1 8-K Filed April 19, 2013

2 Introduction This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payors. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2012, and subsequent SEC filings. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations change.

3 First Quarter Results (In millions, except per share data) (1) See Reconciliation of non-GAAP Financial Measures (included herein) (2) Margins were negatively affected by weather, Medicare payment reductions and the number of days in the first quarter of 2013; inclement weather reduced Adjusted EPS Excluding Amortization by $0.04 in the first quarter of 2013 2013 (2) 2012 +/(-) Revenue 1,440.9$ 1,423.3$ 1.2% Adjusted Operating Income (1) 269.5$ 283.5$ -4.9% Adjusted Op rating Income Margin (1) 18.7% 19.9% (120) bp Adjusted EPS Excluding Amortization (1) 1.74$ 1.74$ 0.0% Operating Cash Flow 198.2$ 197.1$ 0.6% Less: Capital Expenditures (41.7)$ (34.2)$ 21.9% Free Cash Flow 156.5$ 162.9$ -3.9% Three Months Ended Mar 31,

4 Cash Flow Trends Note: 2011 Free Cash Flow calculation above does not include the $49.5 million Hunter Labs settlement Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Free Cash Flow CAGR calculation uses 2001 data (2001 Free Cash Flow was $228 million) 10.3% FCF CAGR from 2001-2012 Weighted Average Diluted Shares (millions) 154.2 154.7 150.7 144.9 134.7 121.3 111.8 109.1 105.4 101.8 97.4

5 Financial Guidance - 2013 Including a negative impact of approximately $0.35 due to Medicare payment reductions and excluding the impact of share repurchase activity after March 31, 2013, guidance for 2013 is: • Revenue growth: Approximately 2.0% - 3.0% • Adjusted EPS Excluding Amortization: $6.85 - $7.15 • Operating cash flow: Approximately $870 Million - $900 Million • Capital expenditures: Approximately $200 Million - $220 Million* *Note: The Company’s capital expenditure guidance is higher than historical levels due to near-term investments in facility consolidation and replacement of a major testing platform

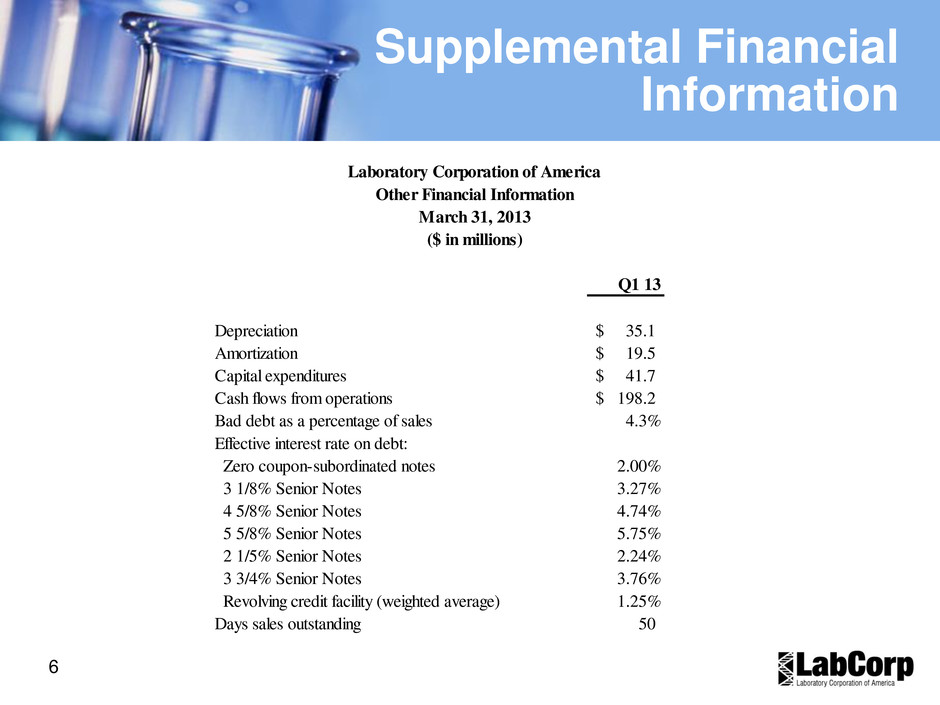

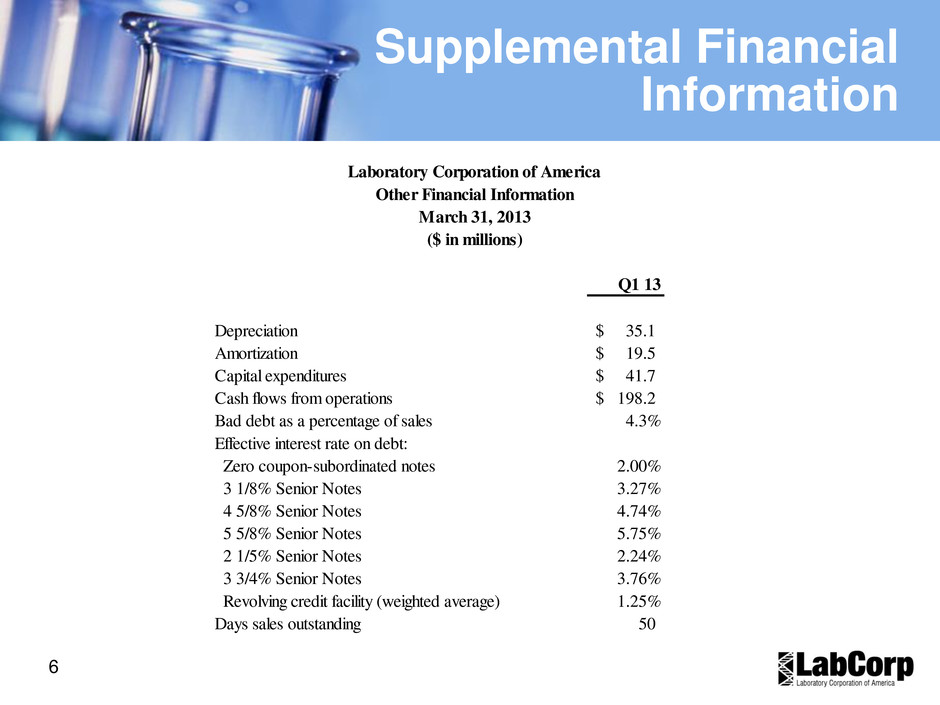

6 Supplemental Financial Information Q1 13 Depreciation 35.1$ Amortization 19.5$ Capital expenditures 41.7$ Cash flows from operations 198.2$ Bad debt as a percentage of sales 4.3% Effective interest rate on debt: Zero coupon-subordinated notes 2.00% 3 1/8% Senior Notes 3.27% 4 5/8% Senior Notes 4.74% 5 5/8% Senior Notes 5.75% 2 1/5% Senior Notes 2.24% 3 3/4% Senior Notes 3.76% Revolving credit facility (weighted average) 1.25% Days sales outstanding 50 Laboratory Corporation of America Other Financial Information March 31, 2013 ($ in millions)

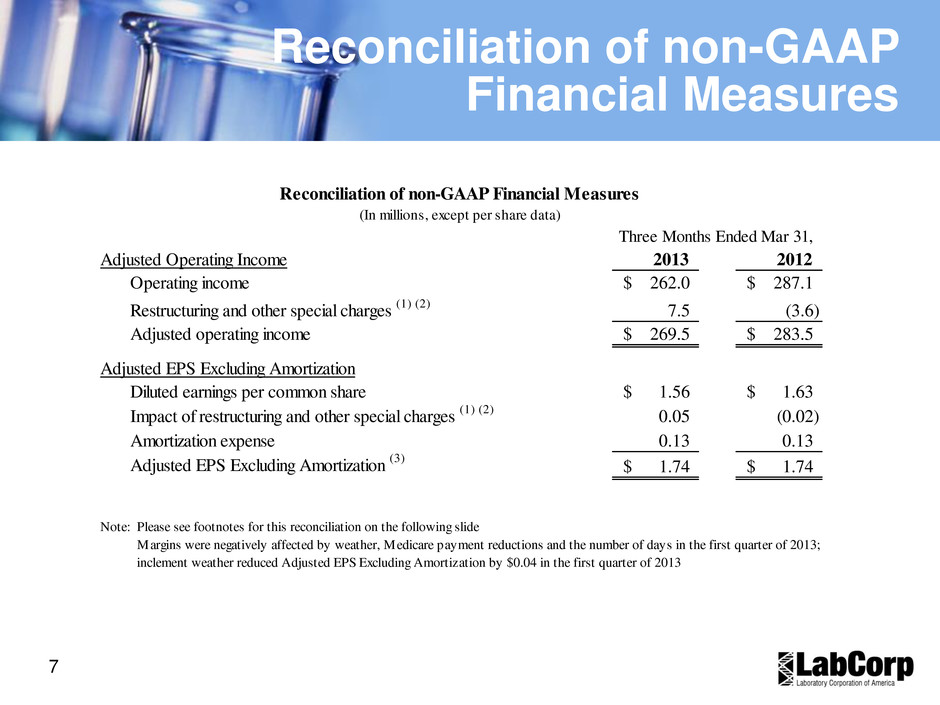

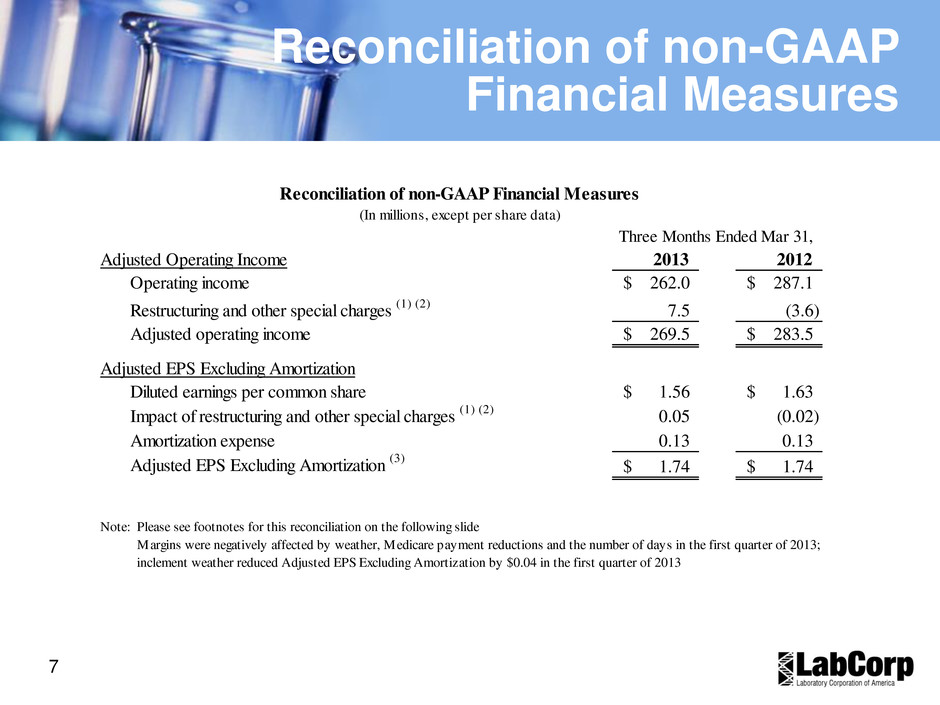

7 Reconciliation of non-GAAP Financial Measures Adjusted Operating Income 2013 2012 Operating income 262.0$ 287.1$ Restructuring and other special charges (1) (2) 7.5 (3.6) Adjusted operating income 269.5$ 283.5$ Adjusted EPS Excluding Amortization Diluted earnings per common share 1.56$ 1.63$ Impact of restructuring and other special charges (1) (2) 0.05 (0.02) Amortization expense 0.13 0.13 Adjusted EPS Excluding Amortization (3) 1.74$ 1.74$ Margins were negatively affected by weather, Medicare payment reductions and the number of days in the first quarter of 2013; Reconciliation of non-GAAP Financial Measures (In millions, except per share data) Three Months Ended Mar 31, Note: Please see footnotes for this reconciliation on the following slide inclement weather reduced Adjusted EPS Excluding Amortization by $0.04 in the first quarter of 2013

8 Reconciliation of non-GAAP Financial Measures - Footnotes Note: GENZYME GENETICS and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. 1) During the first quarter of 2013, the Company recorded net restructuring and other special charges of $7.5 million. The charges included $7.6 million in severance and other personnel costs along with $1.8 million in costs associated with facility closures and general integration initiatives. The Company reversed previously established reserves of $0.6 million in unused severance and $1.3 million in unused facility-related costs. The after tax impact of these charges decreased net earnings for the quarter ended March 31, 2013, by $4.7 million and diluted earnings per share by $0.05 ($4.7 million divided by 94.5 million shares). 2) During the first quarter of 2012, the Company recorded a net credit of $3.6 million in restructuring and other special charges. The Company reversed previously established reserves of $3.8 million in unused severance and $2.4 million in unused facility-related costs. This net credit also includes charges of $1.7 million in severance and other personnel costs along with $0.9 million in facility-related costs primarily related to ongoing integration activities for Orchid and Genzyme Genetics. The after tax impact of the net credit increased net earnings for the quarter ended March 31, 2012, by $2.2 million and diluted earnings per share by $0.02 ($2.2 million divided by 99.1 million shares). 3) The Company continues to grow the business through acquisitions and uses Adjusted EPS Excluding Amortization as a measure of operational performance, growth and shareholder returns. The Company believes adjusting EPS for amortization provides investors with better insight into the operating performance of the business. For the quarters ended March 31, 2013 and 2012, intangible amortization was $19.5 million and $21.4 million, respectively ($12.0 million and $13.1 million net of tax, respectively) and decreased EPS by $0.13 ($12.0 million divided by 94.5 million shares) and $0.13 ($13.1 million divided by 99.1 million shares), respectively.

9 Reconciliation of Free Cash Flow (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 Cash flows from operations1 841.4$ 905.1$ 883.6$ 862.4$ 780.9$ 709.7$ 632.3$ 574.2$ 538.1$ 564.3$ 444.9$ Capital expenditures (173.8) (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) (83.6) (74.3) Free cash flow2 667.6 759.4 757.5 747.7 624.2 567.1 516.4 480.6 443.1 480.7 370.6 Weighted average diluted shares outstanding 97.4 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 144.8 144.2 Reconciliation of non-GAAP Financial Measures (In millions, except per share data)

10