UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 12, 2009

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| DELAWARE | | 1-11353 | | 13-3757370 |

| |

| |

|

(State or other jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

358 SOUTH MAIN STREET,

BURLINGTON, NORTH CAROLINA | | 27215 | | 336-229-1127 |

| |

| |

|

| (Address of principal executive offices) | | (Zip Code)

| | (Registrant's telephone number including area code) |

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company dated February 12, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Laboratory Corporation of America Holdings

(Registrant)

| |

| Date: February 12, 2009 | By: | /s/F. Samuel Eberts III | |

| | | F. Samuel Eberts III, Chief Legal Officer

and Secretary | |

| | | | |

| |

1

8-K Filed February 12, 2009

2

Introduction

This slide presentation contains forward-looking statements

which are subject to change based on various important

factors, including without limitation, competitive actions in the

marketplace and adverse actions of governmental and other

third-party payors.

Actual results could differ materially from those suggested by

these forward-looking statements. Further information on

potential factors that could affect the Company’s financial

results is included in the Company’s Form 10-K for the year

ended December 31, 2007, and subsequent SEC filings.

3

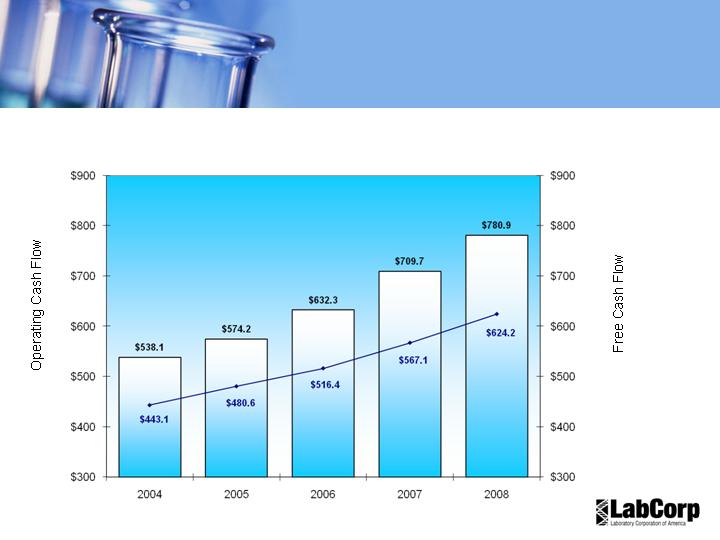

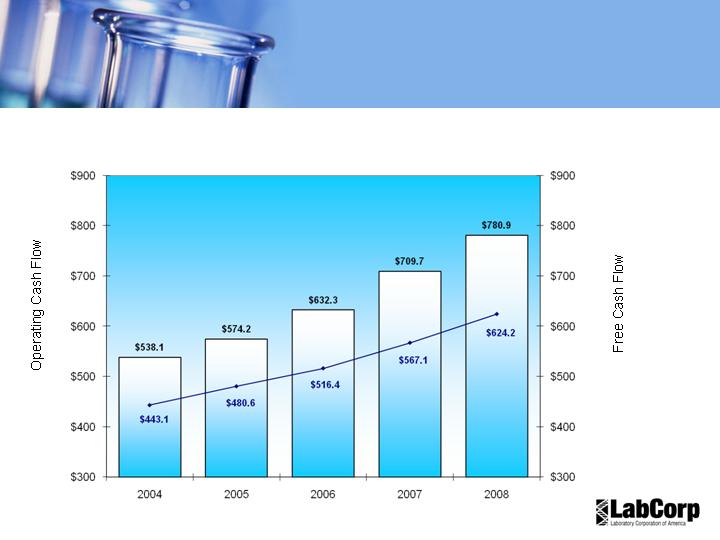

Five-Year Cash Flow Trend

Operating Cash Flow CAGR of 10%

4

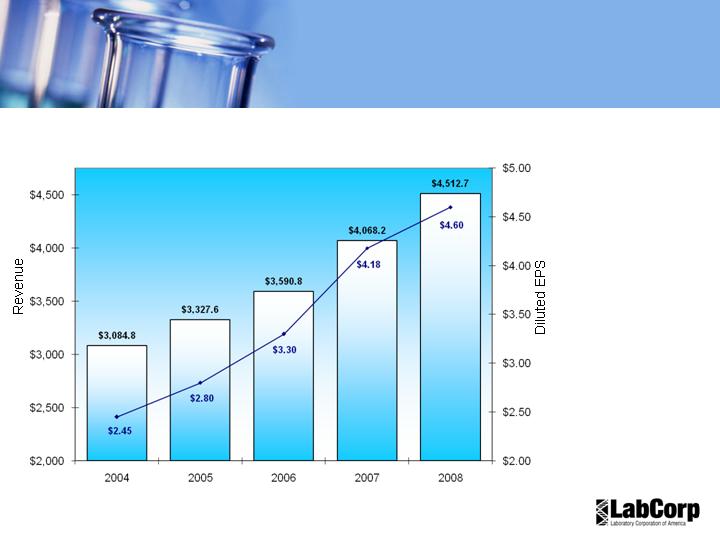

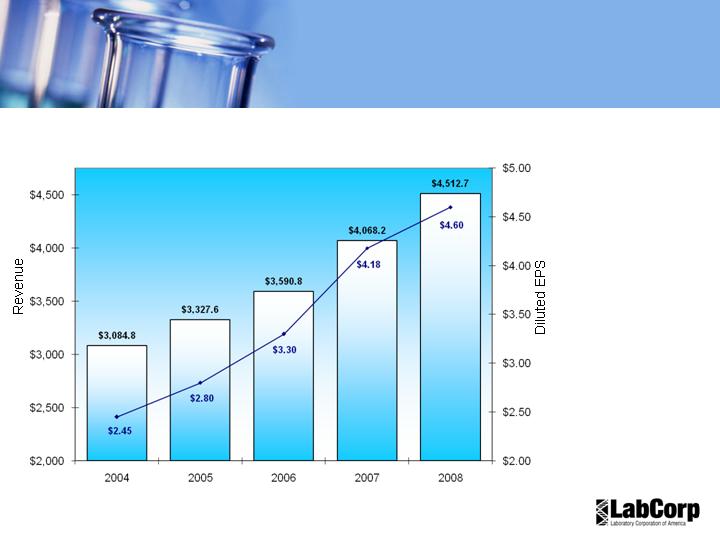

Revenue CAGR of 10.0% – Diluted EPS CAGR of 17.0%

1.

Excluding the $0.09 per

diluted share impact in 2005

of restructuring and other

special charges, and a non-

recurring investment loss.

2.

Excluding the $0.06 per

diluted share impact in 2006

of restructuring and other

special charges.

3.

Excluding the $0.25 per

diluted share impact in 2007

of restructuring and other

special charges.

4.

Excluding the $0.44 per

diluted share impact in 2008

of restructuring and other

special items

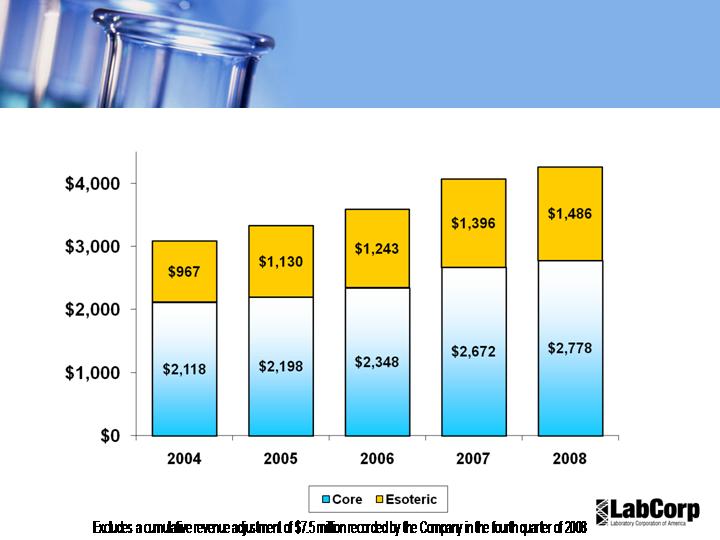

Five-Year Revenue

and EPS Trend

5

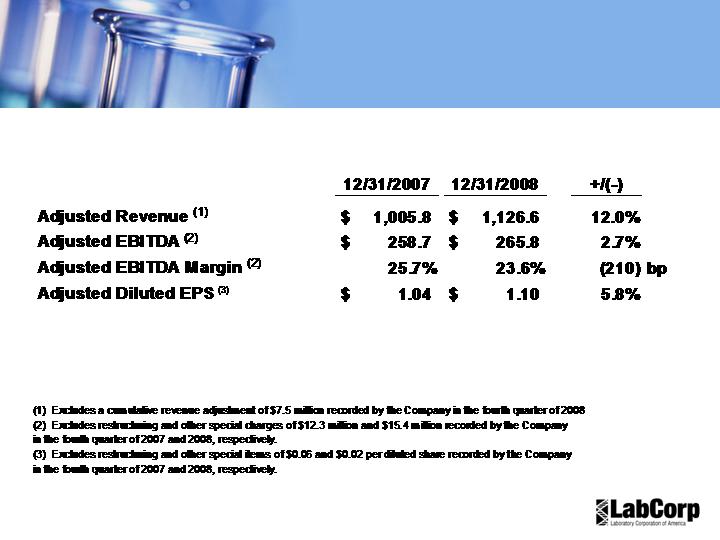

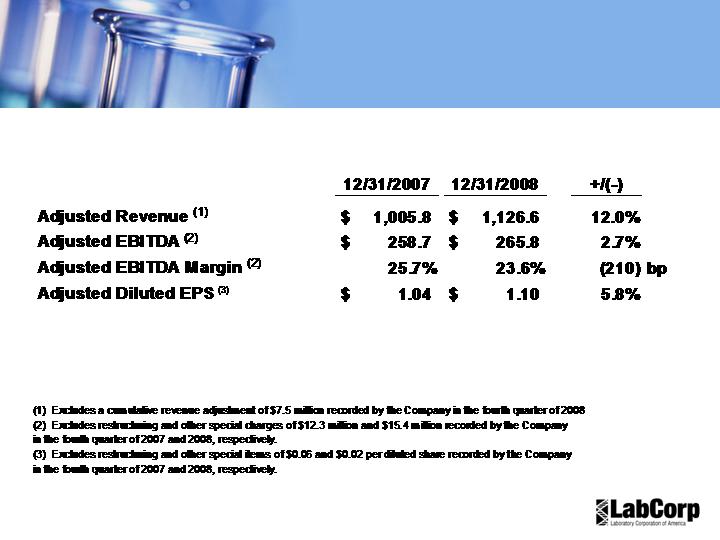

Fourth Quarter Results

(In millions, except per share data)

6

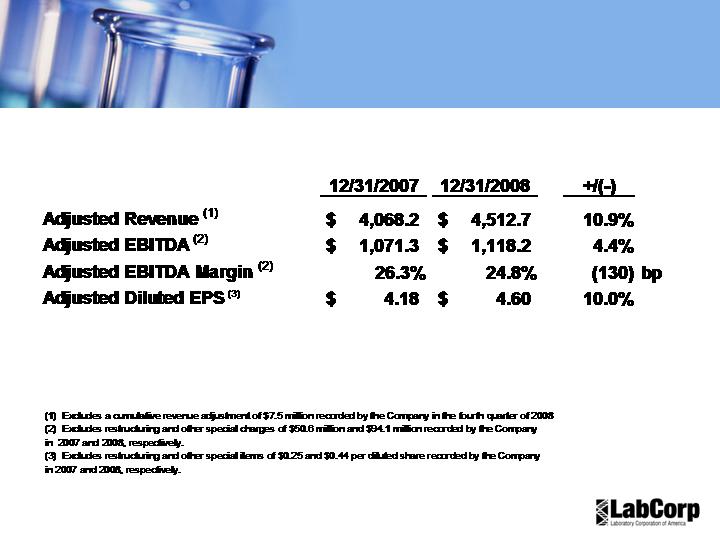

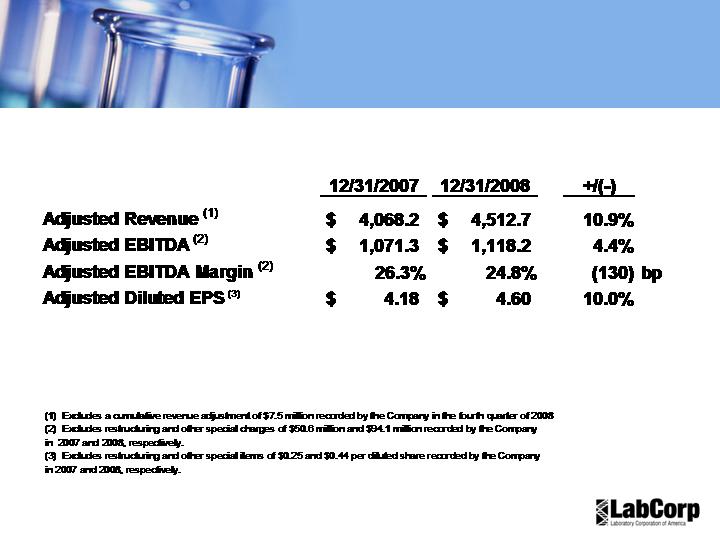

Full Year Results

(In millions, except per share data)

7

2008 Fourth Quarter

Financial Achievements

Adjusted EPS of $1.10 (1)

Adjusted EBITDA margin of 23.6%(2)

Operating cash flow of $215.3 million

Increased revenues

11.3% (10.9% volume, 0.4% revenue per accession)

6.2% (3.0% volume, 3.2% revenue per accession),

excluding Canada and a special charge

8

Full Year

Financial Achievements

Adjusted EPS of $4.60 (1)

Adjusted EBITDA margin of 24.8% (2)

Operating cash flow of $780.9 million

Increased revenues

10.7% (9.8% volume, 0.9% revenue per accession)

4.8% (2.2% volume, 2.6% revenue per accession),

excluding Canada and a special charge

Repurchased $330.4 million of LabCorp stock

9

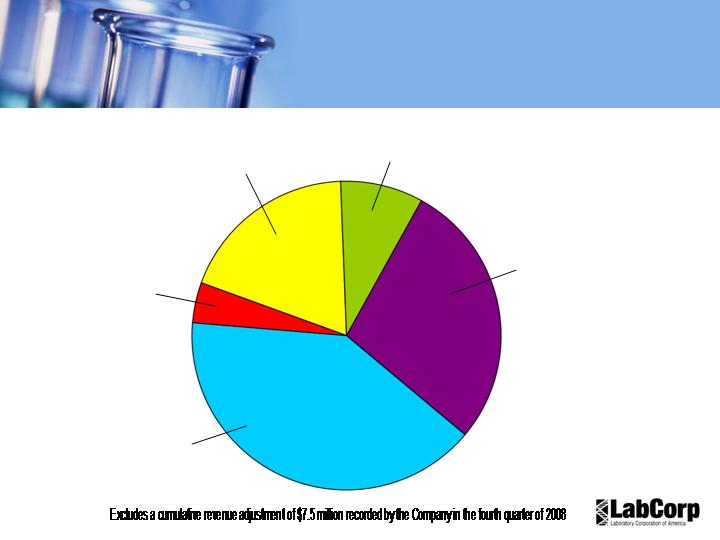

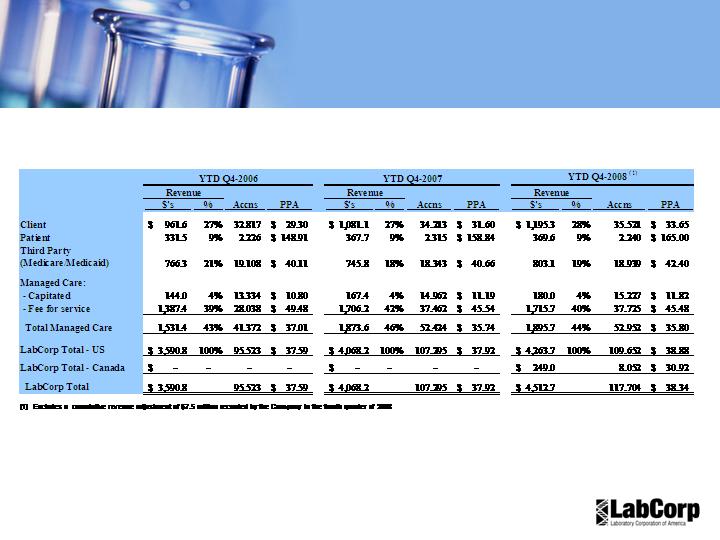

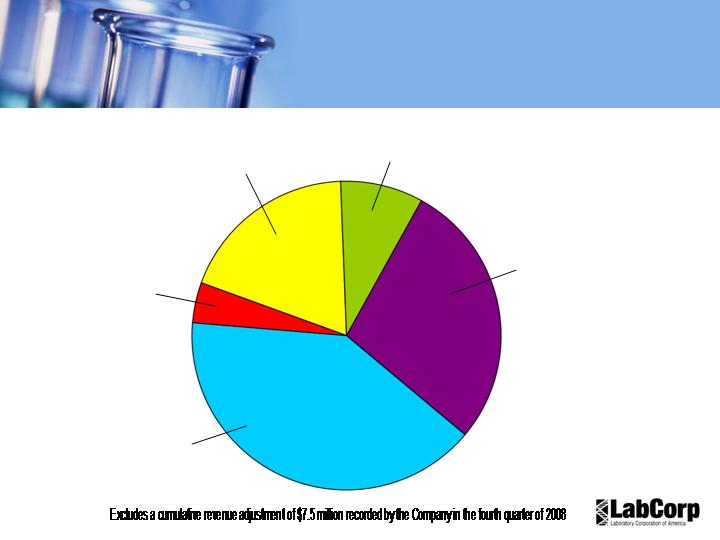

Revenue by Payer- US

2008

(In millions)

Client

$1,195.3 (28%)

Patient

$369.6 (9%)

Managed Care

Capitated

$180.0 (4%)

Medicare & Medicaid

$803.1 (19%)

Managed Care

Fee-for-service

$1,715.7 (40%)

10

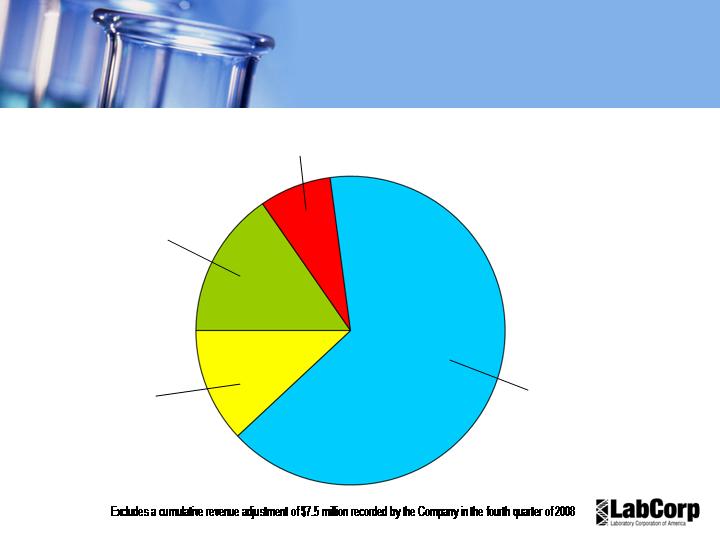

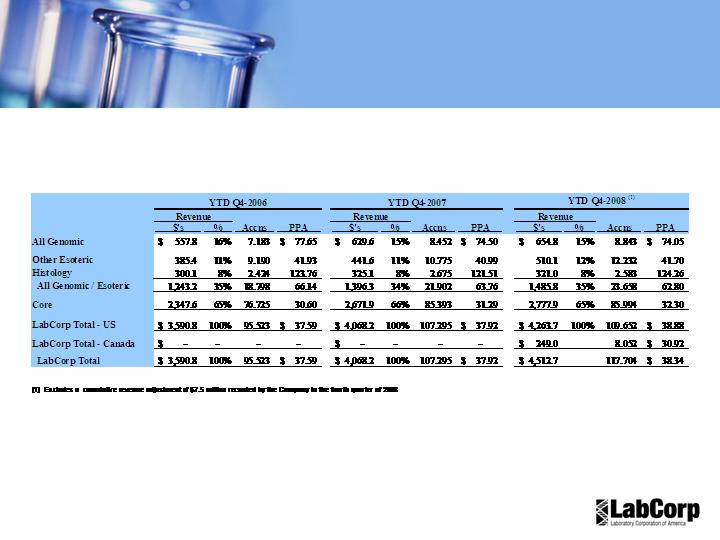

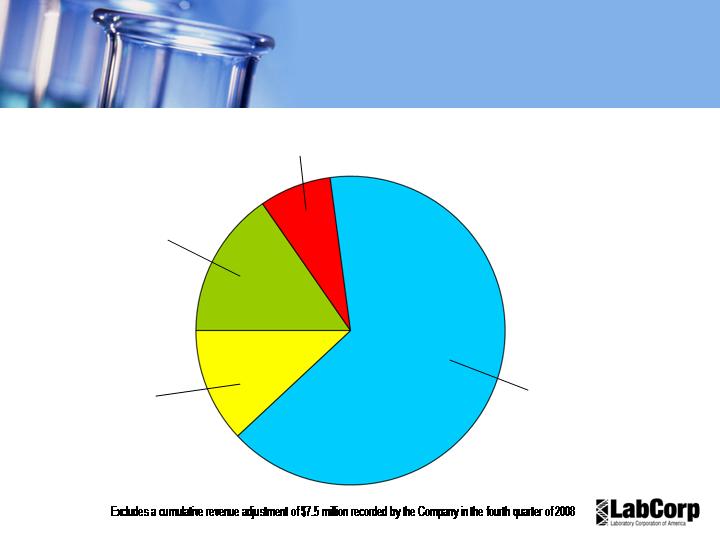

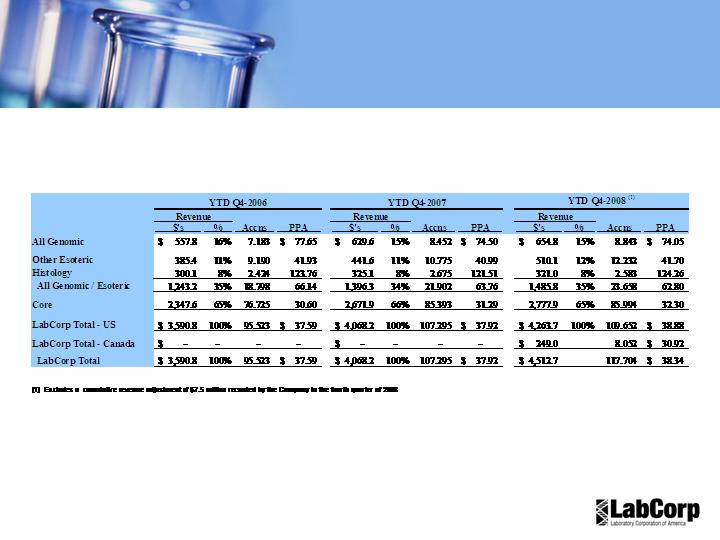

Core

$2,777.9 (65%)

Histology (Non-Pap)

$321.0 (8%)

Other Esoteric

$510.1 (12%)

Genomic

$654.8 (15%)

Revenue by Business Area - US

2008

(In millions)

11

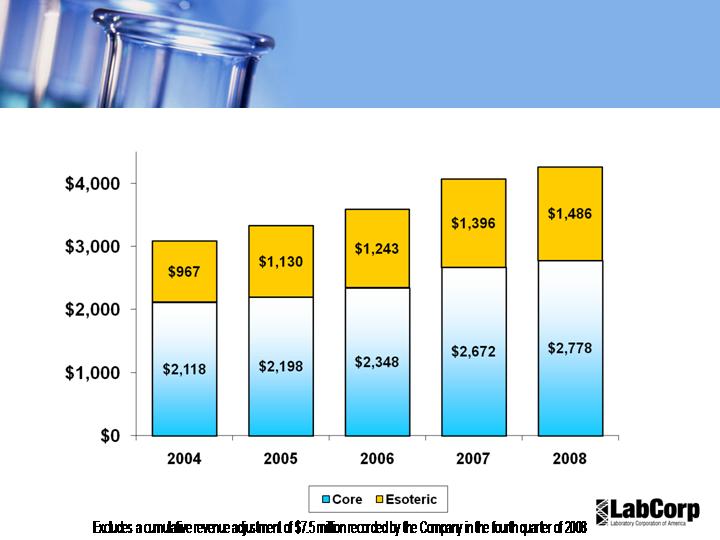

Revenue Mix- US

by Business Area

(In millions)

31%

34%

35%

34%

35%

65%

66%

65%

66%

69%

12

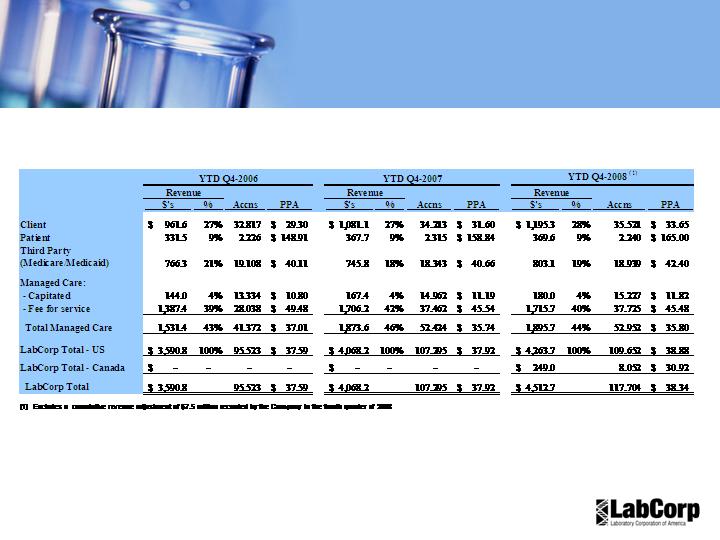

Revenue by Payer

2008

(in millions, except PPA)

13

Revenue by Business Area

2008

(in millions, except PPA)

14

Financial Guidance - 2009

Excluding the impact of restructuring and other special

charges and share repurchase activity after December 31,

2008, guidance for 2009 is:

Revenue growth:

2-4%

Diluted earnings per share:

$4.75 to $4.95

Operating cash flow of approximately(1):

$800 million

Capital expenditures of approximately:

$130 million

(1) Operating cash flow guidance excludes any transition payments to UnitedHealthcare and includes a $56 million

reduction due to required contributions to the Company’s defined benefit retirement plan.

15

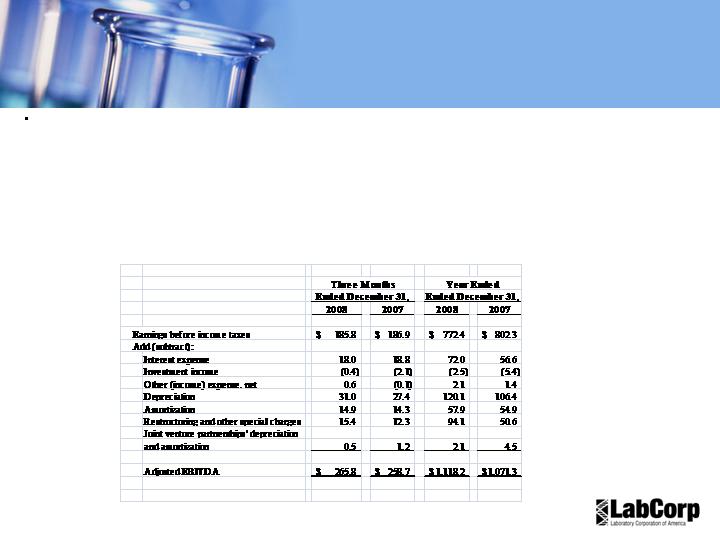

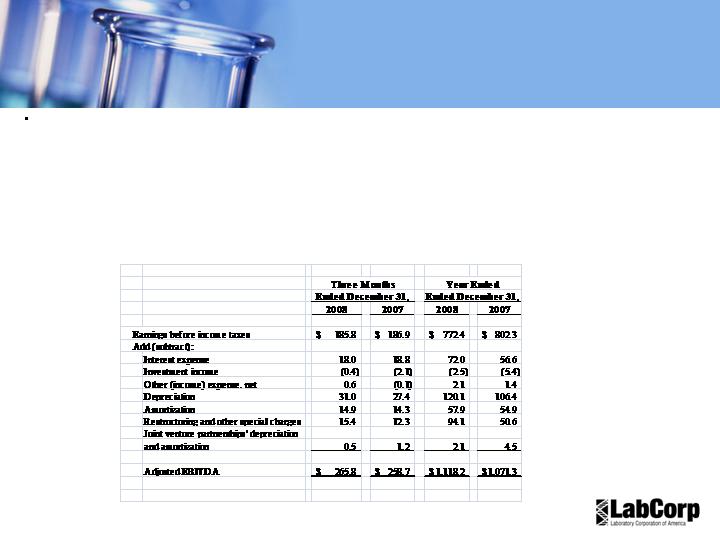

Reconciliation of Non-GAAP

Financial Measures

(In millions)

EBITDA represents earnings before interest, income taxes, depreciation and amortization, and includes the

Company’s proportional share of the underlying EBITDA of the income from joint venture partnerships. The Company

uses EBITDA extensively as an internal management performance measure and believes it is a useful, and commonly

used measure of financial performance in addition to earnings before taxes and other profitability measurements under

generally accepted accounting principles (“GAAP”). EBITDA is not a measure of financial performance under GAAP.

It should not be considered as an alternative to earnings before income taxes (or any other performance measure

under GAAP) as a measure of performance or to cash flows from operating, investing or financing activities as an

indicator of cash flows or as a measure of liquidity. The following table reconciles earnings before income taxes,

representing the most comparable measure under GAAP, to Adjusted EBITDA for the three- and twelve-month

periods ended December 31, 2008 and 2007:

16

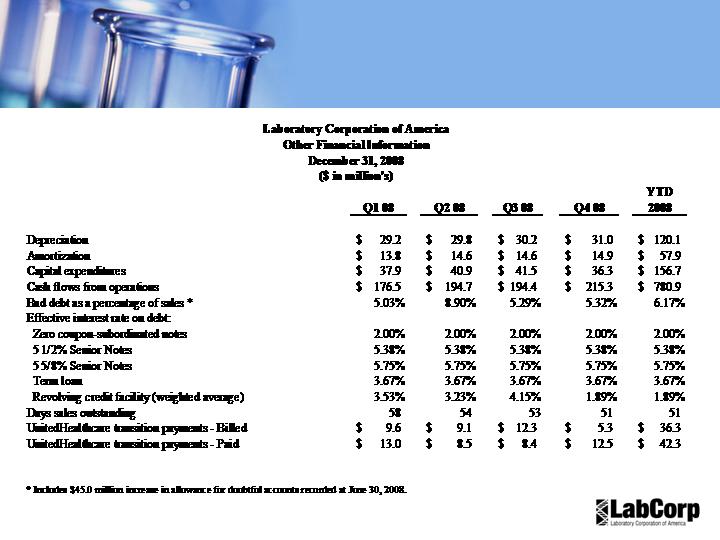

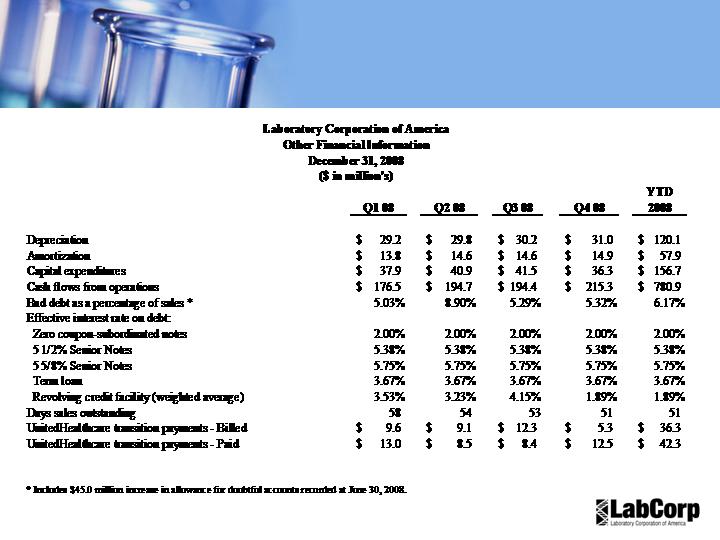

Supplemental Financial

Information

17

Use of Adjusted Measures

The Company has provided in this presentation “adjusted” financial information that has

not been prepared in accordance with GAAP. The Company believes these adjusted

measures are useful to investors, as a supplement to, but not as a substitute for, GAAP

measures, in evaluating the Company’s operational performance, and that the use of

these non-GAAP financial measures provides an additional tool for investors to use in

evaluating operating results and trends, and in comparing the Company’s financial

results with other companies. Reconciliations of these non-GAAP adjusted measures to

the most comparable GAAP measures are included in the tables accompanying the

Company’s press release dated February 12, 2009.

18