May 15, 2012 Las Vegas, NV Bank of America Merrill Lynch 2012 Health Care Conference

2 This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payors. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2011, and subsequent SEC filings. Forward Looking Statement

Introduction Leading National Lab Provider • Fastest growing national lab • $55 billion market • Clinical, Anatomic and Genomic testing • Serving clients in all 50 states and Canada • Foremost worldwide clinical trials testing business 3

Introduction 4

Valuable Service • Small component of total cost influences large percentage of clinical decisions • Screening, early detection, and monitoring reduce downstream costs • Companion diagnostics improve drug efficacy and safety Attractive Market 5

Attractive Market Growth Drivers • Aging population • Industry consolidation • Advances in genomics • Pharmacogenomics/ companion diagnostics • Cost pressures will reward lower cost and more efficient labs Source: CDC National Ambulatory Medical Care Survey and Company Estimates 6 0 2 4 6 8 10 12 14 Under 18 years 18-44 years 45-54 years 55-64 years 65-74 years 75 years + Re lat ive Nu m be r o f L ab Te sts Pe r Y ea r Patient Age 2008 1997

55% 12% 10% 4% 19% Hosiptal Affiliated Quest LabCorp Physician Office Other Independent os ital Affiliated Attractive Market Opportunity to Take Share • Approximately 5,000 independent labs • Less efficient, higher cost competitors Source: Washington G-2 Reports and Company estimates $55 Billion US Lab Market 7

Attractive Market Diversified Payor Mix • No customer > 10% of revenue • Limited government exposure LabCorp U.S. Payor Mix % of revenue, 2011 8

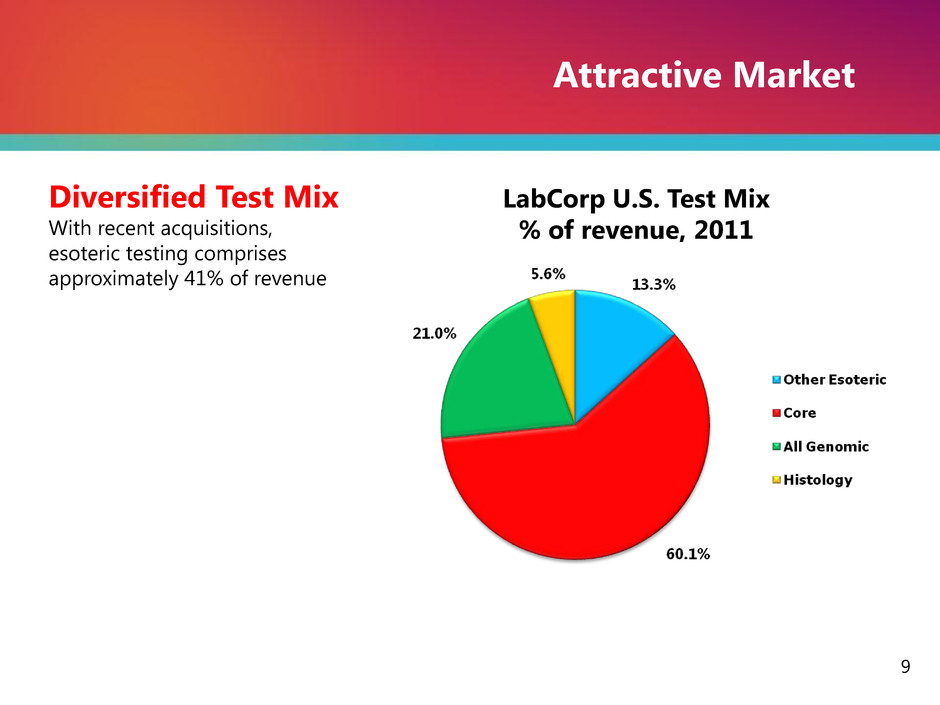

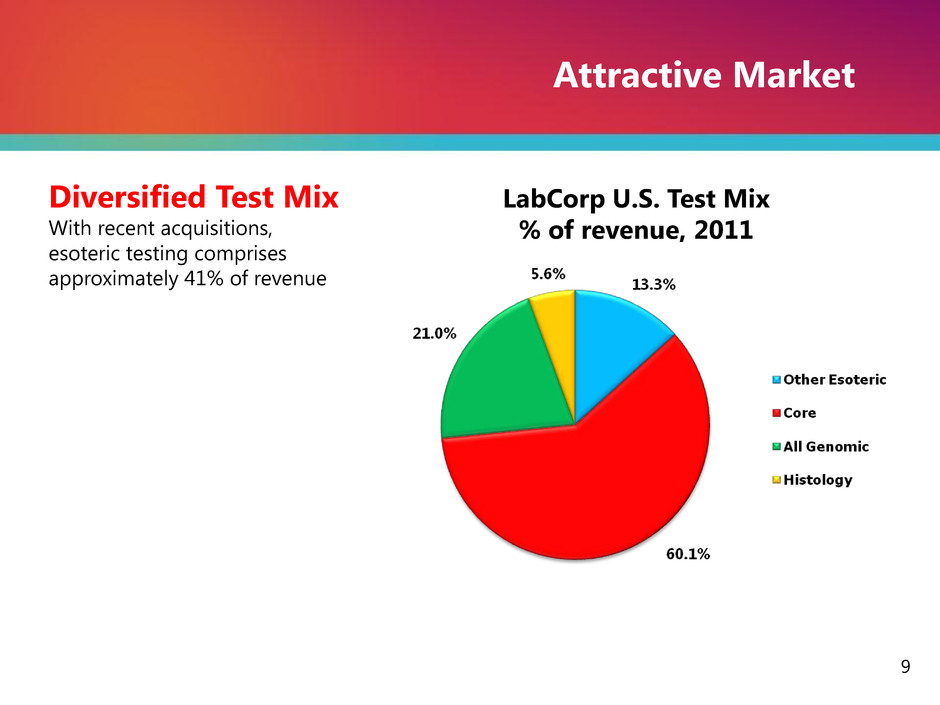

Attractive Market Diversified Test Mix With recent acquisitions, esoteric testing comprises approximately 41% of revenue 9 LabCorp U.S. Test Mix % of revenue, 2011

Mission Statement Five Pillar Strategy We Will Offer The Highest Quality Laboratory Testing and Most Compelling Value to Our Customers We Will Execute This Mission Through Our Five Pillar Strategy 10

Five Pillar Strategy Pillar One Deploy Cash to Enhance Footprint and Test Menu and to Buy Shares 11

$445 $564 $538 $574 $632 $710 $781 $862 $884 $905 $371 $481 $443 $481 $516 $567 $624 $748 $758 $759 $- $200 $400 $600 $800 $1,000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 $ Million s Operating Cash Flow Free Cash Flow Five Pillar Strategy—Pillar One Strong Cash Generation Cash Flow • FCF CAGR of 12.8% from 2001 - 2011 • Strategic acquisitions • $3.9 B share repurchase since 2004 at an average price of approximately $65 per share Note: 2011 Operating Cash Flow and Free Cash Flow figures above do not include the $49.5 million Hunter Labs settlement Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Free Cash Flow CAGR calculation uses 2001 data (Operating Cash Flow of $316 million and Free Cash Flow of $228 million) $ in millions 12

Five Pillar Strategy—Pillar One Impressive FCF Per Share Trend Free Cash Flow Per Share • FCF Per Share CAGR of 16.8% from 2001 – 2011 13 $2.40 $3.11 $2.94 $3.32 $3.83 $4.68 $5.58 $6.85 $7.19 $7.46 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Note: 2011 Free Cash Flow Per Share calculation above does not include the $49.5 million Hunter Labs settlement Free Cash Flow Per Share is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Free Cash Flow Per Share CAGR calculation uses 2001 data (2001 Free Cash Flow Per Share was $1.58)

Five Pillar Strategy—Pillar One Competitive Position Scale and Scope • National infrastructure • Broad test offering • Managed care contracts • Economies of scale Primary LabCorp Testing Locations* Esoteric Lab Locations (CET, CMBP, Dianon, Esoterix, Monogram Biosciences, NGI, OTS, US Labs, Viromed) Patient Service Centers* 14

Five Pillar Strategy—Pillar One Key Uses of Cash Key Uses of Cash • Acquisitions • Genzyme Genetics* • Orchid Cellmark • Share Repurchase • $337 million in 2010 • $650 million in 2011 15 *GENZYME GENETICSSM and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation.

Five Pillar Strategy—Pillar One Genzyme Genetics Rebranding Two new names in specialized testing • As part of a broad rebranding of LabCorp’s specialty testing capabilities, we adopted the name Integrated Genetics for the reproductive portion of the Genzyme Genetics business and LabCorp’s legacy genetics business. • We adopted the name Integrated Oncology for the oncology portion of the Genzyme Genetics business and LabCorp’s legacy oncology business. 16

Five Pillar Strategy—Pillar One Importance of Genetics 17 • Preconception • Pre- and post-natal • Identification of disease carriers • Identification of disease predisposition • Diagnosis of genetically caused or influenced conditions (e.g., developmental delay) • Disease prognosis and treatment (especially cancer)

• More sophisticated methods of cancer testing complement traditional biopsies • Value of diagnostics for disease prognosis, and monitoring of progression and recurrence • Critical role of testing in therapy selection Five Pillar Strategy—Pillar One Importance of Oncology 18

Five Pillar Strategy Pillar Two Enhance IT Capabilities To Improve Physician and Patient Experience 19

Five Pillar Strategy—Pillar Two LabCorp Beacon™ | Physician Experience Intuitive Order Entry • Streamlined ordering Provider, Diagnosis, Test and Collection information are all displayed in a single screen • Requisition and account logic Automatically generates requisitions with appropriate account numbers • Key time-saving features • Send to PSC • Standing orders • Electronic add-on testing • User-defined pick lists 20

Unified Results • Centralizes lab connectivity View lab reports from DIANON Systems, Esoterix, LabCorp, Litholink, US Labs, and CMBP • Share results Email, fax, print and annotations make it easy to share critical information • Visual cues Supports physician decision making, enhances the timeliness of patient care and facilitates follow-up with abnormal results in red and unread reports in bold Five Pillar Strategy—Pillar Two LabCorp Beacon™ | Physician Experience 21

Trends & Analytics • One-click trending Physicians and staff can quickly view a single test or analyte for one patient and the trended history for that patient • Sort and filter results Providers can filter their entire patient population on demographics and test results to identify trends and patients at risk • View lab history Five Pillar Strategy—Pillar Two LabCorp Beacon™ | Physician Experience 22

AccuDraw Integration • Reduce errors • Reduce training time • Proven results Success in LabCorp Patient Service Centers will be extended to customers Online Appointment Scheduling • Patient convenience • Improved service experience • 2011 enhancements improve the collection of payment at the time of scheduling Five Pillar Strategy—Pillar Two LabCorp Beacon™ | Patient Experience 23

Patient Portal • Make an appointment 24 hours a day • Receive lab results as easily as checking email • Share lab results securely and privately • Pay bills online easily and securely • Get notifications and alerts automatically • Manage health care information for the entire family Five Pillar Strategy—Pillar Two LabCorp Beacon™ | Patient Experience 24

Five Pillar Strategy Pillar Three Continue to Improve Efficiency to Offer the Most Compelling Value in Laboratory Services 25

• Standardized lab and billing IT systems • Automation of pre-analytics • Supply chain optimization • Sysmex fully automated hematology operations • Consistent gross margin improvement (net of acquisitions) • Bad debt reduction of approximately 90 bp since the beginning of 2009 Five Pillar Strategy—Pillar Three Most Efficient Provider 26

Five Pillar Strategy Pillar Four Scientific Innovation At Appropriate Pricing 27

FDA approves Zelboraf and companion diagnostic test for late-stage skin cancer “This has been an important year for patients with late-stage melanoma. Zelboraf is the second new cancer drug approved that demonstrates an improvement in overall survival,” Richard Pazdur, M.D., director of the Office of Oncology Drug Products in the FDA’s Center for Drug Evaluation and Research. FDA approves Xalkori with companion diagnostic for a type of late-stage lung cancer “The approval of Xalkori with a specific test allows the selection of patients who are more likely to respond to the drug. Targeted therapies such as Xalkori are important options for treating patients with this disease and may ultimately result in fewer side effects.” Richard Pazdur, M.D., director of the Office of Oncology Drug Products in the FDA’s Center for Drug Evaluation and Research. FDA clears HE4 test in ROMA for ovarian malignancy risk "Using ROMA with HE4 and CA 125 significantly improves our ability to identify women who are at high or low likelihood of ovarian cancer when they present with an ovarian cyst or mass," Richard Moore, MD, associate professor of Obstetrics and Gynecology at the Alpert School of Medicine at Brown University and director of the Center for Biomarkers and Emerging Technologies in the Program for Women's Oncology at Women and Infants' Hospital (Providence, Rhode Island). Five Pillar Strategy—Pillar Four Scientific Innovation • Companion diagnostics and personalized medicine • IL-28B • BRAF V600E metastatic melanoma (Zelboraf) • Vysis ALK Break Apart FISH probe (XALKORI) • K-RAS • HLA-B* 5701 • EGFR Mutation Analysis • HCV GenoSure® NS3/4A • PhenoSense®, PhenoSense GT® • HERmark® • CYP 450 2C19 • Women’s health • ROMA • Nuswab STD testing on a single swab • Expanded Vaginosis and Candida testing • Expanded options for HPV DNA testing • Outcome improvement programs • CKD and CVD programs • Litholink kidney stone program • Bone (osteoporosis) program • Clearstone acquisition • Global clinical trials capability • Presence in China 28

Five Pillar Strategy Pillar Five Alternative Delivery Models 29

$4,068 $4,513 $4,695 $5,004 $5,542 $4.45 $4.91 $5.24 $5.98 $6.37 2007 2008 2009 2010 2011 Revenue ($mil) Adjusted EPS Excluding Amortization (1) Excluding the $0.25 per diluted share impact of restructuring and other special charges and the $0.27 per diluted share impact from amortization in 2007; excluding the $0.44 per diluted share impact of restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per diluted share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the $0.26 per diluted share impact of restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010; excluding the $.72 per diluted share impact of restructuring and other special charges, the $0.03 per diluted share impact from a loss on the divestiture of assets and the $0.51 per diluted share impact from amortization in 2011 (2) EPS, as presented represents adjusted, non-GAAP financial measures. Diluted EPS, as reported in the Company’s Annual Report were: $2.45 in 2004; $2.71 in 2005; $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; and $5.11 in 2011 (3) 2008 revenue includes a $7.5 million adjustment related to the Company’s acquisition of U.S. Labs Excellent Performance 30 Revenue and Adjusted EPS Excluding Amortization Growth: 2007 – 2011 (1) (2) (3)

Recent Accomplishments Our Results • Profitable growth and capital deployment • Esoteric growth • Maintained price • Acquisitions • Improved IT and client connectivity • Beacon order entry rollout • Introduced LabCorp Patient Portal • Enhanced physician and patient experience • Continued efficiency programs • Increased throughput (specimens per employee up 40% since 2007) • Call center consolidation • Lowered bad debt • Furthered scientific leadership • Clearstone acquisition • New offerings in Women’s Health and companion diagnostics • Extended UnitedHealthcare contract through the end of 2018; multi-year extension of the Horizon contract 31

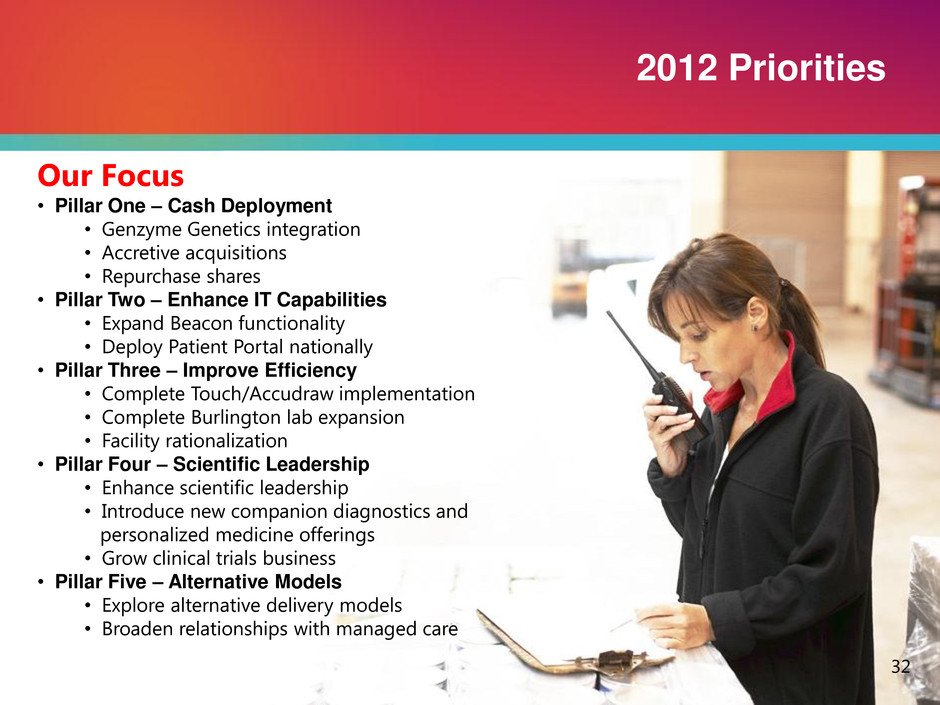

2012 Priorities Our Focus • Pillar One – Cash Deployment • Genzyme Genetics integration • Accretive acquisitions • Repurchase shares • Pillar Two – Enhance IT Capabilities • Expand Beacon functionality • Deploy Patient Portal nationally • Pillar Three – Improve Efficiency • Complete Touch/Accudraw implementation • Complete Burlington lab expansion • Facility rationalization • Pillar Four – Scientific Leadership • Enhance scientific leadership • Introduce new companion diagnostics and personalized medicine offerings • Grow clinical trials business • Pillar Five – Alternative Models • Explore alternative delivery models • Broaden relationships with managed care 32

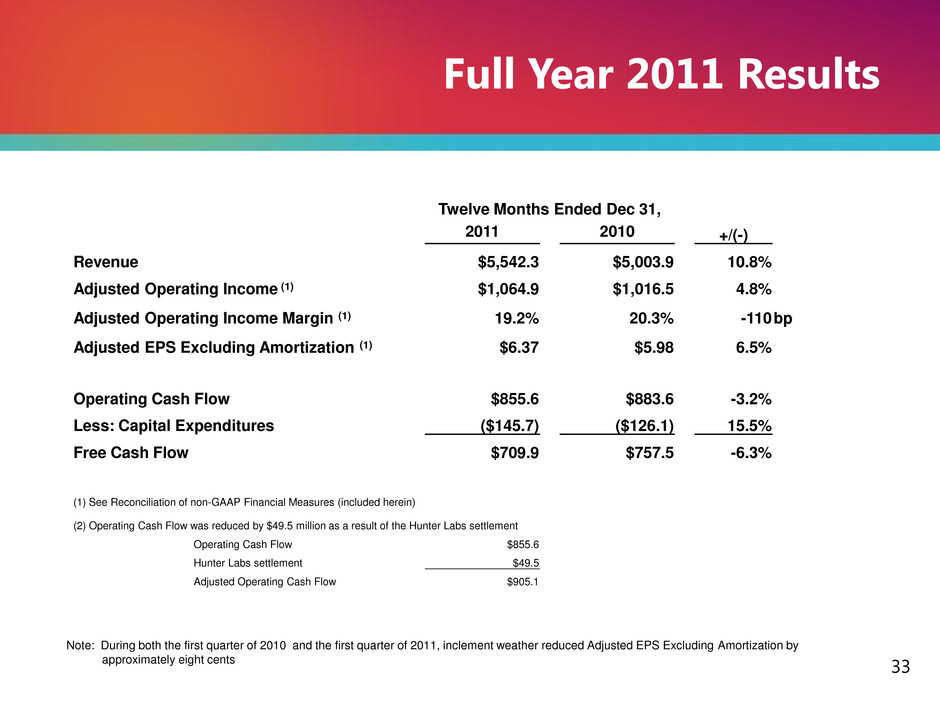

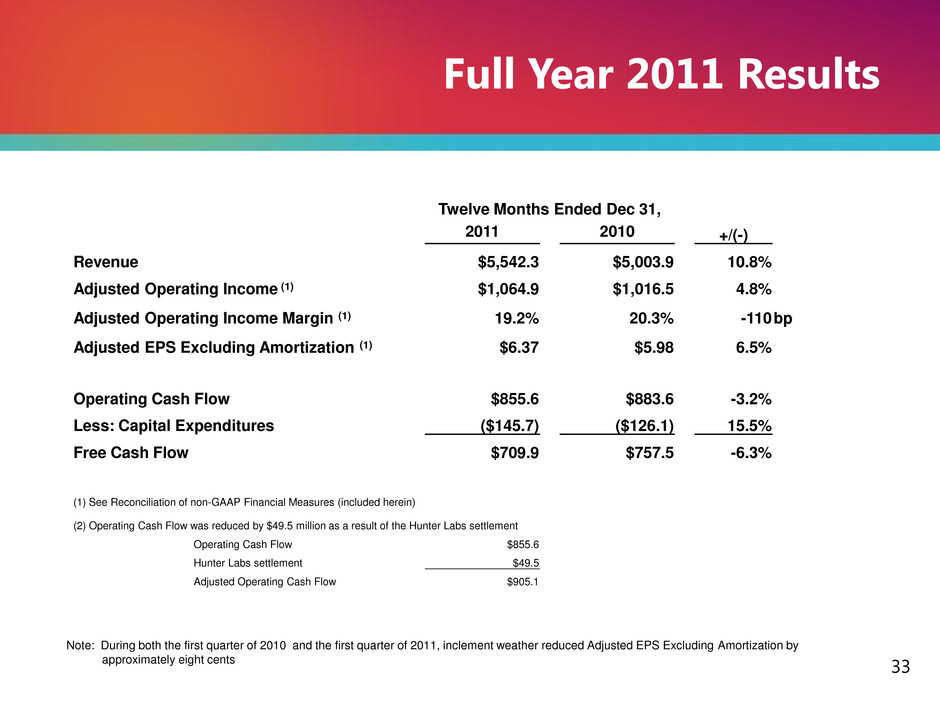

Note: During both the first quarter of 2010 and the first quarter of 2011, inclement weather reduced Adjusted EPS Excluding Amortization by approximately eight cents Full Year 2011 Results 33 Twelve Months Ended Dec 31, 2011 2010 +/(-) Revenue $5,542.3 $5,003.9 10.8% Adjusted Operating Income (1) $1,064.9 $1,016.5 4.8% Adjusted Operating Income Margin (1) 19.2% 20.3% -110 bp Adjusted EPS Excluding Amortization (1) $6.37 $5.98 6.5% Operating Cash Flow $855.6 $883.6 -3.2% Less: Capital Expenditures ($145.7) ($126.1) 15.5% Free Cash Flow $709.9 $757.5 -6.3% (1) See Reconciliation of non-GAAP Financial Measures (included herein) (2) Operating Cash Flow was reduced by $49.5 million as a result of the Hunter Labs settlement Operating Cash Flow $855.6 Hunter Labs settlement $49.5 Adjusted Operating Cash Flow $905.1

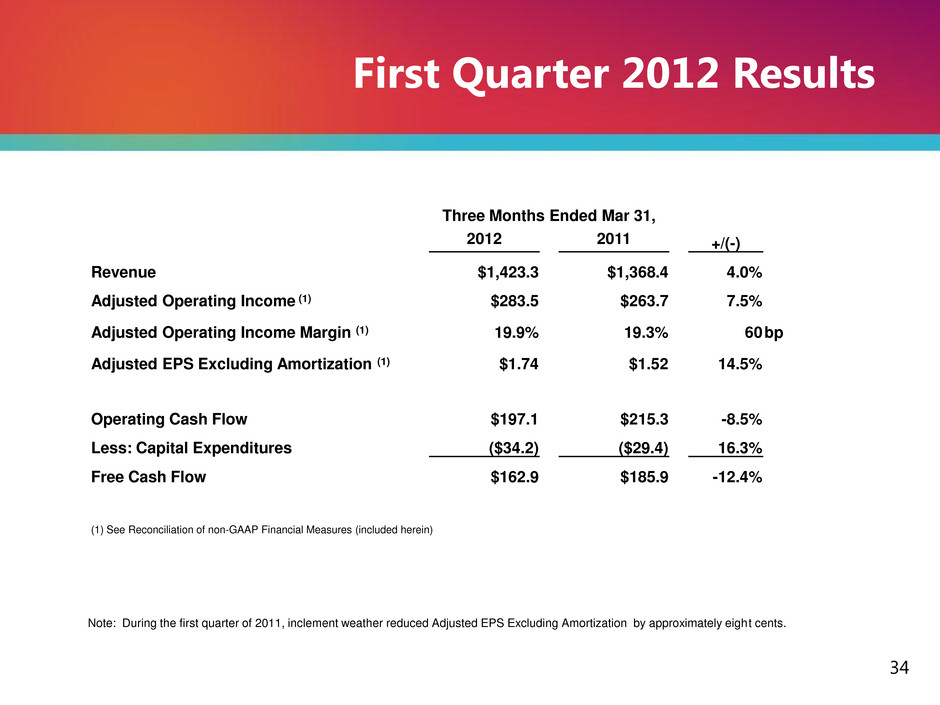

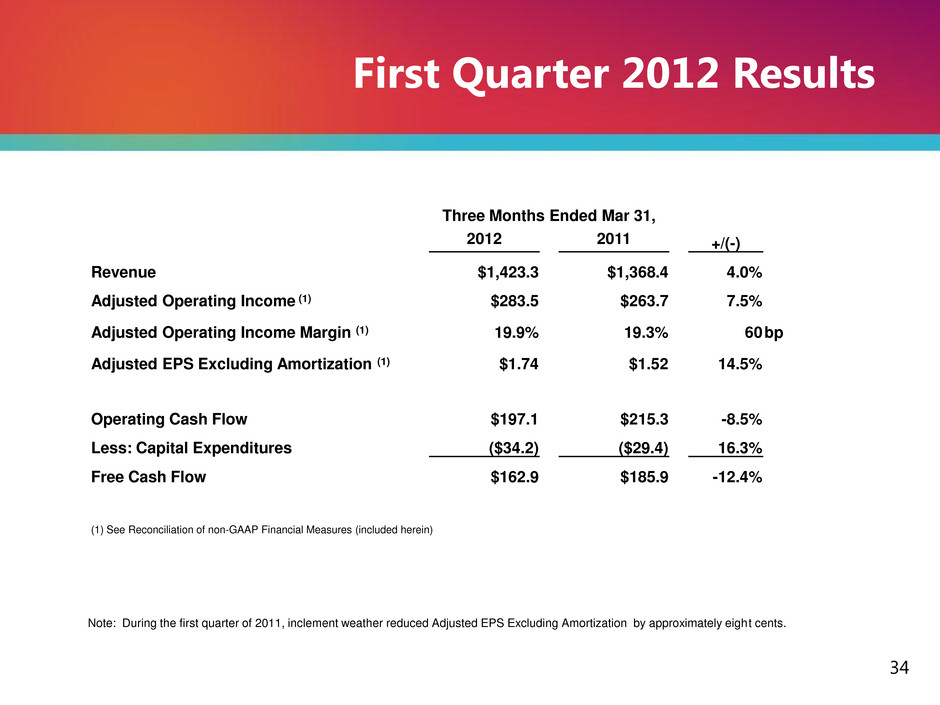

Note: During the first quarter of 2011, inclement weather reduced Adjusted EPS Excluding Amortization by approximately eight cents. 34 First Quarter 2012 Results Three Months Ended Mar 31, 2012 2011 +/(-) Revenue $1,423.3 $1,368.4 4.0% Adjusted Operating Income (1) $283.5 $263.7 7.5% Adjusted Operating Income Margin (1) 19.9% 19.3% 60 bp Adjusted EPS Excluding Amortization (1) $1.74 $1.52 14.5% Operating Cash Flow $197.1 $215.3 -8.5% Less: Capital Expenditures ($34.2) ($29.4) 16.3% Free Cash Flow $162.9 $185.9 -12.4% (1) See Reconciliation of non-GAAP Financial Measures (included herein)

Key Points • Critical position in health care delivery system • Attractive market • Consistent strategy • Excellent cash flow deployed to enhance strong competitive position • IT innovation to improve physician and patient experience • Most efficient provider delivering greatest value • Scientific leadership • Alternative delivery models • Track record of execution and success Conclusion 35

36 Reconciliation of non-GAAP Financial Measures Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Twelve Months Ended Dec 31, Adjusted Operating Income 2011 2010 Operating income $ 948.4 $ 978.8 Restructuring and other special charges (1) (3) 116.5 37.7 Adjusted operating income $ 1,064.9 $ 1,016.5 Adjusted EPS Excluding Amortization Diluted earnings per common share $ 5.11 $ 5.29 Impact of restructuring and other special charges (1) (3) 0.72 0.26 Loss on divestiture of assets (2) 0.03 - Amortization expense 0.51 0.43 Adjusted EPS Excluding Amortization (4) $ 6.37 $ 5.98 Note: Please see footnotes for this reconciliation on the following slide

37 Reconciliation of non-GAAP Financial Measures - Footnotes Note: GENZYME GENETICS and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. 1) During the fourth quarter of 2011, the Company recorded net restructuring and other special charges of $10.6 million, consisting of $6.3 million in severance related liabilities and $1.7 million in net facility-related costs primarily associated with integration of the Orchid Cellmark and Genzyme Genetics acquisitions as well as internal cost reduction initiatives. The charges also included a $2.6 million write-off of an uncollectible receivable from a past installment sale of one of the Company’s lab operations. The after tax impact of these charges decreased net earnings for the three months ended December 31, 2011, by $6.5 million and diluted earnings per share by $0.06 ($6.5 million divided by 101.0 million shares). During the first nine months of 2011, the Company recorded restructuring and other special charges of $105.9 million ($66.3 million after tax). The restructuring charges included $18.8 million in net severance and other personnel costs along with $36.7 million in net facility-related costs primarily associated with the ongoing integration of the Clearstone, Genzyme Genetics and Westcliff acquisitions. The special charges also included $34.5 million ($49.5 million, net of previously recorded reserves of $15.0 million) relating to the settlement of the Hunter Labs litigation in California, along with $1.1 million for legal costs associated with the planned acquisition of Orchid Cellmark incurred during the second quarter of 2011, both of which were recorded in Selling, General and Administrative Expenses in the Company’s Consolidated Statements of Operations. The charges also included a $14.8 million write-off of an investment made in a prior year. For the year ended December 31, 2011, the after tax impact of these combined charges of $116.5 million decreased net earnings by $73.3 million and diluted earnings per share by $0.72 ($73.3 million divided by 101.8 million shares). 2) Following the closing of its acquisition of Orchid Cellmark Inc. (“Orchid”) in mid-December, the Company recorded a net $2.8 million loss on its divestiture of certain assets of Orchid’s U.S. government paternity business, under the terms of the agreement reached with the U.S. Federal Trade Commission. This non- deductible loss on disposal was recorded in Other Income and Expense in the Company’s Consolidated Statements of Operations and decreased net earnings for the three and twelve months ended December 31, 2011, by $2.8 million and diluted earnings per share by $0.03 ($2.8 million divided by 101.0 million shares and $2.8 million divided by 101.8 million shares, respectively). 3) During the fourth quarter of 2010, the Company recorded restructuring and other special charges of $13.6 million, consisting of $14.8 million in professional fees and expenses associated with acquisitions, which are recorded in Selling, General and Administrative Expenses in the Company’s Consolidated Statements of Operations; offset by a net restructuring credit of $1.2 million, resulting from the reversal of unused severance and facility closure liabilities. The after tax impact of these charges decreased net earnings for the three months ended December 31, 2010, by $8.3 million and diluted earnings per share by $0.08 ($8.3 million divided by 104.5 million shares). During the first nine months of 2010, the Company recorded restructuring and other special charges of $31.1 million ($19.1 million after tax), consisting of $10.9 million in professional fees and expenses associated with acquisitions; $7.0 million bridge financing fees (recorded as interest expense) associated with the signing of an asset purchase agreement for Genzyme Genetics; and $13.2 million severance related liabilities associated with workforce reduction initiatives For the year ended December 31, 2010, the after tax impact of these combined charges of $44.7 million decreased net earnings by $27.4 million and diluted earnings per share by $0.26 ($27.4 million divided by 105.4 million shares). 4) The Company continues to grow its business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization will provide investors with better insight into the operating performance of the business. For the quarters ended December 31, 2011 and 2010, intangible amortization was $21.2 million and $19.6 million, respectively ($12.9 million and $12.0 million net of tax, respectively) and decreased EPS by $0.13 ($12.9 million divided by 101.0 million shares) and $0.12 ($12.0 million divided by 104.5 million shares), respectively. For the years ended December 31, 2011 and 2010, intangible amortization was $85.8 million and $72.7 million respectively ($52.4 million and $44.5 million net of tax, respectively) and decreased EPS by $0.51 ($52.4 million divided by 101.8 million shares) and $0.43 ($44.5 million divided by 105.4 million shares), respectively.

38 Reconciliation of non-GAAP Financial Measures Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Three Months Ended Mar 31, Adjusted Operating Income 2012 2011 Operating income $ 287.1 $ 235.8 Restructuring and other special charges (1) (2) (3.6) 27.9 Adjusted operating income $ 283.5 $ 263.7 Adjusted EPS Excluding Amortization Diluted earnings per common share $ 1.63 $ 1.23 Impact of restructuring and other special charges (1) (2) (0.02) 0.16 Amortization expense 0.13 0.13 Adjusted EPS Excluding Amortization (3) $ 1.74 $ 1.52 Note: Please see footnotes for this reconciliation on the following slide

39 1) During the first quarter of 2012, the Company recorded a net credit of $3.6 million in restructuring and other special charges. The Company reversed previously established reserves of $3.8 million in unused severance and $2.4 million in unused facility-related costs. This net credit also includes charges of $1.7 million in severance and other personnel costs along with $0.9 million in facility- related costs primarily related to ongoing integration activities for Orchid and Genzyme Genetics. The after tax impact of the net credit increased net earnings for the quarter ended March 31, 2012, by $2.2 million and diluted earnings per share by $0.02 ($2.2 million divided by 99.1 million shares). 2) During the first quarter of 2011, the Company recorded restructuring and other special charges of $27.9 million. The charges included $4.0 million in severance and other personnel costs along with $9.8 million in facility-related costs associated with the integration of Genzyme Genetics. The charges also included a $14.8 million write-off of an investment made in a prior year. The after tax impact of these charges decreased net earnings for the quarter ended March 31, 2011, by $16.9 million and diluted earnings per share by $0.16 ($16.9 million divided by 103.2 million shares). 3) The Company continues to grow the business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight into the operating performance of the business. For the quarters ended March 31, 2012 and 2011, intangible amortization was $21.4 million and $21.9 million, respectively ($13.1 million and $13.2 million net of tax, respectively) and decreased EPS by $0.13 ($13.1 million divided by 99.1 million shares) and $0.13 ($13.2 million divided by 103.2 million shares), respectively. Note: GENZYME GENETICS and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. Reconciliation of non-GAAP Financial Measures - Footnotes

40 Reconciliation of Free Cash Flow and Free Cash Flow Per Share (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures (3) Free cash flow per share represents free cash flow divided by the weighted average diluted shares outstanding at the end of each period presented Reconciliation of non-GAAP Financial Measures (In millions, except per share data) 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Cash flows from operations1 $ 905.1 $ 883.6 $ 862.4 $ 780.9 $ 709.7 $ 632.3 $ 574.2 $ 538.1 $ 564.3 $ 444.9 Capital expenditures (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) (83.6) (74.3) Free cash flow2 759.4 757.5 747.7 624.2 567.1 516.4 480.6 443.1 480.7 370.6 Weighted average diluted shares outstanding 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 154.7 154.2 Free cash flow per share3 $ 7.46 $ 7.19 $ 6.85 $ 5.58 $ 4.68 $ 3.83 $ 3.32 $ 2.94 $ 3.11 $ 2.40

Supplemental Financial Information 41 Laboratory Corporation of America Other Financial Information Q1 2009 - Q1 2012 Q1 09 Q2 09 Q3 09 Q4 09 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Bad debt as a percentage of sales 5.3% 5.3% 5.3% 5.3% 5.0% 4.8% 4.8% 4.7% 4.7% 4.7% 4.5% 4.5% 4.4% Days sales outstanding1 52 50 48 44 46 45 44 46 47 46 46 46 48 A/R coverage (Allow. for Doubtful Accts. / A/R)2 19.5% 20.6% 21.9% 23.2% 21.7% 20.7% 20.4% 18.5% 19.4% 20.6% 21.1% 22.0% 21.5% (1) Excluding the impact from Genzyme Genetics, DSO was 43 days in Q4 of 2010, 45 days in Q1 of 2011, 43 days in Q2 of 2011. We did not track Genzyme Genetics’ impact on DSO after Q2 of 2011. (2) Excluding the impact from Genzyme Genetics, A/R Coverage was 19.9% in Q4 of 2010, 20.4% in Q1 of 2011, 21.1% in Q2 of 2011, 20.0% in Q3 of 2011, 20.8% in Q4 of 2011, and 20.4% in Q1 of 2012.

42 ©2012 Laboratory Corporation of America® Holdings. All rights reserved. 8026-0112