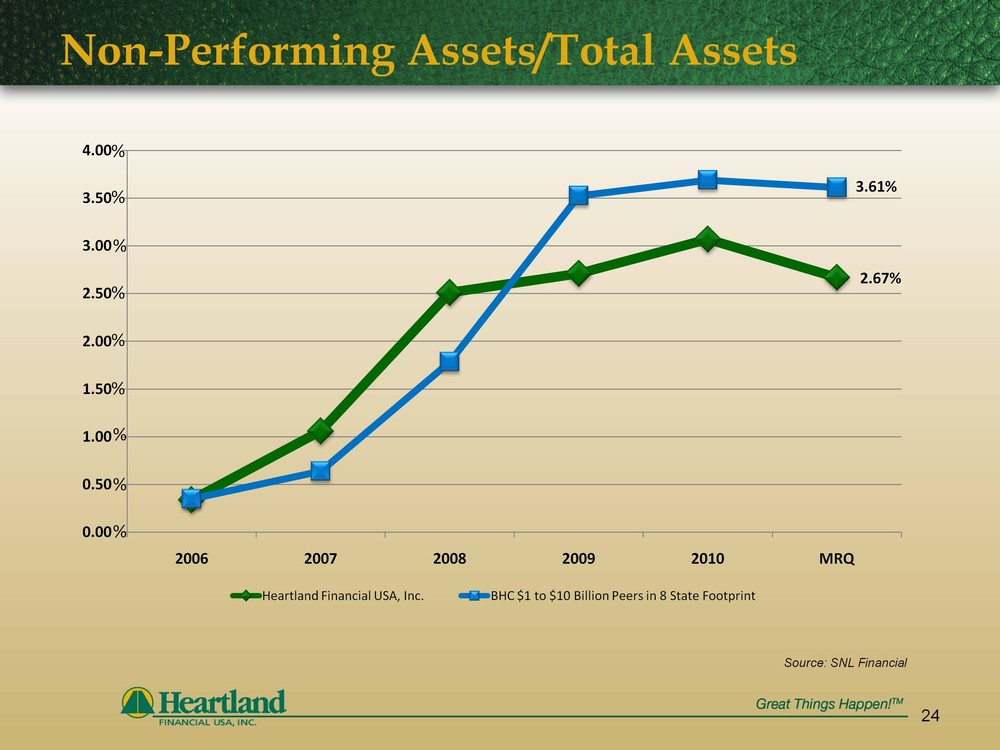

Non-Performing Assets/Total Assets

24

Source: SNL Financial

3.61%

2.67%

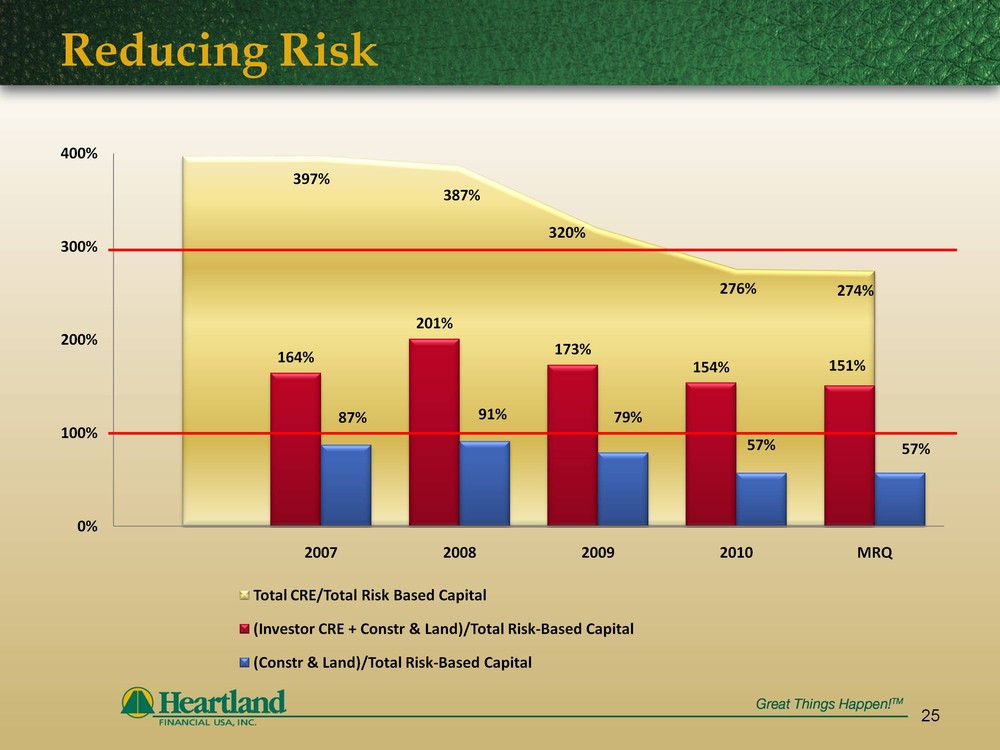

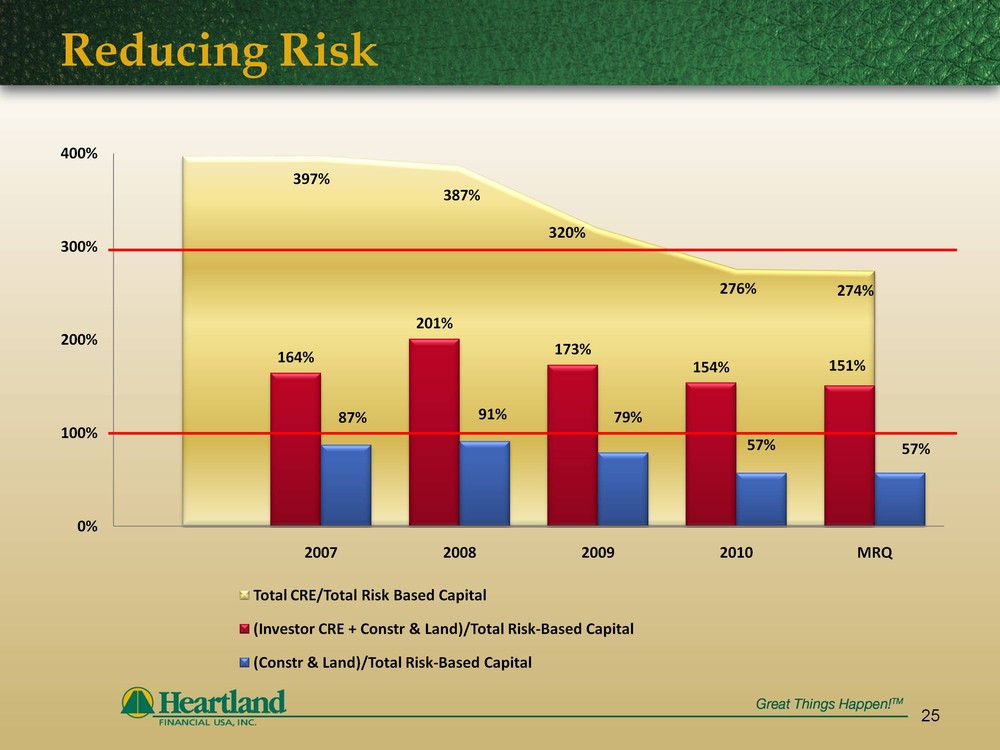

Reducing Risk

25

274%

151%

57%

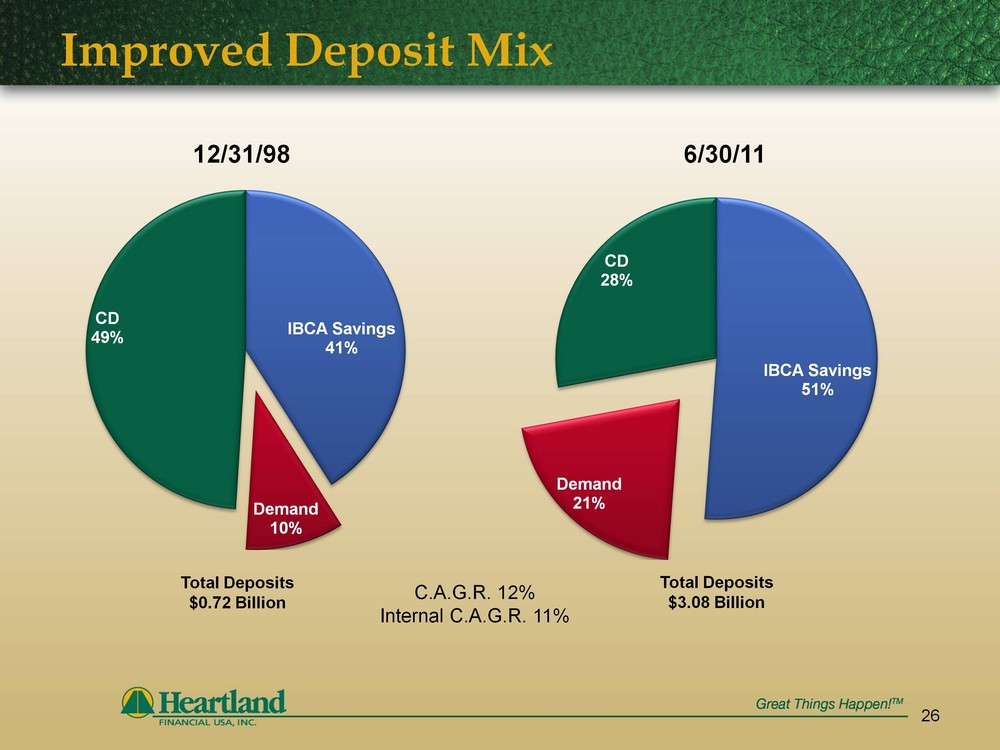

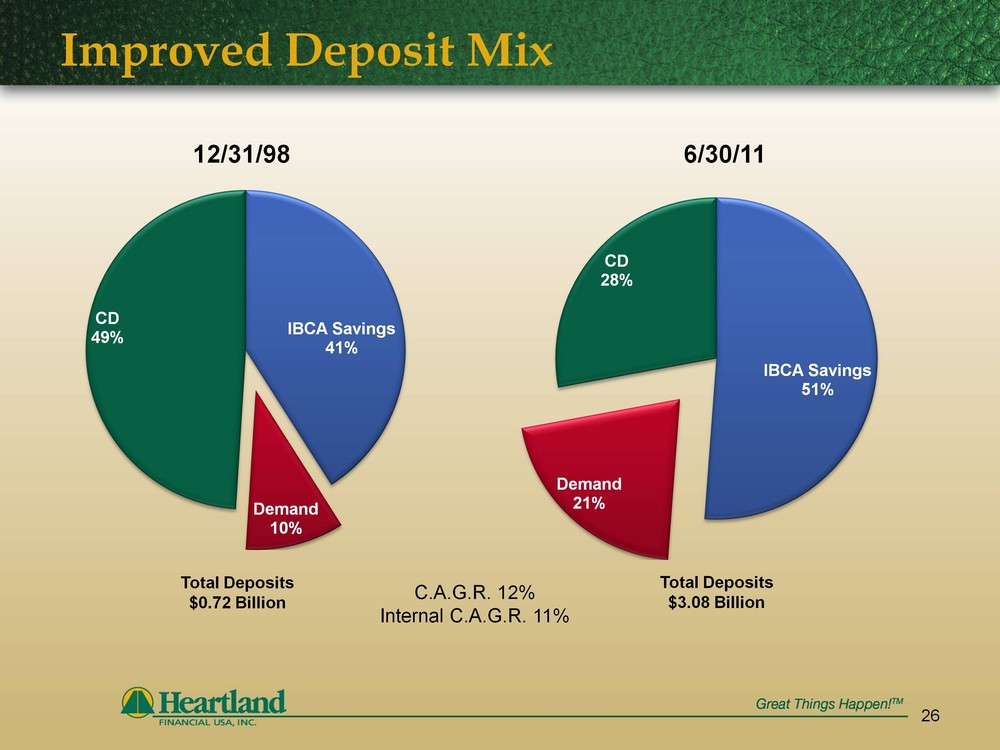

Improved Deposit Mix

Total Deposits $0.72 Billion

12/31/98

6/30/11

Total Deposits $3.08 Billion

C.A.G.R. 12% Internal C.A.G.R. 11%

26

Tangible Common Equity

27

% % % % % % % % %

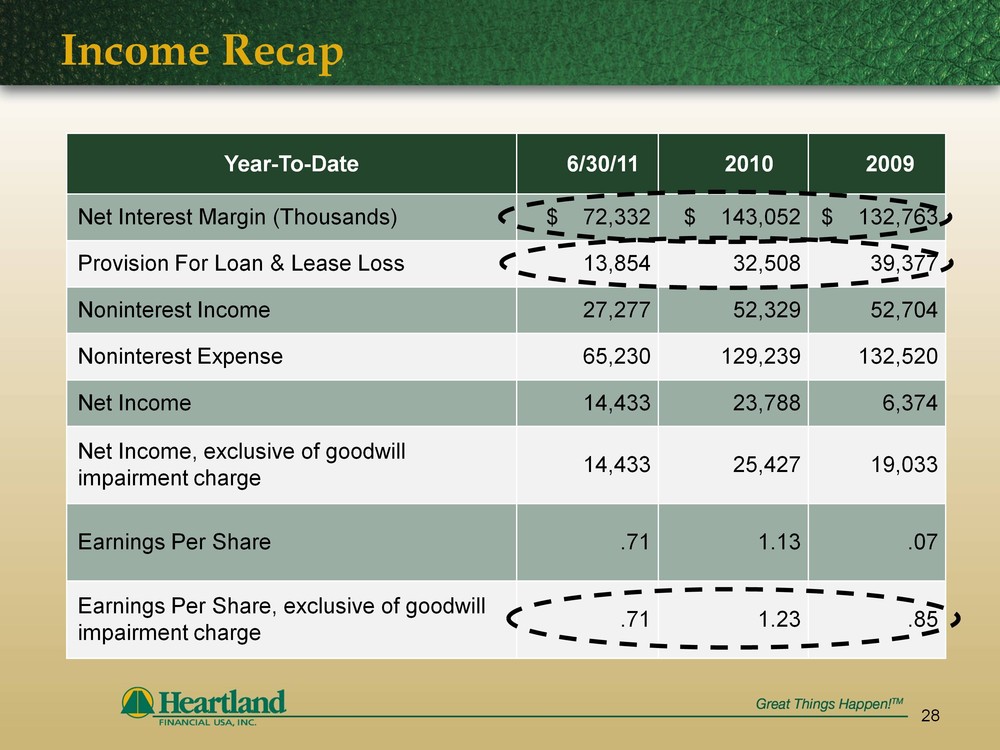

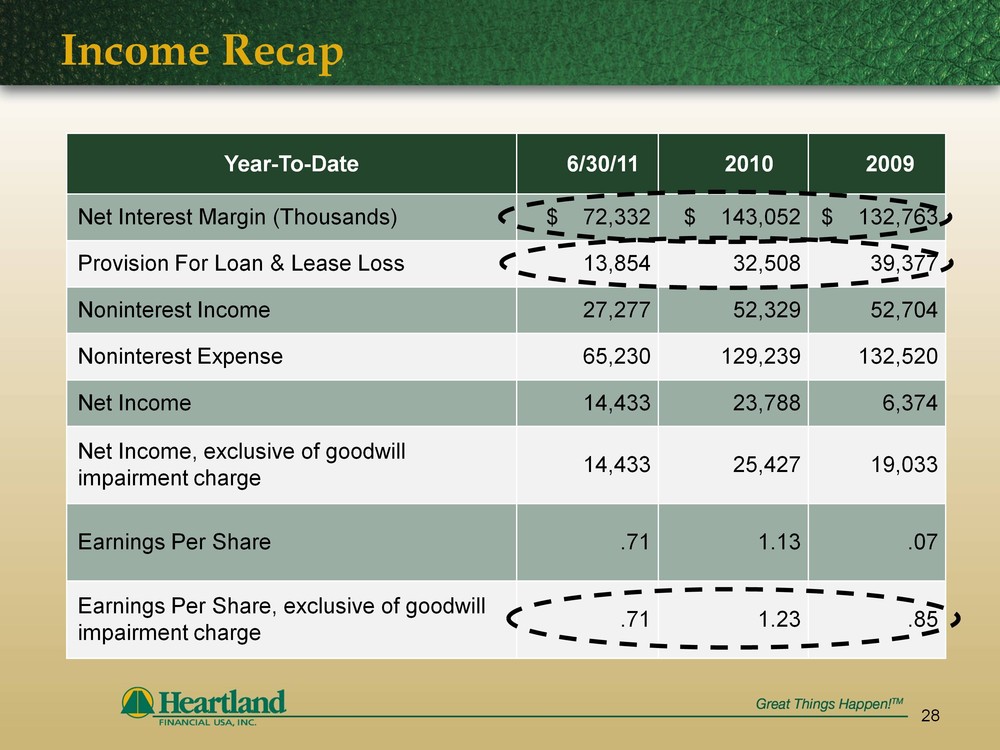

Income Recap

28

Net Interest Margin

29

Source: SNL Financial

4.23%

3.45%

Provision For Loan & Lease Losses

30

Q1 $10.0

Q2 $3.9

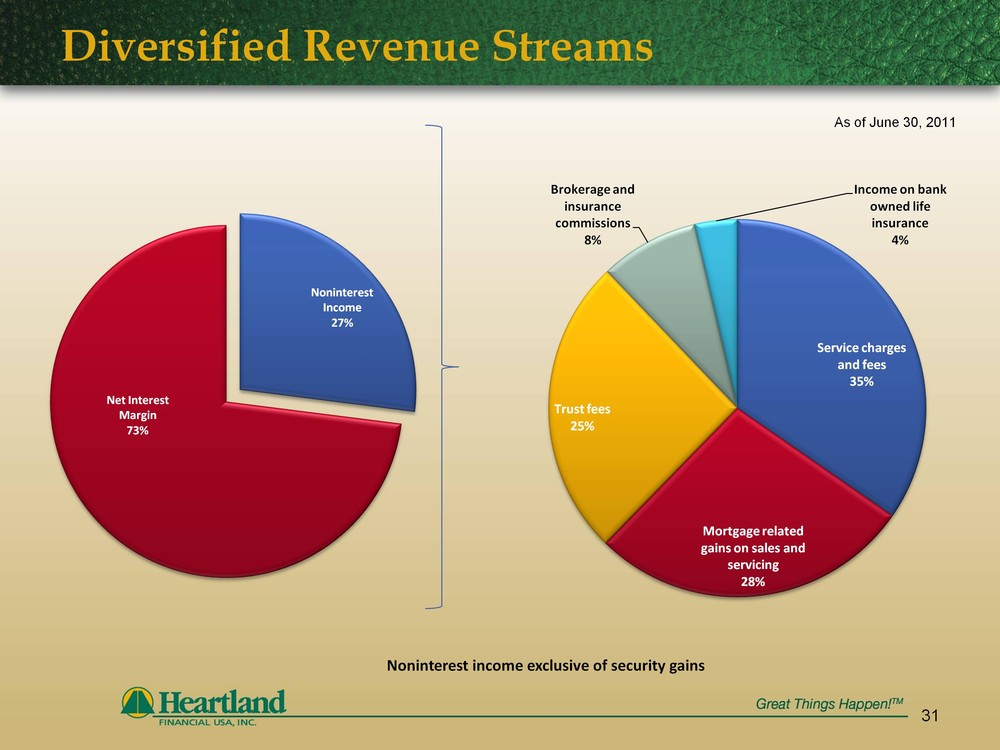

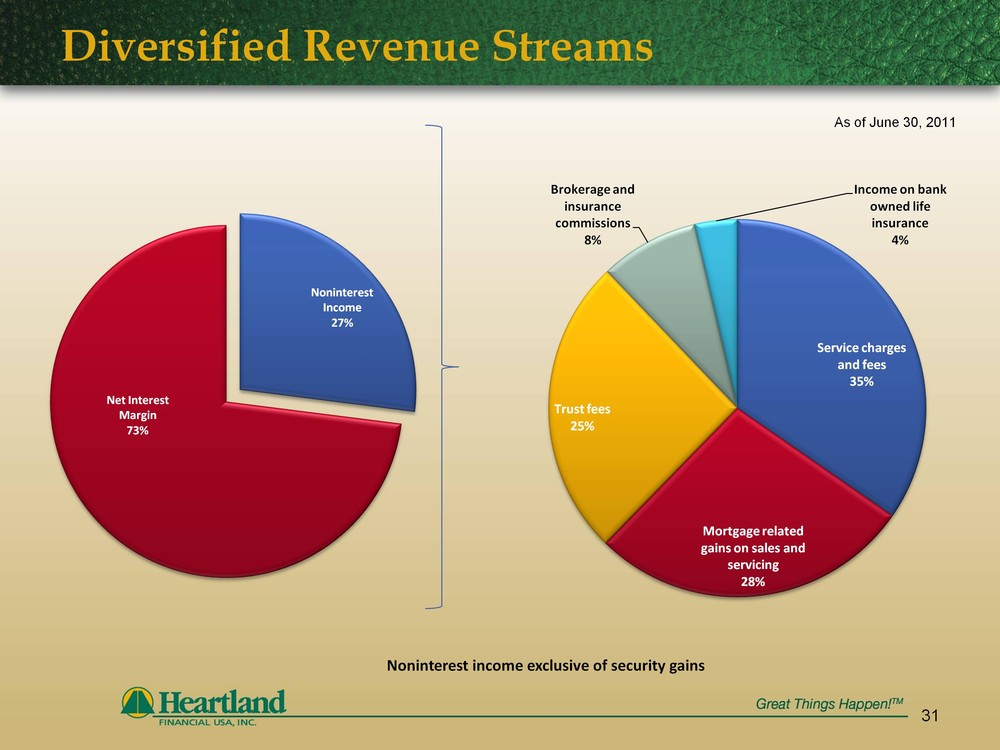

Diversified Revenue Streams

31

As of June 30, 2011

Noninterest income exclusive of security gains

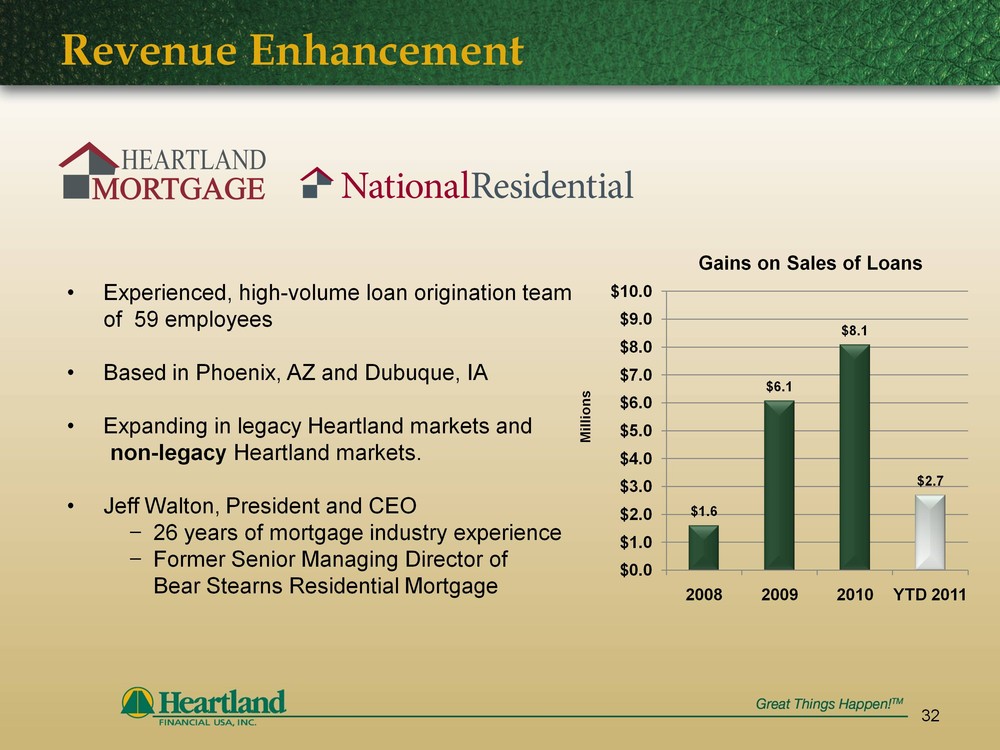

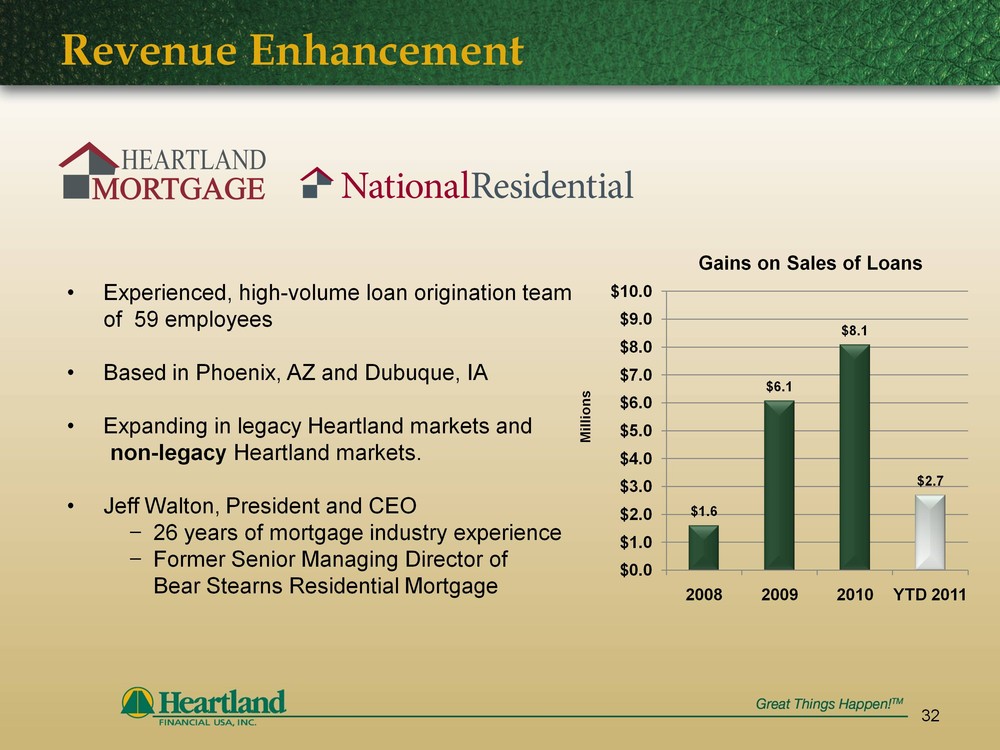

Revenue Enhancement

Experienced, high-volume loan origination team of 59 employees Based in Phoenix, AZ and Dubuque, IA Expanding in legacy Heartland markets and non-legacy Heartland markets. Jeff Walton, President and CEO 26 years of mortgage industry experience Former Senior Managing Director of Bear Stearns Residential Mortgage

32

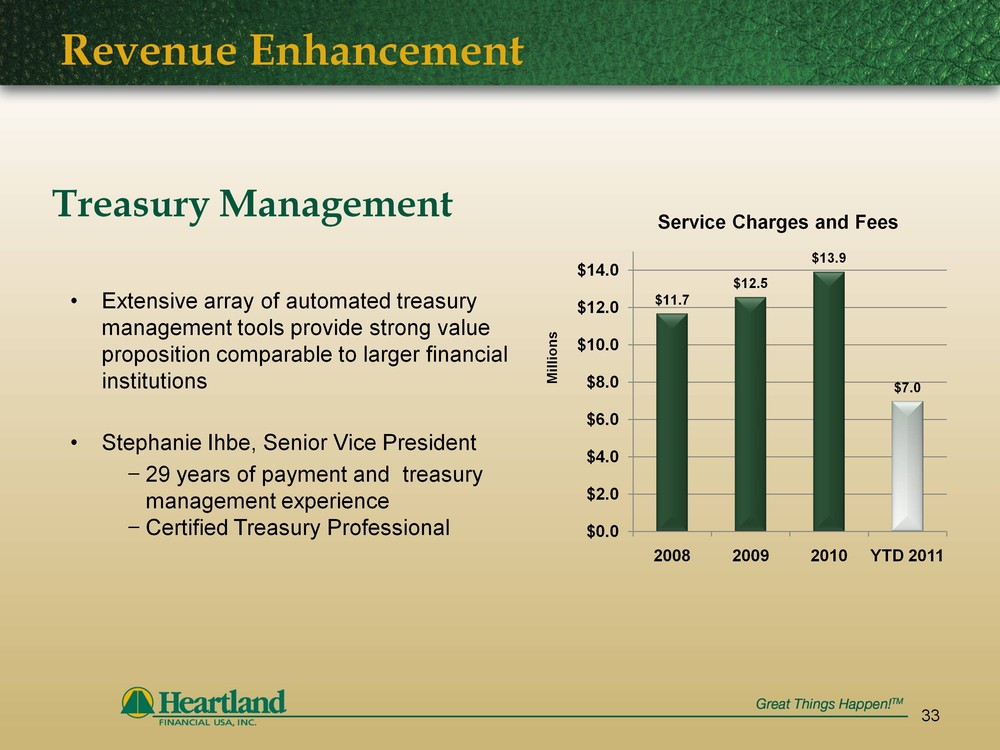

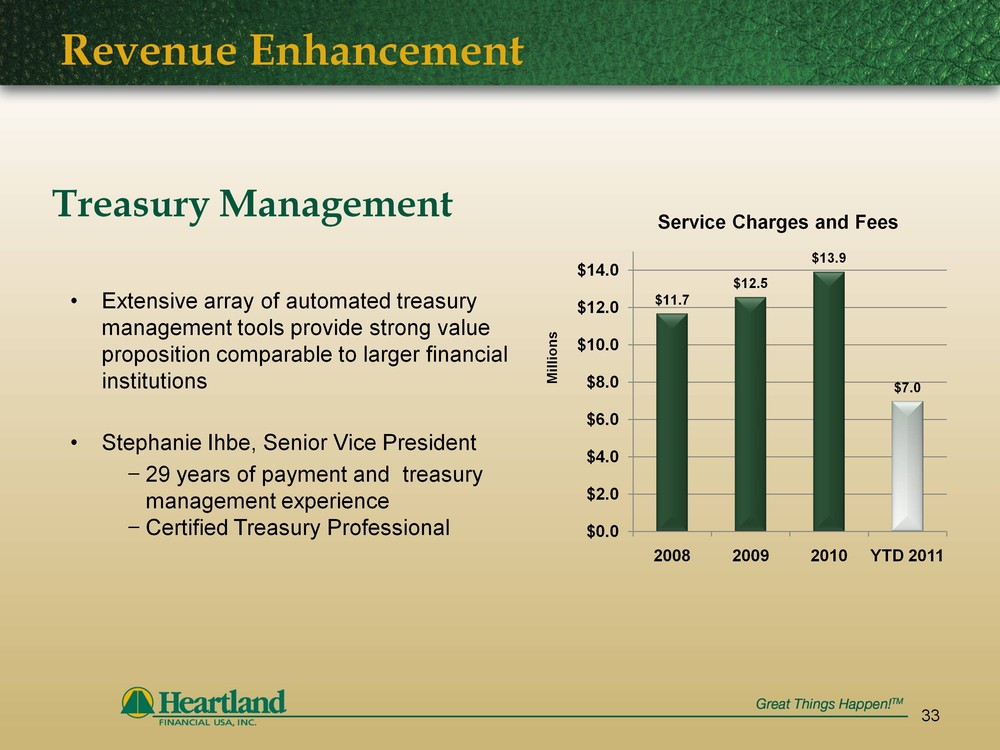

Revenue Enhancement

Treasury Management Extensive array of automated treasury management tools provide strong value proposition comparable to larger financial institutions Stephanie Ihbe, Senior Vice President 29 years of payment and treasury management experience Certified Treasury Professional

33

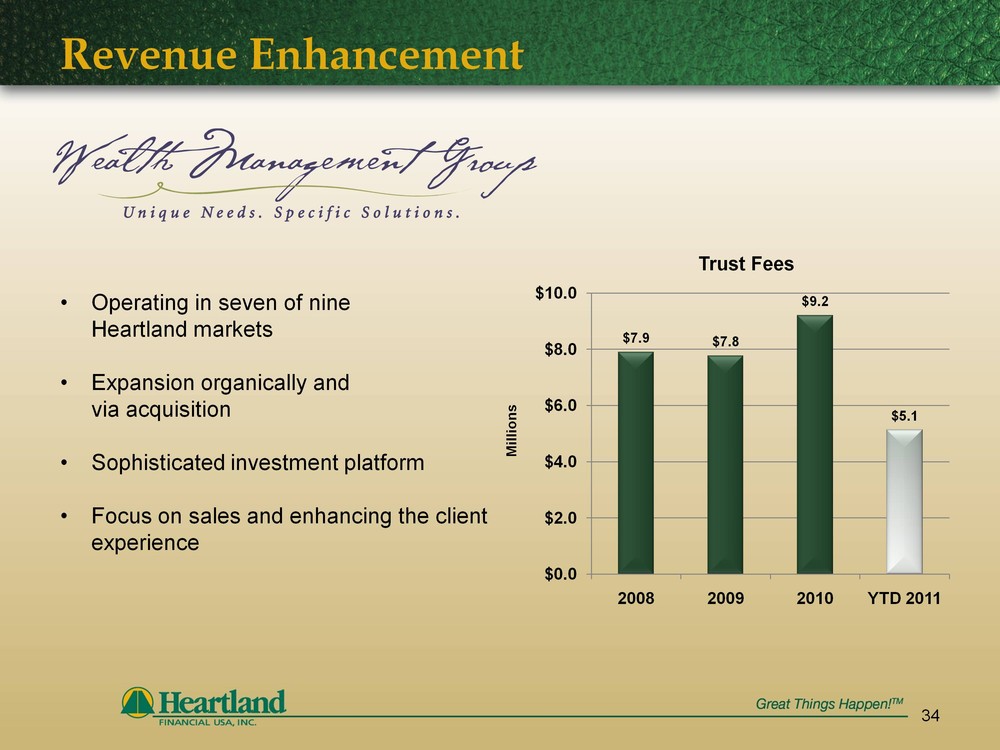

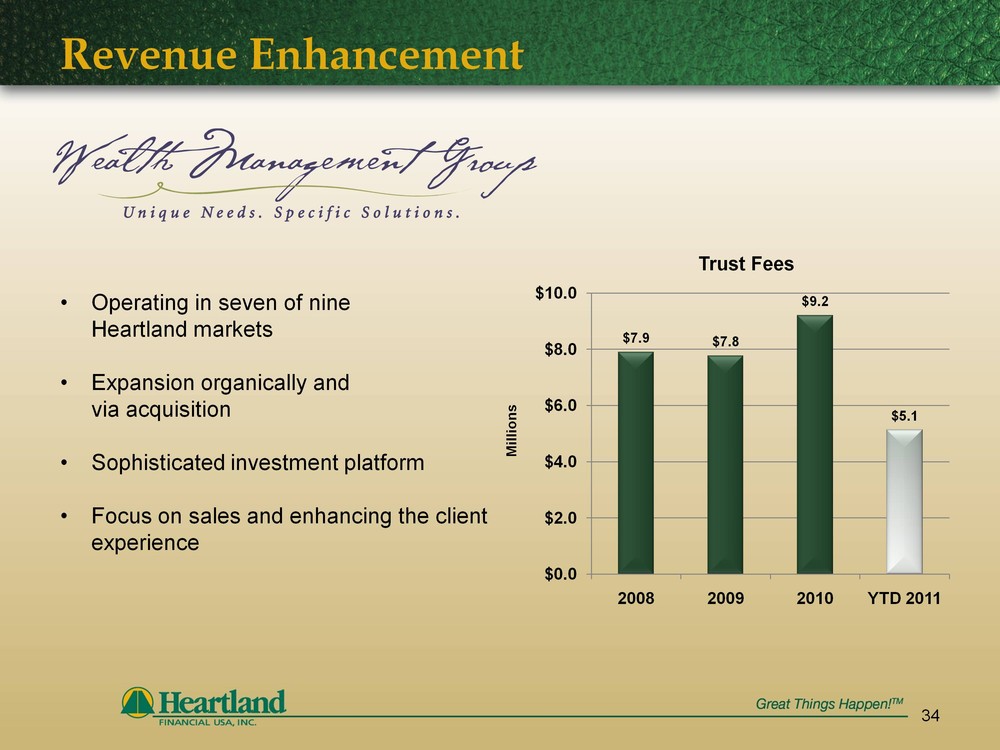

Revenue Enhancement

34

Operating in seven of nine Heartland markets Expansion organically and via acquisition Sophisticated investment platform Focus on sales and enhancing the client experience

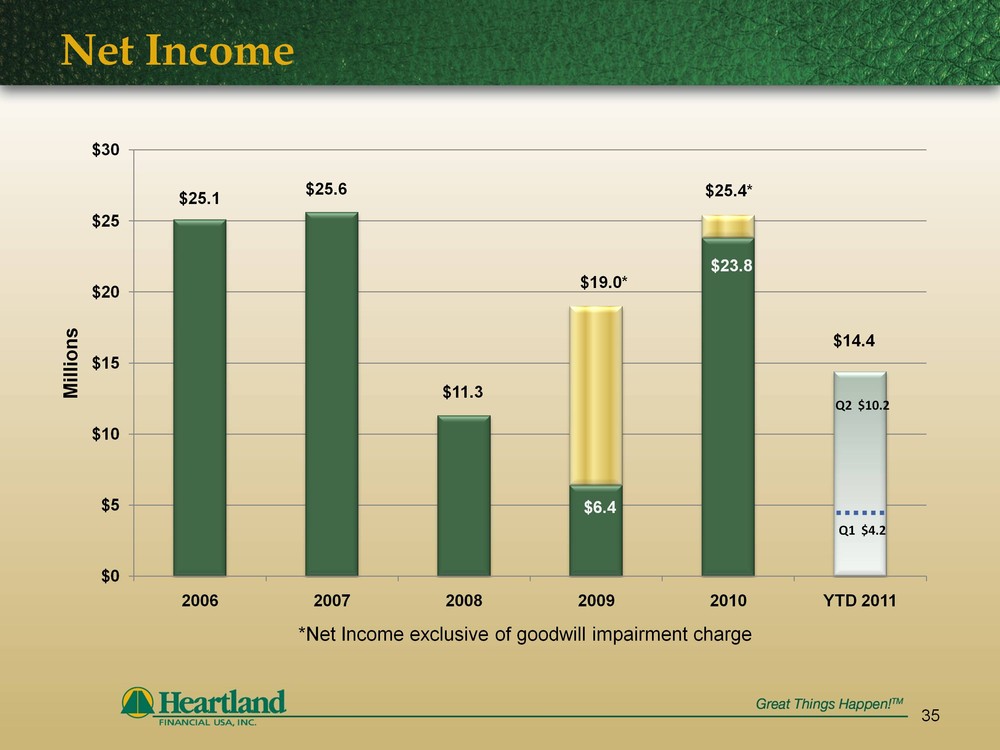

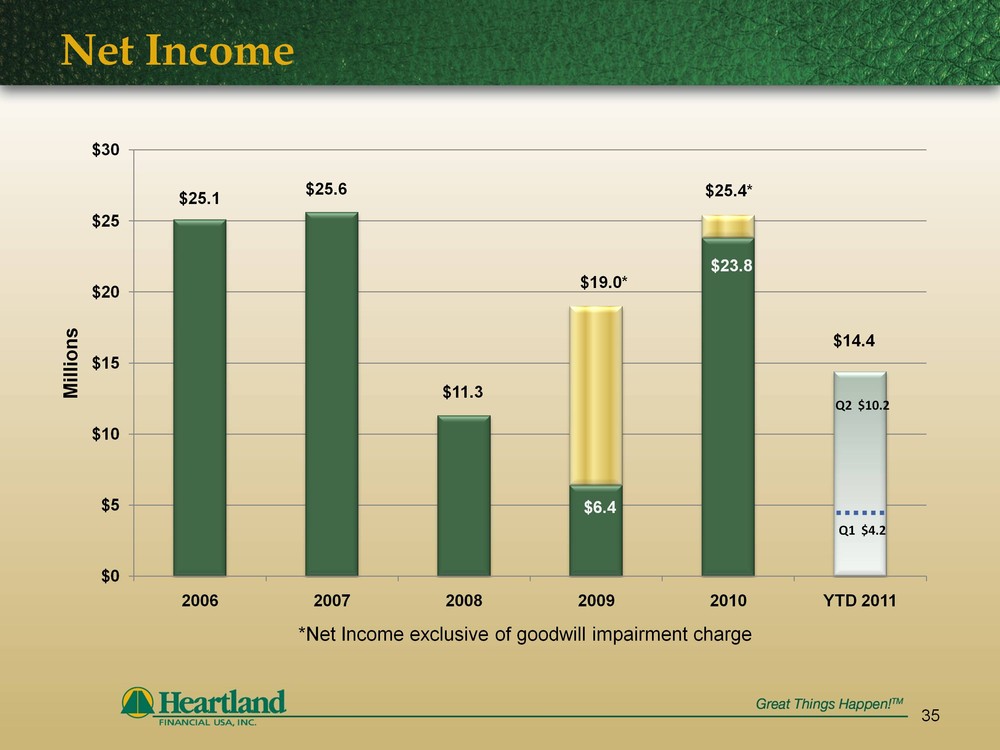

Net Income

$23.8

$19.0*

$6.4

*Net Income exclusive of goodwill impairment charge

35

$25.4*

$14.4

Q1 $4.2

Q2 $10.2

Pre-Tax, Pre-Provision Earnings

Millions

36

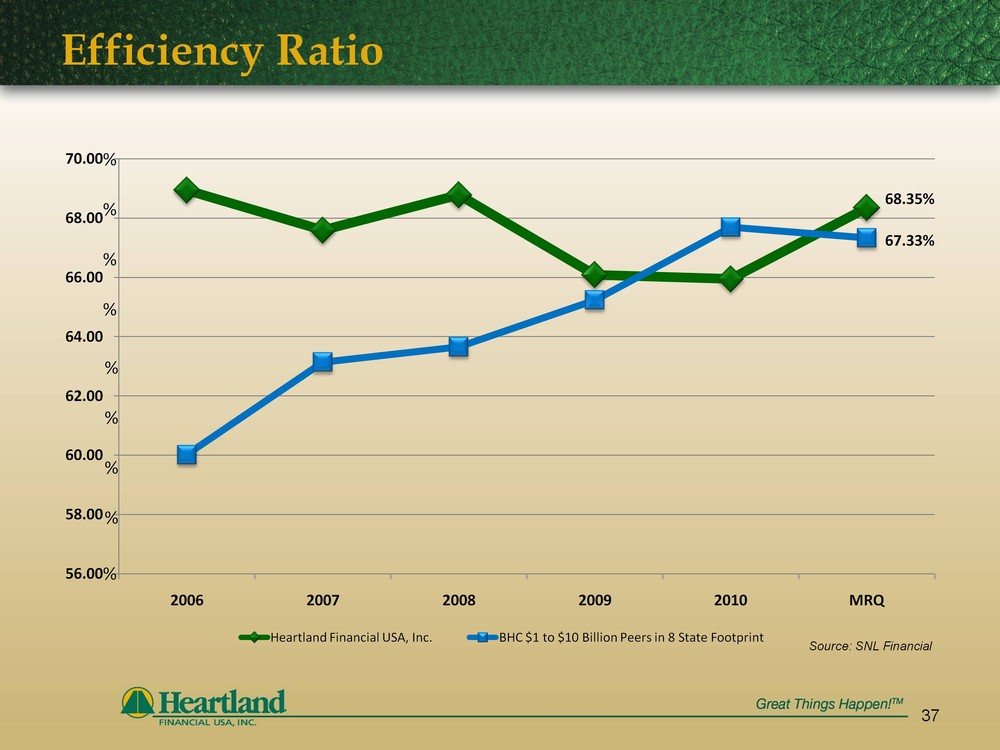

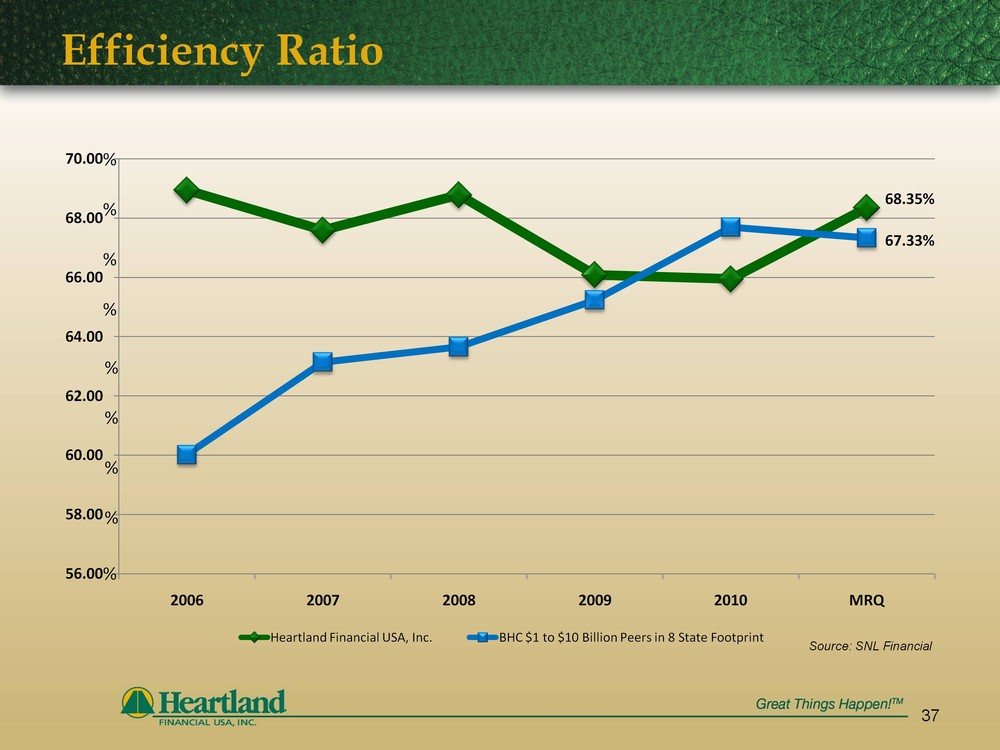

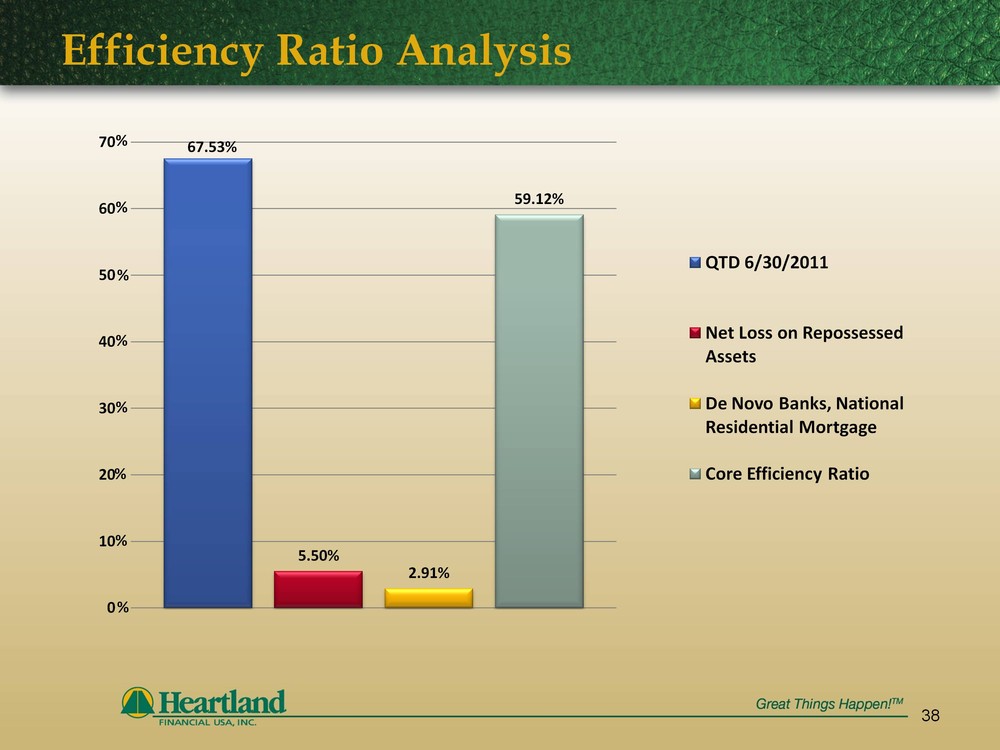

Efficiency Ratio

37

Source: SNL Financial

% % % %

% % % %

%

67.33%

68.35%

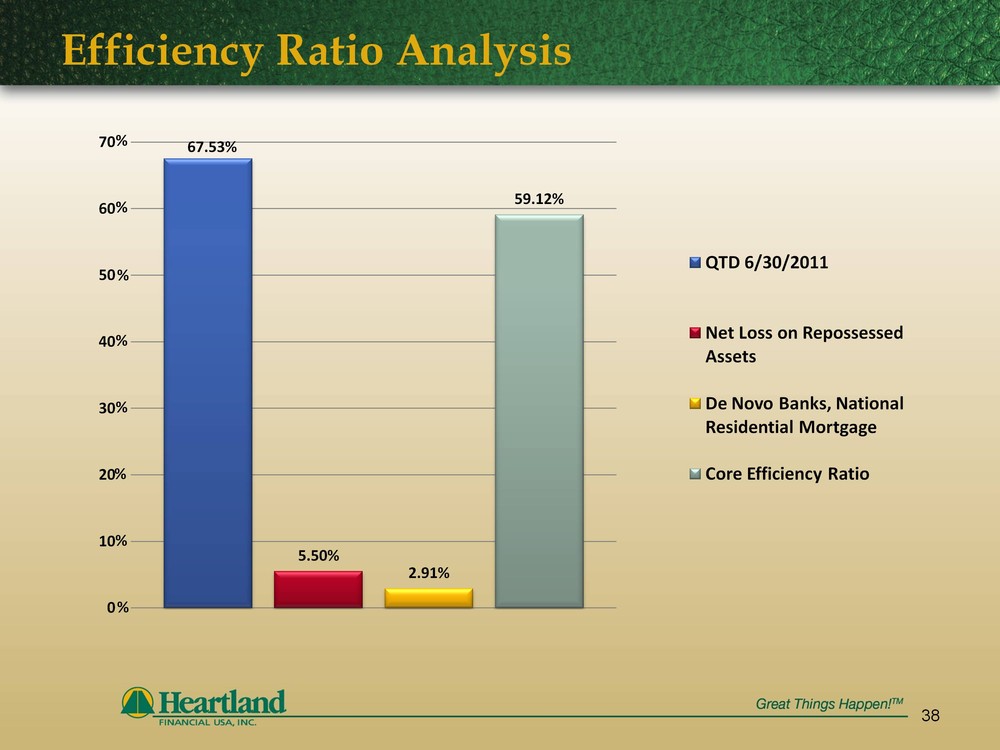

Efficiency Ratio Analysis

38

%

%

%

%

%

%

%

%

Investment Summary

Master strategy of balanced growth and profit Solid Midwest franchise complemented with a Western franchise, which will ultimately be the driver for growth Mix of Midwest and Western markets provides diversification of risk Strong, stable net interest margin Strong and growing sources of non-interest income Earnings have absorbed credit losses

39

40

1398 Central Avenue Dubuque, IA 52001 563.589.2100 Trading Symbol | HTLF www.htlf.com