Investor Presentation Trading Symbol: htlf | www.htlf.com Lynn B. Fuller Chairman President and CEO John K. Schmidt Chief Operating Officer Chief Financial Officer

July 30, 2012 Page 2 Safe Harbor This presentation may contain, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information currently available to management, are generally identifiable by the use of words such as believe, expect, anticipate, plan, intend, estimate, may, will, would, could, should or similar expressions. Additionally, all statements in this release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following: (i) the strength of the local and national economy; (ii) the economic impact of past and any future terrorist threats and attacks and any acts of war or threats thereof, (iii) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (iv) changes in interest rates and prepayment rates of the Company’s assets; (v) increased competition in the financial services sector and the inability to attract new customers; (vi) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (vii) the loss of key executives or employees; (viii) changes in consumer spending; (ix) unexpected results of acquisitions; (x) unexpected outcomes of existing or new litigation involving the Company; and (xi) changes in accounting policies and practices. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including other factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission.

July 30, 2012 Page 3 Heartland By The Numbers 31 31 Year Old Company 9/1 9 Independent Bank Charters 1 Consumer Finance Company 8/64/11/7 8 States 64 Banking Offices 11 Consumer Finance Offices 7 National Residential Mortgage Loan Production Offices

July 30, 2012 Page 4 An Expanding Franchise Midwest to West Heartland Banks Chandler, AZ (2) Mesa, AZ Phoenix, AZ Tempe, AZ Gilbert, AZ Dubuque, IA (7) Farley, IA Epworth, IA Holy Cross, IA Keokuk, IA (2) Carthage, IL East Dubuque, IL Galena, IL (2) Rockford, IL (4) Stockton, IL Elizabeth, IL Albuquerque, NM (7) Rio Rancho, NM (2) Clovis, NM (3) Portales, NM Melrose, NM Santa Fe, NM (2) Bigfork, MT Billings, MT (2) Bozeman, MT Kalispell, MT Plains, MT Plentywood, MT Stevensville, MT Whitehall, MT Cottage Grove, WI Fitchburg, WI Madison, WI Middleton, WI Green Bay, WI Monroe, WI Sheboygan, WI Broomfield, CO Thornton, CO Erie, CO Minneapolis, MN Citizens Finance Dubuque, IA Cedar Rapids, IA Davenport, IA Crystal Lake, IL Elgin, IL Loves Park, IL Tinley Park, IL Appleton, WI Madison, WI Aurora, IL Peoria, IL Heartland Mortgage Austin, TX Reno, NV Minot, ND Des Moines, IA San Diego, CA Boise, ID Buffalo, WY

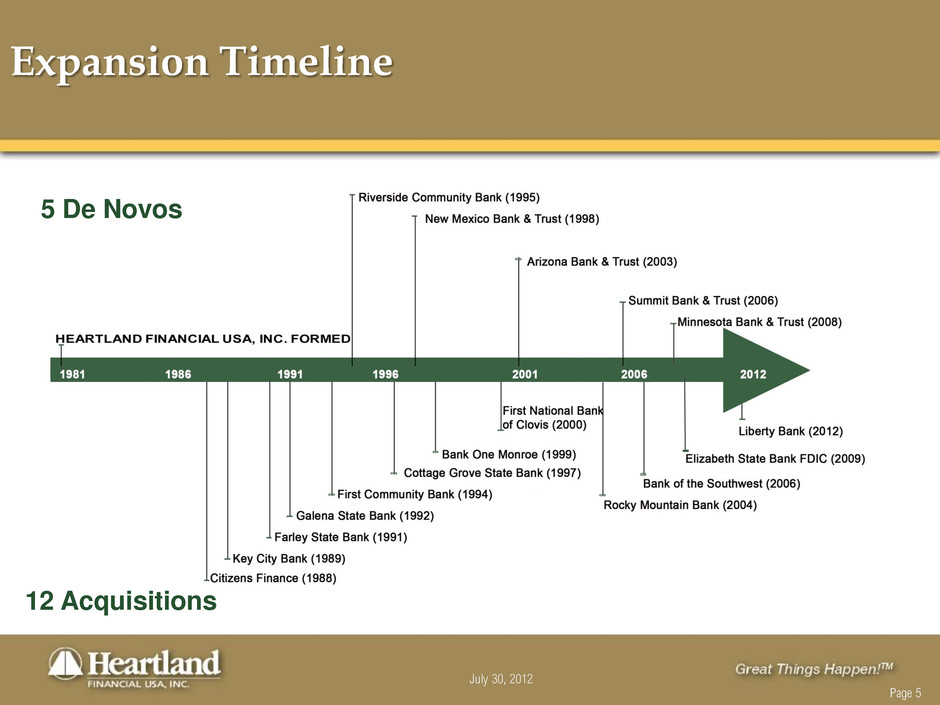

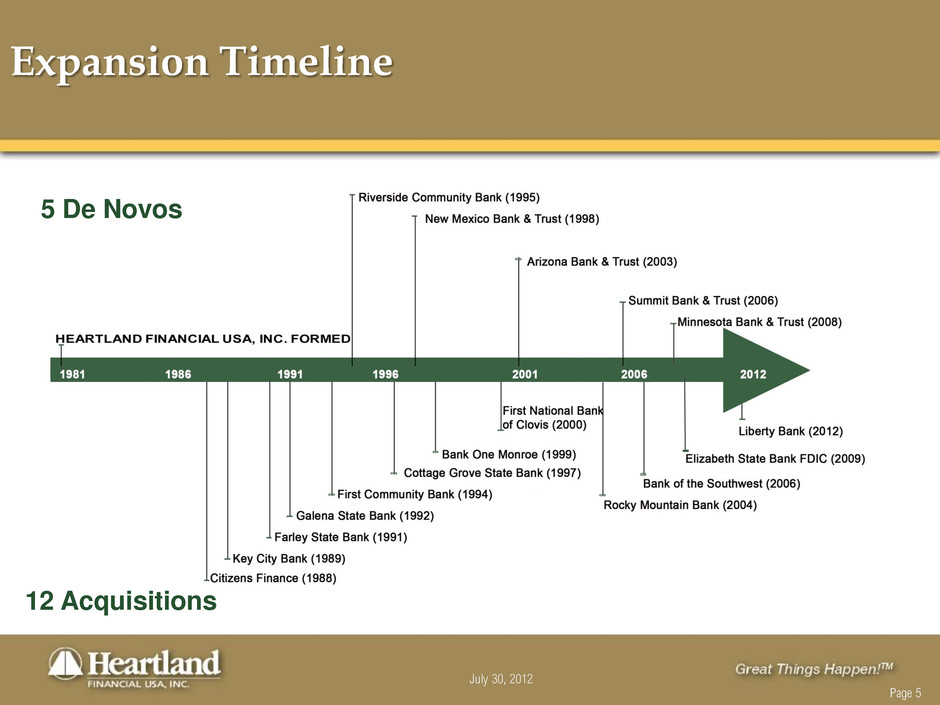

July 30, 2012 Page 5 Expansion Timeline 5 De Novos 12 Acquisitions

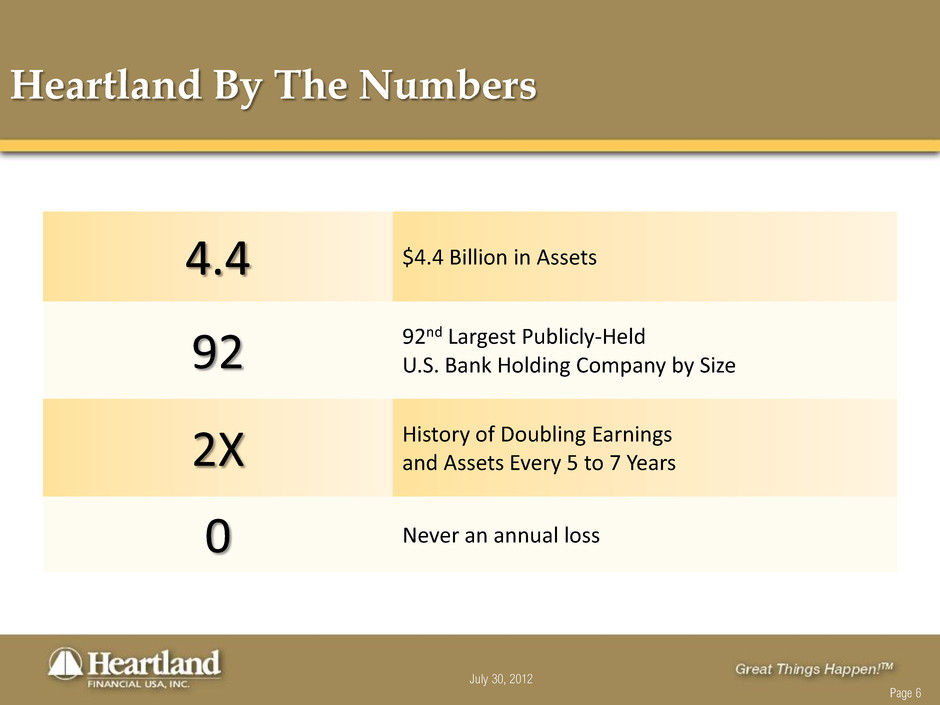

July 30, 2012 Page 6 Heartland By The Numbers 4.4 $4.4 Billion in Assets 92 92 nd Largest Publicly-Held U.S. Bank Holding Company by Size 2X History of Doubling Earnings and Assets Every 5 to 7 Years 0 Never an annual loss

July 30, 2012 Page 7 Market Overview: Expanding in High Growth Markets 6/30/2012 % of Number of Projected Population Med HH Projected HH Income State Deposits in Market Franchise Branches Change '09-'14 (%) Income Change '09-'14 (%) Iowa 959,273 28% 14 1.89 50,616 4.59 Illinois 562,920 17% 8 2.27 60,823 4.62 Wisconsin 415,277 12% 7 2.75 56,363 4.55 Minnesota 77,119 2% 1 3.21 62,767 5.14 HTLF Midwest 2,014,589 59% 30 Montana 356,046 10% 9 4.19 40,864 3.99 New Mexico 725,537 21% 16 6.30 44,681 4.84 Arizona 211,318 6% 6 12.84 55,275 5.46 Colorado 83,977 2% 3 7.75 62,597 5.14 HTLF West 1,376,878 41% 34

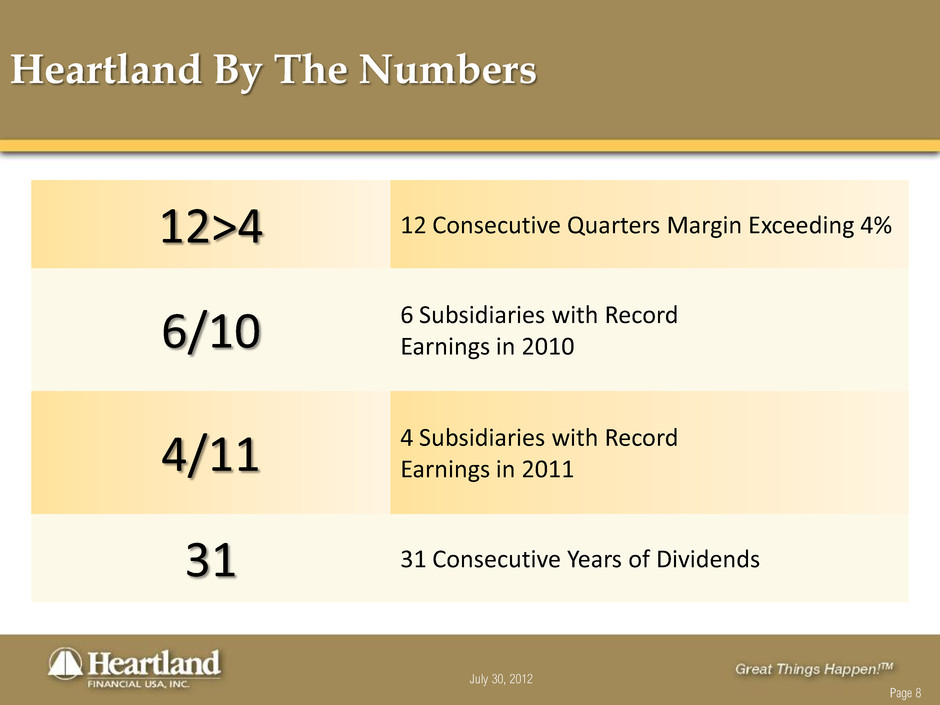

July 30, 2012 Page 8 Heartland By The Numbers 12>4 12 Consecutive Quarters Margin Exceeding 4% 6/10 6 Subsidiaries with Record Earnings in 2010 4/11 4 Subsidiaries with Record Earnings in 2011 31 31 Consecutive Years of Dividends

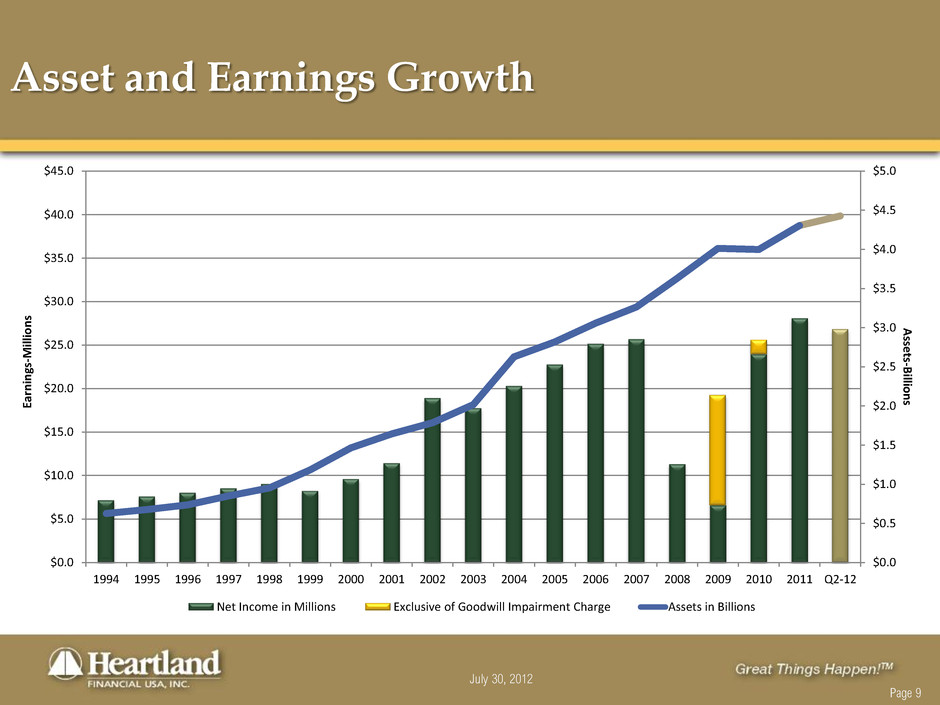

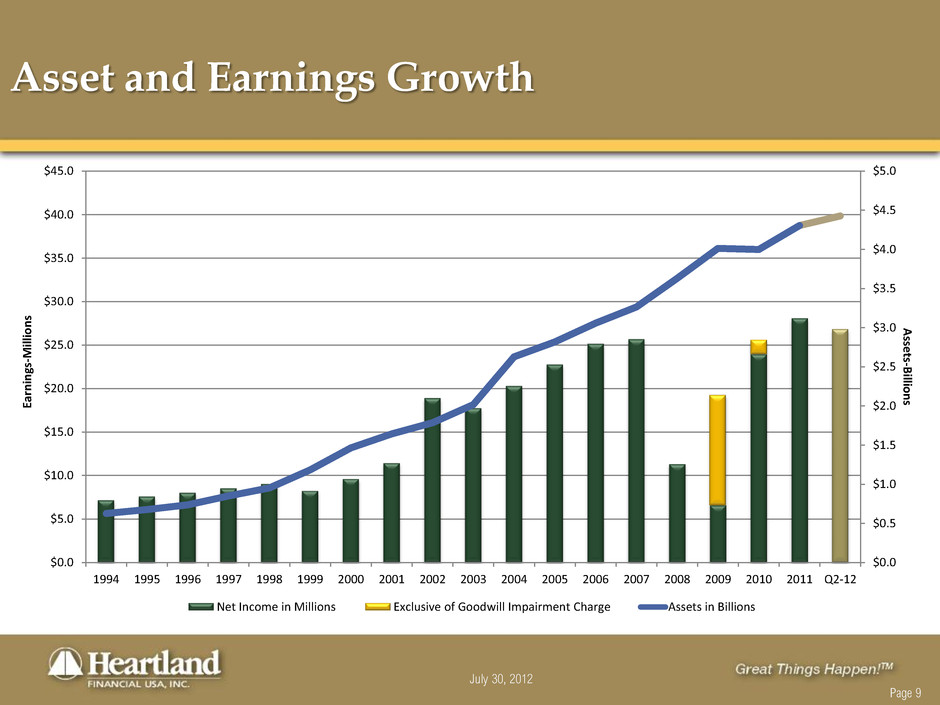

July 30, 2012 Page 9 Asset and Earnings Growth $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Q2-12 A sse ts-B illio n s Ea rn in gs -M ill io n s Net Income in Millions Exclusive of Goodwill Impairment Charge Assets in Billions

July 30, 2012 Page 10 History of Continuous Dividends GOAL: 20%-30% Dividend Payout 1.5 %– 3.0% Dividend Yield $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45

July 30, 2012 Page 11 Company Snapshot 5 Primary Business Lines Heartland Financial USA, Inc. Commercial Banking Retail Banking Wealth Management and Trust Consumer Finance Residential Mortgage

July 30, 2012 Page 12 Primary Target Markets Commercial & Small Business Residential Mortgage Retail Accounts from Immediate Area Personal Accounts of Owners and Employees

July 30, 2012 Page 13 Three Core Pillars of Success Highly Empowered, High- Touch Local Bank Delivery • Deeply rooted local leadership and boards • Local decision-making • Invested in local expertise • Local brands and independent charters • Commitment to exceptional experience, relationship building and value added delivery at competitive prices Extensive Resources for Revenue Enhancement • Expanded commercial and retail products with focus on government guaranteed lending and treasury management • Extensive “value menu” inclusive of wealth management, investment, insurance, leasing, mortgage and consumer financing • Unique approach to consultative relationship building • Highly trained and experienced staff Customer--Transparent Backroom Cost Savings • Leading edge technology • Efficient back-office support • Leverage expertise across all banks gaining economies of scale • Utilize best practices • Big bank punch with the little bank touch

July 30, 2012 Page 14 Company Snapshot Financial Ticker: HTLF Price (6/30/12) $24.00 ---Recent High (7/17/12) $25.07 TCBV (6/30/12) $15.62 Price/TCBV (%) (6/30/12) 154% Market Cap (6/30/12) $393MM Quarterly Dividend/Yield $0.10 / 1.67% Assets (billions) 4.43$ Loans (billions) 2.60$ Deposits (billions) 3.33$ Noninterest Income as % of Revenue 35% DDA as % of Deposits 24% CDs as % of Deposits 24% Banks 9 Independent Charters States 8 (4 Midwest / 4 West) Offices 64 Consumer Fi ance States 3 (Iowa, Illinois, Wisconsin) Offices 11

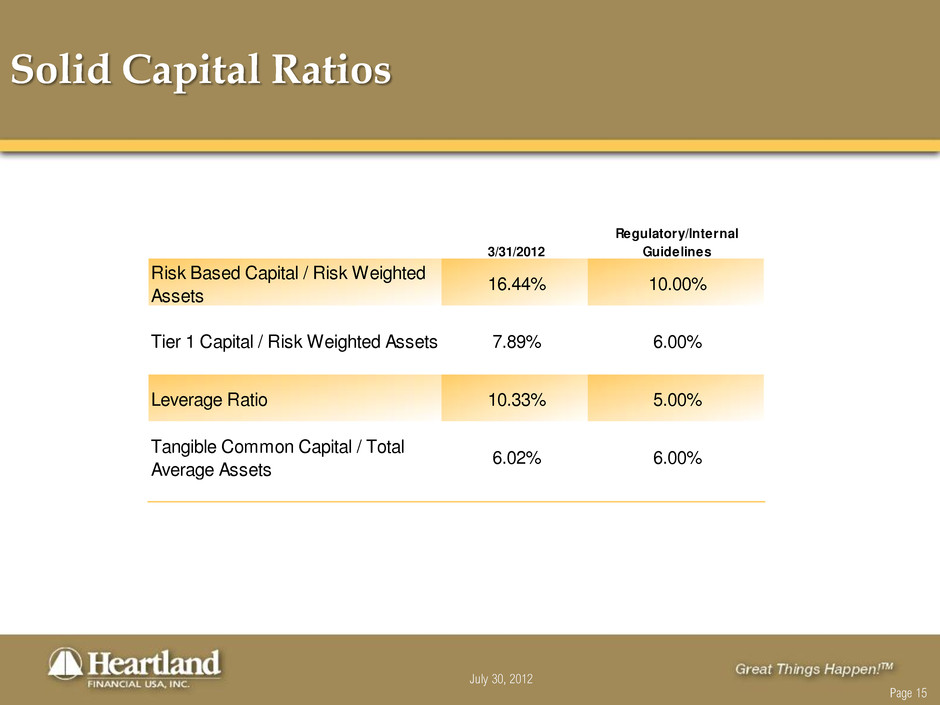

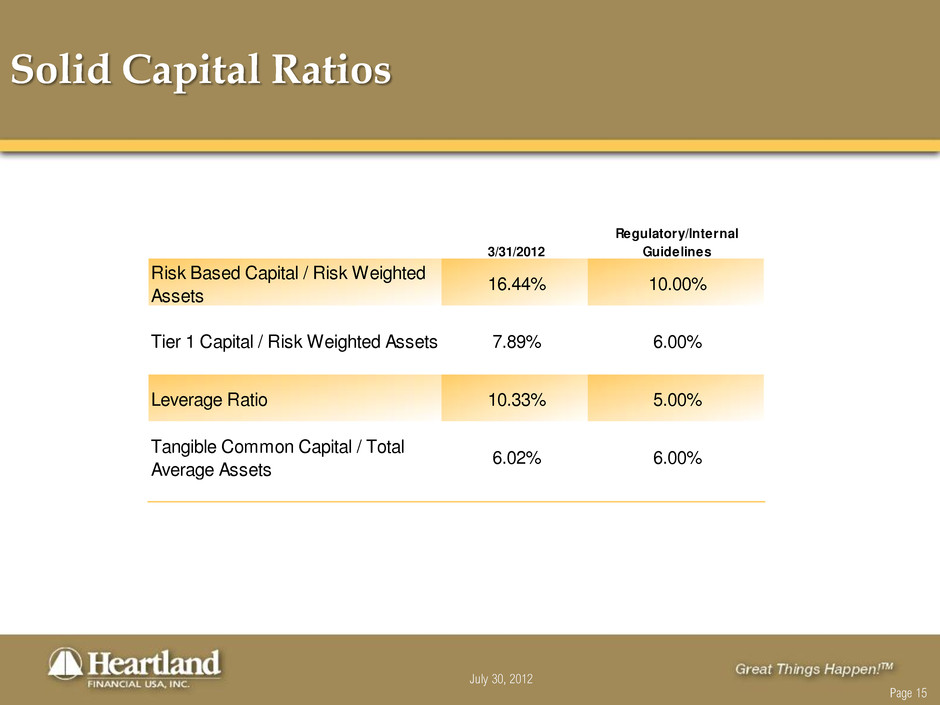

July 30, 2012 Page 15 Solid Capital Ratios 3/31/2012 Regulatory/Internal Guidelines Risk Based Capital / Risk Weighted Assets 16.44% 10.00% Tier 1 Capital / Risk Weighted Assets 7.89% 6.00% Leverage Ratio 10.33% 5.00% Tangible Common Capital / Total Average Assets 6.02% 6.00%

July 30, 2012 Page 16 Small Business Loan Fund • Joined the SBLF on September 15, 2011 with $81.7 preferred stock issue • Simultaneously redeemed $81.7 million in TARP funding • Of 932 applications, 332 or 37% were approved • Achieved $88 million of qualifying SBLF loan growth; goal of $92MM • Very low cost of non-common equity funding • (TRUPS, SBLF and other debt) currently fixed at 4.1% after tax. Maturities are laddered over 4-7 years

July 30, 2012 Page 17 M & A • Opportunities abound across entire footprint • Focus on expansion in existing markets to build scale • IRR > 15% • Commitment to shareholders for accretive transactions • Improved share price will facilitate acquisitions • 1 acquisition announced and closed in 2012

July 30, 2012 Page 18 Coverage Keefe Bruyette & Woods Inc. Market Perform Christopher McGratty Raymond James Market Perform Daniel Cardenas RBC Capital Markets Corp. Sector Perform Jon Arfstrom Sandler O’Neill & Partners LP Buy Brad Milsaps Sidoti and Company Buy John Rowan Stifel Nicolaus & Company Hold Stephen Geyen Analyst Ratings

July 30, 2012 Page 19 Media Ratings Seeking Alpha May 8, 2012 Identified Heartland as one of 16 rallying dividend stocks undervalued by EPS trends Bank Director Magazine Bank Performance Scorecard, Third Quarter 2011 Issue Heartland ranked number 105 among the 150 largest US publicly-traded banks and thrifts based on 2010 calendar year earnings Area Development ranked Dubuque high in several categories. Here’s a brief summary: The 2012 Leading Locations report ranked Dubuque in five categories: • Top 100 Overall Cities – Dubuque ranked 16th, the only city in Iowa ranked in the top 25 • Top 20 Midwest Cities – Dubuque ranked third • Top 50 Small Cities – Dubuque ranked seventh • Top 25 Small Cities in Economic Strength Factors – Dubuque ranked sixth • Top 25 Small Cities in “Recession Busting” Factors – Dubuque ranked eighth Heartland Financial: Stock Surge. June 18, 2012 “Financial services company Heartland Financial USA (HTLF), which operates community banks throughout the country, reported strong first quarter performance, which included a 129% earnings surprise, causing shares to reach a 52-week high. The stock became a Zacks #1 Rank (Strong Buy) based on its strong credit quality, steady capital position and staggering 29% stock growth since the beginning of the year.” Record Earnings Will Bolster This Bank From The Heartland April 24, 2012 | by: Bret Jensen | about: HTLF 7 reasons Heartland should rise from just over $16 a share: • The company just reported earnings that beat estimates and the company's CEO called Heartland's best quarter ever • Several insiders have picked up new shares since March • Earnings are showing good growth. The company made $1.23 in FY2011. Analysts have it earning $1.43 in FY2012 and $1.65 in FY2013 • Estimates for FY2012 and FY2013 have risen in last two months. Based on latest earnings report, I would look for these estimates to increase further • The stock yields 2.4% and did not have to cut its dividend during the financial crisis. Given Heartland's low payout ratio and growing earnings, I would look for the company to increase dividends again in the near future • The stock has a forward PE of just over 10, which is an over 40% discount to its historical average • Return on Assets, Net Interest Margin and deposit growth are all moving in the right direction. This was showcased in the first quarter earnings report where company reported record net income Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in HTLF over the next 72 hours. Additional disclosure: I am also long JPM.

July 30, 2012 Page 20 Investment Attributes • Record quarterly earnings and 18.28% ROE • Margin exceeding 4% for 12 consecutive quarters • Expanding non-interest income sources (Mortgage, Wealth Management, Treasury Management) • Continuing to improve asset quality; 16.30% Texas Ratio • Diverse geographic footprint reduces risk • Master strategy of balanced growth and profit Solid Midwest franchise balanced with a Western franchise, which will ultimately be the driver for growth • Never experienced a loss year • 31 consecutive years of increased or level dividends; 1.67 percent dividend yield • 35% internal ownership. Focused on growing shareholder value

July 30, 2012 Page 21 Financial Highlights

July 30, 2012 Page 22 Financial Performance At Period Ending 6/30/2012 2011 2010 2009 Total Assets (Billions) $4.43 $4.26 $4.00 $4.01 Total Loans $2.67 $2.48 $2.36 $2.34 Total Deposits $3.33 $3.21 $3.03 $3.05

July 30, 2012 Page 23 Loans By Category As of June 30, 2012 Commercial and Commercial Real Estate Loans 72% Residential Mortgages 8% Agricultural Loans 11% Consumer Loans 9% 0% 0% 0%

July 30, 2012 Page 24 Non-Performing Assets/Total Assets Source: SNL Financial #1 PRIORITY 1.87% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2006 2007 2008 2009 2010 2011 Q2-12 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 8 State Footprint

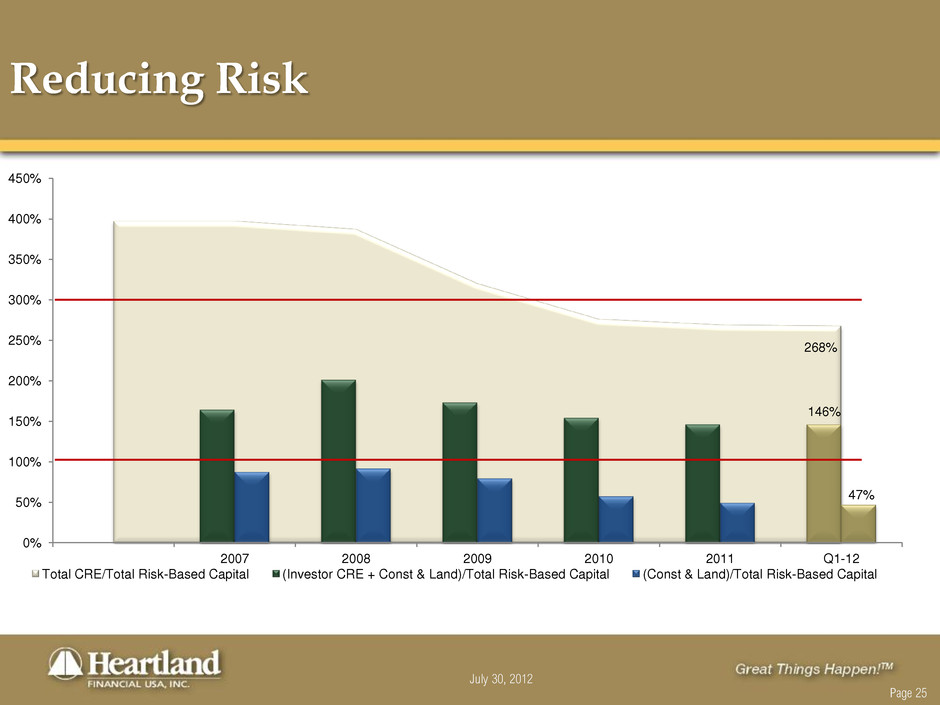

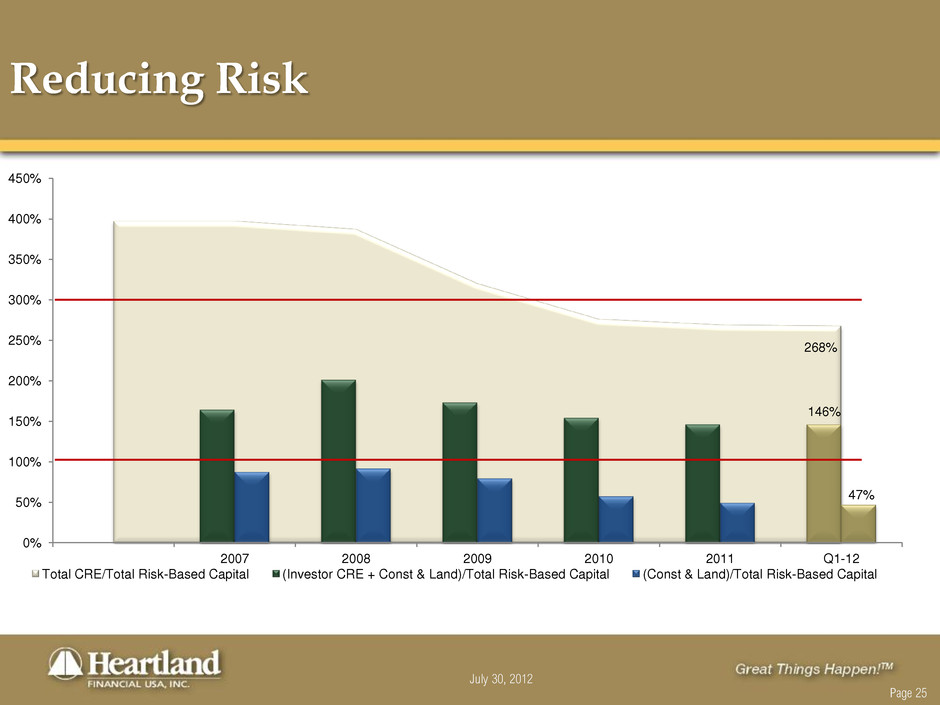

July 30, 2012 Page 25 Reducing Risk 268% 146% 47% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% 2007 2008 2009 2010 2011 Q1-12 Total CRE/Total Risk-Based Capital (Investor CRE + Const & Land)/Total Risk-Based Capital (Const & Land)/Total Risk-Based Capital

July 30, 2012 Page 26 Improved Deposit Mix Total Deposits $0.72 Billion Total Deposits $3.33 Billion C.A.G.R. 12% Internal C.A.G.R. 11% Time 49% IBCA & Savings 41% Non-Interest- Bearing Demand 10% 12/31/1998 Time 24% IBCA & Savings 52% Non-Interest- Bearing Demand 24% 6/30/2012

July 30, 2012 Page 27 Tangible Common Equity 5.98% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2006 2007 2008 2009 2010 2011 Q2-12

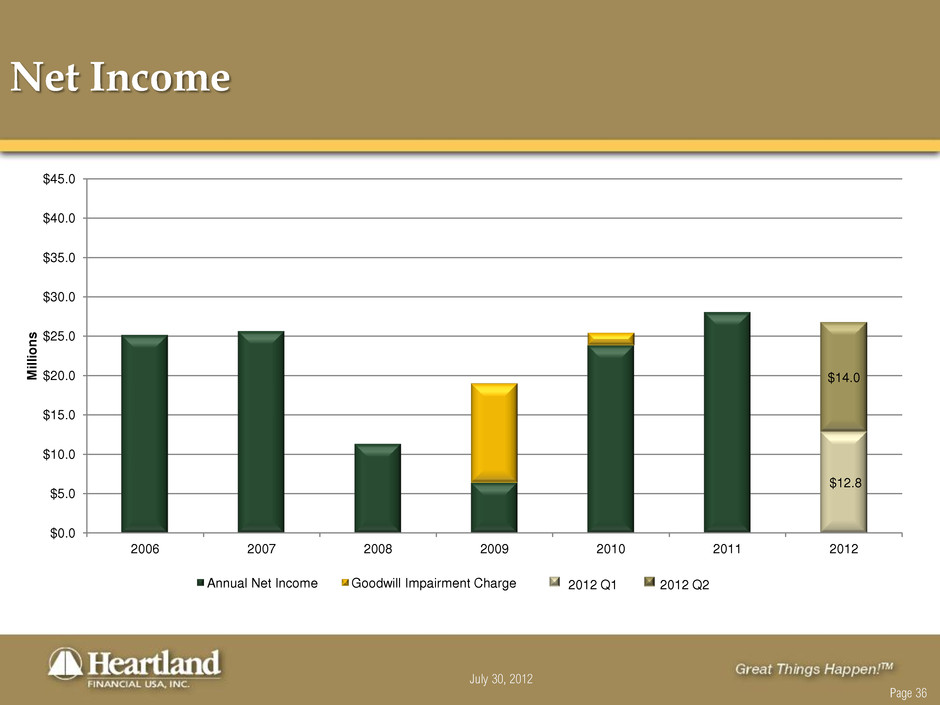

July 30, 2012 Page 28 Income Recap YTD 2011 2010 2009 Net Interest Margin (Thousands) 75,370$ 145,394$ 143,052$ 132,763$ Provision for Loan & Lease Loss 5,354 29,365 32,508 39,377 Noninterest Income 43,723 59,577 52,329 52,704 Noninterest Expense 78,940 137,296 129,239 132,520 Net Income 26,798 28,008 23,788 6,374 Net Income, exclusive of goodwill impairment charge 26,798 28,008 25,427 19,033 Earnings Per Share 1.63$ 1.23$ 1.13$ 0.07$ Earnings Per Share, exclusive of goodwill impairment charge 1.63$ 1.23$ 1.23$ 0.85$

July 30, 2012 Page 29 Net Interest Margin Source: SNL Financial 4.05% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 2006 2007 2008 2009 2010 2011 Q2-12 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 8 State Footprint

July 30, 2012 Page 30 Provision For Loan & Lease Losses $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 2006 2007 2008 2009 2010 2011 Q2-12 M ill io n s $5.4 Annual 2012 Q1 2012 Q2

July 30, 2012 Page 31 Credit Trends Source: SNL Financial $83.0 $0.7 $41.4 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2006 2007 2008 2009 2010 2011 Q2-12 M ill io n s Non-Performing Assets Net Charge-Offs Allowance for Loan & Lease Losses

July 30, 2012 Page 32 Diversified Revenue Streams As of June 30, 2012 Noninterest income exclusive of security gains Income on Bank Owned Life Insurance 2% Brokerage & Insurance 4% Mortgage related gains on sales and servicing 50% Trust Fees 10% Service charges and fees 23% Other non- interest income 11% Net Interest Income 59% Non Interest Income 41%

July 30, 2012 Page 33 Revenue Enhancement • Experienced, high-volume loan origination team of 115 producers • Based in Phoenix, AZ and Dubuque, IA • Expanding in legacy Heartland markets and non-legacy Heartland markets • Target Net Income of 1% of Gross Revenue $8.5 $12.7 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2008 2009 2010 2011 2012 M ill io n s Gain on Sale of Loans Annual 2012 Q1 2012 Q2

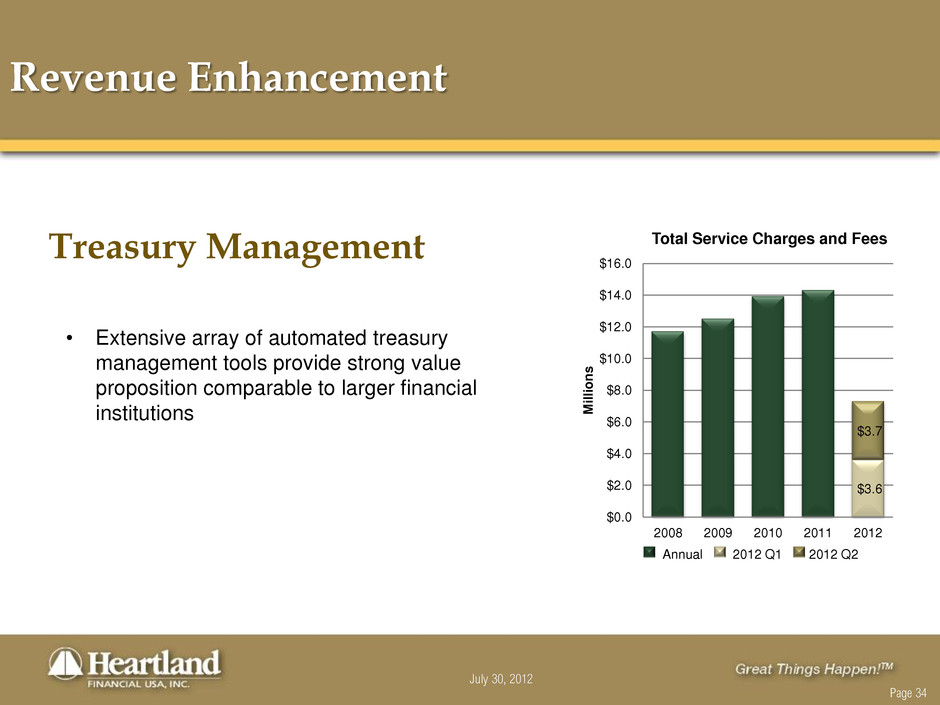

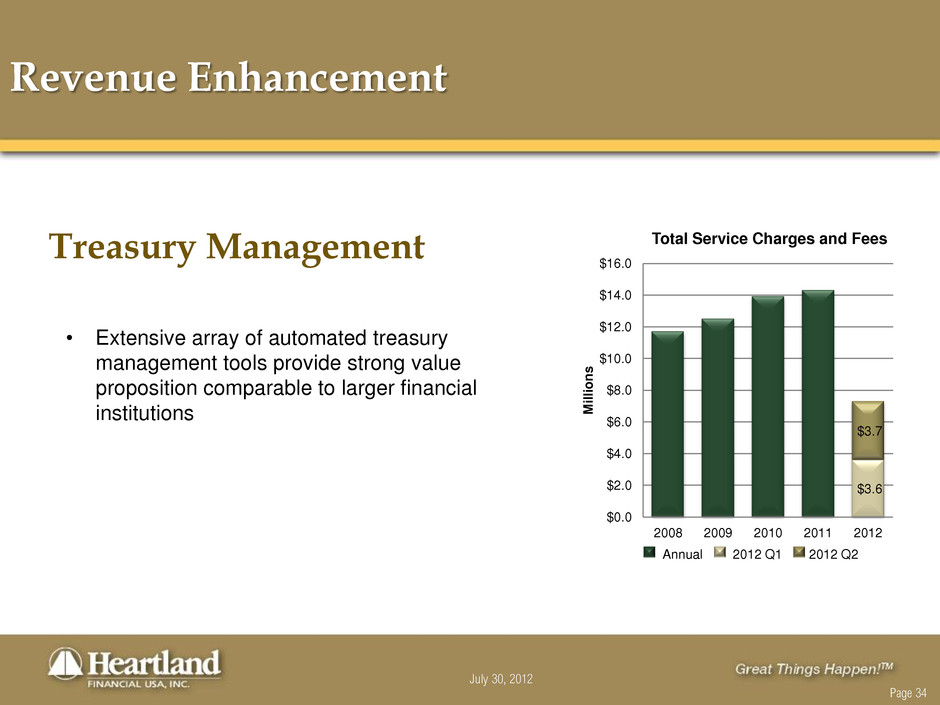

July 30, 2012 Page 34 Revenue Enhancement Treasury Management • Extensive array of automated treasury management tools provide strong value proposition comparable to larger financial institutions $3.6 $3.7 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 2008 2009 2010 2011 2012 M ill io n s Total Service Charges and Fees Annual 2012 Q1 2012 Q2

July 30, 2012 Page 35 Revenue Enhancement • Operating in seven of nine Heartland markets • Expansion organically and via acquisition • Sophisticated investment platform • Focus on sales and enhancing the client experience Wealth Management $2.6 $2.7 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2008 2009 2010 2011 2012 M ill io n s Trust Fees Annual 2012 Q1 2012 Q2

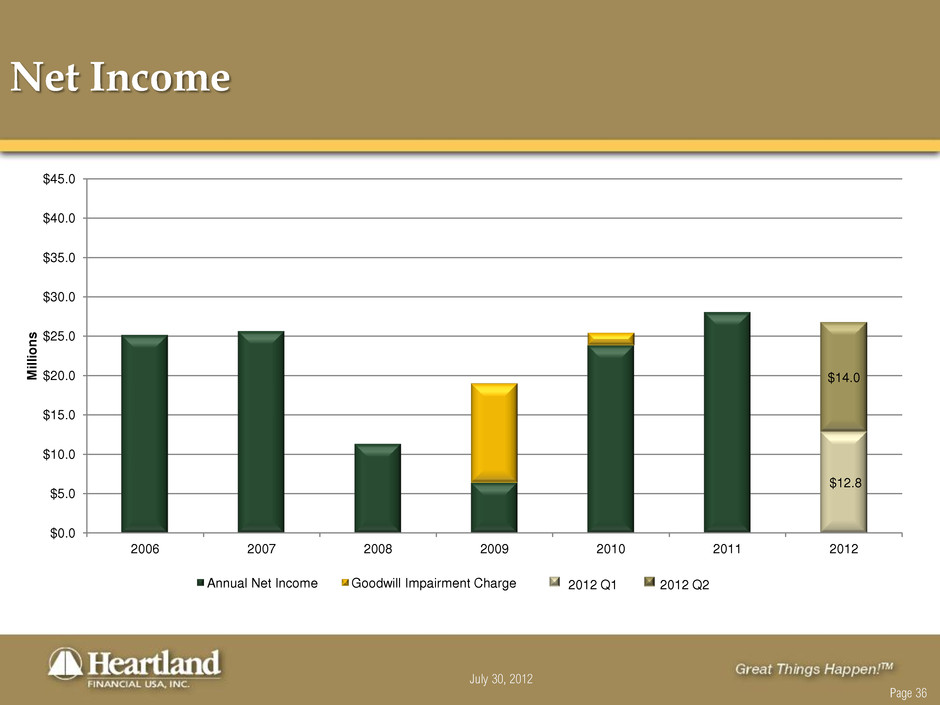

July 30, 2012 Page 36 Net Income $12.8 $14.0 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 2006 2007 2008 2009 2010 2011 2012 M ill io n s Annual Net Income Goodwill Impairment Charge 2012 Q1 2012 Q2

July 30, 2012 Page 37 Pre-Tax, Pre-Provision Earnings $21.4 $24.0 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 2006 2007 2008 2009 2010 2011 2012 M ill io n s Annual 2012 Q1 2012 Q2

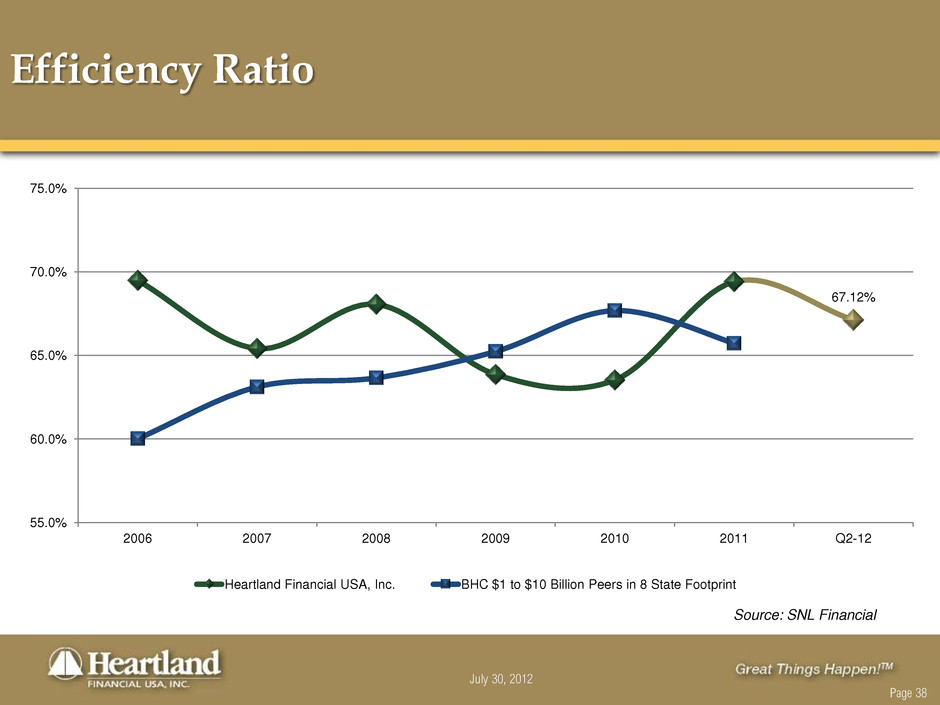

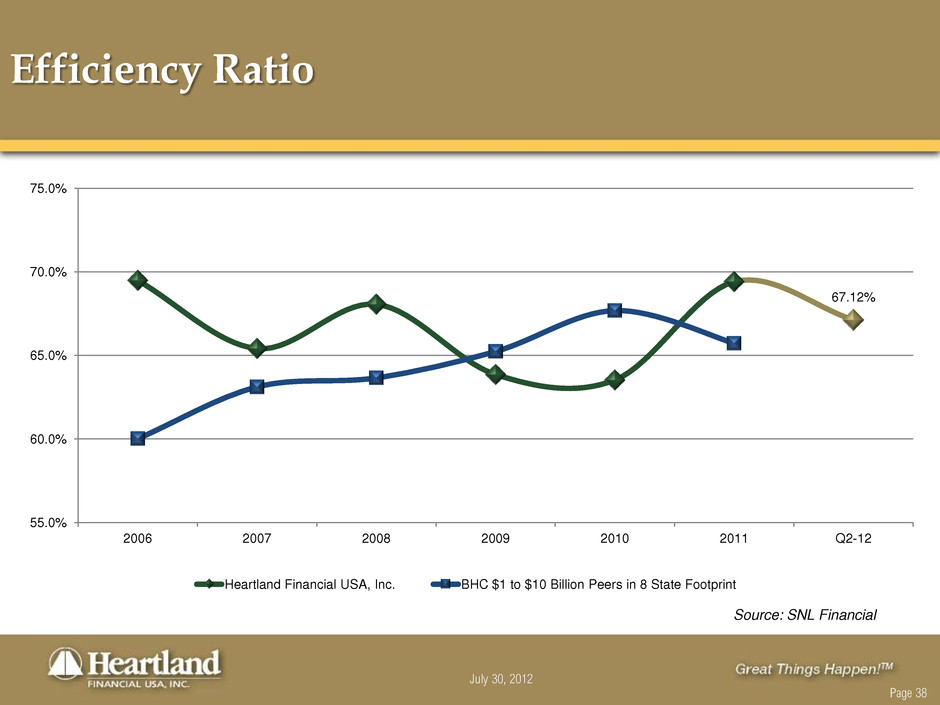

July 30, 2012 Page 38 Efficiency Ratio Source: SNL Financial 67.12% 55.0% 60.0% 65.0% 70.0% 75.0% 2006 2007 2008 2009 2010 2011 Q2-12 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 8 State Footprint

July 30, 2012 Page 39 Restated Efficiency Ratio 2011 Core Efficiency Ratio 60.88% Net Loss on Repossessed Assets 5.18% De Novo Bank, National Residential Mortgage 3.35% 2011 Efficiency Ratio 69.41%

July 30, 2012 Page 40 ROAE 18.28% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 2006 2007 2008 2009 2010 2011 Q2-12

July 30, 2012 Page 41 Investment Summary • Margin exceeding 4% for 12 consecutive quarters • Strong and growing sources of non-interest income • Mix of Midwest and Western markets provides diversification of risk • Solid Midwest franchise complemented with a Western franchise, which will ultimately be the driver for growth • Continuing to improve asset quality with a low Texas Ratio of 16.30% • Master strategy of balanced growth and profit