- LH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Laboratory Corporation of America (LH) 8-KRegulation FD Disclosure

Filed: 23 Oct 08, 12:00am

October 23, 2008

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

| DELAWARE | 1-11353 | 13-3757370 | ||

| (State or other jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 358 SOUTH MAIN STREET, BURLINGTON, NORTH CAROLINA | 27215 | 336-229-1127 | ||

| (Address of principal executive offices) | (Zip Code) | (Registrant's telephone number including area code) |

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company dated October 23, 2008.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Laboratory Corporation of America Holdings (Registrant) | ||||

| Date: October 23, 2008 | By: | /s/Bradford T. Smith | ||

| Bradford T. Smith, Executive Vice President and Secretary | ||||

Introduction

This slide presentation contains forward-looking statements

which are subject to change based on various important

factors, including without limitation, competitive actions in the

marketplace and adverse actions of governmental and other

third-party payors.

Actual results could differ materially from those suggested by

these forward-looking statements. Further information on

potential factors that could affect the Company’s financial

results is included in the Company’s Form 10-K for the year

ended December 31, 2007, and subsequent SEC filings.

The Role of Lab Testing

in Healthcare

In the past, lab testing was primarily used to diagnose disease. Now, lab testing plays

an increasingly large role in the full continuum of healthcare delivery

Source: Deloitte (OAML)

3

The US Healthcare & Clinical

Laboratory Testing Market

Source: CMS, Office of the Actuary, G-2, and Company Estimates

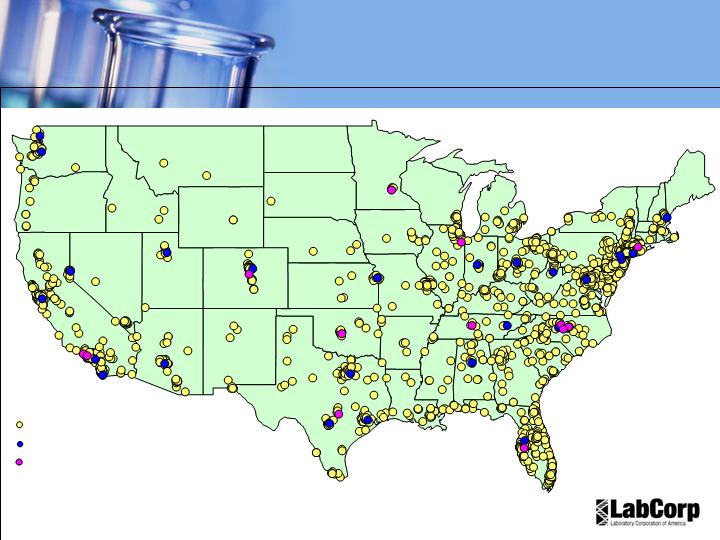

Our Infrastructure

1600+ conveniently

located PSCs

700 MDs & PhDs

6700+ phlebotomists

Lab

Information

System

2600 couriers

1000 sales reps

7 airplanes

Primary testing labs

Esoteric Labs

STAT Labs

Standardized Platforms

Primary LabCorp Testing Locations*

Esoteric Lab Locations

(CET, CMBP, Dianon, Esoterix, NGI, OTS, US Labs, Viromed)

Our Locations

Patient Service Centers*

Cancer diagnostics and monitoring

Advanced cardiovascular disease testing

Advancement through acquisitions and licensing

Strategic Focus Areas

Lab data enables better treatment and outcomes

Partner to control high cost leakage

Recognize value of lab services through appropriate pricing

Quality and service driven culture

First-time problem resolution

Continuous enhancements in customer connectivity

Scientific Leadership

Managed Care

Customer Focus

Revenue Growth Drivers

Industry

Consolidation

Hospital

Opportunity

Aging

Population

-Increased utilization

for older patients

Disease

Management

-Litholink Model

Companion

Diagnostics

-ARCA

-Warfarin

More Esoteric

Testing

-Cardiovascular Disease

- Cancer

Time

Margin

Potential

LabCorp

Competitive Advantages

Standardized Data

Clinical Trials

Dianon, USLabs, Esoterix,

NGI & Viromed

Industry Forces

Focus on Outcomes and Cost Containment (Medical & Drug)

Increased emphasis on drug efficacy, proper dosage and adverse effects

Advances in science and genomics

Expansion of

Managed Care

partnerships

EBITDA Margin Growth Drivers

3.

Further operational

efficiencies

Increase automation in

pre-analytic processes

Logistics / route structure

optimization

Supply chain

management

Improved patient experience and

data capture

1.

Increased volumes through fixed-cost infrastructure

2.

Larger number of esoteric tests offered, more

esoteric tests ordered

Industry-leading EBITDA margins

Significant free cash flow

Focus on providing value to shareholders

Strategic acquisitions

Organic growth opportunities

Share repurchase

$95.4 Million available as of 9/30/08

Flexibility for future growth opportunities

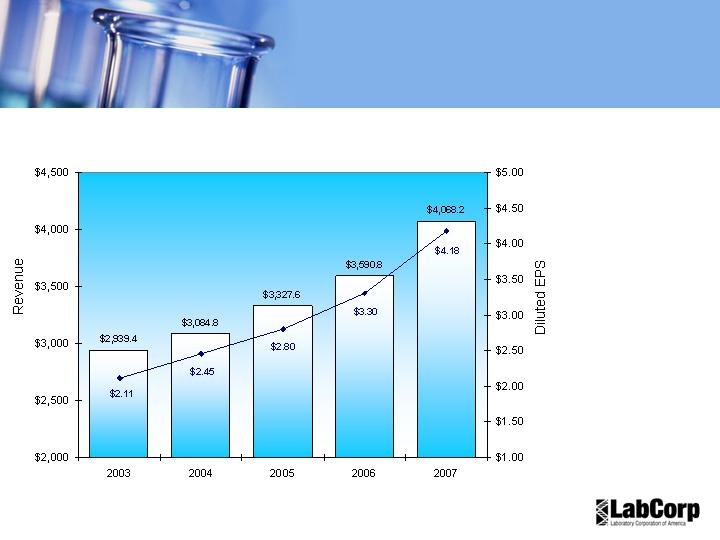

LabCorp’s Investment and

Performance Fundamentals

Revenue CAGR of 8.5% – Diluted EPS CAGR of 18.6%

1.

Excluding the $0.09 per

diluted share impact in 2005

of restructuring and other

special charges, and a non-

recurring investment loss.

2.

Excluding the $0.06 per

diluted share impact in 2006

of restructuring and other

special charges.

3.

Excluding the $0.25 per

diluted share impact in 2007

of restructuring and other

special charges.

Five-Year Revenue

and EPS Trend

1.

Includes approximately

$50 million of benefit

from one-time tax

credits recorded in

2003.

2.

Excluding the impact in

2005 of restructuring

and other special

charges and a non-

recurring investment

loss.

3.

Excluding the impact in

2006 and 2007 of

restructuring and other

special charges

4.

As a result of adopting

FASB 123(R) in 2006,

the Company recorded

incremental stock

compensation expense

of $23.3 and $26.7 in

2006 and 2007,

respectively.

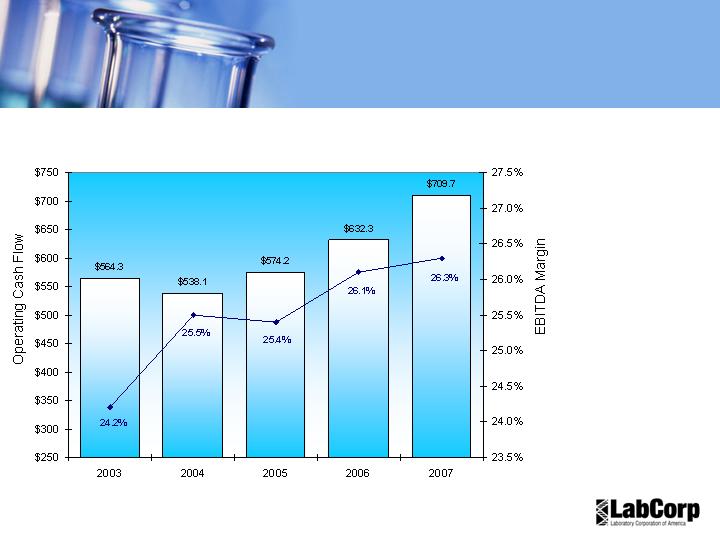

Five-Year OCF and

EBIDTA Margin Trend

OCF CAGR of 6% – EBITDA Margin Growth of 210 bps

2008 Third Quarter

Financial Achievements

Diluted EPS of $1.10 (1)

EBITDA margin of 23.4% of net sales(2)

Operating cash flow of $194.4 million

Increased revenues

11.2% (10.6% volume; 0.6% price)

Excl. Canada 5.4% (3.1% volume, 2.3% price)

Repurchased approximately $263.9 million of

LabCorp stock

2008 YTD Third Quarter

Financial Achievements

Diluted EPS of $3.48 (1)

EBITDA margin of 25.2% of net sales(2)

Operating cash flow of $565.6 million

Increased revenues

10.6% (9.4% volume; 1.2% price)

Excl. Canada 4.3% (2.0% volume, 2.3% price)

Repurchased approximately $330.4 million of

LabCorp stock

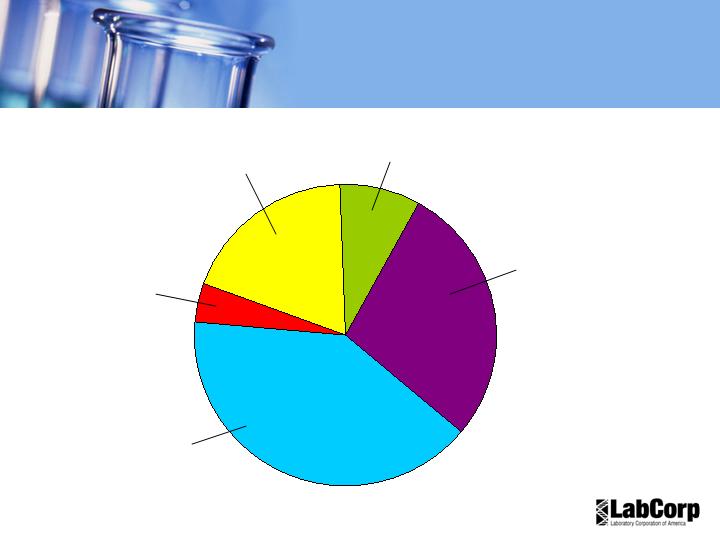

Revenue by Payer- US

YTD Q3 2008

(In millions)

Client

$895.7 (28%)

Patient

$280.1 (9%)

Managed Care

Capitated

$135.5 (4%)

Medicare & Medicaid

$602.0 (19%)

Managed Care

Fee-for-service

$1,282.4 (40%)

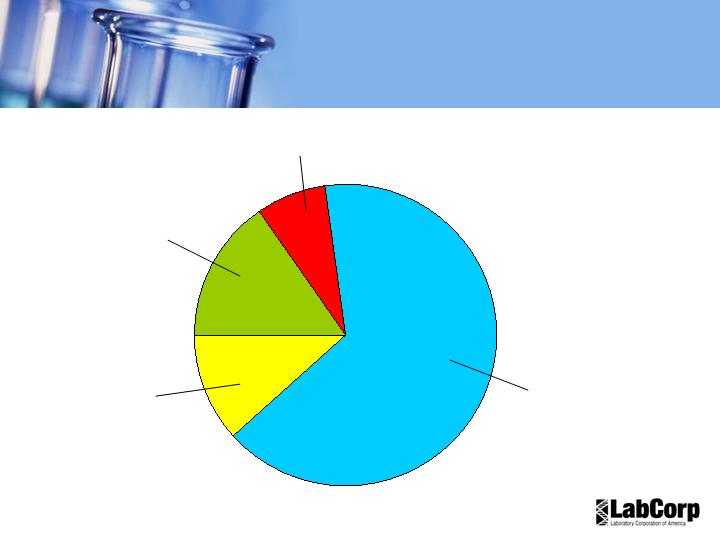

Core

$2,088.5 (65%)

Histology (Non-Pap)

$241.9 (8%)

Other Esoteric

$378.6 (12%)

Genomic

$486.7 (15%)

Revenue by Business Area - US

YTD Q3 2008

(In millions)

Financial Guidance - 2008

Excluding the impact of restructuring and other special

charges and share repurchase activity after Sept 30,

2008, guidance for 2008 is:

$70 million

Net interest of approximately

$140 million to $160 million

Capital expenditures of approximately

$750 million to $770 million

Operating cash flow of approximately

(Excluding any transition payments to UnitedHealthcare)

$4.57 and $4.61

Diluted earnings per share of between

(includes a $0.03 negative impact from weather)

25%

EBITDA margins of approximately

11%

Revenue growth of approximately

Financial Guidance - 2009

Excluding the impact of restructuring and other special

charges and share repurchase activity after Sept 30,

2008, preliminary guidance for 2009 is:

$5.00 and $5.25

Diluted earnings per share of between

3.5% to 5.5%

Revenue growth of approximately

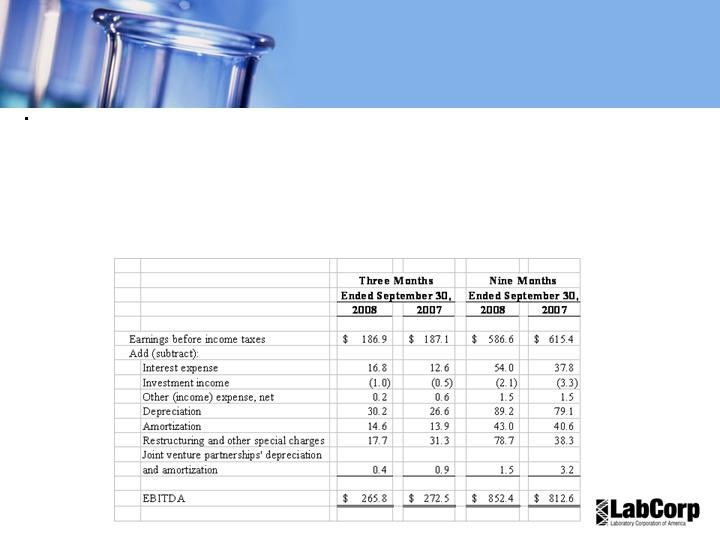

Reconciliation of Non-GAAP

Financial Measures

(In millions)

EBITDA represents earnings before interest, income taxes, depreciation and amortization, and includes the

Company’s proportional share of the underlying EBITDA of the income from joint venture partnerships. The Company

uses EBITDA extensively as an internal management performance measure and believes it is a useful, and commonly

used measure of financial performance in addition to earnings before taxes and other profitability measurements under

generally accepted accounting principles (“GAAP”). EBITDA is not a measure of financial performance under GAAP.

It should not be considered as an alternative to earnings before income taxes (or any other performance measure

under GAAP) as a measure of performance or to cash flows from operating, investing or financing activities as an

indicator of cash flows or as a measure of liquidity. The following table reconciles earnings before income taxes,

representing the most comparable measure under GAAP, to EBITDA for the three- and none-month periods ended

September 30, 2008 and 2007: