BARCLAYS GLOBAL HEALTHCARE CONFERENCE MARCH 11, 2014 | MIAMI, FL

This slide presentation contains forward-looking statements which are subject to change based on various important factors, including without limitation, competitive actions in the marketplace and adverse actions of governmental and other third-party payers. Actual results could differ materially from those suggested by these forward-looking statements. Further information on potential factors that could affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2013, and subsequent SEC filings. FORWARD LOOKING STATEMENT 2

3 LABCORP A PREMIER HEALTHCARE SERVICES COMPANY A Premier Healthcare Services Company Strong Financial Fundamentals Attractive Market Superior Execution Five Pillar Strategy Clear Mission

Valuable Service • Small component of total cost influences large percentage of clinical decisions • Screening, early detection, and monitoring reduce downstream costs • Decision support tools guide providers to better patient outcomes ATTRACTIVE MARKET 4

5 0 2 4 6 8 10 12 14 Under 18 years 18-44 years 45-54 years 55-64 years 65-74 years 75 years + 2008 1997 Growth Drivers • Aging population • Industry consolidation • Advances in genomics • Pharmacogenomics/ companion diagnostics • Key managed care partnerships • Cost pressures will reward more efficient labs Source: CDC National Ambulatory Medical Care Survey and Company Estimates ATTRACTIVE MARKET Relative Number of Lab Tests Per Year

ATTRACTIVE MARKET Four Chronic Diseases Account for More Than Half of the Global Healthcare Spend… … and lab testing is critical to the diagnosis and treatment of each Source: World Economic Forum 6 COPD CVD 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Diabetes Cancer $ B ill io n Annual Growth Rate 10% 5% 6% 7%

International Opportunities • Manageable capital outlay – capital light model • 2010 global healthcare spend of approximately $4.0 trillion, ex U.S.* • Est. $160 billion global diagnostics market, ex U.S. • Chronic conditions growing at approximately 20% annually • Growing middle class in large Asian and Latin American populations • Will look at opportunities in countries with the following characteristics: • Large self-pay segment • 20%+ of population mid to upper class • Majority of population concentrated in a small number of cities • Diagnostic segment approximately 4% of healthcare spend • Physician community aware of, and educated in, complex diagnostics • Infrastructure – airports and roads *Emergo Group and Company estimates ATTRACTIVE MARKET 7

Source: Washington G-2 Reports and Company estimates Opportunity to Take Share • Approximately 5,700 independent labs • Less efficient, higher cost competitors • Full service, “one stop shop” $60 Billion US Lab Market ATTRACTIVE MARKET 55% 11% 10% 4% 20% Hospital Quest LabCorp Physician Office Other Independent 8

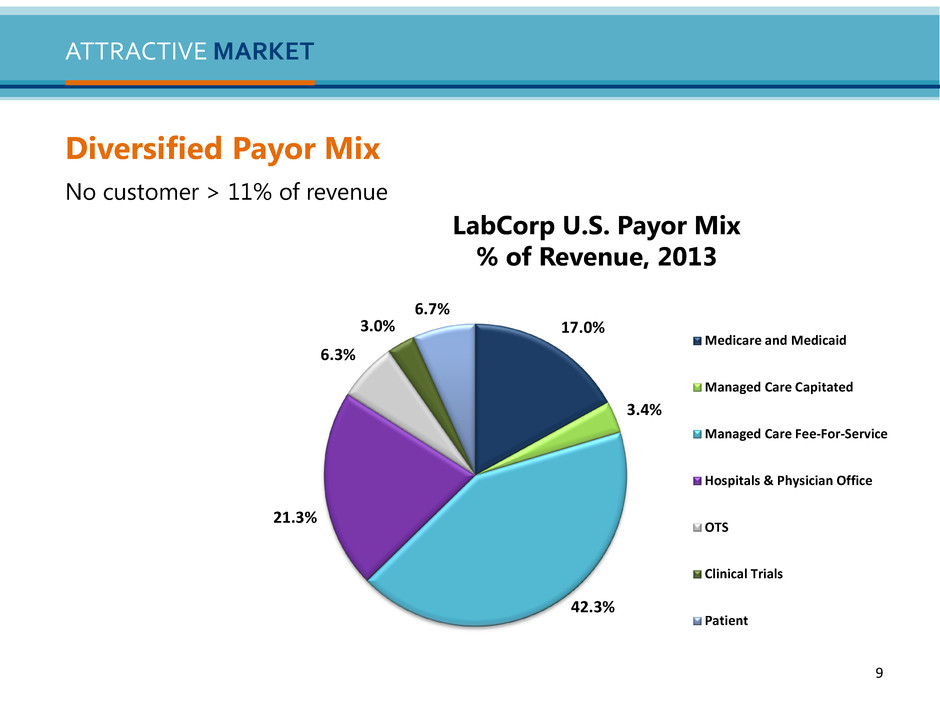

Diversified Payor Mix No customer > 11% of revenue LabCorp U.S. Payor Mix % of Revenue, 2013 ATTRACTIVE MARKET 9 17.0% 3.4% 42.3% 21.3% 6.3% 3.0% 6.7% Medicare and Medicaid Managed Care Capitated Managed Care Fee-For-Service Hospitals & Physician Office OTS Clinical Trials Patient

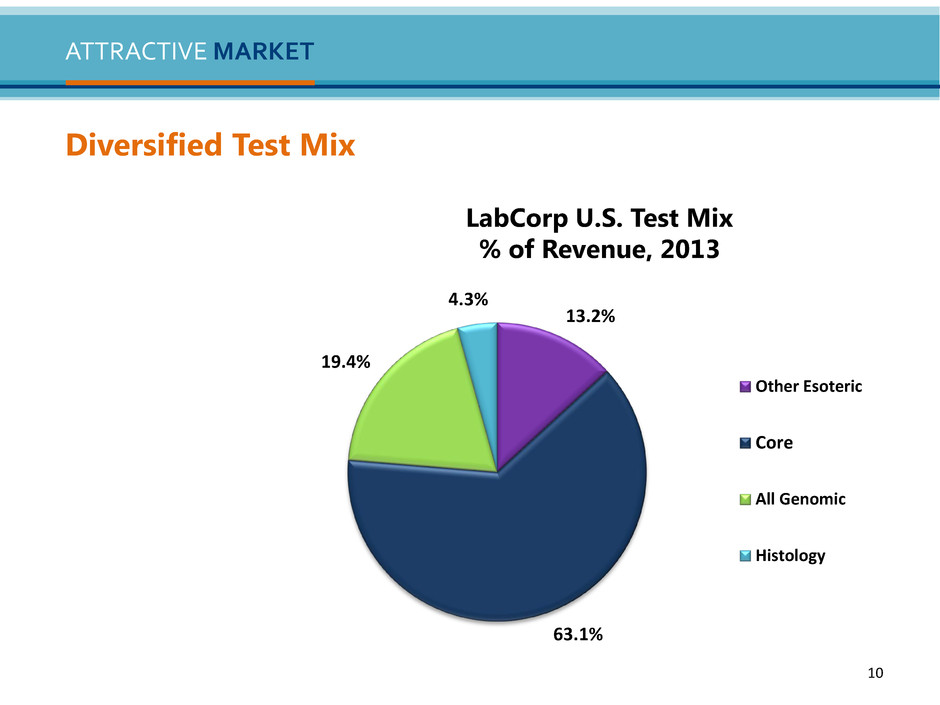

Diversified Test Mix LabCorp U.S. Test Mix % of Revenue, 2013 ATTRACTIVE MARKET 10 13.2% 63.1% 19.4% 4.3% Other Esoteric Core All Genomic Histology

We Will Be a Trusted Knowledge Partner to Stakeholders, Leading to Growth in Our Business and Continued Creation of Shareholder Value We Will Achieve This Mission by Continuing to Execute Our Five Pillar Strategy MISSION STATEMENT 11

Deploy Capital to Investments That Enhance Our Business and Return Capital to Shareholders FIVE PILLAR STRATEGY PILLAR ONE 12

13 Cash Flow Trends Note: 2011 Operating Cash Flow and Free Cash Flow calculation above does not include the $49.5 million Hunter Labs settlement During 2013, government payment reductions and molecular pathology payment issues reduced the Company’s Operating Cash Flow and Free Cash Flow by more than $100 million Free Cash Flow is a non-GAAP metric (see reconciliation of non-GAAP Financial Measures included herein) Weighted Average Diluted Shares (millions) 150.7 144.9 134.7 121.3 111.8 109.1 105.4 101.8 97.4 91.8 FIVE PILLAR STRATEGY PILLAR ONE CAPITAL DEPLOYMENT $538 $574 $632 $710 $781 $862 $884 $905 $841 $819 $443 $481 $516 $567 $624 $748 $758 $759 $668 $617 0 20 40 60 80 100 120 140 160 $- $200 $400 $600 $800 $1,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Number of Shares (Millio ns) $ Mi llion s Operating Cash Flow Free Cash Flow Weighted Avg. Diluted Shares

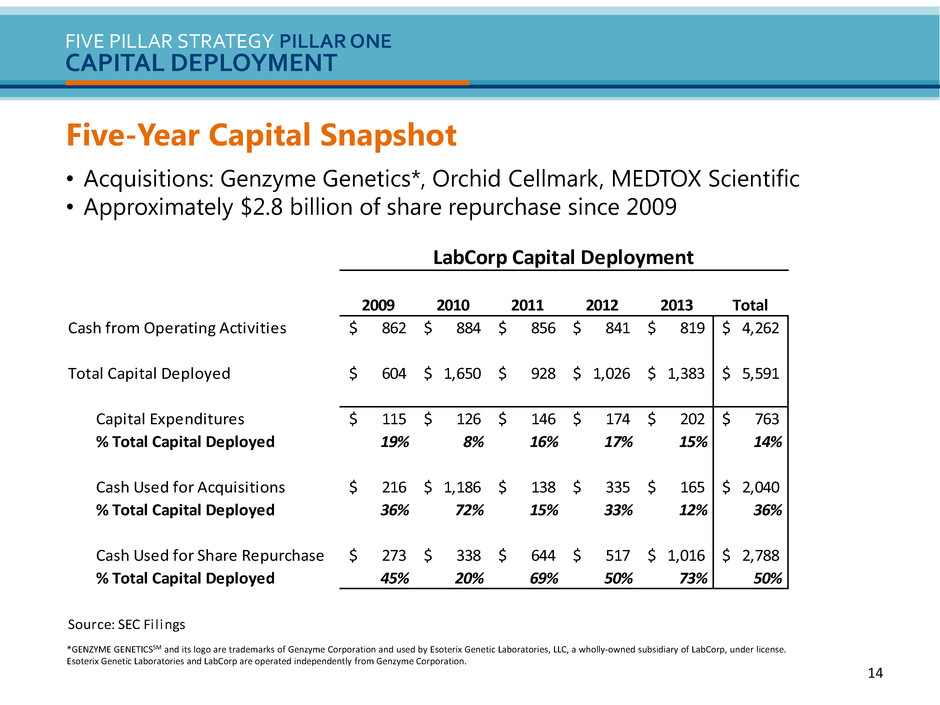

*GENZYME GENETICSSM and its logo are trademarks of Genzyme Corporation and used by Esoterix Genetic Laboratories, LLC, a wholly-owned subsidiary of LabCorp, under license. Esoterix Genetic Laboratories and LabCorp are operated independently from Genzyme Corporation. Five-Year Capital Snapshot • Acquisitions: Genzyme Genetics*, Orchid Cellmark, MEDTOX Scientific • Approximately $2.8 billion of share repurchase since 2009 FIVE PILLAR STRATEGY PILLAR ONE CAPITAL DEPLOYMENT 14 2009 2010 2011 2012 2013 Total Cash from Operating Activities 862$ 884$ 856$ 841$ 819$ 4,262$ Total Capital Deployed 604$ 1,650$ 928$ 1,026$ 1,383$ 5,591$ Capital Expenditures 115$ 126$ 146$ 174$ 202$ 763$ % Total Capital Deployed 19% 8% 16% 17% 15% 14% Cash Used for Acquisitions 216$ 1,186$ 138$ 335$ 165$ 2,040$ % Tot l Capital Deployed 36% 72% 15% 33% 12% 36% Cash Used for Share Repurchase 273$ 338$ 644$ 517$ 1,016$ 2,788$ % Total Capital Deployed 45% 20% 69% 50% 73% 50% Source: SEC Fil ings LabCorp Capital Deployment

Future Capital Deployment Strategy • Target Leverage Ratio of approximately 2.5 to 1 (Debt/EBITDA) over time • Acquisitions • Share Repurchase 15 FIVE PILLAR STRATEGY PILLAR ONE CAPITAL DEPLOYMENT

Enhance IT Capabilities To Improve Physician and Patient Experience FIVE PILLAR STRATEGY PILLAR TWO 16

LabCorp Connectivity Platform • Rich web portal and mobility framework • Physician and Patient portals • Mobility solutions • Enhanced Efficiency and Service • Online appointment scheduling • Express Orders • AccuDraw™ • Integrated results, enhanced reports • Lab Analytics • One-click trending of patient, test and population • View lab history • Services Oriented Architecture • Rules based engines • Content aggregation • Plug in model for seamless integration with practice workflow • Scalable, big data model 17 FIVE PILLAR STRATEGY PILLAR TWO ENHANCE IT CAPABILITIES

Patient Portal • Patients receive lab results as easily as checking email • Provides greater patient intimacy • Over 400,000 patients have signed up for this innovative service • 2014 enhancements will focus on adding content to assist patients in understanding results 18 FIVE PILLAR STRATEGY PILLAR TWO ENHANCE IT CAPABILITIES

Continue to Improve Efficiency to Offer the Most Compelling Value in Laboratory Services FIVE PILLAR STRATEGY PILLAR THREE 19

Focus on Efficiency • Comprehensive review of cost structure • Standardization • Lab platforms, instruments and processes • Billing system • Supply chain optimization • Automation of pre-analytics • Facility rationalization • Propel splitting and sorting robotics 20 FIVE PILLAR STRATEGY PILLAR THREE IMPROVE EFFICIENCY

Scientific Innovation At Appropriate Pricing FIVE PILLAR STRATEGY PILLAR FOUR 21

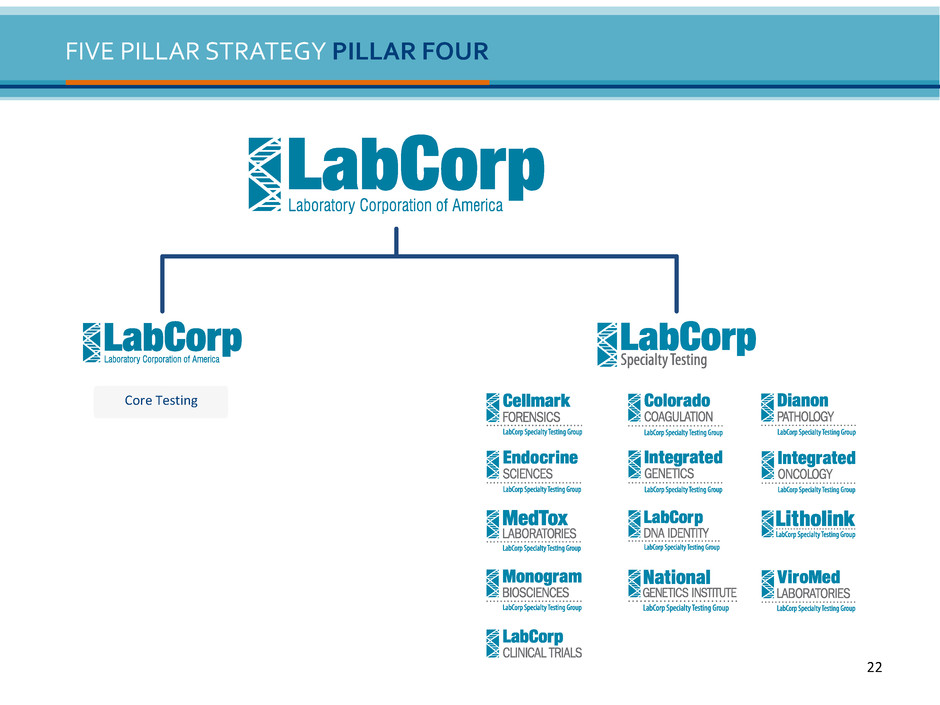

Core Testing FIVE PILLAR STRATEGY PILLAR FOUR 22

Launched 152 new tests in 2013 Recent test introductions • BRCA 1/2 Sequencing • Intelligen NGS Therapeutic Panel • 4th Generation HIV test • HistoPlusSM: Lung Cancer • GeneSeq®: Cardiomyopathy NGS panels • Thiopurine metabolites, expanded Inflammatory Bowel Disease (IBD) offerings • SNP Microarray-Oncology • NanoString ProsignaTM Breast Cancer Prognostic Gene Signature Assay Coming in 2014 • HLA by NGS • NGS Universal Carrier Screening • NGS Gene Panels 23 FIVE PILLAR STRATEGY PILLAR FOUR SCIENTIFIC INNOVATION AT APPROPRIATE PRICING

Develop Knowledge Services FIVE PILLAR STRATEGY PILLAR FIVE 24

25 • Create true consultancy with physicians and providers • Increase intimacy with patients • Develop knowledge solutions through delivery of content, resulting in better care at lower cost • BeaconLBS® • Population health management/data analytics • Decision support • Personalized medicine • Genetic counseling • Mobile health • Connected devices • Care in the home FIVE PILLAR STRATEGY PILLAR FIVE KEY ELEMENTS

26 CLEAR MISSION WHERE WE ARE GOING Pillars 1-4 Pillar 5 CORE BUSINESS IT CAPABILITIES SCIENCE BEACONLBS GENETIC COUNSELING ACQUISITIONS DATA ANALYTICS CLINICAL DECISION SUPPORT OTHER INPUTS / PARTNERS INTERPRETATION/ EDUCATION A Trusted Partner to Healthcare Stakeholders, Providing Knowledge to Optimize Decision Making, Improve Health Outcomes and Reduce Treatment Costs

— a key strategic initiative supporting better outcomes at lower costs, BeaconLBS will provide: • Decision support tools that guide lab and test selection • Decision support tools integrated into existing physician workflows to minimize/eliminate disruption, increase adoption/utilization. • Tools can be accessed through (a) proprietary internet-based multi-lab ordering system; (b) EHR-partner ordering systems; and, (c) labs-of-choice ordering systems. • Clinical guidelines supported by evidence and expert opinion. • Access to a high-quality lab-of-choice network • Key for payers and health systems / providers (moving to risk), lab services meet specific credentialing criteria for tests while complying with coding / billing requirements. • Clinical & administrative rules engine supporting claim adjudication process • Proprietary rules engine interfacing seamlessly with a health plan’s adjudication system. • Rules engine based health plan claims are adjudicated subject to evidence-based guidelines, administrative edits, and labs-of-choice economics. *Zhi M, Ding EL, Theisen-Toupal J, Whelan J, Amaout R. The Landscape of Inappropriate Laboratory Testing: A 15-Year Meta- Analysis. PLoS One. 2013 Nov 15; 8(11):1-29. FIVE PILLAR STRATEGY PILLAR FIVE BEACONLBS 27 Recent Study Reports 20% Overutilization of Laboratory Tests and 45% Underutilization*

28 FIVE PILLAR STRATEGY PILLAR FIVE ENLIGHTEN HEALTH New Business Line Leveraging Our Existing Capabilities EnlightenHealthSM will deliver a suite of business intelligence and patient care tools Health Systems & Providers Pharma Patient / Consumer PATIENT-CENTRIC SOLUTIONS BUSINESS SOLUTIONS

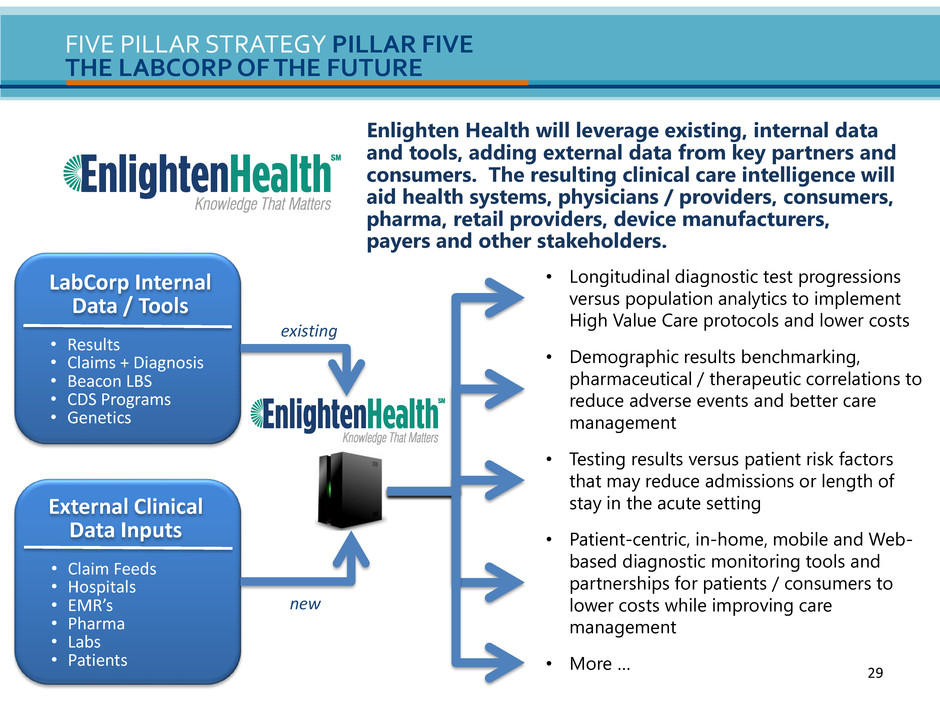

29 FIVE PILLAR STRATEGY PILLAR FIVE THE LABCORP OF THE FUTURE • Patient-centric, in-home, mobile and Web- based diagnostic monitoring tools and partnerships for patients / consumers to lower costs while improving care management • Longitudinal diagnostic test progressions versus population analytics to implement High Value Care protocols and lower costs • Demographic results benchmarking, pharmaceutical / therapeutic correlations to reduce adverse events and better care management • Testing results versus patient risk factors that may reduce admissions or length of stay in the acute setting LabCorp Internal Data / Tools • Results • Claims + Diagnosis • Beacon LBS • CDS Programs • Genetics External Clinical Data Inputs • Claim Feeds • Hospitals • EMR’s • Pharma • Labs • Patients existing new • More … Enlighten Health will leverage existing, internal data and tools, adding external data from key partners and consumers. The resulting clinical care intelligence will aid health systems, physicians / providers, consumers, pharma, retail providers, device manufacturers, payers and other stakeholders.

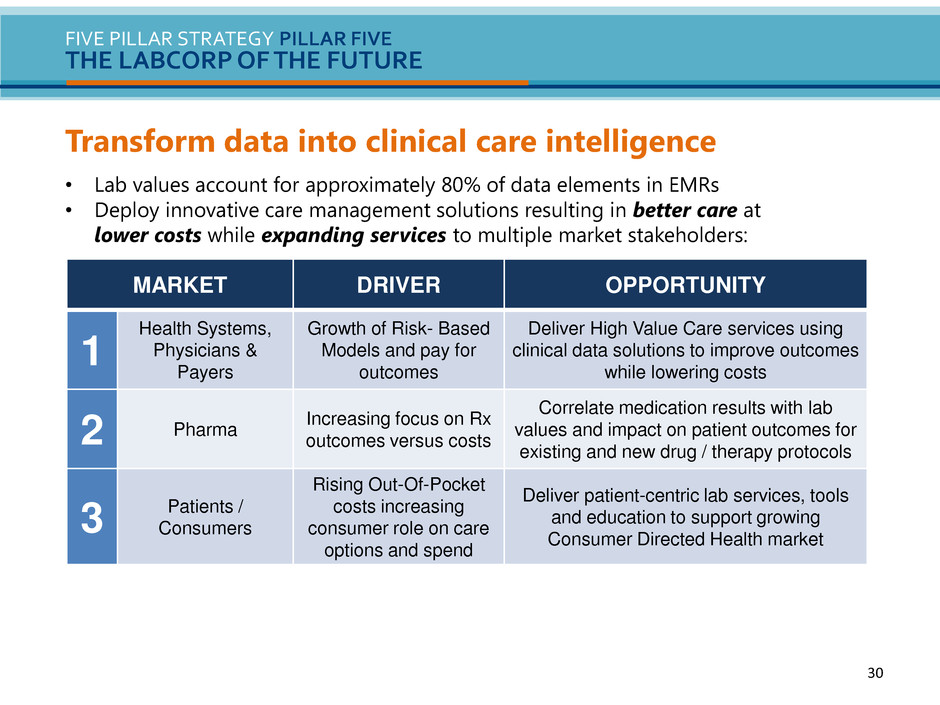

30 FIVE PILLAR STRATEGY PILLAR FIVE THE LABCORP OF THE FUTURE Transform data into clinical care intelligence • Lab values account for approximately 80% of data elements in EMRs • Deploy innovative care management solutions resulting in better care at lower costs while expanding services to multiple market stakeholders: MARKET DRIVER OPPORTUNITY 1 Health Systems, Physicians & Payers Growth of Risk- Based Models and pay for outcomes Deliver High Value Care services using clinical data solutions to improve outcomes while lowering costs 2 Pharma Increasing focus on Rx outcomes versus costs Correlate medication results with lab values and impact on patient outcomes for existing and new drug / therapy protocols 3 Patients / Consumers Rising Out-Of-Pocket costs increasing consumer role on care options and spend Deliver patient-centric lab services, tools and education to support growing Consumer Directed Health market

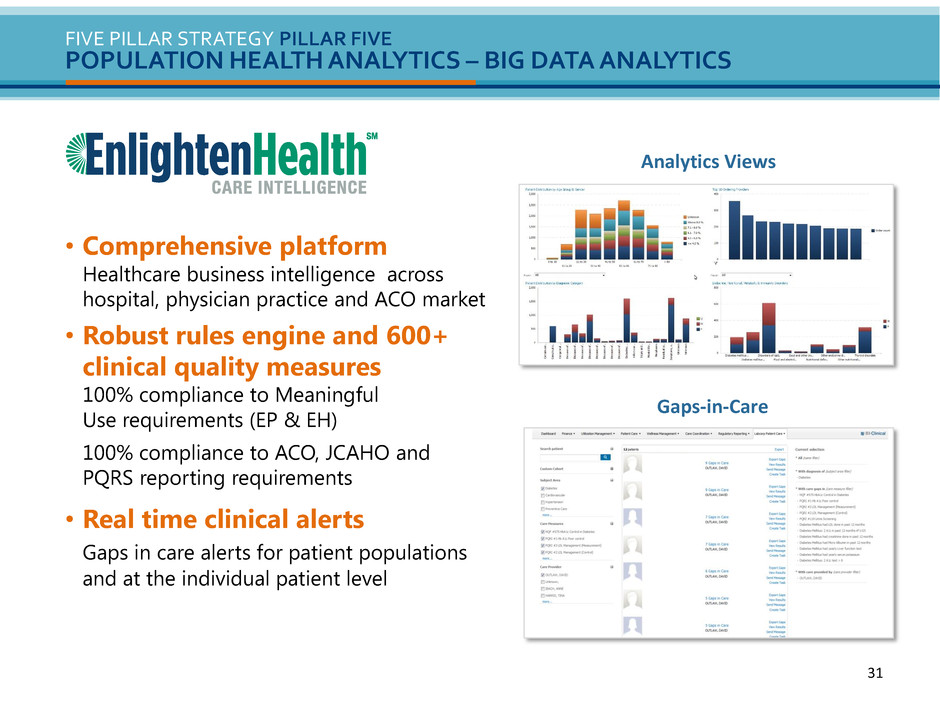

• Comprehensive platform Healthcare business intelligence across hospital, physician practice and ACO market • Robust rules engine and 600+ clinical quality measures 100% compliance to Meaningful Use requirements (EP & EH) 100% compliance to ACO, JCAHO and PQRS reporting requirements • Real time clinical alerts Gaps in care alerts for patient populations and at the individual patient level Gaps-in-Care Analytics Views 31 FIVE PILLAR STRATEGY PILLAR FIVE POPULATION HEALTH ANALYTICS – BIG DATA ANALYTICS

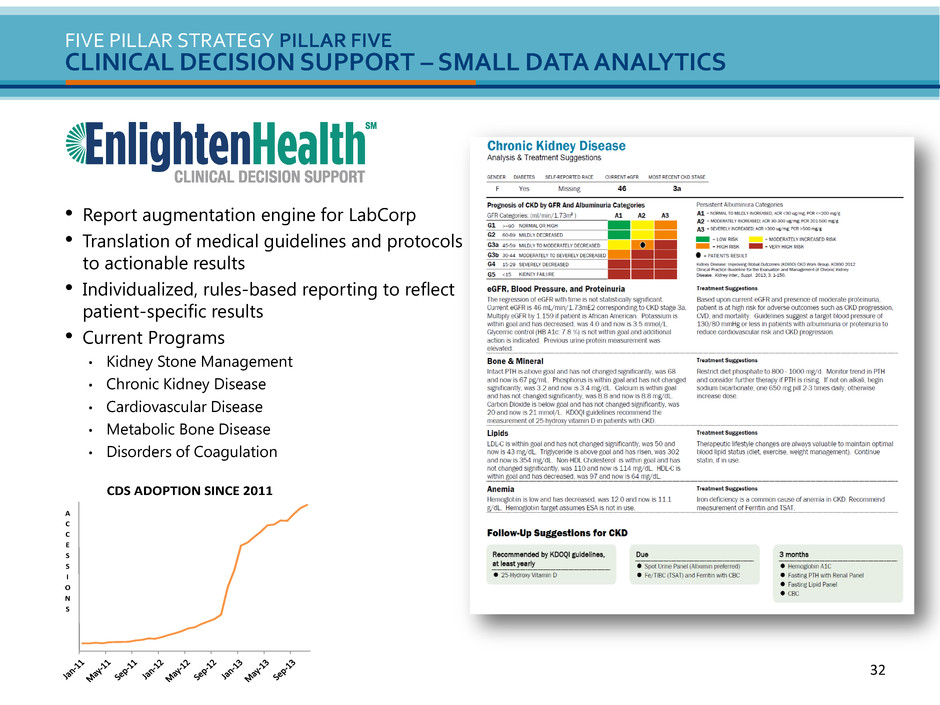

• Report augmentation engine for LabCorp • Translation of medical guidelines and protocols to actionable results • Individualized, rules-based reporting to reflect patient-specific results • Current Programs • Kidney Stone Management • Chronic Kidney Disease • Cardiovascular Disease • Metabolic Bone Disease • Disorders of Coagulation 32 FIVE PILLAR STRATEGY PILLAR FIVE CLINICAL DECISION SUPPORT – SMALL DATA ANALYTICS A C C E S S I O N S CDS ADOPTION SINCE 2011

33 Capitalize on LabCorp Leadership in Companion Diagnostics • Therascreen® K-RAS • COBAS Taqman HCV 2.0 • HCV Q80K for OLYSIOTM • HCV GenoSure® NS3/4A • PhenoSense®, PhenoSense GT® • HERmark® • COBAS EGFR • Beta-1 Cardiac Receptor • Gencaro (atrial fibrillation) FIVE PILLAR STRATEGY PILLAR FIVE PERSONALIZED MEDICINE Capabilities and Applications • 123 Board-certified genetic counselors and 9 medical geneticists • Extensive experience in physician & patient counseling • Applications include reproductive genetics, BRCA and oncology panels • Capability increasing as more complex genetic testing comes to market where payers, physicians & patients require justification for molecular testing & assistance interpreting results

CORE BUSINESS IT CAPABILITIES SCIENCE GENETIC COUNSELING 34 CLEAR MISSION THE LABCORP OF THE FUTURE ACQUISITIONS DATA ANALYTICS CLINICAL DECISION SUPPORT OTHER INPUTS / PARTNERS INTERPRETATION/ EDUCATION A Trusted Partner to Healthcare Stakeholders, Providing Knowledge to Optimize Decision Making, Improve Health Outcomes and Reduce Treatment Costs

$4.91 $5.24 $5.98 $6.37 $6.82 $6.95 2008 2009 2010 2011 2012 2013 $4.513 $4.695 $5.004 $5.542 $5.671 $5.80 2008 2009 201 2011 2012 2013 1. Excluding the $0.44 per diluted share impact of restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per diluted share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the $0.26 per diluted share impact of restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010; excluding the $0.72 per diluted share impact of restructuring and other special charges, the $0.03 per diluted share impact from a loss on the divestiture of assets and the $0.51 per diluted share impact from amortization in 2011; excluding the $0.29 per diluted share impact of restructuring and other special charges and the $0.54 per diluted share impact from amortization in 2012; and excluding the $0.15 per diluted share impact of restructuring and other special charges and the $0.55 per diluted share impact from amortization in 2013 2. EPS, as presented represents adjusted, non-GAAP financial measures. Diluted EPS, as reported in the Company’s Annual Report were: $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; and $6.25 in 2013 3. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made by Medicare for claims submitted by a subsidiary of the Company Revenue and Adjusted EPS Excluding Amortization Growth: 2008 – 2013 1,2,3 EXCELLENT PERFORMANCE 35 Adjusted EPS Excluding Amortization Revenue ($Billions)

36 Reconciliation of Free Cash Flow (1) 2011 cash flows from operations excludes the $49.5 million Hunter Labs settlement payment (2) Free cash flow represents cash flows from operations less capital expenditures 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 Cash flows from operations1 818.7$ 841.4$ 905.1$ 883.6$ 862.4$ 780.9$ 709.7$ 632.3$ 574.2$ 538.1$ Capital expenditures (202.2) (173.8) (145.7) (126.1) (114.7) (156.7) (142.6) (115.9) (93.6) (95.0) Free cash flow2 616.5 667.6 759.4 757.5 747.7 624.2 567.1 516.4 480.6 443.1 Weighted average diluted shares outstanding 91.8 97.4 101.8 105.4 109.1 111.8 121.3 134.7 144.9 150.7 Reconciliation of non-GAAP Financial Measures (In millions, except per share data) RECONCILIATION FREE CASH FLOW