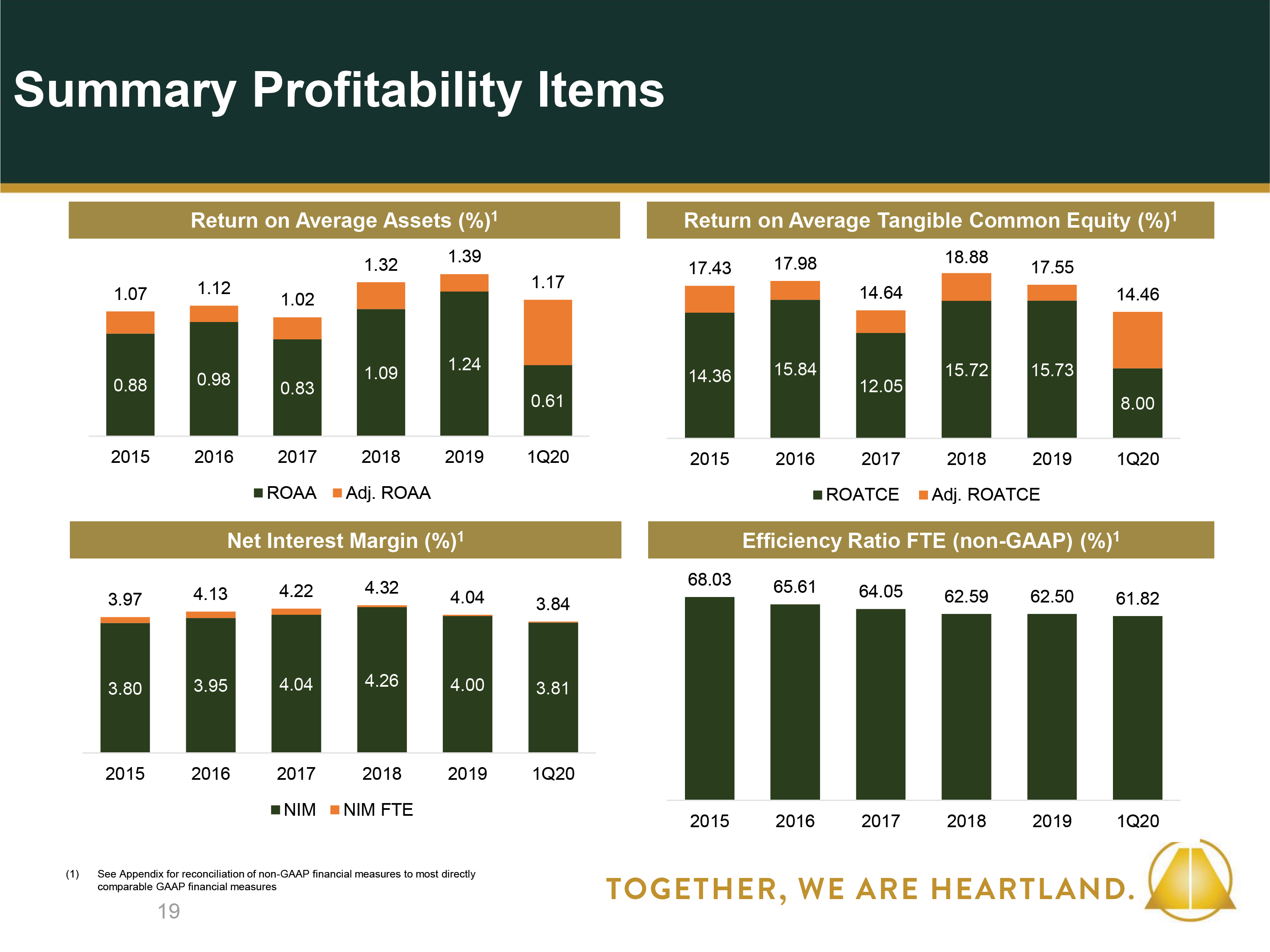

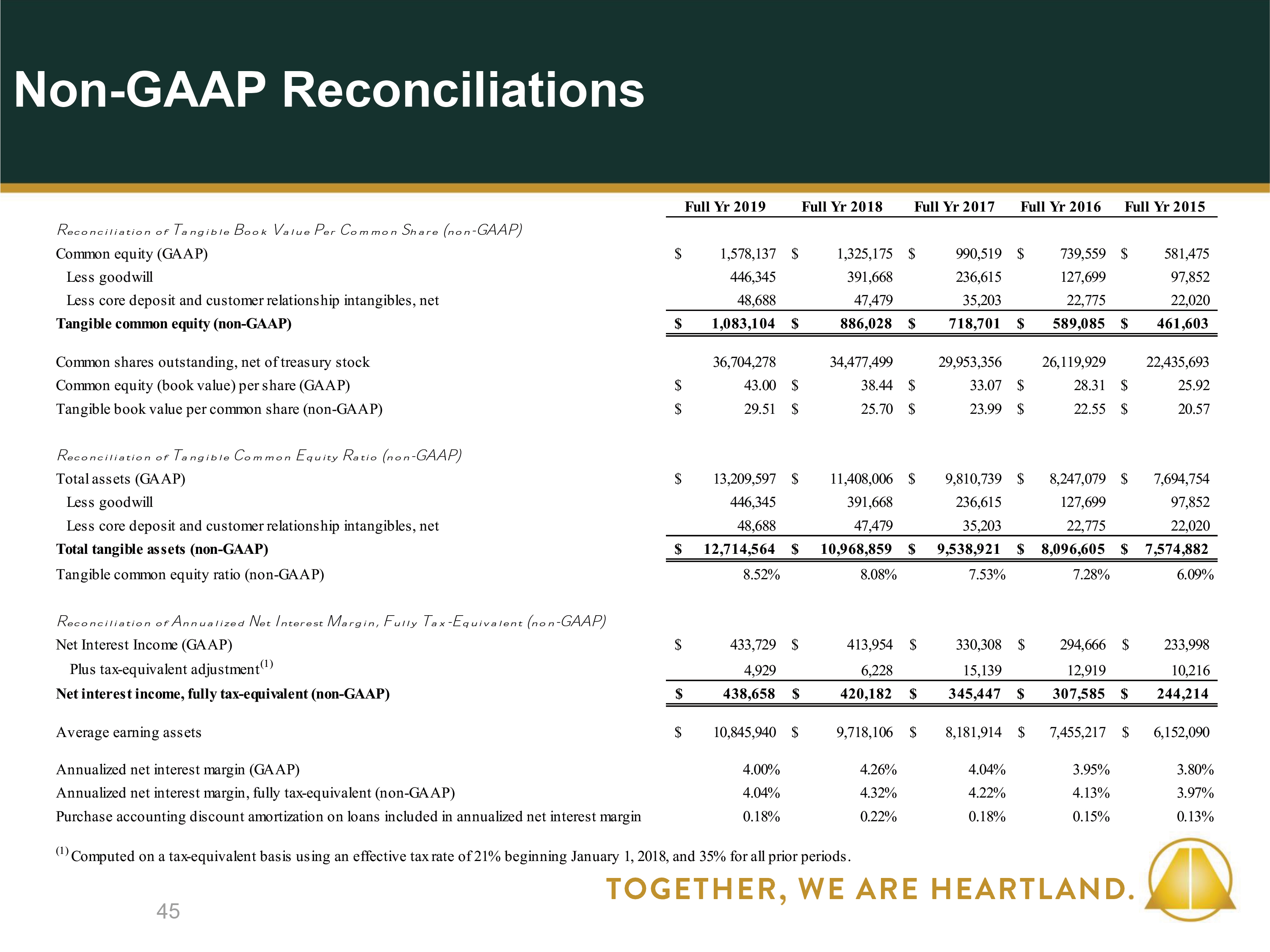

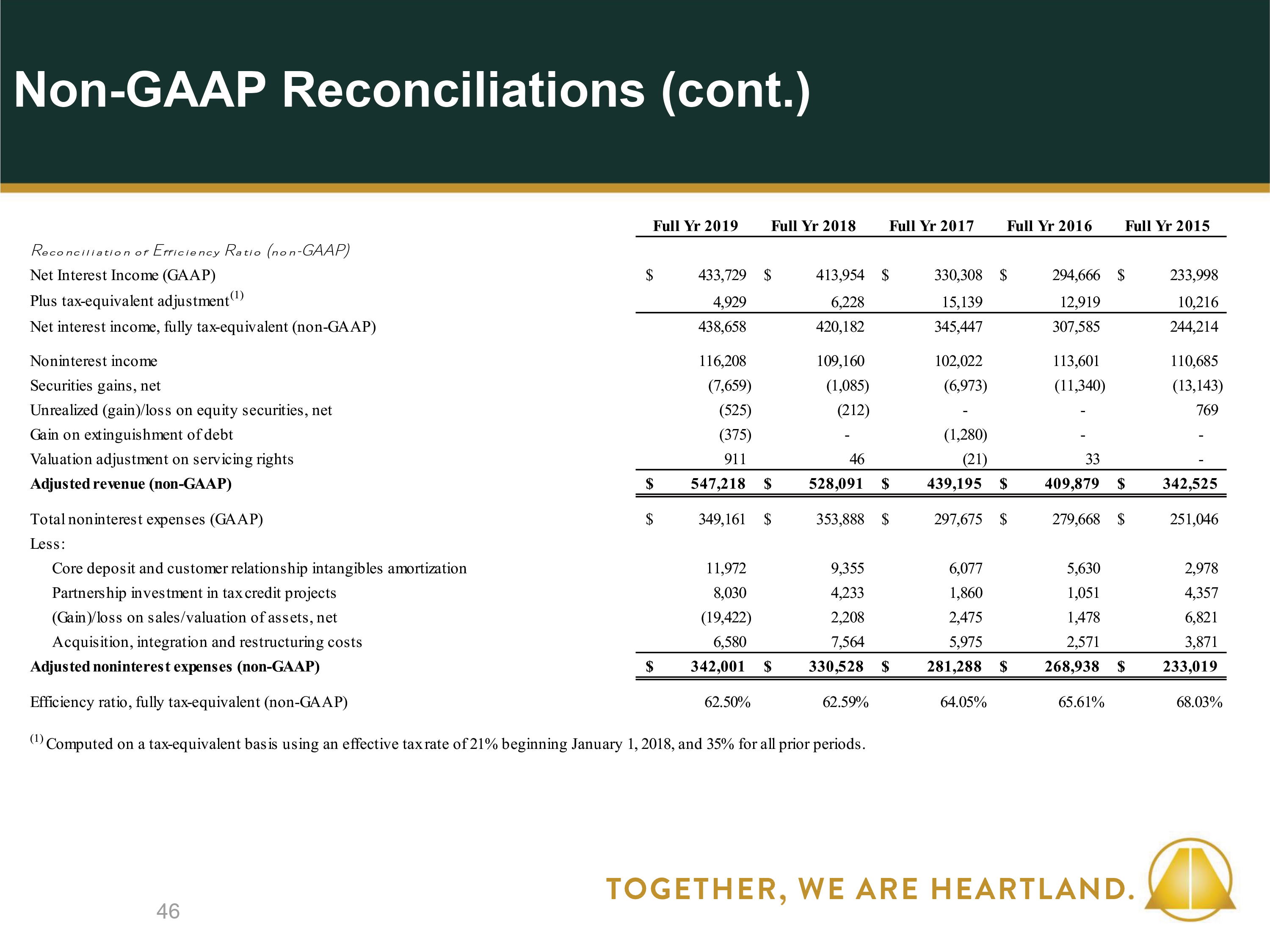

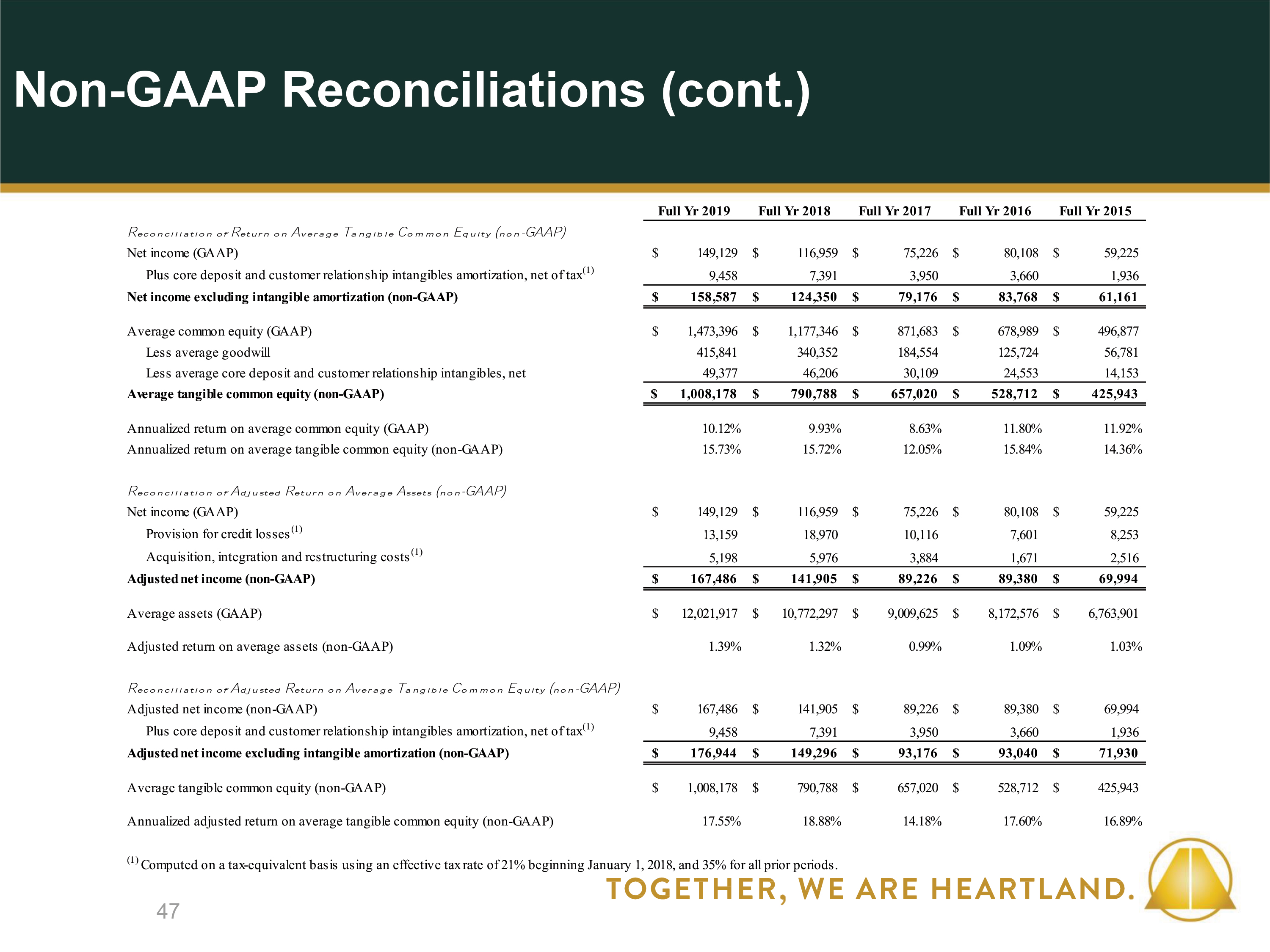

Safe Harbor 2 This presentation, contains, and future oral and written statements of Heartland Financial USA, Inc. ("Heartland") and its management may contain, forward-looking statements within the meaning of such term in the Private Securities Litigation Reform Act of 1995, with respect to the business, financial condition, results of operations, plans, objectives and future performance of Heartland. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of Heartland's management and on information currently available to management, are generally identifiable by the use of words such as "believe," "expect," "anticipate,“ "plan," "intend," "estimate," "may," "will," "would," "could," "should" or other similar expressions. Although Heartland has made these statements based on management's experience and best estimate of future events, there may be events or factors that management has not anticipated, and the accuracy and achievement of such forward-looking statements and estimates are subject to a number of risks, including those identified in our Annual Report on Form 10-K for the year ended December 31, 2019, as updated and supplemented in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and Heartland undertakes no obligation to update any statement in light of new information or future events.The COVID-19 pandemic is adversely affecting Heartland and its customers, counterparties, employees and third-party service providers. The pandemic’s severity, its duration and the extent of its impact on Heartland’s business, financial condition, results of operations, liquidity and prospects remain uncertain. The deterioration in general business and economic conditions and turbulence in domestic or global financial markets caused by the COVID-19 pandemic have negatively affected Heartland’s net income, total equity and book value per common share, and continued economic deterioration could adversely affect the value of its assets and liabilities, reduce the availability of funding to Heartland, lead to a tightening of credit and increased stock price volatility. Some economists and investment banks believe that a recession or depression may result from the continued spread of COVID-19 and the economic consequences.Additional Information and Where to Find ItHeartland has filed a registration statement (including a prospectus) (File No. 333-233120) and will file a preliminary prospectus supplement with the Securities and Exchange Commission (“SEC”) for the offering to which this presentation relates. Before you invest, you should read the prospectus and the preliminary prospectus supplement in that registration statement and the other documents that Heartland has filed with the SEC for more complete information about the company and the offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at www.sec.gov. Alternatively, Heartland, any underwriter or any dealer participating in the offering will arrange to send you copies of the prospectus and the preliminary prospectus supplement relating to the offering if you request it by contacting: Raymond James & Associates, Inc., Attention: Equity Syndicate, 880 Carillon Parkway, St. Petersburg, FL, 33716, or by telephone at (800) 248-8863, or by e-mail at prospectus@raymondjames.com. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third party sources. While Heartland believes these third party sources to be reliable as of the date of this presentation, Heartland has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third party sources.Notes Regarding the Use of Non-GAAP Financial MeasuresThis presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Heartland’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, Heartland believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation