Investor Presentation July 2014 Lynn B. Fuller Chairman, President and CEO Trading Symbol: HTLF | www.htlf.com

Page 2 This presentation may contain, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of the Company’s management and on information currently available to management, are generally identifiable by the use of words such as believe, expect, anticipate, plan, intend, estimate, may, will, would, could, should or similar expressions. Additionally, all statements in this release, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. These factors include, among others, the following: (i) the strength of the local and national economy; (ii) the economic impact of past and any future terrorist threats and attacks and any acts of war or threats thereof, (iii) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (iv) changes in interest rates and prepayment rates of the Company’s assets; (v) increased competition in the financial services sector and the inability to attract new customers; (vi) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (vii) the loss of key executives or employees; (viii) changes in consumer spending; (ix) unexpected results of acquisitions; (x) unexpected outcomes of existing or new litigation involving the Company; and (xi) changes in accounting policies and practices. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including other factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission. Safe Harbor

Page 3 Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial Highlights

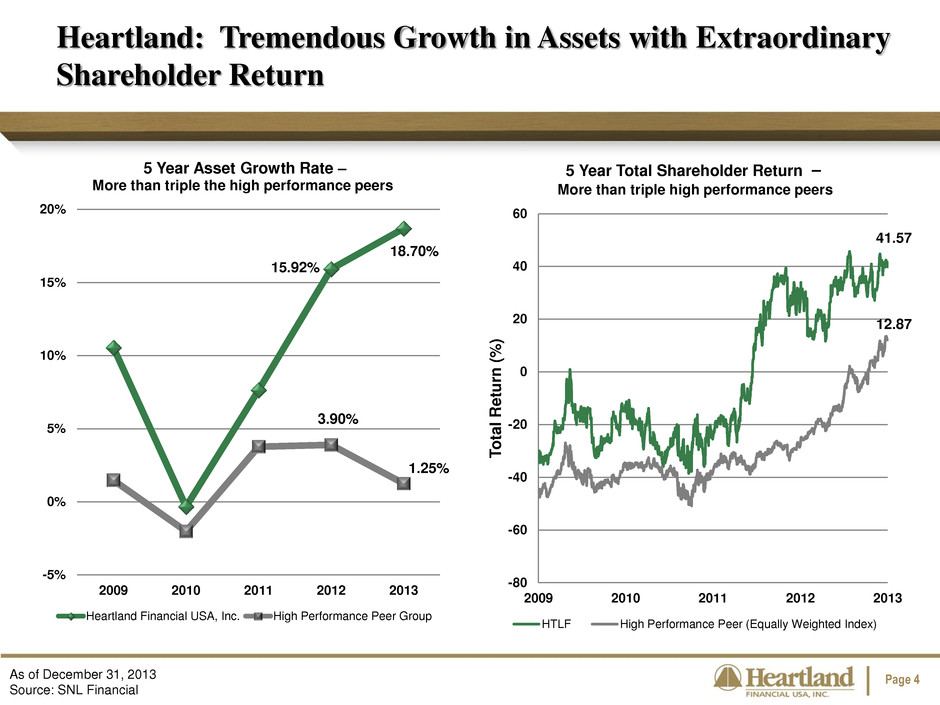

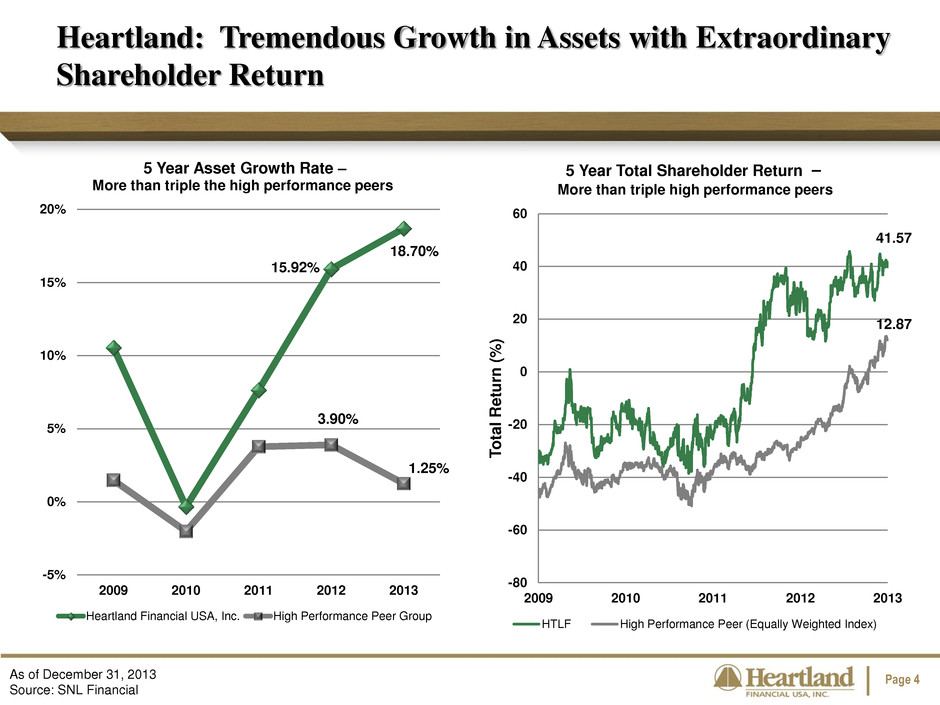

Page 4 Heartland: Tremendous Growth in Assets with Extraordinary Shareholder Return As of December 31, 2013 Source: SNL Financial 41.57 12.87 -80 -60 -40 -20 0 20 40 60 2009 2010 2011 2012 2013 T o ta l Return ( % ) 5 Year Total Shareholder Return – More than triple high performance peers HTLF High Performance Peer (Equally Weighted Index) 15.92% 18.70% 3.90% 1.25% -5% 0% 5% 10% 15% 20% 2009 2010 2011 2012 2013 5 Year Asset Growth Rate – More than triple the high performance peers Heartland Financial USA, Inc. High Performance Peer Group

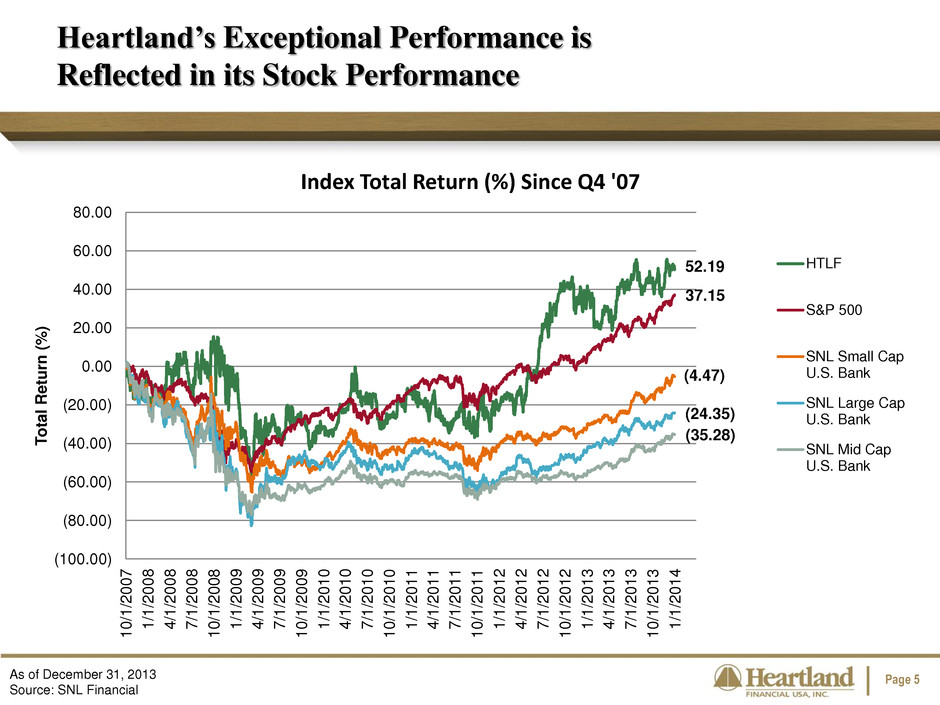

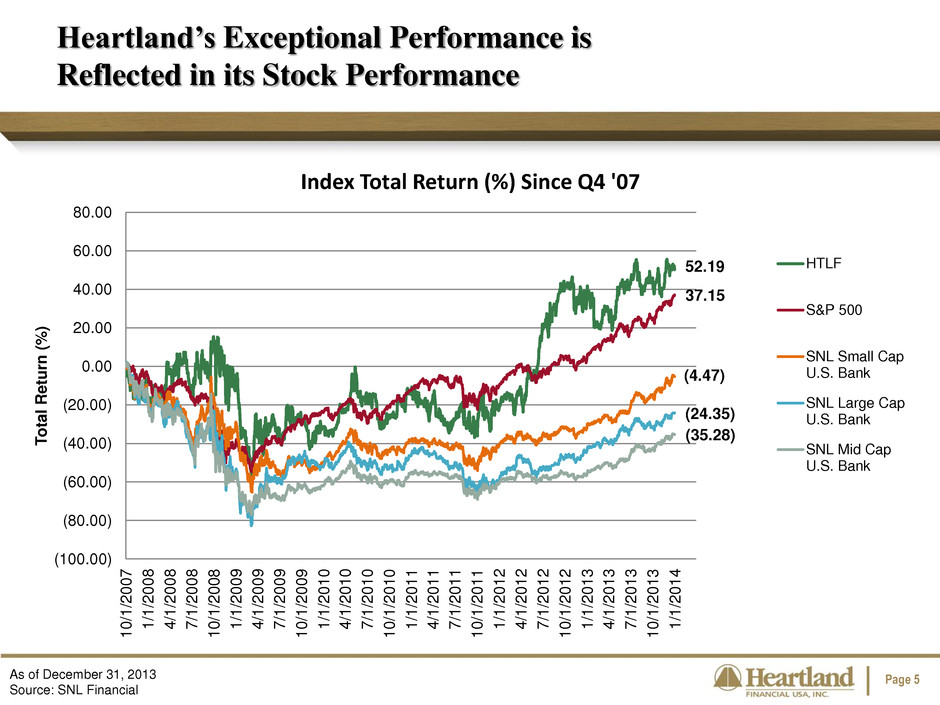

Page 5 Heartland’s Exceptional Performance is Reflected in its Stock Performance 52.19 37.15 (4.47) (24.35) (35.28) (100.00) (80.00) (60.00) (40.00) (20.00) 0.00 20.00 40.00 60.00 80.00 10 /1 /2 00 7 1/ 1/ 20 08 4/ 1/ 20 08 7/ 1/ 20 08 10 /1 /2 00 8 1/ 1/ 20 09 4/ 1/ 20 09 7/ 1/ 20 09 10 /1 /2 00 9 1/ 1/ 20 10 4/ 1/ 20 10 7/ 1/ 20 10 10 /1 /2 01 0 1/ 1/ 20 11 4/ 1/ 20 11 7/ 1/ 20 11 10 /1 /2 01 1 1/ 1/ 20 12 4/ 1/ 20 12 7/ 1/ 20 12 10 /1 /2 01 2 1/ 1/ 20 13 4/ 1/ 20 13 7/ 1/ 20 13 10 /1 /2 01 3 1/ 1/ 20 14 T o ta l Return ( % ) Index Total Return (%) Since Q4 '07 HTLF S&P 500 SNL Small Cap U.S. Bank SNL Large Cap U.S. Bank SNL Mid Cap U.S. Bank As of December 31, 2013 Source: SNL Financial

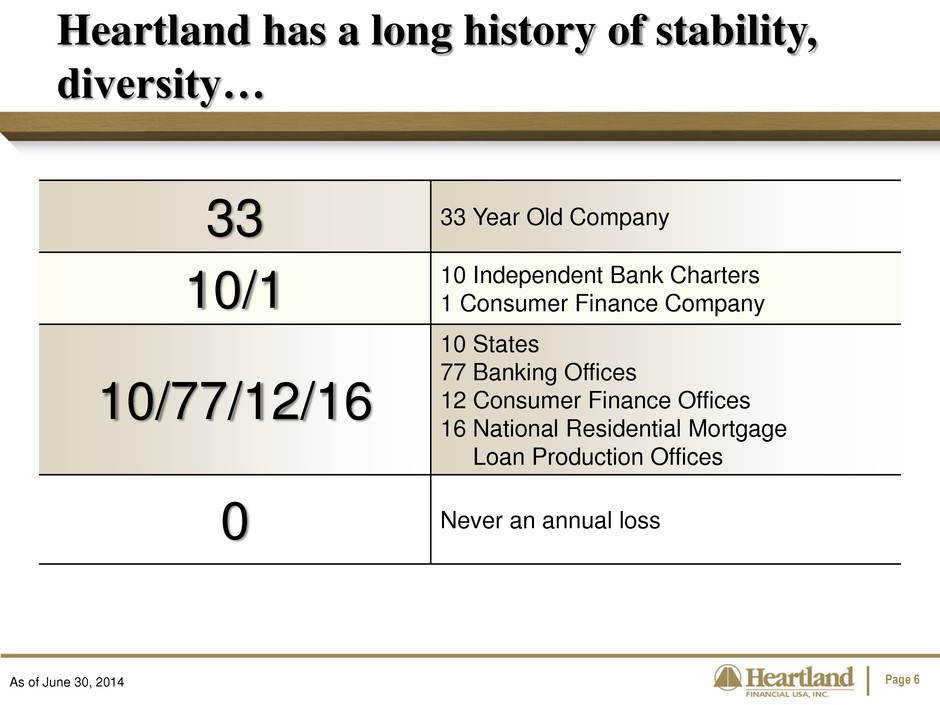

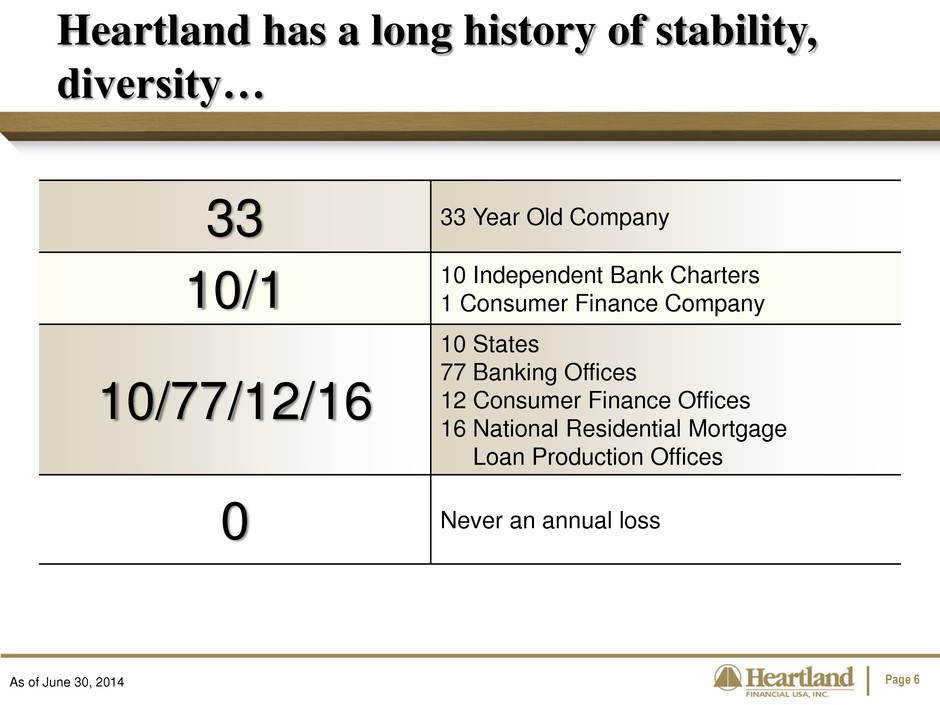

Page 6 33 33 Year Old Company 10/1 10 Independent Bank Charters 1 Consumer Finance Company 10/77/12/16 10 States 77 Banking Offices 12 Consumer Finance Offices 16 National Residential Mortgage Loan Production Offices 0 Never an annual loss Heartland has a long history of stability, diversity… As of June 30, 2014

Page 7 5.9 $5.9 Billion in Assets $438MM Market Cap 2x History of Doubling Earnings and Assets Every 5 to 7 Years 33 33 Consecutive Years of Level or Increased Dividends …but Heartland also has a tremendous history of growth As of June 30, 2014

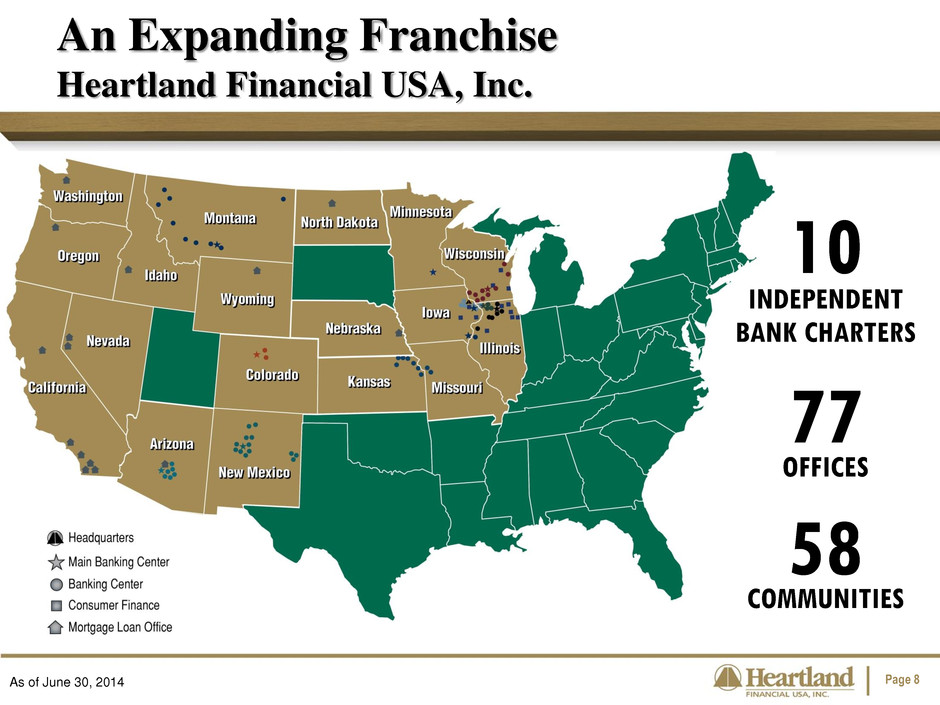

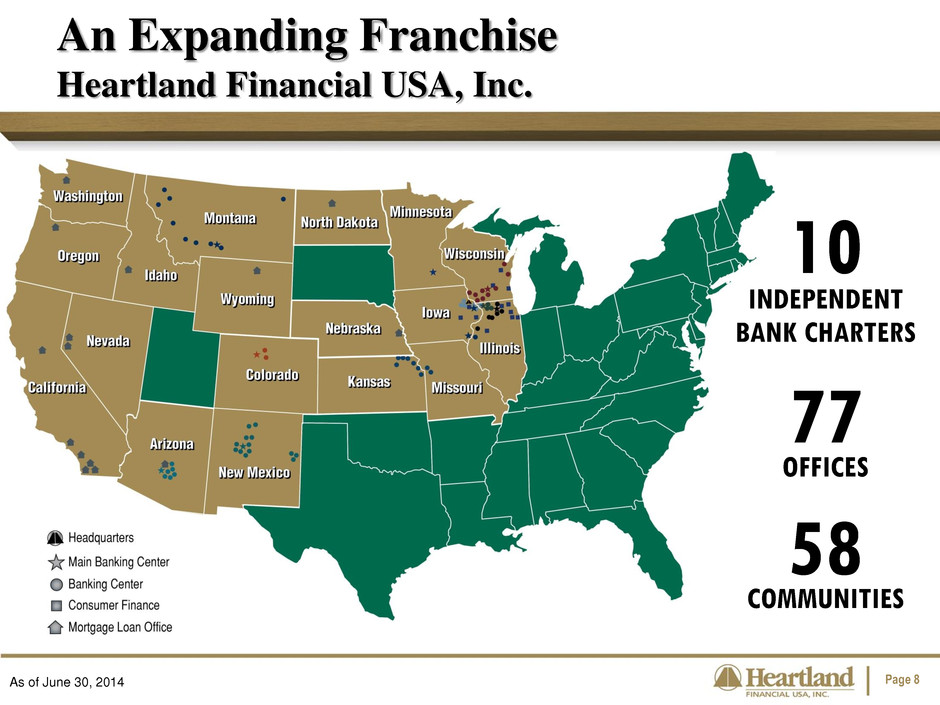

Page 8 An Expanding Franchise Heartland Financial USA, Inc. 10 INDEPENDENT BANK CHARTERS 77 OFFICES 58 COMMUNITIES As of June 30, 2014

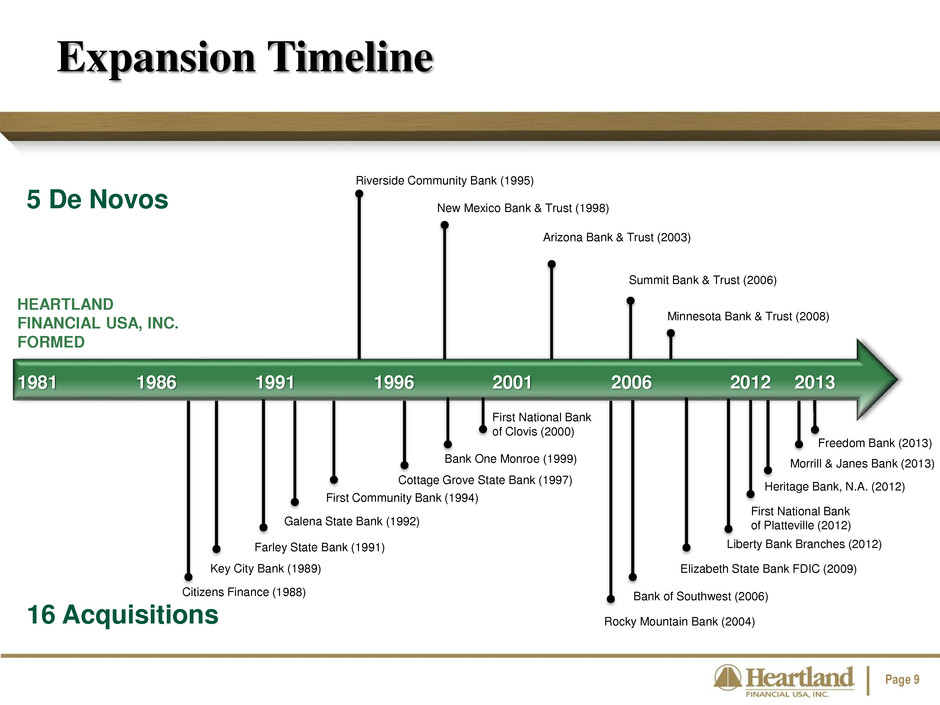

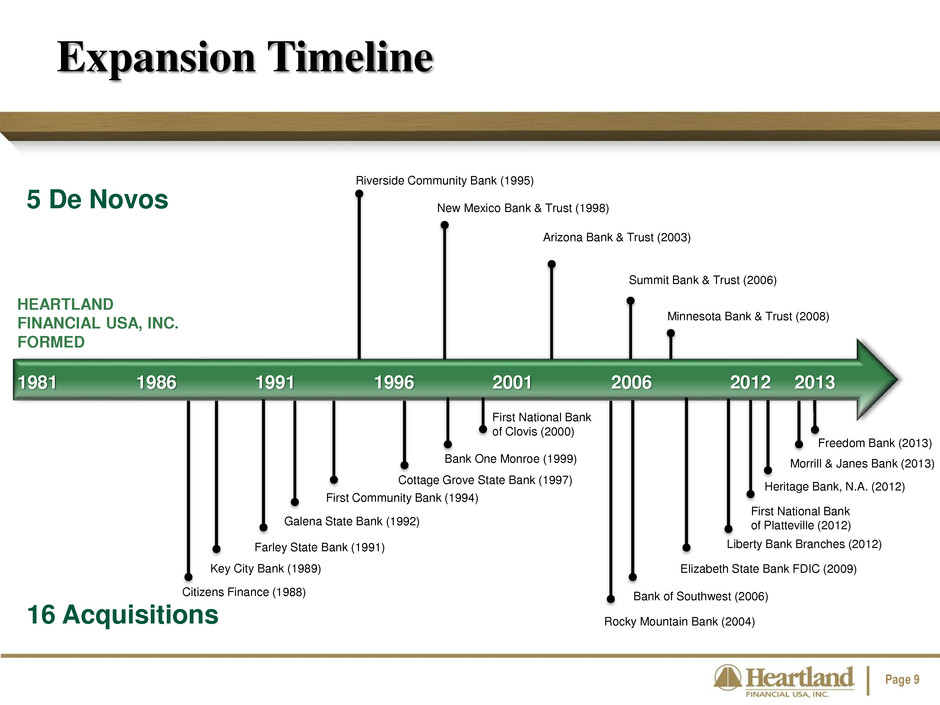

Page 9 Expansion Timeline 1981 1986 1991 1996 2001 2006 2012 Citizens Finance (1988) Key City Bank (1989) Farley State Bank (1991) Galena State Bank (1992) First Community Bank (1994) Cottage Grove State Bank (1997) Bank One Monroe (1999) First National Bank of Clovis (2000) Rocky Mountain Bank (2004) Bank of Southwest (2006) Elizabeth State Bank FDIC (2009) Liberty Bank Branches (2012) First National Bank of Platteville (2012) Riverside Community Bank (1995) New Mexico Bank & Trust (1998) Arizona Bank & Trust (2003) Summit Bank & Trust (2006) Minnesota Bank & Trust (2008) Heritage Bank, N.A. (2012) 5 De Novos 16 Acquisitions HEARTLAND FINANCIAL USA, INC. FORMED 2013 Freedom Bank (2013) Morrill & Janes Bank (2013)

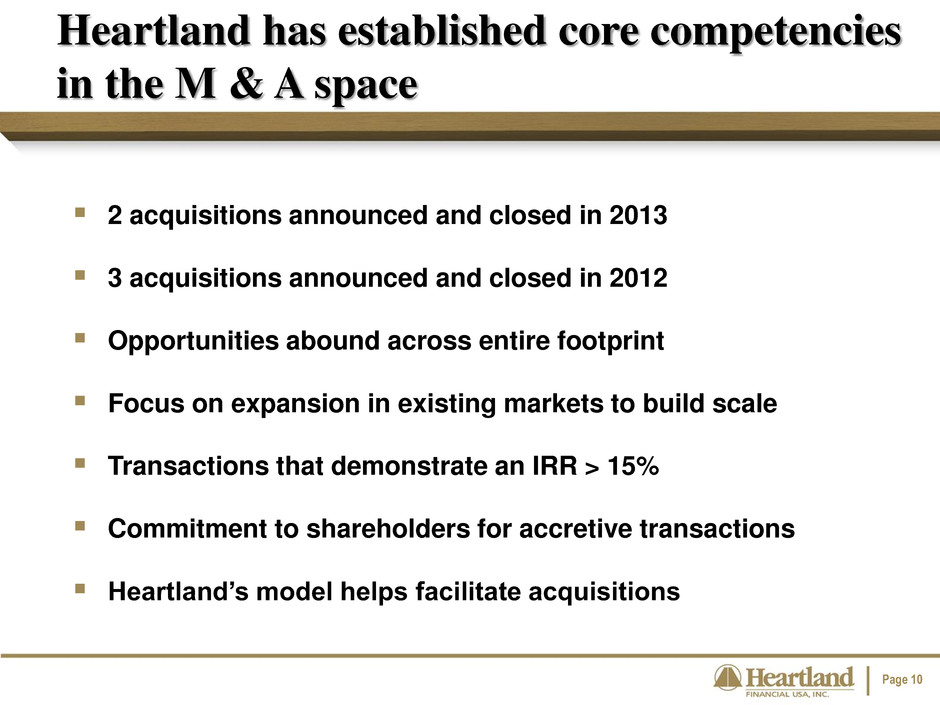

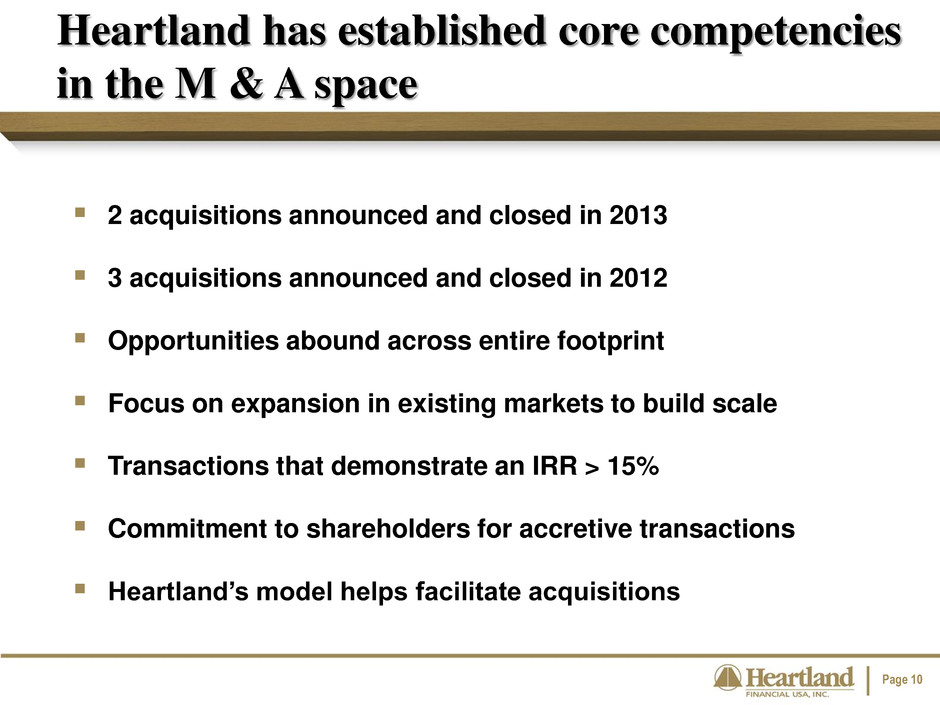

Page 10 2 acquisitions announced and closed in 2013 3 acquisitions announced and closed in 2012 Opportunities abound across entire footprint Focus on expansion in existing markets to build scale Transactions that demonstrate an IRR > 15% Commitment to shareholders for accretive transactions Heartland’s model helps facilitate acquisitions Heartland has established core competencies in the M & A space

Page 11 Parent of Morrill & Janes Bank and Trust Company − Founded in 1871 $790 Million in Assets 11 Locations – Kansas City Metro and N.E. Kansas 10th Heartland Charter Retains name, history, and management team Cash and stock transaction valued at approximately $55.4 million K.C. Metro Population 2.2 million Ranked No.7 on Forbes.com list of “Best Cities for Manufacturing Jobs” Morrill Bancshares Acquisition Acquired October 18, 2013

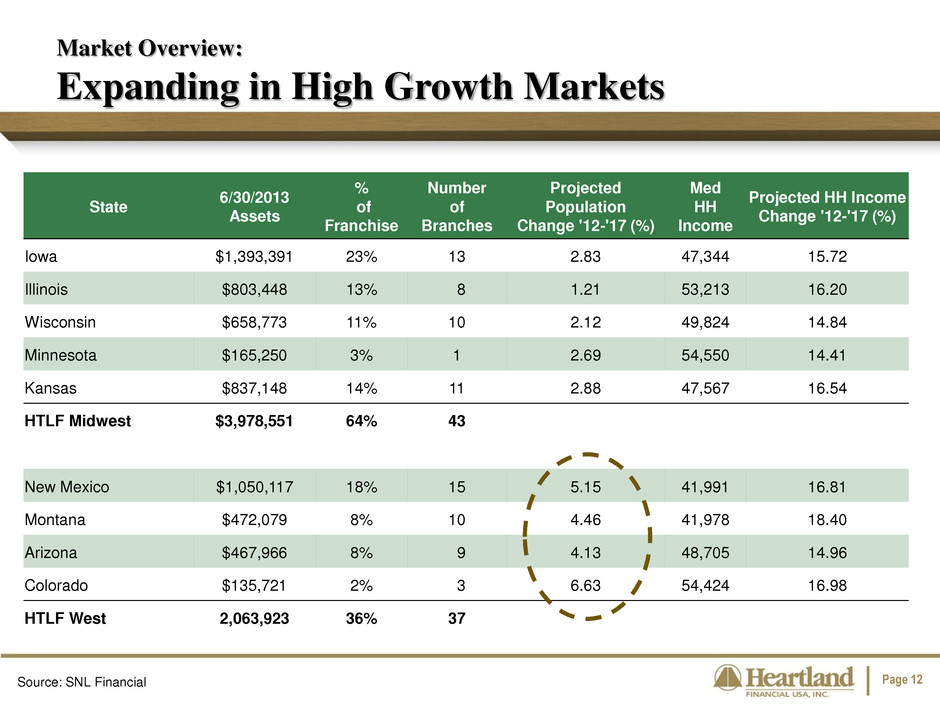

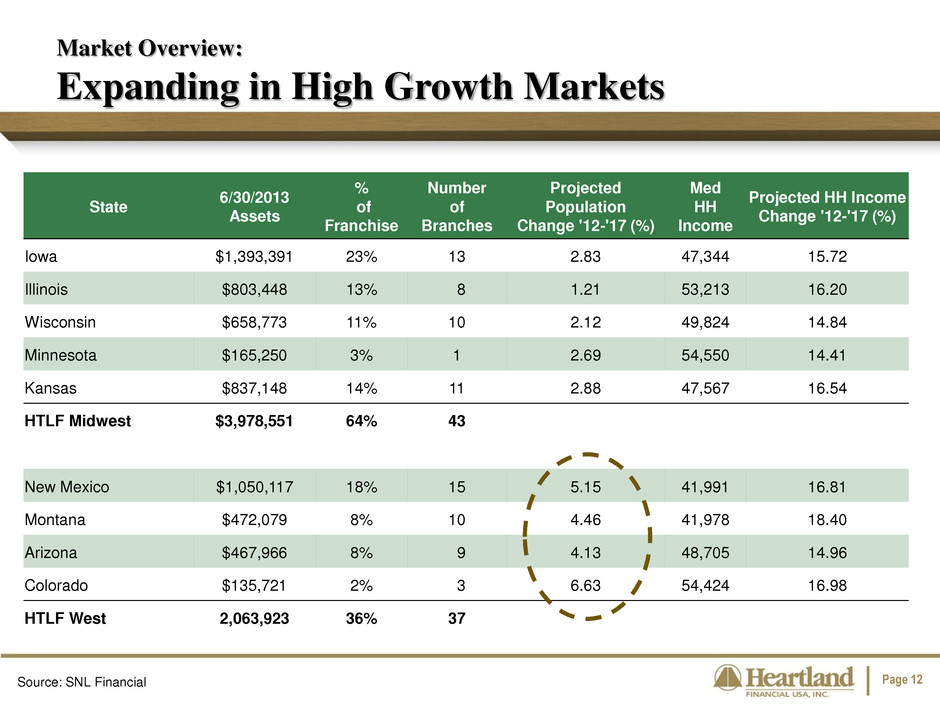

Page 12 Market Overview: Expanding in High Growth Markets State 6/30/2013 Assets % of Franchise Number of Branches Projected Population Change '12-'17 (%) Med HH Income Projected HH Income Change '12-'17 (%) Iowa $1,393,391 23% 13 2.83 47,344 15.72 Illinois $803,448 13% 8 1.21 53,213 16.20 Wisconsin $658,773 11% 10 2.12 49,824 14.84 Minnesota $165,250 3% 1 2.69 54,550 14.41 Kansas $837,148 14% 11 2.88 47,567 16.54 HTLF Midwest $3,978,551 64% 43 New Mexico $1,050,117 18% 15 5.15 41,991 16.81 Montana $472,079 8% 10 4.46 41,978 18.40 Arizona $467,966 8% 9 4.13 48,705 14.96 Colorado $135,721 2% 3 6.63 54,424 16.98 HTLF West 2,063,923 36% 37 Source: SNL Financial

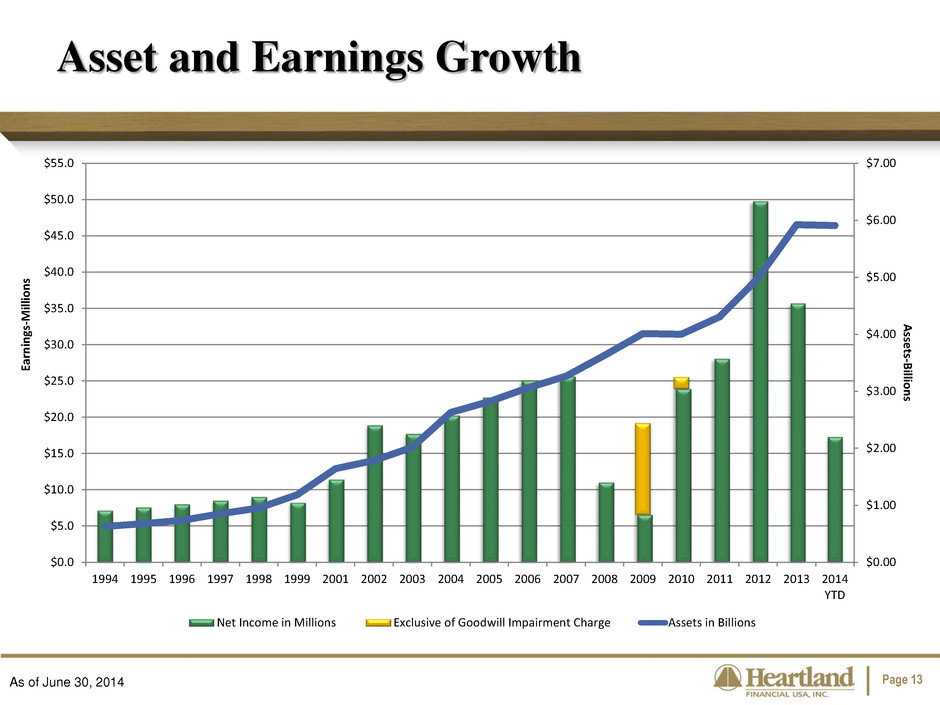

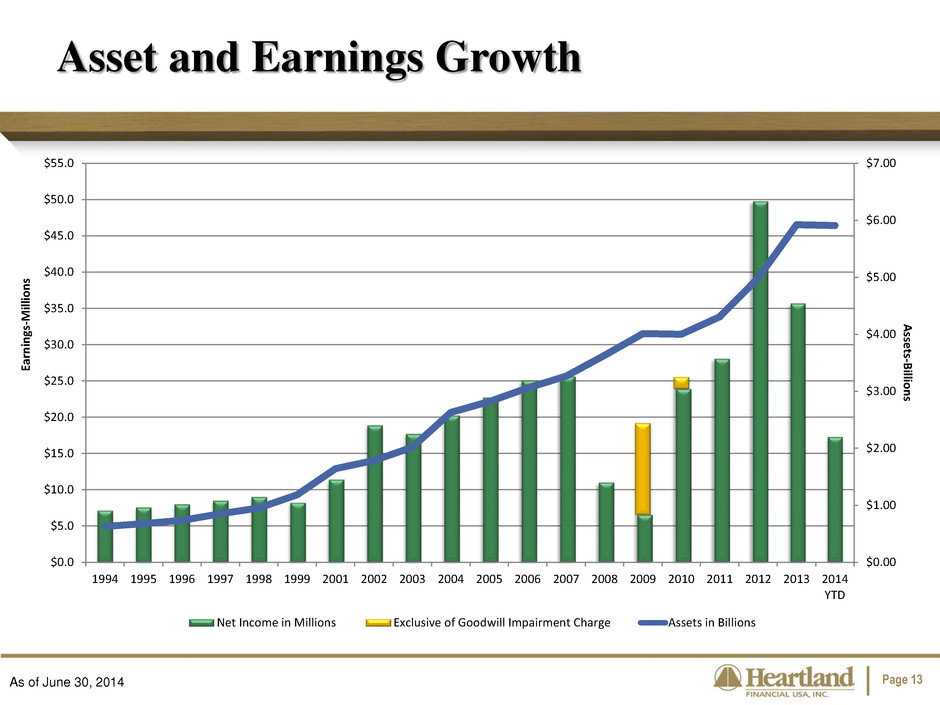

Page 13 Asset and Earnings Growth As of June 30, 2014 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 $55.0 1994 1995 1996 1997 1998 1999 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD A sset s-B illio n s Ea rn in gs -M ill io n s Net Income in Millions Exclusive of Goodwill Impairment Charge Assets in Billions

Page 14 Heartland EPS As of June 30, 2014 $2.04 $0.92 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD EPS Exclusive of Goodwill Impairment Charge

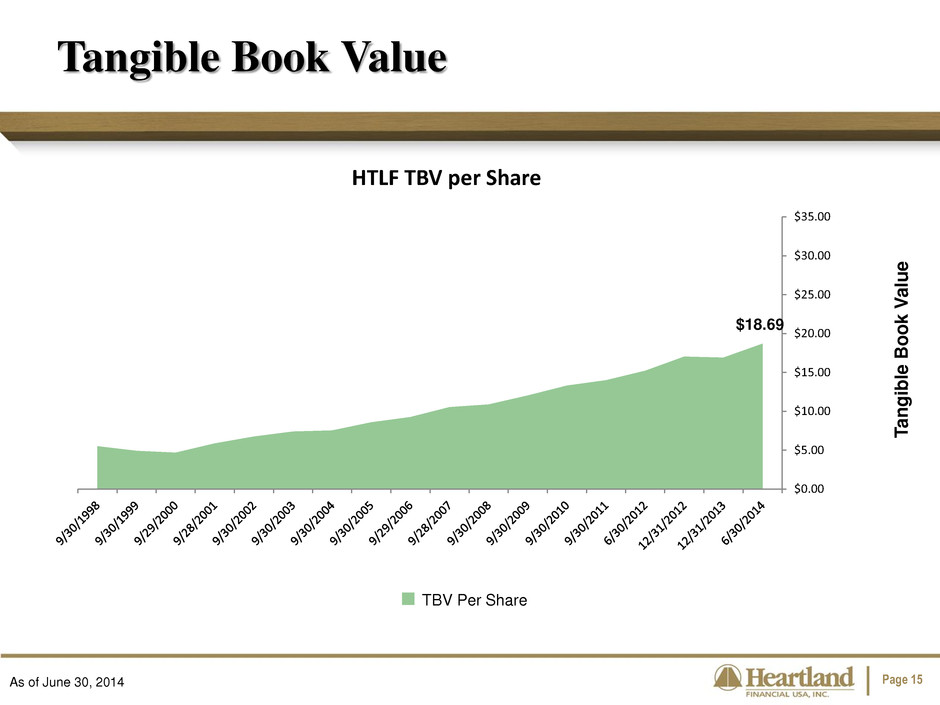

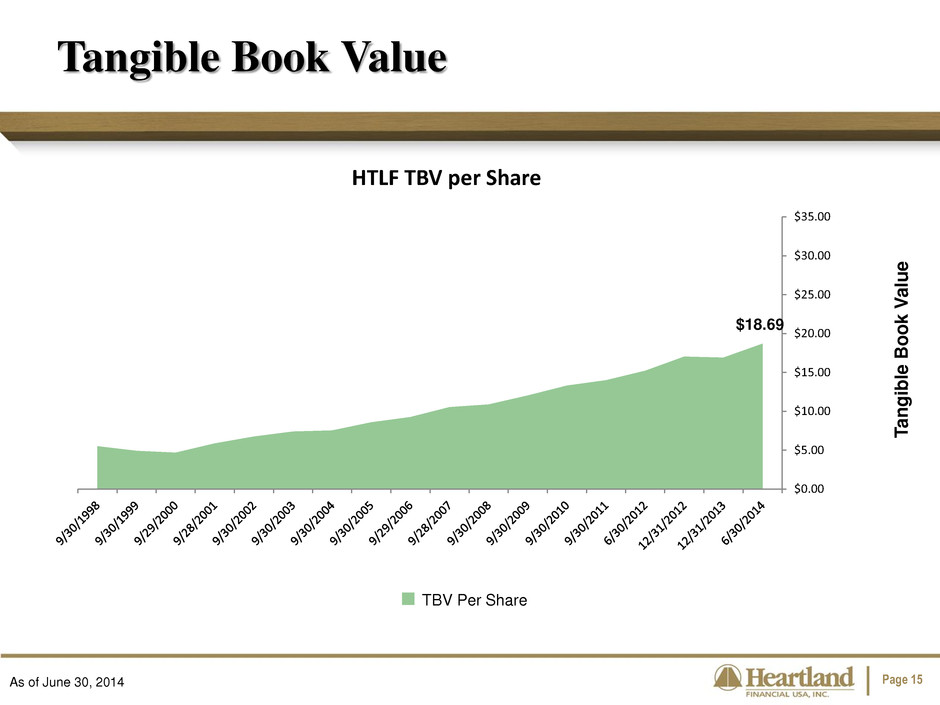

Page 15 Tangible Book Value As of June 30, 2014 T a n g ib le B o o k V a lu e TBV Per Share $18.69 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 HTLF TBV per Share

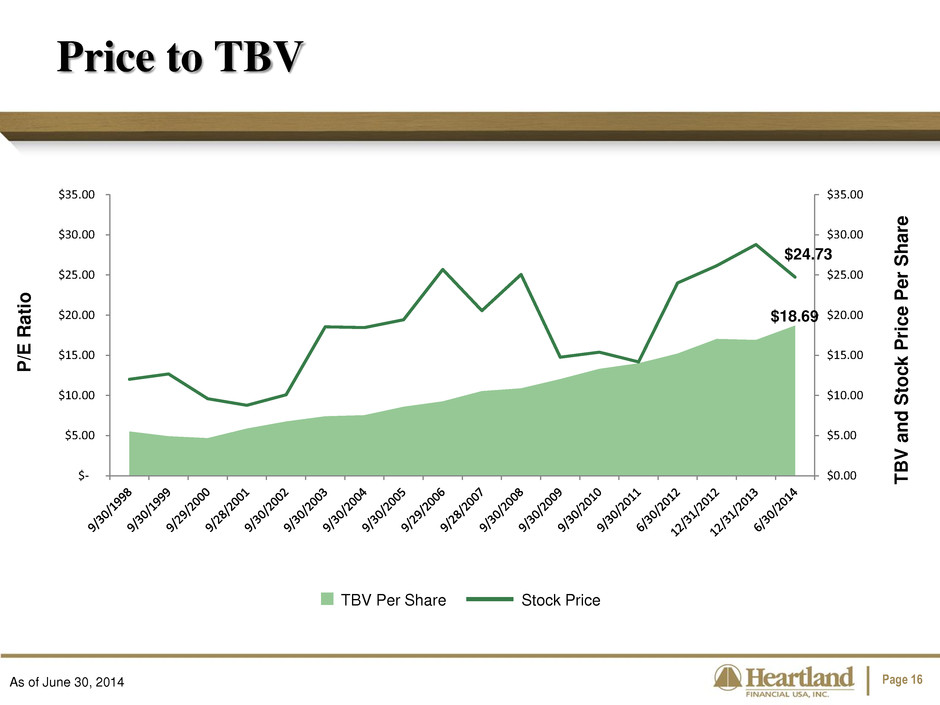

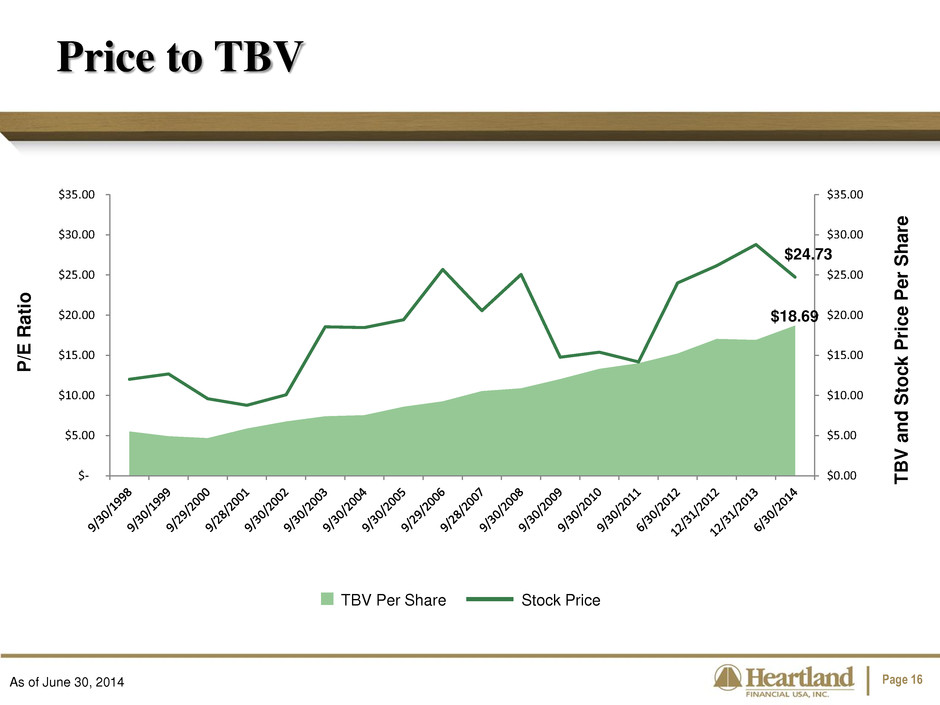

Page 16 Price to TBV As of June 30, 2014 T B V a n d St o ck P ri ce Pe r S h a re TBV Per Share Stock Price $18.69 $24.73 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 P /E R at io

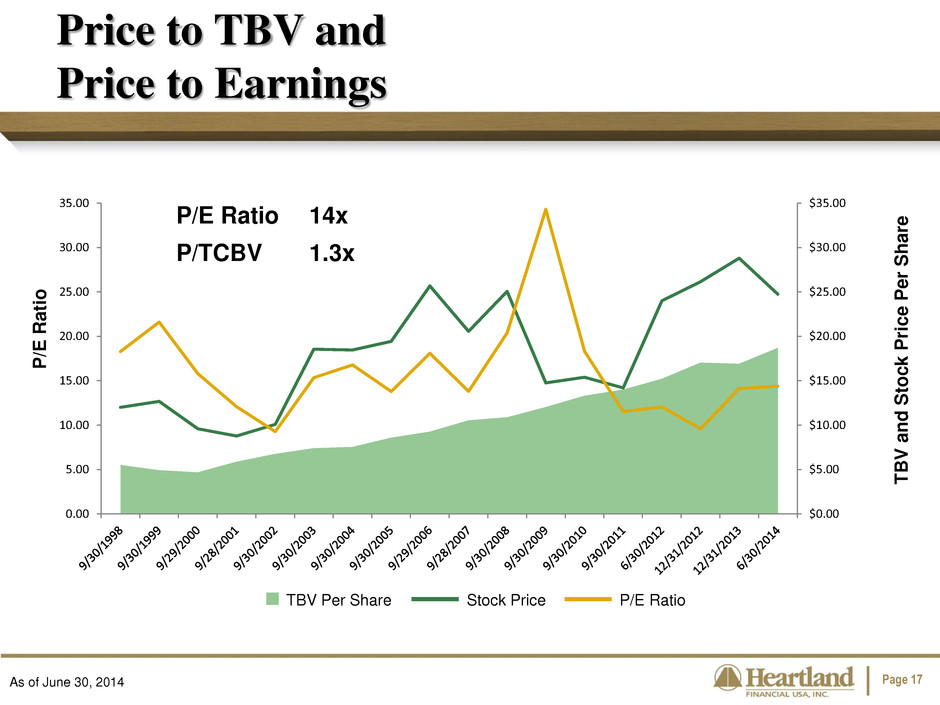

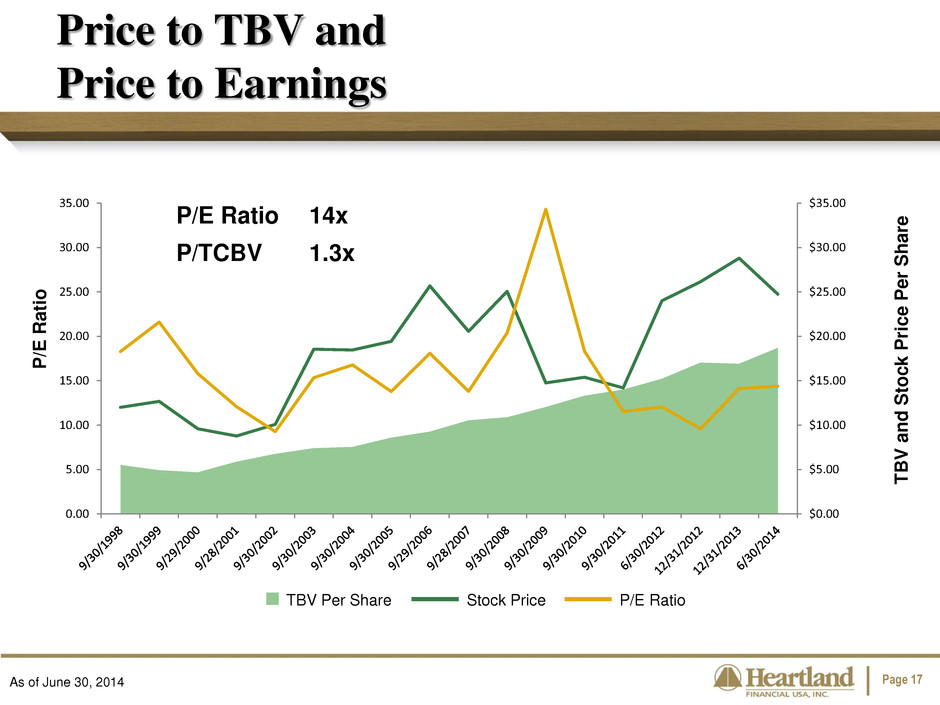

Page 17 Price to TBV and Price to Earnings As of June 30, 2014 T B V a n d St o ck P ri ce Pe r S h a re TBV Per Share Stock Price P/E Ratio P/E Ratio 14x P/TCBV 1.3x P /E R at io 0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00

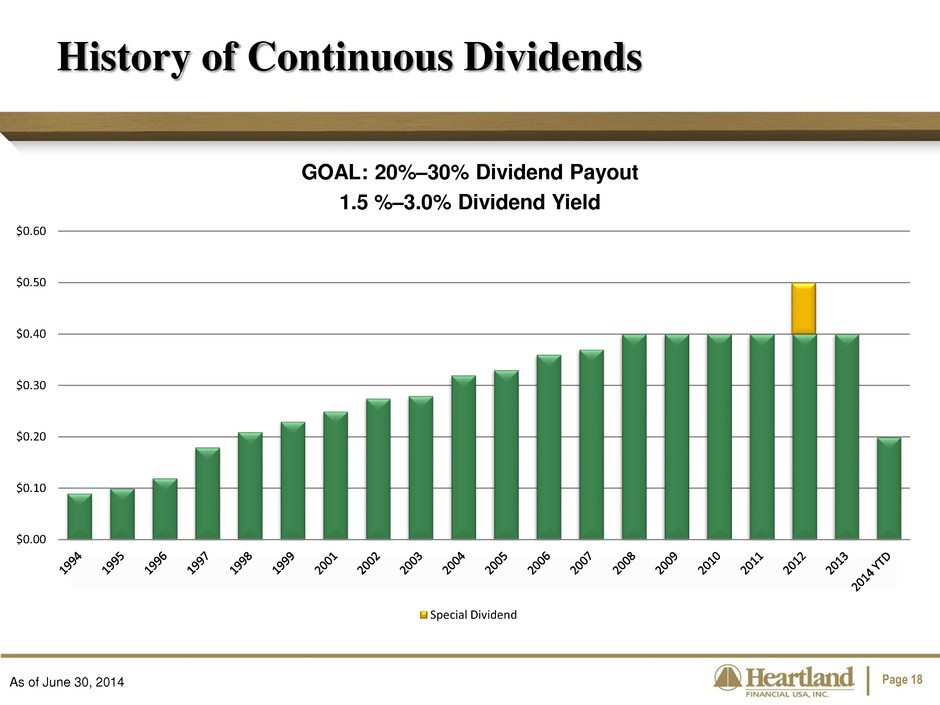

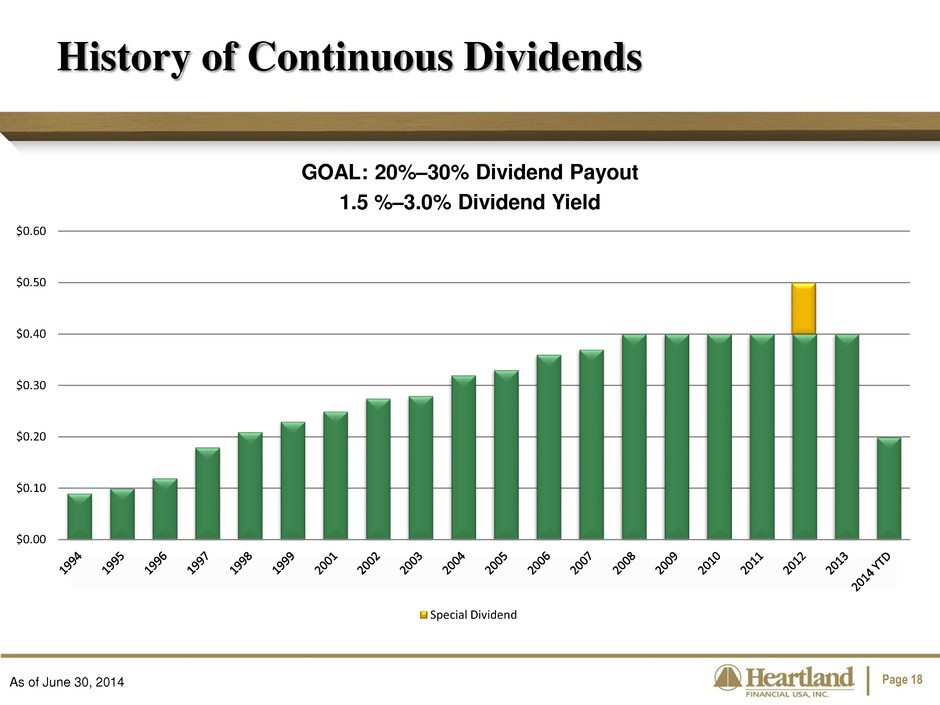

Page 18 GOAL: 20%–30% Dividend Payout 1.5 %–3.0% Dividend Yield History of Continuous Dividends As of June 30, 2014 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Special Dividend

Page 19 Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial Highlights

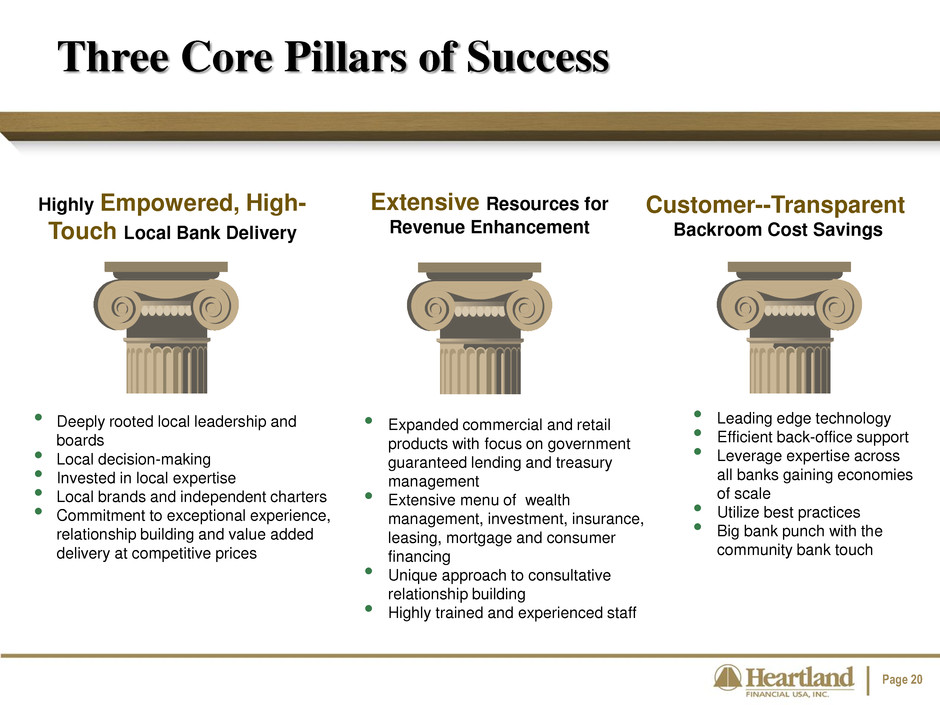

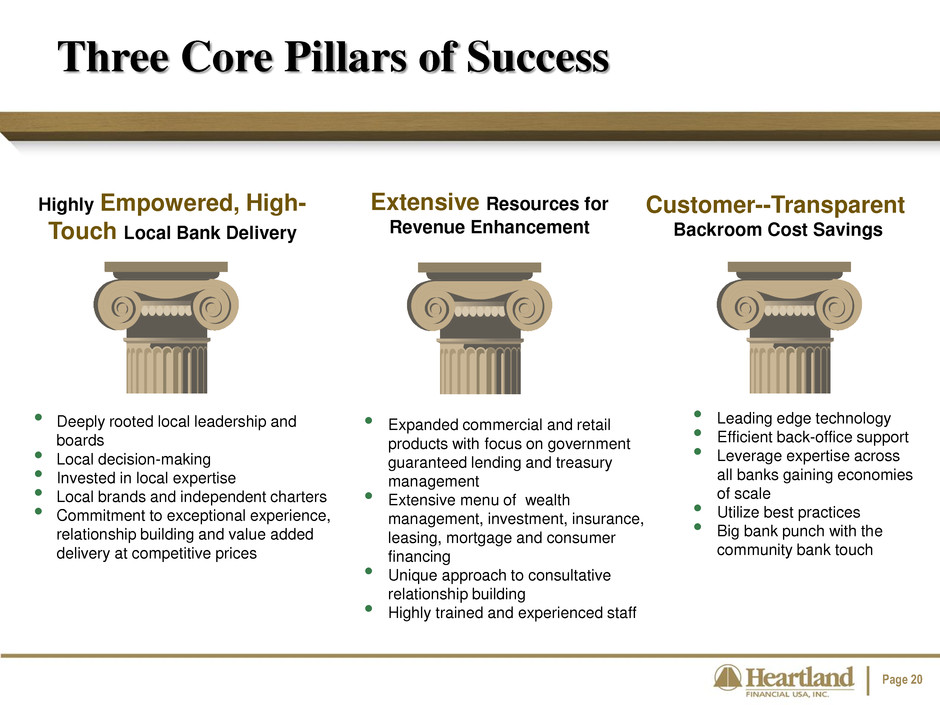

Page 20 Highly Empowered, High- Touch Local Bank Delivery • Deeply rooted local leadership and boards • Local decision-making • Invested in local expertise • Local brands and independent charters • Commitment to exceptional experience, relationship building and value added delivery at competitive prices Extensive Resources for Revenue Enhancement • Expanded commercial and retail products with focus on government guaranteed lending and treasury management • Extensive menu of wealth management, investment, insurance, leasing, mortgage and consumer financing • Unique approach to consultative relationship building • Highly trained and experienced staff Customer--Transparent Backroom Cost Savings • Leading edge technology • Efficient back-office support • Leverage expertise across all banks gaining economies of scale • Utilize best practices • Big bank punch with the community bank touch Three Core Pillars of Success

Page 21 Commercial & Small Business Residential Mortgage Retail Accounts from Immediate Area Personal Accounts of Owners and Employees Primary Target Markets

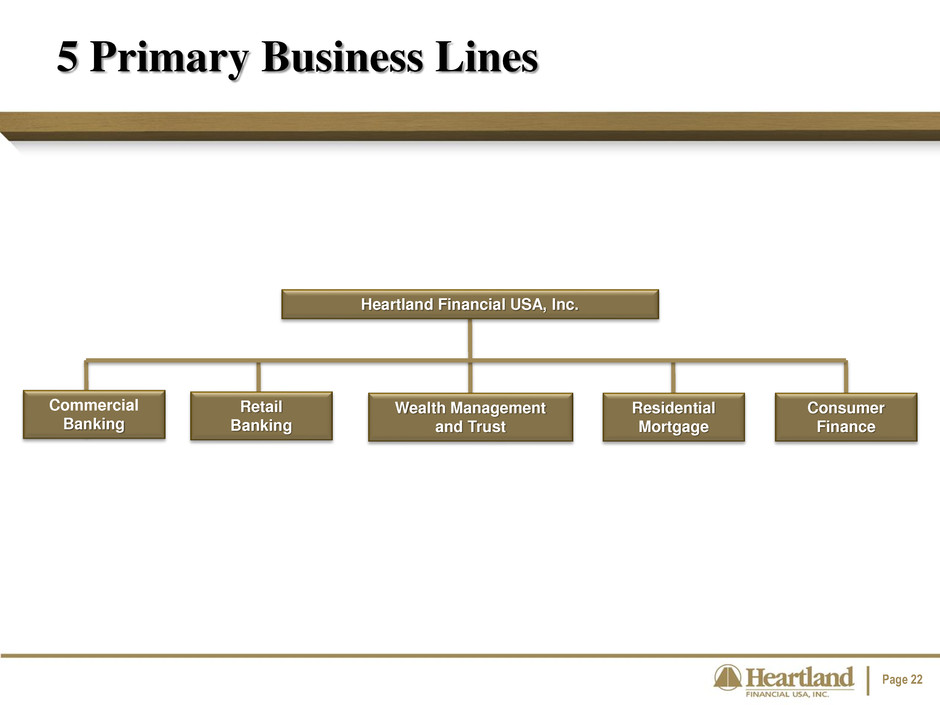

Page 22 Heartland Financial USA, Inc. Commercial Banking Retail Banking Wealth Management and Trust Consumer Finance Residential Mortgage 5 Primary Business Lines

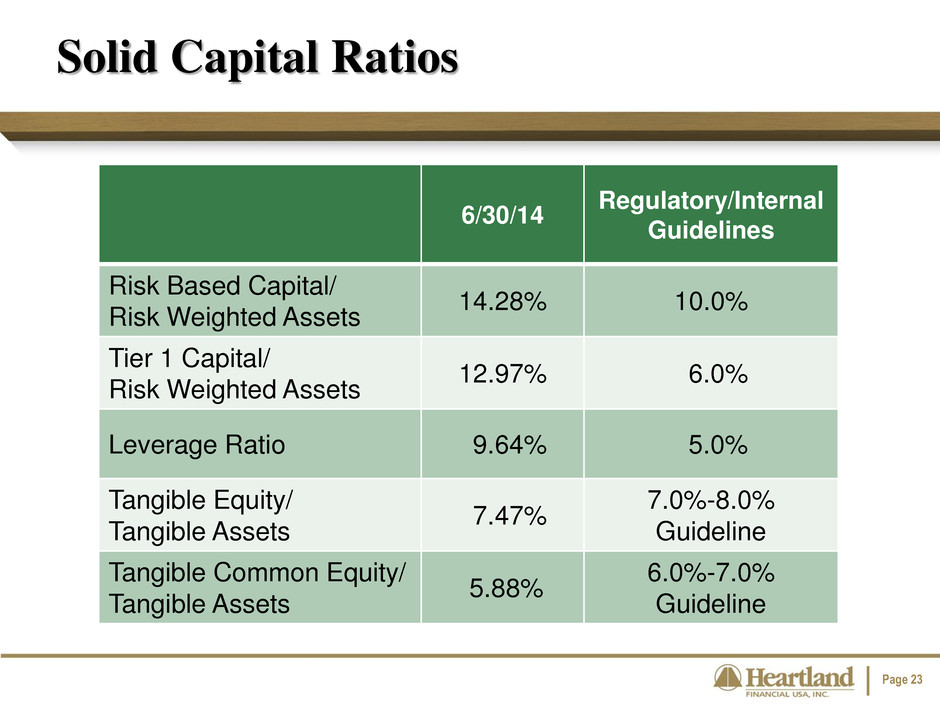

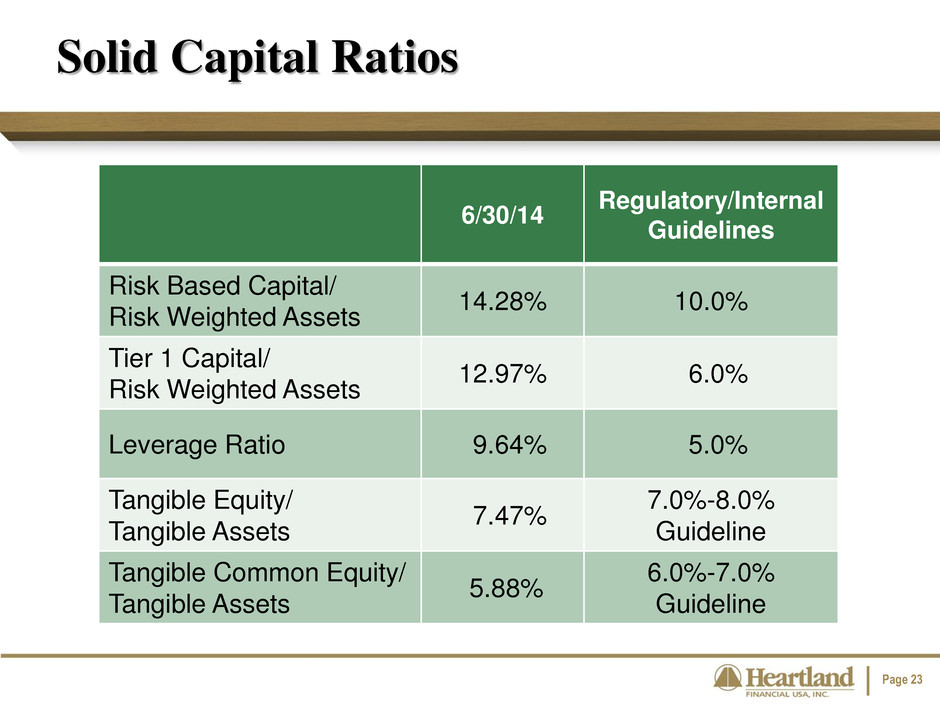

Page 23 Solid Capital Ratios 6/30/14 Regulatory/Internal Guidelines Risk Based Capital/ Risk Weighted Assets 14.28% 10.0% Tier 1 Capital/ Risk Weighted Assets 12.97% 6.0% Leverage Ratio 9.64% 5.0% Tangible Equity/ Tangible Assets 7.47% 7.0%-8.0% Guideline Tangible Common Equity/ Tangible Assets 5.88% 6.0%-7.0% Guideline

Page 24 $81.7MM Small Business Lending Fund - currently at 1% dividend rate (TRUPS, SBLF and other debt) currently fixed at 3.0% after tax. Other debt maturities laddered over 3-6 years Low Cost Non-Common Funding

Page 25 2012 was the best year ever with a 17.41% ROATCE, 2013 ROATCE was 12.16% 2nd Quarter 2014 ROATCE is 12.66% Non-Interest Income of 31% of Total Revenue and Expanding (Mortgage, Wealth Management, Treasury Management) Non-performing assets to total assets as of 12/31/13 was 1.23% and as of 2nd quarter 2014 is .90% Diverse geographic footprint reduces risk HTLF core facts summary

Page 26 Master strategy of balanced growth and profit Solid Midwest franchise balanced with a Western franchise, which will ultimately be the driver for growth Never experienced a loss year 33 consecutive years of increased or level dividends; 1.38 percent dividend yield During the recession, unlike many of our peers, Heartland Financial did not do dilutive common stock issuance HTLF core facts summary (cont.)

Page 27 Agenda Heartland’s growth story Key tenets of Heartland’s business model Financial Highlights

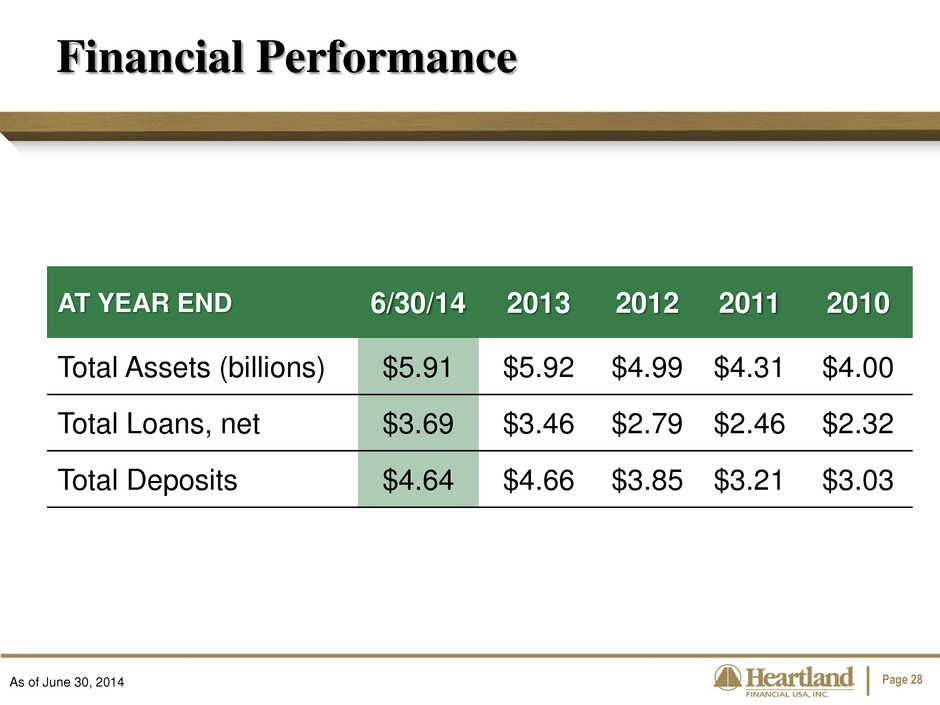

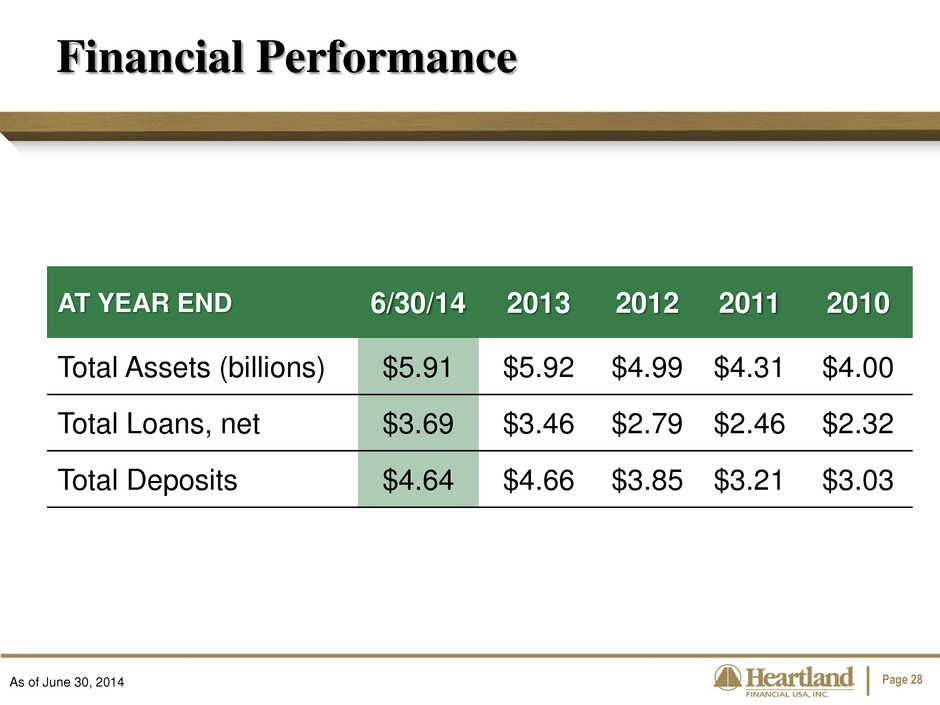

Page 28 Financial Performance As of June 30, 2014 AT YEAR END 6/30/14 2013 2012 2011 2010 Total Assets (billions) $5.91 $5.92 $4.99 $4.31 $4.00 Total Loans, net $3.69 $3.46 $2.79 $2.46 $2.32 Total Deposits $4.64 $4.66 $3.85 $3.21 $3.03

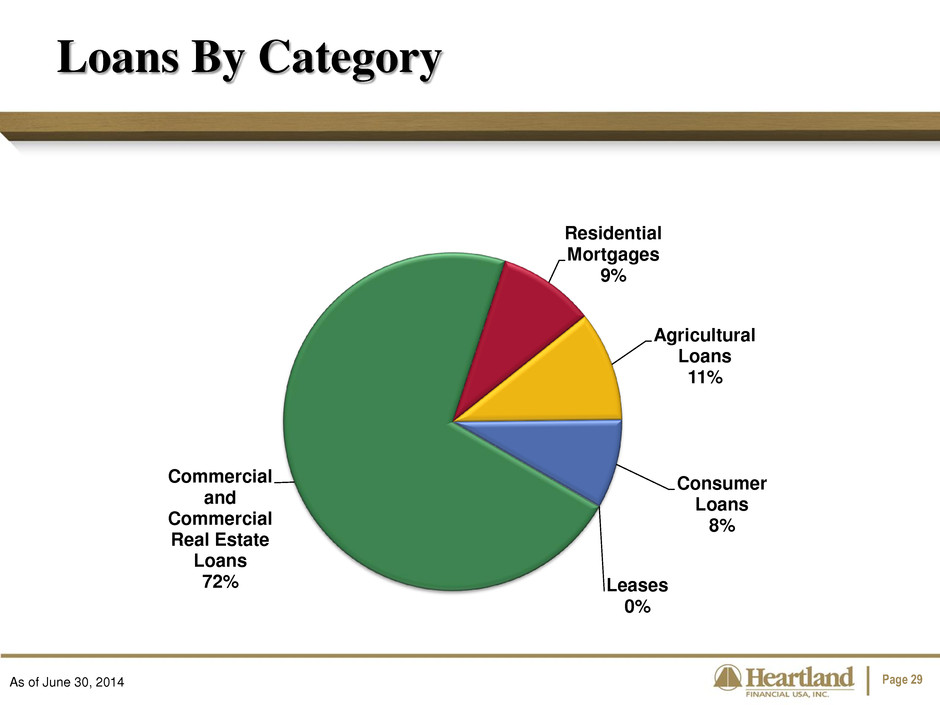

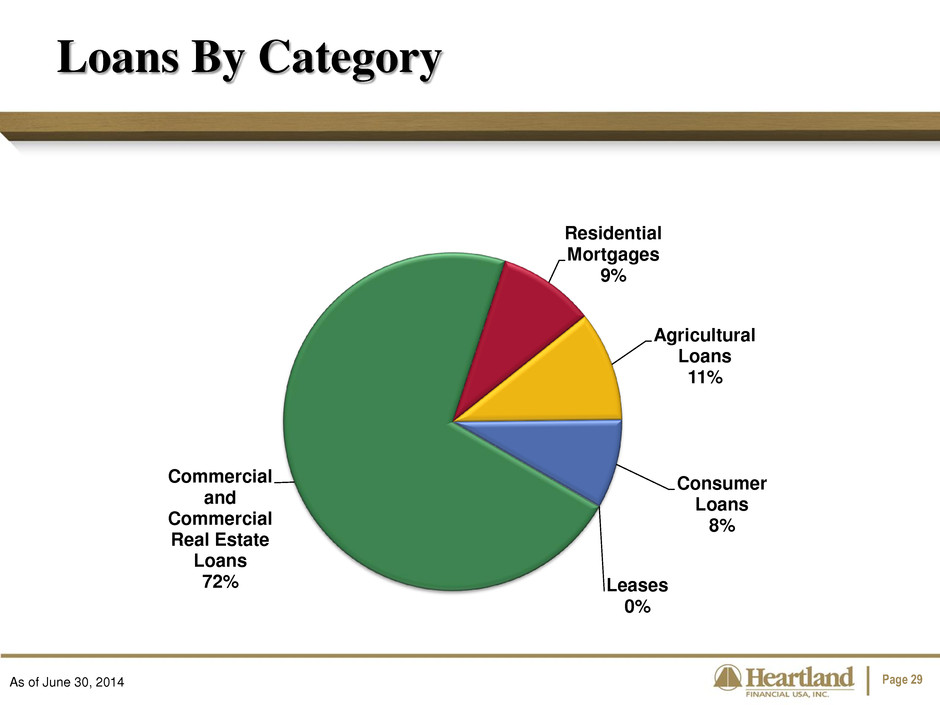

Page 29 Commercial and Commercial Real Estate Loans 72% Residential Mortgages 9% Agricultural Loans 11% Consumer Loans 8% Leases 0% Loans By Category As of June 30, 2014

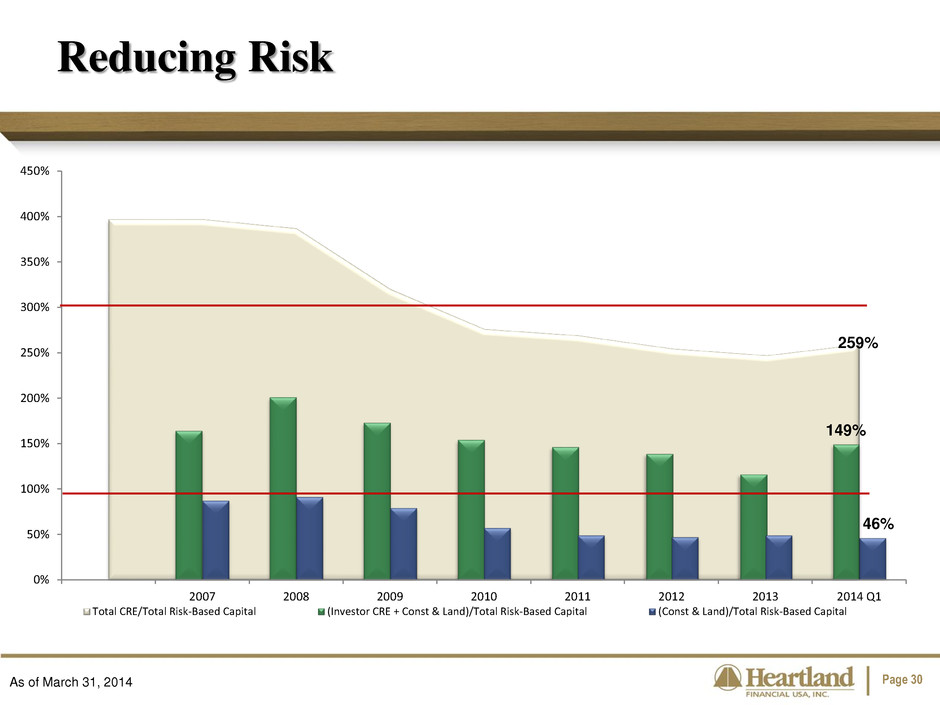

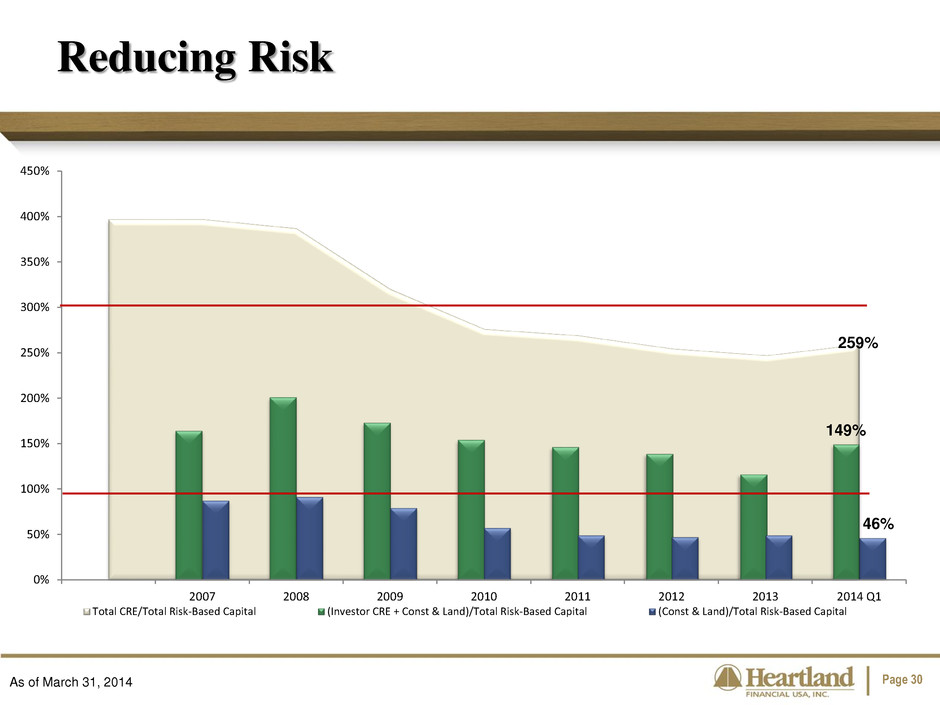

Page 30 Reducing Risk As of March 31, 2014 259% 149% 46% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% 2007 2008 2009 2010 2011 2012 2013 2014 Q1 Total CRE/Total Risk-Based Capital (Investor CRE + Const & Land)/Total Risk-Based Capital (Const & Land)/Total Risk-Based Capital

Page 31 Non-Performing Assets/Total Assets As of June 30, 2014 Source: SNL Financial 0.90% 1.21% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1 2014 Q2 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint

Page 32 Improved Deposit Mix Total Deposits $0.72 Billion Total Deposits $4.64 Billion C.A.G.R. 13% IBCA Savings 41% Demand 10% CD 49% 12/31/1998 IBCA Savings 55% Demand 26% CD 19% 6/30/2014

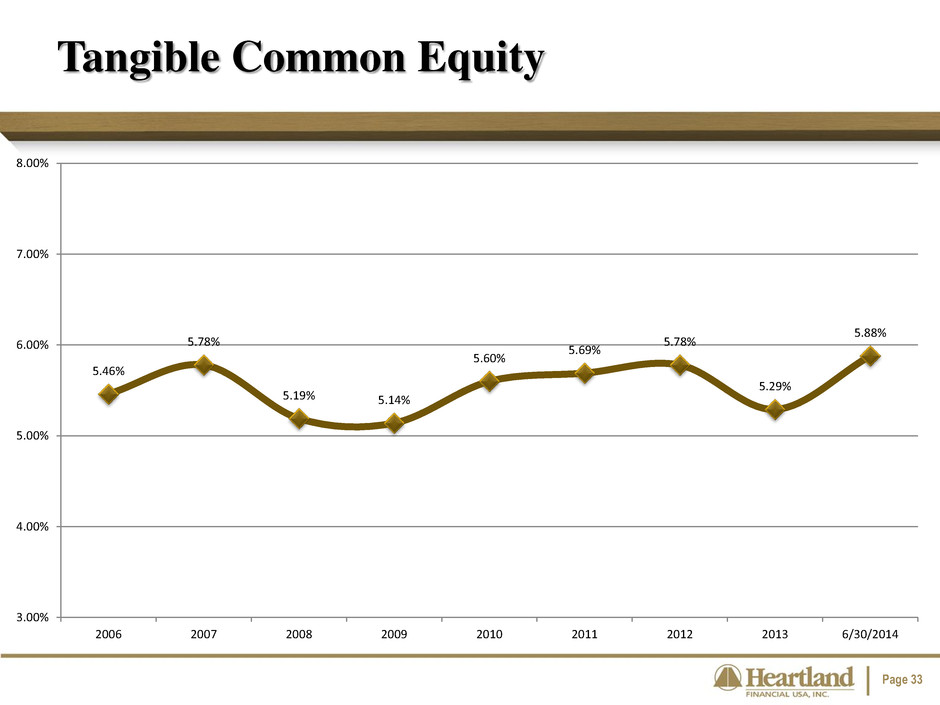

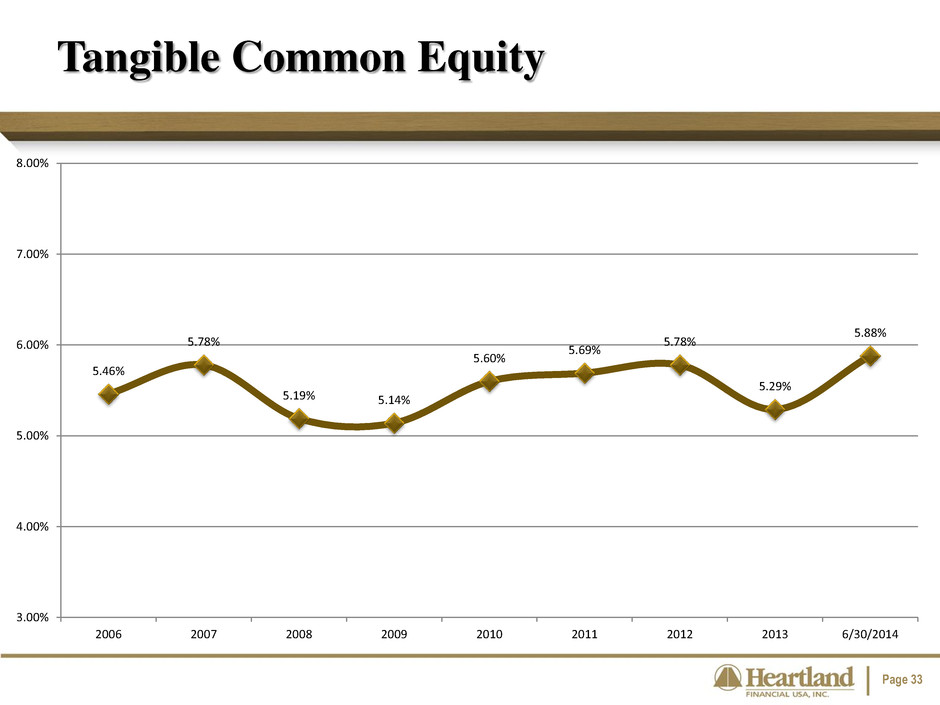

Page 33 Tangible Common Equity 5.46% 5.78% 5.19% 5.14% 5.60% 5.69% 5.78% 5.29% 5.88% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2006 2007 2008 2009 2010 2011 2012 2013 6/30/2014

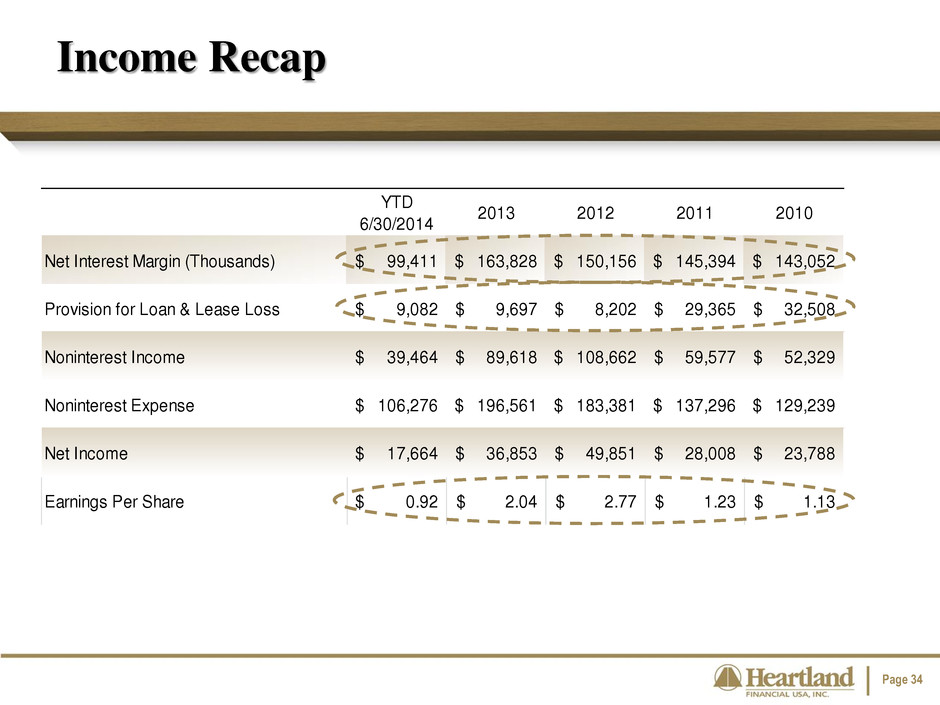

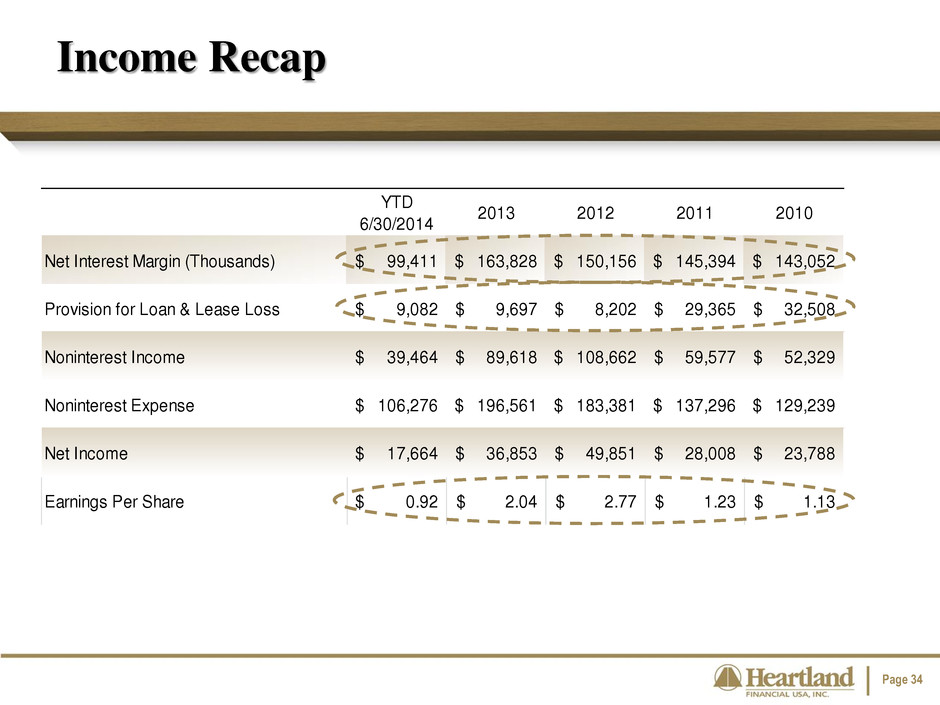

Page 34 YTD 6/30/2014 2013 2012 2011 2010 Net Interest Margin (Thousands) 99,411$ 163,828$ 150,156$ 145,394$ 143,052$ Provision for Loan & Lease Loss 9,082$ 9,697$ 8,202$ 29,365$ 32,508$ Noninterest Income 39,464$ 89,618$ 108,662$ 59,577$ 52,329$ Noninterest Expense 106,276$ 196,561$ 183,381$ 137,296$ 129,239$ Net Income 17,664$ 36,853$ 49,851$ 28,008$ 23,788$ Earnings Per Share 0.92$ 2.04$ 2.77$ 1.23$ 1.13$ Income Recap

Page 35 Net Interest Margin As of June 30, 2014 Source: SNL Financial 4.04% 3.53% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1 2014 Q2 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint

Page 36 Provision For Loan & Lease Losses As of June 30, 2014 $9.1 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD M ill io n s

Page 37 Credit Trends As of June 30, 2014 $54.2 $9.9 $40.9 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD M ill io n s Non-Performing Assets Net Charge-Offs Allowance for Loan & Lease Losses

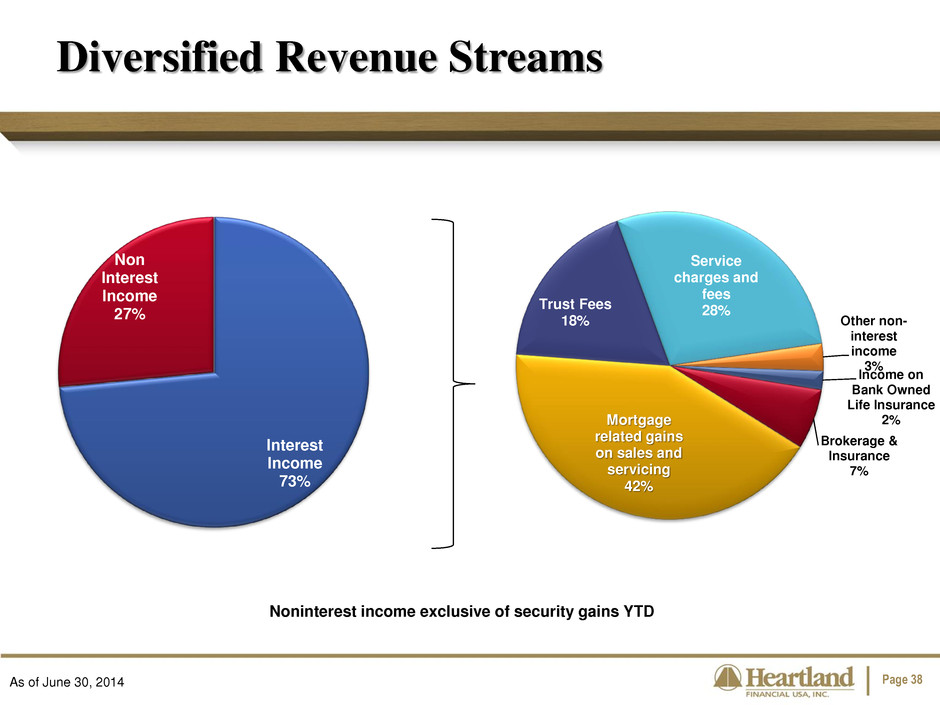

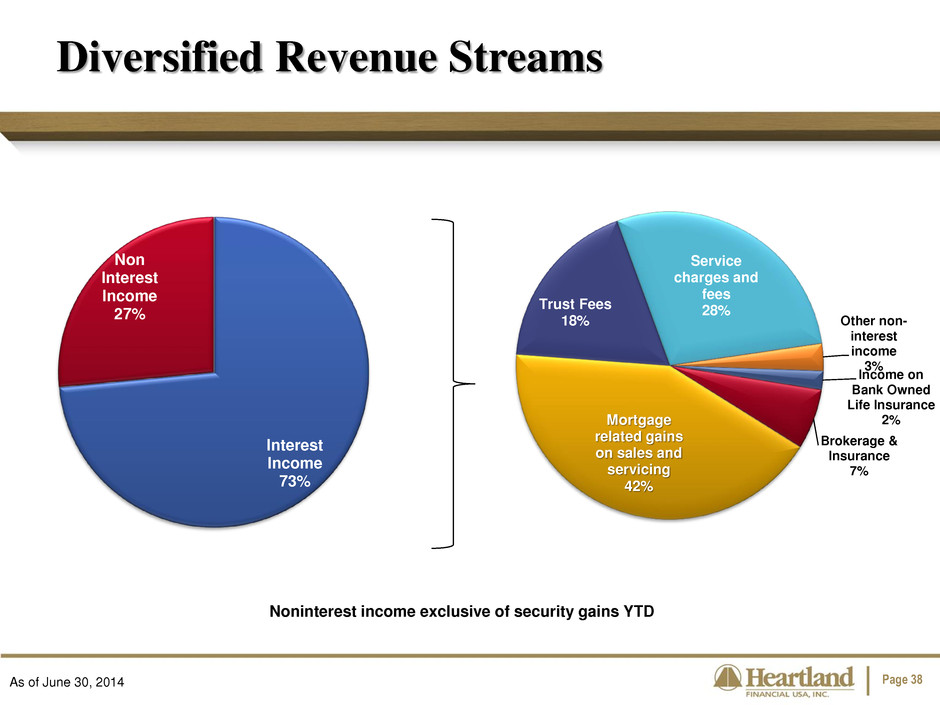

Page 38 Noninterest income exclusive of security gains YTD Diversified Revenue Streams As of June 30, 2014 Income on Bank Owned Life Insurance 2% Brokerage & Insurance 7% Mortgage related gains on sales and servicing 42% Trust Fees 18% Service charges and fees 28% Other non- interest income 3% Interest Income 73% Non Interest Income 27%

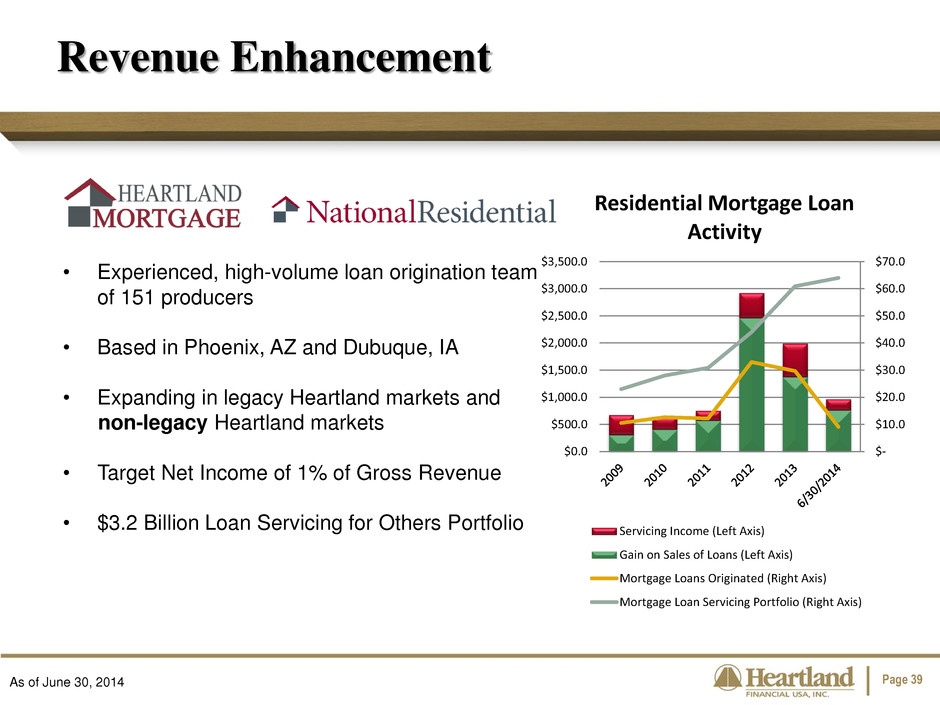

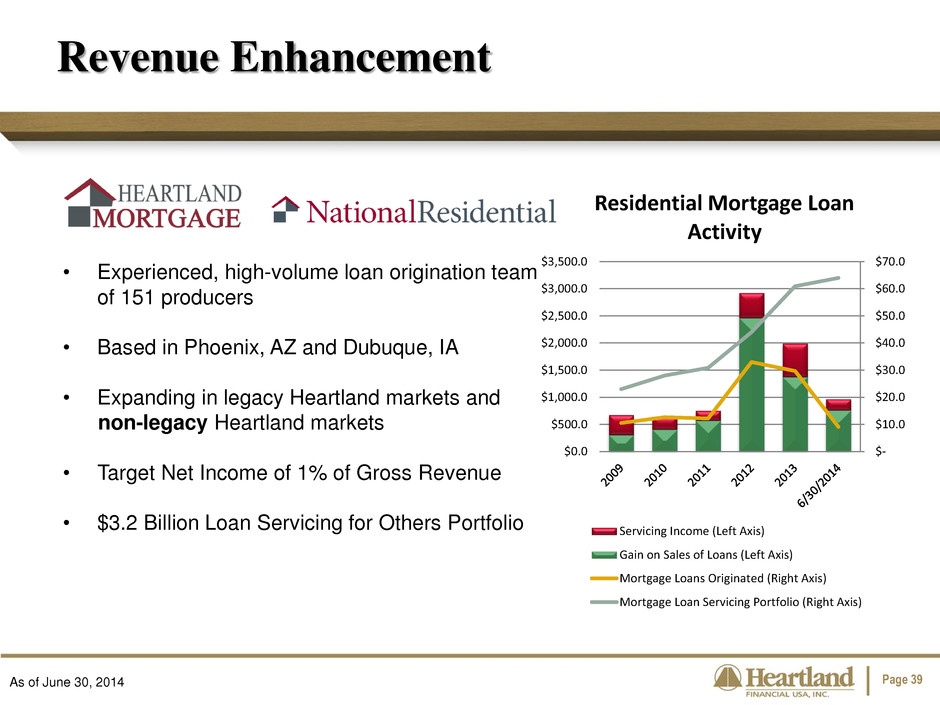

Page 39 • Experienced, high-volume loan origination team of 151 producers • Based in Phoenix, AZ and Dubuque, IA • Expanding in legacy Heartland markets and non-legacy Heartland markets • Target Net Income of 1% of Gross Revenue • $3.2 Billion Loan Servicing for Others Portfolio Revenue Enhancement As of June 30, 2014 $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 $3,000.0 $3,500.0 Residential Mortgage Loan Activity Servicing Income (Left Axis) Gain on Sales of Loans (Left Axis) Mortgage Loans Originated (Right Axis) Mortgage Loan Servicing Portfolio (Right Axis)

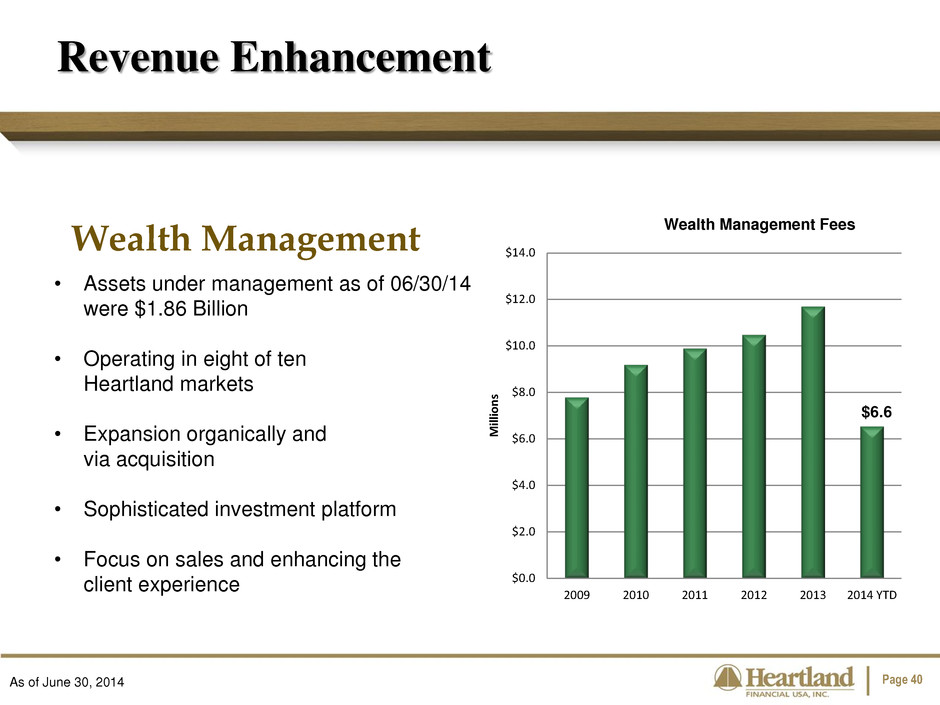

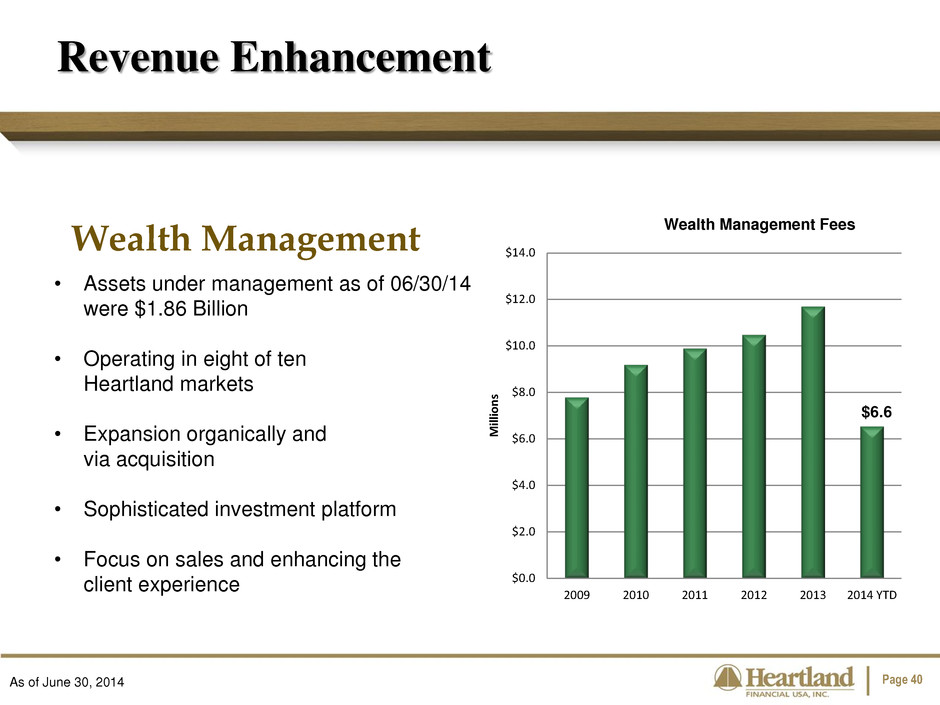

Page 40 • Assets under management as of 06/30/14 were $1.86 Billion • Operating in eight of ten Heartland markets • Expansion organically and via acquisition • Sophisticated investment platform • Focus on sales and enhancing the client experience Wealth Management Revenue Enhancement Wealth Management Fees As of June 30, 2014 $6.6 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2009 2010 2011 2012 2013 2014 YTD M ill io n s

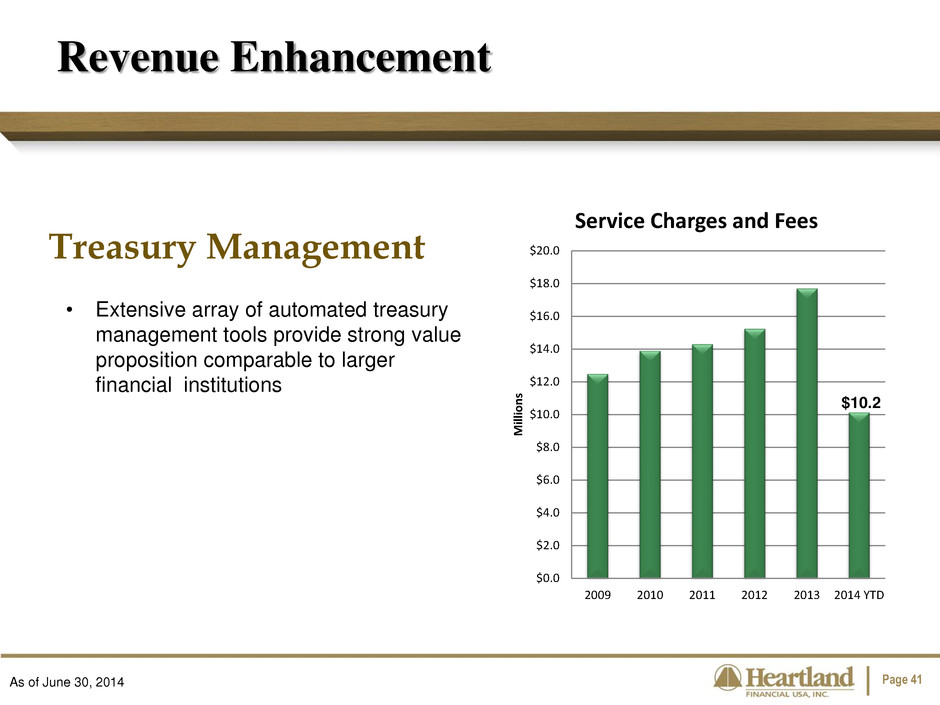

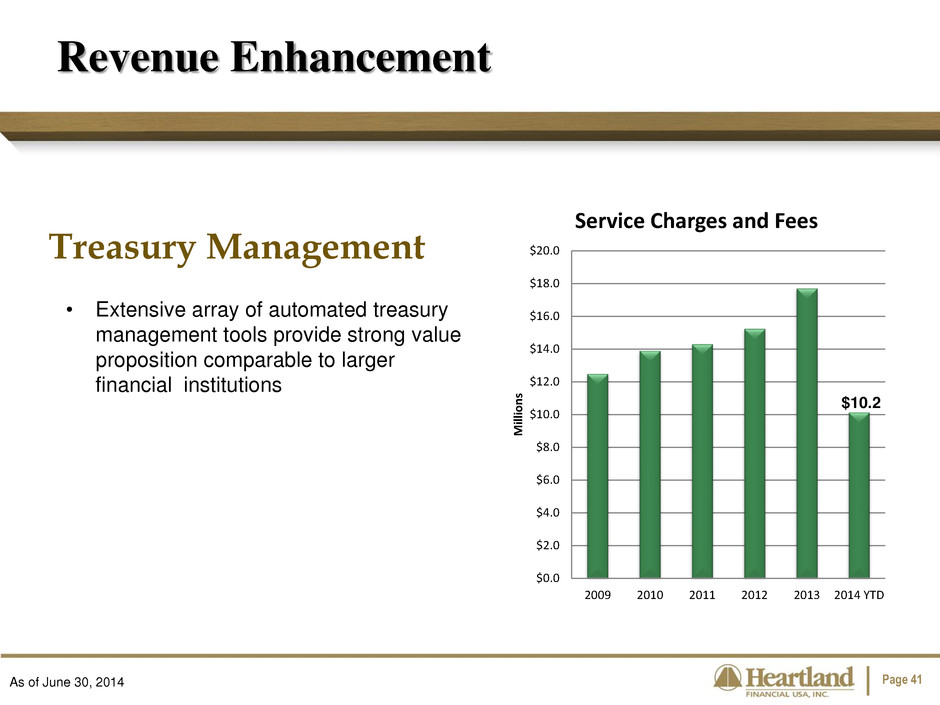

Page 41 Treasury Management • Extensive array of automated treasury management tools provide strong value proposition comparable to larger financial institutions Revenue Enhancement As of June 30, 2014 $10.2 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 2009 2010 2011 2012 2013 2014 YTD M ill io n s Service Charges and Fees

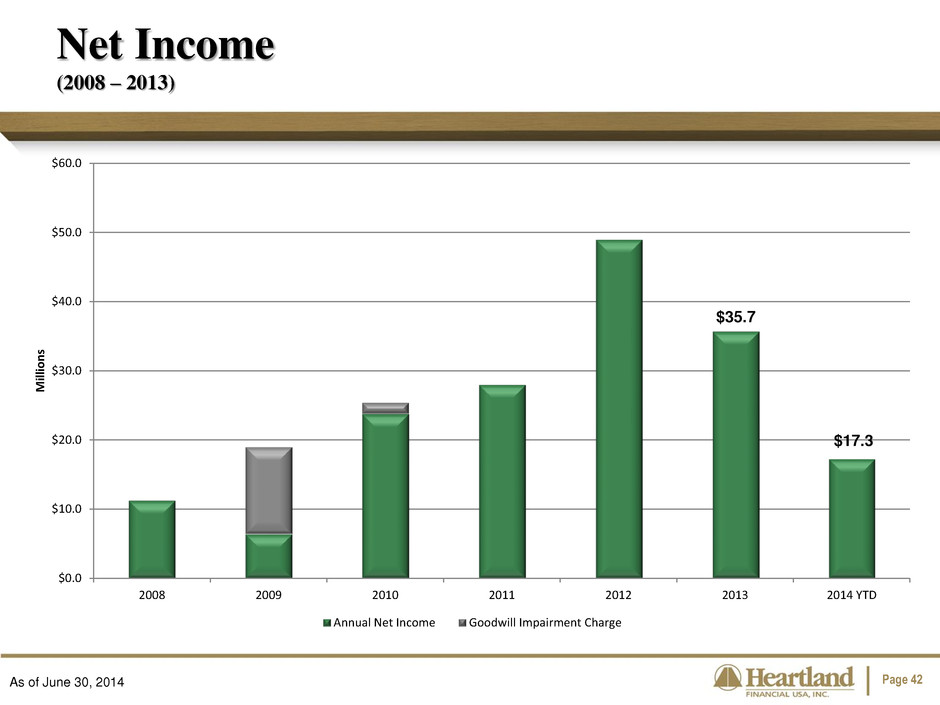

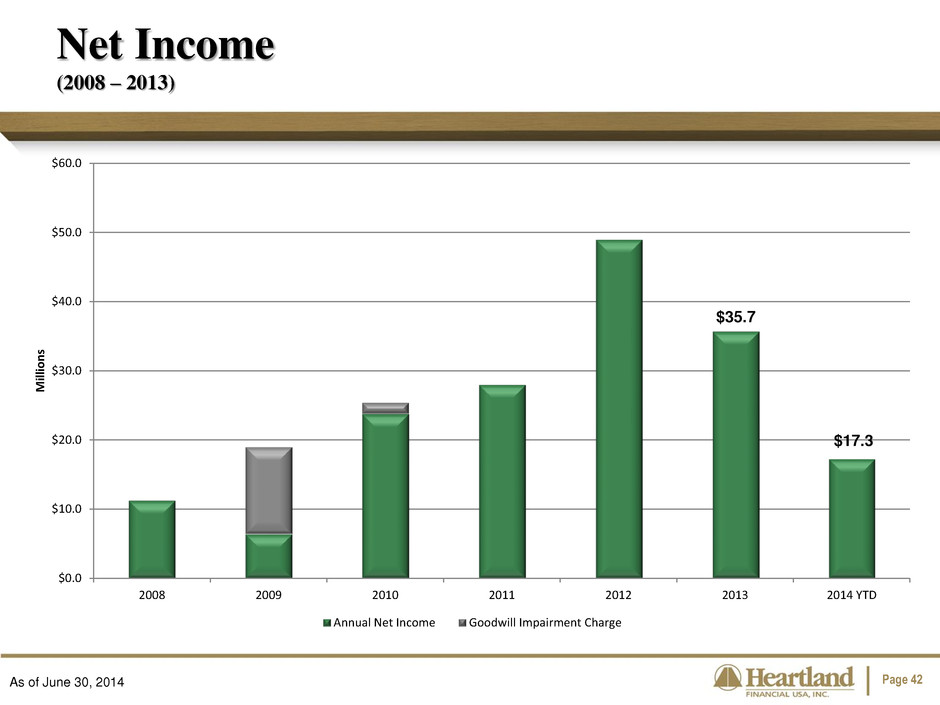

Page 42 Net Income (2008 – 2013) As of June 30, 2014 $35.7 $17.3 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 2008 2009 2010 2011 2012 2013 2014 YTD M ill io n s Annual Net Income Goodwill Impairment Charge

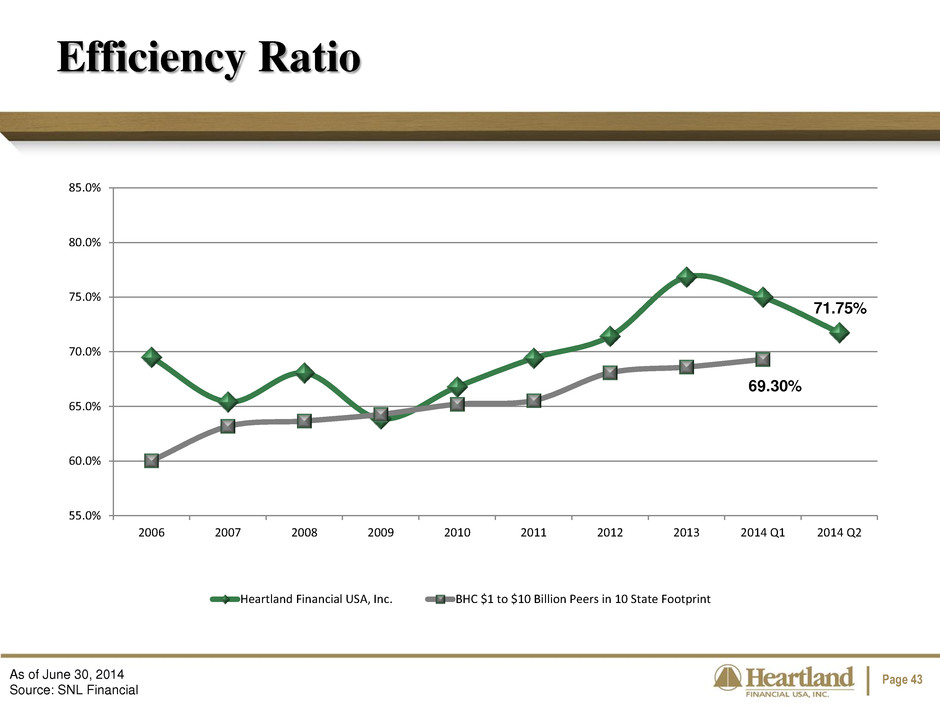

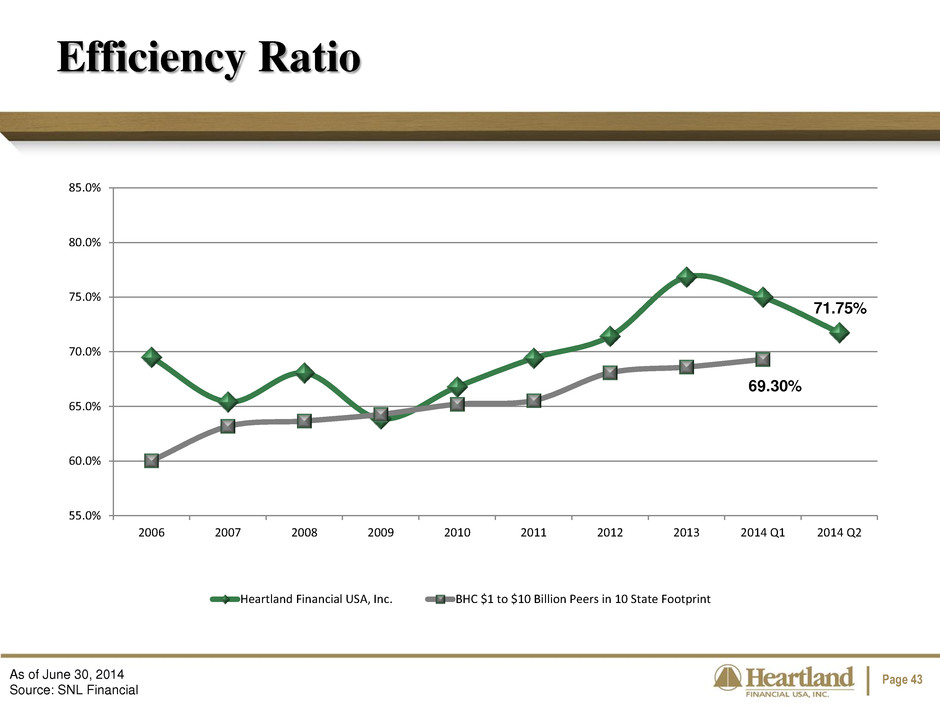

Page 43 Efficiency Ratio As of June 30, 2014 Source: SNL Financial 71.75% 69.30% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 2006 2007 2008 2009 2010 2011 2012 2013 2014 Q1 2014 Q2 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint

Page 44 Return on Averge Common Equity As of June 30, 2014 Source: SNL Financial 7.41% 11.14% -15% -10% -5% 0% 5% 10% 15% 20% 2009 2010 2011 2012 2013 2014 Q1 2014 Q2 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint

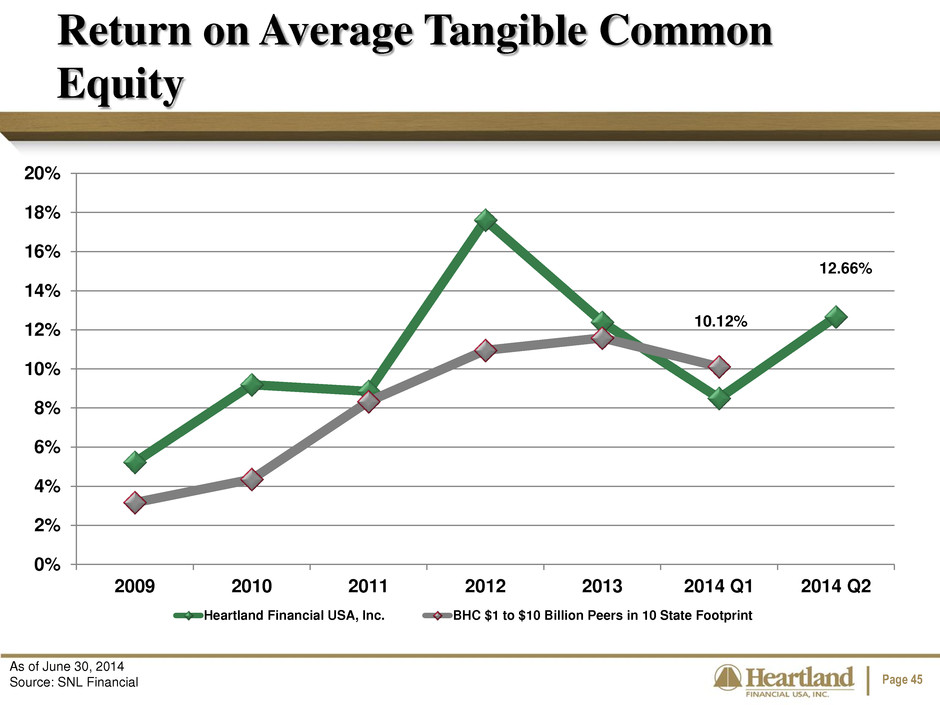

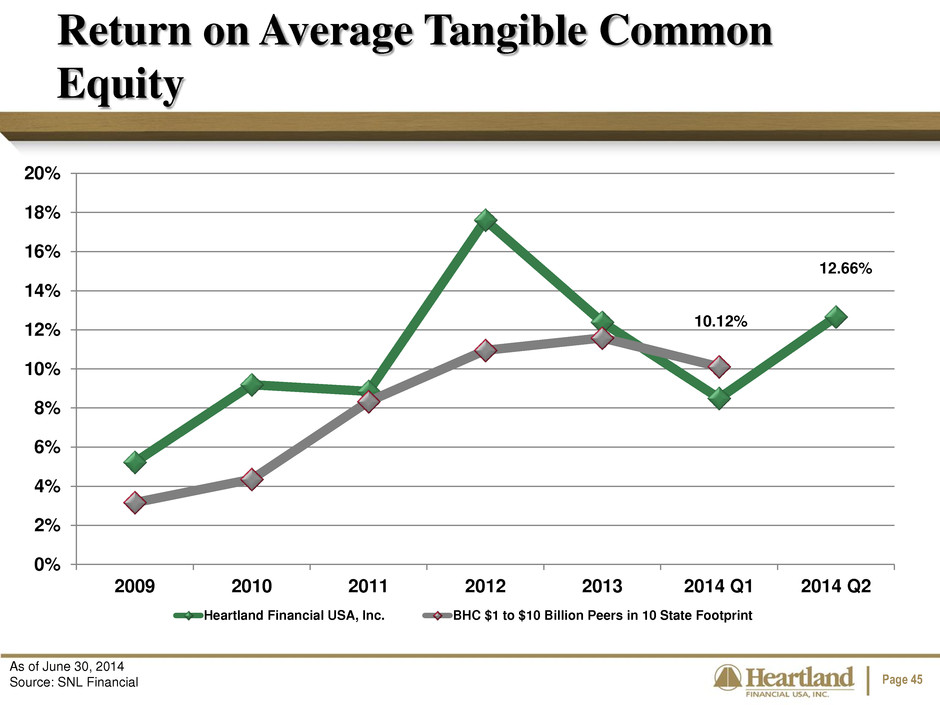

Page 45 Return on Average Tangible Common Equity 12.66% 10.12% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 2009 2010 2011 2012 2013 2014 Q1 2014 Q2 Heartland Financial USA, Inc. BHC $1 to $10 Billion Peers in 10 State Footprint As of June 30, 2014 Source: SNL Financial

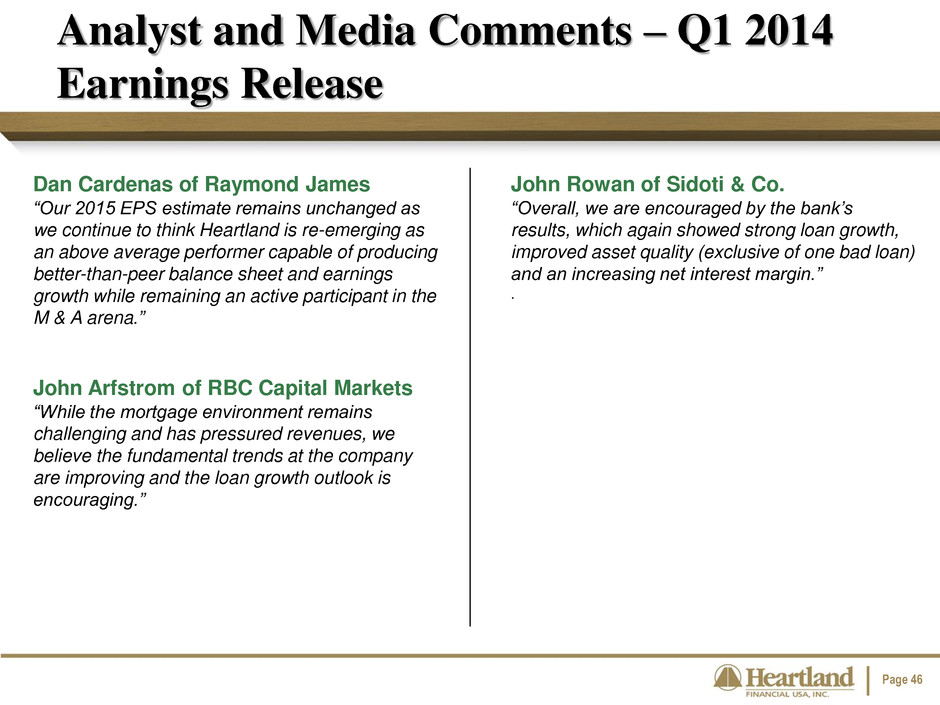

Page 46 Analyst and Media Comments – Q1 2014 Earnings Release Dan Cardenas of Raymond James “Our 2015 EPS estimate remains unchanged as we continue to think Heartland is re-emerging as an above average performer capable of producing better-than-peer balance sheet and earnings growth while remaining an active participant in the M & A arena.” John Arfstrom of RBC Capital Markets “While the mortgage environment remains challenging and has pressured revenues, we believe the fundamental trends at the company are improving and the loan growth outlook is encouraging.” John Rowan of Sidoti & Co. “Overall, we are encouraged by the bank’s results, which again showed strong loan growth, improved asset quality (exclusive of one bad loan) and an increasing net interest margin.” .

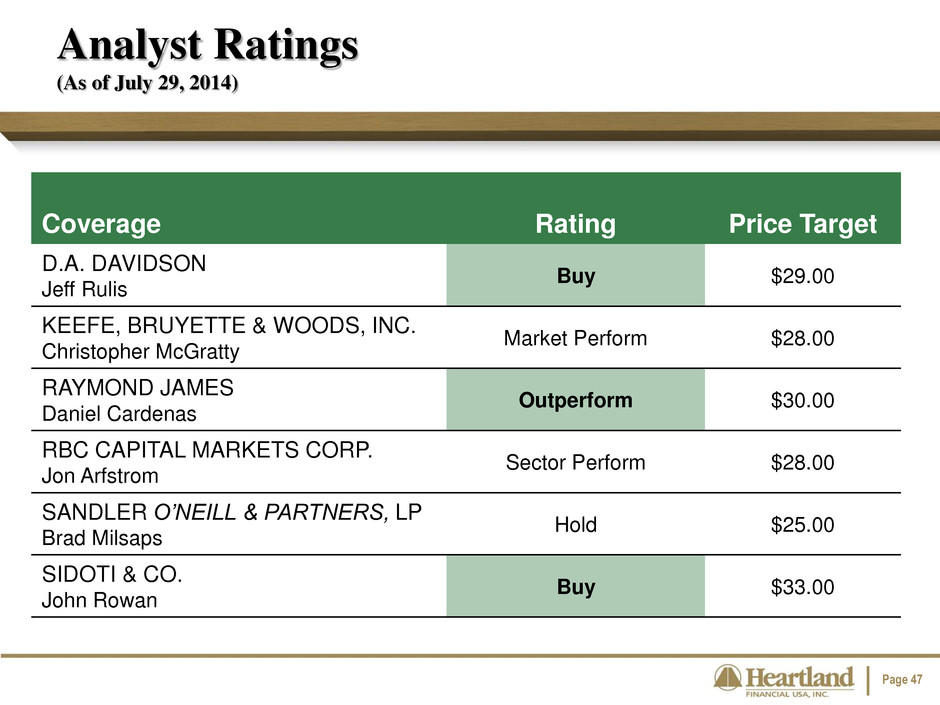

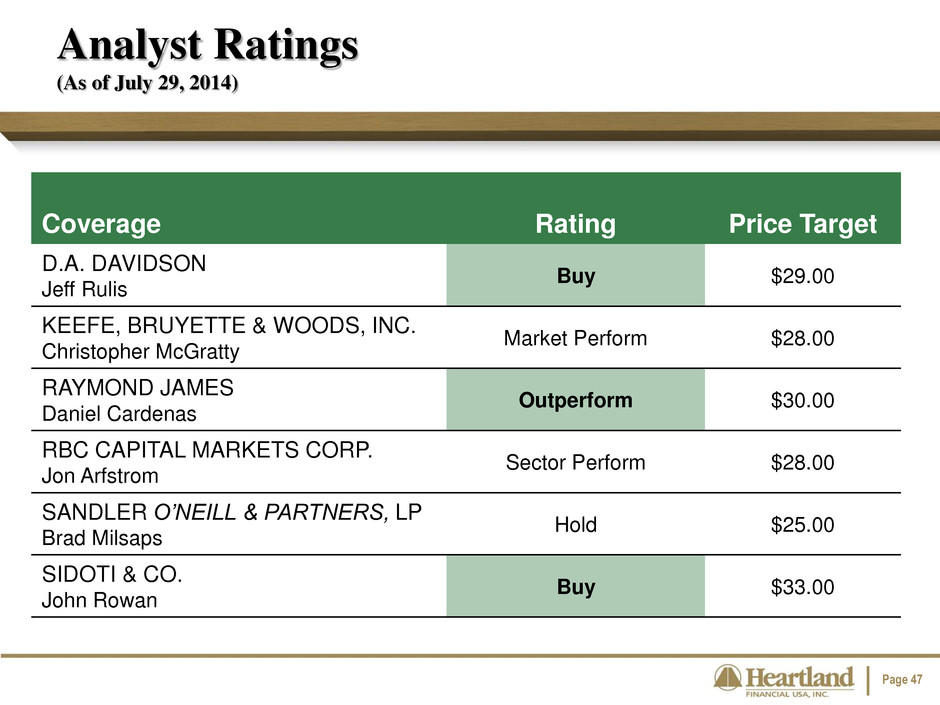

Page 47 Analyst Ratings (As of July 29, 2014) Coverage Rating Price Target D.A. DAVIDSON Jeff Rulis Buy $29.00 KEEFE, BRUYETTE & WOODS, INC. Christopher McGratty Market Perform $28.00 RAYMOND JAMES Daniel Cardenas Outperform $30.00 RBC CAPITAL MARKETS CORP. Jon Arfstrom Sector Perform $28.00 SANDLER O’NEILL & PARTNERS, LP Brad Milsaps Hold $25.00 SIDOTI & CO. John Rowan Buy $33.00

Page 48 • Strong and growing sources of non-interest income • Mix of Midwest and Western markets provides diversification of risk • Solid Midwest franchise complemented with a Western franchise, which will ultimately be the driver for growth • Master strategy of balanced profit and growth • Never a loss year • 33 consecutive years of level or increased dividends Investment Summary

Page 49 Contact Information

Mission Statement: Through excellence In customer service and Respect for the individual, EVERYONE PROFITS Trading Symbol: HTLF | www.htlf.com