UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 12, 2010

(Date of earliest event reported)

LABORATORY CORPORATION OF

AMERICA HOLDINGS

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| DELAWARE | | 1-11353 | | 13-3757370 |

| |

| |

|

(State or other jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

358 SOUTH MAIN STREET,

BURLINGTON, NORTH CAROLINA | | 27215 | | 336-229-1127 |

| |

| |

|

| (Address of principal executive offices) | | (Zip Code)

| | (Registrant's telephone number including area code) |

ITEM 7.01. Regulation FD Disclosure

Summary information of the Company in connection with its Annual Meeting of Stockholders in Burlington, NC on May 12, 2010.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Laboratory Corporation of America Holdings

(Registrant)

| |

| Date: May 12, 2010 | By: | /s/F. Samuel Eberts III | |

| | | F. Samuel Eberts III, Chief Legal Officer

and Secretary | |

| | | | |

| |

May 12, 2010

2010

Annual Meeting

of Stockholders

2

This slide presentation contains forward-looking

statements which are subject to change based on various

important factors, including without limitation, competitive

actions in the marketplace and adverse actions of

governmental and other third-party payors.

Actual results could differ materially from those suggested

by these forward-looking statements. Further information

on potential factors that could affect the Company’s

financial results is included in the Company’s Form 10-K

for the year ended December 31, 2009, and subsequent

SEC filings.

Forward Looking Statement

Introduction

3

Leading National Lab Provider

Fastest growing national lab

$55 Billion market

Clinical, Anatomic and Genomic Testing

Serving clients in all 50 states and Canada

Leading clinical trials testing business

2010 Priorities

4

Our Focus

Profitable revenue growth

IT and client connectivity

Continue scientific

leadership

Maintain price

Control costs

2010 Priorities

5

Profitable Revenue Growth

Target specialty physicians with

breadth of menu and services

Educate payers and physicians on

value of LabCorp testing

Leverage assets from Monogram

acquisition

Continue to improve patient experience

2010 Priorities

6

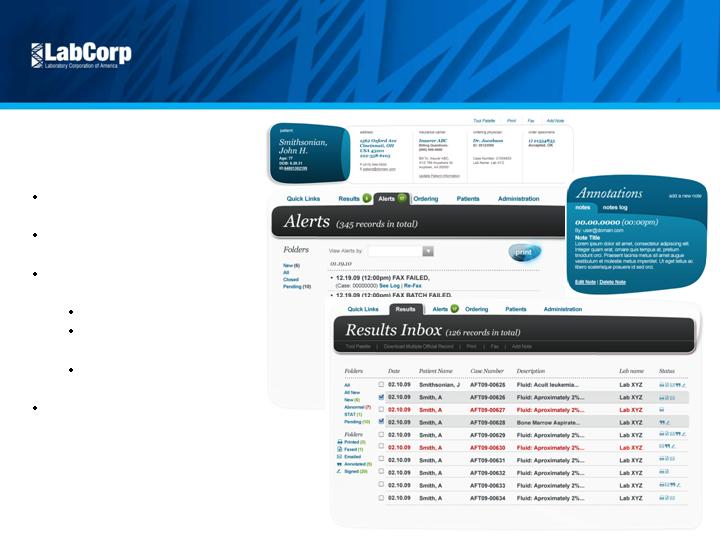

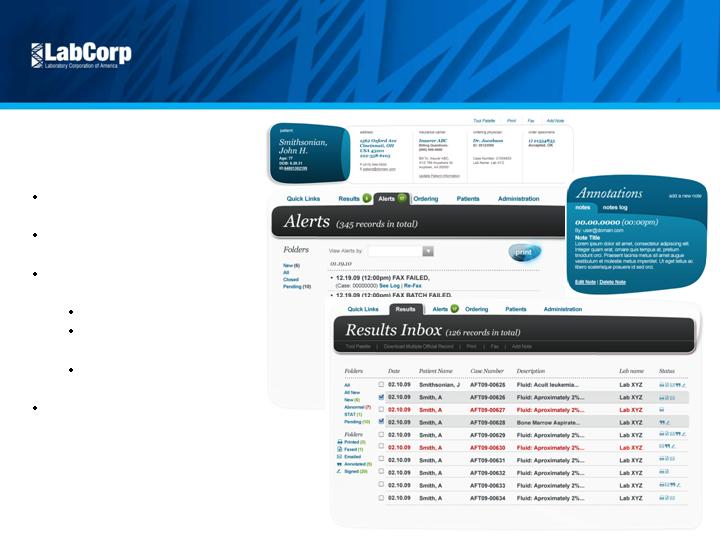

IT and Client

Connectivity

Enhance online services and

analytic tools

LabCorp Inside the Box for

superior connectivity

Improve Patient Experience

through:

Automated PSC workflow

Patient access via PHRs,

online appointments

Enterprise services

including VoIP

Continue “open platform” strategy

to maximize options for users

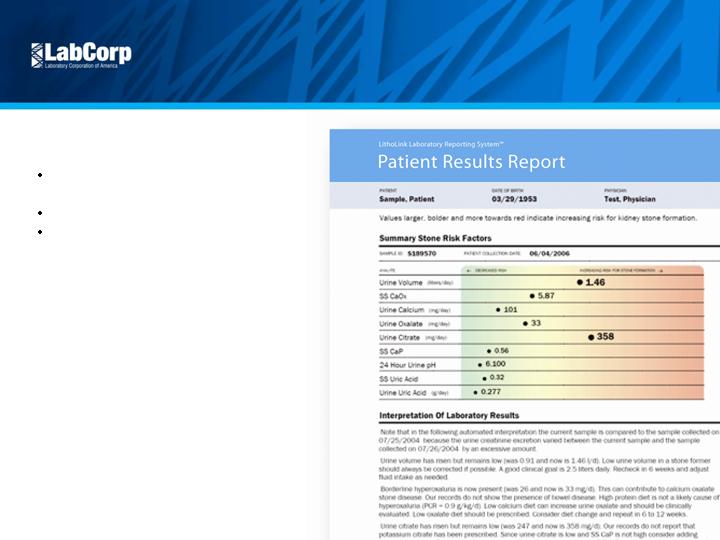

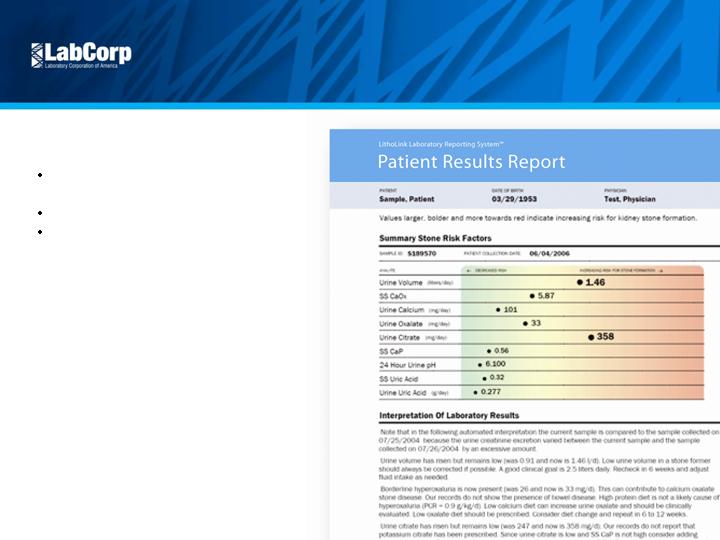

Continue Scientific

Leadership

Increase esoteric testing

Grow and enhance offerings in

personalized medicine:

Expand outcome improvement

programs

Develop and commercialize

companion diagnostics

2010 Priorities

7

2010 Priorities

Maintain Price

Managed care stability; offsets

1.9% Medicare rate decrease

Focus on high-value tests

Promote outcome improvement

8

Control Costs

Continue focus on collections

and bad debt reduction

Optimize supply chain

Use efficiency gains to

improve patient experience

2010 Priorities

9

First Quarter 2010 Results

10

2010

2009

+/(-)

Revenue

(1)

1,193.6

$

1,155.7

$

3.3%

Adjusted Operating Income

243.5

$

240.5

$

1.2%

Adjusted Operating Income Margin

20.4%

20.8%

(40)

bp

Adjusted EPS

(1)

1.30

$

1.22

$

6.6%

Operating Cash Flow

232.0

$

208.9

$

11.1%

Less: Capital Expenditures

(24.5)

$

(30.7)

$

(20.2%)

Free Cash Flow

207.5

$

178.2

$

16.4%

(1) During the quarter inclement weather reduced revenue by an estimated $23 million and EPS by approximately eight cents

Three Months Ended Mar 31,

Supplemental Financial Information

11

Q1 09

Q2 09

Q3 09

Q4 09

Q1 10

Bad debt as a percentage of sales

5.30%

5.30%

5.30%

5.30%

5.05%

Days sales outstanding

52

50

48

44

46

A/R coverage (Allowance for Doubtful Accts. / A/R)

19.5%

20.6%

21.9%

23.2%

21.7%

Laboratory Corporation of America

Other Financial Information

FY 2009 and Q1 2010

($ in millions)

Superior Two-Year Return

LabCorp shares up 4.7%

S&P Healthcare Index down 11.3%

S&P 500 down 16.9%

S&P Financials Index down 42.1%

Stock Performance

12

Note: Period measured is from January 2nd , 2008 – May 3rd, 2010

Source: First Call

Key Points

Critical position in health care delivery system

Attractive market

Strong competitive position - well positioned to gain share

Leadership in personalized medicine

Excellent cash flow

Strong balance sheet

Conclusion

13

14

©2010 LabCorp. All rights reserved. 6967-0409