SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box: | | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-12 |

HEARTLAND FINANCIAL USA, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box): | | | | | |

| x | No fee required |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule, or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

April 27, 2022

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Heartland Financial USA, Inc. The Annual Meeting will be a virtual meeting of stockholders conducted exclusively online via webcast, on Wednesday, June 15, 2022, at 1:00 p.m. Central Daylight Time. You will be able to attend the Annual Meeting online by visiting: www.virtualshareholdermeeting.com/HTLF2022. To participate in the Annual Meeting, you will need the 16-digit control number included in your proxy materials or Notice of Internet Availability of Proxy Materials (the "Internet Notice").

At our Annual Meeting, we will discuss and vote on the matters described in the proxy materials. Your vote is important, regardless of the number of shares you own.

If you are sent an Internet Notice but would prefer to receive the traditional printed proxy materials free of charge, please follow the instructions on the Internet Notice to request the printed materials via U.S. mail. If you received the traditional printed proxy materials in lieu of the Internet Notice, you may vote your shares online, by telephone, or by mail by following the instructions on the proxy card.

| | |

| Bruce K. Lee |

| President and CEO |

1398 Central Avenue · Dubuque, Iowa 52001 · (563) 589-2100

| | | | | | | | | | | | | | |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

TO THE STOCKHOLDERS OF HEARTLAND FINANCIAL USA, INC. ("HTLF"): | | | | | | | | | | | | | | |

| DATE AND TIME | | Wednesday, June 15, 2022 at 1:00 p.m. Central Daylight Time | |

| | | | |

| LOCATION | | The Annual Meeting will be a virtual meeting of stockholders conducted exclusively online via webcast. You will be able to attend the Annual Meeting online by visiting: www.virtualshareholdermeeting.com/HTLF2022. To participate in the Annual Meeting, you will need the 16-digit control number included in your proxy materials or Notice of Internet Availability of Proxy Materials. | |

| | | | |

| ITEMS OF BUSINESS | | (1) | Elect two individuals to serve as Class II directors for a three-year term expiring in 2025 |

| | (2) | Ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2022 | |

| | (3) | Take a non-binding, advisory vote on executive compensation | |

| | (4) | Transact such other business as may properly be presented at the Annual Meeting | |

| | | | |

| RECORD DATE | | Stockholders of record at the close of business on April 18, 2022, are the stockholders entitled to vote at the Annual Meeting and any adjournments or postponements of the meeting. | |

| | | | |

| VOTING BY PROXY | | Whether or not you plan to attend the Annual Meeting, please vote your shares promptly to ensure they are represented. In the event there are an insufficient number of votes for a quorum, or to approve or ratify any of the foregoing proposals, the Annual Meeting may be adjourned or postponed in order to permit further solicitation of proxies. | |

þ The Board of Directors recommends a vote “FOR” the two Class II nominees for election as directors for a three-year term ending 2025, as listed in the proxy statement, and a vote “FOR” Proposals 2 and 3. | | |

| By Order of the Board of Directors: |

| | |

| Jay L. Kim, Corporate Secretary |

| Dubuque, Iowa |

April 27, 2022

The prompt return of proxies will save us the expense of further requests for proxies to ensure a quorum at the Annual Meeting. You may access our proxy materials and vote your shares online by following the instructions on the Internet Notice. If you receive a proxy card, you may vote your shares online, by telephone, or by mail by following the instructions on your proxy card. If you hold shares through a broker or other nominee, please follow the voting instructions provided to you by that broker or other nominee.

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on Wednesday, June 15, 2022. The proxy statement and Annual Report to Stockholders are available through the Investor Relations section of HTLF’s website at ir.htlf.com.

| | | | | |

| Business Results | Despite the ongoing impact of the COVID-19 pandemic, inflationary pressures and supply chain disruptions, our Company enjoyed a year of solid financial performance in 2021: *Record annual net income available to common stockholders of $211.9 million, an increase of 59% from 2020, or $5.00 per diluted common share, a per share increase of 40% from 2020. *Our return on average common equity was 10.49% and return on average assets was 1.19% compared to 8.06% and 0.93% from 2020, respectively. *Annual loan growth of $689.4 million or 8%, exclusive of Paycheck Protection Program ("PPP") loans. *Deposits grew $1.44 billion to $16.42 billion, an increase of 10% from 2020. *Our net interest margin declined to 3.29%, compared to 3.65% during 2020, reflecting the ongoing impact of market interest rates. *Nonperforming assets to total assets declined to 0.37% and 30-89 day loan delinquencies fell to 0.07% of total loans. *Net loan charge-offs for the year of $3.8 million or 0.04% of average loans. *Our efficiency ratio increased to 59.48% compared to 56.65% for 2020. |

| |

Strategic

Developments | We continued our focus on strategic priorities, with an emphasis on improving efficiency while expanding organizational capacity. *We continue to effectively operate under our pandemic management plan to assure workplace and employee safety and business resiliency. *We began implementation of a plan to consolidate our 11 bank charters, which will increase operating capacity, reduce costs and improve operational processes. *We issued $150.0 million aggregate principal amount of 2.75% Fixed-to-Floating Rate Subordinated Notes due 2031, generating net proceeds of $147.6 million and qualifying as Tier 2 capital for regulatory purposes. *We increased dividends per common share to $0.22 for the first and second quarters of 2021, $0.25 for the third quarter of 2021, and $0.27 per common share in fourth quarter of 2021. *We consolidated 8 branch locations and continue to evaluate reductions in branch locations as part of our ongoing branch optimization program. |

| |

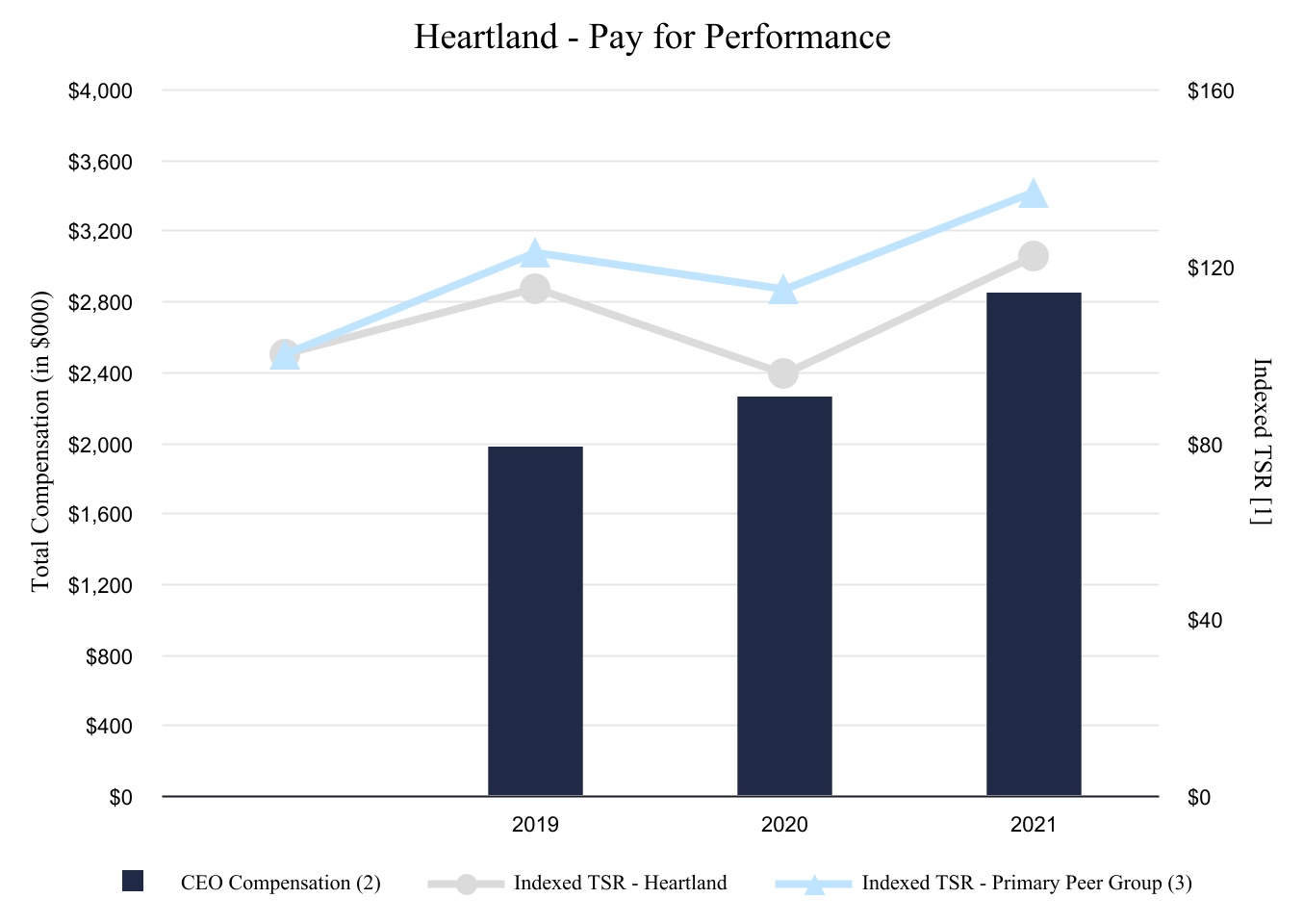

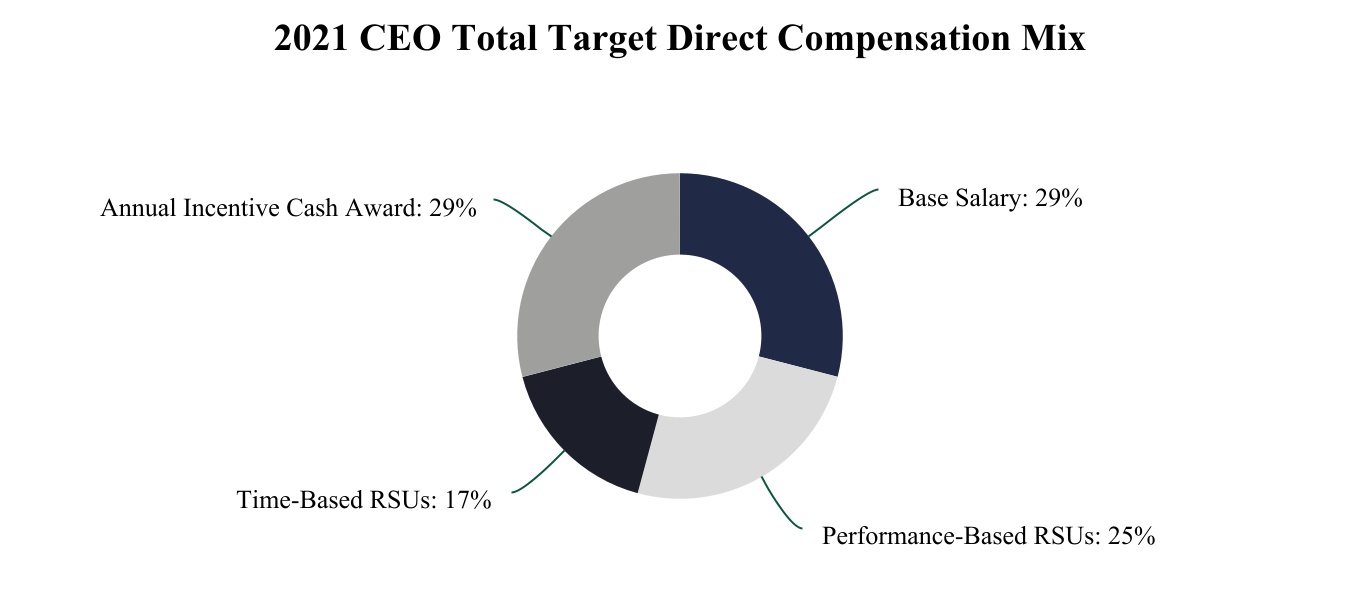

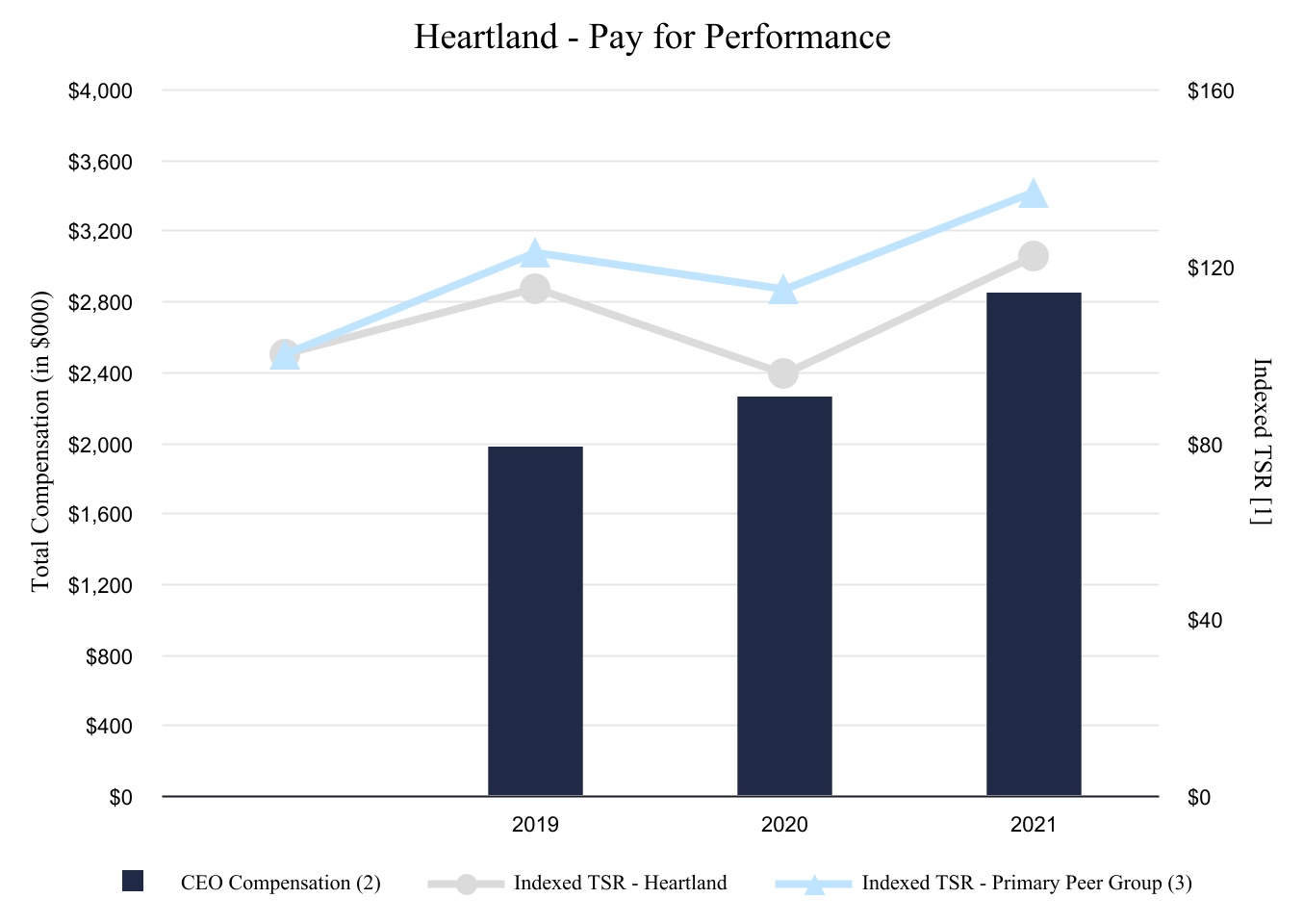

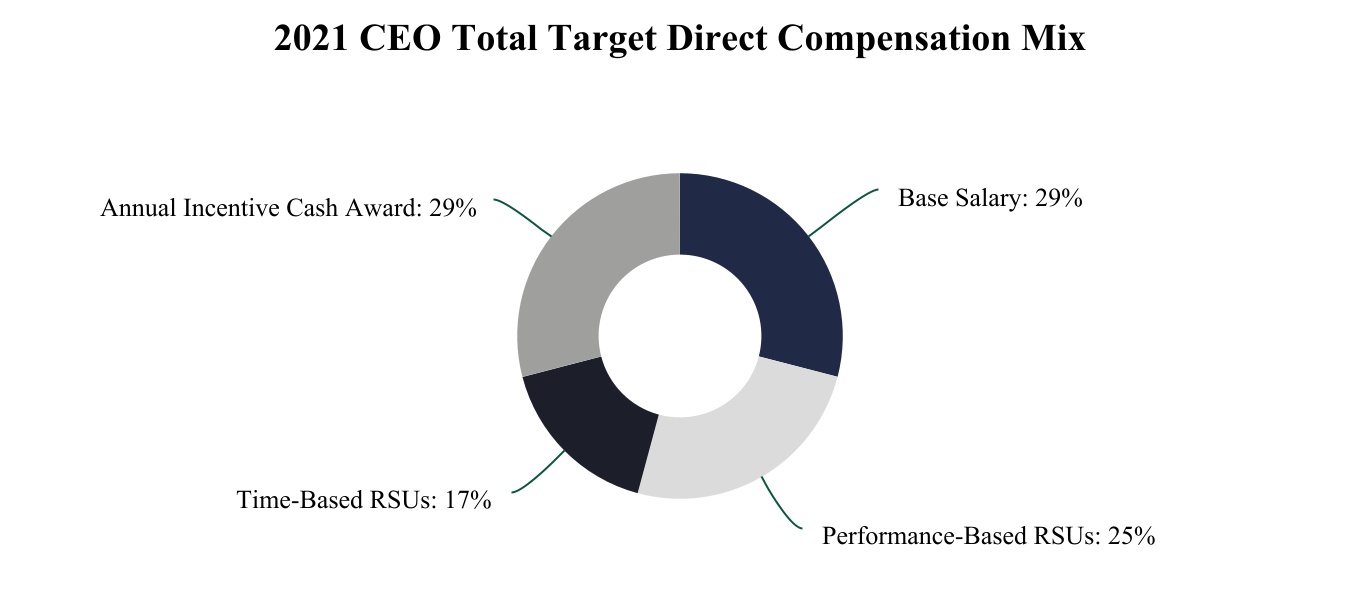

| Compensation | Our executive compensation program is designed to provide a competitive compensation package that rewards executive officers for sustained financial and operating performance while balancing long-term value creation for our stockholders. In 2021, nearly 98% of the votes cast by stockholders who voted on our advisory "say on pay" proposal approved the 2020 compensation of our named executive officers. In 2020, we implemented a number of design changes to our executive compensation program to ensure that incentive payments are market based, commensurate with performance, supported by our stockholders, and within our risk appetite. In 2021, we built on the approach taken in 2020, increasing the percentage of annual incentive compensation that is based on performance factors and adding growth to the performance factors measured. |

| |

Corporate

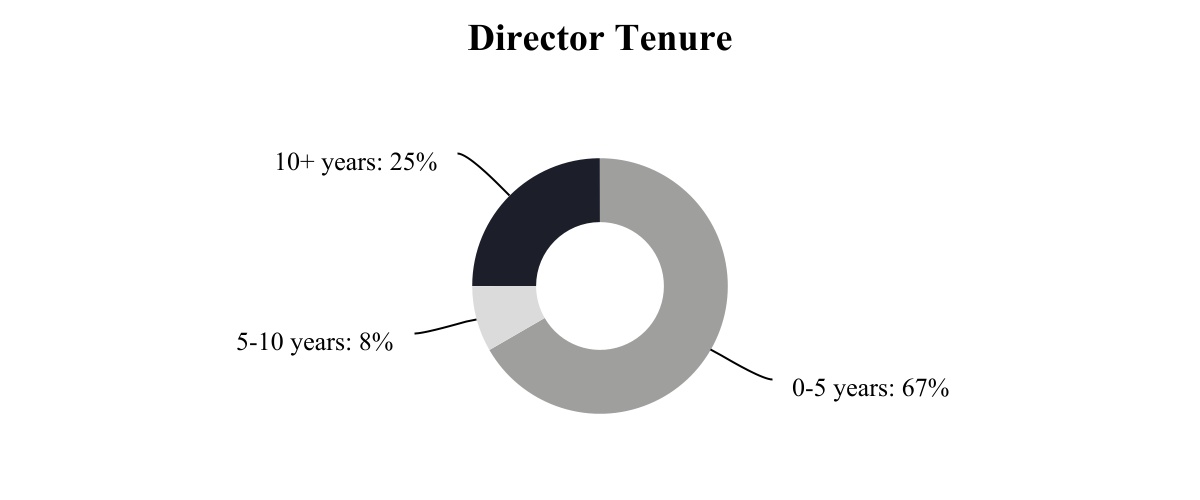

Governance | In March 2022, the Board appointed John K. Schmidt to serve as independent Chairman of the Board, replacing Lynn B. Fuller, who was removed as Executive Operating Chairman of the Board. Mr. Fuller remains a director on the Board. Mark C. Falb resigned from the Board in April 2021 and R. Michael McCoy retired from the Board effective at the 2021 Annual Meeting. In December 2020, the Board appointed Christopher S. Hylen to the Board, and he was then elected to the Board at the 2021 Annual Meeting. Kathryn Graves Unger was nominated and elected to the Board at the 2021 Annual Meeting. The Board is currently comprised of twelve directors, with over half having served five years or fewer, which reflects the Board's commitment to ongoing refreshment. The Board approved a decrease in the total number of directors to eleven, effective at the 2022 Annual Meeting. |

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the "Board") of Heartland Financial USA, Inc. (“HTLF,” the “Company” or “we”) of proxies to be voted at the Annual Meeting of Stockholders. The Annual Meeting will be a virtual meeting of stockholders conducted exclusively online via webcast. You will be able to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/HTLF2022 on Wednesday, June 15, 2022, at 1:00 p.m. Central Daylight Time, or at any adjournments or postponements of the meeting. We first mailed this proxy statement and proxy card on or about April 27, 2022.

Please read this proxy statement carefully. You should consider the information contained in this proxy statement when deciding how to vote your shares at the Annual Meeting. The following information regarding the meeting and the voting process is presented in a question and answer format.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

WHY AM I RECEIVING THIS NOTICE OR PROXY STATEMENT AND PROXY CARD?

You are receiving proxy materials from us because on April 18, 2022, which is the record date for the Annual Meeting, you owned shares of our common stock. This proxy statement describes the matters that will be presented for a vote by the stockholders at the Annual Meeting.

When you submit a proxy, you appoint the designated proxy holder as your representative at the Annual Meeting. The proxy holder will vote your shares as you have instructed whether or not you attend the Annual Meeting. Even if you plan to attend, you should vote your shares in advance of the Annual Meeting in case your plans change.

HOW DO I VOTE BY PROXY?

In order to vote by proxy in advance of the Annual Meeting, you may use the Internet to transmit your voting instructions, vote by phone or vote by mail, in each case by following the instructions on the proxy card. If you use the Internet to transmit your voting instructions or vote by phone, you must vote by 11:59 p.m. Eastern Time on June 14, 2022 for shares held directly and by 11:59 p.m. Eastern Time on June 10, 2022 for shares held in a retirement plan account. If you choose to vote by mail, your proxy card should be mailed sufficiently in advance to allow for delivery no later than June 14, 2022.

HOW CAN I ATTEND THE ANNUAL MEETING?

If you are a stockholder of the Company as of the record date, you will be able to attend the Annual Meeting online by visiting: www.virtualshareholdermeeting.com/HTLF2022 and following the instructions provided in your proxy materials or Notice of Internet Availability of Proxy Materials (the "Internet Notice"). To participate in the Annual Meeting, you will need the 16-digit control number included in your proxy materials or Internet Notice. If you do not have this control number at the time of the meeting, you will still be able to attend as a guest, but you will not be able to vote or ask questions.

WHY IS THE COMPANY HOLDING A VIRTUAL ANNUAL MEETING?

We held virtual annual meetings in 2020 and 2021 because of the public health and business risks associated with gathering our management, directors and stockholders for an in-person meeting during the COVID-19 pandemic. Based on the success of the 2020 and 2021 virtual annual meetings and the ongoing effects of the COVID-19 pandemic, we decided to hold a virtual annual meeting again in 2022. In addition to protecting the health of our management, directors and stockholders, hosting a virtual meeting generally provides ease of access, real-time communication and cost savings for our stockholders and the Company and facilitates stockholder attendance and participation from any location.

HOW WILL THE MEETING BE CONDUCTED?

The Annual Meeting will be conducted online, in a fashion similar to an in-person meeting. You will be able to attend the meeting online, vote your shares electronically, and submit your questions during the meeting. Mr. Schmidt, the Chairman of the Board of Directors, will preside at the meeting.

The meeting will begin promptly at 1:00 p.m., Central Daylight Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m. Central Daylight Time, and you should allow ample time for the check-in procedures.

HOW CAN I ASK QUESTIONS DURING THE MEETING?

You may submit questions in real time during the virtual meeting. We are committed to acknowledging each appropriate question we receive in the order that it was received, with a limit of one question per shareholder until we have allowed each shareholder to ask a question. We will allot approximately 15 minutes for questions during the Annual Meeting. Submitted questions should follow our Rules of Conduct in order to be addressed during the Annual Meeting. Our Rules of Conduct will be posted at www.virtualshareholdermeeting.com/HTLF2022 during the Annual Meeting.

WHAT CAN I DO IF I NEED TECHNICAL ASSISTANCE BEFORE OR DURING THE MEETING?

If you have technical difficulties on the day of the meeting, you may request assistance immediately prior to the meeting by going to www.virtualshareholdermeeting.com/HTLF2022, and following the instructions for obtaining technical assistance. If you have questions regarding the virtual meeting format, please send your questions to annualmeetingquestions@htlf.com at least one business day prior to the meeting.

IF I CAN'T ATTEND THE MEETING, HOW DO I VOTE OR LISTEN TO IT LATER?

You do not need to attend the virtual meeting to vote if you submitted your vote via proxy in advance of the meeting. A replay of the meeting, including the questions answered during the meeting, will be available at ir.htlf.com.

WHAT MATTERS WILL BE VOTED ON AT THE ANNUAL MEETING?

You are being asked to vote on the following matters proposed by our Board of Directors: | | | | | | | | |

| (1) | Elect two individuals to serve as Class II directors for a three-year term expiring in 2025 |

| (2) | Ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2022 | |

| (3) | Take a non-binding, advisory vote on executive compensation | |

| (4) | Transact such other business as may properly be presented at the Annual Meeting | |

þ The Board of Directors recommends a vote “FOR” the two Class II nominees for election as directors for a three-year term ending 2025, as listed in the proxy statement, and a vote “FOR” Proposals 2 and 3.

These matters are more fully described in this proxy statement. We are not aware of any other matters that will be proposed at the Annual Meeting. However, if you have voted your shares and a proposal is properly presented at the Annual Meeting that is not identified in the proxy materials, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

HOW MANY VOTES DO OUR STOCKHOLDERS HAVE?

Holders of common stock have one vote for each share of common stock owned at the close of business on April 18, 2022, the record date for the Annual Meeting.

HOW DO I VOTE?

Stockholders of Record

In addition to voting your shares online at the Annual Meeting, you can also vote your shares of common stock in advance of the Annual Meeting by submitting a proxy using one of the following options:

*online using the instructions for Internet voting shown on the Internet Notice or proxy card;

*by telephone using the instructions for telephone voting shown on the proxy card; or

*by mail by marking the proxy card with your instructions and then signing, dating and returning the proxy card in the enclosed return addressed envelope.

Plan Holders

If you hold shares in a retirement plan account ("Plan") that allows you to direct the Plan trustee how to vote the shares in your account ("Plan Shares"), please follow the voting instructions provided to you by the Plan trustee or administrator. In the absence of instructions from you on how to vote any Plan Shares, the Plan trustee may vote those shares in accordance with the terms of the Plan.

“Street Name” Holders

In addition to voting your shares online at the Annual Meeting, you can also vote your shares of common stock in advance of the Annual Meeting by following the voting instructions provided by your broker or other nominee. Brokers who hold your shares in “street name” have the authority to vote shares for which they do not receive instructions on all routine matters submitted for approval at the Annual Meeting. In the absence of your specific instructions as to how to vote, your broker will not have authority to vote on the matters considered non-routine, which includes all actions other than Proposal 2, the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022, resulting in a so-called "broker non-vote." If you hold your shares through a broker or other nominee it is important that you cast your vote if you want it to count on all of the matters to be considered at the Annual Meeting.

WHAT IF I CHANGE MY MIND AFTER I RETURN MY PROXY?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

*signing another proxy with a later date and returning that proxy to Mr. Jay L. Kim, Corporate Secretary, Heartland Financial USA, Inc., 700 Locust Street, 4th Floor, Dubuque, Iowa 52001;

*sending notice to us that you are revoking your proxy; or

*voting online at the Annual Meeting.

If you hold your shares in the name of your broker and desire to revoke your proxy in advance of the Annual Meeting, you may submit another vote in accordance with the voting instructions sent to you, or you will need to contact your broker. You may also change your vote by voting online at the Annual Meeting.

HOW MANY VOTES DO WE NEED TO HOLD THE ANNUAL MEETING?

A majority of the shares of common stock that are outstanding as of the record date must be present at the Annual Meeting in order to hold the Meeting and conduct business.

Shares are counted as present at the Annual Meeting if the stockholder either:

*is present online at the Annual Meeting; or

*has properly voted via Internet, phone, or proxy card prior to the Annual Meeting.

On April 18, 2022, there were 42,370,210 shares of common stock outstanding. Therefore, shares of common stock with at least 21,185,106 votes need to be present to constitute a quorum to hold the Annual Meeting and conduct business. Presence may be in person or by proxy. Abstentions and broker non-votes are counted as present and entitled to vote at the Annual Meeting for purposes of defining a quorum. Virtual attendance at our Annual Meeting constitutes presence in person for purposes of a quorum at the meeting.

WHERE CAN STOCKHOLDERS GET COPIES OF OUR ANNUAL REPORT?

Stockholders may receive a free copy of our 2021 Annual Report on Form 10-K, including financial statements, by sending a written request to Mr. Jay L. Kim, Corporate Secretary, Heartland Financial USA, Inc., 700 Locust Street, 4th Floor, Dubuque, Iowa 52001.

WHAT HAPPENS IF A NOMINEE FOR DIRECTOR IS UNABLE TO STAND FOR ELECTION?

The Board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxy may be voted for the substitute nominee. Alternatively, the Board may reduce its size. You cannot vote for more than two nominees. The Board has no reason to believe any nominee will be unable to stand for election.

WHAT OPTIONS DO I HAVE IN VOTING ON EACH OF THE PROPOSALS?

You may vote “FOR” or “WITHHOLD” authority to vote for each nominee for director. You may vote “FOR,” “AGAINST” or “ABSTAIN” on any other proposal that may properly be brought before the meeting.

HOW MANY VOTES ARE NEEDED FOR EACH PROPOSAL?

The directors are elected by a plurality of the outstanding shares of our common stock represented at the Annual Meeting and entitled to vote, meaning that the two individuals receiving the highest number of votes cast “FOR” their election will be elected as directors of HTLF. Withholding against the nominees has no effect.

The affirmative vote of a majority of the shares of our common stock represented at the Annual Meeting and entitled to vote is required to approve the other proposals.

The vote on auditor ratification and the vote on executive compensation are both advisory and will not be binding upon HTLF or the Board of Directors. However, the Compensation, Nominating and Corporate Governance Committee of the Board will consider the voting results in establishing our executive compensation plan for subsequent years.

Broker non-votes will not be counted as being entitled to vote for purposes of determining whether any proposal has been approved, but will count for purposes of determining whether or not a quorum is present. Therefore, so long as a quorum is present, broker non-votes will have no effect on the outcome of the matters to be taken up at the meeting. Abstentions will have the same effect as negative votes.

WHERE DO I FIND THE VOTING RESULTS OF THE MEETING?

We will announce preliminary voting results at the Annual Meeting. The voting results will also be disclosed in a Current Report on Form 8-K that we will file with the Securities and Exchange Commission (the “SEC”) by the close of business on the fourth business day after the Annual Meeting.

WHO BEARS THE COST OF SOLICITING PROXIES?

We bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors and employees of HTLF, or its subsidiaries, may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies and we have not engaged a third party proxy solicitor. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders.

| | | | | | | | | | | |

| PROPOSAL 1 | | ELECTION OF DIRECTORS |

| Elect two individuals to serve as Class II directors for a three-year term expiring in 2025 | þ | The Board of Directors recommends that you vote your shares FOR each of the nominees. |

Our Board of Directors carefully considers the qualifications of each director candidate and the overall composition of the Board and believes that Board deliberations are enhanced by the diversity of backgrounds represented and a balance of tenure. The Board has a robust director selection process that is focused on creating a diverse group of candidates who possess the background, skills and expertise to make significant contributions to the Board, and is committed to striving for a composition of the Board that would provide continuity as well as fresh perspectives relevant to the Board's work. Specifically, the Board is currently comprised of twelve directors, with over half having served five or fewer years, which reflects the Board's commitment to ongoing refreshment.

| | | | | | | | |

| Board Diversity Matrix (As of March 31, 2022) |

| Female | Male |

| Total Number of Directors | 12 |

| Part I: Gender Identity | | |

| Directors | 3 | 9 |

| Part II: Demographic Background | | |

| Hispanic or Latinx | 1 | |

| Not Disclosing | | 1 |

| White | 2 | 8 |

At the Annual Meeting, you will be entitled to vote for two Class II Directors to serve for terms expiring in 2025. Mr. Falb resigned from the Board effective April 20, 2021 and at that time, the Board decided to leave the total number of directors at twelve rather than nominate and elect an individual to replace Mr. Falb. In addition, the Board approved a further decrease in the total number of directors to eleven, effective at the 2022 Annual Meeting.

The Board of Directors is divided into three classes of directors having staggered terms of three years. Each of the nominees has agreed to serve as a director, if elected. If for any reason any of the nominees becomes unable to serve before the election, the holders of proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting, or the Board may reduce its size.

Beginning in 2020, the Board engaged a third-party search firm to assist the Compensation, Nominating and Corporate Governance Committee in identifying potential nominees to the Board. After working with the Committee to specify the requirements and preferences for potential nominees, the search firm identifies prospects and works with Committee members to reduce the prospect list to a shorter list of interview candidates.

In conducting its search, the Committee seeks potential nominees to serve as independent directors in accordance with the requirements of the Nasdaq Stock Market, and that at a minimum possess the following additional attributes:

*highest personal and professional ethics, integrity and values;

*sufficient educational and professional background to enable them to understand the Company’s business;

*exemplary management and communication skills;

*demonstrated leadership skills;

*sound judgment in his or her professional and personal life;

*a commitment to representing the long-term interests of all the Company’s shareholders

*a strong sense of service to the communities which we serve; and

*ability to meet the standards and duties set forth in the Company’s Code of Business Conduct and Ethics.

The Committee also takes into account a potential nominee’s:

*senior corporate leadership experience;

*experience with publicly held companies; and

*unique perspective by virtue of their race, gender, geographic or other meaningful differences.

The Committee seeks to identify potential nominees that share the Company’s philosophy, including the same sense of mission, vision and values. Increasing the diversity of the Board, based on race, gender, geographic or other meaningful differences, remains an important objective. Accordingly, the search firm has been directed to continue to identify diverse prospects for the Committee to consider for current and future Board positions.

Set forth below is information concerning the nominees for election and concerning the other directors whose terms of office will continue after the meeting. Included in the information is each director's age, year first elected and business experience during the previous five years.

| | |

DIRECTOR NOMINEES

CLASS II (Term Expires 2025) |

| | | | | | | | | | | | | | |

| John K. Schmidt | Director Since 2001 | Age 62 |

| | Professional and Educational Background:

| | |

| Mr. Schmidt has served as the independent Chairman of the HTLF Board since March 15, 2022. Mr. Schmidt has been the Senior Vice President and Chief Financial Officer of A.Y. McDonald Industries since 2013 and was named Corporate Secretary in 2014. Mr. Schmidt was the Chief Operating Officer (from 2004) and Chief Financial Officer (from 1991) of HTLF until joining A.Y. McDonald Industries. Mr. Schmidt was also an officer of Dubuque Bank and Trust Company from 1984 to 2004 and President from 1999 to 2004. Prior to joining Dubuque Bank and Trust Company in 1984, Mr. Schmidt was employed by the Office of the Comptroller of the Currency (the “OCC”) and Peat Marwick Mitchell, currently known as KPMG LLP. A Certified Public Accountant (inactive), Mr. Schmidt brings to our Board extensive knowledge in operational bank management and accounting. He graduated with a BA from the University of Northern Iowa. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Dubuque Bank and Trust board for more than five years; Past President of Steeple Square; Former member of the Loras College Board of Regents, Dubuque, Iowa, from 2011 to 2021; Board Member and Treasurer, High Voltage LLC; and Director of A.Y. McDonald Industries since 2013. |

| | | | | | | | | | | | | | |

| Duane E. White | Director Since 2013 | Age 66 |

| | Professional and Educational Background:

| | |

| Mr. White is the retired Executive Vice President and Chief Product Officer of Medecision, a healthcare IT provider. He served in that role from May 2018 until December 2019. Mr. White was a Partner at Aveus, a management consulting firm in St. Paul, Minnesota from 2013 until the firm was acquired by Medecision in 2018. Prior to joining Aveus, he was an independent consultant for six years. Mr. White has 15 years of financial services experience, including nine years with U.S. Bancorp. Positions at U.S. Bancorp included President of the mortgage division, SVP of Mergers and Acquisitions and SVP of Marketing Support and Product Management. He began his career as an examiner for the OCC and was also involved with the regulatory supervision of problem banks in his role as the Assistant to the Regional Director of Special Projects. Mr. White brings considerable expertise in financial services to our Board, including merger and acquisition activity, public company board experience and knowledge and perspective with respect to the Minneapolis and St. Paul metropolitan area. He holds an MBA from Harvard Business School and a BBA in Business Economics from the University of Wisconsin – Eau Claire. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Minnesota Bank and Trust from 2008 to 2019; and Director of Fair Isaac Corporation from 2009 to 2016. |

CLASS II (Term Expires in 2022)

| | | | | | | | | | | | | | |

| Barry H. Orr | Director Since 2019 | Age 66 |

| | Professional and Educational Background: | | |

| Mr. Orr has served as Chairman and Chief Executive Officer of First Bank & Trust, since 1996. He previously served as Chief Executive Officer of First Bank & Trust subsidiary PrimeWest Mortgage Corporation, which was merged into the bank in 2020. HTLF acquired Lubbock-based First Bank & Trust as a subsidiary bank in 2018. Mr. Orr has over 30 years of banking leadership experience. He brings to our Board considerable knowledge and expertise in commercial and industrial lending, as well as residential construction and development lending, mortgage services, and mergers and acquisitions. Mr. Orr holds a BBA in finance from Texas Tech University and is also a graduate of the ABA Stonier Graduate School of Banking. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary First Bank & Trust since 1993; and Chairman of Lubbock Economic Development Alliance from 2018 to 2021. |

| | | | | | | | | | | | | | |

| Class III (Term Expires in 2023) |

| | | | | | | | | | | | | | |

| Robert B. Engel | Director Since 2019 | Age 68 |

| | Professional and Educational Background: | | |

| Mr. Engel has served as Managing Director and Chief Executive Officer of BLT Advisory Services, LLC, a boutique advisory firm, since 2017. Prior to that, he served as President and Chief Executive Officer of CoBank, ACB from 2006 to 2017, presiding over its transformation into a high growth financial institution consistently ranked as one of the world's safest banks and serving customers throughout rural America in all 50 states. Prior to CoBank, he spent 14 years at HSBC Bank, USA, ultimately serving as its chief banking officer. He has over 40 years of business and leadership experience, including over 30 years of experience in the banking industry. Mr. Engel brings to our Board considerable financial services expertise and insights on strategic growth, collaborative relationships and talent development. Mr. Engel earned a BBA in accounting and an honorary doctorate, both from Niagara University. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Citywide Banks since 2018; Director of Allied Motion Technologies, Inc since 2019, Chairman of the Board for Alaska Power & Telephone since 2017; and Chairman of the Board of Trustees of Regis University since 2007. |

| | | | | | | | | | | | | | |

| Thomas L. Flynn | Director Since 2002 | Age 66 |

| | Professional and Educational Background:

| | |

| Mr. Flynn, who has served as Vice Chairman of the Board of HTLF since 2005 and Chairman of the Compensation, Nominating and Corporate Governance Committee of HTLF from 2015 to 2021, and who was the Board's Independent Lead Director from 2018 until April 19, 2022, was President of Aggregate Materials Company located in East Dubuque, Illinois from 1999 until his retirement in 2014. Mr. Flynn was President and Chief Executive Officer of Flynn Ready-Mix Concrete Co. from 1999 until his retirement in 2012. He was Chief Financial Officer of Flynn Ready-Mix from 1977 until 1999. He is a past Chairman of the Board of Directors of the National Ready-Mix Concrete Association. Mr. Flynn is a former member of the Iowa Legislature, having served for eight years as a State Senator. He also served for ten years as an adjunct faculty member in the Business Department of a local liberal arts college teaching courses in finance and business research methods. Mr. Flynn brings to our Board considerable small business expertise, business contacts in one of our principal markets and skill in governance. He holds an MBA from the University of Dubuque and a BA in Accounting and Finance from Loras College. |

| | Other Boards and Appointments: | |

| | Director and Chairman of the Board of HTLF subsidiary Dubuque Bank and Trust Company. for more than five years. |

| | | | | | | | | | | | | | |

| Jennifer K. Hopkins | Director Since 2018 | Age 61 |

| | Professional and Educational Background:

| | |

| Ms. Hopkins has been a managing partner at Crescendo Capital, a private investment firm for early stage companies, since 2007. From 2009 through 2021 she was CEO of one of Crescendo’s portfolio companies, American Medical - The Oxygen Concentrator Store. Prior to joining Crescendo Capital, Ms. Hopkins had a twenty-year career with Hewlett Packard and Agilent, leading teams in research and development, marketing, and operations. Her career with Agilent culminated in the role of Vice President of the Global Solutions business unit. Ms. Hopkins brings to our Board a technology background and operational expertise. In addition, she has small business and executive management experience, as well as contacts in the Denver metropolitan area. She holds a Master's in Industrial Engineering from Stanford University and a BS in Industrial Engineering from North Dakota State University. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Citywide Banks since 2018. Board member of Spectralogic Corporation since 2012 and Sartori Cheese Corporation since 2013; North Dakota State University Development Foundation; Craig Hospital Foundation and the Colorado Forum. |

| | | | | | | | | | | | | | |

| Bruce K. Lee | Director Since 2017 | Age 61 |

| | Professional and Educational Background:

| | |

| Mr. Lee is the President and Chief Executive Officer of HTLF. He was named Chief Executive Officer effective June 1, 2018, and he has served as President since 2015. He has over 30 years of experience in the banking industry. Prior to joining HTLF, Mr. Lee spent twelve years at Fifth Third, a $130 billion regional bank holding company headquartered in Cincinnati, Ohio. At Fifth Third, he held numerous leadership positions, including the following: Executive Vice President and Chief Credit Officer; Executive Vice President and Director of the company’s special assets group; and Executive Vice President, Commercial Banking Division Head and Affiliate Senior Commercial Banker. Prior to that, he served as President and CEO of a Fifth Third affiliate bank in northwestern Ohio, where he managed sales and service functions for retail, commercial, residential mortgage and investments, along with the staff functions of finance, human resources and marketing. Mr. Lee has wide-ranging banking experience and perspective as HTLF expands its size and geographic reach. He earned his BA in Business Administration and Management from Siena Heights University. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Citywide Banks since 2017; and Director of HTLF subsidiary First Bank & Trust since 2018. |

| | | | | | | | | | | | | | |

| Class I (Term Expires in 2024) |

| | | | | | | | | | | | | | |

| Lynn B. Fuller | Director Since 1987 | Age 72 |

| | Professional and Educational Background:

| | |

| Mr. Fuller served as the Executive Operating Chairman of HTLF from June 1, 2018 until March 15, 2022. Previously, he served as Chief Executive Officer of HTLF since 1999, Chairman of the Board of HTLF since 2000 and was President of HTLF from 1990 until 2015. He began his banking career with Dubuque Bank and Trust Company in 1971. He then worked as an officer at First National Bank of St. Paul from 1976 until returning to Dubuque Bank and Trust Company in 1978. Mr. Fuller possesses a deep knowledge and understanding of HTLF and has extensive experience in the banking business, with hands-on operational experience and decades of experience in all aspects of commercial banking. He earned an MBA from the University of Iowa and a BS from the University of Dubuque. |

| | Other Boards and Appointments: | |

| | Former Director of HTLF subsidiaries: Dubuque Bank and Trust Company, DB&T Insurance, New Mexico Bank & Trust, Rocky Mountain Bank, Citywide Banks, Minnesota Bank & Trust, Bank of Blue Valley, Premier Valley Bank and First Bank & Trust. He also serves as a Director of Boys and Girls Club of Greater Dubuque since 1989. |

| | | | | | | | | | | | | | |

| Christopher S. Hylen | Director Since 2020 | Age 61 |

| | Professional and Educational Background:

| | |

| Mr. Hylen has served as the Chief Executive Officer and a board member of Reltio, Inc., a leading software as a service company headquartered in Redwood City, California, since September of 2020, where he provides leadership for strategy, operations, overall performance and growth. Prior to that he was the Chief Executive Officer and a director of Imperva, Inc. from 2017 to 2019, where he led the successful turnaround and then sale of the company. He served in executive leadership roles at Citrix Systems from 2013 to 2017, including President and Chief Executive Officer of the Citrix mobility business unit GetGo, and also held leadership roles in the Intuit Payment Solutions division of Intuit Corporation, from 2006 to 2013. Mr. Hylen contributes expertise on information technology and data privacy for financial services companies at a strategic level, with over 25 years of related technology and financial services experience. Mr. Hylen holds an MBA from Harvard Business School and a bachelor’s degree in engineering from Widener University. |

| |

| | Other Boards and Appointments: | |

| | Director of Reltio, Inc. |

| | | | | | | | | | | | | | |

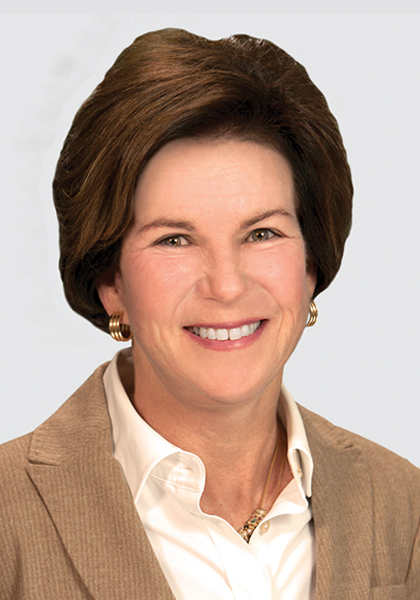

| Susan G. Murphy | Director Since 2018 | Age 65 |

| | Professional and Educational Background:

| | |

| Ms. Murphy has been the Chairperson of the Audit Committee of HTLF since April 5, 2022. She has been a Principal at The Grace Alliance, LLC in Denver, which assists individuals and families in developing and maintaining financial strategies for the future, since 2005. She served as Trustee of the Colorado Public Employees’ Retirement Association from 2007 to 2021, providing oversight to a public pension fund managing $60 billion in assets for 620,000 beneficiaries. She started her career at Ernst and Young and has been a consultant to a variety of businesses and transactions. She is a Certified Public Accountant and is a member of the American Institute of Certified Public Accountants. Ms. Murphy brings significant public accounting, investment advisory and public policy expertise along with knowledge of the Denver metropolitan area. She graduated with a BA in Accounting from the University of Notre Dame. |

| | Other Boards and Appointments: | |

| | Director of HTLF subsidiary Citywide Banks since 2017; Trustee of Arrupe Jesuit High School 2010-16 and Board Chair 2019-Present. |

| | | | | | | | | | | | | | |

| Martin J. Schmitz | Director Since 2018 | Age 64 |

| | Professional and Educational Background:

| | |

| Mr. Schmitz is the Chairman of Citywide Banks, HTLF’s subsidiary bank in Colorado. Prior to HTLF’s acquisition of Citywide, he was Chairman of the Board and oversaw business development and commercial banking. In addition, he was involved in the administration of credit management, audit and regulatory functions over his twenty-one years at Citywide. Prior to his time at Citywide, Mr. Schmitz spent eighteen years in the Denver commercial real estate business as Vice President with a commercial real estate group specializing in investment real estate. Mr. Schmitz brings to our Board community bank leadership experience and knowledge of the Denver metropolitan area. He holds a BA in Accounting, Business Administration and Economics from Regis University. |

| | Other Boards and Appointments: | |

| | Director of Citywide Banks, which became a HTLF subsidiary in 2017, for more than five years; Trustee of Regis University, Denver, Colorado, since 2004; and Director of Boys and Girls Clubs of Metro Denver since 2008. |

| | | | | | | | | | | | | | |

| Kathryn Graves Unger | Director Since 2021 | Age 47 |

| | Professional and Educational Background:

| | |

| Ms. Graves Unger has held executive roles at Cargill Inc. since 2014, and is currently serving as Vice President, North America - Cargill Government Relations and before that, Managing Director, North America - Cargill Aqua Nutrition. From 2005 to 2014, Ms. Graves Unger served in management roles at Cummins, Inc. Ms. Graves Unger is also a certified public accountant. She graduated from University of North Carolina - Chapel Hill with a BA in Spanish education and a masters of accounting. She then received her MBA from Stanford University. Ms. Graves Unger brings to the board substantial business and government relations expertise, as well as education, Spanish language, accounting and tax experience. |

| | Other Boards and Appointments: | |

| | Board member since 2016 and current board chair of Urban Ventures: U.S. Global Leadership Coalition board member since 2020: Member of the Board of Advisors for the Cargill Hispanic-Latino Council since 2015. |

All of our directors will hold office for the terms indicated, and until their respective successors are duly elected and qualified. Mr. Schmitz, was originally appointed to the Board on July 1, 2018 in accordance with the Agreement and Plan of Merger with Citywide Banks of Colorado, Inc. Mr. Schmitz's nomination and subsequent election in 2021 were not made pursuant to any agreement or arrangement that requires that he be selected as a director. Mr. Orr was originally appointed to the Board on July 22, 2019 in accordance with the Agreement and Plan of Merger with First Bank Lubbock Bancshares, Inc. No other director has been nominated or is serving pursuant to any arrangement that requires that they be selected as a director.

| | | | | | | | | | | | | | |

| CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS |

Our Board of Directors

There are currently twelve members on the Board of Directors of HTLF and the Board approved a decrease in the total number of directors to eleven, effective at the 2022 Annual Meeting. Although it is the responsibility of HTLF's officers to manage day-to-day operations, the Board oversees our business and monitors the performance of our management.

Director Independence. Our Board has determined that each of Mses. Hopkins, Murphy and Unger and Messrs. Engel, Flynn, Hylen, Schmidt, and White is an “independent” director, or will be if elected, as defined in the listing standards of Nasdaq and the rules and regulations of the SEC. The Board determined that Mr. Falb, who resigned effective April 20, 2021, was also independent during the time that he served. The Board has also determined that Messrs. Fuller, Lee (as President and Chief Executive Officer of HTLF), Orr and Schmitz are not independent. Mr. Fuller is not an independent director because he served as Executive Operating Chairman of HTLF until March 15, 2022. Mr. Orr is not an independent director because he served as chief executive officer of HTLF subsidiary First Bank & Trust until March 31, 2021, and continues to serve as chairman of the board of directors of First Bank & Trust. Mr. Schmitz is not an independent director because he received payments until June 27, 2019 pursuant to a consulting agreement entered into in connection with the Citywide acquisition. In considering the independence of the directors, our Board reviewed questionnaires prepared by each director, reviewed its own records of transactions with directors and their family members, and inquired of directors whether they, or any member of their immediate families, had engaged in any transaction with us, other than transactions made in the ordinary course of business.

Meetings. Our directors meet on at least a quarterly basis, or as needed at special meetings held periodically throughout the year. During 2021, the Board of Directors held nine regular meetings and four special meetings. All directors attended at least 90% of the meetings of the Board of Directors and 75% of the aggregate of (i) the total number of the meetings of the Board of Directors and (ii) the total number of the meetings held by all Committees on which they served.

The independent directors are offered the opportunity at each meeting of the Board of Directors to meet separately in executive session. During 2021, the independent directors met six times in such capacity led by Mr. Flynn. Each of our Audit Committee, Compensation, Nominating and Corporate Governance Committee and Risk Committee consists solely of independent directors.

It is HTLF's practice that all directors be in attendance at the Annual Meeting unless excused by the Chairman of the Board. In 2021, all directors attended the Annual Meeting.

Board Leadership. Under our Bylaws, the Chairman of the Board presides at meetings of the Board at which he is in attendance. Mr. Schmidt, our independent Chairman, has been Chairman of our Board of Directors since March 15, 2022, replacing Mr. Fuller, our former Executive Operating Chairman since 2018.

Mr. Flynn served as the Board's Independent Lead Director from 2018 until April 19, 2022, when the position of Independent Lead Director was eliminated following the election of Mr. Schmidt as independent Chairman. In his role as Independent Lead Director, Mr. Flynn served as the liaison between the directors and management, promoting open and constructive conversation. He worked closely with both our current Chairman, Mr. Schmidt and his predecessor Mr. Fuller, and our President and Chief Executive Officer, Mr. Lee, to ensure HTLF is building a healthy governance culture. As the Independent Lead Director, Mr. Flynn also assisted in setting the agendas for Board meetings and executive sessions of the Board, chaired the executive sessions of the Board, facilitated the Board evaluation process, and worked with Messrs. Schmidt, Fuller and Lee to monitor progress on the strategic plan and succession planning. Mr. Flynn also serves as Vice Chairman of the Board and as such, may chair meetings of the Board when the Chairman is not in attendance or otherwise unavailable.

Our Board believes that the separation of the Chairman of the Board from the executive officer positions reinforces the independence of the Board from management, creates an environment that encourages objective oversight of the management's performance and enhances the effectiveness of our Board as a whole.

Risk Management - Background. HTLF applies the three lines of defense model to its risk management framework. Under this structure, the first line of defense is management at HTLF’s subsidiaries, together with managers of centralized operations units at HTLF assigned to support them. Collectively, they are accountable and responsible for managing the risks appurtenant to their areas of responsibility. This responsibility includes developing policies, procedures and controls, and executing them. As the second line of defense and within the purview of the Chief Risk Officer, HTLF has established formal

enterprise risk management functions that facilitate risk identification, assessment, monitoring and reporting on the adequacy and effectiveness of risk management processes. The centralized risk management functions are comprised of Enterprise Risk Management, Consumer Compliance, Loan Review, Security (Information/Cybersecurity) and Financial Crimes Risk Management (BSA/AML/OFAC and Fraud). The third line of defense is the centralized Internal Audit function which provides independent quality assurance and validation of the effectiveness of the control environment and entire risk management framework.

Risk Management - The Board. In 2020, the HTLF Board of Directors formed the Risk Committee which has oversight responsibilities for the Company’s enterprise risk management and reporting framework. The Risk Committee reviews reporting on the risk management framework provided by the Chief Risk Officer, including quarterly assessments of the Company’s risk profile and monitoring compliance with the Board approved risk appetite statement and limits. The Audit Committee oversees risks associated with financial reporting, including internal controls over financial reporting, and the effectiveness of the third line of defense and the Internal Audit function, and appoints and oversees the Company’s external auditor. The Compensation, Nominating and Corporate Governance Committee identifies, reviews and oversees risks created by HTLF’s executive and employee compensation programs, including its annual and long-term incentive plans. The Compensation, Nominating and Corporate Governance Committee also reviews the results of the annual incentive compensation risk assessment as presented by the Chief Risk Officer.

Risk Management - Senior Management. Senior Managers, having leadership and managerial responsibility for the first line of defense, have responsibilities for developing plans and implementing effective controls to manage and mitigate risk. This includes coordination of product, service and customer related activities that are largely within the domain of our member banks with operational processes and support activities that are largely within the domain of HTLF centralized business units. Senior managers are also responsible for establishing and maintaining appropriate segregation of duties, defined roles and responsibilities and accountabilities to facilitate the successful execution of our strategic plan and objectives.

Committees of the Board

Audit Committee. The members of the Audit Committee are Mses. Hopkins, Murphy and Unger and Messrs. Engel, Flynn and Schmidt, and each member is an “independent” director under the listing standards of Nasdaq and the rules and regulations of the SEC. The Board of Directors has determined that each of Messrs. Engel, Flynn and Schmidt and Mses. Murphy and Unger qualify as, and should be named as, an “audit committee financial expert” as set forth in the rules and regulations of the SEC. Each member of the Audit Committee also meets the financial literacy and independence requirements for audit committee membership under the listing standards of Nasdaq and the rules and regulations of the SEC.

The primary duties and functions of the Audit Committee are to:

| | | | | |

| * | monitor the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting, risk management, and legal compliance; |

| * | retain, oversee, review and terminate, if necessary, the Company’s independent registered public accounting firm and pre-approve all services performed by such firm; |

| * | provide an avenue of communication among the Company’s independent registered public accounting firm, management, the internal audit function and the Board of Directors; |

| * | encourage adherence to, and continuous improvement of, the Company’s policies, procedures and practices at all levels; |

| * | review areas of potential significant financial risk to the Company; |

| * | oversee the activities and performance of the Company's internal audit function; and |

| * | monitor compliance with legal and regulatory requirements for the Company. |

The Audit Committee's duties and functions are set forth in more detail in its Charter, which can be found under the Investor Relations section of our website, ir.htlf.com

Ms. Murphy has served as Chairperson of the Audit Committee since April 5, 2022, replacing Mr. Schmidt, our former Chairman of the Audit Committee. During 2021, the Audit Committee met nine times. To promote independence of the audit function, the Audit Committee consults both separately and jointly with our independent registered public accounting firm, internal auditors and management.

The Report of the Audit Committee is contained later in this proxy statement, and the processes used by the Audit Committee to approve audit and non-audit services are described later in this proxy statement under the caption, “Relationship With Independent Registered Public Accounting Firm-Audit Committee Pre-Approval Policy.”

Compensation, Nominating and Corporate Governance Committee. The Compensation, Nominating and Corporate Governance Committee is comprised of Mses. Hopkins and Unger and Messrs. Flynn, Hylen and White. Each member is an “independent” director under the listing standards of Nasdaq and the rules and regulations of the SEC and a “non-employee” director under Section 16 of the Securities Exchange Act of 1934 (the "Exchange Act").

The primary duties and functions of the Compensation, Nominating and Corporate Governance Committee are to:

| | | | | |

| * | discharge the responsibilities of the Board relating to the compensation of the Company’s executive officers, including the President and Chief Executive Officer; |

| * | evaluate and make recommendations to the Board relating to the compensation of individuals serving as directors of the Company; |

| * | direct the preparation of and approve an Annual Report on Executive Compensation for inclusion in the Company’s proxy statement in accordance with all applicable rules and regulations; |

| * | identify individuals qualified to become members of the Board of Directors and select such individuals as director nominees for the next Annual Meeting of Stockholders; and |

| * | develop and establish corporate governance policies and procedures for the Company. |

Mr. White has served as Chairman of the Compensation, Nominating and Corporate Governance Committee since May 2021. The Compensation, Nominating and Corporate Governance Committee duties and functions are set forth in more detail in its Charter, which can be found under the Investor Relations section of our website, ir.htlf.com. The Compensation, Nominating and Corporate Governance Committee held ten meetings in 2021.

The process used by the Compensation, Nominating and Corporate Governance Committee to evaluate and determine executive compensation is described in this proxy statement under “Compensation Discussion and Analysis - Administration of Our Compensation Program.” The Report of the Compensation, Nominating and Corporate Governance Committee is also contained later in this proxy statement.

Risk Committee. The Risk Committee is comprised of Ms. Murphy and Messrs. Engel, Hylen, Schmidt and White. Each member is an “independent” director under the listing standards of Nasdaq and the rules and regulations of the SEC and a “non-employee” director under Section 16 of the Exchange Act.

The primary duties and functions of the Risk Committee are to:

| | | | | |

| * | oversee the risk management program and provide guidance to management on risk matters. |

| * | oversee management’s implementation of the ERM Policy which defines the enterprise risk management and reporting framework (including use of objective and quantitative metrics), approves the Risk Appetite Statement, and reviews reporting provided by management on risk identification and monitoring of the Company’s risk profile; |

| * | review and discuss with management emerging (both internal and external) significant risk exposures, including risk mitigating actions as highlighted by enterprise risk management reporting. |

| * | ensure that the risk management function is adequately established and maintained, with sufficient resources, independence and authority to perform its duties commensurate with the size and complexity of the Company. |

| * | review reports from Compliance, Financial Crimes Risk Management, Loan Review, Third Party Risk Management, Model Risk Management and Security (Information/Cybersecurity); and |

| * | receive regulatory updates including exam results and other pertinent updates that impact the Company's risk profile. |

Mr. Engel has served as Chairman of the Risk Committee since April 2021. The Risk Committee duties and functions are set forth in more detail in its Charter, which can be found under the Investor Relations section of our website, ir.htlf.com. The Risk Committee held four meetings in 2021.

Director Nominations and Qualifications

In carrying out its nominating function, the Compensation, Nominating and Corporate Governance Committee evaluates all potential nominees for election, including incumbent directors, Board nominees and stockholder nominees, in the

same manner. Beginning in 2020, the Board engaged a third-party search firm to assist in the ongoing identification and evaluation of potential nominees.

The Committee seeks to identify nominees for the position of independent director who satisfy Nasdaq independence requirements and that at a minimum have the following attributes:

| | | | | |

| * | highest personal and professional ethics, integrity and values; |

| * | sufficient educational and professional background to enable them to understand the Company’s business; |

| * | exemplary management and communication skills; |

| * | demonstrated leadership skills; |

| * | sound judgment in his or her professional and personal life; |

| * | a commitment to representing the long-term interests of all the Company’s shareholders; |

| * | a strong sense of service to the communities which we serve; and |

| * | ability to meet the standards and duties set forth in the Company’s Code of Business Conduct and Ethics. |

The Committee also takes into account a potential nominee’s:

| | | | | |

| * | senior corporate leadership experience; |

| * | experience with publicly held companies; and |

| * | unique perspective by virtue of their race, gender, geographic or other meaningful differences. |

Potential nominees should also share the Company’s philosophy, including the same sense of mission, vision and values.

No nominee is eligible for election or re-election as a director if, at the time of the stockholders' meeting at which such director is elected, such person is 72 or more years of age. Each nominee must also be willing to devote sufficient time to carrying out his or her Board duties and responsibilities effectively.

The Compensation, Nominating and Corporate Governance Committee also evaluates potential nominees to determine if they have any conflicts of interest that may interfere with their ability to serve as effective Board members and whether they are “independent” in accordance with Nasdaq listing standards (to ensure that at least a majority of the directors will, at all times, be independent). The Compensation, Nominating and Corporate Governance Committee held ten meetings in 2021.

Stockholder Communications with the Board, Recommendations, Nomination and Proposal Procedures

General Communications with the Board. As set forth on our website, ir.htlf.com, our Board of Directors can be contacted at 700 Locust Street, 4th Floor, P.O. Box 778, Dubuque, Iowa 52001, Attn: Jay L. Kim, Corporate Secretary, or by telephone at our administrative offices at (563) 589-2100 or toll-free at (888) 739-2100. Each communication relating to the Board's duties or responsibilities will be forwarded to the Board or the specific directors identified in the communication as soon as reasonably possible. Correspondence that is unrelated to a director's duties will be handled at the Corporate Secretary's discretion.

Recommendations. Should stockholders wish to recommend director nominees, such correspondence should be sent to our Corporate Secretary at the above address. The Compensation, Nominating and Corporate Governance Committee will review each recommendation in the same manner regardless of the source and take into account all factors it considers appropriate, including those described under "Director Nominations and Qualifications."

Nominations of Directors. In accordance with our Bylaws, a stockholder may nominate a director for election at an Annual Meeting of Stockholders only if such stockholder's written notice of the nomination is delivered to or mailed and received by us, at our Corporate Secretary's, address set forth above, not less than 30 days nor more than 75 days prior to the date of the Annual Meeting, irrespective of any deferrals, postponements or adjournments thereof to a later date; provided, however, that in the event that less than 40 days' notice or prior public disclosure of the date of the meeting is given or made to the stockholders, the stockholders's written notice of the nomination must be received by us not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. The stockholder's notice of intention to nominate a director must include (i) the name and address of record of the stockholder who intends to make the nomination; (ii) a representation that the stockholder is a holder of record of shares of the corporation entitled to vote at such meeting, and intends to appear in person or by proxy at the meeting

to nominate the person or persons specified in the notice; (iii) the name, age, business and residence address and principal occupation or employment of each nominee; (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; (v) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, as then in effect; and (vi) the consent of each nominee to serve as a director of the corporation if so elected. We may request additional information from any proposed nominee after receiving the notification for the purpose of determining the proposed nominee's eligibility to serve as a director. Persons nominated for election to the Board, in accordance with the above requirements, will not be included in our proxy statement.

Other Stockholder Proposals. If a HTLF stockholder wishes to submit a shareholder proposal pursuant to Rule 14a-8 under the Exchange Act for inclusion in HTLF's proxy statement for its 2023 Annual Meeting of Stockholders, HTLF must have received such proposal and supporting statements, if any, at its principal executive office no later than December 30, 2022, unless the date of HTLF's 2023 Annual Meeting of Stockholders is changed by more than 30 days from June 15, 2023 (the one-year anniversary date of the 2022 Annual Meeting of Stockholders), in which case the proposal must be received a reasonable time before HTLF begins to print and mail its proxy materials.

For proposals to be made by a stockholder outside of Rule 14a-8 and to be brought before the Annual Meeting, the stockholder's written notice of the proposal must be delivered, mailed or telegraphed to us, at our Corporate Secretary's address set forth above, not less than 30 days nor more than 75 days prior to the scheduled date of the Annual Meeting, regardless of any postponements, deferrals or adjournments of the meeting to a later date; provided, however, that if less than 40 days' notice of the date of the scheduled meeting is given or made by the Company, the stockholder's written notice must be delivered, mailed or telegraphed to us not later than the close of business on the 10th day following the date on which notice of the date of the scheduled meeting was first mailed to stockholders. The stockholder's notice must include as to each matter the stockholder proposes to bring before the Annual Meeting: (i) a brief description of the proposal desired to be brought before the meeting and the reasons for conducting such business at the meeting; (ii) the name and address, as they appear on the corporation's books, of the stockholder proposing such business; (iii) the number of shares of the corporation's common stock beneficially owned by such stockholder on the date of such stockholder's notice; and (iv) any financial or other interest of such stockholder in the proposal.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all directors and employees. The Code sets forth the standard of ethics we expect all of our directors and employees to follow, including our Chief Executive Officer and Chief Financial Officer. All directors have received, and acknowledged in writing, the Code of Business Conduct and Ethics Policy, along with the Code of Business Conduct and Ethics Violation Reporting Procedure. The Code of Business Conduct is posted on our website, ir.htlf.com. We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding any amendment to, or waiver of, the Code of Business Conduct with respect to our Chief Executive Officer and Chief Financial Officer and persons performing similar functions, by posting such information on our website.

Director Compensation

Our Board of Directors believes that compensation received by a non-employee director should be tied directly to the success of HTLF and, by extension, the success of all HTLF stockholders. In May 2020, and with the assistance of Aon's Human Capital Solutions Practice, a division of Aon plc ("Aon"), the compensation consultant retained by the Compensation, Nominating and Corporate Governance Committee, the Committee reviewed the structure and amount of compensation payable to the Company's non-employee directors. As a result, per meeting committee fees were eliminated and a new compensation structure was put in place. Non-employee directors are compensated for service on the HTLF Board of Directors by an annual equity award of restricted stock units ("RSUs") that vest in June of the following year plus annual board member and annual committee member retainers. The independent lead director and each committee chair also receive additional annual retainers. Board members may elect to receive their annual retainers in cash or RSUs, or a mix of the two. The RSUs are awarded as of the date of the Annual Meeting and vest in June of the following year, provided that such non-employee director attended 75% of all Board and assigned committee meetings held between the date of grant and the earlier of the vesting date and the date of the next Annual Meeting following the date of grant. In the event a director leaves the Board for any reason prior to any vesting date or a change in control (other than due to death), the director forfeits all right to the respective RSUs. In the event of the death of the non-employee director or a change in control, the RSUs vest immediately and completely.

The following table highlights the material elements of our director compensation program:

| | | | | | | | | | | |

| Compensation Elements | | |

| Annual Independent Lead Director Retainer | | $ | 27,500 | | (1) |

| Annual Independent Board Chair Retainer | | $ | 50,000 | | (2) |

| Annual Board Member Retainer | | $ | 47,500 | | (1) |

| Annual Board Member Equity Award | | $ | 60,000 | | (3) |

| Annual Committee Chair Retainer | | $ | 10,000 | | (1) |

| Annual Committee Member Retainer | | $ | 7,500 | | (1) |

| | | |

| (1) Directors may elect to receive the retainer in RSUs or cash |

| (2) Instituted in 2022 following the election of an independent Board chair. | | | |

| (3) Payable only in RSUs |

To further reinforce the link between directors and stockholders, our directors are subject to stock ownership guidelines that require them to hold common stock with a value of at least three times annual total director compensation. Directors must achieve this holding within five years of being named a director, and all directors with more than five years of service are in compliance with this requirement.

Messrs. Fuller and Lee, who were HTLF or HTLF subsidiary officers in 2021, did not receive any compensation for serving on the Board of HTLF or any of its subsidiary banks. Mr. Falb, who served on the Board of HTLF until resigning in April 2021, did not receive any compensation for serving on the Board of HTLF in 2021.

Mses. Hopkins and Murphy and Messrs. Engel, Flynn, Orr, Schmidt, and Schmitz also serve on the boards of one of our subsidiary banks and receive cash compensation and/or RSUs for such service. Our subsidiary banks compensate directors by granting HTLF RSUs, though the directors are paid in cash for committee work on the Boards of our subsidiary banks. HTLF Directors who served as directors of subsidiary banks each received 150 RSUs during 2021 for their service on the board of a subsidiary bank.

The following table shows non-employee director compensation during 2021 for service on the HTLF Board of Directors and the Boards of our subsidiary banks:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIRECTOR COMPENSATION |

| Name | | Fees Earned or Paid in Cash(1) | | Stock Awards(2) | | All Other

Compensation | | Total |

| Robert B. Engel | | $ | 75,700 | | | $ | 66,585 | | | $ | — | | | $ | 142,285 | |

Mark C. Falb(3) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Thomas L. Flynn | | $ | 96,800 | | | $ | 66,585 | | | $ | — | | | $ | 163,385 | |

| Jennifer K. Hopkins | | $ | 65,700 | | | $ | 66,585 | | | $ | — | | | $ | 132,285 | |

| Christopher S. Hylen | | $ | 62,500 | | | $ | 59,064 | | | $ | — | | | $ | 121,564 | |

Michael J. McCoy(4) | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Susan J. Murphy | | $ | 65,700 | | | $ | 66,585 | | | $ | — | | | $ | 132,285 | |

| Barry H. Orr | | $ | 47,500 | | | $ | 59,064 | | | $ | — | | | $ | 106,564 | |

John K. Schmidt(5) | | $ | 79,300 | | | $ | 66,585 | | | $ | 5,000 | | | $ | 150,885 | |

| Martin J. Schmitz | | $ | 49,900 | | | $ | 66,585 | | | $ | — | | | $ | 116,485 | |

| Kathryn Graves Unger | | $ | 62,500 | | | $ | 59,064 | | | $ | — | | | $ | 121,564 | |

| Duane E. White | | $ | 72,500 | | | $ | 59,064 | | | $ | — | | | $ | 131,564 | |

| | | | | | | | |

(1) The amounts in this column include the annual retainer, committee retainer, and committee chair retainer paid for service on a committee at HTLF or the board of one of HTLF’s subsidiaries. For the annual retainer portion of director compensation, Messrs. Engel, Orr, Schmidt, Schmitz and White elected to receive $47,500 in cash. Messrs. Flynn and Hylen, along with Mses. Hopkins, Murphy and Unger, elected to receive equivalent-value RSUs, and were each granted 950 RSUs. Mr. Flynn elected to receive equivalent-value RSUs for his compensation as the Independent Lead Director and was granted 550 RSUs. For the committee chair retainer, Messrs. Schmidt and White elected to receive $10,000 in cash, and Mr. Engel elected to receive equivalent-value RSUs and was awarded 200 RSUs. For the committee membership retainer, Ms. Murphy and Messrs. Engel, Schmidt and White elected to receive $15,000 in cash for service on two Committees. Mses. Hopkins and Unger and Messrs. Flynn and Hylen elected to receive equivalent-value RSUs and were granted 300 RSUs for service on two committees. |

(2) The amounts in this column represent the fair value, determined based upon the market price of our common stock on the date of grant in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, of RSUs granted for service as directors of HTLF, as well as RSUs granted for service as directors of subsidiary banks. See the discussion of equity awards in Note 16 of our financial statements for the year ended December 31, 2021, contained in our Annual Report on Form 10-K for all assumptions made in the valuation of the RSUs. Each of Messrs. Engel, Flynn, Hylen, Orr, Schmidt, Schmitz and White and Mses. Hopkins, Murphy and Unger was granted 1,200 RSUs on May 19, 2021 as compensation for service on the Board of Directors of HTLF for the period from the 2021 Annual Meeting to the 2022 Annual Meeting. Messrs. Flynn and Schmidt each received 150 RSUs for service as directors of Dubuque Bank and Trust Company on June 1, 2021, and Messrs. Engel and Schmitz as well as Mses. Hopkins and Murphy received 150 RSUs for service as directors of Citywide Banks on June 1, 2021. Mr. Orr received 150 RSUs for service as a director of First Bank & Trust on June 1, 2021. The aggregate number of RSUs outstanding at December 31, 2021 for each director was: 1,550 for Mr. Engel, 2,450 for Mr. Hylen, 3,150 for Mr. Flynn, 2,600 for Ms. Hopkins, 2,300 for Ms. Murphy, 1,350 for Mr. Orr, 1,350 for Mr. Schmidt, 1,350 for Mr. Schmitz, 2,450 for Ms. Unger and 1,200 for Mr. White. Mr. Orr also has 4,268 total performance based RSUs outstanding at December 31, 2021, from his service as President and CEO of First Bank and Trust, which will be measured according to the terms of each grant agreement and vest in 2022, 2023 and 2024. |

| (3) Mr. Falb resigned from the HTLF Board of Directors effective April 20, 2021. |

| (4) Mr. McCoy retired from the HTLF Board of Directors effective at the 2021 Annual Meting. |

| (5) Mr. Schmidt, as a Dubuque Bank and Trust director, directed a contribution of $5,000 to a charitable organization of his choice from Dubuque Bank and Trust. |

| | | | | | | | | | | | | | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table lists the beneficial ownership of our common stock as of March 31, 2022, by each person we know to beneficially own more than 5% of our outstanding common stock, by each director or each executive officer named in the summary compensation table and by all directors and executive officers of HTLF as a group. Except as otherwise indicated below, each of the entities or persons named in the table has sole voting and investment power with respect to all common stock beneficially owned set forth opposite their name.

| | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class(2) |

| 5% Stockholders | | | | | |

| BlackRock, Inc., 55 East 52nd Street, New York, NY 10055 | | 4,533,341 | | (3) | | 10.7% |

| Earnest Partners, LLC 1180 Peachtree Street NE, Atlanta, GA 30309 | | 2,864,601 | | (4) | | 6.8% |

| The Vanguard Group, 100 Vanguard Blvd., Malvern, PA 19355 | | 2,840,134 | | (5) | | 6.7% |

| Directors and Nominees | | | | | |

| Robert B. Engel | | 11,745 | | | | * |

| | | | | |

| Thomas L. Flynn | | 90,252 | | (6) | | * |

| Lynn B. Fuller | | 696,083 | | (7) | | 1.6% |

| Jennifer K. Hopkins | | 11,240 | | | | * |

| Christopher S. Hylen | | 1,208 | | | | * |

| Bruce K. Lee | | 50,502 | | | | * |

| | | | | |

| Susan J. Murphy | | 8,931 | | | | * |

| Barry H. Orr | | 237,975 | | (8) | | * |

| John K. Schmidt | | 122,211 | | (9) | | * |